UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number |

811-01424 |

AIM Equity Funds (Invesco Equity Funds)

(Exact name of registrant as specified in charter)

11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Address of principal executive offices) (Zip code)

Sheri Morris 11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Name and address of agent for service)

| Registrant’s telephone number, including area code: |

(713) 626-1919 |

| Date of fiscal year end: |

10/31 |

|||||

| Date of reporting period: |

10/31/21 |

|||||

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

(a) The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

(b) Not Applicable

| Annual Report to Shareholders | October 31, 2021 | |

Invesco Charter Fund

Nasdaq:

A: CHTRX ∎ C: CHTCX ∎ R: CHRRX ∎ S: CHRSX ∎ Y: CHTYX ∎ R5: CHTVX ∎ R6: CHFTX

Management’s Discussion of Fund Performance

| For the fiscal year ended October 31, 2021, Class A shares of Invesco Charter Fund (the Fund), at net asset value (NAV), underperformed the Russell 1000 Index, the Fund’s style-specific benchmark. |

| |||

| Your Fund’s long-term performance appears later in this report. |

||||

| Fund vs. Indexes |

||||

| Total returns, 10/31/20 to 10/31/21, at net asset value (NAV). Performance shown does not include applicable contingent deferred sales charges (CDSC) or front-end sales charges, which would have reduced performance. |

| |||

| Class A Shares |

40.10 | % | ||

| Class C Shares |

39.00 | |||

| Class R Shares |

39.66 | |||

| Class S Shares |

40.20 | |||

| Class Y Shares |

40.36 | |||

| Class R5 Shares |

40.37 | |||

| Class R6 Shares |

40.49 | |||

| S&P 500 Indexq (Broad Market Index) |

42.91 | |||

| Russell 1000 Indexq (Style-Specific Index) |

43.51 | |||

| Lipper Large-Cap Core Funds Index∎ (Peer Group Index) |

40.30 | |||

| Source(s): qRIMES Technologies Corp.; ∎Lipper Inc. |

||||

Market conditions and your Fund

US equity markets posted gains in the fourth quarter of 2020, as positive news on corona-virus (COVID-19) vaccines and strong corporate earnings outweighed investor concerns about the political disagreement over a fiscal stimulus package and sharply rising COVID-19 infections nationwide. Cyclical sectors like energy and financials led the way, while real estate and consumer staples lagged. Market leadership also shifted during the quarter with value stocks outperforming growth for the first time since the fourth quarter of 2016. While the US economy rebounded significantly since the pandemic began, the recovery appeared to slow in the fourth quarter with employment gains and gross domestic product (GDP) growth down from the third quarter of 2020. However, stocks were buoyed by the US Federal Reserve (the Fed) pledge to maintain its accommodative stance and asset purchases, “until substantial further progress has been made”1 toward employment and inflation targets.

US political unrest and rising COVID-19 infection rates marked the start of the first quarter of 2021. Additionally, retail investors bid up select stocks like GameStop and AMC Theaters, ultimately causing a sharp selloff in late January. Corporate earnings generally beat expectations, but market volatility rose during the quarter as investors worried about rising bond yields and inflation. Despite the Fed’s commitment to an accommodative policy, the 10-year US Treasury yield rose from 0.92% at year-end to 1.75%2 at the end of March 2021. Approval of a third COVID-19 vaccine boosted investors’ optimism for faster economic recovery. Although March 2021 saw increased volatility with consecutive down days in the US stock market, stocks continued to hit all-time highs through April 2021.

The US stock market once again hit new highs in the second quarter of 2021, despite higher volatility stemming from inflation concerns and the potential for rising interest rates. Investors remained optimistic about the strength of the economic recovery after the Bureau of Economic Analysis reported that the US GDP grew at a 6.4% annualized rate for the first quarter of 2021.3 Corporate earnings also remained strong as the majority of S&P 500 companies beat Wall Street earnings forecasts. US equity markets continued to move higher in July despite inflation concerns and increasing COVID-19 infection rates due to the rapidly spreading Delta variant. Despite the Consumer Price Index (CPI) increasing in June through September,3 the Fed declined to raise interest rates at its September Federal Open Market Committee meeting. The US stock market saw continued volatility in August 2021 and a selloff through most of September due to increasing concerns of inflation due to a spike in oil prices and supply chain shortages causing rising costs. In October, investor sentiment improved as many S&P 500 index companies met or exceeded earnings expectations and the index hit new record highs. For the fiscal year, the S&P 500 Index returned 42.91%.4

During the fiscal year, stock selection in the health care, information technology and utilities sectors were the largest contributors to the Fund’s performance versus the Russell 1000 Index. This was offset by weaker stock selection in the consumer discretionary, communication services and energy sectors.

The largest individual contributors to the Fund’s performance relative to the Russell 1000 Index during the fiscal year included Applied Materials, Capital One and HCA Healthcare. Applied Materials benefited from a strong fundamental backdrop as there were secular demand drivers for semiconductors

that supported earnings. Capital One, whose main businesses include credit cards and consumer banking, benefited as it became more apparent that the US would continue its path to reopening. We exited our holding as of the end of the fiscal year. HCA and hospital operators in general, rebounded as they learned how to operate during the COVID-19 pandemic and saw a decrease in procedures being suspended.

The largest individual detractors to the Fund’s performance during the fiscal year included a2 Milk, Quidel and Coterra Energy. a2 Milk, which sells milk and dairy products globally, was negatively impacted by falling sales in China, one of its most important sales channels. Quidel, a maker of rapid diagnostic tests, continued to give back some of the substantial gains it experienced at the onset of the pandemic as more of the population became vaccinated and the growth rate of demand for COVID-19 testing decreased. Co-terra Energy, an exploration and production company, sold off in September 2021 after acquiring another company and we exited our position before the share price recovered in October 2021. We also exited our holdings in a2 Milk and Quidel during the fiscal year.

We continue to maintain our discipline around valuation and focus on companies that we believe have competitive advantages and skilled management teams that are out-executing peers. We believe this disciplined approach is essential to generating attractive long-term performance.

We thank you for your continued investment in Invesco Charter Fund.

| 1 | Source: US Federal Reserve |

| 2 | Source: Bloomberg LP |

| 3 | Source: Bureau of Labor Statistics, July 13, 2021 |

| 4 | Source: Lipper Inc. |

Portfolio manager(s):

Manind Govil - Lead

Paul Larson

Benjamin Ram

The views and opinions expressed in management’s discussion of Fund performance are those of Invesco Advisers, Inc. and its affiliates. These views and opinions are subject to change at any time based on factors such as market and economic conditions. These views and opinions may not be relied upon as investment advice or recommendations, or as an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but Invesco Advisers, Inc. makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

See important Fund and, if applicable, index disclosures later in this report.

| 2 | Invesco Charter Fund |

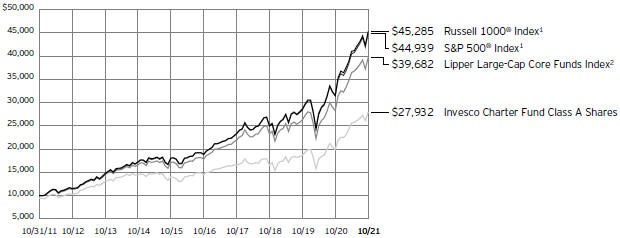

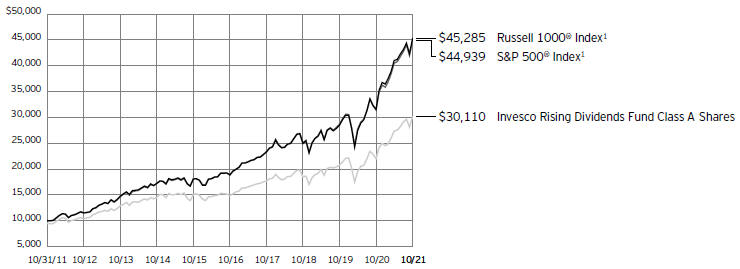

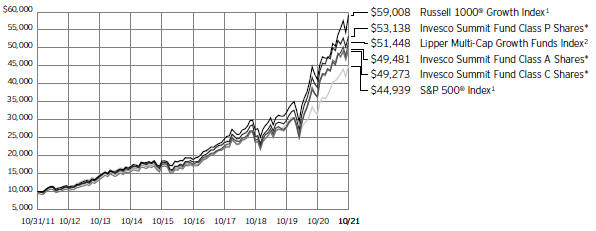

Your Fund’s Long-Term Performance

Results of a $10,000 Investment – Oldest Share Class(es)

Fund and index data from 10/31/11

| 1 | Source: RIMES Technologies Corp. |

| 2 | Source: Lipper Inc. |

Past performance cannot guarantee future results.

