UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant ☒ | |||

|

Filed by a Party other than the Registrant ☐ | |||

|

Check the appropriate box: | |||

|

☒ |

Preliminary Proxy Statement | ||

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

|

☐ |

Definitive Proxy Statement | ||

|

☐ |

Definitive Additional Materials | ||

|

☐ |

Soliciting Material under §240.14a-12 | ||

|

Diffusion Pharmaceuticals Inc. | |||

|

(Name of Registrant as Specified In Its Charter) | |||

|

Not Applicable | |||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |||

|

Payment of Filing Fee (Check the appropriate box): | |||

|

☒ |

No fee required. | ||

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

|

(1) |

Title of each class of securities to which transaction applies: | ||

|

(2) |

Aggregate number of securities to which transaction applies: | ||

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

|

(4) |

Proposed maximum aggregate value of transaction: | ||

|

(5) |

Total fee paid: | ||

|

☐ |

Fee paid previously with preliminary materials. | ||

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

|

(1) |

Amount Previously Paid: | ||

|

(2) |

Form, Schedule or Registration Statement No.: | ||

|

(3) |

Filing Party: | ||

|

(4) |

Date Filed: | ||

Diffusion Pharmaceuticals Inc.

2020 Avon Court, Suite 4

Charlottesville, Virginia 22902

_______, 2017

Dear Fellow Stockholders:

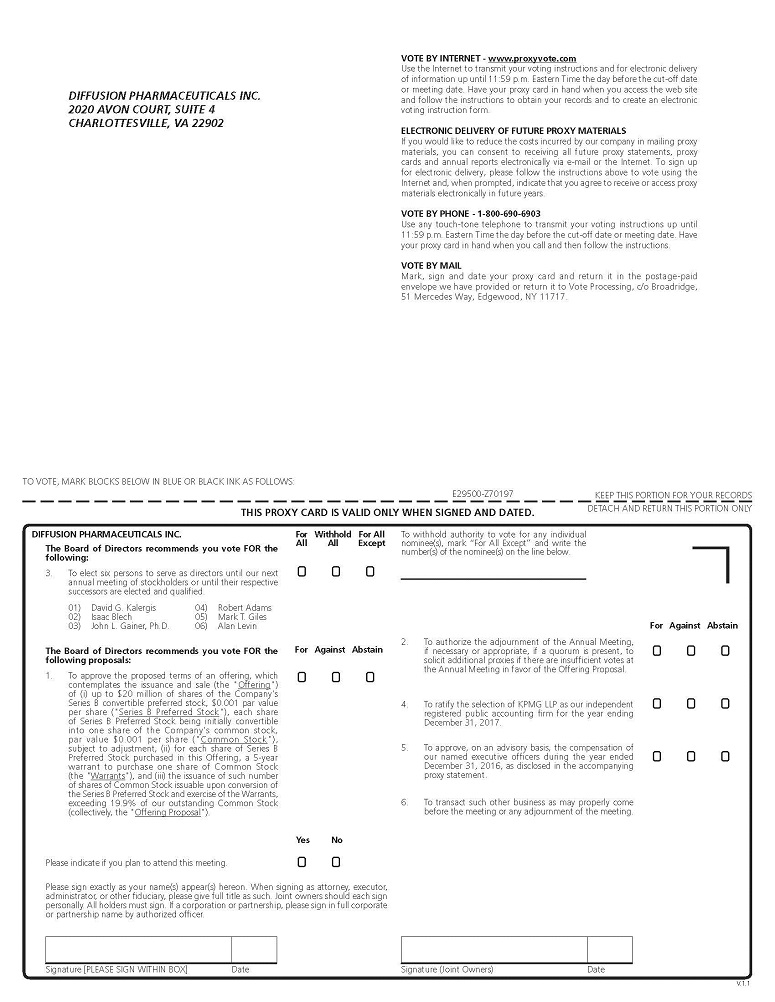

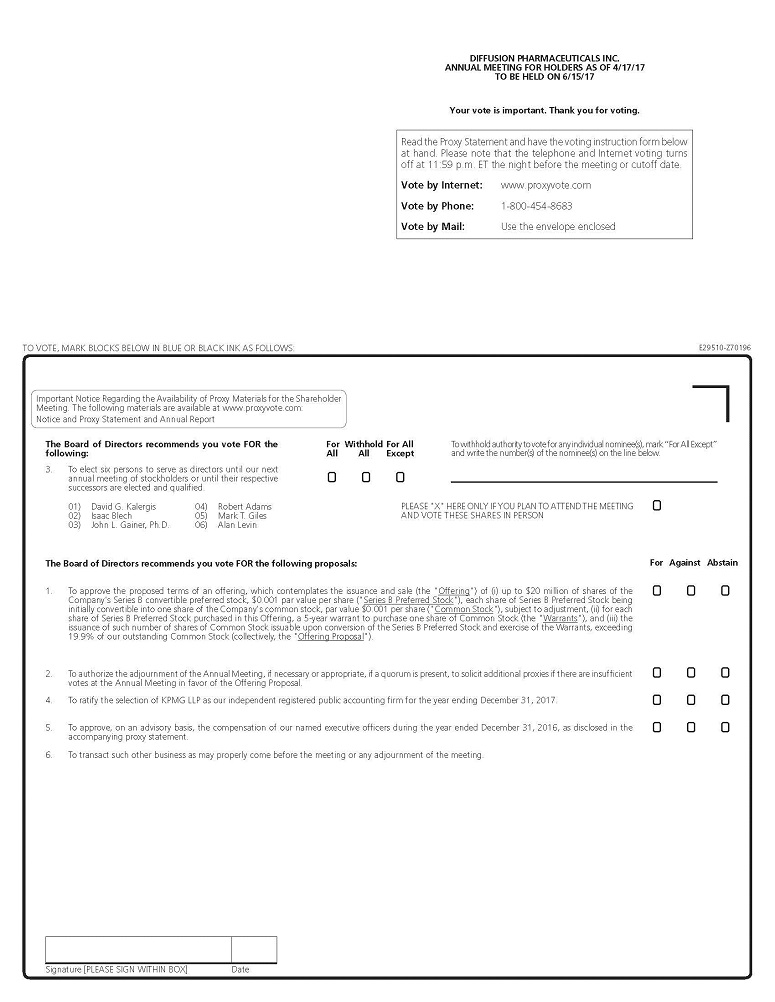

We are pleased to invite you to join us for the Diffusion Pharmaceuticals Inc. Annual Meeting of Stockholders to be held on Thursday, June 15, 2017, at 9:00 a.m., Eastern Time, in the James Monroe Room at the Omni Charlottesville Hotel located at 212 Ridge McIntire Road, Charlottesville, Virginia 22903. Details about the meeting, nominees for election to the Board of Directors and other matters to be acted on at the meeting are presented in the Notice of Annual Meeting of Stockholders and proxy statement that follow.

It is important that your shares be represented at the meeting, regardless of the number of shares you hold. Accordingly, please exercise your right to vote by completing, signing, dating and returning your proxy card, or by using Internet or telephone voting as described in the accompanying proxy statement, or by following the instructions for voting on the Notice Regarding the Availability of Proxy Materials you received for the meeting.

On behalf of the Board of Directors and management of Diffusion Pharmaceuticals Inc., it is my pleasure to express our appreciation for your support.

Sincerely,

David G. Kalergis

Chairman and Chief Executive Officer

Your vote is important. Please exercise your right to vote as soon as possible by completing, signing, dating and returning your proxy card, or by using Internet or telephone voting as described in the accompanying proxy statement. By doing so, you may save us the expense of additional solicitation.

You can help us make a difference by eliminating paper proxy mailings. With your consent, we will provide all future proxy materials electronically. Instructions for consenting to electronic delivery can be found on your proxy card or at www.proxyvote.com. Your consent to receive stockholder materials electronically will remain in effect until canceled.

