UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. 1)

Filed by the Registrant o

Filed by a Party other than the Registrant x

Check the appropriate box:

x Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2))

¨ Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Under Rule 14a-12

|

IPASS INC.

|

|

(Name of Registrant as Specified in Its Charter)

|

|

CATALYSIS PARTNERS, LLC

CATALYSIS OFFSHORE LTD.

FRANCIS CAPITAL MANAGEMENT, LLC

FOXHILL OPPORTUNITY FUND, L.P.

FOXHILL CAPITAL (GP), LLC

FOXHILL CAPITAL PARTNERS, LLC

MAGUIRE FINANCIAL, LP

MAGUIRE ASSET MANAGEMENT, LLC

ZUMA CAPITAL MANAGEMENT LLC

ZCM OPPORTUNITIES FUND LP

JOHN P. FRANCIS

NEIL WEINER

TIMOTHY MAGUIRE

BRENT S. MORRISON

RICHARD A. KARP

DAMIEN J. PARK

NORMAN J. RICE

KENNETH H. TRAUB

|

|

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

¨ Fee paid previously with preliminary materials:

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(1) Amount previously paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED MAY 13, 2015

IPASS SHAREHOLDERS FOR CHANGE

May [__], 2015

Dear Fellow iPass Stockholders:

We are a group of concerned investors of iPass Inc. (“iPass” or the “Company”) led by Maguire Asset Management, LLC, Francis Capital Management, LLC and Foxhill Opportunity Fund, L.P. who have organized as iPass Shareholders for Change. Collectively, iPass Shareholders for Change beneficially owns an aggregate of 5,896,874 shares of common stock of iPass, par value $0.001 per share (the “Common Stock”), or approximately 9.0% of the Company’s outstanding shares, which represents one of the Company’s largest stockholdings. We have nominated a slate of five (5) highly qualified director candidates for election to the Company’s board of directors (the “Board”) at iPass’ upcoming 2015 annual meeting of stockholders (the “Annual Meeting”). We did so because we believe that the Board must be significantly reconstituted in order to ensure that the Company is being run in a manner consistent with the best interests of stockholders.

Over the years, certain members of our investment group have attempted to maintain a constructive and cordial relationship with the Company’s management and members of the Board with the hope that their value improvement recommendations would be taken seriously and implemented for the benefit of all stockholders. The dialogue has covered many issues and serious concerns regarding, among other things, the Company’s business strategy, underperformance, strategic alternatives review process, poor capital allocation decisions, executive compensation, bloated expenses, and poor corporate governance practices, all for the purpose of helping to fundamentally improve the business. Unfortunately, the Board has maintained the troubling status quo and, to date, has failed to meaningfully address our serious concerns.

In our opinion, the most effective way to enhance stockholder value and to restore investor confidence at iPass is by immediately reconstituting the Board with our five (5) highly-qualified director candidates. We believe that these director nominees collectively have the experience, independence, and stockholder-oriented mindset to oversee and implement the changes necessary to drive substantial value creation. If elected, our nominees will bring a fresh perspective into the boardroom, undergo a thorough examination of the recently abandoned strategic alternatives review, act as advocates for all stockholders, and ensure that management is compensated appropriately and ultimately held accountable for its performance.

We have recently attempted to work constructively with the Company to reconstitute the Board with a group of highly qualified director candidates. Despite the Board’s continued indications that it wishes to work with us to address our concerns, there has been no meaningful progress in our discussions to date. Further, on April 21, 2015, the Company announced that the Board unilaterally increased the size of the Board from five (5) to seven (7) directors and has nominated a slate of seven (7) directors for election to the Board at the Annual Meeting. We believe this action by the Board represents a manipulation of the Company’s corporate governance mechanics designed to disenfranchise stockholders and frustrate our lawful proxy solicitation. We believe the effect and purpose of having announced this increase in the size of the Board from five (5) to seven (7) members at this late date and more than six (6) weeks after we nominated what we believed to be a full slate of five (5) director candidates and without ample time for us to properly identify two (2) additional candidates, is to ensure that two (2) of the Company’s director nominees are elected to the Board at the Annual Meeting. Also, perhaps even more disadvantageous to us is that the Company’s unilateral action at this late stage precludes any stockholder wishing to vote for our slate of nominees on our proxy card from voting for two (2) seats on the Company’s Board since we cannot permit stockholders to vote for any of the Company’s nominees on our proxy card.

We are therefore seeking your support at the Annual Meeting to elect our five (5) highly qualified director candidates, who, if elected, would constitute a majority of the Board, and who are committed to reexamining the Company’s current strategy and focusing on specific opportunities to enhance value for stockholders.

As discussed above, the Board is currently composed of seven (7) directors, all of whom are up for election at the Annual Meeting. We are seeking your support at the Annual Meeting to elect our five (5) nominees in opposition to the Company’s director nominees. iPass Shareholders for Change believes that any further attempt to increase or decrease the size of the current Board or to classify the Board would constitute an improper manipulation of iPass’ corporate machinery.

We urge you to carefully consider the information contained in the attached proxy statement (the “Proxy Statement”) and then support our efforts by signing, dating, and returning the enclosed [COLOR] proxy card today. The attached Proxy Statement and the enclosed [COLOR] proxy card are first being furnished to the stockholders on or about May __, 2015.

If you have already voted for the incumbent management slate, you have every right to change your vote by signing, dating, and returning a later dated proxy or by voting in person at the Annual Meeting.

If you have any questions or require any assistance with your vote, please contact [__________],which is assisting us, at its address and toll-free numbers listed below.

|

Thank you for your support.

|

|

/s/ Timothy Maguire

|

|

Timothy Maguire

|

|

On behalf of iPass Shareholders for Change

|

|

If you have any questions, require assistance in voting your [COLOR] proxy card,

or need additional copies of iPass Shareholders for Change’s proxy materials,

please contact [_______] at the phone numbers or email listed below.

[______________]

[______________]

Stockholders Call Toll-Free at: [ ]

E-mail: [ ]

|

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED MAY 13, 2015

2015 ANNUAL MEETING OF STOCKHOLDERS

OF

IPASS INC.

_________________________

PROXY STATEMENT

OF

IPASS SHAREHOLDERS FOR CHANGE

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED [COLOR] PROXY CARD TODAY

Foxhill Opportunity Fund, L.P. (“Foxhill Opportunity”), Foxhill Capital (GP), LLC (“Foxhill GP”), Foxhill Capital Partners, LLC (“Foxhill Capital”), Neil Weiner, Catalysis Partners, LLC (“Catalysis Partners”), Catalysis Offshore Ltd. (“Catalysis Offshore”), Francis Capital Management, LLC (“Francis Capital Management”), John P. Francis, Maguire Financial, LP (“Maguire Financial”), Maguire Asset Management, LLC (“Maguire Asset Management”), Timothy Maguire, Zuma Capital Management LLC (“ZCM”), ZCM Opportunities Fund LP (“ZCM Fund”), Brent S. Morrison, Richard A. Karp, Damien J. Park, Norman J. Rice, III and Kenneth H. Traub (collectively, “iPass Shareholders for Change” or “we”) are significant stockholders of iPass Inc., a Delaware corporation (“iPass” or the “Company”), who, together with the other participants in this solicitation, beneficially own in the aggregate approximately 9.0% of the outstanding shares of common stock, par value $0.001 per share (the “Common Stock”), of the Company.

