|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

|

|

|

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

|

Smaller reporting company

|

Emerging growth company

|

|

PART 1

|

Page

|

|

|

Item 1:

|

1

|

|

|

Item 1A:

|

12

|

|

|

Item 1B:

|

20

|

|

|

Item 2:

|

20

|

|

|

Item 3:

|

20

|

|

|

Item 4:

|

20

|

|

|

PART II

|

||

|

Item 5:

|

21

|

|

|

Item 6:

|

22

|

|

|

Item 7:

|

23

|

|

|

Item 7A:

|

39

|

|

|

Item 8:

|

41

|

|

|

41

|

||

|

Item 9:

|

83

|

|

|

Item 9A:

|

83

|

|

|

Item 9B:

|

85

|

|

|

PART III

|

||

|

Item 10:

|

85

|

|

|

Item 11:

|

85

|

|

|

Item 12:

|

85

|

|

|

Item 13:

|

85

|

|

|

Item 14:

|

85

|

|

|

PART IV

|

||

|

Item 15:

|

86

|

|

|

Item 16:

|

87

|

|

|

87

|

| ITEM 1: |

Business.

|

| • |

The Bank originated 1,738 PPP loans totaling $346.7 million in principal.

|

| • |

Fees generated totaled $10.0 million.

|

| • |

765 PPP loans totaling $113.5 million were forgiven.

|

| • |

Total net fees of $5.4 million were recognized.

|

| • |

The Bank originated 1,000 PPP loans totaling $128.1 million in principal.

|

| • |

Fees generated totaled $5.6 million.

|

| • |

1,722 PPP loans totaling $318.4 million were forgiven.

|

| • |

Total net fees of $8.3 million were recognized.

|

| • |

251 PPP loans totaling $43.2 million were forgiven.

|

| • |

Total net fees of $1.3 million were recognized.

|

|

December 31,

|

||||||||||||

|

(Dollars in thousands)

|

2022

|

2021

|

2020

|

|||||||||

|

Nonperforming loans

|

$

|

78

|

$

|

92

|

$

|

533

|

||||||

|

Other repossessed assets

|

—

|

—

|

—

|

|||||||||

|

Other real estate owned

|

2,343

|

2,343

|

2,537

|

|||||||||

|

Total nonperforming assets

|

$

|

2,421

|

$

|

2,435

|

$

|

3,070

|

||||||

|

Total delinquencies 30 days or greater past due

|

$

|

172

|

$

|

129

|

$

|

581

|

||||||

|

For the Year Ended December 31,

|

||||||||||||

|

(Dollars in thousands)

|

2022

|

2021

|

2020

|

|||||||||

|

Provision for loan losses

|

$

|

(1,125

|

)

|

$

|

(2,050

|

)

|

$

|

3,000

|

||||

|

Net charge-offs (recoveries)

|

(521

|

)

|

(531

|

)

|

2,792

|

|||||||

|

Net charge-offs (recoveries) to average loans

|

(0.05

|

)%

|

(0.04

|

)%

|

0.19

|

%

|

||||||

|

Nonperforming loans to total loans

|

0.01

|

%

|

0.01

|

%

|

0.04

|

%

|

||||||

|

Loans transferred to ORE to average loans

|

—

|

—

|

—

|

|||||||||

|

Performing troubled debt restructurings ("TDRs") to average

loans

|

0.63

|

%

|

0.60

|

%

|

0.60

|

%

|

||||||

|

December 31

|

||||||||||||||||

|

2022

|

2021

|

|||||||||||||||

|

(Dollars in thousands)

|

Amount

|

% of

Total

Loans

|

Amount

|

% of

Total

Loans

|

||||||||||||

|

Real estate - construction (1)

|

$

|

61,247

|

5

|

%

|

$

|

52,019

|

4

|

%

|

||||||||

|

Real estate - mortgage

|

476,356

|

40

|

464,082

|

42

|

||||||||||||

|

Comml and industrial, excl PPP

|

441,716

|

38

|

378,318

|

34

|

||||||||||||

|

PPP loans

|

—

|

—

|

41,939

|

4

|

||||||||||||

|

Total commercial

|

979,319

|

83

|

936,358

|

84

|

||||||||||||

|

Residential mortgage

|

139,148

|

12

|

117,800

|

11

|

||||||||||||

|

Consumer

|

59,281

|

5

|

54,835

|

5

|

||||||||||||

|

Total loans

|

1,177,748

|

100

|

%

|

1,108,993

|

100

|

%

|

||||||||||

|

Less: allowance for loan losses

|

(15,285

|

)

|

(15,889

|

)

|

||||||||||||

|

Total loans, net

|

$

|

1,162,463

|

$

|

1,093,104

|

||||||||||||

| (1) |

Consists of construction and development loans.

|

|

Maturing

|

||||||||||||||||||||

|

(Dollars in thousands)

|

Within One

Year

|

After One, But

Within Five

Years

|

After Five, But

Within Fifteen

Years

|

After Fifteen

Years

|

Total

|

|||||||||||||||

|

Real estate - construction (1)

|

$

|

35,280

|

$

|

6,186

|

$

|

19,781

|

$

|

—

|

$

|

61,247

|

||||||||||

|

Real estate - mortgage

|

30,253

|

262,727

|

183,376

|

—

|

476,356

|

|||||||||||||||

|

Commercial and industrial

|

183,959

|

202,689

|

55,068

|

—

|

441,716

|

|||||||||||||||

|

Total commercial

|

249,492

|

471,602

|

258,225

|

—

|

979,319

|

|||||||||||||||

|

Residential mortgage

|

80

|

3,555

|

51,511

|

84,002

|

139,148

|

|||||||||||||||

|

Consumer

|

2,474

|

4,134

|

5,269

|

47,404

|

59,281

|

|||||||||||||||

|

Total loans

|

$

|

252,046

|

$

|

479,291

|

$

|

315,005

|

$

|

131,406

|

$

|

1,177,748

|

||||||||||

|

Predetermined Interest Rates

|

Floating or Variable Rate

|

Total

|

||||||||||

|

Loans above maturing after one year:

|

||||||||||||

|

Real estate - construction (1)

|

$

|

20,932

|

$

|

5,035

|

$

|

25,967

|

||||||

|

Real estate - mortgage

|

341,591

|

104,512

|

446,103

|

|||||||||

|

Commercial and industrial

|

188,471

|

69,286

|

257,757

|

|||||||||

|

Total commercial

|

550,994

|

178,833

|

729,827

|

|||||||||

|

Residential mortgage

|

65,004

|

74,064

|

139,068

|

|||||||||

|

Consumer

|

6,677

|

50,130

|

56,807

|

|||||||||

|

Total loans

|

$

|

622,675

|

$

|

303,027

|

$

|

925,702

|

||||||

| (1) |

Consists of construction and development loans.

