UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

For the fiscal year ended

or

For the transition period from to

Commission file number

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code:

(

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐ |

|

|

Non-accelerated filer ☐ |

Smaller reporting company |

|

|

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes

The aggregate market value of the registrant’s common stock held by non-affiliates as of July 1, 2022 (based upon the closing price of $6.73 per share of common stock as of July 1, 2022, the last business day of the registrant’s second fiscal quarter of 2022, as quoted on The Nasdaq Stock Market LLC) was $

The number of shares of common stock outstanding as of February 27, 2023 was

DOCUMENTS INCORPORATED BY REFERENCE

WW International, Inc.

Annual Report on Form 10-K

Table of Contents

|

|

Page |

|

|

|

|

1 |

|

|

2 |

|

|

2 |

|

Item 1. |

4 |

|

Item 1A. |

14 |

|

Item 1B. |

36 |

|

Item 2. |

36 |

|

Item 3. |

36 |

|

Item 4. |

36 |

|

|

37 |

|

|

|

|

|

|

|

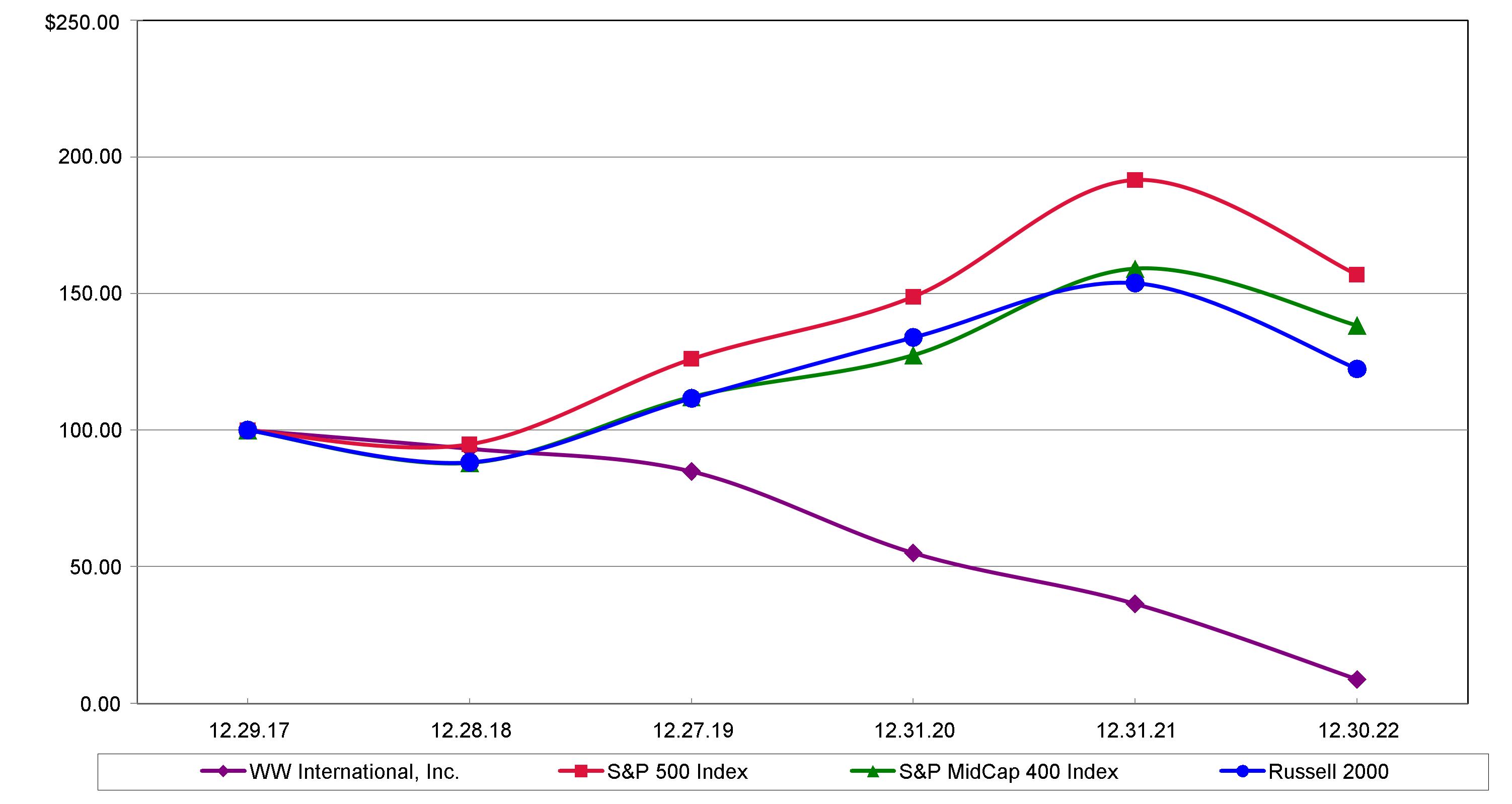

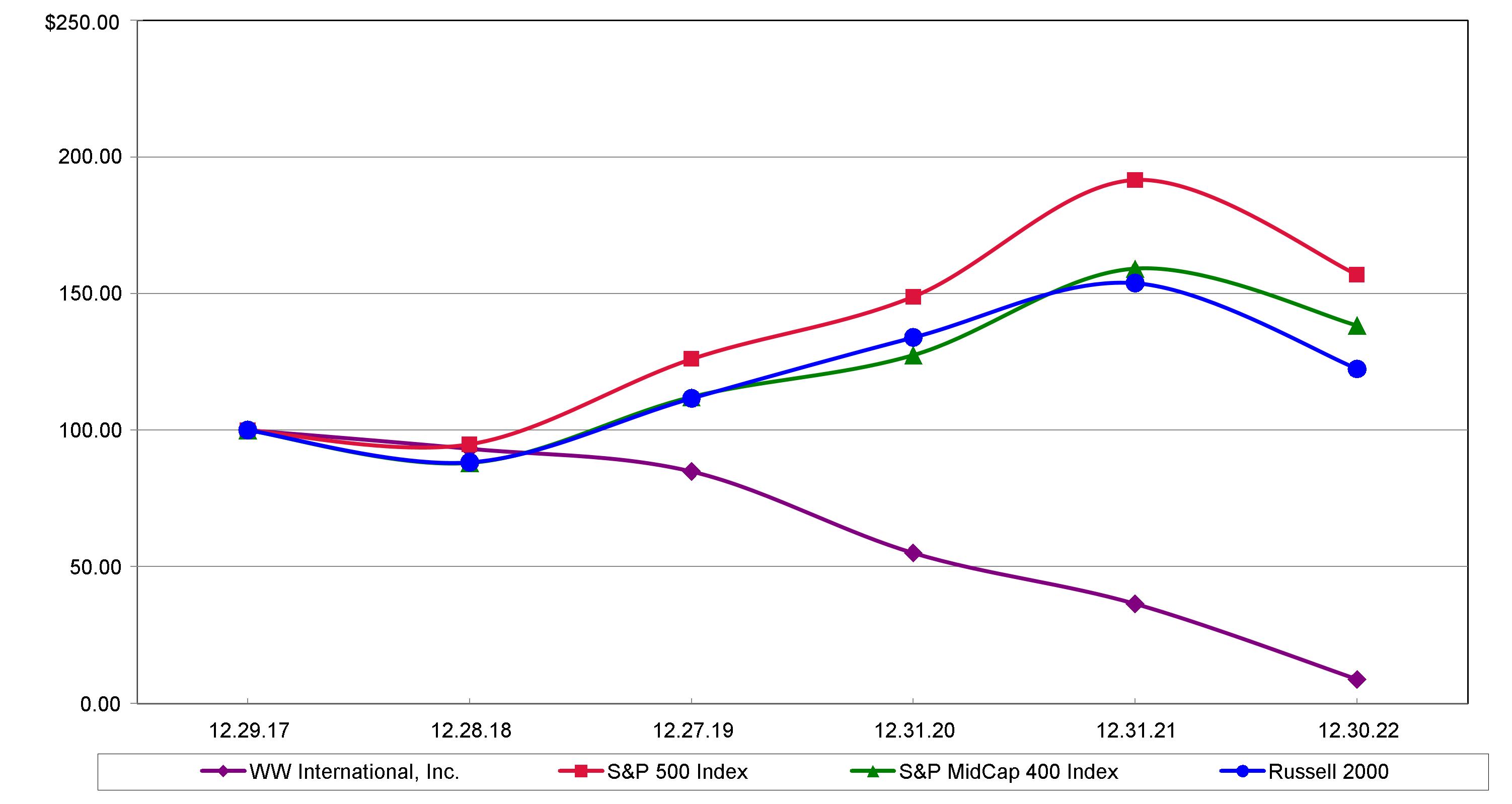

Item 5. |

41 |

|

Item 6. |

42 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

43 |

Item 7A. |

68 |

|

Item 8. |

69 |

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

69 |

Item 9A. |

69 |

|

Item 9B. |

70 |

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

70 |

|

|

|

|

|

|

Item 10. |

71 |

|

Item 11. |

71 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters |

71 |

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

71 |

Item 14. |

71 |

|

|

|

|

|

|

|

Item 15. |

73 |

|

Item 16. |

79 |

i

PART I

BASIS OF PRESENTATION

WW International, Inc. is a Virginia corporation with its principal executive offices in New York, New York. In this Annual Report on Form 10-K unless the context indicates otherwise: “we,” “us,” “our,” the “Company,” “Weight Watchers” and “WW” refer to WW International, Inc. and all of its operations consolidated for purposes of its financial statements; “North America” refers to our North American Company-owned operations; “Continental Europe” refers to our Continental Europe Company-owned operations; “United Kingdom” refers to our United Kingdom Company-owned operations; and “Other” refers to Australia, New Zealand and emerging markets operations and franchise revenues and related costs. Prior to fiscal 2023, each of North America, Continental Europe, United Kingdom and Other was also a reportable segment. See “Item 1. Business—Business Organization—Change in Segment Reporting” of this Annual Report on Form 10-K for additional information.

Our fiscal year ends on the Saturday closest to December 31st and consists of either 52- or 53-week periods. In this Annual Report on Form 10-K:

The following terms used in this Annual Report on Form 10-K are our trademarks: ConnectTM, Digital 360®, PersonalPoints®, Points®, Weight Watchers®, ZeroPoint® and the WW logo.

1

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

Except for historical information contained herein, this Annual Report on Form 10-K includes “forward-looking statements,” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, including, in particular, the statements about our plans, strategies, objectives and prospects under the headings “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” We have generally used the words “may,” “will,” “could,” “expect,” “anticipate,” “believe,” “estimate,” “plan,” “intend,” “aim” and similar expressions in this Annual Report on Form 10-K and the documents incorporated by reference herein to identify forward-looking statements. We have based these forward-looking statements on our current views with respect to future events and financial performance. Actual results could differ materially from those projected in these forward-looking statements.

You should not put undue reliance on any forward-looking statements. You should understand that many important factors, including those identified below and discussed under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” could cause our results to differ materially from those expressed or suggested in any forward-looking statement. Except as required by law, we do not undertake any obligation to update or revise these forward-looking statements to reflect new information or events or circumstances that occur after the date of this Annual Report on Form 10-K or to reflect the occurrence of unanticipated events or otherwise.

SUMMARY OF MATERIAL RISKS

A summary of the principal factors that create risk in investing in our securities and might cause actual results to differ from expectations is set forth below:

2

3

Item 1. Business

Overview

