UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark one)

☒QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2016

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ______________.

Commission file number: 000-24477

DIFFUSION PHARMACEUTICALS INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

30-0645032 |

|

(State of other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

2020 Avon Court, #4

Charlottesville, VA 22902

(Address of principal executive offices, including zip code)

(434) 220-0718

(Registrant’s telephone number including area code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer ☐ |

Accelerated filer ☐ |

Non-accelerated filer ☐ |

Smaller reporting company ☒ |

|

|

|

(Do not check if a smaller reporting company) | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The number of shares of common stock outstanding at May 16, 2016 was 102,429,200 shares.

DIFFUSION PHARMACEUTICALS INC.

form 10-q

MARCH 31, 2016

|

INDEX | ||

| Page | ||

|

PART I – FINANCIAL INFORMATION |

1 | |

|

ITEM 1. |

FINANCIAL STATEMENTS |

1 |

|

ITEM 2. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

20 |

|

ITEM 3. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

29 |

|

ITEM 4. |

CONTROLS AND PROCEDURES |

29 |

|

PART II – OTHER INFORMATION |

31 | |

|

ITEM 1. |

LEGAL PROCEEDINGS |

31 |

|

ITEM 1A. |

RISK FACTORS |

31 |

|

ITEM 2. |

UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS |

31 |

|

ITEM 3. |

DEFAULTS UPON SENIOR SECURITIES |

31 |

|

ITEM 4. |

MINE SAFETY DISCLOSURES |

31 |

|

ITEM 5. |

OTHER INFORMATION |

31 |

|

ITEM 6. |

EXHIBITS |

31 |

As previously disclosed, on January 8, 2016, Diffusion Pharmaceuticals Inc. (f/k/a RestorGenex Corporation), a Delaware corporation (the “Company”), completed the merger (the “Merger”) of its wholly owned subsidiary, Arco Merger Sub, LLC (“Merger Sub”), with and into Diffusion Pharmaceuticals LLC, a Virginia limited liability company (“Diffusion LLC”), in accordance with the terms of the Agreement and Plan of Merger, dated as of December 15, 2015, among the Company, Merger Sub and Diffusion LLC (the “Merger Agreement”). As a result of the Merger, Diffusion LLC, the surviving company in the Merger, became a wholly owned subsidiary of the Company and, following the Merger, the Company changed its corporate name from RestorGenex Corporation (“RestorGenex”) to Diffusion Pharmaceuticals Inc.

For accounting purposes, the Merger is treated as a “reverse acquisition” under generally acceptable accounting principles in the United States (“U.S. GAAP”) and Diffusion LLC is considered the accounting acquirer. Accordingly, Diffusion LLC’s historical results of operations will replace the Company’s historical results of operations for all periods prior to the Merger and, for all periods following the Merger, the results of operations of the combined company will be included in the Company’s financial statements.

This quarterly report on Form 10-Q relates to the Company’s quarter ended March 31, 2016, which includes the date of the completion of the Merger, and is therefore the Company’s first periodic report that includes results of operations for the combined company, including Diffusion LLC.

Unless the context otherwise requires, references to the “Company,” the “combined company” “we,” “our” or “us” in this report refer to Diffusion Pharmaceuticals Inc. and its subsidiaries, references to “Diffusion” refer to the Company following the completion of the Merger, references to “RestorGenex” refer to the Company prior to the completion of the Merger and references to “Diffusion LLC” refer to Diffusion Pharmaceuticals LLC, the Company’s wholly-owned subsidiary following the Merger.

Except as otherwise noted, references to “common stock” in this report refer to common stock, par value $0.001 per share, of the Company.

This report contains the following trademarks, trade names and service marks of ours: RestorGenex and Diffusion. All other trade names, trademarks and service marks appearing in this quarterly report on Form 10-Q are the property of their respective owners. We have assumed that the reader understands that all such terms are source-indicating. Accordingly, such terms appear without the trade name, trademark or service mark notice for convenience only and should not be construed as being used in a descriptive or generic sense.

This quarterly report on Form 10-Q contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and are subject to the safe harbor created by those sections. For more information, see “Part I. Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Special Note Regarding Forward-Looking Statements.”

PART I – FINANCIAL INFORMATION

|

ITEM 1. |

FINANCIAL STATEMENTS |

|

Diffusion Pharmaceuticals Inc. |

|

Condensed Consolidated Balance Sheets |

|

(unaudited) |

|

March 31, |

December 31, |

|||||||

|

2016 |

2015 |

|||||||

|

Assets |

||||||||

|

Current assets: |

||||||||

|

Cash and cash equivalents |

$ | 5,865,611 | $ | 1,997,192 | ||||

|

Prepaid expenses, deposits and other current assets |

385,402 | 45,921 | ||||||

|

Total current assets |

6,251,013 | 2,043,113 | ||||||

| Property and equipment, net of accumulated depreciation of $222,881 and $215,028, respectively | 103,668 | 51,996 | ||||||

|

Intangible assets |

9,317,000 | - | ||||||

|

Goodwill |

7,105,031 | - | ||||||

|

Other assets |

134,265 | 181,487 | ||||||

|

Total assets |

$ | 22,910,977 | $ | 2,276,596 | ||||

|

Liabilities and Stockholders' Equity (Deficit) |

||||||||

|

Current liabilities: |

||||||||

|

Accounts payable |

$ | 1,119,857 | $ | 424,675 | ||||

|

Other accrued expenses and liabilities |

1,087,738 | 621,669 | ||||||

|

Current portion of convertible debt, net |

- | 424,964 | ||||||

|

Total current liabilities |

2,207,595 | 1,471,308 | ||||||

|

Convertible debt, net of current portion |

550,000 | 818,646 | ||||||

|

Deferred income taxes |

3,536,933 | - | ||||||

|

Other liabilities |

37,771 | 28,265 | ||||||

|

Total liabilities |

6,332,299 | 2,318,219 | ||||||

|

Commitments and Contingencies |

||||||||

|

Stockholders' Equity (Deficit) |

||||||||

|

Common stock, $0.001 par value: |

||||||||

|

1,000,000,000 shares authorized; 102,429,200 and 81,186,620 shares issued and outstanding at March 31, 2016 and December 31, 2015, respectively |

102,429 | 81,187 | ||||||

|

Additional paid-in-capital |

64,852,032 | 42,029,808 | ||||||

|

Accumulated deficit |

(48,375,783 | ) | (42,152,618 | ) | ||||

|

Total stockholders' equity (deficit) |

16,578,678 | (41,623 | ) | |||||

|

Total liabilities and stockholders' equity (deficit) |

$ | 22,910,977 | $ | 2,276,596 | ||||

See accompanying notes to the unaudited condensed consolidated financial statements.

|

Diffusion Pharmaceuticals Inc. |

|

Condensed Consolidated Statements of Operations |

|

(unaudited) |

|

Three Months Ended March 31, |

||||||||

|

2016 |

2015 |

|||||||

|

Operating expenses: |

||||||||

|

Research and development |

$ | 2,352,807 | $ | 731,908 | ||||

|

General and administrative |

3,862,484 | 458,757 | ||||||

|

Depreciation |

7,853 | 2,010 | ||||||

|

Loss from operations |

6,223,144 | 1,192,675 | ||||||

|

Interest expense, net |

21 | 50,810 | ||||||

|

Net loss |

$ | (6,223,165 | ) | $ | (1,243,485 | ) | ||

|

Per share information: |

||||||||

|

Net loss per share - basic and diluted |

$ | (0.06 | ) | $ | (0.06 | ) | ||

|

Basic and diluted weighted average shares outstanding |

99,959,157 | 22,087,431 | ||||||

See accompanying notes to the unaudited condensed consolidated financial statements.

