Exhibit

Tenant: Diffusion Pharmaceuticals Inc.

Suite: 1317 Carlton Ave., Suite 400

DEED OF LEASE

THIS DEED OF; LEASE (this “Lease”) is entered into as of the 31st day of March 2017, between ONE CARLTON, LLC, Aa Virginia Limited liability company ("Landlord"), and DIFFUSION PHARMACEUTICALS INC., a Delaware corporation (“Tenant”).

In consideration of the mutual covenants stated below, and intending to be legally bound, the parties covenant and agree as follows:

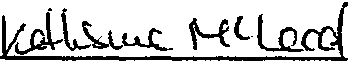

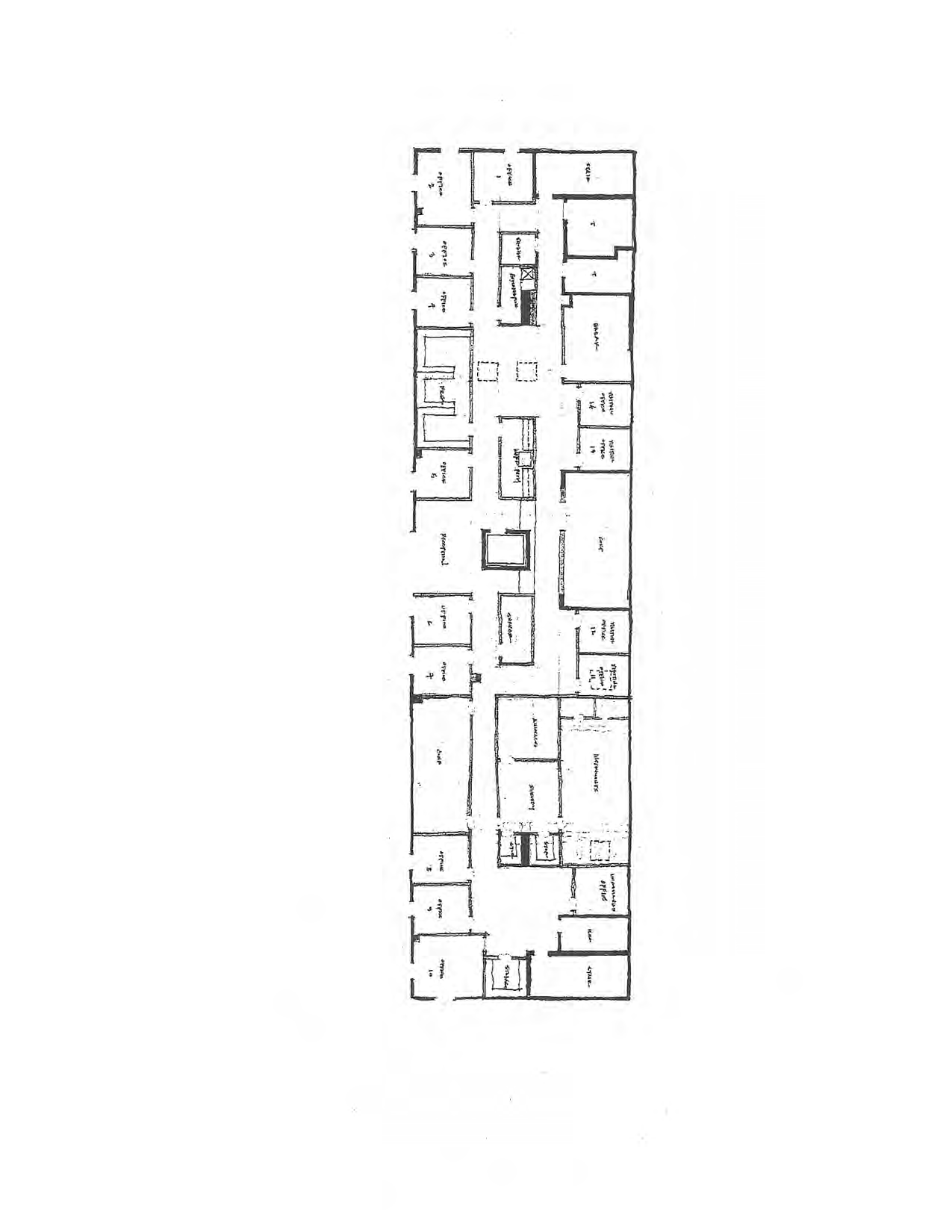

1.PREMISES. Landlord leases to Tenant, and Tenant leases from Landlord, for the Tenant and upon the terms and subject to the conditions of this Lease, the entire second floor of the Building (as shown on Exhibit A attached hereto) but exclusive of the mezzanine space, known-as Suite 400 which the parties stipulate and agree consist of approximately 8,221 rentable square feet of space (the "Premises'') in the Building. The “Building” is the building known as 1317 Carlton Avenue, Charlottesville, Virginia 22902. The ''Project' ' is the land on which the Building is located, -together with the Building and all other improvements thereon. The Premises are delivered "As ls".

2.TERM.

(a) The term of this Lease (the "Term") shall commence on April 15,2017 (the "Commencement Date''). The terms and provisions of this Lease are binding on the parties upon Tenant's and Landlord's execution of this Lease notwithstanding a later Commencement Date for the Term. The Commencement Date and Rent Commencement Date (as hereinafter defined) shall be confirmed by Landlord and Tenant by the execution of a Confirmation of Lease Term (the “COLT") in the form attached hereto as Exhibit B.1f Tenant fails to execute or object to the COLT within ten (I 0) business days of its delivery, Landlord's determination of such dates shall be deemed accepted.

(b) The Term shall end on April 30, 2022, unless extended or sooner terminate pursuant to the term of this Lease.

(c) Provided Tenant is Diffusion Pharmaceuticals, Inc., or any Affiliate (as defined in Section 9(b) below) or Surviving Entity (as defined in Section 9(d) below), Tenant is neither in default at the time of exercise nor has Tenant ever been in default beyond notice and cure (irrespective of the fact that Tenant later cured such default after the applicable cure period expired) of any monetary obligations under the Lease more than twice during the Term, Tenant is fully occupying the Premises and the Lease is in full force and effect, Tenant shall have the right to extend the Term (the "First Extension Option") for sixty (60) months beyond the end of the Term as extended by this option (i.e., from May I, 2022 to April 30, 2027) the "First Extension Term"). Tenant shall furnish written notice to Landlord of intent to extend the Term ("Tenant's First Extension Notice") no later than May 1, 2021, failing which the First Extension Option shall be deemed waived; time being of the essence. The terms and conditions of the Lease during the First Extension Term shall remain unchanged except that the annual Fixed Rent for each twelve (12)-month period of the First Extension Term shall be the amount as set forth in Section 3 (a) below.

(d) Provided Tenant is Diffusion Pharmaceuticals Inc., or any Affiliate or Surviving Entity, Tenant is neither in default at the time of exercise nor has Tenant ever been in default beyond notice and cure (irrespective of the fact that Tenant later cured such default after the applicable cure period expired) of any monetary obligations under the Lease more than twice during the

Term, Tenant is fully occupying the Premises and the Lease is in full force and effect, Tenant shall have the right to extend the Term (the ''Second Extension Option") for sixty (60) months beyond the end of the Term as extended by this second option (i.e., from May 1, 2027 to April 30, 2032) the "Second Extension Term''). Tenant shall furnish written notice to Landlord of intent to extend the Term ("Tenant's Second Extension Notice") no later than May l, 2026, failing which the Second Extension Option shall be deemed waived; time being of the essence. The terms and conditions of the Lease during the Second Extension Term shall remain unchanged except that the annual Fixed Rent for each twelve (12)-month period of the Second Extension Term shall be the amount as set forth in Section 3(a) below. Notwithstanding anything to the contrary herein, Tenant shall have no right to extend the Term other than or beyond the two (2), sixty (60)-month extension terms described in this and the preceding paragraph.

(e) Upon Tenant’s timely and proper exercise of the First Extension Option (and, if timely and properly exercised, the Second Extension Option) pursuant to the terms above and satisfaction of the above conditions, the “Term” shall include the First Extension Term (and the Second Extension Term), and Landlord and Tenant shall execute prior to the expiration of the then-expiring Term an appropriate amendment to this Lease, in form and content reasonably satisfactory to both Landlord and Tenant, memorializing the extension of the Term for the ensuing First or Second Extension Term. Notwithstanding the foregoing, failure of either of the parties to timely execute the said amendment shall not affect the validity of an Extension Term provided Tenant has met the requirements of Section 2(c) or 2(d) above.

3.FIXED RENT; SECURITY DEPOSIT; GUARANTY.

