UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

Form 6-K

______________

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

December 11, 2019

Commission File Number 001-15244

CREDIT SUISSE GROUP AG

(Translation of registrant’s name into English)

Paradeplatz 8, 8001 Zurich, Switzerland

(Address of principal executive office)

______________

Commission File Number 001-33434

CREDIT SUISSE AG

(Translation of registrant’s name into English)

Paradeplatz 8, 8001 Zurich, Switzerland

(Address of principal executive office)

______________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

|

Form 20-F ☒

|

Form 40-F ☐

|

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

This report includes the media release and the slides for the presentation to investors in connection with Investor Day 2019 held on December 11, 2019.

|

Media Release

Zurich, December 11, 2019

|

|

Update:

An earlier version of the media release stated, under ‘Driving TBVPS higher’, that “…we have identified up to 50 basis points of additional cost measures…” It has now been corrected to read 40 basis points.

Investor Day 2019

Highlights

|

§

|

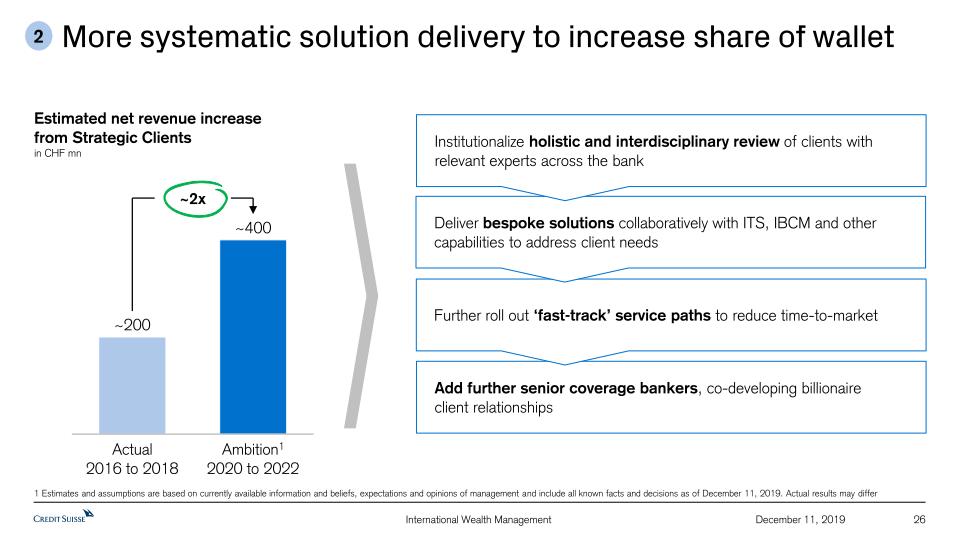

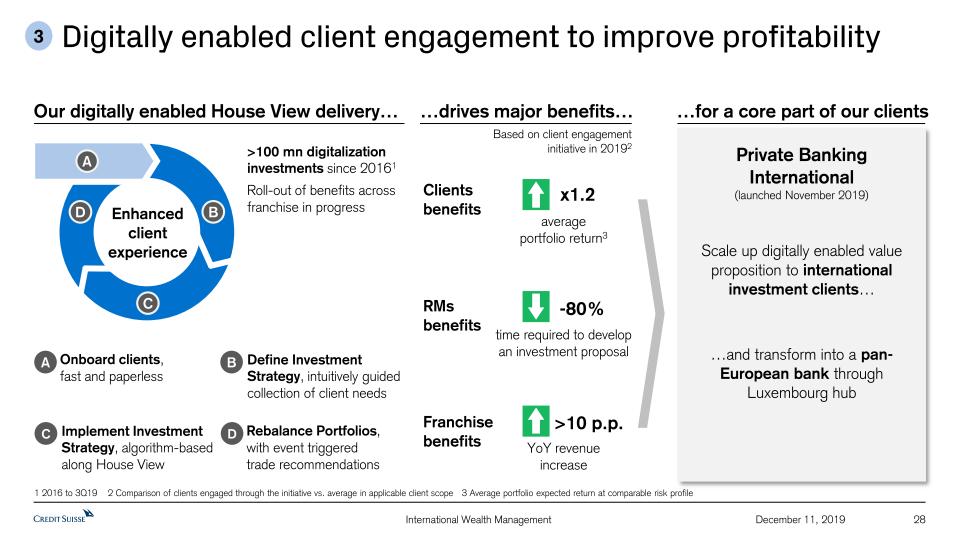

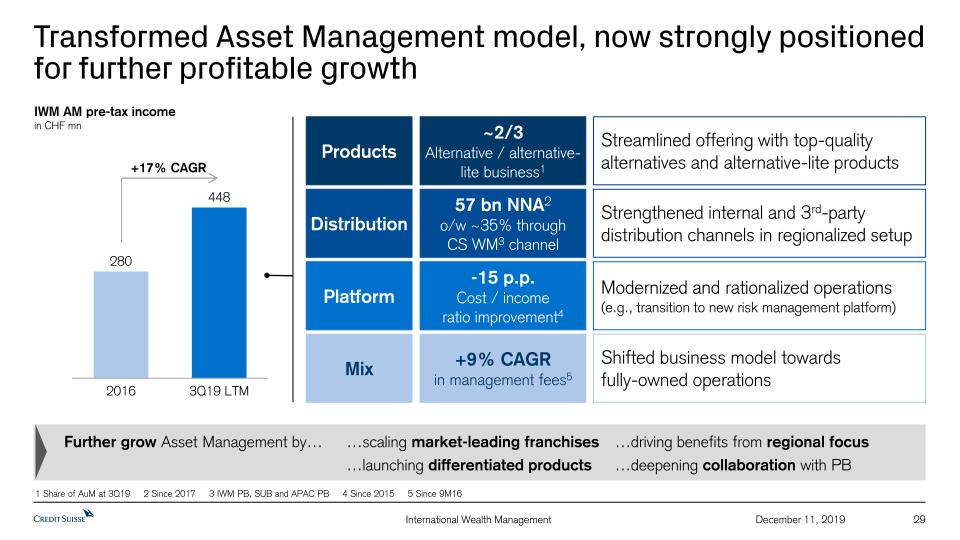

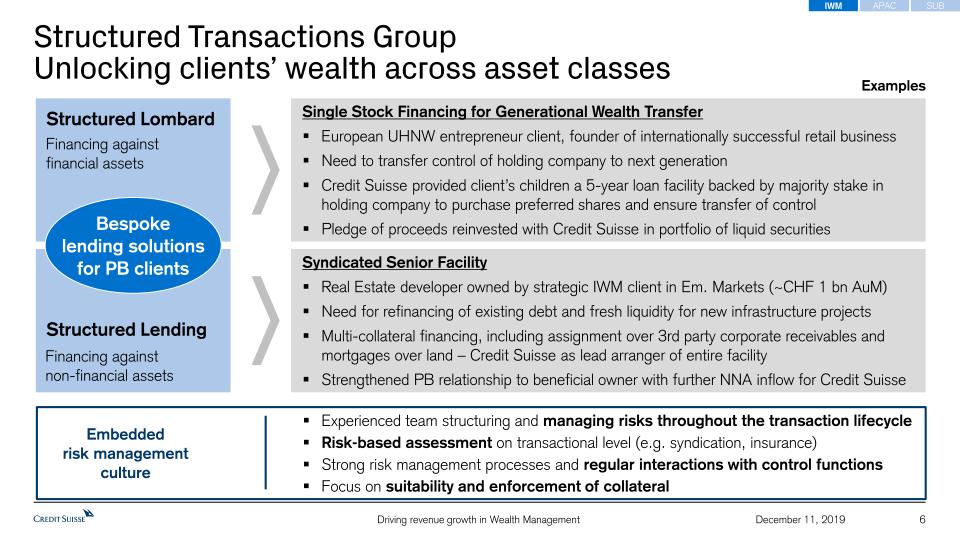

We will continue to grow by offering bespoke solutions to our clients, fully leveraging our wealth management and investment banking capabilities. Our regionalised approach allows us to stay close to our clients whilst capturing global synergies, when relevant.

|

|

§

|

Aim to deliver in 2020:

|

|

§

|

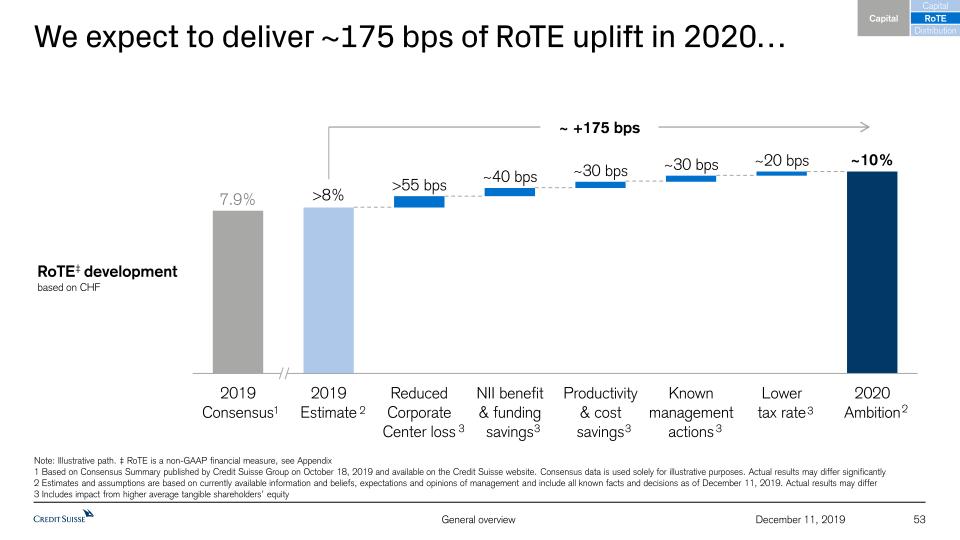

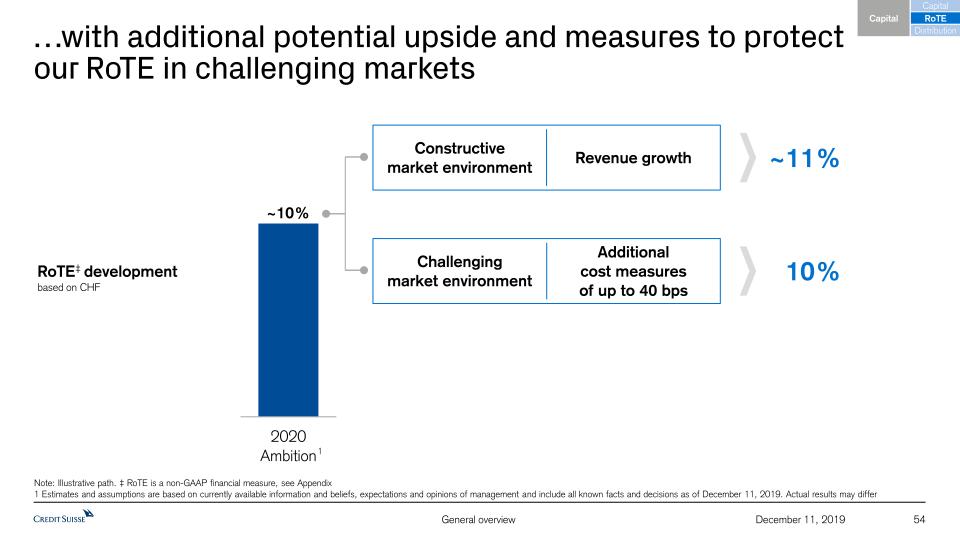

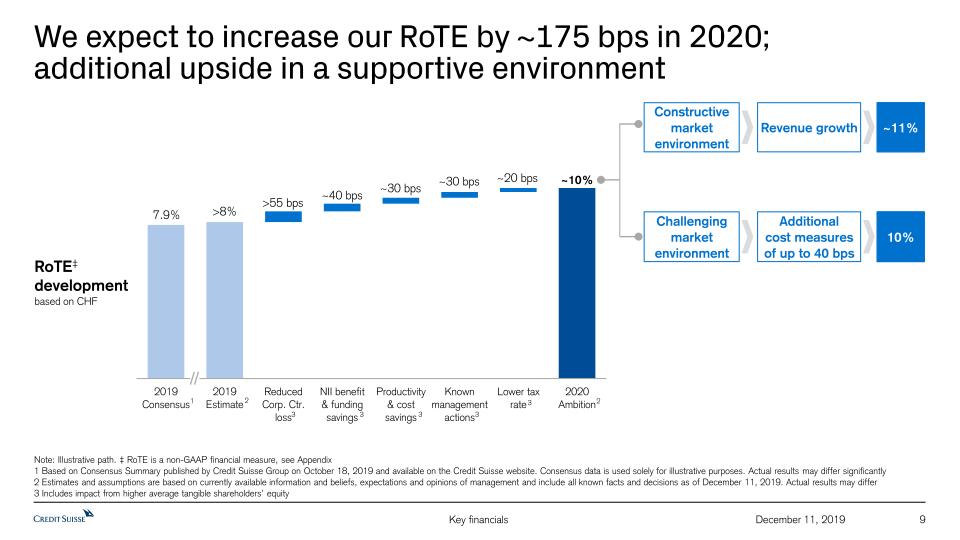

approximately 175 basis points of Return on Tangible Equity (RoTE) uplift, with additional upside in a constructive market environment

|

|

§

|

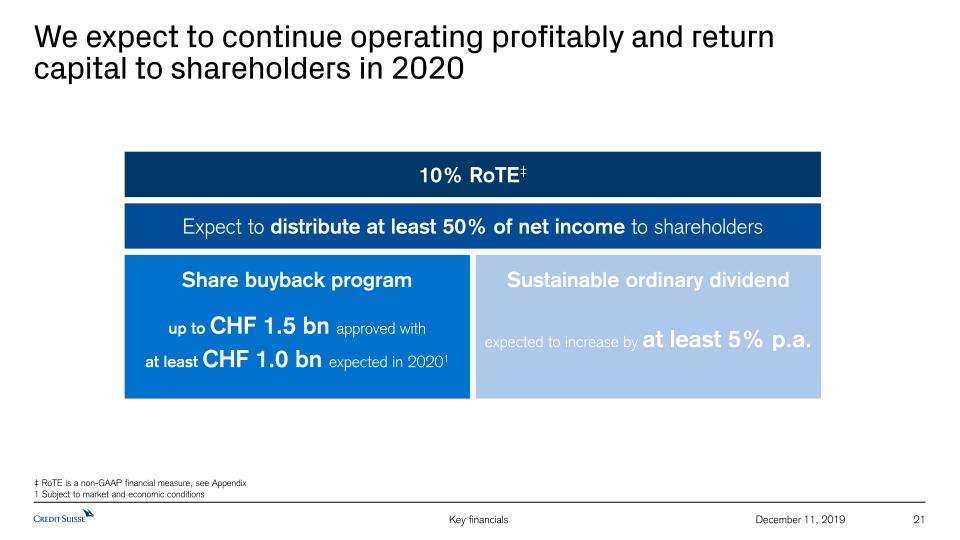

approximately 10% RoTE

|

|

§

|

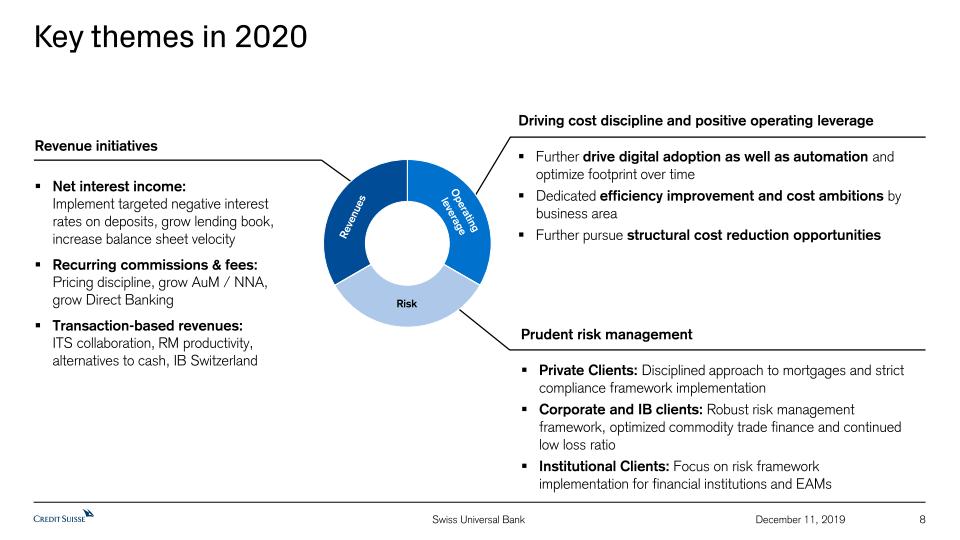

Continued discipline on costs to drive positive operating leverage

|

|

§

|

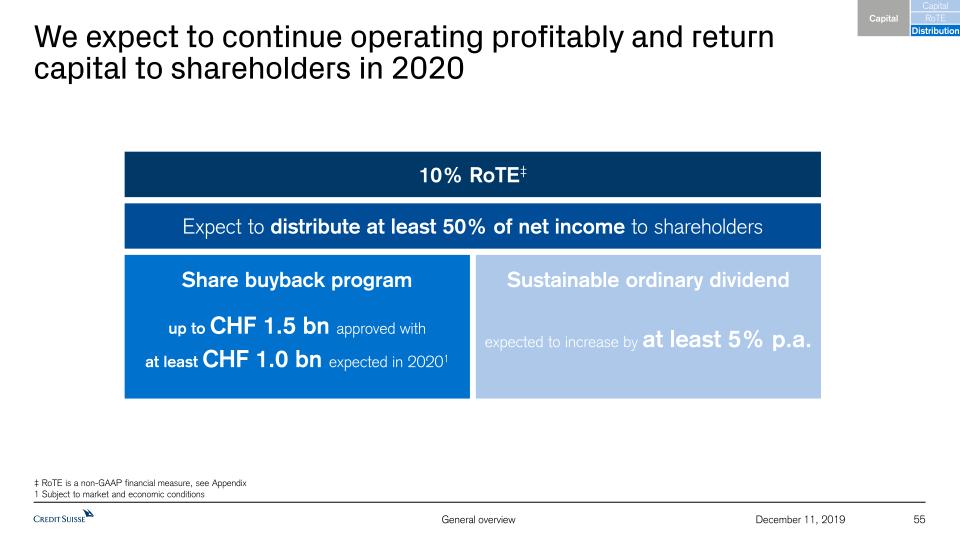

At least 50% of net income expected to be paid out in 2020 through dividends and share buybacks

|

|

§

|

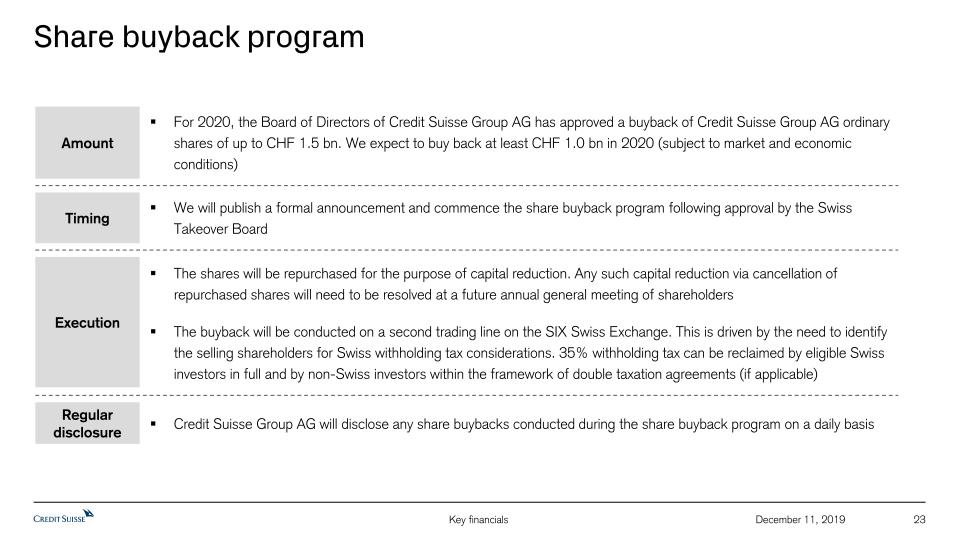

Approved buyback of Credit Suisse Group AG ordinary shares of up to CHF 1.5 billion for 2020, with at least CHF 1.0 billion expected in 20201

|

|

§

|

Plan to continue to increase ordinary dividend by at least 5% per annum

|

|

§

|

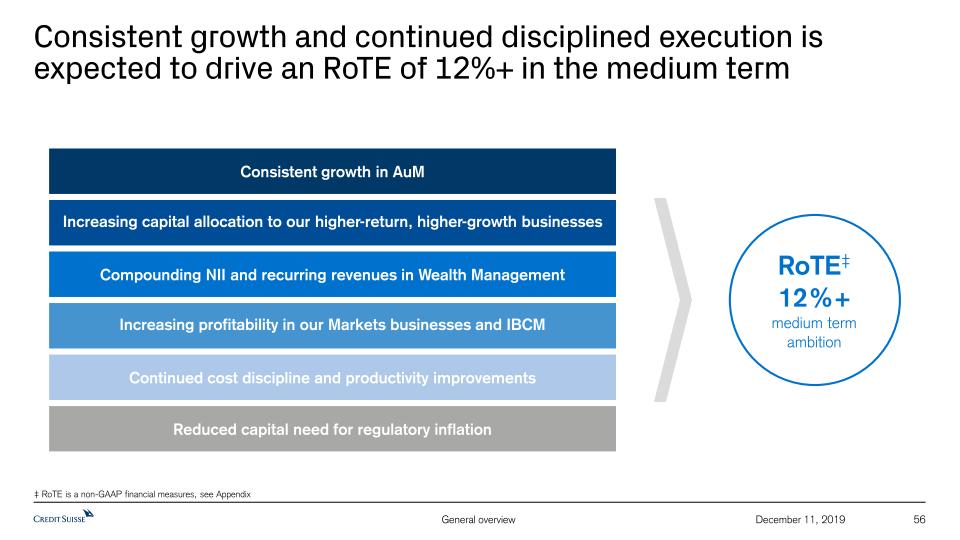

Medium term ambition of 12%+ RoTE

|

|

§

|

ESG policy update: commitment to no longer provide any form of financing specifically related to the development of new coal-fired power plants

|

Zurich, December 11, 2019 – We will today update investors and analysts on the progress we have made in 2019, the first year since the completion of our three-year restructuring programme.

We will outline how we intend to continue to increase our returns in 2020 and beyond, support our clients across our franchises, deliver industry leading performance in our chosen markets, and return capital to our shareholders.

Continued momentum in 2019

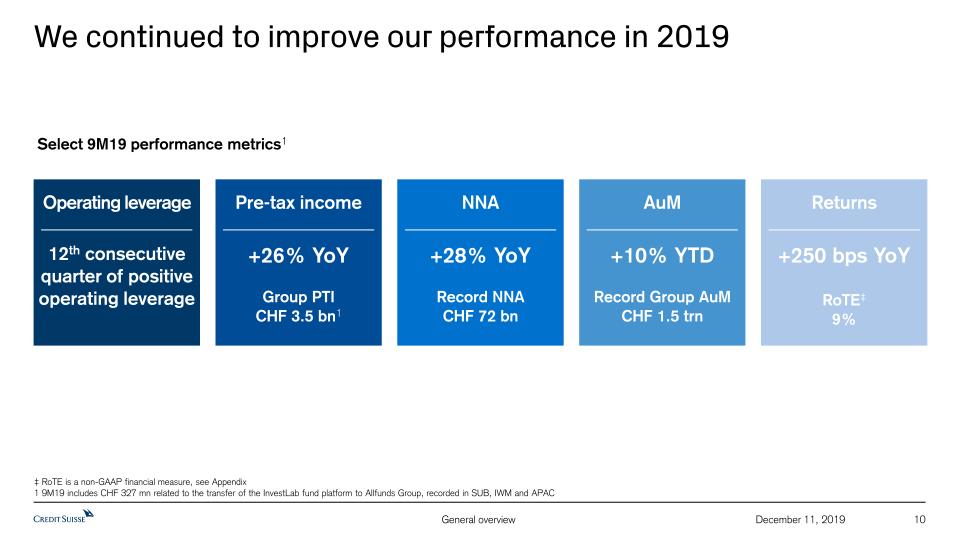

We have achieved strong growth across key metrics:

|

§

|

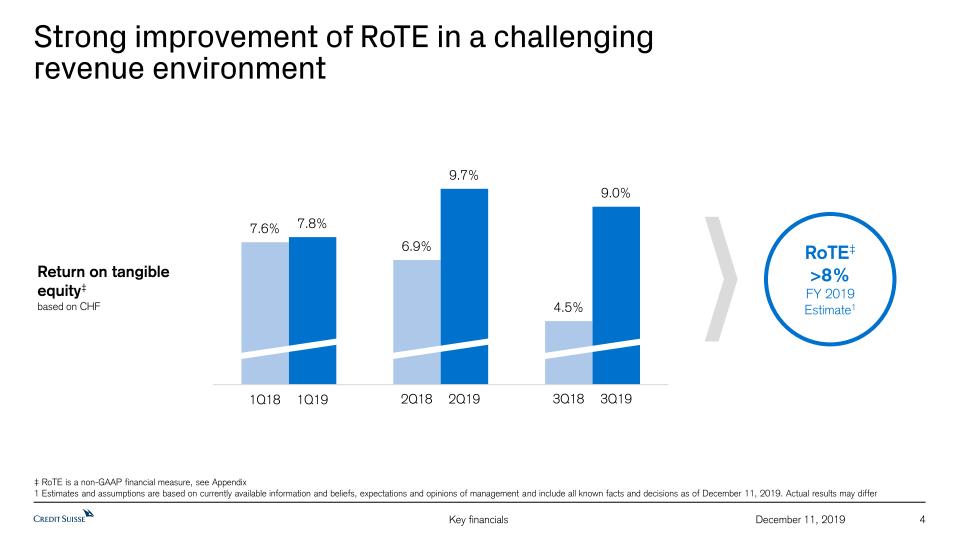

Pre-tax income was up 26%, Return on Equity increased by 220 basis points and RoTE improved by 250 basis points for the first nine months of 2019 versus the same period for 2018

|

|

§

|

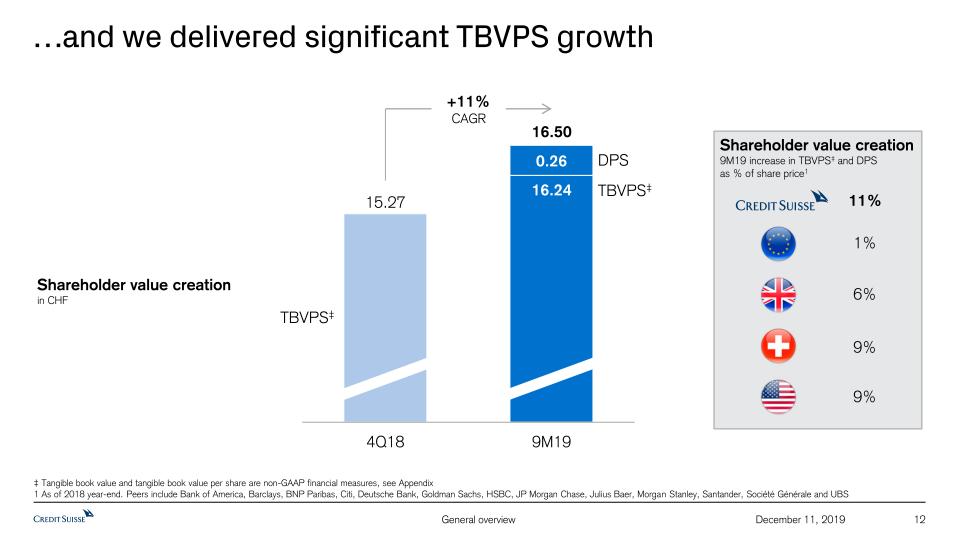

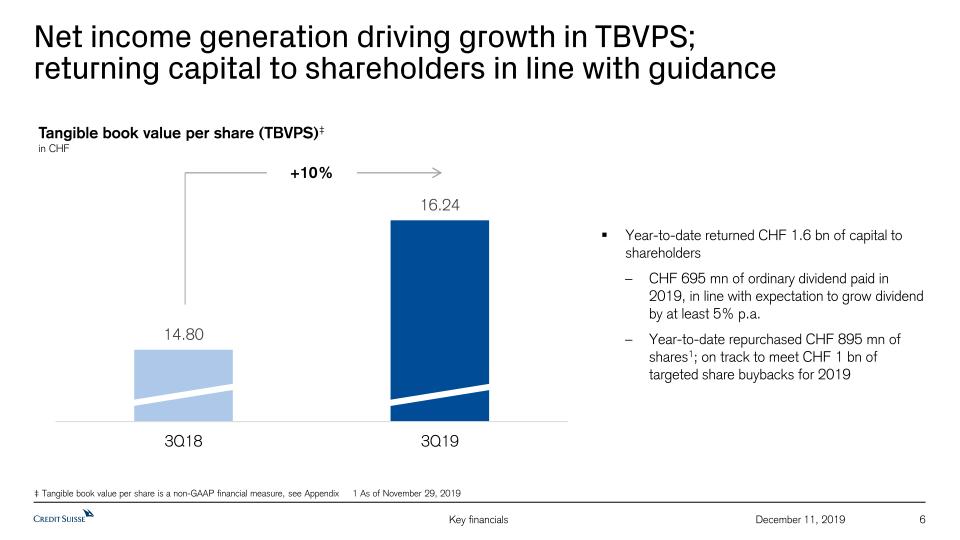

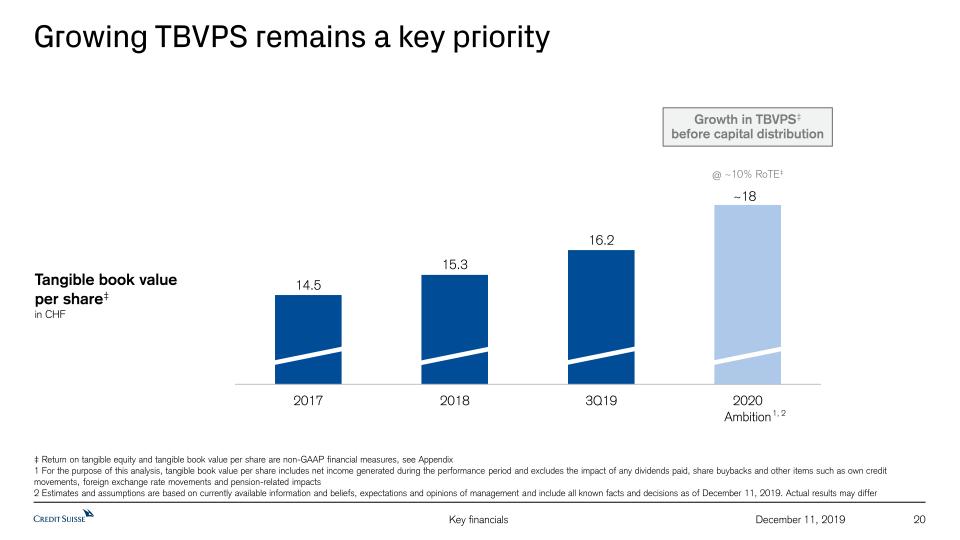

Book value per share grew by a compound annual growth rate (CAGR) of 8% and shareholder value creation grew by a CAGR of 11%2 in the first nine months of 2019

|

|

§

|

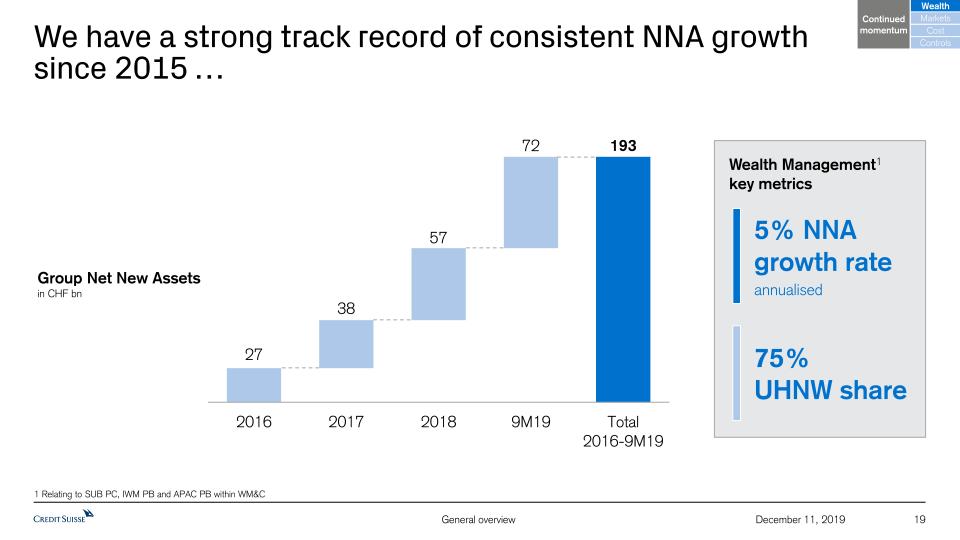

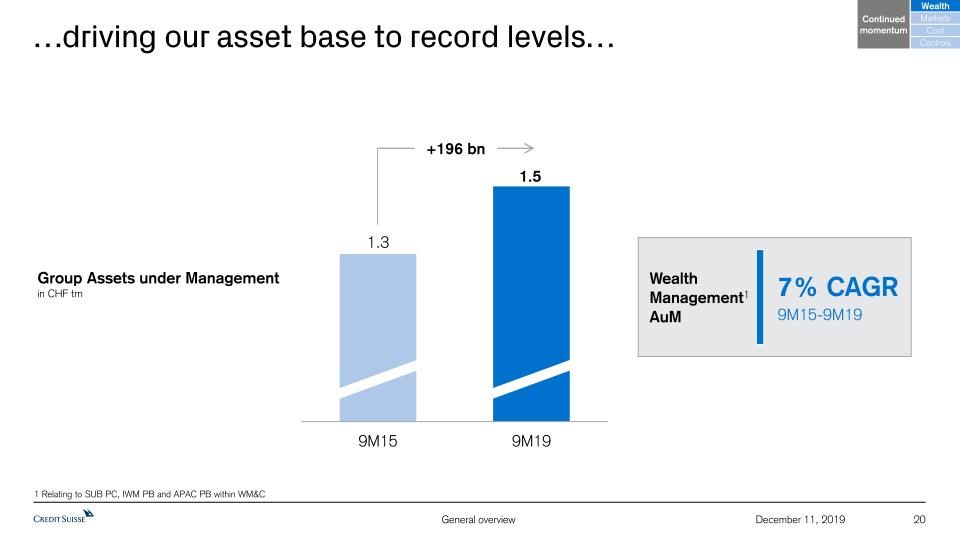

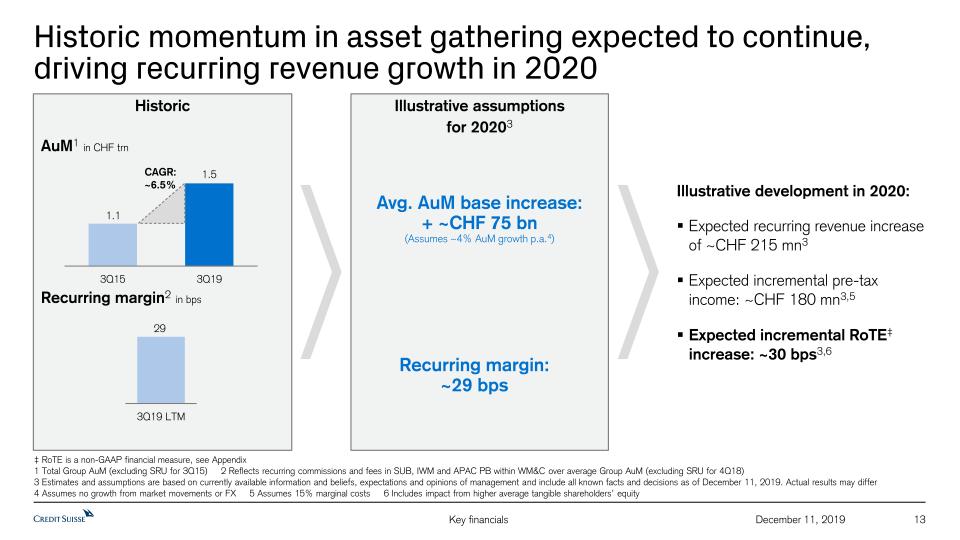

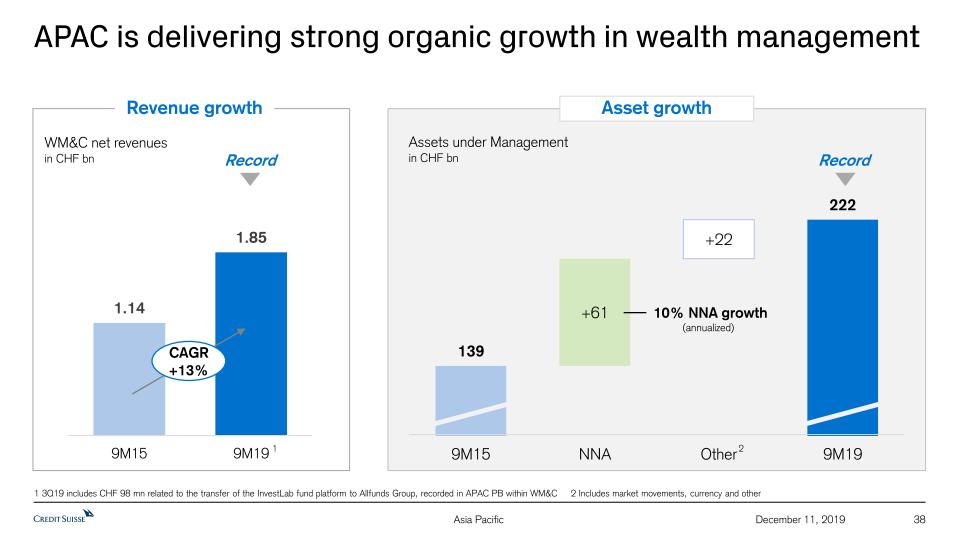

Supported by our wealth management businesses, Net New Asset (NNA) growth across the Group was 28% higher at 9M19 than at 9M18 and we achieved a record NNA of CHF 72 billion at 9M19, driving our Assets under Management to a record CHF 1.5 trillion, winning prestigious industry awards over the course of the year

|

We will address today how we intend to maintain our momentum in 2020.

Page 1

|

Media Release

Zurich, December 11, 2019

|

|

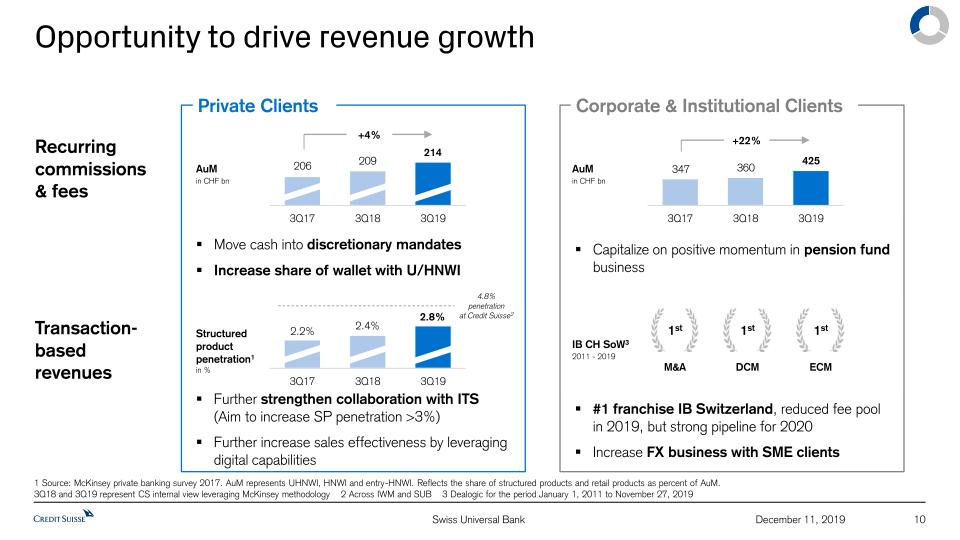

Growing revenues in wealth management

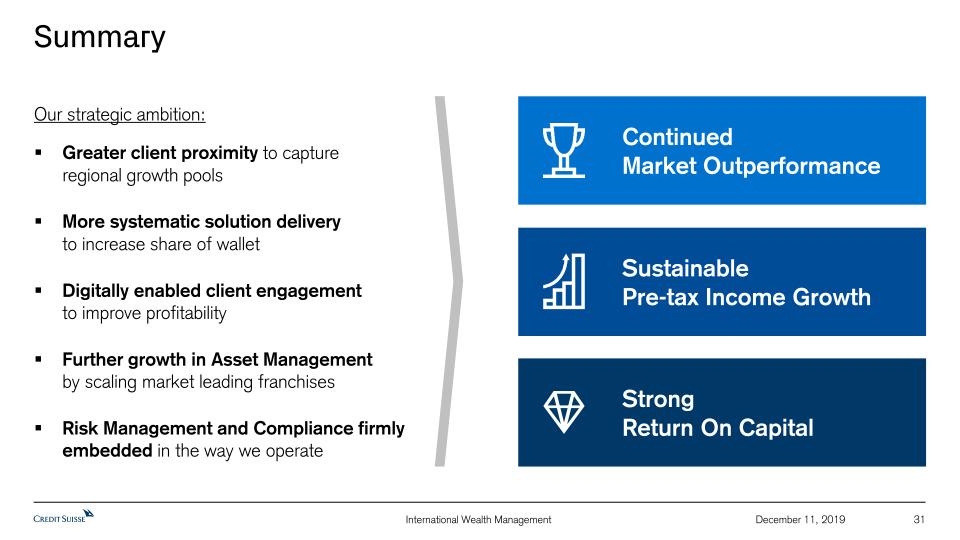

Over the past few years, thanks to the disciplined execution of our strategy - ‘A leading wealth manager with strong investment banking capabilities’ - we have been able to grow faster than our chosen markets, even when the environment was not supportive, as in 2019. Our regionalised structure, aligned to client needs, drives agile decision-making, greater accountability and an effective control framework, with a particular focus on compliance and risk management.

