SECURITIES AND EXCHANGE COMMISSION

Form 6-K

Form 40-F

Form 40-F

|

Media Release

Zurich, February 9, 2023

|

|

|

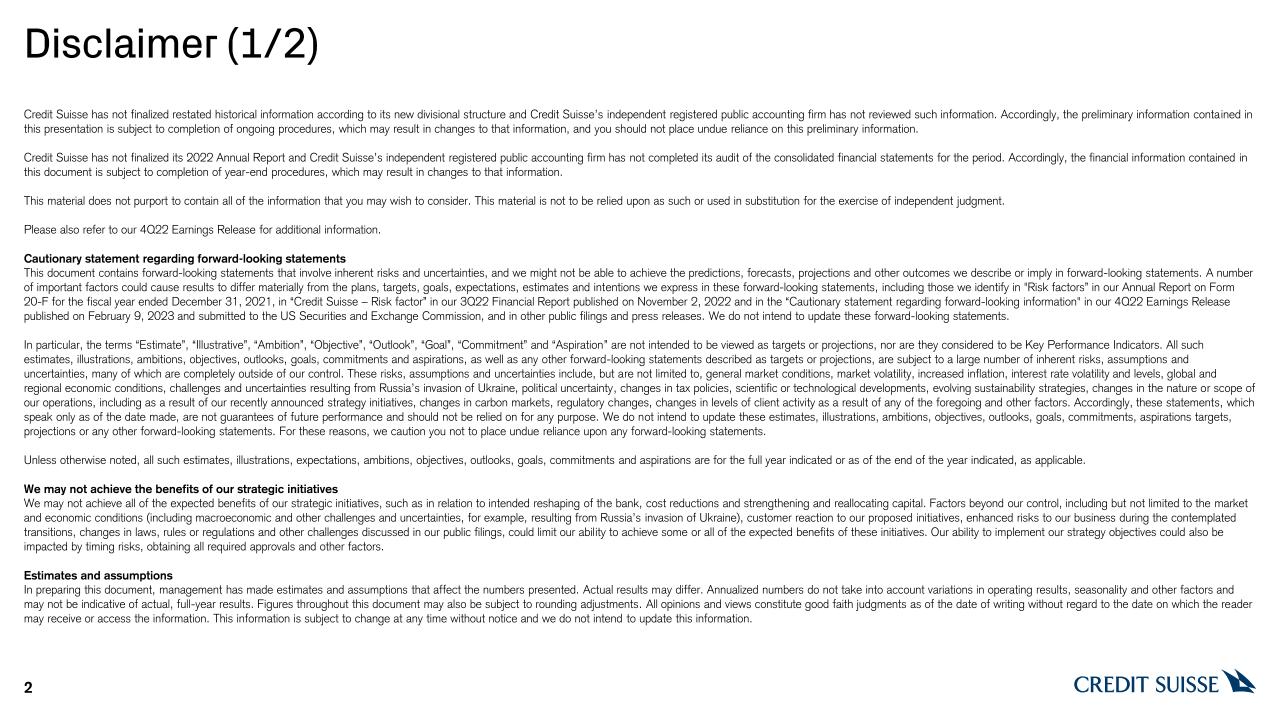

4Q22 financial performance in line with guidance

|

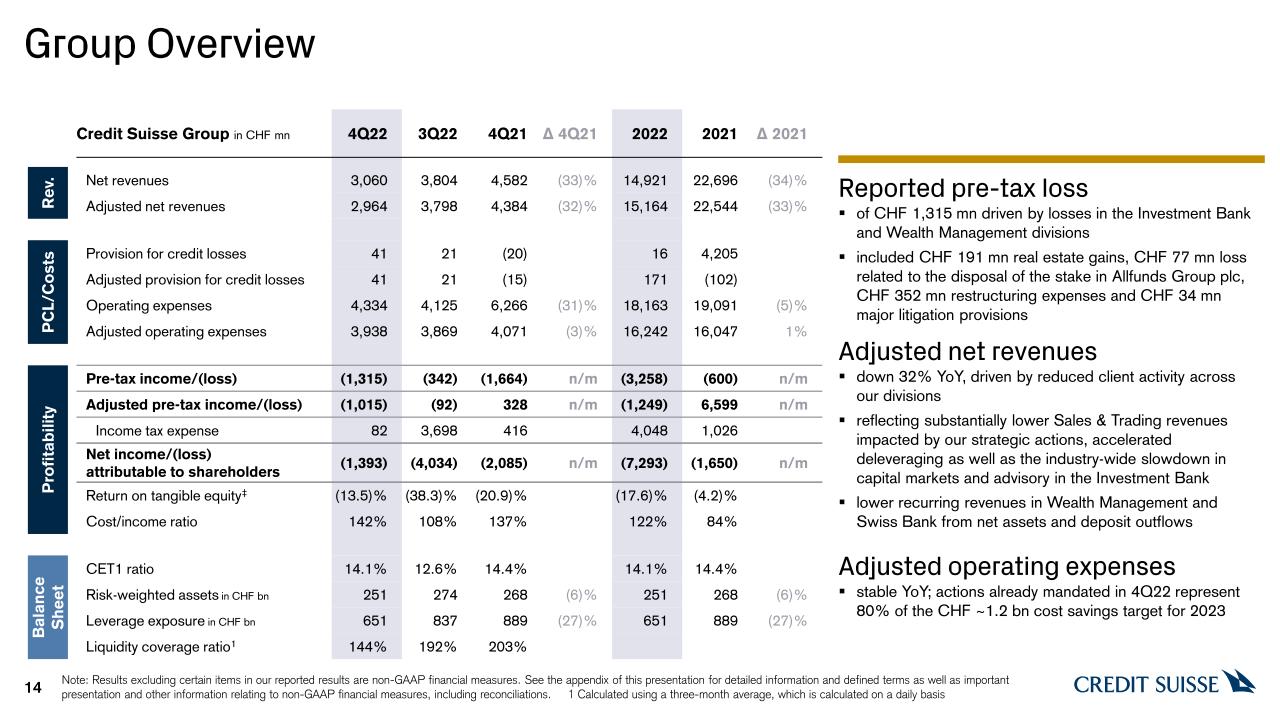

▪ Reported pre-tax loss of CHF 1.3 bn; adjusted* pre-tax loss of

CHF 1.0 bn

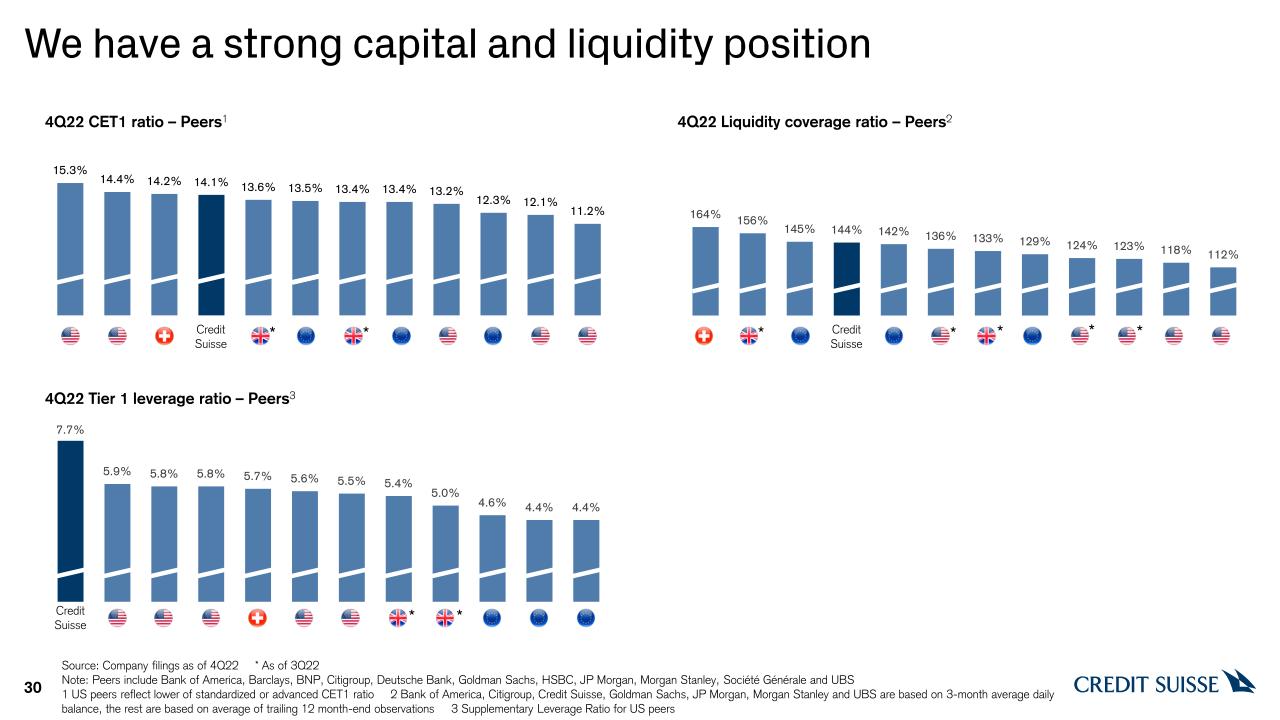

▪ CET1 ratio of 14.1%, Tier 1 leverage ratio of 7.7%

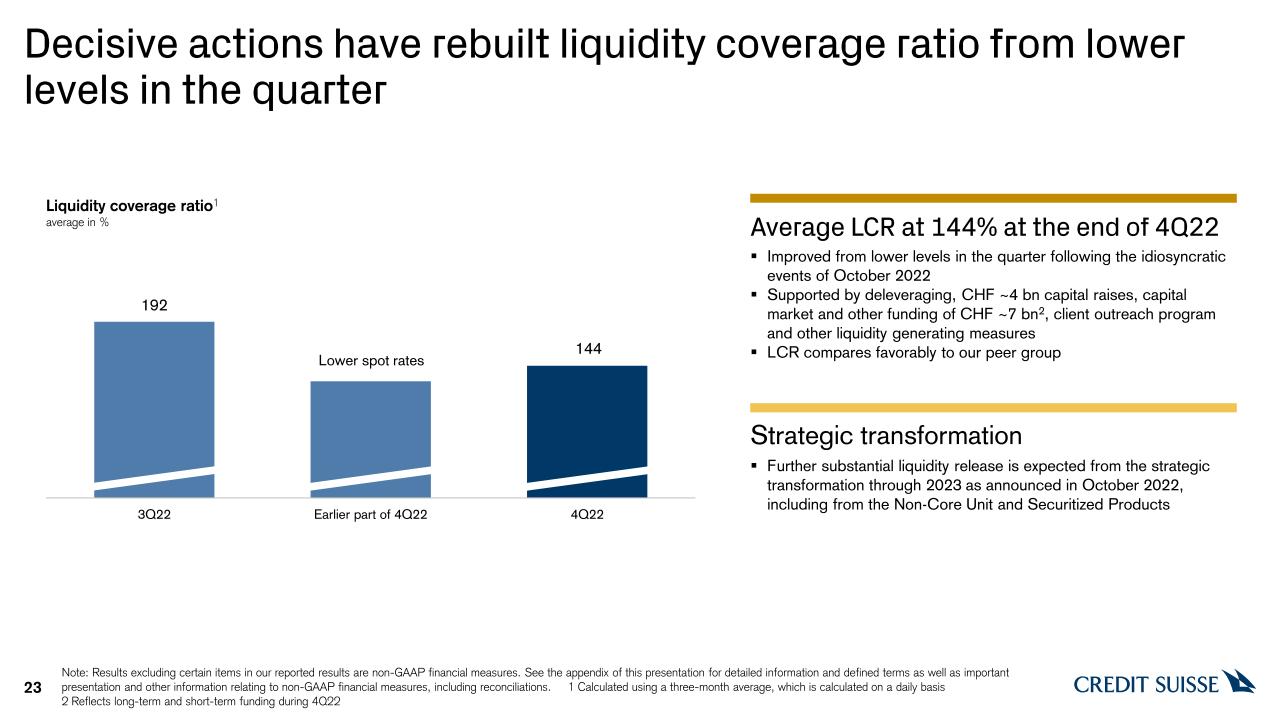

▪ Improved average Liquidity

Coverage Ratio (LCR) of 144%1 at the end of 4Q22 from lower levels in the quarter

▪ Board will propose a cash dividend of CHF 0.05 per share for

2022; subject to shareholder approval at the 2023 Annual General Meeting

|

|

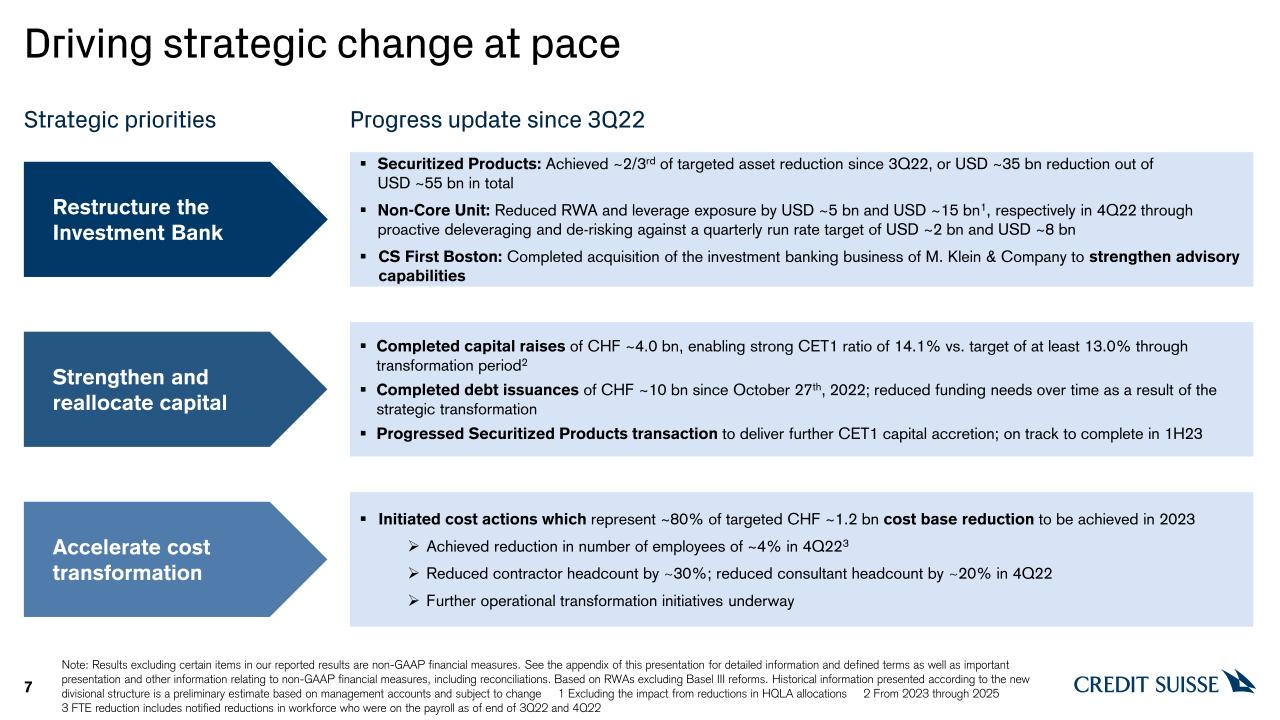

Strategy execution ahead of schedule

|

▪ Strong execution of strategic

actions from a position of capital strength; successful execution of CHF ~4 bn of capital raises

▪ Delivered accelerated deleveraging

of Non-Core Unit (NCU)2 and Securitized Products Group (SPG)

▪ Progressed sale of SPG to Apollo

Global Management3 with first closing of the sale completed on February 8, 2023. On track to complete in 1H23