THIS PROXY STATEMENT IS NOT AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY SHARES OF OUR PREFERRED STOCK, SHARES OF OUR COMMON STOCK OR ANY OTHER SECURITIES.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON THURSDAY, JUNE 15, 2016

To the Stockholders of Diffusion Pharmaceuticals Inc.:

The Annual Meeting of Stockholders of Diffusion Pharmaceuticals Inc., a Delaware corporation (“Diffusion”), will be held Thursday, June 15, 2017 at 9:00 a.m., Eastern Time, in the James Monroe Room at the Omni Charlottesville Hotel located at 212 Ridge McIntire Road, Charlottesville, Virginia 22903 for the following purposes:

|

1. |

To approve the proposed terms of an offering of up to $20 million, which contemplates the issuance and sale (the “Offering”) of (i) shares of the Company’s Series B convertible preferred stock, $0.001 par value per share (“Series B Preferred Stock”), each share of Series B Preferred Stock being initially convertible into one share of the Company’s common stock, par value $0.001 per share (“Common Stock”), subject to adjustment, (ii) for each share of Series B Preferred Stock purchased in this Offering, a 5-year warrant to purchase one share of Common Stock (the “Warrants”), and (iii) the issuance of such number of shares of Common Stock issuable upon conversion of the Series B Preferred Stock and exercise of the Warrants, exceeding 19.9% of our outstanding common stock (collectively, the “Offering Proposal”). |

|

2 |

To authorize the adjournment of the Annual Meeting, if necessary or appropriate, if a quorum is present, to solicit additional proxies if there are insufficient votes at the Annual Meeting in favor of the Offering Proposal. |

|

3. |

To elect six persons to serve as directors until our next annual meeting of stockholders or until their respective successors are elected and qualified. |

|

4. |

To ratify the selection of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2017. |

|

5. |

To approve, on an advisory basis, the compensation of our named executive officers during the year ended December 31, 2016, as disclosed in the accompanying proxy statement. |

|

6. |

To transact such other business as may properly come before the meeting or any adjournment of the meeting. |

Only stockholders of record at the close of business on April 17, 2017 will be entitled to notice of, and to vote at, the meeting and any adjournments thereof. A stockholder list will be available at Diffusion’s corporate offices beginning 10 days prior to the date of the meeting during normal business hours for examination by any stockholder registered on Diffusion’s stock ledger as of the record date for any purpose germane to the meeting.

Important Notice Regarding the Availability of Proxy Materials for the

Stockholder Meeting to Be Held on Thursday, June 15, 2017

Our proxy statement and annual report to stockholders, which includes our annual report on Form 10-K for the fiscal year ended December 31, 2016, are available at www.proxyvote.com.

|

|

By Order of the Board of Directors, |

|

|

|

|

|

|

|

|

Ben L. Shealy |

|

|

Senior Vice President – Finance, Treasurer & Secretary |

_________, 2017

Charlottesville, Virginia

|

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE VOTE VIA THE INTERNET OR OVER THE TELEPHONE AS INSTRUCTED IN THE ENCLOSED PROXY CARD, OR, COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY CARD USING THE ENCLOSED RETURN ENVELOPE, AS PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE ANNUAL MEETING. EVEN IF YOU HAVE VOTED BY PROXY, YOU MAY STILL VOTE IN PERSON IF YOU ATTEND THE ANNUAL MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE ANNUAL MEETING, YOU MUST OBTAIN A PROXY CARD ISSUED IN YOUR NAME FROM THAT INTERMEDIARY. |

THIS PROXY STATEMENT IS NOT AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY SHARES OF OUR PREFERRED STOCK, SHARES OF OUR COMMON STOCK OR ANY OTHER SECURITIES.

|

TABLE OF CONTENTS |

|

|

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING |

1 |

|

When and Where Will the Annual Meeting Be Held? |

1 |

|

What are the Purposes of the Annual Meeting? |

1 |

|

Who is Entitled to Vote at the Annual Meeting? |

2 |

|

What Numbers of Votes is Each Share Entitled To? |

2 |

|

How Do I Vote My Shares? |

2 |

|

How Will My Shares Be Voted? |

3 |

|

How Does the Board of Directors Recommend that I Vote? |

3 |

|

How Can I Revoke or Change My Vote? |

3 |

|

Who is Paying for this Proxy Solicitation? |

4 |

|

How Many Shares Must Be Present to Hold the Annual Meeting? |

4 |

|

What Vote is Required for Each Proposal? |

4 |

|

Who Will Count the Votes? |

5 |

|

Who Do I Contact if I Have Questions Regarding the Annual Meeting? |

5 |

|

Are There Any Matters to be Voted on at the Annual Meeting that are not Included in this Proxy Statement? |

5 |

|

How Will Business Be Conducted at the Annual Meeting? |

5 |

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS |

6 |

|

RECENT CHANGE OF CONTROL |

7 |

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

8 |

|

Section 16(a) Beneficial Ownership Reporting Compliance |

9 |

|

PROPOSAL NO. 1 APPROVAL OF THE PROPOSED ISSUANCE AND SALE OF SERIES B CONVERTIBLE PREFRRED STOCK AND WARRANTS |

10 |

|

General |

10 |

|

Reasons for the Offering |

10 |

|

Material Terms of the Offering |

10 |

|

Description of Series B Convertible Preferred Stock |

10 |

|

Description of Warrants |

11 |

|

Registration Rights |

11 |

|

Possible Effects on Rights of Existing Stockholders |

11 |

|

Appraisal Rights |

12 |

|

Reasons for Stockholder Approval |

12 |

|

Material Relationships between the Company and the Placement Agent |

12 |

|

Interests of Directors and Executive Officers |

13 |

|

Vote Required |

13 |

|

Board Recommendation |

13 |

|

PROPOSAL NO. 2 ADJOURNMENT PROPOSAL |

14 |

|

Vote Required |

14 |

|

Board Recommendation |

14 |

|

PROPOSAL NO. 3 ELECTION OF DIRECTORS |

15 |

|

Number of Directors |

15 |

|

Nominees for Director |

15 |

|

Information About Current Directors and Board Nominees |

15 |

|

Additional Information About Current Directors and Board Nominees |

15 |

|

Board Recommendation |

15 |

|

PROPOSAL NO. 4 RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

18 |

|

Change and Selection of Independent Registered Public Accounting |

18 |

|

Selection of Independent Registered Public Accounting Firm |

18 |

|

Independent Auditor’s Fees |

19 |

|

Pre-Approval Policies and Procedures |

19 |

|

Vote Required |

19 |

|

Board Recommendation |

19 |

|

PROPOSAL NO. 5 ADVISORY VOTE ON EXECUTIVE COMPENSATION |

20 |

|

Introduction |

20 |

|

Proposed Resolution |

20 |

|

Vote Required |

21 |

|

Board Recommendation |

21 |

|

CORPORATE GOVERNANCE |

22 |

|

Introduction |

22 |

|

Corporate Governance Guidelines |

22 |

|

Director Independence |

22 |

|

Board Leadership Structure |

22 |

|

Executive Sessions |

23 |

|

Board Meetings and Attendance |

23 |

|

Board Committees |

23 |

|

Audit Committee |

23 |

|

Compensation Committee |

24 |

|

Nominating and Corporate Governance Committee |

25 |

|

Board Oversight of Risk |

27 |

|

Audit Committee Report |

28 |

|

Policy Regarding Director Attendance at Annual Meetings of Stockholders |

28 |

|

Process Regarding Stockholder Communications with Board of Directors |

28 |

|

DIRECTOR COMPENSATION |

28 |

|

Overview of Director Compensation Program |

28 |

|

Cash Compensation |

29 |

|

Long-Term Equity-Based Incentive Compensation |

29 |

|

Blech Option Agreement |

29 |

|

Indemnification Agreements |

30 |

|

Summary Director Compensation Table for Fiscal 2016 |

30 |

|

EXECUTIVE OFFICERS |

30 |

|

EXECUTIVE COMPENSATION |

31 |

|

Merger with Diffusion Pharmaceuticals LLC |

31 |

|

Summary Compensation Table |

31 |

|

Employment Agreements |

32 |

|

Other Compensatory Arrangements |

33 |

|

Indemnification Agreements |

33 |

|

Outstanding Equity Awards at Fiscal Year End |

34 |

|

401(k) Retirement Plan |

34 |

|

Post-Termination Severance and Change in Control Arrangements |

35 |

|

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS |

36 |

|

Merger with Diffusion LLC |

36 |

|

Donenberg Consulting Agreement |

36 |

|

DOCUMENTS INCORPORATED BY REFERENCE |

36 |

|

OTHER MATTERS |

37 |

|

Stockholder Proposals for 2018 Annual Meeting and Director Nominations |

37 |

|

Annual Report |

37 |

|

Householding of Annual Meeting Materials |

37 |

|

Cost and Method of Solicitation |

38 |

As used in this proxy statement, references to “Diffusion,” the “Company,” “we,” “us,” “our” and similar references refer to Diffusion Pharmaceuticals Inc. and our consolidated subsidiaries, the term “common stock” refers to our common stock, par value $0.001 per share, the term “Series A Preferred Stock” refers to our Series A Convertible Preferred Stock, par value $0.001 per share, the term “Series A private placement” refers to the issuance and sale of the Series A Preferred Stock in a private placement and, unless the context indicates otherwise, the term “stockholder” refers, collectively, to the holders of our common stock and our Series A Preferred Stock. In addition, unless otherwise indicated all share and per share amounts are presented after giving effect to our 1-for-10 reverse stock split effected in August 2016.