We are seeking to elect five (5) highly-qualified nominees to the Company’s Board of Directors (the “Board”) because we believe that the Board must be significantly reconstituted to ensure that the interests of the stockholders, the true owners of iPass, are appropriately represented in the iPass boardroom. We have nominated directors who have strong, relevant backgrounds and who are committed to fully exploring all opportunities to unlock stockholder value. We are seeking your support at the Company’s 2015 Annual Meeting of Stockholders, scheduled to be held on Tuesday, June 30, 2015, at 9:00 a.m. local time at iPass’ offices located at 3800 Bridge Parkway, Redwood Shores, CA 94065 (including any adjournments or postponements thereof and any meeting which may be called in lieu thereof, the “Annual Meeting”), for the following:

|

|

1.

|

To elect iPass Shareholders for Change’s five (5) director nominees, Richard A. Karp, Brent S. Morrison, Damien J. Park, Norman J. Rice, III and Kenneth H. Traub (each a “Nominee” and, collectively, the “Nominees”), to the Board to hold office until the 2016 Annual Meeting of Stockholders (the “2016 Annual Meeting”) and until their respective successors have been duly elected and qualified;

|

|

|

2.

|

To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2015;

|

|

|

3.

|

To consider and approve an advisory (non-binding) proposal concerning the Company’s executive compensation program; and

|

|

|

4.

|

To transact such other business as may properly come before the Annual Meeting.

|

We are seeking to elect a majority of the Board. This proxy statement (the “Proxy Statement”) is soliciting proxies to elect only our Nominees. Accordingly, the enclosed [COLOR] proxy card may only be voted for our Nominees and does not confer voting power with respect to any of the Company’s director nominees. Accordingly, by voting on the enclosed [COLOR] proxy card, you will only be able to vote for our five (5) Nominees and not for a full slate of seven (7) director nominees. See “Voting and Proxy Procedures” on page [__] for additional information. You can only vote for the Company’s director nominees by signing and returning a proxy card provided by the Company. Stockholders should refer to the Company’s proxy statement for the names, backgrounds, qualifications and other information concerning the Company’s nominees.

As of the date hereof, the members of iPass Shareholders for Change collectively beneficially own 5,896,874 shares of Common Stock (the “iPass Shareholders for Change Shares”). We intend to vote all of the iPass Shareholders for Change Shares that are eligible to vote FOR the election of the Nominees, [FOR/AGAINST] the ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm, and [FOR/AGAINST] an advisory (non-binding) proposal concerning the Company’s executive compensation program, as described herein.

The Company has set the close of business on May 15, 2015 as the record date for determining stockholders entitled to notice of and to vote at the Annual Meeting (the “Record Date”). The mailing address of the principal executive offices of the Company is 3800 Bridge Parkway, Redwood Shores, California 94065. Stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. According to the Company, as of the Record Date, there were [______] shares of Common Stock outstanding.

THIS SOLICITATION IS BEING MADE BY IPASS SHAREHOLDERS FOR CHANGE AND NOT ON BEHALF OF THE BOARD OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH IPASS SHAREHOLDERS FOR CHANGE IS NOT AWARE OF AT A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED [COLOR] PROXY CARD WILL VOTE ON SUCH MATTERS IN OUR DISCRETION.

IPASS SHAREHOLDERS FOR CHANGE URGES YOU TO SIGN, DATE AND RETURN THE [COLOR] PROXY CARD IN FAVOR OF THE ELECTION OF THE NOMINEES.

IF YOU HAVE ALREADY SENT A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED IN THIS PROXY STATEMENT BY SIGNING, DATING, AND RETURNING THE ENCLOSED [COLOR] PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting—

This Proxy Statement and our [COLOR] proxy card are available at

This Proxy Statement and our [COLOR] proxy card are available at

http://www.[ ]

______________________

2

IMPORTANT

Your vote is important, no matter how few shares of Common Stock you own. iPass Shareholders for Change urges you to sign, date, and return the enclosed [COLOR] proxy card today to vote FOR the election of the Nominees and in accordance with iPass Shareholders for Change’s recommendations on the other proposals on the agenda for the Annual Meeting.

|

|

·

|

If your shares of Common Stock are registered in your own name, please sign and date the enclosed [COLOR] proxy card and return it to iPass Shareholders for Change, c/o [_________] in the enclosed postage-paid envelope today.

|

|

|

·

|

If your shares of Common Stock are held in a brokerage account or bank, you are considered the beneficial owner of such shares of Common Stock, and these proxy materials, together with a [COLOR] voting form, are being forwarded to you by your broker or bank. As a beneficial owner, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your shares of Common Stock on your behalf without your instructions.

|

|

|

·

|

Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed voting form.

|

Since only your latest dated proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you return the management proxy card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card you may have previously sent to us. Remember, you can vote for our five (5) Nominees only on our [COLOR] proxy card. So please make certain that the latest dated proxy card you return is the [COLOR] proxy card.

|

[_________________]

[_________________]

Stockholders Call Toll-Free at: [ ]

E-mail: [ ]

|

3

Background to the Solicitation

The following is a chronology of material events leading up to this proxy solicitation:

|

|

·

|

On September 18, 2008, Neil Weiner, the Managing Member of Foxhill Opportunity, sent a letter to the Company’s Chairman and lead independent director, John D. Beletic, describing stockholder displeasure with the Board. This displeasure was evidenced by the significant number of stockholders who withheld their votes for two (2) of the Company’s independent directors, including Mr. Beletic. In the letter, Mr. Weiner also reiterated his request that the Company immediately commence a sale process.

|

|

|

·

|

On November 3, 2008, the Company announced that in June 2008 it had engaged an investment-banking firm to explore strategic alternatives. Without disclosing the name of the firm or the details of the alternatives considered, the Board unanimously decided to continue to remain independent and instead focus on an independent strategy.

|

|

|

·

|

On February 27, 2009, Foxhill Opportunity Master Fund, L.P. (“Foxhill Master Fund”) delivered a letter to the Company nominating three (3) candidates for election to the Board.

|

|

|

·

|

On June 2, 2009, the Company and Foxhill Master Fund and its affiliates entered into a settlement agreement whereby, among other things, the Company agreed to add Mr. Traub to the Board and to return up to $40 million to stockholders by the end of 2009 through a share repurchase, cash dividend or other form determined by the Board. In exchange, Foxhill Master Fund withdrew its nomination to elect three (3) nominees at the 2009 annual meeting of stockholders.

|

|

|

·

|

On June 3, 2009, the Company issued a press release announcing the settlement agreement and disclosing the Board’s intention to add Gary Griffiths to the Board.

|

|

|

·

|

On March 20, 2013, Mr. Traub notified the Company that he was declining to stand for re-election to the Board at the 2013 annual meeting of stockholders.

|

|

|

·

|

On May 28, 2014, a representative of ZCM, which also employs one (1) of our Nominee’s, Brent Morrison, had a call with the Company’s CFO to discuss the Company’s expense structure, sales strategy and industry fundamentals. The broader purpose of the meeting was to better understand the Company’s product offering and poor financial performance.

|

|

|

·

|

On September 8, 2014, the Company issued a press release announcing that it had retained Blackstone Advisory Partners, L.P. as its financial advisor to examine strategic alternatives.

|

|

|

·

|

On September 15, 2014, Mr. Francis, Manager of Francis Capital Management, had a call with the Company’s CEO to discuss the Company’s business strategy as well as the announcement that the Company was examining strategic alternatives. During this meeting, Mr. Francis expressed his concerns about the Company’s expense structure and capital allocation policies.

|

|

|

·

|

On November 18, 2014, representatives of Francis Capital Management and ZCM had a call with the Company’s CEO and CFO to discuss the Company’s business strategy, capital allocation plans and process for evaluating strategic alternatives. During this meeting, representatives of Francis Capital Management expressed their view that the Company’s optimal strategic alternative option was to sell itself to the highest bidder.

|

4

|

|

·

|

On December 2, 2014, representatives of each of Francis Capital Management and ZCM met separately with the Company’s CEO and CFO to discuss the Company’s business strategy and process for evaluating its strategic alternatives. Also discussed during the meetings were the business environment and industry trends. During the meetings, Mr. Morrison and representatives of Francis Capital Management recommended that the Company be sold.

|

|

|

·

|

On February 18, 2015, the Company issued a press release announcing the conclusion of the strategic alternatives review process initiated in September 2014. The Company declared its commitment to remain independent and publicized the appointment of Board member Gary Griffiths as the Company’s new CEO.

