|

Reopening Supplement 9 to Pricing Supplement No. CSDRNMF1 To the Underlying Supplement dated August 4, 2017, Product Supplement No. RN-I dated August 4, 2017, Prospectus Supplement dated June 30, 2017 and Prospectus dated June 30, 2017 |

Filed Pursuant to Rule 424(b)(2) Registration Statement No. 333-218604-02 January 25, 2018 | |

|

40* Daily Redeemable Notes (“DRNs”) due May 7, 2025 | ||

General

| · | The DRNs are senior, unsecured debt securities issued by Credit Suisse AG (“Credit Suisse”), acting through its Nassau branch, that are designed for investors who seek exposure to the performance of the Credit Suisse Managed Futures Liquid Index (the “Index”). The Index is designed to provide broad exposure to a basket of currency futures, sovereign bond futures, equity index futures and commodity indices, which we refer to collectively as the “index components.” The Index simulates a “managed futures” strategy but uses a quantitative allocation methodology and established rules to automatically determine the notional portfolio of the index components tracked by the Index. A “managed futures” strategy is a strategy using proprietary trading systems or discretionary methods that may involve taking long or short positions in futures contracts on such underlying assets as metals, grains, or other commodities, equity indexes, currencies or government bonds. By contrast, the Index is not actively managed in any way, and is composed and calculated according to a purely formulaic methodology based on objective quantitative criteria. Investors seeking an actively managed investment strategy should not purchase the DRNs. The DRNs should be purchased only by knowledgeable investors who understand the objectives (and the formulaic methodology used to achieve these objectives) of the Index and the risks and consequences of investing in the DRNs. The Index is published by one of our affiliates and has limited history. For a description of the Index see “Summary of the Index” in this reopening supplement and the accompanying underlying supplement. |

| · | Investors should understand that the DRNs do not pay interest and, if the Index declines or does not increase sufficiently to offset the impact of fees and charges (as described below), be willing to lose up to 100% of their investment. Any payment on the DRNs is subject to our ability to pay our obligations as they become due. |

| · | The DRNs are senior medium-term notes of Credit Suisse, acting through its Nassau branch, maturing May 7, 2025, subject to postponement in certain circumstances. |

| · | The initial issuance of the DRNs priced on May 7, 2015 (the “inception date”) and were settled on May 12, 2015. The purpose of this Reopening Supplement 9 to Pricing Supplement CSDRNMF1 is to offer additional DRNs with an aggregate principal amount of $40,000, which we refer to as the “reopened securities.” |

| · | The reopened securities will constitute a further issuance of, and will be consolidated with and form a single tranche with the initial and subsequent issuances of the DRNs and will have the same CUSIP. Delivery of the DRNs in book-entry form only will be made through The Depository Trust Company (“DTC”). |

| · | The denomination and stated principal amount of each DRN is $1,000. After the inception date, additional DRNs may be offered and sold from time to time at a price higher or lower than the stated principal amount, based on the most recent closing indicative value of the DRNs. |

| · | An investment in the DRNs involves significant risks and is not appropriate for every investor. Investing in the DRNs is not equivalent to investing directly in the Index. Accordingly, the DRNs should be purchased only by knowledgeable investors who understand the terms of the investment in the DRNs and are familiar with the behavior of the Index. Investors should consider potential transaction costs when evaluating an investment in the DRNs and should regularly monitor their holdings of the DRNs to ensure that they remain consistent with their investment strategies. |

| · | The DRNs are subject to early redemption at your option (subject to the applicable early redemption charge) and at our option, in each case subject to the requirements specified below and in the accompanying product supplement. |

| · | The DRNs are subject to a daily investor fee specified below. |

| · | The level of the Index will be reduced by the notional transaction cost and holding cost for each index component as described in the section “The Index” in the accompanying underlying supplement. |

| · | We may from time to time, without notice or your consent, issue other securities linked to the Index, including other DRNs, with a different daily investor fee (or other fee amounts). As explained in this reopening supplement, the daily investor fee will lower the return on the DRNs offered hereby. Such other securities linked to the Index offered by us with different daily investor fees (or other fee amounts) will be offered under a separate reopening supplement, and will constitute a different issuance of securities under the indenture from the DRNs offered hereby. The DRNs offered hereby do not include any such other securities. |

Investing in the DRNs involves a number of risks. See “Selected Risk Considerations” beginning on page PS-9 of this reopening supplement and “Risk Factors” beginning on page US-2 of the accompanying underlying supplement and page PS-4 of the accompanying product supplement.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the DRNs or passed upon the accuracy or the adequacy of this reopening supplement or the accompanying prospectus supplement and the prospectus. Any representation to the contrary is a criminal offense.

| Price to Public | Underwriting Discounts and Commissions | Proceeds to Issuer | |

| Per security | $1,035.71 | $0 | $1,035.71 |

| Total | $41,428.40 | $0 | $41,428.40 |

*Additional DRNs may be issued and sold from time to time at prices based on the most recent closing indicative value of the DRNs at the time of sale. For the initial public offering of the DRNs, we paid no underwriting discounts and commissions, and received proceeds equal to 100% of the offering price of the DRNs sold. After the inception date, the public offering price, concession and discount of such DRNs, including discounts and commissions paid to third-party broker-dealers acting as custodians, may be changed. In exchange for providing certain services relating to the DRNs, Credit Suisse Securities (USA) LLC (“CSSU”), a member of the Financial Industry Regulatory Authority (“FINRA”), or other broker-dealers may receive amounts from us not to exceed the daily investor fee throughout the term of the DRNs. In addition, CSSU will charge investors the applicable early redemption charge as specified herein. Please see “Supplemental Plan of Distribution (Conflicts of Interest)” on page PS-23 of this reopening supplement.

The agent for this offering, CSSU, is our affiliate. For more information, see “Supplemental Plan of Distribution (Conflicts of Interest)” in this reopening supplement.

The DRNs are not deposit liabilities and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency of the United States, Switzerland or any other jurisdiction.

Credit Suisse

January 25, 2018

TABLE OF CONTENTS

Page

| Summary of the DRNs | PS-1 |

| Summary of the Index | PS-4 |

| Hypothetical Examples | PS-6 |

| Selected Risk Considerations | PS-9 |

| Supplemental Use of Proceeds and Hedging | PS-15 |

| Supplemental Description of the DRNs | PS-16 |

| Historical Information | PS-18 |

| Material U.S. Federal Income Tax Considerations | PS-19 |

| Supplemental Plan of Distribution (Conflicts of Interest) | PS-23 |

| Split or Reverse Split of the DRNs | PS-24 |

| Validity of the DRNs | PS-25 |

| Annex A | A-1 |

You should read this Reopening Supplement 9 to Pricing Supplement CSDRNMF1 together with the accompanying underlying supplement dated August 4, 2017, the product supplement dated August 4, 2017, the prospectus supplement dated June 30, 2017 and the prospectus dated June 30, 2017, relating to our Medium-Term Notes of which these DRNs are a part. You may access these documents on the SEC website at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

| • | Underlying Supplement dated August 4, 2017: |

https://www.sec.gov/Archives/edgar/data/1053092/000095010317007627/dp79253_424b2-underlyingsupp.htm

| • | Product Supplement No. RN-I dated August 4, 2017: |

https://www.sec.gov/Archives/edgar/data/1053092/000095010317007628/dp79261_424b2-rni.htm

| • | Prospectus Supplement and Prospectus dated June 30, 2017: |

http://www.sec.gov/Archives/edgar/data/1053092/000104746917004364/a2232566z424b2.htm

Our Central Index Key, or CIK, on the SEC website is 1053092. As used in this reopening supplement, the “Company,” “we,” “us,” or “our” refer to Credit Suisse, and “Daily Redeemable Notes” and “DRNs” refer to the “Redeemable Notes” and “RNs,” respectively, in the accompanying product supplement.

