FINANCIAL PRODUCTS FACT SHEET U3737 |

Filed pursuant to Rule 433 Registration Statement No. 333-218604-02 |

|

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside Principal at Risk Securities Linked to the SPDR® S&P® Biotech ETF due April 29, 2021 Fact Sheet to Pricing Supplement U3737 dated April 29, 2019 |

Summary of Terms

| Issuer | Credit Suisse AG (“Credit Suisse”), acting through its London branch |

| Agent | Wells Fargo Securities, LLC |

| Term | 2 years (unless earlier automatic call) |

| Market Measure | The SPDR® S&P® Biotech ETF (the “Fund”) |

| Pricing Date | April 29, 2019 |

| Issue Date | May 2, 2019 |

| Original Offering Price | $1,000 per security |

| Contingent Coupons | See “How contingent coupons are calculated” on page 2 |

| Contingent Coupon Rate | 9.00% per annum |

| Automatic Call | See “How to determine if the securities will be automatically called” on page 2 |

| Calculation Days | Quarterly, on the 24th day of each January, April, July and October, commencing July 2019 and ending on the final calculation day. To the extent that we make any change to the expected issue date, the calculation days may also be changed in our discretion to ensure that the term of the securities remains the same. |

| Final Calculation Day | April 26, 2021 |

| Payment at Stated Maturity | See “How the payment at stated maturity is calculated” on page 3 |

| Stated Maturity | April 29, 2021. To the extent that we make any change to the expected issue date, stated maturity may also be changed in our discretion to ensure that the term of the securities remains the same. |

| Starting Price | $86.68 |

| Ending Price | The fund closing price on the final calculation day |

| Fund Closing Price | With respect to the Fund (or one unit of any other security for which a fund closing price must be determined) on any trading day, the product of (i) the closing price of one share of the Fund or such other security on such trading day and (ii) the adjustment factor applicable to the Fund on such trading day |

| Closing Price | With respect to a share of the Fund (or one unit of any other security for which a closing price must be determined) on any trading day, the price, at the scheduled weekday closing time, without regard to after hours or any other trading outside the regular trading session hours, of the share on the principal United States securities exchange registered under the Securities Exchange Act of 1934, as amended, on which the share (or any such other security) is listed or admitted to trading |

| Adjustment Factor | 1.0, subject to adjustment in the event of certain events affecting the shares of the Fund |

| Threshold Price | $65.01 (75% of the starting price) |

| Calculation Agent | Credit Suisse International |

| Denominations | $1,000 and any integral multiple of $1,000 |

| Fees | Wells Fargo Securities, LLC (“WFS”) will act as agent for the securities and will receive an agent discount of $19.25 per security. The agent may resell the securities to other securities dealers at the original offering price of the securities less a concession of $12.50 per security. Such securities dealers may include those using the trade name Wells Fargo Advisors (“WFA”). In addition to the concession allowed to WFA, WFS will pay $0.75 per security of the agent’s discount to WFA as a distribution expense fee for each security sold by WFA. |

| CUSIP | 22552F6Y3 |

Investment Description

| · | Linked to the SPDR® S&P® Biotech ETF |

| · | Unlike ordinary debt securities, the securities do not provide for fixed payments of interest, do not repay a fixed amount of principal at maturity and are subject to potential automatic call prior to stated maturity upon the terms described below. Whether the securities pay a contingent coupon, whether the securities are automatically called prior to stated maturity and, if they are not automatically called, whether you are repaid the original offering price of your securities at stated maturity will depend in each case on the fund closing price on the relevant calculation day. |

| · | Contingent Coupon: The securities will pay a contingent coupon on a quarterly basis until the earlier of stated maturity or automatic call if, and only if, the fund closing price on the calculation day for that quarter is greater than or equal to the threshold price. However, if the fund closing price on a calculation day is less than the threshold price, you will not receive any contingent coupon for the relevant quarter. If the closing level is less than the threshold level on every calculation day, you will not receive any contingent coupons throughout the entire term of the securities. The contingent coupon rate is 9.00% per annum |

| · | Automatic Call: If the fund closing price on any of the quarterly calculation days from October 2019 to January 2021, inclusive, is greater than or equal to the starting price, the securities will be automatically called for the original offering price plus a final contingent coupon |

