UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-50327

iPass Inc.

(Exact name of Registrant as specified in its charter)

Delaware | 93-1214598 |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

3800 Bridge Parkway

Redwood Shores, California 94065

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (650) 232-4100

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered |

Common Stock, $0.001 Per Share Par Value | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ¨ | Accelerated filer | x | |

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

Aggregate market value of the registrant’s common stock held by non-affiliates of the registrant, based upon the closing price of a share of the registrant’s common stock on June 30, 2014, as reported by the NASDAQ Global Select Market on that date: $66,416,138. The determination of affiliate status for the purposes of this calculation is not necessarily a conclusive determination for other purposes. The calculation excludes approximately 9,122.334 shares held by directors, officers and stockholders whose ownership exceeded ten percent of the registrant’s outstanding Common Stock as of June 30, 2014. Exclusion of these shares should not be construed to indicate that such person controls, is controlled by or is under common control with the registrant.

The number of shares outstanding of the Registrant’s Common Stock, $0.001 par value, as of February 27, 2015 was 65,958,694.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement in connection with our 2015 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission not later than April 30, 2015, are incorporated by reference in Part III, Items 10, 11, 12, 13 and 14 of this report on Form 10-K.

iPASS INC.

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2014

TABLE OF CONTENTS

Page | ||

2

Disclosure Regarding Forward-Looking Statements

This annual report on Form 10-K contains forward-looking statements regarding expected future events and future results that are based on current expectations, estimates, forecasts, and projections about the industries in which we operate and the beliefs and assumptions of our management. Words such as “expects,” “will,” “anticipates,” “targets,” “goals,” “projects,” "projections'" “intends,” “plans,” “believes,” “estimates,” “potential,” variations of such words, and similar expressions are intended to identify forward-looking statements. In addition, any statements which refer to projections of our future financial performance, our anticipated growth and trends in our business, and other characterizations of future events or circumstances, are forward-looking statements. Readers are cautioned that these forward-looking statements are only predictions and are subject to risks, uncertainties, and assumptions that are difficult to predict. Therefore, actual results may differ materially and adversely from those expressed in any forward-looking statements. Readers are directed to risks and uncertainties identified below, under “Item 1A. Risk Factors” and elsewhere herein, for factors that may cause actual results to be different from those expressed in these forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and except as required by law, we undertake no obligation to revise or update publicly any forward-looking statements for any reason.

Investors and others should note that we announce material financial information to our investors using our investor relations website, SEC filings, press releases, public conference calls and webcasts. We also use social media to communicate with our customers and the public about our company, our products and services and other matters relating to our business and market. It is possible that the information we post on social media could be deemed to be material information. Therefore, we encourage investors, the media, and others interested in our company to review the information we post on the U.S. social media channels including the iPass Twitter Feed, the iPass LinkedIn Feed, the iPass Google+ Feed, the iPass Facebook Page, the iPass Blog, the iPass Instagram account, and the iPass Pinterest account. These social media channels may be updated from time to time.

3

PART I

Item 1. | Business |

Overview

iPass enables business travelers to stay connected by providing them with cost-effective and convenient global Wi-Fi access across smartphones, tablets and laptops. Founded in 1996, iPass (NASDAQ: IPAS) is the world's largest commercial Wi-Fi network, covering over 120 countries and territories and selling to over 700 large corporations, telecom service providers and other strategic partners around the world. Through its cloud-based delivery model, iPass connects business travelers to over 18 million Wi-Fi hotspots in airports, airplanes, hotels and public areas. With the growing need for fast, high bandwidth connectivity, iPass lets business travelers stay close to what matters most while on the road including access to video, unified communications, web conferencing and other cloud based applications.

Business Highlights

Strategic Mobility Assets

We believe iPass has a unique set of mobility assets that provide us with competitive advantages. We see our three core assets as follows:

Open Mobile Platform: Our Open Mobile (OM) platform is a cloud-based mobility management platform that securely manages network connectivity and subscribers across a wide variety of computing and mobile devices and provider networks. We believe this scalable subscriber management, billing and reporting platform is unique in the industry and would be time consuming and expensive to replicate. Our Open Mobile platform has the following key characteristics and functionality:

• | An always-on, lightweight software agent that runs on a wide array of devices including smartphones, tablets, and laptops running operating systems including Android, the Apple (iOS), Windows and Macintosh. |

• | A cloud-based platform that allows businesses to configure and manage its mobility offering by providing in-depth reporting and analytics on mobile usage across the networks and devices used by the employees. |

• | Policy enforcement services that enable our customers to have their costs, compliance and security measures enforced across their mobile workforce. |

• | We exited 2014 with 814,000 active monthly users on our OM platform. |

Integrated Authentication Fabric: We have a global authentication fabric of integrated servers and software that is interconnected with over 150 unique global Wi-Fi networks. This infrastructure allows us to provide secure, highly-available and seamless four-party global authentication, clearing and settlement of Wi-Fi users for our partners and customers. Our technology architecture is designed to:

• | Integrate with existing enterprise security, directory, and business systems. |

• | Integrate with any Wi-Fi network, whether customer-owned networks or third-party provider networks. |

• | Embrace new access methods, devices, and applications. |

• | Support scalable unique users (1.3 million in 2014), authentications (10.4 million in 2014), and Wi-Fi enabled sessions (59.0 million in 2014) across both our paid and unpaid footprint. |

Global Wi-Fi Footprint: We have a Wi-Fi network footprint and supply chain that consists of more than 18 million hotspots in 120 countries and territories, including major airports, convention centers, airplanes, trains, train stations, hotels, restaurants, retail, and small business locations. In the second quarter of 2014, we began including both commercial grade venues and public access and community locations that are accessible in the iPass network. Our technology integration across multiple global network providers forms the basis of our network services and we believe creates a unique cost advantage for our customers. We typically contract with network service providers, integrate their networks into our global infrastructure, and monitor their performance to ensure that our customers have a consistent and reliable end user experience.

• | Our paid Wi-Fi footprint supported 5.8 million usage hours and 6.4 million network sessions in 2014 on an average of approximately 96,000 unique monthly Wi-Fi network users. |

• | Hotspots that cover 95% of the world’s top 100 airports and 82,000 strategic venues such as hotels and convention centers. |

4

Business Portfolio

On June 30, 2014 we entered into an agreement and completed the sale of our Unity Managed Network Services business unit ("Unity business"), which is reported in this filing as discontinued operations. Our Unity Business was focused on delivering and managing high speed Wi-Fi and WAN managed network solutions to customers in a variety of industries. As a result of the sale, we now currently have a single reportable operating segment, Mobility Services. Our Mobility Services, collectively referred to as Open Mobile or "OM", comprises two service offerings: (1) Open Mobile Enterprise Services, and (2) Open Mobile Exchange.

Open Mobile Enterprise Services (“iPass OME” or “OME”): We provide iPass OME to large enterprises to deliver enhanced network mobility services, addressing large enterprises’ needs to manage their mobility economics, high speed network connectivity requirements and proliferation of mobile devices, including the “bring-your-own-device” trend. OME consists primarily of our network services and platform services, as follows:

Network Services: Our network provides our enterprise and carrier customers access to more than 18 million global commercial Wi-Fi hotspots in 120 countries globally and across leading Wi-Fi venues. Our offerings span multiple geographies and are primarily focused on Wi-Fi access technologies. We continue to wind down our legacy Dial-up and 3G connectivity options as we focus our efforts on the Wi-Fi market.

