UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark one)

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2017

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to ______________.

Commission file number: 000-24477

DIFFUSION PHARMACEUTICALS INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

30-0645032 |

|

(State of other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

1317 Carlton Avenue, Suite 400

Charlottesville, VA 22902

(Address of principal executive offices, including zip code)

(434) 220-0718

(Registrant’s telephone number including area code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐ |

Accelerated filer ☐ |

|

Non-accelerated filer ☐ (Do not check if a smaller reporting company) |

Smaller reporting company ☒ |

|

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).Yes ☐ No ☒

The number of shares of common stock outstanding at November 10, 2017 was 14,521,730 shares.

DIFFUSION PHARMACEUTICALS INC.

FORM 10-Q

SEPTEMBER 30, 2017

INDEX

|

Page |

|

|

PART I – FINANCIAL INFORMATION |

1 |

|

ITEM 1. FINANCIAL STATEMENTS |

1 |

|

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

21 |

|

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

31 |

|

ITEM 4. CONTROLS AND PROCEDURES |

31 |

|

PART II – OTHER INFORMATION |

32 |

|

ITEM 1. LEGAL PROCEEDINGS |

32 |

|

ITEM 1A. RISK FACTORS |

32 |

|

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS |

32 |

|

ITEM 3. DEFAULTS UPON SENIOR SECURITIES |

32 |

|

ITEM 4. MINE SAFETY DISCLOSURES |

32 |

|

ITEM 5. OTHER INFORMATION |

32 |

|

ITEM 6. EXHIBITS |

32 |

Unless the context otherwise requires, in this report, references to the “Company,” “we,” “our” or “us” refer to Diffusion Pharmaceuticals Inc. and its subsidiaries, references to “common stock” refer to the common stock, par value $0.001 per share, of the Company and references to "Series A convertible preferred stock" refer to the Series A convertible preferred stock, par value $0.001 per share, of the Company. On August 17, 2016, the Company effected a 1-for-10 reverse split of its common stock. Unless noted otherwise, any share or per share amounts in this report, the accompanying unaudited condensed consolidated financial statements and related notes give retroactive effect to this reverse stock split.

This report contains the following trademarks, trade names and service marks of ours: Diffusion. All other trade names, trademarks and service marks appearing in this quarterly report on Form 10-Q are the property of their respective owners. We have assumed that the reader understands that all such terms are source-indicating. Accordingly, such terms appear without the trade name, trademark or service mark notice for convenience only and should not be construed as being used in a descriptive or generic sense.

PART I – FINANCIAL INFORMATION

|

ITEM 1. |

FINANCIAL STATEMENTS |

Diffusion Pharmaceuticals Inc.

Condensed Consolidated Balance Sheets

(unaudited)

|

September 30, 2017 |

December 31, 2016 |

|||||||

|

Assets |

||||||||

|

Current assets: |

||||||||

|

Cash and cash equivalents |

$ | 1,216,000 | $ | 1,552,852 | ||||

|

Certificate of deposit |

10,020,164 | — | ||||||

|

Prepaid expenses, deposits and other current assets |

1,004,361 | 50,844 | ||||||

|

Total current assets |

12,240,525 | 1,603,696 | ||||||

|

Property and equipment, net |

479,647 | 79,755 | ||||||

|

Intangible asset |

8,639,000 | 8,639,000 | ||||||

|

Goodwill |

6,929,258 | 6,929,258 | ||||||

|

Other assets |

38,813 | 232,675 | ||||||

|

Total assets |

$ | 28,327,243 | $ | 17,484,384 | ||||

|

Liabilities, Convertible Preferred Stock and Stockholders’ Equity |

||||||||

|

Current liabilities: |

||||||||

|

Current portion of convertible debt |

$ | 550,000 | $ | 1,880,000 | ||||

|

Accounts payable |

409,423 | 1,684,158 | ||||||

|

Accrued expenses and other current liabilities |

1,415,707 | 874,264 | ||||||

|

Common stock warrant liability |

16,316,054 | — | ||||||

|

Total current liabilities |

18,691,184 | 4,438,422 | ||||||

|

Convertible debt, net of current portion |

— | 550,000 | ||||||

|

Deferred income taxes |

3,279,363 | 3,279,363 | ||||||

|

Other liabilities |

— | 31,915 | ||||||

|

Total liabilities |

21,970,547 | 8,299,700 | ||||||

|

Commitments and Contingencies |

||||||||

|

Convertible preferred stock, $0.001 par value: |

||||||||

|

Series A - 13,750,000 shares authorized, 12,376,329 and 8,324,032 shares issued and outstanding, respectively at September 30, 2017; No shares authorized, issued or outstanding at December 31, 2016 (liquidation value of $16,814,360 at September 30, 2017) |

— | — | ||||||

|

Total convertible preferred stock |

— | — | ||||||

|

Stockholders’ Equity: |

||||||||

|

Common stock, $0.001 par value: |

||||||||

|

1,000,000,000 shares authorized; 14,503,976 and 10,345,637 shares issued and outstanding at September 30, 2017 and December 31, 2016, respectively |

14,504 | 10,346 | ||||||

|

Additional paid-in capital |

69,686,744 | 69,363,575 | ||||||

|

Accumulated deficit |

(63,344,552 |

) |

(60,189,237 |

) |

||||

|

Total stockholders' equity |

6,356,696 | 9,184,684 | ||||||

|

Total liabilities, convertible preferred stock and stockholders' equity |

$ | 28,327,243 | $ | 17,484,384 | ||||

See accompanying notes to unaudited condensed consolidated financial statements.

Diffusion Pharmaceuticals Inc.

Condensed Consolidated Statements of Operations

(unaudited)

|

Three Months Ended September 30, |

Nine Months Ended |

|||||||||||||||

|

2017 |

2016 |

2017 |

2016 |

|||||||||||||

|

Operating expenses: |

||||||||||||||||

|

Research and development |

$ | 1,759,305 | $ | 1,941,743 | $ | 3,946,420 | $ | 5,739,456 | ||||||||

|

General and administrative |

1,559,399 | 3,852,406 | 4,908,424 | 10,070,878 | ||||||||||||

|

Depreciation |

27,374 | 5,822 | 39,767 | 19,520 | ||||||||||||

|

Loss from operations |

3,346,078 | 5,799,971 | 8,894,611 | 15,829,854 | ||||||||||||

|

Other expense (income): |

||||||||||||||||

|

Interest (income) expense, net |

(1,318 |

) |

1,378 | 73,290 | 854 | |||||||||||

|

Change in fair value of warrant liability (Note 11) |

(8,441,616 |

) |

— | (18,909,792 |

) |

— | ||||||||||

|

Warrant related expenses (Note 8) |

— | — | 10,225,846 | — | ||||||||||||

|

Other financing expenses |

— | — | 2,870,226 | — | ||||||||||||

|

Income (loss) from operations before income tax benefit |

5,096,856 | (5,801,349 |

) |

(3,154,181 |

) |

(15,830,708 |

) |

|||||||||

|

Income tax benefit |

— | (364,796 |

) |

— | (364,796 |

) |

||||||||||

|

Net income (loss) |

$ | 5,096,856 | $ | (5,436,553 |

) |

$ | (3,154,181 |

) |

$ | (15,465,912 |

) |

|||||

|

Per share information: |

||||||||||||||||

|

Net income (loss) per share of common stock, basic |

$ | 0.21 | $ | (0.53 |

) |

$ | (0.35 |

) |

$ | (1.52 |

) |

|||||

|

Net income (loss) per share of common stock, diluted |

$ | 0.20 | $ | (0.53 |

) |

$ | (1.83 |

) |

$ | (1.52 |

) |

|||||

|

Weighted average shares outstanding, basic |

13,937,869 | 10,333,898 | 11,709,128 | 10,198,491 | ||||||||||||

|

Weighted average shares outstanding, diluted |

14,714,853 | 10,333,898 | 12,525,707 | 10,198,491 | ||||||||||||

See accompanying notes to unaudited condensed consolidated financial statements.