(a) Tenant covenants and agrees to pay to Landlord, commencing on May 1, 2017 (the “Rent Commencement Date”) and continuing during the Term, without notice, demand, set-off, deduction or counterclaim, fixed rent (“Fixed Rent”) in the amounts set forth below, payable in accordance with Section 3(b):

|

| | | |

TIME PERIOD | RENT PER R.S.F. | MONTHLY INSTALLMENTS | ANNUAL FIXED RENT |

5/1/17 – 4/30/18 | $13.50 | $9,248.63 | $110,983.50 |

5/1/18 – 4/30/19 | $13.75 | $9,419.90 | $113,038.75 |

5/1/19 – 4/30/20 | $14.00 | $9,591.17 | $115,094.00 |

5/1/20 – 4/30/21 | $14.25 | $9,762.44 | $117,149.25 |

5/1/21 – 4/30/22 | $14.50 | $9,933.71 | $119,204.50 |

(1st x ext) 5/1/22 – 4/30/23 | $14.75 | $10,104.98 | $121,259.75 |

(1st x ext) 5/1/23 – 4/30/24 | $15.00 | $10,276.25 | $123,315.00 |

(1st x ext) 5/1/24 – 4/30/25 | $15.25 | $10,447.52 | $125,370.25 |

(1st x ext) 5/1/25 – 4/30/26 | $15.50 | $10,618.79 | $127,425.50 |

(1st x ext) 5/1/26 – 4/30/27 | $15.75 | $10,790.06 | $129,480.75 |

(2nd x ext) 5/1/27 – 4/30/32 | Market, but not lower than $16.00 sf for 1st year with annual increases of $.25 sf |

-- |

-- |

(b) Monthly installments of Fixed Rent shall be payable in advance on or before the first day of each month of the Term by wire transfer or ACH of immediately available funds to the account at Bank of America account of Henry Liscio Company Escrow Account no.435019970194, ABA wire routing number 026009593 (ACH ABA routing number 05100017), or as otherwise directed in writing by Landlord to Tenant.

(c) Together with Tenant’s execution of this Lease, Tenant shall pay to Landlord the installment of Fixed Rent due for May,2017, and the Security Deposit (as defined below) by two separate checks. If any installment of Fixed Rent is not paid by the fifth of the month, or any other amount due from Tenant is not paid to Landlord when due, Tenant shall also pay as Additional Rent (as defined in Article 4) a late fee of ten percent (10%) of the total payment then due. Tenant shall be required to pay a security deposit of $9,248.63 (the “Security Deposit”), as security for the prompt and complete performance by Tenant of every provision of this Lease. No interest shall be paid to Tenant on the Security Deposit. If Tenant fails to perform any of its obligations hereunder, Landlord may use, apply or retain the whole or any part of the Security Deposit for the payment of: (i) any rent or other sums of money that Tenant may not have paid

when due; (ii) any sum expended by Landlord in accordance with the provisions of this Lease; and/or (iii) any sum that Landlord may expend or be required to expend by reason of Tenant’s default. The use of the Security Deposit by Landlord shall not prevent Landlord from exercising any other remedy provided by this Lease or by law and shall not operate as either liquidated damages or as a limitation on any recovery to which Landlord may otherwise be entitled. If any portion of the Security Deposit is used, applied or retained by Landlord, Tenant agrees, within ten (10) days after the written demand therefor is made by Landlord, to deposit cash with Landlord in an amount sufficient to restore the Security Deposit to its original amount. In addition to the foregoing, if Tenant defaults (irrespective of the fact that Tenant cured such default) more than once in its performance of a monetary obligation and such monetary defaults aggregate in excess of $15,000.00 under this Lease, Landlord may require Tenant to increase the Security Deposit to the greater of twice the: (i) Fixed Rent paid monthly; or (ii) the initial amount of the Security Deposit. If Tenant shall fully comply with all of the provisions of this Lease, the Security Deposit, or any balance thereof shall be returned to Tenant within a reasonable time after the later of the end of the Term or Tenant's delivery of the Premises to Landlord as required hereunder. Upon the return of the Security Deposit to the original Tenant hereunder, or the remaining balance thereof, Landlord shall be completely relieved of liability with respect to the Security Deposit In the event of a transfer of the Building, Landlord shall have the right to transfer the Security Deposit and Landlord shall thereupon be released by Tenant from all liability for the return of such Security Deposit. Upon the assumption of such Security Deposit by the transferee, Tenant agrees to look solely to the new landlord for the return of such Security Deposit.

4, ADDITIONAL RENT.

(a) Commencing on the Commencement Date: and in each calendar year thereafter during the Term, Tenant covenants and agrees to pay in advance on a monthly basis to Landlord Tenant's Share of Operating Expenses, without deduction, counterclaim or set off. "Tenant's Share" equals the number of rentable square feet of the Premises divided by the number of rentable square feet office Building (which the parties confirm contains approximately 78,454 rentable square feet). Tenant's Share on the date of this Lease is stipulated to be 10.48%.

"Operating Expenses" are: (i) all reasonable operating costs and expenses related to the maintenance, operation and repair of the Project incurred by Landlord, including but not limited to a management fee not to exceed five percent (5%) of gross rents and revenues from the Project; utilities; and capital expenditures and capital repairs and replacements, which capital items shall be included as operating expenses solely to the extent of the amortized costs of same over the useful life of the improvement in accordance with generally accepted accounting principles; (ii) all insurance premiums payable by Landlord for insurance with respect to the Project; and (iii) taxes payable on the Project. Each of the Operating Expenses shall for all purposes be treated and considered as Additional Rent. Tenant shall pay, in monthly installments in advance, on account of Tenant's Share of Operating Expenses, the estimated amount of the Operating Expenses for such year as determined by Landlord in its reasonable discretion. Prior to the end of the calendar year in which the Lease commences and thereafter for each successive calendar year during the Term (each, a ''Lease Year'), or part thereof: or as soon as administratively available thereafter, Landlord shall send to Tenant a statement of projected Operating Expenses and shall indicate what Tenant's Share of Operating

Expenses shall be. As soon as administratively available, Landlord shall send to Tenant a statement of actual Operating Expenses for the prior Lease Year showing the actual amount due from Tenant. In the event the amount prepaid by Tenant exceeds the amount that was actually due then Landlord shall issue a credit to Tenant in an amount equal to the overcharge, which

credit Tenant may apply to future payments on account of Operating Expenses until Tenant has been fully credited with the overcharge. If the credit due to Tenant is more than the aggregate total of future rental payments, Landlord shall pay to Tenant the difference between the credit and such aggregate total. In the event Landlord has undercharged Tenant, then Landlord shall send Tenant an invoice with the additional amount due, which amount shall be paid in full by Tenant within twenty (20) days of receipt. Tenant's obligations under this Article 4 shall survive the expiration or sooner termination of this Lease.

(b) ln calculating the Operating Expenses, if for thirty (30) or more days during the preceding Lease Year less than ninety-five percent (95%) of the rentable area of the Building was occupied by tenants, then the Operating Expenses attributable to the Project shall be deemed for such Lease Year to be amounts equal to the Operating Expenses that would normally be expected to be incurred bad such occupancy of the Building beep at least ninety-five percent (95%) throughout such year, as reasonably determined by Landlord (i.e., taking into account that certain expenses depend on occupancy (e.g., janitorial) and certain expenses do not (e.g., landscaping)).

Furthermore, if Landlord shall not furnish any item or items of Operating Expenses to any portions of the Building because such portions are not occupied or because such item is not required by the tenant of such portion of the Building, for the purposes of computing Operating Expenses, an equitable adjustment shall be made so that the item of Operating Expense in question shall be shared only by tenants actually receiving the benefits thereof.

(c) All costs and expenses other than Fixed Rene that Tenant assumes or agrees to pay and any other sum payable by Tenant pursuant to this Lease, including, without limitation, pursuant to this Article 4, shall be deemed "Additional Rent", and all remedies applicable to the nonpayment of Fixed Rent shall be applicable thereto. Fixed Rent and Additional Rent are herein referred to collectively as "Rent". Landlord may apply payments received from Tenant to any obligations of Tenant then accrued, without regard to such obligations as may be designated by Tenant. Additional Rent shall be paid by Tenant in the same manner as Fixed Rent, without any prior notice or demand therefor and without deduction, set-off or counterclaim and without relief from any valuation or appraisement laws.