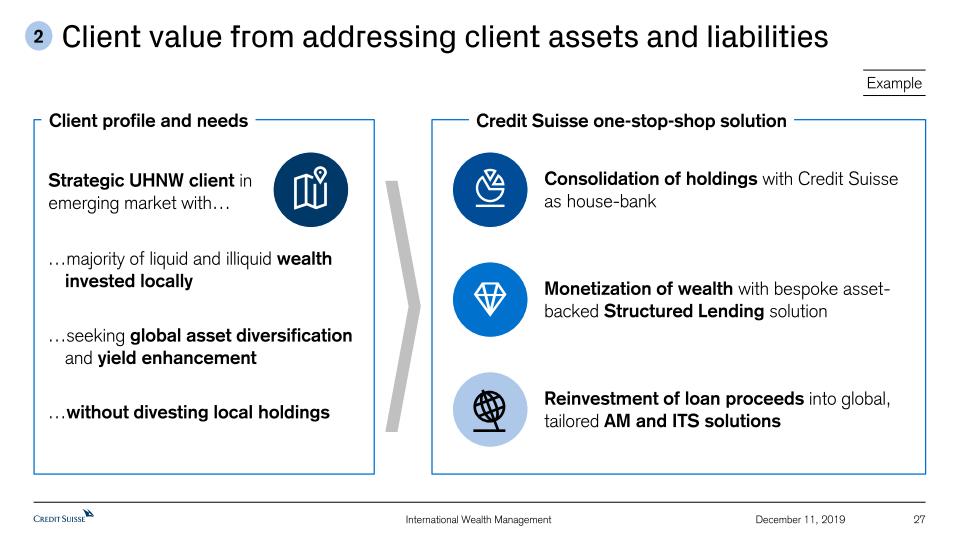

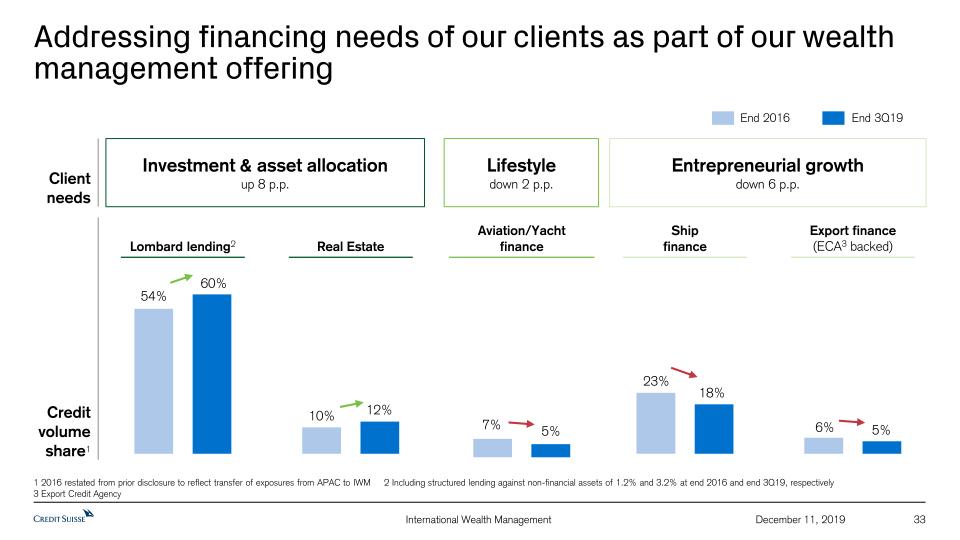

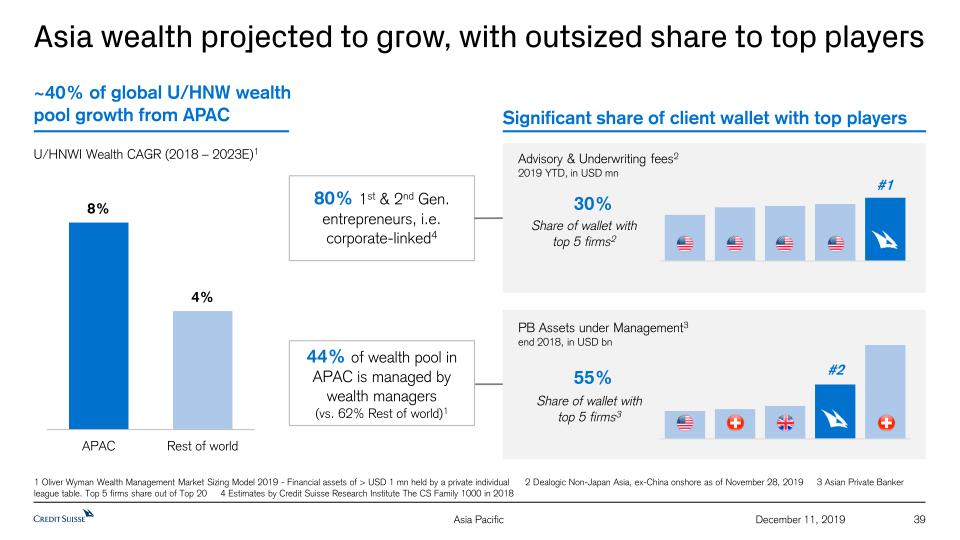

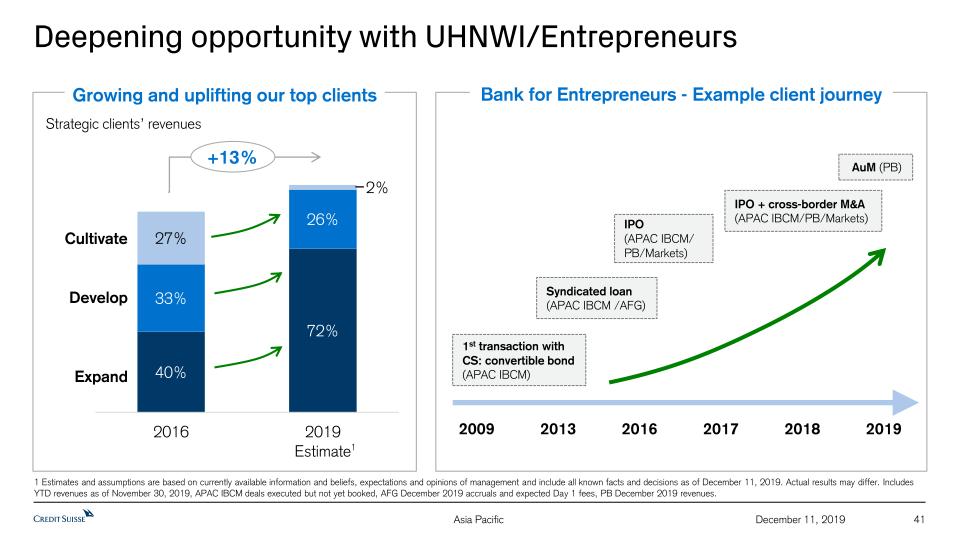

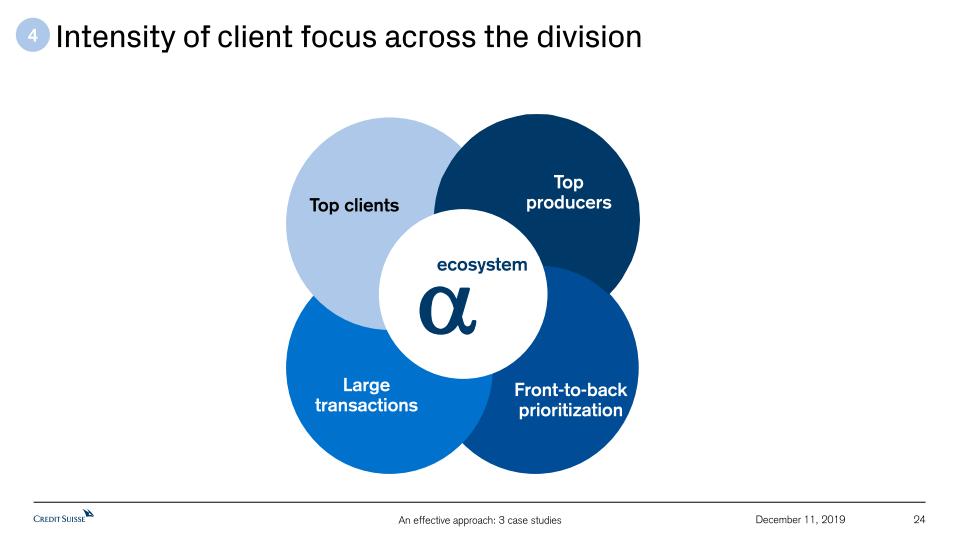

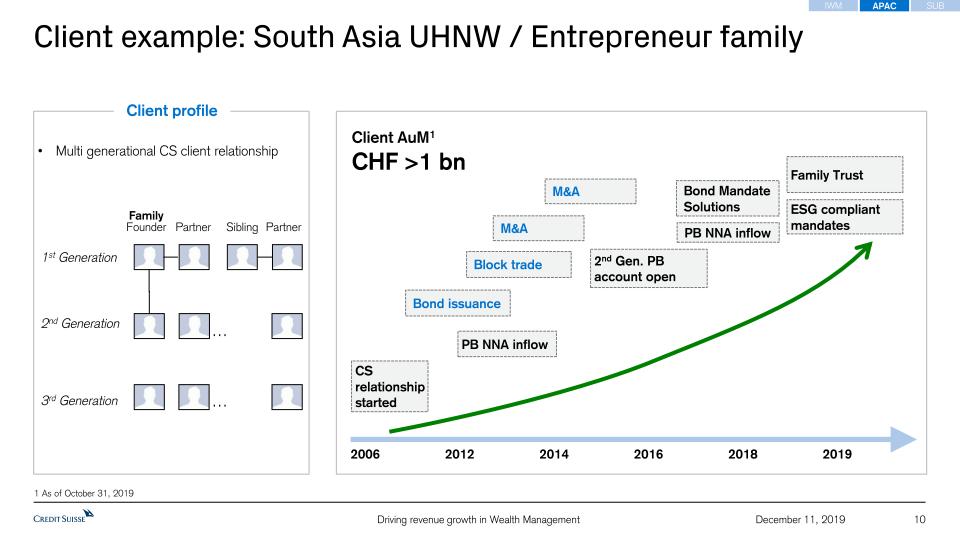

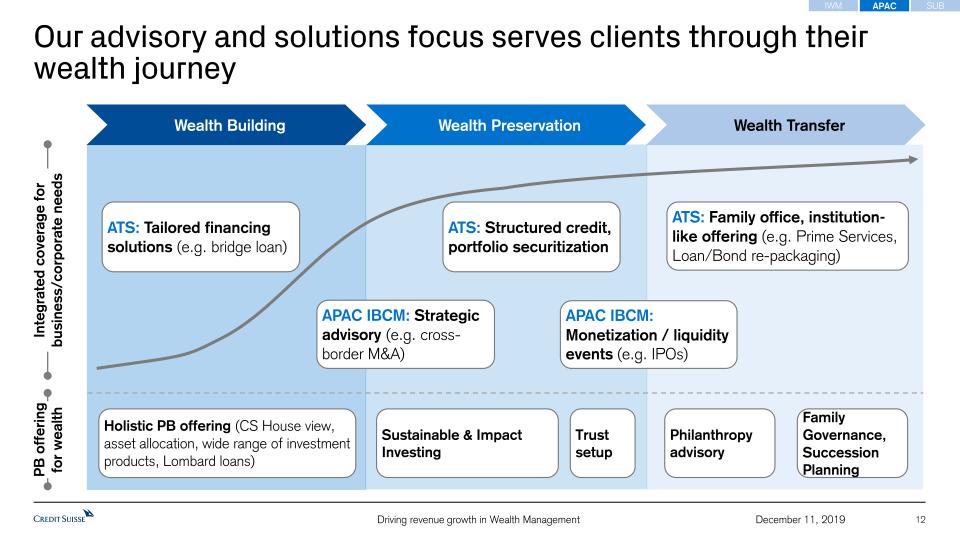

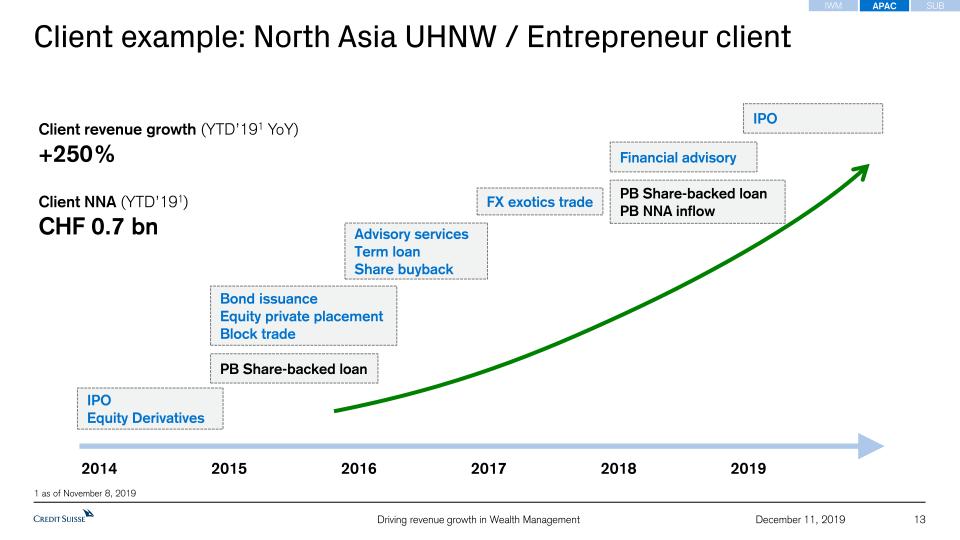

Between the end of 2015 and the end of 3Q19, we had attracted CHF 193 billion of NNA across the Group as a whole. We also achieved a CAGR of 7% for our Wealth Management AuM over those four years. We have delivered consistent asset inflows by being a trusted adviser. Thanks to the strong collaboration among our wealth management, markets and investment banking teams, we provide institutional quality solutions and capabilities to our ultra-high-net-worth (UHNW) and entrepreneur clients. As we continue to further scale our record Wealth Management AuM of CHF 802 billion, we are compounding the growth of our more stable and recurring revenue streams.

Over time this growth in quality, stable, capital efficient revenue should drive significant upside to our Group RoTE.

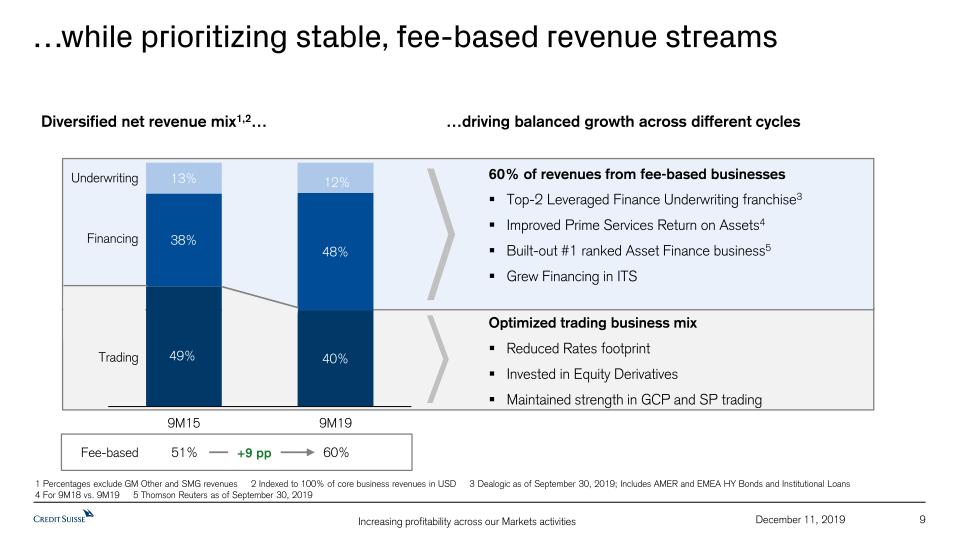

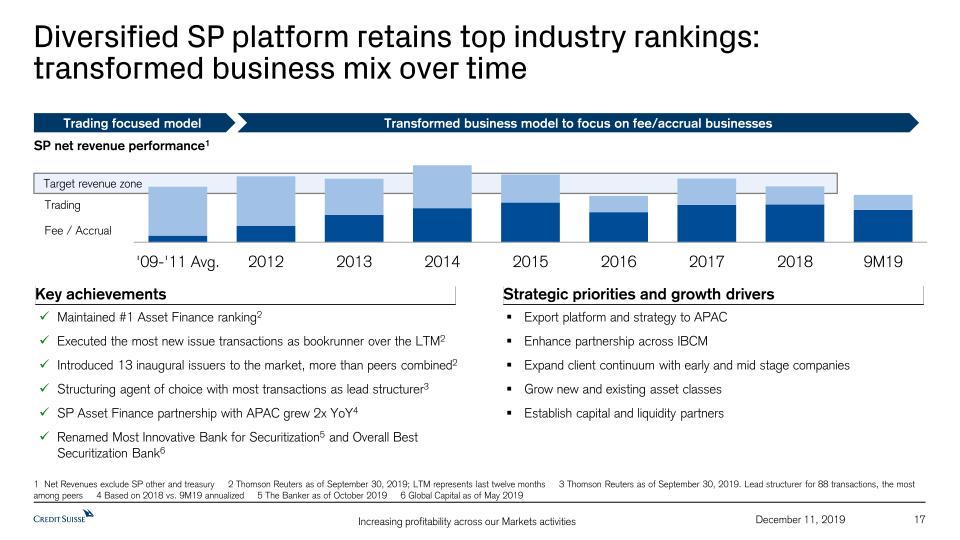

Growing revenues in our markets businesses

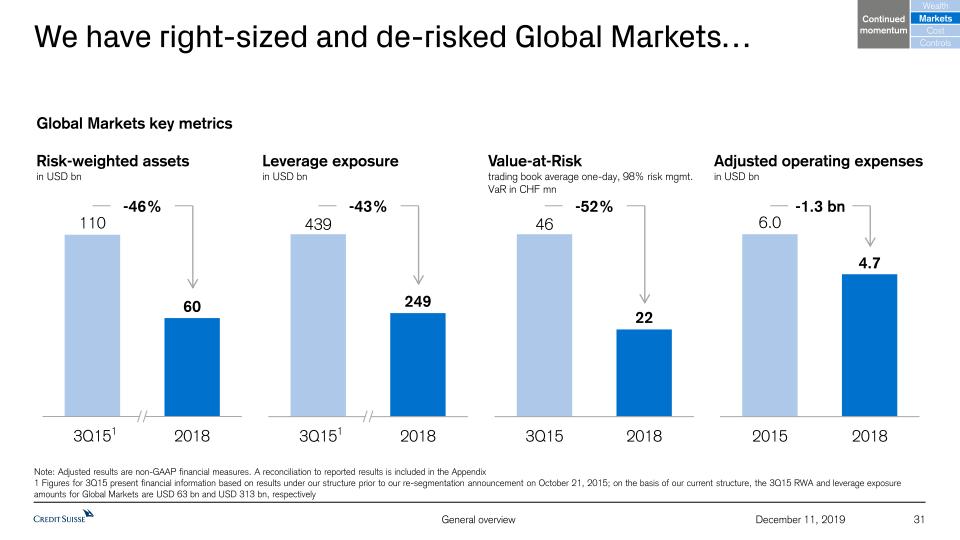

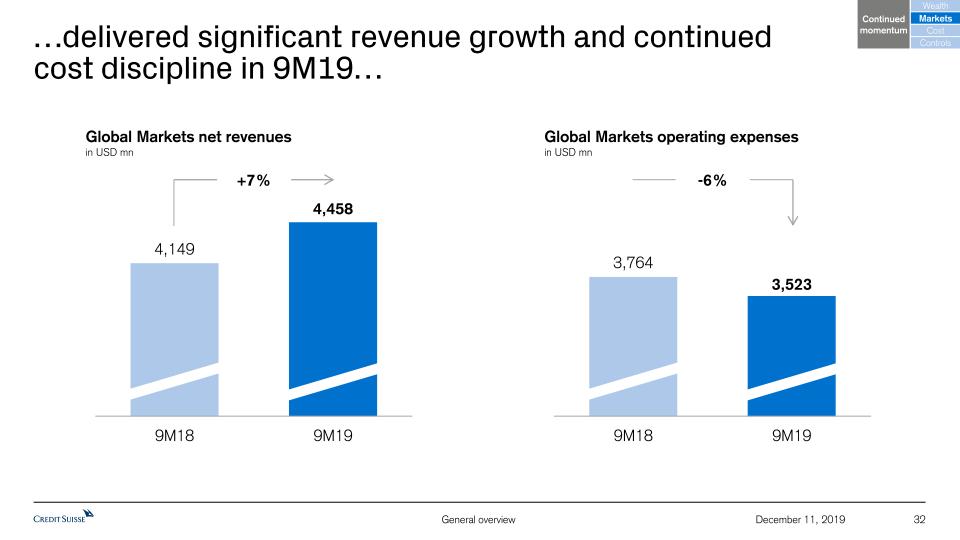

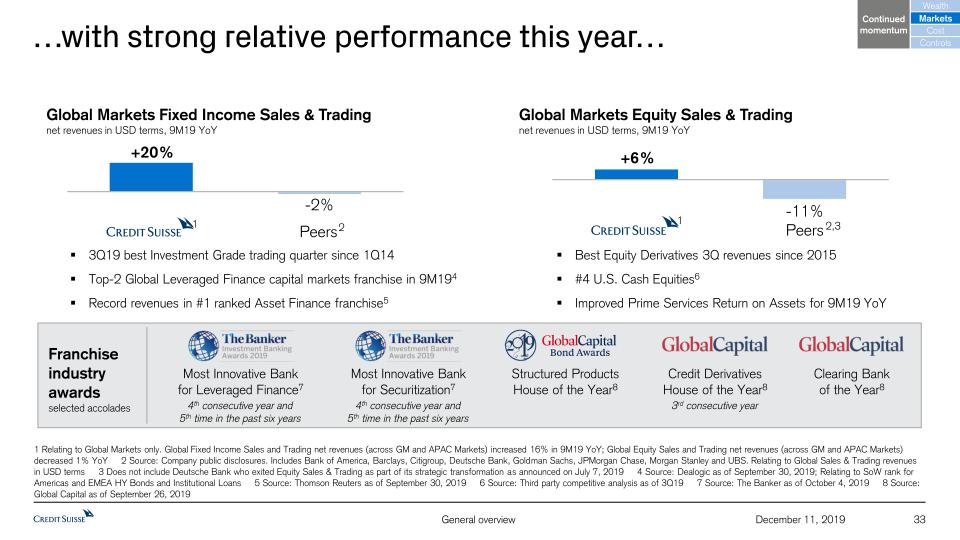

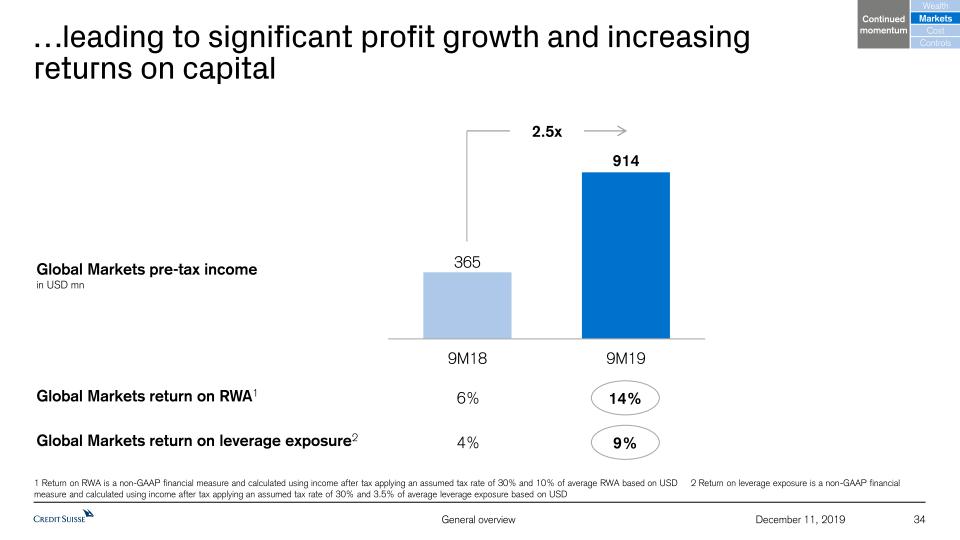

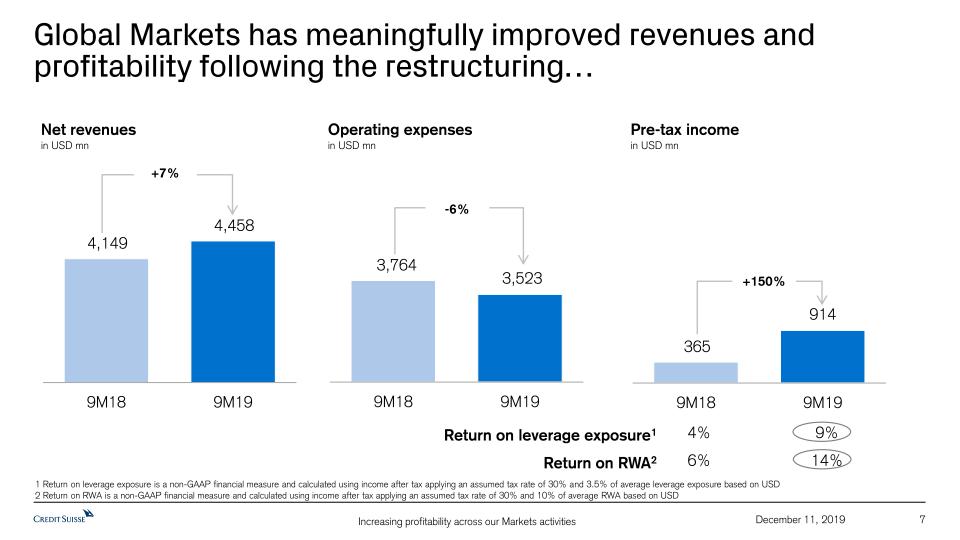

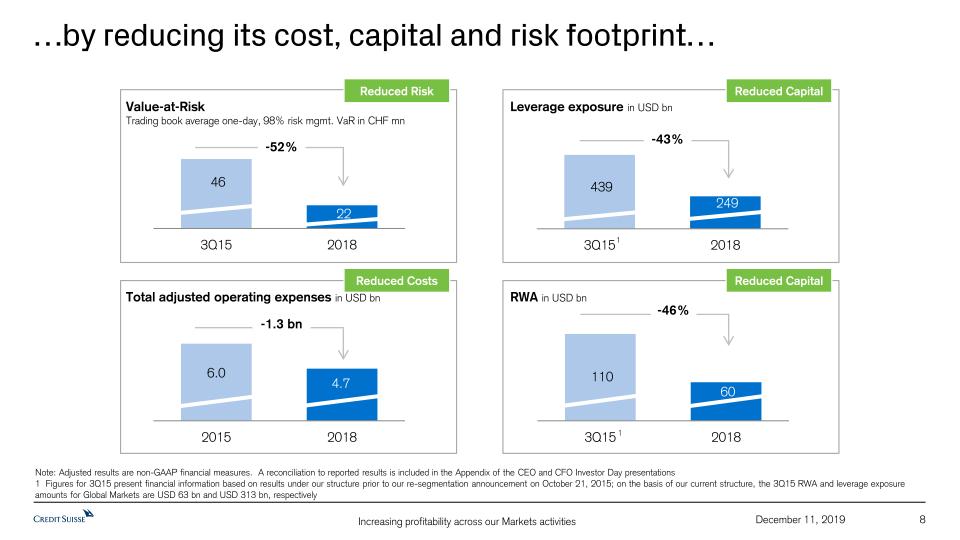

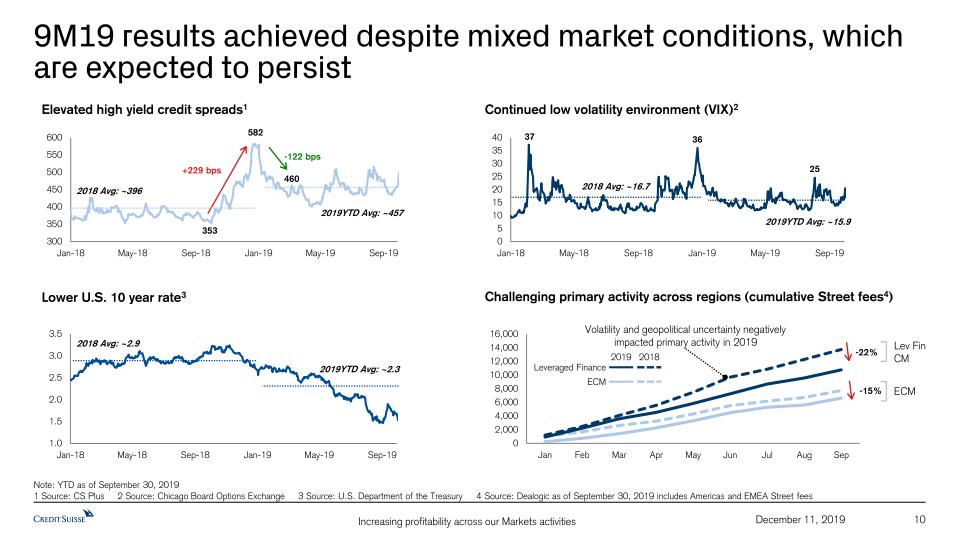

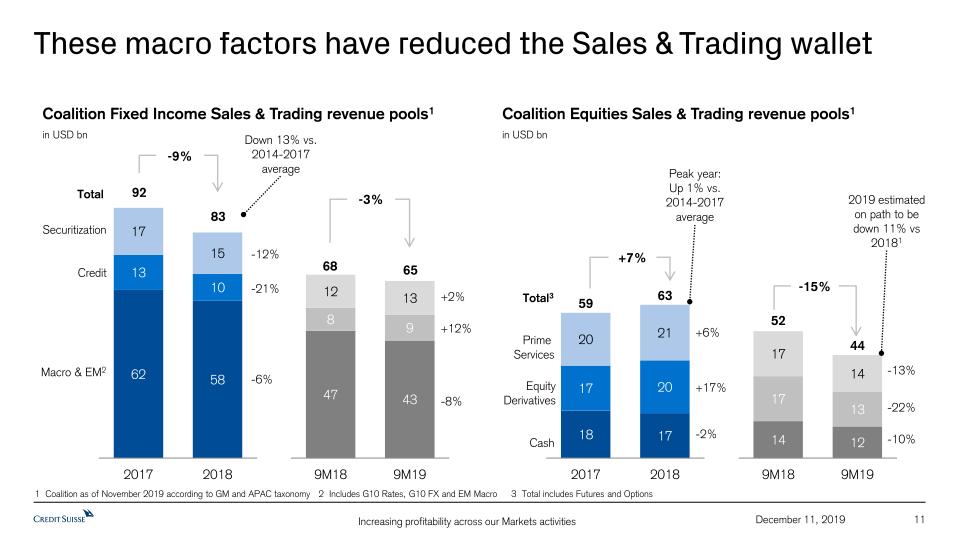

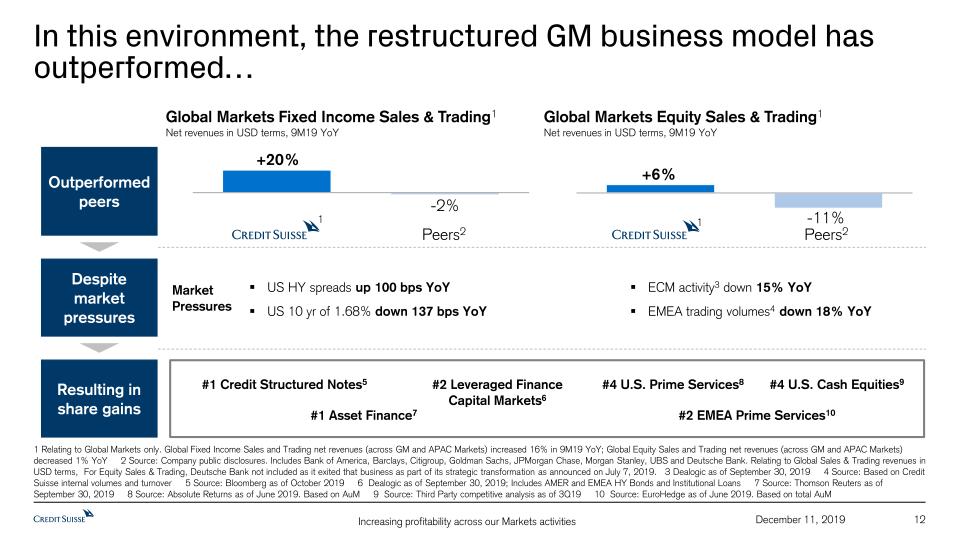

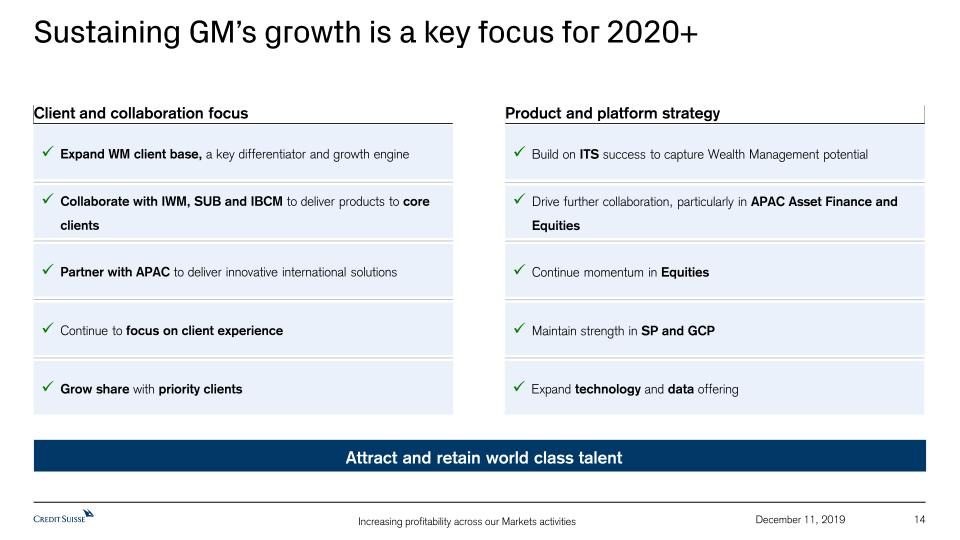

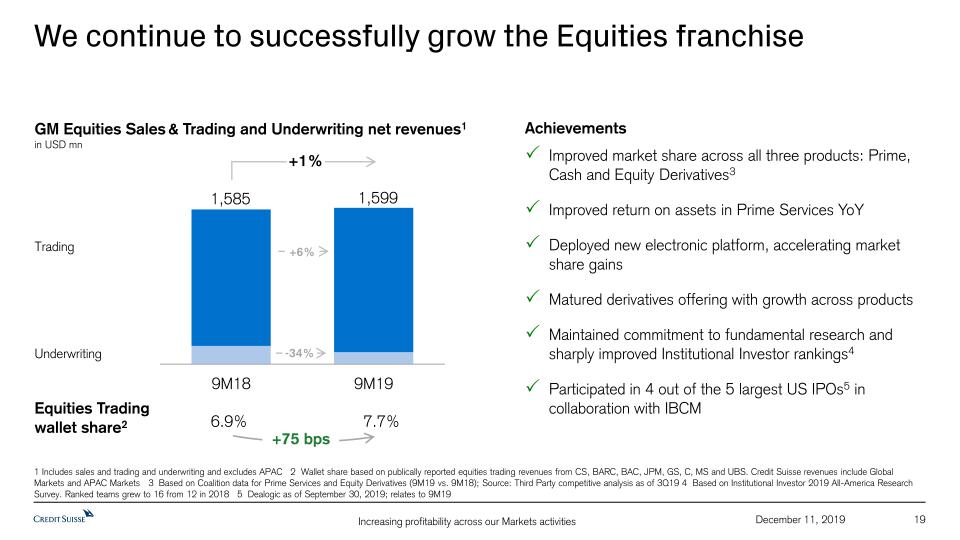

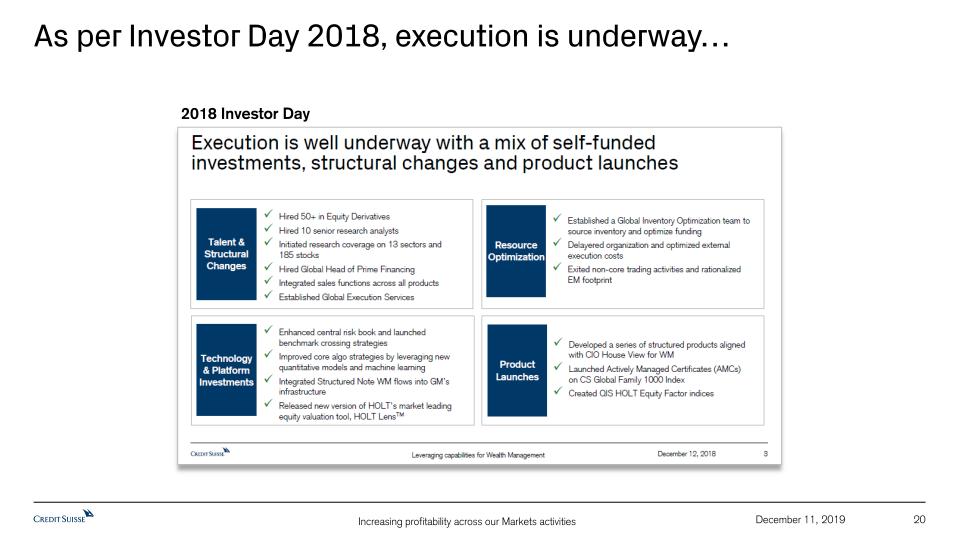

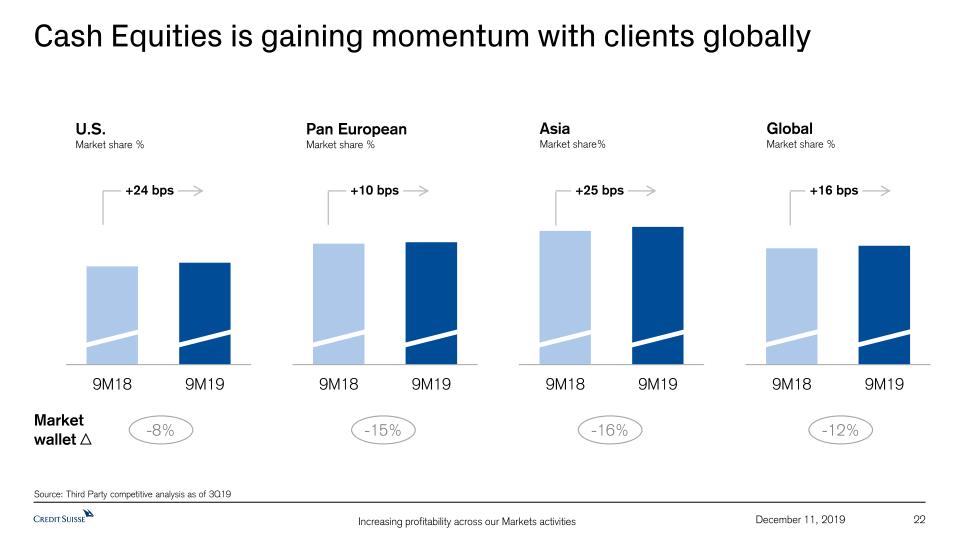

We successfully completed the restructuring of Global Markets (GM) at the end of 2018. We have right-sized and de-risked our platform and increased its connectivity with our wealth management franchise. Global Markets delivered a strong performance in the first nine months of 2019, outperforming our peers across Fixed Income sales and trading and Equity sales and trading3. During that period, Global Markets achieved a pre-tax income of USD 914 million driven by significant revenue growth and continued cost discipline, achieving a return on regulatory capital of 9%, more than double its return on regulatory capital year on year.