| · | Potential Loss of Principal: If the securities are not automatically called prior to stated maturity, you will receive the original offering price at stated maturity if, and only if, the ending price is greater than or equal to the threshold price. If the ending price is less than the threshold price, you will lose more than 25%, and possibly all, of the original offering price of your securities |

| · | The threshold price is equal to 75% of the starting price |

| · | If the securities are not automatically called prior to stated maturity, you will have full downside exposure to the Fund from the starting price to the ending price if the ending price is less than the threshold price, but you will not participate in any appreciation of the Fund and will not receive any dividends on securities included in the Fund |

| · | All payments on the securities are subject to the credit risk of Credit Suisse; if Credit Suisse defaults on its obligations, you could lose some or all of your investment |

| · | No exchange listing; you should be willing and able to hold your securities to stated maturity |

Credit Suisse currently estimates the value of each $1,000 principal amount of the securities on the pricing date is $969.15 (as determined by reference to our pricing models and the rate we are currently paying to borrow funds through issuance of the securities (our internal funding rate)). See “Investment Description” and “Selected Risk Considerations” in the accompanying pricing supplement.

The securities have complex features and investing in the securities involves risks not associated with an investment in conventional debt securities. See “Selected Risk Considerations” in this fact sheet and “Selected Risk Considerations” in the accompanying pricing supplement.

Investors should carefully review the accompanying pricing supplement, underlying supplement, product supplement, prospectus supplement and prospectus before making a decision to invest in the securities.

NOT A BANK DEPOSIT AND NOT INSURED OR GUARANTEED BY THE FDIC OR ANY OTHER GOVERNMENTAL AGENCY

Supplemental terms of the securities

For purposes of the securities offered by the accompanying pricing supplement, all references to each of the following terms used in the accompanying product supplement will be deemed to refer to the corresponding term used in such pricing supplement, as set forth in the table below:

|

Product Supplement Term |

Pricing Supplement Term |

| Underlying | Fund |

| Trade date | Pricing date |

| Principal amount | Original offering price |

| Valuation date | Final calculation day |

| Maturity date | Stated maturity |

| Early redemption | Automatic call |

| Observation date | Calculation day |

| Early redemption date | Call settlement date |

| Initial level | Starting price |

| Final level | Ending price |

| Closing level | Fund closing price |

| Knock-in level | Threshold price |

How contingent coupons are calculated

On each “contingent coupon payment date” (the third business day following each calculation day, subject to postponement as set forth in the accompanying pricing supplement), you will receive a contingent coupon at a per annum rate equal to the contingent coupon rate if, and only if, the fund closing price on the related calculation day is greater than or equal to the threshold price.

If the fund closing price on any calculation day is less than the threshold price, you will not receive any contingent coupon on the related contingent coupon payment date. If the fund closing price is less than the threshold price on all quarterly calculation days, you will not receive any contingent coupons over the term of the securities.

Each quarterly contingent coupon, if any, will be calculated per security as follows:

$1,000 x contingent coupon rate / 4

The contingent coupon rate is 9.00% per annum. Any contingent coupons will be rounded to the nearest cent, with one-half cent rounded upward.

How to determine if the securities will be automatically called

If the fund closing price on any of the quarterly calculation days from October 2019 to January 2021, inclusive, is greater than or equal to the starting price, the securities will be automatically called, and on the related call settlement date you will be entitled to receive a cash payment per security equal to the original offering price per security plus a final contingent coupon. The securities will not be subject to automatic call until the second quarterly calculation day, which is approximately six months after the issue date.

If the securities are automatically called, they will cease to be outstanding on the related call settlement date and you will have no further rights under the securities after such call settlement date.

2

How the payment at stated maturity is calculated

If the securities are not automatically called prior to stated maturity, you will receive at stated maturity a payment per security equal to the redemption amount (in addition to the final contingent coupon, if any). The redemption amount per security will be determined as follows:

| · | If the ending price is greater than or equal to the threshold price, the redemption amount at maturity will be equal to $1,000 |

| · | If the ending price is less than the threshold price, the redemption amount at maturity will be equal to $1,000 minus: |

If the securities are not automatically called prior to stated maturity and the ending price is less than the threshold price, you will lose more than 25%, and possibly all, of the original offering price of your securities at stated maturity.

Any return on the securities will be limited to the sum of your contingent coupons, if any. You will not participate in any appreciation of the Fund, but you will have full downside exposure to the Fund on the final calculation day if the ending price is less than the threshold price.