(d) Notwithstanding the foregoing definition of Operating Expenses, for purposes of this lease, “Operating Expenses” shall not include the following:

(i)the cost of any special work or service performed for any tenant (including Tenant) at such tenant's cost;

(ii)any real estate brokerage commissions or other costs incurred m procuring tenants or any fee lieu of such commission;

(iii) the cost of correcting defects in construction of the Project or the Building;

(iv) compensation paid to officers and executives of Landlord;

(v) the cost of any items for which Landlord is reimbursed by insurance, condemnation or otherwise;

(vi) the cost of any additions, changes, replacements and other items which are solely made in order to prepare for a new tenant’s occupancy;

(vii) interest on debt or amortization payments on any mortgage or deed to secure debt and rental under any ground lease or other underlying lease;

(viii) capital expenditures to the common areas of the Project, unless such capital

expenditures are aimed at reducing Operating Expenses, maintenance of existing equipment, improving safety, or compliance with governmental rules and regulations (such as the installation of low energy lights in the parking area on the Project);

(ix) capital expenditures made as part of the acquisition or redevelopment of the Project;

(x) any expenses for repairs or maintenance which are covered by warranties and service contracts, to the extent such maintenance and repairs are made at no cost to Landlord;

(xi) legal expenses arising solely out of the construction of the improvements on the Project the entering into or enforcement of the provisions of any lease of space within the Building, including without limitation this Lease;

(xii) any advertising expe3nses incurred in connection with the marketing of any rentable space; and

(xiii) rental payments for base building equipment such as HVAC equipment and elevators.

5.UTILITIES.

(a) Landlord shall use commercially reasonable efforts to sub meter utilities to the Premises, in which case Tenant shall make arrangements with the applicable service provider to provide such services to the Premises in Tenant's name, and Tenant shall pay directly to such service providers the cost of all service connection fees and utilities consumed at the Premises throughout the Term. If any utility service is not separately metered, Landlord shall pay such bills and Tenant shall pay to Landlord within fifteen (15) days after actual receipt of the amount due from Landlord an amount based on the actual usage by Tenant (as determined by submeter read by Landlord) and the actual rate charged to Landlord by the utility provider without additional fee from Landlord. If Tenant fails to pay in a timely manner any sum required under this. Article 5. Landlord shall have the right, but not me obligation, to pay any such sum. Any sum so paid by Landlord shall be deemed to be owing by Tenant to Landlord and due and pc1yable as Additional Rent within ten (l 0) days after demand therefor. Notwithstanding anything herein to the contrary, any supplemental heating and/or cooling systems and equipment serving the Premises shall be separately metered to the Premises at Tenant's cost, and Tenant shall be solely responsible for all electricity registered by such meters. Landlord shall not be liable for any interruption or delay in electric or any other utility service for any reason unless caused by the gross negligence or willful misconduct of Landlord.

(b) Use of the-Premises-, or any part thereof, in a manner exceeding the design conditions (including occupancy and connected electrical load) for the heating, ventilation and air conditioning ("HVAC") units serving the Premises, or rearrangement of partitioning which interferes with normal operation of the HVAC system serving the Premises, may require changes in the HVAC system serving the Premises. Landlord has no obligation to keep cool any of Tenant's information technology equipment that is placed together in one room, on a rack, or in any similar manner ("IT Equipment"), and Tenant waives any claim against Landlord in connection with Tenant's IT Equipment. If Tenant exceeds the design conditions for the heating or cooling unts in the Premises or introduces into the Premise’s equipment that overloads the system. and/or in any oilier way causes the system not adequately to perform their proper functions, supplementary systems may at Landlord' s option be provided by Landlord at Tenant's expense. Tenant shall not change or adjust any closed or sealed thermostat or other element of the HV AC system without Landlord's express prior written consent. Landlord may install and

operate meters or any other reasonable system for monitoring or estimating any services or utilities used by Tenant in excess of those required to be provided by Landlord (including a system for Landlord's engineer reasonably to estimate any such excess usage). If such system indicates such excess services or utilities, Tenant shall pay Landlord1s reasonable charges for installing and operating such system and any supplementary air conditioning, ventilation., beat, electrical, or other systems or equipment {or adjustments or modifications to the existing Building systems and equipment), and Landlord's reasonable charges for such amount of excess services or utilities used by Tenant

6.SIGNS: USE OF PREMISES AND COMMON AREAS. At Tenant's cost, Landlord shall provide Tenant with Building-standard identification signage on all Building directories and at the entrance to the Premises. No other signs shall be placed, erected or maintained by Tenant at any place upon the Premises, Building or Project. Tenant's use of the Premises shall be limited to general office and laboratory, including, without limitation, medical testing, use (the “Permitted Use"). The Permitted Use shall be subject to all applicable Laws (as defined in Article 21) and to all reasonable requirements of the insurers of the Building. Without Landlord's prior written consent, Tenant shall not install in or for the Premises any equipment that requires more electric current than is standard in the Building. Tenant shall have the right, non-exclusive and in common with others, to use: (i) the exterior paved driveways and walkways of the Building for vehicular and pedestrian access to the Building; (ii) the internal common area, if any; and (iii) the designated parking areas of the Project for the parking of automobiles of Tenant and its employees and business visitors and vendors; provided Landlord shall have the right in its sole discretion and from time to time, to construct, maintain, operate, repair, close, limit, take out of service, alter, change, and modify all or any part of the common areas of the Project, including without limitation, restricting or limiting Tenant's utilization of the parking areas in the event the same become overburdened and in such case to equitably allocate on proportionate basis or assign parking spaces among Tenant and the other tenants of the Building. Tenant shall be solely responsible for installation of its data/te1ecommurucation systems and wiring at the Premises, which shall be done in compliance with all applicable Laws. Subject to Landlord' s reasonable approval, Tenant may use the vendor of its choice for such installation, Landlord shall mark the spaces outside the front door of the Building as reserved for visitors. In no event will Landlord reduce the ratio of parking spaces to rentable square feet of the Project below the ratio that exists as of the date of this Lease. Tenant shall be given four (4) reserved parking spaces in the parking lot closest to the entrance to the Premises.

7.ENVIRONMENTAL MATTERS. Tenant shall not use, generate, manufacture, refine, transport, treat, store, handle, dispose, bring or otherwise cause to be brought or permit any of its agents, employees, subtenants, contractors or invitees to bring, in, on or about any part of the Project, any hazardous. waste, hazardous substances, toxic substances, oil, asbestos or other hazardous material, pollutant or contaminant as defined by 42 U.S.C. Sections 960 1 et seq., as the same may from time to time be amended, and the regulations promulgated pursuant thereto (CERCLA), or now or hereafter regulated by any Law. Notwithstanding the foregoing, Tenant shall be permitted to bring onto the Premises Hazardous Materials (as defined below) used in connection with its business provided Tenant shall at all times comply \with all Laws (including, without limitation laws gove1ning the use of laboratory space) pertaining to the storage handling, use and application of such Hazardous Materials. This Article 7 shall survive the expiration or sooner termination of this Lease. In no event shall Landlord be required to consent to the installation or use of any Hazardous Material storage tanks at the Project. Tenant, at its sole cost

and expense, shall remediate in a manner satisfactory to the applicable governmental agencies any Hazardous Materials released on or from the Project by Tenant, its agents, employees, contractors, assignees, subtenants or invitees. Tenant shall complete and certify disclosure statements as requested by Landlord from time to time relating to Tenant's transportation, storage, use, generation, manufacture or release of Hazardous Materials at the Premises. As defined in any applicable Laws, Tenant is and shall be deemed to be the "operator” of Tenant's ''facility” and the "owner" of a1J Hazardous Materials brought on the Premises by Tenant, its agents, employees, contractors, assignees, subtenants, or invitees, and the wastes, byproducts, or residues generated, resulting, or produced therefrom. ''Hazardous Materials" means any flammable items, explosives, radioactive materials, hazardous or toxic substances, material or waste or related materials, including any substances defined as or included in the definition of "hazardous substance", "hazardous wastes/' "hazardous material", or "toxic substances" now or subsequently regulated under any applicable federal, state or local Laws or regulations, including without limitation petroleum based products, paints, solvents, lead, cyanide, DDT, printing inks, acids, pesticides, ammonia compounds and other chemical products, asbestos, PCBs and similar compounds. and including any different products and materials that are subsequently found to have adverse effects on the environment or the health and safety of persons. In the event that Hazardous Materia1s are discovered that (i) are located in the Premises and pre-date Tenant's occupancy of the Premises; or, (ii) are located in the Premises and were introduced by Landlord., its agents, employees, or contractors, such Hazardous Materials shall be remediated by Landlord in a manner satisfactory to the applicable governmental agencies at Landlord1s sole cost and expense. Landlord represents and warrants to Tenant that it has received no notice and has no knowledge of any violations of any federal state or local laws, ordinances, orders, regulations and requirements affecting the Premises, the Building, or the Project.