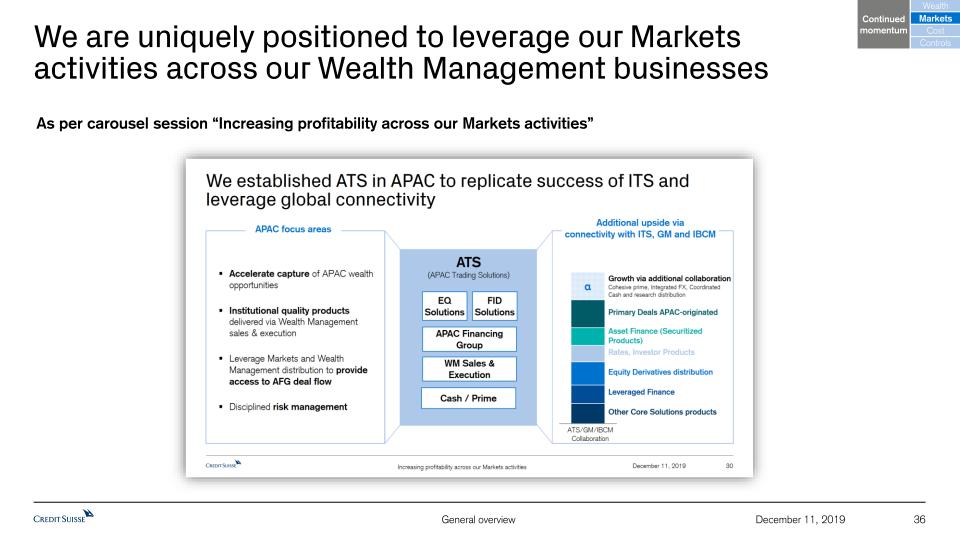

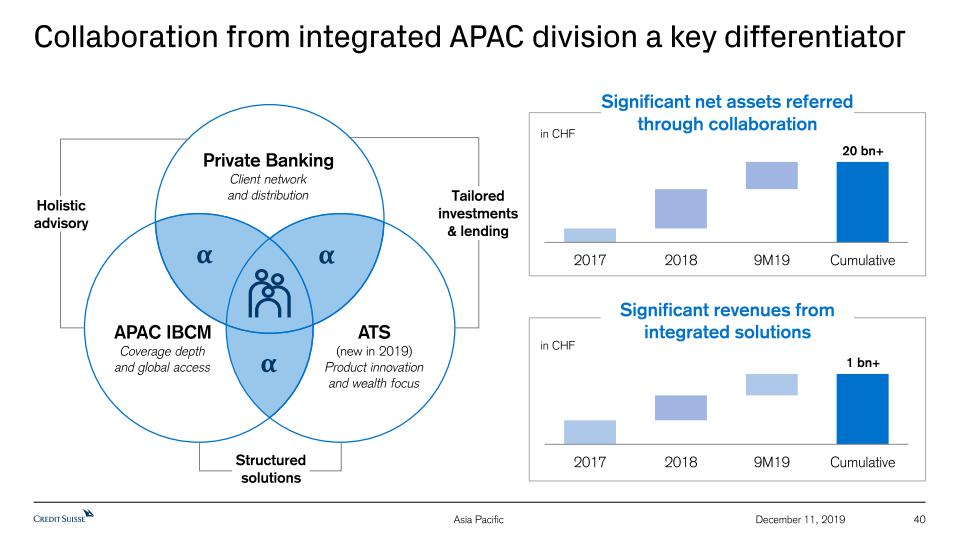

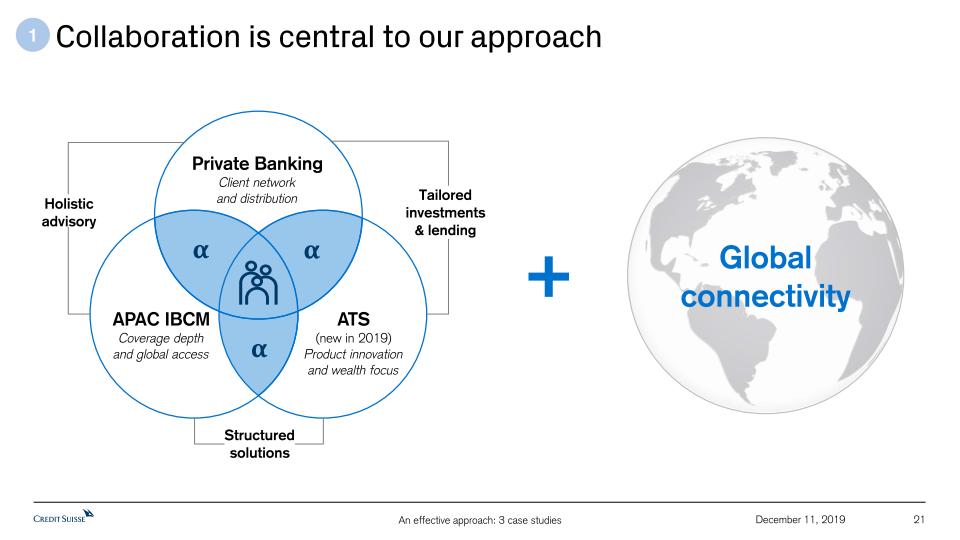

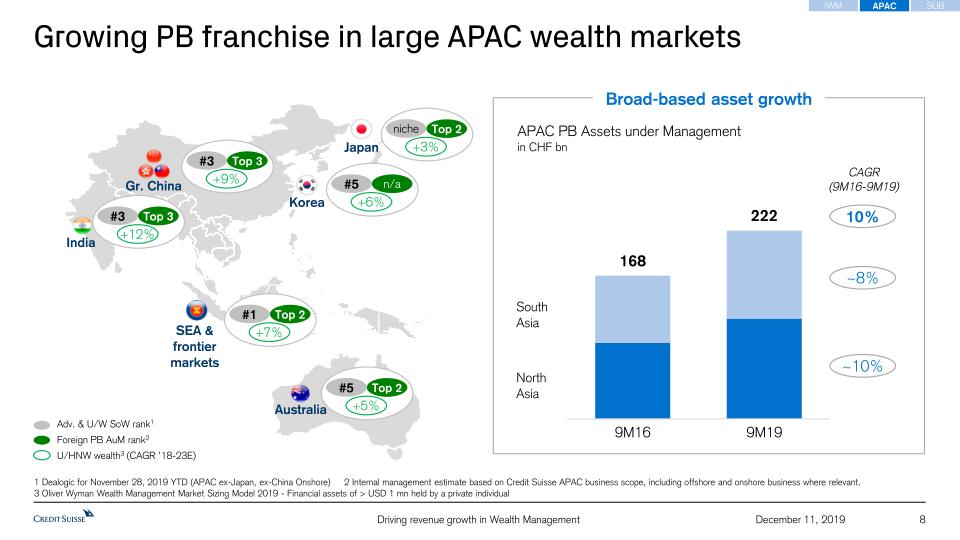

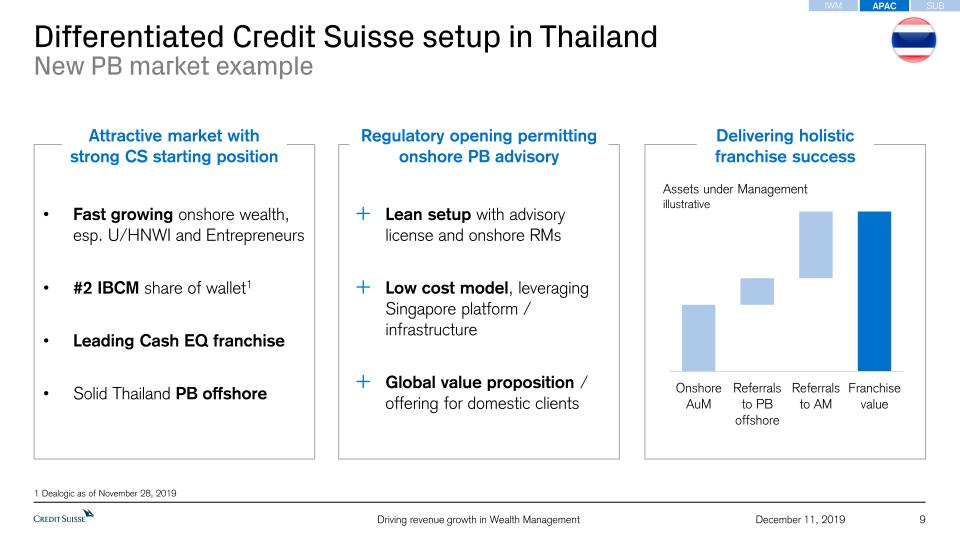

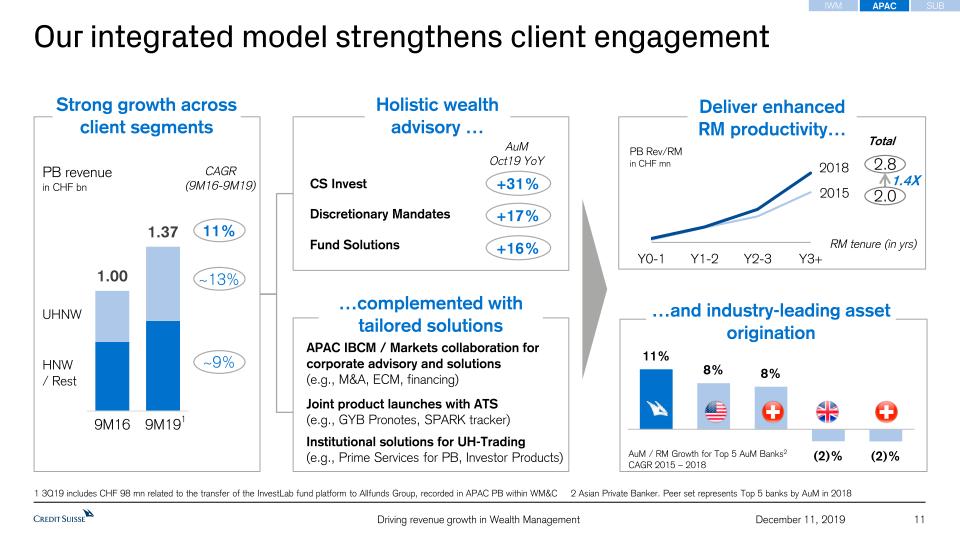

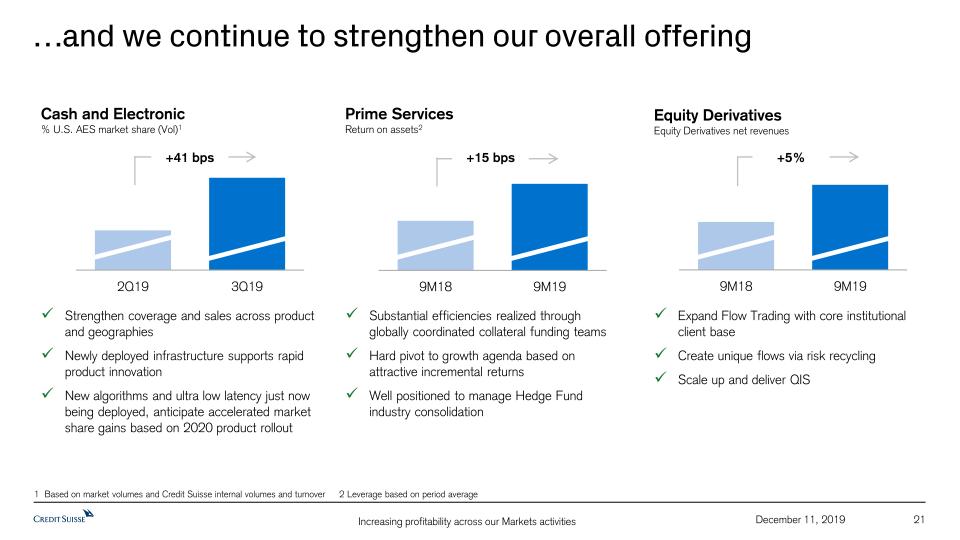

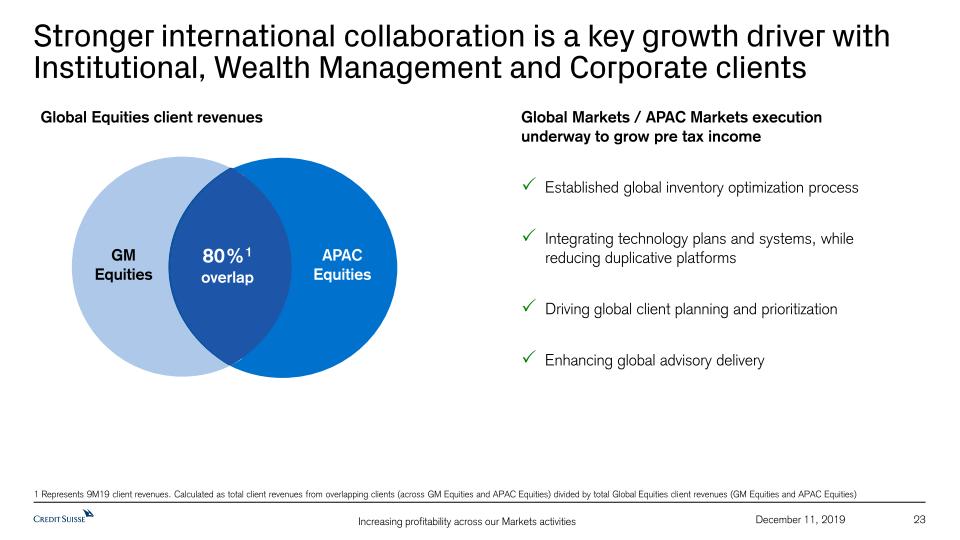

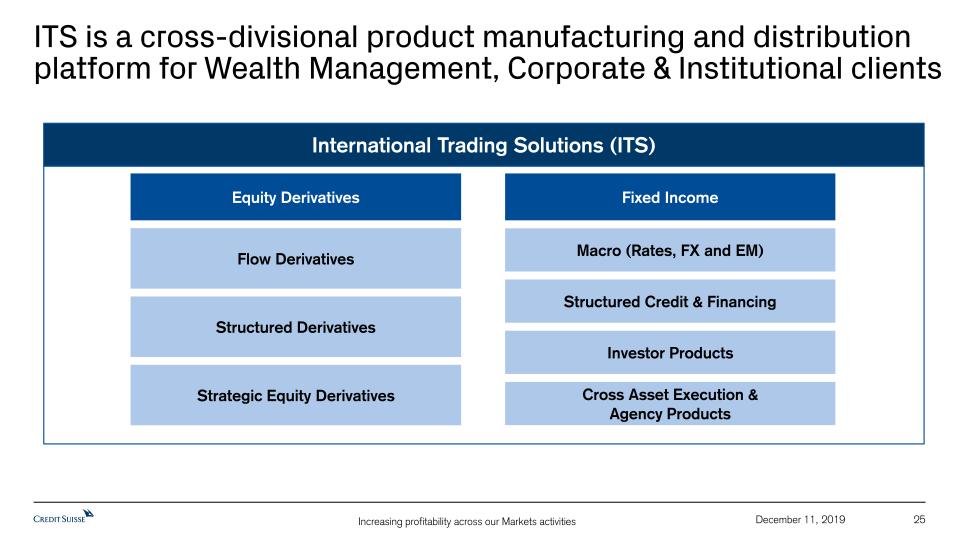

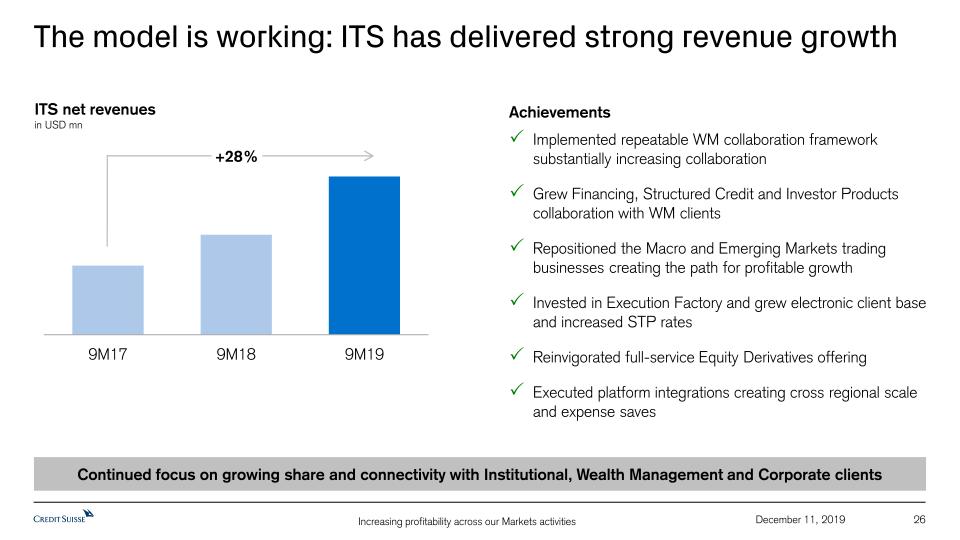

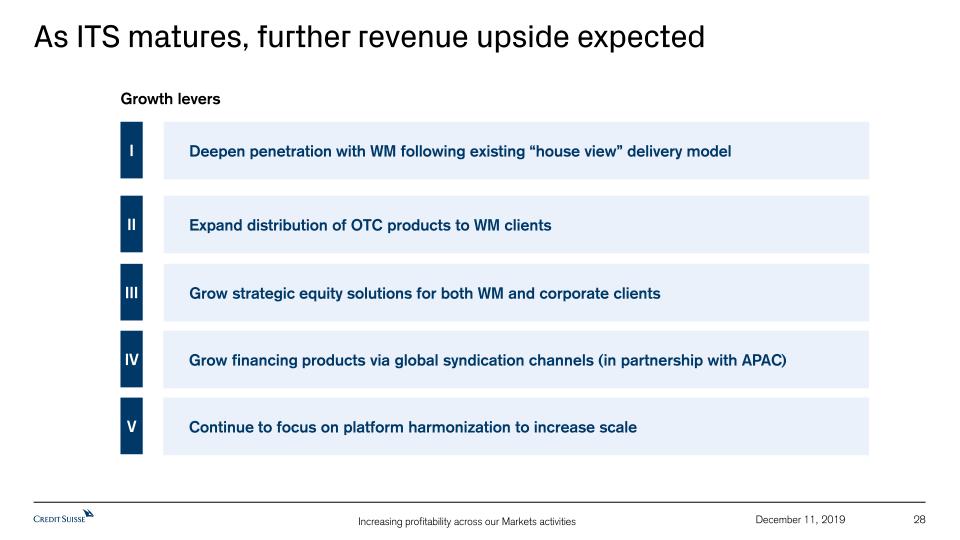

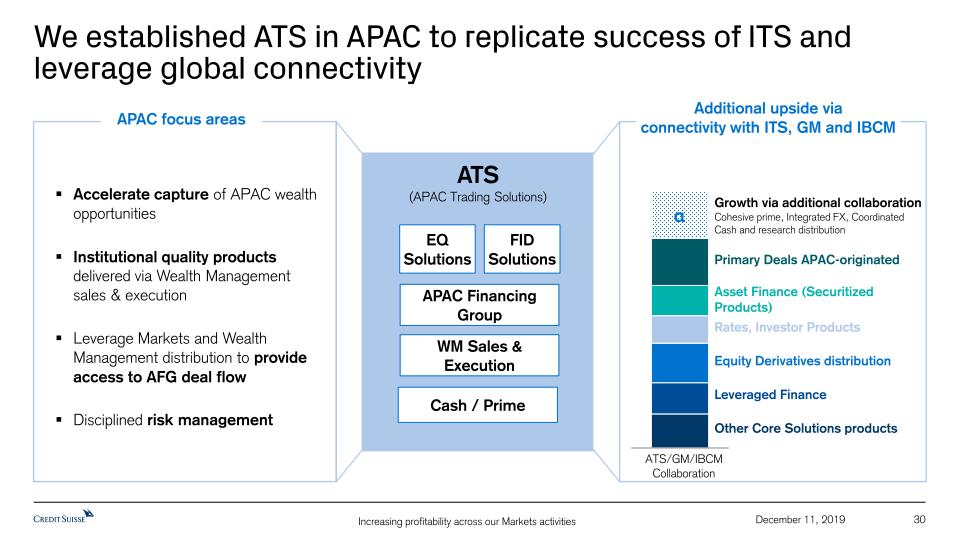

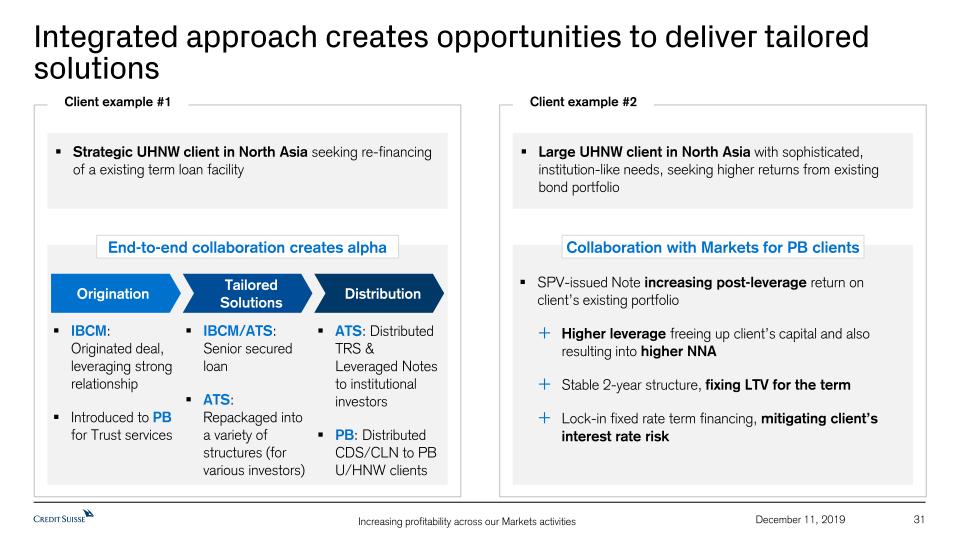

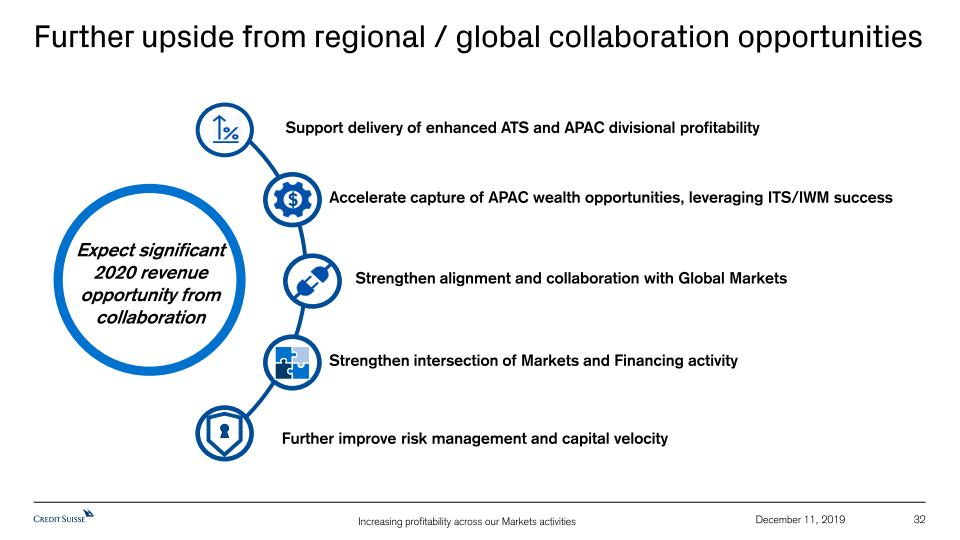

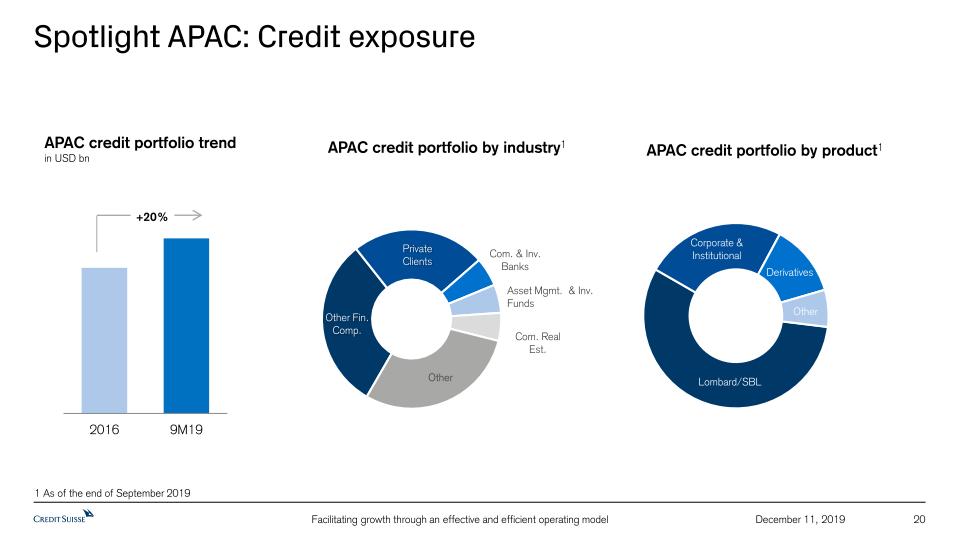

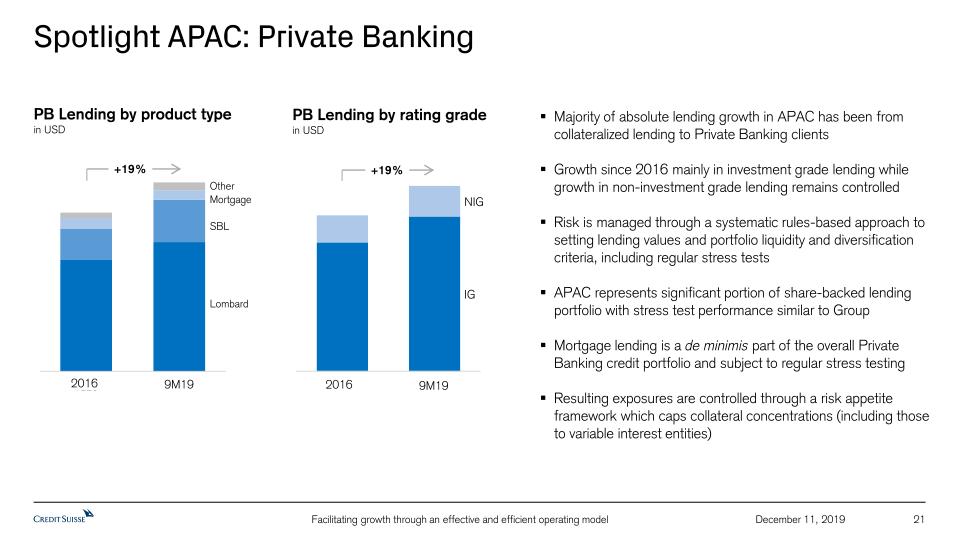

We are uniquely positioned to leverage our markets activities across our wealth management businesses, and we are successfully delivering solutions to our wealth management clients through our ITS platform. With our ATS platform in APAC, we are starting to see early tangible benefits in 4Q19 of working closer together with Global Markets, across Prime and Equity Derivatives, as well as the potential to streamline support and control functions, capturing global synergies when and where relevant in due course.

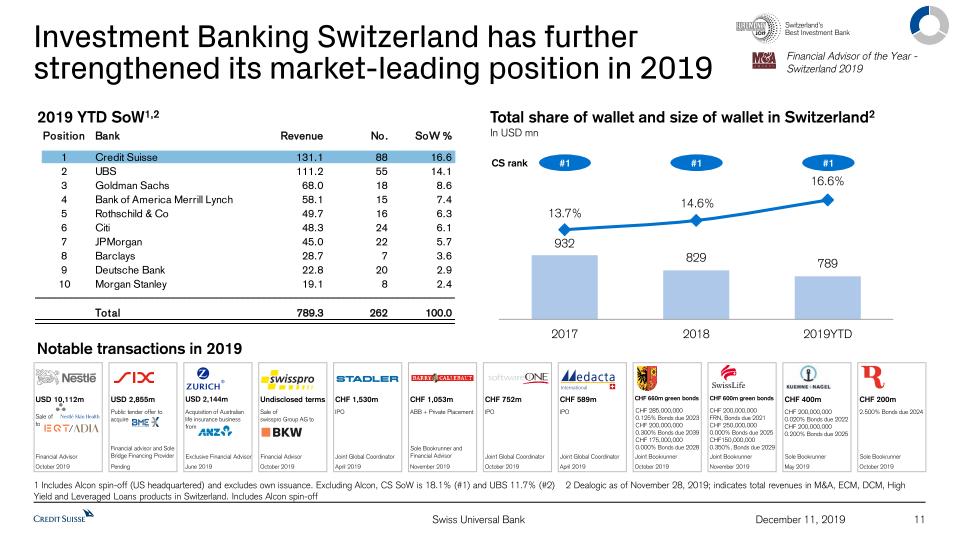

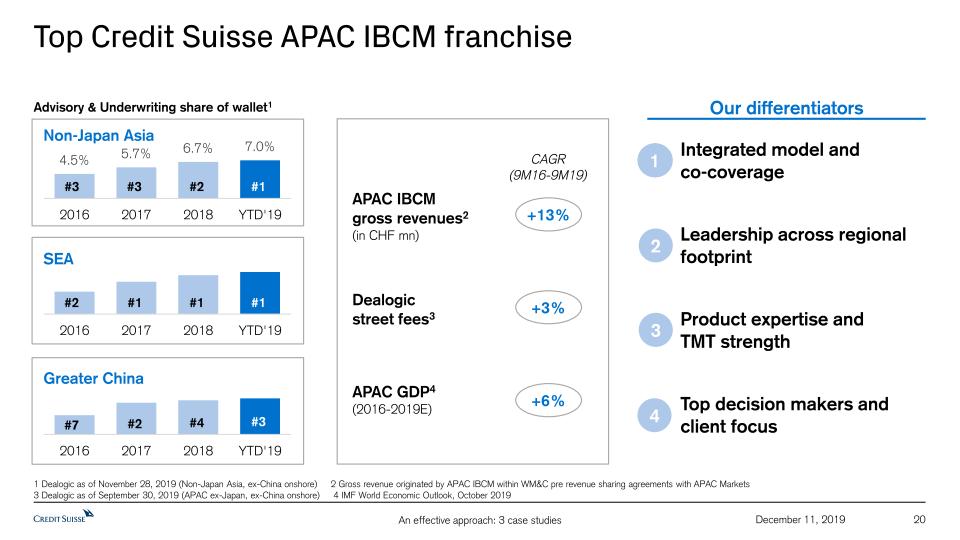

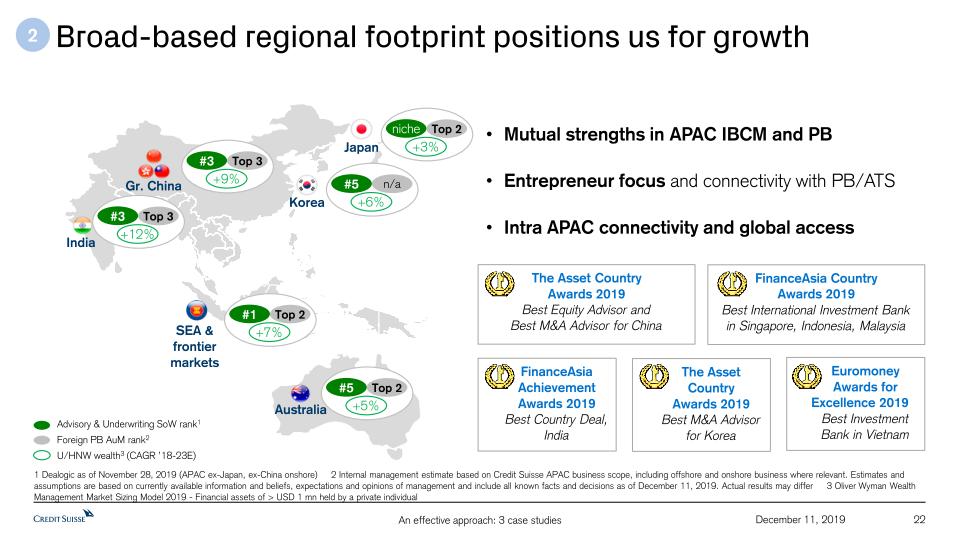

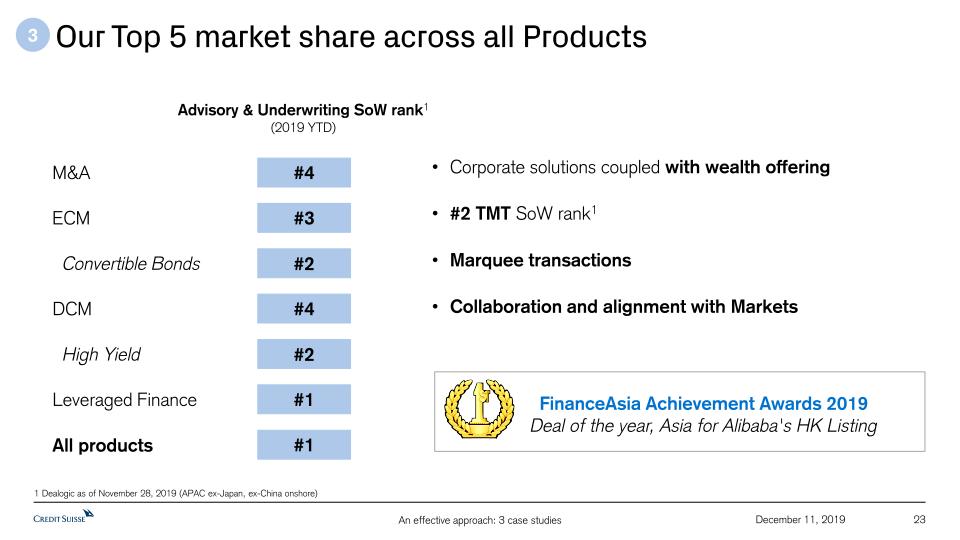

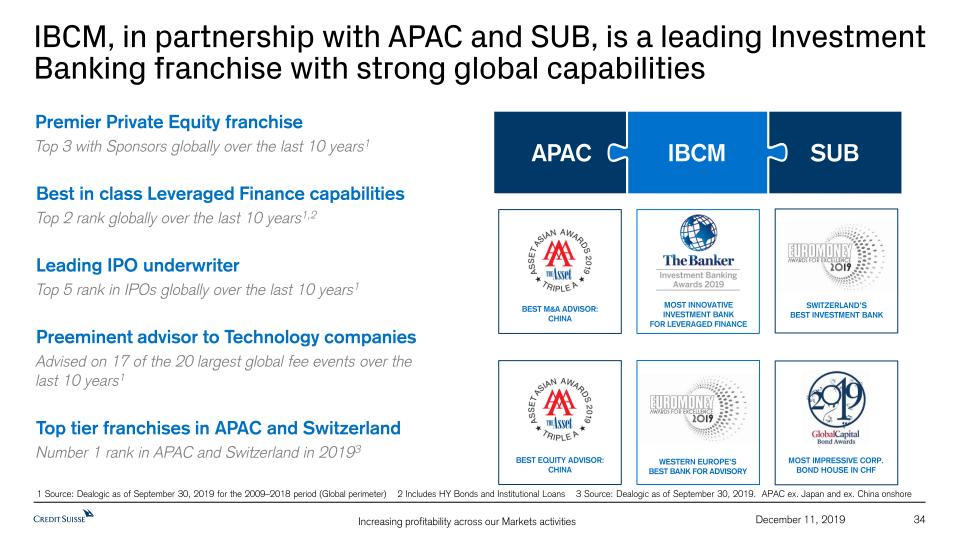

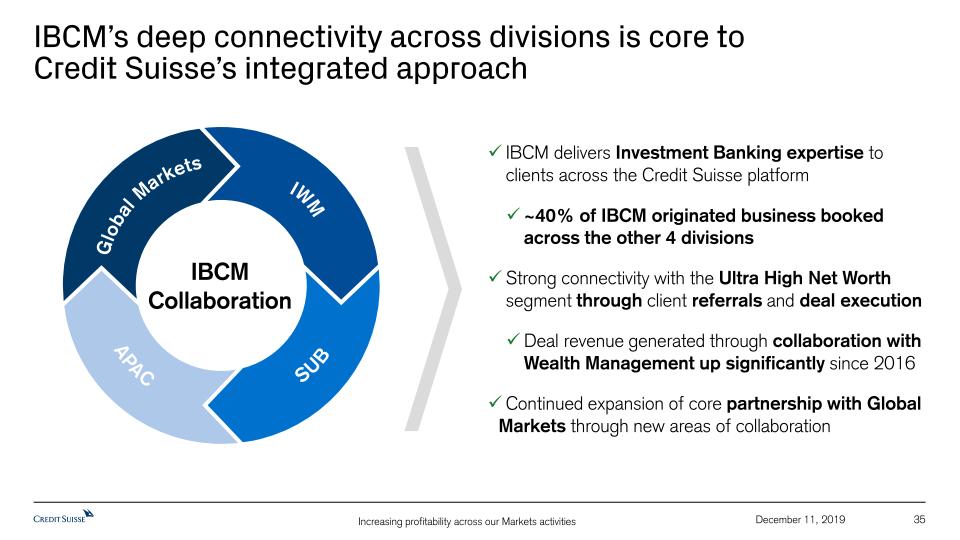

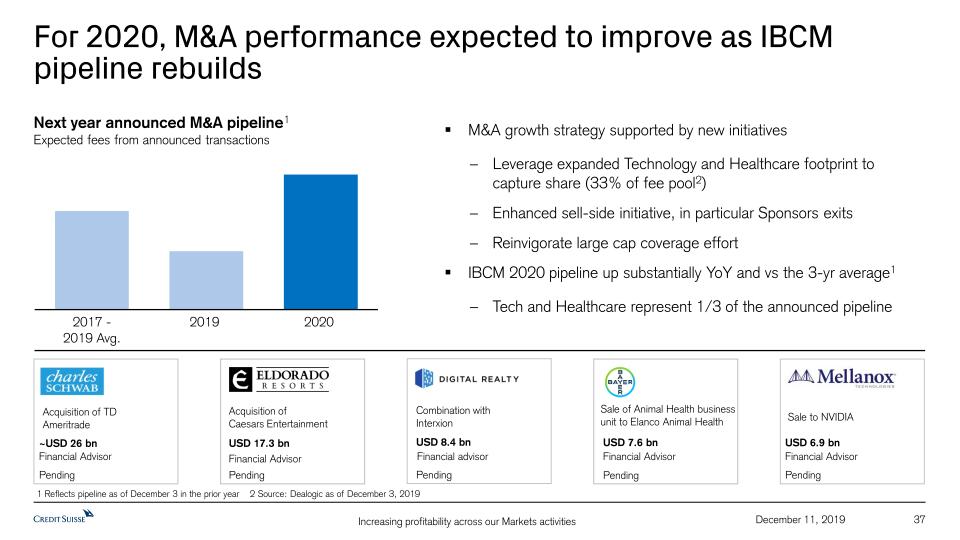

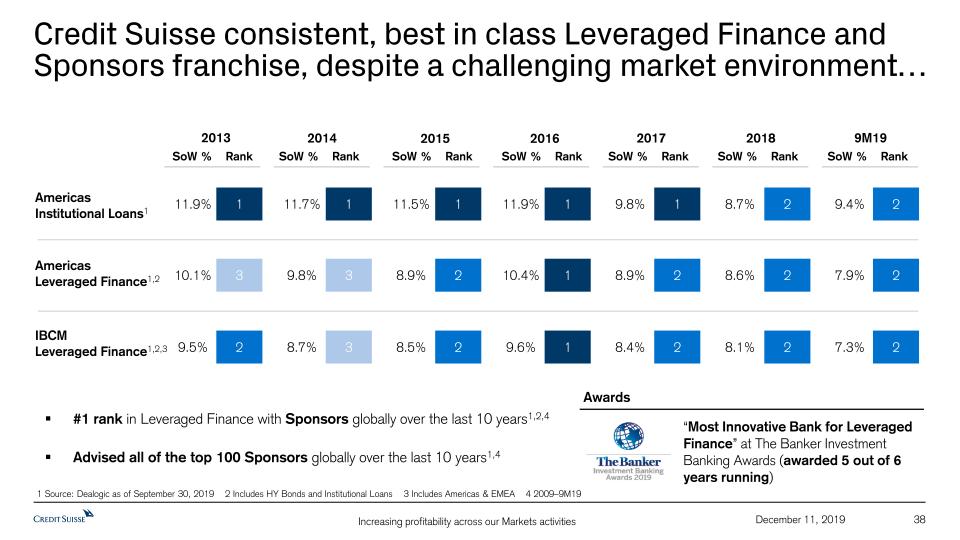

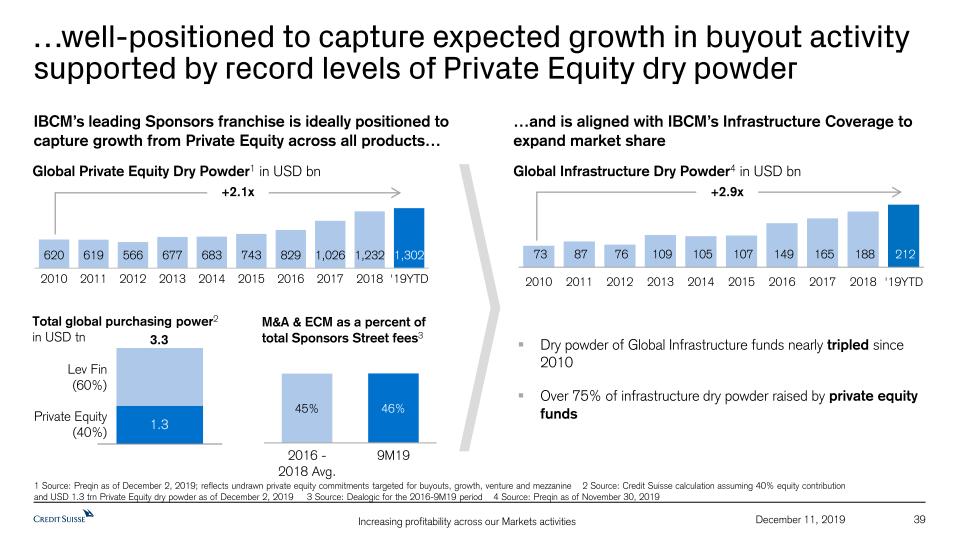

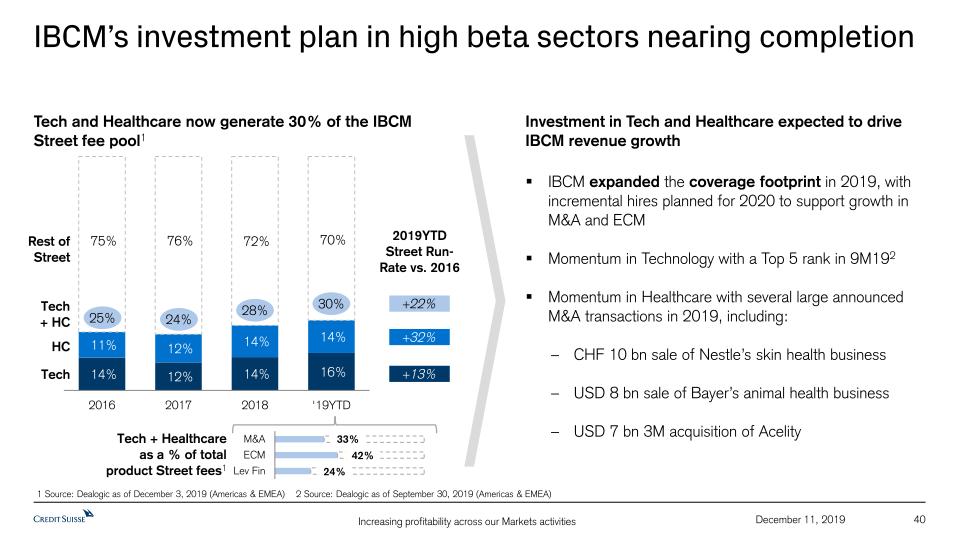

Investment banking key to our success

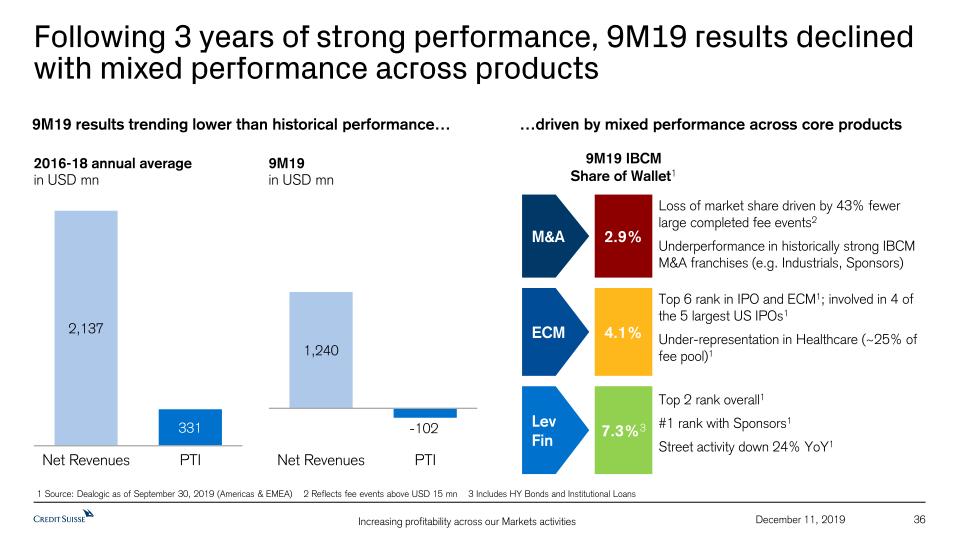

Investment Banking and Capital Market’s (IBCM) leading client franchise is core to our integrated approach. We also have top tier investment banking franchises in Switzerland and in APAC4. Ahead of an expected loss for IBCM in 2019, including restructuring measures, we have put in place new leadership for our activities in New York and London. Looking ahead to 2020, we are working on actions that will reinvigorate the division, building on a strongly improving pipeline, which we expect will put us in a more advantageous position compared to 2019.

