The information in

this preliminary pricing supplement is not complete and may be changed. This preliminary pricing supplement is not an offer to sell these

securities, and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion dated July 5, 2022

PRELIMINARY PRICING SUPPLEMENT No. T2424

Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-238458-02

Dated July 5, 2022

Credit Suisse AG $• Trigger Absolute Return Step Securities

Linked to the Performance of an Unequally Weighted Basket of Equity Indices due July 20, 2027

Principal at Risk Securities

| Investment Description |

These Trigger Absolute Return Step Securities (the “Securities”) are senior, unsecured obligations of Credit Suisse AG, acting through its London branch (“Credit Suisse” or the “Issuer”) linked to the performance of an unequally weighted basket (the “Basket”), consisting of the EURO STOXX 50® Index, the Nikkei 225 Index, the FTSE® 100 Index, the Swiss Market Index® and the S&P/ASX 200 Index (each, a “Basket Component” and, together, the “Basket Components”). The Securities will rank pari passu with all of our other senior unsecured obligations. If the Final Basket Level is greater than or equal to the Step Barrier (which is equal to the Initial Basket Level), Credit Suisse will pay the Principal Amount at maturity plus a return equal to the greater of (i) the Step Return expected to be between 58.50% and 63.50% (the actual Step Return will be determined on the Trade Date) and (ii) the Basket Return. If the Final Basket Level is less than the Step Barrier (which is equal to the Initial Basket Level) but not less than the Downside Threshold, Credit Suisse will pay the Principal Amount at maturity plus the Contingent Absolute Return (which is equal to the absolute value of the Basket Return). However, if the Final Basket Level is less than the Downside Threshold, Credit Suisse will pay less than the full Principal Amount at maturity, if anything, resulting in a loss of principal that is proportionate to the full depreciation of the Basket from the Initial Basket Level to the Final Basket Level. In that case, you will lose a significant portion and possibly all of your investment. Investing in the Securities involves significant risks. You will not receive interest or dividend payments during the term of the Securities. You may lose some or all of your Principal Amount. The contingent repayment of principal applies only if you hold the Securities to maturity. Any payment on the Securities, including any repayment of principal, is subject to the ability of Credit Suisse to pay its obligations as they become due. If Credit Suisse were to default on its obligations, you may not receive any amounts owed to you under the Securities.

| Features | Key Dates* |

| q | Enhanced Growth Potential with Step Return Feature: If the Final Basket Level is greater than or equal to the Step Barrier (which is equal to the Initial Basket Level), Credit Suisse will pay you the Principal Amount at maturity plus a return equal to the greater of (i) the Step Return and (ii) the Basket Return. |

| q | Downside Exposure with Contingent Absolute Return at Maturity: If the Final Basket Level is less than the Step Barrier (which is equal to the Initial Basket Level) but not less than the Downside Threshold, Credit Suisse will pay you the Principal Amount at maturity plus the Contingent Absolute Return, which is equal to the absolute value of the Basket Return. However, if the Final Basket Level is less than the Downside Threshold, Credit Suisse will pay you an amount less than your full Principal Amount, if anything, resulting in a loss of your principal that is proportionate to the full depreciation of the Basket from the Initial Basket Level to the Final Basket Level. The Contingent Absolute Return applies only if you hold the Securities to maturity. Any payment on the Securities, including any repayment of principal, is subject to the ability of Credit Suisse to pay its obligations as they become due. |

| Trade Date* | July 15, 2022 |

| Settlement Date* | July 20, 2022 |

| Final Valuation Date** | July 15, 2027 |

| Maturity Date** | July 20, 2027 |

| * | Expected. |

| ** | Subject to postponement as set forth in any accompanying product supplement under “Description of the Securities—Postponement of calculation dates.” If the Maturity Date is not a business day, the Redemption Amount will be payable on the first following business day, unless that business day falls in the next calendar month, in which case payment will be made on the first preceding business day. |

|

NOTICE TO INVESTORS: THE SECURITIES ARE SIGNIFICANTLY RISKIER THAN CONVENTIONAL DEBT INSTRUMENTS. THE ISSUER IS NOT NECESSARILY OBLIGATED TO PAY THE FULL PRINCIPAL AMOUNT OF THE SECURITIES AT MATURITY, AND THE SECURITIES CAN EXPOSE YOUR INVESTMENT TO THE FULL DEPRECIATION OF THE BASKET FROM THE INITIAL BASKET LEVEL TO THE FINAL BASKET LEVEL. THIS MARKET RISK IS IN ADDITION TO THE CREDIT RISK INHERENT IN PURCHASING A DEBT OBLIGATION OF CREDIT SUISSE. YOU SHOULD NOT PURCHASE THE SECURITIES IF YOU DO NOT UNDERSTAND OR ARE NOT COMFORTABLE WITH THE SIGNIFICANT RISKS INVOLVED IN INVESTING IN THE SECURITIES. YOU SHOULD CAREFULLY CONSIDER THE RISKS DESCRIBED UNDER “KEY RISKS” BEGINNING ON PAGE 7 AND UNDER “RISK FACTORS” BEGINNING ON PAGE PS-3 OF ANY ACCOMPANYING PRODUCT SUPPLEMENT BEFORE PURCHASING ANY SECURITIES. EVENTS RELATING TO ANY OF THOSE RISKS, OR OTHER RISKS AND UNCERTAINTIES, COULD ADVERSELY AFFECT THE MARKET VALUE OF, AND THE RETURN ON, YOUR SECURITIES. YOU MAY LOSE SOME OR ALL OF YOUR INITIAL INVESTMENT IN THE SECURITIES. THE SECURITIES WILL NOT BE LISTED ON ANY EXCHANGE. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the Securities or passed upon the accuracy or the adequacy of this pricing supplement or the accompanying underlying supplement, any product supplement, the prospectus supplement and the prospectus. Any representation to the contrary is a criminal offense. |

| Security Offering |

This pricing supplement relates to Securities linked to the performance of an unequally weighted basket of equity indices. The Basket Components are listed on page 4. The indicative Step Return range for the Securities is listed below. The actual Step Return will be determined on the Trade Date. The Securities are not subject to a predetermined maximum gain and, accordingly, any return at maturity will be determined by the performance of the Basket. The Securities are offered at a minimum investment of 100 Securities at $10 per Security (representing a $1,000 investment), and integral multiples of $10 in excess thereof.

|

Basket |

Weighting of Each Basket Component |

Initial Basket Level |

Step Barrier |

Step Return |

Downside Threshold |

CUSIP |

ISIN |

| An Unequally Weighted Basket of Equity Indices | Set forth in “Key Terms” herein | 100 | 100 | 58.50% to 63.50% | 75 | 22553QBU0 | US22553QBU04 |

Credit Suisse currently estimates the value of each $10 principal amount of the Securities on the Trade Date will be between $9.20 and $9.65 (as determined by reference to our pricing models and the rate we are currently paying to borrow funds through issuance of the Securities (our “internal funding rate”)). This range of estimated values reflects terms that are not yet fixed. A single estimated value reflecting final terms will be determined on the Trade Date. See “Key Risks” in this pricing supplement.