|

|

|

·

|

On February 20, 2015, representatives of ZCM, including Mr. Morrison, had a call with the Company’s CFO and new CEO to discuss business trends as well as the conclusion of the strategic alternatives process. During this meeting, Mr. Morrison expressed his concerns related to the sales process and future direction of the Company.

|

|

|

·

|

On March 4, 2015, Catalysis Partners, the director nominating entity of Francis Capital Management, delivered a letter to the Company notifying it that in accordance with the Company’s bylaws (the “Bylaws”), Catalysis Partners was nominating Messrs. Karp, Morrison, Park, Rice and Traub for election to the Board at the Annual Meeting.

|

|

|

·

|

On March 5, 2015, a call took place among Messrs. Francis and Park and the Company’s Chairman, Mr. Beletic. The parties discussed the need for change in Board composition, the Company’s decision to abandon its plan to sell itself, the abrupt termination of the Company’s CEO, and the decision of the Board to hire Board member Gary Griffiths as the new CEO.

|

|

|

·

|

On March 23, 2015, a call took place among Gary Griffiths, the Company’s recently appointed CEO, and Messrs. Beletic, Francis and Park. During the call the parties discussed the Company’s strategy, sales goals, expense structure and Board composition. At that time, Mr. Beletic noted that, following a Board meeting the previous week, the Board would be willing to expand itself by two (2) members, for a total of seven (7) members, and choose one (1) of Francis Capital Management’s nominees to fill one (1) of the two (2) vacancies. The second vacancy would be filled by a mutually agreed upon candidate that may or may not be chosen from Francis Capital Management’s nominees. Francis Capital Management rejected the offer as insufficient reform but emphasized its willingness to work constructively with the Company to enhance the Board and to avoid a costly proxy contest.

|

|

|

·

|

On April 15, 2015, a call took place among Messrs. Francis, Park and Griffiths. During the call the parties discussed Mr. Griffiths’ ideas and plans for the business. Messrs. Park and Francis explained the need to reconstitute the Board in order to protect and enhance stockholder value. While all parties agreed that there is a preference to resolve matters without having a costly and distracting proxy contest, Mr. Griffiths did not offer any new or substantive proposal to reconstitute the Board.

|

5

|

|

·

|

On April 16, 2015, iPass Shareholders for Change issued an open letter to stockholders of the Company stating that over the past seven (7) years certain members of iPass Shareholders for Change have attempted to maintain a constructive and cordial relationship with the Company’s management and Board to discuss their value improvement recommendations and serious concerns regarding, among other things, the Company’s business strategy, underperformance, strategic alternatives review process, poor capital allocation decisions, executive compensation, bloated expenses, and poor corporate governance practices, all for the purpose of helping to fundamentally improve the business. In the letter, iPass Shareholders for Change expressed its profound disappointment with the outcome of its engagement with the Company and the current Board’s apparent failure to protect and enhance stockholder value. iPass Shareholders for Change also expressed its belief that the problematic status quo and troubling underperformance at the Company is largely a result of a failure of the Board and that new leadership is not only warranted, but long overdue.

|

|

|

·

|

On April 21, 2015, the Company announced that the Board appointed two new directors, David Panos and Laurance “Lo” Toney, to serve on the Board until the Annual Meeting.

|

|

|

·

|

On April 23, 2015, the Company filed a preliminary proxy statement with the Securities and Exchange Commission on Form PREC14A.

|

|

|

·

|

Certain members of iPass Shareholders for Change have been engaged in ongoing settlement discussions with certain representatives of the Company.

|

6

REASONS FOR THE SOLICITATION

We are soliciting your support to elect our Nominees at the Annual Meeting because we have little confidence that the Board, as currently composed, has the objectivity and commitment to take the steps necessary to enhance stockholder value at iPass. We believe that the Board needs to be reconstituted with directors that have the experience, the independence, and the stockholder-oriented mindset to oversee and implement the changes necessary to drive substantial value.

WE ARE CONCERNED ABOUT THE COMPANY’S PROLONGED UNDERPERFORMANCE

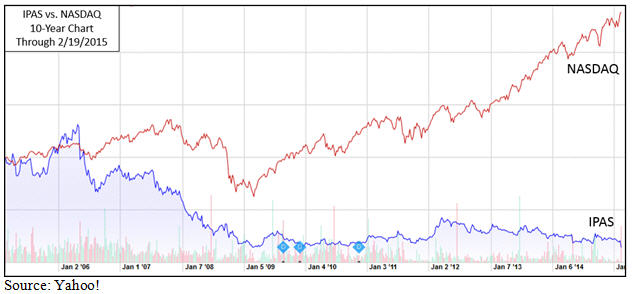

Over the past one (1), three (3), five (5) and ten (10) year periods, the Company’s stock price has generated a negative return and has underperformed the NASDAQ Composite Index, through February 19, 2015, during each time frame.

WE ARE CONCERNED THAT THE COMPANY LACKS A DETAILED PLAN TO RETURN TO PROFITABILITY, WHICH FURTHER EXPOSES STOCKHOLDERS TO CONTINUING FINANCIAL LOSSES

Management has indicated that its operational strategy is limited to doubling-down and continuing its attempts to grow the business using limited stockholder funds. During the fiscal fourth quarter of 2014 earnings call, the former President and CEO, Evan Kaplan, and Mr. Griffiths failed to articulate a clear plan to curtail financial losses or to solve fundamental problems with the business. Instead, they simply stated that “there is no option but change… [and] you can expect change across many fronts,” and mentioned newly signed enterprise customers without acknowledging how fundamental problems will be solved or when the Company will be profitable. Even more concerning, management announced financial results were going to worsen before a turnaround is expected. We fear continued financial losses will force the Company to make constrained strategic decisions as a result of the dissipation of all its excess cash, further destroying stockholder value.

We believe Mr. Griffiths’ credibility further diminished on the Company’s first quarter 2015 earnings call when he indicated the business may be able to achieve profitability when revenues reach $80 million annually. However, instead of detailing a specific timeline to achieve this, or whether it can ever be accomplished, Mr. Griffiths instead stated, “…I won’t pin a date on that profitability now….”

7

WE ARE CONCERNED THAT THE BOARD’S LEADERSHIP HAS BEEN INEFFECTIVE AND UNACCOUNTABLE

John D. Beletic joined the Board in November 1999; the Company went public in July 2003 at $14 per share and in 2003 iPass shares traded above $20 per share. At the Company’s annual meeting of stockholders held on May 29, 2008, holders of more than twenty-seven percent (27%) of iPass stock withheld their votes for Mr. Beletic in an uncontested election. Notwithstanding what we believe to be a strong showing of dissatisfaction by the iPass stockholders, in November 2008, the Board promoted Mr. Beletic to Chairman, a position he has held ever since despite the Company’s continued failures and stockholder value destruction.

WE BELIEVE THAT CRONYISM MAY EXIST ON THE BOARD AND WITHIN MANAGEMENT THAT MAY HAVE UNDERMINED EFFECTIVE GOVERNANCE AND MAY HAVE CONTRIBUTED TO STOCKHOLDER VALUE EROSION

In November 2008, the Company hired Evan Kaplan as President and CEO. Mr. Kaplan is a close personal friend of Mr. Beletic. Notwithstanding such close personal friendship, Mr. Beletic continued not only as Chairman but also as a member of the Compensation Committee, on which he approved significant bonus awards, salary raises and stock grants to Mr. Kaplan despite the failure of the Company to perform well and the continued destruction of stockholder value. Further, upon Mr. Kaplan’s departure from the Company, and in addition to a rich severance package, the Board agreed to significantly extend the exercisability of Mr. Kaplan’s options through March 6, 2017.

Further, Mr. Beletic and Mr. Majiteles have affiliations outside of iPass as they are both currently Operating Partners affiliated with venture capital firm Oak Investment Partners. Mr. Griffiths has been a member of the Board since June 2009, and he was Chairman of the Compensation Committee the entire duration of his tenure on the Board until he became CEO of the Company in February 2015. Most troubling, the Board has failed to provide its stockholders information that justifies its decision to appoint one of its members to the position of CEO.

