|

January 2021 Pricing Supplement No. U5586 Registration Statement No. 333-238458-02 Dated January 19, 2021 Filed pursuant to Rule 424(b)(2) |

Auto-Callable Contingent

Income Securities due January 24, 2024

All Payments on the Securities Subject to the Coupon Barrier and Downside Threshold

Features

Based on the Performance of the Worst Performing of Three Underlyings

Principal at Risk Securities

Unlike ordinary debt securities, the Auto-Callable Contingent Income Securities due January 24, 2024 based on the Performance of the Worst Performing of the Common Stock of The Bank of New York Mellon Corporation, the Common Stock of Northern Trust Corporation and the Common Stock of State Street Corporation (each, an “Underlying”), which we refer to as the securities, do not provide for the regular payment of interest or guarantee the return of any principal at maturity. Instead, the securities offer the opportunity for investors to earn a Contingent Coupon but only if the closing level of each Underlying on the applicable Observation Date is greater than or equal to approximately 60% of its respective Initial Level, which we refer to as its Coupon Barrier Level. If the closing level of any Underlying is less than its respective Coupon Barrier Level on any Observation Date, you will not receive any Contingent Coupon for that period. As a result, investors must be willing to accept the risk of not receiving any Contingent Coupons during the entire term of the securities. In addition, if the closing level of each Underlying is greater than or equal to its Initial Level on any Observation Date scheduled to occur on or after July 19, 2021 (other than the Valuation Date), the securities will be automatically redeemed for an amount per security equal to the Principal Amount plus the Contingent Coupon payable on the immediately following Contingent Coupon Payment Date. At maturity, if the securities have not previously been automatically redeemed and the Final Level of the Worst Performing Underlying is greater than or equal to approximately 60% of its Initial Level, which we refer to as its Downside Threshold Level, investors will receive the Principal Amount, and, because the Final Level of each Underlying is greater than or equal to its respective Coupon Barrier Level, the Contingent Coupon payable with respect to the Valuation Date. However, if the Final Level of the Worst Performing Underlying is less than its Downside Threshold Level, investors will be fully exposed to the decline in the level of the Worst Performing Underlying over the term of the securities, and the Redemption Amount will be less than 60% of the Principal Amount of the securities and could be zero. Accordingly, investors may lose up to their entire initial investment in the securities. Because payments on the securities are based on the performance of each Underlying, a decline beyond the respective Coupon Barrier Level and/or respective Downside Threshold Level, as applicable, of any Underlying will result in few or no Contingent Coupons and/or a significant loss of your investment, as applicable, even if any other Underlying has appreciated or has not declined as much. Investors will not participate in any appreciation of any Underlying. These securities are for investors who seek an opportunity to earn interest at a potentially above-market rate in exchange for the risk of losing a significant portion or all of their principal, the risk of receiving no Contingent Coupon on a Contingent Coupon Payment Date if the closing level of any Underlying is below its respective Coupon Barrier Level on the immediately preceding Observation Date and the risk of an Automatic Redemption of the securities.

All payments on the securities, including the repayment of principal, are subject to the credit risk of Credit Suisse.

| KEY TERMS | |||||||

| Issuer: | Credit Suisse AG (“Credit Suisse”), acting through its London branch | ||||||

| Reference Share Issuer: | For each Underlying, the issuer of such Underlying. | ||||||

| Underlyings: | The Underlyings are set forth in the table below. For more information on the Underlyings, see “The Bank of New York Mellon Summary”, “Northern Trust Corporation Summary” and “State Street Corporation Summary” herein. The Underlying is identified in the table below, together with its Bloomberg ticker symbol, Initial Level, Downside Threshold Level, Coupon Barrier Level and Early Redemption Level: | ||||||

| Underlying | Ticker | Initial Level | Downside Threshold Level | Coupon Barrier Level | Early Redemption Level | ||

| Common stock of The Bank of New York Mellon Corporation |

BK UN <Equity> |

$45.82 | $27.49 (Approximately 60% of Initial Level) | $27.49 (Approximately 60% of Initial Level) | $45.82 (100% of Initial Level) | ||

| Common stock of Northern Trust Corporation |

NTRS UW <Equity> |

$97.36 | $58.42 (Approximately 60% of Initial Level) |

$58.42 (Approximately 60% of Initial Level) |

$97.36 (100% of Initial Level) | ||

| Common stock of State Street Corporation | STT UN <Equity> |

$78.40 | $47.04 (60% of Initial Level) |

$47.04 (60% of Initial Level) |

$78.40 (100% of Initial Level) | ||

| Aggregate Principal Amount: | $15,530,000 | ||||||

| Principal Amount: | $10 per security. The securities are offered at a minimum investment of 100 securities at $10 per security (representing a $1,000 investment), and integral multiples of $10 in excess thereof. | ||||||

| Price to Public: | $10 per security (see “Commissions and Price to Public” below) | ||||||

| Trade Date: | January 19, 2021 | ||||||

| Settlement Date: | January 22, 2021 (3 business days after the Trade Date). Delivery of the securities in book-entry form only will be made through The Depository Trust Company. | ||||||

| Valuation Date: | January 19, 2024, subject to postponement as set forth in any accompanying product supplement under “Description of the Securities—Postponement of calculation dates.” | ||||||

| Maturity Date: | January 24, 2024, subject to postponement as set forth in any accompanying product supplement under “Description of the Securities—Postponement of calculation dates.” If the Maturity Date is not a business day, the Redemption Amount will be payable on the first following business day, unless that business day falls in the next calendar month, in which case payment will be made on the first preceding business day. | ||||||

| Redemption Amount: | If the securities have not previously been automatically redeemed, on the Maturity Date investors will receive a Redemption Amount determined as follows: | ||||||

| · If the Final Level of the Worst Performing Underlying is greater than or equal to its Downside Threshold Level: | the Principal Amount, and, because the Final Level of each Underlying is greater than or equal to its respective Coupon Barrier Level, the Contingent Coupon with respect to the Valuation Date. | ||||||

| · If the Final Level of the Worst Performing Underlying is less than its Downside Threshold Level: |

(i) the Principal Amount multiplied by (ii) the Underlying Return of the Worst Performing Underlying. In this case, the Redemption Amount will be less than $6.00 per $10 principal amount of securities. You could lose your entire investment. | ||||||

| Distributor: | Morgan Stanley Smith Barney LLC (“MSSB”). See “Supplemental Plan of Distribution.” | ||||||

| Calculation Agent: | Credit Suisse International | ||||||

| Listing: | The securities will not be listed on any securities exchange. | ||||||

| Key Terms continued on the following page | |||||||

Investing in the securities involves a number of risks. See “Selected Risk Considerations” beginning on page 11 of this pricing supplement and “Risk Factors” beginning on page PS-3 of any accompanying product supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities or passed upon the accuracy or the adequacy of this pricing supplement or any accompanying product supplement, the prospectus supplement and the prospectus. Any representation to the contrary is a criminal offense.

| Commissions and Price to Public | Price to Public | Underwriting Discounts and Commissions | Proceeds to Issuer |

| Per security | $10 | $0.20(1) | |

| $0.05(2) | $9.75 | ||

| Total | $15,530,000 | $388,250 | $15,141,750 |

(1) We or one of our affiliates will pay to MSSB discounts and commissions of $0.25 per $10 principal amount of securities, of which $0.05 per $10 principal amount of securities will be paid as a structuring fee. For more detailed information, please see “Supplemental Plan of Distribution (Conflicts of Interest)” in this pricing supplement.

(2) Reflects a structuring fee payable to MSSB by Credit Suisse Securities (USA) LLC (“CSSU”) or one of its affiliates of $0.05 for each security.

The agent for this offering, CSSU, is our affiliate. For more information, see “Supplemental Plan of Distribution (Conflicts of Interest)” in this pricing supplement.

Credit Suisse currently estimates the value of each $10 principal amount of the securities on the Trade Date is $9.59 (as determined by reference to our pricing models and the rate we are currently paying to borrow funds through issuance of the securities (our “internal funding rate”)). See “Selected Risk Considerations” in this pricing supplement.