2020 Avon Court, Suite 4

Charlottesville, Virginia 22902

__________________

PROXY STATEMENT FOR

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON THURSDAY, JUNE 15, 2017

__________________

The Board of Directors of Diffusion Pharmaceuticals Inc. (the “Board”) is using this proxy statement to solicit your proxy for use at the Diffusion Pharmaceuticals Inc. 2017 Annual Meeting of Stockholders to be held at 9:00 a.m., Eastern Time, on Thursday, June 15, 2017 (the “Annual Meeting”). The Board expects to make available electronically or to send to our stockholders the Notice of Annual Meeting of Stockholders, this proxy statement and a form of proxy on or about _______, 2017.

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

When and Where Will the Annual Meeting Be Held?

The Annual Meeting of Stockholders of Diffusion Pharmaceuticals Inc. will be held on Thursday, June 15, 2017, at 9:00 a.m., Eastern Time, in the James Monroe Room at the Charlottesville Omni Hotel located at 212 Ridge McIntire Road, Charlottesville, Virginia 22903.

What are the Purposes of the Annual Meeting?

The purposes of the Annual Meeting are to vote on the following items:

|

1. |

To approve the proposed terms of an offering of up to $20 million, which contemplates the issuance and sale (the “Offering”) of (i) shares of the Company’s Series B convertible preferred stock, $0.001 par value per share (“Series B Preferred Stock”), each share of Series B Preferred Stock being initially convertible into one share of the Company’s common stock, subject to adjustment, (ii) for each share of Series B Preferred Stock purchased in this Offering, a 5-year warrant to purchase one share of common stock (the “Warrants”), and (iii) the issuance of such number of shares of common stock issuable upon conversion of the Series B Preferred Stock and exercise of the Warrants exceeding 19.9% of our outstanding common stock (collectively, the “Offering Proposal”). |

|

2 |

To authorize the adjournment of the Annual Meeting, if necessary or appropriate, if a quorum is present, to solicit additional proxies if there are insufficient votes at the Annual Meeting in favor of the Offering Proposal. |

|

3. |

To elect six persons to serve as directors until our next annual meeting of stockholders or until their respective successors are elected and qualified. |

|

4. |

To ratify the selection of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2017. |

|

5. |

To approve, on an advisory basis, the compensation of our named executive officers during the year ended December 31, 2016, as disclosed in this proxy statement. |

|

6. |

To transact such other business as may properly come before the meeting or any adjournment of the meeting. |

Who is Entitled to Vote at the Annual Meeting?

Stockholders of record at the close of business on April 17, 2017 (the “Record Date”) will be entitled to notice of and to vote at the meeting or any adjournment of the Annual Meeting. As of the Record Date, there were 10,345,637 shares of our common stock outstanding and 12,376,329 shares of our Series A Preferred Stock outstanding. Pursuant to the Certificate of Designation of Preferences, Rights and Limitations of the Series A Convertible Preferred Stock (the “Certificate of Designation”), which was approved by the holders of a majority of our common stock on January 6, 2017, the holders of our Series A Preferred Stock are entitled to vote with the holders of common stock on the basis described below, and not as a separate class, on all matters at the Annual Meeting.

What Numbers of Votes is Each Share Entitled To?

Each share of our common stock is entitled to one vote on each matter to be voted on at the Annual Meeting.

Pursuant to the Certificate of Designation, each holder of shares of our Series A Preferred Stock is entitled to that number of votes equal to the whole number of shares of common stock into which the aggregate number of shares of Series A Preferred Stock held of record by such holder are convertible as of the Record Date, based on a conversion price equal to the closing price of our common stock on the date such Series A Preferred Stock was issued.

Accordingly, shares of Series A Preferred Stock issued in the initial closing of the Series A private placement on March 14, 2017 are entitled to 0.84874 votes per share, shares of Series A Preferred Stock issued in the final closing of the Series A private placement on March 31, 2017 are entitled to 0.50627 votes per share and, in the aggregate, the holders of our Series A Preferred Stock are entitled to 8,943,395 votes at the Annual Meeting.

As a result, the effective number of aggregate votes entitled to be cast at the Annual Meeting is 19,289,032.

How Do I Vote My Shares?

Your vote is important. Whether you hold shares directly as a stockholder of record or beneficially in “street name” (through a broker, bank or other nominee), you may vote your shares without attending the Annual Meeting. You may vote by granting a proxy or, for shares held in street name, by submitting voting instructions to your broker or nominee.

If you are a stockholder whose shares are registered in your name, you may vote your shares in person at the meeting or by one of the three following methods:

|

● |

Vote by Internet, by going to the web address http://www.proxyvote.com and following the instructions for Internet voting shown on your proxy card. |

|

● |

Vote by Telephone, by dialing 1-800-690-6903 and following the instructions for telephone voting shown on your proxy card. |

|

● |

Vote by Proxy Card, by completing, signing, dating and mailing the enclosed proxy card in the envelope provided. If you vote by Internet or telephone, please do not mail your proxy card. |

If your shares are held in street name, you may receive a separate voting instruction form or you may need to contact your broker, bank or other nominee to determine whether you will be able to vote electronically using the Internet or telephone.

The deadline for voting by telephone or by using the Internet is 11:59 p.m., Eastern Time, on Wednesday, June 14, 2017. Please see your proxy card or the information your bank, broker or other holder of record provided to you for more information on your options for voting.

How Will My Shares Be Voted?

If you return your signed proxy card or use Internet or telephone voting before the Annual Meeting, the named proxies will vote your shares as you direct.

For Proposal No. 1—Approval of the Offering Proposal, Proposal No. 2—Approval of the Adjournment Proposal, Proposal No. 4—Ratification of Selection of Independent Registered Public Accounting Firm and Proposal No. 5—Advisory Vote on Executive Compensation

|

● |

Vote FOR the proposal; |

|

● |

Vote AGAINST the proposal; or |

|

● |

ABSTAIN from voting on the proposal. |

For Proposal No. 3—Election of Directors, you may:

|

● |

Vote FOR all six of the nominees for director; |

|

● |

WITHHOLD your vote from all six of the nominees for director; or |

|

● |

WITHHOLD your vote from one or more of the six nominees for director that you designate. |

If you send in your proxy card or use Internet or telephone voting, but you do not specify how you want to vote your shares, the proxies will vote your shares:

|

● |

FOR Proposal No. 1—Approval of the Offering Proposal |

|

● |

FOR Proposal No. 2—Approval of the Adjournment Proposal |

|

● |

FOR all six of the nominees for director in Proposal No. 3— Election of Directors; |

|

● |

FOR Proposal No. 4—Ratification of Selection of Independent Registered Public Accounting Firm; and |

|

● |

FOR Proposal No. 5—Advisory Vote on Executive Compensation. |

How Does the Board of Directors Recommend that I Vote?

The Board of Directors recommends that you vote:

|

● |

FOR Proposal No. 1—Approval of the Offering Proposal |

|

● |

FOR Proposal No. 2—Approval of the Adjournment Proposal |

|

● |

FOR all six of the nominees for director in Proposal No. 3— Election of Directors; |

|

● |

FOR Proposal No. 4—Ratification of Selection of Independent Registered Public Accounting Firm; and |

|

● |

FOR Proposal No. 5—Advisory Vote on Executive Compensation. |

How Can I Revoke or Change My Vote?

If you are a stockholder whose shares are registered in your name, you may revoke your proxy at any time before it is voted by one of the following methods:

|

● |

Submitting another proper proxy with a more recent date than that of the proxy first given by following the Internet or telephone voting instructions or completing, signing, dating and returning a proxy card to us; |

|

● |

Sending written notice of revocation to our Secretary; or |

|

● |

Attending the Annual Meeting and voting by ballot. |

If you hold your shares through a broker, bank or other nominee, you may revoke your proxy by following instructions your broker, bank or other nominee provides.

Who is Paying for This Proxy Solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the reasonable cost of forwarding proxy materials to beneficial owners.

How Many Shares Must Be Present to Hold the Annual Meeting?