We are a human-centric technology company powered by our proven, science-based, clinically effective weight loss and weight management program and an award-winning digital subscription platform. We are focused on inspiring people to adopt healthy habits for real life. With nearly six decades of weight management experience, expertise and know-how, we are one of the most recognized and trusted brand names among weight-conscious consumers. We educate our members and provide them with guidance, digital tools and an inspiring community to enable them to develop healthy habits and focus on their overall health and wellness. WW-branded services and products include digital offerings provided through our apps and websites, workshops, consumer products, and various events. Our business has gone through a significant shift to a digital subscription model over the past several years and our primary sources of revenue are subscriptions for our digital products and for our workshops. Our “Digital” business refers to providing subscriptions to our digital product offerings. Our “Workshops + Digital” business refers to providing unlimited access to our workshops combined with our digital subscription product offerings to commitment plan subscribers. For additional details on certain historic offerings in each business, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Overview” in Part II of this Annual Report on Form 10-K.

We combine technology and community to help members reach and sustain their weight loss goals on our science-based program. We believe that the power of our communities -- via our exclusive social network, Connect, and our workshops -- increases accountability and provides our members with inspiration, human connection, and support. This inspires them and enables them to build healthier and more fulfilling food, activity, mindset and sleep habits. Our brands enjoy high awareness and credibility among all types of consumers—women and men, consumers online and offline, the support-inclined and the self-help-inclined. We believe that our program conveys an image of healthy, livable, sustainable and effective weight management in a supportive environment. The efficacy of our commercial weight management programs has been clinically proven in numerous studies and trials. As the number of overweight and obese people worldwide grows, the need for an effective, scalable and consumer-friendly weight management program increases. We believe our global presence and brand awareness uniquely position us in the global weight management market, and thereby provide us a unique platform to impact the wellness market.

We have built our business by helping millions of people around the world lose weight and build healthy habits through a sensible, sustainable and livable approach to weight loss and weight management. As of the end of fiscal 2022, we had a total of approximately 3.5 million subscribers, of which approximately 2.8 million were Digital subscribers and approximately 0.7 million were Workshops + Digital subscribers. Our strong brands, together with the effectiveness of our program, loyal customer base, strong digital offerings and community, enable us to attract new and returning customers.

Business Organization

For fiscal 2022 and in recent years, we had four reportable segments based on an integrated geographical structure as follows: North America, Continental Europe (CE), United Kingdom and Other. Each reportable segment provided similar services and products. Our “North America” reportable segment consisted of our United States and Canada Company-owned operations; our “Continental Europe” reportable segment consisted of our Germany, Switzerland, France, Belgium, Netherlands and Sweden Company-owned operations; our “United Kingdom” reportable segment consisted of our United Kingdom Company-owned operations; and our “Other” reportable segment consisted of our Australia, New Zealand, and Brazil Company-owned operations, as well as revenues and costs from our franchises in the United States and certain other countries.

4

Change in Segment Reporting

Effective the first day of fiscal 2023 (i.e., January 1, 2023), we realigned our organizational structure and resources to more closely align with our strategic priorities and centralized the global management of certain functions and systems. As a result of the change in our organizational structure, we now have two reportable segments, consisting of North America and International, for the purpose of making operational and resource decisions and assessing financial performance. The new reportable segments will continue to provide similar services and products. The segment information presented in this Annual Report on Form 10-K does not reflect this change in reportable segments as the change did not take effect internally until our first quarter of fiscal 2023. We will begin reporting segment information based on these new segments in our Quarterly Report on Form 10-Q for the first quarter of fiscal 2023. For details on our reportable segments in fiscal 2022, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II of this Annual Report on Form 10-K.