The securities are not deposit liabilities and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency of the United States, Switzerland or any other jurisdiction.

Credit Suisse

Auto-Callable Contingent Income Securities due January 24, 2024

All Payments on the Securities Subject to the Coupon Barrier and Downside Threshold Features

Based on the Performance of the Worst Performing of Three Underlyings

Principal at Risk Securities

| Key Terms continued from previous page: | |

| Contingent Coupons: |

· Subject to Automatic Redemption, if, on any Observation Date the closing level of each Underlying is greater than or equal to its respective Coupon Barrier Level, we will pay a Contingent Coupon at an annual rate of 8.00% (corresponding to $0.20 per period per security) on the immediately following Contingent Coupon Payment Date. · If on any Observation Date the closing level of any Underlying is less than its respective Coupon Barrier Level, no Contingent Coupon will be paid with respect to that Observation Date. |

| Automatic Redemption: | If an Early Redemption Event occurs, the securities will be automatically redeemed and you will receive a cash payment equal to the Principal Amount (the “Automatic Redemption Amount”) and the Contingent Coupon payable on the immediately following Contingent Coupon Payment Date (the “Automatic Redemption Date”). No further payments will be made in respect of the securities following an Automatic Redemption. Payment will be made with respect to such Automatic Redemption on the Contingent Coupon Payment Date immediately following the relevant Observation Date. Any payment on the securities is subject to our ability to pay our obligations as they become due. |

| Early Redemption Event: | An Early Redemption Event will occur on any Observation Date scheduled to occur on or after July 19, 2021 (other than the Valuation Date) if the closing level of each Underlying on such Observation Date is equal to or greater than its respective Early Redemption Level. |

| Early Redemption Level: | For each Underlying, 100% of the Initial Level of such Underlying, as set forth in the table above. |

| Coupon Barrier Level: | For each Underlying, approximately 60% of the Initial Level of such Underlying, as set forth in the table above. |

| Downside Threshold Level: | For each Underlying, approximately 60% of the Initial Level of such Underlying, as set forth in the table above. |

| Initial Level: | For each Underlying, the closing level of such Underlying on the Trade Date, as set forth in the table above. |

| Final Level: | For each Underlying, the closing level of such Underlying on the Valuation Date. |

| Observation Dates: | April 19, 2021, July 19, 2021, October 19, 2021, January 19, 2022, April 19, 2022, July 19, 2022, October 19, 2022, January 19, 2023, April 19, 2023, July 19, 2023, October 19, 2023 and the Valuation Date, subject to postponement as set forth in any accompanying product supplement under “Description of the Securities—Postponement of calculation dates.” We also refer to the Observation Date immediately prior to the Maturity Date as the Valuation Date. |

| Contingent Coupon Payment Dates: | April 22, 2021, July 22, 2021, October 22, 2021, January 24, 2022, April 22, 2022, July 22, 2022, October 24, 2022, January 24, 2023, April 24, 2023, July 24, 2023, October 24, 2023 and the Maturity Date, subject to postponement as set forth in any accompanying product supplement under “Description of the Securities—Postponement of calculation dates.” If any Contingent Coupon Payment Date is not a business day, the Contingent Coupon will be payable on the first following business day, unless that business day falls in the next calendar month, in which case payment will be made on the first preceding business day. The amount of any Contingent Coupon will not be adjusted in respect of any postponement of a Contingent Coupon Payment Date and no interest or other payment will be payable on the securities because of any such postponement of a Contingent Coupon Payment Date. No Contingent Coupons will be payable following an Automatic Redemption. Contingent Coupons, if any, will be payable on the applicable Contingent Coupon Payment Date to the holder of record at the close of business on the business day immediately preceding the applicable Contingent Coupon Payment Date, provided that the Contingent Coupon payable, if any, on the Automatic Redemption Date or Maturity Date, as applicable, will be payable to the person to whom the Automatic Redemption Amount or Redemption Amount, as applicable, is payable. |

| Underlying Return: | With respect to each Underlying, the Final Level of such Underlying divided by its Initial Level |

| Worst Performing Underlying: | The Underlying with the lowest Underlying Return |

| Events of Default: |

With respect to these securities, the first bullet of the first sentence of “Description of Debt Securities—Events of Default” in the accompanying prospectus is amended to read in its entirety as follows: · a default in payment of the principal or any premium on any debt security of that series when due, and such default continues for 30 days; |

| CUSIP / ISIN: | 22551F384 / US22551F3846 |

Auto-Callable Contingent Income Securities due January 24, 2024

All Payments on the Securities Subject to the Coupon Barrier and Downside Threshold Features

Based on the Performance of the Worst Performing of Three Underlyings

Principal at Risk Securities

Additional Terms Specific to the Securities

You should read this pricing supplement together with the product supplement dated June 18, 2020, the prospectus supplement dated June 18, 2020 and the prospectus dated June 18, 2020, relating to our Medium-Term Notes of which these securities are a part. You may access these documents on the SEC website at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

| • | Product Supplement No. I−A dated June 18, 2020: |

https://www.sec.gov/Archives/edgar/data/1053092/000095010320011953/dp130590_424b2-ps1a.htm

| • | Prospectus Supplement and Prospectus dated June 18, 2020: |

https://www.sec.gov/Archives/edgar/data/1053092/000110465920074474/tm2019510-8_424b2.htm

In the event the terms of the securities described in this pricing supplement differ from, or are inconsistent with, the terms described in the product supplement, prospectus supplement or prospectus, the terms described in this pricing supplement will control.

Our Central Index Key, or CIK, on the SEC website is 1053092. As used in this pricing supplement, “we,” “us,” or “our” refers to Credit Suisse.

This pricing supplement, together with the documents listed above, contains the terms of the securities and supersedes all other prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, fact sheets, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours. We may, without the consent of the registered holder of the securities and the owner of any beneficial interest in the securities, amend the securities to conform to its terms as set forth in this pricing supplement and the documents listed above, and the trustee is authorized to enter into any such amendment without any such consent. You should carefully consider, among other things, the matters set forth in “Selected Risk Considerations” in this pricing supplement and “Risk Factors” in any accompanying product supplement, “Foreign Currency Risks” in the accompanying prospectus, and any risk factors we describe in the combined Annual Report on Form 20-F of Credit Suisse Group AG and us incorporated by reference therein, and any additional risk factors we describe in future filings we make with the SEC under the Securities Exchange Act of 1934, as amended, as the securities involve risks not associated with conventional debt securities. You should consult your investment, legal, tax, accounting and other advisors before deciding to invest in the securities.

| January 2021 | Page 3 |

Auto-Callable Contingent Income Securities due January 24, 2024

All Payments on the Securities Subject to the Coupon Barrier and Downside Threshold Features

Based on the Performance of the Worst Performing of Three Underlyings

Principal at Risk Securities

Supplemental Terms of the Securities

For purposes of the securities offered by this pricing supplement, all references to the following defined term used in any accompanying product supplement will be deemed to refer to the corresponding defined term used in this pricing supplement, as set forth in the table below:

|

Product Supplement Defined Term |

Pricing Supplement Defined Term |

| Knock-In Level | Downside Threshold Level |

| Lowest Performing Underlying | Worst Performing Underlying |

| January 2021 | Page 4 |

Auto-Callable Contingent Income Securities due January 24, 2024

All Payments on the Securities Subject to the Coupon Barrier and Downside Threshold Features

Based on the Performance of the Worst Performing of Three Underlyings

Principal at Risk Securities

Investment Summary

Auto-Callable Contingent Income Securities

Principal at Risk Securities

The Auto-Callable Contingent Income Securities due January 24, 2024 based on the common stock of The Bank of New York Mellon Corporation, the common stock of Northern Trust Corporation and the common stock of State Street Corporation, which we refer to as the securities, provide an opportunity for investors to earn a Contingent Coupon at an annual rate of 8.00% (corresponding to $0.20 per period per security) but only if the closing level of each Underlying on the applicable Observation Date is greater than or equal to approximately 60% of its respective Initial Level, which we refer to as its Coupon Barrier Level. It is possible that the closing levels of one or more Underlyings could be below their respective Coupon Barrier Levels on most or all of the Observation Dates throughout the entire term of the securities so that you may receive few or no Contingent Coupons during the entire term of the securities. In addition, if the closing level of each Underlying is greater than or equal to its Initial Level on any Observation Date scheduled to occur on or after July 19, 2021 (other than the Valuation Date), the securities will be automatically redeemed for an amount per security equal to the Principal Amount plus the Contingent Coupon payable on the immediately following Contingent Coupon Payment Date.