Platform Services: Our cloud-based Open Mobile Platform enables enterprise users to connect from most mobile devices over a wide range of networks. These services allow our customers to effectively manage their mobile workforces by controlling costs, enforcing compliance and ensuring security when workers connect their mobile devices to the Internet and wireless networks. Effective July 1, 2012 we announced the end-of-life of our legacy iPC platform and continued to manage the wind down of the legacy platform.

Open Mobile Exchange (“iPass OMX” or “OMX”): We provide our iPass OMX to strategic partners that incorporate iPass OMX into their core products and services, geared for the mass market. OMX is best understood as our wholesale delivery mechanism to provide network and platform connectivity to the consumer market. iPass OMX strategic partners include global OEMs (Original Equipment Manufacturers), premium brand partners, software product and service providers, and telecom carriers. We continue to focus on adding new channels to further grow our OMX services revenue.

Our Strategy

We intend to leverage our unique set of mobility assets across our business portfolio offerings to drive growth in users, customers and Wi-Fi usage with a committed focus on smartphone and tablet adoption and delivering customer satisfaction via enhanced end user experience across our platform and network.

Our strategy consists of the following key elements and initiatives specific to our OM service offering:

• | Increased Penetration in Existing Customers: Expand our understanding of our enterprise customers’ end users experience to drive additional virality, penetration, usage, leading to increased revenue. We strive to optimize business intelligence and turn user insights into actionable data to improve our customer activation rates and connection success rates. |

• | New Customer Acquisition: Judiciously invest in sales and marketing programs to increase brand awareness, deepen lead generation activities, and drive organic revenue growth. We intend to continue to expand beyond the traditional enterprise and carrier customers into mid-market business and other consumer and wholesale opportunities. |

• | Continue to Optimize the End User Experience: Smartphones and tablets (“SP&T”) continue to be a largely untapped market for global Wi-Fi roaming. By continuing to focus on improving service quality, connectivity success rates, and leading the evolution of the global Wi-Fi ecosystem, we plan to drive improvements in the global user experience which we expect will translate to increased user demand in the billion-plus market of Wi-Fi enabled mobile devices. |

Geographic Revenue

iPass revenue is derived from the following geographical locations:

5

For the Year Ended December 31, | ||||||||

2014 | 2013 | 2012 | ||||||

United States | ||||||||

Mobility Service Revenues | 35 | % | 37 | % | 41 | % | ||

International | ||||||||

Mobility Service Revenues | 65 | % | 63 | % | 59 | % | ||

Geographic revenues are determined by the location of the customer’s headquarters. One customer accounted for 10% of total revenues from continuing operations for the years ended December 31, 2014. No individual customer accounted for 10% or more of total revenues from continuing operations for the years ended December 31, 2013, and 2012.

For further financial information on the geographic information, refer to the information contained in Note 14, “Segment and Geographic Information,” in the Notes to the Consolidated Financial Statements included in Item 15. For risks attendant to foreign operations, see the risk entitled “Because a meaningful portion of our business is international, we encounter additional risks, which may impact our revenues and profitability” in “Item 1A. Risk Factors” of this Form 10-K.

Seasonality

We generally experience seasonality in our business due to decreased business travel during the summer, particularly in Europe, and during the year-end holiday season which results in lower usage of our network services. Seasonal trends or other factors, such as bad weather, may cause fluctuations in our business results.

Network Service Providers

We have contractual relationships with approximately 200 telecommunications carriers, Internet service providers and other network service providers that enable us to offer our network services around the world. We pay network service providers for access to their network on a usage, session or subscription basis. Most of these contracts have a one or two-year term, after which either party can terminate the contract with notice. The contracts we have entered into with providers are non-exclusive and may contain minimum commitments for the purchase of network access.

Sales and Marketing

Our sales organization is structured into regional account teams, which include sales management, sales engineers and customer success teams. We sell our services directly through our global sales force and indirectly through our reseller and carrier partners. We maintain sales offices or personnel in a number of cities in the United States as well as in the United Kingdom, India, Australia, Japan, Germany, France, Singapore, Netherlands, and China. As of December 31, 2014, our sales organization comprised 44 individuals: 19 in North America, 21 in Europe, Middle East and Africa (“EMEA”) and 4 in Asia Pacific. Our sales and marketing expenses from continuing operations were $15.8 million, $16.4 million and $17.9 million in 2014, 2013, and 2012, respectively.

Our reseller, wholesale, and carrier partners typically sign a one to two-year agreement with us through which we appoint them as a non-exclusive reseller of our services. Their reseller responsibilities vary and may include actively marketing and selling our services, deploying and supporting customer accounts, and implementing and managing billing for their customers. Our current sales structure allows us to offer our services without incurring the full cost of customer acquisition (sales and marketing) or customer post-sales support. Our reseller, wholesale, and carrier partners typically sell complementary hardware, software, and services, and bundle our services with their core offerings. They may also have a base of existing customers to whom they can efficiently sell our portfolio of services. In many cases our salespeople do support our reseller, wholesale, and carrier partners with closing new business, and our post-sales team may work with them to ensure successful implementation of our services. However, the enterprise or consumer remains the customer of our reseller, wholesale, and carrier partners and has no direct financial relationship with us.

We focus our marketing efforts on establishing a strong corporate reputation in the market, creating awareness and preference for our services and their benefits, educating potential customers, generating new sales opportunities, generating end-user awareness and demand within existing customer accounts and enabling our sales force and channel partners to effectively sell and deploy our service offerings. We conduct a variety of marketing programs that may include advertising, promotions, public relations, analyst relations, telemarketing, direct marketing, web and e-mail marketing, collateral and sales tools creation, seminars, events and trade shows, training, co-operative channel marketing, internet marketing and promotions.

Competition

6

The market for mobile connectivity targeted at global travelers is fragmented with a variety of competitors, both direct and indirect, including telecom operators, cloud-based platform operators, cable companies, and smaller Internet service providers. As our primary customer is the enterprise user, we partner with many point Wi-Fi providers to drive incremental users to their connectivity resources, helping to further monetize their assets via our roaming customer base. Our unique authentication fabric and global partnership with over 150 Wi-Fi networks creates a scale and user experience that we believe is hard to replicate by any single competitor, and creates an important differentiating factor for us. However, since we do not own our Wi-Fi network, our competitors who own their Wi-Fi networks can offer lower Wi-Fi pricing than we can offer in specific markets, can bundle Wi-Fi network access with other services, and can use these additional service offerings to drive increased brand awareness.

We believe the principal competitive factors in our industry include the following:

• | Global roaming coverage; |

• | Ease of use and reliability of service; |

• | Price, both directly of Wi-Fi connectivity, and of alternative connectivity options such as 3G/4G; |

• | Brand awareness; |

• | Perceived benefit of connectivity by employees and business travelers; and |

• | Bundled connectivity services. |

See section 1A – Risk factors for additional details regarding competitive factors that could adversely impact our business, financial condition, or results of operations.

Research and Development

We are committed to continuing to enhance our underlying technology and continuing to innovate and incorporate new technologies and features into our services and network architecture. Our research and development efforts are focused on improving and enhancing our platform and service offerings as well as developing new services, especially for smartphones and tablets. As of December 31, 2014, our research and development organization consisted of 110 employees, approximately 41 in North America and 69 in India. Our research and development expenses from continuing operations were $11.9 million, $13.3 million and $13.7 million in 2014, 2013 and 2012, respectively.