|

Diffusion Pharmaceuticals Inc. |

|

Condensed Consolidated Statement of Changes in Stockholders' Equity (Deficit) |

|

For the Three Months Ended March 31, 2016 |

|

(unaudited) |

|

Total |

||||||||||||||||||||

|

Common Stock |

Additional |

|

Stockholders' |

|||||||||||||||||

|

Shares |

Amount |

Paid-in Capital |

Accumulated Deficit |

Equity (Deficit) |

||||||||||||||||

|

Balance, January 1, 2016 |

81,186,620 | $ | 81,187 | $ | 42,029,808 | $ | (42,152,618 | ) | $ | (41,623 | ) | |||||||||

|

Common stock issued to former shareholders of RestorGenex |

18,614,968 | 18,615 | 19,527,385 | – | 19,546,000 | |||||||||||||||

|

RestorGenex stock options assumed |

– | – | 1,321,000 | – | 1,321,000 | |||||||||||||||

|

RestorGenex common stock warrants assumed |

– | – | 384,000 | – | 384,000 | |||||||||||||||

|

Common stock issued for advisory services |

456,427 | 456 | 487,044 | – | 487,500 | |||||||||||||||

|

Conversion of convertible notes |

2,171,185 | 2,171 | 709,324 | – | 711,495 | |||||||||||||||

|

Stock-based compensation expense |

– | – | 393,471 | – | 393,471 | |||||||||||||||

|

Net loss |

– | – | – | (6,223,165 | ) | (6,223,165 | ) | |||||||||||||

|

Balance, March 31, 2016 |

102,429,200 | $ | 102,429 | $ | 64,852,032 | $ | (48,375,783 | ) | $ | 16,578,678 | ||||||||||

See accompanying notes to the unaudited condensed consolidated financial statements.

|

Diffusion Pharmaceuticals Inc. |

|

Condensed Consolidated Statements of Cash Flows |

|

(unaudited) |

|

Three Months Ended March 31, |

||||||||

|

2016 |

2015 |

|||||||

|

Cash flows used in operating activities: |

||||||||

|

Net loss |

$ | (6,223,165 | ) | $ | (1,243,485 | ) | ||

|

Adjustments to reconcile net loss to net cash used in operating activities: |

||||||||

|

Depreciation |

7,853 | 2,010 | ||||||

|

Stock-based compensation expense |

393,471 | 95,856 | ||||||

|

Common stock issued for advisory services |

487,500 | - | ||||||

|

Noncash interest expense |

3,383 | 56,349 | ||||||

|

Changes in operating assets and liabilities: |

||||||||

|

Prepaid expenses, deposits and other assets |

(97,058 | ) | 15,121 | |||||

|

Accounts payable, accrued expenses and accrued liabilities |

797,827 | 135,371 | ||||||

|

Net cash used in operating activities |

(4,630,189 | ) | (938,778 | ) | ||||

|

Cash flows provided by investing activities: |

||||||||

|

Purchases of property and equipment |

(1,994 | ) | (2,183 | ) | ||||

|

Maturities of certificates of deposit |

- | 2,500,000 | ||||||

|

Cash received in reverse merger transaction |

8,500,602 | - | ||||||

|

Net cash provided by investing activities |

8,498,608 | 2,497,817 | ||||||

|

Net increase in cash and cash equivalents |

3,868,419 | 1,559,039 | ||||||

|

Cash and cash equivalents, beginning of period |

1,997,192 | 2,336,519 | ||||||

|

Cash and cash equivalents, end of period |

$ | 5,865,611 | $ | 3,895,558 | ||||

|

Supplemental disclosure of non-cash investing and financing activities: |

||||||||

|

Conversion of convertible notes and related accrued interest into common stock |

$ | 711,495 | $ | - | ||||

| Consideration in connection with RestorGenex Corporation merger transaction | $ | 21,261,000 | $ | - | ||||

See accompanying notes to the unaudited condensed consolidated financial statements.

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED Condensed CONSOLIDATED FINANCIAL STATEMENTS

1. Organization and Description of Business

Diffusion Pharmaceuticals Inc. (“Diffusion” or the “Company”), a Delaware Corporation, is a clinical stage biotechnology company focused on extending the life expectancy of cancer patients by improving the effectiveness of current standard-of-care treatments, including radiation therapy and chemotherapy. The Company’s lead product candidate, trans sodium crocetinate (“TSC”), uses a novel mechanism to re-oxygenate the microenvironment of solid cancerous tumors, thereby enhancing tumor cells’ response to conventional treatment without additional side effects. TSC has received orphan drug designations for the treatment of glioblastoma multiforme (“GBM”) and metastatic brain cancer, and the Company expects to enter a Phase III study in newly diagnosed GBM patients in the next twelve months, assuming the availability of financial resources.

On January 8, 2016, the Company completed a merger (the “Merger”) of a wholly-owned subsidiary with Diffusion Pharmaceuticals LLC (“Diffusion LLC”) pursuant to an Agreement and Plan of Merger, dated December 15, 2015, by and among the Company, Arco Merger Sub LLC and Diffusion LLC (the “Merger Agreement”) and, as a result, Diffusion LLC became a wholly-owned subsidiary of the Company.

At the effective time of the Merger, each outstanding unit of membership interest of Diffusion LLC (“Diffusion Units”) was converted into the right to receive 3.652658 shares of the Company’s common stock, as determined pursuant to the Merger Agreement (“Exchange Ratio”). Also at the effective time of the Merger, $1,125,000 of Diffusion LLC convertible notes were outstanding and the rights of the holders of each outstanding convertible promissory note convertible into Diffusion Units (“Diffusion Convertible Notes”) was converted into the right to convert such securities into a number of shares of the Company’s common stock equal to the number of Diffusion Units such Diffusion Convertible Note would be convertible into pursuant to its terms multiplied by the Exchange Ratio. In addition, at the effective time of the Merger and as a result of the Merger, all outstanding options to purchase Diffusion Units were converted into and became options to purchase the Company’s common stock on terms substantially identical to those in effect prior to the effective time of the Merger, except for adjustments to the underlying number of shares and the exercise price based on the Exchange Ratio. Through December 2015, the Company issued options to purchase Diffusion Units which converted into options to purchase an aggregate of 14,952,101 shares of the Company’s common stock with a weighted average exercise price of $0.40 per share. No fractional shares of the Company’s common stock were issued in connection with the Merger, and holders of Diffusion Units received cash in lieu thereof.

The merger transaction was accounted for as a reverse acquisition under the acquisition method of accounting. Because Diffusion LLC’s pre-transaction owners held an 84.1% economic and voting interest in the combined company immediately following the closing of the merger, Diffusion LLC is considered to be the acquirer of the Company for accounting purposes. Accordingly, the historical financial statements of Diffusion LLC became the Company’s historical financial statements including the comparative prior periods. All references in the unaudited condensed consolidated financial statements to the number of shares and per-share amounts of common stock have been retroactively restated to reflect the Exchange Ratio.

In connection with the Merger, the Company issued 18,614,968 shares of its common stock to its former shareholders, or approximately 15.9% of the common stock of the combined company, in each case, on a fully-diluted basis (subject to certain exceptions and adjustments).

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED Condensed CONSOLIDATED FINANCIAL STATEMENTS

2. Liquidity

The Company has not generated any revenues from product sales and has funded operations primarily from the proceeds of private placements of its membership units and convertible notes. Substantial additional financing will be required by the Company to continue to fund its research and development activities. No assurance can be given that any such financing will be available when needed or that the Company’s research and development efforts will be successful.