This reopening supplement, together with the documents listed above, contains the terms of the DRNs and supersedes all other prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, fact sheets, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours. You should carefully consider, among other things, the matters set forth in “Selected Risk Considerations” in this reopening supplement and “Risk Factors” in the accompanying underlying supplement and product supplement, “Foreign Currency Risks” in the accompanying prospectus, and any risk factors we describe in the combined Annual Report on Form 20-F of Credit Suisse Group AG and us incorporated by reference therein, and any additional risk factors we describe in future filings we make with the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as the DRNs involve risks not associated with conventional debt securities. You should consult your investment, legal, tax, accounting and other advisors before deciding to invest in the DRNs.

i

Summary of the DRNs

| Issuer: | Credit Suisse AG (“Credit Suisse”), acting through its Nassau branch |

| CUSIP/ISIN: | 22546VCP9/ US22546VCP94 |

| Index: |

The return on the DRNs will be based on the performance of the Index during the term of the DRNs. The Index is reported on Bloomberg under ticker symbol “CSLABMF <Index>.” The Index is designed to provide broad exposure to a basket of currency futures, sovereign bond futures, equity index futures and commodity indices, which we refer to collectively as the “index components.” The Index simulates a “managed futures” strategy but uses a quantitative allocation methodology and established rules to automatically determine the notional portfolio of the index components tracked by the Index. A “managed futures” strategy is a strategy using proprietary trading systems or discretionary methods that may involve taking long or short positions in futures contracts on such underlying assets as metals, grains, or other commodities, equity indexes, currencies or government bonds. The Index is not actively managed in any way, and is composed and calculated in a purely formulaic manner based on objective quantitative criteria. Investors seeking an actively managed investment strategy should not purchase the DRNs.

For more information on the Index, see “Summary of the Index” below and “The Index” in the accompanying underlying supplement. |

| Redemption Amount: | If your DRNs have not previously been redeemed (at your option or our option), at maturity you will receive, for each DRN you hold, a cash payment equal to the closing indicative value of your DRNs on the final valuation date. Any payment on the DRNs is subject to our ability to pay our obligations as they become due. |

| Closing Indicative Value: | The closing indicative value for the DRNs on the inception date will equal the $1,000 stated principal amount. The closing indicative value of the DRNs on each calendar day following the inception date will be equal to (1)(a) the closing indicative value on the calendar day immediately preceding such calendar day times (b) the daily index factor on such calendar day minus (2) the daily investor fee on such calendar day. The closing indicative value will never be less than zero. If the closing indicative value is equal to zero on any DRN trading day, the closing indicative value on that day, and on all future days, will be zero. If the DRNs undergo a split or reverse split, the closing indicative value will be adjusted accordingly. See “Split or Reverse Split of the DRNs” in this reopening supplement. |

| Listing: | The DRNs will not be listed on any securities exchange. The DRNs may be redeemed at your option or our option, as set forth below, but we will not purchase the DRNs in the secondary market. |

| Daily Index Factor: | The daily index factor on any DRN trading day will be equal to (1) the closing level of the Index on such DRN trading day divided by (2) the closing level of the Index on the immediately preceding DRN trading day. The daily index factor is deemed to be one (1) on any day that is not a DRN trading day. |

| Daily Investor Fee: |

On any calendar day (each a “calculation day”), the daily investor fee will be equal to the product of (1) the closing indicative value on the immediately preceding calendar day times (2) the daily index factor on such calculation day times (3)(a) the investor fee factor divided by (b) 365.

Because the daily investor fee reduces the amount of your return at maturity or upon early redemption, the level of the Index must increase by an amount sufficient to offset the impact of the daily investor fee (and the applicable early redemption charge for DRNs redeemed at your option, if you elect to have Credit Suisse redeem your DRNs prior to maturity, as described herein) in order for you to receive at least the amount of your initial investment at maturity or upon early redemption. If the level of the Index decreases or does not increase sufficiently, you will receive less, and possibly significantly less, than the amount of your initial investment at maturity or upon early redemption. |

| Investor Fee Factor: | The investor fee factor is 1%. |

| PS-1 |

| Early Redemption of the DRNs at Your Option: |

Subject to the requirements described below and in the accompanying product supplement, you may offer at least the applicable minimum early redemption quantity to Credit Suisse for early redemption on any business day during the term of the DRNs until April 30, 2025 (each such day, an “election date”). The “applicable minimum early redemption quantity” will be 100 DRNs ($100,000 aggregate stated principal amount of DRNs, subject to adjustment in the event of a split or reverse split of the DRNs) on any business day other than a Wednesday and 1 DRN ($1,000 aggregate stated principal amount of DRNs, subject to adjustment in the event of a split or reverse split of the DRNs) on any business day that is a Wednesday. The DRN trading day immediately succeeding the applicable election date will be the valuation date applicable to such early redemption. If you elect to offer your DRNs for early redemption and the requirements for acceptance by Credit Suisse, as described in “Description of the RNs—Early Redemption Procedures—Early Redemption at Your Option” in the accompanying product supplement, are met, you will receive, for each DRN you redeem, a cash payment on the third business day following the applicable valuation date (the “early redemption date”) in an amount equal to the daily early redemption value, less the early redemption charge. However, if we receive your offer for early redemption after 4:00 p.m., New York City time, on a business day, you will be deemed to have made the applicable offer for early redemption on the following business day. If the DRNs undergo a split or reverse split, the minimum number of DRNs needed to exercise your right to redeem will remain the same and the aggregate stated principal amount of DRNs needed to exercise your right to redeem will be adjusted.

Unless the scheduled early redemption date is postponed because it is not a business day or because there is a market disruption event on the scheduled valuation date, the final day on which Credit Suisse will redeem your DRNs at your option will be May 6, 2025. As such, you must offer your DRNs for early redemption no later than April 30, 2025.

Because the daily early redemption value with respect to an early redemption of the DRNs at your option will not be calculated until the close of trading on the DRN trading day immediately following the applicable election date, you will not know the applicable daily early redemption value at the time you exercise your redemption right. Accordingly, you will bear the risk that your DRNs will decline in value between the time of your offer for early redemption and the time at which the daily early redemption value is determined.

Please see “Description of the RNs—Early Redemption Procedures—Early Redemption at Your Option” in the accompanying product supplement for more information. We may, at our option, waive the requirement that the completed irrevocable Offer for Early Redemption be delivered, if we confirm that we have accepted a written indication of an irrevocable offer for early redemption delivered by or on behalf of the beneficial owner of an interest in the DRNs. |

| Early Redemption Charge: | On any valuation date, the early redemption charge will be equal to the product of (1) daily early redemption value times (2) 0.125%. If you elect to offer your DRNs for early redemption and the requirements for acceptance by Credit Suisse are met, you will be charged the early redemption charge. |

| Early Redemption of the DRNs at Our Option: |

We will have the right to redeem the DRNs, in whole but not in part, on any business day during the term of the DRNs. The DRN trading day immediately succeeding the date of our notice of early redemption will be the valuation date applicable to such early redemption. Upon such early redemption, you will receive, for each DRN you hold, a cash payment on the applicable early redemption date in an amount equal to the daily early redemption value.

The final day on which we can deliver an early redemption notice is April 29, 2025.