The data shown in the chart include reinvested distributions, applicable sales charges and Fund expenses including management

fees. Index results include reinvested dividends, but they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses and management fees;

performance of a market index does not. Performance shown in the chart does not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

| 3 | Invesco Charter Fund |

| Average Annual Total Returns |

||||

|

As of 10/31/21, including maximum applicable sales charges |

| |||

| Class A Shares |

||||

| Inception (11/26/68) |

10.75 | % | ||

| 10 Years |

10.82 | |||

| 5 Years |

12.67 | |||

| 1 Year |

32.40 | |||

| Class C Shares |

||||

| Inception (8/4/97) |

6.57 | % | ||

| 10 Years |

10.78 | |||

| 5 Years |

13.11 | |||

| 1 Year |

38.00 | |||

| Class R Shares |

||||

| Inception (6/3/02) |

8.05 | % | ||

| 10 Years |

11.17 | |||

| 5 Years |

13.67 | |||

| 1 Year |

39.66 | |||

| Class S Shares |

||||

| Inception (9/25/09) |

10.84 | % | ||

| 10 Years |

11.56 | |||

| 5 Years |

14.07 | |||

| 1 Year |

40.20 | |||

| Class Y Shares |

||||

| Inception (10/3/08) |

10.46 | % | ||

| 10 Years |

11.73 | |||

| 5 Years |

14.24 | |||

| 1 Year |

40.36 | |||

| Class R5 Shares |

||||

| Inception (7/30/91) |

9.04 | % | ||

| 10 Years |

11.81 | |||

| 5 Years |

14.30 | |||

| 1 Year |

40.37 | |||

| Class R6 Shares |

||||

| 10 Years |

11.85 | % | ||

| 5 Years |

14.38 | |||

| 1 Year |

40.49 | |||

Performance includes litigation proceeds. Had these proceeds not been received, total returns would have been lower.

Class R6 shares incepted on September 24, 2012. Performance shown prior to that date is that of Class A shares at net asset value and includes the 12b-1 fees applicable to Class A shares.

The performance data quoted represent past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ performance for the most recent month-end performance. Performance figures reflect reinvested distributions, changes in net asset value and the effect of the maximum sales charge unless otherwise stated. Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares. Investment return and principal value will fluctuate so that you may have a gain or loss when you sell shares.

Class A share performance reflects the maximum 5.50% sales charge, and Class C share performance reflects the applicable contingent deferred sales charge (CDSC)

for the period involved. The CDSC on Class C shares is 1% for the first year after purchase. Class R, Class S, Class Y, Class R5 and Class R6 shares do not have a front-end sales charge or a CDSC; therefore, performance is at net asset value.

The performance of the Fund’s share classes will differ primarily due to different sales charge structures and class expenses.

Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had the adviser not waived fees and/or reimbursed expenses currently or in the past, returns would have been lower. See current prospectus for more information.

| 4 | Invesco Charter Fund |

Invesco Charter Fund’s investment objective is long-term growth of capital.

∎ Unless otherwise stated, information presented in this report is as of October 31, 2021, and is based on total net assets.

∎ Unless otherwise noted, all data is provided by Invesco.

∎ To access your Fund’s reports/prospectus, visit invesco.com/fundreports.

About indexes used in this report

| ∎ | The S&P 500® Index is an unmanaged index considered representative of the US stock market. |

| ∎ | The Russell 1000® Index is an unmanaged index considered representative of large-cap stocks. The Russell 1000 Index is a trademark/service mark of the Frank Russell Co. Russell® is a trademark of the Frank Russell Co. |

| ∎ | The Lipper Large-Cap Core Funds Index is an unmanaged index considered representative of large-cap core funds tracked by Lipper. |

| ∎ | The Fund is not managed to track the performance of any particular index, including the index(es) described here, and consequently, the performance of the Fund may deviate significantly from the performance of the index(es). |

| ∎ | A direct investment cannot be made in an index. Unless otherwise indicated, index results include reinvested dividends, and they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses; performance of a market index does not. |

| This report must be accompanied or preceded by a currently effective Fund prospectus, which contains more complete information, including sales charges and expenses. Investors should read it carefully before investing. |

| NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE |

| 5 | Invesco Charter Fund |

Fund Information

| Portfolio Composition | |||||

| By sector | % of total net assets | ||||

| Information Technology |

26.43 | % | |||

| Consumer Discretionary |

14.44 | ||||

| Health Care |

14.27 | ||||

| Financials |

11.29 | ||||

| Industrials |

10.96 | ||||

| Communication Services |

8.88 | ||||

| Consumer Staples |

5.07 | ||||

| Real Estate |

2.65 | ||||

| Energy |

2.29 | ||||

| Other Sectors, Each Less than 2% of Net Assets |

3.35 | ||||

| Money Market Funds Plus Other Assets Less Liabilities |

0.37 | ||||

| Top 10 Equity Holdings*

|

|||||||

| % of total net assets | |||||||

| 1. |

Microsoft Corp. | 6.79 | % | ||||

| 2. |

Amazon.com, Inc. | 5.48 | |||||

| 3. |

JPMorgan Chase & Co. | 3.71 | |||||

| 4. |

salesforce.com, inc. | 3.02 | |||||

| 5. |

United Parcel Service, Inc., Class B | 2.84 | |||||

| 6. |

UnitedHealth Group, Inc. | 2.79 | |||||

| 7. |

Alphabet, Inc., Class A | 2.68 | |||||

| 8. |

Prologis, Inc. | 2.66 | |||||

| 9. |

HCA Healthcare, Inc. | 2.48 | |||||

| 10. |

QUALCOMM, Inc. | 2.21 | |||||

The Fund’s holdings are subject to change, and there is no assurance that the Fund will continue to hold any particular security.

* Excluding money market fund holdings, if any.

Data presented here are as of October 31, 2021.