The Company regularly explores alternative means of financing its operations and seeks funding through various sources, including public and private securities offerings, collaborative arrangements with third parties and other strategic alliances and business transactions. The Company currently does not have any commitments to obtain additional funds and may be unable to obtain sufficient funding in the future on acceptable terms, if at all. If the Company cannot obtain funding in the immediate future, it will need to delay, scale back or eliminate some or all of its research and development programs or enter into collaborations with third parties to: commercialize potential products or technologies that it might otherwise seek to develop or commercialize independently; consider various strategic alternatives, including a merger or sale of the Company; or cease operations. If the Company engages in collaborations, it will receive lower consideration upon commercialization of such products than if it had not entered into such arrangements or if it entered into such arrangements at later stages in the product development process.

The Company has prepared its financial statements assuming that it will continue as a going concern, which contemplates realization of assets and the satisfaction of liabilities in the normal course of business. The Company has incurred net losses since inception and it expects to generate losses from operations for the foreseeable future primarily due to research and development costs for its potential product candidates. Various internal and external factors will affect whether and when the Company’s product candidates become approved drugs and how significant their market share will be. The regulatory approval and market acceptance of the Company’s proposed future products, length of time and cost of developing and commercializing these product candidates and/or failure of them at any stage of the drug approval process will materially affect the Company’s financial condition and future operations. The Company believes its cash and cash equivalents at March 31, 2016 are sufficient to fund operations and meet its research and development goals into the third quarter of 2016.

3. Basis of Presentation and Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited interim condensed consolidated financial statements of the Company have been prepared in accordance with U.S. generally accepted accounting principles (GAAP) for interim financial information as found in the Accounting Standard Codification, or ASC, and Accounting Standards Updates, or ASUs, of the Financial Accounting Standards Board, or FASB, and with the instructions to Form 10-Q and Article 10 of Regulation S-X of the Securities and Exchange Commission, or SEC. In the opinion of management, the accompanying condensed consolidated financial statements of the Company include all normal and recurring adjustments (which consist primarily of accruals, estimates and assumptions that impact the financial statements) considered necessary to present fairly the Company's financial position as of March 31, 2016 and its results of operations and cash flows for the three months ended March 31, 2016 and 2015. Operating results for the three months ended March 31, 2016 are not necessarily indicative of the results that may be expected for the year ending December 31, 2016. The interim condensed consolidated financial statements, presented herein, do not contain the required disclosures under GAAP for annual financial statements. The accompanying condensed consolidated financial statements should be read in conjunction with the annual audited financial statements and related notes as of and for the year ended December 31, 2015 filed with the SEC on Form 8-K/A on March 25, 2016.

The Company's members' capital at December 31, 2015 has been recast as common stock and additional paid in capital.

Fair Value of Financial Instruments

The carrying amounts of the Company’s financial instruments, including cash equivalents, accounts payable, and accrued expenses approximate fair value due to the short-term nature of those instruments. The carrying value of the contingent consideration liability is the estimated fair value of the liability (Note 11). As of March 31, 2016 and December 31, 2015, the fair value of the Company’s outstanding convertible notes was approximately $2,300,000 and $4,800,000, respectively. The fair value of the convertible notes falls within Level 3 of the fair value hierarchy at December 31, 2015 as it is significantly driven by the creditworthiness of the Company, which is an unobservable input, and Level 1 at March 31, 2016 as the Company's debt is convertible into shares of the Company's common stock, which has quoted prices in an active market.

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED Condensed CONSOLIDATED FINANCIAL STATEMENTS

Cash and Cash Equivalents

The Company considers any highly liquid investments, such as money market funds, with original maturities of three months or less to be cash and cash equivalents.

Property and Equipment

The Company records property and equipment at cost less accumulated depreciation and amortization. Costs of renewals and improvements that extend the useful lives of the assets are capitalized. Maintenance and repairs are expensed as incurred. Depreciation is recognized on a straight-line basis over the estimated useful lives of the assets, which generally range from five to fifteen years. The Company amortizes leasehold improvements over the shorter of the estimated useful life of the asset or the term of the related lease. Upon retirement or disposition of assets, the costs and related accumulated depreciation and amortization are removed from the accounts with the resulting gains or losses, if any, reflected in results of operations.

Long-Lived Assets

Long-lived assets are reviewed for potential impairment whenever events indicate that the carrying amount of such assets may not be recoverable. The Company does this by comparing the carrying value of the long-lived assets with the estimated future undiscounted cash flows expected to result from the use of the assets, including cash flows from disposition. If it is determined an impairment exists, the asset is written down to its estimated fair value. The Company has not recognized any impairment or disposition of long-lived assets during the three months ended March 31, 2016.

Intangible Assets

Intangible assets are comprised of identifiable in-process research and development (“IPR&D”) assets and are considered indefinite-lived intangible assets and are assessed for impairment annually or more frequently if impairment indicators exist. If the associated research and development effort is abandoned, the related assets will be written-off and the Company will record a non-cash impairment loss on its condensed consolidated statement of operations. For those compounds that reach commercialization, the IPR&D assets will be amortized over their estimated useful lives.

Goodwill

Goodwill is the excess of the cost of an acquired entity over the net amounts assigned to tangible and intangible assets acquired and liabilities assumed. Goodwill is not amortized, but is subject to an annual impairment test. The Company has a single reporting unit and all goodwill relates to that reporting unit.

The Company performs its annual goodwill impairment test on October 1 of its fiscal year or more frequently if changes in circumstances or the occurrence of events suggest that an impairment exists. If the fair value of the reporting unit is less than its carrying value, an impairment loss is recorded to the extent that the implied fair value of the reporting unit’s goodwill is less than the carrying value of the reporting unit’s goodwill.

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED Condensed CONSOLIDATED FINANCIAL STATEMENTS

Research and Development

Major components of research and development costs include internal research and development (such as salaries and related employee benefits, equity-based compensation, supplies and allocated facility costs) and contracted services (research and development activities performed on the Company’s behalf). Costs incurred for research and development are expensed as incurred.

At the end of the reporting period, the Company compares payments made to third-party service providers to the estimated progress toward completion of the research or development objectives. Such estimates are subject to change as additional information becomes available. Depending on the timing of payments to the service providers and the progress that the Company estimates has been made as a result of the service provided, the Company may record net prepaid or accrued expense relating to these costs.

Upfront milestone payments made to third parties who perform research and development services on the Company’s behalf are expensed as services are rendered.

Patent Costs

Patent costs, including related legal costs, are expensed as incurred and are recorded within general and administrative expenses in the statements of operations.

Income Taxes

Prior to the Merger, Diffusion LLC was treated as a partnership for federal and state income tax purposes. The Company’s taxable income or loss, as well as certain other tax attributes, were passed through directly to the Company’s members and were reported in each member’s individual income tax return.

Upon completion of the Merger as discussed in Note 1, Diffusion LLC converted from a partnership to a corporation. As a corporation, the Company uses the asset and liability method of accounting for income taxes. Deferred tax assets and liabilities are recognized for the estimated future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and operating loss and credit carryforwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. A valuation allowance is provided when it is more likely than not that some portion or all of a deferred tax asset will not be realized. The Company recognizes the benefit of an uncertain tax position that it has taken or expects to take on its income tax return it files, if such a position is more likely than not to be sustained.

Debt Issuance Costs

Debt issuance costs incurred in connection with financing arrangements are amortized to interest expense over the life of the respective financing arrangement using the effective interest method.

Stock-Based Compensation

The Company measures employee and nonemployee stock-based awards at grant-date fair value and records compensation expense on a straight-line basis over the vesting period of the award. Stock-based awards issued to non-employees are revalued until the award vests.

The Company uses the Black-Scholes option pricing model to value its stock option awards. Estimating the fair value of stock option awards requires management to apply judgment and make estimates, including the volatility of the Company’s common stock, the expected term of the Company’s stock options, the expected dividend yield and the fair value of the Company’s common stock on the measurement date. As a result, if factors change and management uses different assumptions, stock-based compensation expense could be materially different for future awards.