Please see “Description of the RNs—Early Redemption Procedures—Early Redemption at Our Option” in the accompanying product supplement for more information. |

| Daily Early Redemption Value: | With respect to any early redemption, for each DRN you hold, the daily early redemption value is the closing indicative value of the DRNs on the applicable valuation date. |

| Valuation Date: | May 2, 2025 or, if such date is not a DRN trading day, the next following DRN trading day (the “final valuation date”), and any valuation date for an early redemption of the DRNs. Each valuation date (including the final valuation date) is subject to postponement if a market disruption event occurs on such date, as described in “Supplemental Description of the DRNs—Postponement of a Valuation Date” below. |

| PS-2 |

| DRN Trading Day: | With respect to the DRNs, each day that is an “index business day” and a “trading day”, each as defined in the section “The Index” in the accompanying underlying supplement. |

| Maturity Date: | May 7, 2025. The maturity date is subject to postponement if such date is not a business day or if the scheduled final valuation date is postponed because it is not a DRN trading day or because a market disruption event occurs or is continuing on such scheduled final valuation date, as described in “Supplemental Description of the DRNs—Postponement of a Valuation Date” below. If the scheduled final valuation date is postponed, the maturity date will be postponed by the same number of business days. No interest will accrue or be payable as a result of any delay in payment. |

| Early Redemption Date: | An early redemption date is the third business day following the applicable valuation date. Any applicable early redemption date is subject to postponement if such date is not a business day or if a market disruption event occurs or is continuing on the applicable valuation date. No interest will accrue or be payable as a result of any delay in payment. |

| Further Issuances: |

We may, without your consent, issue and sell additional DRNs after the inception date at our sole discretion. Any further issuances of DRNs will form a single tranche with the offered DRNs, will have the same CUSIP number and will be fungible with the offered DRNs of such tranche upon settlement. Additional DRNs may be issued and sold from time to time through CSSU and one or more dealers at a price that is higher or lower than the stated principal amount, based on the most recent closing indicative value of the DRNs. Any further issuances will increase the outstanding aggregate principal amount of the DRNs. If there is a substantial demand for the DRNs, we may issue additional DRNs frequently. However, we are under no obligation to issue or sell additional DRNs at any time, and if we do sell additional DRNs, we may limit or restrict such sales, and we may stop and subsequently resume selling additional DRNs at any time.

In addition, we may from time to time, without notice or your consent, issue other securities linked to the Index, including other DRNs with a different daily investor fee (or other fee amounts). As explained in this reopening supplement, the daily investor fee will lower the return on the DRNs offered hereby. Such other securities linked to the Index offered by us with different daily investor fees (or other fee amounts) will be offered under a separate reopening supplement, and will constitute a different issuance of securities under the indenture from the DRNs offered hereby. The DRNs offered hereby do not include any such other securities.

The value of your DRNs will be less than if the daily investor fee were lower or if you had purchased other securities linked to the Index with a lower daily investor fee (or other lower fee amounts). |

| Calculation Agent: | Credit Suisse International, except that the closing indicative value will be calculated by NYSE Arca, Inc. The calculation agent will make certain calculations and determinations described in this reopening supplement, including with respect to the value of the DRNs, a split or reverse split of the DRNs, market disruption events and any successor index. |

| PS-3 |

Summary of the Index

The Index is designed to provide broad exposure to a basket of currency futures, sovereign bond futures, equity index futures and commodity indices, which we refer to collectively as the “index components.” The Index simulates a “managed futures” strategy but uses a quantitative allocation methodology and established rules to automatically determine the notional portfolio of the index components tracked by the Index. A “managed futures” strategy is a strategy using proprietary trading systems or discretionary methods that may involve taking long or short positions in futures contracts on such underlying assets as metals, grains, or other commodities, equity indexes, currencies or government bonds. The composition of the Index at any time is determined solely by such allocation methodology, and is not actively managed by Credit Suisse Asset Management, LLC, the sponsor of the Index (the “Index Sponsor”) or any other asset manager. The Index does not track any managed futures hedge funds or any other actively managed investment vehicles. There can be no assurance that the performance of the Index over time will approximate the return of a managed futures strategy or any other actively managed investment strategy.

The Index rebalances on each index business day (as defined under “The Index” in the accompanying underlying supplement) by adjusting the allocation of the Index to each of sixteen “tranches” of each index component based on historical trends in the levels of that index component. We refer to the allocation of the Index to each tranche of an index component as the “factor share” of that tranche of that index component. Each “tranche” of an index component represents a portion of the overall allocation of the Index to that index component that is based on the trend in the levels of that index component over a different prior period ranging from 3 to 18 months. The result of these allocations is that, at any time, the Index will tend to be “long” the index components with positive average historical trends over the past eighteen months, and will tend to be “short” the index components with negative average historical trends over the past eighteen months. The more pronounced the trends are, the larger the position (long or short) will likely be. For each daily rebalancing, the Index also applies a gross exposure limit, and seeks to achieve an annualized target volatility of 10% and to limit the annualized volatility of the Index to under 15%.

There is no guarantee that the allocation methodology or the volatility targeting strategy of the Index will be successful. The Index determines its notional exposure to each index component based on historical trends in the levels of that index component. However, a historical trend may not accurately predict any future trend. For example, even if the level of an index component has been trending upwards over a particular prior period, the level of that index component may not continue increasing and may start decreasing at any time. The allocation methodology may not immediately adjust to such reverse in trends, and as a result the Index may reflect an overly “short” position in the index components that have just started trending positively and may reflect an overly “long” position in the index components that have just started trending negatively. Any delay by the Index to reflect the changes in the historical trends in the level of each index component may reduce the Index level. Furthermore, the Index seeks to achieve an annualized target volatility of 10% and to limit the annualized volatility of the Index to under 15% via its volatility targeting strategy. However, because the Index makes the relevant volatility calculations and adjustments to the index component weights based on historical volatilities and assumptions of the correlations among the index components, the actual realized annualized volatility of the Index after these adjustments may be greater or less than the target volatility of 10%, and may be greater than the volatility limit of 15%.

The Index was launched on January 31, 2011, and the closing level of the Index was set to 1,000 on that date. The Index is published by one of our affiliates and has limited history. Investors should not invest in the DRNs if they do not understand the objectives and risks associated with the Index.

We refer to each index component that is a currency futures contract as a “currency futures component,” each index component that is a sovereign bond futures contract as a “bond futures component,” each index component that is an equity index futures contract as an “equity index futures component” and each index component that is a commodity index as a “commodity index component.” The commodity index components are the excess-return versions of the relevant sub-indices of the Bloomberg Commodity Index, which only track the price returns of the relevant underlying commodity futures contracts, without taking into account the additional returns that would be earned from interest accruals on cash deposits in connection with a fully funded investment in those contracts.

The level of the Index will be reduced by the notional transaction cost and holding cost for each index component. The calculation of the transaction cost for any index component depends on the bid-ask spread (as specified in “The Index” in the accompanying underlying supplement) for that index component and the size of the change from the old position to the new position in that index component. The larger the change (either positively or negatively), the greater the notional transaction cost will be.

| PS-4 |

Likewise, the holding cost for each index component reflects the notional cost that would be incurred to hold the positions in that index component from one index business day to the next index business day. For any index business day, the calculation of the holding cost for any index component depends on the long annual holding rate and short annual holding rate (each as specified in “The Index” in the accompanying underlying supplement) for that index component and on the size of the positions (long or short) in that index component. The larger the absolute value of the sum of the positions for any index component, the larger the holding cost will be for that index component.

The notional transaction cost and the holding cost for each index component will reduce the level of the index, and, as a result, will reduce the value of, and your return on, the DRNs. Such reduction may be significant. The bid-ask spread and holding rates for each index component are subject to adjustment by the Index Sponsor from time to time to reflect prevailing bid-ask spreads and holding rates in the relevant market. For more information, please refer to “The Index” in the accompanying underlying supplement.