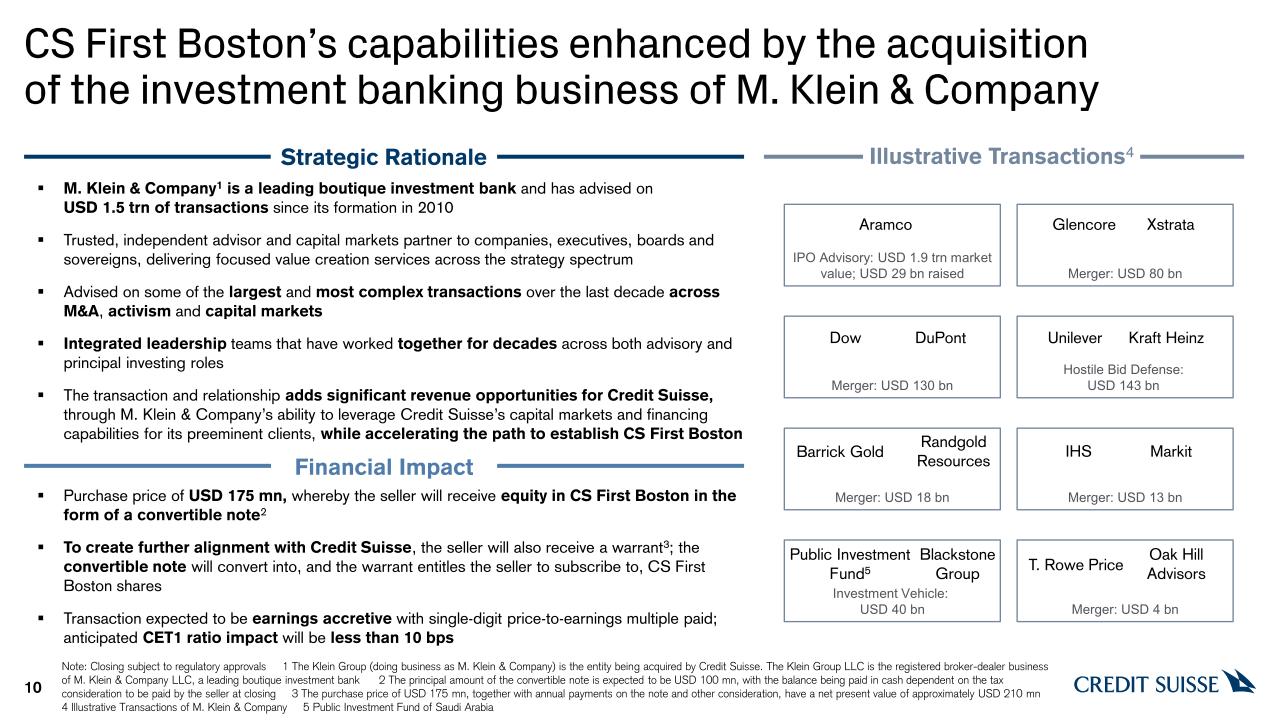

▪ Announced next milestone in the

carveout of CS First Boston with acquisition of The Klein Group LLC4, the investment banking business of M. Klein & Company LLC to strengthen advisory

and capital markets capabilities

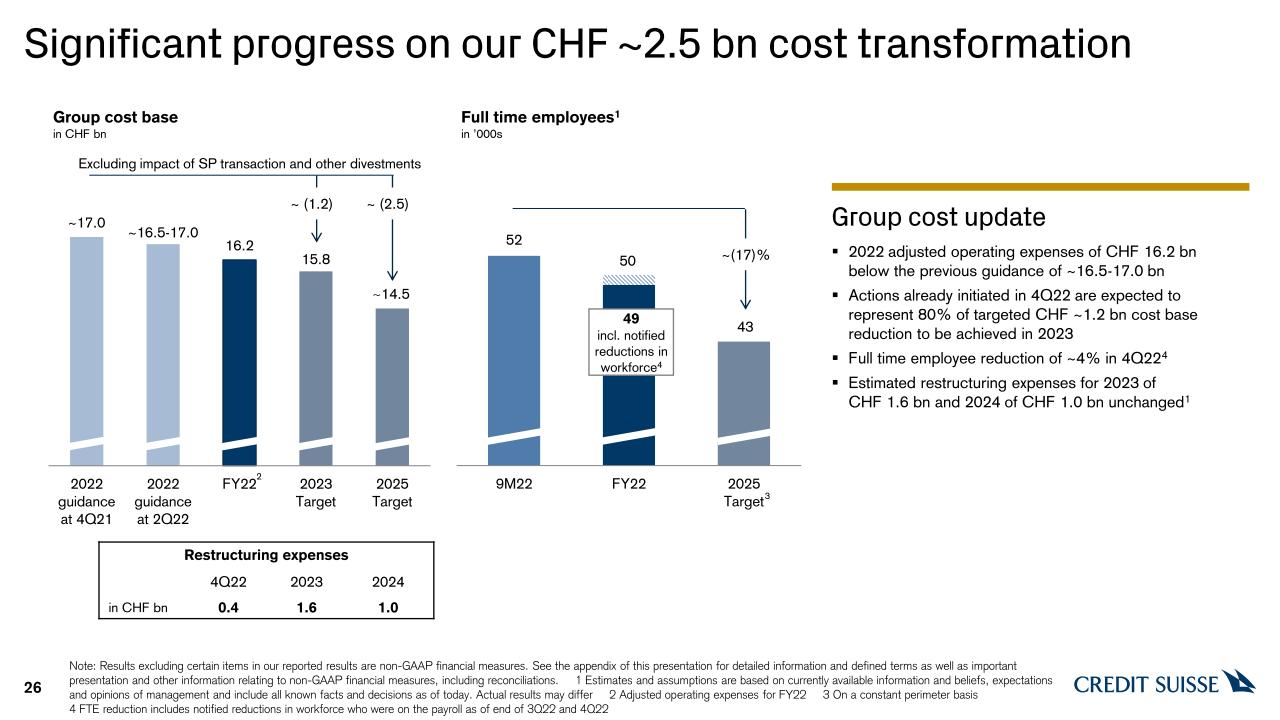

▪ Initiated cost transformation actions in 4Q22, which are

expected to represent ~80% of targeted CHF ~1.2 bn cost base reduction to be achieved in FY23, with further initiatives underway

|

|

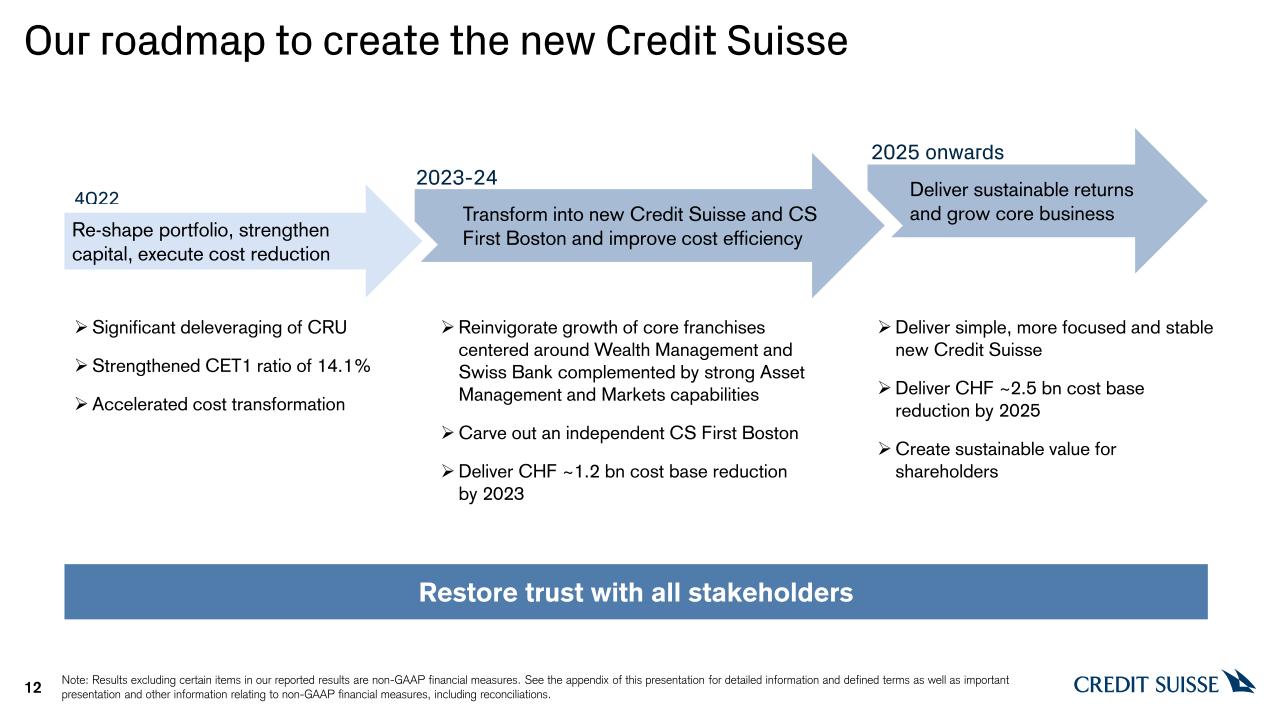

Clear strategic priorities for 2023-2024

|

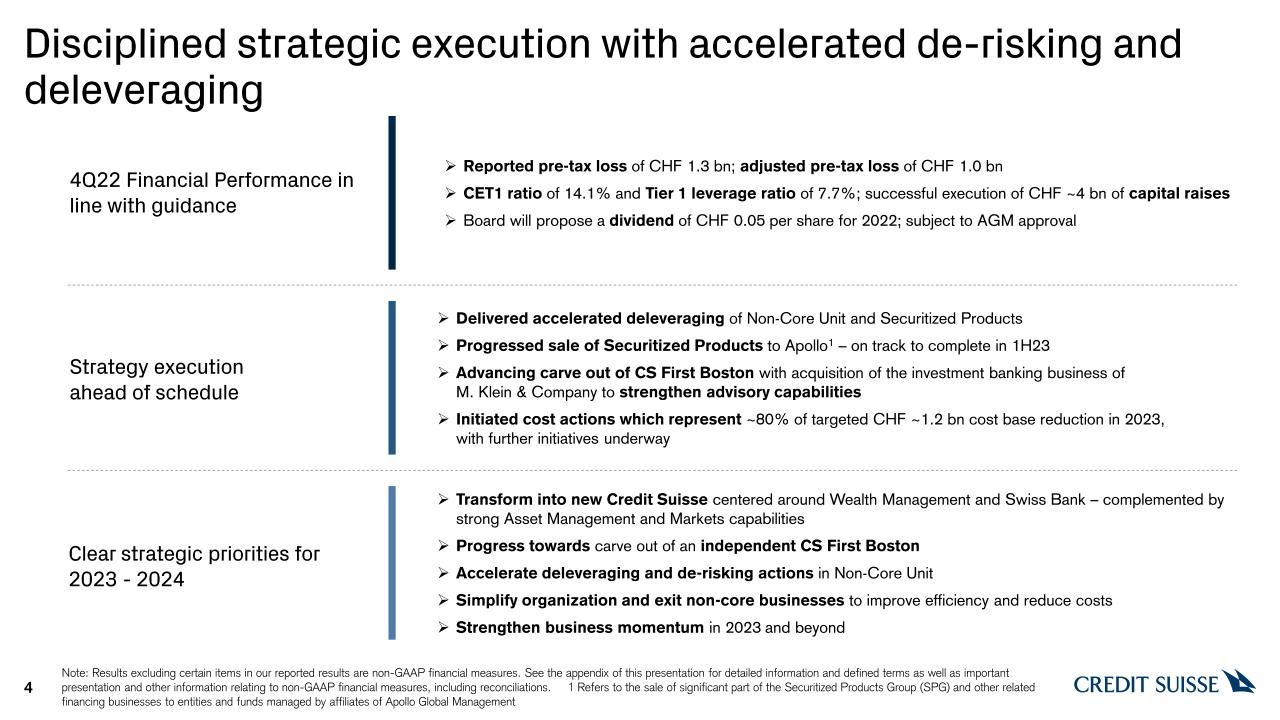

▪ Transform into new Credit Suisse centered around Wealth

Management and Swiss Bank complemented by strong Asset Management and Markets capabilities

▪ Progress towards the carveout of an independent CS First Boston

▪ Accelerate deleveraging and de-risking actions in Non-Core Unit

▪ Simplify organization and exit non-core businesses to improve

efficiency and reduce costs

▪ Strengthen business momentum in 2023 and beyond

|

|

Media Release

Zurich, February 9, 2023

|

|

|

Reported (CHF mn)

|

4Q22

|

3Q22

|

4Q21

|

Δ3Q22

|

Δ4Q21

|

FY22

|

FY21

|

ΔFY21

|

|

Net revenues

|

3,060

|

3,804

|

4,582

|

(20)%

|

(33)%

|

14,921

|

22,696

|

(34)%

|

|

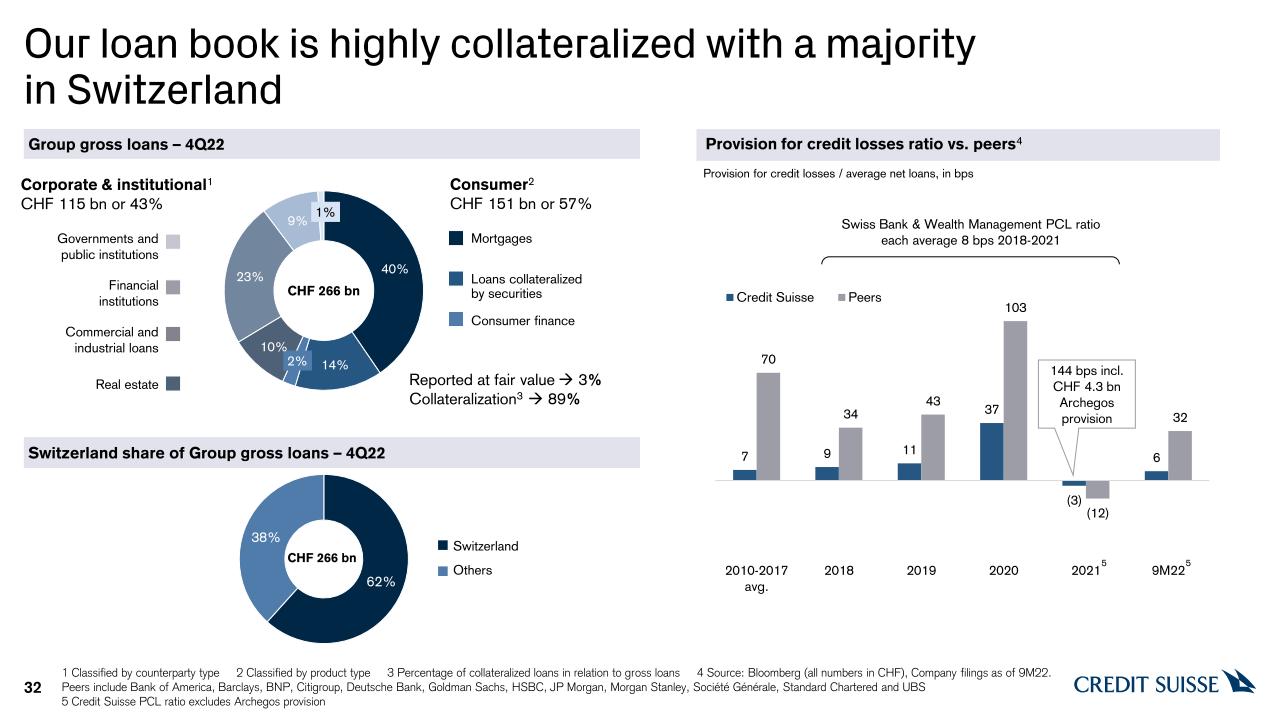

Provision for credit losses

|

41

|

21

|

(20)

|

-

|

-

|

16

|

4,205

|

-

|

|

Total operating expenses

|

4,334

|

4,125

|

6,266

|

5%

|

(31)%

|

18,163

|

19,091

|

(5)%

|

|

Pre-tax income/(loss)

|

(1,315)

|

(342)

|

(1,664)

|

-

|

-

|

(3,258)

|

(600)

|

-

|

|

Income tax expense/(benefit)

|

82

|

3,698

|

416

|

(98)%

|

(80)%

|

4,048

|

1,026

|

-

|

|

Net income/(loss) attributable to shareholders

|

(1,393)

|

(4,034)

|

(2,085)

|

-

|

-

|

(7,293)

|

(1,650)

|

-

|

|

Return on tangible equity

|

(13.5)%

|

(38.3)%

|

(20.9)%

|

-

|

-

|

(17.6)%

|

(4.2)%

|

-

|

|

Cost/income ratio

|

142%

|

108%

|

137%

|

-

|

-

|

122%

|

84%

|

-

|

|

Net New Assets (NNA)/Net Asset Outflows - CHF bn

|

(110.5)

|

(12.9)

|

1.6

|

-

|

-

|

(123.2)