Diffusion Pharmaceuticals Inc.

Condensed Consolidated Statement of Changes in Convertible Preferred Stock and Stockholders' Equity

Nine Months Ended September 30, 2017

(unaudited)

|

Convertible Preferred Stock |

Stockholders' Equity |

|||||||||||||||||||||||||||

|

Series A |

Common Stock |

Additional Paid-in |

Accumulated |

Total Stockholders' |

||||||||||||||||||||||||

|

Shares |

Amount |

Shares |

Amount |

Capital | Deficit | Equity | ||||||||||||||||||||||

|

Balance at January 1, 2017 |

— | $ | — | 10,345,637 | $ | 10,346 | $ | 69,363,575 | $ | (60,189,237 |

) |

$ | 9,184,684 | |||||||||||||||

|

Cumulative effect of change in accounting principle(a) |

— | — | — | — | 1,134 | (1,134 |

) |

— | ||||||||||||||||||||

|

Sale of Series A convertible preferred stock and common stock warrants |

12,376,329 | — | — | — | — | — | — | |||||||||||||||||||||

|

Common stock issued for advisory services |

— | — | 17,606 | 18 | 49,982 | — | 50,000 | |||||||||||||||||||||

|

Series A cumulative preferred dividend |

— | — | — | — | (912,946 |

) |

— | (912,946 |

) |

|||||||||||||||||||

|

Reclassification of accrued dividends upon conversion of Series A |

— | — | 88,436 | 88 | 187,084 | — | 187,172 | |||||||||||||||||||||

|

Conversion of Series A convertible preferred stock to common stock |

(4,052,297 |

) |

— | 4,052,297 | 4,052 | (4,052 |

) |

— | — | |||||||||||||||||||

|

Beneficial conversion feature for accrued interest of convertible debt |

— | — | — | — | 28,017 | — | 28,017 | |||||||||||||||||||||

|

Stock-based compensation expense |

— | — | — | — | 973,950 | — | 973,950 | |||||||||||||||||||||

|

Net loss |

— | — | — | — | — | (3,154,181 |

) |

(3,154,181 |

) |

|||||||||||||||||||

|

Balance at September 30, 2017 |

8,324,032 | $ | — | 14,503,976 | $ | 14,504 | $ | 69,686,744 | $ | (63,344,552 |

) |

$ | 6,356,696 | |||||||||||||||

(a) In 2017, the Company adopted provisions of ASU 2016-09, Improvements to Employee Share Based Payment Accounting, resulting in a cumulative effect adjustment to Accumulated Deficit and Additional Paid-in Capital for previously unrecognized stock-based compensation expense. See Note 3 for further discussion of the impacts of this standard.

See accompanying notes to unaudited condensed consolidated financial statements.

Diffusion Pharmaceuticals Inc.

Condensed Consolidated Statements of Cash Flows

(unaudited)

|

Nine Months Ended September 30, |

||||||||

|

2017 |

2016 |

|||||||

|

Operating activities: |

||||||||

|

Net loss |

$ | (3,154,181 |

) |

$ | (15,465,912 |

) |

||

|

Adjustments to reconcile net loss to net cash used in operating activities: |

||||||||

|

Depreciation |

39,767 | 19,520 | ||||||

|

Loss on sale or disposal of assets |

— | 6,761 | ||||||

|

Stock-based compensation expense |

973,950 | 1,121,990 | ||||||

|

Common stock issued for advisory services |

50,000 | 1,409,363 | ||||||

|

Warrant related expense, change in fair value, and other financing expenses |

(5,813,720 |

) |

— | |||||

|

Abandonment of in-process research and development intangible asset |

— | 951,000 | ||||||

|

Change in deferred income taxes |

— | (364,796 |

) |

|||||

|

Settlement of litigation matter |

— | 2,500,000 | ||||||

|

Non-cash interest expense, net |

11,967 | 7,067 | ||||||

|

Changes in operating assets and liabilities: |

||||||||

|

Prepaid expenses, deposits and other assets |

(661,675 |

) |

50,918 | |||||

|

Accounts payable, accrued expenses and other liabilities |

(1,496,150 |

) |

410,014 | |||||

|

Net cash used in operating activities |

(10,050,042 |

) |

(9,354,075 |

) |

||||

|

Cash flows (used in) provided by investing activities: |

||||||||

|

Purchases of property and equipment |

(438,604 |

) |

(2,331 |

) |

||||

|

Purchase of certificate of deposit |

(10,000,000 |

) |

— | |||||

|

Cash received in reverse merger transaction |

— | 8,500,602 | ||||||

|

Net cash (used in) provided by investing activities |

(10,438,604 |

) |

8,498,271 | |||||

|

Cash flows provided by financing activities: |

||||||||

|

Proceeds from the sale of Series A convertible preferred stock and warrants, net |

22,129,774 | — | ||||||

|

Payment of offering costs for Series B |

(97,980 |

) |

— | |||||

|

Repayment of convertible debt |

(1,880,000 |

) |

||||||

|

Proceeds from the issuance of convertible debt |

— | 1,880,000 | ||||||

|

Net cash provided by financing activities |

20,151,794 | 1,880,000 | ||||||

|

Net (decrease) increase in cash and cash equivalents |

(336,852 |

) |

1,024,196 | |||||

|

Cash and cash equivalents at beginning of period |

1,552,852 | 1,997,192 | ||||||

|

Cash and cash equivalents at end of period |

$ | 1,216,000 | $ | 3,021,388 | ||||

|

Supplemental disclosure of cash flow information: |

||||||||

|

Cash paid for interest |

$ | 112,800 | $ | — | ||||

|

Supplemental disclosure of non-cash investing and financing activities: |

||||||||

|

Series A cumulative preferred dividends |

$ | (912,946 |

) |

$ | — | |||

|

Conversion of accrued dividends related to convertible preferred stock |

$ | 187,172 | $ | — | ||||

|

Conversion of convertible notes and related accrued interest into common stock |

$ | — | $ | 711,495 | ||||

|

Consideration in connection with RestorGenex Corporation merger transaction |

$ | — | $ | 21,261,000 | ||||

See accompanying notes to unaudited condensed consolidated financial statements.

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

1. |

Organization and Description of Business |

Diffusion Pharmaceuticals Inc. (“Diffusion” or the “Company”), a Delaware corporation, is a clinical stage biotechnology company focused on extending the life expectancy of cancer patients by improving the effectiveness of current standard-of-care treatments, including radiation therapy and chemotherapy. The Company is developing its lead product candidate, trans sodium crocetinate (“TSC”) for use in many cancer types in which tumor oxygen deprivation ("hypoxia") is known to diminish the effectiveness of current treatments. TSC is designed to target the cancer’s hypoxic micro-environment, re-oxygenating treatment-resistant tissue and making the cancer cells more susceptible to the therapeutic effects of standard-of-care radiation therapy and chemotherapy. The U.S. Food and Drug Administration (“FDA”) provided Diffusion with final protocol guidance for a Phase 3 trial of TSC in newly diagnosed inoperable GBM patients and the Company plans to begin the trial by the end of 2017.