|

|

December 31

|

||||||||||||||||

|

2022

|

2021

|

|||||||||||||||

|

(Dollars in thousands)

|

Average

Amount

|

Average

Rate

|

Average

Amount

|

Average

Rate

|

||||||||||||

|

Noninterest bearing demand

|

$

|

884,579

|

—

|

%

|

$

|

885,838

|

—

|

%

|

||||||||

|

Interest bearing demand

|

704,926

|

0.14

|

681,411

|

0.03

|

||||||||||||

|

Savings and money market accounts

|

879,273

|

0.28

|

822,235

|

0.03

|

||||||||||||

|

Time

|

88,218

|

0.40

|

101,353

|

0.49

|

||||||||||||

|

Total deposits

|

$

|

2,556,996

|

0.15

|

%

|

$

|

2,490,837

|

0.04

|

%

|

||||||||

|

Non-maturity deposits

|

Time

|

Total

|

||||||||||

|

December 31, 2022

|

||||||||||||

|

Three months or less

|

$

|

1,182,059

|

$

|

4,259

|

$

|

1,186,318

|

||||||

|

Over 3 months through 6 months

|

—

|

6,240

|

6,240

|

|||||||||

|

Over 6 months through 1 year

|

—

|

8,344

|

8,344

|

|||||||||

|

Over 1 year

|

—

|

10,824

|

10,824

|

|||||||||

|

$

|

1,182,059

|

$

|

29,667

|

$

|

1,211,726

|

|||||||

|

Non-maturity deposits

|

Time

|

Total

|

||||||||||

|

December 31, 2021

|

||||||||||||

|

Three months or less

|

$

|

1,167,790

|

$

|

5,706

|

$

|

1,173,496

|

||||||

|

Over 3 months through 6 months

|

—

|

7,310

|

7,310

|

|||||||||

|

Over 6 months through 1 year

|

—

|

8,747

|

8,747

|

|||||||||

|

Over 1 year

|

—

|

6,465

|

6,465

|

|||||||||

|

$

|

1,167,790

|

$

|

28,228

|

$

|

1,196,018

|

|||||||

|

December 31,

|

||||||||

|

(Dollars in thousands)

|

2022

|

2021

|

||||||

|

U.S. Treasury and federal agency securities

|

$

|

475,941

|

$

|

206,845

|

||||

|

U.S. Agency MBS and CMOs

|

113,818

|

86,797

|

||||||

|

Tax-exempt state and municipal bonds

|

134,168

|

174,559

|

||||||

|

Taxable state and municipal bonds

|

112,171

|

79,561

|

||||||

|

Corporate bonds

|

11,924

|

5,304

|

||||||

|

Total

|

$

|

848,022

|

$

|

553,066

|

||||

|

Due Within One Year

|

One to Five Years

|

Five to Ten Years

|

After Ten Years

|

|||||||||||||||||||||||||||||

|

(Dollars in thousands)

|

Amount

|

Average

Yield

|

Amount

|

Average

Yield

|

Amount

|

Average

Yield

|

Amount

|

Average

Yield

|

||||||||||||||||||||||||

|

U.S. Treasury and federal agency securities

|

$

|

—

|

0.00

|

%

|

$

|

444,361

|

2.17

|

%

|

$

|

17,904

|

1.08

|

%

|

$

|

—

|

—

|

%

|

||||||||||||||||

|

U.S. Agency MBS and CMOs

|

12

|

2.49

|

383

|

2.62

|

941

|

2.02

|

112,481

|

2.76

|

||||||||||||||||||||||||

|

Tax-exempt state and municipal bonds (1)

|

34,722

|

1.44

|

83,401

|

1.86

|

29,723

|

3.45

|

—

|

—

|

||||||||||||||||||||||||

|

Taxable state and municipal bonds

|

5,571

|

2.53

|

97,989

|

2.69

|

8,610

|

1.57

|

—

|

—

|

||||||||||||||||||||||||

|

Corporate bonds

|

299

|

3.28

|

11,625

|

1.35

|

—

|

—

|

—

|

—

|

||||||||||||||||||||||||

|

Total (1)

|

$

|

40,604

|

1.61

|

%

|

$

|

637,759

|

2.22

|

%

|

$

|

57,178

|

2.31

|

%

|

$

|

112,481

|

2.76

|

%

|

||||||||||||||||

| (1) |

Yields on tax-exempt securities are computed on a fully taxable-equivalent basis and calculated on a weighted average basis using the investment balances and respective average yields for each investment

category.

|

|

CET1 Risk-Based

Capital Ratio |

Tier 1 Risk-Based

Capital Ratio |

Total Risk-Based

Capital Ratio |

Leverage Ratio

|

|||||

|

Well capitalized

|

6.5% or above

|

8% or above

|

10% or above

|

5% or above

|

||||

|

Adequately capitalized

|

4.5% or above

|

6% or above

|

8% or above

|

4% or above

|

||||

|

Undercapitalized

|

Less than 4.5%

|

Less than 6%

|

Less than 8%

|

Less than 4%

|

||||

|

Significantly undercapitalized

|

Less than 3%

|

Less than 4%

|

Less than 6%

|

Less than 3%

|

||||

|

Critically undercapitalized

|

—

|

—

|

—

|

Ratio of tangible equity to total assets of 2% or less

|

| ITEM 1A: |

Risk Factors.

|

| • |

Variations in our anticipated or actual operating results or the results of our competitors;

|

| • |

Changes in investors' or analysts' perceptions of the risks and conditions of our business;

|

| • |

The size of the public float of our common stock;

|

| • |

Regulatory developments, including changes to regulatory capital levels, components of regulatory capital and how regulatory capital is calculated;

|

| • |

Interest rate changes or credit loss trends;

|

| • |

Trading volume in our common stock;

|

| • |

Market conditions; and

|

| • |

General economic conditions.

|

| ITEM 1B: |

Unresolved Staff Comments.

|

| ITEM 2: |

Properties.

|

|

Location of Facility

|

Use

|

|

10753 Macatawa Drive, Holland

|

Main Branch, Administrative, and Loan Processing Offices

|

|

815 E. Main Street, Zeeland

|

Branch Office

|

|

116 Ottawa Avenue N.W., Grand Rapids

|

Branch Office (Leased facility, lease expires December 2025)

|

|

126 Ottawa Avenue N.W., Grand Rapids

|

Loan Center (Leased facility, lease expires December 2023)

|

|

141 E. 8th Street, Holland

|

Branch Office

|

|

489 Butternut Dr., Holland

|

Branch Office

|

|

145 Columbia Avenue, Holland

|

Satellite Office (Leased facility, lease expires March 2023)

|

|

701 Maple Avenue, Holland

|

Branch Office

|

|

699 E. 16th Street, Holland

|

Branch Office

|

|

41 N. State Street, Zeeland

|

Branch Office

|

|

2020 Baldwin Street, Jenison

|

Branch Office

|

|

6299 Lake Michigan Dr., Allendale

|

Branch Office

|

|

132 South Washington, Douglas

|

Branch Office

|

|

4758 – 136th Street, Hamilton

|

Branch Office (Leased facility, lease expires December 2023)