For more information on the Index, please

see the section “The Index” in the accompanying underlying supplement.

| PS-5 |

Hypothetical Examples

The following examples are provided for illustrative purposes only and are hypothetical. They do not purport to be representative of every possible scenario concerning increases or decreases in the level of the Index relative to its closing level on the inception date. We cannot predict the level of the Index, or your return on the DRNs, on the Maturity Date or, if applicable, Early Redemption Date. The assumptions we have made in connection with the illustrations set forth below may not reflect actual events. You should not take this illustration or these examples as an indication or assurance of the expected performance of the Index or your return on the DRNs. The examples below show how the DRNs would perform in hypothetical circumstances, assuming a closing level of the Index on the inception date of 1,000 and reflecting the $1,000 stated principal amount of each DRN. The hypothetical closing level of 1,000 assumed for the Index on the inception date is for the calculation of these examples only, and may be greater than or less than the actual closing level of the Index on the inception date. For information relating to the historical performance of the Index, please refer to “Historical Information” below in this reopening supplement.

We have included five examples: (1) an example in which the level of the Index increases at a constant rate of 10% each year, (2) an example in which the level of the Index increases at an accelerating rate, (3) an example in which the level of the Index decreases at an accelerating rate, (4) an example in which the level of the Index increases and then decreases over the term of the DRNs and (5) an example in which the level of the Index fluctuates between negative and positive annualized Index returns during the term of the DRNs. These examples highlight the behavior of the closing indicative value of the DRNs at the end of each year in different circumstances. The figures in these examples have been rounded for convenience. The closing indicative values and returns of the DRNs shown in these examples are for illustrative purposes only and are not actual historical results. The actual closing indicative values of the DRNs and your payment at maturity or upon early redemption will be calculated based on the actual closing levels and returns of the Index.

The examples below assume that you hold the DRNs to the maturity date and that your payment at maturity is based on the closing indicative value on the final valuation date. However, you may offer to redeem your DRNs prior to the maturity date and, if the conditions to an early redemption at your option are satisfied, we will redeem your DRNs early on the applicable early redemption date based on the closing indicative value on the applicable early valuation date. Although your payment upon early redemption would be based on the closing indicative value of the DRNs on the applicable valuation date, which is calculated in the same manner illustrated in the examples below, you should be aware that CSSU, our agent for any early redemption at your option, will charge the applicable early redemption charge for DRNs redeemed at the request of an investor prior to maturity. Any payment on the DRNs is subject to our ability to pay our obligations as they become due.

For purposes of the calculations in these tables, each year is assumed to have 365 days. The rate of return on your investment in the DRNs will depend on the price at which you purchased the DRNs.

The examples below, and particularly the Annualized Index Return and Annualized Product Return, assume you purchased the DRNs on the inception date at a closing indicative value of 1,000 and a purchase price of the DRNs of $1,000. However, we may, without your consent, issue and sell additional DRNs after the inception date and use this reopening supplement in connection with those sales. If you purchase the DRNs at levels higher or lower than $1,000 or when the closing indicative value of the Index is higher or lower than 1,000, then the returns on the DRNs will be different than the examples set forth and could be significantly worse.

Example 1. This example assumes that the level of the Index has increased by approximately 159.37% over the term of the DRNs.

| A | B | C | D | E | F |

|

Year |

Index |

Closing |

Annualized |

Investor Fee |

Annualized |

| 0 | 1000 | $1,000 | n/a | n/a | n/a |

| 1 | 1100 | $1,089.11 | 10% | 1.09% | 8.91% |

| 2 | 1210 | $1,186.17 | 10% | 1.09% | 8.91% |

| 3 | 1331 | $1,291.87 | 10% | 1.09% | 8.91% |

| 4 | 1464.10 | $1,407 | 10% | 1.09% | 8.91% |

| 5 | 1610.51 | $1,532.38 | 10% | 1.09% | 8.91% |

| PS-6 |

| 6 | 1771.56 | $1,668.94 | 10% | 1.09% | 8.91% |

| 7 | 1948.72 | $1,817.67 | 10% | 1.09% | 8.91% |

| 8 | 2143.59 | $1,979.65 | 10% | 1.09% | 8.91% |

| 9 | 2357.95 | $2,156.06 | 10% | 1.09% | 8.91% |

| 10 | 2593.74 | $2,348.20 | 10% | 1.09% | 8.91% |

Example 2. This example assumes that the level of the Index has increased by approximately 70.18% over the term of the DRNs.

| A | B | C | D | E | F |

|

Year |

Index |

Closing |

Annualized |

Investor Fee |

Annualized |

| 0 | 1000 | $1,000 | n/a | n/a | n/a |

| 1 | 1010 | $1,000 | 1% | 1% | 0% |

| 2 | 1030.20 | $1,009.91 | 2% | 1.01% | 0.99% |

| 3 | 1061.11 | $1,029.91 | 3% | 1.02% | 1.98% |

| 4 | 1103.55 | $1,060.51 | 4% | 1.03% | 2.97% |

| 5 | 1158.73 | $1,102.52 | 5% | 1.04% | 3.96% |

| 6 | 1228.25 | $1,157.10 | 6% | 1.05% | 4.95% |

| 7 | 1314.23 | $1,225.85 | 7% | 1.06% | 5.94% |

| 8 | 1419.37 | $1,310.81 | 8% | 1.07% | 6.93% |

| 9 | 1547.11 | $1,414.65 | 9% | 1.08% | 7.92% |

| 10 | 1701.82 | $1,540.71 | 10% | 1.09% | 8.91% |

Example 3. This example assumes that the level of the Index has decreased by approximately 43.47% over the term of the DRNs.

| A | B | C | D | E | F |

|

Year |

Index |

Closing |

Annualized |

Investor Fee |

Annualized |

| 0 | 1000 | $1,000 | n/a | n/a | n/a |

| 1 | 990 | $980.20 | -1% | 0.98% | -1.98% |

| 2 | 970.20 | $951.09 | -2% | 0.97% | -2.97% |

| 3 | 941.09 | $913.43 | -3% | 0.96% | -3.96% |

| 4 | 903.45 | $868.21 | -4% | 0.95% | -4.95% |

| 5 | 858.28 | $816.64 | -5% | 0.94% | -5.94% |

| 6 | 806.78 | $760.05 | -6% | 0.93% | -6.93% |

| 7 | 750.31 | $699.85 | -7% | 0.92% | -7.92% |

| 8 | 690.28 | $637.49 | -8% | 0.91% | -8.91% |

| 9 | 628.16 | $574.37 | -9% | 0.90% | -9.90% |

| 10 | 565.34 | $511.82 | -10% | 0.89% | -10.89% |

Example 4. This example assumes that the level of the Index has decreased by approximately 0.55% over the term of the DRNs.

| A | B | C | D | E | F |

|

Year |

Index |

Closing |

Annualized |

Investor Fee |

Annualized |

| 0 | 1000 | $1,000 | n/a | n/a | n/a |

| 1 | 1050 | $1,039.61 | 5% | 1.04% | 3.96% |

| 2 | 1092 | $1,070.49 | 4% | 1.03% | 2.97% |

| 3 | 1124.76 | $1,091.70 | 3% | 1.02% | 1.98% |

| 4 | 1147.26 | $1,102.51 | 2% | 1.01% | 0.99% |

| 5 | 1158.73 | $1,102.52 | 1% | 1% | 0% |

| 6 | 1147.14 | $1,080.69 | -1% | 0.98% | -1.98% |

| 7 | 1124.20 | $1,048.60 | -2% | 0.97% | -2.97% |

| 8 | 1090.47 | $1,007.07 | -3% | 0.96% | -3.96% |

| 9 | 1046.85 | $957.22 | -4% | 0.95% | -4.95% |

| PS-7 |

| 10 | 994.51 | $900.36 | -5% | 0.94% | -5.94% |

Example 5. This example assumes that the level of the Index has decreased by approximately 0.58% over the term of the DRNs.