See “Additional Information about Credit Suisse and the Securities” on page 2. The Securities will have the terms set forth in any accompanying product supplement, prospectus supplement and prospectus and this pricing supplement.

The Securities are not deposit liabilities and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency of the United States, Switzerland or any other jurisdiction.

| Offering of Securities |

Price to Public |

Underwriting Discount and Commissions(1) |

Proceeds to Credit Suisse AG | |||

|

Total |

Per Security |

Total |

Per Security |

Total |

Per Security | |

| Securities Linked to the Performance of an Unequally Weighted Basket of Equity Indices due July 20, 2027 | $• | $10 | $• | $0.35 | $• | $9.65 |

(1) UBS Financial Services Inc. will act as distributor for the Securities. The distributor will receive a fee from Credit Suisse or one of our affiliates of up to $0.35 per $10 principal amount of Securities. For more detailed information, please see “Supplemental Plan of Distribution” in this pricing supplement.

UBS Financial Services Inc.

| Additional Information about Credit Suisse and the Securities |

You should read this pricing supplement together with the underlying supplement dated June 18, 2020 the product supplement dated June 18, 2020, the prospectus supplement dated June 18, 2020 and the prospectus dated June 18, 2020, relating to our Medium-Term Notes of which these Securities are a part. You may access these documents on the SEC website at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

| ¨ | Underlying Supplement dated June 18, 2020: https://www.sec.gov/Archives/edgar/data/1053092/000095010320011950/dp130454_424b2-eus.htm |

| ¨ | Product Supplement No. I–B dated June 18, 2020: https://www.sec.gov/Archives/edgar/data/1053092/000095010320011955/dp130588_424b2-ps1b.htm |

| ¨ | Prospectus Supplement and Prospectus dated June 18, 2020: https://www.sec.gov/Archives/edgar/data/1053092/000110465920074474/tm2019510-8_424b2.htm |

Our Central Index Key, or CIK, on the SEC website is 1053092. As used in this pricing supplement, “we,” “us,” or “our” refers to Credit Suisse.

The Securities are senior, unsecured obligations of Credit Suisse and will rank pari passu with all of our other senior unsecured obligations.

In the event the terms of the Securities described in this pricing supplement differ from, or are inconsistent with, the terms described in the underlying supplement, any accompanying product supplement, the prospectus supplement or prospectus, the terms described in this pricing supplement will control.

This pricing supplement, together with the documents listed above, contains the terms of the Securities and supersedes all other prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, fact sheets, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours. We may, without the consent of the registered holder of the Securities and the owner of any beneficial interest in the Securities, amend the Securities to conform to its terms as set forth in this pricing supplement and the documents listed above, and the trustee is authorized to enter into any such amendment without any such consent. You should carefully consider, among other things, the matters set forth in “Key Risks” in this pricing supplement and “Risk Factors” in any accompanying product supplement, “Foreign Currency Risks” in the accompanying prospectus, and any risk factors we describe in the combined Annual Report on Form 20-F of Credit Suisse Group AG and us incorporated by reference therein, and any additional risk factors we describe in future filings we make with the SEC under the Securities Exchange Act of 1934, as amended, as the Securities involve risks not associated with conventional debt securities. You should consult your investment, legal, tax, accounting and other advisors before deciding to invest in the Securities.

You may revoke your offer to purchase the Securities at any time prior to the time at which we accept such offer on the date the Securities are priced. We reserve the right to change the terms of, or reject any offer to purchase the Securities prior to their issuance. In the event of any changes to the terms of the Securities, we will notify you and you will be asked to accept such changes in connection with your purchase. You may also choose to reject such changes in which case we may reject your offer to purchase.

2

| Investor Suitability |

The Securities may be suitable for you if:

| ¨ | You fully understand the risks inherent in an investment in the Securities, including the risk of loss of your entire initial investment. |

| ¨ | You can tolerate a loss of all or a substantial portion of your investment and you are willing to make an investment that may be exposed to the full depreciation of the Basket from the Initial Basket Level to the Final Basket Level. |

| ¨ | You are willing to forgo any dividends paid on the equity securities included in the Basket Components. |

| ¨ | You are willing to hold the Securities to maturity as stated on the cover hereof, and you accept that there may be little or no secondary market for the Securities. |

| ¨ | You believe the Basket will appreciate over the term of the Securities and you would be willing to invest in the Securities if the Step Return was set equal to the bottom of the range indicated on the cover hereof (the actual Step Return will be set on the Trade Date). |

| ¨ | You understand and accept that your potential positive return from the Contingent Absolute Return feature is limited by the Downside Threshold. |

| ¨ | You can tolerate fluctuations of the price of the Securities prior to maturity that may be similar to or exceed the downside fluctuations in the level of the Basket. |

| ¨ | You do not seek current income from your investment. |

| ¨ | You understand and accept the risks associated with the Basket Components. |

| ¨ | You are willing to assume the credit risk of Credit Suisse for all payments under the Securities, and you understand that the payment of any amount due on the Securities is subject to the credit risk of Credit Suisse. |