|

|

3526 Chicago Drive, Hudsonville

|

Branch Office

|

|

20 E. Lakewood Blvd., Holland

|

Branch Office

|

|

3191 – 44th Street, S.W., Grandville

|

Branch Office

|

|

2261 Byron Center Avenue S.W., Byron Center

|

Branch Office

|

|

5271 Clyde Park Avenue, S.W., Wyoming

|

Branch Office

|

|

4590 Cascade Road, Grand Rapids

|

Branch Office

|

|

3177 Knapp Street, N.E., Grand Rapids

|

Branch Office

|

|

15135 Whittaker Way, Grand Haven

|

Branch Office

|

|

12415 Riley Street, Holland

|

Branch Office

|

|

2750 Walker N.W., Walker

|

Branch Office

|

|

1575 – 68th Street S.E., Grand Rapids

|

Branch Office

|

|

2820 – 10 Mile Road, Rockford

|

Branch Office

|

|

520 Baldwin Street, Jenison

|

Branch Office

|

|

2440 Burton Street, S.E., Grand Rapids

|

Branch Office

|

|

6330 28th Street, S.E., Grand Rapids

|

Branch Office

|

| ITEM 3: |

Legal Proceedings.

|

| ITEM 4: |

Mine Safety Disclosures.

|

| ITEM 5: |

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

|

2022

|

2021

|

|||||||||||||||||||||||

|

Quarter

|

High

|

Low

|

Dividends

Declared

|

High

|

Low

|

Dividends

Declared

|

||||||||||||||||||

|

First Quarter

|

$

|

9.56

|

$

|

8.76

|

$

|

0.08

|

$

|

10.66

|

$

|

8.17

|

$

|

0.08

|

||||||||||||

|

Second Quarter

|

9.31

|

8.38

|

0.08

|

10.15

|

8.74

|

0.08

|

||||||||||||||||||

|

Third Quarter

|

10.28

|

8.65

|

0.08

|

8.90

|

7.37

|

0.08

|

||||||||||||||||||

|

Fourth Quarter

|

11.84

|

9.21

|

0.08

|

9.08

|

7.96

|

0.08

|

||||||||||||||||||

|

Period Ending

|

||||||||||||||||||||||||

|

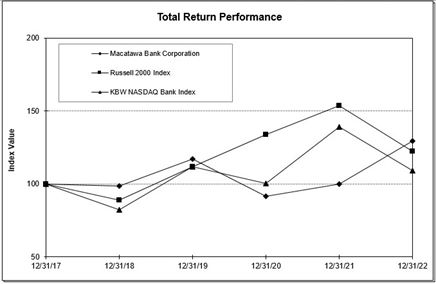

Index

|

12/31/17

|

12/31/18

|

12/31/19

|

12/31/20

|

12/31/21

|

12/31/22

|

||||||||||||||||||

|

Macatawa Bank Corporation

|

100.00

|

98.41

|

116.96

|

91.58

|

100.07

|

129.35

|

||||||||||||||||||

|

Russell 2000

|

100.00

|

88.99

|

111.70

|

134.00

|

153.85

|

122.41

|

||||||||||||||||||

|

KBW Bank NASDAQ

|

100.00

|

82.29

|

112.01

|

100.46

|

138.97

|

109.23

|

||||||||||||||||||

|

Macatawa Bank Corporation Purchases of Equity Securities

|

||||||||

|

Total

Number of

Shares

Purchased

|

Average

Price Paid

Per Share

|

|||||||

|

Period

|

||||||||

|

October 1 - October 31, 2022

|

||||||||

|

Employee Transactions

|

—

|

—

|

||||||

|

November 1 - November 30, 2022

|

||||||||

|

Employee Transactions

|

15,246

|

$

|

11.30

|

|||||

|

December 1 - December 31, 2022

|

||||||||

|

Employee Transactions

|

—

|

—

|

||||||

|

Total for Fourth Quarter ended December 31, 2022

|

||||||||

|

Employee Transactions

|

15,246

|

$

|

11.30

|

|||||

| ITEM 6: |

[Reserved]

|

| ITEM 7. |

Management’s Discussion and Analysis of Results of Operations and Financial Condition.

|

|

As of and for the Year Ended December 31,

|

||||||||||||||||||||

|

(Dollars in thousands, except per share data)

|

2022

|

2021

|

2020

|

2019

|

2018

|

|||||||||||||||

|

Financial Condition

|

||||||||||||||||||||

|

Total assets

|

$

|

2,906,919

|

$

|

2,928,751

|

$

|

2,642,026

|

$

|

2,068,770

|

$

|

1,975,124

|

||||||||||

|

Securities

|

848,022

|

553,066

|

316,300

|

307,969

|

297,320

|

|||||||||||||||

|

Loans

|

1,177,748

|

1,108,993

|

1,429,331

|

1,385,627

|

1,405,658

|

|||||||||||||||

|

Deposits

|

2,615,142

|

2,577,958

|

2,298,587

|

1,753,294

|

1,676,739

|

|||||||||||||||

|

Long-term debt

|

—

|

—

|

20,619

|

20,619

|

41,238

|

|||||||||||||||

|

Other borrowed funds

|

30,000

|

85,000

|

70,000

|

60,000

|

60,000

|

|||||||||||||||

|

Shareholders' equity

|

247,038

|

254,005

|

239,843

|

217,469

|

190,853

|

|||||||||||||||

|

Share Information*

|

||||||||||||||||||||

|

Basic earnings (loss) per common share

|

$

|

1.01

|

$

|

0.85

|

$

|

0.88

|

$

|

0.94

|

$

|

0.78

|

||||||||||

|

Diluted earnings (loss) per common share

|

1.01

|

0.85

|

0.88

|

0.94

|

0.78

|

|||||||||||||||

|

Book value per common share

|

7.20

|

7.41

|

7.01

|

6.38

|

5.61

|

|||||||||||||||

|

Dividends per common share

|

0.32

|

0.32

|

0.32

|

0.28

|

0.25

|

|||||||||||||||

|

Dividend payout ratio

|

31.68

|

%

|

37.65

|

%

|

36.36

|

%

|

29.79

|

%

|

32.05

|

%

|

||||||||||

|

Average dilutive common shares outstanding

|

34,259,604

|

34,202,179

|

34,120,275

|

34,056,200

|

34,018,554

|

|||||||||||||||

|

Common shares outstanding at period end

|

34,298,640

|

34,259,945

|

34,197,519

|

34,103,542

|

34,045,411

|

|||||||||||||||

|

Operations

|

||||||||||||||||||||

|

Interest income

|

$

|

74,906

|

$

|

58,634

|

$

|

67,224

|

$

|

75,942

|

$

|

69,037

|

||||||||||

|

Interest expense

|

4,760

|

2,565

|

5,687

|

12,455

|

9,411

|

|||||||||||||||

|

Net interest income

|

70,146

|

56,069

|

61,537

|

63,487

|

59,626

|

|||||||||||||||

|

Provision for loan losses

|

(1,125

|

)

