|

Free Writing Prospectus No. K1865 filed pursuant to Rule 433 dated December 29, 2021 / Registration Statement No. 333-238458-02 |

Buffered PLUS Based on the Value of the iShares® Global Clean Energy ETF due August 5, 2024

Principal at Risk Securities

The Buffered PLUS are unsecured notes issued by Credit Suisse AG.

You should read the accompanying preliminary pricing supplement dated December 29, 2021, Product Supplement No. I–C dated June 18, 2020, Prospectus Supplement dated June 18, 2020 and Prospectus dated June 18, 2020 to understand fully the terms of the securities and other considerations that are important in making a decision about investing in the securities

| KEY TERMS | |

| Issuer: | Credit Suisse AG (“Credit Suisse”), acting through its London branch |

| Underlying: | iShares® Global Clean Energy ETF |

| Principal Amount: | $10 per security |

| Trade Date: | January 14, 2022 |

| Settlement Date: | January 20, 2022 |

| Valuation Date: | July 31, 2024 |

| Maturity Date: | August 5, 2024 |

| Payment at Maturity: |

If the Final Level is greater than the Initial Level, the lesser of (i) the Maximum Payment at Maturity and (ii) an amount calculated as follows: $10 + Leveraged Upside Payment In no event will the Payment at Maturity exceed the Maximum Payment at Maturity. If the Final Level is less than or equal to the Initial Level but greater than or equal to the Buffer Level, $10 If the Final Level is less than the Buffer Level, an amount calculated as follows: $10 × (Index Performance Factor + Buffer Amount) Under these circumstances, the Payment at Maturity will be less than the principal amount of $10. You could lose up to $9 per $10 principal amount. |

| Leveraged Upside Payment: | $10 × Leverage Factor × Index Percent Increase |

| Index Percent Increase: |

Final Level – Initial Level Initial Level |

| Index Performance Factor: | The Final Level of the Underlying divided by the Initial Level. |

| Initial Level: | The closing level of the Underlying on the Trade Date. |

| Final Level: | The closing level of the Underlying on the Valuation Date |

| Buffer Level: | Expected to be approximately 90% of the Initial Level |

| Buffer Amount: | 10% |

| Leverage Factor: | 200% |

| Maximum Payment at Maturity: | Expected to be $12.20 per security (122% of the principal amount and to be determined on the Trade Date). |

| CUSIP / ISIN: | 22552J153 / US22552J1530 |

| Pricing Supplement: | https://www.sec.gov/Archives/edgar/data/0001053092/00009501 0321020491/dp164427_424b2-k1865.htm |

Credit Suisse currently estimates the value of each $10 principal amount of the securities on the Trade Date will be between $9.30 and $9.70 (as determined by reference to our pricing models and the rate we are currently paying to borrow funds through issuance of the securities (our “internal funding rate”)). This range of estimated values reflects terms that are not yet fixed. A single estimated value reflecting final terms will be determined on the Trade Date. See “Selected Risk Considerations” in the accompanying pricing supplement.

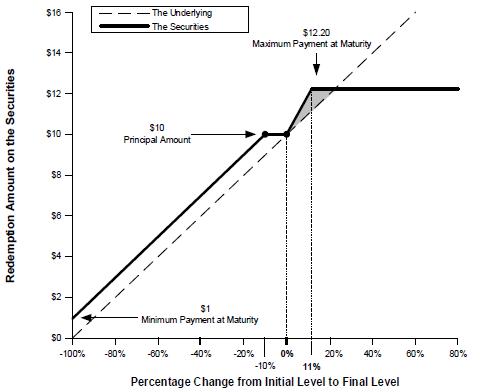

| Securities Payoff Diagram |

|

Hypothetical Payment at Maturity *

| Index Percent Increase | Payment at Maturity | Total Return on Securities | ||||||

| 30% | $12.20 | 22% | ||||||

| 20% | $12.20 | 22% | ||||||

| 11% | $12.20 | 22% | ||||||

| 10% | $12.00 | 20% | ||||||

| 5% | $11.00 | 10% | ||||||

| 0% | $10.00 | 0% | ||||||

| -10% | $10.00 | 0% | ||||||

| -11% | $9.90 | -1% | ||||||

| -20% | $9.00 | -10% | ||||||

| -30% | $8.00 | -20% | ||||||

| *Assumes a maximum payment at maturity of 122% of principal | ||||||||

This document does not provide all of the information that an investor should consider prior to making an investment decision. You should not invest in the securities without reading the accompanying preliminary pricing supplement and related documents for a more detailed description of the Underlying (including historical information relating to the Underlying), the terms of the securities and certain risks. |

About Your Securities |

The Buffered PLUS Based on the Value of the iShares® Global Clean Energy ETF due August 5, 2024, which we refer to as the securities, offer leveraged exposure to a certain range of positive performance of the iShares® Global Clean Energy ETF. In exchange for enhanced performance of 200% of the appreciation of the Underlying, investors forgo performance above the Maximum Payment at Maturity, which is expected to be $12.20 per security (to be determined on the Trade Date). At maturity, if the Underlying has appreciated in value, investors will receive the principal amount of their investment plus leveraged upside performance of the Underlying, subject to the Maximum Payment at Maturity. If the Underlying has depreciated in value, but the Final Level is greater than or equal to the Buffer Level, investors will receive the principal amount of their investment. However, if the Underlying has depreciated in value beyond the Buffer Level, investors will lose 1% for every 1% decline in the level of the Underlying from the Initial Level to the Final Level beyond the Buffer Amount, subject to a minimum payment at maturity of 10% of the principal amount. Under these circumstances, the Payment at Maturity will be less than the principal amount. Investors may lose up to $9 per $10 principal amount.

