|

Free Writing Prospectus No. T2318 filed pursuant to Rule 433 dated March 15, 2022 / Registration Statement No. 333-238458-02 |

Trigger PLUS Based on the Value of the EURO STOXX 50® Index

Principal at Risk Securities

The Trigger PLUS are unsecured notes issued by Credit Suisse AG.

You should read the accompanying preliminary pricing

supplement dated March 15, 2022, Underlying Supplement dated June 18, 2020, Product Supplement No. I–B dated June 18, 2020, Prospectus

Supplement dated June 18, 2020 and Prospectus dated June 18, 2020 to understand fully the terms of the securities and other considerations

that are important in making a decision about investing in the securities.

| KEY TERMS | |

| Issuer: | Credit Suisse AG (“Credit Suisse”), acting through its London branch |

| Underlying: | EURO STOXX 50® Index |

| Principal Amount: | $10 per security |

| Trade Date: | March 31, 2022 |

| Settlement Date: | April 5, 2022 |

| Valuation Date: | March 31, 2026 |

| Maturity Date: | April 7, 2026 |

| Payment at Maturity: |

If the Final Level is greater than the Initial Level, an amount calculated as follows: $10 + Leveraged Upside Payment If the Final Level is equal to or less than the Initial Level but greater than or equal to the Trigger Level, $10 If the Final Level is less than the Trigger Level, $10 × Index Performance Factor Under these circumstances, the Payment at Maturity will be less than the principal amount of $10 and will represent a loss of more than 25%, and possibly all, of your investment. |

| Leveraged Upside Payment: | $10 × Leverage Factor × Index Percent Change |

| Index Percent Change: |

Final Level – Initial Level Initial Level |

| Index Performance Factor: | The Final Level of the Underlying divided by the Initial Level. |

| Initial Level: | The closing level of the Underlying on the Trade Date. |

| Final Level: | The closing level of the Underlying on the Valuation Date |

| Trigger Level: | 75% of the Initial Level |

| Leverage Factor: | 191% |

| CUSIP / ISIN: | 22552J393 / US22552J3932 |

| Pricing Supplement: | https://www.sec.gov/Archives/edgar/data/1053092/ 000095010322004588/dp169020_424b2-t2318.htm |

Credit Suisse currently estimates the value of each $10 principal amount of the securities on the Trade Date will be between $9.30 and $9.70 (as determined by reference to our pricing models and the rate we are currently paying to borrow funds through issuance of the securities (our “internal funding rate”)). This range of estimated values reflects terms that are not yet fixed. A single estimated value reflecting final terms will be determined on the Trade Date. See “Selected Risk Considerations” in the accompanying pricing supplement.

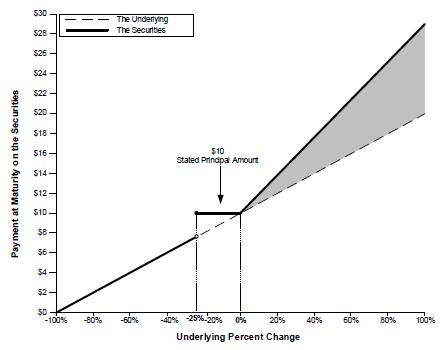

| Securities Payoff Diagram |

|

| Hypothetical Payment at Maturity |

| Index Percent Change | Payment at Maturity | Total Return on Securities |

| 50% | $19.55 | 95.50% |

| 30% | $15.73 | 57.30% |

| 20% | $13.82 | 38.20% |

| 10% | $11.91 | 19.10% |

| 5% | $10.955 | 9.55% |

| 0% | $10.00 | 0% |

| -5% | $10.00 | 0% |

| -10% | $10.00 | 0% |

| -20% | $10.00 | 0% |

| -25% | $10.00 | 0% |

| -26% | $7.40 | -26% |

| -30% | $7.00 | -30% |

| -50% | $5.00 | -50% |

|

This document does not provide all of the information that an investor should consider prior to making an investment decision. You should not invest in the securities without reading the accompanying preliminary pricing supplement and related documents for a more detailed description of the Underlying (including historical information relating to the Underlying), the terms of the securities and certain risks. |

| About Your Securities |

The Trigger PLUS Based on the Value of the EURO STOXX 50® Index due April 7, 2026, which we refer to as the securities, offer leveraged exposure to the positive performance of the Underlying and limited protection against a loss of principal, subject to the credit risk of Credit Suisse. At maturity, if the Underlying has appreciated in value from the Initial Level to the Final Level, investors will receive the principal amount of their investment plus leveraged upside performance of the Underlying. If the Underlying has depreciated in value but the Final Level is greater than or equal to the Trigger Level, investors will receive the stated principal amount of their investment. However, if the Underlying has depreciated in value so that the Final Level is less than the Trigger Level, investors will lose 1% for every 1% decline in the level of the Underlying from the Initial Level to the Final Level. Under these circumstances, the Payment at Maturity will be significantly less than the principal amount and could be zero. Investors may lose their entire initial investment in the securities.