|

30.9

|

-

|

|

Assets under Management (AuM) - CHF bn

|

1,294

|

1,401

|

1,614

|

-

|

-

|

1,294

|

1,614

|

-

|

|

|

||||||||

|

Adjusted* (CHF mn)

|

4Q22

|

3Q22

|

4Q21

|

Δ3Q22

|

Δ4Q21

|

FY22

|

FY21

|

ΔFY21

|

|

Net revenues

|

2,964

|

3,798

|

4,384

|

(22)%

|

(32)%

|

15,164

|

22,544

|

(33)%

|

|

Provision for credit losses

|

41

|

21

|

(15)

|

-

|

-

|

171

|

(102)

|

-

|

|

Total operating expenses

|

3,938

|

3,869

|

4,071

|

2%

|

(3)%

|

16,242

|

16,047

|

1%

|

|

Pre-tax income/(loss)

|

(1,015)

|

(92)

|

328

|

-

|

-

|

(1,249)

|

6,599

|

-

|

|

Capital ratios

|

4Q22

|

3Q22

|

4Q21

|

Δ3Q22

|

Δ4Q21

|

FY22

|

FY21

|

ΔFY21

|

|

CET1 ratio

|

14.1%

|

12.6%

|

14.4%

|

-

|

-

|

14.1%

|

14.4%

|

-

|

|

Tier 1 leverage ratio

|

7.7%

|

6.0%

|

6.1%

|

-

|

-

|

7.7%

|

6.1%

|

-

|

|

CET1 leverage ratio

|

5.4%

|

4.1%

|

4.3%

|

-

|

-

|

5.4%

|

4.3%

|

-

|

|

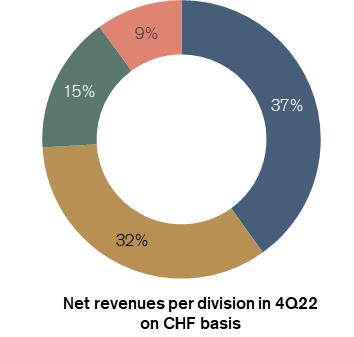

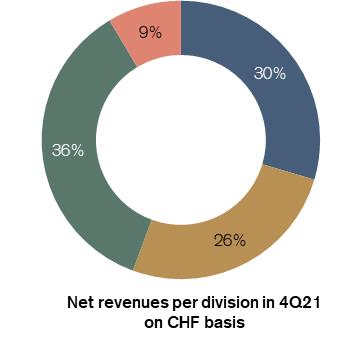

Wealth Management

|

|

Wealth Management

|

|

|||

|

Investment Bank

|

Investment Bank

|

|||||

|

Swiss Bank

|

Swiss Bank

|

|||||

|

Asset Management

|

Asset Management

|

|||||

|

Media Release

Zurich, February 9, 2023

|

|

|

Media Release

Zurich, February 9, 2023

|

|

|

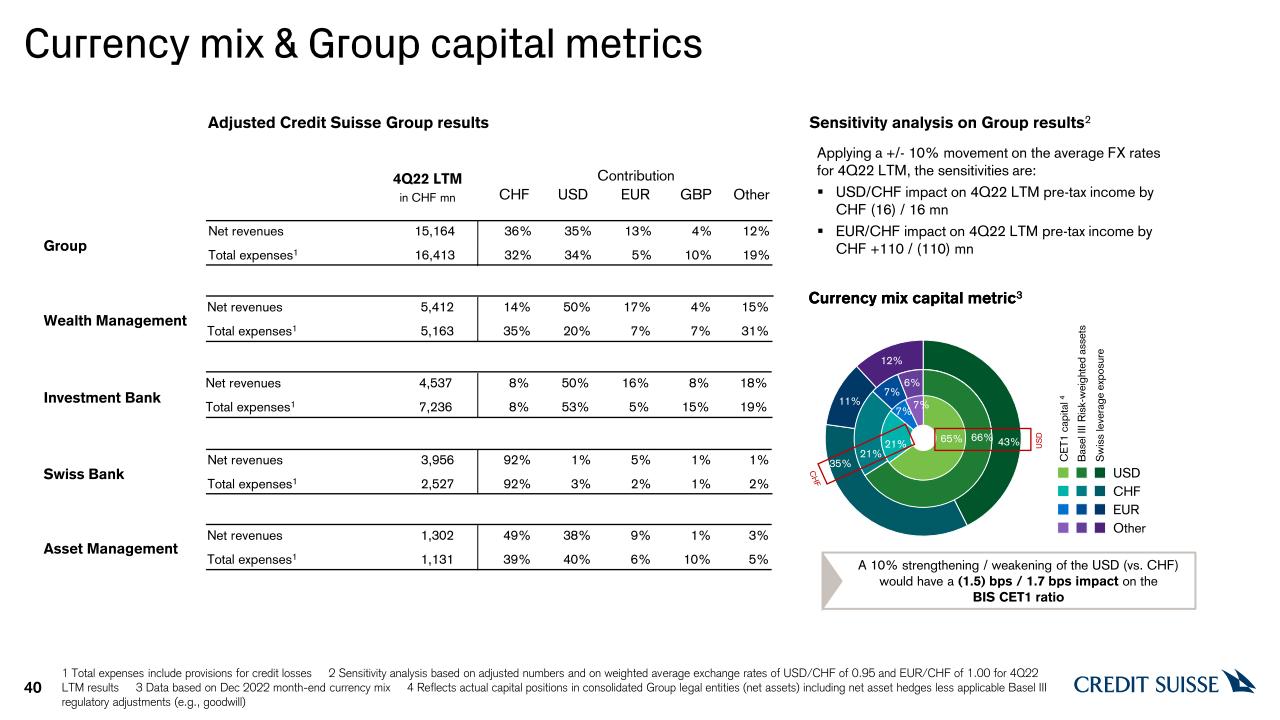

Outlook

|

|

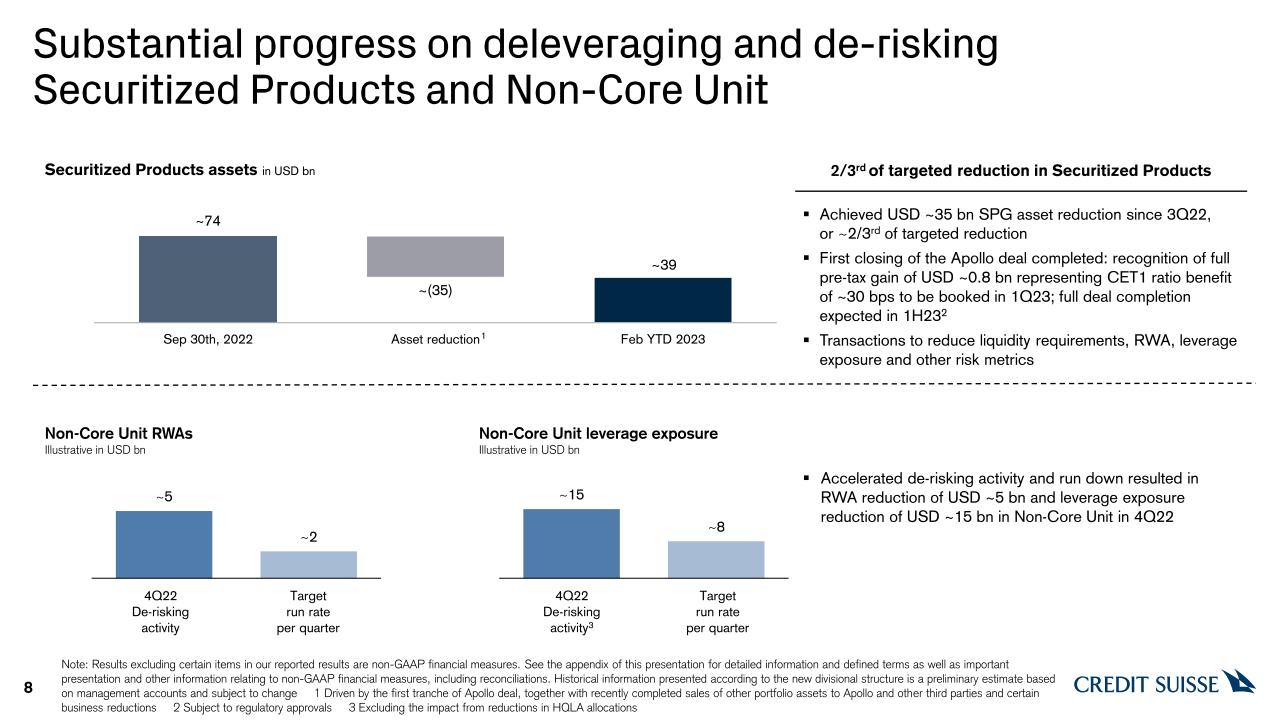

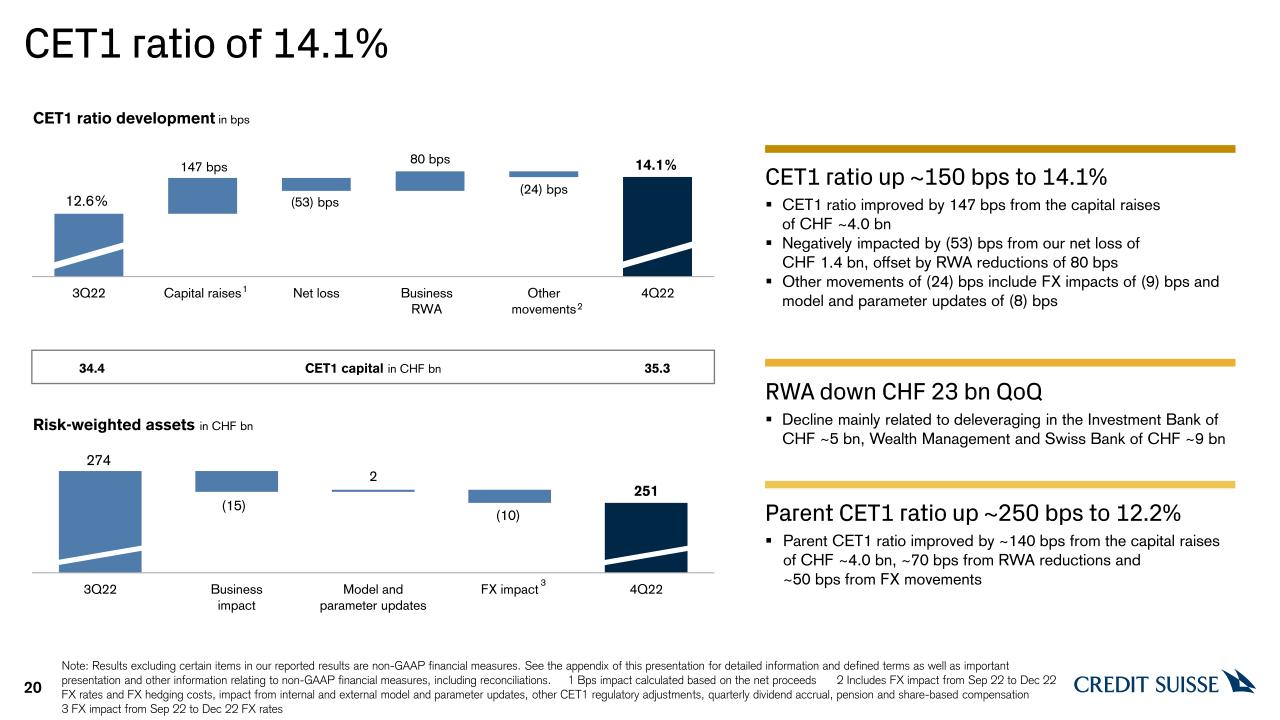

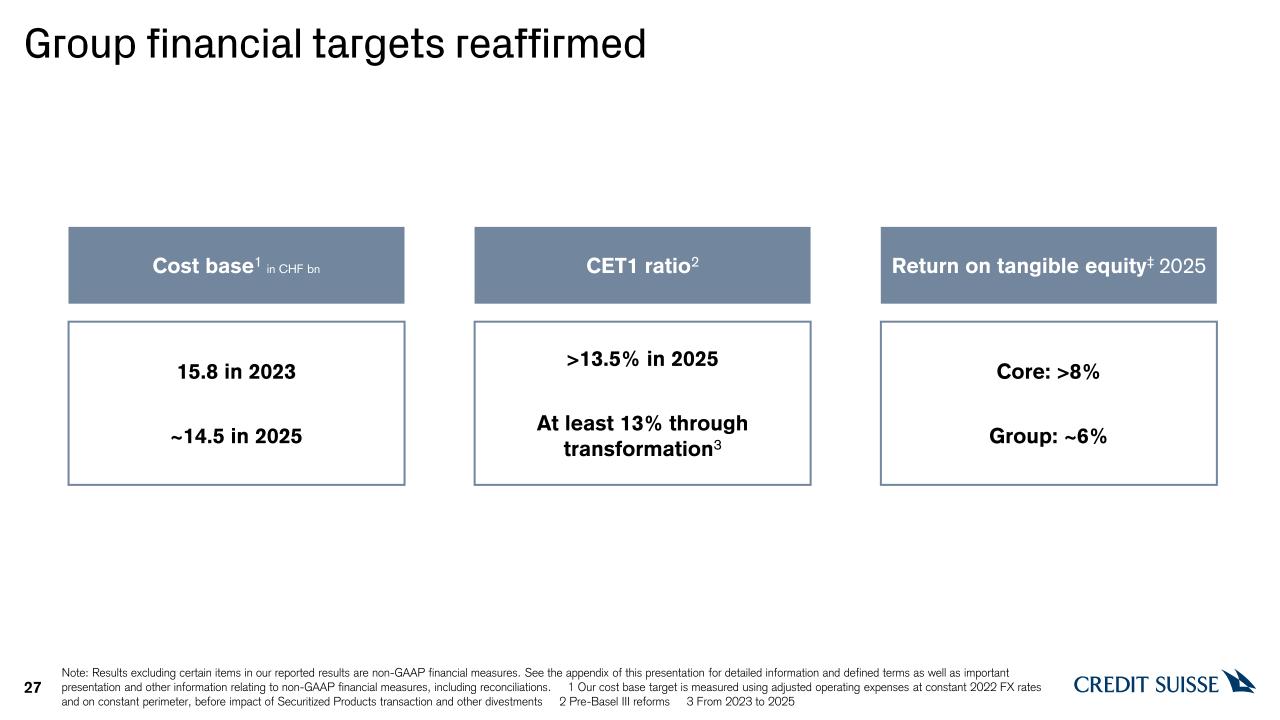

Credit Suisse continues to execute on its strategic transformation at pace and confirms the targets announced at the October 2022 strategy update. We have strengthened our capital position with a 4Q22 CET1

ratio of 14.1%. We have improved our average Liquidity Coverage Ratio to 144% from lower levels in the quarter7. We have also accelerated our cost

transformation program and continued to execute on the decisive strategic actions announced on October 27, 2022. We have accelerated the proactive deleveraging of non-core businesses and exposures as well as progressed on the announced sale

of a significant part of our Securitized Products Group (SPG) to entities and funds managed by affiliates of Apollo Global Management. The reduction in the SPG portfolio has already achieved approximately two-thirds of its targeted asset

reduction since 3Q22, with the first closing of the transaction with Apollo Global Management completed on February 8, 2023, subject to regulatory approvals. After this first closing, Credit Suisse is expecting to recognize the full pre-tax

gain on the sale of approximately USD 0.8 bn, representing a CET1 ratio benefit of ~30 basis points to be booked in 1Q23. The sale is expected to be completed in 1H23. The actions we are taking are expected to further strengthen liquidity

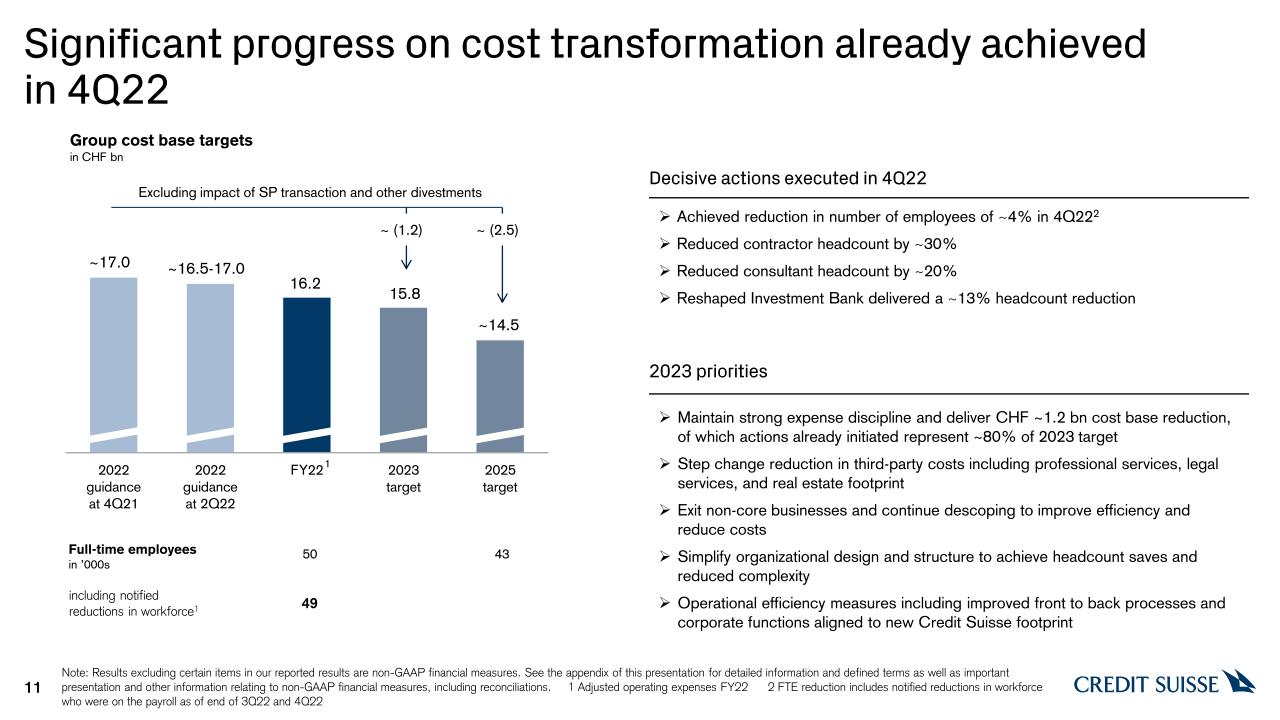

ratios and reduce the funding requirements of the Group. The bank’s cost transformation is well under way and actions already initiated by Credit Suisse in 4Q22 are expected to represent ~80% of the 2023 cost base reduction target of

approximately CHF 1.2 bn, with further initiatives underway.