8.TENANT'S ALTERATIONS. Tenant shall not cut, drill into or secure any fixture, apparatus or equipment or make alterations, improvements or physical additions (collectively, "Alterations") of any kind to any part of the Premises without first obtaining the written consent of Landlord, such consent not to be unreasonably withheld, Alterations shall be in compliance with all Laws. With respect to all Alterations made after the date hereof, other than those expressly made by Landlord pursuant to this Lease, Tenant acknowledges and agrees that

(i) Tenant is not, under any circumstance, acting as the agent of Landlord; (ii) Lru1d!ord did not cause or request such Alterations to be made; (iii) Landlord has not ratified such work; and (iv) Landlord did not authorize such Alterations within the meaning of Section 43 3 of the Code of Virginia or any amendment thereof All Alterations (whether temporary or permanent in character) made in or upon the Premises, either by Landlord or Tenant, shall be Landlo1'd's property upon installation and shall remain on the Premises without compensation to Tenant unless Landlord provides written notice to Tenant to remove same at the expiration or sooner termination of this Lease, in which event Tenant shall promptly remove such Alterations and restore the Premises to good order and condition. Notwithstanding the foregoing, Landlord has consented to Tenant's initial up-fit of the Premises pursuant to the plans attached hereto as Exhibit "D" ("Tenant's Initial Work"). Further, the following items of Tenant's Initial Work shall at all times remain Tenant's property and may be removed on or before the expiration of the Temby Tenant, at Tenant's sole cost and e:XJ>ense, and so long as Tenant repairs any damage occasioned by the removal of such item, s and restores_ the Premises to at least as good of a condition as existed as the date of this Lease, ordinary wear and tear excepted: All parts of Tenant's laboratory space.

9.ASSIGNMENT Mm SUBLETTING.

(a) Except as o otherwise expressly provided in this Article 9, neither Tenant nor Tenant's legal representatives or successors-in-interest by operation of law or otherwise, shall sell, assign, transfer, hypothecate, mortgage, encumber, grant concessions or licenses, sublet, or otherwise dispose of all or any interest in this Lease or the Premises, or permit any person or entity other than Tenant to occupy any portion of the Premises, without Landlord's prior written consent, which consent shall not be unreasonably withheld, conditioned or delayed. Any of the foregoing acts (a "Transfer" to a "Transferee") without such consent shall constitute an Event of Default and shall, at Landlord's option, be void and/or terminate this Lease. Landlord and Tenant acknowledge that Tenant is a publicly traded entity and so long as Tenant remains a publicly traded entity an assignment shall not include any assignment by operation of law, any merger, consolidation, or asset sale involving Tenant, any direct or indirect transfer of control of Tenant and any transfer of a majority of the ownership interests in Tenant. Consent by Landlord to any Transfer shall be held to apply only to the specific Transfer authorized. Such consent shall not be construed as a waiver of the duty of Tenant, or Tenant's legal representatives or assigns, to obtain from Landlord consent to any other or subsequent Transfers, or as modifying or limiting the rights of Landlord under the foregoing covenant by Tenant not to Transfer without Landlord's consent. The acceptance of rental by Landlord from any other person shall not be deemed to be a waiver by Landlord of any provision hereof.

(b) If at any time during the Term Tenant desires to consummate a Transfer which requires Landlord consent, Tenant shall give notice to Landlord of such desire, including the name, address and contact party for the proposed Transferee, the effective date of the proposed Transfer (including the proposed occupancy date by the proposed Transferee), and in the instance of a proposed sublease, the square footage to be subleased, a floor plan professonally drawn to scale depicting the proposed sublease area and a statement of the duration of the proposed sublease (which shall in any and all events expire by its terms prior to the scheduled expiration of this Lease, and immediately upon the sooner termination hereof). Landlord may, at its option, exercisable by notice given to Tenant within forty-five (45) days following Landlord's receipt of Tenant's notice, elect to recapture the Premises if Tenant is proposing to sublet, or terminate this Lease in the event of an assignment.

(c) Regardless of Landlord's consent, no Transfer shall release Tenant of Tenant's obligation or alter the primary liability of Tenant to pay the Rent and to perform all other obligations to be performed by Tenant hereunder, and DIFFUSlON PHARMACEUTICALS INC. and all assignees shall be jointly and severally liable for all Tenant obligations under this Lease, In connection with each proposed Transfer requiring Landlord approval and regardless of whether consent is given, Tenant shall pay to Landlord: (i) an administrative fee of $1,000 per request in order to defer Landlord's administrative expenses arising from such request; plus (ii) Landlord's reasonable attorneys' fees. Any sums or other economic consideration received by Tenant as a result of any Transfer (except payments that are unrelated to Tenant's leasehold interest in the Premises (such as cash consideration for Tenant's stock), and rental or other payments received that are attributable to the amortization of the cost of leasehold improvements made to the transferred portion of the Premises by Tenant to the Transferee, and other reasonable expenses incident to the Transfer, including standard leasing commissions) whether denominated rentals under the sublease or otherwise, that exceed, in the aggregate, the total sums which Tenant is obligated to pay Landlord under this Lease (prorated to reflect obligations allocable to that portion of the Premises subject to such Transfer) shall be divided evenly between Landlord and

Tenant, with Landlord's portion being payable to Landlord as Additional Rent without affecting or reducing any other obligation of Tenant .hereunder.

(d) Notwithstanding the foregoing, Tenant shall have the right without the prior consent of Landlord, but after at least fifteen (15) days' prior written notice to Landlord, to assign this Lease or sublet any portion of the Premises to any Affiliate (as defined below), or an entity (the ''Surviving Entity") into which Tenant merges or that acquires substantially all of the assets or stock of1'enant; provided: (i) such assignee shall, in writing, assume and agree to perform all of the obligations of Tenant under this Lease, and it shall deliver a copy of such assignment and assumption agreement to Landlord within ten (10) days thereafter, together with a certificate of insurance evidencing the assignee's compliance with the insurance requirements of Tenant under this Lease; (ii) the Surviving Entity shall have a tangible net worth at least equal to the greater of the net worth of Tenant on the date of this Lease or on the date of such Transfer; (iii)DIFFUSION PHARMACEUTICALS INC. and any subsequent Tenant/assignor shall not be released or discharged from any liability under this Lease by reason of such Transfer; (iv) the use of the Premises shall be for the Permitted Use; and (v) if the assignment or subletting is to an Affiliate, such assignee or subtenant shall remain an Affiliate1hroughout the Term and if such assignee or subtenant shall cease being an Affiliate, Tenant shall notify Landlord in writing of such change and such transfer shall be deemed an Event of Default if Landlord's consent thereto is not given in writing within ten (l 0) business days of such notification. An "Affiliate" shall mean: (i) an entity which is 50% or more owned by those owning 50% or more of Tenant; (ii) a subsidiary of Tenant, (ill) a parent entity of Tenant; or, (iv) a subsidiary of the parent entity of Tenant.

10.LANDLORD'S RIGHT OF ENTRY. Landlord and persons autb01ized by Landlord may enter the Premises at all reasonable times upon reasonable advance notice with the accompaniment by a Tenant representative or specific written consent of the Tenant to the areas where Landlord and persons authorized by Landlord will be allowed to enter (or any time without notice in the case of an emergency). Landlord shall not be liable for inconvenience to or disturbance of Tenant by reason of any such entity; provided, however, in the case of repairs or work, such shall be done, so far as practicable, so as to not unreasonably interfere with Tenant's use of the Premises. Notwithstanding the foregoing, Landlord and Tenant acknowledge that, as a result of the nature of Tenant's business operations in the Premises, Tenant is required by applicable laws and regulations to restrict access to the Premises and to comply with other extraordinary security procedures. Accordingly, Landlord expressly acknowledges that as a material condition of the Lease, it shall comply with Tenant's security provisions when accessing the Premises for any reason, however, in the event of an emergency, Landlord may use any means necessary to access the Premises. Landlord agrees that if it accesses the Premises in the event of an emergency, Landlord shall immediately or as soon as reasonably practical, notify Tenant of such access. Tenant deals with sensitive non-public information in the conduct of the Permitted Use and Landlord shall, and shall require its contractors’ agents, and employees to, keep confidential any items observed, seen, l1eard, or learned while inside the Premises.

11.REPAJRS AND MAINTENANCE.

(a) Tenant, at its sole cost and exp.en.se and throughout the Term, shall keep and maintain the interior of the Premises and mechanical, plumbing and electrical systems exclusively serving the Premises (including; without limitation, HVAC systems and equipment serving the Premises) in good order and condition, free of rubbish, and shall promptly make all non-structural repairs

necessary to keep and maintain such good order and condition. When used.in this Article-II, the term “repairs" shall include replacements and renewals when necessary. All repairs made by Tenant stall utilize materials and equipment that area least equal in quality and usefulness to those originally used in constructing the Building and the Premises. Landlord shall not be liable to Tenant for any damage caused to Tenant and its property due to the Building or any part or appurtenance thereof being improperly constructed or being or becoming out of repair, or arising from the leaking of gas, water, sewer or steam·pipe·s, or from problems with electrical service, so long as Landlord diligently remedies such defect to the extent under Landlord's control.

