Exhibit 4.4

[FACE OF NOTE]

Unless this certificate is presented by an authorized representative of The Depository Trust Company (55 Water Street, New York, New York) to the issuer or its agent for registration of transfer, exchange or payment, and any certificate issued is registered in the name of Cede & Co. or such other name as requested by an authorized representative of The Depository Trust Company and any payment is made to Cede & Co., ANY TRANSFER, PLEDGE OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL since the registered owner hereof, Cede & Co., has an interest herein.

Unless and until it is exchanged in whole or in part for Notes in definitive registered form, this Note may not be transferred except as a whole by the Depositary to a nominee of the Depositary or by a nominee of the Depositary to the Depositary or another nominee of the Depositary or by the Depositary or any such nominee to a successor Depositary or a nominee of such successor Depositary.

|

REGISTERED NO. AxelaTrader ETN-[ ]

|

[ ] ETNs; Principal Amount: See Schedule I

CUSIP: [ ]

ISIN: [ ]

|

|

CREDIT SUISSE AG linked to the S&P GSCI® [ ] ER due September 14, 2037

| |

CREDIT SUISSE AG, a corporation organized under the laws of, and duly licensed as a bank in, Switzerland (the “Company,” which term includes any successor corporation under the Indenture hereinafter referred to), acting through its Nassau branch (the “Branch”), for value received, hereby promises to pay to Cede & Co., or registered assigns, at the office or agency of the Company in New York, New York, an amount of cash in the coin or currency of the United States determined as set forth on the reverse hereof on the Maturity Date (as defined on the reverse hereof).

Reference is hereby made to the further provisions of this Note set forth on the reverse hereof, which further provisions shall for all purposes have the same effect as if set forth at this place. All capitalized terms used herein but not otherwise defined shall have the meaning assigned to them in the Indenture (as defined on the reverse hereof).

This Note shall not be valid or become obligatory for any purpose until the certificate of authentication hereon shall have been manually signed by the Trustee (as defined on the reverse hereof) under the Indenture referred to on the reverse hereof.

F-1

IN WITNESS WHEREOF, the Company has caused this Note to be duly executed.

| CREDIT SUISSE AG, | |||

| acting through its Nassau branch | |||

| By: | |||

| Name: | |||

| Title: Authorized Signatory | |||

| By: | |||

| Name: | |||

| Title: Authorized Signatory | |||

F-2

CERTIFICATE OF AUTHENTICATION

This is one of the Securities of the series designated therein referred to in the within-mentioned Indenture.

Dated: September 19, 2017

| THE BANK OF NEW YORK MELLON, | |||

| as Trustee | |||

| By: | |||

| Authorized Signatory | |||

F-3

[REVERSE OF NOTE]

CREDIT SUISSE AG

AxelaTrader™ [ ] ETN

linked to the S&P GSCI® [ ] ER

due September 14, 2037

This Note is one of a duly authorized issue of debentures, notes, bonds or other evidences of indebtedness of the Company (the “Securities”) of the series hereinafter specified, all issued or to be issued under and pursuant to a senior indenture, dated as of March 29, 2007, between the Company and The Bank of New York Mellon (the “Trustee”), to which indenture and all indentures supplemental thereto (collectively, the “Indenture”) reference is hereby made for a description of the rights, limitations of rights, obligations, duties and immunities thereunder of the Trustee, the Company and the registered holder (the “Holder”) of the Securities. The Securities may be issued in one or more series, which different series may be issued in various principal amounts, may mature at different times, may pay coupons (if any) at different rates, may be subject to different redemption provisions (if any), may be subject to different sinking, purchase or analogous funds (if any) and may otherwise vary as provided in the Indenture.

This Note (the “Note”) is a tranche (as defined herein) of a series designated as the Senior Medium-Term Notes.

This Note does not bear interest.

This Note is issuable only in registered form without coupons in initial minimum denominations of $100 and any integral multiples of $100 in excess thereof at the office or agency of the Company in the Borough of Manhattan, the City of New York, in the manner and subject to the limitations provided in the Indenture. The minimum denominations and integral multiples in excess thereof are subject to adjustment if this Note is subject to a split or reverse split, as set forth herein.

Maturity Date

The scheduled maturity date of this Note is September 14, 2037 (the “Maturity Date”), subject to postponement if the scheduled Maturity Date is not a Business Day or if the scheduled Final Valuation Date is postponed. If the scheduled Maturity Date is not a Business Day, the Maturity Date will be the next succeeding Business Day. In addition, if the scheduled Final Valuation Date is postponed for any reason, the Maturity Date will be postponed until the date three Business Days following the determination of the Closing Indicative Value on the Final Valuation Date as postponed.