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED Condensed CONSOLIDATED FINANCIAL STATEMENTS

The expected life of stock options was estimated using the “simplified method” for employee options as the Company has no historical information to develop reasonable expectations about future exercise patterns and post vesting employment termination behavior for its stock option grants. The simplified method is based on the average of the vesting tranches and the contractual life of each grant. For options granted to non-employees, the Company uses the remaining contractual life. For stock price volatility, the Company uses comparable public companies as a basis for its expected volatility to calculate the fair value of option grants. The Company assumes no dividend yield because dividends are not expected to be paid in the near future, which is consistent with the Company’s history of not paying dividends. The risk-free interest rate is based on U.S. Treasury notes with a term approximating the expected life of the option.

Net Loss Per Share

Basic loss per share is computed by dividing net loss applicable to common stockholders by the weighted average number of shares of common stock outstanding during each period. Diluted loss per share includes the effect, if any, from the potential exercise or conversion of securities, such as convertible debt, warrants, stock options and unvested restricted stock that would result in the issuance of incremental shares of common stock. In computing the basic and diluted net loss per share applicable to common stockholders, the weighted average number of shares remains the same for both calculations due to the fact that when a net loss exists, dilutive shares are not included in the calculation as the impact is anti-dilutive.

The following potentially dilutive securities outstanding as of March 31, 2016 and 2015 have been excluded from the computation of diluted weighted average shares outstanding, as they would be anti-dilutive:

|

March 31, |

||||||||

|

2016 |

2015 |

|||||||

|

Convertible debt |

2,110,400 | 58,383,144 | ||||||

|

Common stock warrants |

4,776,875 | — | ||||||

|

Stock options |

17,963,599 | 10,578,483 | ||||||

|

Unvested restricted stock awards |

138,070 | — | ||||||

| 24,988,944 | 68,961,627 | |||||||

Amounts in the table reflect the common stock equivalents of the noted instruments.

Recent Accounting Pronouncements

On March 30, 2016, the FASB issued ASU 2016-09, Compensation – Improvements to Employee Share-Based Payment Accounting, which simplifies several aspects of the accounting for employee share-based payment transactions including the accounting for income taxes, forfeitures, and statutory tax withholding requirements, as well as classification in the statement of cash flows. The guidance is applicable to public business entities for fiscal years beginning after December 15, 2016 and interim periods within those years. The Company is evaluating the effect that ASU 2016-09 will have on its condensed consolidated financial statements and related disclosures.

In March 2016, the FASB issued ASU 2016-06, Contingent Put and Call Options in Debt Instruments. The FASB issued final guidance clarifying that the assessment of whether an embedded contingent put or call option is clearly and closely related to the debt host only requires an analysis of the four-step decision sequence outlined in ASC 815-15-25-42. Entities are required to apply the guidance to existing debt instruments (or hybrid financial instruments that are determined to have a debt host) using a modified retrospective transition method as of the period of adoption. The guidance is effective for public business entities for fiscal years beginning after December 15, 2016, and interim periods within those fiscal years. Early adoption is permitted. The Company is evaluating the effect that ASU 2016-06 will have on its condensed consolidated financial statements and related disclosures.

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED Condensed CONSOLIDATED FINANCIAL STATEMENTS

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842). The FASB issued the update to require the recognition of lease assets and liabilities on the balance sheet of lessees. The standard will be effective for fiscal years beginning after December 15, 2018, including interim periods within such fiscal years. The ASU requires a modified retrospective transition method with the option to elect a package of practical expedients. Early adoption is permitted. The Company is currently evaluating the potential impact of the adoption of this standard on its consolidated results of operations, financial position and cash flows and related disclosures.

In August 2014, the FASB issued ASU 2014-15, Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern. The amendments in this update will explicitly require a company’s management to assess an entity’s ability to continue as a going concern, and to provide related footnote disclosures in certain circumstances. The new standard will be effective in the first annual period ending after December 15, 2016. Early application is permitted. The Company is currently evaluating the potential impact of the adoption of this standard, but believes its adoption will have no impact on its consolidated results of operations, financial position or cash flows.

4. Acquisition

Merger of RestorGenex Corporation and Diffusion Pharmaceuticals LLC

On December 15, 2015, the Company, formerly known as RestorGenex Corporation (“RestorGenex”), entered into the Merger Agreement with Diffusion LLC. On January 8, 2016, the Company completed the Merger, with Diffusion LLC surviving as a wholly-owned subsidiary of the Company. Subsequent to the Merger, the Company was renamed “Diffusion Pharmaceuticals Inc.” and the Company’s ticker symbol on the OTC Bulletin Board was changed from “RESX” to “DFFN.” Diffusion LLC and RestorGenex entered into the merger agreement in order to provide improved access to the capital markets in order to obtain the resources necessary to accelerate development of TSC in multiple clinical programs and continue to build an oncology-focused company.

The merger transaction was accounted for as a reverse acquisition under the acquisition method of accounting. Because Diffusion LLC’s pre-transaction owners held an 84.1% economic and voting interest in the combined company immediately following the completion of the merger, Diffusion LLC is considered to be the acquirer of RestorGenex for accounting purposes.

Each outstanding unit of membership interest of Diffusion LLC (the Diffusion Units) was converted into the right to receive 3.652658 shares of the Company’s common stock, par value $0.001 per share (the Common Stock), as determined pursuant to the Merger Agreement (the Exchange Ratio). Additionally, the right of holders of outstanding convertible notes of Diffusion LLC to convert such notes into Diffusion Units was converted into the right to convert such notes into a number of shares of Common Stock equal to the number of Diffusion Units into which such note would have been convertible under the original terms of the note multiplied by the Exchange Ratio. In addition, all outstanding options to purchase Diffusion Units were converted into stock options to purchase Common Stock on terms substantially identical to those in effect prior to the merger transaction, except for adjustments to the underlying number of shares and the exercise price based on the Exchange Ratio.

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED Condensed CONSOLIDATED FINANCIAL STATEMENTS

In December 2015, the Company’s Board of Directors authorized, declared and effected a distribution of contingent value rights (CVRs) to shareholders of the Company as of the close of business on January 7, 2016. Each CVR is a non-transferable right to potentially receive certain cash payments in the event the combined company receives net cash payments during the five-year period after the merger transaction as a result of the sale, transfer, license or similar transaction or any other agreement to the extent relating to the development of the Company’s product currently known as RES-440, a “soft” anti-androgen. The aggregate cash payments to be distributed to the holders of the CVRs, if any, will be equal to the amount of net cash payments received by the combined company as a result of the sale, transfer, license or similar transaction relating to RES-440, but will not exceed $50,000,000 in the aggregate. Any option or warrant holder of the Company as of the record date for the CVRs would, at the time of exercise, be entitled to receive one CVR for each share of the Company’s common stock issued upon the future exercise of the option or warrant, which would entitle the holder to a pro rata portion of any CVR payments made after the date of exercise. The fair value of the potential future payments has been recognized as contingent consideration on the acquisition date and was estimated by applying a risk adjusted discount rate to the potential payments resulting from probability weighted projections and expected proceeds from a sale, transfer, license or similar transaction over the relevant period subject to potential payments. This fair value is based on significant inputs not observable in the market, which are referred to in the guidance as Level 3 inputs. The fair value of the contingent consideration is remeasured at each reporting period with changes recorded in the unaudited condensed consolidated statements of operations. See Note 11 for additional fair value information.

