|

PRICING SUPPLEMENT No. VLS ETN-1/A42† To the Prospectus Supplement dated May 4, 2015 and Prospectus dated May 4, 2015 |

Filed Pursuant to Rule 424(b)(2) August 9, 2016 |

Issued by Credit Suisse AG

275,400,000± VelocityShares™ Daily Inverse VIX Short Term ETNs linked to the S&P 500 VIX Short-Term Futures™ Index due December 4, 2030 (the “Inverse VIX Short Term ETNs”)

1,000,000± VelocityShares™ Daily Inverse VIX Medium Term ETNs linked to the S&P 500 VIX Mid-Term Futures™ Index due December 4, 2030 (the “Inverse VIX Medium Term ETNs”)

4,650,000± VelocityShares™ VIX Short Term ETNs linked to the S&P 500 VIX Short-Term Futures™ Index due December 4, 2030

(the “Long VIX Short Term ETNs”)

1,000,000± VelocityShares™ VIX Medium Term ETNs linked to the S&P 500 VIX Mid-Term Futures™ Index due December 4, 2030

(the “Long VIX Medium Term ETNs”)

52,736,000± VelocityShares™ Daily 2x VIX Short Term ETNs linked to the S&P 500 VIX Short-Term Futures™ Index due December 4, 2030

(the “2x Long VIX Short Term ETNs”)

1,925,000± VelocityShares™ Daily 2x VIX Medium Term ETNs linked to the S&P 500 VIX Mid-Term Futures™ Index due December 4, 2030

(the “2x Long VIX Medium Term ETNs”)

| ETNs | Leverage Amount | ETN Type | Exchange Ticker | Indicative Value Ticker | CUSIP | ISIN |

| Inverse VIX Short Term ETNs | -1 | “Inverse” | XIV | XIVIV | 22542D795 | US22542D7957 |

| Inverse VIX Medium Term ETNs | ZIV | ZIVIV | 22542D829 | US22542D8294 | ||

| Long VIX Short Term ETNs | 1 | “Long” | VIIX | VIIXIV | 22539T621 | US22539T6212 |

| Long VIX Medium Term ETNs | VIIZ | VIIZIV | 22542D787 | US22542D7874 | ||

| 2x Long VIX Short Term ETNs | 2 | “2x Long” or “Leveraged” | TVIX | TVIXIV | 22539T274 | US22539T2740 |

| 2x Long VIX Medium Term ETNs | TVIZ | TVIZIV | 22539T100 | US22539T1007 |

We are offering six separate series of exchange traded notes (collectively, the “ETNs”). We refer to the Inverse VIX Short Term ETNs and the Inverse VIX Medium Term ETNs collectively as the “Inverse ETNs,” the Long VIX Short Term ETNs and the Long VIX Medium Term ETNs collectively as the “Long ETNs” and the 2x Long VIX Short Term ETNs and the 2x Long VIX Medium Term ETNs collectively as the “2x Long ETNs.”

We have listed each series of the ETNs on The NASDAQ Stock Market under the exchange ticker symbols as set forth in the table above. Prior to December 2, 2013, the ETNs were listed on NYSE Arca. As long an active secondary market in the ETNs exists, we expect that investors will purchase and sell the ETNs primarily in this secondary market. We have no obligation to maintain any listing on The NASDAQ Stock Market or any other exchange or quotation system.

The ETNs, and in particular the 2x Long ETNs, are intended to be trading tools for sophisticated investors to manage daily trading risks. They are designed to achieve their stated investment objectives on a daily basis, but their performance over longer periods of time can differ significantly from their stated daily objectives. The ETNs are riskier than securities that have intermediate or long-term investment objectives, and may not be suitable for investors who plan to hold them for longer than one day. Accordingly, the ETNs should be purchased only by knowledgeable investors who understand the potential consequences of investing in volatility indices and of seeking inverse or leveraged investment results, as applicable. Investors should actively and frequently monitor their investments in the ETNs, even intra-day.

As explained in “Risk Factors” in this pricing supplement, because of the way in which the underlying Indices are calculated, the amount payable at maturity or upon redemption or acceleration is likely to be less than the amount of your initial investment in the ETNs, and you are likely to lose part or all of your initial investment. In almost any potential scenario the Closing Indicative Value (as defined below) of your ETNs is likely to be close to zero after 20 years and we do not intend or expect any investor to hold the ETNs from inception to maturity.

Investing in the ETNs involves a number of risks. See “Risk Factors” beginning on page PS-15 of this pricing supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined that this pricing supplement is truthful or complete. Any representation to the contrary is a criminal offense.