The Securities may not be suitable for you if:

| ¨ | You do not fully understand the risks inherent in an investment in the Securities, including the risk of loss of your entire initial investment. |

| ¨ | You seek an investment designed to provide a full return of principal at maturity. |

| ¨ | You cannot tolerate a loss of all or a substantial portion of your investment, and you are unwilling to make an investment that may be exposed to the full depreciation of the Basket from the Initial Basket Level to the Final Basket Level. |

| ¨ | You prefer to receive the dividends paid on the equity securities included in the Basket Components. |

| ¨ | You are unable or unwilling to hold the Securities to maturity as stated on the cover hereof, or you seek an investment for which there will be an active secondary market for the Securities. |

| ¨ | You believe that the level of the Basket will depreciate during the term of the Securities and is likely to close at or below the Downside Threshold on the Final Valuation Date. |

| ¨ | You would be unwilling to invest in the Securities if the Step Return was set equal to the bottom of the range indicated on the cover hereof (the actual Step Return will be set on the Trade Date). |

| ¨ | You cannot tolerate fluctuations in the value of the Securities prior to maturity that may be similar to or exceed the downside fluctuations in the level of the Basket. |

| ¨ | You prefer the lower risk, and, therefore, accept the potentially lower returns, of conventional debt securities with comparable maturities issued by Credit Suisse or another issuer with a similar credit rating. |

| ¨ | You seek current income from your investment. |

| ¨ | You do not understand or do not accept the risks associated with the Basket Components. |

| ¨ | You are unwilling to assume the credit risk of Credit Suisse for all payments under the Securities. |

|

The suitability considerations identified above are not exhaustive. Whether or not the Securities are a suitable investment for you will depend on your individual circumstances and you should reach an investment decision only after you and your investment, legal, tax, accounting and other advisors have carefully considered the suitability of an investment in the Securities in light of your particular circumstances. You should also review “Key Risks” beginning on page 7 of this pricing supplement for risks related to an investment in the Securities. For more information on the Basket and Basket Components, see “Historical Information” in this pricing supplement.

|

3

| Key Terms |

| Issuer | Credit Suisse AG (“Credit Suisse”), acting through its London branch. |

| Principal Amount | $10 per Security |

| Term | Five years. In the event that we make any change to the expected Trade Date and Settlement Date, the calculation agent may adjust the Final Valuation Date and Maturity Date to ensure that the stated term of the Securities remains the same. |

| Basket | Basket Component | Ticker | Initial Level | Weighting |

| EURO STOXX 50® Index | SX5E <Index> | 40% | ||

| Nikkei 225 Index | NKY <Index> | 25% | ||

| FTSE® 100 Index | UKX <Index> | 17.50% | ||

| Swiss Market Index® | SMI <Index> | 10% | ||

| S&P/ASX 200 Index | AS51 <Index> | 7.50% |

| Step Barrier | 100 |

| Contingent Absolute Return | The absolute value of the Basket Return. For example, if the Basket Return is -5%, the Contingent Absolute Return is 5%. |

| Downside Threshold | 75 |

| Step Return | Expected to be between 58.50% and 63.50%. The actual Step Return will be determined on the Trade Date. |

| Payment at Maturity (per Security) |

If the Final Basket Level is greater than or equal to the Step Barrier (which is equal to the Initial Basket Level), Credit Suisse will pay you a cash payment calculated as follows:

$10 + [$10 × (the greater of (i) the Step Return and (ii) the Basket Return)]

If the Final Basket Level is less than the Step Barrier (which is equal to the Initial Basket Level) but equal to or greater than the Downside Threshold, Credit Suisse will pay you a cash payment calculated as follows:

$10 + ($10 × Contingent Absolute Return)

If the Final Basket Level is less than the Downside Threshold, Credit Suisse will pay you a cash payment calculated as follows:

$10 + ($10 × Basket Return)

In this case, you could lose up to all of your Principal Amount in an amount proportionate to the negative Basket Return. |

|

Basket Return

|

Final Basket Level – Initial Basket Level Initial Basket Level |

| Initial Basket Level | 100 |

| Investment Timeline |

|

Trade Date |

The Initial Level for each Basket Component is observed and the Step Return is set.

| ||

|

The Final Basket Level and Basket Return are determined on the Final Valuation Date.

| ||

|

Maturity Date

|

If the Final Basket Level is greater than or equal to the Step Barrier (which is equal to the Initial Basket Level), Credit Suisse will pay you a cash payment per Security equal to:

$10 + [$10 × (the greater of (i) the Step Return and (ii) the Basket Return)]

If the Final Basket Level is less than the Step Barrier (which is equal to the Initial Basket Level) but equal to or greater than the Downside Threshold, Credit Suisse will pay you a cash payment per Security equal to:

$10 + ($10 × Contingent Absolute Return)

If the Final Basket Level is less than the Downside Threshold, Credit Suisse will pay you a cash payment per Security equal to:

$10 + ($10 × Basket Return)

Under these circumstances, you will lose a significant portion, and could lose all, of your Principal Amount.

|

4

| Final Basket Level |

The level of the Basket on the Final Valuation Date, calculated as follows: 100 × [1 + the sum of (each Basket Component Return multiplied by its weighting)] |

| Basket Component Return |

With respect to each Basket Component, the Basket Component Return will be calculated as follows: Final Level – Initial Level Initial Level |

| Initial Level | The Closing Level of the applicable Basket Component on the Trade Date. In the event that the Closing Level for any Basket Component is not available on the Trade Date, the Initial Level for such Basket Component will be determined on the immediately following trading day on which a Closing Level is available. |

| Final Level | The Closing Level of the applicable Basket Component on the Final Valuation Date, as determined by the calculation agent. |

| Closing Level | The Closing Level of any Basket Component on any trading day will be the closing level of such Basket Component on such trading day, as determined by the calculation agent by reference to (i) Bloomberg Financial Services (“Bloomberg”) or any successor reporting service, or (ii) if Bloomberg or such successor reporting service does not publish the closing level on such trading day, the index sponsor. |

| Final Valuation Date(1) | July 15, 2027 |

| Maturity Date(1) | July 20, 2027 |

| Events of Default |

With respect to these Securities, the first bullet of the first sentence of “Description of Debt Securities—Events of Default” in the accompanying prospectus is amended to read in its entirety as follows: · a default in payment of the principal or any premium on any debt security of that series when due, and such default continues for 30 days; |

| CUSIP / ISIN | 22553QBU0 / US22553QBU04 |

(1)Subject to the market disruption event provisions set forth in any accompanying product supplement under “Description of the Securities—Market disruption events.”