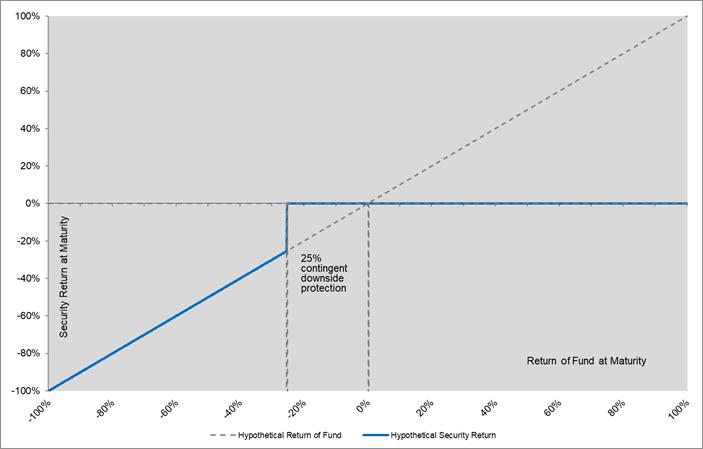

Hypothetical Payout Profile

The following profile illustrates the potential payment at stated maturity on the securities (excluding the final contingent coupon, if any) for a range of hypothetical performances of the Fund on the final calculation day from the starting price to the ending price, assuming the securities have not been automatically called prior to the stated maturity. This graph has been prepared for purposes of illustration only. Your actual return will depend on the actual ending price on the final calculation day and whether you hold your securities to stated maturity.

3

Hypothetical Returns

If the securities are automatically called: If the securities are automatically called prior to stated maturity, you will receive the original offering price of your securities plus a final contingent coupon on the call settlement date. In the event the securities are automatically called, your total return on the securities will equal any contingent coupons received prior to the call settlement date and the contingent coupon received on the call settlement date.

If the securities are not automatically

called: If the securities are not automatically called prior to stated maturity, the following table

illustrates, for a range of hypothetical ending prices of the Fund on the final calculation day, the hypothetical redemption amount

payable at stated maturity per security (excluding the final contingent coupon, if any).

| Hypothetical ending price as percentage of starting price on final calculation day | Hypothetical payment at stated maturity per security |

| 200% | $1,000 |

| 175% | $1,000 |

| 160% | $1,000 |

| 150% | $1,000 |

| 140% | $1,000 |

| 130% | $1,000 |

| 120% | $1,000 |

| 110% | $1,000 |

| 100% | $1,000 |

| 90% | $1,000 |

| 80% | $1,000 |

| 75% | $1,000 |

| 74% | $740 |

| 70% | $700 |

| 60% | $600 |

| 50% | $500 |

| 40% | $400 |

| 30% | $300 |

| 25% | $250 |

| 0% | $0 |

The above figures do not take into account contingent coupons, if any, received during the term of the securities. As evidenced above, in no event will you have a positive rate of return based solely on the redemption amount received at maturity; any positive return will be based solely on the contingent coupons, if any, received during the term of the securities. Each security has an original offering price of $1,000.

The above figures are for purposes of illustration only and may have been rounded for ease of analysis. If the securities are not automatically called prior to stated maturity, the actual amount you will receive at stated maturity will depend on the actual ending price on the final calculation day.

Selected Risk Considerations

The risk factors listed below are discussed in detail in the “Selected Risk Considerations” section in the accompanying pricing supplement. Please review those risk disclosures carefully.

| · | If The Securities Are Not Automatically Called Prior To Stated Maturity, You May Lose Some Or All Of The Original Offering Price Of Your Securities At Stated Maturity. |

| · | Regardless Of The Amount Of Any Payment You Receive On The Securities, Your Actual Yield May Be Different In Real Value Terms. |

| · | The Securities Do Not Provide For Regular Fixed Interest Payments. |

| · | The Starting Price May Be Determined On A Date Later Than The Pricing Date. |

| · | More Favorable Terms Are Generally Associated With Greater Expected Volatility, And Can Indicate A Greater Risk Of Loss. |

| · | At Stated Maturity Or Upon Automatic Call, The Securities Will Not Pay More Than The Original Offering Price Of Your Securities, Plus The Final Contingent Coupon, If Any. |

| · | The Securities Are Subject To A Potential Automatic Call, Which Would Limit Your Opportunity To Be Paid Contingent Coupons Over The Full Term Of The Securities. |