WE ARE CONCERNED THAT THE COMPANY ANNOUNCED IT WOULD CONDUCT A PROCESS TO EXPLORE STRATEGIC ALTERNATIVES BUT THEN FAILED TO RUN AN EFFECTIVE PROCESS TO MAXIMIZE STOCKHOLDER VALUE

On September 8, 2014, the Company announced in a press release that “the iPass [Board] has initiated a process to explore strategic alternatives that may enhance stockholder value.” The press release also stated, “Given the progress of [the Company’s] Open Mobile business and the interest received during the [Unity Managed Network Services business unit’s] sale process, [the Company] believe[s] that now is the right time to explore strategic alternatives to help maximize stockholder value.” In the ten (10) days following this announcement, the Company’s stock price increased fifty-five percent (55%), which we believe reflected investors’ belief that the Company would conduct a serious process to maximize stockholder value.

The Company made no public statement about this process until February 18, 2015, at which time the Company announced that it had completed the process, “concluded that it [was] in the best long-term interests of the [C]ompany to end [its] process now” and that the Company would appoint Gary Griffiths as the new CEO. The day after the Company announced that its previously announced process had failed, the Company’s stock price decreased twenty-nine percent (29%). The stock price had also decreased in the weeks preceding the announcement of failure, which begs a troubling question: who knew of the pending disclosure of failure? We believe the Board should be held accountable for its failure to enhance stockholder value as promised and to execute on a strategic alternatives process that would identify how the Company could best capitalize on the strategic assets that it has developed using a substantial amount of stockholder capital over many years.

8

WE ARE CONCERNED ABOUT THE COMPANY’S DECISION TO HIRE ONE OF ITS OWN BOARD MEMBERS, GARY GRIFFITHS, WITHOUT ANY SEARCH PROCESS AND WITHOUT ANY JUSTIFICATION ABOUT WHY HE IS THE BEST CEO FOR THE COMPANY

Mr. Griffiths has been a member of the Board since June 2009, and has helped to oversee the continued decline of the Company’s operational performance. Mr. Griffiths’ appointment as CEO was announced the same day that the Company announced the failure of the strategic alternatives process. It is not clear if the Board conducted any search for a new CEO or merely handed the most important executive position to one of its own members. Based on the Company’s performance since his appointment as CEO, it does not appear that Mr. Griffiths has the capability or credibility to reverse the Company’s failed execution and dissipation of stockholder value. In fact, upon his appointment as CEO, Mr. Griffiths was granted both 1,000,000 restricted shares and 1,750,000 stock options with an exercise price at the depressed level reflecting the Company’s announcement of its failure in the strategic alternatives process. This grant of 2.75 million restricted shares and options, or more than four percent (4%) of the Company’s shares outstanding, is particularly staggering considering (i) it was in addition to the shares that Mr. Griffiths was granted during his tenure of over five (5) years as a director, and (ii) Mr. Griffiths had, and currently has, in our opinion, no clear qualifications for the position. It is also worth noting that during Mr. Griffiths’ tenure as a director he bought no material amount of stock, which we believe signifies a lack of confidence in the Company.

WE ARE CONCERNED ABOUT THE BOARD’S POOR PERFORMANCE AND JUDGMENT RELATING TO CAPITAL ALLOCATION

The Company has often carried excess capital on its balance sheet in comparison to its industry peers, and in fact, the Company occasionally retained cash that equaled or exceeded the Company’s total equity capitalization. The settlement agreement that the Company entered into with Foxhill Master Fund and Mr. Traub in June 2009 required the Company to return $40 million to stockholders in the form of dividends and share repurchases. Other than the actions the Company took to comply with that settlement agreement, the Company has not taken any subsequent actions to return excess capital to stockholders or optimize stockholder value. On the contrary, the Company has dissipated its cash reserves with continued operating losses caused by poor execution, an excessive cost structure and excessive payments to failed executives.

WE BELIEVE THE COMPANY HAS UNFAIRLY MANIPULATED THE ELECTION OF DIRECTORS AT THE ANNUAL MEETING BY UNILATERALLY INCREASING THE SIZE OF THE BOARD

On April 21, 2015, the Company announced that the Board unilaterally increased the size of the Board from five (5) to seven (7) directors and has nominated a slate of seven (7) directors for election to the Board at the Annual Meeting. We believe this action by the Board represents a manipulation of the Company’s corporate governance mechanics designed to disenfranchise stockholders and frustrate our lawful proxy solicitation. We believe the effect and purpose of having announced this increase in the size of the Board from five (5) to seven (7) members at this late date and more than six (6) weeks after we nominated what we believed to be a full slate of five (5) director candidates and without ample time for us to properly identify two (2) additional candidates, is to ensure that two (2) of the Company’s director nominees are elected to the Board at the Annual Meeting. Also, perhaps even more disadvantageous to us is that the Company’s unilateral action at this late stage precludes any stockholder wishing to vote for our slate of nominees on our proxy card from voting for two (2) seats on the Company’s Board since we cannot permit stockholders to vote for any of the Company’s nominees on our proxy card.

9

For the reasons set forth above, we lack confidence in management’s and the Board’s ability to unlock value for the benefit of all iPass stockholders. We have identified several qualified potential directors with valuable and relevant business and financial experience that we believe will allow them to make informed decisions to explore and identify opportunities to unlock value at the Company.

10

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Board is currently composed of seven (7) directors, each with a term expiring at the Annual Meeting. We are seeking your support at the Annual Meeting to elect our five (5) Nominees: Kenneth H. Traub, Richard A. Karp, Damien J. Park, Brent S. Morrison and Norman J. Rice. If elected, our Nominees will constitute a majority of the Board.

THE NOMINEES

The following information sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions, offices, or employments for the past five (5) years of each Nominee. The nominations were made in a timely manner and in compliance with the applicable provisions of the Company’s governing instruments. The specific experience, qualifications, attributes and skills that led us to conclude that the Nominees should serve as directors of the Company are set forth above in the section entitled “Reasons for the Solicitation” and below. This information has been furnished to us by the Nominees. All of the Nominees are citizens of the United States. Mr. Karp is also a citizen of Ireland.

Richard A. Karp, age 70, is a private investor and serves as the Founder and CEO of TicTran Corp, a high-tech startup founded in January 2010. Dr. Karp served as a director of Novatel Wireless, Inc., a provider of intelligent wireless solutions, from April 2014 to December 2014. From 1986 through 2009, Dr. Karp served as chairman and CEO of Catapult Communications Corp. (formerly NASDAQ: CATT) (“Catapult”), a telecommunications company that he founded. Catapult was taken public and ultimately sold to Ixia (NASDAQ: XXIA) in 2009. Prior to founding Catapult, Dr. Karp held senior positions in the telecommunications and information systems industries. Dr. Karp holds a Bachelor of Science degree from the California Institute of Technology, a Masters degree in Math from the University of Wisconsin-Madison and a Ph.D. in Computer Science from Stanford University. iPass Shareholders for Change believes that Dr. Karp’s extensive experience in the technology industry, together with his public company management and board experience will be a valuable addition to the Board.

Brent S. Morrison, age 39, currently the Managing Director of ZCM, a position he has held since November 2011. Mr. Morrison has also served as a director of AdCare Health Systems, Inc. (NYSEMKT: ADK), a leading long-term care provider, since October 2014, where he also is a member of the Audit Committee. Prior to ZCM, Mr. Morrison was the Senior Research Analyst at the Strome Group, a private investment firm, from January 2009 to July 2012. Mr. Morrison was a Research Analyst at Clocktower Capital, LLC, a global long/short equity hedge fund based in Beverly Hills, California, from 2007 to 2009. Prior to that, he was the VP of Wilshire Associates, a financial consulting firm, from 1999 to 2007. Mr. Morrison received a MBA from the University of California at Los Angeles, with an emphasis in Finance and International Business, and a B.A. in Finance from the University of Colorado at Denver. Mr. Morrison is a Chartered Financial Analyst. iPass Shareholders for Change believes that Mr. Morrison’s financial expertise and knowledge of the wireless technology industry will be a valuable addition to the Board.

