| Class A, C, R and Y | Invesco Charter Fund | ||||||||||||||||||||||||||||||||||||||||||||||||||

| <b>Fund Summary </b> | ||||||||||||||||||||||||||||||||||||||||||||||||||

| <b>Investment Objective(s) </b> | ||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fund’s investment objective is long-term growth of capital. | ||||||||||||||||||||||||||||||||||||||||||||||||||

| <b>Fees and Expenses of the Fund </b> | ||||||||||||||||||||||||||||||||||||||||||||||||||

| This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the Invesco Funds. More information about these and other discounts is available from your financial professional and in the section “Shareholder Account Information – Initial Sales Charges (Class A Shares Only)” on page A-3 of the prospectus and the section “Purchase, Redemption and Pricing of Shares-Purchase and Redemption of Shares” on page L-1 of the statement of additional information (SAI). Investors may pay commissions and/or other forms of compensation to an intermediary, such as a broker, for transactions in Class Y shares, which are not reflected in the table or the Example below. | ||||||||||||||||||||||||||||||||||||||||||||||||||

| <b>Shareholder Fees</b> (fees paid directly from your investment) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||

| <b>Annual Fund Operating Expenses</b> (expenses that you pay each year as a percentage of the value of your investment) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||

| <b>Example.</b> | ||||||||||||||||||||||||||||||||||||||||||||||||||

| This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. This Example does not include commissions and/or other forms of compensation that investors may pay on transactions in Class Y shares. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain equal to the Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement in the first year and the Total Annual Fund Operating Expenses thereafter. Although your actual costs may be higher or lower, based on these assumptions, your costs would be: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||

| You would pay the following expenses if you did not redeem your shares: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||

| <b>Portfolio Turnover.</b> | ||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 46% of the average value of its portfolio. | ||||||||||||||||||||||||||||||||||||||||||||||||||

| <b>Principal Investment Strategies of the Fund </b> | ||||||||||||||||||||||||||||||||||||||||||||||||||

| The portfolio management team seeks to construct a portfolio of issuers that have high or improving return on invested capital, quality management, a strong competitive position and that are trading at attractive valuations. The Fund invests primarily in equity securities. The principal type of equity securities in which the Fund invests is common stock. The Fund may invest in the securities of issuers of all capitalization sizes and, a substantial number of the issuers in which the Fund invests are large-capitalization issuers. The Fund may invest up to 25% of its net assets in foreign securities, which include foreign debt and foreign equity securities. The Fund employs a risk management strategy to help minimize loss of capital and reduce excessive volatility. Pursuant to this strategy, the Fund generally invests a substantial amount of its assets in cash and cash equivalents (including money market funds). As a result, the Fund may not achieve its investment objective. The Fund can invest in derivative instruments, including futures contracts and forward foreign currency contracts. The Fund can use futures contracts, including index futures, to gain exposure to the broad market by equitizing cash and as a hedge against downside risk. The Fund can use forward foreign currency contracts to hedge against adverse movements in the foreign currencies in which portfolio securities are denominated. In selecting securities for the Fund, the portfolio manager conducts fundamental research of issuers to gain a thorough understanding of their business prospects, appreciation potential and return on invested capital. The process the portfolio manager uses to identify potential investments for the Fund includes three phases: financial analysis, business analysis and valuation analysis. Financial analysis evaluates an issuer’s capital allocation, and provides vital insight into historical and potential return on invested capital, which is a key indicator of business quality and caliber of management. Business analysis allows the team to determine an issuer’s competitive positioning by identifying key drivers of the issuer, understanding industry challenges and evaluating the sustainability of competitive advantages. Both the financial and business analyses serve as a basis to construct valuation models that help estimate an issuer’s value. The portfolio manager uses three primary valuation techniques: discounted cash flow, traditional valuation multiples and net asset value. At the conclusion of the research process, the portfolio manager will generally invest in an issuer when they have determined it potentially has high or improving return on invested capital, quality management, a strong competitive position and is trading at an attractive valuation. The portfolio manager considers selling a security when it exceeds the target price, has not shown a demonstrable improvement in fundamentals or a more compelling investment opportunity exists. | ||||||||||||||||||||||||||||||||||||||||||||||||||