No interest or other payment will be payable hereon because of any such postponement of the Maturity Date.

R-1

Payment at Maturity

If this Note has not been previously redeemed or accelerated, on the Maturity Date the Holder will receive a cash payment for each $100 principal amount of this Note equal to the Closing Indicative Value on the final Calculation Date of the Final Valuation Period (such date, the “Final Valuation Date” and such Closing Indicative Value, the “Final Indicative Value”), as calculated by the Indicative Value Calculation Agent (the “Maturity Redemption Amount”). The “Final Valuation Period” is the period of five consecutive Calculation Dates expected to commence on September 2, 2037 and end on September 9, 2037.

A “Calculation Date” is any Index Business Day during the Final Valuation Period or the Acceleration Valuation Period, as applicable, on which a Market Disruption Event has not occurred nor is continuing. However, if a Market Disruption Event occurs on or is continuing for five consecutive Index Business Days during the Final Valuation Period or the Acceleration Valuation Period, as applicable, the fifth such Index Business Day shall be deemed to be the applicable Calculation Date, notwithstanding the fact that a Market Disruption Event occurred or was continuing on such Index Business Day, and the Indicative Value Calculation Agent will determine the applicable Closing Indicative Value using an appropriate closing level of the Index on that Index Business Day taking into account the nature and duration of such Market Disruption Event.

The “Closing Indicative Value” per $100 principal amount of this Note on the Inception Date was $100. On any Index Business Day following the Inception Date, the Closing Indicative Value per $100 principal amount of this Note on such Index Business Day will equal the Non-Valuation Period CIV on such Index Business Day.

Notwithstanding the foregoing, the Closing Indicative Value per $100 principal amount of this Note on any Calculation Date in the Final Valuation Period or the Acceleration Valuation Period, as applicable, will equal the Valuation Period CIV.

The Closing Indicative Value will never be less than zero. If the Intraday Indicative Value is equal to or less than zero at any time or the Closing Indicative Value is equal to zero on any Index Business Day on which a Market Disruption Event has not occurred nor is continuing, the Closing Indicative Value on that day, and all future days, will be zero.

The “Non-Valuation Period CIV” per $100 principal amount of this Note on the Inception Date was $100. The Non-Valuation Period CIV per $100 principal amount of this Note on any Index Business Day following the Inception Date will equal the product of (a) (i) the Non-Valuation Period CIV per $100 principal amount of this Note on the immediately preceding Index Business Day, times (ii) the Daily ETN Performance per $100 principal amount of this Note on such Index Business Day, minus (b) the Daily Investor Fee per $100 principal amount of this Note on such Index Business Day. The Non-Valuation Period CIV will never be less than zero.

The “Valuation Period CIV” per $100 principal amount of this Note on any Calculation Date in the Final Valuation Period or the Acceleration Valuation Period, as applicable, will equal the product of (a) 1/5, multiplied by (b) the sum of (i) the sum of the Non-Valuation Period CIVs per $100 principal amount of this Note on each Calculation Date from, and including, the first

R-2

Calculation Date in the Final Valuation Period or the Acceleration Valuation Period, as applicable, to, and including, such Calculation Date, plus (ii) the product of (1) the Non-Valuation Period CIV per $100 principal amount of this Note on such Calculation Date, times (2) the number of Calculation Dates remaining, if any, in the Final Valuation Period or the Acceleration Valuation Period, as applicable, following such Calculation Date. If any date would have been a Calculation Date during the Final Valuation Period or the Acceleration Valuation Period, as applicable, but for the occurrence or continuation of a Market Disruption Event, then such date will not be a Calculation Date and no Closing Indicative Value will be calculated or published for that day.

The “Inception Date” is September 14, 2017.

The “Daily ETN Performance” on any Index Business Day will equal (1) one, plus (2) the Daily Accrual on such Index Business Day, plus (3) the product of (a) the Daily Index Performance on such Index Business Day, times (b) the Leverage Amount.

The “Index” is the S&P GSCI® [] ER (Index Bloomberg ticker [ ] (or any successor thereto)).

An “Index Business Day” is a day on which (i) trading is generally conducted on the primary exchange on which futures contracts included in the Index are traded, as determined by the Calculation Agent, which is initially [ ] (the “Primary Exchange”), (ii) the Index is scheduled to be published by S&P Dow Jones Indices LLC (“S&P” or the “Index Sponsor”) and (iii) trading is generally conducted on NYSE Arca, in each case as determined by the Calculation Agent.