The purchase consideration in a reverse acquisition is determined with reference to the value of equity that the accounting acquirer, Diffusion LLC, would have had to issue to the owners of the accounting acquiree, RestorGenex, to give the pre-acquisition RestorGenex equity holders the same percentage interest in Diffusion that such pre-acquisition RestorGenex equity holders held in the Company immediately following the reverse acquisition. The purchase price is calculated as follows:

|

Purchase consideration |

||||

|

Fair value of RestorGenex shares outstanding |

$ | 19,546,000 | ||

|

Estimated fair value of RestorGenex stock options assumed by Diffusion |

1,321,000 | |||

|

Estimated fair value of RestorGenex warrants assumed by Diffusion |

384,000 | |||

|

Contingent value rights – RES-440 product candidate |

10,000 | |||

|

Total preliminary purchase price |

$ | 21,261,000 |

The Merger transaction has been accounted for using the acquisition method of accounting, which requires that assets acquired and liabilities assumed be recognized at their fair values as of the acquisition date. The valuation technique utilized to value the IPR&D was the cost approach.

The following table summarizes the preliminary allocation of the purchase price to the assets acquired and liabilities assumed as of the acquisition date:

|

Cash and cash equivalents |

$ | 8,500,602 | ||

|

Prepaid expenses and other assets |

195,200 | |||

|

Property and equipment |

57,531 | |||

|

Intangible assets |

9,317,000 | |||

|

Goodwill |

7,105,031 | |||

|

Accrued liabilities |

(377,431 | ) | ||

|

Deferred tax liability |

(3,536,933 | ) | ||

|

Net assets acquired |

$ | 21,261,000 |

The above allocation of the purchase price is based upon certain preliminary valuations and other analyses that have not been completed as of the date of this filing. Any changes in the estimated fair values of the net assets recorded for this business combination upon the finalization of more detailed analyses of the facts and circumstances that existed at the date of the transaction will change the allocation of the purchase price. As such, the purchase price allocations for this transaction are preliminary estimates, which are subject to change within the measurement period.

Qualitative factors supporting the recognition of goodwill due to the Merger include the Company’s enhanced ability to secure additional capital and gain access to capital market opportunities as a public company and the potential value created by having a more well-rounded clinical development portfolio by adding the earlier stage RestorGenex products to the Company’s later stage product portfolio.

Intangible assets were as follows:

|

March 31, 2016 |

December 31, 2015 |

|||||||||||||||||||||||

|

Gross Carrying Amount |

Accumulated Amortization |

Intangible Assets, net |

Gross Carrying Amount |

Accumulated Amortization |

Intangible Assets, net |

|||||||||||||||||||

|

RES-529 |

$ | 8,385,000 | $ | 0 | $ | 8,385,000 | $ | 0 | $ | 0 | $ | 0 | ||||||||||||

|

RES-440 |

$ | 932,000 | $ | 0 | $ | 932,000 | $ | 0 | $ | 0 | $ | 0 | ||||||||||||

|

Total in-process research and development costs (IPR&D) |

$ | 9,317,000 | $ | 0 | $ | 9,317,000 | $ | 0 | $ | 0 | $ | 0 | ||||||||||||

The Company’s novel PI3K/Akt/mTOR pathway inhibitor, RES-529, is in preclinical development for oncology. Through a series of in vitro and in vivo animal models, RES-529 has been shown to have activity in several cancer types due to its ability to target and inhibit the PI3K/Akt/mTOR signal transduction pathway. RES 529 is a first-in-class inhibitor of both TORC1 and TORC2 that is mechanistically differentiated from other PI3K/Akt/mTOR pathway inhibitors currently in development. RES-529 has shown activity in both in vitro and in vivo glioblastoma animal models and have demonstrated that RES-529 is orally bioavailable and can cross the blood brain barrier.

RES-440 is under development for the treatment of acne vulgaris. RES-440 has completed in vitro and in vivo proof-of-concept studies in tissue and animal models.

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED Condensed CONSOLIDATED FINANCIAL STATEMENTS

Pro Forma Financial Information (Unaudited)

The following pro forma financial information reflects the consolidated results of operations of the Company as if the acquisition of RestorGenex had taken place on January 1, 2015. The pro forma financial information is not necessarily indicative of the results of operations as they would have been had the transactions been effected on the assumed date.

|

Three Months Ended March 31, 2016 |

Three Months Ended March 31, 2015 |

|||||||

|

Net revenues |

$ | 0 | $ | 0 | ||||

|

Net loss |

(4,655,944 |

) |

(4,759,901 |

) | ||||

|

Basic and diluted loss per share |

$ | (0.05 | ) | $ | (0.12 | ) | ||

Nonrecurring pro forma transaction costs directly attributable to the Merger were $1,644,768 and $0 for the three months ended March 31, 2016 and 2015, respectively, have been deducted from the net loss presented above. The costs deducted included a success fee of $1,000,000 and approximately 457,000 shares of common stock with a fair market value of $487,500 paid to a financial advisor upon the closing of the Merger on January 8, 2016. Additionally, RestorGenex incurred approximately $3,000,000 in severance costs as a result of resignations of executive officers immediately prior to the reverse merger. These costs are excluded from the pro forma financial information for the three months ended March 31, 2016.

5. Accrued Expenses

Accrued expenses consisted of the following:

|

March 31, 2016 |

December 31, 2015 |

|||||||

|

Accrued interest payable |

$ | 0 | $ | 14,009 | ||||

|

Accrued payroll and payroll related expenses |

283,585 | 56,947 | ||||||

|

Accrued professional fees |

241,524 | 327,950 | ||||||

|

Accrued clinical studies expenses |

471,406 | 184,737 | ||||||

|

Other accrued expenses |

91,223 | 38,026 | ||||||

|

Total |

$ | 1,087,738 | $ | 621,669 | ||||

6. Convertible Notes

From December 2009 through December 2015, Diffusion LLC issued unsecured convertible promissory notes (the “Convertible Notes”) for gross proceeds of $22,384,320. The Convertible Notes bear interest at either 1% or 1.5% per annum. The Convertible Notes accrue interest beginning on the date of issuance, with the principal and accrued interest due upon the earlier of the maturity date or conversion date. At any time prior to the maturity date, the holders may elect to convert, in whole or in part, the Convertible Notes and any related accrued but unpaid interest into common stock of the Company at a price per share equal to the conversion price. The current and noncurrent portions of accrued interest are included within accrued expenses and other liabilities, respectively, on the accompanying balance sheets.

In the event of a Change of Control or a Qualified Financing (each as defined below), the holders of the Convertible Notes may declare the aggregate outstanding amount of the Convertible Notes to be immediately due and payable or may elect to convert the Convertible Notes and any accrued but unpaid interest as if such conversion took place on the maturity date. A Change of Control is defined as: (i) a merger or consolidation in which the members immediately prior to the transaction do not own, directly or indirectly, more than 50% of the membership interest of the surviving company; (ii) the acquisition of more than 50% of the Company's outstanding membership interest by a single person, entity or group or persons or entities acting in concert or (iii) the sale or transfer of all or substantially all of the assets of the Company. A Qualified Financing is defined as a sale of units or other transaction that results in gross proceeds to the Company of at least $15,000,000, including the conversion of the Convertible Notes. Through the date the financial statements were available to be issued, there have been no Change of Control or Qualified Financing events.

The Company may prepay the Convertible Notes, in full or in part, at any time on a pari passu basis. Upon receipt of notice that the Company intends to prepay the Convertible Notes, holders will have the option to convert their notes in lieu of payment.

At the effective time of the Merger, $1,125,000 in aggregate principal amount of Convertible Notes were outstanding and the rights of the holders of each such outstanding Convertible Note convertible into Diffusion Units were converted into the right to convert such securities into a number of shares of the Company’s common stock equal to the number of Diffusion Units such Convertible Note would be convertible into pursuant to its terms multiplied by the Exchange Ratio.