Damien J. Park, age 43, has served as the Managing Partner of Hedge Fund Solutions LLC, a consulting firm focused on public-company engagements with stockholders on issues relating to operational improvements and corporate governance, since its formation in 2004. Mr. Park has also served as the President and CEO of Hibernian Partners, Inc., a management consulting firm, since 1998. Mr. Park has also served as a director of Deer Valley Corporation, a manufacturer of factory built homes, since September 2014. In addition, Mr. Park is the Co-Chairman of The Conference Board’s Expert Committee on Shareholder Activism, and is often quoted in leading media outlets, and frequently speaks at top business schools and professional conferences contributing his perspective on issues regarding hedge fund activism, corporate governance reform, effective stakeholder communications and stockholder value improvement initiatives. He also is a founding board member of Nightlight Foundation, LLC, a non-profit organization designed to support individuals with autism through affordable, supervised residential living. Mr. Park earned a B.S. from Delaware Valley College and his MBA from Trinity College in Dublin, Ireland. iPass Shareholders for Change believes that Mr. Park’s expertise in corporate governance matters and experience in providing advisory services to public companies regarding effective stockholder communications and stockholder value improvement initiatives makes him well qualified to serve on the Board.

11

Norman J. Rice, III, age 41, has served as the Managing Partner of New Castle Capital Group, LLC, a private equity firm specializing in divestiture, management buyout and exit opportunities for organizations in the middle market, since July 2010. Mr. Rice has also served as a director of DSP Group, Inc. (NASDAQ:DSPG), a leading global provider of wireless chipset solutions for converged communications, since June 2013, where he also serves as a member of the Audit and Strategy Committees. From June 2005 until March 2009, Mr. Rice was the VP of the Communications, Media and Entertainment (CME) Vertical Business Unit of CA, Inc. (n/k/a CA Technologies, Inc.) (NASDAQ: CA), an independent enterprise information technology management software and solutions company. From March 2005 until June 2005, Mr. Rice served as Vice President of Business Development of the Aprisma Management Technologies Business Unit of Concord Communications, Inc., a provider of network service management software solutions, until its acquisition by CA, Inc. in June 2005. Prior to that, Mr. Rice was the VP of Business and Corporate Development at Aprisma Management Technologies, Inc., a company that provided Network assurance solutions, from January 2002 until its acquisition by Concord Communications, Inc. in February 2005. From May 2000 until October 2001, Mr. Rice was the director of Software Solutions and Business Development of HoustonStreet Exchange, Inc., a subsidiary of BayCorp Holdings, Ltd. (AMEX: MWH). Mr. Rice also served in technology consulting and business development roles in the United States and Europe for MicroStrategy, Inc. (NASDAQ: MSTR), from March 1999 to May 2000. In addition, Mr. Rice served as an Advisory Board Member of vKernel (n/k/a Quest Software), a then leading provider of performance and capacity management software that ensures vm performance of VMware, Hyper-V and Red Hat environments from June 2009 to January 2011. Mr. Rice has also served on the board of directors of Nitro Security Inc. (n/k/a McAfee, Inc.), a then leading provider of security information and event management (SIEM) solutions that provides complete visibility and situational awareness to protect critical information and infrastructure, from July 2007 to September 2008. Mr. Rice has worked for leading private investment firms that focus on enhancing stockholder value for technology related businesses, including as a manager in a Gores Technology Group business from September 2002 until March 2005, as a consultant for The Gores Group, LLC from June 2006 until May 2007 and as a consultant to Marlin Equity Partners, LLC from May 2007 to April 2008. Mr. Rice holds Master’s degrees in Engineering and Management from Dartmouth College and a Bachelor of Science from the University of Michigan. iPass Shareholders for Change believes that Mr. Rice’s expertise in business strategy, general management, global sales, marketing, product management and business development, will enable him to provide effective oversight of the Company.

Kenneth H. Traub, age 53, has served as the President and CEO of Ethos Management LLC, which specializes in investing in and advising companies to execute strategies to build and unlock stockholder value, since January 2009. He has also been general partner of Rosemark Capital, a private equity firm, since June 2013. From 1999 until its acquisition by JDS Uniphase Corp. (“JDSU”) in February 2008, he served as President and CEO of American Bank Note Holographics, Inc. (“ABNH”), a leading global supplier of optical security devices. Mr. Traub managed the turnaround, growth and sale of ABNH. Following the sale of ABNH, he served as Vice President of JDSU, a global leader in optical technologies and telecommunications, through September 2008. In 1994, Mr. Traub co-founded Voxware, Inc., a pioneer in voice over Internet protocol communication technologies, and served as its EVP and CFO through 1998. Previously, he served as VP of Trans-Resources, Inc., a multi-national holding company and investment manager. Mr. Traub currently serves on the boards of directors of the following Securities and Exchange Commission (the “SEC”) reporting companies: (i) Vitesse Semiconductor Corporation (NASDAQ: VTSS), a leading supplier of integrated circuit solutions for next-generation carrier and enterprise networks where he has served since March 2013, (ii) MRV Communications, Inc. (NASDAQ: MRVC), a leading provider of optical communications network equipment and integration where he has served since October 2011 and as its chairman of the board of directors since January 2012, (iii) DSP Group, Inc. (NASDAQ: DSPG), a leading global provider of wireless chipset solutions for converged communications where he has served since May 2012, and (iv) Athersys, Inc. (NASDAQ: ATHX), a biotechnology company engaged in the discovery and development of therapeutic product candidates where he has served since June 2012. He previously served on the boards of directors of (i) Phoenix Technologies Ltd. (NASDAQ: PTEC), a supplier of the basic input output system for the personal computer industry, from November 2009 until the company was sold in November 2010, (ii) IPAS, a leading global provider of mobility services for Enterprises and Carriers, from June 2009 to June 2013, (iii) MIPS Technologies, Inc. (NASDAQ: MIPS), a leading provider of industry standard processor architectures and cores, from December 2011 until the company was sold in February 2013, (iv) Xyratex Limited (NASDAQ: XRTX), a leading supplier of data storage technologies, from June 2013 until the company was sold in March 2014, and (v) Tix Corporation (OTCQX: TIXC), a provider of ticketing services, from July 2011 to January 2014. He also served as the chairman of the board of the New Jersey chapter of the Young Presidents Organization in 2010 and 2011. He received a BA from Emory College and an MBA from Harvard Business School. Mr. Traub has over 20 years of senior management, corporate governance, turnaround and transactional experience with various public and private companies. iPass Shareholders for Change believes that Mr. Traub’s wealth of executive management and board experience and corporate governance awareness from his experience as a senior executive of public companies and his current and past service as a director of public companies, including IPAS, would allow him to provide valuable advice and guidance to the Board.

12

The principal business address of Dr. Karp is c/o TicTran Corp, 849-B Independence Avenue, Mountain View, California 94043. The principal business address of Mr. Morrison is 1400 Kelton Avenue, #201, Los Angeles, California 90024. The principal business address of Mr. Park is 3521 Windridge Drive, Fell Carriage House, Doylestown, Pennsylvania 18902. The principal business address of Mr. Rice is One Middle Street, Suite 4, Portsmouth, New Hampshire 03801. The principal business address of Mr. Traub is c/o Ethos Management LLC, 90 Nassau Street, Suite 500, Princeton, New Jersey 08542.

As of the date hereof, Dr. Karp directly owns 350,000 shares of Common Stock. As of the date hereof, Mr. Morrison directly owns 3,500 shares of Common Stock. Mr. Morrison, as the Managing Director of each of ZCM Fund and ZCM, may be deemed to beneficially own the 5,600 shares of Common Stock directly owned by ZCM Fund. As of the date hereof, Mr. Park directly owns 15,000 shares of Common Stock. As of the date hereof, Mr. Rice directly owns 46,600 shares of Common Stock. As of the date hereof, Mr. Traub beneficially owns 309,722 shares of Common Stock, including 139,355 shares of Common Stock underlying certain call options exercisable within sixty (60) days hereof that were awarded to Mr. Traub in connection with his prior service on the Board.