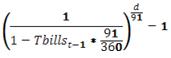

The “Daily Accrual” on any Index Business Day is equal to:

Where Tbillst-1 is the three-month U.S. Treasury rate reported on Bloomberg on the prior Index Business Day and d is the number of calendar days from, and including, the immediately prior Index Business Day to, but excluding, the date of determination.

The “Daily Index Performance” on any Index Business Day will equal (1) (a) the Closing Level of the Index on such Index Business Day, divided by (b) the Closing Level of the Index on the immediately preceding Index Business Day, minus (2) one. If a Market Disruption Event occurs or is continuing on any Index Business Day (the “date of determination”) or if a Market Disruption Event occurred or was continuing on the Index Business Day immediately preceding the date of determination, then the Daily Index Performance on the date of determination will equal (1) (a) the Closing Level of the Index on the date of determination, minus (b) the Closing Level of the Index on the Index Business Day immediately preceding the date of determination, divided by (2) (a) the Closing Level of the Index on the Index Business Day on which no Market Disruption Event occurred or was continuing that most closely precedes the date of determination, plus (b) (i) the Leverage Amount, times (ii) (A) the Closing Level of the Index on the Index Business Day immediately preceding the date of determination, minus (B) the Closing

R-3

Level of the Index on the Index Business Day on which no Market Disruption Event occurred or was continuing that most closely precedes the date of determination.

The “Leverage Amount” is [ ].

On any Index Business Day, the “Daily Investor Fee” will equal the product of (1) the Closing Indicative Value on the immediately preceding Index Business Day, times (2) (a) the Investor Fee Factor, times (b) 1/365, times (c) the number of calendar days from, and including, the immediately prior Index Business Day to, but excluding, such Index Business Day.

The “Investor Fee Factor” is [ ]%.

The “Closing Level” of the Index on any Index Business Day is the closing level reported by S&P on the Bloomberg page [ ] or any successor page on Bloomberg or any successor service, as applicable, as determined by the Calculation Agent, except that in the event a Market Disruption Event occurs or is continuing on any Index Business Day, the Calculation Agent will determine the Daily Index Performance on such Index Business Day using an appropriate Closing Level of the Index determined according to the methodology described below in “Market Disruption Events.”

The “Intraday Indicative Value” shall be a value calculated using the same formula as the Closing Indicative Value, except that instead of using the Closing Level of the Index to calculate the Daily Index Performance at such time, the calculation of the Daily Index Performance shall be based on the most recent intraday level of the Index at the particular time; provided that if the Intraday Indicative Value is equal to or less than zero at any time or the Closing Indicative Value is equal to zero on any Index Business Day on which a Market Disruption Event has not occurred nor is continuing, the Closing Indicative Value on that day, and all future days, will be zero.

A “Business Day” is any day that is not (a) a Saturday or Sunday or (b) a day on which banking institutions generally are authorized or obligated by law or executive order to close in New York.

A “Trading Day” is any day that is (or, but for the occurrence of a Market Disruption Event, would have been) a day on which trading is generally conducted on the Relevant Exchange or Relevant Exchanges, as applicable, or the Related Exchanges (each as defined herein).

Redemption at the Option of the Beneficial Owner

A beneficial owner of an interest in this Note may elect to offer 25,000 ETNs, or integral multiples in excess thereof at one time, (the “Minimum Redemption Amount”) for redemption by the Company during the term of the ETNs until September 1, 2037 (other than in respect of a Redemption Notice submitted to the Company on any day after the Business Day immediately preceding the start of the Acceleration Valuation Period) of by following the procedures set forth below:

| · | Cause its broker to deliver a notice of redemption, in substantially the form of Annex A (the “Redemption Notice”), to CSSU (the “Redemption Agent”) via email or |