On January 8, 2016, the Company completed a reverse merger (the “Merger”) with RestorGenex Corporation (“RestorGenex”) whereby the Company was considered the acquirer for accounting purposes. The operational activity of RestorGenex is included in the Company’s consolidated financial statements from the date of acquisition. Accordingly, all comparative period information presented in these unaudited condensed consolidated financial statements from January 1, 2016 through January 7, 2016 exclude any activity related to RestorGenex.

|

2. |

Liquidity |

The Company has not generated any revenues from product sales and has funded operations primarily from the proceeds of private placements of its membership units (prior to the Merger), convertible notes and convertible preferred stock. Substantial additional financing will be required by the Company to continue to fund its research and development activities. No assurance can be given that any such financing will be available when needed or that the Company’s research and development efforts will be successful.

The Company regularly explores alternative means of financing its operations and seeks funding through various sources, including public and private securities offerings, collaborative arrangements with third parties and other strategic alliances and business transactions. In March 2017, the Company completed a $25.0 million private placement of its securities by offering units consisting of one share of the Company's Series A convertible preferred stock and a warrant to purchase one share of common stock for each share of Series A convertible preferred stock purchased in the offering. The Company sold 12,376,329 units and received approximately $22.1 million in aggregate net cash proceeds from the private placement, after deducting commissions and other expenses of approximately $2.9 million. In addition, the Company granted to its placement agent in the offering warrants to purchase an aggregate 1,179,558 shares of common stock as compensation for its services.

The Company currently does not have any commitments to obtain additional funds and may be unable to obtain sufficient funding in the future on acceptable terms, if at all. If the Company cannot obtain the necessary funding, it will need to delay, scale back or eliminate some or all of its research and development programs, enter into collaborations with third parties to commercialize potential products or technologies that it might otherwise seek to develop or commercialize independently, consider other various strategic alternatives, including a merger or sale of the Company, or cease operations. If the Company engages in collaborations, it may receive lower consideration upon commercialization of such products than if it had not entered into such arrangements or if it entered into such arrangements at later stages in the product development process.

On May 26, 2017, the Company received a written notice from NASDAQ indicating the Company was not in compliance with Nasdaq Listing Rule 5550(b)(2) because the market value of the Company’s listed securities had been below $35.0 million for the previous 30 consecutive business days. NASDAQ also noted that as of such date the Company also did not meet the alternative requirements under Nasdaq Listing Rule 5550(b)(1), due to the Company's failure to maintain stockholders' equity of at least $2.5 million, or Nasdaq Listing Rule 5550(b)(3), due to the Company's failure to generate net income from continuing operations during its last fiscal year or during two of its last three fiscal years. See Note 12 for further details.

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

The Company has prepared its financial statements assuming that it will continue as a going concern, which contemplates realization of assets and the satisfaction of liabilities in the normal course of business. The Company has incurred net losses since inception and it expects to generate losses from operations for the foreseeable future primarily due to research and development costs for its potential product candidates, which raises substantial doubt about the Company’s ability to continue as a going concern. Various internal and external factors will affect whether and when the Company’s product candidates become approved drugs and the extent of their market share. The regulatory approval and market acceptance of the Company’s proposed future products (if any), length of time and cost of developing and commercializing these product candidates and/or failure of them at any stage of the drug approval process will materially affect the Company’s financial condition and future operations. The Company believes its cash and cash equivalents and certificate of deposit at September 30, 2017 are sufficient to fund operations through June 2018.

|

3. |

Basis of Presentation and Summary of Significant Accounting Policies |

The Summary of Significant Accounting Policies included in the Company's Form 10-K for the year ended December 31, 2016, filed with the Securities and Exchange Commission on March 31, 2017 have not materially changed, except as set forth below.

Basis of Presentation

The accompanying unaudited interim condensed consolidated financial statements of the Company have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) for interim financial information as found in the Accounting Standard Codification (“ASC”) and Accounting Standards Updates (“ASUs”) of the Financial Accounting Standards Board (“FASB”), and with the instructions to Form 10-Q and Article 10 of Regulation S-X of the Securities and Exchange Commission (the “SEC”). In the opinion of management, the accompanying unaudited interim condensed consolidated financial statements of the Company include all normal and recurring adjustments (which consist primarily of accruals, estimates and assumptions that impact the financial statements) considered necessary to present fairly the Company’s financial position as of September 30, 2017, its results of operations for the three and nine months ended September 30, 2017 and 2016 and cash flows for the nine months ended September 30, 2017 and 2016. Operating results for the nine months ended September 30, 2017 are not necessarily indicative of the results that may be expected for the year ending December 31, 2017. The unaudited interim condensed consolidated financial statements presented herein do not contain the required disclosures under GAAP for annual financial statements. The accompanying unaudited interim condensed consolidated financial statements should be read in conjunction with the annual audited financial statements and related notes as of and for the year ended December 31, 2016 filed with the SEC on Form 10-K on March 31, 2017.

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Use of Estimates

The preparation of the unaudited interim condensed consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of assets and liabilities at the date the financial statements and reported amounts of expense during the reporting period. Actual results could differ from those estimates. Due to the uncertainty of factors surrounding the estimates or judgments used in the preparation of the unaudited condensed consolidated financial statements, actual results may materially vary from these estimates. Estimates and assumptions are periodically reviewed and the effects of revisions are reflected in the unaudited interim condensed consolidated financial statements in the period they are deemed necessary.

Cash and Cash Equivalents and Certificate of Deposit

The Company considers any highly liquid investments, such as money market funds, with an original maturity of three months or less to be cash and cash equivalents. The Company's certificate of deposit has a maturity greater than three months but within one year of the date of purchase. This certificate of deposit is classified as held-to-maturity, and the estimated fair value of the investment approximates its amortized cost.

Fair Value of Financial Instruments

The carrying amounts of the Company’s financial instruments, including cash equivalents, certificate of deposit, accounts payable, and accrued expenses approximate fair value due to the short-term nature of those instruments. As of September 30, 2017, the fair value of the Company's outstanding Series B convertible note was approximately $0.5 million. As of December 31, 2016, the fair value of the Company’s outstanding 2016 convertible note and Series B convertible note was approximately $2.0 million and $0.6 million, respectively. The 2016 convertible note was paid in full during the three month period ended September 30, 2017. The fair value of the convertible notes is determined using a binomial lattice model that utilizes certain unobservable inputs that fall within Level 3 of the fair value hierarchy.

Offering Costs

Offering costs are either expensed upon completion or abandonment of the related financing or offset against the proceeds of the offering, depending upon the accounting treatment of the offering. Offering costs consist principally of legal costs incurred through the balance sheet date related to the Company’s private placement financings and are recognized in other assets on the consolidated balance sheet. During the three months ended September 30, 2017, management decided to not move forward with the Series B financing, which was originally contemplated and disclosed in the Company's definitive proxy statement filed with the Securities and Exchange Commission on May 1, 2017, and expensed $98,000 of previously capitalized offering costs related to the financing.

Intangible Assets and Goodwill

In connection with the Merger, the Company acquired indefinite-lived In-Process Research and Development Assets (“IPR&D”) RES-529 and RES-440, with estimated fair values of $8.6 million and $1.0 million, respectively, and recognized $6.9 million in goodwill. In the third quarter of 2016, the IPR&D asset associated with RES-440 was abandoned and written down to $0. RES-529 and goodwill are assessed for impairment on each of October 1 of the Company’s fiscal year or more frequently if impairment indicators exist. The Company has a single reporting unit and all goodwill relates to that reporting unit. There were no impairment indicators or impairments to RES-529 or goodwill during the three and nine months ended September 30, 2017.

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Net Income (Loss) Per Common Share

For the three and nine months ended September 30, 2017, the Company used the two-class method to compute basic net income per common share because the Company has issued securities ("Series A convertible preferred stock") that entitle the holder to participate in dividends and earnings of the Company. Under this method, net income is reduced by any dividends earned during the period. The remaining earnings ("undistributed earnings") are allocated to common stock and the Series A convertible preferred stock to the extent that the Series A convertible preferred stock may share in earnings. In periods of net loss, losses are not allocated to participating securities as the holders of such securities have no obligation to fund losses. The total earnings allocated to common stock is then divided by the weighted average common shares outstanding to determine the basic earnings per share.