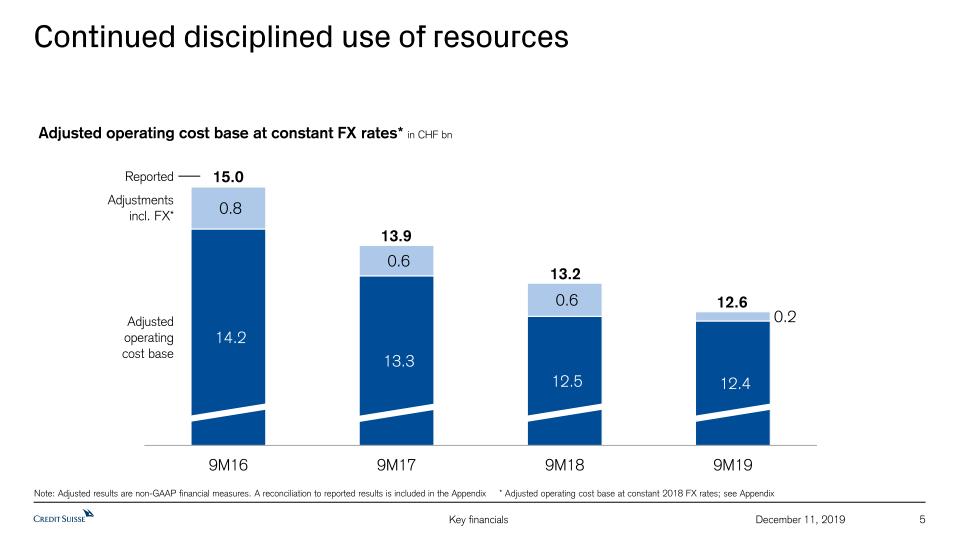

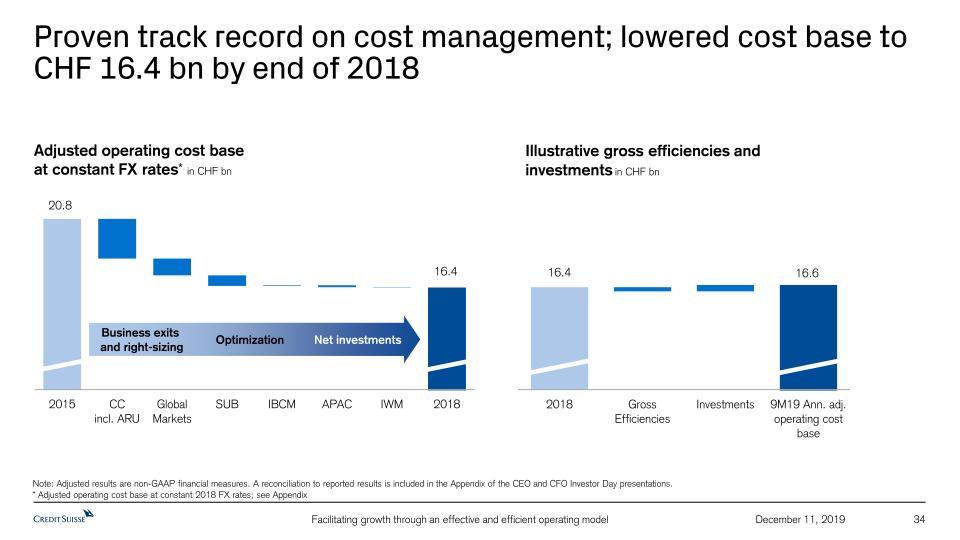

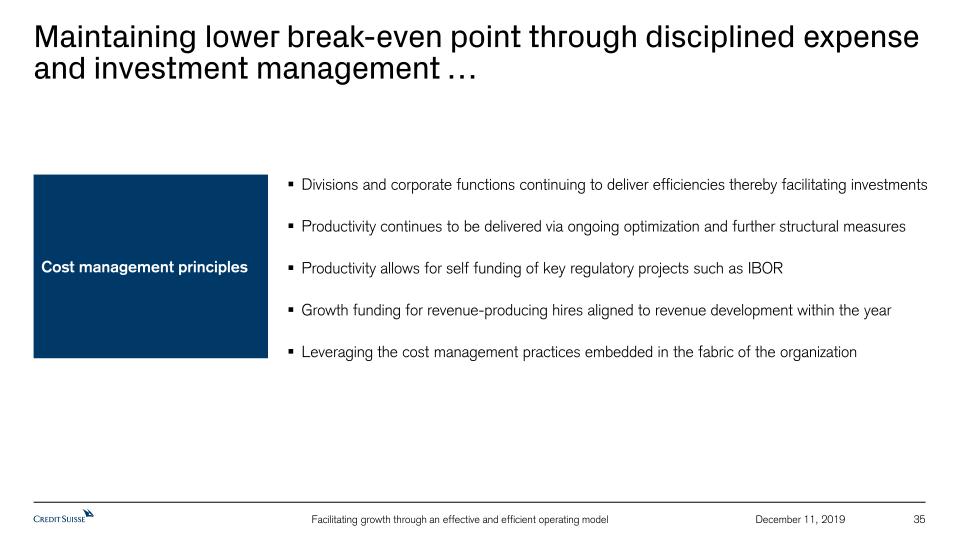

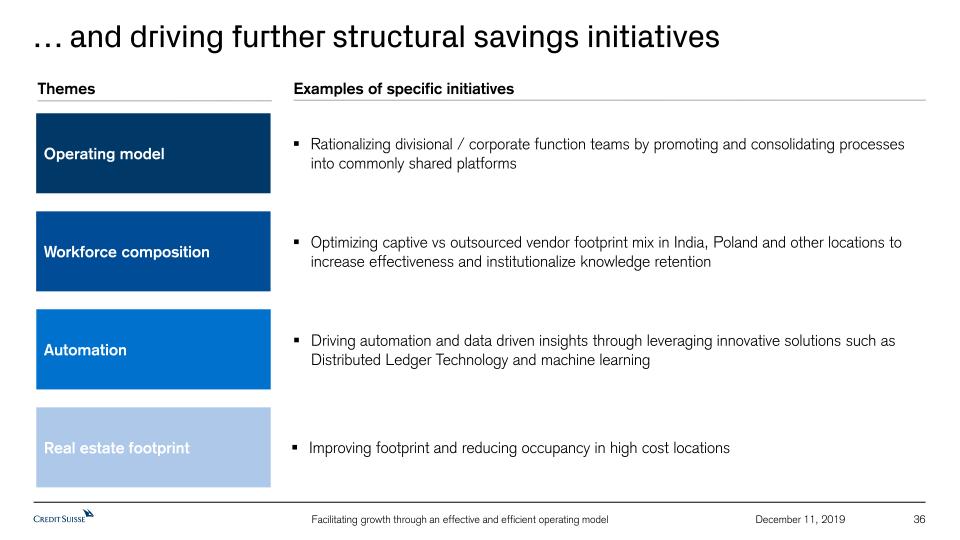

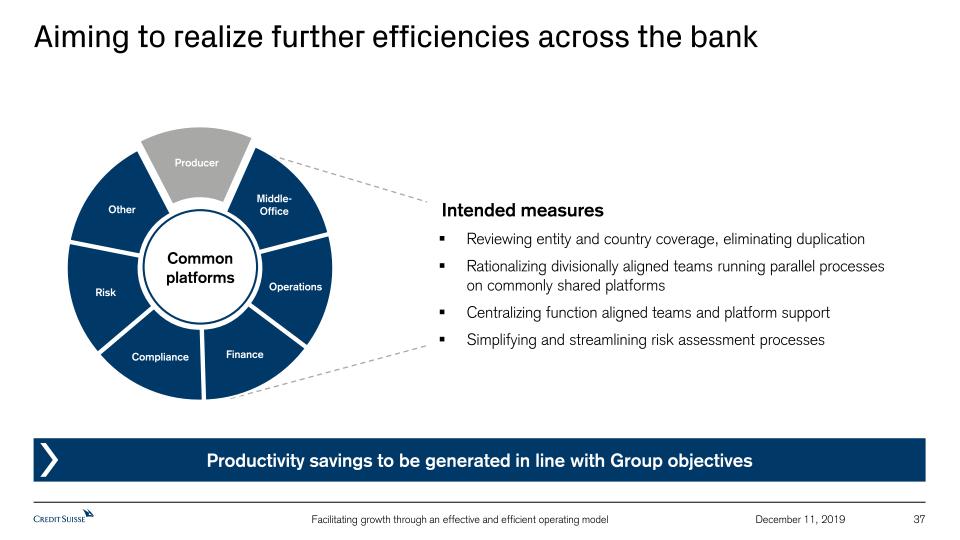

Maintaining cost discipline

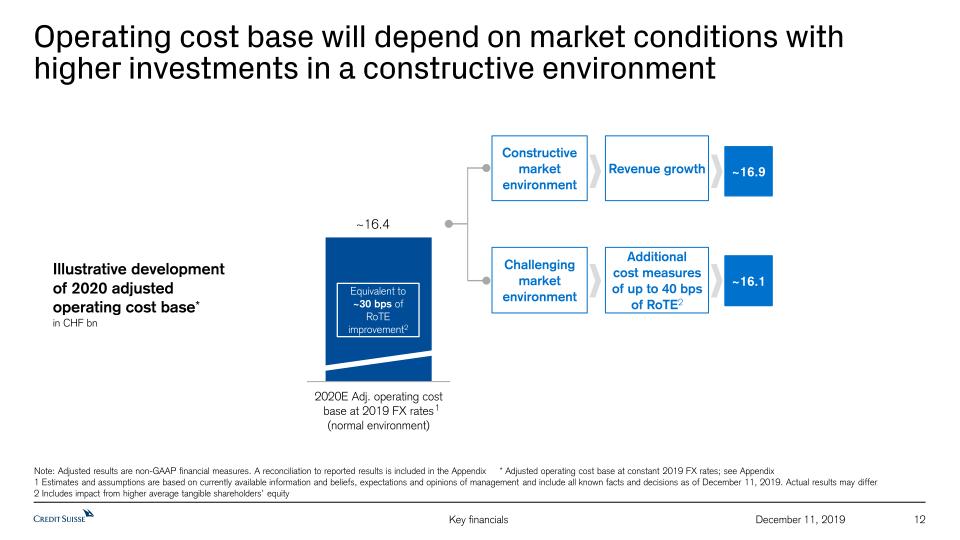

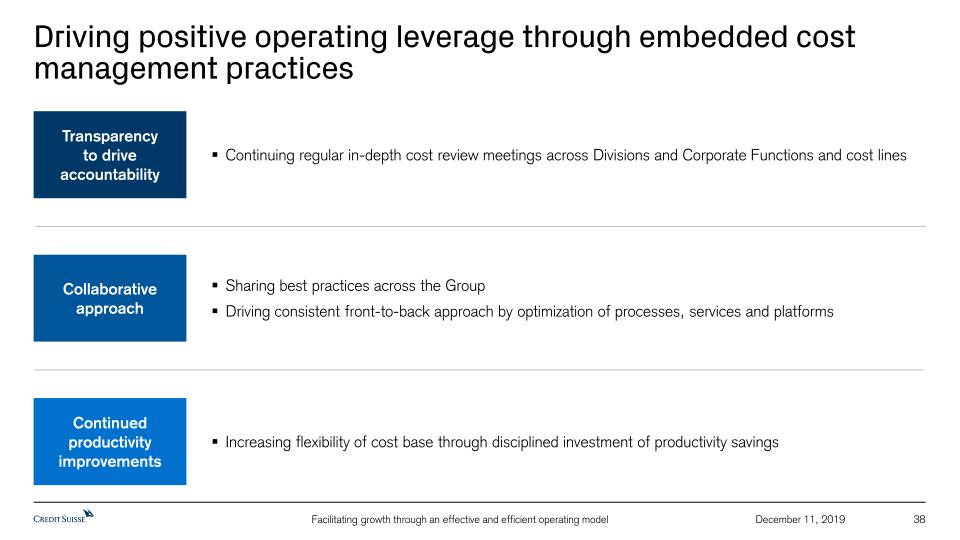

As we have invested in the business and continued to seek opportunities for top-line growth, we have also maintained our cost discipline, consistently creating positive operating leverage during our restructuring and in 2019. We are focused on delivering continued productivity improvements through disciplined expense and investment management and are driving further structural savings initiatives. We

Page 2

|

Media Release

Zurich, December 11, 2019

|

|

aim to realise further efficiencies across the bank, driving operating leverage further through embedded cost management practices including transparency, productivity improvements and a consistent front-to-back approach across the bank.

Continuing to optimise our operating model

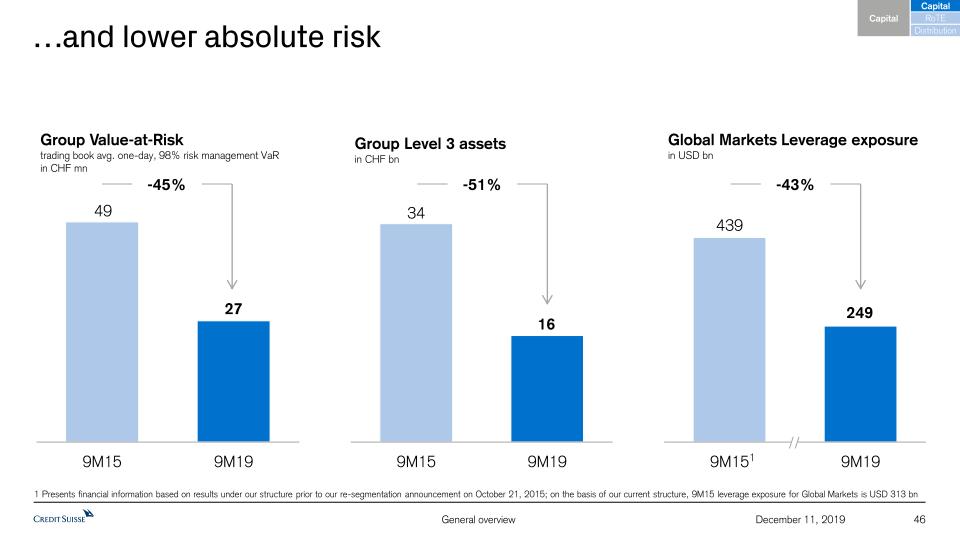

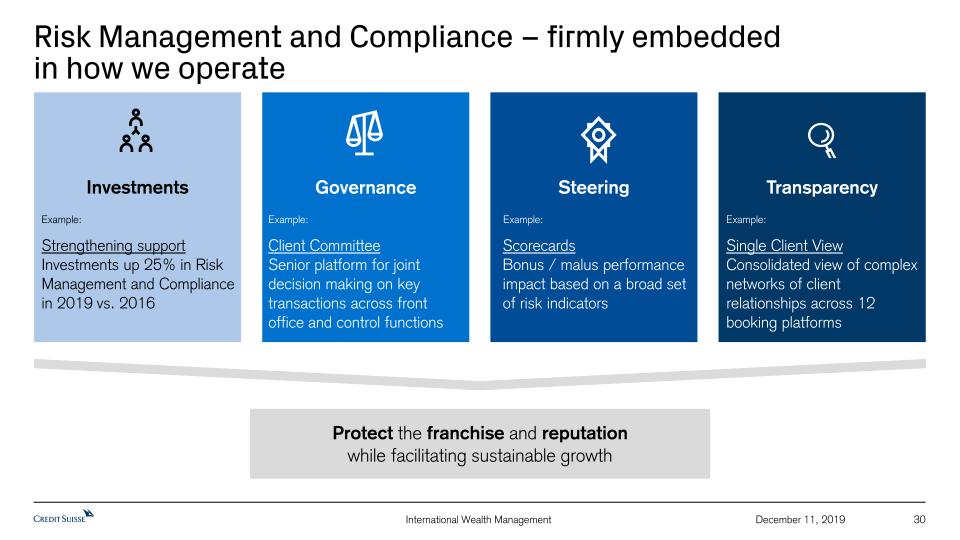

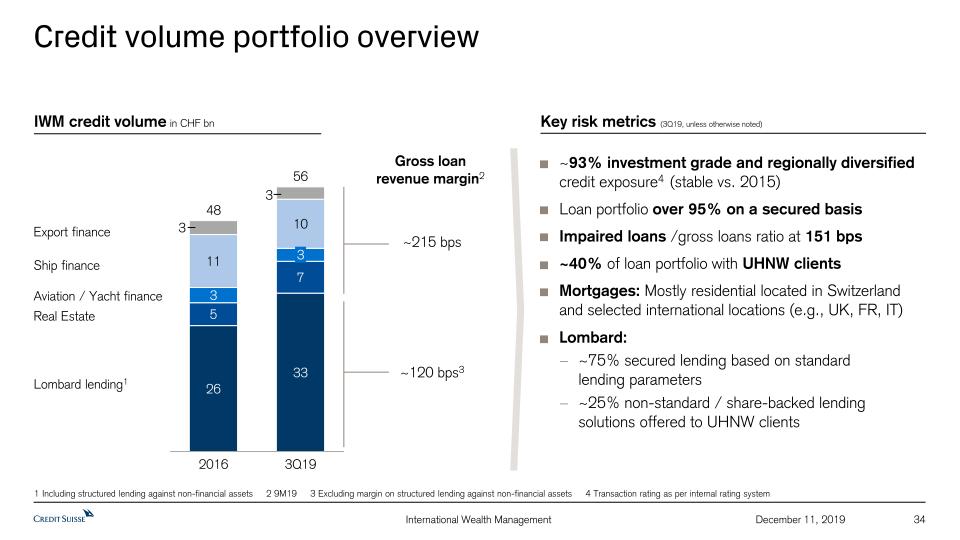

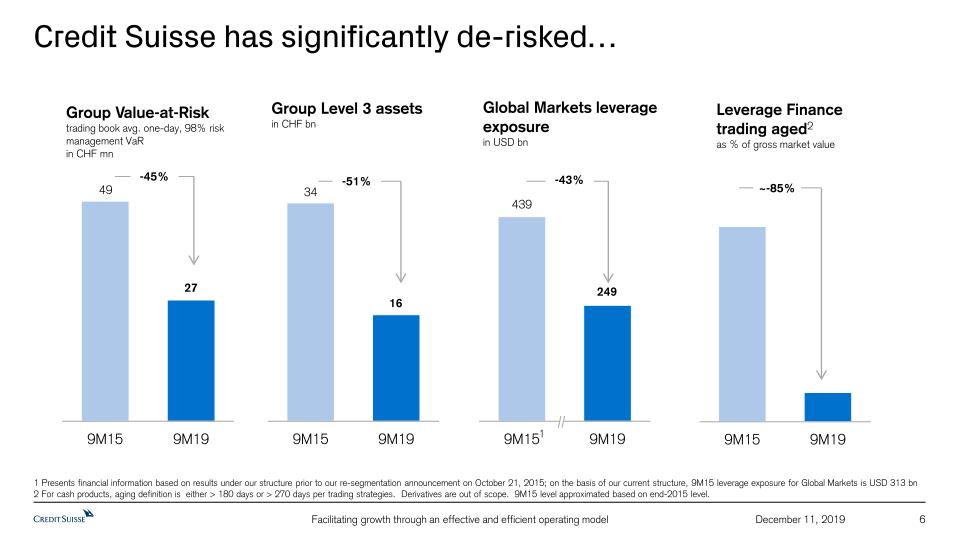

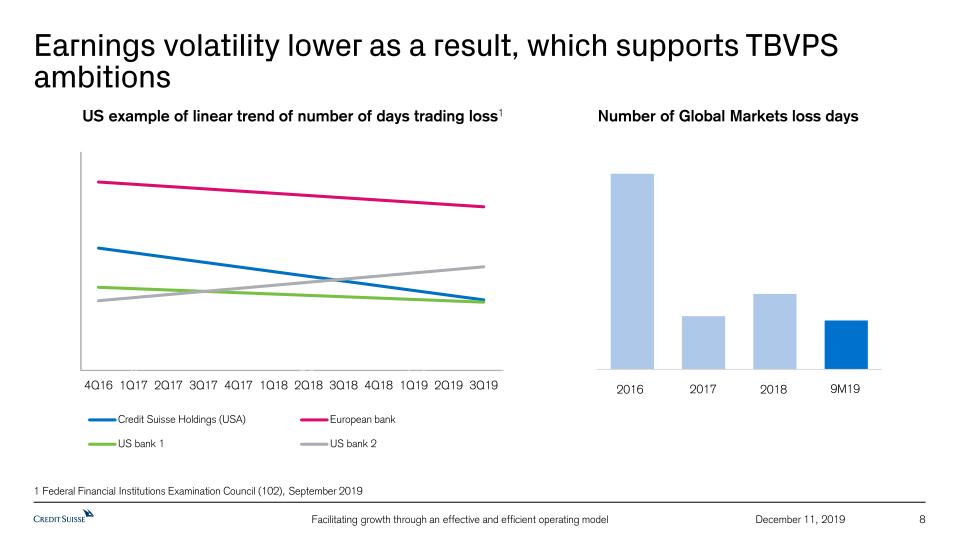

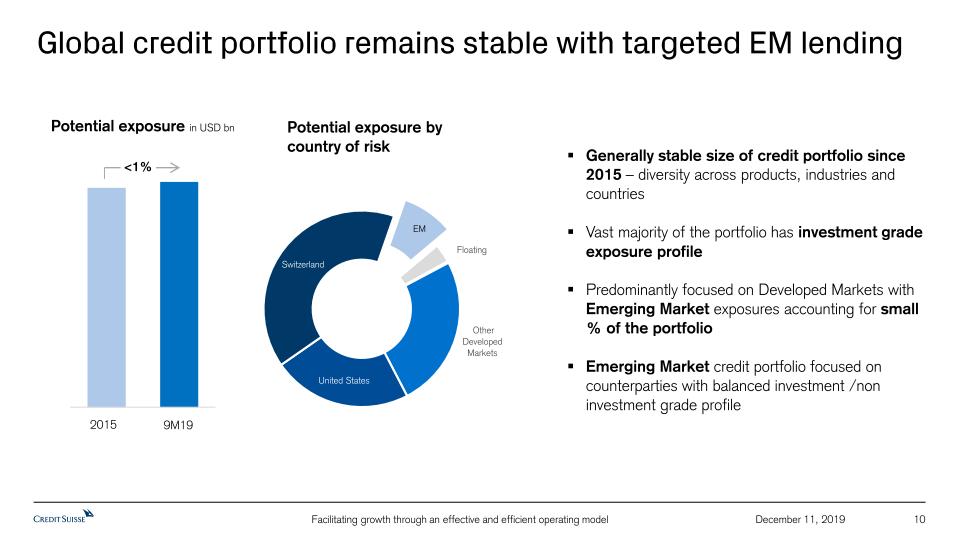

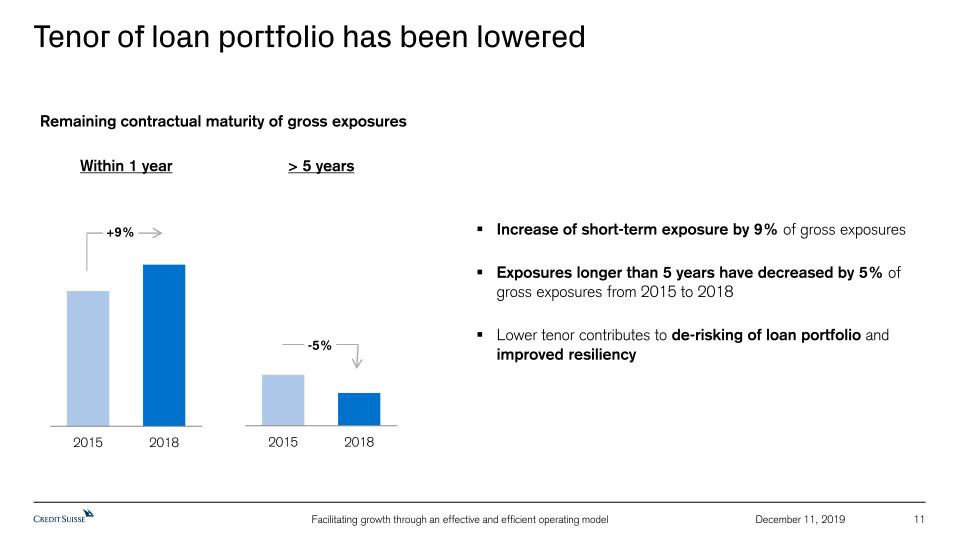

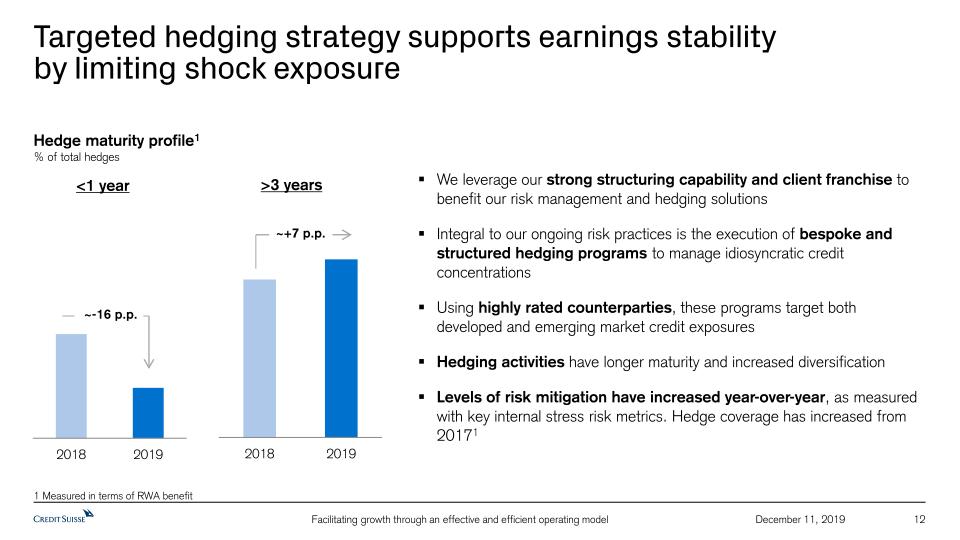

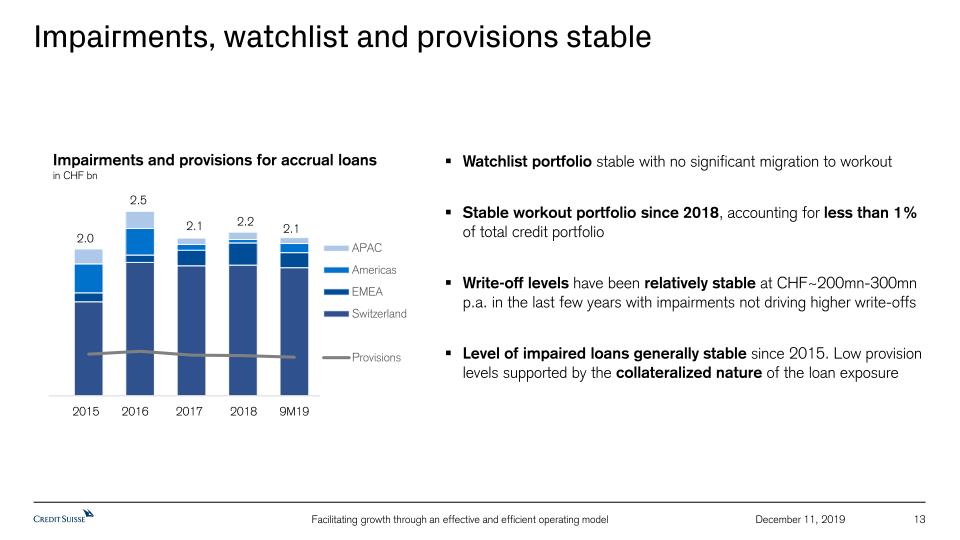

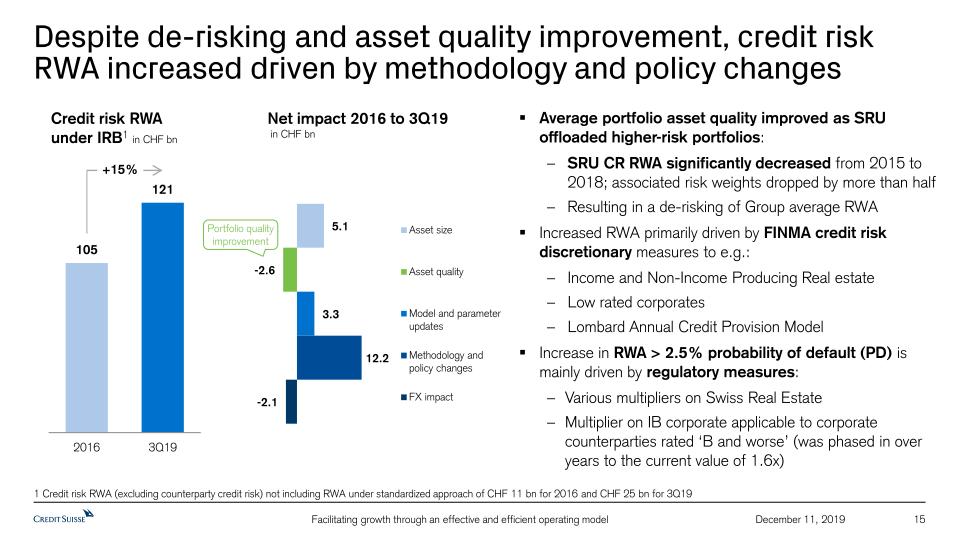

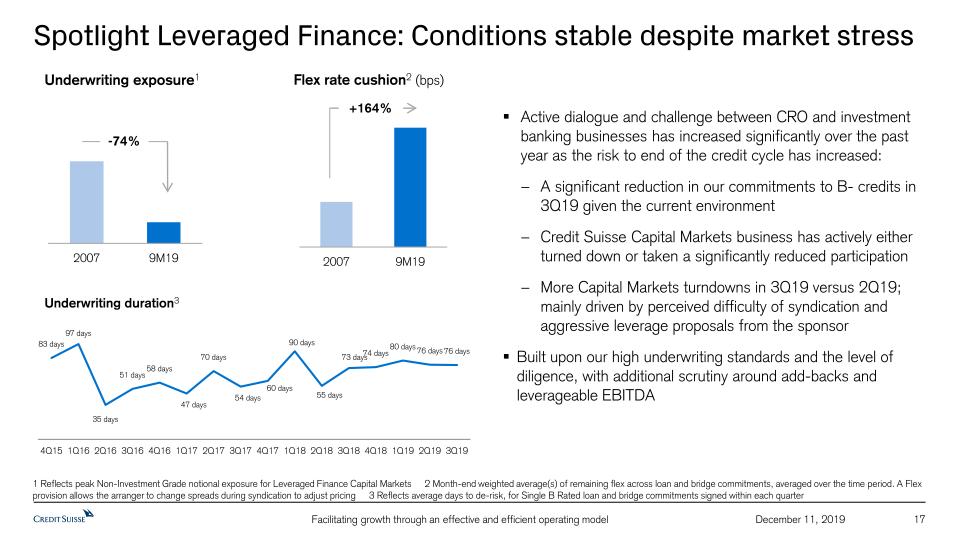

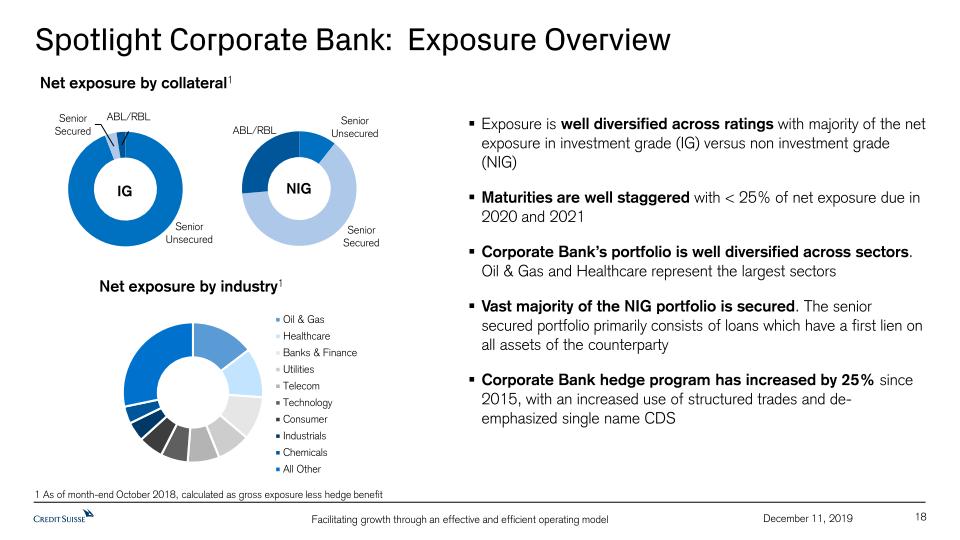

Continuing to invest in our control functions is key to our success as we grow our businesses. To this end, we have strengthened our Risk management function over the last four years, with a focus on Credit Risk management to ensure we are well equipped to navigate the cycle. We have maintained conservative underwriting and lending standards, while increasing hedging against potential tail events, minimising Group Value-at-Risk5, leverage exposure and level 3 assets as we have de-risked the Group over the last four years.

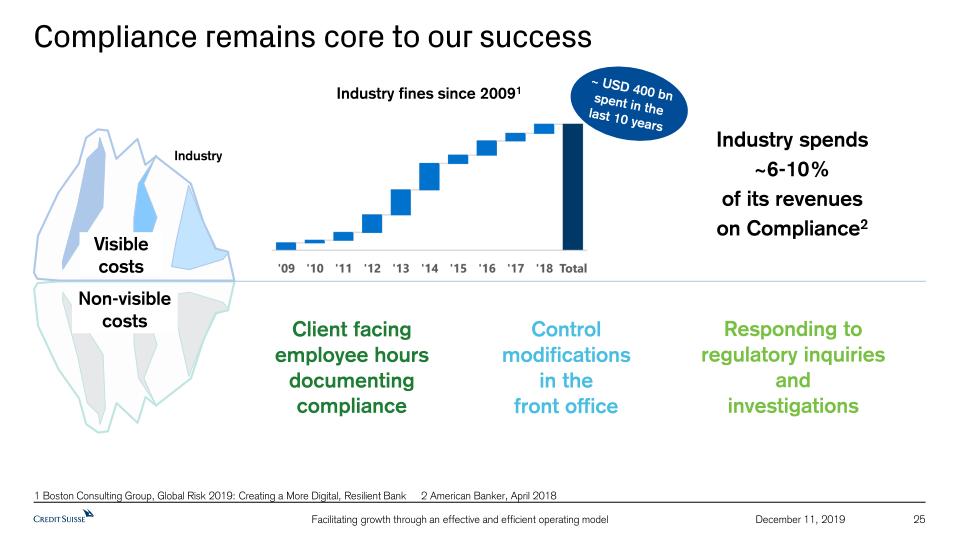

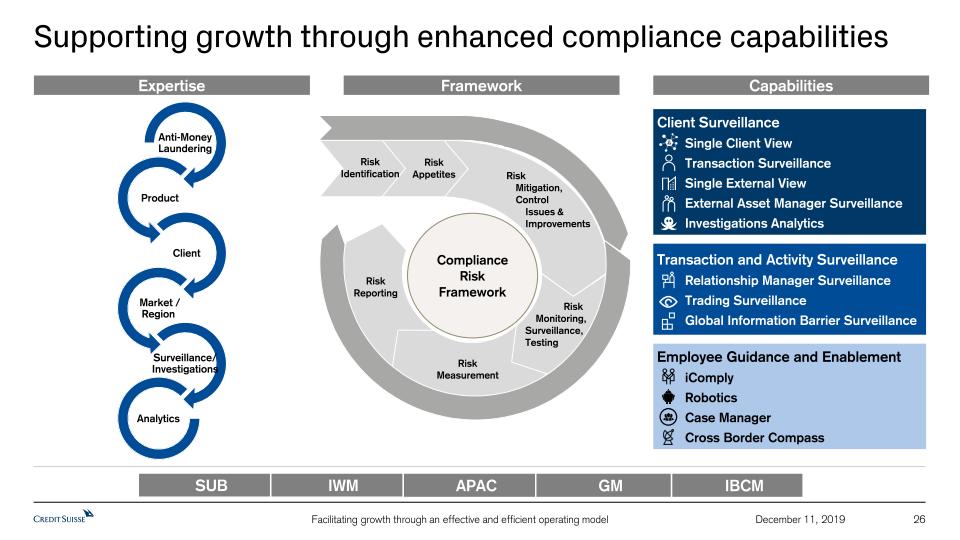

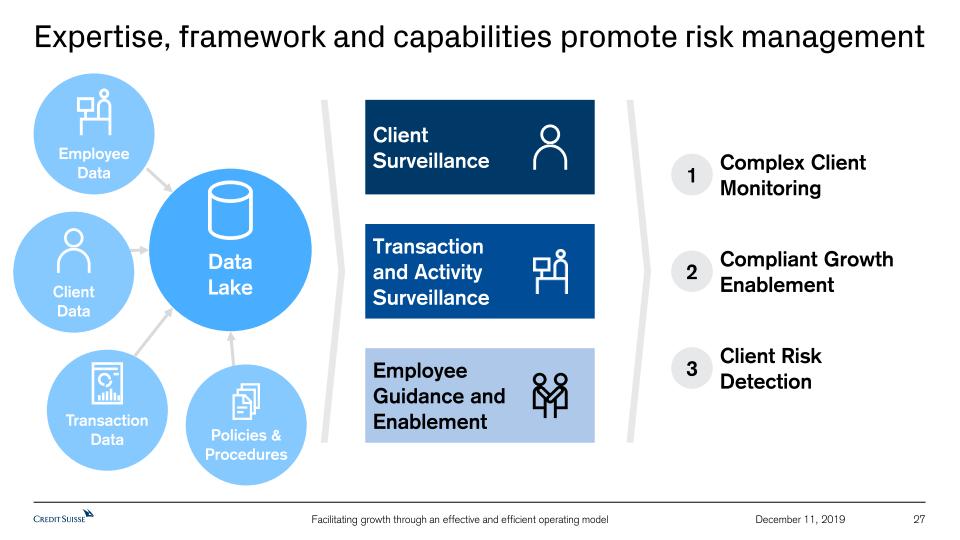

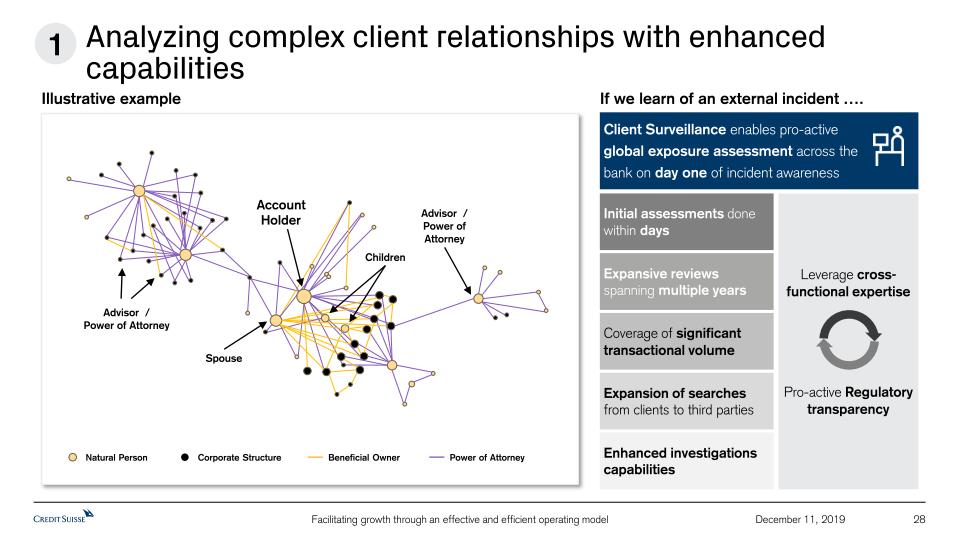

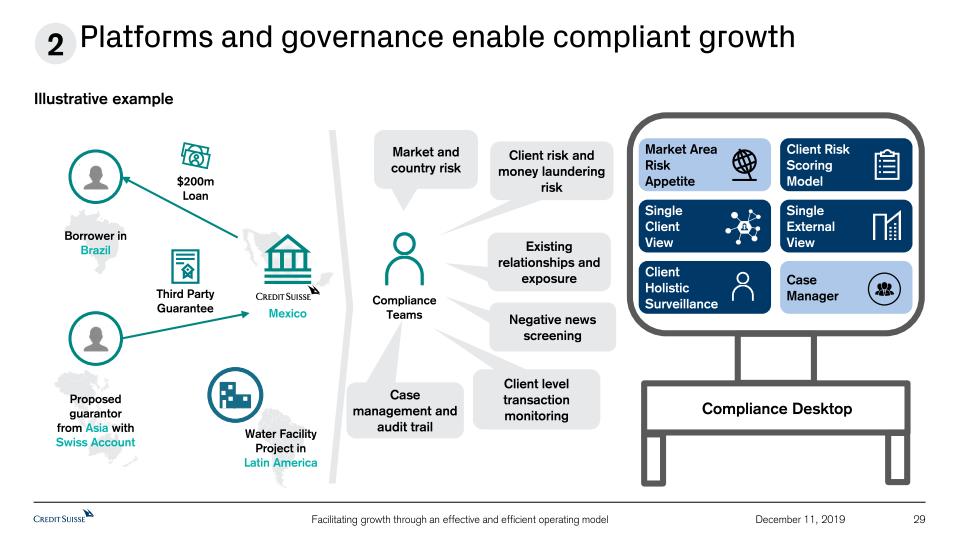

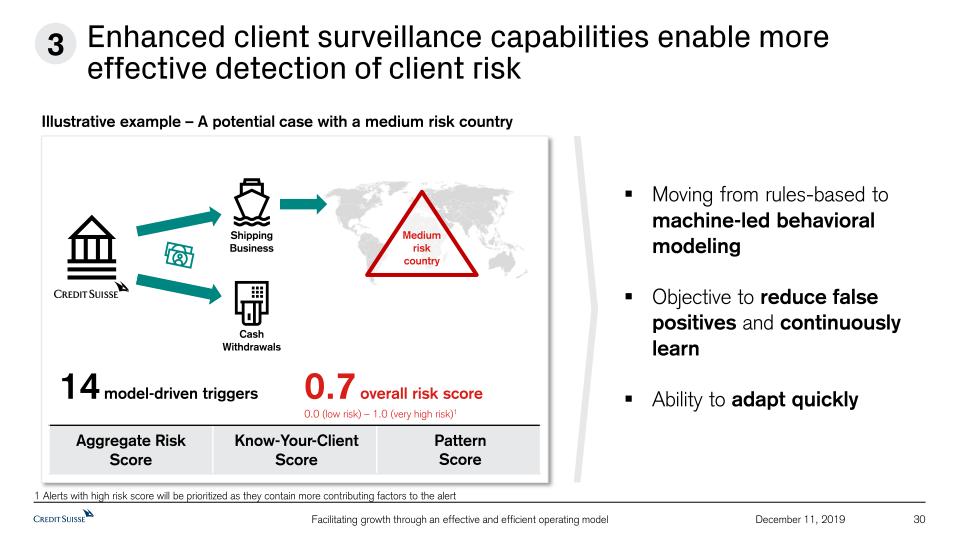

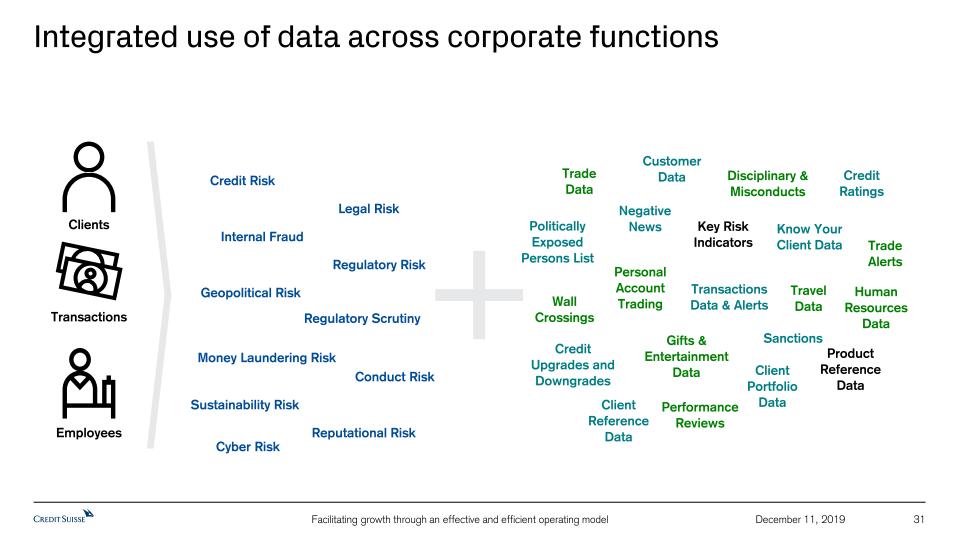

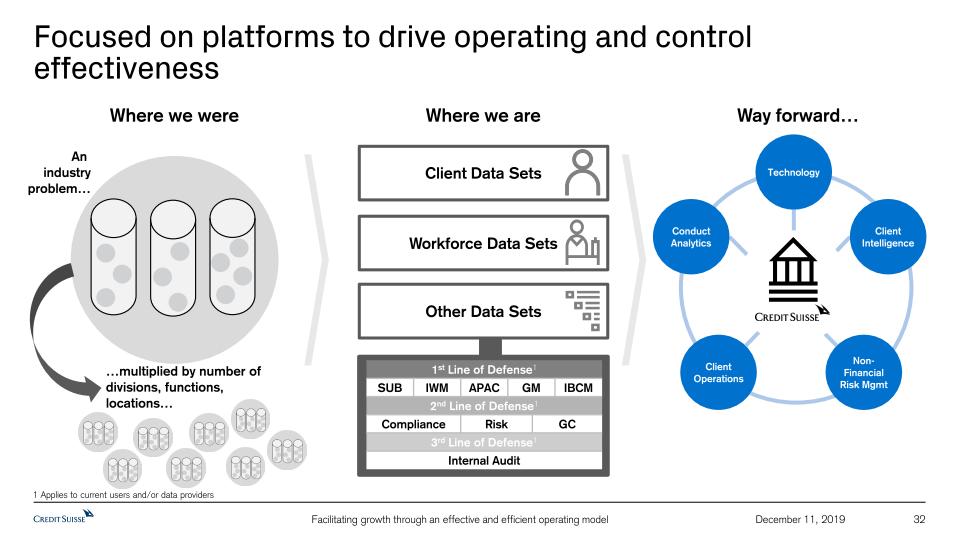

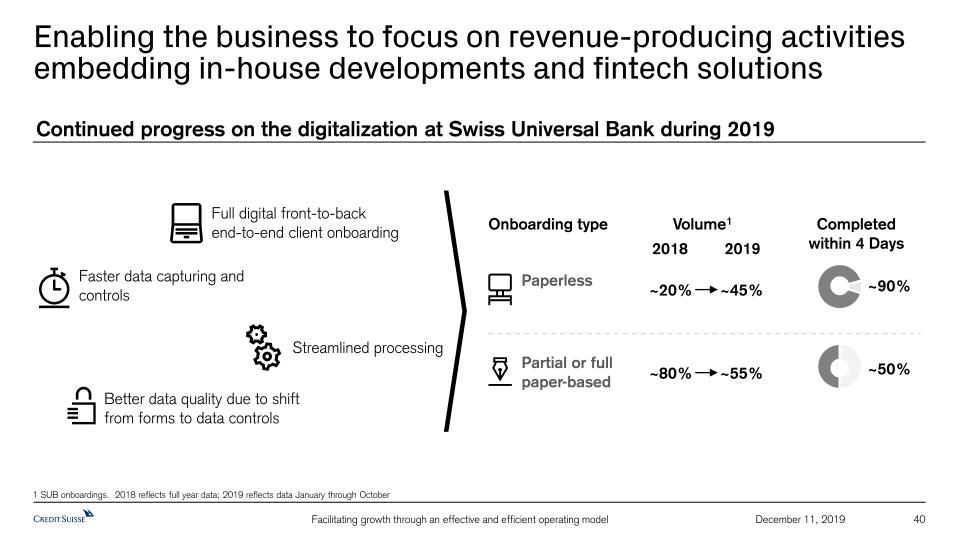

We continue to invest in effective Compliance and Controls, supporting growth through enhanced compliance capabilities. Our Compliance teams continue to utilise smart systems and processes throughout the entire client lifecycle – from onboarding to offboarding – delivering continued shareholder value.