| INVESTING IN THE SECURITIES INVOLVES SIGNIFICANT RISKS. YOU MAY LOSE YOUR ENTIRE PRINCIPAL AMOUNT. ANY PAYMENT ON THE SECURITIES, INCLUDING ANY REPAYMENT OF PRINCIPAL, IS SUBJECT TO THE ABILITY OF CREDIT SUISSE TO PAY ITS OBLIGATIONS AS THEY BECOME DUE. IF CREDIT SUISSE WERE TO DEFAULT ON ITS OBLIGATIONS, YOU MAY NOT RECEIVE ANY AMOUNTS OWED TO YOU UNDER THE SECURITIES. |

5

| Supplemental Terms of the Securities |

For purposes of the Securities offered by this pricing supplement, all references to each of the following defined terms used in any accompanying product supplement will be deemed to refer to the corresponding defined term used in this pricing supplement, as set forth in the table below:

|

Product Supplement Defined Term |

Pricing Supplement Defined Term |

| Knock-In Level | Downside Threshold |

| Valuation Date | Final Valuation Date |

6

| Key Risks |

An investment in the offering of the Securities involves significant risks. This section describes material risks relating to an investment in the Securities. Some of the risks that apply to the Securities are summarized below, but we urge you to read the more detailed explanation of risks relating to the Securities in the “Risk Factors” section of any accompanying product supplement. We also urge you to consult your investment, legal, tax, accounting and other advisors before you invest in the Securities.

Risks Relating to the Securities Generally

| ¨ | You may receive less than the principal amount at maturity — You may receive less at maturity than you originally invested in the Securities. If the Final Basket Level is less than the Downside Threshold, you will be fully exposed to any depreciation in the Basket from the Initial Basket Level to the Final Basket Level and will incur a loss proportionate to the Basket Return. In this case, at maturity, the amount Credit Suisse will pay you will be less than the principal amount of the Securities and you could lose your entire investment. It is not possible to predict whether the Final Basket Level will be less than the Downside Threshold, and in such event, by how much the Final Basket Level will decrease in comparison to the Initial Basket Level. Any payment on the Securities is subject to our ability to pay our obligations as they become due. |

| ¨ | The Securities are subject to the credit risk of Credit Suisse — Investors are dependent on our ability to pay all amounts due on the Securities and, therefore, if we were to default on our obligations, you may not receive any amounts owed to you under the Securities. In addition, any decline in our credit ratings, any adverse changes in the market’s view of our creditworthiness or any increase in our credit spreads is likely to adversely affect the value of the Securities prior to maturity. |

| ¨ | Regardless of the amount of any payment you receive on the Securities, your actual yield may be different in real value terms — Inflation may cause the real value of any payment you receive on the Securities to be less at maturity than it is at the time you invest. An investment in the Securities also represents a forgone opportunity to invest in an alternative asset that generates a higher real return. You should carefully consider whether an investment that may result in a return that is lower than the return on alternative investments is appropriate for you. |

| ¨ | The absolute return feature is contingent, and you will have full downside exposure to the Basket performance if the Final Basket Level is less than the Downside Threshold — If the Final Basket Level is below the Downside Threshold, the Contingent Absolute Return feature of the Securities will not apply and you will lose 1% of the Principal Amount of the Securities for every 1% by which the Final Basket Level is less than the Initial Basket Level. The Securities will have full downside exposure to the decline in the level of the Basket if the Final Basket Level is below the Downside Threshold. As a result, you may lose your entire investment in the Securities. Further, the Contingent Absolute Return applies only if you hold the Securities to maturity. If you are able to sell the Securities prior to maturity you may have to sell them for a loss even if the level of the Basket has not declined below the Downside Threshold. |

| ¨ | The potential for a positive return if the level of the Basket depreciates is limited — Any positive return on the Securities if the level of the Basket depreciates will be limited by the Downside Threshold because, if the Final Basket Level is less than the Step Barrier on the Final Valuation Date, we will pay you the Principal Amount plus the Contingent Absolute Return at maturity only if the Final Basket Level is greater than or equal to the Downside Threshold. You will not receive a Contingent Absolute Return and will lose a substantial portion or all of your investment if the Final Basket Level is less than the Downside Threshold. |

| ¨ | The probability that the Final Basket Level will be less than the Downside Threshold will depend on the volatility of the Basket Components— “Volatility” refers to the frequency and magnitude of changes in the levels of the Basket Components. The greater the expected volatility with respect to the Basket Components on the Trade Date, the higher the expectation as of the Trade Date that the Final Basket Level could be less than the Downside Threshold, indicating a higher expected risk of loss on the Securities. The terms of the Securities are set, in part, based on expectations about the volatility of the Basket Components as of the Trade Date. The volatility of the Basket Components can change significantly over the term of the Securities. |

7

The levels of the Basket Components could fall sharply, which could result in a significant loss of principal. You should be willing to accept the downside market risk of the Basket Components and the potential to lose a significant amount of your principal at maturity.

| ¨ | The Securities do not pay interest — We will not pay interest on the Securities. You may receive less at maturity than you could have earned on ordinary interest-bearing debt securities with similar maturities, including other of our debt securities, since the Payment at Maturity is based on the performance of the Basket. Because the Payment at Maturity may be less than the amount originally invested in the Securities, the return on the Securities (the effective yield to maturity) may be negative. Even if it is positive, the return payable on each Security may not be enough to compensate you for any loss in value due to inflation and other factors relating to the value of money over time. |

| ¨ | The stated payout from the Issuer applies only if you hold the Securities to maturity — The value of the Securities prior to maturity may be less than the initial investment amount and substantially different than the amount expected at maturity. If you are able to sell your Securities prior to maturity in the secondary market, your return may be less than the Basket Return and you may receive less than your initial investment amount even if the level of the Basket is greater than the Downside Threshold at that time. The stated payout on the Securities, including the application of the Downside Threshold and Step Return, applies only if you hold the Securities to maturity. |

| ¨ | The U.S. federal tax consequences of an investment in the Securities are unclear — There is no direct legal authority regarding the proper U.S. federal tax treatment of the Securities, and we do not plan to request a ruling from the Internal Revenue Service (the “IRS”). Consequently, significant aspects of the tax treatment of the Securities are uncertain, and the IRS or a court might not agree with the treatment of the Securities as prepaid financial contracts that are treated as “open transactions.” If the IRS were successful in asserting an alternative treatment of the Securities, the tax consequences of the ownership and disposition of the Securities, including the timing and character of income recognized by U.S. investors and the withholding tax consequences to non-U.S. investors, might be materially and adversely affected. Moreover, future legislation, Treasury regulations or IRS guidance could adversely affect the U.S. federal tax treatment of the Securities, possibly retroactively. |