For purposes of calculating diluted loss per common share, the denominator includes both the weighted average common shares outstanding and the number of common stock equivalents if the inclusion of such common stock equivalents would be dilutive. Dilutive common stock equivalents potentially include stock options, unvested restricted stock awards and warrants using the treasury stock method. The Company considers the potential dilutive impact of its convertible debt instruments using the "if-converted" method. In addition, the Company considers the potential dilutive impact of its convertible preferred shares using the “if-converted” method if more dilutive than the two-class method. For convertible preferred shares, the two-class method was more dilutive than the “if-converted” method for the three months ended September 30, 2017.

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

The following table sets forth the computation of basic and diluted earnings per share:

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

|

2017 |

2016 |

2017 |

2016 |

|||||||||||||

|

Basic net income (loss) per common share calculation: |

||||||||||||||||

|

Net income (loss) |

$ | 5,096,856 | $ | (5,436,553 |

) |

$ | (3,154,181 |

) |

$ | (15,465,912 |

) |

|||||

|

Accretion of Series A cumulative preferred dividends |

(366,641 |

) |

— | (912,946 |

) |

— | ||||||||||

|

Undistributed earnings to participating securities |

(1,838,354 |

) |

— | — | — | |||||||||||

|

Net income (loss) attributable to common stockholders |

$ | 2,891,861 | $ | (5,436,553 |

) |

$ | (4,067,127 |

) |

$ | (15,465,912 |

) |

|||||

|

Weighted average shares outstanding, basic |

13,937,869 | 10,333,898 | 11,709,128 | 10,198,491 | ||||||||||||

|

Net income (loss) per share of common, basic |

$ | 0.21 | $ | (0.53 |

) |

$ | (0.35 |

) |

$ | (1.52 |

) |

|||||

|

Diluted net income (loss) per common share calculation: |

||||||||||||||||

|

Net income (loss) attributable to common stockholders |

2,891,861 | (5,436,553 |

) |

(4,067,127 |

) |

(15,465,912 |

) |

|||||||||

|

Change in fair value of warrant liability |

— | — | (18,909,792 |

) |

||||||||||||

|

Interest on convertible debt |

28,891 | — | — | — | ||||||||||||

|

Diluted net loss |

2,920,752 | (5,436,553 |

) |

(22,976,919 |

) |

(15,465,912 |

) |

|||||||||

|

Weighted average common shares outstanding, basic |

13,937,869 | 10,333,898 | 11,709,128 | 10,198,491 | ||||||||||||

|

Common stock equivalents arising from stock options |

20,608 | — | — | — | ||||||||||||

|

Common stock equivalents arising from warrants |

— | — | 816,579 | — | ||||||||||||

|

Common stock equivalents arising from convertible debt |

756,376 | — | — | — | ||||||||||||

|

Common stock equivalents |

14,714,853 | 10,333,898 | 12,525,707 | 10,198,491 | ||||||||||||

|

Net income (loss) per share of common stock, diluted |

$ | 0.20 | $ | (0.53 |

) |

$ | (1.83 |

) |

$ | (1.52 |

) |

|||||

The following potentially dilutive securities outstanding as of September 30, 2017 and 2016 have been excluded from the computation of diluted weighted average shares outstanding, as they would be anti-dilutive:

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

|

2017 |

2016 |

2017 |

2016 |

|||||||||||||

|

Convertible debt |

— | 749,280 | 213,879 | 749,280 | ||||||||||||

|

Common stock warrants |

14,003,608 | 460,721 | 447,721 | 460,721 | ||||||||||||

|

Stock options |

2,521,605 | 2,010,409 | 2,545,989 | 2,010,409 | ||||||||||||

|

Unvested restricted stock awards |

4,599 | 10,738 | 4,599 | 10,738 | ||||||||||||

| 16,529,812 | 3,231,148 | 3,212,188 | 3,231,148 | |||||||||||||

Amounts in the table reflect the common stock equivalents of the noted instruments.

Recent Accounting Pronouncements

In July 2017, the FASB issued ASU 2017-11, Earnings Per Share (Topic 260); Distinguishing Liabilities from Equity (Topic 480); Derivatives and Hedging (Topic 815): (Part I) Accounting for Certain Financial Instruments with Down Round Features, (Part II) Replacement of the Indefinite Deferral for Mandatorily Redeemable Financial Instruments of Certain Nonpublic Entities and Certain Mandatorily Redeemable Noncontrolling Interests with a Scope Exception. The first part of this update addresses the complexity of accounting for certain financial instruments with down round features and the second part addresses the complexity of distinguishing liabilities from equity. The guidance is applicable to public business entities for fiscal years beginning after December 15, 2018 and interim periods within those years. The Company is currently evaluating the potential impact of the adoption of this standard on its consolidated results of operations, financial position and cash flows and related disclosures.

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

In May 2017, the FASB issued ASU No. 2017-09, Modification Accounting for Share-Based Payment Arrangements, which amends the scope of modification accounting for share-based payment arrangements. The ASU provides guidance on the types of changes to the terms or conditions of share-based payment awards to which an entity would be required to apply modification accounting under ASC 718. Specifically, an entity would not apply modification accounting if the fair value, vesting conditions, and classification of the awards are the same immediately before and after the modification. The guidance is applicable to public business entities for fiscal years beginning after December 15, 2017 and interim periods within those years. Early adoption is permitted, including adoption in any interim period. The Company does not expect this new guidance to have a material impact on its condensed consolidated financial statements.

In March 2016, the FASB issued ASU 2016-09, Compensation – Improvements to Employee Share-Based Payment Accounting, which simplifies several aspects of the accounting for employee share-based payment transactions including the accounting for income taxes, forfeitures, and statutory tax withholding requirements, as well as classification in the statement of cash flows. The guidance is applicable to public business entities for fiscal years beginning after December 15, 2016 and interim periods within those years. The Company adopted this standard in 2017 by electing to account for forfeitures in the period that they occur. Under ASU 2016-09, accounting changes adopted using the modified retrospective method must be calculated as of the beginning of the period adopted and reported as a cumulative-effect adjustment. As a result, the Company recognized cumulative-effect adjustment of approximately $1,000 on January 1, 2017.

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842). The FASB issued the update to require the recognition of lease assets and liabilities on the balance sheet of lessees. The standard will be effective for fiscal years beginning after December 15, 2018, including interim periods within such fiscal years. The ASU requires a modified retrospective transition method with the option to elect a package of practical expedients. Early adoption is permitted. The Company is currently evaluating the potential impact of the adoption of this standard on its consolidated results of operations, financial position and cash flows and related disclosures.

|

4. |

Acquisition |

Reverse Merger with RestorGenex

On January 8, 2016, the Company completed a reverse merger transaction with RestorGenex. The Company entered into the Merger transaction in an effort to provide improved access to the capital markets in order to obtain the resources necessary to accelerate development of TSC in multiple clinical programs and continue to build an oncology-focused company.

The purchase price was calculated as follows:

|

Fair value of RestorGenex shares outstanding |

$ | 19,546,000 | ||

|

Estimated fair value of RestorGenex stock options outstanding |

1,321,000 | |||

|

Estimated fair value of RestorGenex warrants outstanding |

384,000 | |||

|

CVRs – RES-440 product candidate |

10,000 | |||

|

Total purchase price |

$ | 21,261,000 |

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

The Merger transaction has been accounted for using the acquisition method of accounting, which requires that assets acquired and liabilities assumed be recognized at their fair values as of the acquisition date. The valuation technique utilized to value the IPR&D was the cost approach.