| · | The Securities Are Subject To A Potential Automatic Call, Which Exposes You To Reinvestment Risk. |

| · | Historical Performance Of The Fund Is Not Indicative Of Future Performance. |

| · | We Cannot Control The Actions Of Any Issuers Whose Equity Securities Are Included In Or Held By The Fund. |

| · | The Securities Are Subject To The Credit Risk Of Credit Suisse. |

| · | There Are Risks Associated With The Fund. |

| · | The Performance And Market Value Of The Fund, Particularly During Periods Of Market Volatility, May Not Correlate To The Performance Of The Tracked Index. |

| · | The Fund May Not Be Representative Of An Investment In The Biotechnology Industry. |

4

| · | The Stocks Included In The Fund Are Concentrated In One Particular Sector. |

| · | Hedging And Trading Activity Could Adversely Affect Our Payment To You At Stated Maturity. |

| · | The Estimated Value Of The Securities On The Pricing Date Is Less Than The Original Offering Price. |

| · | Effect Of Interest Rate Used In Structuring The Securities. |

| · | The Estimated Value Of The Securities Is Not An Indication Of The Price, If Any, At Which Credit Suisse Or Any Other Person May Be Willing To Buy The Securities From You In The Secondary Market. |

| · | A Contingent Coupon Payment Date, A Call Settlement Date And The Stated Maturity May Be Postponed If A Calculation Day Is Postponed. |

| · | Postponement Of Certain Dates May Adversely Affect Your Return. |

| · | Credit Suisse Is Subject To Swiss Regulation. |

| · | The Securities Will Not Be Listed On Any Securities Exchange And A Trading Market For The Securities May Not Develop. |

| · | Our Economic Interests Are Potentially Adverse To Your Interests. |

| · | Unpredictable Economic And Market Factors Will Affect The Value Of The Securities. |

| · | No Ownership Rights Relating To The Fund. |

| · | No Dividend Payments Or Voting Rights. |

| · | Anti-Dilution Protection Is Limited. |

| · | The U.S. Federal Tax Consequences Of An Investment In The Securities Are Unclear. |

Additional Information

This document is a summary of the terms of the securities and factors that you should consider before deciding to invest in the securities. Credit Suisse has filed a registration statement (including pricing supplement, underlying supplement, product supplement, prospectus supplement and prospectus) with the Securities and Exchange Commission, or SEC, for the offering to which this offering summary relates. Before you invest, you should read this summary together with the Pricing Supplement dated April 29, 2019, Underlying Supplement dated April 19, 2018, Product Supplement No. I–C dated June 30, 2017, Prospectus Supplement and Prospectus dated June 30, 2017, to understand fully the terms of the securities and other considerations that are important in making a decision about investing in the securities. If the terms described in the applicable pricing supplement are inconsistent with those described herein, the terms described in the applicable pricing supplement will control. You may get these documents without cost by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, Credit Suisse, any agent or any dealer participating in this offering will arrange to send you the pricing supplement, underlying supplement, product supplement, prospectus supplement and prospectus if you so request by calling toll-free 1-800-221-1037.

This fact sheet is a general description of the terms of the offering. Please see the full description in the applicable pricing supplement:

https://www.sec.gov/Archives/edgar/data/1053092/000095010319005701/dp106082_424b2-u3737.htm

You may access the underlying supplement, product supplement, prospectus supplement and prospectus on the SEC website at www.sec.gov or by clicking on the hyperlinks to each of the respective documents incorporated by reference in the pricing supplement.

Not suitable for all investors

Investment suitability must be determined individually for each investor. The securities described herein are not a suitable investment for all investors. In particular, no investor should purchase the securities unless they understand and are able to bear the associated market, liquidity and yield risks. Unless market conditions and other relevant factors change significantly in your favor, a sale of the securities prior to maturity is likely to result in sale proceeds that are substantially less than the original offering price per security. Credit Suisse, WFS and their affiliates are not obligated to purchase the securities from you at any time prior to maturity.

Not a research report

This material is not a product of Credit Suisse’s research department.

Consult your tax advisor

Investors should review carefully the accompanying pricing supplement, underlying supplement, product supplement, prospectus supplement and prospectus and consult their tax advisors regarding the application of the U.S. federal tax laws to their particular circumstances, as well as any tax consequences arising under the laws of any state, local or non-U.S. jurisdiction.

Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

5