R-4

other electronic delivery as requested by the Redemption Agent. If the Redemption Notice is delivered prior to 4:00 p.m., New York City time, on any Business Day, the first immediately following Index Business Day on which a Market Disruption Event has not occurred nor is continuing will be the “Early Redemption Valuation Date.” Otherwise, the second following Index Business Day on which a Market Disruption Event has not occurred nor is continuing will be the Early Redemption Valuation Date. Notwithstanding the foregoing, if a Market Disruption Event occurs on or is continuing for five consecutive Index Business Days following such first or second Index Business Day, as applicable, on which a Market Disruption Event occurs or is continuing, the fifth such Index Business Day shall be deemed to be the Early Redemption Valuation Date, notwithstanding the fact that a Market Disruption Event occurred or was continuing on such fifth Index Business Day, and the Indicative Value Calculation Agent will determine the applicable Closing Indicative Value using an appropriate closing level of the Index on that Index Business Day taking into account the nature and duration of such Market Disruption Event. The Company will not accept a Redemption Notice submitted to the Company on any day after the Business Day immediately preceding the start of the Acceleration Valuation Period. If the Redemption Agent receives Redemption Notice no later than 4:00 p.m., New York City time, on any Business Day, the Redemption Agent will send the broker an acknowledgment of the Redemption Notice and acceptance of the redemption request by 7:30 p.m., New York City time, on the Business Day prior to the Early Redemption Valuation Date. The Redemption Agent or its affiliate must acknowledge to the broker acceptance of the Redemption Notice in order for the redemption request to be effective;

| · | Cause its broker to cause the DTC custodian to book a delivery versus payment trade with respect to the principal amount of offered for redemption on the Early Redemption Valuation Date at a price equal to the Early Redemption Amount, facing the Company; and |

| · | Cause its broker to cause the DTC custodian to deliver the trade as booked for settlement via DTC at or prior to 10:00 a.m. New York City time, on the Early Redemption Date (the second Business Day following the Early Redemption Valuation Date). |

If the Redemption Agent does not (i) receive the Redemption Notice from the broker by 4:00 p.m., New York City time, and (ii) deliver an acknowledgment of such Redemption Notice to the broker accepting the redemption request by 7:30 p.m., New York City time, on the Business Day prior to the Early Redemption Valuation Date, such notice will not be effective for such Business Day and the Redemption Agent will treat such Redemption Notice as if it were received on the next Business Day. Any redemption instructions for which the Redemption Agent receives a valid confirmation in accordance with the procedures described above will be irrevocable.

If the Redemption Agent ceases to perform its role, the Company will, at its sole discretion, either perform such role or appoint another party to do so. The Company will not accept a Redemption Notice submitted to the Company on any day after the Business Day immediately

R-5

preceding the start of the Acceleration Valuation Period. Upon compliance with the foregoing procedures, the Company will be obliged to redeem the portion this Note so requested to be redeemed as set forth under “Payment upon Early Redemption” below. The Company or the Calculation Agent may, from time to time reduce, in part or in whole, the Minimum Redemption Amount. If the ETNs are subject to a split or reverse split, the minimum number of ETNs needed to exercise the right to redeem will remain the same.

Payment upon Early Redemption at the Option of the Beneficial Owner

If a beneficial owner of an interest in this Note elects to offer this Note for redemption, and the requirements for acceptance by the Company are met, the Holder will receive a cash payment per $100 principal amount of this Note on the Early Redemption Date equal to the Early Redemption Amount.

The “Early Redemption Date” is the second Business Day following an Early Redemption Valuation Date.

The “Early Redemption Amount” is a cash payment equal to the greater of (A) zero and (B) (1) the Closing Indicative Value on the Early Redemption Valuation Date, minus (2) the Early Redemption Charge.

The “Early Redemption Charge” will equal 0.10% times the Closing Indicative Value on the Early Redemption Valuation Date.

Acceleration at the Option of the Company

On or after the Initial Settlement Date, the Company may, at its option, accelerate this Note in whole but not in part (an “Optional Acceleration”). To exercise its right of Optional Acceleration, the Company must provide notice to the Holder (the “Optional Acceleration Notice”) not less than ten calendar days prior to the Acceleration Date specified in the Optional Acceleration Notice. The Holder will receive a cash payment per $100 principal amount of this Note equal to the Acceleration Redemption Amount on the Acceleration Date.

The “Acceleration Redemption Amount” will equal the Closing Indicative Value on the Acceleration Valuation Date.

The “Acceleration Date” is the third Business Day following the Acceleration Valuation Date.

The “Acceleration Valuation Date” is the final Calculation Date of the Acceleration Valuation Period. The expected Acceleration Valuation Date will be specified in the Optional Acceleration Notice; provided that if the scheduled Acceleration Valuation Date as specified in the Optional Acceleration Notice is postponed, the Acceleration Date will be postponed to the third Business Day following the Acceleration Valuation Date as postponed.

The “Acceleration Valuation Period” is a period of five consecutive Calculation Dates, the expected dates which will be specified in the Company’s Optional Acceleration Notice, the first

R-6

Calculation Date of which shall be no earlier than the date on which the Company gives the Holder notice of such Optional Acceleration.