The presence at the Annual Meeting, in person or by proxy, of the holders of a majority (9,644,517 shares) of the voting power represented by the outstanding shares of our common stock and our Series A Preferred Stock as of the Record Date will constitute a quorum for the transaction of business at the Annual Meeting. In general, shares of our common stock and Series A Preferred Stock represented by a properly signed and returned proxy card will be counted as shares present and entitled to vote at the Annual Meeting for purposes of determining a quorum. Shares of our common stock and Series A Preferred Stock represented by proxies marked “Abstain” and “broker non-votes” are counted in determining whether a quorum is present. A “broker non-vote” is a proxy returned by a broker on behalf of its beneficial owner customer that is not voted on a particular matter because voting instructions have not been received by the broker from the customer, and the broker does not have discretionary authority to vote on behalf of such customer on such matter. If there is not a quorum, a majority of the voting power represented by the shares of our common stock and our Series A Preferred Stock present at the Annual Meeting may adjourn the Annual Meeting to a later date.

What Vote is Required for Each Proposal?

Assuming a quorum is represented at the Annual Meeting, either in person or by proxy, the following vote is required for each of the following matters:

|

● |

Proposal No. 1—Approval of the Offering Proposal requires “For” votes from the holders of a majority of shares present in person or represented by proxy and entitled to vote on the matter. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect. |

|

● |

Proposal No. 2—Approval of the Adjournment Proposal “For” votes from the holders of a majority of shares present in person or represented by proxy and entitled to vote on the matter. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect. |

|

● |

Proposal No. 3—Election of Directors requires the affirmative vote of a plurality of the votes cast at the election. Only votes “For” or “Withheld” will affect the outcome |

|

● |

Proposal No. 4—Ratification of Selection of Independent Registered Public Accounting Firm requires “For” votes from the holders of a majority of shares present in person or represented by proxy and entitled to vote on the matter. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect. |

|

● |

Proposal No. 5— Advisory Vote on Executive Compensation requires “For” votes from the holders of a majority of shares present in person or represented by proxy and entitled to vote on the matter. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect. |

If your shares are held in “street name” and you do not indicate how you wish to vote, your broker is permitted to exercise its discretion to vote your shares on certain “routine” matters. The only routine matter to be submitted to our stockholders at the Annual Meeting is Proposal No. 4—Ratification of Selection of Independent Registered Public Accounting Firm. None of our other proposals are routine matters. Accordingly, if you do not direct your broker how to vote for a director in Proposal No. 3 or how to vote for Proposals No.1, Proposal No.2 or Proposal No.5, your broker may not exercise discretion and may not vote your shares on that proposal.

The following table summarizes the vote threshold required for approval of each proposal and the effect on the outcome of the vote of abstentions and uninstructed shares held by brokers (referred to as broker non-votes).

|

Proposal |

|

Item |

|

Vote Required for |

|

Effect of |

|

Effect of Broker Non-Votes |

|

1 |

Approval of the Offering Proposal |

Majority of shares present and entitled to vote |

|

Counted “against” |

|

Not voted/No effect | ||

|

2 |

Approval of the Adjournment Proposal |

Majority of shares present and entitled to vote |

|

Counted “against” |

|

Not voted/No effect | ||

|

3 |

|

Election of Directors |

|

Plurality of votes cast |

|

No effect |

|

Not voted/No effect |

|

4 |

|

Ratification of Selection of Independent Registered Public Accounting Firm |

|

Majority of shares present and entitled to vote |

|

Counted “against” |

|

Shares may be voted by brokers in their discretion but any non-votes have no effect |

|

5 |

|

Advisory Vote on Executive Compensation |

|

Majority of shares present and entitled to vote |

|

Counted “against” |

|

Not voted/No effect |

Who Will Count the Votes?

We currently expect that Broadridge Financial Solutions, Inc. will tabulate the votes and our Secretary will be our inspector of elections for the Annual Meeting.

Who Do I Contact if I Have Questions Regarding the Annual Meeting?

If you have questions about the Annual Meeting or would like additional copies of this proxy statement, you should contact our Senior Vice President – Finance, Treasurer & Secretary, Ben L. Shealy, at 2020 Avon Court, Suite 4, Charlottesville, Virginia 22902.

Are There Any Matters to be Voted on at the Annual Meeting that are not Included in this Proxy Statement?

We currently are not aware of any business to be acted upon at the Annual Meeting other than that described in this proxy statement. If, however, other matters properly are brought before the Annual Meeting, or any adjournment or postponement of the Annual Meeting, your proxy includes discretionary authority on the part of the individuals appointed to vote your shares or act on those matters according to their best judgment, including to adjourn the Annual Meeting if a quorum is not present.

How Will Business Be Conducted at the Annual Meeting?

The presiding officer at the Annual Meeting will determine how business at the meeting will be conducted. Only nominations and other proposals brought before the Annual Meeting in accordance with the advance notice and information requirements of our Amended and Restated Bylaws will be considered, and no such nominations or other proposals were received. In order for a stockholder proposal to have been included in our proxy statement for the Annual Meeting, our Secretary must have received such proposal a reasonable period of time before we began to print and send our proxy materials. Under our Amended and Restated Bylaws, complete and timely written notice of a proposed nominee for election to the Board at the Annual Meeting or a proposal for any other business to be brought before the Annual Meeting must have been received by our Secretary not later than April 21, 2017, and must have contained the specific information required by our Amended and Restated Bylaws, in order to be included in this proxy statement.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This proxy statement contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and are subject to the safe harbor created by those sections. We have identified some of these forward-looking statements with words like “believe,” “may,” “could,” “would,” “might,” “possible,” “potential,” “will,” “should,” “expect,” “intend,” “plan,” “predict,” “anticipate,” “estimate” and “continue”, the negative of these words, other words and terms of similar meaning and the use of future dates. Forward-looking statements involve risks and uncertainties. These uncertainties include factors that affect all businesses as well as matters specific to us. Forward-looking statements by their nature address matters that are, to different degrees, uncertain. Uncertainties and risks may cause our actual results to be materially different than those expressed in or implied by our forward-looking statements. For us, particular uncertainties and risks include, among others, our history of operating losses and negative cash flow, uncertainties regarding clinical testing, the difficulty of developing pharmaceutical products, obtaining regulatory and other approvals and achieving market acceptance and other risks and uncertainties described in our filings with the Securities and Exchange Commission (the “SEC”), including:

|

|

● |

our estimates regarding expenses, future revenues, capital requirements and needs for additional financing; |

|

|

● |

the success and timing of our preclinical studies and clinical trials; |

|

|

● |

the difficulties in obtaining and maintaining regulatory approval of our products and product candidates, and the labeling under any approval we may obtain; |

|

|

● |

our plans and ability to develop and commercialize our product candidates; |

|

|

● |

our failure to recruit or retain key scientific or management personnel or to retain our executive officers; |

|

|

● |

the accuracy of our estimates of the size and characteristics of the potential markets for our product candidates and our ability to serve those markets; |

|

|

● |

regulatory developments in the United States and foreign countries; |

|

|

● |

the rate and degree of market acceptance of any of our product candidates; |

|

|

● |

our ability to obtain additional financing; |

|

|

● |

obtaining and maintaining intellectual property protection for our product candidates and our proprietary technology; |

|

|

● |

our ability to operate our business without infringing the intellectual property rights of others; |

|

|

● |

recently enacted and future legislation regarding the healthcare system; |

|

|

● |

the success of competing products that are or become available; and |

|

|

● |

the performance of third parties, including contract research organizations and manufacturers. |

All forward-looking statements in this proxy statement speak only as of the date of this proxy statement and are based on our current beliefs and expectations. We undertake no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as otherwise required by law.

RECENT CHANGE OF CONTROL

On December 15, 2015, we entered into a merger agreement (the “Merger Agreement”) with Diffusion Pharmaceuticals LLC (“Diffusion LLC”) and on January 8, 2016 we completed the merger (the “Merger”) with Diffusion LLC surviving as our wholly-owned subsidiary

At the effective time of the Merger (the “Effective Time”), each outstanding unit of membership interest of Diffusion LLC (the “Diffusion Units”) was converted into the right to receive 0.3652658 shares of our common stock (the “Exchange Ratio”). Also at the Effective Time, the rights of the holders of each outstanding convertible promissory note convertible into Diffusion Units (the “Diffusion Convertible Notes”) and each outstanding option to purchase Diffusion Units upon the conversion or exercise thereof were converted into the right to receive shares of our common stock based on the Exchange Ratio.