You may revoke your offer to purchase the securities at any time prior to the time at which we accept such offer on the date the securities are priced. We reserve the right to change the terms of, or reject any offer to purchase the securities prior to their issuance. In the event of any changes to the terms of the securities, we will notify you and you will be asked to accept such changes in connection with your purchase. You may also choose to reject such changes in which case we may reject your offer to purchase.

This document is a summary of the terms of the securities and factors that you should consider before deciding to invest in the securities. Credit Suisse has filed a registration statement (including preliminary pricing supplement, product supplement, prospectus supplement and prospectus) with the Securities and Exchange Commission, or SEC, for the offering to which this offering summary relates. Before you invest, you should read this summary together with the Preliminary Pricing Supplement dated December 29, 2021, Product Supplement No. I–C dated June 18, 2020, Prospectus Supplement dated June 18, 2020 and Prospectus dated June 18, 2020 to understand fully the terms of the securities and other considerations that are important in making a decision about investing in the securities. If the terms described in the applicable preliminary pricing supplement are inconsistent with those described herein, the terms described in the applicable preliminary pricing supplement will control. You may get these documents without cost by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, Credit Suisse, any agent or any dealer participating in this offering will arrange to send you the preliminary pricing supplement, product supplement, prospectus supplement and prospectus if you so request by calling toll-free 1 (800) 221-1037.

| • | Product Supplement No. I–C dated June 18, 2020: https://www.sec.gov/Archives/edgar/data/1053092/000095010320011958/dp130587_424b2-ps1c.htm |

| • | Prospectus Supplement and Prospectus dated June 18, 2020: https://www.sec.gov/Archives/edgar/data/1053092/000110465920074474/tm2019510-8_424b2.htm |

RISK FACTORS |

This section describes the material risks relating to the securities. For a complete list of risk factors, please see the accompanying pricing supplement, any accompanying product supplement, prospectus and prospectus supplement. Investors should consult their financial and legal advisers as to the risks entailed by an investment in the securities and the appropriateness of the securities in light of their particular circumstances.

The following risk factors are discussed in greater detail in the accompanying preliminary pricing supplement:

Risks Relating to the Securities Generally

| · | The investment in the securities may result in a loss |

| · | Regardless of the amount of any payment you receive on the securities, your actual yield may be different in real value terms |

| · | The securities have limited appreciation potential |

| · | The securities do not pay interest |

| · | The probability that the Final Level will be less than the Buffer Level will depend on the volatility of the Underlying |

| · | The U.S. federal tax consequences of an investment in the securities are unclear |

Risks Relating to the Underlying

| · | Although shares of the Underlying are listed for trading on a national securities exchange and a number of similar products have been traded on various national securities exchanges for varying periods of time, there is no assurance that an active trading market will continue for the shares of the Underlying or that there will be liquidity in the trading market |

| · | The performance and market value of the Underlying, particularly during periods of market volatility, may not correlate to the performance of the Tracked Index |

| · | The stocks included in the Underlying are concentrated in one particular sector |

| · | The performance of the Underlying and the value of the securities are subject to foreign securities markets risk |

| · | The Underlying is exposed to the political and economic risks of emerging market countries |

| · | Because the prices of the non-U.S. equity securities included in the Underlying are converted into U.S. dollars for purposes of calculating the level of the Underlying, investors will be exposed to currency exchange rate risk with respect to each of the currencies in which the non-U.S. equity securities included in the Underlying trade |

| · | No ownership rights relating to the Underlying |

| · | Anti-dilution protection is limited |

| · | Government regulatory action, including legislative acts and executive orders, could result in material changes to the Underlying and could negatively affect your return on the securities |

Risks Relating to the Issuer

| · | The securities are subject to the credit risk of Credit Suisse |

| · | Credit Suisse is subject to Swiss regulation |

Risks Relating to Conflicts of Interest

| · | Hedging and trading activity |

| · | Potential conflicts |

Risks Relating to the Estimated Value and Secondary Market Prices of the Securities

| · | Unpredictable economic and market factors will affect the value of the securities |

| · | The estimated value of the securities on the Trade Date may be less than the Price to Public |

| · | Effect of interest rate in structuring the securities |

| · | Secondary market prices |

| · | Lack of liquidity |

Tax Considerations

You should review carefully the discussion in the accompanying preliminary pricing supplement under the caption “United States Federal Tax Considerations” concerning the U.S. federal income tax consequences of an investment in the securities, and you should consult your tax adviser.