| <b>Principal Risks of Investing in the Fund </b> | ||||||||||||||||||||||||||||||||||||||||||||||||||

| As with any mutual fund investment, loss of money is a risk of investing. An investment in the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. The risks associated with an investment in the Fund can increase during times of significant market volatility. The principal risks of investing in the Fund are: Cash/Cash Equivalents Risk. In rising markets, holding cash or cash equivalents will negatively affect the Fund’s performance relative to its benchmark. Debt Securities Risk. The prices of debt securities held by the Fund will be affected by changes in interest rates, the creditworthiness of the issuer and other factors. An increase in prevailing interest rates typically causes the value of existing debt securities to fall and often has a greater impact on longer-duration debt securities and higher quality debt securities. Falling interest rates will cause the Fund to reinvest the proceeds of debt securities that have been repaid by the issuer at lower interest rates. Falling interest rates may also reduce the Fund’s distributable income because interest payments on floating rate debt instruments held by the Fund will decline. The Fund could lose money on investments in debt securities if the issuer or borrower fails to meet its obligations to make interest payments and/or to repay principal in a timely manner. Changes in an issuer’s financial strength, the market’s perception of such strength or in the credit rating of the issuer or the security may affect the value of debt securities. The Adviser’s credit analysis may fail to anticipate such changes, which could result in buying a debt security at an inopportune time or failing to sell a debt security in advance of a price decline or other credit event. Derivatives Risk. The value of a derivative instrument depends largely on (and is derived from) the value of an underlying security, currency, commodity, interest rate, index or other asset (each referred to as an underlying asset). In addition to risks relating to the underlying assets, the use of derivatives may include other, possibly greater, risks, including counterparty, leverage and liquidity risks. Counterparty risk is the risk that the counterparty to the derivative contract will default on its obligation to pay the Fund the amount owed or otherwise perform under the derivative contract. Derivatives create leverage risk because they do not require payment up front equal to the economic exposure created by holding a position in the derivative. As a result, an adverse change in the value of the underlying asset could result in the Fund sustaining a loss that is substantially greater than the amount invested in the derivative or the anticipated value of the underlying asset, which may make the Fund’s returns more volatile and increase the risk of loss. Derivative instruments may also be less liquid than more traditional investments and the Fund may be unable to sell or close out its derivative positions at a desirable time or price. This risk may be more acute under adverse market conditions, during which the Fund may be most in need of liquidating its derivative positions. Derivatives may also be harder to value, less tax efficient and subject to changing government regulation that could impact the Fund’s ability to use certain derivatives or their cost. Derivatives strategies may not always be successful. For example, derivatives used for hedging or to gain or limit exposure to a particular market segment may not provide the expected benefits, particularly during adverse market conditions. Foreign Securities Risk. The Fund's foreign investments may be adversely affected by political and social instability, changes in economic or taxation policies, difficulty in enforcing obligations, decreased liquidity or increased volatility. Foreign investments also involve the risk of the possible seizure, nationalization or expropriation of the issuer or foreign deposits (in which the Fund could lose its entire investments in a certain market) and the possible adoption of foreign governmental restrictions such as exchange controls. Unless the Fund has hedged its foreign securities risk, foreign securities risk also involves the risk of negative foreign currency rate fluctuations, which may cause the value of securities denominated in such foreign currency (or other instruments through which the Fund has exposure to foreign currencies) to decline in value. Currency exchange rates may fluctuate significantly over short periods of time. Currency hedging strategies, if used, are not always successful. Management Risk. The Fund is actively managed and depends heavily on the Adviser’s judgment about markets, interest rates or the attractiveness, relative values, liquidity, or potential appreciation of particular investments made for the Fund’s portfolio. The Fund could experience losses if these judgments prove to be incorrect. Additionally, legislative, regulatory, or tax developments may adversely affect management of the Fund and, therefore, the ability of the Fund to achieve its investment objective. Market Risk. The market values of the Fund’s investments, and therefore the value of the Fund’s shares, will go up and down, sometimes rapidly or unpredictably. Market risk may affect a single issuer, industry or section of the economy, or it may affect the market as a whole. Individual stock prices tend to go up and down more dramatically than those of certain other types of investments, such as bonds. During a general downturn in the financial markets, multiple asset classes may decline in value. When markets perform well, there can be no assurance that specific investments held by the Fund will rise in value. Small- and Mid-Capitalization Companies Risks. Small- and mid-capitalization companies tend to be more vulnerable to changing market conditions, may have little or no operating history or track record of success, and may have more limited product lines and markets, less experienced management and fewer financial resources than larger companies. These companies’ securities may be more volatile and less liquid than those of more established companies, and their returns may vary, sometimes significantly, from the overall securities market. | ||||||||||||||||||||||||||||||||||||||||||||||||||