Intellectual Property

We believe our technology and platform contains valuable intellectual property. We rely on a combination of trademark, copyright, trade secret laws, patents and disclosure restrictions to protect these intellectual property rights. We license third-party technologies that are incorporated in our services. We also enter into confidentiality and proprietary rights agreements with our employees, consultants and other third parties and control access to software, documentation and other proprietary information. We have a patent portfolio, related to our Mobility Services, consisting of twenty-four U.S. patents, and six international patents. Our patents expire between 2016 and 2025. We currently have ten U.S. patent applications pending, and sixteen international patent applications pending (in the same subject areas as the U.S. patent applications). iPass and the iPass logo are registered trademarks. We have also applied for or registered company trademarks in the U.S. and numerous other countries.

Employees

As of December 31, 2014, we had 250 employees of which 118 were located in North America, 93 in Asia Pacific, and 39 in EMEA.

Available Information

We use our website, www.ipass.com, as a routine channel for distribution of important information, including news releases, annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities and Exchange Act, as amended, as soon as reasonably practicable after they are electronically filed with, or furnished to the U.S. Securities and Exchange Commission (“SEC”). All of these postings and filings are available on our website free of charge. The content on any website referred to in this Form 10-K is not incorporated by reference into this Form 10-K.

7

Item 1A. Risk Factors

Our business is subject to a number of risks, many of which are described below. If any of the events described in these risks factors actually occur, our business, financial condition or results of operations could be materially and adversely affected, which would likely have a corresponding impact on the value of our common stock. Further, the risk factors described below could cause actual results to differ materially from the results contemplated by the forward-looking statements contained in this report. These risk factors should be reviewed carefully.

If customer adoption and deployment of our Open Mobile Platform is slow, especially on smartphone and tablet devices, our ability to grow our Mobility Services business could be harmed.

The future success of our business will depend in large part on our current and prospective customers’ timeliness of adoption and deployment of our Open Mobile Platform. Key risks associated with our Open Mobile Platform and services are as follows:

Customer adoption and deployment of our Open Mobile Platform, especially on smartphone and tablet devices, may be slow. We believe that the growth of our business is dependent on the timely adoption and deployment of the Open Mobile Platform by our customers. In particular, smartphone and tablet devices are becoming more relied upon by our customers for their mobile computing needs and may cause our users to stop using laptops while traveling, or to use them less often. We believe it is critical for our business that our services for smartphone and tablet devices achieve market acceptance and that our customers rapidly adopt and deploy our services on smartphone and tablet devices. A material delay in the adoption and deployment of the Open Mobile Platform by our customers, on smartphone and tablet devices in particular, will adversely impact our ability to grow revenues and achieve profitability.

Customer deployment of our Open Mobile Platform may not result in increased use of our services. We believe it is important to the future success of our business that users of our Mobility Services increase their usage of our platform and network services. We believe that the deployment by our customers of our Open Mobile Platform, especially on smartphone and tablet devices, will lead to increased usage of our platform services and correspondingly, our network services, which will lead to an increase in our revenue. However, even if a significant portion of our customers deploy our Open Mobile Platform, there is no guarantee that our customers will use our services more frequently.

Our Open Mobile Platform may have technical limitations that cause our customers to delay adoption or deployment. There is risk that the Open Mobile Platform may contain technological limitations, bugs or errors that would cause our customers to not adopt or delay the adoption of the Open Mobile Platform. If some or all of these risks associated with our Open Mobile Platform were to occur, adoption and deployment of our Open Mobile Platform may not occur and our business could be harmed.

Customers must be willing to continue to pay for our platform or our revenue growth may slow. We believe that it is important that the value proposition of our Open Mobile Platform is accepted by our customers such that they are willing to pay for their users to use our mobility services. If our customers are willing to adopt our Open Mobile Platform but are not willing to pay for the platform, our ability to grow revenues and achieve profitability could be adversely impacted.

If our OMX service offerings do not achieve expanded market acceptance our ability to grow our business could be harmed.

Our OMX service offerings were introduced in 2011 and incorporate our Open Mobile Platform, global authentication fabric, and global Wi-Fi network to provide reseller, wholesale, and carrier partners around the world with the infrastructure to offer their customers new mobility services. We have entered into contracts with a number of customers for our OMX services, but ramping revenues takes time to develop. We have and plan to continue to devote significant resources to building our OMX service line of business. If OMX service offerings do not achieve expanded market acceptance and generate meaningful revenues our financial condition may be harmed.

If Global 3G/4G data roaming rates decline precipitously, our ability to grow our business could be harmed.

For our network services to be attractive to our customers, the cost of 3G/4G roaming must be meaningfully greater than the cost of our Wi-Fi network services. Currently, in certain geographies such as Asia, 3G/4G roaming prices are not significantly higher than our rates for Wi-Fi access. In Europe, legislation has been enacted mandating the reduction of wholesale 3G/4G roaming prices. If 3G/4G roaming prices do not remain meaningfully higher than our Wi-Fi network prices then our ability to sell our Mobility Services could be impacted and our business harmed.

Our decision to “End-of-Life” our legacy iPC platform product has and will continue to impact our total revenues.

8

As of July 1, 2012 our iPC or legacy platform reached end-of-life. While the iPC platform continues to function for existing customers, we only provide basic support and only for customers that pay extended support fees. While we believe that the end-of-life of iPC will encourage our customers to migrate to our Open Mobile platform, iPC customers may decide to instead terminate their service with us. If the number of iPC customers who decide to terminate their service with us is greater than expected, our results of operations could be negatively impacted.

If key global Wi-Fi venues offer “no charge” Internet access to all users, our network revenues could be negatively affected.

We derive a significant portion of our network revenue from providing Wi-Fi access in certain key venues (e.g., hotels, airports and cafes). In general, these venues charge their customers for Wi-Fi access. If these venues begin offering Wi-Fi access at no charge, the amount we can charge our customers for Wi-Fi access at these venues will likely decrease or we may not charge our customers for Wi-Fi access at these venues. For example, Starbucks and certain airports in the United States have ceased charging their customers for Wi-Fi access and we have experienced reduced revenues as a result. If this trend continues at other key Wi-Fi venues, our network revenues and overall profitability may be negatively impacted.

If we do not accurately predict network usage for our Flat Rate price plans, our costs could increase without a corresponding increase in network revenue.

A significant number of our customers have purchased our Flat Rate network price plans, and we are signing new customers to this plan. In this plan, our customers pay a flat rate price to access our network services. However, in the majority of situations we continue to pay our providers based on actual network usage. The rate we charge in our Flat Rate price plans is based on statistical predictions of usage across a pool of users within a customer. If actual usage is higher than expected our ability to achieve profitability could be negatively impacted.

In 2014, we implemented certain fixed rate buying structures with some providers to mitigate this risk. However, buying network access at a fixed rate creates additional risk if our customers were to use less Wi-Fi in the future, which could negatively impact our profitability.

If demand for mobility services does not grow or grows in ways that do not require use of our services, we may experience a decline in revenues and profitability.