Our Services and Products

Our Program and Food Plan

We offer services and products that are based on our weight loss and weight management program and that help our members build habits to lead healthier, more active, more fulfilling lives. Our program is rooted in advanced nutrition science and founded on a simplified, holistic approach for the body and mind. It is comprised of a range of science-based nutritional, activity, behavioral and lifestyle tools and approaches. Our program continues to be grounded in our scientific Points system, which uses a proprietary nutritional algorithm to assign each food a value based on its calorie, saturated fat, unsaturated fat, added sugar, protein and fiber content. After a proprietary, personal assessment takes into account a member’s metabolic rate, members receive a tailored daily and weekly Points Budget to guide them towards healthy foods and appropriate portion sizes, forming the foundation of a healthy eating pattern. Members can also take advantage of over 200 ZeroPoint foods (nutritious foods which do not need to be weighed, measured, or tracked). Our program can also take into account the dietary needs of those living with diabetes by tailoring their plans towards foods that are less likely to impact blood sugar levels.

In addition to focusing on healthy eating habits, and in furtherance of our mission to focus on overall health and wellness, our program also provides tools to address other aspects of a healthy and fulfilled life. These include a customized weekly activity target, trackers for food, water, activity, sleep and weight (and, for members on our diabetes-tailored plan, a tracker for blood sugar) and content regarding behavioral techniques for building healthy habits. WW’s Connect platform, a members-only social network accessed through our app, fosters meaningful relationships by helping people find communities based on interests including food preferences, identity cohorts, wellness journey, activity, mindset, hobbies, locations, events and workshops.

Our Subscription Businesses

Our members mainly participate in our program either by solely using our digital product or by using our digital product supplemented by group workshops. Within these two channels, members can find services and tools that best meet their preferences and needs. Additionally, our coaches educate members on our program and provide inspiration and support to members in developing healthy habits.

The payment structure for our services globally is through subscription plans. Pursuant to these plans, a member typically commits to a minimum term and is automatically charged on a monthly basis until the member elects to cancel.

5

Digital Business

In our Digital business, we offer a digital subscription product based on the WW approach to weight loss and weight management. Our app provides interactive and personalized resources that allow subscribers to follow our weight management program. These resources also help subscribers adopt a healthier and more active lifestyle, a helpful mindset, and healthy habits, with a view toward long-term behavior modification — a key aspect of the WW approach toward healthy and sustainable weight loss. Our app provides subscribers with content, functionality, access to coaches on Connect and wellness resources. We believe our personalized and interactive Digital subscription product gives subscribers an engaging experience. Our Connect online community, which can be accessed via our app and our web-based platform, gives our subscribers a way to stay virtually connected and support and inspire each other. We continually innovate our Digital offerings to maximize the design, usability, features and capabilities of our app to support our weight loss and weight management program and community. As of the end of fiscal 2022, we had approximately 2.8 million Digital subscribers.

Workshops + Digital Business

In our Workshops + Digital business, we present our program in workshops of 30 to 45 minutes in duration, conveniently scheduled throughout the day. In March 2020, we introduced virtual workshops in immediate response to the impact of COVID-19, and we continue to innovate this offering to address the shift in consumer sentiment towards digitally-enabled offerings. For more information on the impact of COVID-19, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Material Trends—COVID-19 Pandemic” of this Annual Report on Form 10-K. Workshops + Digital members can attend unlimited workshops both virtually and, where available, in-person. Our interactive communities remain the cornerstone of our workshops. Coaches facilitate interactive workshops that encourage learning and inspire members to make positive changes towards their individual goals. Members provide each other inspiration and support by sharing their experiences with, and by providing encouragement and empathy to, other people on weight loss and weight management journeys. In addition, our members have access to our digital tools to assist them on their journeys. As of the end of fiscal 2022, we had approximately 0.7 million Workshops + Digital subscribers.

We have franchisees in a limited number of territories. In fiscal 2022, revenues from our franchisees were immaterial. Pursuant to long-standing agreements, we and our franchisees typically pay each other royalties and other fees. We have enjoyed a mutually beneficial relationship with our franchisees over many years. Most franchise agreements are perpetual and can be terminated only upon a material breach or bankruptcy of the franchisee.

Our Consumer Product Sales

We sell a range of consumer products that complement our program and help our customers in their weight management efforts. Our WW-branded products include bars, snacks, cookbooks and kitchen tools. We also license our trademarks and other intellectual property in certain categories of food, beverages and other relevant consumer products and services. Additionally, we co-brand or endorse with carefully selected branded consumer products and services. We primarily sell consumer products online through our e-commerce platforms, at our studios, and through our trusted partners. In fiscal 2022, sales of consumer products represented approximately 9.4% of our total revenues. By partnering with carefully selected companies in categories relevant and helpful to weight- and health-conscious consumers, we have a high margin licensing business that gives us access to these consumers and also increases the awareness of our brands. In connection with our acquisition from The Kraft Heinz Company (successor to H.J. Heinz Company), or Heinz, in September 1999, Heinz received a perpetual royalty-free license to continue using our brand in certain food categories. We believe that the strength of the WW brands will create new long-term licensing and partnership opportunities for us.

Healthcare Offerings

As healthcare costs continue to be a significant concern on the minds of employers and their employees, we believe that our broad range of services and products uniquely positions us to serve the market and help employers reduce their healthcare costs and improve the overall well-being of their employees. We are leveraging our organizational capability to serve employers with both our Digital and Workshops + Digital offerings.

We believe the healthcare market, including the diabetes segment, represents an important channel to reach new consumers. We continue to explore different approaches to, and strategies for, this market.

6

Our Clinical Efficacy and Reputation in the Marketplace

WW is one of the most clinically-studied commercial weight management programs, including by way of more than 140 published, scientific, peer reviewed studies (including over 35 randomized controlled trials) over more than four decades. For example, in 2022, a randomized controlled trial conducted by research teams at the University of North Carolina - Chapel Hill, University of British Columbia, and University of Leeds and funded by us was published in JAMA Network Open and found that study participants assigned to WW for 12 months had over two times more weight loss compared to participants who were assigned to a do-it-yourself weight loss approach. In addition, those assigned to the WW program were more likely to achieve clinically significant weight loss of five percent at three and twelve months. Research has shown that WW has an impact that reaches beyond our members. In 2018, a 6-month randomized controlled trial conducted by researchers at the University of Connecticut funded by us and published in Obesity showed a “ripple effect” of WW – significant weight loss among untreated spouses of WW members.

In 2021, a six-month clinical trial of our program conducted by the University of Connecticut and funded by us found that participants on the program experienced clinically significant benefits, including weight loss. Study participants reported a 40% increase in their healthy habits as well as a 15% decrease in hunger.

WW also has demonstrated efficacy among individuals with diabetes and prediabetes. In 2016, a randomized controlled trial conducted by the Indiana University School of Medicine and funded by us was published in the American Journal of Public Health and found that adults with prediabetes following our Diabetes Prevention Program, or DPP, lost significantly more weight and experienced better blood sugar control than those following a self-initiated diabetes prevention program using supplemental counseling materials. A continuation study published in 2018 showed that these outcomes were maintained at 18 and 24 months and that our DPP was highly cost-effective. Another randomized controlled trial conducted by the Medical University of South Carolina, funded by us and published in Obesity in 2016, found that adults with Type 2 diabetes who followed our diabetes program lost significantly more weight and experienced better blood sugar control than those in a standard diabetes care program. In 2021, a clinical trial conducted at Pennington Biomedical Research Center, University of Florida and Virginia Commonwealth University and funded by us found that the WW program, modified for adults with Type 2 diabetes, had favorable and clinically meaningful effects on glycemic control, body weight and diabetes distress at 12 and 24 weeks. In 2020, a review published in Endocrinology and Metabolism Clinics of North America highlighted the potential for physicians to refer patients with obesity to commercial weight loss programs. It noted that WW is one of only four commercial weight loss programs meeting guideline-recommended standards with demonstrated safety and efficacy at 12 months and one of only two commercial weight loss programs with demonstrated effects on reducing HbA1c levels in participants with Type 2 diabetes. Authors of the review concluded physicians might consider referral to WW for patients with obesity and those with obesity and Type 2 diabetes.