The Company will give the Holder notice of Optional Acceleration through customary channels used to deliver notices to holders of exchange traded notes.

Split or Reverse Split

The Company may initiate a split or reverse split on any Trading Day. If the Company initiates a split or reverse split, the Company will issue a notice to the Holder and a press release announcing the split or reverse split and specifying the effective date thereof. The Company will determine the ratio of such split or reverse split, as the case may be, using relevant market indicia, and the Calculation Agent will adjust the terms of this Note accordingly. Any adjustment of the Closing Indicative Value will be rounded to four decimal places. The Calculation Agent will, in its reasonable discretion, make any calculations, determinations and adjustments deemed necessary by the Calculation Agent in connection with splits and reverse splits.

“Related Exchange” is each exchange or quotation system where trading has a material effect (as determined by the Calculation Agent) for the overall market for futures or options contracts relating to (i) the Index or (ii) the underlying futures contracts.

In the case of a reverse split, the Company reserves the right to address odd numbers of ETNs (commonly referred to as “partials”) in a manner determined by the Calculation Agent in its sole discretion.

Market Disruption Events

A “Market Disruption Event” is any event that, in the determination of the Calculation Agent, could materially interfere with the Company’s, the Company’s affiliates, or third parties with whom the Company transacts or similarly situated third parties’ ability to establish, maintain or unwind all or a material portion of a hedge that could be effected with respect to this Note, including, but not limited to:

| · | a termination or suspension of, or a material limitation or disruption in trading in, any futures contract included in, or option contract related to, the Index, or any such futures contract included in, or option contract related to, any component of the Index (or the Successor Index or Substitute Index, as defined below) (an “index component”) that prevents the relevant exchange on which such index component is traded from establishing an official settlement price for such index component as of the regularly scheduled time; |

| · | the settlement price for any index component being a “limit price,” which means that the settlement price for such index component for a day has increased or decreased from the previous day’s settlement price by the maximum amount permitted under applicable exchange rules; |

| · | failure by the applicable exchange or other price source to announce or publish the settlement price for any futures contract included in, or option contract related to, the |

R-7

Index, or any such futures contract included in, or option contract related to, any component of the Index;

| · | failure of the sponsor of the Index (or the Successor Index or Substitute Index, as defined below) to publish the level of the Index (or the Successor Index or Substitute Index), subject to certain adjustments described below under “—Discontinuation or Modification of an Index” herein; |

| · | the occurrence since the Inception Date of a material change in the content, composition, or constitution of the Index; and |

| · | the occurrence since the Inception Date of a material change in the formula for or the method of calculating the Index. |

If a Market Disruption Event occurs or is continuing on any Index Business Day, the Calculation Agent will determine the Daily Index Performance on such Index Business Day using an appropriate Closing Level of the Index for such Index Business Day taking into account the nature and duration of such Market Disruption Event.

If the determination of the Closing Indicative Value for the Final Valuation Date, the Acceleration Valuation Date or any Early Redemption Valuation Date, as applicable, is postponed, the Maturity Date, the corresponding Early Redemption Date or the Acceleration Date, as the case may be, will be postponed until the date three Business Days following the Final Valuation Date, the Acceleration Valuation Date or any Early Redemption Valuation Date, as applicable, as postponed.

In addition, if a Market Disruption Event occurs, the calculation of the Daily Index Performance will be modified so that the leveraged exposure does not reset until the first Index Business Day on which no Market Disruption Event is continuing. If a Market Disruption Event occurs or is continuing on any Index Business Day (the “date of determination”) or if a Market Disruption Event occurred or was continuing on the Index Business Day immediately preceding the date of determination, then the Daily Index Performance on the date of determination will equal (1) (a) the Closing Level of the Index on the date of determination, minus (b) the Closing Level of the Index on the Index Business Day immediately preceding the date of determination, divided by (2) (a) the Closing Level of the Index on the Index Business Day on which no Market Disruption Event occurred or was continuing that most closely precedes the date of determination, plus (b) (i) the Leverage Amount, times (ii) (A) the Closing Level of the Index on the Index Business Day immediately preceding the date of determination, minus (B) the Closing Level of the Index on the Index Business Day on which no Market Disruption Event occurred or was continuing that most closely precedes the date of determination.