| <b>Performance Information </b> | ||||||||||||||||||||||||||||||||||||||||||||||||||

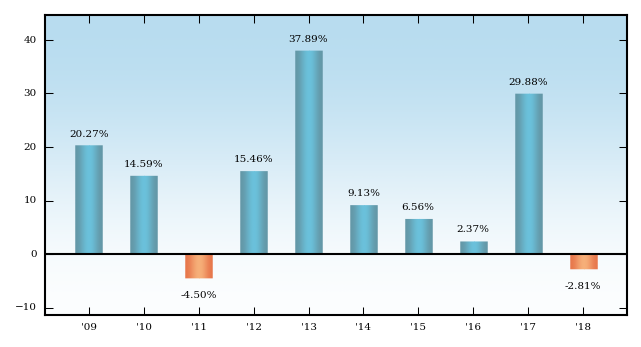

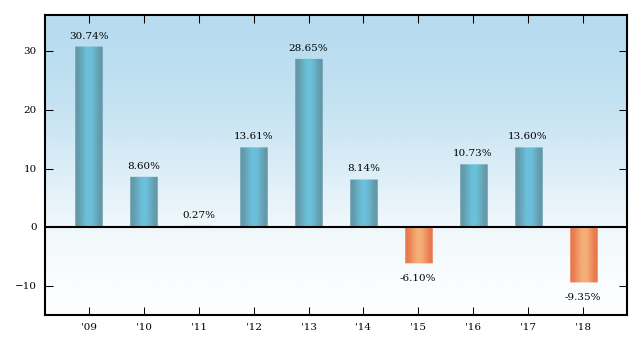

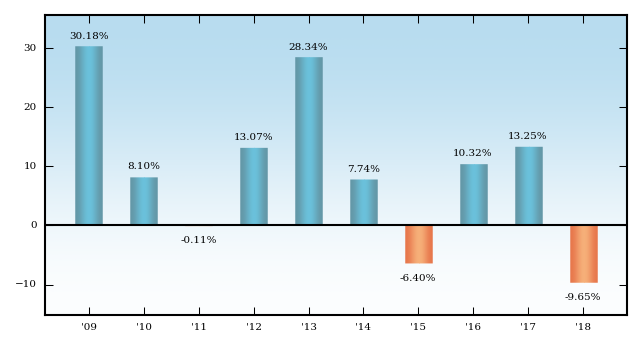

| The bar chart and performance table provide an indication of the risks of investing in the Fund. The bar chart shows changes in the performance of the Fund from year to year as of December 31. The performance table compares the Fund's performance to that of a style-specific benchmark, a broad-based securities market benchmark and a peer group benchmark comprised of funds with investment objectives and strategies similar to those of the Fund (in that order). For more information on the benchmarks used see the “Benchmark Descriptions” section in the prospectus. The Fund's past performance (before and after taxes) is not necessarily an indication of its future performance. Updated performance information is available on the Fund's website at www.invesco.com/us. | ||||||||||||||||||||||||||||||||||||||||||||||||||

| <b>Annual Total Returns </b> | ||||||||||||||||||||||||||||||||||||||||||||||||||

| The bar chart does not reflect sales loads. If it did, the annual total returns shown would be lower. | ||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||

| Best Quarter (ended June 30, 2009): 16.50% Worst Quarter (ended December 31, 2018): -14.07% | ||||||||||||||||||||||||||||||||||||||||||||||||||

| <b>Average Annual Total Returns</b> (for the periods ended December 31, 2018) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||

| After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who hold their Fund shares through tax-advantaged arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown for Class A shares only and after-tax returns for other classes will vary. | ||||||||||||||||||||||||||||||||||||||||||||||||||