Our efficacy and the value of our offerings are also well-acknowledged in the marketplace. For instance, in 2023, we again were recognized by U.S. News & World Report in the “Best Diets” rankings, including ranking #1 for “Best Weight-Loss Diets” for the thirteenth consecutive year and #1 for “Best Diet Programs.”

Marketing and Promotion

Our communications with consumers and other promotional efforts enhance our brand image and awareness, and motivate both former and potential new customers to join WW. We utilize a data-driven approach to our media placements, promotional offers, and website and app store presence to enhance marketing efficiency, drive conversion, and maximize subscription value. Our advertising campaigns are supported across multiple platforms (e.g., television, YouTube, social media, programmatic, audio, search, affiliate, branded content, electronic customer relationship marketing (eCRM), direct mail, and public relations). We develop and maintain a high level of engagement with current and potential customers on various social media platforms including Facebook, Instagram and TikTok. Also, we utilize brand ambassadors, spokespersons and social media influencers, including celebrities, as part of our advertising and marketing.

In addition to the above advertising channels, we take advantage of other channels for which we are uniquely positioned given our long history and network of WW coaches and members. The word of mouth generated by our current and former members, combined with our strong brand and known effectiveness, enable us to attract new and returning members. We also carry out many of our key public relations initiatives through the efforts of current and former WW coaches and members, and celebrity brand ambassadors.

7

In October 2015, we entered into a Strategic Collaboration Agreement with Oprah Winfrey, pursuant to which, among other things, Ms. Winfrey provides us with services in her discretion to promote the Company and our programs, products and services, including in advertisements and promotions, and making personal appearances on our behalf. Further information on this agreement and our partnership with Ms. Winfrey can be found below under “—History—Winfrey Transaction.”

Seasonality

Our core business is seasonal due to the importance of the winter season to our overall member recruitment environment. Historically, we experience our highest level of recruitment during the first quarter of the year, which is supported with the highest concentration of advertising spending. Therefore, our number of End of Period Subscribers (as defined below) in the first quarter of the year is typically higher than the number in other quarters of the year, historically reflecting a decline over the course of the year.

Pending Acquisition of Weekend Health (d/b/a Sequence)

On March 4, 2023, the Company, Well Holdings, Inc., a Delaware corporation and a wholly-owned subsidiary of the Company, Weekend Health, Inc., doing business as Sequence, a Delaware corporation (“Weekend Health”), and Fortis Advisors LLC, a Delaware limited liability company, solely in its capacity as the Equityholders’ Representative for Weekend Health, entered into an Agreement and Plan of Merger (the “Merger Agreement”). The Merger Agreement provides for the Company’s acquisition of Weekend Health (the “Acquisition”). Upon completion of the Acquisition, Weekend Health will become a wholly-owned subsidiary of the Company. The Acquisition is expected to close during the second quarter of fiscal 2023.

As consideration for the Acquisition, the Company has agreed to pay an aggregate amount equal to $132.0 million (inclusive of a minimum of $26.0 million of cash on the balance sheet of Weekend Health), subject to the adjustments set forth in the Merger Agreement (the “Merger Consideration”). Subject to the terms and conditions of the Merger Agreement, the Merger Consideration shall be paid as follows: (i) $65.0 million in cash and $35.0 million in the form of 8,064,516 newly issued shares of Company common stock (valued at $4.34 per share), in each case, to be paid at the closing of the Acquisition, (ii) $16.0 million in cash to be paid on the first (1st) anniversary of the closing of the Acquisition, and (iii) $16.0 million in cash to be paid on the second (2nd) anniversary of the closing of the Acquisition. In addition, the Company expects to obtain a standard representation and warranty insurance policy in connection with the Merger Agreement.

The Merger Agreement contains representations, warranties and covenants customary for transactions of this type, including covenants regarding the operation of the business of Weekend Health prior to the closing of the Acquisition. The closing of the Acquisition is subject to certain conditions, including, among others, (i) the adoption of the Merger Agreement by Weekend Health’s stockholders, and (ii) the continued employment of certain key employees of Weekend Health. See “Risk Factors—Risks Related to Our Proposed Acquisition of Weekend Health (d/b/a Sequence).” The closing of the Acquisition is not subject to any financing condition or the approval of the Company’s stockholders.

Weekend Health provides a technology-powered care platform and mobile web application through its subscription based service, which includes a comprehensive weight management program, pharmacotherapy treatment, nutrition plans, health insurance coordination services, and access to clinicians, dietitians, fitness coaches and care coordinators.

We are focused on expanding our offerings in weight management, and we expect Weekend Health will augment our current products and services by providing a digital health platform offering access to a clinical weight management program. By integrating our products and services, which are grounded in our decades of experience in nutrition and behavioral science-based weight management, with Weekend Health’s clinical expertise and digital infrastructure capabilities, which provide access to the latest innovations in pharmacotherapy treatments, we will strongly position ourselves to provide a differentiated, comprehensive suite of weight management products and services.

8

We expect the combination of Weekend Health’s services with our pre-existing lifestyle support and behavioral capabilities will create a unique and effective science-based direct-to-consumer service in the weight-management and wellness space. Members who are medically eligible may benefit from developments in the ever-evolving pharmacotherapy field, which we expect to complement our core program strengths and lifestyle approach with the support of our WW communities. Overall, we expect the Acquisition will further strengthen our ability to help people reach their weight-management and wellness goals.

Competition

We compete in the global weight management and wellness market. The weight management and wellness industries include commercial weight management programs; the pharmaceutical industry and prescription and over the counter weight management and weight loss pills and appetite suppressants; weight loss and wellness apps and monitoring solutions, such as wearable trackers; surgical procedures; the genetics and biotechnology industry; self-help weight management regimens and other self-help weight management products, services and publications, such as books, magazines, websites, and social media influencers and groups; dietary supplements and meal replacement products; healthy living services, coaching, products, content and publications; weight management services administered by doctors, nutritionists and dieticians; government agencies and non-profit groups that offer weight management services; fitness centers; and national drug store chains.

Competition among commercial weight management programs is largely based on program recognition and reputation; the effectiveness, ease of use, safety, personalization and price of the program; and the related digital platform, content and user experience. We compete with several other companies in the commercial weight management industry, although we believe that in certain cases their businesses are not comparable to ours. For example, we believe our prominence as one of the most clinically-studied commercial weight management programs differentiates us from many of our competitors. Additionally, certain of these competitors’ businesses are based on the sale of pre-packaged meals and meal replacements. In conjunction with our flexible, healthy food plan and emphasis on behavioral change education, we believe that the power of our communities -- via our online social network, Connect, and workshops -- increases accountability and provides our members with inspiration, human connection, and support, which motivates them and enables them to build healthier and more fulfilling food, activity and lifestyle habits.

We believe that food manufacturers that produce meal replacement products are not comparable competition because these businesses’ meal replacement products do not engender behavior modification through education in conjunction with a flexible, customized healthy food plan.

We also compete with various self-help products, diets, services and publications, such as apps, activity monitors and other free or low-cost “do-it yourself” alternatives. Increased attention by consumers and the media to recent developments, innovations, and approvals of weight management drug therapies, and the perception of their safety, effectiveness and ease of use, may also delay or prevent consumer engagement in our core businesses.

Trademarks, Patents and Other Proprietary Rights

We own numerous domestic and international trademarks, patents, domain names and other proprietary rights that are valuable assets and are important to our business. Depending upon the jurisdiction, trademarks are valid as long as they are used in the regular course of trade and/or their registrations are properly maintained. Patent protection extends for varying periods according to the date of patent filing or grant and the legal term of patents in the jurisdiction in which the patent is granted. The actual protection afforded by a patent may vary from country to country depending upon the type of patent, the scope of its coverage and the availability of legal remedies in the country. We believe the protection of our trademarks, copyrights, patents, domain names, trade dress and trade secrets is important to our success. We aggressively protect our intellectual property rights by relying on a combination of trademark, copyright, patent, trade dress, trade secret and other intellectual property laws, and through domain name dispute resolution systems.