Immediately following the Merger, the former equity holders of Diffusion LLC owned approximately 84.1% of our common stock, and our pre-Merger stockholders owned approximately 15.9% of our common stock, in each case, on a fully-diluted basis (subject to certain exceptions and adjustments) and calculated in accordance with the terms of the Merger Agreement. For accounting purposes, the Merger is treated as a “reverse acquisition” under generally acceptable accounting principles in the United States and Diffusion LLC is considered the accounting acquirer.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Based on information available to us and filings with the SEC, the following table sets forth certain information regarding the beneficial ownership (as defined by Rule 13d-3 under the Exchange Act) of our outstanding common stock and Series A Preferred Stock as of the Record Date for (i) each person who beneficially owns 5% or more of the shares of common stock or Series A Preferred Stock then outstanding; (ii) each of our current directors and nominees; (iii) each of our current named executive officers (as defined in Item 402(a)(3) of Regulation S-K under the Exchange Act); and (iv) all of our current directors and executive officers as a group.

Beneficial ownership and percentage ownership are determined in accordance with the rules of the SEC and include voting or investment power with respect to shares of stock. This information does not necessarily indicate beneficial ownership for any other purpose. Under these rules, shares of common stock issuable under stock options, the Series A Preferred Stock, our convertible debt instruments or warrants that are exercisable or convertible within 60 days of the Record Date are deemed outstanding for the purpose of computing the beneficial ownership percentage of the holder thereof, but are not deemed outstanding for the purpose of computing the beneficial ownership percentage of any other person. Ownership is based upon information provided by each respective director and officer, Forms 4, Schedules 13D and 13G and other public documents filed with the SEC for some of the stockholders.

Unless otherwise indicated and subject to applicable community property laws, to our knowledge, each stockholder named in the following table possesses sole voting and investment power over their shares of common stock, except for those jointly owned with that person’s spouse. Unless otherwise indicated below, the address of each person listed on the table is c/o Diffusion Pharmaceuticals Inc. 2020 Avon Court, Suite 4, Charlottesville Virginia 22902.

|

Name and Address of Beneficial Owner |

Shares of Common Stock Beneficially Owned(1) |

Common Stock Beneficial Ownership Percentage (2) |

Percentage of Total Voting Power (2)(3) |

|||||||||

|

Greater than 5% Holders |

||||||||||||

|

Richard Baxter Gilliam (4) |

1,424,836 | 13.8 | % | 7.4 | % | |||||||

|

Ally Bridge Group Capital Partners II L.P. (5) |

1,133,281 | 9.9 | % | 2.8 | % | |||||||

|

MTG Investment Holdings, LLC (6) |

802,689 | 7.8 | % | 4.2 | % | |||||||

|

Michael S. & Ellen A. Geismar |

552,414 | 5.3 | % | 2.9 | % | |||||||

|

Current Directors and Executive Officers |

||||||||||||

|

David G. Kalergis (7) |

286,458 | 2.7 | % | * | ||||||||

|

John L. Gainer, Ph.D. (8) |

506,686 | 4.8 | % | 1.9 | % | |||||||

|

Ben L. Shealy (9) |

95,491 | * | * | |||||||||

|

Thomas Byrne (10) |

260,544 | 2.5 | % | * | ||||||||

|

Mark T. Giles (6)(11) |

878,679 | 8.4 | % | 4.2 | % | |||||||

|

Alan Levin (12) |

61,805 | * | * | |||||||||

|

Robert Adams (13) |

134,298 | 1.3 | % | * | ||||||||

|

Isaac Blech (14) |

90,503 | * | * | |||||||||

|

All current directors and executive officers as a group (eight persons) (15) |

2,314,464 | 20.9 | % | 8.1 | % | |||||||

*Indicates less than 1%.

|

(1) |

Represents shares of common stock and shares of restricted stock held as of the Record Date plus shares of common stock that may be acquired upon conversion of preferred shares or debt or exercise of options, warrants and other rights exercisable within sixty (60) days of the Record Date. | |

|

(2) |

Based on 10,345,637 shares of common stock that were issued and outstanding as of the Record Date. The percentage ownership and voting power for each person (or all directors and executive officers as a group) is calculated by assuming the exercise or conversion of all options, warrants and convertible securities (including the Series A Preferred Stock) exercisable or convertible within sixty (60) days of the Record Date held by such person and the non-exercise and non-conversion of all outstanding warrants, options and convertible securities (including the Series A Preferred Stock) held by all other persons (including our other directors and executive officers). | |

|

(3) |

Based on an effective number of aggregate votes entitled to be cast of 19,289,032 and the number of shares of common stock and Series A Preferred Stock issued, outstanding and held by the holder as of the Record Date. On the Record Date, 10,345,637 shares of common stock and 12,376,329 shares of Series A Preferred Stock that were issued and outstanding as of the Record Date. In accordance with the Certificate of Designation, shares of Series A Preferred Stock issued in the initial closing of the Series A private placement on March 14, 2017 are entitled to 0.84874 votes per share and shares of Series A Preferred Stock issued in the final closing of the Series A private placement on March 31, 2017 are entitled to 0.50627 votes per share entitling the holders of shares of the Series A Preferred Stock to 8,943,395 votes in the aggregate. | |

|

(4) |

Based solely on the Form 3 filed with the Securities and Exchange Commission by Mr. Gilliam on February 19, 2016. Consists of (a) 1,268,798 shares of common stock held by Mr. Gilliam directly and (b) 156,038 shares of common stock held by Westwood Tall Oaks LLC. Mr. Gilliam is a manager of Westwood Tall Oaks LLC. | |

|

(5) |

Shares beneficially owned is based solely on the Schedule 13G/A filed with the SEC on April 6, 2017 by Ally Bridge Group Capital Partners II, L.P. (“Ally Bridge”). The address of Ally Bridge is Unit 3002-3004, 30th Floor, Gloucester Tower, The Landmark, 15 Queen’s Road Central, Hong Kong. | |

|

(6) |

Mark T. Giles, one of our directors, is the sole member of MTG Investment Holdings, LLC and may be deemed to be the beneficial owner of such securities. Mr. Giles disclaims beneficial ownership of such securities except to the extent of his pecuniary interest therein. | |

|

(7) |

Consists of (a) 68,670 shares of common stock held directly by Mr. Kalergis directly, (b) 7,388 shares of common stock held by Mr. Kalergis’ wife, (c) 38,252 shares of common stock held jointly with Mr. Kalergis’ wife, and (d) 172,148 shares of common stock issuable upon the exercise of options exercisable within 60 days of the Record Date. | |

|

(8) |

Consists of (a) 372,572 shares of common stock held by the John L. Gainer Declaration of Trust dated February 19, 2008 and (b) 134,114 shares of common stock issuable upon the exercise of options exercisable within 60 days of the Record Date. Dr. Gainer is a trustee of the revocable trust, and, as such, may be deemed to share beneficial ownership of such shares. Dr. Gainer expressly disclaims beneficial ownership of any such shares except to the extent of his pecuniary interest therein. | |

|

(9) |

Consists of shares of common stock issuable upon the exercise of options exercisable within 60 days of January 3, 2016. | |

|

(10) |

Consists of (a) 139,187 shares of common stock held by Mr. Byrne directly and (b) 121,357 shares of common stock issuable upon the exercise of options exercisable within 60 days of the Record Date. | |

|

(11) |

Consists of (a) 4,407 shares of common stock held for the benefit of Mr. Giles in his individual retirement account, (b) 802,689 shares of common stock held by MTG Investment Holdings, LLC and (c) 71,583 shares of common stock issuable upon the exercise of options exercisable within 60 days of the Record Date. | |

|

(12) 1 |

Consists of (a) 24,804 shares of common stock held by Mr. Levin directly and (b) 37,001 shares of common stock issuable upon the exercise of options exercisable within 60 days of the Record Date. | |

|

(13) |

Consists of (a) 25,587 shares of common stock held directly by Mr. Adams directly, (b) 9,464 shares of common stock held jointly with Mr. Adams’ wife, (c) 18,898 shares of common stock held for the benefit of Mr. Adams in his 401(k) retirement account and (d) 80,349 shares of common stock issuable upon the exercise of options exercisable within 60 days of the Record Date. | |

|

(14) |

Consists of (a) 28,334 shares of common stock held directly by Mr. Blech directly, (b) 11,905 shares of common stock held jointly with Mr. Blech’s wife, (c) 11,905 shares of common stock held for the benefit of Mr. Blech in a trust and (d) 38,359 shares of common stock issuable upon the exercise of options and warrants exercisable within 60 days of the Record Date. | |

|

(15) |

Includes 750,402 shares of common stock issuable upon the exercise of options and warrants exercisable within 60 days of the Record Date. | |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors and executive officers and all persons who beneficially own more than 10 percent of the outstanding shares of our common stock to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock. Directors, executive officers and greater than 10 percent beneficial owners also are required to furnish us with copies of all Section 16(a) forms they file.