Each of the Nominees, as a member of a “group” for the purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), may be deemed to beneficially own the shares of Common Stock owned in the aggregate by the other members of the group. Each Nominee disclaims beneficial ownership of such shares of Common Stock, except to the extent of his pecuniary interest therein. For information regarding purchases and sales of securities of the Company during the past two (2) years by the Nominees and other members of iPass Shareholders for Change, see Schedule I.

On April 16, 2015, the members of iPass Shareholders for Change entered into a Joint Filing and Solicitation Agreement in which, among other things, (a) they agreed to the joint filing on behalf of each of them of statements on Schedule 13D with respect to the securities of the Company, (b) they agreed to form a Section 13(d) group for the purposes of seeking representation on the Board at the Annual Meeting and to take any and all action necessary to achieve the foregoing, and (c) each of Catalysis Partners, Catalysis Offshore, Francis Capital Management, Mr. Francis (collectively, “Francis Capital”), Foxhill Opportunity, Foxhill GP, Foxhill Capital, Mr. Weiner (collectively, “Foxhill”), and Maguire Financial, Maguire Asset Management and Mr. Maguire (collectively, “Maguire”) agreed to bear all expenses incurred in connection with the activities set forth therein based on the number of shares of Common Stock owned in the aggregate by each of Francis Capital, Foxhill and Maguire.

Mr. Traub was previously appointed to the Board in June 2009 in connection with the Settlement Agreement, dated June 2, 2009, by and among iPass and Foxhill Master Fund and its affiliates. Mr. Traub subsequently tendered his resignation from the Board, effective just prior to the start of the Company’s 2013 annual meeting of stockholders.

13

Notwithstanding the foregoing, iPass Shareholders for Change believes that each Nominee presently is, and, if elected as a director of the Company, will be, an “independent director” within the meaning of (i) applicable NASDAQ listing standards applicable to board composition, including Rule 5605(a)(2), and (ii) Section 301 of the Sarbanes-Oxley Act of 2002. No Nominee is a member of the Company’s compensation, nominating or audit committees that is not independent under any such committee’s applicable independence standards.

If iPass Shareholders for Change is successful in electing at least four (4) of the Nominees at the Annual Meeting, then a change in control of the Board may be deemed to have occurred. Based on its review of the Company’s material contracts and agreements, including the Company’s proxy statement, the Company provides certain benefits in the event that an executive officer’s employment is involuntarily terminated following a change in control. Under the Company’s Amended and Restated Executive Corporate Transaction and Severance Benefit Plan, a “change in control” would occur in the event that the current members serving on the Board cease for any reason to constitute at least a majority of the members of the Board. Change in control benefits would only be triggered in the event that an executive officer’s employment is involuntarily terminated following a change in control and such benefits would include a lump sum cash payment based on the executive officer’s annual salary and annual bonus target, continued health benefits coverage for a period of time, and accelerated vesting of equity awards.

There are no arrangements or understandings among members of iPass Shareholders for Change or any other person or persons pursuant to which the nomination of the Nominees described herein is to be made, other than the consent by each Nominee to be named in this Proxy Statement and to serve as a director of the Company if elected as such at the Annual Meeting. None of the Nominees is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries in any material pending legal proceedings.

We do not expect that any of the Nominees will be unable to stand for election, but, in the event any Nominee is unable to serve or for will not serve, the shares of Common Stock represented by the enclosed [COLOR] proxy card will be voted for substitute nominee(s), to the extent this is not prohibited under the Bylaws and applicable law. In addition, we reserve the right to nominate substitute person(s) if the Company makes or announces any changes to the Bylaws or takes or announces any other action that has, or if consummated would have, the effect of disqualifying any Nominee, to the extent this is not prohibited under the Bylaws and applicable law. In any such case, shares of Common Stock represented by the enclosed [COLOR] proxy card will be voted for such substitute nominee(s). We reserve the right to nominate additional person(s), to the extent this is not prohibited under the Bylaws and applicable law, if the Company increases the size of the Board above its existing size or increases the number of directors whose terms expire at the Annual Meeting. Additional nominations made pursuant to the preceding sentence are without prejudice to the opinion of iPass Shareholders for Change that any attempt to increase the size of the current Board or to classify the Board constitutes an unlawful manipulation of the Company’s corporate machinery.

WE URGE YOU TO VOTE FOR THE ELECTION OF THE NOMINEES ON THE ENCLOSED [COLOR] PROXY CARD.

14

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

As discussed in further detail in the Company’s proxy statement, the Audit Committee of the Board has appointed KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2015. The Company is submitting the appointment of KPMG LLP for ratification of the stockholders at the Annual Meeting.

[WE MAKE NO RECOMMENDATION] WITH RESPECT TO THE RATIFICATION OF THE APPOINTMENT OF KPMG LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF THE COMPANY FOR ITS FISCAL YEAR ENDING DECEMBER 31, 2015 AND INTEND TO VOTE OUR SHARES [“FOR/AGAINST”] THIS PROPOSAL.

15

PROPOSAL NO. 3

ADVISORY VOTE ON THE COMPANY’S EXECUTIVE COMPENSATION

As discussed in further detail in the Company’s proxy statement, the Company is asking stockholders to indicate their support for the compensation of the Company’s named executive officers. This proposal, commonly known as a “say-on-pay” proposal, is not intended to address any specific item of compensation, but rather the overall compensation of the Company’s named executive officers and the philosophy, policies and practices described in the Company’s proxy statement. Accordingly, the Company is asking stockholders to approve, on an advisory basis, the compensation of its named executive officers, as disclosed in the Company’s proxy statement pursuant to the compensation disclosure rules of the SEC, including the Compensation Discussion and Analysis, the compensation tables and the related narrative disclosure set forth in the Company’s proxy statement. Accordingly, the Board is asking stockholders to indicate support for the following resolution:

“RESOLVED, that the compensation paid to iPass’ named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion in this Proxy Statement, is hereby APPROVED.”

According to the Company’s proxy statement, the stockholder vote on the Say-on-Pay Proposal is an advisory vote only, and is not binding on the Company or the Board.

[WE MAKE NO RECOMMENDATION] WITH RESPECT TO THIS PROPOSAL AND INTEND TO VOTE OUR SHARES [“FOR”/”AGAINST”] THIS PROPOSAL.

16

VOTING AND PROXY PROCEDURES

Stockholders are entitled to one (1) vote for each share of Common Stock held of record on the Record Date with respect to each matter to be acted on at the Annual Meeting. Only stockholders of record on the Record Date will be entitled to notice of and to vote at the Annual Meeting. Stockholders who sell their shares of Common Stock before the Record Date (or acquire them without voting rights after the Record Date) may not vote such shares of Common Stock. Stockholders of record on the Record Date will retain their voting rights in connection with the Annual Meeting even if they sell such shares of Common Stock after the Record Date. Based on publicly available information, iPass Shareholders for Change believes that the only outstanding class of securities of the Company entitled to vote at the Annual Meeting is the Common Stock.

Shares of Common Stock represented by properly executed [COLOR] proxy cards will be voted at the Annual Meeting as marked and, in the absence of specific instructions, will be voted FOR the election of the Nominees, [FOR/AGAINST] the ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm, and [FOR/AGAINST] an advisory (non-binding) proposal concerning the Company’s executive compensation program and in the discretion of the persons named as proxies on all other matters as may properly come before the Annual Meeting, as described herein.