9

History

Early Development

In 1961, Jean Nidetch, our founder, attended a New York City obesity clinic and took what she learned from her personal experience at the obesity clinic and began weight-loss meetings with a group of her overweight friends in the basement of a New York apartment building. Under Ms. Nidetch’s leadership, the group members supported each other in their weight-loss efforts, and word of the group’s success quickly spread. Ms. Nidetch and Al and Felice Lippert, who all successfully lost weight through these efforts, formally launched our business in 1963. WW International, Inc. (formerly known as Weight Watchers International, Inc.) was incorporated as a Virginia corporation in 1974 and succeeded to the business started in New York in 1963. Heinz acquired us in 1978.

Artal Ownership

In September 1999, Artal Luxembourg S.A., or Artal Luxembourg, acquired us from Heinz. Artal Luxembourg is an indirect subsidiary of Artal Group S.A., or Artal Group, which together with its parents and its subsidiaries is referred to in this Annual Report on Form 10-K as Artal. Currently, Artal Luxembourg is the record holder of all our shares owned by Artal. As a result of Artal selling a portion of its shares of our common stock in fiscal 2018, we are no longer a “controlled company” under the rules of The Nasdaq Global Select Market, or Nasdaq.

Winfrey Transaction

On October 18, 2015, we entered into a Strategic Collaboration Agreement with Ms. Winfrey, or, as amended, the Strategic Collaboration Agreement, pursuant to which Ms. Winfrey granted us the right to use, subject to her approval, her name, image, likeness and endorsement for and in connection with the Company and its programs, products and services (including in advertising, promotion, materials and content), and we granted Ms. Winfrey the right to use our trademarks and service marks to collaborate with and promote the Company and its programs, products and services. The Strategic Collaboration Agreement had an initial term of five years, or the Initial Term, with additional successive one year renewal terms. On December 15, 2019, we entered into an amendment of the Strategic Collaboration Agreement, or the Strategic Collaboration Amendment, with Ms. Winfrey, pursuant to which, among other things, the Initial Term was extended until April 17, 2023 (with no additional successive renewal terms) after which a second term will commence and continue through the earlier of the date of the Company’s 2025 annual meeting of shareholders or May 31, 2025, or the Second Term and together with the Initial Term, the Strategic Term. During the remainder of the Initial Term, Ms. Winfrey will consult with us and participate in developing, planning, executing and enhancing the WW programs and related initiatives, and provide us with services in her discretion to promote the Company and its programs, products and services, including in advertisements and promotions, and making personal appearances on our behalf. Subsequently, during the Second Term, Ms. Winfrey and the Company will collaborate with each other towards the mutual objective of advancing and promoting the WW programs and the Company, and in connection therewith, Ms. Winfrey will consult with the Company and participate in developing, planning, executing and enhancing the WW programs and related initiatives. In connection therewith, Ms. Winfrey will make available to the Company her knowledge, expertise, and abilities in the areas of corporate management, consumer insights, advertising and marketing, consumer motivation, and community activation and consult and participate in the design and planning of creative strategy and the related execution of the consumer experience in connection with the WW programs. In addition, throughout the Second Term, except as otherwise prohibited by applicable law, the Company will cause Ms. Winfrey to be nominated as a director of the Company. Ms. Winfrey will not grant anyone but the Company the right to use her name, image, likeness or endorsement for or in connection with any other weight loss or weight management programs during the Strategic Term, and she will not engage in any other weight loss or weight management business, program, products, or services during the Strategic Term and for one year thereafter. The Strategic Collaboration Amendment became operative on May 6, 2020 when our shareholders approved the Winfrey Amendment Option (as defined below).

10

On October 18, 2015, we also entered into a Share Purchase Agreement with Ms. Winfrey, or, as amended, the Winfrey Purchase Agreement, pursuant to which we issued and sold to Ms. Winfrey an aggregate of 6,362,103 shares of our common stock for an aggregate cash purchase price of $43,198,679. The purchased shares are subject to a right of first offer and right of first refusal held by the Company. Under the Winfrey Purchase Agreement, Ms. Winfrey has certain demand registration rights and piggyback rights with respect to these purchased shares. On December 15, 2019, the Company entered into an amendment to the Winfrey Purchase Agreement with Ms. Winfrey. Initially, the Winfrey Purchase Agreement provided Ms. Winfrey with the right to be nominated as a director of the Company for so long as she and certain permitted transferees own at least 3% of our issued and outstanding common stock. The amendment to the Winfrey Purchase Agreement provided Ms. Winfrey with the right to be nominated as a director of the Company through and until January 1, 2023. Ms. Winfrey was not required to resign as a director at such time. The amendment to the Winfrey Purchase Agreement became operative on May 6, 2020 when our shareholders approved the Winfrey Amendment Option.

In consideration of Ms. Winfrey entering into the Strategic Collaboration Agreement and the performance of her obligations thereunder, on October 18, 2015, we granted Ms. Winfrey a fully vested option to purchase 3,513,468 shares of our common stock, or the Winfrey Option. The term sheet for the Winfrey Option, which includes the terms and conditions appended thereto, relating to the grant of the Winfrey Option is referred to herein as the Winfrey Option Agreement. The Winfrey Option is exercisable at a price of $6.97 per share, in whole or in part, at any time prior to October 18, 2025, subject to earlier termination under certain circumstances, including if (i) the Strategic Collaboration Agreement expires as a result of Ms. Winfrey’s decision not to renew the term of such agreement and (ii) a change in control (as defined in the Winfrey Option Agreement) of the Company occurs. The shares issuable upon exercise of the Winfrey Option are subject to a right of first offer and right of first refusal held by the Company.

In consideration of Ms. Winfrey entering into the Strategic Collaboration Amendment and the performance of her obligations thereunder, on December 15, 2019, the Company and Ms. Winfrey entered into a term sheet relating to the grant of a fully vested option to purchase 3,276,484 shares of our common stock, or the Winfrey Amendment Option. The term sheet for the Winfrey Amendment Option, which includes the terms and conditions appended thereto, is referred to herein as the Winfrey Amendment Option Agreement. Upon our shareholders approving the Winfrey Amendment Option on May 6, 2020, it became exercisable at a price of $38.84 per share, in whole or in part, at any time prior to November 30, 2025, subject to earlier termination under certain circumstances, including if a change in control (as defined in the Winfrey Amendment Option Agreement) of the Company occurs. The shares issuable upon exercise of the Winfrey Amendment Option are subject to certain transfer restrictions and a right of first offer and right of first refusal held by the Company.

In fiscal 2020, as permitted under the Winfrey Purchase Agreement and the Winfrey Option Agreement transfer provisions, Ms. Winfrey sold 2,782,476 of the purchased shares discussed above and exercised a portion of the Winfrey Option resulting in the sale of 1,118,036 shares issuable under such option, respectively. Similarly, in fiscal 2021, Ms. Winfrey sold 1,541,564 of the purchased shares discussed above and exercised a portion of the Winfrey Option resulting in the sale of 581,348 shares issuable under such option.

The transactions contemplated by the Strategic Collaboration Agreement, Winfrey Purchase Agreement, Winfrey Option Agreement and Winfrey Amendment Option Agreement are collectively referred to herein as the Winfrey Transaction. For additional information on risks arising from a potential loss of Ms. Winfrey’s services or a change in the nature of our partnership with her, please see “Item 1A. Risk Factors—Loss of key personnel, strategic partners or consultants or failure to effectively manage and motivate our workforce could negatively impact our sales of services and products, business, financial condition and results of operations.” of this Annual Report on Form 10-K.

