FINANCIAL PRODUCTS TERM SHEET T2431 |

Filed pursuant to Rule 433 Registration Statement No. 333-238458-02

|

|

Market-Linked Securities – Auto-Callable with Fixed Percentage Buffered Downside Principal at Risk Securities Linked to an International Equity Index Basket due August 3, 2026 Term Sheet to Preliminary Pricing Supplement No. T2431 dated July 18, 2022 |

Summary of Terms

| Issuer: | Credit Suisse AG (“Credit Suisse”), acting through its London branch |

| Agent: | Wells Fargo Securities, LLC |

| Market Measure: | A basket (the “Basket”) comprised of the following unequally weighted basket components (each, a “Basket Component” and, together, the “Basket Components”), with the return of each Basket Component having the weighting noted parenthetically: the EURO STOXX 50® Index (45%); the FTSE® 100 Index (20%); the Nikkei 225 Index (20%); the Swiss Market Index® (7.50%); and the S&P/ASX 200 Index (7.50%) |

| Pricing Date*: | July 29, 2022 |

| Issue Date*: | August 3, 2022 |

| Face Amount and Original Offering Price: | $1,000 per security |

| Automatic Call: | If the basket closing level on any call date is greater than or equal to the starting level, the securities will be automatically called for the face amount plus the call premium applicable to that call date. |

| Call Dates* and Call Premiums: | Call Date | Call Premium† |

| August 3, 2023 | At least 10.15% of the face amount | |

| August 5, 2024 | At least 20.30% of the face amount | |

| August 4, 2025 |

At least 30.45% of the face amount | |

| July 27, 2026 (the “final calculation day”) | At least 40.60% of the face amount |

| † to be determined on the pricing date. | |

| Maturity Payment Amount (per security): |

If the securities are not automatically called, the “maturity payment amount” will equal: · if the ending level is less than the starting level but greater than or equal to the threshold level: $1,000; or · if the ending level is less than the threshold level: $1,000 + [$1,000 × (basket return + buffer amount)] |

| Stated Maturity Date*: | August 3, 2026 |

| Call Settlement Date*: | Five business days after the applicable call date (if the securities are called on the last call date, the call settlement date will be the stated maturity date). |

| Ending Level: | The basket closing level on the final calculation day. |

| Basket Closing Level: | On any calculation day, the “basket closing level” will be calculated based on the weighted returns of the Basket Components and will be equal to the product of (i) 100 and (ii) an amount equal to 1 plus the sum of: (A) 45% of the component return of the EURO STOXX 50® Index on such calculation day; (B) 20% of the component return of the FTSE® 100 Index on such calculation day; (C) 20% of the component return of the Nikkei 225 Index on such calculation day; (D) 7.50% of the component return of the Swiss Market Index® on such calculation day; and (E) 7.50% of the component return of the S&P/ASX 200 Index on such calculation day. |

| Basket Return: |

The “basket return” will be equal to: ending level – starting level starting level |

| Component Return: |

On any calculation day, the “component return” of a Basket Component will be equal to: basket component closing level – initial component level initial component level where,

· the “initial component level” will be the closing level of such Basket Component on the pricing date; and · the “basket component closing level” will be the closing level of such Basket Component on such calculation day. In the event that the closing level of any Basket Component is not available on the pricing date, the initial component level of such Basket Component will be determined on the immediately following trading day on which a closing level of such Basket Component is available. |