We sold a portion of the ETNs on the Inception Date and received proceeds equal to 100% of their stated principal amount as of the Inception Date. We expect to receive proceeds equal to 100% of the issue price to the public of the ETNs we issue and sell after the Inception Date, less any commissions paid to Credit Suisse Securities (USA) LLC (“CSSU”) or any other agent. The agent for this offering, CSSU, is our affiliate. For any ETNs we issue on or after the date hereof, CSSU is expected to charge a creation fee of up to approximately 0.15% times the Closing Indicative Value of such ETNs on the date on which we price such ETNs, provided however that CSSU may from time to time increase or decrease the creation fee. In exchange for providing certain services relating to the distribution of the ETNs, CSSU, a member of the Financial Industry Regulatory Authority (“FINRA”), or another FINRA member may receive all or a portion of the investor fee. In addition, CSSU will charge investors a redemption charge of 0.05% times the Closing Indicative Value on the Early Redemption Valuation Date of any ETN that is redeemed at the investor’s option. Please see “Supplemental Plan of Distribution (Conflicts of Interest)” in this pricing supplement for more information.

The ETNs are not deposit liabilities and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency of the United States, Switzerland or any other jurisdiction.

Credit Suisse

August 9, 2016

(continued on next page)

(continued from previous page)

†This amended and restated pricing supplement amends and restates and supersedes Pricing Supplement No. VLS ETN-1/A41 dated July 1, 2016 (together with any previous supplements or amendments) in its entirety. We refer to this amended and restated pricing supplement as the “pricing supplement.”

± Reflects the number of such ETNs offered hereby. As of August 5, 2016, there were issued and outstanding the following:

| · | 24,953,880 Inverse VIX Short Term ETNs ($249,538,800 in stated principal amount). †† |

| · | 1,813,000 Inverse VIX Medium Term ETNs ($22,662,500 in stated principal amount). †† |

| · | 995,970 Long VIX Short Term ETNs ($995,970,000 in stated principal amount). †† |

| · | 65,000 Long VIX Medium Term ETNs ($6,500,000 in stated principal amount). |

| · | 319,777,750 2x Long VIX Short Term ETNs ($31,977,775,000,000 in stated principal amount). †† |

| · | 164,490 2x Long VIX Medium Term ETNs ($164,490,000 in stated principal amount). †† |

†† For additional information relating to splits and reverse splits, see “Description of the ETNs – Split or Reverse Split of the ETNs” herein.

General

| · | The ETNs are senior medium-term notes of Credit Suisse AG, acting through its Nassau Branch, maturing December 4, 2030 (the “Maturity Date”). The Maturity Date will be postponed if such date is not a Business Day or if the scheduled Final Valuation Date is not an Index Business Day or if a Market Disruption Event occurs and is continuing on the Final Valuation Date. No interest or additional payment will accrue or be payable as a result of any postponement of the Maturity Date. See “Specific Terms of the ETNs—Market Disruption Events.” |

| · | The initial issuance of ETNs of each series priced on November 29, 2010 (the “Inception Date”) and settled on December 2, 2010 (the “Initial Settlement Date”). |

| · | The ETNs are designed for investors who seek exposure to the applicable underlying Index. The ETNs do not guarantee any return of principal at maturity and do not pay any interest during their term. For each ETN, investors will receive a cash payment at maturity, upon early redemption or upon acceleration by us that will be linked to the performance of the applicable underlying Index, plus a Daily Accrual and less a Daily Investor Fee (each as defined herein). Investors should be willing to forgo interest payments and, if the applicable underlying Index declines or increases, as applicable, be willing to lose up to 100% of their investment. Any payment on the ETNs is subject to our ability to pay our obligations as they become due. |

| · | The exchange ticker and the denominations and stated principal amount per ETN for each series of ETNs is set forth below. ETNs may be issued at a price that is higher or lower than the stated principal amount, based on the most recent Intraday Indicative Value or Closing Indicative Value of the ETNs. For additional information, see “Description of the ETNs – Split or Reverse Split of the ETNs” herein. |

| ETNs | Exchange Ticker | Denomination and Stated Principal Amount per ETN |

| Inverse VIX Short Term ETNs | XIV | $10 |

| Inverse VIX Medium Term ETNs | ZIV | $12.50 |

| Long VIX Short Term ETNs | VIIX | $1,000 |

| Long VIX Medium Term ETNs | VIIZ | $100 |

| 2x Long VIX Short Term ETNs | TVIX | $2,500,000 |

| 2x Long VIX Medium Term ETNs | TVIZ | $1,000 |

Additional ETNs of each series may be issued and sold from time to time through CSSU and one or more dealers at a price that is higher or lower than the stated principal amount, based on the indicative value of the ETNs of such series at that time. Delivery of the ETNs in book-entry form only will be made through The Depository Trust Company (“DTC”). Any further issuances of ETNs of any series will form a single series with the offered ETNs of such series, will have the same CUSIP number and will trade interchangeably with the offered ETNs of such series upon settlement. Any further issuances will increase the outstanding number of the applicable series of the ETNs. See “Supplemental Plan of Distribution (Conflicts of Interest)” in this pricing supplement for further information.