According to the Company’s proxy statement for the Annual Meeting, the current Board intends to nominate seven (7) candidates for election at the Annual Meeting. We are seeking to change a majority of the Board. Accordingly, the enclosed [COLOR] proxy card may only be voted for the Nominees and does not confer voting power with respect to the Company’s nominees. Accordingly, by voting on the enclosed [COLOR] proxy card, you will only be able to vote for our five (5) Nominees and not for a full slate of seven (7) director nominees. You can only vote for the Company’s director nominees by signing and returning a proxy card provided by the Company. Stockholders should refer to the Company’s proxy statement for the names, backgrounds, qualifications and other information concerning the Company’s nominees. The participants in this solicitation intend to vote all of the iPass Shareholders for Change Shares in favor of the election of the Nominees.

QUORUM; BROKER NON-VOTES; DISCRETIONARY VOTING

A quorum is the minimum number of shares of Common Stock that must be represented at a duly called meeting in person or by proxy in order to legally conduct business at the meeting. For the Annual Meeting, the presence, in person or by proxy, of the holders of a majority of the shares of Common Stock outstanding as of the Record Date, will be considered a quorum allowing votes to be taken and counted for the matters before the stockholders. As of the Record Date, there were [ ] shares of Common Stock outstanding and entitled to vote. Thus, holders of [ ] shares of Common Stock must be present, or represented by proxy, at the Annual Meeting for a quorum to be considered present.

Abstentions are counted as present and entitled to vote for purposes of determining a quorum. Shares represented by “broker non-votes” also are counted as present and entitled to vote for purposes of determining a quorum. However, if you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote (a “broker non-vote”). Under rules of The NASDAQ Stock Market, your broker will not have discretionary authority to vote your shares at the Annual Meeting on any of the proposals.

If you are a stockholder of record, you must deliver your vote by mail or attend the Annual Meeting in person and vote in order to be counted in the determination of a quorum.

If you are a beneficial owner, your broker will vote your shares pursuant to your instructions, and those shares will count in the determination of a quorum. Brokers do not have discretionary authority to vote on any of the proposals at the Annual Meeting. Accordingly, unless you vote via proxy card or provide instructions to your broker, your shares of Common Stock will count for purposes of attaining a quorum, but will not be voted on those proposals.

17

VOTES REQUIRED FOR APPROVAL

Election of Directors ─ The Company has adopted a plurality vote standard for contested director elections. The seven (7) nominees receiving the highest number of affirmative votes will be elected as directors of the Company. With respect to the election of directors, only votes cast “FOR” a nominee will be counted. Proxy cards specifying that votes should be withheld with respect to one (1) or more nominees will result in those nominees receiving fewer votes but will not count as a vote against the nominees. A broker non-vote will not count as a vote cast “FOR” or “AGAINST” a director nominee. Therefore, broker non-votes will have no direct effect on the outcome of the election of directors.

Ratification of the Appointment of Accounting Firm ─ According to the Company’s proxy statement, assuming that a quorum is present, the selection of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2015 will be deemed to have been ratified if the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting vote in favor of such ratification. According to the Company’s proxy statement, broker non-votes will have no effect on the ratification of the appointment, but abstentions will act as a vote against ratification of the appointment.

Advisory Vote on Executive Compensation ─ According to the Company’s proxy statement, and although the vote is non-binding, assuming that a quorum is present, the advisory vote on the Company’s executive compensation program will be approved if the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting vote in favor of approval of the executive compensation program. According to the Company’s proxy statement, broker non-votes will have no effect on the approval of the executive compensation program, but abstentions will act as a vote against approval of the executive compensation program.

Under applicable Delaware law, none of the holders of Common Stock is entitled to appraisal rights in connection with any matter to be acted on at the Annual Meeting. If you sign and submit your [COLOR] proxy card without specifying how you would like your shares voted, your shares will be voted in accordance with iPass Shareholders for Change’s recommendations specified herein and in accordance with the discretion of the persons named on the [COLOR] proxy card with respect to any other matters that may be voted upon at the Annual Meeting.

REVOCATION OF PROXIES

Stockholders of the Company may revoke their proxies at any time prior to exercise by attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not in and of itself constitute revocation of a proxy) or by delivering a written notice of revocation. The delivery of a subsequently dated proxy that is properly completed will constitute a revocation of any earlier proxy. The revocation may be delivered either to iPass Shareholders for Change in care of [________] at the address set forth on the back cover of this Proxy Statement or any other address provided by the Company. Although a revocation is effective if delivered to the Company, we request that either the original or photostatic copies of all revocations be mailed to iPass Shareholders for Change in care of [_______] at the address set forth on the back cover of this Proxy Statement so that we will be aware of all revocations and can more accurately determine if and when proxies have been received from the holders of record on the Record Date of a majority of the outstanding shares of Common Stock. Additionally, [________] may use this information to contact stockholders who have revoked their proxies in order to solicit later dated proxies for the election of the Nominees.

18

IF YOU WISH TO VOTE FOR THE ELECTION OF THE NOMINEES TO THE BOARD, PLEASE SIGN, DATE AND RETURN PROMPTLY THE ENCLOSED [COLOR] PROXY CARD IN THE POSTAGE-PAID ENVELOPE PROVIDED.

SOLICITATION OF PROXIES

The solicitation of proxies pursuant to this Proxy Statement is being made by iPass Shareholders for Change. Proxies may be solicited by mail, facsimile, telephone, telegraph, Internet, in person and by advertisements.

[______] will solicit proxies from individuals, brokers, banks, bank nominees and other institutional holders. Certain members of iPass Shareholders for Change have requested banks, brokerage houses and other custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial owners of the shares of Common Stock they hold of record. Certain members of iPass Shareholders for Change will reimburse these record holders for their reasonable out-of-pocket expenses in so doing. It is anticipated that [______] will employ approximately [__] persons to solicit stockholders for the Annual Meeting.

The entire expense of soliciting proxies is being borne by Francis Capital, Foxhill and Maguire. Costs of this solicitation of proxies are currently estimated to be approximately $[_____]. Francis Capital, Foxhill and Maguire estimate that through the date hereof their expenses in connection with this solicitation are approximately $[_____]. Each of Francis Capital, Foxhill and Maguire intends to seek reimbursement from the Company of all expenses it incurs in connection with this solicitation. They do not intend to submit the question of such reimbursement to a vote of security holders of the Company.

ADDITIONAL PARTICIPANT INFORMATION

The members of iPass Shareholders for Change are participants in this solicitation.

The principal business of each of Catalysis Partners and Catalysis Offshore is investing in securities. Francis Capital Management serves as the managing member and investment manager of Catalysis Partners and the investment manager of Catalysis Offshore and certain managed accounts (the “FCM Managed Accounts”). The principal occupation of Mr. Francis is serving as the managing member of Francis Capital Management. The principal business of Foxhill Opportunity is investing in securities. Foxhill GP serves as the general partner of Foxhill Opportunity. Foxhill Capital provides investment management services and serves as the investment manager of Foxhill Opportunity. The principal occupation of Mr. Weiner is serving as the managing member of each of Foxhill Capital and Foxhill GP. The principal business of Maguire Financial is serving as a private investment vehicle. Maguire Asset Management provides investment management services and serves as the general partner of Maguire Financial. The principal occupation of Mr. Maguire is serving as the managing member of Maguire Asset Management. The principal business of ZCM Fund is investing in securities. ZCM provides investment management services and serves as the investment manager of ZCM Fund. The principal occupation of Mr. Morrison is serving as the managing director of each of ZCM Fund and ZCM.

The address of the principal office of each of Catalysis Partners, Francis Capital Management and Mr. Francis is 1453 Third Street, Suite 470, Santa Monica, California 90401. The address of the principal office of Catalysis Offshore is c/o Mourant Cayman Corporate Services, Harbour Centre, 42 North Church St., PO Box 1348, Grand Cayman KY1-1108, Cayman Islands. The address of the principal office of each of Foxhill Opportunity, Foxhill GP, Foxhill Capital and Mr. Weiner is 12 Roszel Road, Suite C-101, Princeton, New Jersey 08540. The address of the principal office of each of Maguire Financial, Maguire Asset Management and Mr. Maguire is 1810 Ocean Way, Laguna Beach, California 92651. The address of the principal office of each of ZCM Fund, ZCM and Mr. Morrison is 1400 Kelton Avenue, #201, Los Angeles, California 90024.