|

(2,050

|

)

|

3,000

|

(450

|

)

|

450

|

||||||||||||

|

Net interest income after provision for loan losses

|

71,271

|

58,119

|

58,537

|

63,937

|

59,176

|

|||||||||||||||

|

Total noninterest income

|

20,019

|

23,695

|

23,976

|

19,728

|

17,503

|

|||||||||||||||

|

Total noninterest expense

|

48,226

|

46,090

|

45,725

|

44,224

|

44,329

|

|||||||||||||||

|

Income before income tax

|

43,064

|

35,724

|

36,788

|

39,441

|

32,350

|

|||||||||||||||

|

Federal income tax

|

8,333

|

6,710

|

6,623

|

7,462

|

5,971

|

|||||||||||||||

|

Net income attributable to common shares

|

34,731

|

29,014

|

30,165

|

31,979

|

26,379

|

|||||||||||||||

|

Performance Ratios

|

||||||||||||||||||||

|

Return on average equity

|

14.19

|

%

|

11.74

|

%

|

13.19

|

%

|

15.66

|

%

|

14.69

|

%

|

||||||||||

|

Return on average assets

|

1.21

|

1.02

|

1.27

|

1.59

|

1.40

|

|||||||||||||||

|

Yield on average interest-earning assets

|

2.73

|

2.19

|

3.00

|

4.04

|

3.91

|

|||||||||||||||

|

Cost on average interest-bearing liabilities

|

0.28

|

0.15

|

0.38

|

0.94

|

0.76

|

|||||||||||||||

|

Average net interest spread

|

2.45

|

2.04

|

2.62

|

3.10

|

3.15

|

|||||||||||||||

|

Average net interest margin

|

2.56

|

2.09

|

2.75

|

3.38

|

3.38

|

|||||||||||||||

|

Efficiency ratio

|

53.49

|

57.78

|

53.47

|

53.14

|

57.47

|

|||||||||||||||

|

Capital Ratios

|

||||||||||||||||||||

|

Period-end equity to total assets

|

8.50

|

%

|

8.67

|

%

|

9.08

|

%

|

10.51

|

%

|

9.66

|

%

|

||||||||||

|

Average equity to average assets

|

8.55

|

8.71

|

9.62

|

10.17

|

9.51

|

|||||||||||||||

|

Total risk-based capital ratio (consolidated)

|

17.87

|

18.32

|

18.29

|

15.78

|

15.54

|

|||||||||||||||

|

Credit Quality Ratios

|

||||||||||||||||||||

|

Allowance for loan losses to total loans

|

1.30

|

%

|

1.43

|

%

|

1.22

|

%

|

1.24

|

%

|

1.20

|

%

|

||||||||||

|

Nonperforming assets to total assets

|

0.08

|

0.08

|

0.12

|

0.14

|

0.24

|

|||||||||||||||

|

Nonaccrual loans to total loans

|

0.01

|

0.01

|

0.04

|

0.01

|

0.09

|

|||||||||||||||

|

Allowance for loan losses to nonaccrual loans

|

19,596.15

|

17,270.65

|

3,266.04

|

8,472.91

|

1,293.18

|

|||||||||||||||

|

Net charge-offs / (recoveries) to average loans

|

(0.05

|

)

|

(0.04

|

)

|

0.19

|

(0.06

|

)

|

0.01

|

||||||||||||

|

For the years ended December 31,

|

||||||||||||||||||||||||

|

2022

|

2021

|

|||||||||||||||||||||||

|

Average

Balance

|

Interest

Earned

or Paid

|

Average

Yield

or Cost

|

Average

Balance

|

Interest

Earned

or Paid

|

Average

Yield

or Cost

|

|||||||||||||||||||

|

Assets

|

||||||||||||||||||||||||

|

Taxable securities

|

$

|

597,899

|

$

|

11,333

|

1.90

|

%

|

$

|

210,513

|

$

|

3,283

|

1.56

|

%

|

||||||||||||

|

Tax-exempt securities (1)

|

151,888

|

2,803

|

2.38

|

152,459

|

3,056

|

2.58

|

||||||||||||||||||

|

Commercial loans (2)

|

938,817

|

40,197

|

4.23

|

1,068,667

|

43,875

|

4.06

|

||||||||||||||||||

|

Residential mortgage loans

|

125,202

|

4,211

|

3.36

|

132,472

|

4,521

|

3.41

|

||||||||||||||||||

|

Consumer loans

|

56,684

|

2,768

|

4.88

|

55,940

|

2,268

|

4.05

|

||||||||||||||||||

|

Federal Home Loan Bank stock

|

10,411

|

199

|

1.89

|

11,558

|

211

|

1.80

|

||||||||||||||||||

|

Federal funds sold and other short-term investments

|

862,240

|

13,395

|

1.53

|

1,067,237

|

1,420

|

0.13

|

||||||||||||||||||

|

Total interest earning

assets (1)

|

2,743,141

|

74,906

|

2.73

|

2,698,846

|

58,634

|

2.19

|

||||||||||||||||||

|

Noninterest earning assets:

|

||||||||||||||||||||||||

|

Cash and due from banks

|

36,428

|

34,740

|

||||||||||||||||||||||

|

Other

|

85,685

|

103,041

|

||||||||||||||||||||||

|

Total assets

|

$

|

2,865,254

|

$

|

2,836,627

|

||||||||||||||||||||

|

Liabilities

|

||||||||||||||||||||||||

|

Deposits:

|

||||||||||||||||||||||||

|

Interest bearing demand

|

$

|

704,926

|

$

|

952

|

0.14

|

%

|

$

|

681,411

|

$

|

166

|

0.03

|

%

|

||||||||||||

|

Savings and money

market accounts

|

879,273

|

2,474

|

0.28

|

822,235

|

246

|

0.03

|

||||||||||||||||||

|

Time deposits

|

88,218

|

347

|

0.40

|

101,353

|

503

|

0.49

|

||||||||||||||||||

|

Borrowings:

|

||||||||||||||||||||||||

|

Other borrowed funds

|

49,622

|

987

|

1.96

|

74,246

|

1,331

|

1.77

|

||||||||||||||||||

|

Long-term debt

|

—

|

—

|

—

|

10,564

|

319

|

2.98

|

||||||||||||||||||

|

Total interest bearing liabilities

|

1,722,039

|

4,760

|

0.28

|

1,689,809

|

2,565

|

0.15

|

||||||||||||||||||

|

Noninterest bearing liabilities:

|

||||||||||||||||||||||||

|

Noninterest bearing demand accounts

|

884,579

|

885,838

|

||||||||||||||||||||||

|

Other noninterest bearing liabilities

|

13,795

|

13,905

|

||||||||||||||||||||||

|

Shareholders' equity

|

244,841

|

247,075

|

||||||||||||||||||||||

|

Total liabilities and shareholders' equity

|

$

|

2,865,254

|

$

|

2,836,627

|

||||||||||||||||||||

|

Net interest income

|

$

|

70,146

|

$

|

56,069

|

||||||||||||||||||||

|

Net interest spread (1)

|

2.45

|

%

|

2.04

|

%

|

||||||||||||||||||||

|

Net interest margin (1)

|

2.56

|

%

|

2.09

|

%

|

||||||||||||||||||||

|

Ratio of average interest earning assets to average interest bearing liabilities

|

159.30

|

%

|

159.71

|

%

|

||||||||||||||||||||

| (1) |

Yields are presented on a tax equivalent basis using a 21% tax rate.