Risks Relating to the Basket Components

| ¨ | Changes in the values of the Basket Components may offset each other — Movements in the level of the Basket Components may not correlate with each other. At a time when the value of one or more of the Basket Components increases, the level of the other Basket Components may not increase as much or may even decline. Therefore, in calculating the Basket Return, increases in the level of one or more of the Basket Components may be moderated, or more than offset, by lesser increases or declines in the level of the other Basket Components. |

| ¨ | The Basket Components may be highly correlated in decline — The performances of the Basket Components may become highly correlated during periods of declining prices. This may occur because of events that have broad effects on markets generally or on the Basket Components specifically. If the Basket Components become correlated in decline, the depreciation of one Basket Components will not be offset by the performance of the other Basket Components and, in fact, each Basket Component may contribute to an overall decline from the Initial Basket Level to the Final Basket Level. |

| ¨ | The Basket Components are not equally weighted — The Securities are linked to a basket of equity indices and the Basket Components have significantly different weights in determining the value of the Basket. The same percentage change in any two Basket Components could therefore have different effects on the Final Basket Level because of the unequal weighting. For example, if the weighting of one Basket Component is greater than the weighting of the other Basket Component, a 5% decrease from the Initial Level to the Final Level of the Basket Component with the greater weighting will have a greater impact on the Final Basket Level than a 5% increase from the Initial Level to the Final Level of the Basket Component with the lesser weighting. |

| ¨ | The Closing Levels of the Basket Components will not be adjusted for changes in exchange rates relative to the U.S. Dollar even though the equity securities included in the Basket Components are |

8

traded in foreign currencies and the Securities are denominated in U.S. Dollars — The value of your Securities will not be adjusted for exchange rate fluctuations between the U.S. Dollar and the currencies in which the equity securities included in each of the Basket Components are based. Therefore, if the applicable currencies appreciate or depreciate relative to the U.S. Dollar over the term of the Securities, you will not receive any additional payment or incur any reduction in your return, if any, at maturity.

| ¨ | Foreign securities markets risk — Some or all of the assets included in the Basket Components are issued by foreign companies and trade in foreign securities markets. Investments in the Securities therefore involve risks associated with the securities markets in those countries, including risks of volatility in those markets, government intervention in those markets and cross shareholdings in companies in certain countries. Also, foreign companies are generally subject to accounting, auditing and financial reporting standards and requirements and securities trading rules different from those applicable to U.S. reporting companies. The equity securities included in the Basket Components may be more volatile than domestic equity securities and may be subject to different political, market, economic, exchange rate, regulatory and other risks, including changes in foreign governments, economic and fiscal policies, currency exchange laws or other laws or restrictions. Moreover, the economies of foreign countries may differ favorably or unfavorably from the economy of the United States in such respects as growth of gross national product, rate of inflation, capital reinvestment, resources and self-sufficiency. These factors may adversely affect the values of the equity securities included in the Basket Components, and therefore the performance of the Basket Components and the value of the Securities. |

| ¨ | No ownership rights relating to the Basket Components — Your return on the Securities will not reflect the return you would realize if you actually owned the equity securities that comprise the Basket Components. The return on your investment is not the same as the total return you would receive based on the purchase of the equity securities that comprise the Basket Components. |

| ¨ | No dividend payments or voting rights — As a holder of the Securities, you will not have voting rights or rights to receive cash dividends or other distributions or other rights with respect to the equity securities that comprise the Basket Components. Further, the performance of the Basket Components will not include these dividends or distributions and does not contain a “total return” feature. |

| ¨ | Government regulatory action, including legislative acts and executive orders, could result in material changes to a Basket Component and could negatively affect your return on the Securities — Government regulatory action, including legislative acts and executive orders, could materially affect a Basket Component. For example, in response to recent executive orders, stocks of companies that are determined to be linked to the People’s Republic of China military, intelligence and security apparatus may be delisted from a U.S. exchange, removed as a component in indices or exchange traded funds, or transactions in, or holdings of, securities with exposure to such stocks may otherwise become prohibited under U.S. law. If government regulatory action results in such consequences, there may be a material and negative effect on the Securities. |

Risks Relating to the Issuer

| ¨ | Credit Suisse is subject to Swiss regulation — As a Swiss bank, Credit Suisse is subject to regulation by governmental agencies, supervisory authorities and self-regulatory organizations in Switzerland. Such regulation is increasingly more extensive and complex and subjects Credit Suisse to risks. For example, pursuant to Swiss banking laws, the Swiss Financial Market Supervisory Authority (FINMA) may open resolution proceedings if there are justified concerns that Credit Suisse is over-indebted, has serious liquidity problems or no longer fulfills capital adequacy requirements. FINMA has broad powers and discretion in the case of resolution proceedings, which include the power to convert debt instruments and other liabilities of Credit Suisse into equity and/or cancel such liabilities in whole or in part. If one or more of these measures were imposed, such measures may adversely affect the terms and market value of the Securities and/or the ability of Credit Suisse to make payments thereunder and you may not receive any amounts owed to you under the Securities. |

Risks Relating to Conflicts of Interest

| ¨ | Hedging and trading activity — We, any dealer or any of our or their respective affiliates may carry out hedging activities related to the Securities, including in instruments related to the Basket Components. We, any |

9

dealer or our or their respective affiliates may also trade instruments related to the Basket Components from time to time. Any of these hedging or trading activities on or prior to the Trade Date and during the term of the Securities could adversely affect our payment to you at maturity.

| ¨ | Potential conflicts — We and our affiliates play a variety of roles in connection with the issuance of the Securities, including acting as calculation agent, hedging our obligations under the Securities and determining their estimated value. In performing these duties, the economic interests of us and our affiliates are potentially adverse to your interests as an investor in the Securities. Further, hedging activities may adversely affect any payment on or the value of the Securities. Any profit in connection with such hedging activities will be in addition to any other compensation that we and our affiliates receive for the sale of the Securities, which creates an additional incentive to sell the Securities to you. |