The growth of our business is dependent, in part, upon the increased use of mobility services and our ability to capture a higher proportion of this market. If the demand for mobility services does not continue to grow, or grows in ways that do not require use of our services, then we may not be able to grow our business, or achieve or maintain profitability. Increased usage of our Mobility Services depends on numerous factors, including:

• | Willingness of enterprises to make additional information technology expenditures; |

• | Availability of security services necessary to ensure data privacy over a variety of networks; |

• | Quality, cost and functionality of our services and competing services; |

• | Increased adoption of wireless broadband access methods and our ability to support these new methods; |

• | Proliferation of smartphones, tablets and mobile handheld devices and related applications, and our ability to provide valuable services and support for those devices; |

• | Our ability to partner with mobile network operators and service providers that are willing to stimulate consumer awareness and adoption of our Mobility Services; and |

• | Our ability to timely implement technology changes to our services to meet evolving industry standards for mobile devices, Wi-Fi network access and customer business requirements. |

If we are unable to meet the challenges posed by Wi-Fi access, our ability to profitably grow our business may be impaired.

A substantial portion of the growth of our business has depended, and will continue to depend, in part upon our ability to expand our global Wi-Fi network. Such an expansion may not result in additional revenues to us. Key challenges in expanding our Wi-Fi network include:

The Wi-Fi access market continues to develop at a rapid pace. We derive a significant portion of our revenues from wireless broadband “hotspots,” such as certain airports, hotels and convention centers. The Wi-Fi access market continues to develop rapidly, in particular: the market for enterprise connectivity services through Wi-Fi is characterized by evolving industry standards and specifications and there is currently no uniform standard for Wi-Fi access. Furthermore, although the use of wireless frequencies generally does not require a license in the United States and abroad, if Wi-Fi

9

frequencies become subject to licensing requirements, or are otherwise restricted, this would substantially impair the growth of Wi-Fi access. Some large telecommunications providers and other stakeholders that pay large sums of money to license other portions of the wireless spectrum may seek to have the Wi-Fi spectrum become subject to licensing restrictions. If the Wi-Fi access market develops in ways that limit access growth, our ability to generate substantial revenues from Wi-Fi access could be harmed.

The Wi-Fi service provider market is highly fragmented. There are currently many Wi-Fi service providers that provide coverage in only one or a small number of hotspots. We have entered into contractual relationships with numerous Wi-Fi service providers. These contracts generally have an initial term of two years or less. We must continue to develop relationships with many providers on terms commercially acceptable to us to provide adequate coverage for our customers’ mobile workers and to expand our Wi-Fi coverage. We may also be required to develop additional technologies to integrate new wireless broadband services into our service offering. If we are unable to develop these relationships or technologies, our ability to grow our business could be impaired.

Consolidation of large Wi-Fi service providers may impair our ability to expand network service coverage, negotiate favorable network access terms, and deliver consistent service in our network. The telecommunications industry is rapidly evolving and highly competitive. These factors may cause large Wi-Fi network service providers to consolidate, which would reduce the number of network service providers from which we are able to obtain network access in key locations. If significant consolidation occurs, we will have a smaller number of network service providers to acquire Wi-Fi network access from and we may not be able to provide additional or sufficient redundant access points in some geographic areas, which could diminish our ability to provide broad, reliable, redundant coverage. Further, our ability to negotiate favorable access rates from Wi-Fi network service providers could be impaired, which could increase our network access expenses and harm our operating results.

Wi-Fi service provider actions may restrict our ability to sell our services. Some Wi-Fi network providers restrict our ability to sell access to their networks to our resellers whom they consider competitive with them. This can reduce our revenue by limiting the footprint our partners can make available to their customers.

Significant dependency on key network providers could negatively affect our revenues.

There are certain venues (hotels, airports, airplanes, cafes, etc.) globally where we depend on key providers for network access in those venues. In addition, in certain geographies we depend on a small number of providers for a large portion of network access. If such a provider were to go out of business, terminate their agreement with us, encounter technical difficulty such that network access was not available to our customers for an extended period of time, it could have a negative impact on our revenues and profitability if we cannot find an alternative provider to enable network access in those venues or geographies.

We face competition in the market for mobility services, which could make it difficult for us to succeed.

While we do not believe there are service providers in the mobility services market that offer a platform or range of services in an integrated offering as we do, we compete with a variety of service providers, including facilities-based carriers, cloud-based platform operators and mobility management solution providers. Some of these providers have substantially greater resources, larger customer bases, longer operating histories and/or greater name recognition than we have. In addition, we face the following challenges:

Many of our competitors can compete on price. Because many of our facilities-based competitors own and operate physical networks they may be able to provide additional hotspot access at little incremental cost to them. As a result, they may offer network access services at a lower cost, and may be willing to discount or subsidize network access services to capture other sources of revenue. In contrast, we have traditionally purchased network access from facilities-based network service providers to enable our network access service and in these cases, may not be able to compete aggressively on price. In addition, new cloud-based platform operators may enter the mobility services market and compete on price. In either case, we may lose business or be forced to lower our prices to compete, which could reduce our revenues.

Many of our competitors offer additional services that we do not, which enables them to bundle these services and compete favorably against us. Some of our competitors provide services that we do not, such as 3G/4G data roaming, local exchange and long distance services, voicemail and digital subscriber line, or DSL, services. Potential customers that desire these services on a bundled basis may choose to subscribe to network access from a competitor that provides these additional services.

Our potential customers may have unrelated business relationships with our competitors and consider those relationships when deciding between our services and those of our competitors. Many of our competitors are large facilities-

10

based carriers that purchase substantial amounts of services or provide other services or goods unrelated to network access services. As a result, if a potential customer is also a supplier to one of our large competitors, or purchases unrelated services or goods from our competitor, the potential customer may be motivated to purchase its network access services from our competitor to maintain or enhance its business relationship with that competitor. In addition, our current or potential carrier customers may already have or may consider buying services from mobility management solution providers which may impact our ability to sell our services to those customers as well as drive market prices down for the services that we offer.

Users may take advantage of free Wi-Fi networks for Internet and corporate access. Telecommunications providers may offer free Wi-Fi as part of a home broadband or other service contract, which may force down the prices which the market will bear for our services and could reduce our revenues.

If our carrier and channel partners do not successfully market our services to their customers, then our ability to grow our revenues could be impaired.

We sell our services directly through our sales force and indirectly through our channel partners, which include telecommunication carriers, systems integrators and value-added resellers. A large percentage of our sales outside the United States are made through our carrier and channel partners. Our business depends on the efforts and the success of these carrier and channel partners in marketing our services to their customers. Our own ability to promote our services directly to our carrier and channel partners’ customers is often limited. Many of our carrier and channel partners may offer services to their customers that may be similar to, or competitive with, our services. Therefore, these channel partners may not actively promote our services. If our channel partners fail to market our services effectively, our ability to grow our revenue could be reduced and our business may be impaired.

Our revenue and overall profitability may be adversely impacted by material reductions in existing customer and partner purchase commitments.

Our customers and partners have traditionally entered into contractual provisions that require them to pay the greater of the fees generated from the use of our services or a minimum committed amount over a pre-determined time period. Minimum commitments are negotiated by customers to improve their unit pricing, effectively guaranteeing a certain volume to achieve a reduced unit price. Recent global economic conditions in certain cases caused our customers and partners to generate fees from the use of our services that are significantly less than their minimum committed amounts. Consequently this shortfall has caused some partners and customers upon renewal of their contracts with us, to renew with a lower minimum commitment and in some cases with no minimum commitment. Additionally, in some cases partners and customers are requesting a re-evaluation of their minimum commitments on a prospective basis during the term of their existing contract; to maintain these commercial relationships, we have addressed these requests on a contract by contract basis. The reduction or elimination of minimum purchase commitments could result in lower future revenues.