| A | B | C | D | E | F |

|

Year |

Index |

Closing |

Annualized |

Investor Fee |

Annualized |

| 0 | 1000 | $1,000 | n/a | n/a | n/a |

| 1 | 980 | $970.30 | -2% | 0.97% | -2.97% |

| 2 | 999.60 | $979.91 | 2% | 1.01% | 0.99% |

| 3 | 969.61 | $941.11 | -3% | 0.96% | -3.96% |

| 4 | 998.70 | $959.75 | 3% | 1.02% | 1.98% |

| 5 | 978.73 | $931.25 | -2% | 0.97% | -2.97% |

| 6 | 998.30 | $940.47 | 2% | 1.01% | 0.99% |

| 7 | 958.37 | $893.92 | -4% | 0.95% | -4.95% |

| 8 | 996.70 | $920.47 | 4% | 1.03% | 2.97% |

| 9 | 946.87 | $865.80 | -5% | 0.94% | -5.94% |

| 10 | 994.21 | $900.09 | 5% | 1.04% | 3.96% |

| PS-8 |

Selected Risk Considerations

The DRNs are senior unsecured debt obligations of Credit Suisse. The DRNs are senior medium-term notes as described in the accompanying prospectus supplement and prospectus and are riskier than ordinary unsecured debt securities. The return on the DRNs is linked to the performance of the Index. Investing in the DRNs is not equivalent to investing directly in the Index or any instrument tracked by the Index. See “The Index” in the accompanying underlying supplement for more information.

This section describes some of the most significant risks relating to an investment in the DRNs. In addition, please see the accompanying underlying supplement for a description of the risks relating to the Index and the accompanying product supplement for the risks related to DRNs generally. We urge you to read the following information about these risks, together with the other information in this reopening supplement and the accompanying underlying supplement, product supplement, prospectus supplement and prospectus, including information incorporated by reference, before investing in the DRNs.

The DRNs are subject to the risks relating to the Index

Because the DRNs are linked to the Index, the DRNs are subject to the risks relating to the Index. These include, without limitation:

| · | The Index has limited history, therefore it has not been tested through all economic and market conditions and may perform in unexpected ways; |

| · | There can be no assurance that the performance of the Index over time will approximate the return of a managed futures strategy or any other actively managed investment strategy; |

| · | The allocation methodology of the Index may not be successful. The Index determines its notional exposure to each index component based on historical trends in the levels of that index component, but a historical trend may not predict any future trend accurately. Furthermore, the allocation of Index weights to each index component is calculated by comparing a short-term 5-day moving average level of that index component with longer-term historical moving averages of that index component over various periods of time. This particular method of measuring the historical trend in the level of an index component is only one of many potential methods—each no less valid than any other—that could have been used. The particular method of measuring the historical trend in the level of an index component used by the allocation methodology may be less predictive of any future trend in the level of an index component than other methods that could have been used, or may not be predictive at all; |

| · | The Index may not achieve its target volatility and may exceed its volatility limit, because the Index makes the relevant volatility calculations and adjustments to the index component weights based on historical volatilities and assumptions of the correlations among the index components, which may be different from the actual volatilities of, and correlations among, the index components; |

| · | The level of the Index will be reduced by the notional transaction cost and holding cost for each index component. The calculation of the transaction cost and holding cost for any index component depends in part, respectively, on the bid-ask spread and the long annual holding rate and short annual holding rate (each as specified in “The Index” in the accompanying underlying supplement), respectively, for that index component, which are subject to adjustment by the Index Sponsor from time to time to reflect prevailing bid-ask spreads and holding rates in the relevant market. Such costs are calculated formulaically and will reduce the level of the Index. As a result, they will reduce the value of, and your return on, the DRNs. Such reduction may be significant; |

| · | Exposures to short positions in the Index components may adversely affect your return on the DRNs; |

| · | Higher future prices or levels, as applicable, of currencies, sovereign bonds, equity indices or commodities relative to their current prices or levels, as applicable, or “contango,” may lead to a decrease in the level of the Index and the amount payable on the DRNs; |

| · | Lower future prices or levels, as applicable, of currencies, sovereign bonds, equity indices or commodities relative to their current prices or levels, as applicable, or “backwardation,” may lead to a decrease in the level of |

| PS-9 |

the Index and the amount payable on the DRNs;

| · | Suspension or disruptions of market trading in futures contracts may adversely affect the level of the Index and therefore the value of the DRNs; and |

| · | Adjustments to the Index by the Index Sponsor or to the commodity index components by their sponsor could adversely affect the DRNs. |

For more information on these and other risks relating to the Index, please see “Risk Factors” in the accompanying underlying supplement.

The DRNs do not have a minimum redemption amount or daily early redemption value and you may lose all or a significant portion of your investment in the DRNs

The DRNs do not have a minimum redemption amount or daily early redemption value. You may receive less, and possibly significantly less, at maturity or upon early redemption than the amount you originally invested. Our cash payment on your DRNs at maturity or upon early redemption will be based primarily on any increase or decrease in the closing levels of the Index, and will be reduced by the daily investor fee (and the early redemption charge of 0.125% times the daily early redemption value per DRN if you offer your DRNs for early redemption). You may lose some or all of your investment in the DRNs if the level of the Index decreases or does not increase sufficiently to offset the impact of the daily investor fee (and the early redemption charge for any DRNs redeemed at your option). Any payment on the DRNs is subject to our ability to pay our obligations as they become due.

You will not receive coupon payments on the DRNs

We will not make coupon payments on the DRNs. You may receive less at maturity or upon early redemption than you could have earned on ordinary interest-bearing debt securities with similar maturities, including other of our debt securities, because the redemption amount and the daily early redemption value are based on the appreciation or depreciation of the Index. Because the payment due at maturity or the daily early redemption value, as applicable, may be less than the amount originally invested in the DRNs, the return on the DRNs (the effective yield to maturity) may be negative. Even if it is positive, the return payable on the DRNs may not be enough to compensate you for the early redemption charge, if applicable, any loss in value due to inflation and other factors relating to the value of money over time.

The DRNs are subject to the credit risk of Credit Suisse

Although the return on the DRNs will be based on the performance of the Index, the payment of any amount due on the DRNs, including at maturity or upon early redemption, is subject to the credit risk of Credit Suisse. Investors are dependent on Credit Suisse’s ability to pay all amounts due on the DRNs, and therefore investors are subject to our credit risk. In addition, any decline in our credit ratings, any adverse changes in the market’s view of our creditworthiness or any increase in our credit spreads is likely to adversely affect the value of the DRNs prior to maturity.

The value of the DRNs is reduced by fees associated with the DRNs and by costs embedded in the Index

As an investor in the DRNs, you will be exposed to fees and costs at two levels. First, because the closing indicative value is reduced by the daily investor fee, you will bear the direct costs of the daily investor fee. If you offer your DRNs to us for early redemption, you will also pay the applicable early redemption charge of 0.125% times the daily early redemption value per DRN. See “Risk Factors—Your return on the DRNs will be reduced by the daily investor fee” below.

Second, because the level of the Index is reduced by the notional transaction cost and holding cost for each index component, you will bear the indirect costs associated with the index because, all else being equal, these costs will cause the level of the index to decline with the passage of time. See “—The DRNs are subject to the risks relating to the Index” above and “Risk Factors—The level of the index will be reduced by the notional transaction cost and holding cost for each index component” in the accompanying underlying supplement.

Your return on the DRNs will be reduced by the daily investor fee

The daily investor fee will reduce the amount of your return (whether positive or negative) on the DRNs. Therefore the level of the Index must increase by an amount sufficient to offset the impact of the daily investor fee (and the applicable early redemption charge of 0.125% times the daily early redemption value per DRN if you offer your DRNs for early redemption)

| PS-10 |

in order for you to receive at least the amount of your initial investment at maturity or upon early redemption. If the level of the Index decreases or does not increase sufficiently to offset the impact of these adjustments, you will receive less, and possibly significantly less, than the amount of your initial investment at maturity or upon early redemption of the DRNs.