Discontinuation or Modification of the Index

If the Index Sponsor discontinues publication of the Index and the Index Sponsor or anyone else publishes a substitute index that the Calculation Agent determines is comparable to that Index, then the Calculation Agent will permanently replace the original Index with that substitute index (the “Successor Index”) for all purposes under this Note, and all provisions

R-8

described herein as applying to the Index will thereafter apply to the Successor Index instead. If the Calculation Agent replaces the original Index with a Successor Index, then the Indicative Value Calculation Agent will determine the Early Redemption Amount, the Acceleration Redemption Amount or the Maturity Redemption Amount, as applicable, by reference to the Successor Index.

If the Calculation Agent determines that the publication of the Index is discontinued and there is no Successor Index, the Calculation Agent will determine the applicable level of the Index by a computation methodology that the Calculation Agent determines will as closely as reasonably possible replicate the Index.

If the Calculation Agent determines that the Index, the futures contracts included in the Index or the method of calculating the Index is changed at any time in any respect, including whether the change is made by the Index Sponsor under its existing policies or following a modification of those policies, is due to the publication of a Successor Index, is due to events affecting the futures contracts included in the Index or is due to any other reason and is not otherwise reflected in the level of the Index by the Index Sponsor pursuant to the methodology described herein, then the Calculation Agent will be permitted (but not required) to make such adjustments in the Index or the method of its calculation as its believes are appropriate to ensure that the applicable Closing Level of the Index used to determine the Early Redemption Amount, the Acceleration Redemption Amount or the Maturity Redemption Amount, as applicable, is equitable.

Role of Calculation Agent and Indicative Value Calculation Agent

Credit Suisse International, an affiliate of the Company, will serve as the “Calculation Agent.” ICE Data Indices or its successor will serve initially as the “Indicative Value Calculation Agent.” The Company has appointed the Indicative Value Calculation Agent to calculate the Closing Indicative Value and the Intraday Indicative Value. The Calculation Agent will, in its reasonable discretion, make other calculations and determinations, including calculations and determinations relating to Market Disruption Events, Business Days and Index Business Days, the Closing Level of the Index on any Index Business Day, the Maturity Date, any Early Redemption Dates, the Acceleration Date, splits and reverse splits and any other calculations or determinations to be made by the Calculation Agent as specified herein. Absent manifest error, all determinations of the Calculation Agent or the Indicative Value Calculation Agent, as applicable, will be final and binding on the Holder and the Company, without any liability on the part of the Calculation Agent or the Indicative Value Calculation Agent, as applicable.

If the Calculation Agent or the Indicative Value Calculation Agent, as applicable, ceases to perform its role, the Company will either, at its sole discretion, perform such role, appoint another party to do so or accelerate this Note.

The Company may appoint a different Calculation Agent from time to time without notice to or consent of any Holder.

R-9

Default Amount on Acceleration

In case an Event of Default with respect to this Note shall have occurred and be continuing, the amount declared due and payable upon any acceleration of this Note will be determined by the Calculation Agent and will equal, for each $100 principal amount of this Note, the Closing Indicative Value determined by the Calculation Agents occurring on the Index Business Day following the date on which this Note was declared due and payable.

Manner of Payment

This Note is payable in the manner, with the effect and subject to the conditions provided in the Indenture.

Unless otherwise stated herein, if a payment date is not a Business Day as defined in the Indenture at a place of payment, payment may be made at that place on the next succeeding day that is a Business Day, and no interest shall accrue for the intervening period.

Any payment on this Note at maturity will be made to accounts designated by the Holder and approved by the Company, or at the office of the trustee in New York City, but only when this Note is surrendered to the trustee at that office. The Company also may make any payment or delivery in accordance with the applicable procedures of the depositary.

Amendments

The Indenture contains provisions which provide that the Company and the Trustee may amend or supplement the Indenture or the Securities without notice to or the consent of any Holder in order to (i) cure any ambiguity, defect or inconsistency in the Indenture, provided that such amendments or supplements shall not materially and adversely affect the interests of the Holders; (ii) comply with the requirements of the Indenture if the Company consolidates with, merges with or into, or sells, conveys, transfers, leases or otherwise disposes of all or substantially all of its property and assets, to any person; (iii) comply with any requirements of the Commission in connection with the qualification of the Indenture under the Trust Indenture Act; (iv) evidence and provide for the acceptance of appointment hereunder with respect to the Securities by a successor trustee; (v) establish the form or forms or terms of Securities of any series or of the coupons appertaining to such Securities as permitted by the Indenture; (vi) provide for uncertificated or unregistered Securities and to make all appropriate changes for such purpose; (vii) provide for a guarantee from a third party on outstanding Securities that are issued under the Indenture; or (viii) make any change that does not materially and adversely affect the rights of any Holder.