Our software is complex and may contain errors that could damage our reputation and decrease usage of our services.

Our software may contain errors that interrupt network access or have other unintended consequences. If network access is disrupted due to a software error, or if any other unintended negative results occur, such as the loss of billing information, a security breach, unauthorized access to our cloud-based platform or the introduction of a virus by our software onto our customers’ computers or networks, our reputation could be harmed and our business may suffer. Our contracts generally limit our exposure to incidental and consequential damages and to the extent possible, we further limit our exposure by entering into insurance policies that are designed to protect our customers and us from these and other types of losses. If these contract provisions are not enforced or enforceable, or if liabilities arise that are not effectively limited or insured, our operating results and financial condition could be harmed.

Because a meaningful portion of our business is international, we encounter additional risks, which may impact our revenues and profitability.

We generate a substantial portion of our revenues from international customers. Revenues from customers domiciled outside of the United States were approximately 65% of our revenues in 2014, of which approximately 48% and 15% were generated in the EMEA and Asia Pacific regions, respectively. The functional currency of our foreign subsidiaries is the U.S. Dollar and we currently bill nearly all of our services in U.S. Dollars. However, we pay certain expenses in local currencies. During the years ended December 31, 2014, 2013 and 2012, we have not entered into any hedging contracts to manage foreign currency exposure. Our international operations subject our business to specific risks that could negatively impact our business, including:

• | Generally longer payment cycles for foreign customers; |

11

• | The impact of changes in foreign currency exchange rates on both the attractiveness of our USD-based pricing and our operating results, particularly upon the re-measurement of assets, liabilities, revenues and expenses and the transactional settlement of outstanding local currency liabilities; |

• | High taxes in some foreign jurisdictions; |

• | Difficulty in complying with Internet and data privacy related regulations in foreign jurisdictions; |

• | Difficulty enforcing intellectual property rights and weaker laws protecting these rights; and |

• | Ability to efficiently deploy capital and generate returns in foreign jurisdictions. |

We may be exposed to credit risk, collection risk and payment delinquencies on our accounts receivable.

A substantial majority of our outstanding accounts receivables are not secured. Our standard terms and conditions permit payment within a specified number of days following the receipt of our services. While we have procedures to monitor and limit exposure to credit risk on our receivables, there can be no assurance such procedures will effectively limit our collection risk and avoid losses. In addition, under poor global economic conditions, certain of our customers have faced and may face liquidity concerns and have delayed and may delay or may be unable to satisfy their payment obligations, which may have a material adverse effect on our financial condition and operating results.

Our sales cycles are lengthy and could require us to incur substantial costs that may not result in related revenues.

Our business is characterized by a lengthy sales cycle. Once a contract with a customer is signed there is typically an extended period before the customer or customer’s end-users actually begin to use our services,

which is when we begin to realize network revenues. As a result, we may invest a significant amount of time and effort in attempting to secure a customer which may not result in any revenues in the near term. Even if we enter into a contract, we may have incurred substantial sales-related expenses well before we recognize any related revenues. If the expenses associated with sales efforts increase and, we are not successful in our sales efforts, or we are unable to generate associated offsetting revenues in a timely manner, our operating results could be harmed.

Cyber security risks and privacy concerns related to Internet-based services could reduce demand for our services.

The secure transmission of confidential information and mission critical data when using Internet-based services is extremely important to our customers. A key component of our ability to attract and retain customers is the security measures that we have engineered into our network for the authentication of the end-user’s credentials. These measures are designed to protect against unauthorized access to our customers’ networks. Because techniques used to obtain unauthorized access or to sabotage networks change frequently and generally are not recognized until launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative measures against unauthorized access or sabotage. If an actual or perceived breach of network security occurs, that is attributable to our services, the market perception of the effectiveness of our cyber security measures could be harmed resulting in a negative impact to our business.

As part of providing our services, we collect certain information about the users of our service. As such we must comply with evolving laws and regulations regarding the protection and disclosure of such user information. While we have taken steps to comply with applicable privacy laws and regulations and to protect user information, any well-publicized compromises of our users’ data may reduce demand for our services and harm our business.

We rely significantly on information technology to accurately bill our customers and any failure, inadequacy or interruption of that technology could negatively impact our ability to report on our financial performance on a timely basis.

A key component of our ability to attract and retain customers is the timely and accurate furnishing of monthly detail billing records of activity on our network, rated for the agreements in place with both our customers and our suppliers. Our ability to meet these billing requirements, as well as to effectively manage and maintain our books and records and internal reporting requirements, depends significantly on our internal information technology.

If licenses to third party technologies do not continue to be available to us at a reasonable cost, or at all, our business and operations may be adversely affected.

We license technologies from several software providers that are incorporated into our services. We anticipate that we will continue to license technology from third parties in the future. Licenses to third party technologies may not continue to be available to us at a reasonable cost, or at all. The loss of the right to use these technologies or other technologies

12

that we license could have an adverse effect on our services and increase our costs or cause interruptions, degradations or delays in our services until substitute technologies, if available, are developed or identified, licensed and successfully integrated into our services.

Litigation arising out of intellectual property infringement could be expensive and disrupt our business.

We cannot be certain that our services do not, or will not, infringe upon patents, trademarks, copyrights or other intellectual property rights held by third parties, or that other parties will not assert infringement claims against us. Any claim of infringement of proprietary rights of others, even if ultimately decided in our favor, could result in substantial costs and diversion of our resources. Successful claims against us may result in an injunction or substantial monetary liability, which in either case could significantly impact our results of operations or materially disrupt the conduct of our business. If we are enjoined from using a technology, we will need to obtain a license to use the technology, but licenses to third-party technology may not be available to us at a reasonable cost, or at all.

To compete we must attract and retain key employees, and our failure to do so could harm our results of operations.

To compete we must attract and retain executives, sales representatives, engineers and other key employees. Hiring and retaining qualified executives, sales representatives and engineers are critical to our business, and competition for experienced employees in our industry can be intense. If we experience significant turnover of our executives, sales representatives, engineers and other key employees it will be difficult to achieve our business objectives and could adversely impact our results of operations.

If we fail to develop and effectively market our brand, our operating results may be harmed.

We believe that expanding awareness of the iPass brand is important to growing and achieving acceptance of our iPass Open Mobile Platform. We have increased our marketing efforts, including new promotional and marketing activities, to further implement our global marketing objectives. These promotional and marketing activities may not result in any increased revenue. Further, any potential revenue increase as a result of these promotional and marketing activities may not offset the expenses incurred in further promoting the iPass brand.

Item 1B. | Unresolved Staff Comments |

None

Item 2. | Properties |

We currently lease approximately 48,000 square feet of space for our headquarters in Redwood Shores. We recently signed a lease renewal and effective May 1, 2015, we will lease approximately 25,000 square feet of space for our headquarters in Redwood Shores, California under a lease that expires in 2020. We also lease sales and support offices in other parts of the United States and abroad in EMEA and Asia Pacific. We believe that our principal facility in Redwood Shores, and sales and support offices in other parts of the United States and abroad are adequate for our business needs, and we expect that additional facilities will be available in other jurisdictions to the extent we need to add new offices.