We may from time to time, without notice or your consent, issue other securities linked to the Index, including other DRNs with a different daily investor fee (or other fee amounts)

As explained in this reopening supplement, the daily investor fee will adversely affect your return on the DRNs offered hereby. Other securities linked to the Index offered by us with different daily investor fees (or other fee amounts) will be offered under a separate reopening supplement, and will constitute a different issuance of securities under the indenture from the DRNs offered hereby. The value of your DRNs will be less than if the daily investor fee were lower or if you had purchased other securities linked to the Index with a lower daily investor fee (or other lower fee amounts).

If the closing indicative value is equal to zero on any DRN trading day, you will lose all of your investment

If the closing indicative value is equal to zero on any DRN trading day, the closing indicative value on that day, and on all future days, will be zero and you will lose all of your investment in the DRNs. Due to the application of the daily investor fee, among other factors, the closing indicative value may be equal to zero on any DRN trading day when the level of the Index is above zero on that day.

An early redemption charge will be charged upon an early redemption at your option

CSSU will act as our agent in connection with any early redemption at your option and will charge the applicable early redemption charge for DRNs redeemed at your option, if you elect to have us redeem your DRNs prior to maturity. The imposition of this charge will mean that you will not receive the full amount of the daily early redemption value upon an early redemption at your option. If you elect to offer your DRNs for early redemption and the requirements for acceptance by Credit Suisse are met, you will be charged the early redemption charge, which will be $1.25 per $1,000 principal amount of DRNs.

There are certain restrictions and procedures you must follow to offer your DRNs to Credit Suisse for early redemption

Credit Suisse will redeem your DRNs at your election prior to maturity only if you have satisfied the requirements and have followed the procedures for early redemption detailed in this reopening supplement under “Summary of the DRNs—Early Redemption of the DRNs at Your Option” and in the accompanying product supplement, provided, however, that we may, at our option, waive the requirement that the completed irrevocable Offer for Early Redemption be delivered. To offer your DRNs for early redemption, you must offer at least the applicable minimum early redemption quantity. The applicable minimum early redemption quantity will be 100 DRNs ($100,000 aggregate stated principal amount of DRNs, subject to adjustment in the event of a split or reverse split of the DRNs) on any business day other than a Wednesday and 1 DRN ($1,000 aggregate stated principal amount of DRNs, subject to adjustment in the event of a split or reverse split of the DRNs) on any business day that is a Wednesday.

In addition, you must follow the procedures for early redemption detailed in this reopening supplement and in the accompanying product supplement. These procedures represent substantial restrictions on your ability to cause Credit Suisse to redeem your DRNs prior to the maturity date. If your irrevocable offer for early redemption is received after 4:00 p.m., New York City time on a business day, you will be deemed to have made your offer for early redemption on the following business day. For example, if you wish to redeem less than 100 DRNs and your irrevocable offer for early redemption is received after 4:00 p.m., New York City time on a Wednesday that is a business day, your irrevocable offer for early redemption will not be accepted until the next Wednesday that is a business day.

Additionally, unless the scheduled early redemption date is postponed because it is not a business day or because there is a market disruption event on the scheduled valuation date, the final day on which Credit Suisse will redeem your DRNs prior to maturity will be May 6, 2025. As such, you must offer your DRNs for early redemption no later than April 30, 2025.

You will not know the daily early redemption value you will receive at the time an election is made to redeem your DRNs prior to maturity

You will not know the daily early redemption value at the time you elect to have us redeem your DRNs or at the time we elect to redeem your DRNs prior to the maturity date. Your election to have us redeem your DRNs will become irrevocable

| PS-11 |

after we accept your offer. You will not know the daily early redemption value until the applicable valuation date, which will be the DRN trading day immediately following the business day on which either you deliver the redemption offer to Credit Suisse or on which we deliver the relevant notice to DTC. We will pay you the daily early redemption value, if any (in the case of early redemption at your option, less the applicable early redemption charge), on the applicable early redemption date, which is the third business day following the applicable valuation date. The determination of the closing level of the Index for a valuation date, and the related early redemption date, will be postponed if a market disruption event exists on such scheduled valuation date. See “Supplemental Description of the DRNs—Postponement of a Valuation Date” below. As a result, you will be exposed to market risk in the event that the market fluctuates between the time either you deliver the early redemption offer to Credit Suisse or on which we deliver the relevant notice to DTC and the applicable valuation date.

Credit Suisse may redeem your DRNs at its option at any time

We have the right to redeem your DRNs, in whole but not in part, on any business day during the term of the DRNs. The amount you may receive upon an early redemption by Credit Suisse may be less than the amount you would receive on your investment at maturity or if you had elected to have Credit Suisse redeem your DRNs at a time of your choosing. If Credit Suisse exercises its right to redeem your DRNs prior to the maturity date, you will receive, for each DRN you hold, a cash payment in an amount equal to the daily early redemption value, which is the closing indicative value of the DRN on the applicable valuation date. Credit Suisse has no obligation to take your interests into account when deciding whether to call the DRNs. The payment of any amount due on the DRNs, including any redemption amount or upon early redemption, is subject to the credit risk of Credit Suisse.

The value of the DRNs is expected to be influenced by many unpredictable factors

The value of your DRNs is expected to fluctuate between the date you purchase them and the applicable valuation date. You may sustain a significant loss if you sell the DRNs prior to maturity. Several factors, many of which are beyond our control, will influence the value of the DRNs. We expect that generally the level of the Index will affect the value of the DRNs more than any other factor. Other factors that may influence the value of the DRNs include:

| · | the time remaining to the maturity of the DRNs; |

| · | our early redemption right, which is likely to limit the value of the DRNs; |

| · | interest and yield rates in the market generally; |

| · | the volatility of the Index, the currency futures components, bond futures components, equity index futures components and commodity futures contracts included in the commodity index components; |

| · | the liquidity of the currency futures components, bond futures components, equity index futures components and commodity futures contracts included in the commodity index components; |

| · | the notional transaction cost and holding cost for each index component; |

| · | the expected volatility of the equity indices underlying the equity index futures components and the dividend rate on the equity securities comprising such equity indices; |

| · | governmental programs and policies, national and international monetary, trade, economic, financial, regulatory, political, judicial, military and other events that affect currencies, sovereign bond and commodities markets generally, the Index, the currency futures components, bond futures components, equity index futures components or commodity futures contracts included in the commodity index components; |

| · | supply and demand for the U.S. dollar, the underlying currencies for the currency futures components and the foreign currencies in which the bond futures components and equity index futures components are denominated and, economic and political developments in the relevant countries, existing and expected rates of inflation and interest rate levels, the balance of payments in the relevant countries and between each relevant country and its major trading partners, the extent of governmental surplus or deficit in the relevant countries, the stability of the governments and banking systems of the relevant countries, and other factors that affect the currency markets generally; |

| · | supply and demand for the underlying sovereign bonds for the bond futures components, fiscal and monetary |

| PS-12 |

policies of the governments of the issuing countries, inflation and expectations concerning inflation, the prevailing market and futures prices and yields for the underlying sovereign bonds of variable maturities, the prevailing spread between yields on the underlying sovereign bonds and the yields on other investable fixed income securities and equity securities; and market expectations of interest rates on the underlying sovereign bonds and of macroeconomic trends and future rates of inflation in the issuing countries;

| · | global supply and demand for the commodities upon which the futures contracts included in the commodity index components are based, which is influenced by such factors as forward selling and purchases made by producers of such commodities in order to unwind hedge positions, speculation and trading activities in such commodities, central bank purchases and sales of such commodities, and production and cost levels in major producing countries of such commodities; |

| · | the prevailing rate of interest; and |

| · | our creditworthiness, including actual or anticipated downgrades in our credit ratings. |

These factors interrelate in complex ways, and the effect of one factor on the value of your DRNs may offset or enhance the effect of another factor.