If the securities have not been previously automatically redeemed and the Final Level of the Worst Performing Underlying is greater than or equal to approximately 60% of its Initial Level, which we refer to as its Downside Threshold Level, the Redemption Amount will be the Principal Amount and, because the Final Level of each Underlying is greater than or equal to its Coupon Barrier Level, the Contingent Coupon with respect to the Valuation Date. However, if the Final Level of the Worst Performing Underlying is less than its Downside Threshold Level, investors will be fully exposed to the decline in the Worst Performing Underlying over the term of the securities and will receive a Redemption Amount that is significantly less than the Principal Amount, in proportion to the decline in the Worst Performing Underlying from its Initial Level to its Final Level. In this scenario, the value of any such payment will be less than 60% of the Principal Amount of the securities and could be zero. Investors in the securities must be willing to accept the risk of losing their entire principal and also the risk of not receiving any Contingent Coupons. In addition, investors will not participate in any appreciation of any Underlying.

| Maturity: | Approximately three years, unless automatically redeemed earlier |

| Redemption Amount: |

If the securities have not previously been automatically redeemed, investors will receive on the Maturity Date a Redemption Amount determined as follows:

If the Final Level of the Worst Performing Underlying is greater than or equal to its Downside Threshold Level, investors will receive the Principal Amount and, because the Final Level of each Underlying is also greater than or equal to its Coupon Barrier Level, the Contingent Coupon with respect to the Valuation Date.

If the Final Level of the Worst Performing Underlying is less than its Downside Threshold Level, investors will receive a Redemption Amount that is less than 60% of the Principal Amount of the securities and could be zero. Accordingly, investors in the securities must be willing to accept the risk of losing their entire initial investment. |

| Contingent Coupons: |

A Contingent Coupon at an annual rate of 8.00% (corresponding to $0.20 per period per security) will be paid on the securities on each Contingent Coupon Payment Date but only if the closing level of each Underlying is at or above its respective Coupon Barrier Level on the immediately preceding Observation Date.

If, on any Observation Date, the closing level of any Underlying is less than its respective Coupon Barrier Level, we will pay no coupon for the applicable period. |

| Automatic Redemption: |

If an Early Redemption Event occurs, the securities will be automatically redeemed and you will receive a cash payment equal to the Principal Amount and the Contingent Coupon payable on the immediately following Contingent Coupon Payment Date. No further payments will be made in respect of the securities following an Automatic Redemption. Payment will be made in respect of such Automatic Redemption on the Contingent Coupon Payment Date immediately following the relevant Observation Date.

An Early Redemption Event will occur on any Observation Date scheduled to occur on or after July 19, 2021 (other than the Valuation Date) if the closing level of each Underlying on such Observation Date is equal to or greater than its respective Early Redemption Level. |

| January 2021 | Page 5 |

Auto-Callable Contingent Income Securities due January 24, 2024

All Payments on the Securities Subject to the Coupon Barrier and Downside Threshold Features

Based on the Performance of the Worst Performing of Three Underlyings

Principal at Risk Securities

Key Investment Rationale

The securities do not guarantee any repayment of principal at maturity and offer investors an opportunity to earn a Contingent Coupon of 8.00% per annum (corresponding to $0.20 per period per security) but only if the closing level of each Underlying on the applicable Observation Date is greater than or equal to approximately 60% of its Initial Level, which we refer to as its Coupon Barrier Level. The securities have been designed for investors who seek an opportunity to earn interest at a potentially above-market rate in exchange for the risk of (i) losing a significant portion or all of their principal, (ii) receiving no Contingent Coupon on a Contingent Coupon Payment Date if the level of any Underlying is below its respective Coupon Barrier Level on the immediately preceding Observation Date and (iii) an Automatic Redemption of the securities. The following scenarios are for illustrative purposes only to demonstrate how the Contingent Coupon and the Redemption Amount (if the securities have not previously been automatically redeemed) are calculated, and do not attempt to demonstrate every situation that may occur. Accordingly, the securities may or may not be automatically redeemed, the Contingent Coupon may be payable in none of, or some but not all of, the periods during the term of the securities and the Redemption Amount may be less than 60% of the Principal Amount of the securities and may be zero.

| Scenario 1: The securities are automatically redeemed prior to maturity. | This scenario assumes that the securities are automatically redeemed prior to the Maturity Date on one of the Contingent Coupon Payment Dates for the Automatic Redemption Amount equal to the Principal Amount plus the Contingent Coupon payable on such Contingent Coupon Payment Date. Prior to the Automatic Redemption, each Underlying may close at or above its respective Coupon Barrier Level on some or all of the Observation Dates. In this scenario, investors receive the Contingent Coupon with respect to each Observation Date on which each Underlying closes at or above its respective Coupon Barrier Level, but not for the Observation Dates on which any Underlying closes below its respective Coupon Barrier Level. No further payments will be made on the securities once they have been automatically redeemed. |

| Scenario 2: The securities are not automatically redeemed prior to maturity, and investors receive principal back at maturity. | This scenario assumes that the securities are not automatically redeemed on any of the Contingent Coupon Payment Dates, and, as a result, investors hold the securities to maturity. During the term of the securities, each Underlying may close at or above its respective Coupon Barrier Level on some but not all of the Observation Dates. Consequently, investors receive the Contingent Coupon with respect to each Observation Date on which each Underlying closes at or above its respective Coupon Barrier Level, but not for the Observation Dates on which any Underlying closes below its respective Coupon Barrier Level. On the Valuation Date, the Worst Performing Underlying closes at or above its Downside Threshold Level. Therefore, at maturity, investors will receive the Principal Amount, and, because the Final Level of each Underlying is greater than or equal to its respective Coupon Barrier Level, the Contingent Coupon with respect to the Valuation Date. |

| Scenario 3: The securities are not automatically redeemed prior to maturity, and investors suffer a substantial loss of principal at maturity. | This scenario assumes that the securities are not automatically redeemed on any of the Contingent Coupon Payment Dates, and, as a result, investors hold the securities to maturity. During the term of the securities, one or more Underlyings close below their respective Coupon Barrier Levels on all or nearly all of the Observation Dates. In this scenario, investors do not receive any Contingent Coupons, or receive Contingent Coupons for only a limited number of Contingent Coupon Payment Dates. On the Valuation Date, the Worst Performing Underlying closes below its Downside Threshold Level. Therefore, investors receive an amount equal to the Principal Amount multiplied by the Underlying Return of the Worst Performing Underlying at maturity. Under these circumstances, the Redemption Amount will be less than 60% of the Principal Amount and could be zero. No coupon will be paid at maturity in this scenario. |

| January 2021 | Page 6 |

Auto-Callable Contingent Income Securities due January 24, 2024

All Payments on the Securities Subject to the Coupon Barrier and Downside Threshold Features

Based on the Performance of the Worst Performing of Three Underlyings

Principal at Risk Securities

The Bank of New York Mellon Corporation Summary

Companies with securities registered under the Securities Exchange Act of 1934 (the “Exchange Act”) are required to periodically file certain financial and other information specified by the SEC. Information provided to or filed with the SEC by the Reference Share Issuer pursuant to the Exchange Act can be located by reference to the SEC file number provided below. According to its publicly available filings with the SEC, The Bank of New York Mellon Corporation is divided into two main business segments, investment services and investment management. The common stock of The Bank of New York Mellon Corporation is listed on the New York Stock Exchange. The Bank of New York Mellon Corporation’s SEC file number is 001-35651 and can be accessed through www.sec.gov.