| 6 | Invesco Charter Fund |

October 31, 2021

| Shares | Value | |||||||

|

|

||||||||

| Common Stocks & Other Equity Interests–99.63% |

| |||||||

| Aerospace & Defense–1.76% |

| |||||||

| Raytheon Technologies Corp. |

758,904 | $ | 67,436,209 | |||||

|

|

||||||||

| Air Freight & Logistics–2.84% |

| |||||||

| United Parcel Service, Inc., Class B |

508,761 | 108,605,211 | ||||||

|

|

||||||||

| Airlines–0.46% |

| |||||||

| Southwest Airlines Co.(b) |

372,270 | 17,600,926 | ||||||

|

|

||||||||

| Application Software–4.47% |

| |||||||

| Manhattan Associates, Inc.(b) |

63,768 | 11,576,443 | ||||||

|

|

||||||||

| salesforce.com, inc.(b) |

385,193 | 115,438,490 | ||||||

|

|

||||||||

| Workday, Inc., Class A(b) |

151,479 | 43,925,880 | ||||||

|

|

||||||||

| 170,940,813 | ||||||||

|

|

||||||||

| Automobile Manufacturers–1.82% |

| |||||||

| General Motors Co.(b) |

834,589 | 45,426,679 | ||||||

|

|

||||||||

| Tesla, Inc.(b) |

21,836 | 24,325,304 | ||||||

|

|

||||||||

| 69,751,983 | ||||||||

|

|

||||||||

| Automotive Retail–1.85% |

| |||||||

| CarMax, Inc.(b) |

278,729 | 38,163,575 | ||||||

|

|

||||||||

| O’Reilly Automotive, Inc.(b) |

52,125 | 32,438,430 | ||||||

|

|

||||||||

| 70,602,005 | ||||||||

|

|

||||||||

| Biotechnology–0.90% |

| |||||||

| Seagen, Inc.(b) |

195,306 | 34,438,307 | ||||||

|

|

||||||||

| Cable & Satellite–1.47% |

| |||||||

| Comcast Corp., Class A |

1,095,078 | 56,319,862 | ||||||

|

|

||||||||

| Commodity Chemicals–0.72% |

| |||||||

| Valvoline, Inc. |

814,487 | 27,659,979 | ||||||

|

|

||||||||

| Communications Equipment–1.41% |

| |||||||

| Motorola Solutions, Inc. |

216,944 | 53,930,109 | ||||||

|

|

||||||||

| Construction Machinery & Heavy Trucks–1.36% |

| |||||||

| Caterpillar, Inc. |

254,225 | 51,864,442 | ||||||

|

|

||||||||

| Construction Materials–1.20% |

| |||||||

| Vulcan Materials Co. |

240,358 | 45,696,863 | ||||||

|

|

||||||||

| Data Processing & Outsourced Services–2.20% |

| |||||||

| Fiserv, Inc.(b) |

467,030 | 45,997,784 | ||||||

|

|

||||||||

| Mastercard, Inc., Class A |

113,665 | 38,136,881 | ||||||

|

|

||||||||

| 84,134,665 | ||||||||

|

|

||||||||

| Distillers & Vintners–1.32% |

| |||||||

| Constellation Brands, Inc., Class A |

233,652 | 50,658,090 | ||||||

|

|

||||||||

| Diversified Banks–3.71% |

| |||||||

| JPMorgan Chase & Co. |

835,948 | 142,019,206 | ||||||

|

|

||||||||

| Electric Utilities–1.43% |

| |||||||

| FirstEnergy Corp. |

1,422,218 | 54,798,060 | ||||||

|

|

||||||||

| Electrical Components & Equipment–1.19% |

| |||||||

| Hubbell, Inc. |

97,320 | 19,402,688 | ||||||

|

|

||||||||

| Rockwell Automation, Inc. |

81,390 | 25,995,966 | ||||||

|

|

||||||||

| 45,398,654 | ||||||||

|

|

||||||||

| Shares | Value | |||||||

|

|

||||||||

| Environmental & Facilities Services–0.58% |

|

|||||||

| Waste Connections, Inc. |

163,330 | $ | 22,214,513 | |||||

|

|

||||||||

| Financial Exchanges & Data–1.90% |

|

|||||||

| Intercontinental Exchange, Inc. |

524,443 | 72,614,378 | ||||||

|

|

||||||||

| Food Distributors–0.90% |

||||||||

| Sysco Corp. |

448,488 | 34,488,727 | ||||||

|

|

||||||||

| General Merchandise Stores–1.35% |

|

|||||||

| Target Corp. |

199,406 | 51,769,786 | ||||||

|

|

||||||||

| Health Care Facilities–2.96% |

||||||||

| HCA Healthcare, Inc. |

379,233 | 94,982,697 | ||||||

|

|

||||||||

| Tenet Healthcare Corp.(b) |

252,549 | 18,097,662 | ||||||

|

|

||||||||

| 113,080,359 | ||||||||

|

|

||||||||

| Health Care Services–1.90% |

||||||||

| CVS Health Corp. |

812,336 | 72,525,358 | ||||||

|

|

||||||||

| Health Care Supplies–0.98% |

||||||||

| Cooper Cos., Inc. (The) |

89,877 | 37,471,519 | ||||||

|

|

||||||||

| Home Improvement Retail–1.87% |

||||||||

| Floor & Decor Holdings, Inc., Class A(b) |

76,757 | 10,432,811 | ||||||

|

|

||||||||

| Home Depot, Inc. (The) |

163,893 | 60,925,584 | ||||||

|

|

||||||||

| 71,358,395 | ||||||||

|

|

||||||||

| Homebuilding–0.80% |

||||||||

| D.R. Horton, Inc. |

341,842 | 30,516,235 | ||||||

|

|

||||||||

| Hotels, Resorts & Cruise Lines–1.28% |

|

|||||||

| Airbnb, Inc., Class A(b) |

285,979 | 48,805,176 | ||||||

|

|

||||||||

| Household Products–1.77% |

||||||||

| Procter & Gamble Co. (The) |

474,052 | 67,784,695 | ||||||

|

|

||||||||

| Industrial Machinery–1.36% |

||||||||

| Otis Worldwide Corp. |

649,382 | 52,151,868 | ||||||

|

|

||||||||

| Industrial REITs–2.65% |

||||||||

| Prologis, Inc. |

700,242 | 101,507,080 | ||||||

|

|

||||||||

| Integrated Oil & Gas–0.69% |

||||||||

| Exxon Mobil Corp. |

410,164 | 26,443,273 | ||||||

|

|

||||||||

| Integrated Telecommunication Services–1.59% |

| |||||||

| Verizon Communications, Inc. |

1,146,015 | 60,727,335 | ||||||

|

|

||||||||

| Interactive Home Entertainment–0.39% |

|

|||||||

| Zynga, Inc., Class A(b) |

2,012,694 | 14,853,682 | ||||||

|

|

||||||||

| Interactive Media & Services–3.02% |

|

|||||||

| Alphabet, Inc., Class A(b) |

34,593 | 102,427,106 | ||||||

|

|

||||||||

| Snap, Inc., Class A(b) |

245,233 | 12,894,351 | ||||||

|

|

||||||||

| 115,321,457 | ||||||||

|

|

||||||||

| Internet & Direct Marketing Retail–5.48% |

|

|||||||

| Amazon.com, Inc.(b) |

62,153 | 209,606,642 | ||||||

|

|

||||||||

| Internet Services & Infrastructure–0.60% |

|

|||||||

| Snowflake, Inc., Class A(b) |

64,559 | 22,843,557 | ||||||

|

|

||||||||

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| 7 | Invesco Charter Fund |

| Shares | Value | |||||||

|

|

||||||||

| IT Consulting & Other Services–1.88% |

| |||||||

| Accenture PLC, Class A |

159,896 | $ | 57,369,086 | |||||

|

|

||||||||

| Amdocs Ltd. |

185,067 | 14,405,615 | ||||||

|

|

||||||||

| 71,774,701 | ||||||||

|

|

||||||||

| Life Sciences Tools & Services–0.73% |

| |||||||

| Avantor, Inc.(b) |

690,956 | 27,900,803 | ||||||

|

|

||||||||

| Managed Health Care–2.79% |

| |||||||

| UnitedHealth Group, Inc. |

231,685 | 106,683,992 | ||||||

|

|

||||||||

| Movies & Entertainment–2.42% |

| |||||||

| Netflix, Inc.(b) |

114,270 | 78,881,724 | ||||||

|

|

||||||||

| Warner Music Group Corp., Class A |

274,839 | 13,601,782 | ||||||

|

|

||||||||

| 92,483,506 | ||||||||

|

|

||||||||

| Oil & Gas Refining & Marketing–1.01% |

| |||||||

| Valero Energy Corp. |

500,771 | 38,724,621 | ||||||

|

|

||||||||

| Oil & Gas Storage & Transportation–0.58% |

| |||||||

| Magellan Midstream Partners L.P. |

455,097 | 22,299,753 | ||||||

|

|

||||||||

| Other Diversified Financial Services–1.91% |

| |||||||

| Equitable Holdings, Inc. |

2,181,779 | 73,089,596 | ||||||

|

|

||||||||

| Packaged Foods & Meats–1.07% |

| |||||||

| Mondelez International, Inc., Class A |

674,949 | 40,996,402 | ||||||

|

|

||||||||

| Pharmaceuticals–4.02% |

| |||||||

| AstraZeneca PLC, ADR (United Kingdom) |

999,464 | 62,346,564 | ||||||

|

|

||||||||

| Bayer AG (Germany) |

203,603 | 11,455,892 | ||||||

|

|

||||||||

| Eli Lilly and Co. |

314,127 | 80,026,995 | ||||||

|

|

||||||||

| 153,829,451 | ||||||||

|

|

||||||||

| Property & Casualty Insurance–0.93% |

| |||||||

| Allstate Corp. (The) |

287,055 | 35,500,092 | ||||||

|

|

||||||||

| Railroads–0.93% |

| |||||||

| Union Pacific Corp. |

147,873 | 35,696,542 | ||||||

|

|

||||||||

| Regional Banks–2.21% |

| |||||||

| CIT Group, Inc. |

409,985 | 20,306,557 | ||||||

|

|

||||||||

| First Citizens BancShares, Inc., Class A(c) |

16,854 | 13,717,471 | ||||||

|

|

||||||||

| Signature Bank |

73,088 | 21,767,068 | ||||||

|

|

||||||||

| SVB Financial Group(b) |

40,206 | 28,843,784 | ||||||

|

|

||||||||

| 84,634,880 | ||||||||

|

|

||||||||

| Research & Consulting Services–0.47% |

| |||||||

| TransUnion |

156,333 | 18,023,632 | ||||||

|

|

||||||||

| Investment Abbreviations:

|

| ADR – American Depositary Receipt |

| REIT – Real Estate Investment Trust |

| Shares | Value | |||||||

|

|

||||||||

| Semiconductor Equipment–1.79% |

| |||||||

| Applied Materials, Inc. |

502,227 | $ | 68,629,320 | |||||

|

|

||||||||

| Semiconductors–3.70% |

| |||||||

| Advanced Micro Devices, Inc.(b) |

472,288 | 56,783,186 | ||||||

|

|

||||||||

| QUALCOMM, Inc. |

635,753 | 84,580,579 | ||||||

|

|

||||||||

| 141,363,765 | ||||||||

|

|

||||||||

| Systems Software–8.60% |

| |||||||

| Microsoft Corp. |

782,623 | 259,533,439 | ||||||

|

|

||||||||

| ServiceNow, Inc.(b) |

34,988 | 24,413,227 | ||||||

|

|

||||||||

| VMware, Inc., Class A(b)(c) |

295,945 | 44,894,857 | ||||||

|

|

||||||||

| 328,841,523 | ||||||||

|

|

||||||||

| Technology Hardware, Storage & Peripherals–1.79% |

| |||||||

| Apple, Inc. |

456,950 | 68,451,110 | ||||||

|

|

||||||||

| Thrifts & Mortgage Finance–0.62% |

| |||||||

| Rocket Cos., Inc., Class A |

1,442,874 | 23,778,564 | ||||||

|

|

||||||||

| Total Common Stocks & Other Equity Interests |

|

3,810,641,672 | ||||||

|

|

||||||||

| Money Market Funds–0.17% |

| |||||||

| Invesco Government & Agency Portfolio, Institutional Class, |

2,257,044 | 2,257,044 | ||||||

|

|

||||||||

| Invesco Liquid Assets Portfolio, Institutional Class, 0.01%(d)(e) |

1,783,535 | 1,784,070 | ||||||

|

|

||||||||

| Invesco Treasury Portfolio, Institutional

Class, |

2,579,479 | 2,579,479 | ||||||

|

|

||||||||

| Total Money Market Funds |

|

6,620,593 | ||||||

|

|

||||||||

| TOTAL INVESTMENTS IN SECURITIES (excluding investments purchased with cash collateral from

securities on loan)-99.80% |

|

3,817,262,265 | ||||||

|

|

||||||||

| Investments Purchased with Cash Collateral from Securities on Loan |

| |||||||

| Money Market Funds–1.32% |

| |||||||

| Invesco Private Government Fund, 0.02%(d)(e)(f) |

15,128,732 | 15,128,732 | ||||||

|

|

||||||||

| Invesco Private Prime Fund, |

35,286,260 | 35,300,375 | ||||||

|

|

||||||||

| Total Investments Purchased with Cash Collateral from Securities on Loan |

|

50,429,107 | ||||||

|

|

||||||||

| TOTAL INVESTMENTS IN SECURITIES–101.12% |

|

3,867,691,372 | ||||||

|

|

||||||||

| OTHER ASSETS LESS LIABILITIES–(1.12)% |

|

(42,693,676 | ) | |||||

|

|

||||||||

| NET ASSETS–100.00% |

|

$ | 3,824,997,696 | |||||

|

|

||||||||

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| 8 | Invesco Charter Fund |

Notes to Schedule of Investments:

| (a) | Industry and/or sector classifications used in this report are generally according to the Global Industry Classification Standard, which was developed by and is the exclusive property and a service mark of MSCI Inc. and Standard & Poor’s. |

| (b) | Non-income producing security. |

| (c) | All or a portion of this security was out on loan at October 31, 2021. |

| (d) | Affiliated issuer. The issuer and/or the Fund is a wholly-owned subsidiary of Invesco Ltd., or is affiliated by having an investment adviser that is under common control of Invesco Ltd. The table below shows the Fund’s transactions in, and earnings from, its investments in affiliates for the fiscal year ended October 31, 2021. |

| Value October 31, 2020 |

Purchases at Cost |

Proceeds from Sales |

Change in Unrealized Appreciation (Depreciation) |

Realized Gain |

Value October 31, 2021 |

Dividend Income | |||||||||||||||||||||||||||||

| Investments in Affiliated Money Market Funds: | |||||||||||||||||||||||||||||||||||

| Invesco Government & Agency Portfolio, Institutional Class |

$ | 2,008,474 | $ | 159,983,550 | $ | (159,734,980 | ) | $ | - | $ | - | $ | 2,257,044 | $ | 1,367 | ||||||||||||||||||||

| Invesco Liquid Assets Portfolio, Institutional Class |

2,203,693 | 114,057,734 | (114,477,219 | ) | (535 | ) | 397 | 1,784,070 | 966 | ||||||||||||||||||||||||||

| Invesco Treasury Portfolio, Institutional Class |

2,295,398 | 182,838,343 | (182,554,262 | ) | - | - | 2,579,479 | 634 | |||||||||||||||||||||||||||

| Investments Purchased with Cash Collateral from Securities on Loan: | |||||||||||||||||||||||||||||||||||

| Invesco Private Government Fund |

13,216,103 | 179,059,980 | (177,147,351 | ) | - | - | 15,128,732 | 2,253 | * | ||||||||||||||||||||||||||

| Invesco Private Prime Fund |

19,824,154 | 332,804,846 | (317,328,625 | ) | (224 | ) | 224 | 35,300,375 | 29,163 | * | |||||||||||||||||||||||||

| Total |

$ | 39,547,822 | $ | 968,744,453 | $ | (951,242,437 | ) | $ | (759 | ) | $ | 621 | $ | 57,049,700 | $ | 34,383 | |||||||||||||||||||

| * | Represents the income earned on the investment of cash collateral, which is included in securities lending income on the Statement of Operations. Does not include rebates and fees paid to lending agent or premiums received from borrowers, if any. |

| (e) | The rate shown is the 7-day SEC standardized yield as of October 31, 2021. |

| (f) | The security has been segregated to satisfy the commitment to return the cash collateral received in securities lending transactions upon the borrower’s return of the securities loaned. See Note 1I. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| 9 | Invesco Charter Fund |

Statement of Assets and Liabilities

October 31, 2021

| Assets: |

||||

| Investments in unaffiliated securities, at value |

$3,810,641,672 | |||

|

|

||||

| Investments in affiliated money market funds, at value |

57,049,700 | |||

|

|

||||

| Foreign currencies, at value (Cost $1,458) |

1,516 | |||

|

|

||||

| Receivable for: |

||||

| Investments sold |

9,219,813 | |||

|

|

||||

| Fund shares sold |

203,021 | |||

|

|

||||

| Dividends |

3,731,086 | |||

|

|

||||

| Investment for trustee deferred compensation and retirement plans |

1,692,031 | |||

|

|

||||

| Other assets |

75,930 | |||

|

|

||||

| Total assets |

3,882,614,769 | |||

|

|

||||

| Liabilities: |

||||

| Payable for: |

||||

| Investments purchased |

648,064 | |||

|

|

||||

| Fund shares reacquired |

2,563,143 | |||

|

|

||||

| Collateral upon return of securities loaned |

50,429,107 | |||

|

|

||||

| Accrued fees to affiliates |

1,980,904 | |||

|

|

||||

| Accrued other operating expenses |

188,485 | |||

|

|

||||

| Trustee deferred compensation and retirement plans |

1,807,370 | |||

|

|

||||

| Total liabilities |

57,617,073 | |||

|

|

||||

| Net assets applicable to shares outstanding |

$3,824,997,696 | |||

|

|

||||

| Net assets consist of: |

||||

| Shares of beneficial interest |

$2,075,630,810 | |||

|

|

||||

| Distributable earnings |

1,749,366,886 | |||

|

|

||||

| $3,824,997,696 | ||||

|

|

||||

| Net Assets: |

||||

| Class A |

$ | 3,609,723,557 | ||

|

|

||||

| Class C |

$ | 27,725,256 | ||

|

|

||||

| Class R |

$ | 20,442,306 | ||

|

|

||||

| Class S |

$ | 21,012,625 | ||

|

|

||||

| Class Y |

$ | 116,053,860 | ||

|

|

||||

| Class R5 |

$ | 9,108,746 | ||

|

|

||||

| Class R6 |

$ | 20,931,346 | ||

|

|

||||

| Shares outstanding, no par value, with an unlimited number of shares authorized: |

| |||

| Class A |

164,996,485 | |||

|

|

||||

| Class C |

1,392,591 | |||

|

|

||||

| Class R |

945,020 | |||

|

|

||||

| Class S |

959,862 | |||

|

|

||||

| Class Y |

5,272,982 | |||

|

|

||||

| Class R5 |

391,699 | |||

|

|

||||

| Class R6 |

900,511 | |||

|

|

||||

| Class A: |

||||

| Net asset value per share |

$ | 21.88 | ||

|

|

||||

| Maximum offering price per share |

$ | 23.15 | ||

|

|

||||

| Class C: |

||||

| Net asset value and offering price per share |

$ | 19.91 | ||

|

|

||||

| Class R: |

||||

| Net asset value and offering price per share |

$ | 21.63 | ||

|

|

||||

| Class S: |

||||

| Net asset value and offering price per share |

$ | 21.89 | ||

|

|

||||

| Class Y: |

||||

| Net asset value and offering price per share |

$ | 22.01 | ||

|

|

||||

| Class R5: |

||||

| Net asset value and offering price per share |

$ | 23.25 | ||

|

|

||||

| Class R6: |

||||

| Net asset value and offering price per share |

$ | 23.24 | ||

|

|

||||

| * | At October 31, 2021, securities with an aggregate value of $49,069,097 were on loan to brokers. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| 10 | Invesco Charter Fund |