Item 3. | Legal Proceedings |

Not applicable.

Item 4. | Mine Safety Disclosures |

Not applicable.

13

PART II

Item 5. | Market For Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Price Range of Common Stock

Our common stock is traded on the NASDAQ Global Select Market under the symbol “IPAS”. The following table sets forth the intra-day high and low sale price of our common stock, in each quarterly period presented within the two most recent years, as reported on the NASDAQ Global Select Market:

Price range | |||||||

High | Low | ||||||

Year ended December 31, 2014: | |||||||

First Quarter | $ | 1.88 | $ | 1.45 | |||

Second Quarter | 1.70 | 1.05 | |||||

Third Quarter | 1.82 | 1.11 | |||||

Fourth Quarter | 1.67 | 1.32 | |||||

Year ended December 31, 2013: | |||||||

First Quarter | $ | 2.37 | $ | 1.85 | |||

Second Quarter | 2.08 | 1.56 | |||||

Third Quarter | 2.36 | 1.78 | |||||

Fourth Quarter | 2.20 | 1.29 | |||||

We had 65,958,694 shares of our common stock outstanding as of February 27, 2015, held by 115 holders of record, although there are a significantly larger number of beneficial owners of our common stock.

Dividends

We did not pay cash dividends on our common stock in 2014, 2013, or 2012. We currently do not expect to pay cash dividends, although the declaration of any future cash dividend is at the discretion of the Board of Directors and will depend on the financial condition, results of operations, capital requirements, business conditions and other factors, as well as a determination that cash dividends are in the best interest of our stockholders.

Unregistered Sales of Equity Securities and Use of Proceeds

During the year ended December 31, 2014, the Compensation Committee of our Board of Directors authorized the withholding of shares upon the vesting of restricted stock awards held by an executive officer in order to satisfy tax obligations that are triggered/realized at the time of vesting; the number of shares that have been withheld from the total amount vested in order to satisfy certain tax obligations is set forth in the table below.

Date Shares Withheld | Total Number of Shares Purchased (1) | Average Price Paid Per Share (2) | Total Number of Shares (or units) Purchased as Part of Publicly Announced Plans or Programs | Maximum Number (or approximate dollar value) of Shares (or units) That May Yet Be Purchased Under the Plans or Programs | ||||||||||

August 29, 2014 | 37,580 | $ | 1.16 | $ | — | $ | — | |||||||

October 10, 2014 | 3,757 | $ | 1.57 | $ | — | $ | — | |||||||

(1) | In this table, the number of shares that have been withheld are referred to as the “Total Number of Shares Purchased.” We do not currently have any stock repurchase plan in place. |

(2) | The price per share was equal to the closing market price of our common stock on the date the shares were withheld. |

14

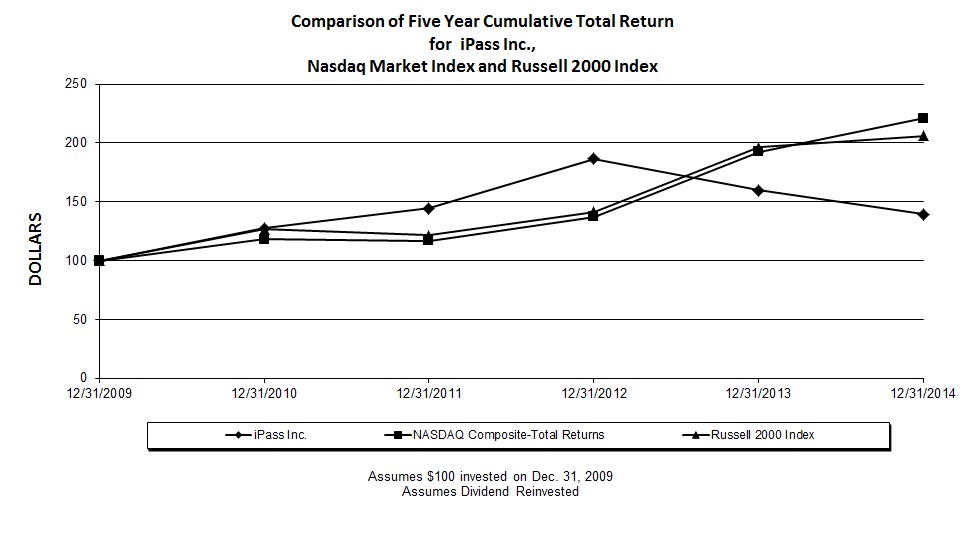

Performance Graph(1)

The performance line graph below compares the cumulative total stockholder return on our common stock with the cumulative total return of the NASDAQ Market Index and the Russell 2000 Index for the five years ended December 31, 2014. The graph and table assumes that $100 was invested on December 31, 2009 in our common stock, the NASDAQ Market Index and the Russell 2000 Index and that all the dividends were reinvested.

12/31/09 | 12/31/10 | 12/31/11 | 12/31/12 | 12/31/13 | 12/31/14 | ||||||||||||||||||

iPass Inc. | $ | 100.00 | $ | 127.32 | $ | 144.64 | $ | 186.40 | $ | 159.92 | $ | 139.55 | |||||||||||

Russell 2000 Index | 100.00 | 126.81 | 121.52 | 141.42 | 196.32 | 205.93 | |||||||||||||||||

NASDAQ Market Index | 100.00 | 118.02 | 117.04 | 137.47 | 192.62 | 221.02 | |||||||||||||||||

We do not believe that there is any published industry or line of business indices that are directly relevant to our line of business. In addition, we do not believe that we can construct a peer group index as many of the services similar to ours are only a small portion of the business of the companies providing such services. Consequently, in addition to the NASDAQ Market Index, we are comparing our stock price performance to the Russell 2000 Index because we believe that this broad market index provides a reasonable comparison of stockholder returns.

(1) This Section is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any filing of iPass under the 1933 Act or the 1934 Act whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

Item 6. | Selected Financial Data |

The following table sets forth selected financial data from continuing operations as of the end of, and for, the last five fiscal years. This selected financial data should be read in conjunction with the consolidated financial statements and related notes included in Item 15 of this report.

15

Year Ended December 31, | |||||||||||||||||||

2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||||

(In thousands, except per share data) | |||||||||||||||||||

Statement of Continuing Operations Data | |||||||||||||||||||

Revenue | $ | 69,804 | $ | 77,729 | $ | 92,530 | $ | 110,703 | $ | 128,675 | |||||||||

Total cost of revenues and operating expenses | 89,253 | 92,673 | 98,533 | 113,667 | 133,454 | ||||||||||||||

Operating loss | (19,449 | ) | (14,944 | ) | (6,003 | ) | (2,965 | ) | (4,779 | ) | |||||||||

Net loss from continuing operations | (12,205 | ) | (14,705 | ) | (5,991 | ) | (3,312 | ) | (3,914 | ) | |||||||||

Basic and diluted net loss per share from continuing operations | (0.19 | ) | (0.23 | ) | (0.10 | ) | (0.06 | ) | (0.07 | ) | |||||||||

Cash dividends declared per common share | — | — | — | 0.07 | 0.48 | ||||||||||||||

Total assets | $ | 55,255 | $ | 54,916 | $ | 60,124 | $ | 63,105 | $ | 73,982 | |||||||||

Total stockholders’ equity | 38,481 | 29,242 | 36,901 | 37,447 | 37,822 | ||||||||||||||

On June 30, 2014, we signed and closed the sale of our Unity Managed Network Services business unit. As a result, fiscal 2014 results of operations and all prior comparative periods are recast to reflect the Unity Managed Network Services business as a discontinued operation.