* subject to change

Summary of Terms (continued)

| Starting Level: | The “starting level” is 100. |

| Threshold Level: | 90, which is equal to 90% of the starting level |

| Buffer Amount: | 10% |

| Calculation Agent: | Credit Suisse International |

| Denominations: | $1,000 and any integral multiple of $1,000 |

| Fees: | Wells Fargo Securities, LLC (“WFS”) will act as agent for the securities and will receive an agent discount of up to $28.25 per security. The agent may resell the securities to other securities dealers at the original offering price of the securities less a concession not in excess of $17.50 per security. Such securities dealers may include those using the trade name Wells Fargo Advisors (“WFA”). In addition to the concession allowed to WFA, WFS may pay $0.75 per security of the agent’s discount to WFA as a distribution expense fee for each security sold by WFA. In addition, Credit Suisse may pay a fee of up to $1.00 per security to selected securities dealers in consideration for marketing and other services in connection with the distribution of the securities to other securities dealers. |

| CUSIP: | 22553QD53 |

| Material Tax Consequences: | See the preliminary pricing supplement |

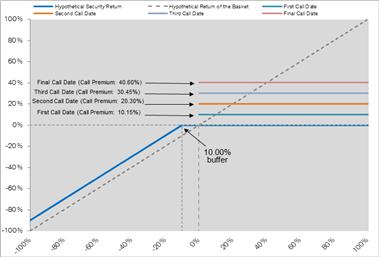

Hypothetical Payout Profile**

**assumes a call premium equal to the lowest possible call premium that may be determined on the pricing date.

If the securities are not automatically called and the ending level is less than the threshold level, you will have 1-to-1 downside exposure to the decrease in the level of the Basket in excess of the buffer amount and will lose some, and possibly up to 90%, of the face amount of your securities at maturity.

Any positive return on the securities will be limited to the applicable call premium, even if the basket closing level on the applicable call date significantly exceeds the starting level. You will not participate in any appreciation of the Basket beyond the applicable call premium.

Credit Suisse currently estimates the value of each $1,000 face amount of the securities on the pricing date will be between $945.00 and $975.00 (as determined by reference to our pricing models and the rate we are currently paying to borrow funds through issuance of the securities (our internal funding rate)). This range of estimated values reflects terms that are not yet fixed. A single estimated value reflecting final terms will be determined on the pricing date. See “Investment Description” and “Selected Risk Considerations” in the accompanying preliminary pricing supplement.

[Preliminary

Pricing Supplement: https://www.sec.gov/Archives/edgar/data/1053092/00009501032201

2514/dp177091_424b2-t2431.htm

]

|

The securities have complex features and investing in the securities involves risks not associated with an investment in conventional debt securities. See “Selected Risk Considerations” in this term sheet and the accompanying preliminary pricing supplement and “Risk Factors” in the accompanying product supplement. This introductory term sheet does not provide all of the information that an investor should consider prior to making an investment decision. Investors should carefully review the accompanying preliminary pricing supplement, underlying supplement, product supplement, prospectus supplement and prospectus before making a decision to invest in the securities. NOT A BANK DEPOSIT AND NOT INSURED OR GUARANTEED BY THE FDIC OR ANY OTHER GOVERNMENTAL AGENCY |

Selected Risk Considerations

The risks set forth below are discussed in detail in the “Selected Risk Considerations” section in the accompanying preliminary pricing supplement. Please review those risk disclosures carefully.

Risks Relating to the Securities Generally

| · | If The Securities Are Not Automatically Called, You May Lose Some, And Possibly Up To 90% Of The Face Amount Of Your Securities At Maturity. |

| · | The Securities Are Subject To The Credit Risk Of Credit Suisse. |

| · | Regardless Of The Amount Of Any Payment You Receive On The Securities, Your Actual Yield May Be Different In Real Value Terms. |

| · | No Periodic Interest Will Be Paid On The Securities. |

| · | The Potential Return On The Securities Is Limited To The Call Premium. |

| · | The Initial Component Level Of A Basket Component May Be Determined On A Date Later Than The Pricing Date. |

| · | The Probability That The Ending Level Will Be Less Than The Threshold Level Will Depend On The Volatility Of The Basket Components. |

| · | The Securities Are Subject To A Potential Automatic Call, Which Exposes You To Reinvestment Risk. |

| · | A Call Settlement Date And The Stated Maturity Date May Be Postponed If A Call Date Is Postponed. |

| · | The U.S. Federal Tax Consequences Of An Investment In The Securities Are Unclear. |