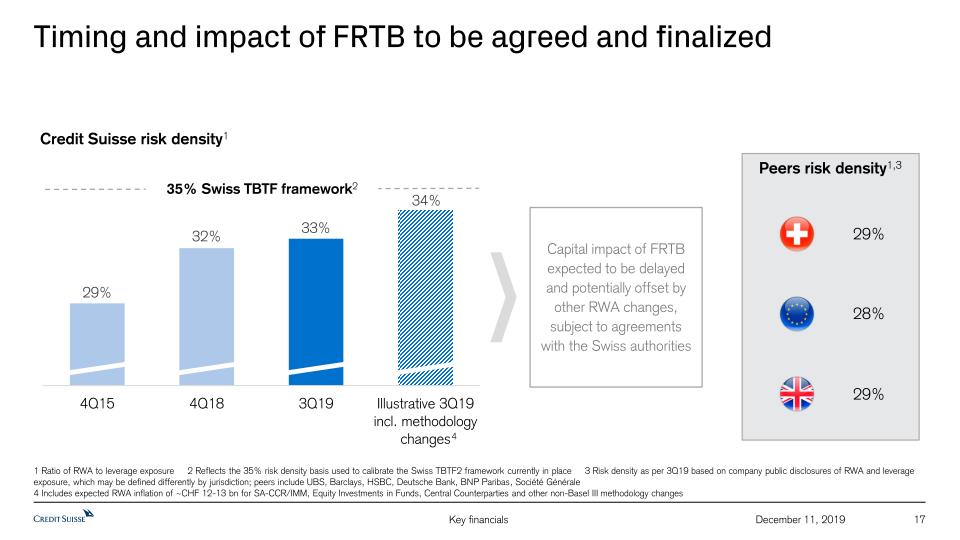

Swiss regulatory capital rebalancing substantially complete

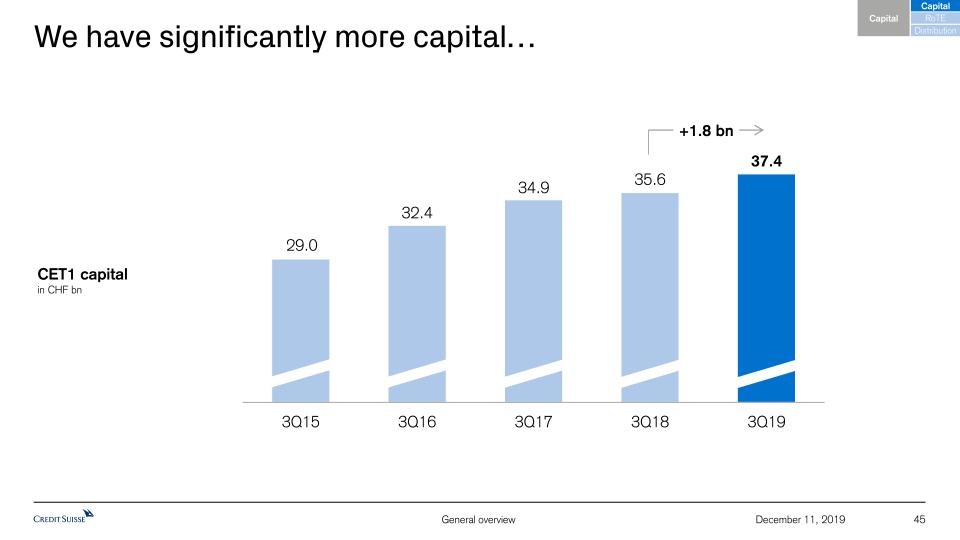

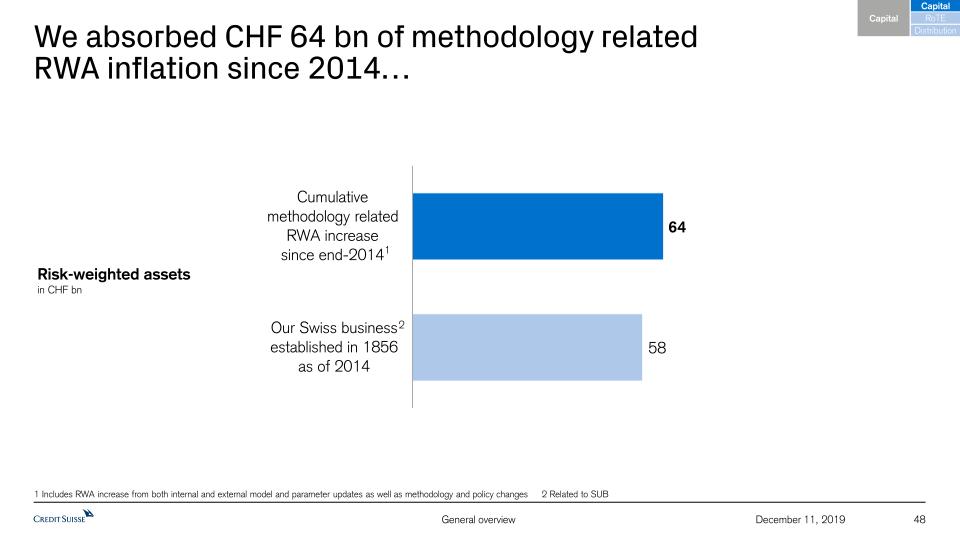

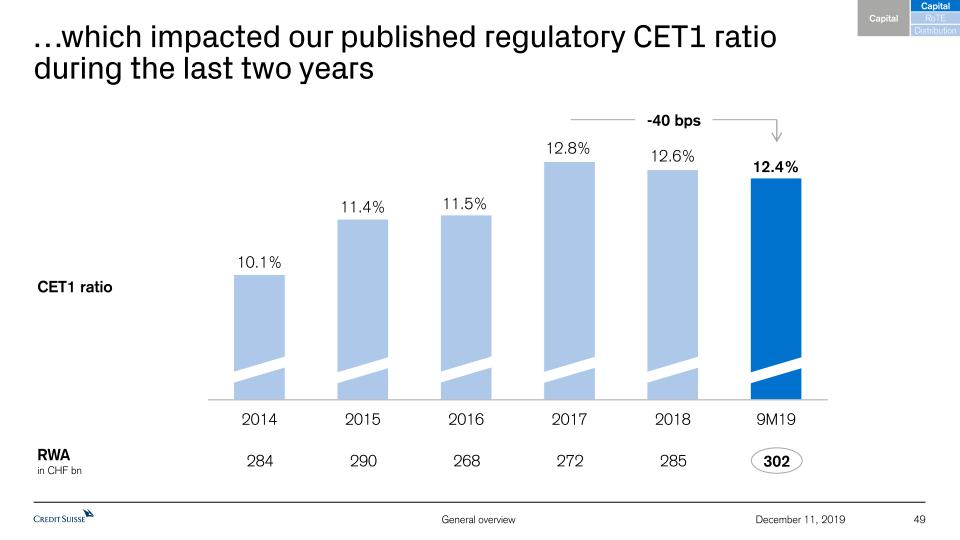

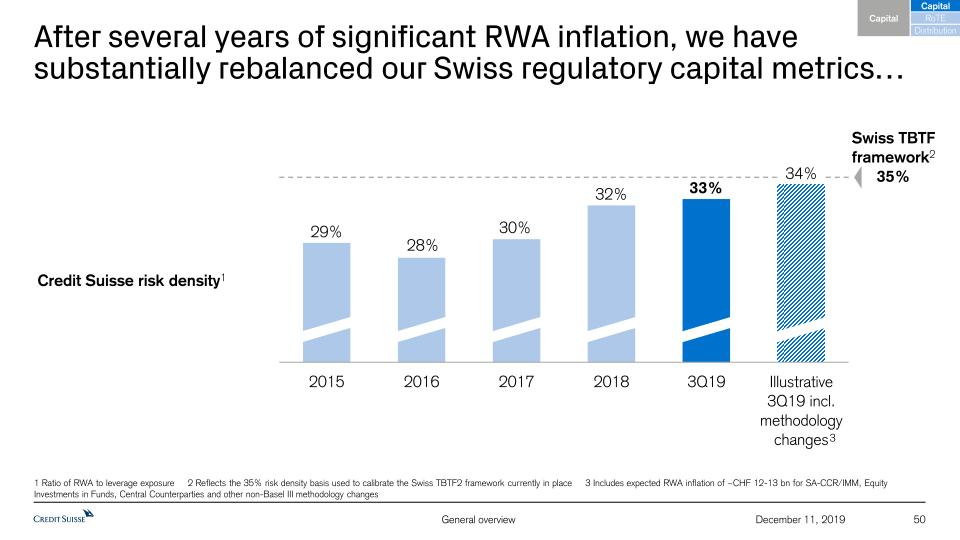

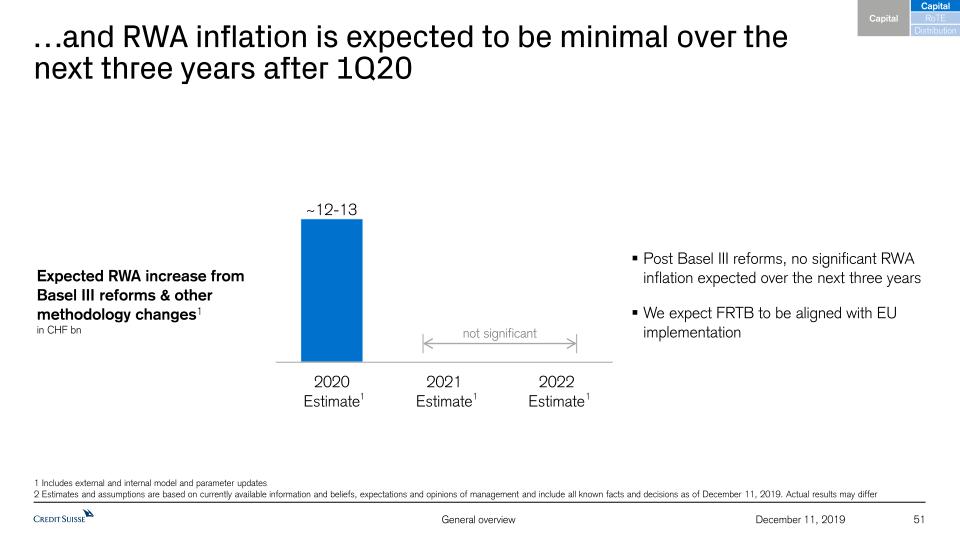

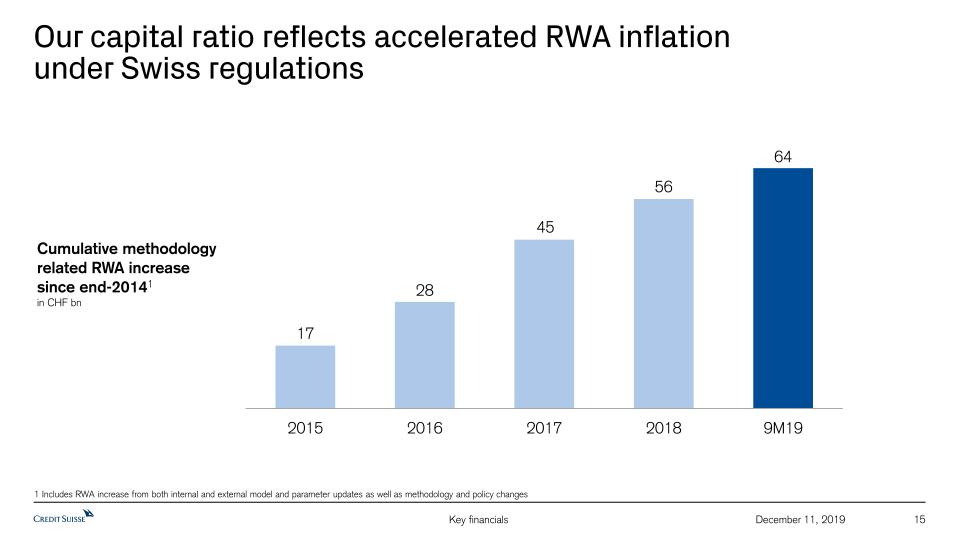

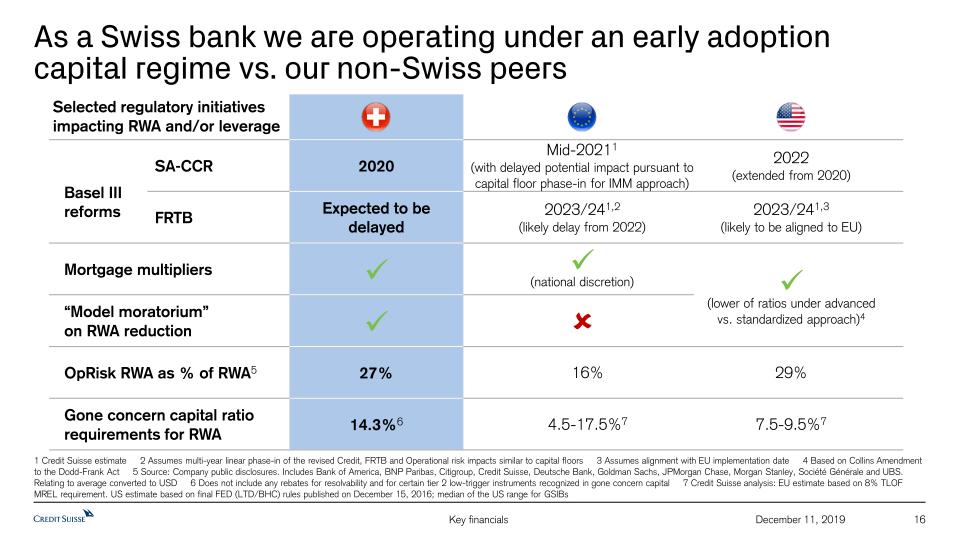

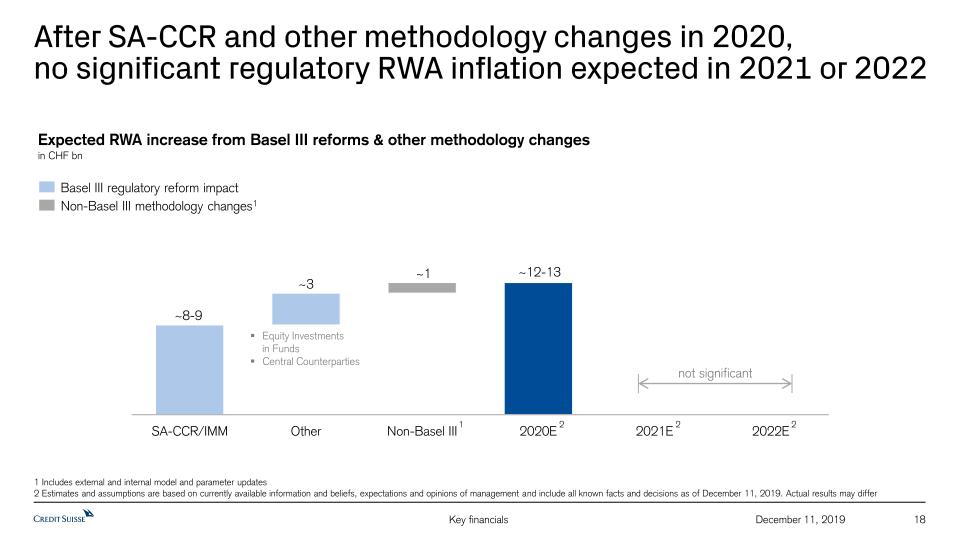

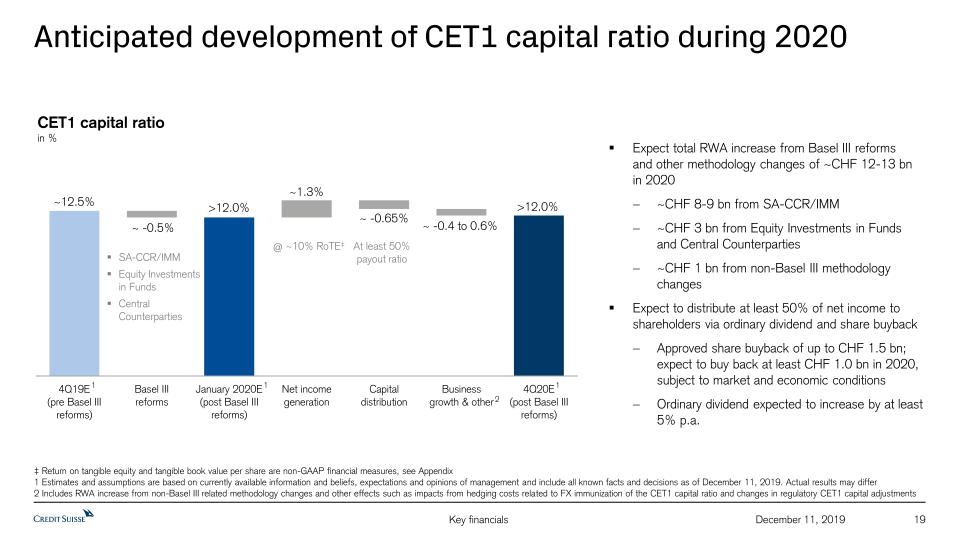

Since 2015, we have absorbed more than CHF 64 billion of methodology-driven RWA inflation. During the same period, we have de-risked our bank and significantly strengthened our capital base, with CET1 capital of CHF 37.4 billion at 3Q19. As a result, we expect to operate with a risk density6 of 34% in 1Q20, and believe that our Swiss regulatory capital metrics are substantially rebalanced. Subsequently, we expect additional RWA inflation to be minimal over the next three years, after the RWA increase expected in 1Q20 from the Basel III reforms.

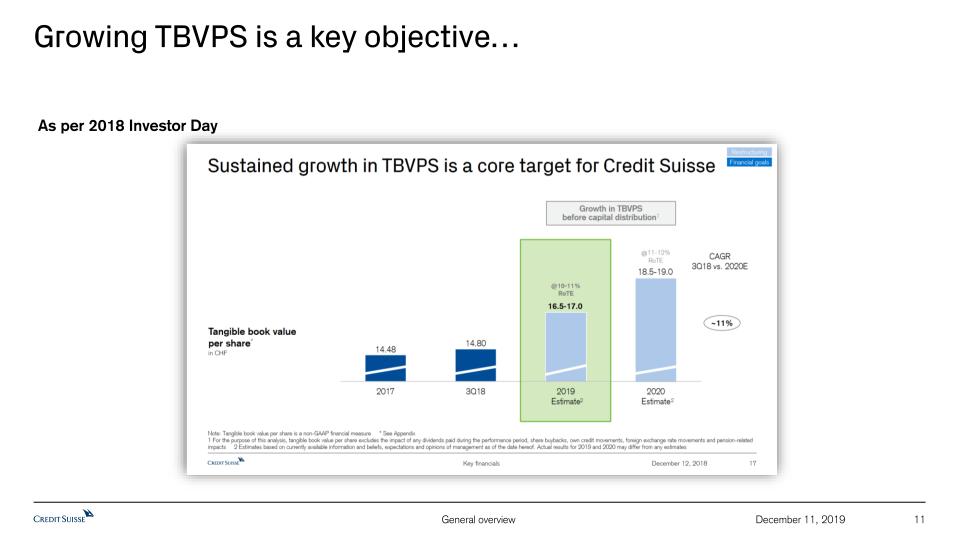

Driving TBVPS higher

We are generating capital to drive growth investments and reward shareholders. We have added 250 basis points to our RoTE for the nine months ending September 30, 2019 year on year and we aim to deliver approximately 175 basis points of further RoTE uplift in 2020 compared to 2019, taking us to approximately 10% by year-end 2020, driving Tangible Book Value per Share higher. We believe we can achieve this primarily by implementing measures we have already identified.

If markets are constructive and support revenue growth, we would expect our year-end 2020 RoTE to be approximately 11%. Conversely, should markets remain challenging in 2020, we have identified up to 40 basis points of additional cost measures in order to protect our RoTE ambition of approximately 10%.

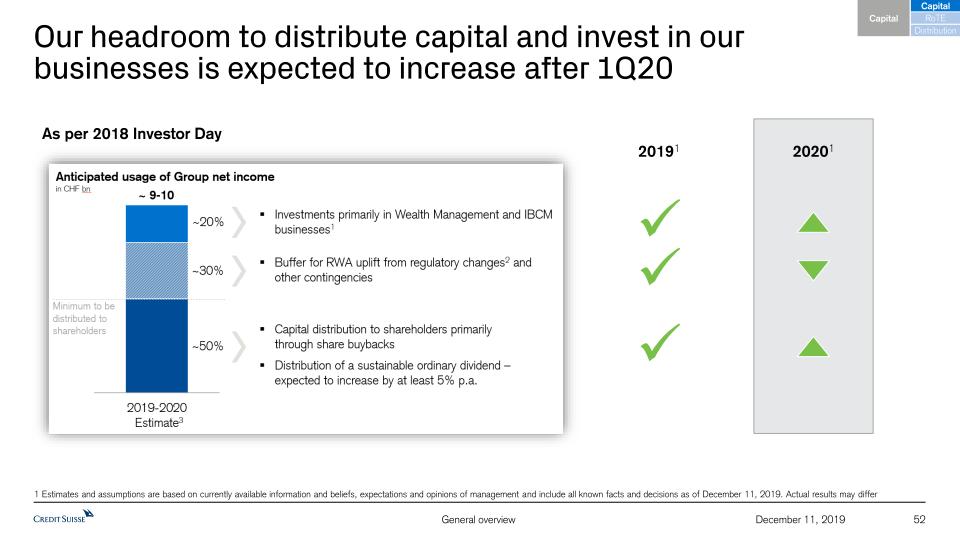

Distributing capital to shareholders

As a result of our Swiss regulatory capital metrics rebalancing, we anticipate capital requirements as a percentage of Group net income to decrease in 2020. Our expected RoTE improvement would increase our headroom to further invest in our businesses and distribute capital to shareholders in 2020.

We expect to distribute at least 50% of net income to shareholders through a combination of both a sustainable ordinary dividend, which we expect to increase by at least 5% per annum, and a similar share buyback programme to 2019, with a buyback of up to CHF 1.5 billion approved by the Board of Directors for 2020, from which we expect a buyback of at least CHF 1 billion, subject to market and economic conditions. By delivering on our ambitions over the coming quarters and years, we aim to earn

Page 3

|

Media Release

Zurich, December 11, 2019

|

|

the right to invest more to grow our business as we demonstrate to investors our ability to generate above cost of capital returns.

Credit Suisse’s climate commitment: ESG policy update

As we recognise our share of responsibilities in addressing the challenges of climate change, Credit Suisse continues to expand its own role in supporting the transition to a low-carbon and climate-resilient economy. In 3Q19, we introduced a Group-wide Climate Risk Strategy, one important element of which is working with our clients to support the respective transition of their business models, and further integrating climate change into our risk management models.

As part of this effort, Credit Suisse is today announcing a significant policy change. The bank has decided to no longer provide any form of financing specifically related to the development of new coal-fired power plants. This is in addition to the bank’s existing policy of not providing any form of financing that is specifically related to the development of new greenfield thermal coal mines. This commitment also applies to cases where the majority of the use of proceeds is intended for the development of a new coal-fired power plant or a new greenfield thermal coal mine, respectively.

The bank continues to review its relevant policies and guidelines on an ongoing basis.

As we recognise our share of responsibilities in addressing the challenges of climate change, Credit Suisse continues to expand its own role in supporting the transition to a low-carbon and climate-resilient economy. In 3Q19, we introduced a Group-wide Climate Risk Strategy, one important element of which is working with our clients to support the respective transition of their business models, and further integrating climate change into our risk management models.

As part of this effort, Credit Suisse is today announcing a significant policy change. The bank has decided to no longer provide any form of financing specifically related to the development of new coal-fired power plants. This is in addition to the bank’s existing policy of not providing any form of financing that is specifically related to the development of new greenfield thermal coal mines. This commitment also applies to cases where the majority of the use of proceeds is intended for the development of a new coal-fired power plant or a new greenfield thermal coal mine, respectively.

The bank continues to review its relevant policies and guidelines on an ongoing basis.

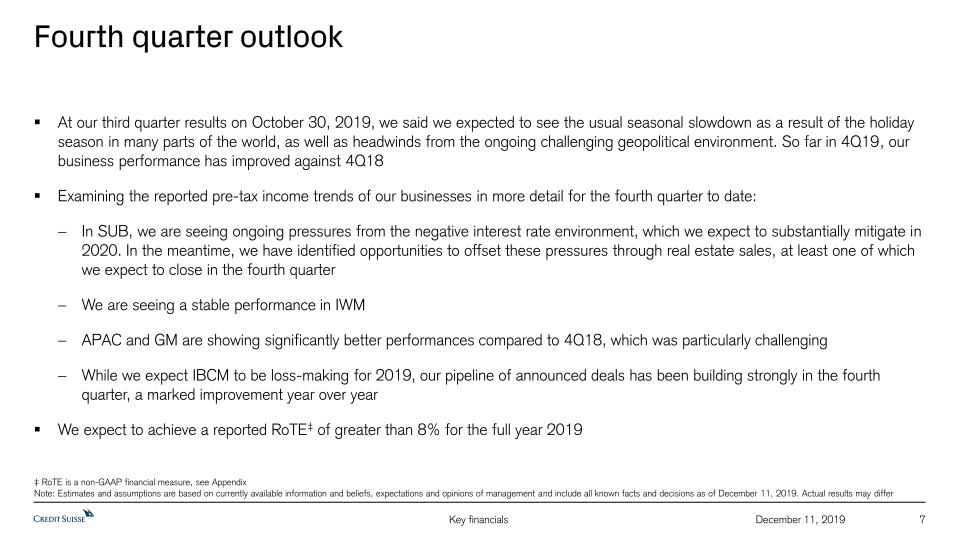

Outlook

At our third quarter results on October 30, we said we expected to see the usual seasonal slowdown as a result of the holiday season in many parts of the world, as well as headwinds from the ongoing challenging geopolitical environment. So far in 4Q19, our business performance has improved against 4Q18.

Examining the Reported PTI trends of our businesses in more detail for the fourth quarter to date:

|

§

|

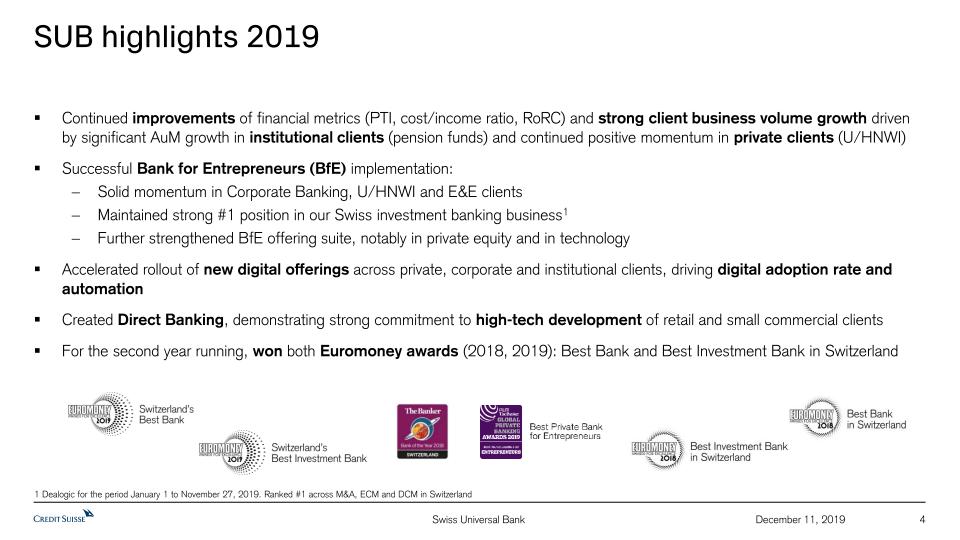

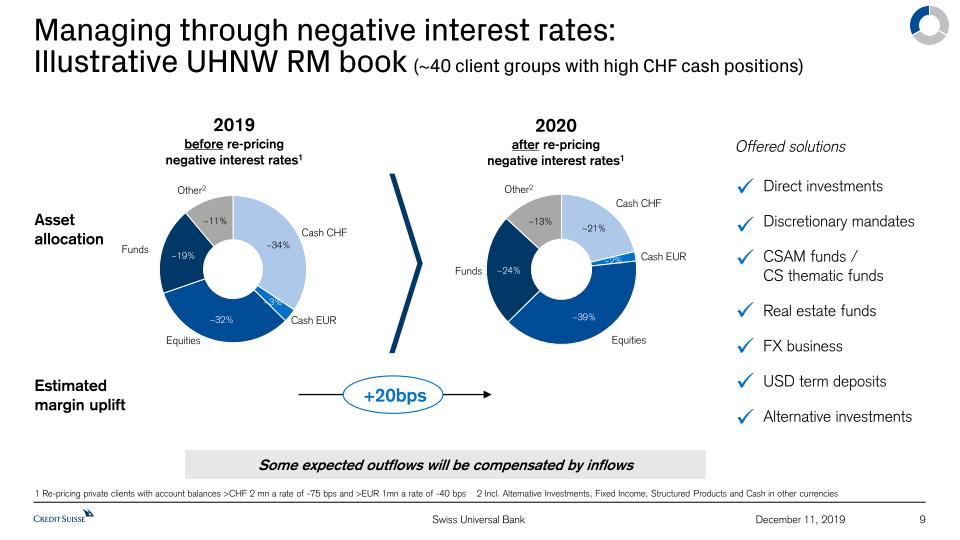

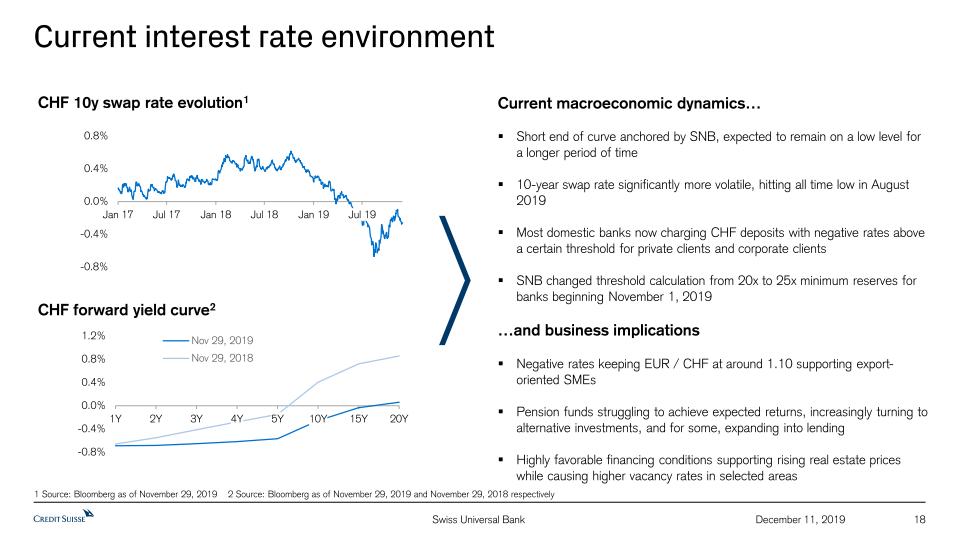

In SUB, we are seeing ongoing pressures from the negative interest rate environment, which we expect to substantially mitigate in 2020. In the meantime, we have identified opportunities to offset these pressures through real estate sales, at least one of which we expect to close in the fourth quarter

|

|

§

|

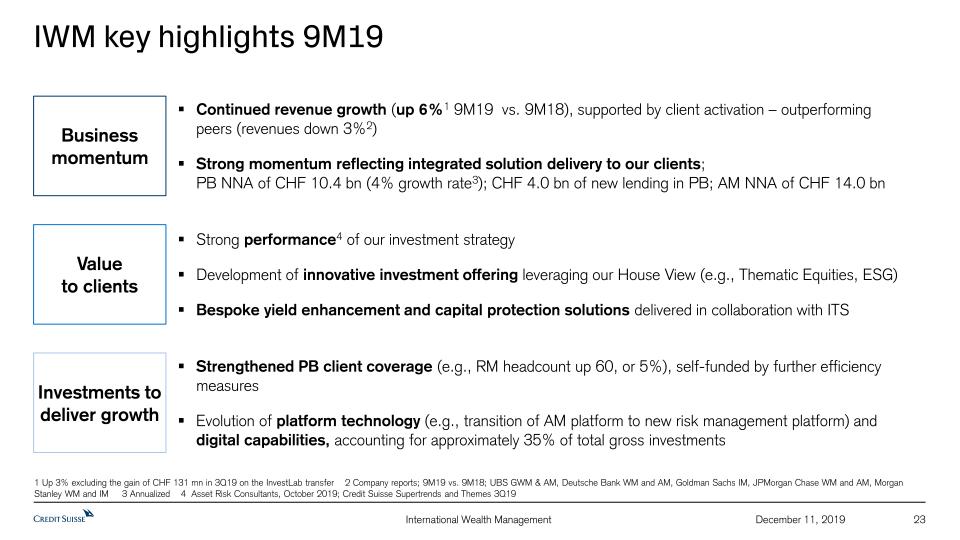

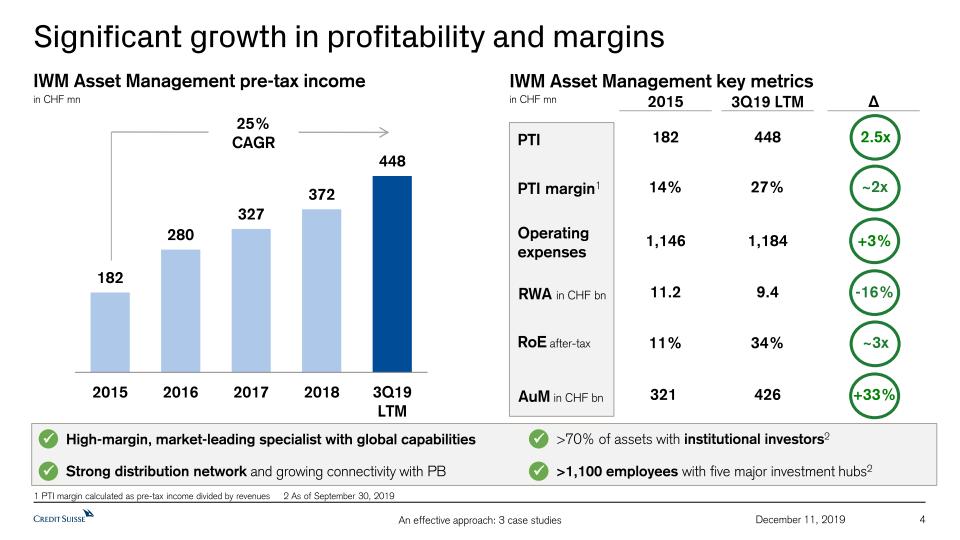

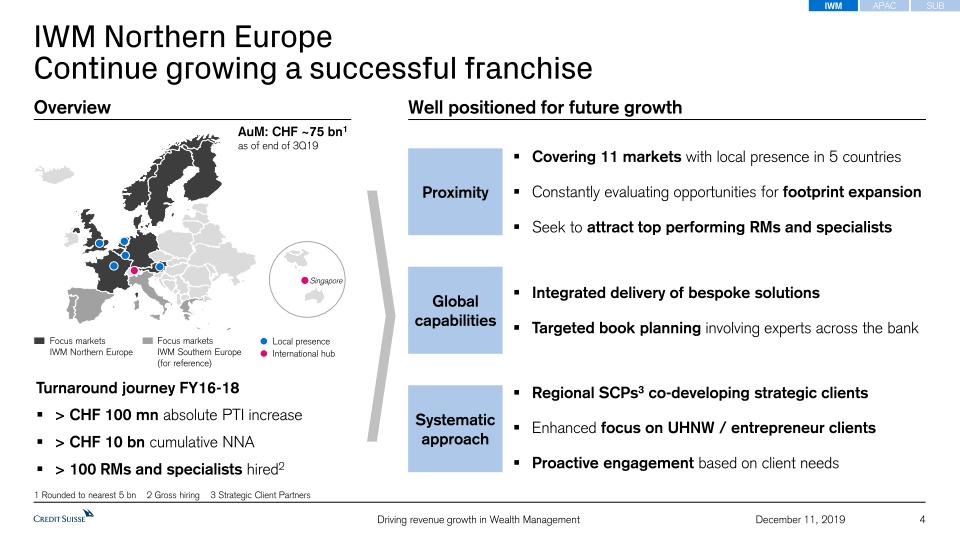

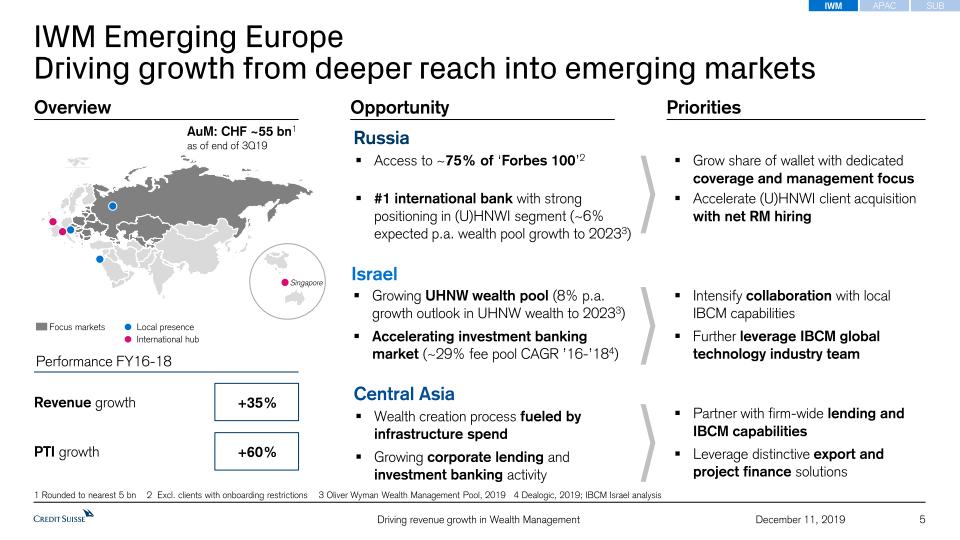

We are seeing a stable performance in IWM

|

|

§

|

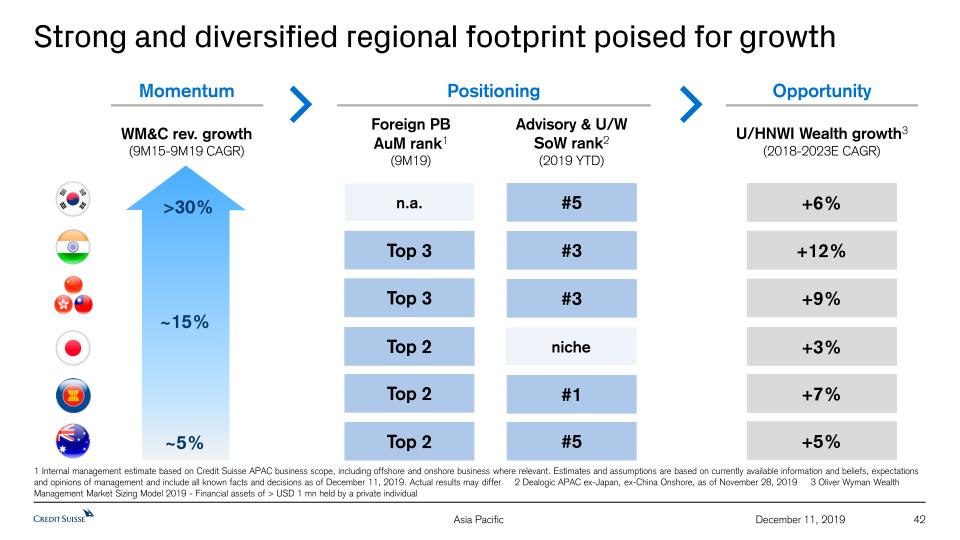

APAC and GM are showing significantly better performances compared to 4Q18, which was particularly challenging

|

|

§

|

While we expect IBCM to be loss-making for 2019, our pipeline of announced deals has been building strongly in the fourth quarter, a marked improvement year on year

|

We expect to achieve a Reported RoTE of greater than 8% for the full year 2019.