Our financial results for 2022 were significantly affected by the challenging macro and geopolitical environment with market uncertainty and client risk aversion. This environment has had an adverse impact

on client activity across all our divisions. While we would expect these market conditions to continue in the coming months, we have taken comprehensive measures to further increase our client engagement, regain deposits as well as AuM and

improve cost efficiencies.

As previously disclosed, Credit Suisse experienced deposit and net asset outflows in 4Q22. While these outflows were significant, approximately two thirds of the outflows in the quarter were concentrated in

October and had reduced substantially for the rest of the quarter. While the bank continues to take proactive actions to regain client inflows, lower deposits and AuM are expected to lead to reduced net interest income and recurring

commissions and fees. While this is likely to lead to a loss for WM in the 1Q23, performance for the remainder of 2023 will depend on our ability to execute our strategy, net asset flows and market conditions.

Strategic actions taken to significantly reduce the Group’s risk profile are expected to be reflected in our financial results and given the challenging market backdrop, we would expect the IB to report a

loss in 1Q23. In light of the adverse revenue impact from the previously disclosed exit from non-core businesses and exposures as well as, in particular restructuring charges related to our cost transformation, Credit Suisse would also

expect the Group to report a substantial loss before taxes in 2023. The Group’s actual results will depend on a number of factors including the performance of the IB and WM divisions, the continued exit of non-core positions, any goodwill

impairments, litigation, regulatory actions, credit spreads and related funding costs, and the outcome of certain other items, including potential real estate sales. We estimate restructuring expenses for 2023 of CHF ~1.6 bn and 2024 of CHF

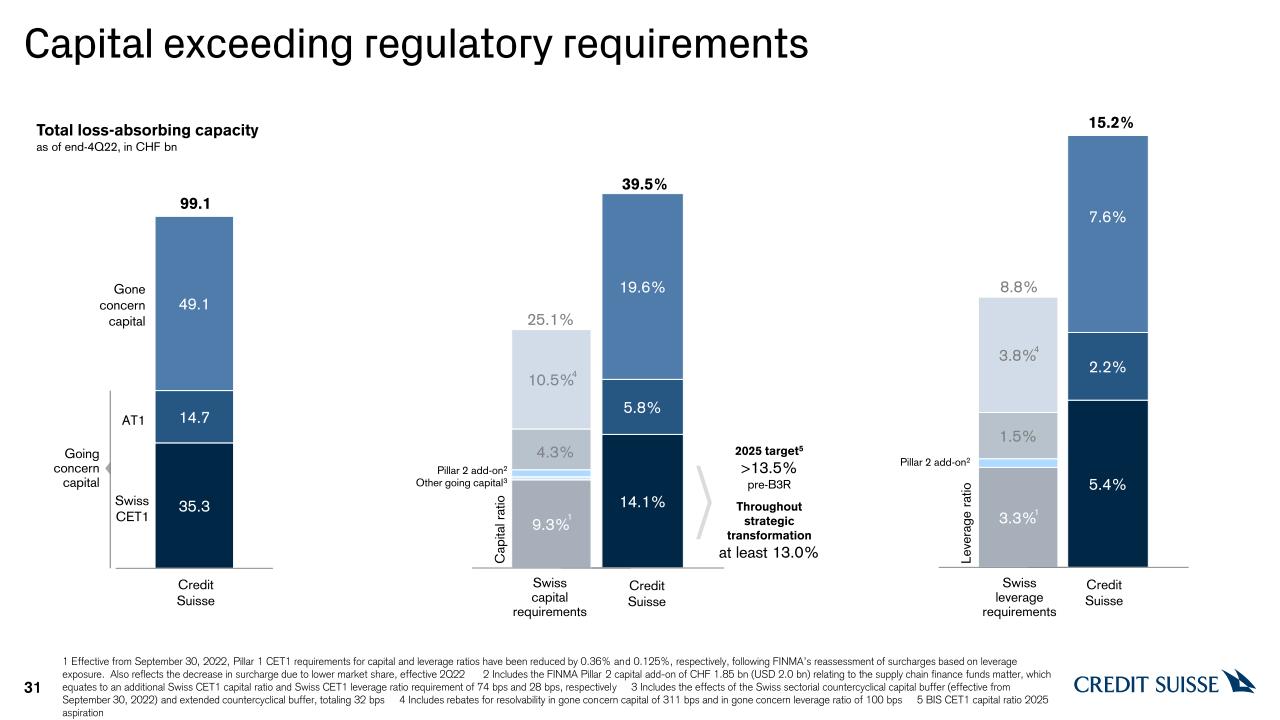

~1.0 bn, unchanged from previous guidance8. In respect of regulatory capital, the Group continues to target a 2025 pre-Basel III reform CET1 ratio of more than

13.5%, while expecting to maintain a pre-Basel III reform CET1 ratio of at least 13% throughout the transformation period through 2025.

|

|

Media Release

Zurich, February 9, 2023

|

|

| ▪ |

Completed our capital raises with gross proceeds of CHF ~4 bn, marking a significant milestone on our transformation journey. Through the capital raises we strengthened our CET1 ratio by approximately 147 bps9, enabling us to progress with our strategic actions from a position of capital strength. Our CET1 capital ratio was 14.1% as of the end of 4Q22, up from 12.6% at the end of 3Q22

|

| ▪ |

Announced that we have entered into definitive transaction agreements to sell a significant part of SPG to entities and funds managed by affiliates of Apollo Global Management. With the execution of the first closing of the transaction,

we have achieved USD ~35 bn asset reduction in SPG and other related financing businesses since the end of 3Q22, or approximately two-thirds of the targeted asset reduction

|

| ▪ |

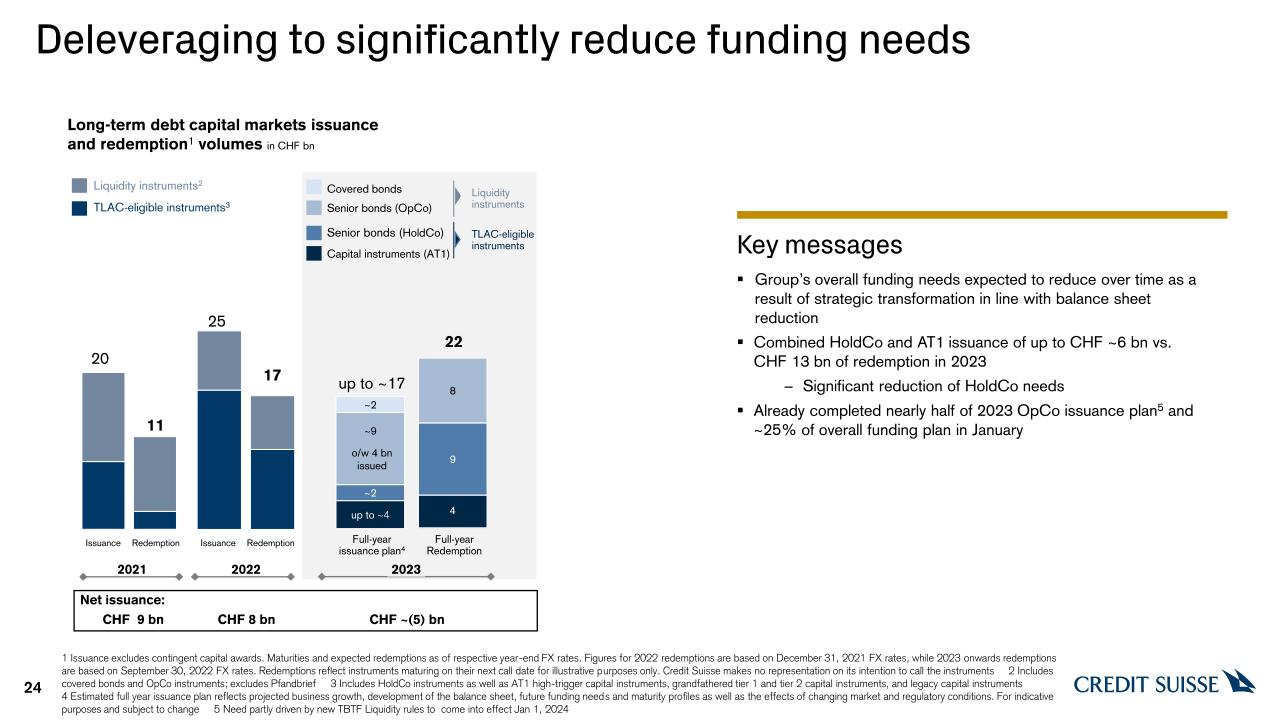

Successfully executed our funding plan for 2022; completed debt issuances of CHF ~10 bn since October 27, 2022, including issuance of over USD 5 bn through three bond sales in November and December 2022, which saw strong investor demand

|

| ▪ |

Accelerated cost transformation is well under way. The cost actions already initiated as of December 2022, are expected to represent ~80% of the 2023 cost base reduction target of approximately CHF ~1.2 bn, with

further initiatives in progress. The number of employees reduced by ~4% in 4Q22, including notified reductions in workforce10. We have also reduced contractor

headcount by ~30% and consultant headcount by ~20% in 4Q22

|

| ▪ |

Total RWA reduced QoQ by CHF 23 bn in 4Q22. The decline is mainly related to deleveraging in the Investment Bank of CHF ~5 bn and CHF ~9 bn in WM and SB, in light of our strategic actions and in response to the Group’s significant

deposit outflows in 4Q22

|

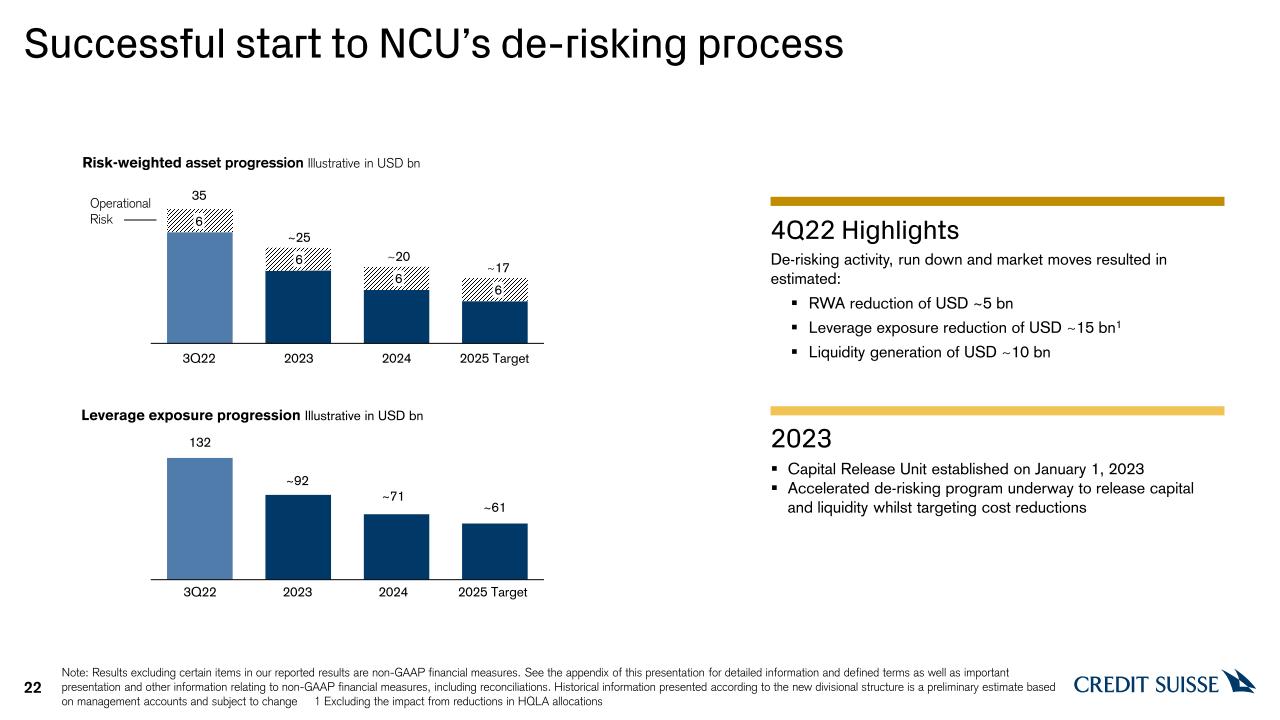

| ▪ |

Successful establishment of our Capital Release Unit, on January 1, 2023, which includes the NCU. Progressing the Group’s de-risking activity with RWA reduction of USD ~5 bn and leverage reduction of USD ~15 bn11 in 4Q22. De-risking activity generated USD ~10 bn of liquidity in 4Q22

|

| ▪ |

Capitalizing on the strength of our WM franchise and reinvigorating growth; reinforcing SB’s leading position as a universal bank. Leveraging our strong and differentiated capabilities in AM and Markets to

complement the core

|

| ▪ |

The full SPG transaction with Apollo Global Management12 is expected to

close in 1H23, subject to regulatory approvals. Following the first closing, we are now expecting to recognize the full pre-tax gain on the sale of USD ~0.8 bn, representing CET1 ratio benefit

~30 basis points to be booked in 1Q23. We expect that the transaction will reduce liquidity requirements, RWA, leverage exposure and other risk metrics and expect to deliver further CET1 accretion.

|

| ▪ |

As we reduce residential mortgage-backed securities (RMBS) exposures and activity as part of our announced strategy towards a managed exit from the SPG business and to de-risk the bank, we anticipate, based on

ongoing regulatory discussions, that operational risk RWA associated with historical RMBS activity will decrease

|

| ▪ |

Advancing on the carveout of CS First Boston as a distinct, leading independent capital markets and advisory business. Acquisition of The Klein Group LLC13, the investment banking business of M. Klein & Company LLC to strengthen CS First Boston’s advisory and capital markets capabilities; additional revenue opportunities from Credit Suisse’s complementary

strengths

|

| ▪ |

Maintaining strong expense discipline by continuing our cost transformation measures throughout 2023, with an aim to deliver CHF ~1.2 bn reduction in the cost base for FY23. We estimate restructuring expenses for