Risks Relating to the Estimated Value and Secondary Market Prices of the Securities

| ¨ | Unpredictable economic and market factors will affect the value of the Securities — The payout on the Securities can be replicated using a combination of the components described in “The estimated value of the Securities on the Trade Date may be less than the Price to Public.” Therefore, in addition to the levels of the Basket Components, the terms of the Securities at issuance and the value of the Securities prior to maturity may be influenced by factors that impact the value of fixed income securities and options in general, such as: |

| o | the expected and actual volatility of the Basket Components; |

| o | the time to maturity of the Securities; |

| o | the dividend rate on the equity securities included in the Basket Components; |

| o | interest and yield rates in the market generally; |

| o | investors’ expectations with respect to the rate of inflation; |

| o | geopolitical conditions and economic, financial, political, regulatory, judicial or other events that affect the components included in the Basket Components or markets generally and which may affect the levels of the Basket Components; and |

| o | our creditworthiness, including actual or anticipated downgrades in our credit ratings. |

Some or all of these factors may influence the price that you will receive if you choose to sell your Securities prior to maturity, and such price could be less than your initial investment and significantly different than the amount expected at maturity. The impact of any of the factors set forth above may enhance or offset some or all of any change resulting from another factor or factors.

| ¨ | The estimated value of the Securities on the Trade Date may be less than the Price to Public — The

initial estimated value of your Securities on the Trade Date (as determined by reference

to our pricing models and our internal funding rate) may be significantly less than the original Price to Public. The Price to Public

of the Securities includes any discounts or commissions as well as transaction costs such as expenses incurred to create, document and

market the Securities and the cost of hedging our risks as issuer of the Securities through one or more of our affiliates (which includes

a projected profit). These costs will be effectively borne by you as an investor in the Securities. These amounts will be retained by

Credit Suisse or our affiliates in connection with our structuring and offering of the Securities (except to the extent discounts or commissions

are reallowed to other broker-dealers or any costs are paid to third parties). On the Trade Date, we value the components of the Securities in accordance with our pricing models. These include a fixed income component valued using our internal funding rate, and individual option components valued using proprietary pricing models dependent on inputs such as volatility, correlation, dividend rates, interest rates and other factors, including assumptions about future market events and/or environments. These inputs may be market-observable or may be based on assumptions made by us in our discretionary judgment. |

10

As such, the payout on the Securities can be replicated using a combination of these components and the value of these components, as determined by us using our pricing models, will impact the terms of the Securities at issuance. Our option valuation models are proprietary. Our pricing models take into account factors such as interest rates, volatility and time to maturity of the Securities, and they rely in part on certain assumptions about future events, which may prove to be incorrect.

Because Credit Suisse’s pricing models may differ from other issuers’ valuation models, and because funding rates taken into account by other issuers may vary materially from the rates used by Credit Suisse (even among issuers with similar creditworthiness), our estimated value at any time may not be comparable to estimated values of similar securities of other issuers.

| ¨ | Effect of interest rate used in structuring the Securities — The internal funding rate we use in structuring notes such as these Securities is typically lower than the interest rate that is reflected in the yield on our conventional debt securities of similar maturity in the secondary market (our “secondary market credit spreads”). If on the Trade Date our internal funding rate is lower than our secondary market credit spreads, we expect that the economic terms of the Securities will generally be less favorable to you than they would have been if our secondary market credit spread had been used in structuring the Securities. We will also use our internal funding rate to determine the price of the Securities if we post a bid to repurchase your Securities in secondary market transactions. See “—Secondary Market Prices” below. |

| ¨ | Secondary market prices — If

Credit Suisse (or an affiliate) bids for your Securities in secondary market transactions, which we are not obligated to do, the secondary

market price (and the value used for account statements or otherwise) may be higher or lower than the Price to Public and the estimated

value of the Securities on the Trade Date. The estimated value of the Securities on the cover of this pricing supplement does not represent

a minimum price at which we would be willing to buy the Securities in the secondary market (if any exists) at any time. The secondary

market price of your Securities at any time cannot be predicted and will reflect the then-current estimated value determined by reference

to our pricing models, the related inputs and other factors, including our internal funding

rate, customary bid and ask spreads and other transaction costs, changes in market conditions and deterioration or improvement in our

creditworthiness. In circumstances where our internal funding

rate is higher than our secondary market credit spreads, our secondary market bid for your Securities could be less favorable than what

other dealers might bid because, assuming all else equal, we use the higher internal funding rate to price the Securities and other dealers

might use the lower secondary market credit spread to price them. Furthermore,

assuming no change in market conditions from the Trade Date, the secondary market price of your Securities will be lower than the Price

to Public because it will not include any discounts or commissions and hedging and other transaction costs. If you sell your Securities

to a dealer in a secondary market transaction, the dealer may impose an additional discount or commission, and as a result the price you

receive on your Securities may be lower than the price at which we may repurchase the Securities from such dealer. We (or an affiliate) may initially post a bid to repurchase the Securities from you at a price that will exceed the then-current estimated value of the Securities. That higher price reflects our projected profit and costs, which may include discounts and commissions that were included in the Price to Public, and that higher price may also be initially used for account statements or otherwise. We (or our affiliate) may offer to pay this higher price, for your benefit, but the amount of any excess over the then-current estimated value will be temporary and is expected to decline over a period of approximately nine months. The Securities are not designed to be short-term trading instruments and any sale prior to maturity could result in a substantial loss to you. You should be willing and able to hold your Securities to maturity. |

| ¨ | Lack of liquidity — The Securities will not be listed on any securities exchange. Credit Suisse (or its affiliates) intends to offer to purchase the Securities in the secondary market but is not required to do so. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the Securities when you wish to do so. Because other dealers are not likely to make a secondary market for the Securities, the price at which you may be able to trade your Securities is likely to depend on the price, if any, at which Credit Suisse (or its affiliates) is willing to buy the Securities. If you have to sell your Securities prior to maturity, you may not be able to do so or you may have to sell them at a substantial loss. |

11

| Hypothetical Examples of How the Securities Might Perform |

Hypothetical terms only. Actual terms may vary. See the cover page for actual offering terms.