19

As of the date hereof, Catalysis Partners directly owns 424,006 shares of Common Stock. As of the date hereof, Catalysis Offshore directly owns 275,994 shares of Common Stock. Francis Capital Management, as the managing member and investment manager of Catalysis Partners and the investment manager of Catalysis Offshore, may be deemed to beneficially own an aggregate of 700,000 shares of Common Stock owned by Catalysis Partners and Catalysis Offshore. Mr. Francis, as the managing member of Francis Capital Management, may be deemed to beneficially own an aggregate of 700,000 shares of Common Stock owned by Catalysis Partners and Catalysis Offshore. As of the date hereof, Foxhill Opportunity directly owns 1,196,488 shares of Common Stock. Foxhill GP, as the general partner of Foxhill Opportunity, may be deemed to beneficially own the 1,196,488 shares of Common Stock owned by Foxhill Opportunity. Foxhill Capital, as the investment manager of Foxhill Opportunity, may be deemed to beneficially own the 1,196,488 shares of Common Stock owned by Foxhill Opportunity. Mr. Weiner, as the managing member of Foxhill GP and Foxhill Capital, may be deemed to beneficially own the 1,196,488 shares of Common Stock owned by Foxhill Opportunity. As of the date hereof, Maguire Financial directly owns 3,269,964 shares of Common Stock. Maguire Asset Management, as the general partner of Maguire Financial, may be deemed to beneficially own the 3,269,964 shares of Common Stock owned by Maguire Financial. Mr. Maguire, as the managing member of Maguire Asset Management, may be deemed to beneficially own the 3,269,964 shares of Common Stock owned by Maguire Financial. As of the date hereof, ZCM Fund directly owns 5,600 shares of Common Stock. ZCM, as the investment manager of ZCM Fund, may be deemed to beneficially own the 5,600 shares of Common Stock owned by ZCM Fund. As of the date hereof, Mr. Morrison directly owns 3,500 shares of Common Stock. Mr. Morrison, as the managing director of each of ZCM Fund and ZCM, may be deemed to beneficially own the 5,600 shares of Common Stock owned by ZCM Fund.

Each participant in this solicitation, as a member of a “group” with the other participants for the purposes of Section 13(d)(3) of the Exchange Act, may be deemed to beneficially own the 5,896,874 shares of Common Stock owned in the aggregate by all of the participants in this solicitation. Each participant in this solicitation disclaims beneficial ownership of the shares of Common Stock he or it does not directly own. For information regarding purchases and sales of securities of the Company during the past two (2) years by certain of the participants in this solicitation, see Schedule I.

The shares of Common Stock owned directly by each of Catalysis Partners, Catalysis Offshore, Foxhill Opportunity, Maguire Financial, and ZCM Fund were purchased with working capital (which may, at any given time, include margin loans made by brokerage firms in the ordinary course of business), except as otherwise noted, as set forth in Schedule I. The shares of Common Stock purchased by each of Messrs. Karp, Morrison, Park, Rice and Traub were purchased in the open market with personal funds. Mr. Traub was also awarded restricted stock and call options in connection with his prior service on the Board.

Except as set forth in this Proxy Statement (including the Schedules hereto), (i) during the past ten (10) years, no participant in this solicitation has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no participant in this solicitation directly or indirectly beneficially owns any securities of the Company; (iii) no participant in this solicitation owns any securities of the Company, which are owned of record but not beneficially; (iv) no participant in this solicitation has purchased or sold any securities of the Company during the past two (2) years; (v) no part of the purchase price or market value of the securities of the Company owned by any participant in this solicitation is represented by funds borrowed or otherwise obtained for the purpose of acquiring or holding such securities; (vi) no participant in this solicitation is, or within the past year was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies; (vii) no associate of any participant in this solicitation owns beneficially, directly or indirectly, any securities of the Company; (viii) no participant in this solicitation owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company; (ix) no participant in this solicitation or any of his or its associates was a party to any transaction, or series of similar transactions, since the beginning of the Company’s last fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000; (x) no participant in this solicitation or any of his or its associates has any arrangement or understanding with any person with respect to any future employment by the Company or its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may be a party; and (xi) no participant in this solicitation has a substantial interest, direct or indirect, by securities holdings or otherwise, in any matter to be acted on at the Annual Meeting.

20

There are no material proceedings to which any participant in this solicitation or any of his or its associates is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries. With respect to each Nominee, none of the events enumerated in Item 401(f)(1)-(8) of Regulation S-K of the Exchange Act occurred during the past ten (10) years.

OTHER MATTERS AND ADDITIONAL INFORMATION

iPass Shareholders for Change is unaware of any other matters to be considered at the Annual Meeting. However, should other matters that iPass Shareholders for Change is not aware of at a reasonable time before this solicitation be brought before the Annual Meeting, the persons named as proxies on the enclosed [COLOR] proxy card will vote on such matters in their discretion consistent with Rule 14a-4(c)(3) promulgated under the Exchange Act.

STOCKHOLDER PROPOSALS

According to the Company’s proxy statement for the Annual Meeting, any stockholder wishing to submit a proposal to be included in the Company’s proxy statement for the 2016 Annual Meeting pursuant to Rule 14a-8, must deliver such proposal(s) to iPass’ Corporate Secretary on or before [_____]. Stockholder proposals should be mailed to the Corporate Secretary at, iPass, Inc., 3800 Bridge Parkway, Redwood Shores, CA 94065.

In addition, according to the Company’s proxy statement for the Annual Meeting, under the Bylaws, any stockholder wishing to nominate a director or bring other business before the stockholders at the 2016 Annual Meeting, must notify the Company’s Corporate Secretary in writing between March 2, 2016 and April 1, 2016; however, if the 2016 Annual Meeting is held before May 31, 2016, or after July 30, 2016, such proposal(s) must be received between ninety (90) days and one hundred and twenty (120) days before the 2016 Annual Meeting, or not more than ten (10) days after the Company’s announcement of the date of such meeting.

Stockholders should contact the Corporate Secretary in writing, at iPass, Inc., 3800 Bridge Parkway, Redwood Shores, CA 94065, to make any submission or to obtain additional information as to the proper form and content of submissions.

The information set forth above regarding the procedures for submitting stockholder proposals for consideration at the 2016 Annual Meeting is based on information contained in the Company’s proxy statement for the Annual Meeting. The incorporation of this information in this Proxy Statement should not be construed as an admission by iPass Shareholders for Change that such procedures are legal, valid or binding.

21

INCORPORATION BY REFERENCE

WE HAVE OMITTED FROM THIS PROXY STATEMENT CERTAIN DISCLOSURE REQUIRED BY APPLICABLE LAW THAT IS, OR WILL BE, INCLUDED IN THE COMPANY’S PROXY STATEMENT RELATING TO THE ANNUAL MEETING. THIS DISCLOSURE INCLUDES, AMONG OTHER THINGS, CURRENT BIOGRAPHICAL INFORMATION ABOUT THE COMPANY’S DIRECTORS, INFORMATION CONCERNING EXECUTIVE COMPENSATION, AND OTHER IMPORTANT INFORMATION. SEE SCHEDULE II FOR INFORMATION REGARDING PERSONS WHO BENEFICIALLY OWN MORE THAN 5% OF THE SHARES AND THE OWNERSHIP OF THE SHARES BY THE DIRECTORS AND MANAGEMENT OF THE COMPANY.

The information concerning the Company contained in this Proxy Statement and the Schedules attached hereto has been taken from, or is based upon, publicly available information.

|

IPASS SHAREHOLDERS FOR CHANGE

|

|

May [__], 2015

|

22

SCHEDULE I

TRANSACTIONS IN SECURITIES OF THE COMPANY

DURING THE PAST TWO YEARS

|

Shares of Common Stock

Purchased / (Sold)

|

Date of

Purchase / Sale

|

|