This pricing supplement relates only to the securities offered hereby and does not relate to the Underlying or other securities of the Reference Share Issuer. We have derived all disclosures contained in this pricing supplement regarding the Underlying and the Reference Share Issuer from the publicly available documents described in the preceding paragraph. In connection with the offering of the securities, neither we nor our affiliates have participated in the preparation of such documents or made any due diligence inquiry with respect to the Reference Share Issuer.

Information as of market close on January 19, 2021:

| Bloomberg Ticker Symbol: | BK UN <Equity> |

| Current Closing Level: | $45.82 |

| 52 Weeks Ago (on 1/21/2020): | $46.78 |

| 52 Week High (on 2/6/2020): | $47.54 |

| 52 Week Low (on 3/23/2020): | $27.49 |

For additional historical information, see “Common Stock of The Bank of New York Mellon Corporation Historical Performance” below.

Northern Trust Corporation Summary

Companies with securities registered under the Securities Exchange Act of 1934 (the “Exchange Act”) are required to periodically file certain financial and other information specified by the SEC. Information provided to or filed with the SEC by the Reference Share Issuer pursuant to the Exchange Act can be located by reference to the SEC file number provided below. According to its publicly available filings with the SEC, Northern Trust Corporation is a provider of wealth management, asset servicing, asset management and banking solutions to corporations, institutions, families and individuals. The common stock of Northern Trust Corporation is listed on the Nasdaq Stock Market. Northern Trust Corporation’s SEC file number is 001-36609 and can be accessed through www.sec.gov.

This pricing supplement relates only to the securities offered hereby and does not relate to the Underlying or other securities of the Reference Share Issuer. We have derived all disclosures contained in this pricing supplement regarding the Underlying and the Reference Share Issuer from the publicly available documents described in the preceding paragraph. In connection with the offering of the securities, neither we nor our affiliates have participated in the preparation of such documents or made any due diligence inquiry with respect to the Reference Share Issuer.

Information as of market close on January 19, 2021:

| Bloomberg Ticker Symbol: | NTRS UW <Equity> |

| Current Closing Level: | $97.36 |

| 52 Weeks Ago (on 1/21/2020): | $108.57 |

| 52 Week High (on 1/21/2020): | $108.57 |

| 52 Week Low (on 3/16/2020): | $62.22 |

For additional historical information, see “Common Stock of Northern Trust Corporation Historical Performance” below.

| January 2021 | Page 7 |

Auto-Callable Contingent Income Securities due January 24, 2024

All Payments on the Securities Subject to the Coupon Barrier and Downside Threshold Features

Based on the Performance of the Worst Performing of Three Underlyings

Principal at Risk Securities

State Street Corporation Summary

Companies with securities registered under the Securities Exchange Act of 1934 (the “Exchange Act”) are required to periodically file certain financial and other information specified by the SEC. Information provided to or filed with the SEC by the Reference Share Issuer pursuant to the Exchange Act can be located by reference to the SEC file number provided below. According to its publicly available filings with the SEC, State Street Corporation is a financial holding company that provides a range of financial products and services to institutional investors. The common stock of State Street Corporation is listed on the New York Stock Exchange. State Street Corporation’s SEC file number is 001-07511 and can be accessed through www.sec.gov.

This pricing supplement relates only to the securities offered hereby and does not relate to the Underlying or other securities of the Reference Share Issuer. We have derived all disclosures contained in this pricing supplement regarding the Underlying and the Reference Share Issuer from the publicly available documents described in the preceding paragraph. In connection with the offering of the securities, neither we nor our affiliates have participated in the preparation of such documents or made any due diligence inquiry with respect to the Reference Share Issuer.

Information as of market close on January 19, 2021:

| Bloomberg Ticker Symbol: | STT UN <Equity> |

| Current Closing Level: | $78.40 |

| 52 Weeks Ago (on 1/21/2020): | $81.31 |

| 52 Week High (on 1/17/2020): | $82.56 |

| 52 Week Low (on 3/23/2020): | $43.21 |

For additional historical information, see “Common Stock of State Street Corporation Historical Performance” below.

| January 2021 | Page 8 |

Auto-Callable Contingent Income Securities due January 24, 2024

All Payments on the Securities Subject to the Coupon Barrier and Downside Threshold Features

Based on the Performance of the Worst Performing of Three Underlyings

Principal at Risk Securities

Hypothetical Examples

The following hypothetical examples are for illustrative purposes only. Whether you receive a Contingent Coupon and whether an Early Redemption Event occurs will be determined on each Observation Date. If the securities are not automatically redeemed, the Redemption Amount will be determined by reference to the Final Level of the Worst Performing Underlying. The actual Initial Level, Coupon Barrier Level, Downside Threshold Level and Early Redemption Level for each Underlying are set forth in “Key Terms” herein. All payments on the securities are subject to the credit risk of Credit Suisse. The numbers in the hypothetical examples may be rounded for ease of analysis. The below examples are based on the following terms:

| Hypothetical Initial Level of the Underlyings: |

Underlying A: $50

Underlying B: $100

Underlying C: $80 |

| Hypothetical Coupon Barrier Level of the Underlyings: |

Underlying A: $30, which is 60% of the hypothetical Initial Level

Underlying B: $60, which is 60% of the hypothetical Initial Level

Underlying C: $48, which is 60% of the hypothetical Initial Level |

| Hypothetical Downside Threshold Level of the Underlyings: |

Underlying A: $30, which is 60% of the hypothetical Initial Level

Underlying B: $60, which is 60% of the hypothetical Initial Level

Underlying C: $48, which is 60% of the hypothetical Initial Level |

| Hypothetical Early Redemption Level of the Underlyings: |

Underlying A: $50, which is 100% of the hypothetical Initial Level

Underlying B: $100, which is 100% of the hypothetical Initial Level

Underlying C: $80, which is 100% of the hypothetical Initial Level |

| Contingent Coupons: |

8.00% per annum (corresponding to $0.20 per period per security)

A Contingent Coupon is paid on each Contingent Coupon Payment Date but only if the closing level of each Underlying is at or above its respective Coupon Barrier Level on the related Observation Date. |

| Automatic Redemption: | If on any Observation Date scheduled to occur on or after July 19, 2021 (other than the Valuation Date) the closing level of each Underlying is greater than or equal to its Initial Level, the securities will be automatically redeemed for an Automatic Redemption Amount equal to the Principal Amount plus the Contingent Coupon payable on the immediately following Contingent Coupon Payment Date. |

| Redemption Amount (if the securities have not been automatically redeemed): |

If the Final Level of the Worst Performing Underlying is greater than or equal to its Downside Threshold Level: the Principal Amount, and, because the Final Level of each Underlying is greater than or equal to its respective Coupon Barrier Level, the Contingent Coupon with respect to the Valuation Date.

If the Final Level of the Worst Performing Underlying is less than its Downside Threshold Level: (i) the Principal Amount multiplied by (ii) the Underlying Return of the Worst Performing Underlying. |

| Principal Amount: | $10 |

In Example 1, the securities are automatically redeemed on one of the Contingent Coupon Payment Dates, and no further payments are made on the securities after they have been automatically redeemed. In Examples 2, 3, and 4, the securities are not automatically redeemed prior to, and remain outstanding until, maturity.

Example 1 — The closing level of each Underlying is at or above its respective Early Redemption Level on the third Observation Date, but below its respective Early Redemption Level on each prior Observation Date, so the securities are automatically redeemed on the Contingent Coupon Payment Date immediately following the third Observation Date. The closing level of each Underlying is also at or above its respective Coupon Barrier Level on each Observation Date prior to (and excluding) the Observation Date immediately preceding the Automatic Redemption. Therefore, you would receive the Contingent Coupons with respect to those Observation Dates, totaling $0.20 × 2 = $0.40. The closing level of each Underlying is greater than or equal to its respective Coupon Barrier Level on the Observation Date immediately preceding the Automatic Redemption. Upon Automatic Redemption, investors receive the Automatic Redemption Amount calculated as $10 + $0.20 = $10.20.

| January 2021 | Page 9 |

Auto-Callable Contingent Income Securities due January 24, 2024

All Payments on the Securities Subject to the Coupon Barrier and Downside Threshold Features

Based on the Performance of the Worst Performing of Three Underlyings

Principal at Risk Securities

The total payment over the 9-month term of the securities is $0.40 + $10.20 = $10.60.