To our knowledge, based on a review of the copies of such reports and amendments to such reports furnished to us with respect to the year ended December 31, 2016, and based on written representations by our directors and executive officers, all required Section 16 reports under the Exchange Act, for our directors, executive officers and beneficial owners of greater than 10 percent of our common stock were filed on a timely basis during the year ended December 31, 2016, except for the following: on January 13, 2016, Mr. Kalergis filed a Form 4 for a transaction that occurred on January 8, 2016; on February 19, 2016, Mr. Gilliam filed a Form 3 for a transaction that occurred on January 8, 2016; on May 20, 2016, each of Dr. Gainer and Messrs. Kalergis, Shealy and Byrne filed a Form 4 for transactions that occurred on May 16, 2016; on August 30, 2016 and September 16, 2016, Mr. Blech filed a Form 3 and a Form 4, respectively, for transactions that occurred on August 11, 2016 and August 31, 2016, respectively; and on December 13, 2016, each of Dr. Gainer and Messrs. Kalergis, Shealy, Levin, Giles and Adams filed a Form 4 for transactions that occurred on December 8, 2016.

PROPOSAL NO. 1

TO APPROVE THE PROPOSED ISSUANCE AND SALE OF SHARES OF SERIES B CONVERTIBLE

PREFERRED STOCK AND WARRANTS

General

Our Board has unanimously approved, and recommended that our stockholders approve, the proposed terms of an offering, which contemplates the issuance and sale (the “Offering”) of (i) shares of the Company’s Series B Preferred Stock, each share of Series B Preferred Stock being initially convertible into one share of the Company’s common stock, subject to adjustment, (ii) for each share of Series B Preferred Stock purchased in this Offering, a 5-year warrant to purchase one share of common stock (the “Warrants”), and (iii) the issuance of such number of shares of common stock issuable upon conversion of the Series B Preferred Stock and exercise of the Warrants, exceeding 19.9% of our outstanding common stock (collectively, the “Offering Proposal”). We have also engaged an investment bank to act as our placement agent for the Offering (the “Placement Agent”). The securities to be offered in the Offering have not been and will not be registered under the Securities Act of 1933, as amended, and may not be resold by the purchasers thereof except pursuant to a registration statement or an exemption from registration.

Reasons for the Offering

Our Board has determined that the Offering is advisable and in the best interest of our stockholders. The Company currently intends to use the proceeds of this Offering to fund research and development of its lead product candidate, transcrocetinate sodium, also known as trans sodium crocetinate and for general corporate purposes. A stockholder vote against the Offering Proposal could have the impact of restricting our ability to consummate or maximize the proceeds to the Company in connection with the Offering.

Material Terms of the Offering

The Company will offer Securities for aggregate gross proceeds of up to a maximum of $20,000,000 (the “Maximum Offering”). The minimum individual purchase is $50,000 although the Company and the Placement Agent may allow sales of a lesser amount at their discretion.

The price of the Securities will be $2.10 per share (the “Offering Price”).

The first sale of Securities is expected to occur on or about July 15, 2017 (the “Initial Closing”). Subsequent closings will be held periodically until the Securities are fully subscribed or the Offering is terminated by the Company, and in any event no later than September 30, 2017 (subject to the right of the Company and the Placement Agent to extend this Offering for an additional thirty (30) days in their sole discretion, without further notice to investors) (the “Expiration Date”).

Description of Series B Convertible Preferred Stock

The following is a summary of the rights, preferences and privileges of the Series B Preferred Stock as set forth in the Certificate of Designation of Preferences, Rights and Limitations of the Series B Preferred Stock to be filed with the Delaware Secretary of State prior to the Initial Closing (the “Certificate of Designation”), attached hereto as Appendix A.

Voting. The holders of the Series B Preferred Stock will be entitled to vote with the holders of common stock (and any other class or series that may similarly be entitled to vote with the holders of common stock as the Board may authorize and issue, including the Company’s Series A Preferred Stock and not as a separate class, at any annual or special meeting of stockholders of the Company, and may act by written consent in the same manner as the holders of common stock. In the event of any such vote or action by written consent, each holder of shares of Series B Preferred Stock shall be entitled to that number of votes equal to the whole number of shares of common stock into which the aggregate number of shares of Series B Preferred Stock held of record by such Holder are convertible as of the close of business on the record date fixed for such vote or such written consent based on a conversion price, solely for such purpose, equal to the closing price of our common stock on the date such Series B Preferred Stock was issued. In addition, for as long as 50% of the shares of Series B Preferred Stock outstanding immediately after the final closing remain outstanding, without the consent of holders of at least a majority of the then outstanding shares of Series B Preferred Stock, the Company may not (a) amend the Charter or bylaws so as to materially and adversely affect any rights of the holders of the Series B Preferred Stock, (b) increase or decrease (other than by conversion of the Series B Preferred Stock) the authorized number of Series B Preferred Stock to be in excess of the number of shares required to satisfy the Maximum Offering, (c) amend the Certificate of Designation, (d) repay, repurchase or offer to repay, repurchase or otherwise acquire more than a de minimis number of shares of common stock or common stock equivalents or (e) enter into any agreement or understanding with respect to (a) through (d).

Liquidation. The Series B Preferred Stock will rank senior to the common stock and each other class of capital stock of the Company or series of preferred stock of the Company authorized by the Board in the future that does not expressly provide that such class or series ranks senior to, or on parity with, the Series B Preferred Stock (“Junior Securities”). The Series B Preferred Stock will rank on parity with each other class or series of capital stock of the Company established hereafter by the Board the terms of which expressly provide that such class or series will rank equally with the Series B Preferred Stock. The Series B Preferred Stock will rank junior to the Series A Preferred Stock and each other class or series of capital stock of the Company authorized by the Board in the future the terms of which expressly provide that such class or series will rank senior to the Series B Preferred Stock. In the event of a Liquidation Event (as defined in the Certificate of Designation), the holders of the Series B Preferred Stock shall be entitled to receive, out of the assets of the Company or proceeds thereof legally available therefor, an amount in cash equal to 100% of the stated value of the Series B Preferred Stock before any payment or distribution of the assets of the Company is made or set apart for the holders of Junior Securities. In addition, prior to such Liquidation Event, the holders of Series B Preferred Stock shall be entitled to notice so that they may exercise their conversion rights prior to such event.

Conversion. At any time after the date of issuance, each share of the Series B Preferred Stock, at the holder’s sole and absolute discretion, shall initially be convertible into one (1) share of common stock. Holders may immediately convert their Series B Preferred Stock prior to the occurrence of certain Liquidation Events (as defined in the Certificate of Designation). In addition, each share of Series B Preferred Stock will automatically convert, initially, into one (1) share of common stock on the earliest to occur of (a) any date that is more than 30 trading days after the final closing date of the Offering that the 30 day moving average of the closing price of the common stock on the NASDAQ Capital Market (or any other exchange where the common stock is traded) exceeds $8.00 per share (subject to adjustment in the event of a stock dividend or split), (b) the one (1) year anniversary of the initial closing date of the Offering or (c) upon the majority vote of the voting power of the then outstanding shares of Series B Preferred Stock. The conversion price of the Series B Preferred Stock will be subject to adjustment as described in the Certificate of Designation. The Company is not required to issue any fractional shares of Series B Preferred Stock or common stock in connection with the conversion of Series B Preferred Stock and may, in each case, at the Company’s discretion, pay the holder such amount in cash or deliver an additional whole share in lieu thereof.

Description of Warrants

The Warrants will have an exercise price equal to $2.31, will be immediately exercisable, will have a cashless exercise provision in certain circumstances and will be subject to customary anti-dilution adjustments and adjustments in the event of certain transformative transactions. The Warrants will be exercisable for five (5) years following the final closing date. The Warrants are subject to a provision prohibiting the exercise of such Warrants to the extent that, after giving effect to such exercise, the holder of such Warrant (together with the holder’s affiliates, and any other persons acting as a group together with the holder or any of the holder’s affiliates), would beneficially own in excess of 19.99% of the outstanding common stock.