|

| (2) |

Loan fees of $1.8 million and $9.4 million for 2022 and 2021, respectively, are included in interest income. Included in these fee amounts were $1.3 million and $8.3 million in fees on PPP loans in 2022

and 2021, respectively. Includes average nonaccrual loans of approximately $86,000 and $431,000 for 2022 and 2021, respectively.

|

|

For the years ended December 31,

|

||||||||||||

|

2022 vs 2021

Increase (Decrease) Due to

|

||||||||||||

|

Volume

|

Rate

|

Total

|

||||||||||

|

(Dollars in thousands)

|

||||||||||||

|

Interest income

|

||||||||||||

|

Taxable securities

|

$

|

7,206

|

$

|

844

|

$

|

8,050

|

||||||

|

Tax-exempt securities

|

(11

|

)

|

(242

|

)

|

(253

|

)

|

||||||

|

Commercial loans

|

(5,462

|

)

|

1,784

|

(3,678

|

)

|

|||||||

|

Residential mortgage loans

|

(245

|

)

|

(65

|

)

|

(310

|

)

|

||||||

|

Consumer loans

|

31

|

469

|

500

|

|||||||||

|

Federal Home Loan Bank stock

|

(23

|

)

|

11

|

(12

|

)

|

|||||||

|

Federal funds sold and other short-term investments

|

(324

|

)

|

12,299

|

11,975

|

||||||||

|

Total interest income

|

1,172

|

15,100

|

16,272

|

|||||||||

|

Interest expense

|

||||||||||||

|

Interest bearing demand

|

$

|

6

|

$

|

780

|

$

|

786

|

||||||

|

Savings and money market accounts

|

18

|

2,210

|

2,228

|

|||||||||

|

Time deposits

|

(60

|

)

|

(96

|

)

|

(156

|

)

|

||||||

|

Other borrowed funds

|

(475

|

)

|

131

|

(344

|

)

|

|||||||

|

Long-term debt

|

(319

|

)

|

—

|

(319

|

)

|

|||||||

|

Total interest expense

|

(830

|

)

|

3,025

|

2,195

|

||||||||

|

Net interest income

|

$

|

2,002

|

$

|

12,075

|

$

|

14,077

|

||||||

|

2022

|

2021

|

|||||||

|

Service charges and fees on deposit accounts

|

$

|

4,769

|

$

|

4,446

|

||||

|

Net gains on mortgage loans

|

706

|

4,691

|

||||||

|

Trust fees

|

4,143

|

4,331

|

||||||

|

ATM and debit card fees

|

6,768

|

6,505

|

||||||

|

Bank owned life insurance (“BOLI”) income

|

878

|

1,033

|

||||||

|

Investment services fees

|

1,691

|

1,505

|

||||||

|

Other income

|

1,064

|

1,184

|

||||||

|

Total noninterest income

|

$

|

20,019

|

$

|

23,695

|

||||

|

For the Year Ended December 31,

|

||||||||

|

2022

|

2021

|

|||||||

|

Gain on sales of loans

|

$

|

706

|

$

|

4,691

|

||||

|

Real estate mortgage loans originated for sale

|

$

|

26,236

|

$

|

124,287

|

||||

|

Real estate mortgage loans sold

|

28,134

|

132,993

|

||||||

|

Net gain on the sale of mortgage loans as a percent of real estate mortgage loans sold ("Loan sale margin")

|

2.51

|

%

|

3.53

|

%

|

||||

|

2022

|

2021

|

|||||||

|

Salaries and benefits

|

$

|

26,194

|

$

|

25,216

|

||||

|

Occupancy of premises

|

4,200

|

3,986

|

||||||

|

Furniture and equipment

|

4,008

|

3,940

|

||||||

|

Legal and professional

|

961

|

1,042

|

||||||

|

Marketing and promotion

|

803

|

723

|

||||||

|

Data processing

|

3,756

|

3,456

|

||||||

|

FDIC assessment

|

789

|

749

|

||||||

|

Interchange and other card expense

|

1,586

|

1,517

|

||||||

|

Bond and D&O insurance

|

518

|

448

|

||||||

|

Outside services

|

2,139

|

1,922

|

||||||

|

Other noninterest expense

|

3,272

|

3,091

|

||||||

|

Total noninterest expense

|

$

|

48,226

|

$

|

46,090

|

||||

|

2022

|

2021

|

|||||||

|

Salaries and other compensation

|

22,694

|

22,171

|

||||||

|

Salary deferral from commercial loans

|

(855

|

)

|

(1,062

|

)

|

||||

|

Bonus

|

1,154

|

1,121

|

||||||

|

Mortgage production - variable comp

|

430

|

1,049

|

||||||

|

Brokerage - variable comp

|

470

|

440

|

||||||

|

401(k) matching contributions

|

755

|

412

|

||||||

|

Medical insurance costs

|

1,546

|

1,085

|

||||||

|

Total salaries and benefits

|

$

|

26,194

|

$

|

25,216

|

||||

|

December 31, 2022

|

December 31, 2021

|

|||||||||||||||

|

Balance

|

Percent of

Total Loans

|

Balance

|

Percent of

Total Loans

|

|||||||||||||

|

Commercial real estate: (1)

|

||||||||||||||||

|

Residential developed

|

$

|

7,234

|

0.6

|

%

|

$

|

4,862

|

0.4

|

%

|

||||||||

|

Unsecured to residential developers

|

—

|

—

|

5,000

|

0.4

|

||||||||||||

|

Vacant and unimproved

|

36,270

|

3.1

|

36,240

|

3.3

|

||||||||||||

|

Commercial development

|

103

|

—

|

171

|

—

|

||||||||||||

|

Residential improved

|

112,791

|

9.6

|

100,077

|

9.0

|

||||||||||||

|

Commercial improved

|

259,281

|

22.0

|

259,039

|

23.4

|

||||||||||||

|

Manufacturing and industrial

|

121,924

|

10.4

|

110,712

|

10.0

|

||||||||||||

|

Total commercial real estate

|

537,603

|

45.7

|

516,101

|

46.5

|

||||||||||||

|

Commercial and industrial, excluding PPP

|

441,716

|

37.5

|

378,318

|

34.1

|

||||||||||||

|

Paycheck Protection Program (PPP)

|

—

|

—

|

41,939

|

3.8

|

||||||||||||

|

Total commercial

|

979,319

|

83.2

|

936,358

|

84.4

|

||||||||||||

|

Consumer

|

||||||||||||||||

|

Residential mortgage

|

139,148

|

11.8

|

117,800

|

10.7

|

||||||||||||

|

Unsecured

|

121

|

—

|

210

|

—

|

||||||||||||

|

Home equity

|

56,321

|

4.8

|

51,269

|

4.6

|

||||||||||||

|

Other secured

|

2,839

|

0.2

|

3,356

|

0.3

|

||||||||||||

|

Total consumer

|

198,429

|

16.8

|

172,635

|

15.6

|

||||||||||||

|

Total loans

|

$

|

1,177,748

|

100.0

|

%

|

$

|

1,108,993

|

100.0

|

%

|

||||||||

| (1) |

Includes both owner occupied and non-owner occupied commercial real estate.