Example 2 — The closing level of each Underlying is below its respective Early Redemption Level on each Observation Date prior to the Valuation Date, so the securities are not automatically redeemed prior to maturity. The closing level of each Underlying is at or above its respective Coupon Barrier Level on every Observation Date including the Valuation Date, and the Final Level of the Worst Performing Underlying is above its Initial Level. Therefore, you would receive (i) the Contingent Coupons with respect to each Observation Date prior to (and excluding) the Valuation Date, totaling $0.20 × 11 = $2.20 and (ii) the Redemption Amount calculated as $10 + $0.20 = $10.20.

The total payment over the 3-year term of the securities is $2.20 + $10.20 = $12.40.

This example illustrates the scenario where you receive a Contingent Coupon on every Contingent Coupon Payment Date throughout the term of the securities and receive your principal back at maturity, resulting in a 8.00% per annum interest rate. Despite the fact that the Final Level of the Worst Performing Underlying is greater than its Initial Level, you will not participate in any appreciation of any Underlying. This is therefore the maximum amount payable over the term of the securities. To the extent that coupons are not paid on every Contingent Coupon Payment Date, the effective interest rate on the securities will be less than 8.00% per annum and could be zero. If the securities are automatically redeemed prior to maturity, you will receive no more Contingent Coupons, may be forced to invest in a lower interest rate environment and may not be able to reinvest at comparable terms or returns.

Example 3 — The closing level of each Underlying is below its respective Early Redemption Level on each Observation Date prior to the Valuation Date, so the securities are not automatically redeemed prior to maturity. The closing level of each Underlying is at or above its respective Coupon Barrier Level on two of the Observation Dates prior to the Valuation Date. The Final Level of the Worst Performing Underlying is above its Downside Threshold Level and Coupon Barrier Level on the Valuation Date. In this scenario, you receive a Redemption Amount equal to the Principal Amount and the Contingent Coupon with respect to the Valuation Date. Therefore, you would receive (i) the Contingent Coupons with respect to two Observation Dates prior to the Valuation Date, totaling $0.20 × 2 = $0.40, but not for the other Observation Dates prior to the Valuation Date, and (ii) the Redemption Amount calculated as $10 + $0.20 = $10.20.

The total payment over the 3-year term of the securities is $0.40 + $10.20 = $10.60.

Example 4 — The closing level of each Underlying is below its respective Early Redemption Level on each Observation Date prior to the Valuation Date, so the securities are not automatically redeemed prior to maturity. The closing levels of one or more Underlyings are below their respective Coupon Barrier Levels on all of the Observation Dates, and the Final Level of the Worst Performing Underlying (which is Underlying C) is $40, which is below its Downside Threshold Level. Therefore, you would receive no Contingent Coupons, and the Redemption Amount would be calculated as $10 × $40 / $200 = $2.00.

The total payment over the 3-year term of the securities is $0 + $2.00 = $2.00.

If the securities are not automatically redeemed prior to maturity and the Final Level of the Worst Performing Underlying is less than its Downside Threshold Level, you will lose a significant portion or all of your investment in the securities.

| January 2021 | Page 10 |

Auto-Callable Contingent Income Securities due January 24, 2024

All Payments on the Securities Subject to the Coupon Barrier and Downside Threshold Features

Based on the Performance of the Worst Performing of Three Underlyings

Principal at Risk Securities

Selected Risk Considerations

This section describes the material risks relating to the securities. For a complete list of risk factors, please see any accompanying product supplement, prospectus and prospectus supplement. Investors should consult their financial and legal advisers as to the risks entailed by an investment in the securities and the appropriateness of the securities in light of their particular circumstances.

Risks Relating to the Securities Generally

| § | The securities do not guarantee the return of any principal. The terms of the securities differ from those of ordinary debt securities in that the securities do not guarantee the payment of regular interest or the return of any of the principal amount at maturity. Instead, if the securities have not automatically been redeemed prior to maturity and the Final Level of the Worst Performing Underlying is less than its Downside Threshold Level, you will be fully exposed to the decline in the Worst Performing Underlying over the term of the securities, and you will receive for each security that you hold at maturity an amount of cash that is significantly less than the Principal Amount, in proportion to the decline in the level of the Worst Performing Underlying from its Initial Level to its Final Level. Under this scenario, the value of any such payment will be less than 60% of the Principal Amount and could be zero. You may lose up to your entire initial investment in the securities. Any payment on the securities is subject to our ability to pay our obligations as they become due. |

| § | Regardless of the amount of any payment you receive on the securities, your actual yield may be different in real value terms. Inflation may cause the real value of any payment you receive on the securities to be less at maturity than it is at the time you invest. An investment in the securities also represents a forgone opportunity to invest in an alternative asset that generates a higher real return. You should carefully consider whether an investment that may result in a return that is lower than the return on alternative investments is appropriate for you. |

| § | The securities will not pay more than the Principal Amount plus Contingent Coupons, if any— The securities will not pay more than the Principal Amount plus Contingent Coupons, if any, regardless of the performance of any Underlying. Even if the Final Level of each Underlying is greater than its respective Initial Level, you will not participate in the appreciation of any Underlying. Therefore, the maximum amount payable with respect to the securities (excluding Contingent Coupons, if any) is the Principal Amount. This payment will not be increased to include reimbursement for any discounts or commissions and hedging and other transaction costs, even upon an Automatic Redemption. |

| § | The securities do not provide regular fixed interest payments. Unlike conventional debt securities, the securities do not provide for regular fixed interest payments. You will receive a Contingent Coupon with respect to a Contingent Coupon Payment Date only if the closing level of each Underlying on the related Observation Date is greater than or equal to its respective Coupon Barrier Level. If the closing level of any Underlying is less than its respective Coupon Barrier Level on each Observation Date, you will not receive any Contingent Coupons. Thus, the securities are not a suitable investment for investors who require regular fixed income payments, since the number of Contingent Coupons is variable and may be zero. |

In addition, if rates generally increase over the term of the securities, it is more likely that the Contingent Coupon, if any, could be less than the yield one might receive based on market rates at that time. This would have the further effect of decreasing the value of your securities both nominally in terms of below-market coupons and in real value terms. Furthermore, it is possible that you will not receive some or all of the Contingent Coupons over the term of the securities, and still lose your principal amount. Even if you do receive some or all of your principal amount at maturity, you will not be compensated for the time value of money. These securities are not short-term investments, so you should carefully consider these risks before investing.

| § | More favorable terms to you are generally associated with an Underlying with greater expected volatility and therefore can indicate a greater risk of loss. “Volatility” refers to the frequency and magnitude of changes in the level of an Underlying. The greater the expected volatility with respect to an Underlying on the Trade Date, the higher the expectation as of the Trade Date that the closing level of such Underlying could be less than its (i) Coupon Barrier Level on any Observation Date or (ii) Downside Threshold Level on the Valuation Date, indicating a higher expected risk of loss on the securities. This greater expected risk will generally be reflected in a higher Contingent Coupon than the yield payable on our conventional debt securities with a similar maturity, or in more favorable terms (such as lower Coupon Barrier Levels or Downside Threshold Levels) than for similar securities linked to the performance of an underlying with a lower expected volatility as of the Trade Date. You should therefore understand that a relatively higher Contingent Coupon may indicate an increased risk of loss. Further, relatively lower Coupon Barrier Levels or Downside Threshold Levels may not necessarily |

| January 2021 | Page 11 |

Auto-Callable Contingent Income Securities due January 24, 2024

All Payments on the Securities Subject to the Coupon Barrier and Downside Threshold Features

Based on the Performance of the Worst Performing of Three Underlyings

Principal at Risk Securities

indicate that you will receive a Contingent Coupon on any Contingent Coupon Payment Date or that the securities have a greater likelihood of a return of principal at maturity. The volatility of any Underlying can change significantly over the term of the securities. The levels of the Underlyings for your securities could fall sharply, which could result in a significant loss of principal. You should be willing to accept the downside market risk of the Underlyings and the potential to lose a significant amount of your principal at maturity.