The following table summarizes the allocation of the purchase price to the assets acquired and liabilities assumed as of the acquisition date:

|

Cash and cash equivalents |

$ | 8,500,602 | ||

|

Prepaid expenses and other assets |

195,200 | |||

|

Property and equipment |

57,531 | |||

|

Intangible assets |

9,600,000 | |||

|

Goodwill |

6,929,258 | |||

|

Accrued liabilities |

(377,432 |

) |

||

|

Deferred tax liability |

(3,644,159 |

) |

||

|

Net assets acquired |

$ | 21,261,000 |

Qualitative factors supporting the recognition of goodwill due to the Merger transaction include the Company’s anticipated enhanced ability to secure additional capital and gain access to capital market opportunities as a public company and the potential value created by having a more well-rounded clinical development portfolio by adding the earlier stage products acquired in the reverse merger transaction to the Company’s later stage product portfolio. The goodwill is not deductible for income tax purposes.

Pro Forma Financial Information (Unaudited)

The following pro forma financial information reflects the condensed consolidated results of operations of the Company as if the acquisition of RestorGenex had taken place on January 1, 2016. The pro forma financial information is not necessarily indicative of the results of operations as they would have been had the transactions been effected on the assumed date.

|

Nine Months Ended September 30, 2016 |

||||

|

Net revenues |

$ | — | ||

|

Net loss |

(13,900,691 |

) |

||

|

Basic and diluted loss per share |

$ | (1.36 |

) |

|

Non-recurring pro forma transaction costs directly attributable to the Merger were $1.6 million for the nine months ended September 30, 2016 and have been deducted from the net loss presented above. The costs deducted from the nine months ended September 30, 2016 period includes a success fee of $1.1 million and approximately 46,000 shares of common stock with a fair market value of $0.5 million paid to a financial adviser upon the closing of the Merger on January 8, 2016. Additionally, RestorGenex incurred approximately $3.0 million in severance costs as a result of resignations of executive officers immediately prior to the Merger and approximately $2.7 million in share based compensation expense as a result of the acceleration of vesting of stock options at the time of the Merger. These costs are excluded from the pro forma financial information for the nine months ended September 30, 2016. No such costs were recorded in the three and nine months ended September 30, 2017 or in the three months ended September 30, 2016.

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

5. |

Prepaid expenses, deposits and other current assets |

Prepaid expenses, deposits and other current assets consisted of the following:

|

September 30, 2017 |

December 31, 2016 |

|||||||

|

Prepaid research and development expense |

$ | 844,521 | $ | 12,725 | ||||

|

Prepaid insurance expense |

126,733 | 9,731 | ||||||

|

Prepaid other |

33,107 | 28,388 | ||||||

|

Total |

$ | 1,004,361 | $ | 50,844 | ||||

|

6. |

Other Accrued Expenses and Liabilities |

Other accrued expenses and liabilities consisted of the following:

|

September 30, 2017 |

December 31, 2016 |

|||||||

|

Accrued interest payable |

$ | 36,029 | $ | 29,359 | ||||

|

Accrued Series A dividends |

725,774 | — | ||||||

|

Accrued payroll and payroll related expenses |

398,859 | 399,740 | ||||||

|

Accrued professional fees |

114,268 | 72,855 | ||||||

|

Accrued clinical studies expenses |

88,175 | 220,978 | ||||||

|

Other accrued expenses |

52,602 | 151,332 | ||||||

|

Total |

$ | 1,415,707 | $ | 874,264 | ||||

|

7. |

Convertible Debt |

The components of debt outstanding at September 30, 2017 and December 31, 2016 are as follows:

|

September 30, 2017 |

December 31, 2016 |

|||||||

|

2016 Convertible notes |

$ | — | $ | 1,880,000 | ||||

|

Series B convertible notes |

550,000 | 550,000 | ||||||

| 550,000 | 2,430,000 | |||||||

|

Less current portion |

(550,000 |

) |

(1,880,000 |

) |

||||

|

Long-term debt, net of current portion |

$ | — | $ | 550,000 | ||||

Upon maturity of the 2016 Convertible Notes during the third quarter of 2017, the Company repaid the outstanding principal and interest of $1.9 million and $0.1 million, respectively. The accrued interest related to the Company’s Series B Convertible Note is included within accrued expenses and other current liabilities within the unaudited condensed consolidated balance sheets. As of September 30, 2017, the Company had accrued interest of approximately $36,000.

|

8. |

Convertible Preferred Stock and Common Stock Warrants |

In contemplation of completing the private placement described below, the Company amended and restated its articles of incorporation and authorized 13,750,000 shares of Series A convertible preferred stock. The Company has classified its Series A convertible preferred stock outside of stockholders’ equity because the shares contain deemed liquidation rights that are contingent redemption features not solely within the control of the Company.

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Series A Convertible Preferred Stock Transaction

In March 2017, the Company completed a $25.0 million private placement of its securities in which the Company offered and sold units consisting of one share of the Company’s Series A convertible preferred stock and a warrant to purchase one share of common stock for each share of Series A convertible preferred stock purchased in the offering. Each share of Series A convertible preferred stock entitles the holder to an 8.0% cumulative dividend payable in shares of our common stock on a semi-annual basis. The holders may, at their option, convert each share of Series A convertible preferred stock into one share of the Company’s common stock based on the initial conversion price of $2.02 per share, subject to adjustment. Each warrant entitles the holder to purchase one share of common stock at an initial exercise price of $2.22, subject to adjustment and expires on the fifth anniversary of their original issuance date.

The Company sold 12,376,329 units in the private placement and received approximately $22.1 million in aggregate net cash proceeds, after deducting commissions and other expenses of approximately $2.9 million. In addition, as compensation for its services, the Company granted to its placement agent in the offering warrants to purchase an aggregate of 1,179,558 shares of common stock at an initial exercise price of $2.22 per share, which expire on the fifth anniversary of their original issuance date.

During its evaluation of equity classification for the common stock warrants, the Company considered the conditions as prescribed within ASC 815-40, Derivatives and Hedging, Contracts in an Entity’s own Equity (“ASC 815-40”). The conditions within ASC 815-40 are not subject to a probability assessment. As the Company is obligated to issue a variable number of shares to settle the cumulative dividends on the Series A convertible preferred stock, the Company cannot assert there will be sufficient authorized shares available to settle the warrants issued in connection with the Series A offering. Accordingly, these warrants are classified as liabilities. The Company will continue to classify such warrants as liabilities until they are exercised, expire, or are no longer required to be classified as liabilities.

As the fair value of the warrants upon issuance was in excess of the proceeds of the Series A offering, there are no proceeds allocated to the Series A convertible preferred stock. The excess fair value of the warrants over the gross proceeds of the Series A offering and the fair value of the warrants granted to its placement agent was $10.2 million in the aggregate and was recorded as warrant related expenses in the statement of operations for the nine months ended September 30, 2017.

Dividends

The Company shall pay a cumulative preferential dividend on each share of the Series A convertible preferred stock outstanding at a rate of 8.0% per annum, payable only in shares of common stock, semi-annually in arrears on April 1 and October 1 of each year commencing on October 1, 2017. This cumulative preferential dividend is not subject to declaration. The Company recognized approximately $0.4 million and $0.9 million in dividends, respectively, for the three and nine months ended September 30, 2017.