(b) Tenant shall, at its expense, enter into contracts (or, at. Landlord’s option, accept the assignment and responsibility for existing contracts) for: (i) preventive maintenance and service for regularly scheduled maintenance of all HVAC systems and equipment serving the Premises; and (ii) termite and pest prevention and extermination services to the Premises. The contractors and the terms and conditions of the contracts, including the scope of services and the maintenance or service schedule, shall be subject to the prior written approval of Landlord, which approval shall not be unreasonably withheld. The contracts must be in effect and a fully executed copy thereof must be provided to Landlord within thirty (30) days after the Commencement Date. Tenant shall provide or cause the contractors to provide Landlord with copies of all work orders and other maintenance or service records for all work performed within the Premises promptly following each maintenance or service activity. If Tenant shall fail to perform any of its obligations hereunder, Landlord may cure such default on behalf of Tenant, and Tenant shall reimburse Landlord upon demand for any sums paid or costs incurred by Landlord in cure such default, including attorneys' fees and other legal expenses, together with interest at the Default Rate (as defined in Section 19(b) below).

(c) Landlord shall make allnecessary repairs to thefooti(c) Landlord shall make all necessary repairs to the footings and foundations and the steel columns and girders forming a part of the Premises, and to the Building outside of the Premises and repairs made necessary by a negligent or willful act or omission of Tenant or any employee, agent, contractor, or invitee of Tenant shall be made at sole cost and expense of Tenant, except to the extent of insurance proceeds received by Landlord. Landlord represents and warrants to the best of Landlord’s knowledge that, as of the date of this Lease, for buildings, of like age and class, all structural parts of the Premises, including but not limited to the foundation, roof, exterior walls, plumbing and electrical systems meet and comply with all federal, state, and local laws, ordinances and regulations, all handicapped accessibility standards, including but not limited to the Americans with Disabilities Act (“ADA”) accessibility requirements, and are in good, sanitary order, condition, and repair.

(d) Landlord shall deliver the Premises with the HVAC systems and equipment serving the Premises in good working order. If me cost of any one (l) repair to the HVAC systems and equipment serving the Premises incurred by Tenant during the first twelve (12) months after the Commencement Date exceeds Five Hundred andNoll00 Dollars ($500.00), then Land1ord shall reimburse Tenant for such costs incurred in excess of Five Hundred and Noll00 Dollars ($500.00) within thirty (30) days after receipt of an invoice therefor together with reasonable supporting documentation. If the costs of any series of repairs or replacements to the HVAC systems exceeds $1,500 in any twelve (12) month period during the Term, Landlord shall reimburse Tenant for such costs incurred in excess of $1,500 within thirty (30) days after receipt of an invoice therefor together with reasonable supporting documentation. Notwithstanding the foregoing, Landlord's obligation to reimburse Tenant is expressly conditioned on; (i) Tenant maintaining a preventative maintenance contract on the HVAC units; (ii) the cause for the repairs or replacements not being the negligence or willful misconduct of Tenant or its agents, employees or contractors; and (iii) Landlord being given the opportunity to inspect the applicable and equipment and proposals prior to

either party incurring costs.

12.INSURANCE: SUBROGATION RIGHT’S. Tenant shall obtain and keep in force at all times during the Term, at its own expense, commercial general liability insurance including contractual liability and personal injury1iability and all similar coverage, with combined single limits of $2,000,0Qp.oo .on account of bodily injury to or death of one or more persons as the result of any one accident or disaster and on account of damage to property, together with an umbrella policy of$4,000,000.00, or in such other amounts as Landlord may from time to time require. Tenant shall also require its movers to procure and deliver to Landlord a certificate of insurance covering. Landlord as an additional insured. Tenant shall, at its sole cost and expense, maintain in full force and effect on al} Tenant's trade fixtures, equipment and personal property in the Premises, a policy of ''special form” property insurance covering the full replacement value of such property. All liability insurance required hereunder shall IlQ1 be subject to cancellation without at least thirty (30) days' prior notice to all insureds, and shall name Tenant as insured, and Landlord and Landlord's property manager as additional insureds, and, if requested by Landlord, shall also name as an additional insured any mortgagee or holder of any mortgage that may be or become a lien upon any part of the Premises. Prior to the commencement of the Term, Tenant shall provide Landlord with certificates that evidence that the coverages required have been obtained for the policy periods. Tenant shall also furnish.to Landlord or Landlord's designated agent throughout the Term replacement certificates at least thirty (30) days prior to the expiration dates of the then-current policy or policies. All the insurance required under this Lease shall be issued by insurance companies authorized to do business in the Commonwealth of Virginia with a financial rating of at least an A-X as rated in the most recent edition of Best's Insurance Reports and in business for the past five (5) years. The limit of any such insurance shall not limit the liability of Tenant hereunder. If Tenant fails to maintain such insurance, Landlord may but is not required to, procure and maintain the same, at Tenant's expense to be reimbursed by Tenant as Additional Rent within ten (I 0) days of written demand. Any deductible under such insurance policy in excess of Twenty-Five Thousand Dollars ($25,000) must be approved by Landlord in writing prior to issuance of such policy. Tenant shall not self-insure-without Landlord's prior written consent Landlord and Tenant shall each procure an appropriate clause in or endorsement to any property insurance covering the Project or any portion thereof and personal property, fu.1Ures and equipment located therein, wherein the insurer waives subrogation or consents to a waiver of right of recovery. Both Landlord and Tenant agree to immediately give each insurance company which has issued to it policies of fire and extended coverage insurance written notice of the terms of such mutu.al waivers and to cause such insurance policies to be properly endorsed, if necessary, to prevent the invalidation thereof by reason of such waivers and shall furnish to the other party written evidence of such foregoing endorsements or that such endorsement is not required. Landlord and Tenant hereby waive and agree not to make any claim against, or seek to recover from, the other for any loss or damage to its property or the property of others resulting from tire or other hazards to the e>..1:ent covered (or would have been covered if the party had obtained and maintained the insurance it was required to carry under this Lease or if Tenant did not elect to self-insure for any such matter or risk) by the property insurance that was required co be carried by that party under the terms of this Lease. The foregoing waivers shall not apply to Joss or damage in excess of actual or required policy limits (whichever is greater) or to the first $25,000.00 of any deductible, co-insurance or self-insured retentions applicable under any policy maintained by Landlord. Landlord. will maintain a policy of “special form:'' property insurance covering the full replacement value of Landlord's interest in the Project with a deductible in an amount not to exceed $25,000. Landlord will maintain a commercial general liability insurance policy for the Project in a reasonable amount.

13.INDEMNIFICATION.

(a) Tenant shall defend, indemnify and bold harmless Landlord, Landlord's property manager and each of Landlord's directors, officers, members, partners, trustees, employees and agents (collectively, the "Landlord Indemnitees") from and against any and all third-party claims, actions, damages, liabilities and expenses (including all reasonable costs and expenses (including reasonable attorneys' fees)) arising from: (i) Tenant's breach of this Lease; (ii) any negligence or willful act of Tenant, any Tenant Indemnitees (as defined in Section 13(b) below), or any of Tenant's invitees, subtenants, or contractors; provided, however, Tenant's indemnity obligations shall not

extend to loss of business, loss of profits, or other consequential damages that may be suffered by Landlord and (iii) any acts or omissions occurring at, or the condition, use or operation of, the Premises, except to the extent arising from Landlord's negligence or willful misconduct. If Tenant fails to promptly defend a Landlord Indemnitee following written demand by the Landlord Indemnitee, the Landlord Indemnitee shall defend the same at Tenant's expense, by retaining or employing counsel reasonably satisfactory to such Landlord Indemnitee.

(b) Landlord shall defend, indemnify and hold harmless Tenant and each of Tenant's directors, officers, members, partners, trustees,employees and agents (collectively, the ''Tenant Indemnitees") from and against any and all third-party claims, actions, damages, liabilities and expenses (including all reasonable costs and expenses (including reasonable attorneys' fees)) arising from: (i) Landlord's breach of this Lease; and (ii) any negligence or willful misconduct of Landlord or any Landlord indemnitees; provided, however Landlord's

indemnity obligations shall not extend to loss of business, loss of profits, or other consequential damages that may be suffered by Tenant. If Landlord fails to promptly defend a Tenant Indemnitee following written demand by the Tenant indemnitee, the Tenant Indemnitee shall defend the same at Landlord's expense, by retaining or employing counsel reasonably satisfactory to such Tenant Indemnitee.