Lack of liquidity of the DRNs

The DRNs will not be listed on any securities exchange. We may redeem the DRNs pursuant to the early redemption right at your option or our option, but we will not purchase the DRNs in the secondary market. Also, the number of DRNs outstanding or held by persons other than our affiliates could be reduced at any time due to early redemptions of the DRNs. There may be little or no secondary market for the DRNs. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the DRNs when you wish to do so. Because other dealers are not likely to make a secondary market for the DRNs, the price at which you may be able to sell your DRNs (other than by effecting an early redemption at your option) is likely to depend on the closing indicative value of the DRNs on the applicable valuation date. If you have to sell your DRNs in the secondary market, you may not be able to do so or you may have to sell them at a substantial loss.

We are under no obligation to issue or sell additional DRNs at any time, and if we do sell additional DRNs, we may limit or restrict such sales, and we may stop and subsequently resume selling additional DRNs at any time

At our sole discretion, we may decide to issue and sell additional DRNs from time to time at a price that is higher or lower than the stated principal amount, based on the most recent closing indicative value of the DRNs. The price of the DRNs in any subsequent sale may differ substantially (higher or lower) from the issue price paid in connection with any other issuance of the DRNs. However, we are under no obligation to issue or sell additional DRNs at any time, and if we do sell additional DRNs, we may limit or restrict such sales, and we may stop and subsequently resume selling additional DRNs at any time.

Any historical performance of the Index should not be taken as an indication of the future performance of the Index or the DRNs

The Index was launched on January 31, 2011. Therefore, the Index has a limited performance history. Because the Index is of recent origin with limited performance history, an investment linked to the Index may involve a greater risk than an investment linked to one or more indices with an established record of performance. A longer history of actual performance through various economic and market conditions would have provided greater and more reliable information, based upon which an investor could assess the validity of the Index’s investment thesis and Index methodology. A longer history of actual performance would also have made the Index more widely accepted in the market, and, consequently, less likely that the Index Sponsor would amend or terminate the Index. However, any historical performance of the Index is not an indication of how the Index will perform in the future.

The historical performance of the Index set forth in this reopening supplement does not give effect to the daily investor fee or other charges on the DRNs. The daily investor fee will adversely affect your return on the DRNs. See “Risk Factors—Your return on the DRNs will be reduced by the daily investor fee” in this reopening supplement.

| PS-13 |

Potential conflicts

We and our affiliates play a variety of roles in connection with the issuance of the DRNs, including acting as calculation agent and hedging our obligations under the DRNs. In addition, an affiliate of ours, Credit Suisse Asset Management, LLC, is the Index Sponsor. In performing these duties, the economic interests of the calculation agent and other affiliates of ours are potentially adverse to your interests as an investor in the DRNs. Please see “Risk Factors—There may be potential conflicts of interest” in the accompanying product supplement and “Risk Factors— We or our affiliates may have economic interests adverse to the holders of the securities” in the accompanying underlying supplement.

Credit Suisse is subject to Swiss regulation

As a Swiss bank, Credit Suisse is subject to regulation by governmental agencies, supervisory authorities and self-regulatory organizations in Switzerland. Such regulation is increasingly more extensive and complex and subjects Credit Suisse to risks. For example, pursuant to Swiss banking laws, the Swiss Financial Market Supervisory Authority (FINMA) may open resolution proceedings if there are justified concerns that Credit Suisse is over-indebted, has serious liquidity problems or no longer fulfills capital adequacy requirements. FINMA has broad powers and discretion in the case of resolution proceedings, which include the power to convert debt instruments and other liabilities of Credit Suisse into equity and/or cancel such liabilities in whole or in part. If one or more of these measures were imposed, such measures may adversely affect the terms and value of the DRNs and/or the ability of Credit Suisse to make payments thereunder and you may not receive any amounts owed to you under the DRNs.

You will not have any rights in the index components tracked by the Index

As an owner of the DRNs, you will not own or have any beneficial or other legal interest in, and will not be entitled to any rights with respect to, any index component tracked by the Index. Additionally, the return on the DRNs, if any, may be less than the return on a similar investment in other instruments tracking the Index due to the daily investor fee (and the applicable early redemption charge for DRNs redeemed at your option, if you elect to have us redeem your DRNs prior to maturity). Also, the return on the DRNs, if any, may be less than the return on a direct investment in the index components tracked by the Index due to the Index’s notional transaction cost and holding cost for each index component. The return on the DRNs may also differ from the results of the Index for the reasons described under “—The DRNs are subject to the credit risk of Credit Suisse.”

The United States federal income tax treatment of the DRNs is uncertain

The United States federal income tax consequences of an investment in DRNs are uncertain, both as to the timing and character of any inclusion in income in respect of the DRNs. Some of these consequences are summarized below but you should read the more detailed discussion in “Material U.S. Federal Income Tax Considerations” in this pricing supplement and also consult your tax advisor as to the tax consequences of investing in the DRNs. By purchasing a DRN, you agree, in the absence of a change in law, an administrative determination or a judicial ruling to the contrary, to characterize the DRN for all U.S. federal income tax purposes as a pre-paid forward contract with respect to the Index. Under this characterization of the DRNs, and subject to the following sentence, if you are a U.S. holder (as defined below), you should generally recognize capital gain or loss upon the sale, redemption or maturity of your DRNs in an amount equal to the difference between the amount you receive at such time and the amount you paid for the DRNs. However, as discussed in more detail under “Material U.S. Federal income Tax Considerations -- Foreign Currency Gain or Loss” below, it is possible that the IRS will assert that any gain or loss that you recognize with respect to your DRN that is attributable to the foreign currency futures contracts that are included in the Index should be treated as ordinary gain or loss unless you make the capital gain election described in more detail below.

Notwithstanding your agreement to treat the DRNs as a pre-paid forward contract with respect to the Index, the Internal Revenue Service (“IRS”) could assert that the DRNs should be taxed in a manner that is different than described in this pricing supplement. As discussed further below, the IRS has issued a Notice indicating that it and the Treasury Department are actively considering whether, among other issues, you should be required to accrue ordinary income over the term of an instrument such as the DRNs even though you will not receive any payments with respect to the DRNs until redemption or maturity and whether all or part of the gain you may recognize upon sale or maturity of an instrument such as the DRNs could be treated as ordinary income. The outcome of this process is uncertain and could apply on a retroactive basis.

YOU ARE URGED TO CONSULT WITH YOUR OWN TAX ADVISOR REGARDING ALL ASPECTS OF THE U.S. FEDERAL INCOME TAX CONSEQUENCES OF INVESTING IN THE DRNs.

| PS-14 |

Supplemental Use of Proceeds and Hedging

We intend to use the proceeds of this offering for our general corporate purposes, which may include the refinancing of existing debt outside Switzerland. Some or all of the proceeds we receive from the sale of the DRNs may be used in connection with hedging our obligations under the securities through one or more of our affiliates. Such hedging or trading activities on or prior to the inception date and during the term of the securities (including on the applicable valuation date) could adversely affect the value of the Index and, as a result, could decrease your return on the DRNs. For additional information, see “Supplemental Use of Proceeds and Hedging” in the accompanying product supplement.

| PS-15 |

Supplemental Description of the DRNs

Postponement of a Valuation Date:

If the calculation agent determines that a market disruption event has occurred or is continuing on a valuation date, including the final valuation date, such valuation date will be postponed to the immediately following DRN trading day on which no market disruption event has occurred or is continuing. However, in no event will any valuation date be postponed for more than five consecutive DRN trading days. If a valuation date has been postponed to the sixth DRN trading day after the originally scheduled valuation day, and a market disruption event has occurred or is continuing on such day, the calculation agent will make all calculations and determinations with respect to the DRNs based on its good- faith and commercially reasonable determination of the relevant levels or values required for such calculations or determinations as of that day. If a valuation date has been postponed for five consecutive DRN trading days as a result of an “index disruption event” with respect to an index component, as defined in the accompanying underlying supplement, on the sixth DRN trading day after the originally scheduled valuation day, if the index disruption event is continuing or another index disruption event has occurred, the calculation agent will determine the closing level of the Index for such valuation date by reference to: (i) with respect to each index component that is unaffected by the index disruption event, the closing level of such unaffected index component on the originally scheduled valuation date and (ii) with respect to each index component that is affected by the index disruption event, its good-faith and commercially reasonable determination of the closing level of each such affected index component as of that day.