|

|

Year ended December 31, 2022

|

Year ended December 31, 2021

|

|||||||||||||||||||||||

|

Portfolio

Originations

|

Percent of

Total

Originations

|

Average

Loan Size

|

Portfolio

Originations

|

Percent of

Total

Originations

|

Average

Loan Size

|

|||||||||||||||||||

|

Commercial real estate:

|

||||||||||||||||||||||||

|

Residential developed

|

$

|

5,998

|

1.2

|

%

|

$

|

600

|

$

|

7,620

|

1.4

|

%

|

$

|

423

|

||||||||||||

|

Unsecured to residential developers

|

—

|

—

|

—

|

—

|

—

|

—

|

||||||||||||||||||

|

Vacant and unimproved

|

10,982

|

2.2

|

998

|

18,762

|

3.3

|

1,173

|

||||||||||||||||||

|

Commercial development

|

—

|

—

|

—

|

—

|

—

|

—

|

||||||||||||||||||

|

Residential improved

|

51,565

|

10.5

|

549

|

101,492

|

17.9

|

634

|

||||||||||||||||||

|

Commercial improved

|

76,523

|

15.5

|

1,594

|

71,486

|

12.6

|

1,191

|

||||||||||||||||||

|

Manufacturing and industrial

|

71,641

|

14.6

|

2,470

|

25,827

|

4.6

|

922

|

||||||||||||||||||

|

Total commercial real estate

|

216,709

|

44.0

|

1,129

|

225,187

|

39.8

|

799

|

||||||||||||||||||

|

Commercial and industrial, excluding PPP

|

164,535

|

33.4

|

885

|

110,667

|

19.5

|

838

|

||||||||||||||||||

|

PPP loans

|

—

|

—

|

—

|

128,473

|

22.7

|

128

|

||||||||||||||||||

|

Total commercial

|

381,244

|

77.4

|

1,009

|

464,327

|

82.0

|

327

|

||||||||||||||||||

|

Consumer

|

||||||||||||||||||||||||

|

Residential mortgage

|

55,289

|

11.2

|

302

|

48,930

|

8.6

|

314

|

||||||||||||||||||

|

Unsecured

|

—

|

—

|

—

|

—

|

—

|

—

|

||||||||||||||||||

|

Home equity

|

54,249

|

11.0

|

134

|

51,270

|

9.1

|

125

|

||||||||||||||||||

|

Other secured

|

1,855

|

0.4

|

36

|

1,567

|

0.3

|

23

|

||||||||||||||||||

|

Total consumer

|

111,393

|

22.6

|

174

|

101,767

|

18.0

|

161

|

||||||||||||||||||

|

Total loans

|

$

|

492,637

|

100.0

|

%

|

484

|

$

|

566,094

|

100.0

|

%

|

275

|

||||||||||||||

|

December 31,

|

||||||||||||||||||||

|

2022

|

2021

|

2020

|

2019

|

2018

|

||||||||||||||||

|

Nonaccrual loans

|

$

|

78

|

$

|

91

|

$

|

533

|

$

|

203

|

$

|

1,303

|

||||||||||

|

Loans 90 days or more delinquent and still accruing

|

—

|

1

|

—

|

—

|

1

|

|||||||||||||||

|

Total nonperforming loans (NPLs)

|

78

|

92

|

533

|

203

|

1,304

|

|||||||||||||||

|

Foreclosed assets

|

2,343

|

2,343

|

2,537

|

2,748

|

3,380

|

|||||||||||||||

|

Repossessed assets

|

—

|

—

|

—

|

—

|

—

|

|||||||||||||||

|

Total nonperforming assets (NPAs)

|

$

|

2,421

|

$

|

2,435

|

$

|

3,070

|

$

|

2,951

|

$

|

4,684

|

||||||||||

|

NPLs to total loans

|

0.01

|

%

|

0.01

|

%

|

0.04

|

%

|

0.01

|

%

|

0.09

|

%

|

||||||||||

|

NPAs to total assets

|

0.08

|

%

|

0.08

|

%

|

0.12

|

%

|

0.14

|

%

|

0.24

|

%

|

||||||||||

|

December 31, 2022

|

December 31, 2021

|

|||||||||||||||||||||||

|

Commercial

|

Consumer

|

Total

|

Commercial

|

Consumer

|

Total

|

|||||||||||||||||||

|

Performing TDRs

|

$

|

4,121

|

$

|

2,886

|

$

|

7,007

|

$

|

4,497

|

$

|

3,024

|

$

|

7,521

|

||||||||||||

|

Nonperforming TDRs (1)

|

—

|

—

|

—

|

5

|

—

|

5

|

||||||||||||||||||

|

Total TDRs

|

$

|

4,121

|

$

|

2,886

|

$

|

7,007

|

$

|

4,502

|

$

|

3,024

|

$

|

7,526

|

||||||||||||

| (1) |

Included in nonperforming asset table above

|

|

December 31,

|

||||||||||||||||||||

|

2022

|

2021

|

2020

|

2019

|

2018

|

||||||||||||||||

|

Commercial and industrial TDRs

|

$

|

3,604

|

$

|

3,375

|

$

|

3,957

|

$

|

5,797

|

$

|

6,502

|

||||||||||

|

Commercial real estate TDRs

|

517

|

1,127

|

1,439

|

2,770

|

3,305

|

|||||||||||||||

|

Consumer TDRs

|

2,886

|

3,024

|

4,049

|

5,140

|

6,346

|

|||||||||||||||

|

Total TDRs

|

$

|

7,007

|

$

|

7,526

|

$

|

9,445

|

$

|

13,707

|

$

|

16,153

|

||||||||||

|

December 31

|

||||||||

|

2022

|

2021

|

|||||||

|

Ratios:

|

||||||||

|

Net charge-offs (recoveries) to average loans outstanding - Total

|

(0.05

|

)%

|

(0.04

|

)%

|

||||

|

Net charge-offs (recoveries) to average loans outstanding - Commercial Loans

|

(0.05

|

)%

|

(0.05

|

)%

|

||||

|

Net charge-offs (recoveries) to average loans outstanding - Residential Mortgage Loans