| § | The securities are subject to a potential Automatic Redemption, which exposes you to reinvestment risk. The securities are subject to a potential Automatic Redemption. If the securities are automatically redeemed prior to the Maturity Date, you may be unable to invest in other securities with a similar level of risk that provide you with the opportunity to be paid the same coupons as the securities. |

| § | The securities are subject to a potential Automatic Redemption, which would limit your opportunity to be paid Contingent Coupons over the full term of the securities. The securities are subject to a potential Automatic Redemption. If an Early Redemption Event occurs, the securities will be automatically redeemed and you will receive a cash payment equal to the Principal Amount and the Contingent Coupon payable on that Contingent Coupon Payment Date, and no further payments will be made with respect to the securities. In this case, you will lose the opportunity to continue to be paid Contingent Coupons from the Automatic Redemption Date to the scheduled Maturity Date. |

| § | Contingent Coupons, if any, are paid on a periodic basis and are based solely on the closing levels of the Underlyings on the specified Observation Dates. Whether the Contingent Coupon will be paid with respect to an Observation Date will be based on the closing levels of the Underlyings on such date. As a result, you will not know whether you will receive the Contingent Coupon until near the end of the relevant period. Moreover, because the Contingent Coupon is based solely on the closing levels of the Underlyings on a specific Observation Date, if the closing level of an Underlying is less than its Coupon Barrier Level on an Observation Date, you will not receive any Contingent Coupon with respect to such Observation Date, even if the closing level of such Underlying was higher on other days during the relevant period. |

| § | Investors will not participate in any appreciation in the level of any of the Underlyings. Investors will not participate in any appreciation in the level of each Underlying from its Initial Level, and the return on the securities will be limited to the Contingent Coupons, if any, that are paid with respect to each Observation Date on which the closing level of each Underlying is greater than or equal to its respective Coupon Barrier Level until the securities are automatically redeemed or reach maturity. It is possible that the closing levels of one or more Underlyings could be below their respective Coupon Barrier Levels on most or all of the Observation Dates so that you will receive few or no Contingent Coupons. If you do not earn sufficient Contingent Coupons over the term of the securities, the overall return on the securities may be less than the amount that would be paid on a conventional debt security of the issuer of comparable maturity. |

| § | The U.S. federal tax consequences of an investment in the securities are unclear. There is no direct legal authority regarding the proper U.S. federal tax treatment of the securities, and we do not plan to request a ruling from the Internal Revenue Service (the “IRS”). Consequently, significant aspects of the tax treatment of the securities are uncertain, and the IRS or a court might not agree with the treatment of the securities as described in “United States Federal Tax Considerations” below. If the IRS were successful in asserting an alternative treatment, the tax consequences of ownership and disposition of the securities, including the timing and character of income recognized by U.S. investors and the withholding tax consequences to non-U.S. investors, might be materially and adversely affected. Moreover, future legislation, Treasury regulations or IRS guidance could adversely affect the U.S. federal tax treatment of the securities, possibly retroactively. |

Risks Relating to the Underlyings

| § | You will be subject to risks relating to the relationship between the Underlyings. The securities are linked to the individual performance of each Underlying. As such, the securities will perform poorly if only one of the Underlyings performs poorly. For example, if one Underlying appreciates from its Initial Level to its Final Level, but the Final Level of the Worst Performing Underlying is less than its Downside Threshold Level, you will be exposed to the depreciation of the Worst Performing Underlying and you will not benefit from the performance of any other Underlying. Each additional Underlying to which the securities are linked increases the risk that the securities will perform poorly. By investing in the securities, you assume the risk that (i) the Final Level of at least one of the Underlyings will be less than its Downside Threshold Level and (ii) the closing level of at least one of the Underlyings is less than its respective Coupon Barrier Level on at least one or more Observation Dates, regardless of the performance of any other Underlying. Because payments on the securities are based on the performance of each Underlying, a decline beyond the respective Coupon Barrier Level and/or respective |

| January 2021 | Page 12 |

Auto-Callable Contingent Income Securities due January 24, 2024

All Payments on the Securities Subject to the Coupon Barrier and Downside Threshold Features

Based on the Performance of the Worst Performing of Three Underlyings

Principal at Risk Securities

Downside Threshold Level, as applicable, of any Underlying will result in few or no Contingent Coupons and/or a significant loss of your investment, as applicable, even if any other Underlying has appreciated or has not declined as much.

It is impossible to predict the relationship between the Underlyings. If the performances of the Underlyings exhibit no relationship to each other, it is more likely that one of the Underlyings will cause the securities to perform poorly. However, if the Reference Share Issuers’ businesses tend to be related such that the performances of the Underlyings are correlated, then there is less likelihood that only one Underlying will cause the securities to perform poorly. Furthermore, to the extent that each Underlying represents a different market segment or market sector, the risk of one Underlying performing poorly is greater. As a result, you are not only taking market risk on each Reference Share Issuer and its businesses, you are also taking a risk relating to the relationship between each Reference Share Issuer and Underlying to others.

| § | No affiliation with the Reference Share Issuers. We are not affiliated with the Reference Share Issuers. You should make your own investigation into the Underlyings and the Reference Share Issuers. In connection with the offering of the securities, neither we nor our affiliates have participated in the preparation of any publicly available documents or made any due diligence inquiry with respect to the Reference Share Issuers. |

| § | No ownership rights in the Underlyings. Your return on the securities will not reflect the return you would realize if you actually owned shares of the Underlyings. The return on your investment is not the same as the total return based on a purchase of shares of the Underlyings. For example, as a holder of the securities, you will not have any ownership interest or rights in the Underlyings, such as voting rights or dividend payments. In addition, the issuer of the Underlyings will not have any obligation to consider your interests as a holder of the securities in taking any corporate action that might affect the value of the Underlyings and therefore, the value of the securities. |

| § | Anti-dilution protection is limited. The calculation agent will make anti-dilution adjustments for certain events affecting the Underlyings. However, an adjustment will not be required in response to all events that could affect the Underlyings. If an event occurs that does not require the calculation agent to make an adjustment, or if an adjustment is made but such adjustment does not fully reflect the economics of such event, the value of the securities may be materially and adversely affected. See “Description of the Securities—Adjustments—For equity securities of a reference share issuer” in any accompanying product supplement. |

Risks Relating to the Issuer

| § | The securities are subject to the credit risk of Credit Suisse. Investors are dependent on our ability to pay all amounts due on the securities and, therefore, if we were to default on our obligations, you may not receive any amounts owed to you under the securities. In addition, any decline in our credit ratings, any adverse changes in the market’s view of our creditworthiness or any increase in our credit spreads is likely to adversely affect the value of the securities prior to maturity. |

| § | Credit Suisse is subject to Swiss regulation. As a Swiss bank, Credit Suisse is subject to regulation by governmental agencies, supervisory authorities and self-regulatory organizations in Switzerland. Such regulation is increasingly more extensive and complex and subjects Credit Suisse to risks. For example, pursuant to Swiss banking laws, the Swiss Financial Market Supervisory Authority (FINMA) may open resolution proceedings if there are justified concerns that Credit Suisse is over-indebted, has serious liquidity problems or no longer fulfills capital adequacy requirements. FINMA has broad powers and discretion in the case of resolution proceedings, which include the power to convert debt instruments and other liabilities of Credit Suisse into equity and/or cancel such liabilities in whole or in part. If one or more of these measures were imposed, such measures may adversely affect the terms and market value of the securities and/or the ability of Credit Suisse to make payments thereunder and you may not receive any amounts owed to you under the securities. |