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

This section is organized as follows:

Key Corporate Objectives | Our overall strategy and goals |

Significant Trends and Events | Operating, financial and other material highlights affecting our company |

Key Operating Metrics | Discussion of key metrics and measures that we use to evaluate our operating performance |

Segment Financial Information and Geographic Information | Discussion of the segment of our business: Mobility Services |

Critical Accounting Policies and Estimates | Accounting policies and estimates that we believe are most important to understanding the assumptions and judgments incorporated in our reported financial results |

Results of Operations | An analysis of our financial results comparing the years ended December 31, 2014, December 31, 2013 and December 31, 2012 |

Liquidity and Capital Resources | An analysis of changes in our balance sheets and cash flows, and discussion of our financial condition and potential sources of liquidity |

Overview

We provide global enterprises and telecommunications carriers with cloud-based mobility management and Wi-Fi connectivity services.

As announced on July 1, 2014, we signed and closed the sale of our Unity Managed Network Services business unit ("Unity business") on June 30, 2014. Our Unity business was focused on delivering and managing high speed Wi-Fi and WAN managed network solutions to customers in a variety of industries. Our fourth quarter 2014 and fiscal 2014 results of operations and all prior comparative periods are recast to reflect the Unity business as a discontinued operation, and our MD&A focuses primarily on our continuing operations. For a detailed discussion of our business, see “Item 1. Business.”

Key Corporate Objectives

We are focused on driving revenue growth and profitability by adding new customers through brand awareness, improving our customer activation rates, and optimizing end user experience. Our plan is to continue to expand the strategic value of our business by leveraging our mobility assets to address both large and compelling market opportunities and to execute on key growth initiatives in our business. For a detailed discussion regarding our key corporate objectives, see section entitled “Our Strategy” under “Item 1. Business.”

Significant Trends and Events

16

The following describes significant trends and events that impacted our financial condition, results of operations, and/or the direction of our business in 2014:

Continued Focus on Growing Users

We have continued to show solid progress against two key metrics: (i) the number of active OM Platform Active users; and (ii) the number of OP Wi-Fi Network users. During 2014, we grew our Open Mobile Platform users from 622,000 for the fourth quarter of 2013 to 814,000 for the fourth quarter of 2014. We grew our Open Mobile Wi-Fi Network users from 67,000 for the fourth quarter of 2013 to 84,000 for the fourth quarter of 2014. Our Open Mobile growth has been driven by a combination of organic customer user and usage ramps, legacy platform customer migrations, and new enterprise customer acquisition. We are focused on growing Open Mobile revenues by growing these two key metrics. See “Key Operating Metrics” below for a full discussion of our user metrics.

Broadened our Wholesale OMX Distribution Channels

Our OMX business was originally developed as a wholesale product for our carrier partners to resell Wi-Fi network access to their end-users. While this is still a viable distribution channel for the OMX business, in 2014 we saw success in broadening that wholesale distribution to a variety of other reseller partners, including original equipment manufacturers (OEMs), premium branding partners, and software product and service providers. Opening these new distribution channels in 2014 resulted in growing OMX revenue by 29% year over year and has provided new opportunities to monetize our Wi-Fi network with consumers.

Sold our Unity Managed Network Services Business

We announced on July 1, 2014, that we signed and closed the sale of the Unity business on June 30, 2014. Our fourth quarter 2014 results of operations and all prior comparative periods are recast to reflect the Unity business as a discontinued operation. Selling our non-strategic Unity business has allowed management to focus time and resources fully on our OM business.

Actively Managed the Wind Down of our Legacy Revenues

We define our legacy revenue to include Dial-up and 3G network, our iPC platform, and iPC user driven network usage. Legacy revenues represented 17% of our 2014 revenue, down from 38% for 2013. We exited the fourth quarter of 2014 with legacy revenue representing 11% of revenue for the quarter. We have actively terminated supply agreements for dial and 3G services and will continue to wind down those revenue streams. We have migrated a significant portion of our iPC users to OM and will continue to migrate or terminate the remaining iPC users.

Key Operating Metrics

Described below are key metrics that we use to evaluate our operating performance and our success in transforming our business and driving future growth.

OM Wi-Fi Network Users

OM Wi-Fi Network Users is the number of our platform users each month in a given quarter that paid for Wi-Fi network services from iPass.

OM Platform Active Users

OM Platform Active Users is the number of users who were billed Open Mobile platform fees and who have used or deployed Open Mobile.

The following table summarizes the number of active users of iPass OME services (in thousands). Each metric below is calculated as the average number of active users per month, during a given quarter, for which a fee was billed by iPass for either Wi-Fi or Platform services:

For the Quarter Ended | ||||||||||||||

December 31, 2014 | September 30, 2014 | June 30, 2014 | March 31, 2014 | December 31, 2013 | ||||||||||

Wi-Fi Network Users | 84 | 78 | 80 | 71 | 67 | |||||||||

Active Platform Users | 814 | 765 | 753 | 681 | 622 | |||||||||

Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (“Adjusted EBITDA”)

17

Adjusted EBITDA is used by our management as a measure of operating efficiency, financial performance and as a benchmark against our peers and competitors. In addition, we also use this metric as a factor in our incentive compensation payouts. Management also believes that Adjusted EBITDA is useful to investors because it is frequently used by securities analysts, investors and other interested parties to understand our performance excluding the impact of items which may obscure trends in our core operating performance. Furthermore, the use of Adjusted EBITDA facilitates comparisons with other companies in our industry which may use similar financial measures to supplement their GAAP (accounting principles generally accepted in the United States) results. We define Adjusted EBITDA as net loss adjusted for interest, income taxes, depreciation and amortization, stock-based compensation, restructuring charges, net income (loss) from discontinued operations, collection of previously written off bad debt expense from bankruptcy proceeding, certain state sales and federal tax items and other discrete items, and other non-operating income. We adjust for these excluded items because we believe that, in general, these items possess one or more of the following characteristics: their magnitude and timing is largely outside of our control; they are unrelated to the ongoing operation of the business in the ordinary course; they are unusual or infrequent and we do not expect them to occur in the ordinary course of business; or non-cash expenses involving stock option grants and restricted stock issuances. Adjusted EBITDA is not a measure determined in accordance with GAAP and should not be considered in isolation or as a substitute for operating income (loss), net income (loss) or any other measure determined in accordance with GAAP.

The following table reconciles Adjusted EBITDA to GAAP net loss (in thousands):

Year Ended December 31, | |||||||||||

2014 | 2013 | 2012 | |||||||||

Adjusted EBITDA income (loss) | $ | (13,651 | ) | $ | (9,368 | ) | $ | (1,736 | ) | ||

Interest income (expense) | (119 | ) | (18 | ) | 19 | ||||||

Income tax benefit (expense) | 7,101 | 782 | 269 | ||||||||

Depreciation of property and equipment | (3,154 | ) | (2,397 | ) | (2,010 | ) | |||||

Amortization of intangible assets | — | — | (169 | ) | |||||||

Stock-based compensation | (1,996 | ) | (3,061 | ) | (2,346 | ) | |||||

Restructuring (charges) benefit | (733 | ) | (653 | ) | (26 | ) | |||||

Other non-operating income | 2 | 10 | 8 | ||||||||

Collection of previously written off bad debt expense from bankruptcy proceeding | 345 | — | — | ||||||||

Net income (loss) from discontinued operations | 19,179 | 2,393 | 1,613 | ||||||||

GAAP Total Net income (loss) | $ | 6,974 | $ | (12,312 | ) | $ | (4,378 | ) | |||

Segment Financial Information and Geographic Information

On June 30, 2014 we entered into an agreement and completed the sale of our Unity business segment, which is reported in this filing as discontinued operations. Therefore, we currently have a single reportable operating

segment, Mobility Services.