2023 of CHF ~1.6 bn and 2024 of CHF ~1.0 bn, unchanged from previous guidance14

|

| ▪ |

Group-wide review of Credit Suisse’s organizational set up to reduce layers and duplication across divisions and functions, which we expect will support a more effective, less complex design

|

| ▪ |

Detailed review of all aspects of third party spend to drive further efficiencies across divisions and functions including but not limited to real estate footprint and procurement

|

| ▪ |

Group’s overall funding needs expected to reduce over time as a result of strategic transformation in line with balance sheet reduction; 2023 funding plan of up to CHF ~17 bn against CHF 22 bn of redemptions

|

| ▪ |

Strengthening capital and leverage ratios through planned divestments as well as RWA and leverage exposure reductions from the NCU

|

|

Media Release

Zurich, February 9, 2023

|

|

|

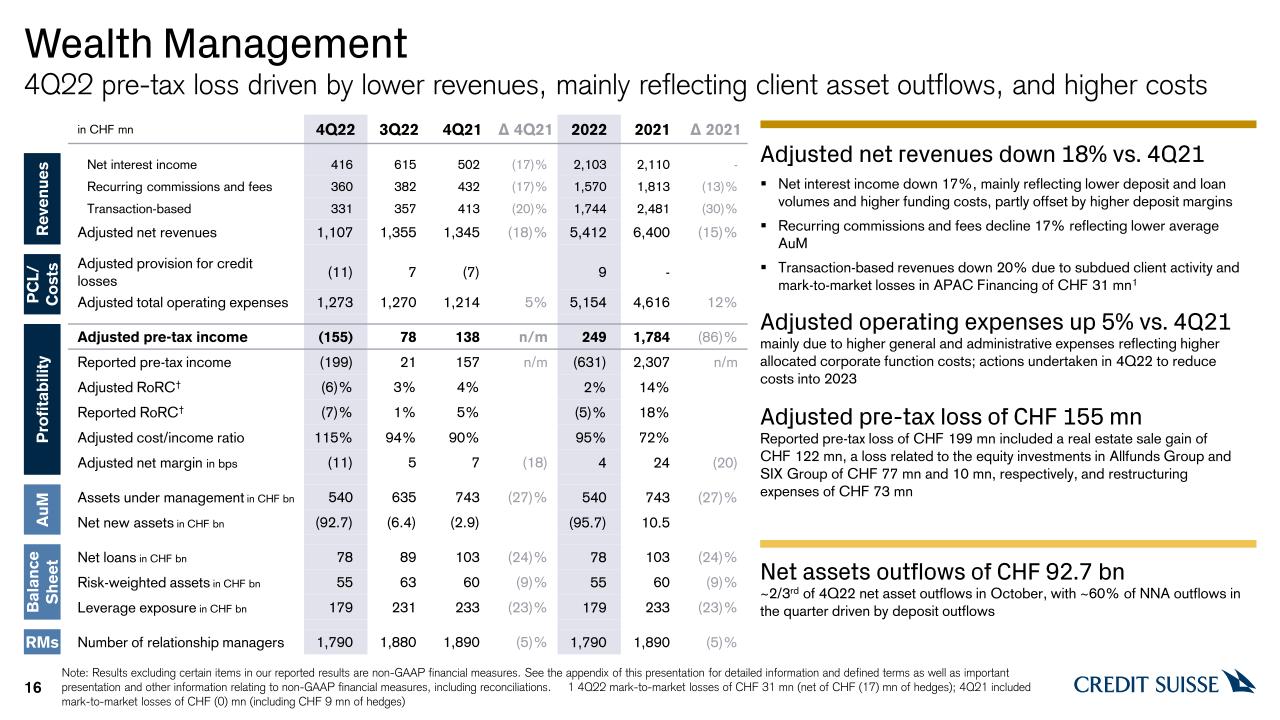

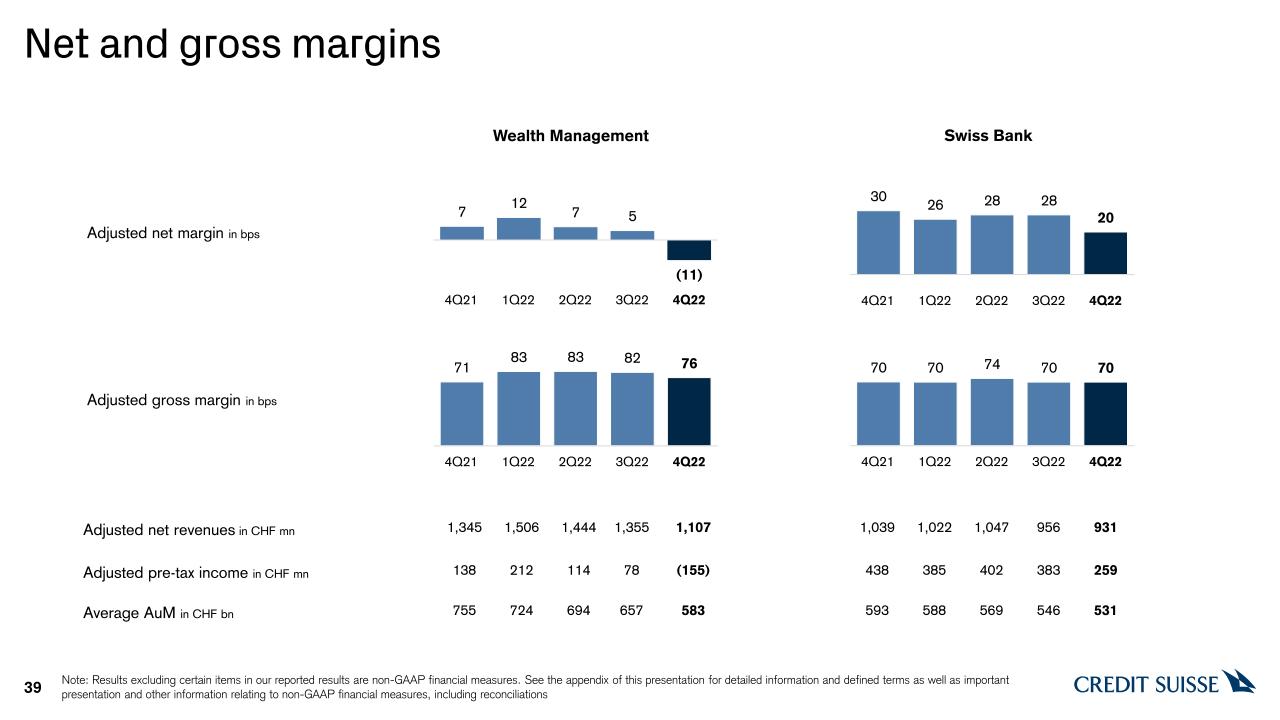

Wealth Management (WM)

|

|||

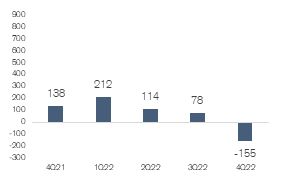

Adjusted* pre-tax income/loss QoQ in CHF million

|

4Q22

On an adjusted* basis, WM had a pre-tax loss of CHF 155 mn, down year on year from a pre-tax income of CHF 138 mn, as client asset outflows and sentiment weighed on revenues, combined with higher costs. The

reported pre-tax loss for the quarter of CHF 199 mn, included a real estate sale gain of CHF 122 mn, losses related to the equity investments in Allfunds Group and SIX Group of CHF 77 mn and CHF 10 mn, respectively, as well as

restructuring expenses of CHF 73 mn.

WM had reported net revenues of CHF 1.1 bn, down 17% year on year. Adjusted* net revenues of CHF 1.1 bn were down 18%. Net interest income was down 17% year on year, mainly reflecting lower volumes for deposits and loans, including the

related adverse impacts of lower funding benefits, and interest rate management costs. Recurring commissions and fees were also down 17%, mainly reflecting lower average AuM. Finally, transaction and performance-based revenues were down 20%

year on year, mainly due to subdued client activity, lower corporate advisory fees and mark-to-market losses in APAC Financing of CHF 31 mn15.

WM had higher adjusted* operating expenses of CHF 1.3 bn, up 5%, mainly due to higher general and administrative expenses, reflecting higher allocated corporate function costs.

WM had net asset outflows of CHF 92.7 bn in 4Q22. Approximately two thirds of net asset outflows for the quarter were in October 2022, with ~60% of net asset outflows driven by deposit outflows. WM reported AuM of CHF 540 bn, compared to

CHF 743 bn as of the end of 4Q21 and CHF 635 bn as of the end of 3Q22. The decrease in AuM quarter on quarter was mainly driven by net asset outflows across all regions.

|

||

Adjusted* pre-tax income YoY in CHF billion

|

FY22

On an adjusted* basis, WM had a pre-tax income of CHF 249 mn, down 86% year on year. This was driven by lower revenues across transaction- and performance-based revenues, recurring commissions and fees, the revenue impact of the outflows

in 4Q22, as well as higher operating expenses. WM’s adjusted* pre-tax income was adversely impacted by an impairment of IT-related assets of CHF 183 mn, following a review of WM’s technology and platform

strategy throughout 2022, and mark-to-market losses in APAC Financing Group of CHF 121 mn16. The

reported pre-tax loss for FY22 of CHF 631 mn, included a real estate sale gain of CHF 147 mn, losses related to the equity investment in Allfunds Group and SIX Group of CHF 588 mn and CHF 17 mn, respectively, as well as major litigation

provisions of CHF 306 mn and restructuring expenses of CHF 109 mn.

WM had reported net revenues of CHF 5.0 bn, down 30% year on year. Adjusted* net revenues of CHF 5.4 bn were down 15%. Transaction- and performance-based revenues were down 30% year on year, mainly due to lower brokerage and product

issuing fees and lower Global Trading Solutions (GTS) revenues. Recurring commissions and fees were down 13%, mainly reflecting lower average AuM. Net interest income was flat year on year, as higher margin on deposits offset the impact of

lower volumes for deposits and loans and the adverse impact of higher funding and higher interest rate management costs.

WM had higher adjusted* operating expenses, up 12%, mainly due to higher general and administrative expenses.

WM had net asset outflows of CHF 95.7 bn in FY22 driven by outflows across all regions, reflecting significant outflows in 4Q22. AuM was down CHF 202 bn year on year, mainly driven by net asset outflows, unfavorable market movements and

structural effects, including reclassifications of CHF 17.6 bn related to the sanctions imposed in connection with Russia’s invasion of Ukraine.

|

||

|

Media Release

Zurich, February 9, 2023

|

|

|

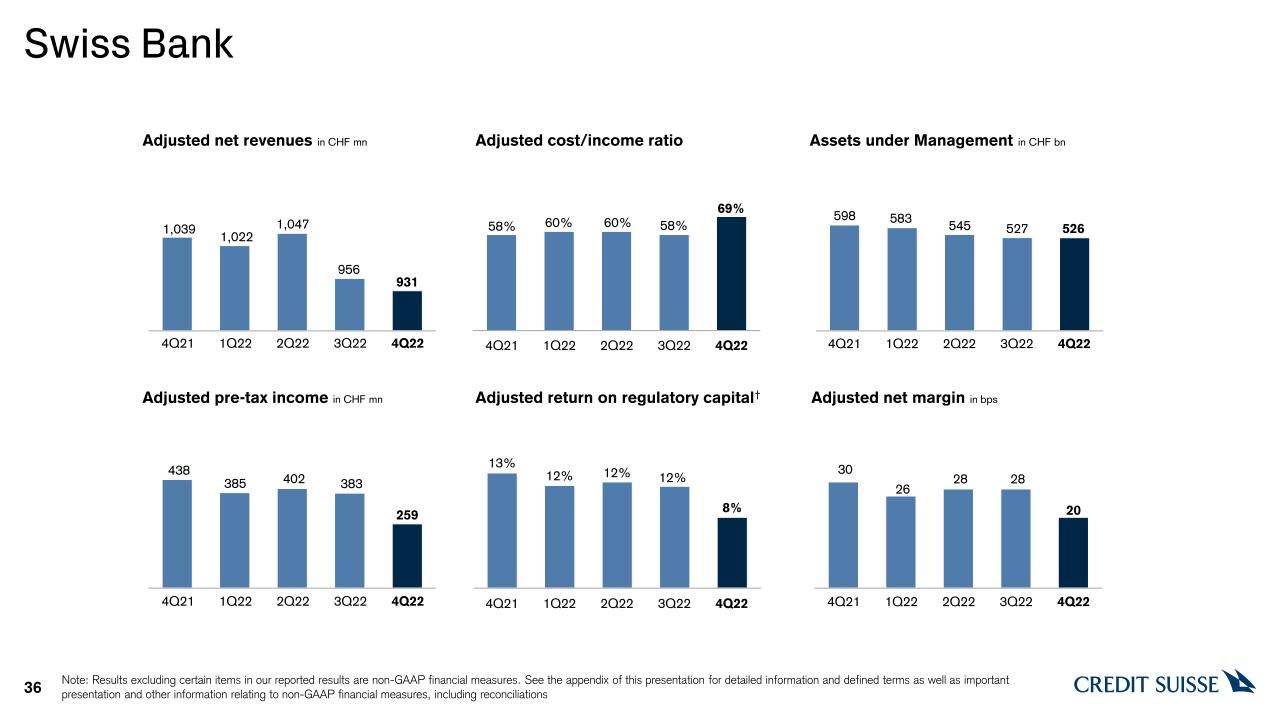

Swiss Bank (SB)

|

||

Adjusted* pre-tax income QoQ in CHF million

|

4Q22

SB had a resilient 4Q22 despite being negatively impacted by normalizing provisions and compensation expenses. On an adjusted* basis, SB had a pre-tax income of CHF 259 mn, down 41% year on year, reflecting decreased net revenues, higher

operating expenses and normalizing provision for credit losses of CHF 28 mn, at 7 basis points of our net loans. SB had higher adjusted* operating expenses, up 6%, due to increased compensation expenses, mainly reflecting higher deferral of

compensation in 4Q21. SB’s adjusted* cost to income ratio was 69%.

SB’s reported net revenues were CHF 972 mn, down 20% year on year; adjusted* net revenues were down 10%. Net interest income decreased by 11% year on year with higher deposit income more than offset by decreased income from loans and

lower SNB threshold benefits from the SNB increase of interest rates; on a QoQ basis, net interest income is stable. Recurring commissions and fees were down 10% reflecting lower average AuM. Transaction-based revenues were down 18%, mainly

driven by equity investments17; excluding those, transaction-based revenues would have been down 8% due to lower client activity.

SB had net asset outflows of CHF 8.3 bn mainly driven by outflows in private clients. The division’s AuM as of the end of 4Q22 were CHF 526 bn, stable compared to CHF 527 bn at the end of 3Q22, mainly reflecting net asset outflows and

unfavorable foreign exchange-related movements, offset by favorable market movements.

|

|

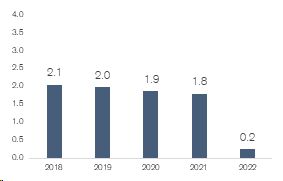

Adjusted* pre-tax income YoY in CHF billion

|

FY22

On an adjusted* basis, SB had a pre-tax income of CHF 1.4 bn, down 19% year on year, mainly driven by lower net revenues down 4% and provision for credit losses of CHF 90 mn. Adjusted* operating expenses were up 2%, reflecting Group-wide

risk, compliance and technology costs, higher occupancy expenses as well as targeted advertising and marketing campaigns, while compensation expenses were stable. SB’s adjusted* cost to income ratio was 62%.

SB’s reported net revenues were CHF 4.1 bn, down 5% year on year; adjusted* net revenues were down 4% mainly driven by lower net interest income, down 5%, primarily reflecting lower SNB threshold benefits from the SNB increase of

interest rates, and lower loan income, partially offset by higher deposit income. Transaction-based revenues were down 9%, mainly driven by equity investments18

and gains related to IBOR transition19, excluding those, transaction-based revenues would have been down 3%. Recurring commissions and fees were flat year on

year.