Risks Relating to Conflicts of Interest

| § | Hedging and trading activity. We, any dealer or any of our or their respective affiliates may carry out hedging activities related to the securities, including in the Underlyings or instruments related to the Underlyings. We, any dealer or our or their respective affiliates may also trade in the Underlyings or instruments related to the Underlyings from time to time. Any of these hedging or trading activities on or prior to the Trade Date and during the term of the securities could adversely affect our payment to you at maturity. |

| § | Potential conflicts. We and our affiliates play a variety of roles in connection with the issuance of the securities, including acting as calculation agent and as agent of the issuer for the offering of the securities, hedging our obligations under the securities and determining their estimated value. In performing these duties, the economic interests of us and our affiliates are potentially adverse to your interests as an investor in the securities. For instance, as calculation agent, Credit Suisse |

| January 2021 | Page 13 |

Auto-Callable Contingent Income Securities due January 24, 2024

All Payments on the Securities Subject to the Coupon Barrier and Downside Threshold Features

Based on the Performance of the Worst Performing of Three Underlyings

Principal at Risk Securities

International will determine the Initial Level, the Coupon Barrier Level, and the Downside Threshold Level and the Early Redemption Level for each Underlying, whether you receive a Contingent Coupon on each Contingent Coupon Payment Date and the Redemption Amount, if any. Moreover, certain determinations made by Credit Suisse International, in its capacity as calculation agent, may require it to exercise discretion and make subjective judgments, such as with respect to the occurrence or non-occurrence of market disruption events and the selection of a successor underlying or calculation of the closing level in the event of a market disruption event or discontinuance of an Underlying. These potentially subjective determinations may adversely affect the payout to you at maturity, if any. In addition, hedging activities by us or our affiliates on or prior to the Trade Date could potentially increase the Initial Levels of the Underlyings, and therefore, could increase the Coupon Barrier Levels, which are the respective levels at or above which each Underlying must close in order for you to receive a Contingent Coupon, and the Downside Threshold Levels, which are the respective levels at or above which each Underlying must close so that you are not exposed to the negative performance of the Worst Performing Underlying on the Valuation Date. Further, hedging activities may adversely affect any payment on or the value of the securities. Any profit in connection with such hedging activities will be in addition to any other compensation that we and our affiliates receive for the sale of the securities, which creates an additional incentive to sell the securities to you.

We and/or our affiliates may also currently or from time to time engage in business with the Reference Share Issuers, including extending loans to, or making equity investments in, the Reference Share Issuers or providing advisory services to the Reference Share Issuers. In addition, one or more of our affiliates may publish research reports or otherwise express opinions with respect to the Reference Share Issuers and these reports may or may not recommend that investors buy or hold shares of the Underlyings. As a prospective purchaser of the securities, you should undertake an independent investigation of the Reference Share Issuers that in your judgment is appropriate to make an informed decision with respect to an investment in the securities.

Risks Relating to the Estimated Value and Secondary Market Prices of the Securities

| § | Unpredictable economic and market factors will affect the value of the securities. The payout on the securities can be replicated using a combination of the components described in “The estimated value of the securities on the Trade Date is less than the Price to Public.” Therefore, in addition to the levels of any Underlying, the terms of the securities at issuance and the value of the securities prior to maturity may be influenced by factors that impact the value of fixed income securities and options in general such as: |

o the expected and actual volatility of the Underlyings;

o the expected and actual correlation, if any, between the Underlyings;

o the time to maturity of the securities;

o the dividend rate on the Underlyings;

o interest and yield rates in the market generally;

o investors’ expectations with respect to the rate of inflation;

o events affecting companies engaged in the respective industries of the Reference Share Issuers;

o geopolitical conditions and economic, financial, political, regulatory, judicial or other events that affect the Reference Share Issuers or markets generally and which may affect the levels of the Underlyings; and

o our creditworthiness, including actual or anticipated downgrades in our credit ratings.

Some or all of these factors may influence the price that you will receive if you choose to sell your securities prior to maturity. The impact of any of the factors set forth above may enhance or offset some or all of any change resulting from another factor or factors.

| § | The estimated value of the securities on the Trade Date is less than the Price to Public. The initial estimated value of your securities on the Trade Date (as determined by reference to our pricing models and our internal funding rate) is less |

| January 2021 | Page 14 |

Auto-Callable Contingent Income Securities due January 24, 2024

All Payments on the Securities Subject to the Coupon Barrier and Downside Threshold Features

Based on the Performance of the Worst Performing of Three Underlyings

Principal at Risk Securities

than the original Price to Public.

The Price to Public of the securities includes any discounts or commissions as well as transaction costs such as expenses incurred

to create, document and market the securities and the cost of hedging our risks as issuer of the securities through one or more

of our affiliates (which includes a projected profit). These costs will be effectively borne by you as an investor in the securities.

These amounts will be retained by Credit Suisse or our affiliates in connection with our structuring and offering of the securities

(except to the extent discounts or commissions are reallowed to other broker-dealers or any costs are paid to third parties).

On the Trade Date, we value the components of the securities in accordance with our pricing models. These include a fixed income

component valued using our internal funding rate, and individual option components valued using proprietary pricing models dependent

on inputs such as volatility, correlation, dividend rates, interest rates and other factors, including assumptions about future

market events and/or environments. These inputs may be market-observable or may be based on assumptions made by us in our discretionary

judgment. As such, the payout on the securities can be replicated using a combination of these components and the value of these

components, as determined by us using our pricing models, will impact the terms of the securities at issuance. Our option valuation

models are proprietary. Our pricing models take into account factors such as interest rates, volatility and time to maturity of

the securities, and they rely in part on certain assumptions about future events, which may prove to be incorrect.

Because Credit Suisse’s pricing models may differ from other issuers’ valuation models, and because funding rates taken into account by other issuers may vary materially from the rates used by Credit Suisse (even among issuers with similar creditworthiness), our estimated value at any time may not be comparable to estimated values of similar securities of other issuers.

| § | Effect of interest rate in structuring the securities. The internal funding rate we use in structuring notes such as these securities is typically lower than the interest rate that is reflected in the yield on our conventional debt securities of similar maturity in the secondary market (our “secondary market credit spreads”). If on the Trade Date our internal funding rate is lower than our secondary market credit spreads, we expect that the economic terms of the securities will generally be less favorable to you than they would have been if our secondary market credit spread had been used in structuring the securities. We will also use our internal funding rate to determine the price of the securities if we post a bid to repurchase your securities in secondary market transactions. See “—Secondary Market Prices” below. |

| § | Secondary market prices. If Credit Suisse (or an affiliate) bids for your securities in secondary market transactions, which we are not obligated to do, the secondary market price (and the value used for account statements or otherwise) may be higher or lower than the Price to Public and the estimated value of the securities on the Trade Date. The estimated value of the securities on the cover of this pricing supplement does not represent a minimum price at which we would be willing to buy the securities in the secondary market (if any exists) at any time. The secondary market price of your securities at any time cannot be predicted and will reflect the then-current estimated value determined by reference to our pricing models, the related inputs and other factors, including our internal funding rate, customary bid and ask spreads and other transaction costs, changes in market conditions and deterioration or improvement in our creditworthiness. In circumstances where our internal funding rate is higher than our secondary market credit spreads, our secondary market bid for your securities could be less favorable than what other dealers might bid because, assuming all else equal, we use the higher internal funding rate to price the securities and other dealers might use the lower secondary market credit spread to price them. Furthermore, assuming no change in market conditions from the Trade Date, the secondary market price of your securities will be lower than the Price to Public because it will not include any discounts or commissions and hedging and other transaction costs. If you sell your securities to a dealer in a secondary market transaction, the dealer may impose an additional discount or commission, and as a result the price you receive on your securities may be lower than the price at which we may repurchase the securities from such dealer. |

We (or an affiliate) may initially post a bid to repurchase the securities from you at a price that will exceed the then-current estimated value of the securities. That higher price reflects our projected profit and costs, which may include discounts and commissions that were included in the Price to Public, and that higher price may also be initially used for account statements or otherwise. We (or our affiliate) may offer to pay this higher price, for your benefit, but the amount of any excess over the then-current estimated value will be temporary and is expected to decline over a period of approximately three months.