Ends

Page 4

|

Media Release

Zurich, December 11, 2019

|

|

Contact details

|

Adam Gishen, Investor Relations

Tel: +41 44 333 71 49

Email: investor.relations@credit-suisse.com

|

|

James Quinn, Corporate Communications

Tel: +41 844 33 88 44

E-mail: media.relations@credit-suisse.com

|

|

The Investor Day media release and all presentation slides will be available to download from 7:00 CET today at: https://www.credit-suisse.com/investorday

|

Note: Our estimates, ambitions, objectives and targets often include metrics that are non-GAAP financial measures and are unaudited. A reconciliation of the estimates, ambitions, objectives and targets to the nearest GAAP measures is unavailable without unreasonable efforts. Return on tangible equity is based on tangible shareholders' equity (also known as tangible book value), a non-GAAP financial measure, which is calculated by deducting goodwill and other intangible assets from total shareholders’ equity as presented in our balance sheet, both of which are unavailable on a prospective basis. Such estimates, ambitions, objectives and targets are calculated in a manner that is consistent with the accounting policies applied by us in preparing our financial statements.

Webcast details

|

Date

|

Wednesday, December 11, 2019

|

|

Time

|

08:30 GMT / 09:30 CET

|

|

Webcast

|

https://www.credit-suisse.com/investorday

|

|

Telephone

|

Switzerland: +41 445 807 121

Europe: +44 2071 928 522

US: +1 917 677 75 38

Conference passcode: 1504800 #

|

|

Note

|

Due to the large volume of callers expected we strongly recommend that you dial in approximately 20 minutes before the start of the presentation.

Please enter the Direct Event Passcode when prompted. You will be joined automatically to the conference.

Due to regional restrictions some participants may receive operator assistance when joining this conference call and will not be automatically connected.

|

Page 5

|

Media Release

Zurich, December 11, 2019

|

|

|

Documents

|

All documentation will be available on https://www.credit-suisse.com/investorday

|

|

Playbacks

|

A replay of the telephone conference will be available approximately four hours after the event.

|

Footnotes

1 Subject to market and economic conditions

2 Book value per share was CHF 18.25 at 9M19 compared to CHF 17.22 at 4Q18.Shareholder value creation is measured as 9M19 tangible book value per share of CHF 16.24 plus the dividend of CHF 0.26 per share paid in 2019 compared to 4Q18 tangible book value per share of CHF 15.27

3 Credit Suisse analysis based on company public disclosures. Includes Bank of America, Barclays, Citigroup, Deutsche Bank, Goldman Sachs, JPMorgan Chase, Morgan Stanley and UBS. For Equity Sales & Trading, does not include Deutsche Bank, who exited Equity Sales & Trading as part of its strategic transformation as announced on July 7, 2019. Analysis relates to Global Sales & Trading revenues in USD terms

4 Ranked number #1 in Switzerland and in APAC, excluding Japan and China onshore; Source: Dealogic as of September 30, 2019

5 Average one day, 98% trading book risk management Value-at-Risk

6 Rate of RWA to leverage exposure

Abbreviations

APAC – Asia Pacific; ATS – Asia Pacific Trading Solutions; AuM – assets under management; BCBS – Basel Committee on Banking Supervision; BIS – Bank for International Settlements; CAGR – Compound Annual Growth Rate; CHF – Swiss francs; CET1 – common equity tier 1; FINMA – Swiss Financial Market Supervisory Authority; GAAP – Generally accepted accounting principles; GM – Global Markets; IBCM – Investment Banking & Capital Markets; ITS – International Trading Solutions; IWM – International Wealth Management; M&A – mergers and acquisitions; NNA – net new assets; PB – Private Banking; PC – Private Clients; RoTE – Return on Tangible Equity; RWA – risk weighted assets; SEC – US Securities and Exchange Commission; SUB – Swiss Universal Bank; TBVPS – tangible book value per share; UHNW – ultra-high-net-worth; USD – US dollar; WM&C – Wealth Management & Connected

Important information about this media release

In preparing this media release, management has made estimates and assumptions that affect the numbers presented. Estimates and assumptions are based on currently available information and beliefs, expectations and opinions of management and include all known facts and decisions as of the date hereof. Actual results may differ. Annualised numbers do not take into account variations in operating results, seasonality and other factors and may not be indicative of actual, full-year results. Figures throughout this media release may also be subject to rounding adjustments. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information. This information is subject to change at any time without notice and we do not intend to update this information.

We may not achieve all of the expected benefits of our strategic initiatives. Factors beyond our control, including but not limited to the market and economic conditions, changes in laws, rules or regulations and other challenges discussed in our public filings, could limit our ability to achieve some or all of the expected benefits of these initiatives.

In particular, the terms “Estimate”, “Illustrative”, “Ambition”, “Objective”, “Outlook” and “Goal” are not intended to be viewed as targets or projections, nor are they considered to be Key Performance Indicators. All such estimates, illustrations, ambitions, objectives, outlooks and goals are subject to a large number of inherent risks, assumptions and uncertainties, many of which are completely outside of our control. These risks, assumptions and uncertainties include, but are not limited to, general market conditions, market volatility, interest rate volatility and levels, global and regional economic conditions, political uncertainty, changes in tax policies, regulatory changes, changes in levels of client activity as a result of any of the foregoing and other factors. Accordingly, this information should not be relied on for any purpose. We do not intend to update these estimates, illustrations, ambitions, objectives, outlooks or goals.

Return on tangible equity is based on tangible shareholders’ equity, a non-GAAP financial measure, which is calculated by deducting goodwill and other intangible assets from total shareholders’ equity as presented in our balance sheet. Tangible book value per share is a non-GAAP financial measure, which is calculated by dividing tangible shareholders' equity by total number of shares outstanding. Management believes that return on tangible equity and tangible book value per share are meaningful as they are measures used and relied upon by industry analysts and investors to assess valuations and capital adequacy. For end-3Q18, tangible shareholders’ equity excluded goodwill of CHF 4,736 million and other intangible assets of CHF 214 million from total shareholders’ equity of CHF 42,734 million as presented in our balance sheet. For end-4Q18, tangible shareholders’ equity excluded goodwill of CHF 4,766 million and other intangible assets of CHF 219 million from total shareholders’ equity of CHF 43,922 million as presented in our

Page 6

|

Media Release

Zurich, December 11, 2019

|

|

balance sheet. For end-3Q19, tangible shareholders’ equity excluded goodwill of CHF 4,760 million and other intangible assets of CHF 219 million from total shareholders’ equity of CHF 45,150 million as presented in our balance sheet. Shares outstanding were 2,552.4 million at end-3Q18, 2,550.6 million at end-4Q18 and 2,473.8 million at end-3Q19.

Regulatory capital is calculated as the worst of 10% of RWA and 3.5% of leverage exposure. Return on regulatory capital (a non-GAAP financial measure) is calculated using income / (loss) after tax and assumes a tax rate of 30% and capital allocated based on the worst of 10% of average RWA and 3.5% of average leverage exposure. For the Markets business within the APAC division and for the Global Markets and Investment Banking & Capital Markets divisions, return on regulatory capital is based on US dollar denominated numbers. Adjusted return on regulatory capital is calculated using adjusted results, applying the same methodology to calculate return on regulatory capital.

Credit Suisse is subject to the Basel III framework, as implemented in Switzerland, as well as Swiss legislation and regulations for systemically important banks, which include capital, liquidity, leverage and large exposure requirements and rules for emergency plans designed to maintain systemically relevant functions in the event of threatened insolvency. Credit Suisse has adopted the Bank for International Settlements (BIS) leverage ratio framework, as issued by the Basel Committee on Banking Supervision (BCBS) and implemented in Switzerland by the Swiss Financial Market Supervisory Authority FINMA (FINMA).

References to Wealth Management net new assets and assets under management refer to the combined results of SUB PC, IWM PB and APAC PB within WM&C.

Information referenced in this media release, whether via website links or otherwise, is not incorporated into this media release.

Investors and others should note that we announce material information (including quarterly earnings releases and financial reports) to the investing public using press releases, SEC and Swiss ad hoc filings, our website and public conference calls and webcasts.

We intend to also use our Twitter account @creditsuisse (https://twitter.com/creditsuisse) to excerpt key messages from our public disclosures, including earnings releases. We may retweet such messages through certain of our regional Twitter accounts, including @csschweiz (https://twitter.com/csschweiz) and @csapac (https://twitter.com/csapac). Investors and others should take care to consider such abbreviated messages in the context of the disclosures from which they are excerpted. The information we post on these Twitter accounts is not a part of this media release.

Cautionary statement regarding forward-looking information

This document contains statements that constitute forward-looking statements. In addition, in the future we, and others on our behalf, may make statements that constitute forward-looking statements. Such forward-looking statements may include, without limitation, statements relating to the following:

|

§

|

our plans, targets or goals;

|

|

§

|

our future economic performance or prospects;

|

|

§

|

the potential effect on our future performance of certain contingencies; and

|

|

§

|

assumptions underlying any such statements.

|

Words such as “believes,” “anticipates,” “expects,” “intends” and “plans” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. We do not intend to update these forward-looking statements.

By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks exist that predictions, forecasts, projections and other outcomes described or implied in forward-looking statements will not be achieved. We caution you that a number of important factors could cause results to differ materially from the plans, targets, goals expectations, estimates and intentions expressed in such forward-looking statements. These factors include:

|

§

|

the ability to maintain sufficient liquidity and access capital markets;

|

|

§

|

market volatility and interest rate fluctuations and developments affecting interest rate levels;

|

|

§

|

the strength of the global economy in general and the strength of the economies of the countries in which we conduct our operations, in particular the risk of continued slow economic recovery or downturn in the US or other developed countries or in emerging markets in 2019 and beyond;

|

|

§

|

the direct and indirect impacts of deterioration or slow recovery in residential and commercial real estate markets;

|

|

§

|

adverse rating actions by credit rating agencies in respect of us, sovereign issuers, structured credit products or other credit-related exposures;

|

|

§

|

the ability to achieve our strategic goals, including those related to our targets and financial goals;

|

|

§

|

the ability of counterparties to meet their obligations to us;

|

|

§

|

the effects of, and changes in, fiscal, monetary, exchange rate, trade and tax policies, as well as currency fluctuations;

|

|

§

|

political and social developments, including war, civil unrest or terrorist activity;

|

|

§

|

the possibility of foreign exchange controls, expropriation, nationalisation or confiscation of assets in countries in which we conduct our operations;

|

|

§

|

operational factors such as systems failure, human error, or the failure to implement procedures properly;

|

|

§

|

the risk of cyber attacks, information or security breaches or technology failure on our business or operations;

|

|

§

|

the adverse resolution of litigation, regulatory proceedings and other contingencies;

|

Page 7

|

Media Release

Zurich, December 11, 2019

|

|

|

§

|

actions taken by regulators with respect to our business and practices and possible resulting changes to our business organisation, practices and policies in countries in which we conduct our operations;

|

|

§

|

the effects of changes in laws, regulations or accounting or tax standards, policies or practices in countries in which we conduct our operations;

|

|

§

|

the potential effects of proposed changes in our legal entity structure;

|

|

§

|

competition or changes in our competitive position in geographic and business areas in which we conduct our operations;

|

|

§

|

the ability to retain and recruit qualified personnel;

|

|

§

|

the ability to maintain our reputation and promote our brand;

|

|

§

|

the ability to increase market share and control expenses;

|

|

§

|

technological changes;

|

|

§

|

the timely development and acceptance of our new products and services and the perceived overall value of these products and services by users;

|

|

§

|

acquisitions, including the ability to integrate acquired businesses successfully, and divestitures, including the ability to sell non-core assets; and

|

|

§

|

other unforeseen or unexpected events and our success at managing these and the risks involved in the foregoing.

|

We caution you that the foregoing list of important factors is not exclusive. When evaluating forward-looking statements, you should carefully consider the foregoing factors and other uncertainties and events, including the information set forth in “Risk factors” in I – Information on the company in our Annual Report 2018.

Page 8

Credit Suisse Investor Day 2019General overview Tidjane Thiam, Chief Executive OfficerDecember 11, 2019

Disclaimer 2 December 11, 2019 This material does not purport to contain all of the information that you may wish to consider. This material is not to be relied upon as such or used in substitution for the exercise of independent judgment.Cautionary statement regarding forward-looking statementsThis presentation contains forward-looking statements that involve inherent risks and uncertainties, and we might not be able to achieve the predictions, forecasts, projections and other outcomes we describe or imply in forward-looking statements. A number of important factors could cause results to differ materially from the plans, targets, goals, expectations, estimates and intentions we express in these forward-looking statements, including those we identify in "Risk factors” in our Annual Report on Form 20-F for the fiscal year ended December 31, 2018 and in the “Cautionary statement regarding forward-looking information" in our media release relating to Investor Day, published on December 11, 2019 and filed with the US Securities and Exchange Commission, and in other public filings and press releases. We do not intend to update these forward-looking statements. In particular, the terms “Estimate”, “Illustrative”, “Ambition”, “Objective”, “Outlook” and “Goal” are not intended to be viewed as targets or projections, nor are they considered to be Key Performance Indicators. All such estimates, illustrations, ambitions, objectives, outlooks and goals are subject to a large number of inherent risks, assumptions and uncertainties, many of which are completely outside of our control. These risks, assumptions and uncertainties include, but are not limited to, general market conditions, market volatility, interest rate volatility and levels, global and regional economic conditions, political uncertainty, changes in tax policies, regulatory changes, changes in levels of client activity as a result of any of the foregoing and other factors. Accordingly, this information should not be relied on for any purpose. We do not intend to update these estimates, illustrations, ambitions, objectives, outlooks or goals. We may not achieve the benefits of our strategic initiativesWe may not achieve all of the expected benefits of our strategic initiatives. Factors beyond our control, including but not limited to the market and economic conditions, changes in laws, rules or regulations and other challenges discussed in our public filings, could limit our ability to achieve some or all of the expected benefits of these initiatives. Estimates and assumptionsIn preparing this presentation, management has made estimates and assumptions that affect the numbers presented. Actual results may differ. Annualized numbers do not take into account variations in operating results, seasonality and other factors and may not be indicative of actual, full-year results. Figures throughout this presentation may also be subject to rounding adjustments. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information. This information is subject to change at any time without notice and we do not intend to update this information. Cautionary statements relating to interim financial informationThis presentation contains certain unaudited interim financial information for the fourth quarter of 2019. This information has been derived from management accounts, is preliminary in nature, does not reflect the complete results of the fourth quarter of 2019 or the full year 2019 and is subject to change, including as a result of any normal quarterly adjustments in relation to the financial statements for the full year 2019. This information has not been subject to any review by our independent registered public accounting firm. There can be no assurance that the final results for these periods will not differ from these preliminary results, and any such differences could be material. Quarterly financial results for the fourth quarter of 2019 and full year results will be included in our 4Q19 Earnings Release and our 2019 Annual Report. Statement regarding non-GAAP financial measuresThis presentation also contains non-GAAP financial measures, including adjusted results as well as return on regulatory capital, return on tangible equity and tangible book value per share (which are based on tangible shareholders’ equity). Information needed to reconcile such non-GAAP financial measures to the most directly comparable measures under US GAAP can be found in this presentation in the Appendix, which is available on our website at www.credit-suisse.com.Our estimates, ambitions, objectives and targets often include metrics that are non-GAAP financial measures and are unaudited. A reconciliation of the estimates, ambitions, objectives and targets to the nearest GAAP measures is unavailable without unreasonable efforts. Adjusted results exclude goodwill impairment, major litigation provisions, real estate gains and other revenue and expense items included in our reported results, all of which are unavailable on a prospective basis. Return on Tangible Equity is based on tangible shareholders' equity (also known as tangible book value), a non-GAAP financial measure, which is calculated by deducting goodwill and other intangible assets from total shareholders' equity as presented in our balance sheet, both of which are unavailable on a prospective basis. Tangible book value per share excludes the impact of any dividends paid during the performance period, share buybacks, own credit movements, foreign exchange rate movements and pension-related impacts, all of which are unavailable on a prospective basis. Such estimates, ambitions, objectives and targets are calculated in a manner that is consistent with the accounting policies applied by us in preparing our financial statements.Statement regarding capital, liquidity and leverageCredit Suisse is subject to the Basel III framework, as implemented in Switzerland, as well as Swiss legislation and regulations for systemically important banks (Swiss Requirements), which include capital, liquidity, leverage and large exposure requirements and rules for emergency plans designed to maintain systemically relevant functions in the event of threatened insolvency. Credit Suisse has adopted the Bank for International Settlements (BIS) leverage ratio framework, as issued by the Basel Committee on Banking Supervision (BCBS) and implemented in Switzerland by the Swiss Financial Market Supervisory Authority FINMA. References to phase-in and look-through included herein refer to Basel III capital requirements and Swiss Requirements. Phase-in reflects that, for the years 2014-2018, there was a five-year (20% per annum) phase-in of goodwill, other intangible assets and other capital deductions (e.g., certain deferred tax assets) and a phase-out of an adjustment for the accounting treatment of pension plans. For the years 2013-2022, there is a phase-out of certain capital instruments. Look-through assumes the full phase-in of goodwill and other intangible assets and other regulatory adjustments and the phase-out of certain capital instruments.Unless otherwise noted, leverage exposure is based on the BIS leverage ratio framework and consists of period-end balance sheet assets and prescribed regulatory adjustments. The look-through tier 1 leverage ratio and CET1 leverage ratio are calculated as look-through BIS tier 1 capital and CET1 capital, respectively, divided by period-end leverage exposure. Swiss leverage ratios are measured on the same period-end basis as the leverage exposure for the BIS leverage ratio.SourcesThis presentation contains certain material prepared by Credit Suisse on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. Credit Suisse has not sought to independently verify information obtained from public and third-party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information. Certain information has been derived from internal management accounts.

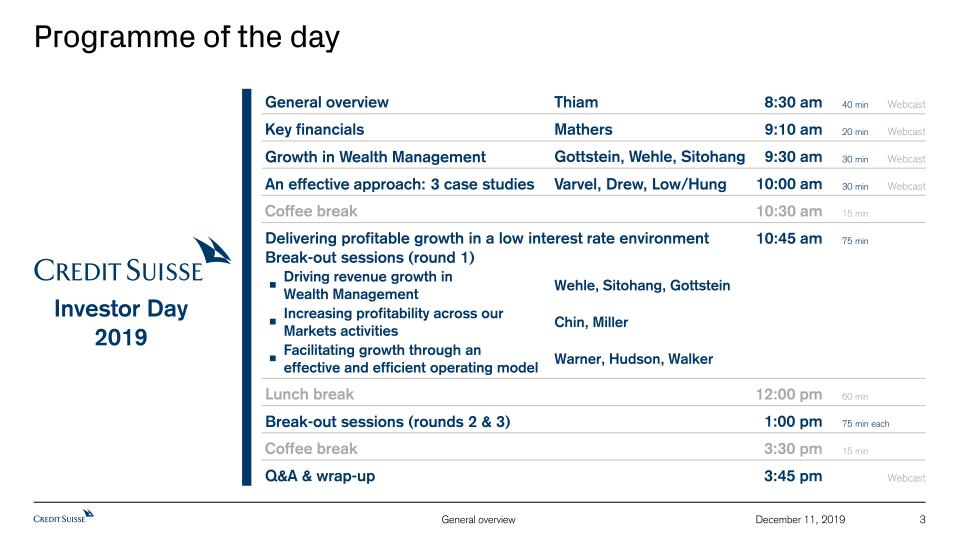

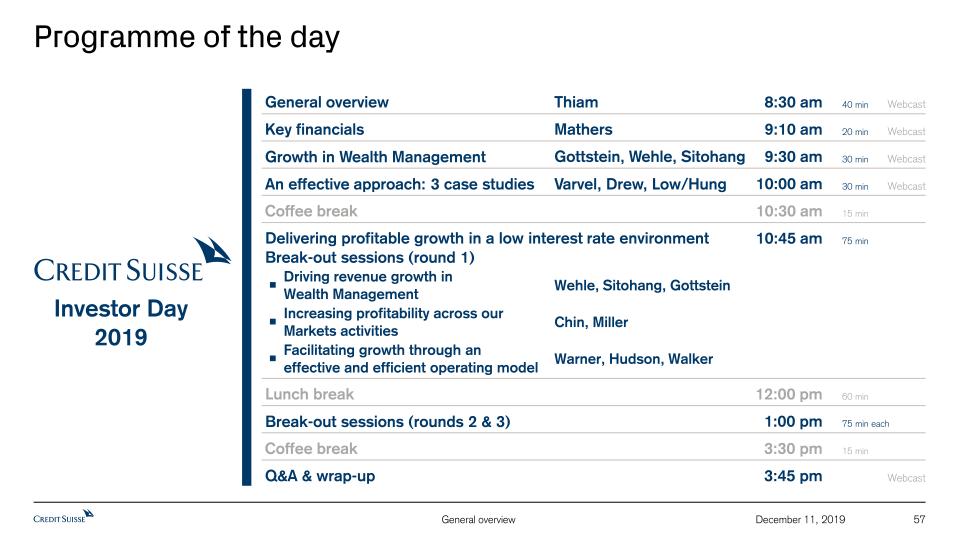

3 December 11, 2019 Programme of the day Q&A & wrap-up Webcast 3:45 pm Investor Day 2019 Lunch break 12:00 pm 60 min Coffee break 3:30 pm 15 min General overview Webcast 8:30 am Thiam 40 min Coffee break 10:30 am 15 min Key financials Webcast 9:10 am 20 min Mathers Growth in Wealth Management Webcast 9:30 am Gottstein, Wehle, Sitohang 30 min Break-out sessions (rounds 2 & 3) 1:00 pm 75 min each Wehle, Sitohang, Gottstein Driving revenue growth in Wealth Management Chin, Miller Increasing profitability across our Markets activities Warner, Hudson, Walker Facilitating growth through an effective and efficient operating model 10:45 am 75 min Delivering profitable growth in a low interest rate environmentBreak-out sessions (round 1) An effective approach: 3 case studies Webcast 10:00 am Varvel, Drew, Low/Hung 30 min

Resilient business model - delivering profitable, compliant growth 2 Continued momentum in 2019 1 Agenda 4 December 11, 2019 Capital 3

We have a clear and consistent strategy 5 December 11, 2019 A leading Wealth Manager… Following a balanced approach between Mature and Emerging Markets in Wealth Management… …with strong Investment Banking capabilities …focusing on UHNW and entrepreneur clients… …serving both our clients’ private wealth and business financial needs

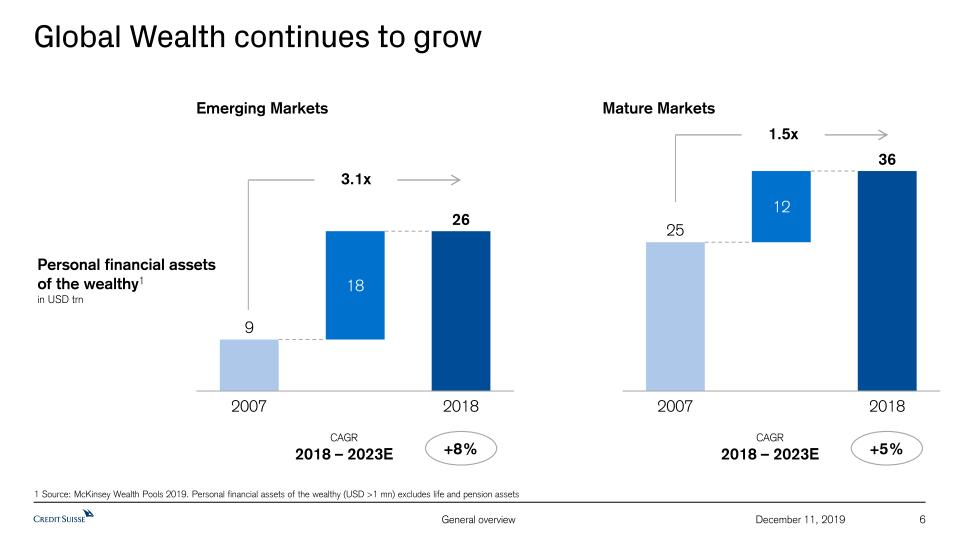

Global Wealth continues to grow 6 December 11, 2019 Emerging Markets Mature Markets 2007 2018 18 9 26 3.1x 12 25 2007 2018 36 1.5x CAGR2018 – 2023E +8% CAGR2018 – 2023E +5% 1 Source: McKinsey Wealth Pools 2019. Personal financial assets of the wealthy (USD >1 mn) excludes life and pension assets Personal financial assets of the wealthy1in USD trn

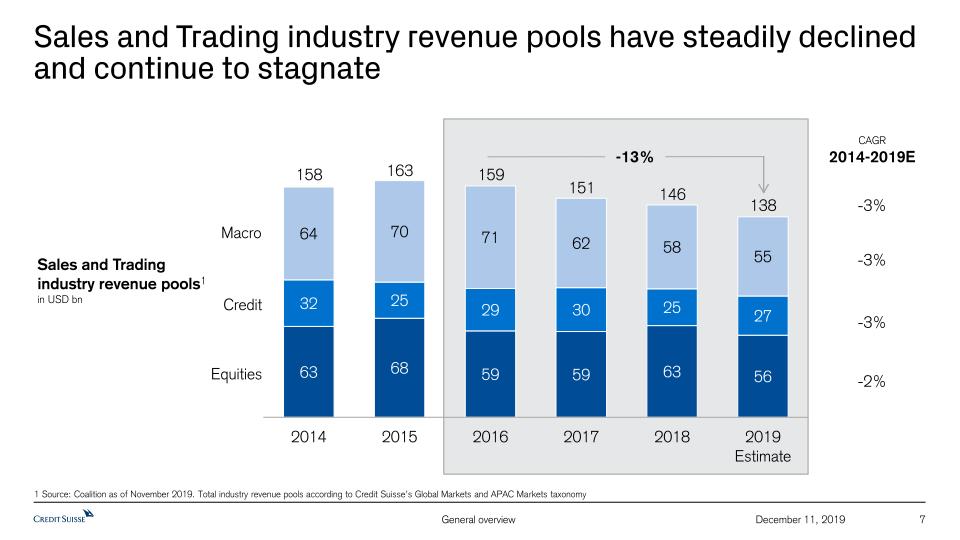

Sales and Trading industry revenue pools have steadily declined and continue to stagnate 7 December 11, 2019 1 Source: Coalition as of November 2019. Total industry revenue pools according to Credit Suisse’s Global Markets and APAC Markets taxonomy -3% -13% -3% Macro Credit Equities 158 163 138 159 146 151 -2% CAGR2014-2019E -3% Sales and Trading industry revenue pools1in USD bn

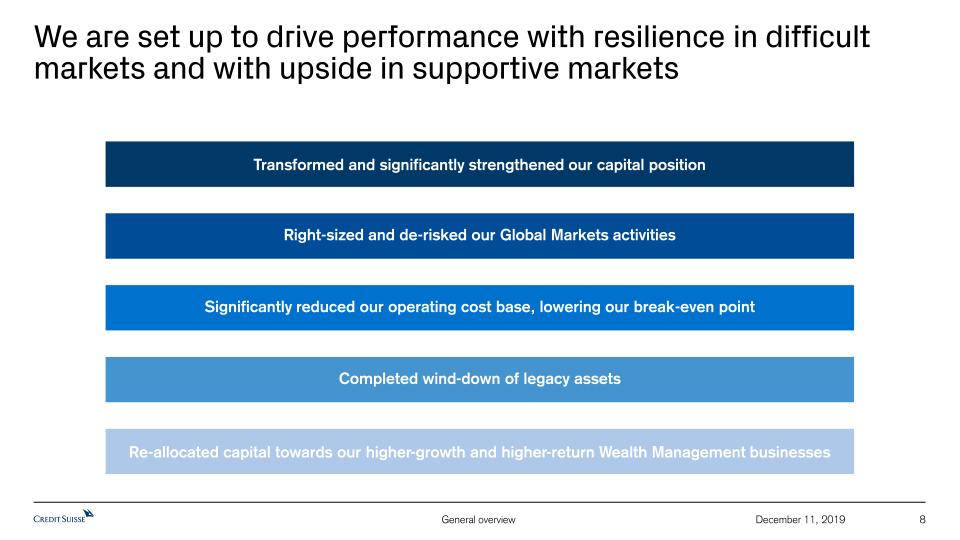

We are set up to drive performance with resilience in difficult markets and with upside in supportive markets 8 December 11, 2019 Transformed and significantly strengthened our capital position Significantly reduced our operating cost base, lowering our break-even point Completed wind-down of legacy assets Right-sized and de-risked our Global Markets activities Re-allocated capital towards our higher-growth and higher-return Wealth Management businesses

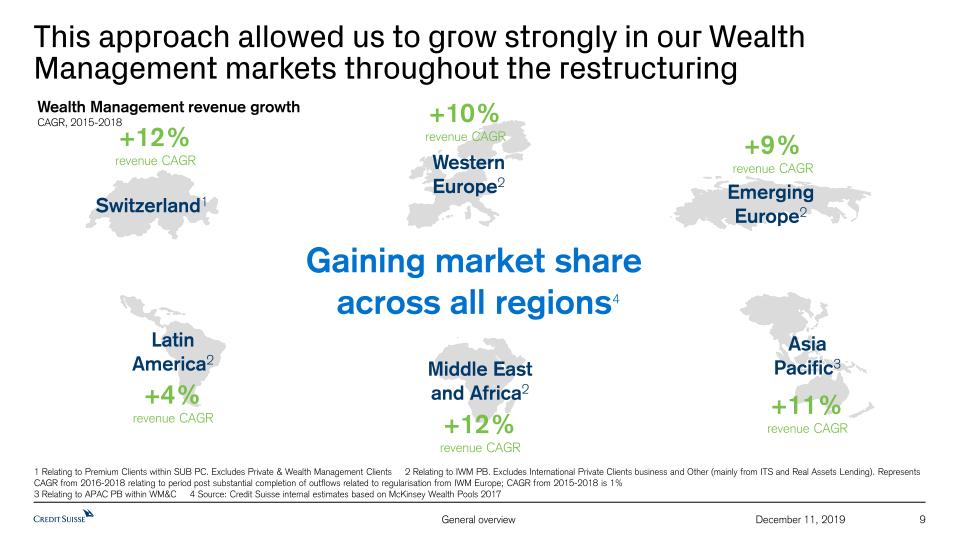

This approach allowed us to grow strongly in our Wealth Management markets throughout the restructuring 9 December 11, 2019 Western Europe2 Switzerland1 Latin America2 Middle East and Africa2 Emerging Europe2 Asia Pacific3 Gaining market share across all regions +12%revenue CAGR +10%revenue CAGR +9%revenue CAGR +4%revenue CAGR +12%revenue CAGR +11%revenue CAGR 1 Relating to Premium Clients within SUB PC. Excludes Private & Wealth Management Clients 2 Relating to IWM PB. Excludes International Private Clients business and Other (mainly from ITS and Real Assets Lending). Represents CAGR from 2016-2018 relating to period post substantial completion of outflows related to regularisation from IWM Europe; CAGR from 2015-2018 is 1% 3 Relating to APAC PB within WM&C 4 Source: Credit Suisse internal estimates based on McKinsey Wealth Pools 2017 Wealth Management revenue growthCAGR, 2015-2018 4

10 December 11, 2019 We continued to improve our performance in 2019 Operating leverage12th consecutivequarter of positive operating leverage Pre-tax income+26% YoY Group PTI CHF 3.5 bn1 NNA+28% YoYRecord NNA CHF 72 bn AuM+10% YTDRecord Group AuMCHF 1.5 trn Returns+250 bps YoY RoTE‡9% ‡ RoTE is a non-GAAP financial measure, see Appendix1 9M19 includes CHF 327 mn related to the transfer of the InvestLab fund platform to Allfunds Group, recorded in SUB, IWM and APAC Select 9M19 performance metrics1

Growing TBVPS is a key objective… 11 December 11, 2019 As per 2018 Investor Day

…and we delivered significant TBVPS growth 12 December 11, 2019 Shareholder value creationin CHF +11% CAGR 16.50 DPS 6% Shareholder value creation 9M19 increase in TBVPS‡ and DPSas % of share price1 1% 9% 11% 9% ‡ Tangible book value and tangible book value per share are non-GAAP financial measures, see Appendix 1 As of 2018 year-end. Peers include Bank of America, Barclays, BNP Paribas, Citi, Deutsche Bank, Goldman Sachs, HSBC, JP Morgan Chase, Julius Baer, Morgan Stanley, Santander, Société Générale and UBS TBVPS‡ TBVPS‡

Resilient business model - delivering profitable, compliant growth 2 Continued momentum in 2019 1 Agenda 13 December 11, 2019 Capital 3

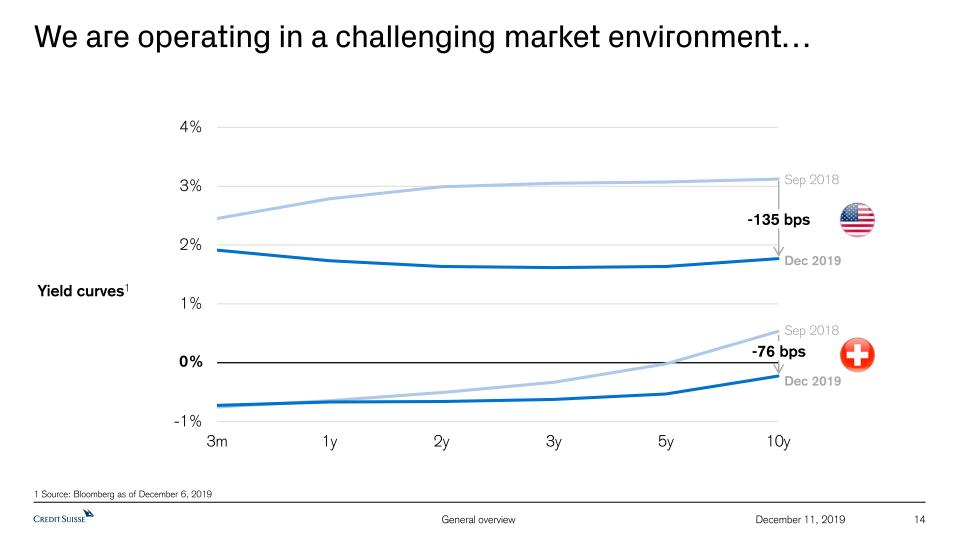

We are operating in a challenging market environment… 14 December 11, 2019 Dec 2019 Sep 2018 -135 bps -76 bps Dec 2019 Sep 2018 1 Source: Bloomberg as of December 6, 2019 Yield curves1 0%

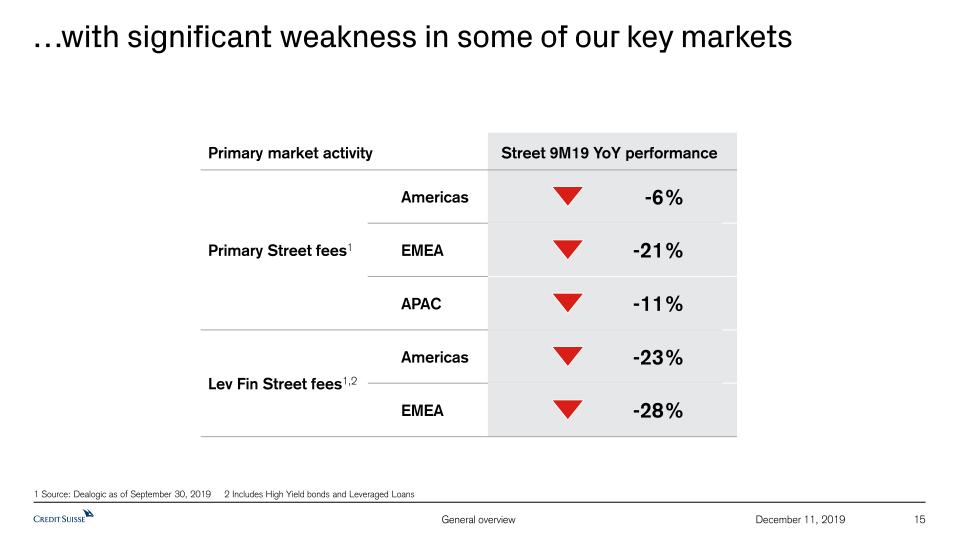

…with significant weakness in some of our key markets 15 December 11, 2019 1 Source: Dealogic as of September 30, 2019 2 Includes High Yield bonds and Leveraged Loans Americas -6% -21% EMEA APAC -11% Primary market activity Street 9M19 YoY performance Primary Street fees1 Lev Fin Street fees1,2 -23% Americas -28% EMEA

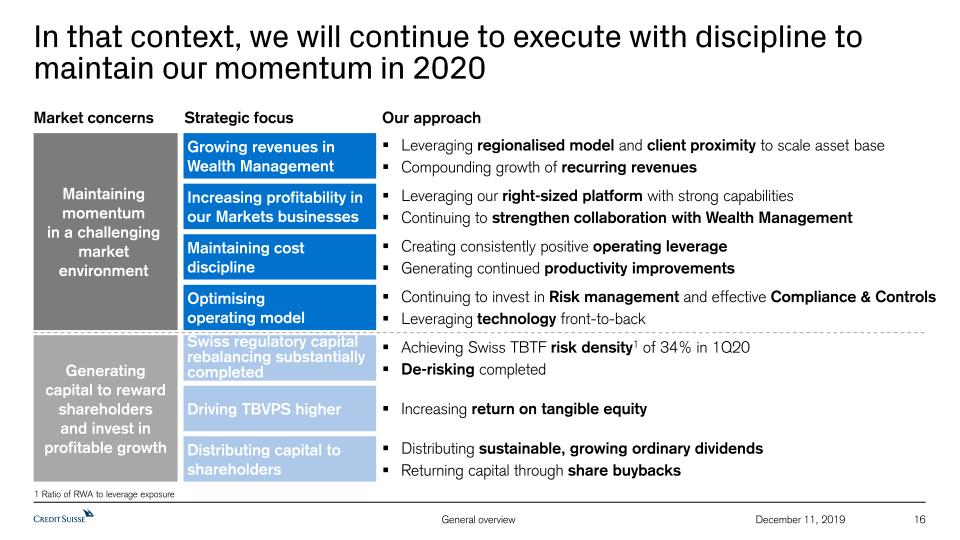

In that context, we will continue to execute with discipline to maintain our momentum in 2020 16 December 11, 2019 Maintaining momentumin a challenging market environment Market concerns Generating capital to reward shareholders and invest in profitable growth Strategic focus Creating consistently positive operating leverageGenerating continued productivity improvements Maintaining cost discipline Optimising operating model Swiss regulatory capital rebalancing substantially completed Continuing to invest in Risk management and effective Compliance & ControlsLeveraging technology front-to-back Driving TBVPS higher Achieving Swiss TBTF risk density1 of 34% in 1Q20De-risking completed Increasing return on tangible equity Our approach Leveraging our right-sized platform with strong capabilitiesContinuing to strengthen collaboration with Wealth Management Increasing profitability inour Markets businesses Growing revenues in Wealth Management Leveraging regionalised model and client proximity to scale asset base Compounding growth of recurring revenues Distributing capital to shareholders Distributing sustainable, growing ordinary dividendsReturning capital through share buybacks 1 Ratio of RWA to leverage exposure

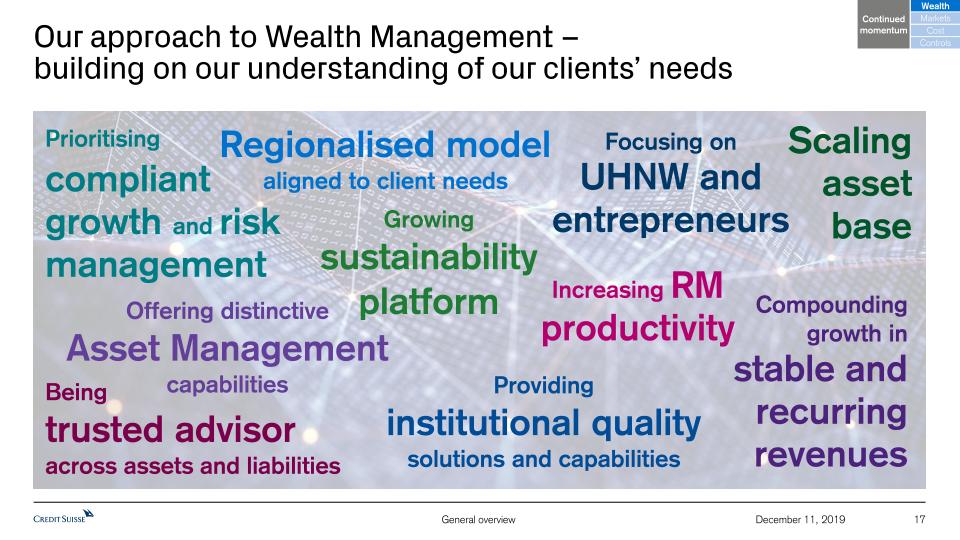

Our approach to Wealth Management – building on our understanding of our clients’ needs 17 December 11, 2019 Scalingasset base Compoundinggrowth instable andrecurring revenues Providing institutional qualitysolutions and capabilities Focusing onUHNW and entrepreneurs Beingtrusted advisoracross assets and liabilities Regionalised model aligned to client needs Continued momentum Markets Wealth Cost Controls Prioritising compliantgrowth and riskmanagement Increasing RM productivity Growingsustainabilityplatform Offering distinctiveAsset Management capabilities

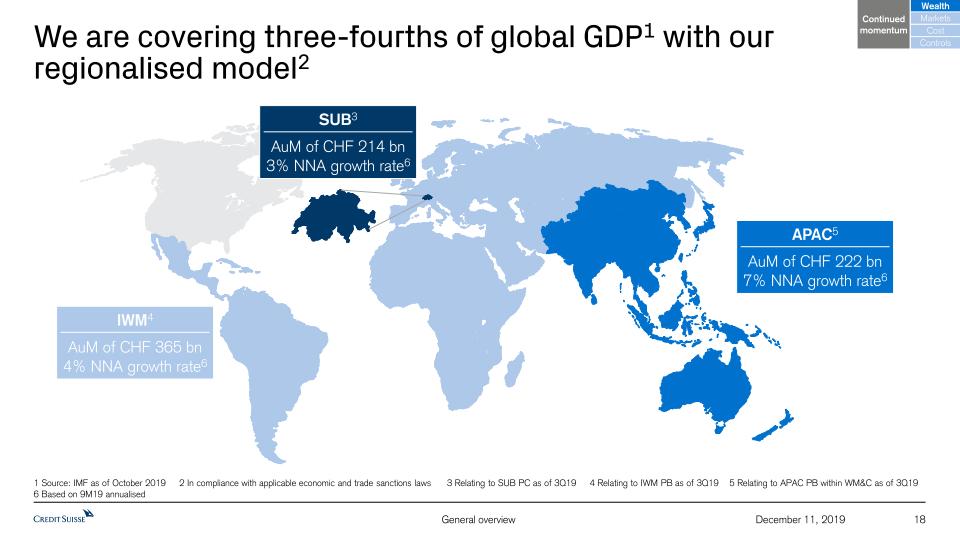

We are covering three-fourths of global GDP1 with our regionalised model2 18 December 11, 2019 Continued momentum Markets Wealth Cost Controls IWM4AuM of CHF 365 bn4% NNA growth rate6 APAC5AuM of CHF 222 bn7% NNA growth rate6 SUB3AuM of CHF 214 bn3% NNA growth rate6 1 Source: IMF as of October 2019 2 In compliance with applicable economic and trade sanctions laws 3 Relating to SUB PC as of 3Q19 4 Relating to IWM PB as of 3Q19 5 Relating to APAC PB within WM&C as of 3Q19 6 Based on 9M19 annualised