(c) The provisions of this Article 13 shall survive the expiration or earlier termination of this Lease

14.FIRE DAMAGE. If there occurs any casualty to the Premises and: {i) the casualty damage is of a

nature or extent that, in Landlord's reasonable judgment, the repair and restoration work would require more than two hundred ten (210) consecutive days to complete after the casualty (assuming normal work crews not engaged in overtime); or (ii) more than thirty (30%) percent of the total area of the Building is extensively damaged; or (iii) the casualty occurs in the last Lease Year of the Term and Tenant bas not exercised a renewal right; or (iv) insurance proceeds are unavailable or insufficient, either party shall have the right to terminate this Lease and all the unaccrued obligations of the parties hereto, by sending written notice of such termination to the other within thirty

(30) days of the date of casualty. Such notice is to specify a termination date no less1han fifteen (15) days after its

transmission. Notwithstanding the foregoing, if the casualty was caused by the act or omission of Tenant or any of Tenant's agents, employees, invitees, assignees, subtenants, licensees or contractors, Tenant shall have no right to terminate th.is Lease due to the casualty. In the event of damage or destruction to the Premises or any part thereof and neither party has terminated this Lease, Tenant's obligation to pay Fixed Rent and Additional Rent shall be equitably adjusted or abated.

15.SUBORDINATION AND NON-DISTURBANCE: RIGHTS OF MORTGAGEE. Provided the holder of a mortgage or Deed of Trust (as hereinafter defined) agrees to recognize ibis Lease in the event of a foreclosure or deed in lieu of foreclosure, this Lease shall be subordinate at all times to the lien of any mortgages now or hereafter placed upon the Premises, Building and/or Project and land of which they are a part without the necessity of any further instrument or act on the part of Tenant to effectuate such subordination. Tenant further agrees to execute and deliver within ten (10) days of demand such further instrument evidencing such subordination, non-disturbance and attornment as shall be reasonably required by any mortgagee. If Landlord shall be or is alleged to be in default of any of its obligations owing to Tenant under this Lease, Tenant shall give to the holder (the "Mortgagee'') of any mortgage or deed of trust now or here after placed upon the Premises, Building and/or Project (provided Tenant has received written notice of the name and address of such Mortgagee), notice by overnight mail of any such default that Tenant shall have served upon Landlord. Tenant shall not be entitled to terminate this Lease because of any default by Landlord without having given such notice to the Mortgagee. If Landlord shall fail to cure such default, prior t0 Tenant terminating the Lease, the Mortgagee shall have forty-five (45) additional days within which to cute such default. In addition, the Mortgagee (or a trustee on behalf of the Mortgagee), may, at its option, execute and record among the land records of the jurisdiction where the Premises are located a subordination statement or statements with respect to this Lease whereby this Lease will be made superior to the lien of the deed of trust or the mortgage held by the Mortgagee and encumbe1ing the: Project (the "Deed of Trust''). Tenant acknowledges the right of the Mortgagee to file such a subordination statement, and agrees that from and after the recordation of such a subordination statement, this Lease shall be superior in lien and in dignity to the lien of the Deed of Trust, and shall not be affected by any foreclosure of the Deed of Trust.

16.CONDEMNATION. If a taking renders the Building reasonably unsuitable for the Permitted Use, this Lease shall, at either party's option, terminate as of the date title to condemned real estate vests in the condemner, the Rent herein reserved shall be apportioned and paid in full by Tenant to Landlord to such date, all Rent prepaid for period beyond that date shall forthwith be repaid by Landlord to Tenant, and neither party shall thereafter have any liability for any unaccrued obligations hereunder. If this Lease is not terminated after a condemnation, the Fixed

Rent and the Additional Rent shall be equitably reduced in proportion to the area of the Premises that has been taken for the balance of the Term. Tenant shall have the right to make a claim against the condemner for moving expenses and business dislocation damages to the extent that such claim does not reduce the sums otherwise payable by the condemner to Landlord.

17.ESTESTOP£'.E.L CERTIFICATE. Each party agrees at any time and from time to time, within ten (10) days after the other party's written request, to execute and deliver of the other party a written instrument: in recordable form certifying all information reasonably requested..

18.DEFAULT.

(a) An "Event of Default" shall be deemed to exist and Tenant shall be in default hereunder if: CO Tenant fails to pay any Rent when due and such failure continues for more than three (3) business days after Landlord bas given Tenant written notice of such failure; provided, however, in no event shall Landlord have any obligation to give Tenant more than two (2) such notices in any twelve (12)-month period, after which there shall be an Event of Default if Tenant fails to pay any 'Rent when due, regardless of Tenant's receipt of notice of such non- payment; (ii) Tenant ceases to use the Premises for its Permitted Use or removes substantially all of its furniture, equipment and personal property from the Premises (other than in the case of a permitted subletting or assignment)t or permits the same to be unoccupied; (iii) Tenant fails to bond over -a construction or mechanics lien within ten (10) days of demand; (iv) any assignment or subletting (regardless of whether the same might be void under this Lease) in violation of the terms of this Lease; (v) the occurrence of any default beyond any applicable notice and/or cure period under any guaranty executed in connection with this Lease; (vi)Tenant fails to deliver any Landlord requested estoppel certificate or subordination agreement within ten (10) business days after receipt of notice that such document was not received within the time period required under this Lease; or (vii) Tenant fails to observe or perform any of Tenant's other non-monetary agreements or obligations herein contained within ten (l0) days after written notice specifying the default, or the expiration of such additional time period as is reasonably necessary to cure such default (not to exceed ninety (90) days), provided Tenant immediately commences and thereafter proceeds with all due diligence and in good faith to cure such default, h

(b) If an Event of Default shall occur, the following provisions shall apply and Landlord shall have, in addition to all other rights and remedies available at law or in equity, including the right to terminate this Lease. the rights and remedies set forth herein, which may be exercised upon or at any rime following the occurrence of an Event of Default. 1. Acceleration of Rent. Landlord shall have the right to accelerate all Rent and all expenses due hereunder and otherwise payable in installments over the remainder of the Term. The amount of accelerated rent to the termination da te, without further notice or demand for payment, shall be due and payable by Tenant within five (5) days after Landlord has so notified Tenant. If Tenant has paid to Landlord all accelerated rent for the balance of the Term and if Landlord shall subsequently lease the Premises or a portion thereof for the balance of the Term or portion thereof: Landlord shall pay Tenant 50% of any such rent actually collected. Additional Rent that has not been included, in whole or in part, in accelerated rent, shall be due and payable by Tenant during the remainder of the Term, in the amounts and at the times otherwise provided for in this Lease. 2. Termination of Lease; Termination of Possession. Landlord shall have the right to terminate this Lease and recover all damages caused by Tenant' s breach, including consequential damages for lost future rent, and/or repossess the Premises, with or without terminating, and relet the Premises at such amount as Landlord deems reasonable, and/or seize and bold any personal property of Tenant located in the Premises and assert against the same a lien for monies due Landlord, and/or lock the Premises and deny Tenant access thereto without obtaining any court authorization, and/or obtain an order for unlawful detainer from any court of competent jurisdiction without prejudice to Landlord's rights to otherwise collect Rent or breach of contract damages from Tenant, and/or pursue any other remedy available in law or equity. 3. Landlord's Damages. The damages that Landlord shall be entitled to recover from Tenant shall be the sum of: (i) all Fixed Rent and Additional Rent accrued and unpaid as of the termination date; (ii) all costs and expenses incurred by Landlord in recovering possession of the Premises, including legal fees, and removal and storage of Tenant's property; (iii) the costs and expenses of restoring the Premises to the condition in which the same were to have been surrendered by Tenant as of the expiration of the Term; (iv) the costs of reletting commissions; (v) all Fixed Rent and Additional Rent otherwise payable by Tenant over the remainder of the Term as reduced to present value and all consequential damages relating to Tenant's breach of this Lease; (vi) all legal fees and court costs incurred by Landlord in connection with the Event of Default; plus (vii) the unamortized portion (as reasonably determined by Landlord) of brokerage commissions and consulting fees incurred by Landlord, and tenant concessions including free rent given by Landlord, in connection with th.is Lease. Less deducting from the total determined under subsections (i) through (vii) above, all Rent that Landlord receives from other tenant(s) by reason of the leasing of the Premises during any period falling within the otherwise remainder of the Term. 4. Landlord's Right to Cure. Without limiting the generality of the foregoing, if Tenant shall fail to perform any of its obligations

hereunder, Landlord may, in addition to any other rights it may have in law or in equity, cure such default on behalf of Tenant, and Tenant shall reimburse Landlord upon demand for any sums paid or costs incurred by Landlord in curing such default, including attorneys' fees and other legal expenses, together with interest at twelve percent (12%) (the "Default Rate") from1he dates of Landlord's incurring of costs or expenses. 5. Interest on Damage Amounts. Any sums payable by Tenant hereunder that are not paid after the same shall be due shall bear interest at the Default Rate. 6. No Waiver by Landlord. No delay or forbearance by Landlord in exercising. any right or remedy hereunder, or Landlord's undertaking or performing any act or matter that is not expressly required to be undertaken b y Landlord shall be construed1 respectively, to be a waiver of Landlord's rights or to represent any agreement by Landlord to undertake or perform such act or matter thereafter. Waiver by Landlord of any breach by Tenant of any covenant or condition herein contained (which waiver shall be effective only if so expressed in writing by Landlord) or failure by Landlord to exercise any right or remedy in respect of any such breach shall not constitute a waiver or relinquishment for the future of Landlord's right to have any such covenant or condition duly performed or observed by Tenant, or of Landlord's rights arising because of any subsequent breach of any such. covenant or condition nor bar any right or remedy of Landlord in respect of such breach or any subsequent breach. All tights and remedies of Landlord are cumulative, and the exercise of any one shall not be an election excluding Landlord at any other time from exercise of a different or inconsistent remedy.