Voting

Subject to certain preferred stock class votes specified in the Certificate of Designation of Preferences, Rights and Limitations of the Series A Convertible Preferred Stock (the “Certificate of Designation”) or as required by law, the holders of the Series A convertible preferred stock votes together with the holders of common stock as a single class on an adjusted as-converted basis. In accordance with NASDAQ listing rules, in any matter voted on by the holders of our common stock, each share of Series A convertible preferred stock entitles the holder thereof to a number of votes based upon the closing price of our common stock on the NASDAQ Capital Market on the date of issuance of such shares of Series A convertible preferred stock. Accordingly, shares of Series A convertible preferred stock issued in the initial closing of the private placement on March 14, 2017 are entitled to 0.84874 votes per share and shares of Series A Preferred Stock issued in the final closing of the private placement on March 31, 2017 are entitled to 0.50627 votes per share, in each case, subject to adjustment as described in the Certificate of Designation.

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Liquidation Preference

The Series A convertible preferred stock is senior to the common stock. In the event of a liquidation, dissolution or winding up of the Company, either voluntary or involuntary, or in the event of a deemed liquidation event, which includes a sale of the Company as defined in the Certificate of Designation, the holders of the Series A convertible preferred stock shall be entitled to receive their original investment amount. If upon the occurrence of such event, the assets and funds available for distribution are insufficient to pay such holders the full amount to which they are entitled, then the entire remaining assets and funds legally available for distribution shall be distributed ratably among the holders of the Series A convertible preferred stock in proportion to the full amounts to which they would otherwise be entitled.

Conversion

The Series A convertible preferred stock is convertible, at the holder’s option, into common stock. At the Company’s option, the Series A convertible preferred stock can be converted into common stock upon (a) the thirty-day moving average of the closing price of the Company’s common stock exceeding $8.00 per share, (b) a financing of at least $10.0 million or (c) upon the majority vote of the voting power of the then outstanding shares of Series A convertible preferred stock. The conversion price of the Series A convertible preferred stock is subject to adjustment as described in the Certificate of Designation.

Upon any conversion, any unpaid dividends shall be payable to the holders of Series A convertible preferred stock. During the three and nine months ended September 30, 2017, 2,125,306 and 4,052,297 shares of Series A convertible preferred stock, respectively, were converted into common stock. During the three and nine months ended September 30, 2017, approximately $0.1 million and $0.2 million in accrued dividends, respectively, were converted into 62,701 and 88,436 shares of common stock, respectively.

Make-Whole Provision

Until March 2020 and subject to certain exceptions, if the Company issues at least $10.0 million of its common stock or securities convertible into or exercisable for common stock at a per share price less than $2.02 (such lower price, the “Make-Whole Price”) while any shares of Series A convertible preferred stock remain outstanding, the Company will be required to issue to these holders of Series A convertible preferred stock a number of shares of common stock equal to the additional number of shares of common stock that such shares of Series A convertible preferred stock would be convertible into if the conversion price of such shares was equal to 105% of the Make-Whole Price (the “Make-Whole Adjustment”). The Make-Whole Adjustment was evaluated and was not required to be bifurcated from the Series A convertible preferred stock.

Common Stock Warrants

As of September 30, 2017, the Company had the following warrants outstanding to acquire shares of its common stock:

|

Outstanding |

Range of exercise price per share |

||||||||

|

Common stock warrants issued prior to Merger |

447,721 | $20.00 | - | $750.00 | |||||

|

Common stock warrants issued in Series A |

13,555,887 | $2.22 | |||||||

| 14,003,608 | |||||||||

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

During the nine months ended September 30, 2017, 13,000 warrants, issued prior to the Merger, expired. These common stock warrants will expire periodically through 2019. The common stock warrants issued in connection with the March 2017 Series A private placement expire in March 2022. During the three and nine months ended September 30, 2017, the Company recognized a net gain of $8.4 million and $5.8 million in warrant related charges associated with the Series A private placement, which consisted primarily of the change in fair value of the common stock warrants from issuance and the excess fair value of the common stock warrants over the gross cash proceeds of the Series A offering.

|

9. |

Stock-Based Compensation |

2015 Equity Plan

The Diffusion Pharmaceuticals Inc. 2015 Equity Plan, as amended (the "2015 Equity Plan"), provides for increases to the number of shares reserved for issuance thereunder each January 1, equal to 4.0% of the total shares of the Company’s common stock outstanding as of the immediately preceding December 31, unless a lesser amount is stipulated by the Compensation Committee of the Company's Board of Directors. Accordingly, 413,825 shares were added to the reserve as of January 1, 2017, which shares may be issued in connection with the grant of stock-based awards, including stock options, restricted stock, restricted stock units, stock appreciation rights and other types of awards as deemed appropriate, in each case, in accordance with the terms of the 2015 Equity Plan. As of September 30, 2017, there were 114,291 shares of common stock available for future issuance under the 2015 Equity Plan.

The Company recorded stock-based compensation expense in the following expense categories of its unaudited interim condensed consolidated statements of operations for the periods indicated:

|

Three Months Ended September 30, |

Nine Months Ended |

|||||||||||||||

|

2017 |

2016 |

2017 |

2016 |

|||||||||||||

|

Research and development |

$ | 14,333 | $ | 174,932 | $ | 81,737 | $ | 601,260 | ||||||||

|

General and administrative |

278,168 | 215,425 | 892,213 | 520,730 | ||||||||||||

|

Total stock-based compensation expense |

$ | 292,501 | $ | 390,357 | $ | 973,950 | $ | 1,121,990 | ||||||||

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

The following table summarizes the activity related to all stock option grants to employees and non-employees for the nine months ended September 30, 2017:

|

Number of Options |

Weighted average exercise price per share |

Weighted average remaining contractual life (in years) |

||||||||||

|

Balance at January 1, 2017 |

2,207,409 | $ | 8.09 | |||||||||

|

Granted |

340,041 | 2.49 | ||||||||||

|

Expired |

(1,461 |

) |

15.00 | |||||||||

|

Outstanding at September 30, 2017 |

2,545,989 | $ | 7.34 | 7.37 | ||||||||

|

Exercisable at September 30, 2017 |

1,746,809 | $ | 8.51 | 6.62 | ||||||||

Non-employee Stock Options

Non-employee options are remeasured to fair value each period using a Black-Scholes option-pricing model until the options vest. During the nine months ended September 30, 2017, the Company granted 9,394 stock options to non-employees. The total fair value of non-employee stock options vested during the three months ended September 30, 2017 and 2016 was approximately $7,000 and $0.2 million, respectively. The total fair value of non-employee stock options vested during the nine months ended September 30, 2017 and 2016 was approximately $83,000 and $0.7 million, respectively. At September 30, 2017, there were 18,572 unvested options subject to remeasurement and approximately $26,000 of unrecognized compensation expense that will be recognized over a weighted-average period of 1.64 years.

Employee Stock Options

During the nine months ended September 30, 2017, the Company granted 330,647 stock options to employees. The weighted average grant date fair value of stock option awards granted to employees was $2.12 during the nine months ended September 30, 2017. During the three months ended September 30, 2017 and 2016 the Company recognized stock-based compensation expense of $0.3 million and $0.1 million, respectively. During the nine months ended September 30, 2017 and 2016, the Company recognized stock-based compensation expense $0.9 million and $0.4 million, respectively. No options were exercised during any of the periods presented. At September 30, 2017, there was $2.8 million of unrecognized compensation expense that will be recognized over a weighted-average period of 5.33 years.

Options granted were valued using the Black-Scholes model and the weighted average assumptions used to value the options granted during the first nine months of 2017 were as follows:

|

Expected term (in years) |

6.03 | |||

|

Risk-free interest rate |

2.0 |

% |

||

|

Expected volatility |

114.9 |

% |

||

|

Dividend yield |

— |

% |

Restricted Stock Awards

As of September 30, 2017, there were 4,599 unvested shares of restricted stock. During the three months ended September 30, 2017 and 2016, there were 1,533 and 1,534 shares that vested, respectively and the Company recognized stock-based compensation expense of approximately $3,000 and $3,000, respectively. During the nine months ended September 30, 2017 and 2016, there were 4,599 and 4,603 shares that vested, respectively and the Company recognized stock-based compensation expense of approximately $9,000 and $9,000, respectively. At September 30, 2017, there was approximately $9,000 of unrecognized compensation expense that will be recognized over a weighted-average period of less than 1.0 year.