We have a strong track record of consistent NNA growthsince 2015 … 19 December 11, 2019 1 Relating to SUB PC, IWM PB and APAC PB within WM&C Group Net New Assetsin CHF bn 5% NNAgrowth rateannualised 75%UHNW share Continued momentum Markets Wealth Cost Controls Wealth Management1 key metrics

…driving our asset base to record levels… 20 December 11, 2019 1 Relating to SUB PC, IWM PB and APAC PB within WM&C Group Assets under Managementin CHF trn +196 bn Continued momentum Markets Wealth Cost Controls 7% CAGR9M15-9M19 Wealth Management1AuM

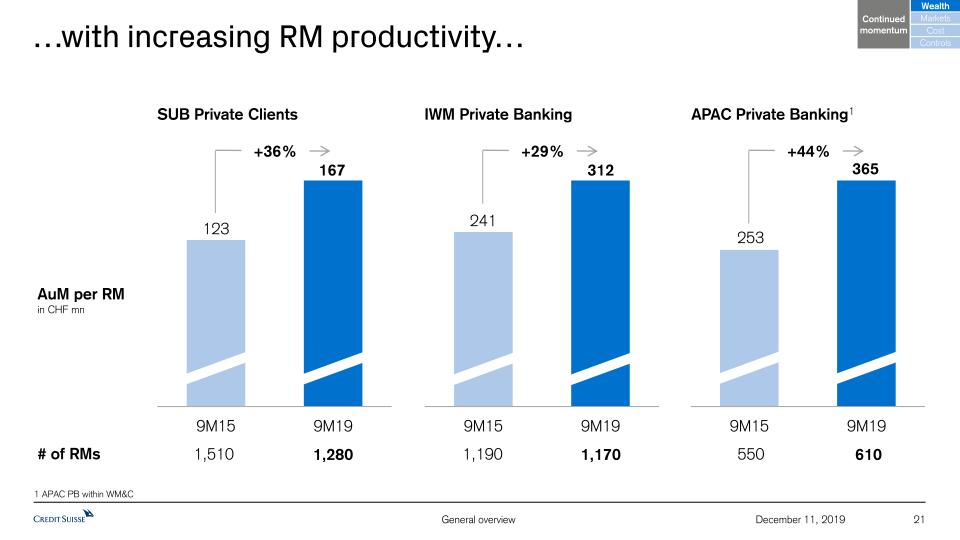

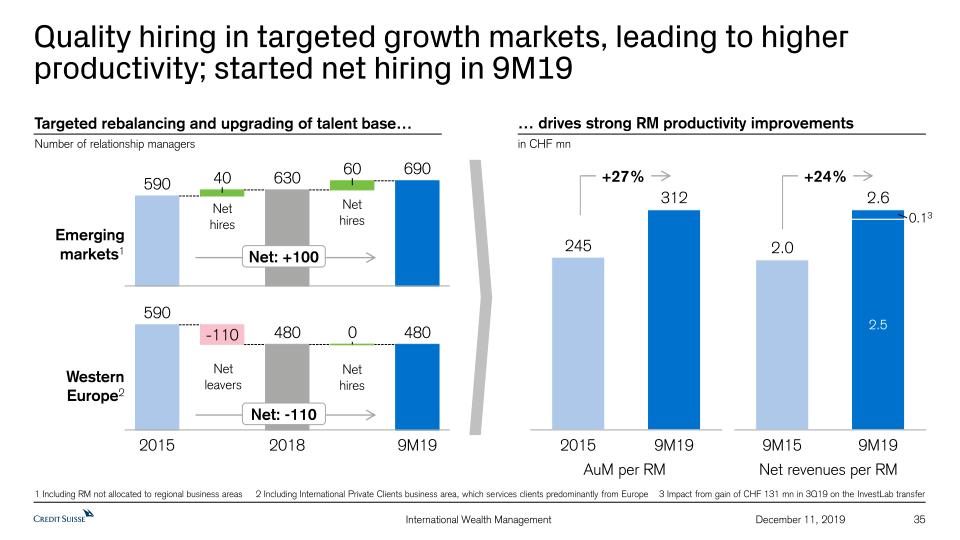

…with increasing RM productivity… 21 December 11, 2019 AuM per RMin CHF mn +36% Continued momentum Markets Wealth Cost Controls # of RMs SUB Private Clients IWM Private Banking APAC Private Banking1 1,510 1,280 1,190 1,170 550 610 +29% +44% 1 APAC PB within WM&C

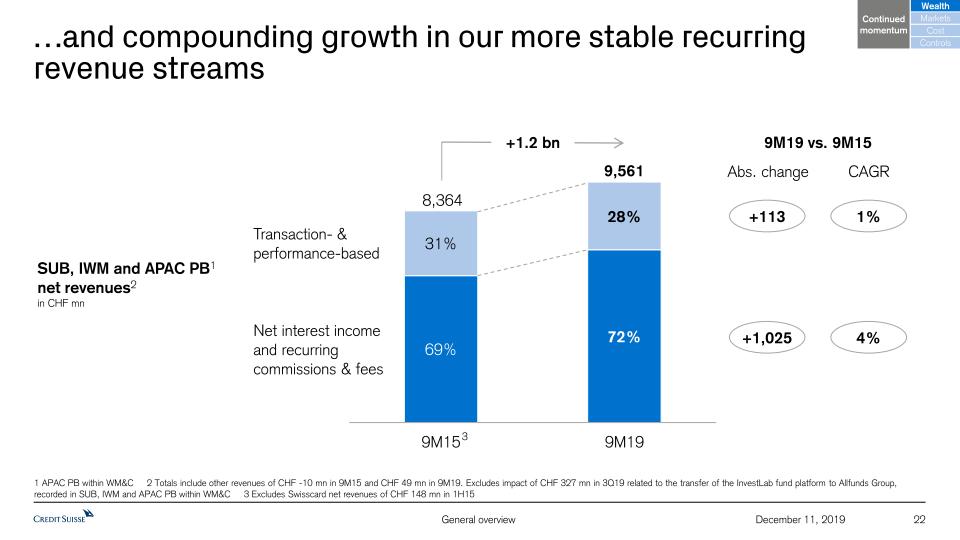

…and compounding growth in our more stable recurring revenue streams 22 December 11, 2019 Net interest income and recurring commissions & fees Transaction- & performance-based +1.2 bn 8,364 9,561 +1,025 +113 Abs. change 3 9M19 vs. 9M15 CAGR 4% 1% 1 APAC PB within WM&C 2 Totals include other revenues of CHF -10 mn in 9M15 and CHF 49 mn in 9M19. Excludes impact of CHF 327 mn in 3Q19 related to the transfer of the InvestLab fund platform to Allfunds Group, recorded in SUB, IWM and APAC PB within WM&C 3 Excludes Swisscard net revenues of CHF 148 mn in 1H15 SUB, IWM and APAC PB1net revenues2in CHF mn Continued momentum Markets Wealth Cost Controls

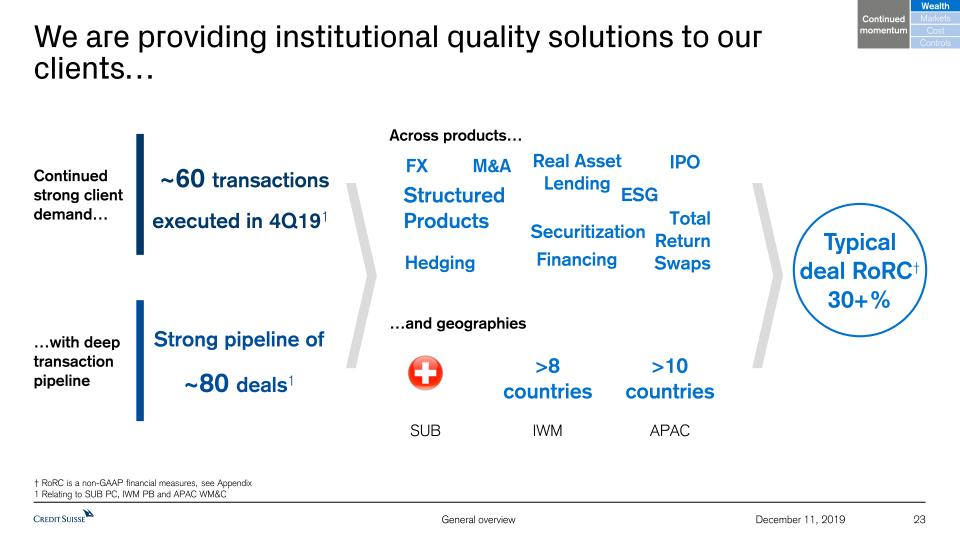

We are providing institutional quality solutions to our clients… 23 December 11, 2019 Continued momentum Markets Wealth Cost Controls ~60 transactions executed in 4Q191 Continued strong client demand… Strong pipeline of~80 deals1 † RoRC is a non-GAAP financial measures, see Appendix1 Relating to SUB PC, IWM PB and APAC WM&C Across products… Financing M&A Structured Products FX …and geographies …with deep transaction pipeline Real Asset Lending Total Return Swaps Hedging IPO Securitization SUB IWM APAC >8 countries >10 countries Typicaldeal RoRC† 30+% ESG

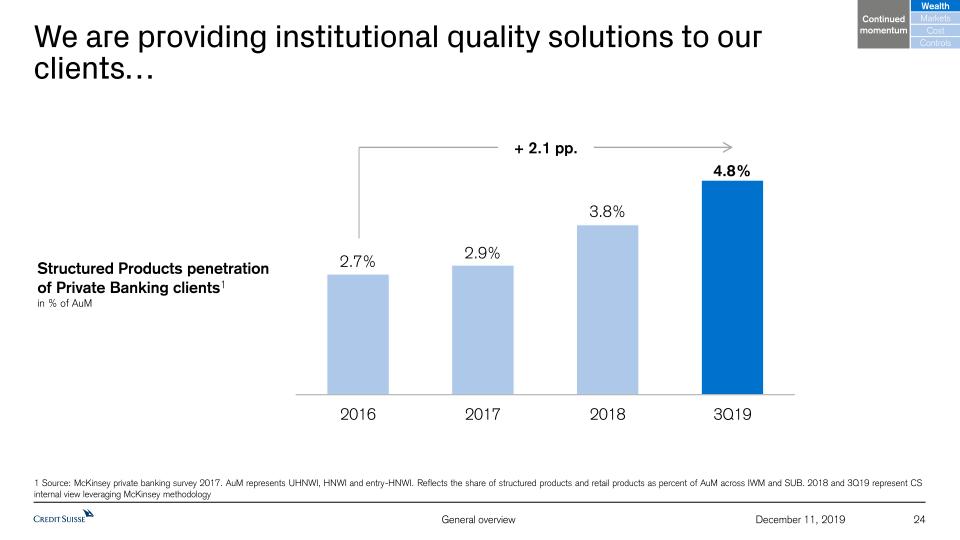

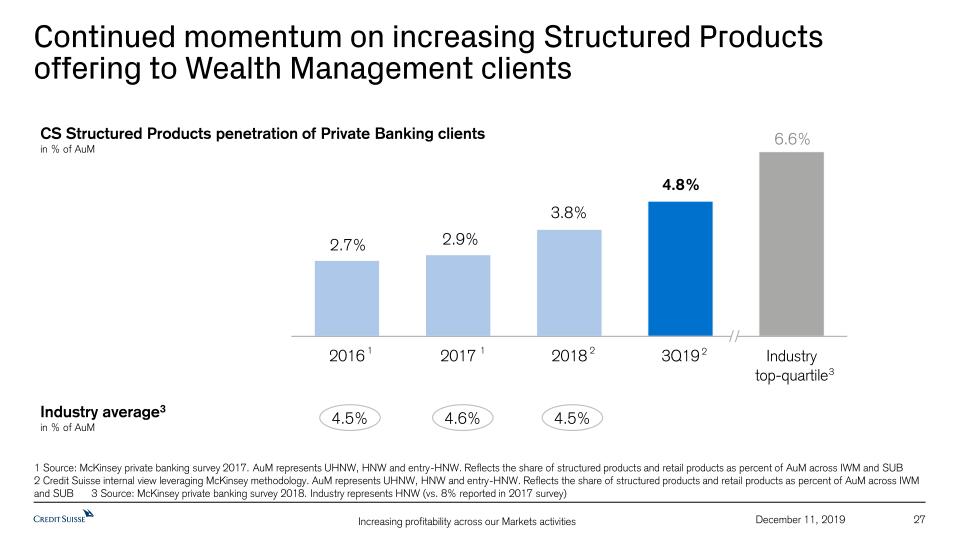

We are providing institutional quality solutions to our clients… 24 December 11, 2019 + 2.1 pp. 1 Source: McKinsey private banking survey 2017. AuM represents UHNWI, HNWI and entry-HNWI. Reflects the share of structured products and retail products as percent of AuM across IWM and SUB. 2018 and 3Q19 represent CS internal view leveraging McKinsey methodology Continued momentum Markets Wealth Cost Controls Structured Products penetration of Private Banking clients1in % of AuM

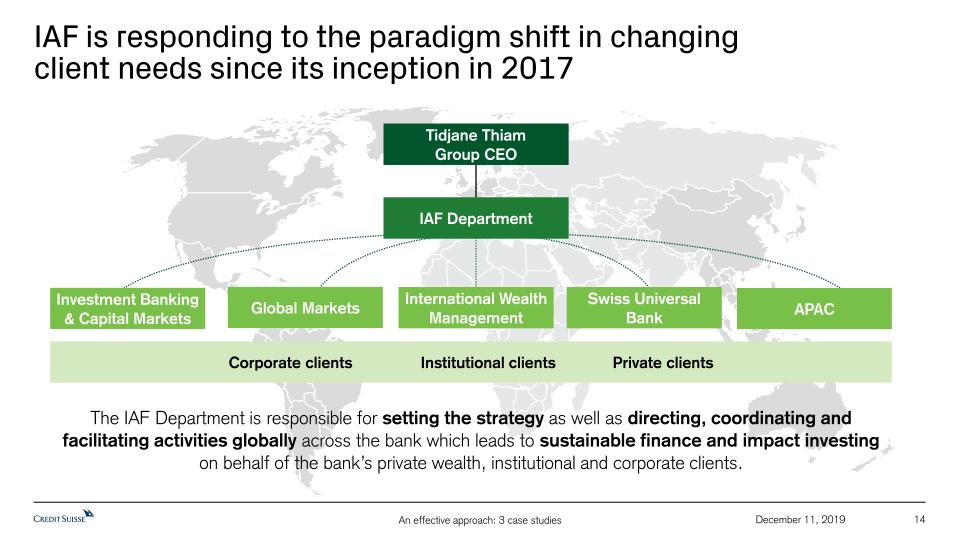

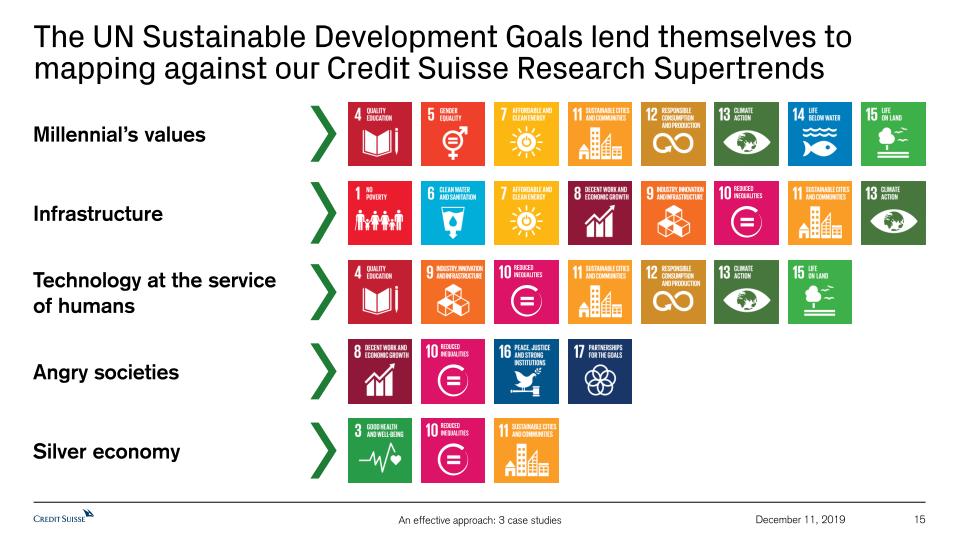

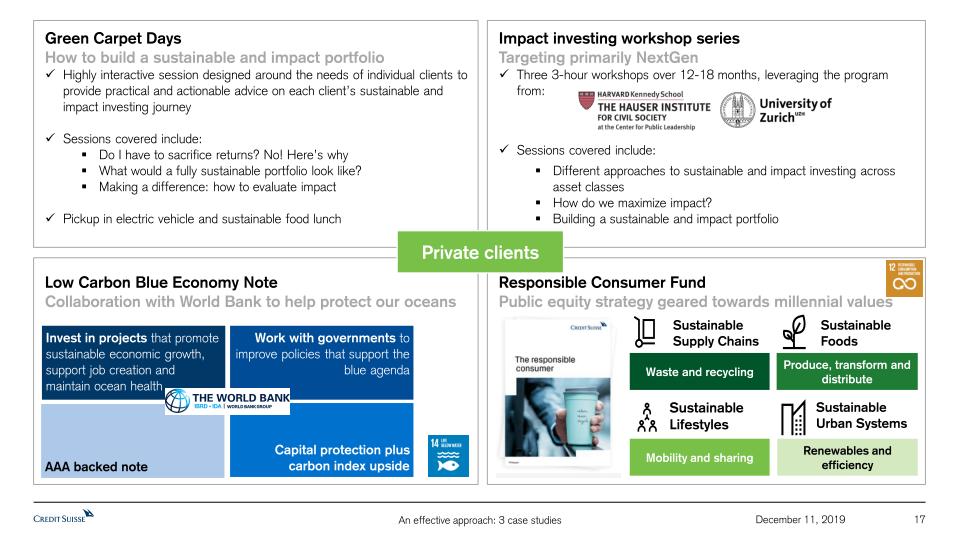

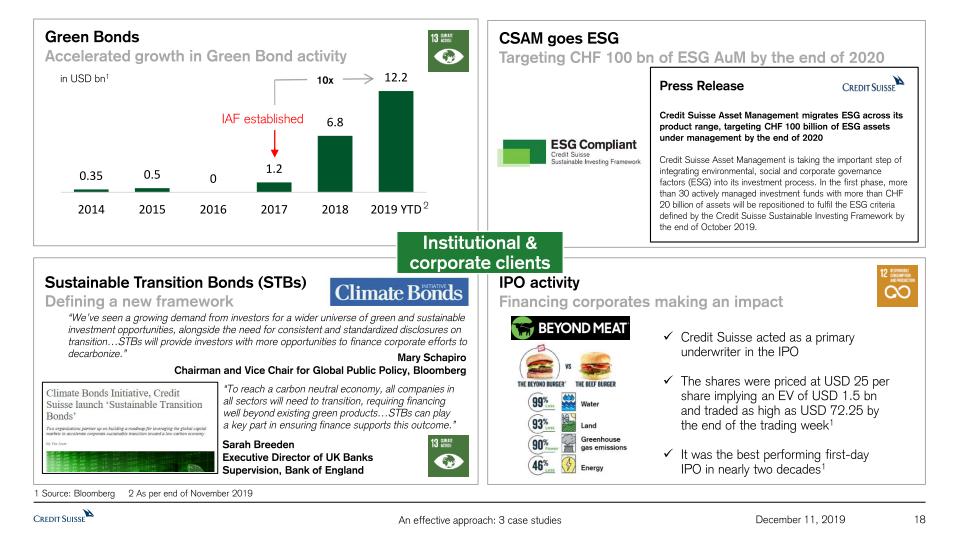

…and addressing the growing demand for sustainable investment opportunities 25 December 11, 2019 Continued momentum Markets Wealth Cost Controls As per carousel session “An effective approach: 3 case studies - Impact Advisory & Finance”

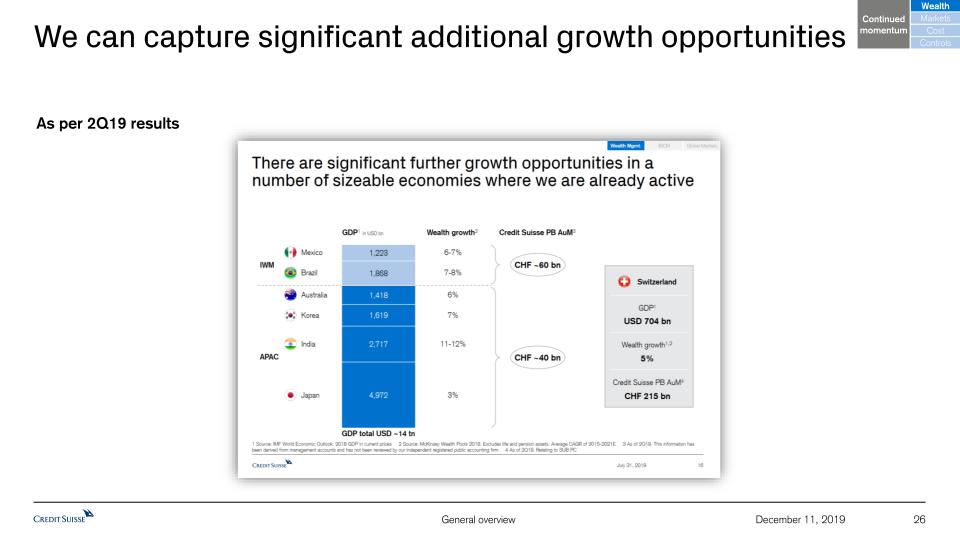

We can capture significant additional growth opportunities 26 December 11, 2019 As per 2Q19 results Continued momentum Markets Wealth Cost Controls

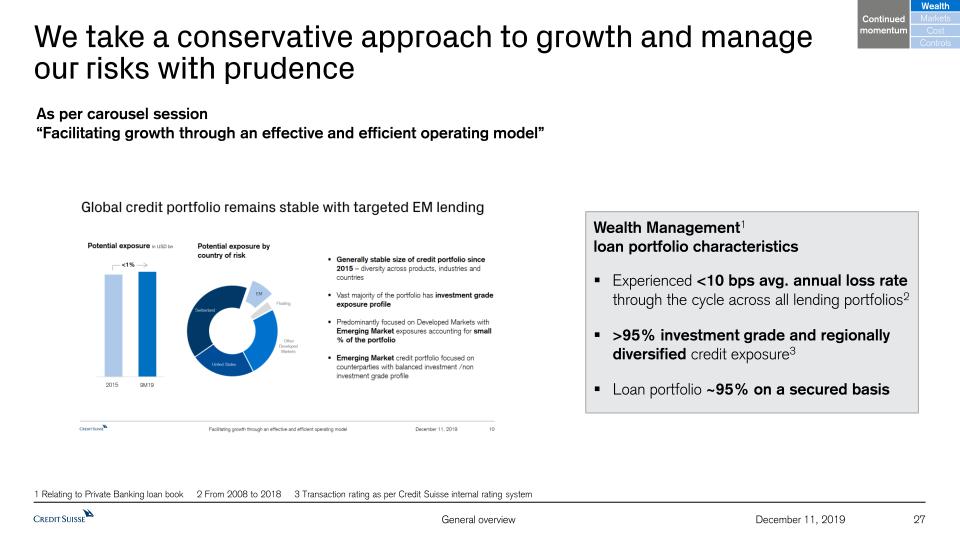

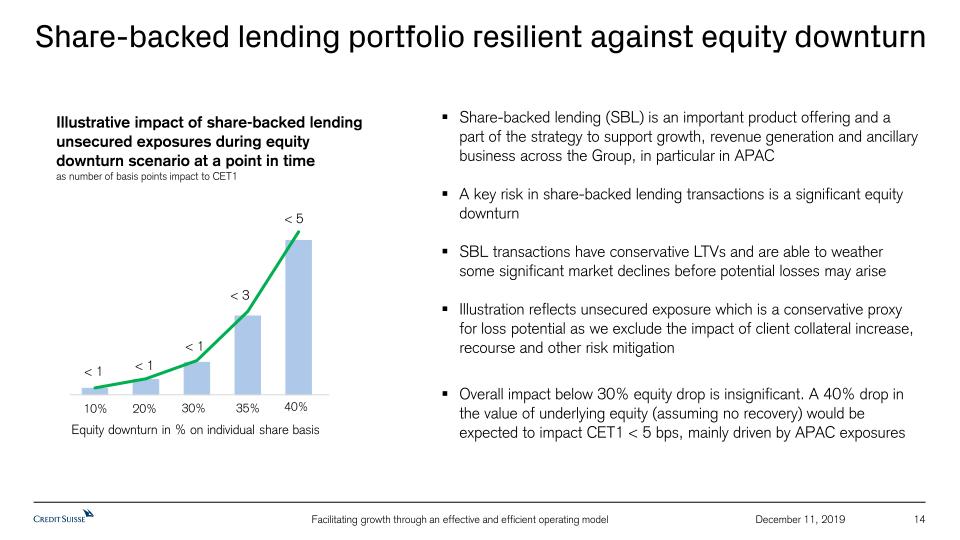

We take a conservative approach to growth and manage our risks with prudence 27 December 11, 2019 Continued momentum Markets Wealth Cost Controls As per carousel session “Facilitating growth through an effective and efficient operating model” Experienced <10 bps avg. annual loss rate through the cycle across all lending portfolios2>95% investment grade and regionally diversified credit exposure3Loan portfolio ~95% on a secured basis Wealth Management1 loan portfolio characteristics 1 Relating to Private Banking loan book 2 From 2008 to 2018 3 Transaction rating as per Credit Suisse internal rating system

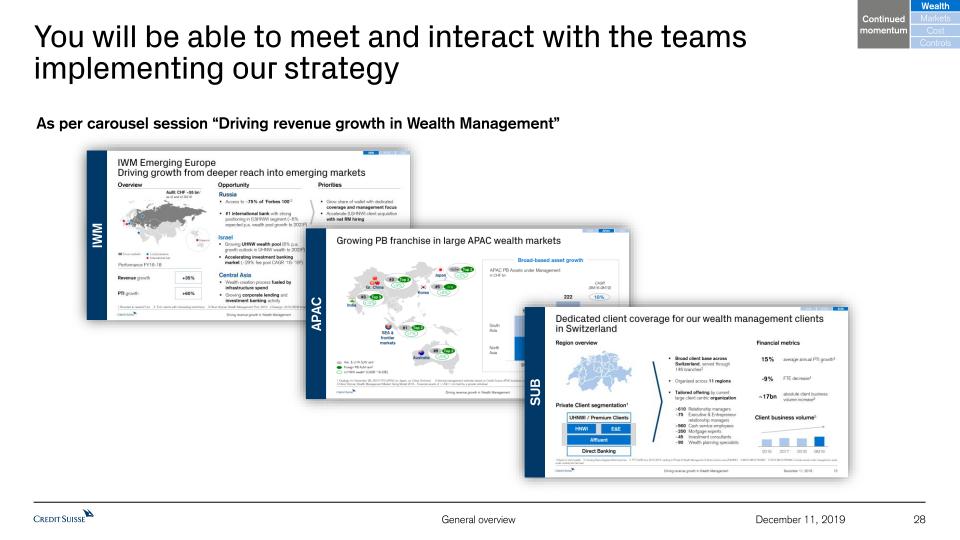

You will be able to meet and interact with the teams implementing our strategy 28 December 11, 2019 As per carousel session “Driving revenue growth in Wealth Management” Continued momentum Markets Wealth Cost Controls IWM IWM APAC APAC SUB SUB

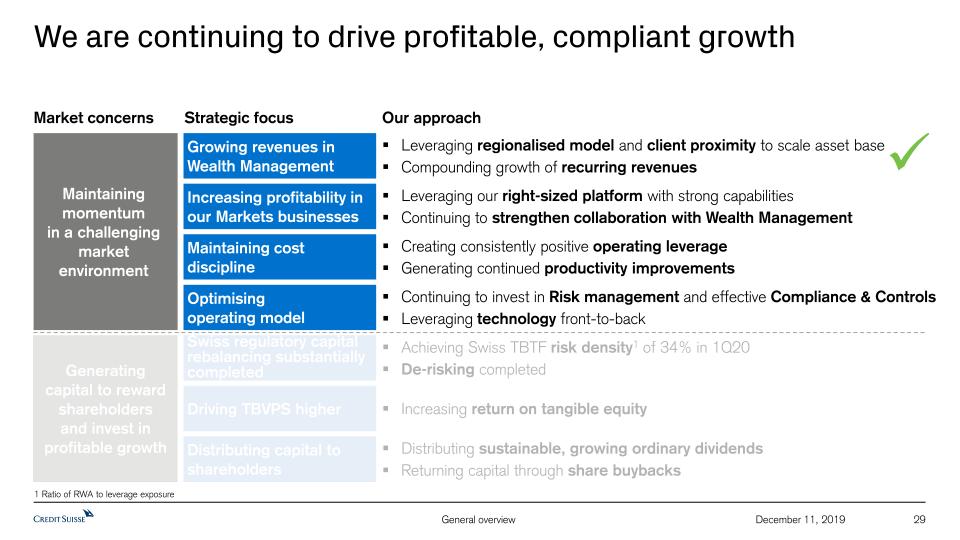

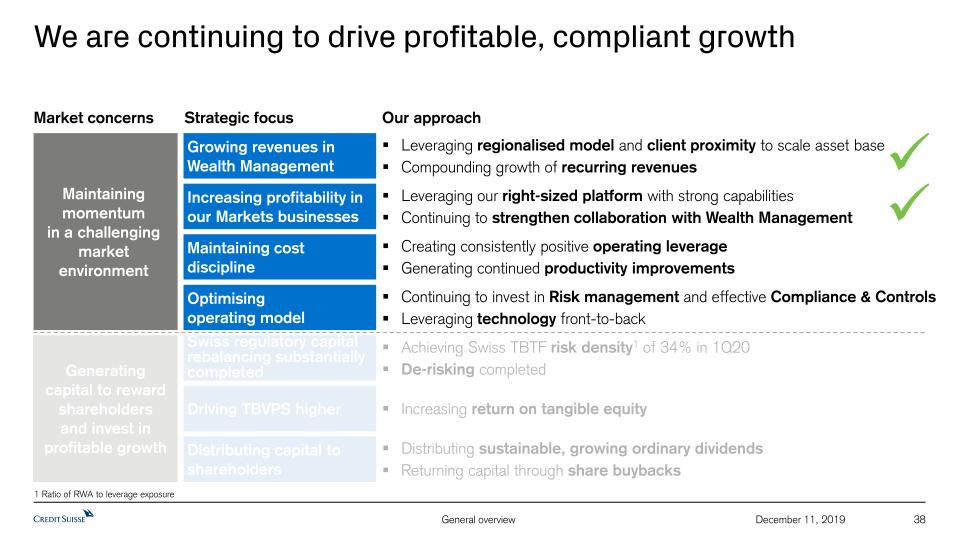

We are continuing to drive profitable, compliant growth 29 December 11, 2019 1 Ratio of RWA to leverage exposure Maintaining momentumin a challenging market environment Market concerns Generating capital to reward shareholders and invest in profitable growth Strategic focus Creating consistently positive operating leverageGenerating continued productivity improvements Maintaining cost discipline Optimising operating model Swiss regulatory capital rebalancing substantially completed Continuing to invest in Risk management and effective Compliance & ControlsLeveraging technology front-to-back Driving TBVPS higher Achieving Swiss TBTF risk density1 of 34% in 1Q20De-risking completed Increasing return on tangible equity Our approach Leveraging our right-sized platform with strong capabilitiesContinuing to strengthen collaboration with Wealth Management Increasing profitability inour Markets businesses Growing revenues in Wealth Management Leveraging regionalised model and client proximity to scale asset base Compounding growth of recurring revenues Distributing capital to shareholders Distributing sustainable, growing ordinary dividendsReturning capital through share buybacks

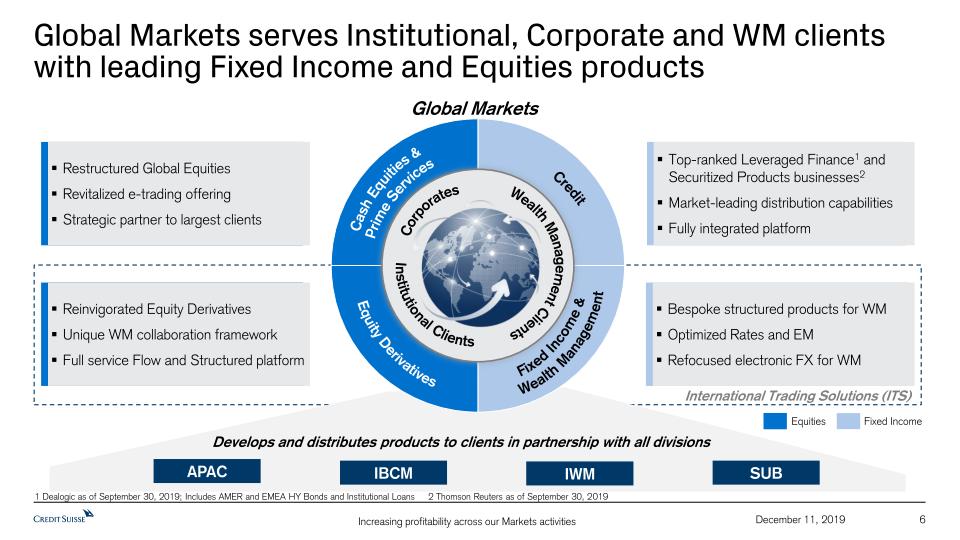

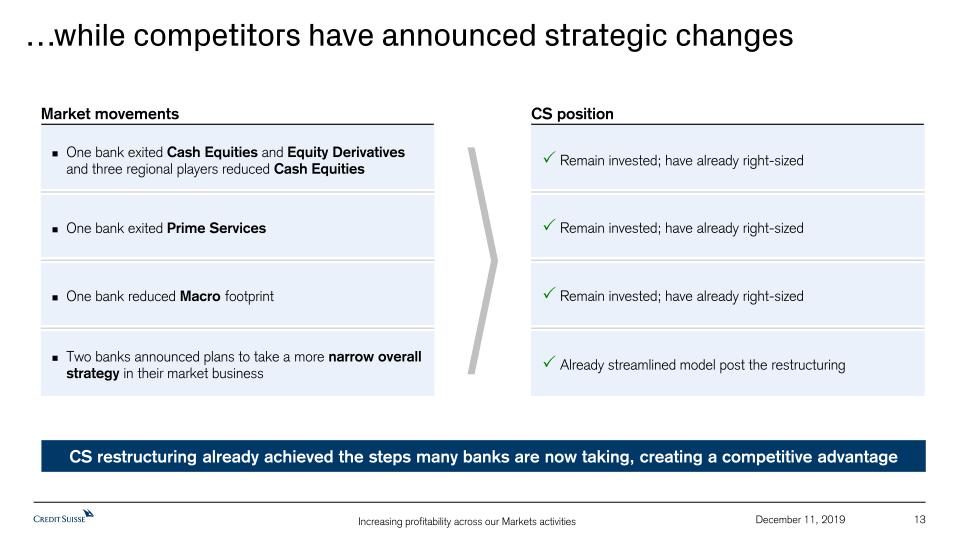

Our approach to our Markets businesses 30 December 11, 2019 Increasingconnectivity to Wealth Management Equities is keyto Wealth Management Drivingrevenue growth Completedright-sizingand de-risking Leveraging capabilitiesglobally Achieving Cost of Capital Continued momentum Markets Wealth Cost Controls

Risk-weighted assetsin USD bn We have right-sized and de-risked Global Markets… 31 December 11, 2019 -46% Note: Adjusted results are non-GAAP financial measures. A reconciliation to reported results is included in the Appendix1 Figures for 3Q15 present financial information based on results under our structure prior to our re-segmentation announcement on October 21, 2015; on the basis of our current structure, the 3Q15 RWA and leverage exposure amounts for Global Markets are USD 63 bn and USD 313 bn, respectively Global Markets key metrics Leverage exposurein USD bn Value-at-Risktrading book average one-day, 98% risk mgmt. VaR in CHF mn Adjusted operating expensesin USD bn 1 -43% 1 -52% -1.3 bn Continued momentum Markets Wealth Cost Controls

…delivered significant revenue growth and continuedcost discipline in 9M19… 32 December 11, 2019 Global Markets net revenuesin USD mn +7% Global Markets operating expensesin USD mn -6% Continued momentum Markets Wealth Cost Controls

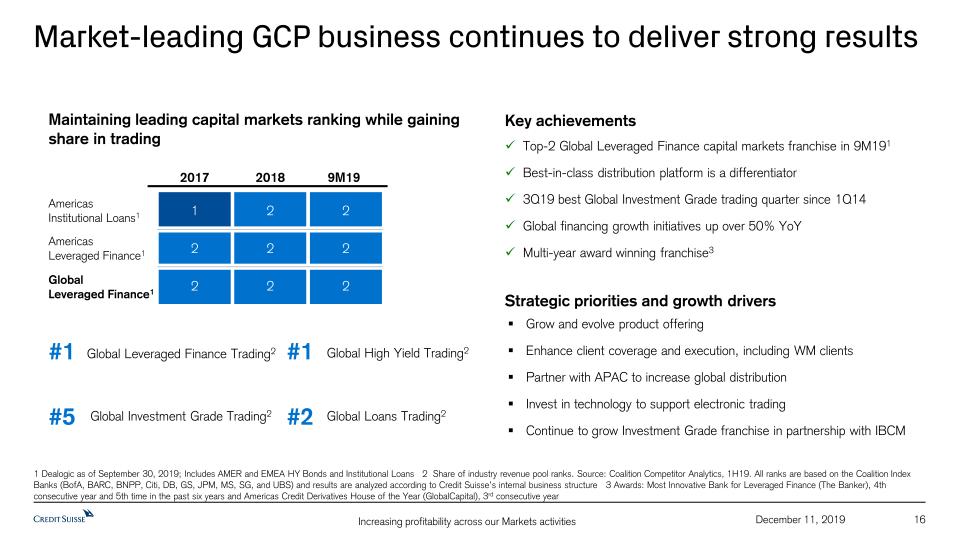

…with strong relative performance this year… 33 December 11, 2019 1 Relating to Global Markets only. Global Fixed Income Sales and Trading net revenues (across GM and APAC Markets) increased 16% in 9M19 YoY; Global Equity Sales and Trading net revenues (across GM and APAC Markets) decreased 1% YoY 2 Source: Company public disclosures. Includes Bank of America, Barclays, Citigroup, Deutsche Bank, Goldman Sachs, JPMorgan Chase, Morgan Stanley and UBS. Relating to Global Sales & Trading revenues in USD terms 3 Does not include Deutsche Bank who exited Equity Sales & Trading as part of its strategic transformation as announced on July 7, 2019 4 Source: Dealogic as of September 30, 2019; Relating to SoW rank for Americas and EMEA HY Bonds and Institutional Loans 5 Source: Thomson Reuters as of September 30, 2019 6 Source: Third party competitive analysis as of 3Q19 7 Source: The Banker as of October 4, 2019 8 Source: Global Capital as of September 26, 2019 3Q19 best Investment Grade trading quarter since 1Q14Top-2 Global Leveraged Finance capital markets franchise in 9M194Record revenues in #1 ranked Asset Finance franchise5 Best Equity Derivatives 3Q revenues since 2015#4 U.S. Cash Equities6Improved Prime Services Return on Assets for 9M19 YoY Global Markets Equity Sales & Tradingnet revenues in USD terms, 9M19 YoY 2 Global Markets Fixed Income Sales & Tradingnet revenues in USD terms, 9M19 YoY 2,3 1 1 Franchise industry awardsselected accolades Clearing Bankof the Year8 Structured ProductsHouse of the Year8 Most Innovative Bankfor Leveraged Finance7 4th consecutive year and5th time in the past six years Most Innovative Bankfor Securitization7 4th consecutive year and5th time in the past six years Credit DerivativesHouse of the Year8 3rd consecutive year Peers Peers Continued momentum Markets Wealth Cost Controls

…leading to significant profit growth and increasing returns on capital 34 December 11, 2019 Global Markets pre-tax incomein USD mn 2.5x Global Markets return on RWA1 14% 6% Global Markets return on leverage exposure2 9% 4% 1 Return on RWA is a non-GAAP financial measure and calculated using income after tax applying an assumed tax rate of 30% and 10% of average RWA based on USD 2 Return on leverage exposure is a non-GAAP financial measure and calculated using income after tax applying an assumed tax rate of 30% and 3.5% of average leverage exposure based on USD Continued momentum Markets Wealth Cost Controls

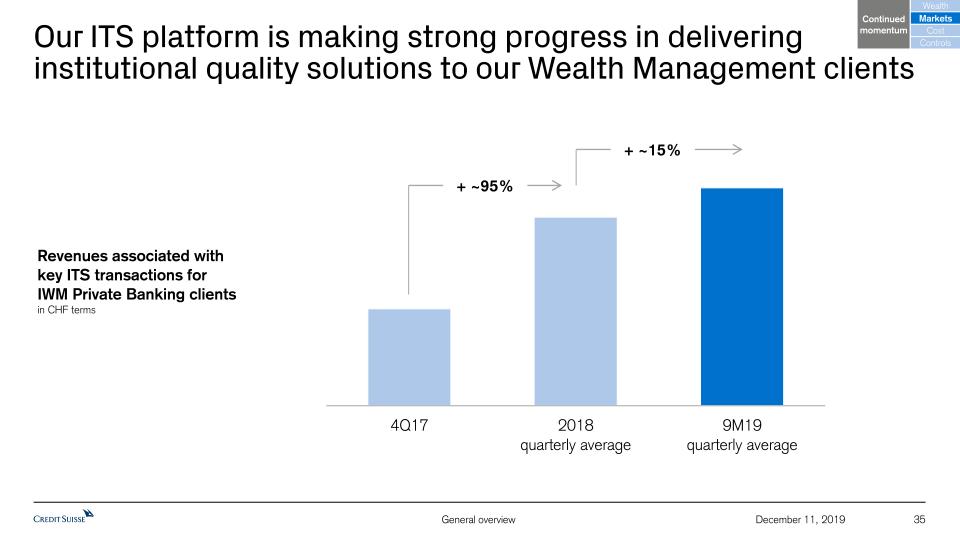

Our ITS platform is making strong progress in delivering institutional quality solutions to our Wealth Management clients 35 December 11, 2019 + ~95% + ~15% Continued momentum Markets Wealth Cost Controls Revenues associated withkey ITS transactions forIWM Private Banking clientsin CHF terms

We are uniquely positioned to leverage our Markets activities across our Wealth Management businesses 36 December 11, 2019 As per carousel session “Increasing profitability across our Markets activities” Continued momentum Markets Wealth Cost Controls

Advisory and Underwriting is core to our strategy 37 December 11, 2019 Continued momentum Markets Wealth Cost Controls We have delivered 3 years of strong results since the announcement of our strategy in 2015 and we maintain leading market positions in ECM and Leveraged FinanceOur integrated approach to Wealth Management and Investment Banking has proven successful: #1 ranked in APAC1 and Switzerland in 20192New management under the leadership of David MillerWe will continue to invest in our IBCM franchise across the US and EMEAWe are implementing a number of M&A focused strategic initiatives expected to drive incrementalrevenues for 2020-2022 and our pipeline of announced deals has been improving strongly in 4Q19Expecting pre-tax loss for 2019 including early restructuring measures 1 Source: Dealogic for the period ending September 30, 2019. Relating to APAC ex-Japan and excluding China onshore. Includes USD, EUR and JPY currencies in DCM and Loans and excludes A shares in ECM 2 Source: Dealogic as of September 30, 2019