(c) If Landlord is compelled to engage the services of attorneys (either outside counsel or in house counsel) to enforce the provisions of this Lease, to the extent that Landlord incurs any cost or expense in connection with such enforcement, including without limitation instituting, prosecuting or defending its rights in any action, proceeding or dispute by reason of any default by Tenant, the sum or sums so paid or billed to Landlord, together with all interest, costs and disbursements, shall be due from Tenant immediately upon receipt of an invoice therefor following the occurrence of such expenses. If, in the context of a bankruptcy ca se Landlord is compelled at any time to incur any expense, including attorneys' fees, in enforcing or attempting to enforce the terms of this Lease or to enforce or attempt to enforce any actions required under the Bankruptcy Code to be taken by the trustee or by Tenant, as debtor-in-possession then the sum so, paid by Landlord shall be awarded to Landlord by the Bankruptcy Court and shall be immediately due and payable by the trustee or by Tenant's bankruptcy estate to Landlord in accordance with the terms of the order of the Bankruptcy Court.

(d) If Landlord fails to pay when due any sum due Tenant hereunder, which failure continues for a

period of fifteen (15) days after receipt of written notice of such failure from Tenant to Landlord, or if Landlord fail to keep, perform or observe any of the other covenants to be kept, observed or performed by Landlord hereunder, which failure continues for a period of thirty (30) days after written notice of such failure from Tenant to Landlord (unless such failure is of such a nature that it will require more than thirty (30) days to cure, in which case such cure period shall be extended for so long as Landlord shall promptly commence and diligently prosecute the cure of such failure, and while doing so shall continue to perform all of its monetary obligations hereunder, but in no event to exceed one hundred twenty (120) days), then, in either of such events, an ''Event of Default by Landlord" shall exist hereunder.

(e) If an Event of Default by Landlord exists, then Tenant may exercise any and all remedies available at law or in equity, including, without limitation, any one or more of the following remedies, while such default is continuing or remains uncured:

(i) to commence an action for specific performance against Landlord; and/or

(ii) to commence an action for damages suffered or incurred by Tenant as a result of Landlord's default; and/or

(iii) to itself perform, or cause to be performed, the covenant, performance or condition required to be kept, observed or performed by Landlord and which is in default and to thereafter pursue a court action against Landlord for amounts expended on Landlord's account.

19.SURRENDER. No later than upon the expiration or earlier termination of the Term or Tenant's right to possession of the Premises, Tenant shall vacate and surrender the Premises to Landlord in good order and condition and in conformity with the applicable provisions of this Lease, including without limitation Article 11. Tenant shall have no right to hold over beyond the expiration of the Term, and if Tenant does not vacate as required such failure shall be deemed an Event of Default and Tenant's occupancy shall not be construed to effect or constitute anything other than a tenancy at sufferance. During any period of occupancy beyond the expiration or earlier termination of the Term the amount of Rent owed by Tenant. a Landlord shall be one hundred fifty percent (150%) of the Rent that would otherwise be due under this Lease, without prorating for any partial month of holdover. The acceptance of

Rent by Landlord or the failure or delay of Landlord in notifying or evicting Tenant following the expiration or earlier termination of the Term shall not create any tenancy rights in Tenant and any such payments by Tenant may be applied by Landlord against its costs and expenses, including reasonable attorneys' fees, incurred by Landlord as a result of such holdover. The provisions of this section shall not constitute a waiver by Landlord of any right of re-entry as set forth in this Lease; nor shall receipt of any Rent or any other act in apparent affirmance of the tenancy operate as a waiver of Landlord's right to terminate this Lease for a breach of any of the terms, covenants, or obligations herein on Tenant's part to be performed. In addition, if Tenant fails to vacate and surrender the Premises as herein required, Tenant shall indemnify, defend and hold harmless Landlord from all costs, losses, expenses or liabilities incurred as a result of such failure, including without limitation, claims made by any succeeding tenant and real estate brokers' claims and reasonable attorneys' fees. At the end of the Term or sooner termination of Tenant's right to possession of the Premises, Tenant shall, at Landlord's option, remove all furniture, movable trade fixtures and equipment (including telephone security and communication equipment system wiring and cabling) in a good and workmanlike manner so as not to damage the Premises or Building and in such manner so as not to disturb other tenants in the Building. Tenant's obligation to pay Rent and to perform all other Lease obligations for the period up to and including the expiration or earlier termination of this Lease, and the provisions of this Article 19. sha11survive the expiration or earlier termination of this Lease.

20.RULES AND REGULATIONS. At all times during the Term, Tenant, its employees, agents, subtenants, invitees and licensees shall comply with all rules and regulations specified on Exhibit G attached hereto and such other written rules and regulations established by Landlord for the Project from time to time (provided, no later adopted rules shall interfere with Tenant' s use of the Premises for the Permitted Use). In.the event of an inconsistency between the rules and regulations and this Lease, the provisions of this Lease shall control.

21.GOVERNMENTAL REGULATIONS. Tenant shall. in the use and occupancy of the Premises and the conduct of Tenant's business or profession therein, at all times comply with all applicable laws, ordinances, orders, notices, rules and regulations of the federal, state and municipal governments (collectively, "Laws"). Landlord shall be responsible for compliance with Title III of the Americans with Disabilities Act of 1990, 42 U.S.C. §12181 et seq. and its regulations (collectively, the "ADA"): (a) as to the design and construction of exterior and interior common areas (e.g. sidewalks, parking areas and common area bathrooms); and (b) with respect to the design and construction of the Premises as of the date of this Lease. Except as set forth above in the preceding sentence, Tenant shall be responsible for compliance with the ADA in all other respects concerning the use and occupancy of the Premises, which. Compliance shall include, without limitation: (i) provision for full and equal enjoyment of the goods, services, facilities, privileges, advantages or accommodations of the Premises as contemplated by and to the extent required by the ADA; (ii) compliance relating to requirements under the ADA or amendments thereto arising after the date of this Lease; and (iii) compliance re1ating to the design, layout, renovation redecorating, refurbishment, alteration, or improvement to the Premises made or requested by Tenant.

22.NOTICES. Wherever in this Lease it shall be required or permitted that notice or demand be given or served by either party to this Lease to or on the other party, such notice or demand shall be duly given or served if in writing and either: (i) personally served; (ii) delivered by pre-paid nationally recognized overnight courier service (e.g., Federal Express) with evidence of receipt required for delivery; (ill) forwarded by registered or certified mail, return receipt requested, postage prepaid; (iv) sent by facsimile with a copy mailed by first class United States mail; or (v) if an e-mail address is provided, e-mailed with evidence of receipt and delivery of a copy of the notice by first class mail in all such cases addressed to the parties at the addresses set forth below_ Each such notice shall be deemed to have been given to or served upon the party to which addressed on the date the same is delivered or delivery is refused. Each party shall have the right to change its address for notices (provided such new address is in the continental United States) by a writing sent to the other party in accordance with this Article 22, and each party shall, if requested, within ten (10) days confirm to the other its notice address. Notices from Landlord may be given by either an agent or attorney acting on behalf of Landlord.

|

| | |

Tenant: | | DIFFUSION PHARMACEUTICALS INC, Attn: David Kalergis 1317 Carlton Avenue, Sµite400 Charlottesville, VA 22902 Pax No: (434) 220-0722 E-mail: dkalergis@diffusionpharma.com

|

Landlord: | | ONE CARLTO N, LLC Attn: Frayser White 1100 Harris Street Charlottesville, VA 22903 E-mail: frayser.white@!!lilaiLcom

|

With a copy to: | | Henry Lisico Henry Lisico Company 12704 Crimson Ct., Suite 101 Richmond, VA.23233-7657 E-mail: henrviisjco@verizon.net

|

23.BROKERS. Landlord and Tenant each represents and warrants to the other that such party has had no dealings, negotiations or consultations with respect to the Premises or this transaction wi.th any broker or finder other than Cushman & Wakefield/Thalhimer. Each party shall indemnify and hold the other harmless from and against all liability, cost and expense, including attorneys' fees and court costs, arising out of any misrepresentation

or breach of warranty under this Article.