11

Regulation

A number of laws and regulations govern our advertising and marketing, services, products, operations and relations with consumers, licensees, franchisees, strategic and other contractual partners, coaches, guides, employees and government authorities in the countries in which we operate. Certain federal, state and foreign agencies, such as the U.S. Federal Trade Commission, or FTC, and the U.S. Food and Drug Administration, or FDA, regulate and enforce such laws and regulations relating to advertising and marketing, promotions, packaging, labeling, privacy, consumer pricing and billing arrangements and other consumer protection matters. We are subject to many distinct employment, labor, commercial, benefits and tax laws and regulations in each country in which we operate, including regulations affecting our employment and wage and hour practices and our relations with our coaches, guides and employees. Laws and regulations directly applicable to data protection and communications, operations or commerce over the Internet, such as those governing consumer protection, intellectual property, privacy and taxation, continue to evolve. Our operations are subject to these laws and regulations and we continue to monitor their development and our compliance. In addition, we are subject to other laws and regulations in the United States and internationally. See “Risk Factors—Risks Related to Our Proposed Acquisition of Weekend Health (d/b/a Sequence)—If the Acquisition is consummated, we expect to be subject to extensive fraud, waste, and abuse laws that may give rise to federal and state audits and investigations, including actions for false and other improper claims.”

During the mid-1990s, the FTC filed complaints against a number of commercial weight management providers alleging violations of federal law in connection with the use of advertisements that featured testimonials, claims for program success and program costs. In 1997, we entered into a consent order with the FTC settling all contested issues raised in the complaint filed against us. The consent order required us to comply with certain procedures and disclosures in connection with our advertisements of services and products and expired by its terms in 2017. From time to time, we have been in discussions with the FTC regarding such matters. Subsequent to our 2018 acquisition of Kurbo Health, Inc., or Kurbo, we engaged in discussions with the FTC regarding online privacy obligations associated with that program. In February 2022, the FTC filed a complaint and proposed settlement order to resolve allegations that Kurbo violated the Children’s Online Privacy Protection Act. We entered into a consent order with the FTC in March 2022 settling all contested issues raised in the complaint filed against us, and determined in the second quarter of fiscal 2022 to exit the Kurbo business in the third quarter of fiscal 2022 as part of our strategic plan.

Human Capital Management

At WW our core mission is to inspire healthy habits for real life - for people, families, communities and the world. We believe that our workforce plays an integral role in achieving our mission. As of December 31, 2022, we had approximately 7,100 employees, a majority of whom were part-time employees. In addition, in certain of our international markets, our coaches and guides are self-employed and are not included in this total.

Diversity and Inclusion

We believe that a diverse and inclusive workforce helps us to explore and realize the many different paths to health and wellness for our members, which leads to better execution of our strategic initiatives. For example, over 50% of our executive officers, including our Chief Executive Officer and our Interim Principal Financial Officer, are women. To further our commitment to create an inclusive and diverse culture, we have a Head of Inclusion & Diversity who reports directly to our Chief People Officer. Additionally, we offer forums and formal training programs for our employees to enable them to continue their education and share best practices and experiences, which creates an ongoing evolution and community with respect to diversity and inclusion and belonging in the workplace.

Training and Development

We develop our personnel by offering in-house learning and development resources. These include online and in-person training programs on a variety of topics in order to foster career growth both long term and short term. For example, we offer leadership training to help ensure our future business leaders have the necessary skill sets to manage and lead our organization.

12

Wellness, Health and Safety

We are focused on promoting the total wellness of our employees, and offer resources, programs and services to support our employees’ physical, mental, financial and social wellness. For example, in 2022 we improved and expanded our global paid parental leave policy for all parents (both full-time and part-time eligible employees), making us a leader in providing equitable and meaningful parental leave. We believe this investment not only contributes to gender balance and equity in care-taking, but is also linked to improved health and economic outcomes of women, children, and families.

As a wellness company, we believe in creating a work environment that supports our employees’ wellbeing, while still maintaining our commitment to our members. Our work model, called Work from Wherever (WfW), is designed to enhance productivity and foster innovation by allowing our corporate employees and their leaders to work together in determining when, where and how they work to achieve the best possible results. We believe this approach strikes an appropriate balance between our purpose-driven culture of helping our members develop healthy habits while respecting the wellness, health and safety of our employees. To facilitate virtual and in-person collaboration, we offer forums and formal training programs to provide our employees with the tools and skills to be successful in a hybrid workplace. WfW continues to positively contribute to employee engagement and gives WW a competitive advantage in the external talent market.

As always, protecting the privacy and security of our data is one of our top priorities, and we continue to enhance an advanced industry standard Zero-Trust software-defined network, coupled with multi-factor authentication, to secure our environment from unauthorized access.

Total Rewards

We provide competitive compensation and benefits programs for our employees. In addition to salaries, these programs (which vary by employee level and by the country where the employees are located) include, among other items, bonuses, stock awards, retirement benefits including 401(k) (or local market equivalent), healthcare and insurance benefits, health savings and flexible spending accounts, paid time off, paid parental leave, advocacy resources, flexible work schedules and employee assistance programs.

Available Information

Corporate information and our press releases, Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and amendments thereto, are available free of charge on our corporate website at corporate.ww.com as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission, or the SEC. Moreover, we also make available at that site the Section 16 reports filed electronically by our officers, directors and 10 percent shareholders.

We use our corporate website at corporate.ww.com and certain social media channels such as our corporate Facebook page (www.facebook.com/WW), Instagram account (Instagram.com/WW) and Twitter account (@ww_us) as channels of distribution of Company information. The information we post through these channels may be deemed material. Accordingly, investors should monitor these channels, in addition to following our press releases, SEC filings and public conference calls and webcasts. The contents of our website and social media channels shall not be deemed to be incorporated herein by reference.

Our Amended and Restated Code of Business Conduct and Ethics, or the Code of Business Conduct and Ethics, and our Corporate Governance Guidelines as amended are also available on our corporate website at corporate.ww.com.

13

Item 1A. Risk Factors

You should consider carefully, in addition to the other information contained in this Annual Report on Form 10-K and the exhibits hereto, the following risk factors in evaluating our business. Our business, financial condition or results of operations could be materially adversely affected by any of these risks. The following discussion of risks is not all inclusive but is designed to highlight what we believe are the most significant risks that we face. Additional risks and uncertainties, not presently known to us or that we currently deem immaterial, may also have a material adverse effect on our business, financial condition or results of operations.

Risks Related to Our Business and Operations

The COVID-19 pandemic has adversely impacted, and may continue to adversely impact, our business performance and the consumer environment and markets in which we operate.

The novel coronavirus (including its variants, COVID-19) pandemic has had a significant adverse impact on our business as well as on the business environment, overall economic conditions and the markets in which we operate. Although the global economy has largely re-opened following distribution of approved vaccines for COVID-19, we have continued to observe unpredictable, significant shifts in consumer sentiment and behavior with respect to the weight loss and wellness marketplace and the prioritization of discretionary spending, which we believe in part is attributable to the evolution of the pandemic and may continue to impact our business performance and operations. COVID-19 had a significant effect on our recruitments starting in March 2020. Our Workshops + Digital recruitments were substantially negatively impacted during the first year of the pandemic. While Digital recruitments were strong in the beginning of the COVID-19 pandemic, a subsequent turn in consumer sentiment drove a decline in Digital recruitments. Given the long-term subscription model of our business, these declines in recruitment continued to impact the number of our End of Period Subscribers in the fourth quarter of fiscal 2022, which declined compared to the prior year. Additionally, our mix shift toward our Digital business, which was significant during the onset of the pandemic, especially when amplified by the nature of our subscription business, negatively impacted revenue and may continue to do so. Over the longer term, it remains uncertain how the COVID-19 pandemic will impact consumer demand for our products and services and recruitment and retention of members as well as consumer preferences and behavior generally.