We are continuing to drive profitable, compliant growth 38 December 11, 2019 1 Ratio of RWA to leverage exposure Maintaining momentumin a challenging market environment Market concerns Generating capital to reward shareholders and invest in profitable growth Strategic focus Creating consistently positive operating leverageGenerating continued productivity improvements Maintaining cost discipline Optimising operating model Swiss regulatory capital rebalancing substantially completed Continuing to invest in Risk management and effective Compliance & ControlsLeveraging technology front-to-back Driving TBVPS higher Achieving Swiss TBTF risk density1 of 34% in 1Q20De-risking completed Increasing return on tangible equity Our approach Leveraging our right-sized platform with strong capabilitiesContinuing to strengthen collaboration with Wealth Management Increasing profitability inour Markets businesses Growing revenues in Wealth Management Leveraging regionalised model and client proximity to scale asset base Compounding growth of recurring revenues Distributing capital to shareholders Distributing sustainable, growing ordinary dividendsReturning capital through share buybacks

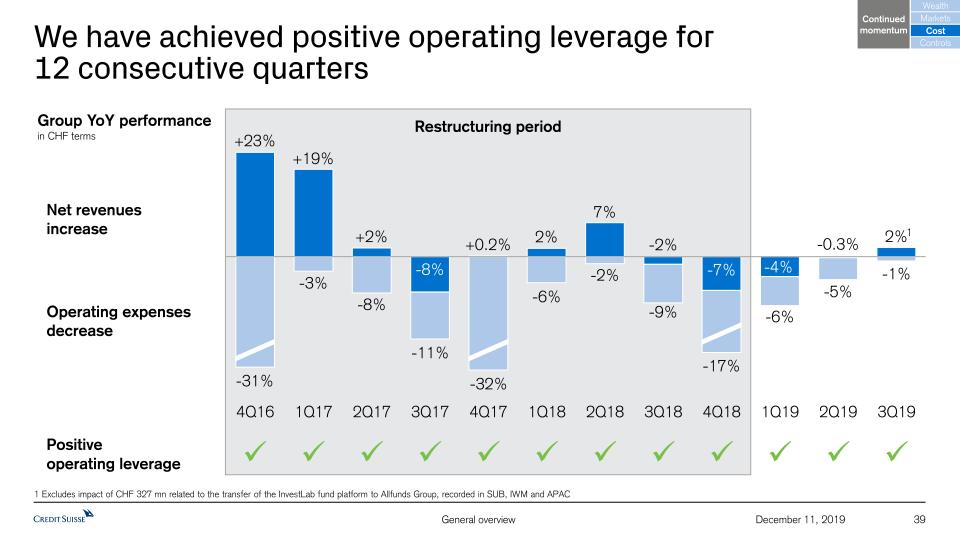

We have achieved positive operating leverage for 12 consecutive quarters 39 December 11, 2019 -31% -32% Positiveoperating leverage Group YoY performancein CHF terms Net revenuesincrease Operating expenses decrease -17% 1 Excludes impact of CHF 327 mn related to the transfer of the InvestLab fund platform to Allfunds Group, recorded in SUB, IWM and APAC 1 Restructuring period -11% Continued momentum Markets Wealth Cost Controls

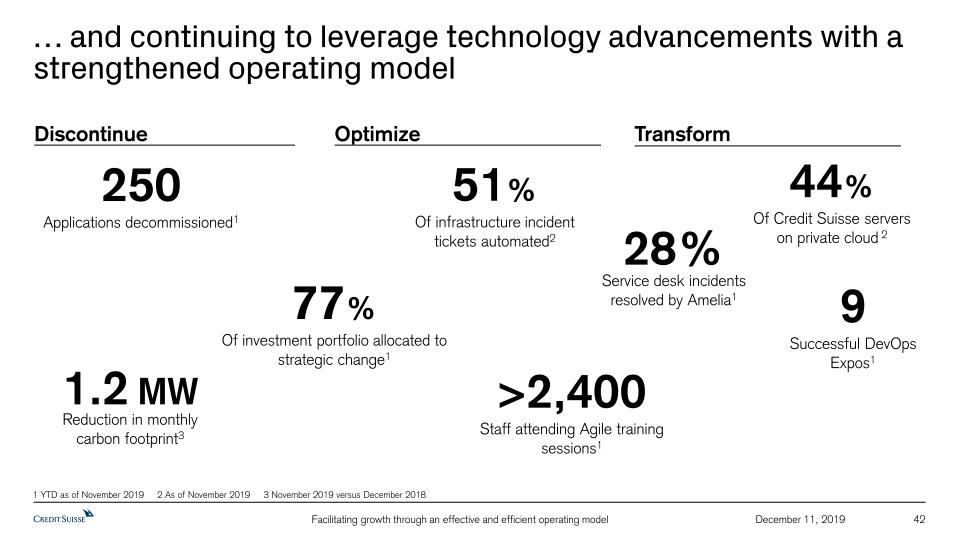

We are working hard to be both more effective and more efficient… 40 December 11, 2019 As per carousel session “Facilitating growth through an effective and efficient operating model” Continued momentum Markets Wealth Cost Controls

…and are increasingly leveraging technology 41 December 11, 2019 As per carousel session “Facilitating growth through an effective and efficient operating model” Continued momentum Markets Wealth Cost Controls

Continuing to invest in our control functions is key to our success as we grow our businesses 42 December 11, 2019 As per carousel session “Facilitating growth through an effective and efficient operating model” Compliance Risk Management Continued momentum Markets Wealth Cost Controls

Resilient business model - delivering profitable, compliant growth 2 Continued momentum in 2019 1 Agenda 43 December 11, 2019 Capital 3

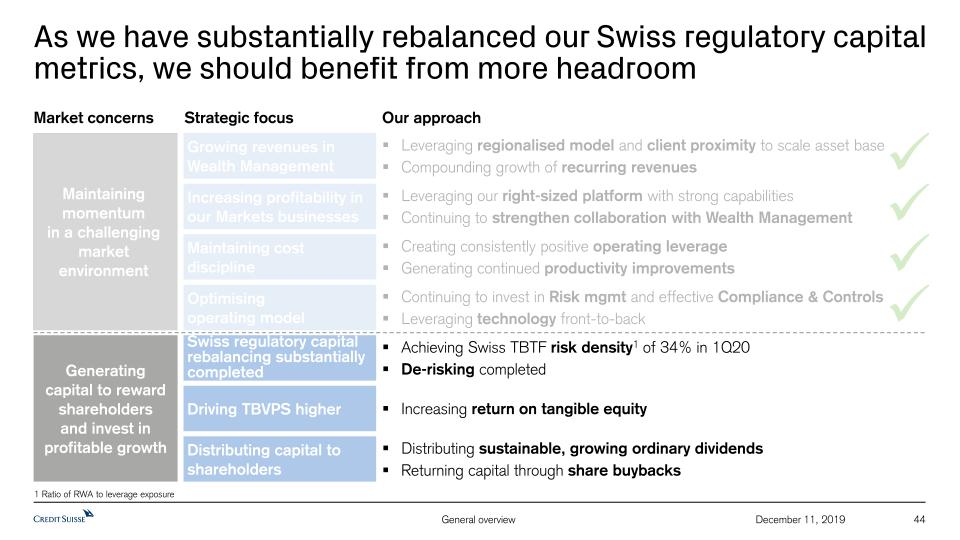

As we have substantially rebalanced our Swiss regulatory capital metrics, we should benefit from more headroom 44 December 11, 2019 1 Ratio of RWA to leverage exposure Maintaining momentumin a challenging market environment Market concerns Generating capital to reward shareholders and invest in profitable growth Strategic focus Creating consistently positive operating leverageGenerating continued productivity improvements Maintaining cost discipline Optimising operating model Swiss regulatory capital rebalancing substantially completed Continuing to invest in Risk mgmt and effective Compliance & ControlsLeveraging technology front-to-back Driving TBVPS higher Achieving Swiss TBTF risk density1 of 34% in 1Q20De-risking completed Increasing return on tangible equity Our approach Leveraging our right-sized platform with strong capabilitiesContinuing to strengthen collaboration with Wealth Management Increasing profitability inour Markets businesses Growing revenues in Wealth Management Leveraging regionalised model and client proximity to scale asset base Compounding growth of recurring revenues Distributing capital to shareholders Distributing sustainable, growing ordinary dividendsReturning capital through share buybacks

We have significantly more capital… 45 December 11, 2019 CET1 capitalin CHF bn +1.8 bn Capital RoTE Capital Distribution

…and lower absolute risk 46 December 11, 2019 Group Value-at-Risktrading book avg. one-day, 98% risk management VaRin CHF mn -45% Group Level 3 assetsin CHF bn -51% Global Markets Leverage exposurein USD bn -43% Capital RoTE Capital Distribution 1 Presents financial information based on results under our structure prior to our re-segmentation announcement on October 21, 2015; on the basis of our current structure, 9M15 leverage exposure for Global Markets is USD 313 bn 1

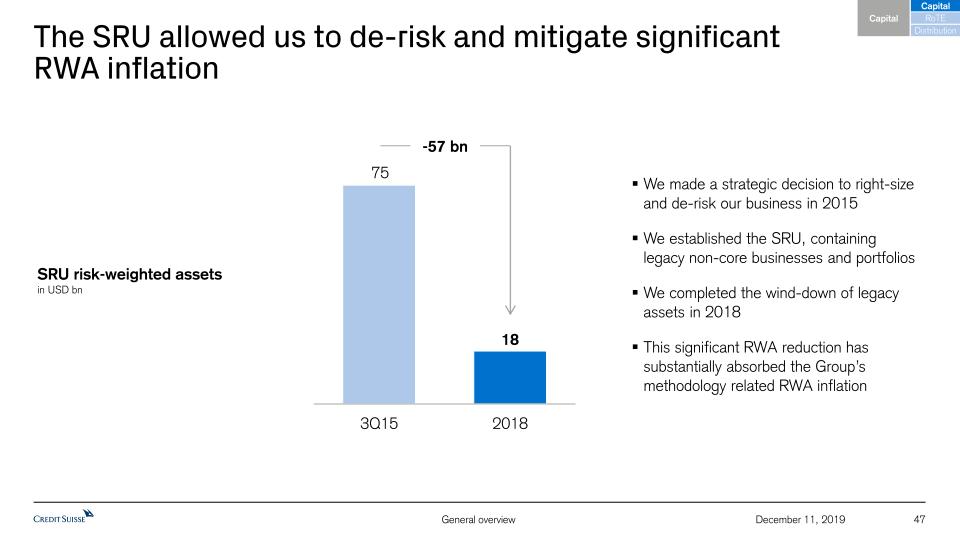

The SRU allowed us to de-risk and mitigate significant RWA inflation 47 December 11, 2019 SRU risk-weighted assetsin USD bn Capital RoTE Capital Distribution -57 bn 75 We made a strategic decision to right-size and de-risk our business in 2015We established the SRU, containinglegacy non-core businesses and portfoliosWe completed the wind-down of legacy assets in 2018This significant RWA reduction has substantially absorbed the Group’s methodology related RWA inflation

We absorbed CHF 64 bn of methodology relatedRWA inflation since 2014… 48 December 11, 2019 Risk-weighted assetsin CHF bn 1 Includes RWA increase from both internal and external model and parameter updates as well as methodology and policy changes 2 Related to SUB 2 Capital RoTE Capital Distribution 1

…which impacted our published regulatory CET1 ratio during the last two years 49 December 11, 2019 CET1 ratio -40 bps RWA in CHF bn 302 290 268 272 285 284 Capital RoTE Capital Distribution

After several years of significant RWA inflation, we have substantially rebalanced our Swiss regulatory capital metrics… 50 December 11, 2019 1 Ratio of RWA to leverage exposure 2 Reflects the 35% risk density basis used to calibrate the Swiss TBTF2 framework currently in place 3 Includes expected RWA inflation of ~CHF 12-13 bn for SA-CCR/IMM, Equity Investments in Funds, Central Counterparties and other non-Basel III methodology changes Capital RoTE Capital Distribution Swiss TBTF framework235% Credit Suisse risk density1 3 34%

…and RWA inflation is expected to be minimal over the next three years after 1Q20 51 December 11, 2019 1 Includes external and internal model and parameter updates2 Estimates and assumptions are based on currently available information and beliefs, expectations and opinions of management and include all known facts and decisions as of December 11, 2019. Actual results may differ Expected RWA increase fromBasel III reforms & other methodology changes1in CHF bn Post Basel III reforms, no significant RWA inflation expected over the next three yearsWe expect FRTB to be aligned with EU implementation ~12-13 1 1 1 Capital RoTE Capital Distribution not significant

Our headroom to distribute capital and invest in our businesses is expected to increase after 1Q20 52 December 11, 2019 1 Estimates and assumptions are based on currently available information and beliefs, expectations and opinions of management and include all known facts and decisions as of December 11, 2019. Actual results may differ Capital RoTE Capital Distribution As per 2018 Investor Day 20191 20201

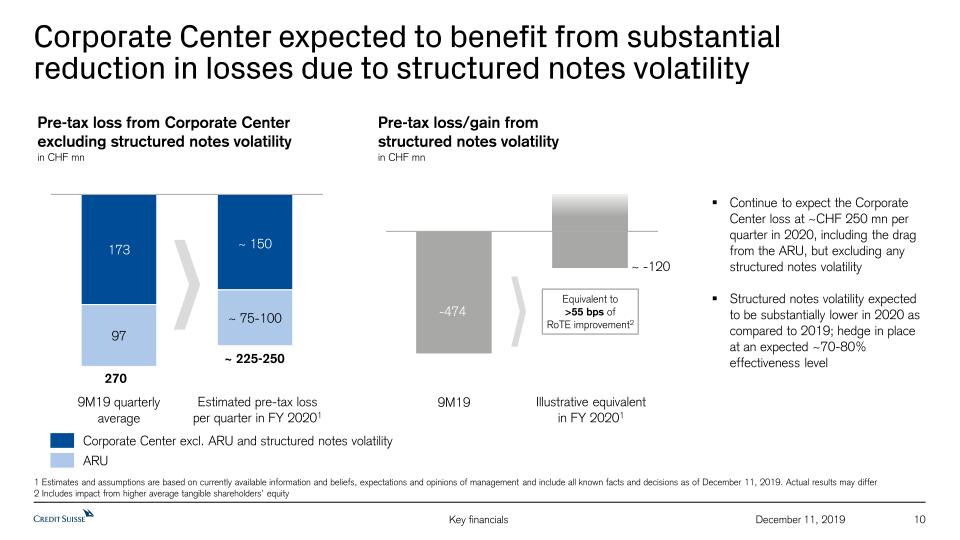

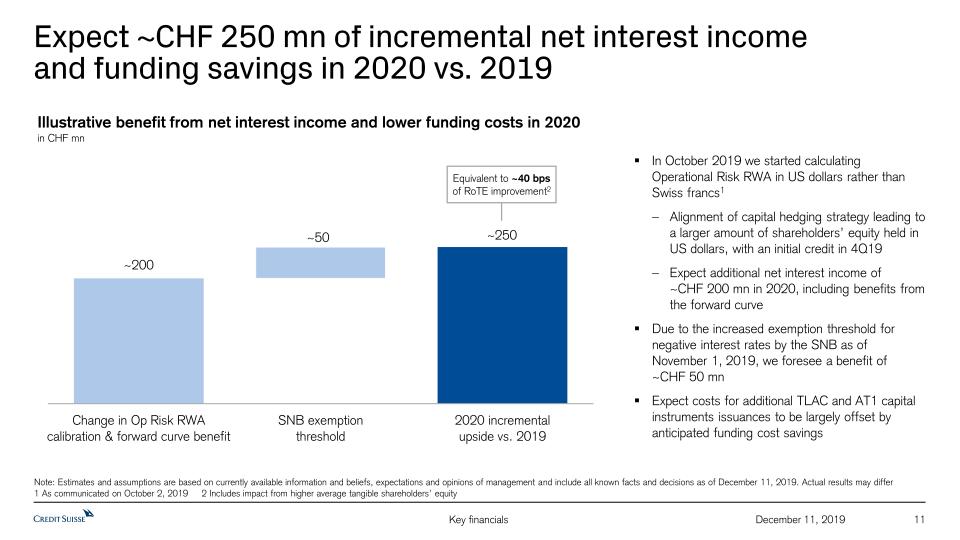

We expect to deliver ~175 bps of RoTE uplift in 2020… 53 December 11, 2019 Note: Illustrative path. ‡ RoTE is a non-GAAP financial measure, see Appendix1 Based on Consensus Summary published by Credit Suisse Group on October 18, 2019 and available on the Credit Suisse website. Consensus data is used solely for illustrative purposes. Actual results may differ significantly 2 Estimates and assumptions are based on currently available information and beliefs, expectations and opinions of management and include all known facts and decisions as of December 11, 2019. Actual results may differ 3 Includes impact from higher average tangible shareholders’ equity ~ +175 bps 1 3 2 3 2 3 Capital RoTE Capital Distribution RoTE‡ developmentbased on CHF 3 3

…with additional potential upside and measures to protect our RoTE in challenging markets 54 December 11, 2019 Constructive market environment Challenging market environment ~11% 10% Revenue growth Additional cost measuresof up to 40 bps Note: Illustrative path. ‡ RoTE is a non-GAAP financial measure, see Appendix1 Estimates and assumptions are based on currently available information and beliefs, expectations and opinions of management and include all known facts and decisions as of December 11, 2019. Actual results may differ ~10% RoTE‡ developmentbased on CHF 1 Capital RoTE Capital Distribution

We expect to continue operating profitably and return capital to shareholders in 2020 55 December 11, 2019 Share buyback programup to CHF 1.5 bn approved withat least CHF 1.0 bn expected in 20201 Sustainable ordinary dividendexpected to increase by at least 5% p.a. ‡ RoTE is a non-GAAP financial measure, see Appendix1 Subject to market and economic conditions Capital RoTE Capital Distribution 10% RoTE‡ Expect to distribute at least 50% of net income to shareholders

Consistent growth and continued disciplined execution is expected to drive an RoTE of 12%+ in the medium term 56 December 11, 2019 RoTE‡12%+medium term ambition Consistent growth in AuM Compounding NII and recurring revenues in Wealth Management Increasing profitability in our Markets businesses and IBCM Continued cost discipline and productivity improvements Reduced capital need for regulatory inflation ‡ RoTE is a non-GAAP financial measures, see Appendix Increasing capital allocation to our higher-return, higher-growth businesses

57 December 11, 2019 Programme of the day Q&A & wrap-up Webcast 3:45 pm Investor Day 2019 Lunch break 12:00 pm 60 min Coffee break 3:30 pm 15 min General overview Webcast 8:30 am Thiam 40 min Coffee break 10:30 am 15 min Key financials Webcast 9:10 am 20 min Mathers Growth in Wealth Management Webcast 9:30 am Gottstein, Wehle, Sitohang 30 min Break-out sessions (rounds 2 & 3) 1:00 pm 75 min each Wehle, Sitohang, Gottstein Driving revenue growth in Wealth Management Chin, Miller Increasing profitability across our Markets activities Warner, Hudson, Walker Facilitating growth through an effective and efficient operating model 10:45 am 75 min Delivering profitable growth in a low interest rate environmentBreak-out sessions (round 1) An effective approach: 3 case studies Webcast 10:00 am Varvel, Drew, Low/Hung 30 min

Appendix 58 December 11, 2019

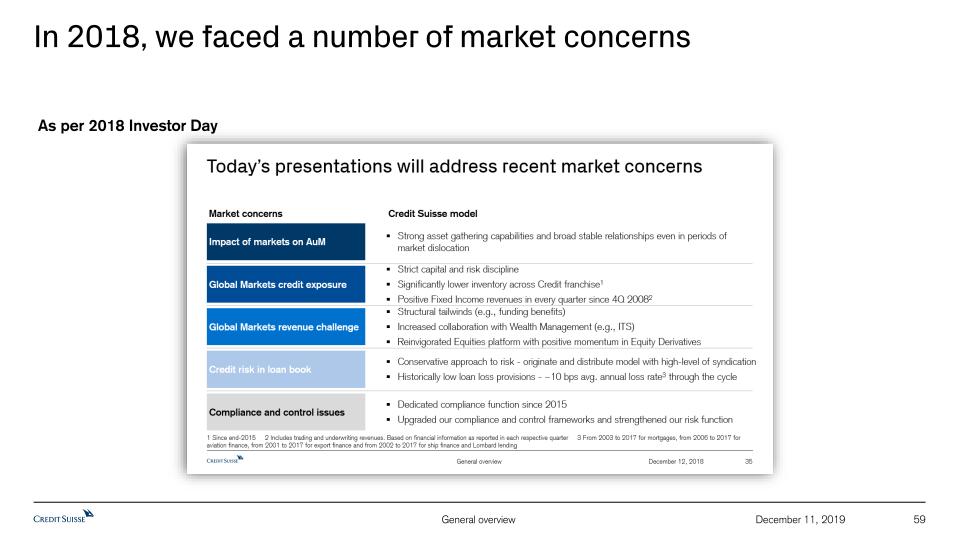

In 2018, we faced a number of market concerns 59 December 11, 2019 As per 2018 Investor Day

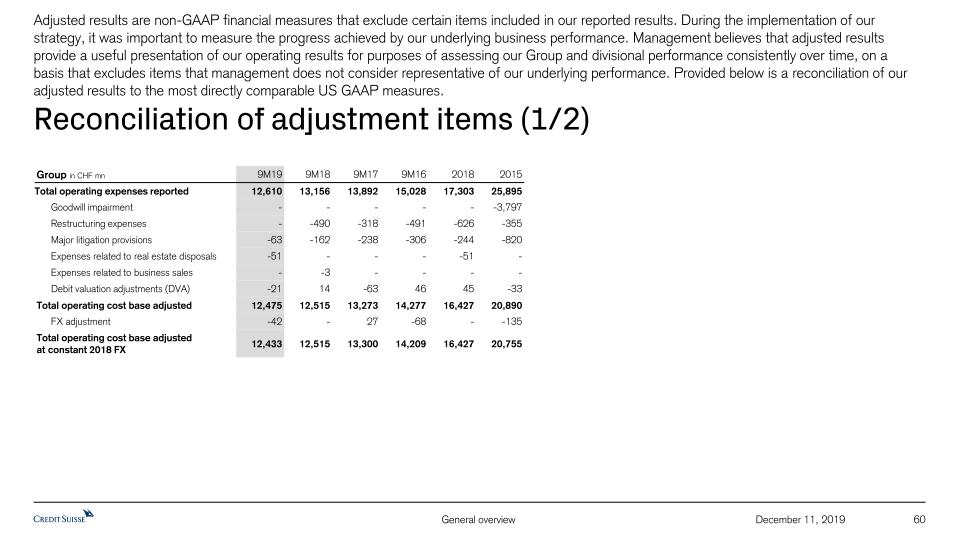

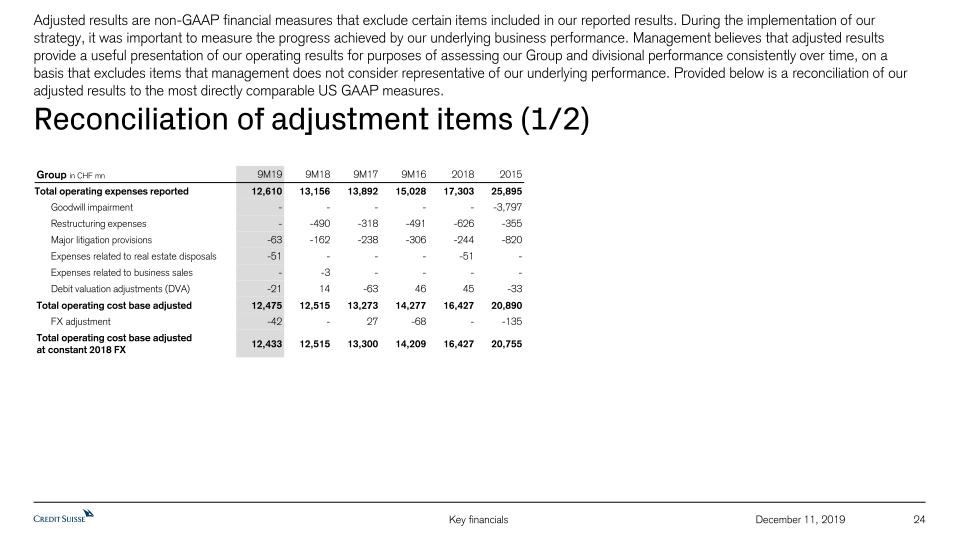

Reconciliation of adjustment items (1/2) 60 December 11, 2019 Adjusted results are non-GAAP financial measures that exclude certain items included in our reported results. During the implementation of our strategy, it was important to measure the progress achieved by our underlying business performance. Management believes that adjusted results provide a useful presentation of our operating results for purposes of assessing our Group and divisional performance consistently over time, on a basis that excludes items that management does not consider representative of our underlying performance. Provided below is a reconciliation of our adjusted results to the most directly comparable US GAAP measures. Group in CHF mn 9M19 9M18 9M17 9M16 2018 2015 Total operating expenses reported 12,610 13,156 13,892 15,028 17,303 25,895 Goodwill impairment - - - - - -3,797 Restructuring expenses - -490 -318 -491 -626 -355 Major litigation provisions -63 -162 -238 -306 -244 -820 Expenses related to real estate disposals -51 - - - -51 - Expenses related to business sales - -3 - - - - Debit valuation adjustments (DVA) -21 14 -63 46 45 -33 Total operating cost base adjusted 12,475 12,515 13,273 14,277 16,427 20,890 FX adjustment -42 - 27 -68 - -135 Total operating cost base adjusted at constant 2018 FX 12,433 12,515 13,300 14,209 16,427 20,755

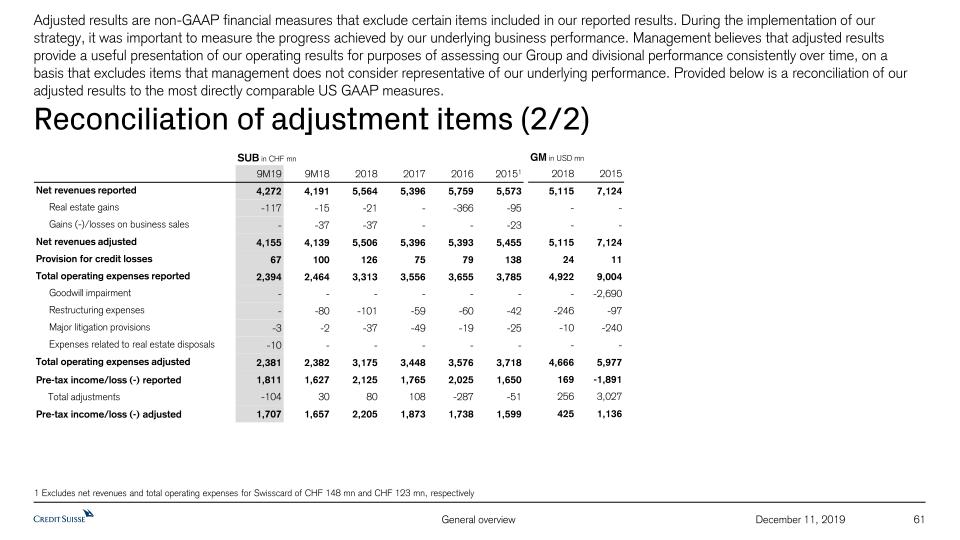

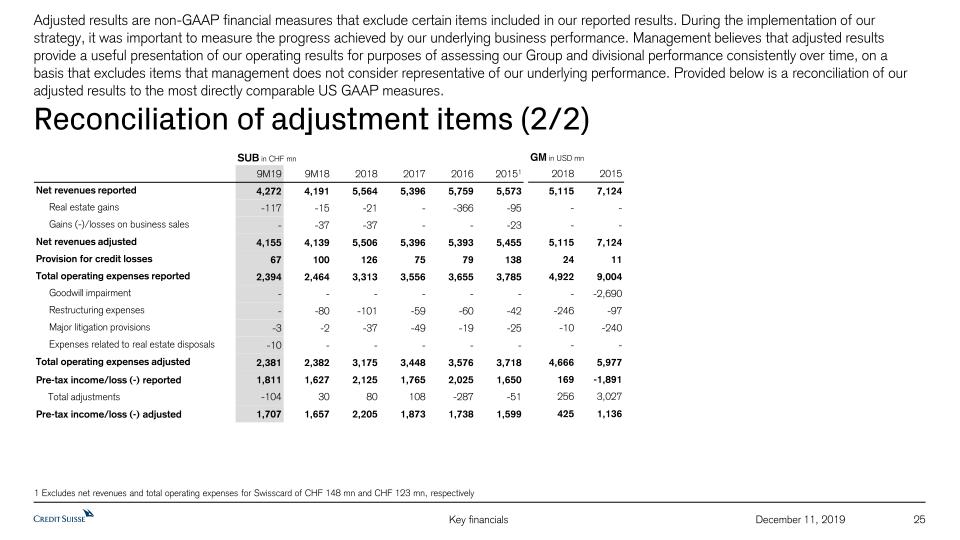

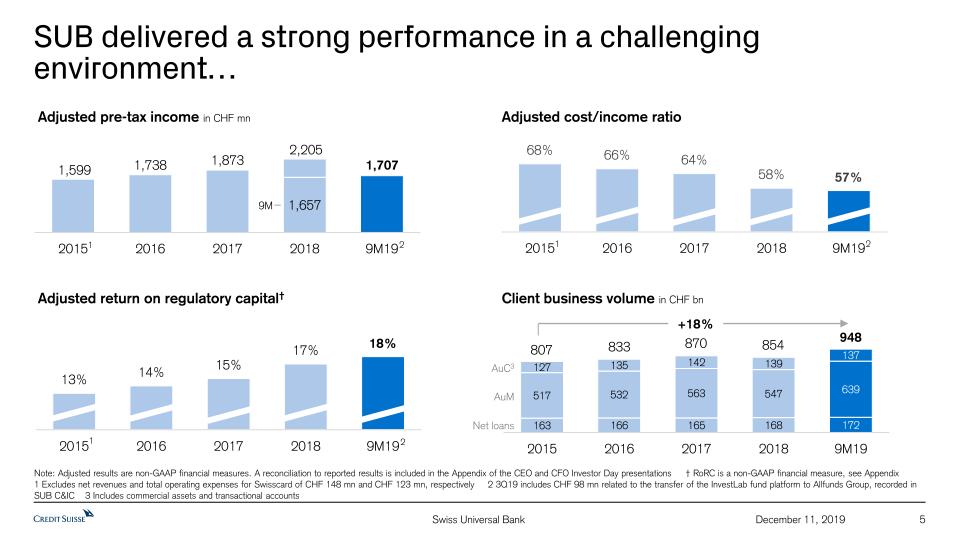

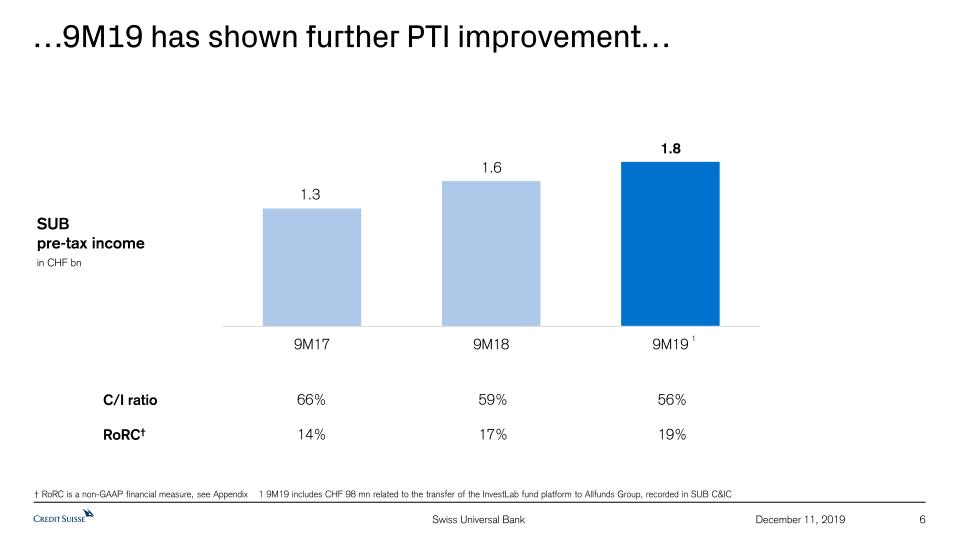

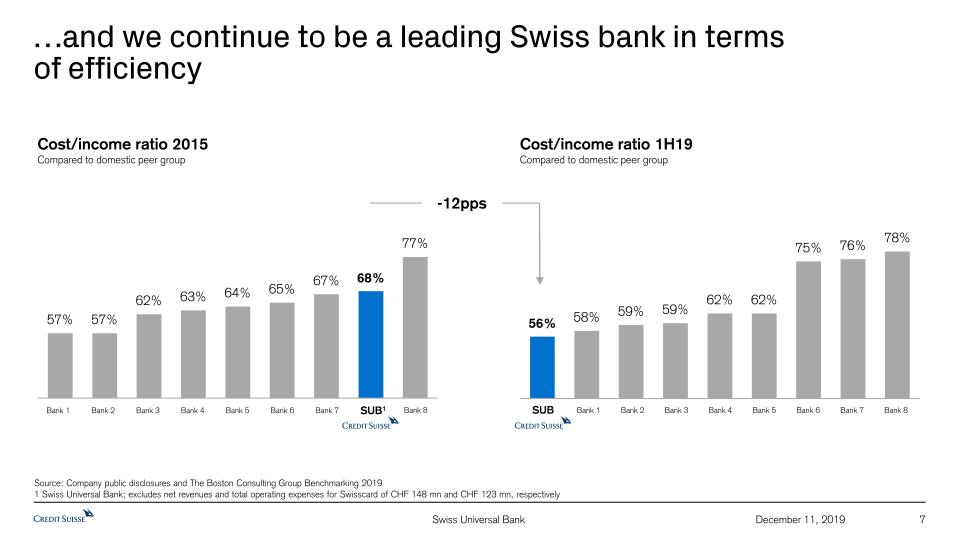

Reconciliation of adjustment items (2/2) 61 December 11, 2019 Adjusted results are non-GAAP financial measures that exclude certain items included in our reported results. During the implementation of our strategy, it was important to measure the progress achieved by our underlying business performance. Management believes that adjusted results provide a useful presentation of our operating results for purposes of assessing our Group and divisional performance consistently over time, on a basis that excludes items that management does not consider representative of our underlying performance. Provided below is a reconciliation of our adjusted results to the most directly comparable US GAAP measures. GM in USD mn 2018 2015 5,115 7,124 - - - - 5,115 7,124 24 11 4,922 9,004 - -2,690 -246 -97 -10 -240 - - 4,666 5,977 169 -1,891 256 3,027 425 1,136 SUB in CHF mn 9M19 9M18 2018 2017 2016 20151 Net revenues reported 4,272 4,191 5,564 5,396 5,759 5,573 Real estate gains -117 -15 -21 - -366 -95 Gains (-)/losses on business sales - -37 -37 - - -23 Net revenues adjusted 4,155 4,139 5,506 5,396 5,393 5,455 Provision for credit losses 67 100 126 75 79 138 Total operating expenses reported 2,394 2,464 3,313 3,556 3,655 3,785 Goodwill impairment - - - - - - Restructuring expenses - -80 -101 -59 -60 -42 Major litigation provisions -3 -2 -37 -49 -19 -25 Expenses related to real estate disposals -10 - - - - - Total operating expenses adjusted 2,381 2,382 3,175 3,448 3,576 3,718 Pre-tax income/loss (-) reported 1,811 1,627 2,125 1,765 2,025 1,650 Total adjustments -104 30 80 108 -287 -51 Pre-tax income/loss (-) adjusted 1,707 1,657 2,205 1,873 1,738 1,599 1 Excludes net revenues and total operating expenses for Swisscard of CHF 148 mn and CHF 123 mn, respectively

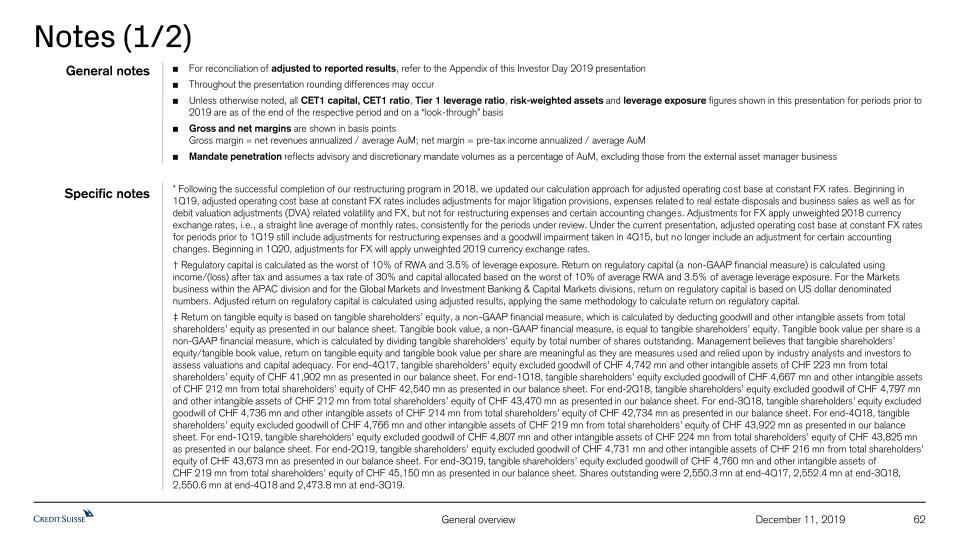

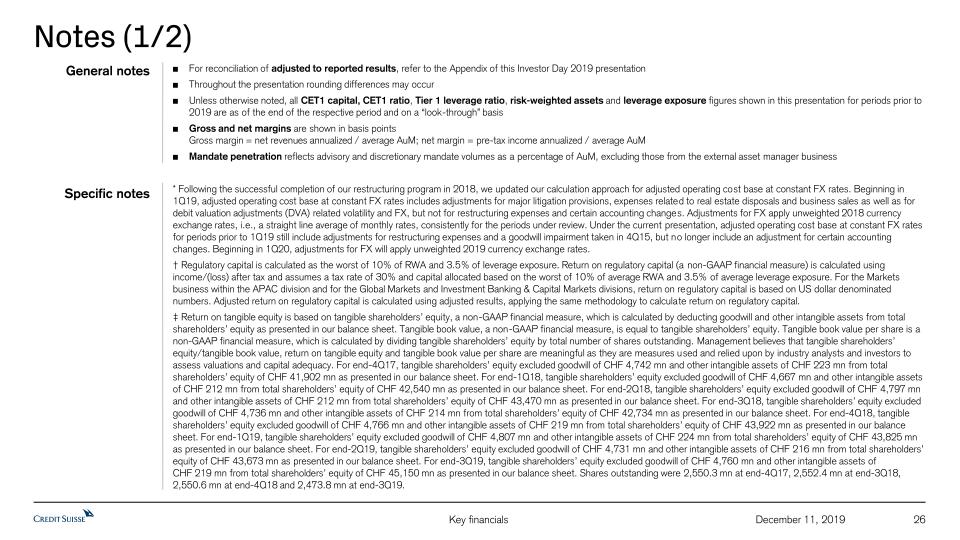

62 December 11, 2019 Notes (1/2) For reconciliation of adjusted to reported results, refer to the Appendix of this Investor Day 2019 presentationThroughout the presentation rounding differences may occurUnless otherwise noted, all CET1 capital, CET1 ratio, Tier 1 leverage ratio, risk-weighted assets and leverage exposure figures shown in this presentation for periods prior to 2019 are as of the end of the respective period and on a “look-through” basisGross and net margins are shown in basis pointsGross margin = net revenues annualized / average AuM; net margin = pre-tax income annualized / average AuMMandate penetration reflects advisory and discretionary mandate volumes as a percentage of AuM, excluding those from the external asset manager business General notes Specific notes * Following the successful completion of our restructuring program in 2018, we updated our calculation approach for adjusted operating cost base at constant FX rates. Beginning in 1Q19, adjusted operating cost base at constant FX rates includes adjustments for major litigation provisions, expenses related to real estate disposals and business sales as well as for debit valuation adjustments (DVA) related volatility and FX, but not for restructuring expenses and certain accounting changes. Adjustments for FX apply unweighted 2018 currency exchange rates, i.e., a straight line average of monthly rates, consistently for the periods under review. Under the current presentation, adjusted operating cost base at constant FX rates for periods prior to 1Q19 still include adjustments for restructuring expenses and a goodwill impairment taken in 4Q15, but no longer include an adjustment for certain accounting changes. Beginning in 1Q20, adjustments for FX will apply unweighted 2019 currency exchange rates.† Regulatory capital is calculated as the worst of 10% of RWA and 3.5% of leverage exposure. Return on regulatory capital (a non-GAAP financial measure) is calculated using income/(loss) after tax and assumes a tax rate of 30% and capital allocated based on the worst of 10% of average RWA and 3.5% of average leverage exposure. For the Markets business within the APAC division and for the Global Markets and Investment Banking & Capital Markets divisions, return on regulatory capital is based on US dollar denominated numbers. Adjusted return on regulatory capital is calculated using adjusted results, applying the same methodology to calculate return on regulatory capital. ‡ Return on tangible equity is based on tangible shareholders’ equity, a non-GAAP financial measure, which is calculated by deducting goodwill and other intangible assets from total shareholders’ equity as presented in our balance sheet. Tangible book value, a non-GAAP financial measure, is equal to tangible shareholders’ equity. Tangible book value per share is a non-GAAP financial measure, which is calculated by dividing tangible shareholders’ equity by total number of shares outstanding. Management believes that tangible shareholders’ equity/tangible book value, return on tangible equity and tangible book value per share are meaningful as they are measures used and relied upon by industry analysts and investors to assess valuations and capital adequacy. For end-4Q17, tangible shareholders’ equity excluded goodwill of CHF 4,742 mn and other intangible assets of CHF 223 mn from total shareholders’ equity of CHF 41,902 mn as presented in our balance sheet. For end-1Q18, tangible shareholders’ equity excluded goodwill of CHF 4,667 mn and other intangible assets of CHF 212 mn from total shareholders’ equity of CHF 42,540 mn as presented in our balance sheet. For end-2Q18, tangible shareholders’ equity excluded goodwill of CHF 4,797 mn and other intangible assets of CHF 212 mn from total shareholders’ equity of CHF 43,470 mn as presented in our balance sheet. For end-3Q18, tangible shareholders’ equity excluded goodwill of CHF 4,736 mn and other intangible assets of CHF 214 mn from total shareholders’ equity of CHF 42,734 mn as presented in our balance sheet. For end-4Q18, tangible shareholders’ equity excluded goodwill of CHF 4,766 mn and other intangible assets of CHF 219 mn from total shareholders’ equity of CHF 43,922 mn as presented in our balance sheet. For end-1Q19, tangible shareholders’ equity excluded goodwill of CHF 4,807 mn and other intangible assets of CHF 224 mn from total shareholders’ equity of CHF 43,825 mn as presented in our balance sheet. For end-2Q19, tangible shareholders’ equity excluded goodwill of CHF 4,731 mn and other intangible assets of CHF 216 mn from total shareholders’ equity of CHF 43,673 mn as presented in our balance sheet. For end-3Q19, tangible shareholders’ equity excluded goodwill of CHF 4,760 mn and other intangible assets ofCHF 219 mn from total shareholders’ equity of CHF 45,150 mn as presented in our balance sheet. Shares outstanding were 2,550.3 mn at end-4Q17, 2,552.4 mn at end-3Q18, 2,550.6 mn at end-4Q18 and 2,473.8 mn at end-3Q19.