Statement of Operations

For the year ended October 31, 2021

| Investment income: |

||||

| Dividends (net of foreign withholding taxes of $36,478) |

$ | 49,157,925 | ||

|

|

||||

| Dividends from affiliated money market funds (includes securities lending income of $558,172) |

561,139 | |||

|

|

||||

| Total investment income |

49,719,064 | |||

|

|

||||

| Expenses: |

||||

| Advisory fees |

21,925,465 | |||

|

|

||||

| Administrative services fees |

504,562 | |||

|

|

||||

| Custodian fees |

5,605 | |||

|

|

||||

| Distribution fees: |

||||

| Class A |

8,340,130 | |||

|

|

||||

| Class C |

276,639 | |||

|

|

||||

| Class R |

95,397 | |||

|

|

||||

| Class S |

29,555 | |||

|

|

||||

| Transfer agent fees – A, C, R, S and Y |

4,586,758 | |||

|

|

||||

| Transfer agent fees – R5 |

8,370 | |||

|

|

||||

| Transfer agent fees – R6 |

6,078 | |||

|

|

||||

| Trustees’ and officers’ fees and benefits |

72,656 | |||

|

|

||||

| Registration and filing fees |

118,852 | |||

|

|

||||

| Reports to shareholders |

134,322 | |||

|

|

||||

| Professional services fees |

66,097 | |||

|

|

||||

| Other |

56,961 | |||

|

|

||||

| Total expenses |

36,227,447 | |||

|

|

||||

| Less: Fees waived and/or expense offset arrangement(s) |

(13,815 | ) | ||

|

|

||||

| Net expenses |

36,213,632 | |||

|

|

||||

| Net investment income |

13,505,432 | |||

|

|

||||

| Realized and unrealized gain (loss) from: |

||||

| Net realized gain (loss) from: |

||||

| Unaffiliated investment securities |

521,987,917 | |||

|

|

||||

| Affiliated investment securities |

621 | |||

|

|

||||

| Foreign currencies |

(14,742 | ) | ||

|

|

||||

| 521,973,796 | ||||

|

|

||||

| Change in net unrealized appreciation (depreciation) of: |

||||

| Unaffiliated investment securities |

615,772,954 | |||

|

|

||||

| Affiliated investment securities |

(759 | ) | ||

|

|

||||

| Foreign currencies |

(2,887 | ) | ||

|

|

||||

| 615,769,308 | ||||

|

|

||||

| Net realized and unrealized gain |

1,137,743,104 | |||

|

|

||||

| Net increase in net assets resulting from operations |

$ | 1,151,248,536 | ||

|

|

||||

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| 11 | Invesco Charter Fund |

Statement of Changes in Net Assets

For the years ended October 31, 2021 and 2020

| 2021 | 2020 | |||||||

|

|

||||||||

| Operations: |

||||||||

| Net investment income |

$ | 13,505,432 | $ | 21,571,362 | ||||

|

|

||||||||

| Net realized gain |

521,973,796 | 57,681,020 | ||||||

|

|

||||||||

| Change in net unrealized appreciation |

615,769,308 | 118,558,169 | ||||||

|

|

||||||||

| Net increase in net assets resulting from operations |

1,151,248,536 | 197,810,551 | ||||||

|

|

||||||||

| Distributions to shareholders from distributable earnings: |

||||||||

| Class A |

(72,039,347 | ) | (488,454,497 | ) | ||||

|

|

||||||||

| Class C |

(646,926 | ) | (6,728,167 | ) | ||||

|

|

||||||||

| Class R |

(378,832 | ) | (3,099,805 | ) | ||||

|

|

||||||||

| Class S |

(443,411 | ) | (2,802,798 | ) | ||||

|

|

||||||||

| Class Y |

(2,368,090 | ) | (15,304,355 | ) | ||||

|

|

||||||||

| Class R5 |

(203,608 | ) | (1,394,325 | ) | ||||

|

|

||||||||

| Class R6 |

(461,672 | ) | (3,107,812 | ) | ||||

|

|

||||||||

| Total distributions from distributable earnings |

(76,541,886 | ) | (520,891,759 | ) | ||||

|

|

||||||||

| Share transactions–net: |

||||||||

| Class A |

(221,272,537 | ) | 110,614,848 | |||||

|

|

||||||||

| Class C |

(11,600,194 | ) | (5,090,743 | ) | ||||

|

|

||||||||

| Class R |

(1,874,578 | ) | (1,324,095 | ) | ||||

|

|

||||||||

| Class S |

(1,789,206 | ) | 1,508,504 | |||||

|

|

||||||||

| Class Y |

3,757,091 | (1,746,025 | ) | |||||

|

|

||||||||

| Class R5 |

(1,005,584 | ) | (861,996 | ) | ||||

|

|

||||||||

| Class R6 |

(1,481,654 | ) | (359,119 | ) | ||||

|

|

||||||||

| Net increase (decrease) in net assets resulting from share transactions |

(235,266,662 | ) | 102,741,374 | |||||

|

|

||||||||

| Net increase (decrease) in net assets |

839,439,988 | (220,339,834 | ) | |||||

|

|

||||||||

| Net assets: |

||||||||

| Beginning of year |

2,985,557,708 | 3,205,897,542 | ||||||

|

|

||||||||

| End of year |

$ | 3,824,997,696 | $ | 2,985,557,708 | ||||

|

|

||||||||

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| 12 | Invesco Charter Fund |

The following schedule presents financial highlights for a share of the Fund outstanding throughout the periods indicated.

| Net asset value, beginning of period |

Net investment income (loss)(a) |

Net gains (losses) on securities (both realized and unrealized) |

Total from investment operations |

Dividends from net investment income |

Distributions from net realized gains |

Total distributions |

Net asset value, end of period |

Total return (b) |

Net assets, end of period (000’s omitted) |

Ratio of expenses to average net assets with fee waivers and/or expenses absorbed |

Ratio of expenses to average net assets without fee waivers and/or expenses absorbed |

Ratio of net investment income (loss) to average net assets |

Portfolio turnover (c) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Class A |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/21 |

$ | 15.99 | $ | 0.07 | $ | 6.24 | $ | 6.31 | $ | (0.10 | ) | $ | (0.32 | ) | $ | (0.42 | ) | $ | 21.88 | 40.10 | % | $ | 3,609,724 | 1.03 | % | 1.03 | % | 0.38 | % | 47 | % | |||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/20 |

17.79 | 0.11 | 1.02 | 1.13 | (0.13 | ) | (2.80 | ) | (2.93 | ) | 15.99 | 6.71 | 2,816,198 | 1.07 | 1.07 | 0.70 | 45 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/19 |

17.52 | 0.13 | 1.86 | (d) | 1.99 | (0.07 | ) | (1.65 | ) | (1.72 | ) | 17.79 | 12.96 | (d) | 3,007,391 | 1.07 | 1.07 | 0.74 | 82 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/18 |

18.75 | 0.06 | (0.04 | ) | 0.02 | (0.10 | ) | (1.15 | ) | (1.25 | ) | 17.52 | (0.04 | ) | 2,951,279 | 1.07 | 1.08 | 0.35 | 46 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/17 |