|

(0.02

|

)%

|

(0.01

|

)%

|

||||

|

Net charge-offs (recoveries) to average loans outstanding - Consumer Loans

|

(0.07

|

)%

|

0.05

|

%

|

||||

|

Nonaccrual loans to loans outstanding at year-end

|

0.01

|

%

|

0.01

|

%

|

||||

|

Allowance for loan losses to loans outstanding at year-end

|

1.30

|

%

|

1.43

|

%

|

||||

|

Allowance for loan losses to nonaccrual loans at year-end

|

19,596

|

%

|

17,640

|

%

|

||||

|

Allowance for loan losses to nonperforming loans at year-end

|

19,596

|

%

|

17,271

|

%

|

||||

|

(Dollars in millions)

|

2022

|

2021

|

2020

|

2019

|

2018

|

|||||||||||||||

|

Commercial loans

|

$

|

979.3

|

$

|

936.4

|

$

|

1,217.6

|

$

|

1,098.0

|

$

|

1,082.1

|

||||||||||

|

Nonperforming loans

|

0.1

|

0.1

|

0.5

|

0.2

|

1.3

|

|||||||||||||||

|

Other real estate owned and repo assets

|

2.3

|

2.3

|

2.5

|

2.7

|

3.4

|

|||||||||||||||

|

Total nonperforming assets

|

2.4

|

2.4

|

3.0

|

3.0

|

4.7

|

|||||||||||||||

|

Net charge-offs (recoveries)

|

(0.5

|

)

|

(0.5

|

)

|

2.8

|

(0.8

|

)

|

0.2

|

||||||||||||

|

Total delinquencies

|

0.2

|

0.1

|

0.6

|

0.4

|

0.9

|

|||||||||||||||

|

December 31,

|

||||||||||||||||

|

2022

|

2021

|

|||||||||||||||

|

(Dollars in thousands)

|

Allowance

Amount

|

% of

Each

Category

to Total

Loans

|

Allowance

Amount

|

% of

Each

Category

to Total

Loans

|

||||||||||||

|

Commercial and commercial real estate

|

$

|

12,827

|

84

|

%

|

$

|

13,256

|

84

|

%

|

||||||||

|

Residential mortgage

|

1,755

|

11

|

1,836

|

11

|

||||||||||||

|

Consumer

|

703

|

5

|

797

|

5

|

||||||||||||

|

Total

|

$

|

15,285

|

100

|

%

|

$

|

15,889

|

100

|

%

|

||||||||

|

December 31,

|

||||||||||||||||

|

2022

|

2021

|

|||||||||||||||

|

(Dollars in thousands)

|

Balance of

Loans

|

Allowance

Amount

|

Balance of

Loans

|

Allowance

Amount

|

||||||||||||

|

Commercial and commercial real estate:

|

||||||||||||||||

|

Impaired with allowance recorded

|

$

|

812

|

$

|

75

|

$

|

3,215

|

$

|

327

|

||||||||

|

Impaired with no allowance recorded

|

3,309

|

—

|

1,287

|

—

|

||||||||||||

|

Loss allocation factor on non-impaired loans

|

975,198

|

12,751

|

931,856

|

12,929

|

||||||||||||

|

979,319

|

12,826

|

936,358

|

13,256

|

|||||||||||||

|

Residential mortgage and consumer:

|

||||||||||||||||

|

Reserves on troubled debt restructurings

|

2,886

|

220

|

3,024

|

238

|

||||||||||||

|

Loss allocation factor

|

195,543

|

2,239

|

169,611

|

2,395

|

||||||||||||

|

Total

|

$

|

1,177,748

|

$

|

15,285

|

$

|

1,108,993

|

$

|

15,889

|

||||||||

|

December 31, 2022

|

||||||||||||||||

|

Total

|

Percent of

Total Loans

|

Percent Grade 4 or

Better

|

Percent Grade 5 or

Worse

|

|||||||||||||

|

Industry:

|

||||||||||||||||

|

Agricultural Products

|

$

|

41,194

|

4.21

|

%

|

92.04

|

%

|

7.96

|

%

|

||||||||

|

Mining and Oil Extraction

|

406

|

0.04

|

%

|

87.93

|

%

|

12.07

|

%

|

|||||||||

|

Utilities

|

—

|

0.00

|

%

|

0.00

|

%

|

0.00

|

%

|

|||||||||

|

Construction

|

80,670

|

8.24

|

%

|

97.68

|

%

|

2.32

|

%

|

|||||||||

|

Manufacturing

|

131,376

|

13.42

|

%

|

96.55

|

%

|

3.45

|

%

|

|||||||||

|

Wholesale Trade

|

64,377

|

6.57

|

%

|

100.00

|

%

|

0.00

|

%

|

|||||||||

|

Retail Trade

|

113,484

|

11.59

|

%

|

99.95

|

%

|

0.05

|

%

|

|||||||||

|

Transportation and Warehousing

|

62,825

|

6.42

|

%

|

99.73

|

%

|

0.27

|

%

|

|||||||||

|

Information

|

568

|

0.06

|

%

|

5.99

|

%

|

94.01

|

%

|

|||||||||

|

Finance and Insurance

|

47,940

|

4.90

|

%

|

100.00

|

%

|

0.00

|

%

|

|||||||||

|

Real Estate and Rental and Leasing

|

274,151

|

27.99

|

%

|

99.95

|

%

|

0.05

|

%

|

|||||||||

|

Professional, Scientific and Technical Services

|

5,698

|

0.58

|

%

|

96.51

|

%

|

3.49

|

%

|

|||||||||

|

Management of Companies and Enterprises

|

7,049

|

0.72

|

%

|

100.00

|

%

|

0.00

|

%

|

|||||||||

|

Administrative and Support Services

|

21,703

|

2.22

|

%

|

97.99

|

%

|

2.01

|

%

|

|||||||||

|

Education Services

|

5,268

|

0.54

|

%

|

100.00

|

%

|

0.00

|

%

|

|||||||||

|

Health Care and Social Assistance

|

34,486

|

3.52

|

%

|

100.00

|

%

|

0.00

|

%

|

|||||||||

|

Arts, Entertainment and Recreation

|

3,675

|

0.38

|

%

|

91.65

|

%

|

8.35

|

%

|

|||||||||

|

Accommodations and Food Services

|

52,322

|

5.34

|

%

|

86.71

|

%

|

13.29

|

%

|

|||||||||

|

Other Services

|

32,127

|

3.28

|

%

|

100.00

|

%

|

0.00

|

%

|

|||||||||

|

Public Administration

|

—

|

0.00

|

%

|

0.00

|

%

|

0.00

|

%

|

|||||||||

|

Private Households

|

—

|

0.00

|

%

|

0.00

|

%

|

0.00

|

%

|

|||||||||

|

Total commercial loans

|

$

|

979,319

|

100.00

|

%

|

98.11

|

%

|

1.89

|

%

|

||||||||

|

December 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Total capital to risk weighted assets

|

17.9

|

%

|

18.3

|

%

|

18.3

|

%

|

||||||

|

Common Equity Tier 1 to risk weighted assets

|

16.9

|

17.2

|

15.8

|

|||||||||

|

Tier 1 capital to risk weighted assets

|

16.9

|

17.2

|

17.1

|

|||||||||

|

Tier 1 capital to average assets

|

9.7

|

8.7

|

9.9

|

|||||||||

|

December 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Average equity to average assets

|

8.3

|

%

|

8.8

|

%

|

10.2

|

%

|

||||||

|

Total capital to risk weighted assets

|

17.4

|

17.8

|

17.8

|

|||||||||

|

Common Equity Tier 1 to risk weighted assets

|

16.4

|

16.7

|

16.7

|

|||||||||

|

Tier 1 capital to risk weighted assets

|

16.4

|

16.7

|

16.7

|

|||||||||

|

Tier 1 capital to average assets

|

9.4

|

8.4

|

9.6

|

|||||||||

| Item 7A. |

Quantitative and Qualitative Disclosures About Market Risk.