Competition from other weight management and wellness industry participants or the development of more effective or more favorably perceived weight management methods could result in decreased demand for our services and products.

The weight management and wellness marketplace is highly competitive. We compete against a wide range of providers of weight management services and products. Our competitors include: commercial weight management programs; the pharmaceutical industry and prescription and over the counter weight management and weight loss pills and appetite suppressants; weight loss and wellness apps and monitoring solutions, such as wearable trackers; surgical procedures; the genetics and biotechnology industry; self-help weight management regimens and other self-help weight management products, services and publications, such as books, magazines, websites, and social media influencers and groups; dietary supplements and meal replacement products; healthy living services, coaching, products, content and publications; weight management services administered by doctors, nutritionists and dieticians; government agencies and non-profit groups that offer weight management services; fitness centers; and national drug store chains. As we or others develop new or different weight management services, products, methods or technologies, additional competitors may emerge. Furthermore, existing competitors may enter new markets or channels of distribution or expand their offerings or advertising and marketing programs, and future competitors may do the same. More effective or more favorably perceived, or easier to use, diet and weight and healthy living management methods, including pharmaceutical treatments, fat and sugar substitutes or other technological and scientific advancements in weight management methods, also may be developed. Some of our competitors are also significantly larger than we are and have substantially greater resources. This competition may reduce demand for our services and products.

14

Increased attention by consumers and the media to recent developments, innovations, and approvals of chronic weight management drug therapies, and the perception of their safety, effectiveness and ease of use, may also delay or prevent consumer engagement in our core businesses. If the Acquisition is consummated, we and our members may also experience the consequences of the increased consumer interest in such drug therapies, including shortages, manufacturing-related delays, and stock issues at mail order and local pharmacies that fill prescriptions for such therapies. If the Acquisition is consummated, we anticipate competition from other companies that provide telehealth services associated with weight management, and certain of these competitors have greater financial and other resources than us and have operations in therapeutic or other areas where we may seek to expand in the future.

The purchasing decisions of weight management and healthy living consumers are highly subjective and can be influenced by many factors, such as perception of the ease of use and efficacy of the service and product offerings as well as brand image or reputation, marketing programs, cost, social media presence and sentiment, consumer trends, personalization, the digital platform, content and user experience. Moreover, consumers can, and frequently do, change approaches easily. For example, fad diets and weight loss trends, such as low-carbohydrate diets, have adversely affected our revenues from time to time. Also, our revenue has been and may continue to be adversely affected by the popularity of apps, pharmacotherapy treatments, activity monitors and other free or low-cost “do-it-yourself” alternatives. Any decrease in demand for our services and products may adversely affect our business, financial condition or results of operations.

A failure to continue to retain and grow our subscriber base could adversely affect our results of operations and business.

Subscriptions to our businesses generate the predominant portion of our revenue, and our future growth depends upon our ability to retain and grow our subscriber base and audience. To do so will require us to continue to evolve our subscription model, user experience and digital platforms; address changing consumer demands and developments in technology; and improve our services and products while continuing to provide our members with guidance, compelling content, personalization and an inspiring community to enable them to develop healthy habits. We have invested and will continue to invest significant resources in these efforts, but there is no assurance that we will be able to successfully maintain and increase our subscriber base or that we will be able to do so without taking steps such as reducing pricing or incurring subscription acquisition costs that would affect our subscription revenues, margin and/or profitability.

If we do not continue to develop new, innovative services and products or if our services, products or brands do not continue to appeal to the market, or if we are unable to successfully expand into new channels of distribution or respond to consumer trends or sentiment, our business may suffer.

The weight management and wellness marketplace is subject to changing consumer demands and sentiment based, in large part, on the efficacy, ease of use and popular appeal of weight management and healthy living programs. The popularity of weight management and healthy living programs is dependent, in part, on their ease of use, cost and channels of distribution as well as consumer trends or sentiment. For example, consumers are increasingly focusing on more integrated lifestyle and fitness approaches and may associate our program with just food, nutrition and diet, which could adversely impact its popularity. Additionally, developments in public opinion on the types of products and services we provide could negatively impact the popular appeal of our services and products. For example, public opinion on the use of chronic weight management medication is significantly shifting as the popularity of clinical solutions grows and more medications are approved by the FDA. The growing acceptance of the use of medication to manage weight could negatively impact the popular appeal of our Digital and Workshops + Digital businesses. Our future success depends on our ability to continue to develop and market new, innovative services and products and to enhance our existing services and products, each on a timely basis, to respond to new and evolving consumer demands and sentiment, achieve market acceptance and keep pace with new nutritional, weight management, healthy living, technological and other developments. We may not be successful in developing, introducing on a timely basis or marketing any new or enhanced services and products. Additionally, new or enhanced services or products may not appeal to the market or the market’s perception of us. As we announce new brands, sub-brands or articulations of our brands, and we adopt new trademarks, the marketplace may not embrace or accept them and it may take time to build their reputation and goodwill, both with consumers and with our partners. Our future success also will depend, in part, on our ability to successfully distribute our services and products through appealing channels of distribution. Our failure to develop new, innovative services and products and to enhance our existing services and products, the failure of our services, products or brands to continue to appeal to the market or respond to consumer trends or sentiment, or the failure to expand into appealing new channels of distribution could have an adverse impact on our ability to attract and retain members and subscribers and thus adversely affect our business, financial condition or results of operations.

15

We may not be able to successfully implement our strategic initiatives, which could adversely impact our business, financial conditions or results of operations.

We are continually evaluating the changing consumer environment and the competitive environment of the weight management and healthy living marketplace and seeking out opportunities to improve our performance through the implementation of selected strategic initiatives. The goal of these efforts is to develop and implement a comprehensive and competitive business strategy that addresses those changes. Over the past several years, we have expanded our offerings in health and wellness. We may not be able to successfully implement our strategic initiatives and realize the intended business opportunities, growth prospects, including new business channels, and competitive advantages. Our efforts to capitalize on business opportunities may not bring the intended results. Assumptions underlying expected financial results or consumer demand and receptivity may not be met or economic or consumer conditions may deteriorate. We also may be unable to attract and retain highly qualified and skilled personnel, or engage with partners of choice, to implement our strategic initiatives. If these or other factors limit our ability to successfully execute our strategic initiatives, our business activities, financial condition or results of operations may be adversely affected.

We continually innovate our offerings to best serve our members. For example, in November 2021, we launched a new food plan innovation, with corresponding design, usability, features and capabilities updates to our app. As we continue to embrace an “always on” innovation strategy across multiple areas of our offerings, these innovations may not be successful in meeting the needs or preferences of many of our current or potential members. As a result, we may experience decreases in our recruitment and retention of members, or increased member cancellations. We may not be able to successfully launch new virtual or other digital offerings and realize the intended business opportunities, growth prospects, including new business channels, and competitive advantages of our digital strategy. Assumptions underlying expected financial results or consumer demand and receptivity may not be met or economic or consumer conditions may deteriorate, including as a result of the impact of COVID-19, and may adversely impact our ability to continue to successfully implement this digital strategy. If these or other factors limit our ability to successfully execute this strategic initiative, our business, financial conditions or results of operations may be adversely impacted. Additionally, as we continue to innovate our workshop experience and explore new in-person formats, we may not be successful in meeting the needs of many of our current or potential members.

We may not be successful in the evolution of our Workshops + Digital business strategy, which could adversely affect our business, reputation, or financial results.