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED Condensed CONSOLIDATED FINANCIAL STATEMENTS

The following table provides the details of the Convertible Notes outstanding at March 31, 2016:

|

Convertible Note Series |

Issue Date |

Maturity Date |

Conversion Price |

Interest Rate |

Total Principal |

|||||||||||

|

B |

3/15/2011 |

6/30/2018 |

$0.27377 | 1.0% | $ | 550,000 | ||||||||||

|

Total principal amount |

$ | 550,000 | ||||||||||||||

During the three months ended March 31, 2016, the following Convertible Notes and the related accrued interest were converted into 2,171,185 shares of common stock:

|

Convertible Note Series |

Principal |

Accrued Interest |

Total Principal and Accrued Interest |

|||||||||

|

B |

$ | 20,000 | $ | 962 | $ | 20,962 | ||||||

|

C |

425,000 | 14,538 | 439,538 | |||||||||

|

E |

50,000 | 770 | 50,770 | |||||||||

|

F |

200,000 | 225 | 200,225 | |||||||||

|

Total |

$ | 695,000 | $ | 16,495 | $ | 711,495 | ||||||

During the three months ended March 31, 2015, no convertible notes and related accrued interest were converted to equity.

7. Stockholder’s Equity

Common Stock

In connection with the reverse merger, as discussed in Note 4, the Company ascribed non-cash consideration of $384,000 to 4,781,574 warrants outstanding prior to the reverse merger. During the three months ended March 31, 2016, the Company issued 21,242,580 shares of its common stock, of which 18,614,968 shares related to the former shareholders of RestorGenex upon the completion of the Merger, 456,427 shares were issued for advisory services provided to Diffusion LLC in connection with the merger and 2,171,185 shares were issued pursuant to conversions of convertible debt as discussed in Note 6. The Company did not purchase or retire any shares of its common stock.

Legacy RestorGenex Warrants

During the three months ended March 31, 2016, the Company did not grant any warrants to purchase shares of its common stock and no warrants were exercised. During the three months ended March 31, 2016, warrants to purchase an aggregate of 4,700 shares of common stock expired unexercised.

Warrants to purchase an aggregate of 4,776,874 shares of the Company’s common stock were outstanding and exercisable as of March 31, 2016, with per share exercise prices ranging from $2.00 to $100.00 and a weighted average exercise price of $7.99 per share.

8. Stock-Based Compensation

Stock-based Compensation

Through December 2015, Diffusion LLC issued various non-qualified stock options to employees, directors and consultants. Options granted generally vested monthly over three years and expired ten years from the date of grant. During the three months ended March 31, 2015, Diffusion LLC granted 1,753,275 stock options with a weighted average exercise price of $0.41 per share and a weighted average fair value of $0.19 per stock option. This 2015 information is presented on an as converted basis.

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED Condensed CONSOLIDATED FINANCIAL STATEMENTS

In addition, during the year ended December 31, 2015, Diffusion LLC granted 184,093 restricted stock awards to a member of the board of directors. The weighted-average grant date fair value of these awards was $0.20 per share. The awards vest monthly over 36 months. This 2015 information is presented on an as converted basis.

Upon consummation of the reverse merger with RestorGenex on January 8, 2016, all outstanding options to purchase Diffusion LLC units were converted into stock options to purchase the Company’s common stock on terms substantially identical to those in effect prior to the reverse merger, except for adjustments to the underlying number of shares and the exercise price based on the Exchange Ratio. As a result of the Merger, the Company assumed 3,011,498 RestorGenex stock options that are exercisable for shares of the Company’s common stock at a weighted average exercise price of $4.02 per share.

The Company recorded stock-based compensation expense in the following expense categories of its unaudited condensed consolidated statements of operations for the three months ended March 31, 2016 and 2015:

|

Three months ended March 31, |

||||||||

|

2016 |

2015 |

|||||||

|

Research and development |

$ | 242,277 | $ | 39,956 | ||||

|

General and administrative |

151,194 | 55,900 | ||||||

| $ | 393,471 | $ | 95,856 | |||||

The following table summarizes the activity related to all stock option grants to employees and non-employees for the three months ended March 31, 2016:

|

Number of Options |

Weighted average exercise price per share |

Weighted average remaining contractual life (in years) |

||||||||||

|

Balance at January 1, 2016 |

14,955,753 | $ | 0.39 | |||||||||

|

Assumed in connection with Merger |

3,011,498 | 4.02 | ||||||||||

|

Cancelled |

(3,652 | ) | 1.36 | |||||||||

|

Outstanding at March 31, 2016 |

17,963,599 | $ | 1.00 | 7.8 | ||||||||

|

Exercisable at March 31, 2016 |

12,306,562 | $ | 1.23 | 7.1 | ||||||||

|

Vested and expected to vest at March 31, 2016 |

17,929,054 | $ | 1.00 | 7.8 | ||||||||

At March 31, 2016, there was $2,104,971 of unrecognized compensation cost related to non-vested options of which $1,167,453 is attributable to 1,172,907 options issued to non-employees and subject to re-measurement until vested. The total unrecognized compensation expense of $2,104,971 will be recognized as expense over a weighted-average period of 1.8 years. Other than 6,650 stock options, all other stock options outstanding have been issued outside of the 2015 Equity Plan.

Restricted Stock Awards

As of March 31, 2016 and December 31, 2015, there were 138,070 and 153,412, respectively, unvested shares of restricted stock. During the three months ended March 31, 2016, 15,342 shares vested and the Company recognized stock-based compensation expense of $3,024. At March 31, 2016, there was $26,536 of unrecognized compensation cost related to unvested restricted stock that will be recognized as expense over a weighted average period of 2.2 years.

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED Condensed CONSOLIDATED FINANCIAL STATEMENTS

2015 Equity Plan

The 2015 Equity Plan allows for the issuance of up to a maximum of 2,500,000 shares of common stock in connection with the grant of stock-based awards, including stock options, restricted stock, restricted stock units, stock appreciation rights and other types of awards as deemed appropriate. Of the 17,963,599 options outstanding at March 31, 2016, 6,650 options were issued under the 2015 Equity Plan and 2,493,350 shares of common stock remained available for future issuance.

9. Commitments and Contingencies

Office Space Rental

The Company leases office and laboratory facilities in Charlottesville, Virginia under a month-to-month cancelable operating lease. Rent expense related to the operating lease was $16,500 during the three months ended March 31, 2016 and 2015.

The Company also leases office space totaling approximately 2,900 square feet in Buffalo Grove, Illinois. The term of the lease commenced on September 15, 2014 and will continue through February 28, 2018. The Company has an option to renew the lease for one renewal term of three years. Under the lease agreement, the first five months were rent free and then the base rent is approximately $6,000 per month through February 28, 2016 for a total of approximately $72,000 per year. The base rent will increase to approximately $6,100 per month for the first year thereafter and $6,200 per month for the second year thereafter.

The Company’s contractual obligations with respect to rental commitments as of March 31, 2016 were as follows:

|

Rental Commitments |

||||

|

Payments due by period: |

||||

|

One year |

$ | 73,300 | ||

|

Two years |

68,200 | |||

|

Three years |

— | |||

|

Thereafter |

— | |||

|

Total |

$ | 141,500 | ||

Legal Proceedings

From time to time, the Company is subject to various pending or threatened legal actions and proceedings, including those that arise in the ordinary course of its business, which may include employment matters, breach of contract disputes and stockholder litigation. Such actions and proceedings are subject to many uncertainties and to outcomes that are not predictable with assurance and that may not be known for extended periods of time. The Company records a liability in its unaudited condensed consolidated financial statements for costs related to claims, including future legal costs, settlements and judgments, when the Company has assessed that a loss is probable and an amount can be reasonably estimated. If the reasonable estimate of a probable loss is a range, the Company records the most probable estimate of the loss or the minimum amount when no amount within the range is a better estimate than any other amount. The Company discloses a contingent liability even if the liability is not probable or the amount is not estimable, or both, if there is a reasonable possibility that a material loss may have been incurred. In the opinion of management, as of March 31, 2016, the amount of liability, if any, with respect to these matters, individually or in the aggregate, will not materially affect the Company’s condensed consolidated results of operations, financial position or cash flows.