The examples and table below illustrate Payments at Maturity for a hypothetical offering of the Securities under various scenarios, with the assumptions set forth below (the actual terms for the Securities offering will be determined on the Trade Date). Numbers in the examples and table below have been rounded for ease of analysis. The “total return” as used in this pricing supplement is the number, expressed as a percentage, that results from comparing the total payment on the Securities per $10 principal amount to the $10 Price to Public. You should not take these examples or the table below as an indication or assurance of the expected performance of the Basket. You should consider carefully whether the Securities are suitable to your investment goals. Any payment on the Securities is subject to our ability to pay our obligations as they become due.

| Principal Amount: | $10 |

| Term: | Five years |

| Step Barrier: | 100 |

| Downside Threshold: | 75 |

| Step Return: | 58.50% (the bottom of the expected range of 58.50% to 63.50%) |

Example 1— The level of the Basket increases by 70% from the Initial Basket Level to the Final Basket Level. The Basket Return is greater than the Step Return, and the Payment at Maturity is calculated as follows:

$10 + [$10 × (the greater of (i) the Step Return and (ii) the Basket Return)]

$10 + [$10 × (the greater of (i) 58.50% and (ii) 70%)]

Payment at Maturity = $10 + ($10 × 70%) = $17

Because the Final Basket Level is greater than or equal to the Step Barrier (which is equal to the Initial Basket Level) and the Basket Return is equal to 70%, the Payment at Maturity is equal to $17 per $10 Principal Amount of Securities, resulting in a total return on the Securities of 70%.

Example 2— The level of the Basket increases by 10% from the Initial Basket Level to the Final Basket Level. The Basket Return is greater than or equal to zero but less than the Step Return, and the Payment at Maturity is calculated as follows:

$10 + [$10 × (the greater of (i) the Step Return and (ii) the Basket Return)]

$10 + [$10 × (the greater of (i) 58.50% and (ii) 10%)]

Payment at Maturity = $10 + ($10 × 58.50%) = $15.85

Because the Final Basket Level is greater than or equal to the Step Barrier (which is equal to the Initial Basket Level) and the Basket Return is equal to 10%, the Payment at Maturity is equal to $15.85 per $10 Principal Amount of Securities, resulting in a total return on the Securities of 58.50%.

Example 3— The level of the Basket decreases by 20% from the Initial Basket Level to the Final Basket Level. The Basket Return is negative, and the Payment at Maturity is calculated as follows:

$10 + [$10 × Contingent Absolute Return]

Payment at Maturity = $10 + ($10 × |-20%|) = $10 + ($10 × 20%) = $12

Because the Final Basket Level is less than the Step Barrier (which is equal to the Initial Basket Level) but equal to or greater than the Downside Threshold, the Contingent Absolute Return is equal to 20% and Credit Suisse will pay you a Payment at Maturity equal to $12 per $10 Principal Amount of Securities, resulting in a total return on the Securities of 20%.

Example 4— The level of the Basket decreases by 60% from the Initial Basket Level to the Final Basket Level. The Basket Return is negative, and the Payment at Maturity is calculated as follows:

$10 + [$10 × Basket Return]

Payment at Maturity = $10 + ($10 × -60%) = $4

12

Because the Final Basket Level is less than the Downside Threshold, the Securities will be fully exposed to any decline in the level of the Basket as of the Final Valuation Date. Therefore, the Payment at Maturity is equal to $4 per $10 Principal Amount of Securities, resulting in a total loss on the Securities of 60%.

If the Final Basket Level is less than the Downside Threshold, the Securities will be fully exposed to any decline in the Basket, and you will lose a significant portion and possibly all of your Principal Amount at maturity.

13

Hypothetical Payment at Maturity (per Security)

The table below illustrates, for a $10 investment in the Securities, hypothetical Payments at Maturity for a hypothetical range of Basket Returns. The hypothetical Payments at Maturity set forth below are for illustrative purposes only. The actual Payment at Maturity applicable to a purchaser of the Securities will depend on the Final Basket Level. You should consider carefully whether the Securities are suitable to your investment goals. Any payment on the Securities is subject to our ability to pay our obligations as they become due. The numbers appearing in the table below have been rounded for ease of analysis.

|

Basket Return |

Return on the Securities |

Payment at Maturity per Security |

| 100% | 100% | $20 |

| 90% | 90% | $19 |

| 80% | 80% | $18 |

| 70% | 70% | $17 |

| 60% | 60% | $16 |

| 58.50% | 58.50% | $15.85 |

| 50% | 58.50% | $15.85 |

| 40% | 58.50% | $15.85 |

| 30% | 58.50% | $15.85 |

| 20% | 58.50% | $15.85 |

| 10% | 58.50% | $15.85 |

| 0% | 58.50% | $15.85 |

| −10% | 10% | $11 |

| −20% | 20% | $12 |

| −25% | 25% | $12.50 |

| −26% | −26% | $7.40 |

| −30% | −30% | $7 |

| −40% | −40% | $6 |

| −50% | −50% | $5 |

| −60% | −60% | $4 |

| −70% | −70% | $3 |

| −80% | −80% | $2 |

| −90% | −90% | $1 |

| −100% | −100% | $0 |

14

| Supplemental Use of Proceeds and Hedging |

We intend to use the proceeds of this offering for our general corporate purposes, which may include the refinancing of existing debt outside Switzerland. Some or all of the proceeds we receive from the sale of the Securities may be used in connection with hedging our obligations under the Securities through one or more of our affiliates. Such hedging or trading activities on or prior to the Trade Date and during the term of the Securities (including on any calculation date, as defined in any accompanying product supplement) could adversely affect the value of the Basket and, as a result, could decrease the amount you may receive on the Securities at maturity. For additional information, see “Supplemental Use of Proceeds and Hedging” in any accompanying product supplement.

15

| United States Federal Tax Considerations |

This discussion supplements and, to the extent inconsistent therewith, supersedes the discussion in the accompanying product supplement under “United States Federal Tax Considerations.”

There are no statutory, judicial or administrative authorities that address the U.S. federal income tax treatment of the Securities or instruments that are similar to the Securities. In the opinion of our counsel, Davis Polk & Wardwell LLP, a Security should be treated as a prepaid financial contract that is an “open transaction” for U.S. federal income tax purposes. However, there is uncertainty regarding this treatment. Moreover, our counsel’s opinion is based on market conditions as of the date of this preliminary pricing supplement and is subject to confirmation on the Trade Date.