The securities are not designed to be short-term trading instruments and any sale prior to maturity could result in a substantial loss to you. You should be willing and able to hold your securities to maturity.

| § | Lack of liquidity. The securities will not be listed on any securities exchange. Credit Suisse (or its affiliates) intends to offer to purchase the securities in the secondary market but is not required to do so. Even if there is a secondary market, it may |

| January 2021 | Page 15 |

Auto-Callable Contingent Income Securities due January 24, 2024

All Payments on the Securities Subject to the Coupon Barrier and Downside Threshold Features

Based on the Performance of the Worst Performing of Three Underlyings

Principal at Risk Securities

not provide enough liquidity to allow you to trade or sell the securities when you wish to do so. Because other dealers are not likely to make a secondary market for the securities, the price at which you may be able to trade your securities is likely to depend on the price, if any, at which Credit Suisse (or its affiliates) is willing to buy the securities. If you have to sell your securities prior to maturity, you may not be able to do so or you may have to sell them at a substantial loss.

| January 2021 | Page 16 |

Auto-Callable Contingent Income Securities due January 24, 2024

All Payments on the Securities Subject to the Coupon Barrier and Downside Threshold Features

Based on the Performance of the Worst Performing of Three Underlyings

Principal at Risk Securities

Supplemental Use of Proceeds and Hedging

We intend to use the proceeds of this offering for our general corporate purposes, which may include the refinancing of existing debt outside Switzerland. Some or all of the proceeds we receive from the sale of the securities may be used in connection with hedging our obligations under the securities through one or more of our affiliates. Such hedging or trading activities on or prior to the Trade Date and during the term of the securities (including on any calculation date, as defined in any accompanying product supplement) could adversely affect the value of the Underlyings and, as a result, could decrease the amount you may receive on the securities at maturity. For additional information, see “Supplemental Use of Proceeds and Hedging” in any accompanying product supplement.

| January 2021 | Page 17 |

Auto-Callable Contingent Income Securities due January 24, 2024

All Payments on the Securities Subject to the Coupon Barrier and Downside Threshold Features

Based on the Performance of the Worst Performing of Three Underlyings

Principal at Risk Securities

Common Stock of The Bank of New York Mellon Corporation Historical Performance

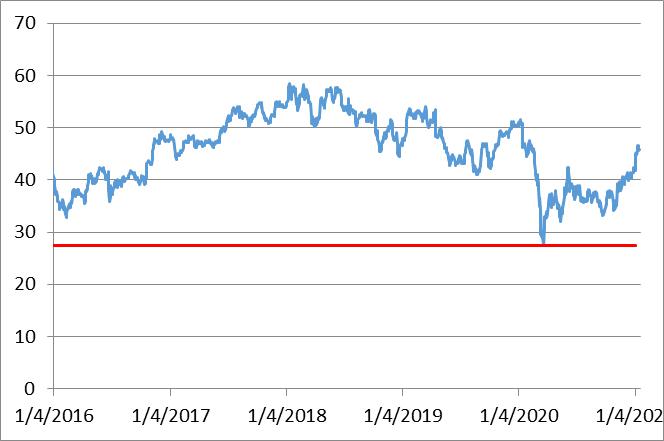

The following graph sets forth the daily closing levels of the common stock of The Bank of New York Mellon Corporation for the period from January 4, 2016 through January 19, 2021. The related table sets forth the published high and low closing levels, as well as end-of-quarter closing levels, of the common stock of The Bank of New York Mellon Corporation for each quarter in the same period. The closing level on January 19, 2021 was $45.82. We obtained the information in the table below from Bloomberg Financial Markets, without independent verification. The historical values of the common stock of The Bank of New York Mellon Corporation should not be taken as an indication of future performance, and no assurance can be given as to the level of the common stock of The Bank of New York Mellon Corporation on any Observation Date. The graph below may have been adjusted to reflect certain corporate actions such as stock splits and reverse stock splits.

|

Common Stock of The Bank of New York Mellon Corporation Daily Closing Levels January 4, 2016 to January 19, 2021 |

|

|

* The solid red line in the graph indicates the Coupon Barrier Level and the Downside Threshold Level.

|

| January 2021 | Page 18 |

Auto-Callable Contingent Income Securities due January 24, 2024

All Payments on the Securities Subject to the Coupon Barrier and Downside Threshold Features

Based on the Performance of the Worst Performing of Three Underlyings

Principal at Risk Securities

| Common Stock of The Bank of New York Mellon Corporation | High | Low | Period End |

| 2016 | |||

| First Quarter | $39.97 | $32.74 | $36.83 |

| Second Quarter | $42.39 | $35.49 | $38.85 |

| Third Quarter | $41.71 | $37.13 | $39.88 |

| Fourth Quarter | $49.17 | $39.09 | $47.38 |

| 2017 | |||

| First Quarter | $48.71 | $43.87 | $47.23 |

| Second Quarter | $51.02 | $46.20 | $51.02 |

| Third Quarter | $54.04 | $50.28 | $53.02 |

| Fourth Quarter | $54.97 | $50.82 | $53.86 |

| 2018 | |||

| First Quarter | $58.42 | $50.61 | $51.53 |

| Second Quarter | $57.72 | $50.15 | $53.93 |

| Third Quarter | $55.64 | $50.14 | $50.99 |

| Fourth Quarter | $52.78 | $44.49 | $47.07 |

| 2019 | |||

| First Quarter | $53.98 | $46.56 | $50.43 |

| Second Quarter | $53.44 | $42.69 | $44.15 |

| Third Quarter | $47.60 | $40.95 | $45.21 |

| Fourth Quarter | $51.22 | $42.24 | $50.33 |

| 2020 | |||

| First Quarter | $51.48 | $27.49 | $33.68 |

| Second Quarter | $42.30 | $32.06 | $38.65 |

| Third Quarter | $38.97 | $33.14 | $34.34 |

| Fourth Quarter | $42.44 | $34.08 | $42.44 |

| 2021 | |||

| First Quarter (through January 19, 2021) | $46.56 | $41.69 | $45.82 |

| January 2021 | Page 19 |

Auto-Callable Contingent Income Securities due January 24, 2024

All Payments on the Securities Subject to the Coupon Barrier and Downside Threshold Features

Based on the Performance of the Worst Performing of Three Underlyings

Principal at Risk Securities

Common Stock of Northern Trust Corporation Historical Performance

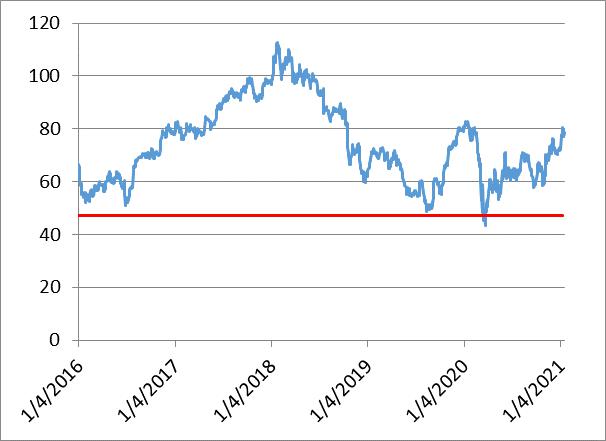

The following graph sets forth the daily closing levels of the common stock of Northern Trust Corporation for the period from January 4, 2016 through January 19, 2021. The related table sets forth the published high and low closing levels, as well as end-of-quarter closing levels, of the common stock of Northern Trust Corporation for each quarter in the same period. The closing level on January 19, 2021 was $97.36. We obtained the information in the table below from Bloomberg Financial Markets, without independent verification. The historical values of the common stock of Northern Trust Corporation should not be taken as an indication of future performance, and no assurance can be given as to the level of the common stock of Northern Trust Corporation on any Observation Date. The graph below may have been adjusted to reflect certain corporate actions such as stock splits and reverse stock splits.

|

Common Stock of Northern Trust Corporation Daily Closing Levels January 4, 2016 to January 19, 2021 |

|

|

* The solid red line in the graph indicates the Coupon Barrier Level and the Downside Threshold Level.

|

| January 2021 | Page 20 |

Auto-Callable Contingent Income Securities due January 24, 2024

All Payments on the Securities Subject to the Coupon Barrier and Downside Threshold Features

Based on the Performance of the Worst Performing of Three Underlyings