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

10. |

Commitments and Contingencies |

Office Space Lease Commitment

The Company leases office and laboratory facilities in Charlottesville, Virginia. On March 31, 2017, the Company entered into a lease for its office and laboratory facilities at a new location in Charlottesville, Virginia. During the nine months ended September 30, 2017, the Company capitalized approximately $0.4 million in leasehold improvements as part of the build out of the new office and laboratory location. Rent expense related to the Company's operating leases for the three months ended September 30, 2017 and 2016 was $28,000 and $34,000, respectively. Rent expense for the nine months ended September 30, 2017 and 2016 was $80,000 and $115,000, respectively. For the new operating lease, lease payments commenced on May 1, 2017 and expire on April 30, 2022. The Company will continue to recognize rent expense on a straight-line basis over the lease period and will accrue for rent expense incurred but not yet paid. Future minimum rental payments under the Company's new non-cancelable operating lease at September 30, 2017 was as follows:

|

Rental Commitments |

||||

|

2017 |

$ | 27,746 | ||

|

2018 |

112,354 | |||

|

2019 |

114,409 | |||

|

2020 |

116,464 | |||

|

2021 |

118,519 | |||

|

Thereafter |

58,232 | |||

|

Total |

$ | 547,724 | ||

Arrangement with Clinical Research Organization

On July 5, 2017, the Company entered into a Master Services Agreement ("MSA") with a contract research organization ("CRO") to provide clinical trial services for individual studies and projects by executing individual work orders. The MSA and associated work orders are designed such that quarterly payments are to be made in advance of the work to be performed. The Company recognized research and development expenses related to this MSA of $0.6 million for the three months ended September 30, 2017. As of September 30, 2017, there was $1.0 million of prepaid research and development costs that are estimated to be recognized during the fourth quarter of fiscal 2017.

Legal Proceedings

On August 7, 2014, a complaint was filed in the Superior Court of Los Angeles County, California by Paul Feller, the Company’s former Chief Executive Officer under the caption Paul Feller v. RestorGenex Corporation, Pro Sports & Entertainment, Inc., ProElite, Inc. and Stratus Media Group, GmbH (Case No. BC553996). The complaint asserts various causes of action, including, among other things, promissory fraud, negligent misrepresentation, breach of contract, breach of employment agreement, breach of the covenant of good faith and fair dealing, violations of the California Labor Code and common counts. The plaintiff is seeking, among other things, compensatory damages in an undetermined amount, punitive damages, accrued interest and an award of attorneys’ fees and costs. On December 30, 2014, the Company filed a petition to compel arbitration and a motion to stay the action. On April 1, 2015, the plaintiff filed a petition in opposition to the Company’s petition to compel arbitration and a motion to stay the action. After a hearing for the petition and motion on April 14, 2015, the Court granted the Company’s petition to compel arbitration and a motion to stay the action. On January 8, 2016, the plaintiff filed an arbitration demand with the American Arbitration Association. No arbitration hearing has yet been scheduled. The Company believes this matter is without merit and intends to defend the arbitration vigorously. Because this matter is in an early stage, the Company is unable to predict its outcome and the possible loss or range of loss, if any, associated with its resolution or any potential effect the matter may have on the Company’s financial position. Depending on the outcome or resolution of this matter, it could have a material effect on the Company’s financial position.

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

11. |

Fair Value Measurements |

Certain assets and liabilities are carried at fair value under GAAP. Fair value is defined as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. Valuation techniques used to measure fair value must maximize the use of observable inputs and minimize the use of unobservable inputs. Financial assets and liabilities carried at fair value are to be classified and disclosed in one of the following three levels of the fair value hierarchy, of which the first two are considered observable and the last is considered unobservable:

• Level 1—Quoted prices in active markets for identical assets or liabilities.

• Level 2—Observable inputs (other than Level 1 quoted prices), such as quoted prices in active markets for similar assets or liabilities, quoted prices in markets that are not active for identical or similar assets or liabilities, or other inputs that are observable or can be corroborated by observable market data.

• Level 3—Unobservable inputs that are supported by little or no market activity and that are significant to determining the fair value of the assets or liabilities, including pricing models, discounted cash flow methodologies and similar techniques.

The asset’s or liability’s fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. Accordingly, transfers between levels within the valuation hierarchy occur when there are significant changes to the inputs, such as increases or decreases in market activity, changes to the availability of current prices, changes to the transparency to underlying inputs, and whether there are significant variances in quoted prices. Transfers in and/or out of any level are assumed to occur at the end of the period.

The following table presents the Company’s assets and liabilities that are measured at fair value on a recurring basis:

|

September 30, 2017 |

||||||||||||

|

(Level 1) |

(Level 2) |

(Level 3) |

||||||||||

|

Assets |

||||||||||||

|

Cash and cash equivalents |

$ | 1,216,000 | $ | — | $ | — | ||||||

|

Certificate of deposit |

$ | 10,020,164 | ||||||||||

|

Liabilities |

||||||||||||

|

Common stock warrant liability |

$ | — | $ | — | $ | 16,316,054 | ||||||

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

December 31, 2016 |

||||||||||||

|

(Level 1) |

(Level 2) |

(Level 3) |

||||||||||

|

Assets |

||||||||||||

|

Cash and cash equivalents |

$ | 1,552,852 | $ | — | $ | — | ||||||

The reconciliation of the common stock warrant liability measured at fair value on a recurring basis using significant unobservable inputs (Level 3) is as follows:

|

Common Stock Warrant Liability |

||||

|

Balance at December 31, 2016 |

$ | — | ||

|

Issued in connection with the Series A convertible preferred stock |

35,225,846 | |||

|

Change in fair value |

(18,909,792 |

) |

||

|

Balance at September 30, 2017 |

$ | 16,316,054 | ||

The common stock warrants issued in connection with the Series A convertible preferred stock are classified as liabilities on the accompanying balance sheet at September 30, 2017. The liability is marked-to-market each reporting period with the change in fair value recorded as either income or expense in the accompanying statements of operations until the warrants are exercised, expire or other facts and circumstances lead the liability to be reclassified to stockholders’ equity. The fair value of the warrant liability is estimated using the Black-Scholes model and assumptions used to value the warrant liability as of September 30, 2017 were as follows:

|

Stock price |

$ | 1.66 | ||

|

Exercise price |

$ | 2.22 | ||

|

Expected term (in years) |

4.5 | |||

|

Risk-free interest rate |

1.8 |

% |

||

|

Expected volatility |

109.3 |

% |

||

|

Dividend yield |

— |

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

12. |

Subsequent events |

On November 1, 2017 the Company held a Special Shareholders meeting, requesting shareholders, both common and Series A, to approve a proposed amendment to the Company’s Certificate of Incorporation to permit the Company to pay dividends on the Company’s Series A Convertible Preferred Stock in either cash or shares of the Company’s Common Stock, which was approved by the shareholders. As a result of this amendment, the Company is able to assert there will be sufficient authorized shares available to settle the Series A warrants. Upon this assertion, the Series A warrants were reclassified from liabilities to stockholders’ equity. Prior to the amendment, for accounting purposes, the warrants were recorded as a liability under U.S. generally accepted accounting principles. The warrant liability resulted in a reduction of our stockholders’ equity, as of March 31, 2017 and June 30, 2017, below the required level under the Nasdaq Capital Market’s continued listing standards. The Charter Amendment, by permitting the Company to assert share settlement of the warrants, resulted in a reclassification of the warrant liability to stockholders’ equity as of the date of the amendment.