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED Condensed CONSOLIDATED FINANCIAL STATEMENTS

On August 7, 2014, a complaint was filed in the Superior Court of Los Angeles County, California by Paul Feller, the Company’s former Chief Executive Officer under the caption Paul Feller v. RestorGenex Corporation, Pro Sports & Entertainment, Inc., ProElite, Inc. and Stratus Media Group, GmbH (Case No. BC553996). The complaint asserts various causes of action, including, among other things, promissory fraud, negligent misrepresentation, breach of contract, breach of employment agreement, breach of the covenant of good faith and fair dealing, violations of the California Labor Code and common counts. The plaintiff is seeking, among other things, compensatory damages in an undetermined amount, punitive damages, accrued interest and an award of attorneys’ fees and costs. On December 30, 2014, the Company filed a petition to compel arbitration and a motion to stay the action. On April 1, 2015, the plaintiff filed a petition in opposition to the Company’s petition to compel arbitration and a motion to stay the action. After a hearing for the petition and motion on April 14, 2015, the Court granted the Company’s petition to compel arbitration and a motion to stay the action. On January 8, 2016, the plaintiff filed an arbitration demand with the American Arbitration Association. No arbitration hearing has yet been scheduled. The Company believes this matter is without merit and intends to defend the arbitration vigorously. Because this matter is in an early stage, the Company is unable to predict its outcome and the possible loss or range of loss, if any, associated with its resolution or any potential effect the matter may have on the Company’s financial position. Depending on the outcome or resolution of this matter, it could have a material effect on the Company’s financial position.

On September 21, 2015, David Schmidt, a member of Diffusion LLC, filed suit (the “Complaint”) in the Circuit Court for Albemarle County, Virginia (Case. No. CL15-791, David G. Schmidt v. Diffusion Pharmaceuticals LLC). The Complaint alleged a claim for breach of contract asserting that Diffusion LLC breached the terms of a $1.5 million convertible promissory note, dated December 15, 2009, which he elected to fully convert into membership units on the same day at the contractual per-unit conversion price of $3.50. Mr. Schmidt also alleged that the anti-dilution provisions of the convertible promissory note and certain terms of the operating agreement entitle him to convert his note at the conversion price of $1.00 per unit, which was the conversion price that Diffusion LLC subsequently renegotiated in 2012 with other noteholders who had not converted their notes (the “2012 Renegotiation”). Mr. Schmidt contends that if he had converted his note at $1.00 per unit instead of $3.50 per unit, he would have received an additional 1,071,432.50 units. His claim for relief was an award of specific performance requiring Diffusion LLC to issue him an additional 1,071,432.50 units or to pay damages equal to the value of such units. Mr. Schmidt also asserted tort claims for breach of fiduciary duty and conversion, together with a claim for unjust enrichment. Diffusion LLC filed a Demurrer asking the court to dismiss the Complaint for failing to state a viable cause of action and various other grounds. A hearing on Diffusion LLC’s Demurrer was held on March 14, 2016, at which hearing the claim was dismissed for failing to state a viable cause of action. Mr. Schmidt had up to 21 days to file an amended, restated complaint.

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED Condensed CONSOLIDATED FINANCIAL STATEMENTS

On April 14, 2016, Mr. Schmidt filed an Amended Complaint. His Amended Complaint asserts a single claim for breach of contract. Mr. Schmidt alleges that he was denied the opportunity to exercise his preemptive rights under the Company’s Operating Agreement as a result of the 2012 Renegotiation. Mr. Schmidt contends that this reduction of the conversion price resulted in his ownership interest in the Company being diluted and that he should have been afforded the opportunity to purchase such number of additional units at $1.00 per unit so as to enable him to maintain the ownership percentage of the Company that he would have owned if the other notes had been converted at the original conversion price of $3.50 per unit instead of $1.00 per unit. Mr. Schmidt alleges that such number of units is 1,071,432.50 and that he would have exercised his preemptive rights to purchase this number of units for $1,071,432.50. The sole relief sought by Schmidt in the Amended Complaint is an order of specific performance requiring the Company to issue him an additional 1,071,432.50 units in exchange for his payment of $1,071,432.50.

Management and legal counsel for the Company are of the opinion that the plaintiff’s claim is without merit and the Company will continue to vigorously defend the suit.

Due to the operating losses for the three months ended March 31, 2016, and estimated for the year-ending December 31, 2016, the Company’s estimated annual effective tax rate is 0%. Accordingly, no income tax provision is recorded for the three months ended March 31, 2016.

Deferred tax assets and liabilities are determined based on the differences between the financial statement carrying amounts and tax bases of assets and liabilities using enacted tax rates in effect for years in which differences are expected to reverse. A deferred tax liability of approximately $3,536,933 is recorded for the basis differences associated with indefinite-lived in-process R&D assets. Due to their indefinite-lived treatment, the related deferred tax liabilities are not expected to reverse in a period that would support the realization of the Company's deferred tax assets. The Company maintains a valuation allowance against its deferred tax assets.

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED Condensed CONSOLIDATED FINANCIAL STATEMENTS

The Company has incurred net operating losses for federal and state income tax purposes since inception. The Tax Reform Act of 1986 (the “Act”) provides for limitation on the use of net operating loss and research and development tax credit carryforwards following certain ownership changes (as defined in the Act) that could limit the Company's ability to utilize these carryforwards. The Company may have experienced various ownership changes as a result of past financings and acquisitions. Accordingly, the Company's ability to utilize the aforementioned carryforwards may be limited. Additionally, U.S. tax laws limit the time during which these carryforwards may be applied against future taxes; therefore, the Company has determined it is more likely than not that these net operating losses will not be realized.

Certain assets and liabilities are carried at fair value under GAAP. Fair value is defined as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. Valuation techniques used to measure fair value must maximize the use of observable inputs and minimize the use of unobservable inputs. Financial assets and liabilities carried at fair value are to be classified and disclosed in one of the following three levels of the fair value hierarchy, of which the first two are considered observable and the last is considered unobservable:

|

● |

Level 1—Quoted prices in active markets for identical assets or liabilities. |

|

● |

Level 2—Observable inputs (other than Level 1 quoted prices), such as quoted prices in active markets for similar assets or liabilities, quoted prices in markets that are not active for identical or similar assets or liabilities, or other inputs that are observable or can be corroborated by observable market data. |

|

● |

Level 3—Unobservable inputs that are supported by little or no market activity and that are significant to determining the fair value of the assets or liabilities, including pricing models, discounted cash flow methodologies and similar techniques. |

The asset’s or liability’s fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement.

The following table presents the Company’s assets and liabilities that are measured at fair value on a recurring basis:

|

March 31, 2016 |

||||||||||||

|

(Level 1) |

(Level 2) |

(Level 3) |

||||||||||

|

Assets |

||||||||||||

|

Cash and cash equivalents |

$ | 5,006,299 | $ | - | $ | - | ||||||

|

Liabilities |

||||||||||||

|

Contingent consideration |

$ | - | $ | - | $ | 10,000 | ||||||

|

December 31, 2015 |

||||||||||||

|

(Level 1) |

(Level 2) |

(Level 3) |

||||||||||

|

Assets |

||||||||||||

|

Cash and cash equivalents |

$ | 1,985,953 | $ | - | $ | - | ||||||

|

Contingent consideration |

$ | - | $ | - | $ | - | ||||||

As of March 31, 2016 and December 31, 2015, the fair value of the convertible notes was $2,300,000 and $4,800,000, respectively. The fair value of the convertible notes falls within Level 3 of the fair value hierarchy at December 31, 2015 as it is significantly driven by the creditworthiness of the Company, which is an unobservable input, and Level 1 at March 31, 2016 as the Company's debt is convertible into shares of the Company's common stock, which has quoted prices in an active market.