The Indenture provides that, without prior notice to any Holders, the Company and the Trustee may amend the Indenture and the Securities of any series with the written consent of the Holders of a majority in principal amount of the outstanding Securities of all series affected by such amendment (all such series voting as one class), and the Holders of a majority in principal amount of the outstanding Securities of all series affected thereby (all such series voting as one class) by written notice to the Trustee may waive future compliance by the Company with any provision of the Indenture or the Securities of such series; provided that, without the consent of

R-10

each Holder of the Securities affected thereby, an amendment or waiver, including a waiver of past defaults, may not (i) extend the stated maturity of the Principal of, or any sinking fund obligation or any installment of interest on, such Holder’s Security, or reduce the principal amount thereof or the rate of interest thereon (including any amount in respect of original issue discount), or adversely affect the rights of such Holder under any mandatory redemption or repurchase provision or any right of redemption or repurchase at the option of such Holder, or reduce the amount of the Principal of an Original Issue Discount Security that would be due and payable upon an acceleration of the maturity thereof or the amount thereof provable in bankruptcy, insolvency or similar proceeding, or change any place of payment where, or the currency in which, the principal amount or the interest thereon is payable, modify any right to convert or exchange such Holder’s Security for another security to the detriment of the Holder or impair the right to institute suit for the enforcement of any such payment on or after the due date therefor; (ii) reduce the percentage in principal amount of outstanding Securities the consent of whose Holders is required for any such supplemental indenture, for any waiver of compliance with certain provisions of the Indenture or certain Defaults and their consequences provided for in the Indenture; (iii) waive a Default in the payment of the principal amount of or interest on any Security of such Holder; or (iv) modify any of the provisions of the Indenture governing supplemental indentures except to increase the required percentage or to provide that certain other provisions of the Indenture cannot be modified or waived without the consent of the Holder of each outstanding Security affected thereby.

In addition, this Note may be amended, without the consent of any Holder, to conform the terms of this Note to the terms as set forth in Pricing Supplement No. AxelaTrader ETN-[ ] dated [ ], and the prospectus supplement and prospectus referred to therein, each related to this Note and filed with the Securities and Exchange Commission, and the Trustee is hereby authorized to enter into any such amendment to this Note without the consent thereto of any such Holder.

Substitution

The Indenture contains provisions that provide that the Company may at any time designate another branch of the Company (the “Substitution Branch”) as substitute for the Branch through which it acts under a tranche of a series of Securities with the same effect as if such Substitution Branch had been originally named as the Branch for all purposes under the Indenture and the Securities.

General

The Company, the Trustee and any agent of the Company or the Trustee may deem and treat the Holder hereof as the absolute owner of this Note (whether or not this Note shall be overdue and notwithstanding any notation of ownership or other writing hereon) for the purpose of receiving payment of, or on account of, the redemption amount hereof, and, subject to the provisions hereof, for all other purposes, neither the Company nor the Trustee nor any agent of the Company or the Trustee shall be affected by any notice to the contrary.

No recourse under or upon any obligation, covenant or agreement contained in the Indenture or any indenture supplemental thereto or in this Note, or because of any indebtedness evidenced thereby or hereby, shall be had against any incorporator as such, or against any past, present or

R-11

future stockholder, officer, director or employee, as such, of the Company or of any successor, either directly or through the Company or any successor, under any rule of law, statute or constitutional provision or by the enforcement of any assessment or by any legal or equitable proceeding or otherwise, all such liability being expressly waived and released by the acceptance hereof and as part of the consideration for the issue hereof.

The Indenture provides that, subject to certain conditions, the Holders of at least a majority in principal amount (or, if any Securities are Original Issue Discount Securities, such portion of the principal amount as is then accelerable) of the outstanding Securities of all series affected (voting as a single class), by notice to the Trustee, may waive an existing Default or Event of Default with respect to the Securities of such series and its consequences, except a Default in the payment of Principal of or interest on any Security or in respect of a covenant or provision of the Indenture which cannot be modified or amended without the consent of the Holder of each outstanding Security affected. Upon any such waiver, such Default shall cease to exist, and any Event of Default with respect to the Securities of such series arising therefrom shall be deemed to have been cured for every purpose of the Indenture, but no such waiver shall extend to any subsequent or other Default or Event of Default or impair any right consequent thereto.