SB had net asset outflows of CHF 5.4 bn for FY22 driven by outflows in private clients, partially offset by inflows in institutional clients. SB’s AuM were CHF 72 bn lower year on year, mainly driven by unfavorable market movements and

net asset outflows.

|

|

Media Release

Zurich, February 9, 2023

|

|

|

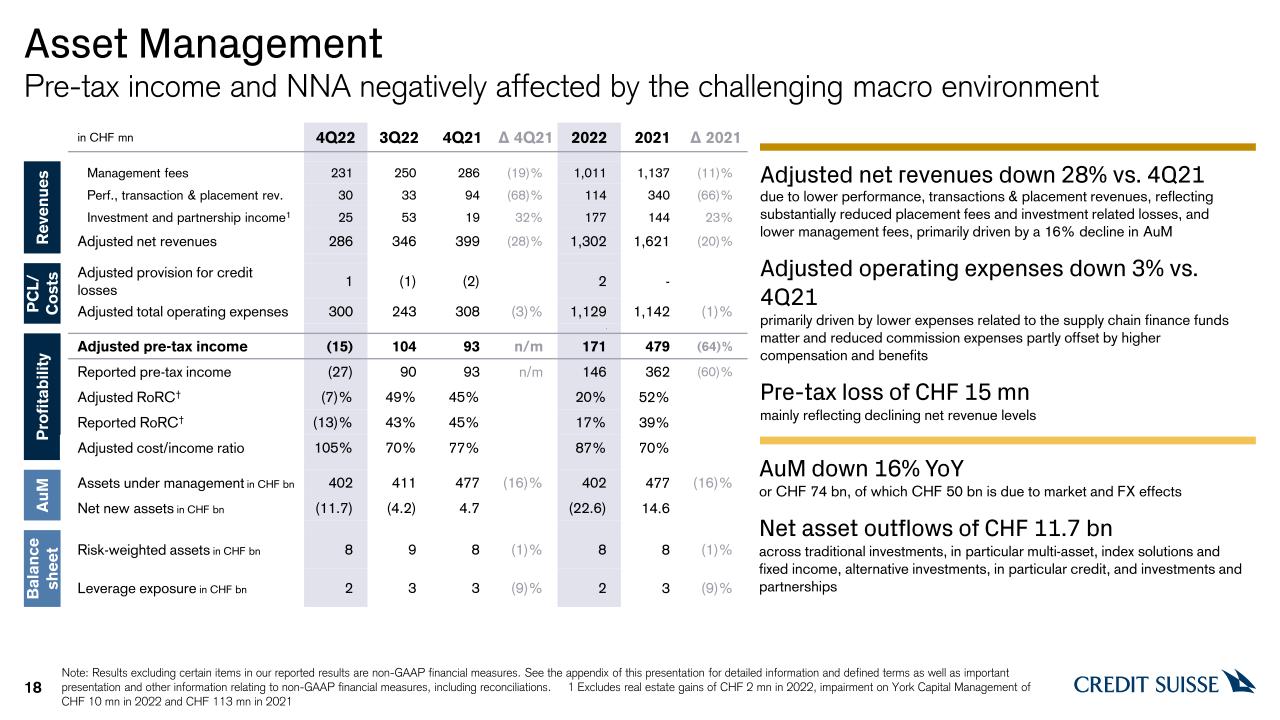

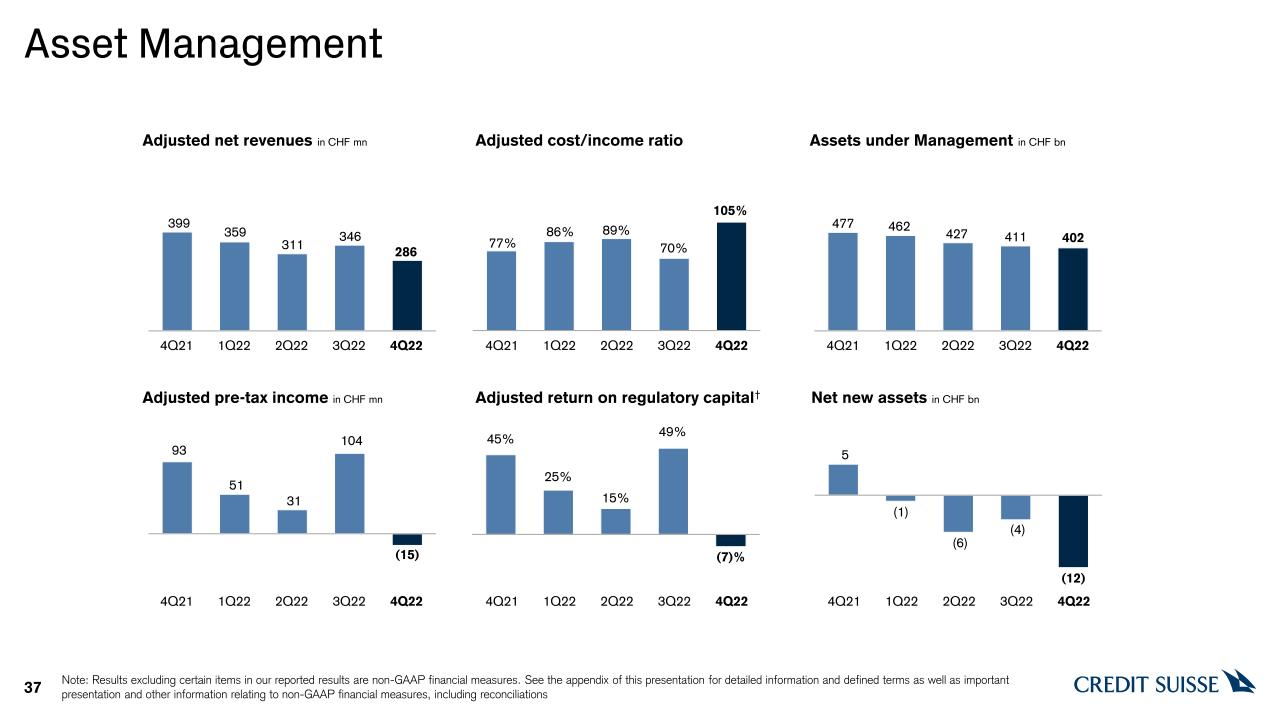

Asset Management (AM)

|

||

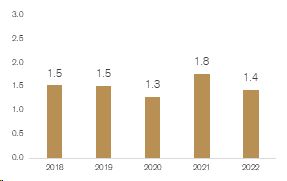

Adjusted* pre-tax income QoQ in CHF million

|

4Q22

AM’s performance continued to be adversely affected by the challenging macro-environment. On an adjusted* basis, AM had a pre-tax loss of CHF 15 mn for 4Q22, down year on year compared to a pre-tax income of CHF 93 mn in 4Q21. The

adjusted* pre-tax loss was driven by lower net revenues. Adjusted* operating expenses were down 3% mainly reflecting lower expenses related to the Supply Chain Finance Funds matter and reduced commission expenses, partly offset by an

increase in compensation and benefits.

AM’s reported net revenues were down 28% year on year at CHF 286 mn. The decrease in net revenues was due to lower performance, transaction and placement revenues, down 68% year on year, mainly reflecting lower placement fees and

investment-related losses. Management fees were down 19%, reflecting a combination of the 16% decline in AuM year on year as well as increased investor bias towards passive products. AM saw higher investment and partnership income, up 32%

year on year, mainly due to equity participation gains, including the gain from the disposal of the Group’s interest in Energy Infrastructure Partners AG, partially offset by reduced performance fees.

AM had net asset outflows of CHF 11.7 bn for the quarter across driven by outflows from traditional investments, primarily related to outflows in multi-asset solutions, index solutions and fixed income; from investments and partnerships,

primarily related to an emerging markets joint venture; and from alternative investments, primarily related to outflows in credit. AM had AuM of CHF 402 bn at the end of 4Q22, down 16% year on year or CHF 75 bn, of which CHF ~50 bn was due

to market and FX-related movements.

|

|

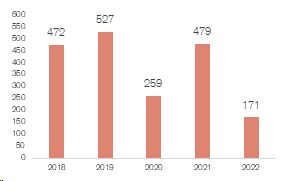

Adjusted* pre-tax income YoY in CHF million

|

FY22

On adjusted* basis, AM had a pre-tax income of CHF 171 mn for FY22, down 64% year on year, primarily driven by lower net revenues. Adjusted* operating expenses were down 1% primarily due to reduced professional services fees related to

the wind down and administration of the Supply Chain Finance Funds as well as reduced commission expenses.

AM’s reported net revenues were down 14% year on year at CHF 1.3 bn driven by decreased performance, transaction and placement revenues and declining management fees, partially offset by higher investment and partnership income. The

decrease in net revenues was due to lower performance, transaction and placement revenues, down 66% year on year, reflecting primarily investment related losses as opposed to gains in 2021, reduced placement fees and decreasing performance

fees. Net revenues also reflected reduced management fees, down 11%, due to lower average AuM and increased investor bias towards passive products. These were partly offset by higher investment and partnerships income, primarily driven by

an impairment of CHF 113 mn related to our non-controlling interest in York Capital Management in FY21. Adjusted* net revenues were down 20% year on year.

AM had net asset outflows of CHF 22.6 bn for FY22 across traditional investments and alternative investments, partially offset by investments and partnerships.

|

|

Media Release

Zurich, February 9, 2023

|

|

|

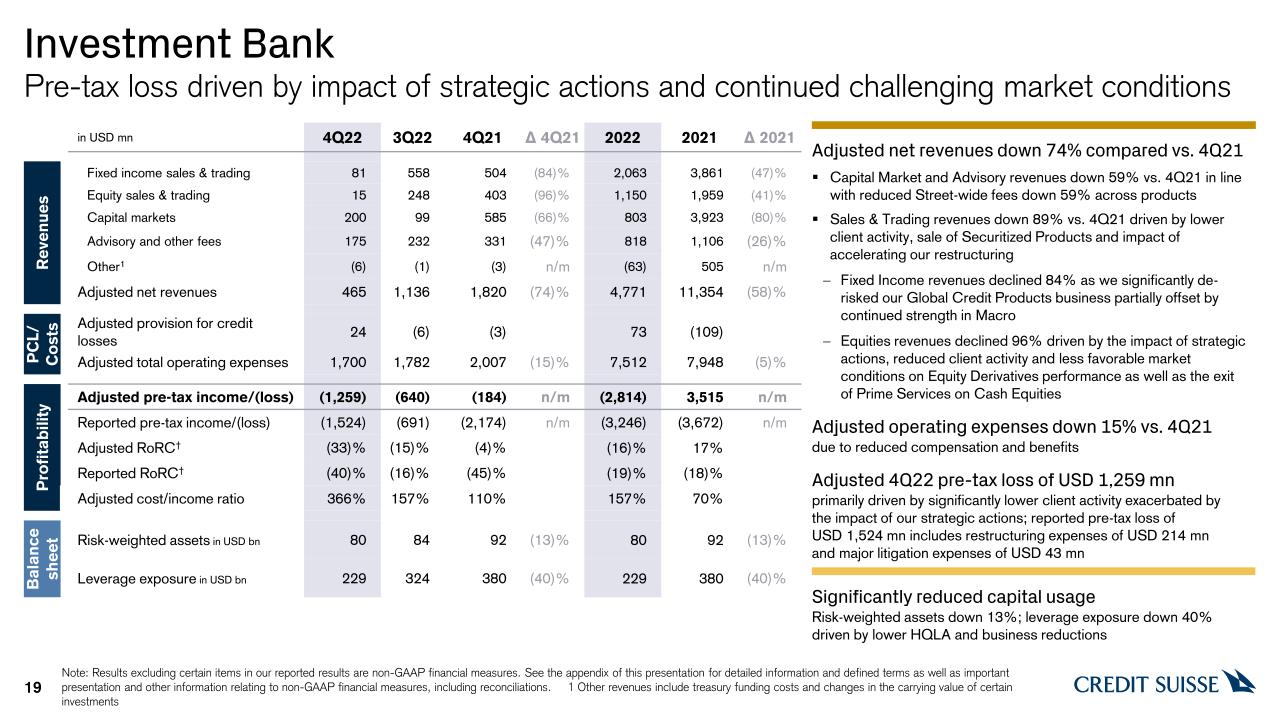

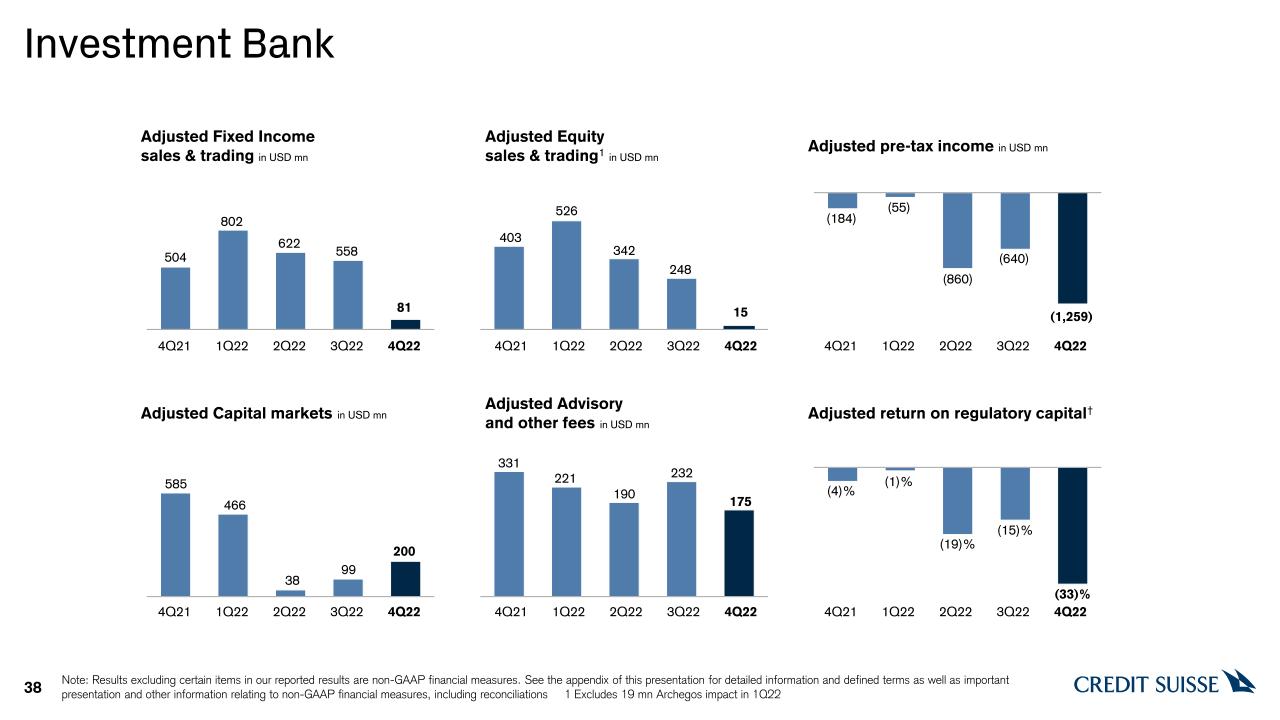

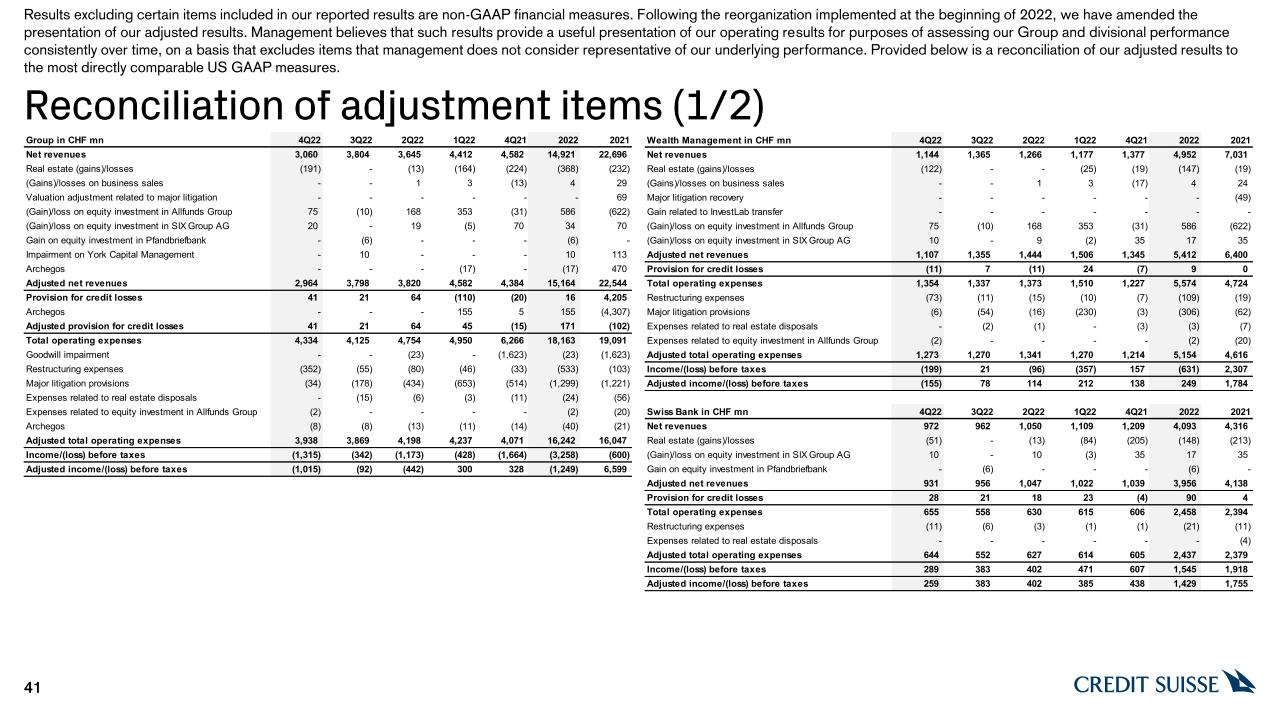

Investment Bank (IB)

|

||

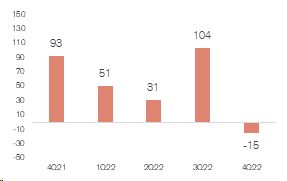

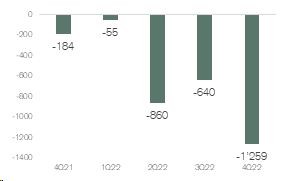

Adjusted* pre-tax income/loss QoQ in USD million

|

4Q22

On an adjusted* basis, the IB posted a pre-tax loss of USD 1.3 bn, up compared to a pre-tax loss of USD 184 mn in 4Q21, reflecting lower net revenues of USD 465 mn, down 74% year on year, amid challenging market

conditions driven by higher volatility as well as muted primary issuance and widened credit spreads. IB’s performance also reflected the impact of accelerated deleveraging in light of our strategic actions and in response to the Group’s

significant deposit outflows in 4Q22. The reported pre-tax loss was USD 1.5 bn, compared to a reported pre-tax loss of USD 2.2 bn in 4Q21. Reported operating expenses were down 51% year on year, as 4Q21 included a goodwill impairment charge

of USD 1.8 bn. Adjusted* operating expenses were down 15% year on year, primarily due to lower compensation and benefits as well as lower revenue-related expenses.