It is therefore the belief of the Company that this fundamental change will allow the Company to regain its NASDAQ compliant status. The following pro-forma information shows adjustments to the September 30, 2017 balances to (i) remove the Series A warrant liability of $16.3 million as of September 30, 2017 from total liabilities, (ii) show the reclassification of the fair value of the Series A warrants of $13.2 million as of November 1, 2017 to APIC, and (iii) to adjust the accumulated deficit balance for the change in fair value of the Series A warrants from September 30, 2017 to November 1, 2017 of $3.2 million.

|

As of September 30, 2017 |

|||||||||||||

|

Actual |

Adjustments |

Pro-forma |

|||||||||||

|

Total assets |

$ | 28,327,243 | $ | — | $ | 28,327,243 | |||||||

|

Total liabilities |

21,970,547 | (16,316,054 |

) |

(i) |

5,654,493 | ||||||||

|

Convertible preferred stock |

— | — | — | ||||||||||

|

Stockholders' equity |

|||||||||||||

|

Common stock |

14,504 | — | 14,504 | ||||||||||

|

Additional paid-in-capital |

69,686,744 | 13,153,524 |

(ii) |

82,840,268 | |||||||||

|

Accumulated deficit |

(63,344,552 |

) |

3,162,530 |

(iii) |

(60,182,022 |

) |

|||||||

|

Total stockholders' equity |

6,356,696 | 16,316,054 | 22,672,750 | ||||||||||

|

Total liabilities, convertible preferred stock and stockholders' equity |

$ | 28,327,243 | $ | — | $ | 28,327,243 | |||||||

|

ITEM 2. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

You should read the following discussion of our financial condition and results of operations together with the unaudited interim condensed consolidated financial statements and the notes thereto included elsewhere in this report and other financial information included in this report. The following discussion may contain predictions, estimates and other forward looking statements that involve a number of risks and uncertainties, including those discussed under “Part I — Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Special Note Regarding Forward Looking Statements” in this report and under “Part I — Item 1A. Risk Factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2016. These risks could cause our actual results to differ materially from any future performance suggested below.

Business Overview

We are a clinical stage biotechnology company focused on extending the life expectancy of cancer patients by improving the effectiveness of current standard-of-care treatments, including radiation therapy and chemotherapy. We are developing our lead product candidate, transcrocetinate sodium, also known as trans sodium crocetinate, or TSC, for use in the many cancer types in which tumor oxygen deprivation (“hypoxia”) is known to diminish the effectiveness of current treatments. TSC is designed to target the cancer’s hypoxic micro-environment, re-oxygenating treatment-resistant tissue and making the cancer cells more susceptible to the therapeutic effects of standard-of-care radiation therapy and chemotherapy.

Our lead development programs target TSC against cancers known to be inherently treatment-resistant, including brain cancers and pancreatic cancer. A Phase 2 clinical program, completed in the second quarter of 2015, evaluated 59 patients with newly diagnosed glioblastoma multiforme (“GBM”). This open label, historically controlled study demonstrated a favorable safety and efficacy profile for TSC combined with standard of care, including a 37% improvement in overall survival over the control group at two years. A particularly strong efficacy signal was seen in the inoperable patients, where survival of TSC-treated patients at two years was increased by almost four-fold over the controls. The U.S. Food and Drug Administration, or FDA, provided Diffusion with final protocol guidance for a Phase 3 trial of TSC in newly diagnosed inoperable GBM patients. The Company has responded to all outstanding points raised by the FDA and plans to begin the trial under the protocol agreed to by the FDA by the end of 2017. The trial will enroll 236 patients in total, 118 in each arm. Due to its novel mechanism of action, TSC has safely re-oxygenated a range of tumor types in our preclinical and clinical studies. Diffusion believes its therapeutic potential is not limited to specific tumors, thereby making it potentially useful to improve standard-of-care treatments of other life-threatening cancers. Given TSC's safety profile and animal data, we can move into Phase 2 studies in metastatic brain cancer or pancreatic cancer. We also believe that TSC has potential application in other indications involving hypoxia, such as neurodegenerative diseases and emergency medicine. For example, our stroke program is now in advanced discussions with doctors from UCLA and the University of Virginia, with whom we have established a joint team dedicated to developing a program to test TSC in the treatment of stroke, with an in-ambulance trial of TSC in stroke under consideration. Planning for such a trial is on-going.

In addition to the TSC programs, we are exploring alternatives regarding how best to capitalize upon our product candidate, RES-529, which may include possible out-licensing and other options. RES-529 is a novel PI3K/Akt/mTOR pathway inhibitor which has completed two Phase 1 clinical trials for age-related macular degeneration and was in preclinical development in oncology, specifically GBM. RES-529 has shown activity in both in vitro and in vivo glioblastoma animal models and has been demonstrated to be orally bioavailable and can cross the blood brain barrier.

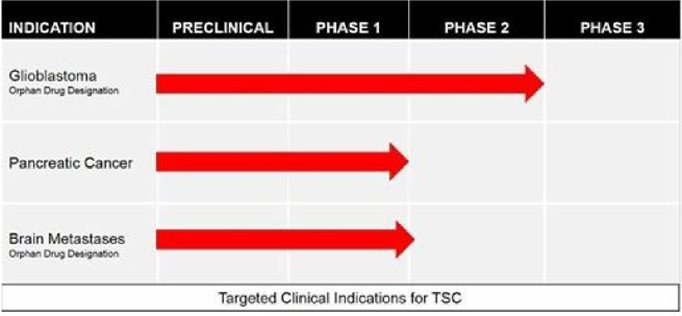

Summary of Current Product Candidate Pipeline

The following table, as of September 30, 2017, summarizes the targeted clinical indications for Diffusion’s lead molecule, TSC:

Financial Summary

In March 2017, we completed a $25.0 million private placement of our securities by offering units consisting of one share of our Series A convertible preferred stock and a warrant to purchase one share of our common stock for each share of Series A convertible preferred stock purchased in the offering. We sold 12,376,329 units and received approximately $22.1 million in aggregate net cash proceeds from the private placement, after deducting commissions and other expenses of approximately $2.9 million. In addition, we granted our placement agent in the offering warrants to purchase an aggregate of 1,179,558 shares of our common stock as compensation for its services.

At September 30, 2017, we had cash and cash equivalents of $1.2 million and a certificate of deposit of $10.0 million. We have incurred operating losses since inception, have not generated any product sales revenue and have not achieved profitable operations. We had net income of $5.1 million and incurred a net loss of $3.2 million for the three and nine months ended September 30, 2017, respectively. Our net income for the three months ended September 30, 2017 was primarily related to the remeasurement of our common stock warrant liability at September 30, 2017 which resulted in a $8.4 million gain (see Notes 8 and 11 to the accompanying unaudited condensed consolidated financial statements). Our accumulated deficit as of September 30, 2017 was $63.3 million, and we expect to continue to incur substantial losses in future periods. We anticipate that our operating expenses will increase substantially as we continue to advance our lead, clinical-stage product candidate, TSC. We anticipate that our expenses will substantially increase as we:

|

• |

complete regulatory and manufacturing activities and commence clinical trials for TSC; |

|

• |

continue the research, development and scale-up manufacturing capabilities to optimize products and dose forms for which we may obtain regulatory approval; |

|

• |

conduct other preclinical and clinical studies to support the filing of a New Drug Application (“NDA”) with the FDA; |

|

• |

maintain, expand and protect our global intellectual property portfolio; |

|

• |

hire additional clinical, manufacturing, and scientific personnel; and |

|

• |

add operational, financial and management information systems and personnel, including personnel to support our drug development and potential future commercialization efforts. |