|

|

Interest Rate Scenario

|

Economic

Value of

Equity

|

Percent

Change

|

Net Interest

Income

|

Percent

Change

|

||||||||||||

|

Interest rates up 200 basis points

|

$

|

399,394

|

(2.88

|

)%

|

$

|

107,097

|

3.78

|

%

|

||||||||

|

Interest rates up 100 basis points

|

405,735

|

(1.33

|

)

|

105,139

|

1.89

|

|||||||||||

|

No change

|

411,224

|

—

|

103,193

|

—

|

||||||||||||

|

Interest rates down 100 basis points

|

410,965

|

(0.06

|

)

|

100,847

|

(2.27

|

)

|

||||||||||

|

Interest rates down 200 basis points

|

387,338

|

(5.81

|

)

|

96,611

|

(6.38

|

)

|

||||||||||

| ITEM 8: |

Financial Statements and Supplementary Data.

|

| • |

Testing the design and operating effectiveness of internal controls over the data used by management to assess certain qualitative factors and their effect on the estimation of

inherent losses within the loan portfolio.

|

| • |

Evaluating the reliability of the data and assumptions used by management to support their assessment of the qualitative factors by vouching to

internal and external sources, including considerations of contradictory evidence.

|

| • |

Evaluating the reasonableness of management’s conclusion on the qualitative assessment and the resulting adjustment to the allowance.

|

|

2022

|

2021

|

|||||||

|

ASSETS

|

||||||||

|

Cash and due from banks

|

$

|

|

$

|

|

||||

|

Federal funds sold and other short-term investments

|

|

|

||||||

|

Cash and cash equivalents

|

|

|

||||||

|

Securities available for sale, at fair value

|

|

|

||||||

|

Securities held to maturity (fair value 2022 -

$

|

|

|

||||||

|

Federal Home Loan Bank (FHLB) stock

|

|

|

||||||

|

Loans held for sale, at fair value

|

|

|

||||||

|

Total loans

|

|

|

||||||

|

Allowance for loan losses

|

(

|

)

|

(

|

)

|

||||

|

Net loans

|

|

|

||||||

|

Premises and equipment – net

|

|

|

||||||

|

Accrued interest receivable

|

|

|

||||||

|

Bank-owned life insurance (BOLI)

|

|

|

||||||

|

Other real estate owned - net

|

|

|

||||||

|

Net deferred tax asset

|

|

|

||||||

|

Other assets

|

|

|

||||||

|

Total assets

|

$

|

|

$

|

|

||||

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

||||||||

|

Deposits

|

||||||||

|

Noninterest-bearing

|

$

|

|

$

|

|

||||

|

Interest-bearing

|

|

|

||||||

|

Total deposits

|

|

|

||||||

|

Other borrowed funds

|

|

|

||||||

|

Long-term debt

|

|

|

||||||

|

Accrued expenses and other liabilities

|

|

|

||||||

|

Total liabilities

|

|

|

||||||

|

Commitments and Contingencies

|

|

|

||||||

|

Shareholders’ equity

|

||||||||

|

Common stock,

|

|

|

||||||

|

Retained earnings

|

|

|

||||||

|

Accumulated other comprehensive loss

|

(

|

)

|

(

|

)

|

||||

|

Total shareholders’ equity

|

|

|

||||||

|

Total liabilities and shareholders’ equity

|

$

|

|

$

|

|

||||

|

2022

|

2021

|

|||||||

|

Interest income

|

||||||||

|

Loans, including fees

|

$

|

|

$

|

|

||||

|

Securities

|

||||||||

|

Taxable

|

|

|

||||||

|

Tax-exempt

|

|

|

||||||

|

FHLB Stock

|

|

|

||||||

|

Federal funds sold and other short-term investments

|

|

|

||||||

|

Total interest income

|

|

|

||||||

|

Interest expense

|

||||||||

|

Deposits

|

|

|

||||||

|

Other borrowings

|

|

|

||||||

|

Long-term debt

|

|

|

||||||

|

Total interest expense

|

|

|

||||||

|

Net interest income

|

|

|

||||||

|

Provision for loan losses

|

(

|

)

|

(

|

)

|

||||

|

Net interest income after provision for loan losses

|

|

|

||||||

|

Noninterest income

|

||||||||

|

Service charges and fees

|

|

|

||||||

|

Net gains on mortgage loans

|

|

|

||||||

|

Trust fees

|

|

|

||||||

|

ATM and debit card fees

|

|

|

||||||

|

BOLI income

|

|

|

||||||

|

Other

|

|

|

||||||

|

Total noninterest income

|

|

|

||||||

|

Noninterest expense

|

||||||||

|

Salaries and benefits

|

|

|

||||||

|

Occupancy of premises

|

|

|

||||||

|

Furniture and equipment

|

|

|

||||||

|

Legal and professional

|

|

|

||||||

|

Marketing and promotion

|

|

|

||||||

|

Data processing

|

|

|

||||||

|

FDIC assessment

|

|

|

||||||

|

Interchange and other card expense

|

|

|

||||||

|

Bond and D&O Insurance

|

|

|

||||||

|

Other

|

|

|

||||||

|

Total noninterest expenses

|

|

|

||||||

|

Income before income tax

|

|

|

||||||

|

Income tax expense

|

|

|

||||||

|

Net income

|

$

|

|

$

|

|

||||

|

Basic earnings per common share

|

$

|

|

$

|

|

||||

|

Diluted earnings per common share

|

$

|

|

$

|

|

||||

|

Cash dividends per common share

|

$

|

|

$

|

|

||||

|

2022

|

2021

|

|||||||

|

Net income

|

$

|

|

$

|

|

||||

|

Other comprehensive income:

|

||||||||

|

Unrealized gains (losses):

|

||||||||

|

Net change in unrealized losses on debt securities available for sale

|

(

|

)

|

(

|

)

|

||||

|

Net unrealized gain at time of transfer on securities transferred to held-to-maturity

|

||||||||

|

Amortization of net unrealized gains on securities transferred to held-to-maturity

|

( |

) | ||||||

|