18.31 | 0.09 | 2.29 | 2.38 | (0.17 | ) | (1.77 | ) | (1.94 | ) | 18.75 | 13.83 | 3,363,073 | 1.10 | 1.11 | 0.50 | 30 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Class C |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/21 |

14.61 | (0.07 | ) | 5.69 | 5.62 | – | (0.32 | ) | (0.32 | ) | 19.91 | 39.00 | 27,725 | 1.78 | 1.78 | (0.37 | ) | 47 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/20 |

16.47 | (0.01 | ) | 0.95 | 0.94 | – | (2.80 | ) | (2.80 | ) | 14.61 | 5.96 | 30,607 | 1.82 | 1.82 | (0.05 | ) | 45 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/19 |

16.39 | (0.00 | ) | 1.73 | (d) | 1.73 | – | (1.65 | ) | (1.65 | ) | 16.47 | 12.14 | (d) | 40,493 | 1.82 | 1.82 | (0.01 | ) | 82 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/18 |

17.65 | (0.07 | ) | (0.04 | ) | (0.11 | ) | – | (1.15 | ) | (1.15 | ) | 16.39 | (0.80 | ) | 133,804 | 1.82 | 1.83 | (0.40 | ) | 46 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/17 |

17.32 | (0.04 | ) | 2.16 | 2.12 | (0.02 | ) | (1.77 | ) | (1.79 | ) | 17.65 | 12.98 | 167,073 | 1.85 | 1.86 | (0.25 | ) | 30 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Class R |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/21 |

15.82 | 0.02 | 6.16 | 6.18 | (0.05 | ) | (0.32 | ) | (0.37 | ) | 21.63 | 39.66 | 20,442 | 1.28 | 1.28 | 0.13 | 47 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/20 |

17.62 | 0.07 | 1.01 | 1.08 | (0.08 | ) | (2.80 | ) | (2.88 | ) | 15.82 | 6.46 | 16,500 | 1.32 | 1.32 | 0.45 | 45 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/19 |

17.34 | 0.08 | 1.85 | (d) | 1.93 | – | (1.65 | ) | (1.65 | ) | 17.62 | 12.68 | (d) | 19,772 | 1.32 | 1.32 | 0.49 | 82 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/18 |

18.55 | 0.02 | (0.04 | ) | (0.02 | ) | (0.04 | ) | (1.15 | ) | (1.19 | ) | 17.34 | (0.24 | ) | 23,251 | 1.32 | 1.33 | 0.10 | 46 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/17 |

18.13 | 0.05 | 2.26 | 2.31 | (0.12 | ) | (1.77 | ) | (1.89 | ) | 18.55 | 13.53 | 30,187 | 1.35 | 1.36 | 0.25 | 30 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Class S |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/21 |

16.00 | 0.09 | 6.23 | 6.32 | (0.11 | ) | (0.32 | ) | (0.43 | ) | 21.89 | 40.20 | 21,013 | 0.93 | 0.93 | 0.48 | 47 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/20 |

17.80 | 0.13 | 1.02 | 1.15 | (0.15 | ) | (2.80 | ) | (2.95 | ) | 16.00 | 6.82 | 16,783 | 0.97 | 0.97 | 0.80 | 45 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/19 |

17.53 | 0.14 | 1.87 | (d) | 2.01 | (0.09 | ) | (1.65 | ) | (1.74 | ) | 17.80 | 13.09 | (d) | 16,906 | 0.97 | 0.97 | 0.84 | 82 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/18 |

18.76 | 0.08 | (0.04 | ) | 0.04 | (0.12 | ) | (1.15 | ) | (1.27 | ) | 17.53 | 0.07 | 17,317 | 0.97 | 0.98 | 0.45 | 46 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/17 |

18.32 | 0.11 | 2.28 | 2.39 | (0.18 | ) | (1.77 | ) | (1.95 | ) | 18.76 | 13.94 | 19,028 | 1.00 | 1.01 | 0.60 | 30 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Class Y |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/21 |

16.09 | 0.12 | 6.26 | 6.38 | (0.14 | ) | (0.32 | ) | (0.46 | ) | 22.01 | 40.36 | 116,054 | 0.78 | 0.78 | 0.63 | 47 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/20 |

17.88 | 0.15 | 1.04 | 1.19 | (0.18 | ) | (2.80 | ) | (2.98 | ) | 16.09 | 7.03 | 81,404 | 0.82 | 0.82 | 0.95 | 45 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/19 |

17.61 | 0.17 | 1.87 | (d) | 2.04 | (0.12 | ) | (1.65 | ) | (1.77 | ) | 17.88 | 13.24 | (d) | 93,143 | 0.82 | 0.82 | 0.99 | 82 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/18 |

18.84 | 0.11 | (0.04 | ) | 0.07 | (0.15 | ) | (1.15 | ) | (1.30 | ) | 17.61 | 0.23 | 101,885 | 0.82 | 0.83 | 0.60 | 46 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/17 |

18.39 | 0.14 | 2.29 | 2.43 | (0.21 | ) | (1.77 | ) | (1.98 | ) | 18.84 | 14.13 | 129,285 | 0.85 | 0.86 | 0.75 | 30 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Class R5 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/21 |

16.98 | 0.14 | 6.60 | 6.74 | (0.15 | ) | (0.32 | ) | (0.47 | ) | 23.25 | 40.37 | 9,109 | 0.75 | 0.75 | 0.66 | 47 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/20 |

18.71 | 0.17 | 1.09 | 1.26 | (0.19 | ) | (2.80 | ) | (2.99 | ) | 16.98 | 7.11 | 7,511 | 0.76 | 0.76 | 1.01 | 45 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/19 |

18.34 | 0.19 | 1.96 | (d) | 2.15 | (0.13 | ) | (1.65 | ) | (1.78 | ) | 18.71 | 13.34 | (d) | 9,163 | 0.75 | 0.75 | 1.06 | 82 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/18 |

19.58 | 0.13 | (0.06 | ) | 0.07 | (0.16 | ) | (1.15 | ) | (1.31 | ) | 18.34 | 0.25 | 12,018 | 0.76 | 0.77 | 0.66 | 46 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/17 |

19.05 | 0.16 | 2.38 | 2.54 | (0.24 | ) | (1.77 | ) | (2.01 | ) | 19.58 | 14.19 | 29,835 | 0.77 | 0.78 | 0.83 | 30 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Class R6 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/21 |

16.97 | 0.15 | 6.60 | 6.75 | (0.16 | ) | (0.32 | ) | (0.48 | ) | 23.24 | 40.49 | 20,931 | 0.68 | 0.68 | 0.73 | 47 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/20 |

18.70 | 0.18 | 1.09 | 1.27 | (0.20 | ) | (2.80 | ) | (3.00 | ) | 16.97 | 7.19 | 16,553 | 0.69 | 0.69 | 1.08 | 45 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/19 |

18.34 | 0.20 | 1.95 | (d) | 2.15 | (0.14 | ) | (1.65 | ) | (1.79 | ) | 18.70 | 13.38 | (d) | 19,030 | 0.69 | 0.69 | 1.12 | 82 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/18 |

19.58 | 0.14 | (0.05 | ) | 0.09 | (0.18 | ) | (1.15 | ) | (1.33 | ) | 18.34 | 0.34 | 20,404 | 0.69 | 0.70 | 0.73 | 46 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/17 |

19.05 | 0.17 | 2.38 | 2.55 | (0.25 | ) | (1.77 | ) | (2.02 | ) | 19.58 | 14.27 | 18,290 | 0.69 | 0.70 | 0.91 | 30 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (a) | Calculated using average shares outstanding. |

| (b) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Does not include sales charges and is not annualized for periods less than one year, if applicable. |

| (c) | Portfolio turnover is calculated at the fund level and is not annualized for periods less than one year, if applicable. |

| (d) | Includes litigation proceeds received during the year ended October 31, 2019. Had these litigation proceeds not been received, Net gains (losses) on securities (both realized and unrealized) per share would have been $1.81, $1.68, $1.80, $1.82, $1.82, $1.91 and $1.90 for Class A, Class C, Class R, Class S, Class Y, Class R5, and Class R6 shares, respectively. |

| Total returns would have been lower. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| 13 | Invesco Charter Fund |

October 31, 2021

NOTE 1–Significant Accounting Policies

Invesco Charter Fund (the “Fund”) is a series portfolio of AIM Equity Funds (Invesco Equity Funds) (the “Trust”). The Trust is a Delaware statutory trust registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end series management investment company authorized to issue an unlimited number of shares of beneficial interest. Information presented in these financial statements pertains only to the Fund. Matters affecting the Fund or each class will be voted on exclusively by the shareholders of the Fund or each class.