DIFFUSION PHARMACEUTICALS INC.

NOTES TO UNAUDITED Condensed CONSOLIDATED FINANCIAL STATEMENTS

Contingent Value Rights Distribution

In December 2015, the Company’s Board of Directors authorized, declared and effected a distribution of contingent value rights (CVRs) to shareholders of the Company as of the close of business on January 7, 2016 (the “CVR Record Date”) at a rate of one CVR for each share of the Company’s common stock. The CVRs, which are not certificated and not attached to the shares of the Company’s common stock, were payable immediately prior to the effective time. Each CVR represents a non-transferable right (subject to certain limited exceptions) to potentially receive certain cash payments in the event the Company receives net cash payments during the five-year period after the Merger as a result of the sale, transfer, license or similar transaction relating to the Company’s product currently known as RES-440, which is a “soft” anti-androgen, upon the terms and subject to the conditions set forth in a contingent value rights agreement, dated January 8, 2016, between the Company and Computershare, Inc., as rights agent (the “CVR Agreement”). The aggregate cash payments to be distributed to the holders of the CVRs, if any, will be equal to the amount of net cash payments received by the Company as a result of the sale, transfer, license or similar transaction relating to RES-440, as determined pursuant to the CVR Agreement, but will not exceed $50,000,000 in the aggregate. Any option or warrant holder of the Company as of the record date for the CVRs would, at the time of exercise, be entitled to receive one CVR for each share of the Company’s common stock issued upon the future exercise of the option or warrant, which would entitle the holder to a pro rata portion of any CVR payments made after the date of exercise. The key assumptions used in determining the fair value of the CVR is the estimated future licensing arrangements between $1,000,000 and $10,000,000 and the likelihood of entering into such licensing arrangements between 0% - 100%.

The reconciliation of the contingent consideration liability measured at fair value on a recurring basis using significant unobservable inputs (Level 3) is as follows:

|

Contingent Consideration |

||||||

|

Issued in connection with the merger transaction |

$ | 10,000 | ||||

|

Change in fair value |

- | |||||

|

Balance at March 31, 2016 |

$ | 10,000 | ||||

|

ITEM 2. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

You should read the following discussion of our financial condition and results of operations together with the unaudited condensed consolidated financial statements and the notes thereto included elsewhere in this report and other financial information included in this report. The following discussion may contain predictions, estimates and other forward looking statements that involve a number of risks and uncertainties, including those discussed under “Part I — Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Special Note Regarding Forward Looking Statements” in this report and under “Part I — Item 1A. Risk Factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2015. These risks could cause our actual results to differ materially from any future performance suggested below.

Business Overview

We are a clinical stage biotechnology company focused on extending the life expectancy of cancer patients by improving the effectiveness of current standard-of-care treatments, including radiation therapy and chemotherapy. We are developing our lead product candidate, transcrocetinate sodium, also known as trans sodium crocetinate (“TSC”), for use in the many cancer types in which tumor oxygen deprivation (“hypoxia”) is known to diminish the effectiveness of current treatments. TSC is designed to target the cancer’s hypoxic micro-environment, re-oxygenating treatment-resistant tissue and making the cancer cells more susceptible to the therapeutic effects of standard-of-care radiation therapy and chemotherapy.

Our lead development programs target TSC against cancers known to be inherently treatment-resistant, including brain cancers and pancreatic cancer. A Phase 1/2 clinical trial of TSC combined with first-line radiation and chemotherapy in patients newly diagnosed with primary brain cancer (“glioblastoma” or “GBM”) was completed in 2015. This trial provided evidence of efficacy and safety in extending overall survival without the addition of toxicity. Based on these results, an End-of-Phase 2 meeting was held with the U.S. Food and Drug Administration (“FDA”) in August 2015, resulting in agreement on the design of a single 400 patient pivotal Phase 3 registration study which, if successful, would be sufficient to support approval. Discussions with the FDA regarding extension of the TSC development program from first line GBM into first-line pancreatic cancer treatment are currently underway. TSC has been granted Orphan Drug designations for the treatment of GBM and metastatic brain cancer.

In addition to cancer, TSC also has potential applications in other indications involving hypoxia, such as hemorrhagic shock, stroke, peripheral artery disease and neurodegenerative diseases.

On January 8, 2016, we entered into a business combination whereby a wholly-owned subsidiary of the Company merged with and into Diffusion LLC, with Diffusion LLC surviving as our wholly-owned subsidiary (the “Merger”). In connection with the Merger, the Company issued to the holders of outstanding units of Diffusion LLC an aggregate of approximately 82.9 million shares of the Company’s common stock (“Common Stock”) and, as a result, immediately following the completion of the Merger, the former equity holders of Diffusion LLC owned approximately 84.1% of the Common Stock and the stockholders of RestorGenex immediately prior to the Merger owned approximately 15.9% of the Common Stock, in each case, on a fully-diluted basis (subject to certain exceptions and adjustments). Also in connection with the Merger, the pre-Merger directors and officers of the Company tendered their resignations and the pre-Merger directors and officers of Diffusion LLC were appointed as the new directors and officers of the Company, and our corporate headquarters was moved from Buffalo Grove, Illinois to Charlottesville, Virginia. Following the completion of the Merger, the Company changed its corporate name from “RestorGenex Corporation” to “Diffusion Pharmaceuticals Inc.” and changed the trading symbol of the Company’s Common Stock from “RESX” to “DFFN.”

For accounting purposes, the Merger is treated as a “reverse acquisition” under generally acceptable accounting principles in the United States (“U.S. GAAP”) and Diffusion LLC is considered the accounting acquirer. Accordingly, Diffusion LLC’s historical results of operations will replace the Company’s historical results of operations for all periods prior to the Merger and, for all periods following the Merger, the results of operations of the combined company will be included in the Company’s financial statements. Unless otherwise stated, all comparisons in this Management’s Discussion and Analysis to prior year periods are to the results of Diffusion LLC for such period on a stand-alone basis.

Summary of Current Product Candidate Pipeline

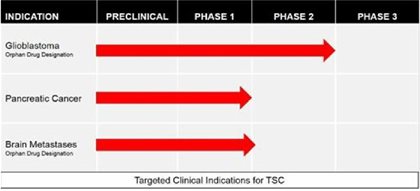

The following table, as of March 31, 2016, summarizes the targeted clinical indications for Diffusion’s lead molecule, trans sodium crocetinate:

In addition to the TSC programs depicted in the table, we are exploring alternatives regarding how best to capitalize upon the legacy RestorGenex product candidates, which include RES-529, a novel PI3K/Akt/mTOR pathway inhibitor which has completed two Phase I clinical trials for age-related macular degeneration and was in preclinical development in oncology, specifically GBM, and RES-440, a “soft” anti-androgen compound for the treatment of acne vulgaris.

Financial Summary

At March 31, 2016, we had cash and cash equivalents balances of $5.9 million. We have incurred operating losses since inception, have not generated any product sales revenue and have not achieved profitable operations. We incurred a net loss of $6.2 million for the three months ended March 31, 2016. Our accumulated deficit as of March 31, 2016 was $48.4 million, and we expect to continue to incur substantial losses in future periods. We anticipate that our operating expenses will increase substantially as we continue to advance our lead, clinical-stage product candidate, TSC. We anticipate that our expenses will substantially increase as we:

|

● |

complete regulatory and manufacturing activities and commence our planned Phase II and III clinical trials for TSC; |

|

● |

continue the research, development and scale-up manufacturing capabilities to optimize products and dose forms for which we may obtain regulatory approval; |

|

● |

conduct other preclinical and clinical studies to support the filing of a New Drug Application (“NDA”) with the FDA; |

|

● |

maintain, expand and protect our global intellectual property portfolio; |

|

● |

hire additional clinical, manufacturing, and scientific personnel; and |

|

● |