We will also issue warrants exercisable for common stock to the Placement Agent as part of compensation for its services.

Registration Rights

In connection with the Offering, the Company will offer registration rights to each investor that purchased our Series B Preferred Stock pursuant to which the Company will be required to file a registration statement to register the common stock issuable upon the conversion or exercise of the Securities, subject to certain limitations and the terms contained therein. The form of Registration Rights Agreement is attached hereto as Appendix B.

Possible Effects on Rights of Existing Stockholders

Existing stockholders will suffer significant dilution in ownership interests and voting rights as a result of the issuance of the Series B Preferred Stock and the potential issuance of shares of our common stock upon the conversion of the Series B Preferred Stock or the exercise of the Warrants. The Series B Preferred Stock will be senior to our common stock with respect to dividends and liquidation preferences. The holders of Series B Preferred Stock will vote with the holders of common stock and Series A Preferred Stock in any vote on an adjusted as-converted basis. The potential dilution described above does not give effect to (i) the issuance of additional shares of common stock due to potential future anti-dilution adjustments on the Series B Preferred Stock, (ii) the issuance of shares of common stock pursuant to other outstanding options and warrants or (iii) any other future issuances of our common stock. The sale into the public market of these shares also could materially and adversely affect the market price of our common stock.

If the Offering has aggregate gross proceeds of at least $10 million, in addition to the effects above, the Series A Preferred Stock will automatically convert into the applicable number of shares of our common stock and the make-whole adjustment will no longer apply to the Series A Preferred Stock pursuant to Sections 4(b) and 5(g), respectively, of the Certificate of Designation of Preferences, Rights and Limitations of the Series A Preferred Stock.

Appraisal Rights

Under Delaware General Corporation Law, stockholders are not entitled to appraisal rights with respect to the proposed Offering described in this Proposal 1.

Reasons for Stockholder Approval

Our common stock is listed on The Nasdaq Capital Market and, as such, we are subject to the Nasdaq Listing Rules. Nasdaq Listing Rule 5635(d) (the “Nasdaq 20% Rule”) requires that an issuer obtain stockholder approval prior to the issuance of common stock if such issuance is for less than the greater of book or market value of the common stock and would equal 20% or more of the common stock or voting power of the issuer outstanding before the issuance. The $2.10 price per share of the Series B Preferred Stock may be less than the greater of the book or market value of our common stock immediately before we enter into a Subscription Agreement. In addition, the terms of the Series B Preferred Stock include anti-dilution adjustments that could result in a reduction of the conversion price in the future. We will also issue additional shares to the Placement Agent as compensation under our arrangement with the Placement Agent. If this proposal is approved, the issuance of our common stock upon conversion of the Series B Preferred Stock and exercise of the Warrants may exceed 20% of our common stock outstanding as of the Record Date. We seek your approval of this proposal in order to satisfy the requirements of the Nasdaq 20% Rule with respect to the issuance of the common stock upon conversion of the Series B Preferred Stock and/or exercise of the Warrants.

Furthermore, under Nasdaq Listing Rule 5635(c) (the “Nasdaq Employee Participation Rule”) prior stockholder approval is required to allow officers, directors and employees of the Company to participate in the below market offering. We may allow our officers, directors and employees to participate in the Offering, and therefore we also seek your approval of this proposal in order to satisfy the requirements of the Nasdaq Employee Participation Rule with respect to the participation of our officers, directors and employees in the Offering. Based on indications of interest received to date, we expect subscriptions from our officers, directors and employees to be no more than $500,000 in the aggregate.

In addition, under Nasdaq Listing Rule 5635(b) (the “Nasdaq Change of Control Rule”) prior stockholder approval is required for issuances of securities that will result in a "change of control" of the issuer. Nasdaq may deem a change of control to occur when, as a result of an issuance, an investor or a group of investors acting together would own, or have the right to acquire, 20% or more of the outstanding shares of common stock or voting power and such ownership or voting power would be the largest ownership position of the issuer. Following the closing of the Offering, one or more investors in the Offering, assuming the conversion of their Series B Preferred Stock and the exercise of their warrants in full, may own shares of our common stock which represent more than 20% of the total voting power of the Company's voting securities following the closing of the Offering. As the identities of the potential investors in the Offering are currently unknown, additional stockholder approval would be required in order to satisfy the requirements of the Nasdaq Change of Control Rule with respect to the issuance of the common stock upon conversion of the Series B Preferred Stock and/or exercise of the Warrants.

Approval of this proposal will constitute approval pursuant to the Nasdaq 20% Rule and the Nasdaq Employee Participation Rule. The information set forth in this proposal is qualified in its entirety by reference to the actual terms of the Certificate of Designation, Registration Rights Agreement, the Subscription Agreement and the Warrant, attached hereto as Appendices A through D, respectively, and which are incorporated herein by reference. Stockholders are urged to carefully read these documents.

Material Relationships between the Company and the Placement Agent

We have agreed: (i) to pay the Placement Agent a cash commission equal to 9% of the aggregate gross proceeds of the Series B Preferred Stock sold at each closing, subject to certain exceptions; (ii) to grant to the Placement Agent or its designees 5-year warrants to purchase shares of Common Stock equal to 8% of the aggregate number of shares of Preferred Stock sold through their efforts in this Offering at each closing, subject to certain exceptions, at a price per share equal to $2.31, with such warrants containing a cashless exercise provision; (iii) to indemnify the Placement Agent against certain liabilities; and (iv) to reimburse the Placement Agent for certain reasonable and documented expenses.

The Placement Agent also provides general financial advisory service to the Company from time to time pursuant to a separate arrangement. On June 1, 2016, the Company issued 102,430 shares of its common stock to the Placement Agent as compensation for such services in reliance upon an exemption pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended. The Company has also previously engaged the Placement Agent to act as placement agent in prior private placement transactions, pursuant to which the Company paid the placement agent approximately $2.45 million in fees and expenses, in the aggregate, issued to the Placement Agent warrants to purchase, in the aggregate, 1,179,558 shares of common stock, subject to adjustment, and granted the Placement Agent a right of first refusal with respect to certain future equity offerings.

Interests of Directors and Executive Officers

Our directors and executive officers have no substantial interests, directly or indirectly, in the matters set forth in this proposal except to the extent of their ownership of shares of common stock and the indications of interest described above. As discussed above under the heading “—Reasons for Stockholder Approval”, if this Proposal No. 1 is approved, our officers, directors and employees may participate in the Offering.

Vote Required

The Offering Proposal will be approved if a majority vote of the shares present in person or represented by proxy and entitled to vote on the matter is cast FOR the proposal. Accordingly, abstentions will be counted as votes cast and, therefore, will have the effect of an “Against” vote of this proposal. Broker non-votes will have no effect on this proposal.

Board Recommendation

The Board of Directors unanimously recommends a vote FOR the approval of the Offering Proposal

PROPOSAL NO. 2

ADJOURNMENT PROPOSAL

If at the Annual Meeting the number of shares of capital stock present or represented and voting in favor of the Offering Proposal is insufficient to approve the Offering, management may move to adjourn, postpone or continue the Annual Meeting in order to enable the Board to continue to solicit additional proxies in favor of the Offering Proposal.

In this Adjournment Proposal, we are asking you to authorize the holder of any proxy solicited by the Board to vote in favor of adjourning, postponing or continuing the Annual Meeting and any later adjournments. If the stockholders approve the Adjournment Proposal, we could adjourn, postpone or continue the Annual Meeting, and any adjourned session of the Annual Meeting, to use the additional time to solicit additional proxies in favor of the Offering Proposal. Among other things, approval of the Adjournment Proposal could mean that, even if proxies representing a sufficient number of votes against the Offering Proposal have been received, we could adjourn, postpone or continue the Annual Meeting without a vote on the Offering Proposal, and seek to convince the holders of those shares to change their votes to votes in favor of the Offering Proposal.

Vote Required

The Adjournment Proposal will be approved if a majority vote of the shares present in person or represented by proxy and entitled to vote on the matter is cast FOR the proposal. Accordingly, abstentions will be counted as votes cast and, therefore, will have the effect of an “Against” vote of this proposal. Broker non-votes will have no effect on this proposal.

Board Recommendation

The Board of Directors unanimously recommends a vote FOR the approval of the Adjournment Proposal

PROPOSAL NO. 3

ELECTION OF DIRECTORS

Number of Directors

Our Amended and Restated Bylaws provide that the Board of Directors will consist of at least one member, or such other number as may be determined by the Board of Directors or our stockholders. The Board of Directors has fixed the number of directors at six.