The Fund’s investment objective is long-term growth of capital.

The Fund currently consists of seven different classes of shares: Class A, Class C, Class R, Class S, Class Y, Class R5 and Class R6. Class Y shares are available only to certain investors. Class A shares are sold with a front-end sales charge unless certain waiver criteria are met. Under certain circumstances, load waived shares may be subject to contingent deferred sales charges (“CDSC”). Class C shares are sold with a CDSC. Class R, Class S, Class Y, Class R5 and Class R6 shares are sold at net asset value. Class C shares held for eight years after purchase are eligible for automatic conversion into Class A shares of the same Fund (the “Conversion Feature”). The automatic conversion pursuant to the Conversion Feature will generally occur at the end of the month following the eighth anniversary after a purchase of Class C shares.

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 946, Financial Services – Investment Companies.

The following is a summary of the significant accounting policies followed by the Fund in the preparation of its financial statements.

| A. | Security Valuations – Securities, including restricted securities, are valued according to the following policy. |

A security listed or traded on an exchange (except convertible securities) is valued at its last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded, or lacking any sales or official closing price on a particular day, the security may be valued at the closing bid price on that day. Securities traded in the over-the-counter market are valued based on prices furnished by independent pricing services or market makers. When such securities are valued by an independent pricing service they may be considered fair valued. Futures contracts are valued at the final settlement price set by an exchange on which they are principally traded. Listed options are valued at the mean between the last bid and asked prices from the exchange on which they are principally traded. Options not listed on an exchange are valued by an independent source at the mean between the last bid and asked prices. For purposes of determining net asset value (“NAV”) per share, futures and option contracts generally are valued 15 minutes after the close of the customary trading session of the New York Stock Exchange (“NYSE”).

Investments in open-end and closed-end registered investment companies that do not trade on an exchange are valued at the end-of-day net asset value per share. Investments in open-end and closed-end registered investment companies that trade on an exchange are valued at the last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded.

Debt obligations (including convertible securities) and unlisted equities are fair valued using an evaluated quote provided by an independent pricing service. Evaluated quotes provided by the pricing service may be determined without exclusive reliance on quoted prices, and may reflect appropriate factors such as institution-size trading in similar groups of securities, developments related to specific securities, dividend rate (for unlisted equities), yield (for debt obligations), quality, type of issue, coupon rate (for debt obligations), maturity (for debt obligations), individual trading characteristics and other market data. Pricing services generally value debt obligations assuming orderly transactions of institutional round lot size, but a fund may hold or transact in the same securities in smaller, odd lot sizes. Odd lots often trade at lower prices than institutional round lots. Debt obligations are subject to interest rate and credit risks. In addition, all debt obligations involve some risk of default with respect to interest and/or principal payments.

Foreign securities’ (including foreign exchange contracts) prices are converted into U.S. dollar amounts using the applicable exchange rates as of the close of the NYSE. If market quotations are available and reliable for foreign exchange-traded equity securities, the securities will be valued at the market quotations. Because trading hours for certain foreign securities end before the close of the NYSE, closing market quotations may become unreliable. If between the time trading ends on a particular security and the close of the customary trading session on the NYSE, events occur that the investment adviser determines are significant and make the closing price unreliable, the Fund may fair value the security. If the event is likely to have affected the closing price of the security, the security will be valued at fair value in good faith using procedures approved by the Board of Trustees. Adjustments to closing prices to reflect fair value may also be based on a screening process of an independent pricing service to indicate the degree of certainty, based on historical data, that the closing price in the principal market where a foreign security trades is not the current value as of the close of the NYSE. Foreign securities’ prices meeting the approved degree of certainty that the price is not reflective of current value will be priced at the indication of fair value from the independent pricing service. Multiple factors may be considered by the independent pricing service in determining adjustments to reflect fair value and may include information relating to sector indices, American Depositary Receipts and domestic and foreign index futures. Foreign securities may have additional risks including exchange rate changes, potential for sharply devalued currencies and high inflation, political and economic upheaval, the relative lack of issuer information, relatively low market liquidity and the potential lack of strict financial and accounting controls and standards.

Securities for which market prices are not provided by any of the above methods may be valued based upon quotes furnished by independent sources. The last bid price may be used to value equity securities. The mean between the last bid and asked prices is used to value debt obligations, including corporate loans.

Securities for which market quotations are not readily available or became unreliable are valued at fair value as determined in good faith by or under the supervision of the Trust’s officers following procedures approved by the Board of Trustees. Issuer specific events, market trends, bid/asked quotes of brokers and information providers and other market data may be reviewed in the course of making a good faith determination of a security’s fair value.

The Fund may invest in securities that are subject to interest rate risk, meaning the risk that the prices will generally fall as interest rates rise and, conversely, the prices will generally rise as interest rates fall. Specific securities differ in their sensitivity to changes in interest rates depending on their individual characteristics. Changes in interest rates may result in increased market volatility, which may affect the value and/or liquidity of certain Fund investments.

Valuations change in response to many factors including the historical and prospective earnings of the issuer, the value of the issuer’s assets, general market conditions which are not specifically related to the particular issuer, such as real or perceived adverse economic conditions, changes in the general outlook for revenues or corporate earnings, changes in interest or currency rates, regional or global instability, natural or environmental disasters, widespread disease or other public health issues, war, acts of terrorism or adverse investor sentiment generally and market liquidity. Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon actual sale of those investments.

| B. | Securities Transactions and Investment Income – Securities transactions are accounted for on a trade date basis. Realized gains or losses on sales are computed on the basis of specific identification of the securities sold. Interest income (net of withholding tax, if any) is recorded on an accrual basis from settlement date and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Dividend income (net of withholding tax, if any) is recorded on the ex-dividend date. |

The Fund may periodically participate in litigation related to Fund investments. As such, the Fund may receive proceeds from litigation settlements. Any proceeds received are included in the Statement of Operations as realized gain (loss) for investments no longer held and as unrealized gain (loss) for investments still held.

| 14 | Invesco Charter Fund |

Brokerage commissions and mark ups are considered transaction costs and are recorded as an increase to the cost basis of securities purchased and/or a reduction of proceeds on a sale of securities. Such transaction costs are included in the determination of net realized and unrealized gain (loss) from investment securities reported in the Statement of Operations and the Statement of Changes in Net Assets and the net realized and unrealized gains (losses) on securities per share in the Financial Highlights. Transaction costs are included in the calculation of the Fund’s net asset value and, accordingly, they reduce the Fund’s total returns. These transaction costs are not considered operating expenses and are not reflected in net investment income reported in the Statement of Operations and the Statement of Changes in Net Assets, or the net investment income per share and the ratios of expenses and net investment income reported in the Financial Highlights, nor are they limited by any expense limitation arrangements between the Fund and the investment adviser.

The Fund allocates income and realized and unrealized capital gains and losses to a class based on the relative net assets of each class.

| C. | Country Determination – For the purposes of making investment selection decisions and presentation in the Schedule of Investments, the investment adviser may determine the country in which an issuer is located and/or credit risk exposure based on various factors. These factors include the laws of the country under which the issuer is organized, where the issuer maintains a principal office, the country in which the issuer derives 50% or more of its total revenues and the country that has the primary market for the issuer’s securities, as well as other criteria. Among the other criteria that may be evaluated for making this determination are the country in which the issuer maintains 50% or more of its assets, the type of security, financial guarantees and enhancements, the nature of the collateral and the sponsor organization. Country of issuer and/or credit risk exposure has been determined to be the United States of America, unless otherwise noted. |

| D. | Distributions – Distributions from net investment income and net realized capital gain, if any, are generally declared and paid annually and recorded on the ex-dividend date. The Fund may elect to treat a portion of the proceeds from redemptions as distributions for federal income tax purposes. |

| E. | Federal Income Taxes – The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), necessary to qualify as a regulated investment company and to distribute substantially all of the Fund’s taxable earnings to shareholders. As such, the Fund will not be subject to federal income taxes on otherwise taxable income (including net realized capital gain) that is distributed to shareholders. Therefore, no provision for federal income taxes is recorded in the financial statements. |

The Fund recognizes the tax benefits of uncertain tax positions only when the position is more likely than not to be sustained. Management has analyzed the Fund’s uncertain tax positions and concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions. Management is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months.