You may revoke your offer to purchase the securities at any time prior to the time at which we accept such offer on the date the securities are priced. We reserve the right to change the terms of, or reject any offer to purchase the securities prior to their issuance. In the event of any changes to the terms of the securities, we will notify you and you will be asked to accept such changes in connection with your purchase. You may also choose to reject such changes in which case we may reject your offer to purchase.

This document is a summary of the terms of the securities and factors that you should consider before deciding to invest in the securities. Credit Suisse has filed a registration statement (including preliminary pricing supplement, underlying supplement, product supplement, prospectus supplement and prospectus) with the Securities and Exchange Commission, or SEC, for the offering to which this offering summary relates. Before you invest, you should read this summary together with the Preliminary Pricing Supplement dated March 15, 2022, Underlying Supplement dated June 18, 2020, Product Supplement No. I–B dated June 18, 2020, Prospectus Supplement dated June 18, 2020 and Prospectus dated June 18, 2020 to understand fully the terms of the securities and other considerations that are important in making a decision about investing in the securities. If the terms described in the applicable preliminary pricing supplement are inconsistent with those described herein, the terms described in the applicable preliminary pricing supplement will control. You may get these documents without cost by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, Credit Suisse, any agent or any dealer participating in this offering will arrange to send you the preliminary pricing supplement, product supplement, prospectus supplement and prospectus if you so request by calling toll-free 1 (800) 221-1037.

| • | Underlying Supplement dated

June 18, 2020: https://www.sec.gov/Archives/edgar/data/1053092/000095010320011950/dp130454_424b2-eus.htm |

| • | Product Supplement No. I–B

dated June 18, 2020: https://www.sec.gov/Archives/edgar/data/1053092/000095010320011955/dp130588_424b2-ps1b.htm |

| • | Prospectus Supplement and Prospectus

dated June 18, 2020: https://www.sec.gov/Archives/edgar/data/1053092/000110465920074474/tm2019510-8_424b2.htm |

| RISK FACTORS |

This section describes the material risks relating to the securities. For a complete list of risk factors, please see the accompanying pricing supplement, any accompanying underlying supplement, product supplement, prospectus and prospectus supplement. Investors should consult their financial and legal advisers as to the risks entailed by an investment in the securities and the appropriateness of the securities in light of their particular circumstances.

The following risk factors are discussed in greater detail in the accompanying preliminary pricing supplement:

Risks Relating to the Securities Generally

| · | The securities do not guarantee the return of any principal |

| · | Regardless of the amount of any payment you receive on the securities, your actual yield may be different in real value terms |

| · | The securities do not pay interest |

| · | The probability that the Final Level will be less than the Trigger Level will depend on the volatility of the Underlying |

| · | The amount payable on the securities is not linked to the value of the Underlying at any time other than the Valuation Date |

| · | The U.S. federal tax consequences of an investment in the securities are unclear |

Risks Relating to the Underlying

| · | No ownership rights relating to the Underlying |

| · | Adjustments to the Underlying could adversely affect the value of the securities |

| · | The closing level of the EURO STOXX 50® Index will not be adjusted for changes in exchange rates relative to the U.S. Dollar even though the equity securities included in the EURO STOXX 50® Index are traded in a foreign currency and the securities are denominated in U.S. Dollars |

| · | Foreign securities markets risk |

| · | No voting rights or dividend payments |

| · | Government regulatory action, including legislative acts and executive orders, could result in material changes to the Underlying and could negatively affect your return on the securities |

Risks Relating to the Issuer

| · | The securities are subject to the credit risk of Credit Suisse |

| · | Credit Suisse is subject to Swiss regulation |

Risks Relating to Conflicts of Interest

| · | Hedging and trading activity |

| · | Potential conflicts |

Risks Relating to the Estimated Value and Secondary Market Prices of the Securitie

| · | Unpredictable economic and market factors will affect the value of the securities |

| · | The estimated value of the securities on the Trade Date may be less than the Price to Public |

| · | Effect of interest rate in structuring the securities |

| · | Secondary market prices |

| · | Lack of liquidity |

Tax Considerations

You should review carefully the discussion in the accompanying preliminary pricing supplement under the caption “United States Federal Tax Considerations” concerning the U.S. federal income tax consequences of an investment in the securities, and you should consult your tax adviser.