Capital Markets revenues decreased 66% year on year as muted primary issuance and macro conditions continued to weigh on client sentiment. Advisory revenues were down 47% year on year in line with reduced

industry-wide deal closings. Combined, Capital Markets and Advisory revenues decreased 59% year on year, in line with the reduced street-wide fees across products20.

Revenues in our Fixed Income Sales & Trading business were down 84%, as continued strength in Macro was offset by a substantial decline in Securitized Products and Global Credit Products largely due to the strategic actions taken in the

quarter. Equity Sales & Trading revenues declined by 96% year on year reflecting less favorable market conditions compared to 4Q21. Results also reflect the impact of our strategic actions, a slowdown in client activity due in part to

the Group’s credit rating downgrades and the exit of Prime Services on Equity Derivatives and Cash Equities.

For 4Q22, we significantly reduced capital usage in the IB. Risk-weighted assets were down 13% year on year at USD 80 bn and Leverage Exposure was down 40% year on year, at USD 229 bn, due to lower high-quality

liquid assets (HQLA) reflecting reductions in cash held at central banks and reductions in non-cash HQLA relating to the significant deposit outflows the Group experienced in 4Q22 and business reductions.

|

|

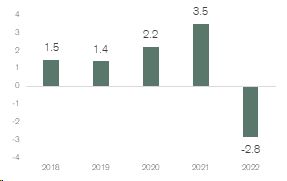

Adjusted* pre-tax income/loss YoY in USD billion

|

FY22

On an adjusted* basis, the IB posted a significant pre-tax loss of USD 2.8 bn, down significantly year on year, reflecting extremely challenging market conditions, particularly in our capital markets business and

the impact of our restructuring of the IB. The reported pre-tax loss was USD 3.3 bn, mainly driven by significantly lower revenues. The division’s reported net revenues were USD 4.8 bn for FY22, down 55% year on year; on an adjusted* basis,

net revenues were down 58%, largely due to significantly lower capital markets and fixed income sales and trading revenues as well as lower equity sales and trading revenues. Reported operating expenses were down 18%, mainly reflecting the

goodwill impairment of USD 1.8 bn in FY21. Adjusted* operating expenses were down 5% year on year, primarily due to lower compensation and benefits.

Capital Markets revenues decreased 80% year on year, impacted by significantly challenged primary issuance. Advisory revenues were down 26% year on year due to lower announced deals in the year. Revenues in our

Fixed Income Sales & Trading business were down 47% from FY21 and reflected the impact of our strategic actions to de-risk the business and reduce capital in light of our announced strategy. On an adjusted* basis, Equity Sales &

Trading21 revenues declined by 54% driven by lower revenues across all products, particularly in Equity Derivatives, and also reflecting the exit of Prime

Services22.

|

|

Media Release

Zurich, February 9, 2023

|

|

| ▪ |

4Q22 AuM, classified under Credit Suisse’s Sustainable Investment Framework as Exclusion, Integration, Thematic or Impact, of CHF 132 bn, compared to CHF 150 bn in 4Q21, on the same basis, resulting in a penetration of 10.2% of total AuM

as of December 31, 2022, compared to 9.3% as of the end of 4Q21

|

| ▪ |

Number of WM funds classified according to Credit Suisse’s Sustainable Investment Framework23 increased to 171 as of the end of 4Q22

compared to 156 at the end of 4Q21

|

| ▪ |

Credit Suisse’s bond for The Nature Conservancy's blue loan for Belize, won Capital Monitor’s Most Innovative Sustainable Bond category in their inaugural Sustainable Banking Awards in December 2022

|

| ▪ |

In December we published a dedicated Climate Action Plan for Credit Suisse AM and Investment Solutions & Sustainability within WM, which details the divisions’ goal to achieve net zero across their investment

portfolios by 2050, as well as a 2030 interim goal for a 50% reduction in investment-associated emissions in intensity terms compared to 2019. We continue to review our policies and approach

|

| ▪ |

The 2022 Sustainability Report, which is scheduled for publication on March 9, 2023, will provide further highlights for FY22 such as our progress towards the previously communicated Sustainable Finance, Net Zero

and Diversity & Inclusion ambitions

|

|

Event

|

4Q22 Analyst and Investor Call

|

4Q22 Media Call

|

|

Time

|

08:15 CET (Zurich)

07:15 GMT (London)

02:15 EST (New York)

|

10:30 CET (Zurich)

09:30 GMT (London)

04:30 EST (New York)

|

|

Language

|

English

|

English

|

|

Access

|

Switzerland: +41 58 310 51 26

Europe: +44 121 281 80 12

US: +1 631 232 79 97

Reference:

Credit Suisse Analysts and Investors Call

Conference ID:

20220714

Please dial in 10 minutes before the start

of the call. When dialing in please enter

the Passcode/Conference ID and leave

your first, last name and company name

after the tone. You will be joined

automatically to the conference.

Webcast link here.

|

Switzerland: +41 (0) 583105126

UK: +44 (0) 1212 818 012

US: +1 631 232 7997

Reference:

Credit Suisse Media Call

Conference ID:

20220715

Please dial in 10 minutes before the start

of the call. When dialing in please enter

the Passcode/Conference ID and leave

your first, last name and company name

after the tone. You will be joined

automatically to the conference.

Webcast link here.

|

|

Q&A Session

|

Following the presentation, you will have

the opportunity to ask the speakers

questions if you are an analyst or investor

|

Following the presentation, you will have

the opportunity to ask the speakers

questions

|

|

Playback

|

Replay available at our website.

|

Replay available our website.

|

|

Appendix

|

|

| Key metrics | |||||||||||||||||

| in / end of | % change | in / end of | % change | ||||||||||||||

| 4Q22 | 3Q22 | 4Q21 | QoQ | YoY | 2022 | 2021 | YoY | ||||||||||

| Credit Suisse Group results (CHF million) | |||||||||||||||||

| Net revenues | 3,060 | 3,804 | 4,582 | (20) | (33) | 14,921 | 22,696 | (34) | |||||||||

| Provision for credit losses | 41 | 21 | (20) | 95 | – | 16 | 4,205 | (100) | |||||||||

| Compensation and benefits | 2,062 | 1,901 | 2,145 | 8 | (4) | 8,813 | 8,963 | (2) | |||||||||

| General and administrative expenses | 1,710 | 1,919 | 2,182 | (11) | (22) | 7,782 | 7,159 | 9 | |||||||||

| Commission expenses | 210 | 250 | 283 | (16) | (26) | 1,012 | 1,243 | (19) | |||||||||

| Goodwill impairment | 0 | – | 1,623 | – | (100) | 23 | 1,623 | (99) | |||||||||

| Restructuring expenses | 352 | 55 | 33 | – | – | 533 | 103 | 417 | |||||||||

| Total other operating expenses | 2,272 | 2,224 | 4,121 | 2 | (45) | 9,350 | 10,128 | (8) | |||||||||

| Total operating expenses | 4,334 | 4,125 | 6,266 | 5 | (31) | 18,163 | 19,091 | (5) | |||||||||

| Loss before taxes | (1,315) | (342) | (1,664) | 285 | (21) | (3,258) | (600) | 443 | |||||||||

| Income tax expense | 82 | 3,698 | 416 | (98) | (80) | 4,048 | 1,026 | 295 | |||||||||

| Loss attributable to shareholders | (1,393) | (4,034) | (2,085) | (65) | (33) | (7,293) | (1,650) | 342 | |||||||||

| Balance sheet statistics (CHF million) | |||||||||||||||||

| Total assets | 531,358 | 700,358 | 755,833 | (24) | (30) | 531,358 | 755,833 | (30) | |||||||||

| Risk-weighted assets | 250,540 | 273,598 | 267,787 | (8) | (6) | 250,540 | 267,787 | (6) | |||||||||

| Leverage exposure | 650,551 | 836,881 | 889,137 | (22) | (27) | 650,551 | 889,137 | (27) | |||||||||

| Assets under management and net new assets (CHF billion) | |||||||||||||||||

| Assets under management | 1,293.6 | 1,400.6 | 1,614.0 | (7.6) | (19.9) | 1,293.6 | 1,614.0 | (19.9) | |||||||||

| Net new assets/(net asset outflows) | (110.5) | (12.9) | 1.6 | – | – | (123.2) | 30.9 | – | |||||||||

| Basel III regulatory capital and leverage statistics (%) | |||||||||||||||||

| CET1 ratio | 14.1 | 12.6 | 14.4 | – | – | 14.1 | 14.4 | – | |||||||||

| CET1 leverage ratio | 5.4 | 4.1 | 4.3 | – | – | 5.4 | 4.3 | – | |||||||||

| Tier 1 leverage ratio | 7.7 | 6.0 | 6.1 | – | – | 7.7 | 6.1 | – | |||||||||

|

Appendix

|

|

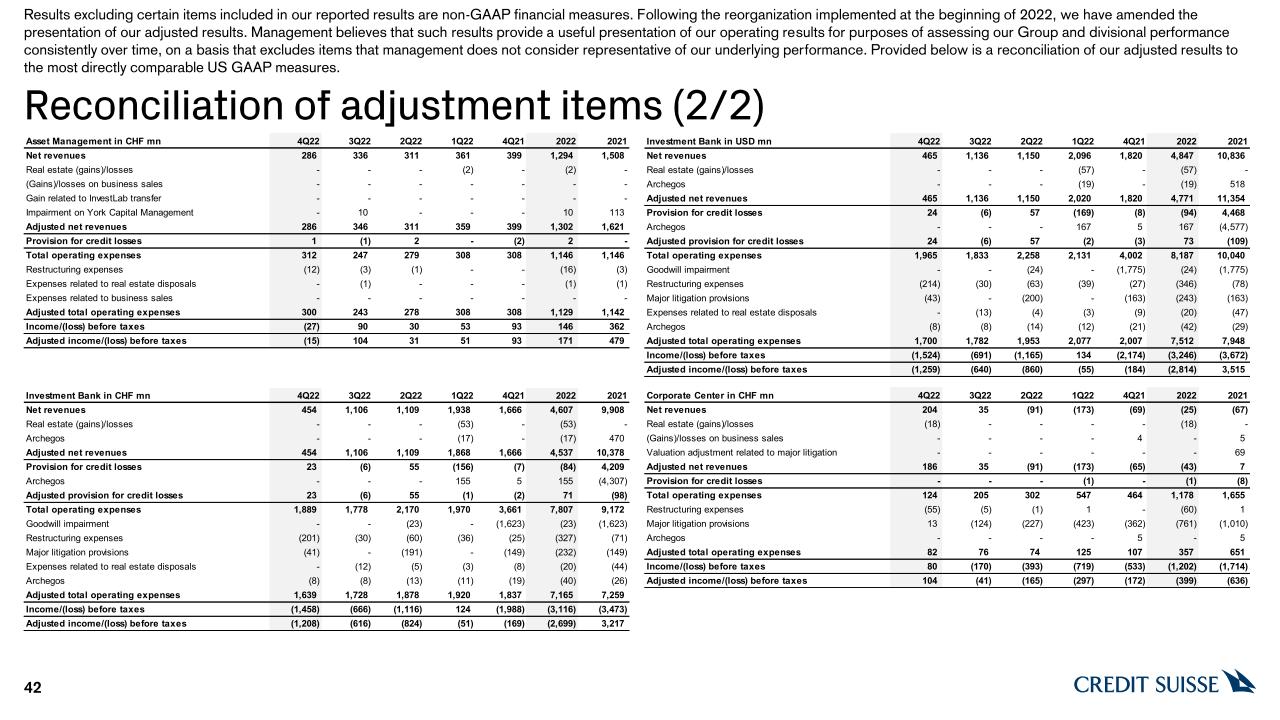

| Reconciliation of adjustment items | |||||||||||

| Group | |||||||||||

| in | 4Q22 | 3Q22 | 4Q21 | 2022 | 2021 | ||||||

| Results (CHF million) | |||||||||||

| Net revenues | 3,060 | 3,804 | 4,582 | 14,921 | 22,696 | ||||||

| Real estate (gains)/losses | (191) | 0 | (224) | (368) | (232) | ||||||

| (Gains)/losses on business sales | 0 | 0 | (13) | 4 | 29 | ||||||

| Major litigation recovery | 0 | 0 | 0 | 0 | (49) | ||||||

| Valuation adjustment related to major litigation | 0 | 0 | 0 | 0 | 69 | ||||||

| (Gain)/loss on equity investment in Allfunds Group | 75 | (10) | (31) | 586 | (622) | ||||||

| (Gain)/loss on equity investment in SIX Group AG | 20 | 0 | 70 | 34 | 70 | ||||||

| (Gain)/loss on equity investment in Pfandbriefbank | 0 | (6) | 0 | (6) | 0 | ||||||

| Impairment on York Capital Management | 0 | 10 | 0 | 10 | 113 | ||||||

| Archegos | 0 | 0 | 0 | (17) | 470 | ||||||

| Adjusted net revenues | 2,964 | 3,798 | 4,384 | 15,164 | 22,544 | ||||||

| Provision for credit losses | 41 | 21 | (20) | 16 | 4,205 | ||||||

| Archegos | 0 | 0 | 5 | 155 | (4,307) | ||||||

| Adjusted provision for credit losses | 41 | 21 | (15) | 171 | (102) | ||||||

| Total operating expenses | 4,334 | 4,125 | 6,266 | 18,163 | 19,091 | ||||||

| Goodwill impairment | – | 0 | (1,623) | (23) | (1,623) | ||||||

| Restructuring expenses | (352) | (55) | (33) | (533) | (103) | ||||||

| Major litigation provisions | (34) | (178) | (514) | (1,299) | (1,221) | ||||||

| Expenses related to real estate disposals | 0 | (15) | (11) | (24) | (56) | ||||||

| Expenses related to equity investment in Allfunds Group | (2) | 0 | 0 | (2) | (20) | ||||||

| Archegos | (8) | (8) | (14) | (40) | (21) | ||||||

| Adjusted total operating expenses | 3,938 | 3,869 | 4,071 | 16,242 | 16,047 | ||||||

| Income/(loss) before taxes | (1,315) | (342) | (1,664) | (3,258) | (600) | ||||||