The Fund files tax returns in the U.S. Federal jurisdiction and certain other jurisdictions. Generally, the Fund is subject to examinations by such taxing authorities for up to three years after the filing of the return for the tax period.

| F. | Expenses – Fees provided for under the Rule 12b-1 plan of a particular class of the Fund are charged to the operations of such class. Transfer agency fees and expenses and other shareholder recordkeeping fees and expenses attributable to Class R5 and Class R6 are allocated based on relative net assets of Class R5 and Class R6. Sub-accounting fees attributable to Class R5 are charged to the operations of the class. Transfer agency fees and expenses and other shareholder recordkeeping fees and expenses relating to all other classes are allocated among those classes based on relative net assets. All other expenses are allocated among the classes based on relative net assets. |

| G. | Accounting Estimates – The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period including estimates and assumptions related to taxation. Actual results could differ from those estimates by a significant amount. In addition, the Fund monitors for material events or transactions that may occur or become known after the period-end date and before the date the financial statements are released to print. |

| H. | Indemnifications – Under the Trust’s organizational documents, each Trustee, officer, employee or other agent of the Trust is indemnified against certain liabilities that may arise out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts, including the Fund’s servicing agreements, that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss as a result of such indemnification claims is considered remote. |

| I. | Securities Lending – The Fund may lend portfolio securities having a market value up to one-third of the Fund’s total assets. Such loans are secured by collateral equal to no less than the market value of the loaned securities determined daily by the securities lending provider. Such collateral will be cash or debt securities issued or guaranteed by the U.S. Government or any of its sponsored agencies. Cash collateral received in connection with these loans is invested in short-term money market instruments or affiliated, unregistered investment companies that comply with Rule 2a-7 under the Investment Company Act and money market funds (collectively, “affiliated money market funds”) and is shown as such on the Schedule of Investments. The Fund bears the risk of loss with respect to the investment of collateral. It is the Fund’s policy to obtain additional collateral from or return excess collateral to the borrower by the end of the next business day, following the valuation date of the securities loaned. Therefore, the value of the collateral held may be temporarily less than the value of the securities on loan. When loaning securities, the Fund retains certain benefits of owning the securities, including the economic equivalent of dividends or interest generated by the security. Lending securities entails a risk of loss to the Fund if, and to the extent that, the market value of the securities loaned were to increase and the borrower did not increase the collateral accordingly, and the borrower failed to return the securities. The securities loaned are subject to termination at the option of the borrower or the Fund. Upon termination, the borrower will return to the Fund the securities loaned and the Fund will return the collateral. Upon the failure of the borrower to return the securities, collateral may be liquidated and the securities may be purchased on the open market to replace the loaned securities. The Fund could experience delays and costs in gaining access to the collateral and the securities may lose value during the delay which could result in potential losses to the Fund. Some of these losses may be indemnified by the lending agent. The Fund bears the risk of any deficiency in the amount of the collateral available for return to the borrower due to any loss on the collateral invested. Dividends received on cash collateral investments for securities lending transactions, which are net of compensation to counterparties, are included in Dividends from affiliated money market funds on the Statement of Operations. The aggregate value of securities out on loan, if any, is shown as a footnote on the Statement of Assets and Liabilities. |

On September 29, 2021, the Board of Trustees appointed Invesco Advisers, Inc. (the “Adviser” or “Invesco”) to serve as an affiliated securities lending agent for the Fund. Prior to September 29, 2021, the Bank of New York Mellon (“BNYM”) served as the sole securities lending agent for the Fund under the securities lending program. BNYM also continues to serve as a lending agent. To the extent the Fund utilizes the Adviser as an affiliated securities lending agent, the Fund conducts its securities lending in accordance with, and in reliance upon, no-action letters issued by the SEC staff that provide guidance on how an affiliate may act as a direct agent lender and receive compensation for those services in a manner consistent with the federal securities laws. For the year ended October 31, 2021, there were no securities lending transactions with the Adviser.

| J. | Foreign Currency Translations – Foreign currency is valued at the close of the NYSE based on quotations posted by banks and major currency dealers. Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of portfolio securities (net of foreign taxes withheld on disposition) and income items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. The Fund does not separately account for the portion of the results of operations resulting from changes in foreign exchange rates on investments and the fluctuations arising from changes in market prices of securities held. The combined results of changes in foreign exchange rates and the fluctuation of market prices on investments (net of estimated foreign tax withholding) are included with the net realized and unrealized gain or loss from investments in the Statement of Operations. Reported net realized foreign currency gains or losses arise from (1) sales of foreign currencies, (2) currency gains or losses realized between the trade and settlement dates on securities transactions, and (3) the difference between the amounts of dividends, |

| 15 | Invesco Charter Fund |

| interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign currency gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities at fiscal period end, resulting from changes in exchange rates. |

The Fund may invest in foreign securities, which may be subject to foreign taxes on income, gains on investments or currency repatriation, a portion of which may be recoverable. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests and are shown in the Statement of Operations.

| K. | Forward Foreign Currency Contracts – The Fund may engage in foreign currency transactions either on a spot (i.e. for prompt delivery and settlement) basis, or through forward foreign currency contracts, to manage or minimize currency or exchange rate risk. |

The Fund may also enter into forward foreign currency contracts for the purchase or sale of a security denominated in a foreign currency in order to “lock in” the U.S. dollar price of that security, or the Fund may also enter into forward foreign currency contracts that do not provide for physical settlement of the two currencies, but instead are settled by a single cash payment calculated as the difference between the agreed upon exchange rate and the spot rate at settlement based upon an agreed upon notional amount (non-deliverable forwards). The Fund will set aside liquid assets in an amount equal to the daily mark-to-market obligation for forward foreign currency contracts.

A forward foreign currency contract is an obligation between two parties (“Counterparties”) to purchase or sell a specific currency for an agreed-upon price at a future date. The use of forward foreign currency contracts does not eliminate fluctuations in the price of the underlying securities the Fund owns or intends to acquire but establishes a rate of exchange in advance. Fluctuations in the value of these contracts are measured by the difference in the contract date and reporting date exchange rates and are recorded as unrealized appreciation (depreciation) until the contracts are closed. When the contracts are closed, realized gains (losses) are recorded. Realized and unrealized gains (losses) on the contracts are included in the Statement of Operations. The primary risks associated with forward foreign currency contracts include failure of the Counterparty to meet the terms of the contract and the value of the foreign currency changing unfavorably. These risks may be in excess of the amounts reflected in the Statement of Assets and Liabilities.

| L. | COVID-19 Risk – The COVID-19 strain of coronavirus has resulted in instances of market closures and dislocations, extreme volatility, liquidity constraints and increased trading costs. Efforts to contain its spread have resulted in travel restrictions, disruptions of healthcare systems, business operations and supply chains, layoffs, lower consumer demand, and defaults, among other significant economic impacts that have disrupted global economic activity across many industries. Such economic impacts may exacerbate other pre-existing political, social and economic risks locally or globally. |

The ongoing effects of COVID-19 are unpredictable and may result in significant and prolonged effects on the Fund’s performance.

NOTE 2–Advisory Fees and Other Fees Paid to Affiliates

The Trust has entered into a master investment advisory agreement with the Adviser. Under the terms of the investment advisory agreement, the Fund accrues daily and pays monthly an advisory fee to the Adviser based on the annual rate of the Fund’s average daily net assets as follows:

| Average Daily Net Assets | Rate | |||||

|

|

||||||

| First $ 250 million |

0.695% | |||||

|

|

||||||

| Next $4.05 billion |

0.615% | |||||

|

|

||||||

| Next $3.9 billion |

0.570% | |||||

|

|

||||||

| Next $1.8 billion |

0.545% | |||||

|

|

||||||

| Over $10 billion |

0.520% | |||||

|

|

||||||

For the year ended October 31, 2021, the effective advisory fee rate incurred by the Fund was 0.62%.

Under the terms of a master sub-advisory agreement between the Adviser and each of Invesco Asset Management Deutschland GmbH, Invesco Asset Management Limited, Invesco Asset Management (Japan) Limited, Invesco Hong Kong Limited, Invesco Senior Secured Management, Inc. and Invesco Canada Ltd. (collectively, the “Affiliated Sub-Advisers”) the Adviser, not the Fund, will pay 40% of the fees paid to the Adviser to any such Affiliated Sub-Adviser(s) that provide(s) discretionary investment management services to the Fund based on the percentage of assets allocated to such Affiliated Sub-Adviser(s).