Assuming this treatment of the Securities is respected and subject to the discussion in “United States Federal Tax Considerations” in the accompanying product supplement, the following U.S. federal income tax consequences should result:

| ¨ | You should not recognize taxable income over the term of the Securities prior to maturity, other than pursuant to a sale or other disposition. |

| ¨ | Upon a sale or other disposition (including retirement) of a Security, you should recognize capital gain or loss equal to the difference between the amount realized and your tax basis in the Security. Such gain or loss should be long-term capital gain or loss if you held the Security for more than one year. |

We do not plan to request a ruling from the IRS regarding the treatment of the Securities, and the IRS or a court might not agree with the treatment described herein. In particular, the IRS could treat the Securities as contingent payment debt instruments, in which case the tax consequences of ownership and disposition of the Securities, including the timing and character of income recognized, could be materially and adversely affected. Moreover, the U.S. Treasury Department and the IRS have requested comments on various issues regarding the U.S. federal income tax treatment of “prepaid forward contracts” and similar financial instruments and have indicated that such transactions may be the subject of future regulations or other guidance. In addition, members of Congress have proposed legislative changes to the tax treatment of derivative contracts. Any legislation, Treasury regulations or other guidance promulgated after consideration of these issues could materially and adversely affect the tax consequences of an investment in the Securities, possibly with retroactive effect. You should consult your tax advisor regarding possible alternative tax treatments of the Securities and potential changes in applicable law.

Non-U.S. Holders. Subject to the discussions in the next paragraph and in “United States Federal Tax Considerations—Tax Consequences to Non-U.S. Holders” and “United States Federal Tax Considerations—FATCA” in the accompanying product supplement, if you are a Non-U.S. Holder (as defined in the accompanying product supplement) of the Securities, you generally should not be subject to U.S. federal withholding or income tax in respect of any amount paid to you with respect to the Securities, provided that (i) income in respect of the Securities is not effectively connected with your conduct of a trade or business in the United States, and (ii) you comply with the applicable certification requirements.

As discussed under “United States Federal Tax Considerations—Tax Consequences to Non-U.S. Holders—Dividend Equivalents under Section 871(m) of the Code” in the accompanying product supplement, Section 871(m) of the Internal Revenue Code generally imposes a 30% withholding tax on “dividend equivalents” paid or deemed paid to Non-U.S. Holders with respect to certain financial instruments linked to U.S. equities or indices that include U.S. equities. Treasury regulations under Section 871(m), as modified by an IRS notice, exclude from their scope financial instruments issued prior to January 1, 2023 that do not have a “delta” of one with respect to any U.S. equity. Based on the terms of the Securities and representations provided by us as of the date of this preliminary pricing supplement, our counsel is of the opinion that the Securities should not be treated as transactions that have a “delta” of one within the meaning of the regulations with respect to any U.S. equity and, therefore, should not be subject to withholding tax under Section 871(m). However, the final determination regarding the treatment of the Securities under Section 871(m) will be made as of the Trade Date for the Securities and it is possible that the Securities will be subject to withholding tax under Section 871(m) based on circumstances on that date.

A determination that the Securities are not subject to Section 871(m) is not binding on the IRS, and the IRS may disagree with this determination. Moreover, Section 871(m) is complex and its application may depend on your particular circumstances, including your other transactions. You should consult your tax advisor regarding the potential application of Section 871(m) to the Securities.

If withholding tax applies to the Securities, we will not be required to pay any additional amounts with respect to amounts withheld.

16

You should read the section entitled “United States Federal Tax Considerations” in the accompanying product supplement. The preceding discussion, when read in combination with that section, constitutes the full opinion of Davis Polk & Wardwell LLP regarding the material U.S. federal tax consequences of owning and disposing of the Securities.

You should also consult your tax advisor regarding all aspects of the U.S. federal income and estate tax consequences of an investment in the Securities and any tax consequences arising under the laws of any state, local or non-U.S. taxing jurisdiction.

17

| Historical Information |

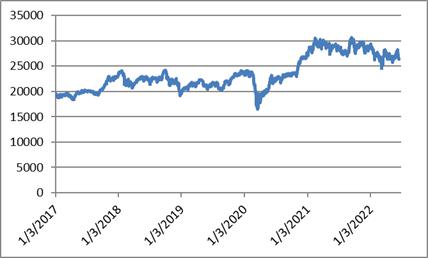

The following graphs set forth the historical performance of the Basket Components, as well as the Basket as a whole, based on the Closing Levels of the Basket Components from January 3, 2017 through June 29, 2022.

We obtained the historical information below from Bloomberg, without independent verification.

You should not take the historical levels of the Basket as an indication of future performance of the Basket or the Securities. Any historical trend in the level of the Basket during any period set forth below is not an indication that the level of the Basket is more or less likely to increase or decrease at any time over the term of the Securities.

For additional information on the Basket Components, see “The Reference Indices—The STOXX Indices—The EURO STOXX 50® Index,” “The Reference Indices—The Nikkei 225 Index,” “The Reference Indices—The FTSE Russell Indices—The FTSE® 100 Index,” “The Reference Indices—The Swiss Market Index®” and “The Reference Indices—The S&P Dow Jones Indices—The S&P/ASX 200 Index” in the accompanying underlying supplement.

Historical Information

The Closing Level of the EURO STOXX 50® Index on June 29, 2022 was 3514.32.

The Closing Level of the Nikkei 225 Index on June 29, 2022 was 26804.60.

18

The Closing Level of the FTSE® 100 Index on June 29, 2022 was 7312.32.

The Closing Level of the Swiss Market Index® on June 29, 2022 was 10811.75.

19

The Closing Level of the S&P/ASX 200 Index on June 29, 2022 was 6700.225.

The following Basket graph sets forth the historical performance of the Basket from January 3, 2017 through June 29, 2022. The graph of the historical Basket performance assumes the Basket Level on June 29, 2022 was 100 and the weightings for each Basket Component were as specified on the cover of this pricing supplement. The red line on the graph represents the Downside Threshold.

20

|

Supplemental Plan of Distribution |

Under the terms of a distributor accession confirmation with UBS Financial Services Inc., dated as of March 12, 2014, UBS Financial Services Inc. will act as distributor for the Securities. The distributor will receive a fee from Credit Suisse or one of our affiliates of up to $0.35 per $10 principal amount of Securities. For additional information, see “Underwriting (Conflicts of Interest)” in any accompanying product supplement.

We expect to deliver the Securities against payment for the Securities on the Settlement Date indicated herein, which may be a date that is greater or less than two business days following the Trade Date. Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in two business days, unless the parties to a trade expressly agree otherwise. Accordingly, if the Settlement Date is more than two business days after the Trade Date, purchasers who wish to transact in the Securities more than two business days prior to the Settlement Date will be required to specify alternative settlement arrangements to prevent a failed settlement.

21