| Adjusted income/(loss) before taxes | (1,015) | (92) | 328 | (1,249) | 6,599 | ||||||

| Adjusted economic profit | (1,798) | (1,122) | (842) | (5,089) | 808 | ||||||

| Adjusted return on tangible equity (%) | (9.6) | (35.2) | (1.0) | (12.3) | 11.2 | ||||||

|

Appendix

|

|

| Wealth Management | |||||||||||||||||

| in / end of | % change | in / end of | % change | ||||||||||||||

| 4Q22 | 3Q22 | 4Q21 | QoQ | YoY | 2022 | 2021 | YoY | ||||||||||

| Results (CHF million) | |||||||||||||||||

| Net revenues | 1,144 | 1,365 | 1,377 | (16) | (17) | 4,952 | 7,031 | (30) | |||||||||

| Provision for credit losses | (11) | 7 | (7) | – | 57 | 9 | 0 | – | |||||||||

| Total operating expenses | 1,354 | 1,337 | 1,227 | 1 | 10 | 5,574 | 4,724 | 18 | |||||||||

| Income/(loss) before taxes | (199) | 21 | 157 | – | – | (631) | 2,307 | – | |||||||||

| Metrics | |||||||||||||||||

| Economic profit (CHF million) | (316) | (168) | (68) | 88 | 365 | (1,186) | 969 | – | |||||||||

| Cost/income ratio (%) | 118.4 | 97.9 | 89.1 | – | – | 112.6 | 67.2 | – | |||||||||

| Assets under management (CHF billion) | 540.5 | 635.4 | 742.6 | (14.9) | (27.2) | 540.5 | 742.6 | (27.2) | |||||||||

| Net new assets/(net asset outflows) (CHF billion) | (92.7) | (6.4) | (2.9) | – | – | (95.7) | 10.5 | – | |||||||||

| Gross margin (annualized) (bp) | 79 | 83 | 73 | – | – | 75 | 94 | – | |||||||||

| Net margin (annualized) (bp) | (14) | 1 | 8 | – | – | (10) | 31 | – | |||||||||

| Reconciliation of adjustment items | |||||||||||

| Wealth Management | |||||||||||

| in | 4Q22 | 3Q22 | 4Q21 | 2022 | 2021 | ||||||

| Results (CHF million) | |||||||||||

| Net revenues | 1,144 | 1,365 | 1,377 | 4,952 | 7,031 | ||||||

| Real estate (gains)/losses | (122) | 0 | (19) | (147) | 1 | (19) | |||||

| (Gains)/losses on business sales | 0 | 0 | (17) | 4 | 24 | ||||||

| Major litigation recovery | 0 | 0 | 0 | 0 | (49) | ||||||

| (Gain)/loss on equity investment in Allfunds Group | 75 | (10) | (31) | 586 | (622) | ||||||

| (Gain)/loss on equity investment in SIX Group AG | 10 | 0 | 35 | 17 | 35 | ||||||

| Adjusted net revenues | 1,107 | 1,355 | 1,345 | 5,412 | 6,400 | ||||||

| Provision for credit losses | (11) | 7 | (7) | 9 | 0 | ||||||

| Total operating expenses | 1,354 | 1,337 | 1,227 | 5,574 | 4,724 | ||||||

| Restructuring expenses | (73) | (11) | (7) | (109) | (19) | ||||||

| Major litigation provisions | (6) | (54) | (3) | (306) | (62) | ||||||

| Expenses related to real estate disposals | 0 | (2) | (3) | (3) | (7) | ||||||

| Expenses related to equity investment in Allfunds Group | (2) | 0 | 0 | (2) | (20) | ||||||

| Adjusted total operating expenses | 1,273 | 1,270 | 1,214 | 5,154 | 4,616 | ||||||

| Income/(loss) before taxes | (199) | 21 | 157 | (631) | 2,307 | ||||||

| Adjusted income/(loss) before taxes | (155) | 78 | 138 | 249 | 1,784 | ||||||

| Adjusted economic profit | (282) | (126) | (82) | (526) | 578 | ||||||

| Adjusted return on regulatory capital (%) | (5.5) | 2.5 | 4.5 | 2.1 | 14.2 | ||||||

|

1

Of which CHF 142 million is reflected in other revenues and CHF 5 million is reflected in transaction- and performance-based revenues.

|

|||||||||||

|

Appendix

|

|

| Investment Bank | |||||||||||||||||

| in / end of | % change | in / end of | % change | ||||||||||||||

| 4Q22 | 3Q22 | 4Q21 | QoQ | YoY | 2022 | 2021 | YoY | ||||||||||

| Results (CHF million) | |||||||||||||||||

| Net revenues | 454 | 1,106 | 1,666 | (59) | (73) | 4,607 | 9,908 | (54) | |||||||||

| Provision for credit losses | 23 | (6) | (7) | – | – | (84) | 4,209 | – | |||||||||

| Total operating expenses | 1,889 | 1,778 | 3,661 | 6 | (48) | 7,807 | 9,172 | (15) | |||||||||

| Loss before taxes | (1,458) | (666) | (1,988) | 119 | (27) | (3,116) | (3,473) | (10) | |||||||||

| Metrics | |||||||||||||||||

| Economic profit (CHF million) | (1,420) | (873) | (1,897) | 63 | (25) | (3,810) | (4,347) | (12) | |||||||||

| Cost/income ratio (%) | 416.1 | 160.8 | 219.7 | – | – | 169.5 | 92.6 | – | |||||||||

| Results (USD million) | |||||||||||||||||

| Net revenues | 465 | 1,136 | 1,820 | (59) | (74) | 4,847 | 10,836 | (55) | |||||||||

| Provision for credit losses | 24 | (6) | (8) | – | – | (94) | 4,468 | – | |||||||||

| Total operating expenses | 1,965 | 1,833 | 4,002 | 7 | (51) | 8,187 | 10,040 | (18) | |||||||||

| Loss before taxes | (1,524) | (691) | (2,174) | 121 | (30) | (3,246) | (3,672) | (12) | |||||||||

| Net revenue detail | |||||||||||

| in / end of | 4Q22 | 3Q22 | 4Q21 | 2022 | 2021 | ||||||

| Net revenue detail (USD million) | |||||||||||

| Fixed income sales and trading | 81 | 558 | 504 | 2,063 | 3,861 | ||||||

| Equity sales and trading | 15 | 248 | 403 | 1,150 | 1,959 | ||||||

| Capital markets | 200 | 99 | 585 | 803 | 3,923 | ||||||

| Advisory and other fees | 175 | 232 | 331 | 818 | 1,106 | ||||||

| Other revenues | (6) | (1) | (3) | 13 | (13) | ||||||

| Net revenues | 465 | 1,136 | 1,820 | 4,847 | 10,836 | ||||||

|

Appendix

|

|

| Reconciliation of adjustment items | |||||||||||

| Investment Bank | |||||||||||

| in | 4Q22 | 3Q22 | 4Q21 | 2022 | 2021 | ||||||

| Results (CHF million) | |||||||||||

| Net revenues | 454 | 1,106 | 1,666 | 4,607 | 9,908 | ||||||

| Real estate (gains)/losses | 0 | 0 | 0 | (53) | 0 | ||||||

| Archegos | 0 | 0 | 0 | (17) | 470 | ||||||

| Adjusted net revenues | 454 | 1,106 | 1,666 | 4,537 | 10,378 | ||||||

| Provision for credit losses | 23 | (6) | (7) | (84) | 4,209 | ||||||

| Archegos | 0 | 0 | 5 | 155 | (4,307) | ||||||

| Adjusted provision for credit losses | 23 | (6) | (2) | 71 | (98) | ||||||

| Total operating expenses | 1,889 | 1,778 | 3,661 | 7,807 | 9,172 | ||||||

| Goodwill impairment | 0 | 0 | (1,623) | (23) | (1,623) | ||||||

| Restructuring expenses | (201) | (30) | (25) | (327) | (71) | ||||||

| Major litigation provisions | (41) | 0 | (149) | (232) | (149) | ||||||

| Expenses related to real estate disposals | 0 | (12) | (8) | (20) | (44) | ||||||

| Archegos | (8) | (8) | (19) | (40) | (26) | ||||||

| Adjusted total operating expenses | 1,639 | 1,728 | 1,837 | 7,165 | 7,259 | ||||||

| Income/(loss) before taxes | (1,458) | (666) | (1,988) | (3,116) | (3,473) | ||||||

| Adjusted income/(loss) before taxes | (1,208) | (616) | (169) | (2,699) | 3,217 | ||||||

| Adjusted economic profit | (1,233) | (835) | (533) | (3,497) | 670 | ||||||

| Adjusted return on regulatory capital (%) | (33.0) | (14.9) | (3.8) | (16.4) | 16.9 | ||||||

| Reconciliation of adjustment items | |||||||||||

| Investment Bank | |||||||||||

| in | 4Q22 | 3Q22 | 4Q21 | 2022 | 2021 | ||||||

| Results (USD million) | |||||||||||

| Net revenues | 465 | 1,136 | 1,820 | 4,847 | 10,836 | ||||||

| Real estate (gains)/losses | 0 | 0 | 0 | (57) | 0 | ||||||

| Archegos | 0 | 0 | 0 | (19) | 518 | ||||||

| Adjusted net revenues | 465 | 1,136 | 1,820 | 4,771 | 11,354 | ||||||

| Provision for credit losses | 24 | (6) | (8) | (94) | 4,468 | ||||||

| Archegos | 0 | 0 | 5 | 167 | (4,577) | ||||||

| Adjusted provision for credit losses | 24 | (6) | (3) | 73 | (109) | ||||||

| Total operating expenses | 1,965 | 1,833 | 4,002 | 8,187 | 10,040 | ||||||

| Goodwill impairment | – | – | (1,775) | (24) | (1,775) | ||||||

| Restructuring expenses | (214) | (30) | (27) | (346) | (78) | ||||||

| Major litigation provisions | (43) | 0 | (163) | (243) | (163) | ||||||

| Expenses related to real estate disposals | 0 | (13) | (9) | (20) | (47) | ||||||

| Archegos | (8) | (8) | (21) | (42) | (29) | ||||||

| Adjusted total operating expenses | 1,700 | 1,782 | 2,007 | 7,512 | 7,948 | ||||||

| Income/(loss) before taxes | (1,524) | (691) | (2,174) | (3,246) | (3,672) | ||||||

| Adjusted income/(loss) before taxes | (1,259) | (640) | (184) | (2,814) | 3,515 | ||||||

| Adjusted economic profit | (1,286) | (866) | (579) | (3,671) | 751 | ||||||

| Adjusted return on regulatory capital (%) | (33.0) | (14.9) | (3.8) | (16.4) | 16.9 | ||||||

|

Appendix

|

|

| Swiss Bank | |||||||||||||||||

| in / end of | % change | in / end of | % change | ||||||||||||||

| 4Q22 | 3Q22 | 4Q21 | QoQ | YoY | 2022 | 2021 | YoY | ||||||||||

| Results (CHF million) | |||||||||||||||||

| Net revenues | 972 | 962 | 1,209 | 1 | (20) | 4,093 | 4,316 | (5) | |||||||||

| Provision for credit losses | 28 | 21 | (4) | 33 | – | 90 | 4 | – | |||||||||

| Total operating expenses | 655 | 558 | 606 | 17 | 8 | 2,458 | 2,394 | 3 | |||||||||

| Income before taxes | 289 | 383 | 607 | (25) | (52) | 1,545 | 1,918 | (19) | |||||||||

| Metrics | |||||||||||||||||

| Economic profit (CHF million) | 24 | 88 | 256 | (73) | (91) | 367 | 629 | (42) | |||||||||

| Cost/income ratio (%) | 67.4 | 58.0 | 50.1 | – | – | 60.1 | 55.5 | – | |||||||||

| Assets under management (CHF billion) | 525.8 | 527.1 | 597.9 | (0.2) | (12.1) | 525.8 | 597.9 | (12.1) | |||||||||

| Net new assets/(net asset outflows) (CHF billion) | (8.3) | (1.5) | 1.0 | – | – | (5.4) | 5.9 | – | |||||||||

| Gross margin (annualized) (bp) | 73 | 71 | 82 | – | – | 73 | 74 | – | |||||||||

| Net margin (annualized) (bp) | 22 | 28 | 41 | – | – | 28 | 33 | – | |||||||||

| Reconciliation of adjustment items | |||||||||||

| Swiss Bank | |||||||||||

| in | 4Q22 | 3Q22 | 4Q21 | 2022 | 2021 | ||||||

| Results (CHF million) | |||||||||||

| Net revenues | 972 | 962 | 1,209 | 4,093 | 4,316 | ||||||

| Real estate (gains)/losses | (51) | 0 | (205) | (148) | (213) | ||||||

| (Gain)/loss on equity investment in SIX Group AG | 10 | 0 | 35 | 17 | 35 | ||||||

| (Gain)/loss on equity investment in Pfandbriefbank | 0 | (6) | 0 | (6) | 0 | ||||||

| Adjusted net revenues | 931 | 956 | 1,039 | 3,956 | 4,138 | ||||||

| Provision for credit losses | 28 | 21 | (4) | 90 | 4 | ||||||

| Total operating expenses | 655 | 558 | 606 | 2,458 | 2,394 | ||||||

| Restructuring expenses | (11) | (6) | (1) | (21) | (11) | ||||||

| Expenses related to real estate disposals | 0 | 0 | 0 | 0 | (4) | ||||||

| Adjusted total operating expenses | 644 | 552 | 605 | 2,437 | 2,379 | ||||||

| Income before taxes | 289 | 383 | 607 | 1,545 | 1,918 | ||||||

| Adjusted income before taxes | 259 | 383 | 438 | 1,429 | 1,755 | ||||||

| Adjusted economic profit | 1 | 88 | 129 | 280 | 506 | ||||||

| Adjusted return on regulatory capital (%) | 8.1 | 11.5 | 13.2 | 10.9 | 13.0 | ||||||

|

Appendix

|

|

| Asset Management | |||||||||||||||||

| in / end of | % change | in / end of | % change | ||||||||||||||

| 4Q22 | 3Q22 | 4Q21 | QoQ | YoY | 2022 | 2021 | YoY | ||||||||||

| Results (CHF million) | |||||||||||||||||

| Net revenues | 286 | 336 | 399 | (15) | (28) | 1,294 | 1,508 | (14) | |||||||||

| Provision for credit losses | 1 | (1) | (2) | – | – | 2 | 0 | – | |||||||||

| Total operating expenses | 312 | 247 | 308 | 26 | 1 | 1,146 | 1,146 | 0 | |||||||||

| Income/(loss) before taxes | (27) | 90 | 93 | – | – | 146 | 362 | (60) | |||||||||

| Metrics | |||||||||||||||||

| Economic profit (CHF million) | (32) | 55 | 57 | – | – | 60 | 215 | (72) | |||||||||

| Cost/income ratio (%) | 109.1 | 73.5 | 77.2 | – | – | 88.6 | 76.0 | – | |||||||||

| Reconciliation of adjustment items | |||||||||||

| Asset Management | |||||||||||

| in | 4Q22 | 3Q22 | 4Q21 | 2022 | 2021 | ||||||

| Results (CHF million) | |||||||||||

| Net revenues | 286 | 336 | 399 | 1,294 | 1,508 | ||||||

| Real estate (gains)/losses | 0 | 0 | 0 | (2) | 0 | ||||||

| Impairment on York Capital Management | 0 | 10 | 0 | 10 | 113 | ||||||

| Adjusted net revenues | 286 | 346 | 399 | 1,302 | 1,621 | ||||||

| Provision for credit losses | 1 | (1) | (2) | 2 | 0 | ||||||

| Total operating expenses | 312 | 247 | 308 | 1,146 | 1,146 | ||||||

| Restructuring expenses | (12) | (3) | – | (16) | (3) | ||||||

| Expenses related to real estate disposals | 0 | (1) | 0 | (1) | (1) | ||||||

| Adjusted total operating expenses | 300 | 243 | 308 | 1,129 | 1,142 | ||||||

| Income/(loss) before taxes | (27) | 90 | 93 | 146 | 362 | ||||||

| Adjusted income/(loss) before taxes | (15) | 104 | 93 | 171 | 479 | ||||||

| Adjusted economic profit | (24) | 65 | 57 | 78 | 304 | ||||||

| Adjusted return on regulatory capital (%) | (7.1) | 48.7 | 44.7 | 20.5 | 52.0 | ||||||

|

Appendix

|

|