If a valuation date relating to early redemption of the DRNs or the final valuation date is postponed, the applicable early redemption date or the maturity date, as applicable, will be postponed by an equal number of business days. Any such postponement or determinations by the calculation agent may adversely affect your return on the DRNs. In addition, no interest or other payment will be payable as a result of such postponement. Notwithstanding the foregoing, the determination of both the closing level of the Index and the daily index factor solely for purposes of calculating the daily investor fee on any DRN trading day will not be postponed as a result of such day not being a DRN trading day or as a result of a market disruption event occurring or continuing on such day.

A “market disruption event” occurs on a DRN trading day if on such DRN trading day (i) the Index Sponsor fails to publish the closing level of the Index as a result of the occurrence of an “index disruption event” as defined in the accompanying underlying supplement, or the successor index sponsor fails to publish the closing level of the successor index, as applicable, subject to certain adjustments described below under “—Changes to the Calculation of the Index” below, or (ii) an “index disruption event” as defined in the accompanying underlying supplement has occurred with respect to any commodity index component. If a market disruption event has occurred as a result of (ii) on any DRN trading day, the calculation agent will postpone any relevant valuation date in accordance with the postponement mechanism described above, notwithstanding that the sponsor of the affected commodity index component may nonetheless publish a closing level for that commodity index component and the Index Sponsor may publish a closing level of the Index for that DRN trading day.

Changes to the Calculation of the Index:

If the Index Sponsor discontinues publication of the Index and the Index Sponsor or any other person or entity calculates and publishes an index that the calculation agent, after consultation with Credit Suisse, reasonably determines is comparable to the Index and approves as a successor index, then the calculation agent will determine the closing level of the Index on any valuation date and the amount payable at maturity or upon early redemption by reference to such successor index for the period following the discontinuation of the Index.

If the calculation agent reasonably determines that the publication of the Index is discontinued and that there is no successor index, then the calculation agent, after consultation with Credit Suisse, will determine the amount payable by a computation methodology that the calculation agent determines will as closely as reasonably possible replicate the Index.

If the calculation agent reasonably determines that the Index or the method of calculating the Index has been changed at any time in any significant respect, whether the change is made by the Index Sponsor under its existing policies or following a modification of those policies, is due to the publication of a successor index, is due to events affecting one or more of the index components, or is due to any other reason, then the calculation agent, after consultation with Credit Suisse, will be permitted (but not required) to make such adjustments to the Index or method of calculating the Index as it reasonably believes are appropriate to ensure that the level of the Index used to determine the amount payable on the DRNs at maturity

| PS-16 |

or upon early redemption is as close as possible to the level of the Index had no such change occurred.

All determinations and adjustments to be made by the calculation agent with respect to the level of the Index and the amount payable at maturity or upon early redemption will be made in the calculation agent’s reasonable discretion. The calculation agent will make all determinations and adjustments such that the fundamental economic terms of the Index are equivalent to those immediately prior to the event requiring or permitting such determinations or adjustments.

| PS-17 |

Historical Information

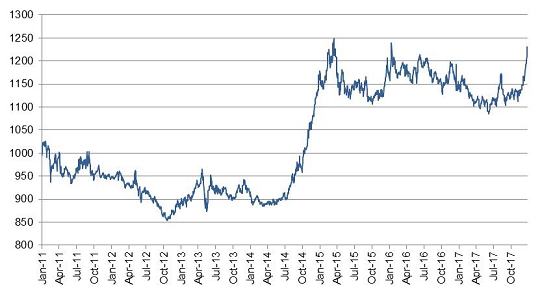

The graph below sets forth the historical performance of the Index from January 31, 2011 through January 25, 2018. The closing level of the Index on January 25, 2018 was 1219.970. We obtained the historical performance below from Bloomberg, without independent verification.

The historical performance of the Index below does not give effect to the daily investor fee or other charges on the DRNs. The daily investor fee will adversely affect your return on the DRNs. See “Selected Risk Considerations—Your return at maturity or upon early redemption will be reduced by the daily investor fee” in this reopening supplement.

The historical Index performance should not be taken as an indication of future performance of the Index, and no assurance can be given as to the closing level of the Index on any DRN trading day, including on any applicable valuation date. We cannot give you assurance that the performance of the Index will result in the return of any of your initial investment.

For additional information on the Index, see information set forth under “The Index” in the accompanying underlying supplement.

Historical Performance of the Credit Suisse Managed Futures Liquid Index

Source: Bloomberg

| PS-18 |

Material U.S. Federal Income Tax Considerations

The following section is a summary of the U.S. federal income tax considerations applicable to the purchase and ownership of DRNs and it supplements the discussion in the accompanying prospectus under “Taxation”. Except for the discussion under the heading “—Non-U.S. Holders” below, it applies to you only if you are a U.S. holder (as defined below) and you hold your DRNs as capital assets for tax purposes. This section does not apply to you if you are a member of a class of holders subject to special rules, such as:

| · | a dealer in securities or currencies; |

| · | a trader in securities that elects to use a mark-to-market method of accounting for your securities holdings; |

| · | a bank; |

| · | a life insurance company; |

| · | a tax-exempt organization; |

| · | a regulated investment company; |

| · | a partnership or other pass-through entity; |

| · | a person that owns a DRN as a hedge or that is hedged against interest rate risks; |

| · | a person that owns a DRN as part of a straddle or conversion transaction for tax purposes; or |

| · | a U.S. holder (as defined below) whose functional currency for tax purposes is not the U.S. dollar. |

This section is based on the U.S. Internal Revenue Code of 1986, as amended, its legislative history, existing and proposed regulations under the Internal Revenue Code, published rulings and court decisions, all as currently in effect. These laws are subject to change, possibly on a retroactive basis.

You should consult your tax advisor concerning the U.S. federal income tax and other tax consequences of your investment in the DRNs in your particular circumstances, including the application of state, local or other tax laws and the possible effects of changes in federal or other tax laws.

You are a U.S. holder if you are a beneficial owner of an DRN and you are for U.S. federal income tax purposes:

| · | a citizen or resident of the United States; |

| · | a domestic corporation; |

| · | an estate whose income is subject to U.S. federal income tax regardless of its source; or |

| · | a trust if a U.S. court can exercise primary supervision over the trust’s administration and one or more U.S. persons are authorized to control all substantial decisions of the trust. |

You are a non-U.S. holder if you are not a U.S. holder and you are not an entity that is classified as a partnership for U.S. federal income tax purposes.

Classification of the DRNs

In the opinion of our special tax counsel, Sullivan and Cromwell LLP, the DRNs should be treated as a pre-paid forward contract with respect to the Index. Pursuant to the terms of the DRNs, you agree, in the absence of a change in law or an administrative or judicial ruling to the contrary, to treat the DRNs for all U.S. federal income tax purposes in accordance with such characterization. If the DRNs are so treated, and subject to the discussion below under “Foreign Currency Gain or Loss”, you should generally recognize capital gain or loss upon the sale, redemption or maturity of your DRNs in an amount equal to the difference between the amount you receive at such time and your tax basis in the DRNs. In general, your tax basis in your DRNs will be equal to the price you paid for your DRNs. Capital gain of a noncorporate U.S. holder is generally taxed at preferential rates in cases where the holder has a holding period of greater than one year.