Risks Relating to the Basket Components

| · | Changes In The Values Of The Basket Components May Offset Each Other. |

| · | The Basket Components Are Not Equally Weighted. |

| · | The Basket Components May Be Highly Correlated in Decline. |

| · | The Closing Level Of The Basket Components Will Not Be Adjusted For Changes In Exchange Rates Relative To The U.S. Dollar Even Though The Equity Securities Included In The Basket Components Are Traded In A Foreign Currency And The Securities Are Denominated In U.S. Dollars. |

| · | Foreign Securities Markets Risk. |

| · | Historical Performance Of Any Basket Component Is Not Indicative Of Its Future Performance. |

| · | Except To The Extent That Credit Suisse Is Included In The Swiss Market Index®, We And Our Affiliates Generally Do Not Have Any Affiliation With Any Basket Component Or Basket Component Sponsor And Are Not Responsible For Its Public Disclosure of Information. |

| · | The Swiss Market Index® Is Concentrated In A Small Number Of Constituents. |

| · | Changes To Any Basket Component Could Adversely Affect The Securities. |

| · | We Cannot Control The Actions Of Any Issuers Whose Equity Securities Are Included In Or Held By Any Basket Component. |

| · | No Ownership Rights Relating To The Basket Components. |

| · | No Voting Rights Or Dividend Payments. |

| · | Government Regulatory Action, Including Legislative Acts And Executive Orders, Could Result In Material Changes To The Basket Components And Could Negatively Affect Your Return On The Securities. |

Risks Relating to the Issuer

| · | Credit Suisse Is Subject To Swiss Regulation. |

Risks Relating to Conflicts of Interest

| · | Hedging And Trading Activity Could Adversely Affect Our Payment To You At Maturity. |

| · | Our Economic Interests Are Potentially Adverse To Your Interests. |

Risks Relating to the Estimated Value and Secondary Market Prices of the Securities

| · | Unpredictable Economic And Market Factors Will Affect The Value Of The Securities. |

| · | The Estimated Value Of The Securities On The Pricing Date May Be Less Than The Original Offering Price. |

| · | If On The Pricing Date The Internal Funding Rate We Use In Structuring Notes Such As These Securities Is Lower Than The Interest Rate That Is Reflected In The Yield On Our Conventional Debt Securities Of Similar Maturity In The Secondary Market (Our "Secondary Market Credit Spreads"), We Expect That The Economic Terms Of The Securities Will Generally Be Less Favorable To You Than They Would Have Been If Our Secondary Market Credit Spread Had Been Used In Structuring The Securities. |

| · | The Estimated Value Of The Securities Is Not An Indication Of The Price, If Any, At Which Credit Suisse Or Any Other Person May Be Willing To Buy The Securities From You In The Secondary Market. |

| · | The Securities Will Not Be Listed On Any Securities Exchange And A Trading Market For The Securities May Not Develop. |

Credit Suisse has filed a registration statement (including preliminary pricing supplement, underlying supplement, product supplement, prospectus supplement and prospectus) with the Securities and Exchange Commission, or SEC, for the offering to which this offering summary relates. Before you invest, you should read this summary together with the Preliminary Pricing Supplement dated July 18, 2022, Underlying Supplement dated June 18, 2020, Product Supplement No. I–B dated June 18, 2020 and Prospectus Supplement and Prospectus dated June 18, 2020, to understand fully the terms of the securities and other considerations that are important in making a decision about investing in the securities. If the terms described in the applicable preliminary pricing supplement are inconsistent with those described herein, the terms described in the applicable preliminary pricing supplement will control. You may get these documents without cost by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, Credit Suisse, any agent or any dealer participating in this offering will arrange to send you the preliminary pricing supplement, underlying supplement, product supplement, prospectus supplement and prospectus if you so request by calling toll-free 1-800-221-1037.

Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo Finance LLC and Wells Fargo & Company.

2