Mobility Services reflects our two primary areas of mobility services, (i) enterprise mobility services that consist of Open Mobile Enterprise services, our legacy enterprise mobility services and other ancillary services including professional consulting and other value-add services, and (ii) our Open Mobile Exchange services that were launched in 2011.

For a more complete discussion of business risks that Mobility Services faces see the discussion that appears in Part I, “Item 1A. Risk Factors,” of this Form 10-K.

For further information on the Mobility Services segment and geographic information, refer to the information contained in Note 14, “Segment and Geographic Information,” in the Notes to the Consolidated Financial Statements included in Item 15. For risks attendant to foreign operations, see the risk entitled “Because a meaningful portion of our business is international, we encounter additional risks, which may impact our revenues and profitability” in “Item 1A. Risk Factors” of this Form 10-K.

Critical Accounting Policies and Estimates

Our discussion and analysis of our financial condition and results of operations is based upon our consolidated financial statements which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these consolidated financial statements requires us to make estimates and judgments that affect the

18

reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. We base our estimates and judgments on our historical experience, knowledge of current conditions and our belief of what could occur in the future considering available information, including assumptions that are believed to be reasonable under the circumstances. By their nature, these estimates and judgments are subject to an inherent degree of uncertainty and actual results could differ materially from the amounts reported based on these policies. On an ongoing basis, we evaluate our estimates, including those related to revenue recognition. We believe our most significant estimates, judgments and assumptions used in the preparation of our consolidated financial statements are used in the following critical accounting policies.

Revenue Recognition

Our revenue recognition policy requires us to make certain estimates and judgments, for example, in the recognition of monthly minimum commitment (“MMC”) revenue.

For customers that have agreed to a MMC fee in connection with network usage, such customer’s monthly invoice reflects the greater of the customer’s actual usage during the month or the customer’s contractually committed monthly minimum for that month. If the MMC exceeds actual usage (“Shortfall”), we determine whether the Shortfall is fixed or determinable in accordance with the revenue recognition criteria. If we conclude that the Shortfall is fixed or determinable, based upon customer specific collection history, and all other revenue recognition criteria have been met, we recognize as revenue the amount of the Shortfall which is invoiced. If the customer is in a Shortfall situation and it is determined that the Shortfall is not fixed or determinable, we recognize revenue only when the Shortfall is collected.

Performance -Based Restricted Stock Awards

Certain restricted stock awards have performance-based goals based on the achievement of targeted quarterly revenue of Open Mobile or targeted EBITA, which require an assessment of the probability and timing of vesting. We amortize stock-based compensation expense for performance-based awards on a graded vesting basis over the vesting period, after assessing probability of achieving the requisite performance criteria. Estimating the time in which we expect to achieve the requisite performance criteria requires judgment. If events or circumstances occur that cause us to revise our estimated vest dates, we recognize the unamortized expense prospectively over the revised estimated vesting period. Such a change in estimated vest dates could have a material impact on our financial statements. We believe vesting of all performance-based restricted stock awards is probable at December 31, 2014.

Recently Issued Accounting Standards

In July 2013, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2013-11, Income Taxes: Presentation of an Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists. ASU 2013-11 requires the unrecognized tax benefit to be presented as a reduction of a deferred tax asset for a net operating loss carryforward, or similar tax loss or tax credit carryforward, except that, if a net operating loss carryforward, a similar tax loss or a tax credit carryforward is not available at the reporting date to settle any additional income taxes that would result from the disallowance of a tax position, then the unrecognized tax benefit should be presented as a liability. ASU No. 2013-11 is effective prospectively for fiscal years, and interim periods within those years beginning after December 15, 2013. The adoption of ASU No. 2013-11 has not had a material impact on our financial position or results of operations.

In April 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2014-08, Presentation of Financial Statements (Topic 205) and Property, Plant, and Equipment (Topic 360) Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity. ASU 2014-08 changes the requirements for reporting discontinued operations under current U.S. GAAP (Accounting Standards Codification Subtopic 205-20 Discontinued Operations, “ASC 205-20”) and provides a new definition of discontinued operations. ASU No. 2014-08 is effective prospectively for fiscal years, and interim periods within those years beginning after December 15, 2014. Early adoption is permitted, but only for disposals (or classifications as held for sale) that have not been reported in financial statements previously issued or available for issuance. We have not adopted ASU 2014-08 in the current fiscal year. We do not expect that this guidance will materially impact our consolidated financial statements.

On May 28, 2014, the FASB issued ASU No. 2014-09, Revenue from Contracts with Customers, which requires an entity to recognize the amount of revenue to which it expects to be entitled for the transfer of promised goods or services to customers. The ASU will replace most existing revenue recognition guidance in U.S. GAAP when it becomes effective. The new standard is effective for us on January 1, 2017. Early application is not permitted. The standard permits the use of either

19

the retrospective or cumulative effect transition method. We are evaluating the effect that ASU 2014-09 will have on our consolidated financial statements and related disclosures. We have not yet selected a transition method nor have we determined the effect of the standard on our ongoing financial reporting.

On August 27, 2014, the FASB issued ASU No. 2014-15, Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern, which requires management to assess an entity's ability to continue as a going concern, and provide related footnote disclosures in certain circumstances. The new standard is effective for us in the first annual period ending after December 31, 2016. Early adoption is permitted. We have not adopted ASU 2014-15 in the current fiscal year. We do not expect that this guidance will materially impact our consolidated financial statements.

Results of Operations

Sources of Revenues

On June 30, 2014, we entered into an agreement and completed the sale of our Unity business. Accordingly, we currently have a single reportable operating segment, Mobility Services, and analyze revenue from continuing operations. Within Mobility Services, we differentiate and analyze our Open Mobile and legacy generated revenues separately.

Open Mobile generated revenues consist of:

• | Network—Wi-Fi and minimum customer commitments based on the number of network users sourced from the Open Mobile platform. |

• | Platform—Fees based on the number of Open Mobile Platform Active users and other fees specific to providing additional value add services to Open Mobile customers. |

• | Open Mobile Exchange—Revenues generated from our OMX customers. |

Legacy generated revenues consist of Dial-up and 3G network, our iPC platform, and related platform services, as well as iPC driven network usage, including iPC user driven Wi-Fi and minimum commit shortfall.

For the Year Ended December 31, | |||||||||||

2014 | 2013 | 2012 | |||||||||

(in thousands) | |||||||||||

Mobility Services | $ | 69,804 | $ | 77,729 | $ | 92,530 | |||||

Open Mobile | 57,737 | 47,915 | 27,057 | ||||||||

Open Mobile Enterprise: | 54,697 | 45,553 | 26,271 | ||||||||

Network | 38,625 | 29,710 | 13,963 | ||||||||