We believe that the power of our community is one of the factors that enables us to attract new and returning customers. At the onset of the COVID-19 pandemic, we rapidly transitioned our in-person workshops to an entirely digital experience and thereafter selectively resumed in-person workshops where profitable and consistent with promoting the health and safety of our employees and members. As part of our focus on best meeting our members’ and consumers’ evolving needs in the wake of the COVID-19 pandemic, we consolidated certain of our studios and continue to close certain other branded studio locations. We continue to serve our members virtually, both via our Digital business and through virtual workshops. However, we have not seen a resurgence in demand to pre-pandemic levels for our Workshops + Digital business. The related management of our real estate portfolio has led to the current number of our studio locations being significantly lower than prior to the pandemic, and we continue to reconsider both our studio footprint and workshop strategy as we evaluate our cost structure and respond to shifting consumer sentiment. As a result, we have incurred, and will continue to incur, significant costs associated with our real estate realignment and the corresponding reduction of operations in this business. The evolution of our traditional in-person formats, or the introduction of new ones, may dilute the competitive advantage of our community or discourage current or potential Workshops + Digital members from subscribing to our offerings. New iterations of this business may not develop in accordance with the expectations of our investors or our network of coaches and members, which could negatively impact our public or market perception and, in turn, adversely affect our business, reputation, or financial results.

16

Our business depends on the effectiveness and efficiency of our advertising and marketing programs across multiple platforms, including the strength of our social media presence, to attract and retain members and subscribers.

Our business success depends on our ability to attract and retain members and subscribers. Our ability to attract and retain members and subscribers depends significantly on the effectiveness and efficiency of our advertising and marketing practices across multiple platforms. For example, if our advertising and marketing programs are not effective and fail to attract sufficient recruitments during the first quarter of the fiscal year, our most important period for recruitments, it historically has had an outsized negative impact on our performance for the remainder of the year. Our competitors may create more compelling marketing campaigns or marketing campaigns that appeal to diverse audiences, or may devote greater financial and other resources to marketing and advertising, which could drive our current and potential members and subscribers to our competitors. Additionally, our marketing initiatives may become increasingly expensive and generating a meaningful return on those initiatives may be difficult. In addition, from time-to-time, we use the success stories of our members and subscribers, and utilize brand ambassadors, spokespersons and social media influencers, including in some cases celebrities, in our advertising and marketing programs to communicate on a personal level with consumers. Actions taken by these individuals that harm their personal reputation or image, or include the cessation of using our services and products, could have an adverse impact on the advertising and marketing campaigns in which they are featured. We and our brand ambassadors, spokespersons and social media influencers also use social media channels as a means of communicating with consumers. Unauthorized or inappropriate use of these channels could result in harmful publicity or negative consumer experiences, which could have an adverse impact on the effectiveness of our marketing in these channels. In addition, substantial negative commentary by others on social media platforms could have an adverse impact on our reputation and ability to attract and retain members and subscribers. If our advertising and marketing campaigns do not generate a sufficient number of members and subscribers, or fail to develop a high level of engagement with current and potential members and subscribers on various platforms, our business, financial condition and results of operations will be adversely affected.

Our reputation could be impaired due to actions taken by our franchisees, licensees, suppliers and other partners.

We believe that our brands, including their widespread recognition and strong reputation and goodwill in the market, are one of our most valuable assets and they provide us with a competitive advantage. Our franchisees operate their businesses under our brands. We license our trademarks to third parties for the manufacture and sale in retail stores by such parties of a variety of goods, including food products, and also co-brand or endorse third-party branded consumer services and products. We also sell through a variety of channels, including online through our e-commerce platforms, at our studios, and through our trusted partners, food and non-food products manufactured by third-party suppliers. In addition, we integrate our services and products with those of other third parties, including through bundled and joint offerings, and integrate data from trusted third-party partners into our offerings. Our third-party partnerships also extend to event sponsorships and co-promotions. Our franchisees, licensees, suppliers and other partners are independent third parties with their own financial objectives, third-party relationships and brand associations. Actions taken by them, including violations of generally accepted ethical business practices or breaches of law, regulations or contractual obligations, such as not following our program or not maintaining our quality and safety standards, could harm our reputation. Also, our products and services, or the third-party products or services with which we integrate our own services and products, may be subject to product recalls, brand confusion, litigation, regulatory action or other deficiencies, as the case may be, which could harm our brands. Any negative publicity associated with these actions or these third parties would adversely affect our reputation and may result in decreased recruitment, Digital product subscriptions, workshop attendance and product sales and, as a result, lower revenues and profits.

17

If the Acquisition is consummated, we, along with our managed professional corporations, professional associations or equivalent entities, which are legal entities organized under state laws that employ or contract with healthcare professionals in one or more states to provide telehealth services (collectively, “PCs”), may suffer losses or reputational harm from medical malpractice liability, professional liability or other claims against the healthcare professionals employed by, or contracting with, us or the PCs (the “Affiliated Professionals”). We and/or the PCs may be unable to obtain or maintain adequate insurance against these claims. Healthcare professionals providing telehealth services have become subject to a number of lawsuits alleging malpractice and some of these lawsuits may involve large claims and significant defense costs. If the Acquisition is consummated, it is possible that these claims could also be asserted against us, and include us as an additional defendant. Any suits against us, the PCs or the Affiliated Professionals, if successful, could result in substantial damage awards to the claimants that may exceed the limits of any applicable insurance coverage. Although we do not expect to control the practice of telehealth by the PCs and the Affiliated Professionals, if the Acquisition is consummated, it could be asserted that we should be held liable for malpractice of a healthcare professional employed by a PC.

In addition, if the Acquisition is consummated, we and the PCs could incur reputational harm or negative publicity in relation to a material malpractice or care-related event involving an Affiliated Professional. Malpractice lawsuits and claims can also lead to increased scrutiny by state regulators. In addition, some plaintiffs have asserted allegations of corporate practice of medicine in connection with malpractice lawsuits. There can be no assurance, however, that a future claim or claims will not be successful. Malpractice insurance, moreover, can be expensive and varies from state to state and there can be no assurance that malpractice insurance will be available to us or the PCs or the Affiliated Professionals at costs acceptable to us or such healthcare professionals or at all.

If the Acquisition is consummated, successful malpractice claims asserted against us or our PCs or the Affiliated Professionals could have a material adverse effect on our business, financial condition and results of operations. Additionally, our inability to obtain adequate insurance may also have a material adverse effect on our business and financial results.

Additionally, a number of laws and regulations govern the business of advertising, promotion, dispensing, and marketing services and products, including generic and branded pharmaceuticals. These regulatory regimes are overseen by governmental bodies, principally the FDA and, as applicable, the Drug Enforcement Administration, the U.S. Department of Health and Human Services (“HHS”), the FTC and several state and local government agencies in the United States. If the Acquisition is consummated, failure to comply with the laws and regulations of these governmental agencies may result in legal or other enforcement actions, including orders to cease non-compliant activities. If the Acquisition is consummated, we will depend on pharmacy, laboratory and other contractors to provide services for members. These third parties may be subject to inspections and audits by federal, state or local health authorities, health insurers, and pharmacy benefit managers. If these third parties do not maintain appropriate licenses or comply with legal and regulatory requirements or are subject to enforcement actions, our business may be adversely affected.

If the Acquisition is consummated, any inquiry into the safety, efficacy or regulatory status of the products prescribed by the Affiliated Professionals and any related interruption in the marketing and sale of these products could damage our reputation and image in the marketplace. For example, the use of such products may cause adverse events or other undesirable side effects, which could cause regulatory authorities to issue warnings about the products or could lead to recalls, withdrawals of approvals for such products or other regulatory or other enforcement actions. The FDA has also issued warning letters to companies alleging improper claims regarding their pharmaceutical products. If the FDA or any other regulatory authorities determine that we have made inappropriate drug claims, we could receive a warning or untitled letter, be required to modify our claims or take other actions to satisfy the FDA or any other regulatory authorities. There can be no assurance that we will not be subject to state, federal or foreign government actions or class action lawsuits, which could harm our business, financial condition and results of operations.

18

We have in the past and may in the future be required to recognize asset impairment charges for indefinite- and definite-lived assets.