Nominees for Director

The Board of Directors has nominated the following six individuals to serve as our directors until the next annual meeting of our stockholders or until their successors are elected and qualified. All of the nominees named below are current members of the Board of Directors.

| ● | David G. Kalergis | |

|

● |

Isaac Blech |

|

● |

John L. Gainer, Ph.D. |

|

● |

Robert Adams |

|

● |

Mark T. Giles |

|

● |

Alan Levin |

Proxies only can be voted for the number of persons named as nominees in this proxy statement, which is six.

If prior to the Annual Meeting, the Board of Directors should learn that any nominee will be unable to serve for any reason, the proxies that otherwise would have been voted for this nominee will be voted for a substitute nominee as selected by the Board of Directors. Alternatively, the proxies, at the discretion of the Board of Directors, may be voted for that fewer number of nominees as results from the inability of any nominee to serve. The Board of Directors has no reason to believe that any of the nominees will be unable to serve.

Information About Current Directors and Board Nominees

The table below sets forth, as of the Record Date, certain information that has been furnished to us by each current director and each individual who has been nominated by the Board of Directors to serve as a director of our company.

|

Name |

Age |

Director Since | ||

|

David G. Kalergis |

68 |

2016 | ||

|

Isaac Blech |

67 |

2016 | ||

|

John L. Gainer, Ph.D. |

78 |

2016 | ||

|

Robert Adams(1) |

67 |

2016 | ||

|

Mark T. Giles(1) |

62 |

2016 | ||

|

Alan Levin(1) |

55 |

2016 |

________________________

|

(1) |

Current member of the Audit, Compensation and Nominating and Corporate Governance Committees. |

Additional Information About Current Directors and Board Nominees

The paragraphs below provide information about each current director and nominee for director, including all positions he holds, his principal occupation and business experience for the past five years, and the names of other publicly held companies of which he currently serves as a director or served as a director during the past five years. We believe that all of our director nominees display personal and professional integrity; satisfactory levels of education and/or business experience; broad-based business acumen; an appropriate level of understanding of our business and its industry and other industries relevant to our business; the ability and willingness to devote adequate time to the work of the Board of Directors and its committees; a fit of skills and personality with those of our other directors that helps build a board of directors that is effective, collegial and responsive to the needs of our company; strategic thinking and a willingness to share ideas; a diversity of experiences, expertise and background; and the ability to represent the interests of all of our stockholders. The information presented below regarding each director and nominee for director also sets forth specific experience, qualifications, attributes and skills that led the Board of Directors to the conclusion that he or she should serve as a director in light of our business and structure.

David G. Kalergis – Mr. Kalergis has served as our Chairman of the Board and Chief Executive Officer since the completion of the Merger. Mr. Kalergis, along with Dr. Gainer, is the Company’s co-founder and has served as a director of Diffusion LLC since its inception in 2001 and as its Chief Executive Officer since 2004. Prior to joining the Diffusion LLC, Mr. Kalergis held positions with the University of Virginia, as the general counsel and director of business development for Pharmaceutical Research Associates, Inc., a pharmaceutical contract research organization, as an intelligence analyst for the U.S. Government and with the law firm Dewey, Ballantine, Bushby, Palmer & Wood, practicing in the areas of corporate finance, public offerings and mergers and acquisitions. In addition, from July 1998 until May 2012, Mr. Kalergis served on the board of directors and audit committee of Virginia National Bank. Mr. Kalergis received a B.A. in psychology, as well as an M.B.A. and J.D., from the University of Virginia, and is a graduate of the Harvard Business School’s Leadership and Strategy in the Pharmaceutical and Biotechnology Industry program.

The Board believes Mr. Kalergis’ perspective and experience as the Chief Executive Officer and a director of Diffusion, as well as his depth of operating and senior management experience in our industry and educational background, provide him with the qualifications to serve as a director.

Isaac Blech – Mr. Blech has served as a director since August 2016. Mr. Blech is a biotechnology entrepreneur and investor. Mr. Blech’s current roles include serving as vice chairman of the board of directors of Edge Therapeutics, Inc., a clinical-stage biotechnology company, founder and director of Cerecor, Inc., a CNS company, director of ContraFect Corporation, an infectious disease company, director of Aevi Genomic Medicine (previously Medgenics, Inc.), a biotechnology company, and vice chairman of InspireMD, a stent company. He is vice chairman of the boards of directors of Centrexion Corporation, a private company which is developing new modalities of pain control, Regenovation, Inc., a private company developing new ways to regenerate human tissue, X4 Pharmaceuticals, a private cancer immunology company, Sapience Therapeutics, a private oncology company, Aridis Pharmaceuticals, a private company with a product to treat pneumonia, WaveGuide Corporation, a private company developing the world’s smallest NMR machine, Alveo, a private company developing a hand held diagnostic device to replace PC, X-VAX Technology, Inc., a private vaccine company whose initial product is a preventative vaccine for Herpes 1 and Herpes 2, SpendSmart Networks, Inc., a private electronic rewards company, and root9B Technologies, a private cyber security company. Mr. Blech earned a B.A. degree from Baruch College in 1975. Mr. Blech was previously a member of the board of directors of the Company prior to the Merger.

The Board believes Mr. Blech’s broad and substantial experience as a founder, director and major investor in numerous biotechnology companies, provide him with the qualifications to serve as a director.

John L. Gainer, Ph.D. – Dr. Gainer has served as a director and as our Chief Scientific Officer since the completion of the Merger in January 2016. Dr. Gainer, along with Mr. Kalergis, is the Company’s co-founder and has served as one of Diffusions LLC’s directors and as its Chief Scientific Officer since its inception in 2001. From 1966 until his retirement in 2005, Dr. Gainer was a professor of chemical engineering at the University of Virginia. During his career, Dr. Gainer authored more than 100 scientific journal articles, including more than 30 published in medical journals, and spent two sabbaticals investigating drug actions and related research at Karolinska Institute in Stockholm and the laboratory of a major pharmaceutical company. He has been a member of the International Society for Oxygen Transport in Tissues since its inception in 1973. Dr. Gainer received a BSChE from West Virginia University, a MS in chemical engineering from the Massachusetts Institute of Technology, and a Ph.D. in chemical engineering from the University of Delaware.

The Board believes Dr. Gainer’s perspective and experience as a director and officer of Diffusion, as well as the depth and breadth of his scientific knowledge, provide him with the qualifications to serve as a director.

Robert Adams – Mr. Adams has served as a director since the completion of the Merger in January 2016 and as a director of Diffusion LLC since 2002. Prior to his retirement in 2015, Mr. Adams was a partner in the intellectual property law firm of Nixon & Vanderhye P.C, where he had practiced for over 25 years, focusing on patent litigation and international patent licensing and negotiations. During that time period, Mr. Adams was lead litigation counsel in more than 50 major intellectual property lawsuits, where he directly handled, for example, all intellectual property valuations and settlements on behalf of his U.S. and foreign clients. Moreover, Mr. Adams served as the head negotiator for a well-known Japanese consumer products company for 15 years in various complicated licensing situations. Those negotiations typically involved the cross-licensing of up to hundreds of U.S. and foreign patent rights. His lead licensing activities on behalf of that client included, among other things, multi-year negotiations with Texas Instruments, Advanced Micro Devices and Freescale. Mr. Adams received a B.A. from the University of Maryland and a J.D. from George Washington University (with honors), and is a member of the Virginia State Bar.

The Board believes Mr. Adams’ perspective and experience as a director of Diffusion, as well as the depth and breadth of his intellectual property experience, provide him with the qualifications to serve as a director.

Mark T. Giles – Mr. Giles has served as a director since the completion of the Merger in January 2016 and as a director of Diffusion LLC since 2008. Since July 2007, Mr. Giles has been the sole managing member of Panda Holdings, LLC, which engages in the investment and management of private capital. Prior to joining Panda Holdings, Mr. Giles served as the Chief Executive Officer of Virginia National Bank from July 1998 until June 2007 and thereafter continued to serve as the non-executive Chairman until December 2011. Prior to joining Virginia National Bank, Mr. Giles also served as the president of two publicly traded bank holding companies and subsidiary banks in Texas and practiced law with the banking group of a Houston law firm. He chairs the board of Expedition Trust Company and is a director of Door to Door Organics, Inc. Mr. Giles received a B.S. from the McIntire School of Commerce at the University of Virginia and a J.D. from the University of Virginia School of Law.