The Indenture provides that a series of Securities may include one or more tranches (each a “tranche”) of Securities, including Securities issued in a Periodic Offering. The Securities of different tranches may have one or more different terms, but all the Securities within each such tranche shall have identical terms, provided that Securities within a tranche may have different authentication dates, public offering prices, initial interest accrual dates and initial interest payment dates, if applicable. Notwithstanding any other provision of the Indenture, subject to certain exceptions, with respect to sections of the Indenture concerning the execution, authentication and terms of the Securities, redemption of the Securities, Events of Default of the Securities, defeasance of the Securities and amendment of the Indenture, if any series of Securities includes more than one tranche, all provisions of such sections applicable to any series of Securities shall be deemed equally applicable to each tranche of any series of Securities in the same manner as though originally designated a series unless otherwise provided with respect to such series or tranche pursuant to a board resolution or a supplemental indenture establishing such series or tranche.

This Note is unsecured and ranks pari passu with all other unsecured and unsubordinated indebtedness of the Company.

The interest rate, if any, coupon, if any, or redemption amount, as applicable, will in no event be higher than the maximum rate permitted by New York or other applicable state law, as such law may be modified by United States law of general application.

No reference herein to the Indenture and no provision of this Note or of the Indenture shall alter or impair the obligation of the Company, which is absolute and unconditional, to pay on the date or dates due hereunder the redemption amount (whether at maturity or otherwise) on this Note in the manner, at the place, at the time and in the coin or currency herein prescribed.

The laws of the state of New York (without regard to conflicts of laws principles thereof) shall govern this Note.

R-12

FOR VALUE RECEIVED, the undersigned hereby sell(s), assign(s) and transfer(s) unto

| [PLEASE INSERT SOCIAL SECURITY OR OTHER IDENTIFYING NUMBER OF ASSIGNEE] | |

| [PLEASE PRINT OR TYPE NAME AND ADDRESS, INCLUDING ZIP CODE, OF ASSIGNEE] | |

| the within Note and all rights thereunder, hereby irrevocably constituting and appointing | |

| ___________________________________________________________________________ Attorney to transfer such Note on the books of the Issuer, with full power of substitution in the premises. | |

| Signature: | |

| Dated:_____________________________ | |

NOTICE: The signature to this assignment must correspond with the name as written upon the face of the within Note in every particular without alteration or enlargement or any change whatsoever. |

R-13

SCHEDULE I

The initial principal amount of this Security is TWENTY-FIVE MILLION DOLLARS ($25,000,000). The following increases or decreases in the Principal amount of this Security have been made:

| Date | Amount of increase in principal amount of this Security | Amount of decrease in principal amount of this Security | Principal amount of this Security following such increase or decrease | Initials of Officer |

| $ | $ | $ | ||

R-14

ANNEX A

FORM OF OFFER FOR REDEMPTION

Email: list.etndesk@credit-suisse.com

The undersigned holder of AxelaTraderTM Exchange Traded Notes due September 14, 2037 issued by Credit Suisse AG (“Credit Suisse”) CUSIP No. (the “AxelaTraderTM ETNs”) hereby irrevocably offers to Credit Suisse for redemption the AxelaTraderTM ETNs in the amounts and on the date set forth below as described in the pricing supplement relating to the AxelaTraderTM ETNs (the “Pricing Supplement”). Terms not defined herein have the meanings given to such terms in the Pricing Supplement.

Name:

DTC Account Number:

Ticker:

Number of AxelaTraderTM ETNs offered for redemption:

Desired Early Redemption Valuation Date:

In addition to any other requirements specified in the Pricing Supplement being satisfied, the undersigned acknowledges that the AxelaTraderTM ETNs specified above will not be redeemed unless (i) this offer for redemption is delivered to Credit Suisse Securities (USA) LLC (the “Redemption Agent”) on a Business Day, (ii) the Redemption Agent has responded by sending an acknowledgment of the Redemption Notice accepting the redemption request, (iii) the DTC Participant has booked a “delivery versus payment” (“DVP”) trade on the applicable Early Redemption Valuation Date facing Credit Suisse AG, DTC #355, and (iv) the DTC Participant instructs DTC to deliver the DVP trade for settlement via DTC at or prior to 10:00 a.m. New York City time on the applicable Early Redemption Date (the second Business Day following the Early Redemption Valuation Date, subject to postponement if such Early Redemption Valuation Date is not an Index Business Day or if a Market Disruption Event occurs or is continuing on such date).

The undersigned acknowledges that the redemption obligation is solely an obligation of Credit Suisse and the Redemption Agent is acting only to facilitate the redemption for Credit Suisse.

R-15