24.LANDLORD'S LIABILITY. Landlord’s obligations hereunder shall be binding upon Landlord only

for the period of time that Landlord is in ownership of the Building, and upon termination of that ownership, Tenant except as to any obligations that are then due and owing, shall look solely to Landlord's successor-in-interest in ownership of the Building for the satisfaction of each and every obligation of Landlord hereunder. Upon request and without charge, Tenant shall attorn to any successor to Landlord's interest in this Lease and, at the option of any Mort gees, to such Mortgagees. Landlord shall have no personal liability under any of the terms, conditions or covenants of this Lease and Tenant shall look solely to the equity of Landlord in the Building and/or the proceeds therefrom for the satisfaction of any claim, remedy or cause of action of any kind whatsoever arising from the relationship between the parties or any rights and obligations they may have relating to the Project, this Lease, or anything related to either, including without limitation as a result of the breach of any section of this Lease by Landlord. In addition, no recourse shall be had for an obligation of Landlord hereunder, or for any claim based thereon or otherwise in respect thereof or the relationship between the parties, against any past, present or future Landlord Indemnitee (other than Landlord), whether by virtue of any statute or rule of law, or by the enforcement of any assessment or penalty or otherwise, all such other liability being expressly waived and released by Tenant with respect to the Landlord Indemnitees (other than Landlord).

25.MISCELLANEOUS PROVISIONS. (a) Successors. The respective rights and obligations provided in this Lease shall bind and inure to the benefit of the parties hereto, their successors and assigns; provided; however, no rights shall inure to the benefit of any successors or assigns of Tenant unless Landlord's written consent for the transfer to such successor and/or assignee has first been obtained as provided in Article 9 hereof. (b) Governing Law. This Lease shall be construed, governed and enforced in accordance with the laws of the Commonwealth of Virginia, without regard to principles relating to conflicts of l aw. (c) Entire Agreement. The exhibits attached to this Lease are expressly incorporated into this Lease. This Lease supersedes any prior discussions, proposals, negotiations and discussions between the parties, and this Lease contains all the agreements, conditions, understandings, representations and warranties made between the parties hereto with respect to the subject matter hereof, and may not be modified orally or in any manner other than by an agreement in writing signed by both parties hereto or their respective successors in interest. Without in any way limiting the generality of the foregoing, this Lease can only be extended pursuant to the terms hereof, with the due exercise of. an option(if any) contained herein or pursuant to a written agreement signed by both Landlord and Tenant specifically extending the term. No negotiations, correspondence by Landlord or offers to extend the term shall be deemed an extension of the termination date for any period whatsoever. (d) Time of the Essence. TXME IS OF THE ESSENCE IN ALL PROVISIONS OF THIS LEASE, INCLUDING ALL NOTICE PROVISIONS. (e) Accord and Satisfaction. No

payment by Tenant or receipt by Landlord of a lesser-amount than any payment of Fixed Rent or Additional Rent herein stipulated shall be deemed to be other than on ac-count of the earliest stipulated Fixed Rent or Additional Rent due and payable hereunder, nor shall any endorsement or statement or any check or any letter accompanying any check or payment as Rent be deemed an accord and satisfaction. Landlord may accept such check or payment without prejudice to Landlord’s right to recover the balance of such Rent or pursue any other right or remedy provided for in this Lease, at law or in equity. (f) Guaranty. Intentionally deleted. (g) Force Majeure. Whenever a party hereto is required by the provisions of this Lease to perform an obligation and such party is prevented beyond its reasonable control from doing so by reason of a Force Majeure Event (as defined below), such party shall be temporarily relieved of its obligation to perform the obligation provided such party promptly notifies the other party of the specific delay and exercises due diligence to remove or overcome it. In no event, however, shall Tenant be excused from paying Rent because of a Force Majeure Event. A "Force Majeure Event" shall mean any and all delays beyond a party’s reasonable control, including without limitation, delays caused by the other party, governmental restrictions, governmental regulations and controls, order of civil, military or naval authority, governmental preemption, strikes, labor disputes, lock-outs, acts of God, fire, earthquake, floods, e:xplosions, extreme weather conditions, enemy action, and civil commotion, riot or insurrection, but expressly excluding insufficiency of funds, inability to obtain financing. casualty and condemnation. (h) Financial Statements. Tenant shall furnish to Landlord, the Mortgagee, prospective mortgagee or purchaser reasonably requested financial information; provided, so long as Tenant is publicly traded, Tenant's financial statements which are publicly available on the SEC website shall be all that Tenant is required to provide. (i) Authority. Each of Tenant and Landlord represents and warrants to the other that: (i) it is duly organized, validly existing in its state of incorporation/organization and legally authorized to do business in the Commonwealth of Virginia; and (ii) the persons executing this Lease are duly authorized to execute and deliver this Lease on behalf of such party. (j) Attorneys' Fees. In connection with any litigation arising out of this Lease, the prevailing pa1iy, Tenant or Landlo, rd shall be entitled to recover all costs incurred, including reasonabl1;1 attorneys' fees. (k) Waiver: of Jury Trial. To the extent permitted by applicable law, Landlord and Tenant hereby waive trial by jury in any action, proceeding or counterclaim brought by either against the other on any matter arising out of or in any way connected with this Lease, the relationship of Landlord and Tenant, or Tenant's use or occupancy of the Building, any claim or injury or damage, or any emergency or other statutory remedy with respect thereto. (1) Press Releases. Landlord shall have the right, without further notice to Tenant, to include general information relating to this Lease including without limitation Tenant's name, the Building and the square footage of the Premises, in press releases relating to Landlord's and its affiliates' leasing activity. Information relating to rates will not be released without Tenant's prior written consent, such consent not to be unreasonably withheld, conditioned or delayed. (m) Calculation of Time. Io computing any period of time prescribed or allowed by any provision of this Lease, the day of the act, event or default from which the designated period of time begins to run shall not be included. The last day of the period so computed shall be included, unless it is a Saturday, Sunday or a legal holiday, in which event the period runs until the end of the next day which is not a Saturday, Sunday; or legal holiday. Unless otherwise provided herein, all notices and other periods expire as of 5:00 p.ro.. (local time in Charlottesville, Virginia) on the last day of the notice or other period. (n) Landlord's Consent. Under no circumstances shall Landlord be liable to Tenant for any failure or refusal to grant its consent when consent is required hereunder. Tenant shall not claim any money damages by way of setoff, counterclaim or defense, based on any claim that Landlord unreasonably withbe1d its consent, in which case Tenant' s sole and exclusive remedy shall be an action for specific performance, injunction or declaratory judgment. (o) Landlord's Fees. Whenever Tenant requests Landlord to take any action not required of it hereunder or give any consent required or permitted under this Lease, Tenant shall reimburse Landlord for Landlord's reasonable, out of-pocket costs incurred by Landlord in reviewing the proposed action or consent. including reasonable attorneys', engineers' or architects' fees; within thirty (30) days after Landlord's delivery to Tenant of a statement of such costs. Tenant shall make such reimbursement without regard to whether Landlord consents to any such proposed action. Tenant shall not owe any fees to Landlord for review and approval of Tenant's Initial Work. (p) Confidentiality. Tenant acknowledges and agrees that the terms of this Lease (and any preliminary drafts hereof) are confidential and constitute proprietary information of Landlord, and may not be disclosed by Tenant to anyone except to Tenant's employees, brokers, accountants, attorneys, and permitted assignees and subtenants, who have each been informed of the confidentiality clause in this Lease, by any manner or means, directly or indirectly, without Landlord's prior written consent except as and to the extent required by court order. The consent by Landlord to any disclosures shall not be deemed to be a waiver on the part of Landlord of any prohibition against any future disclosure. Disclosure of thee ter.ms of 'this Lease could adversely affect the ability of Landlord to negotiate other leases and may impair Landlord's relationship with other tenants. It is understood and agreed that damages alone would be an inadequate remedy for the breach of this provision by Tenant, and Landlord shall also have the right to seek specific performance of this provision and injunctive relief to prevent its breach or continued breach.