If there is a substantial demand for the ETNs, we may issue additional ETNs frequently. We have placed conditions on our acceptance of offers

to purchase the 2x Long VIX Short Term ETNs and the Inverse VIX Short Term ETNs. For more information, see “Specific Terms of the ETNs – Further Issuances” herein. However, we are under no obligation to sell additional ETNs of any series at any time, and if we do sell additional ETNs of any series, we may limit or restrict such sales, and we may stop and subsequently resume selling additional ETNs of such series at any time. Any limitation or suspension on the issuance of the ETNs may materially and adversely affect the price and liquidity of the ETNs in the secondary market. Alternatively, the decrease in supply may cause an imbalance in the market supply and demand, which may cause the ETNs to trade at a premium over the indicative value of the ETNs. Any premium may be reduced or eliminated at any time. Paying a premium purchase price over the indicative value of the ETNs could lead to significant losses in the event the investor sells such ETNs at a time when such premium is no longer present in the market place or such ETNs are accelerated (including at our option, which we have the discretion to do at any time), in which case investors will receive a cash payment in an amount equal to the Closing Indicative Value on the Accelerated Valuation Date (each as defined herein). Investors should consult their financial advisors before purchasing or selling the ETNs, especially for ETNs trading at a premium over their indicative value. Any limitation or suspension on the issuance of the ETNs will not affect the early redemption rights of holders as described herein or other ETNs issued by us.

Janus Distributors LLC (“JD”) will receive all or a portion of the Daily Investor Fee in consideration for its role in marketing and placing the securities under the “VelocityShares™” brand. See “Supplemental Plan of Distribution (Conflicts of Interest)” in this pricing supplement for further information.

This pricing supplement provides specific pricing information in connection with the issuance of each series of the ETNs. Prospective investors should read this pricing supplement together with the accompanying prospectus supplement and prospectus for a description of the specific terms and conditions of the ETNs. This pricing supplement amends and supersedes the accompanying prospectus supplement and prospectus to the extent that the information provided in this pricing supplement is different from the terms set forth in the prospectus supplement or the prospectus.

(cover continued on next page)

(continued from previous page)

We may from time to time purchase outstanding ETNs of any series in the open market or in other transactions, and we may use this pricing supplement together with the accompanying prospectus supplement and prospectus in connection with resales of some or all of the purchased ETNs in the secondary market.

(continued from previous page)

Key Terms

| Issuer: | Credit Suisse AG (“Credit Suisse”), acting through its Nassau Branch |

| Index: | The return on the ETNs of any series will be based on the performance of the applicable underlying Index during the term of such ETNs. Each series of ETNs tracks the daily performance of either the S&P 500 VIX Short-Term Futures™ Index ER or S&P 500 VIX Mid-Term Futures™ Index ER (each such index, an “Index” and collectively the “Indices”). The Indices are designed to provide investors with exposure to one or more maturities of futures contracts on the CBOE Volatility Index® (the “VIX Index”), which reflect implied volatility of the S&P 500® Index at various points along the volatility forward curve. The calculation of the level of the VIX Index is based on prices of put and call options on the S&P 500® Index. Futures contracts on the VIX Index allow investors the ability to invest in forward volatility based on their view of the future direction of movement of the VIX Index. Each Index is intended to reflect the returns that are potentially available through an unleveraged investment in the relevant futures contract or contracts on the VIX Index. The S&P 500 VIX Short-Term Futures™ Index ER targets a constant weighted average futures contracts maturity of one month and the S&P 500 VIX Mid-Term Futures™ Index ER targets a constant weighted average futures contracts maturity of five months. The Indices were created by S&P Dow Jones Indices LLC (“S&P” or the “Index Sponsor”). The Index Sponsor calculates the level of the relevant Index daily when the Chicago Board Options Exchange, Incorporated (the “CBOE”) is open (excluding holidays and weekends) and publishes it on the Bloomberg pages specified below as soon as practicable thereafter. Each Index, or any successor index to such Index, may be modified, replaced or adjusted from time to time, as determined by the Calculation Agents as set forth below. See “The Indices” in this pricing supplement for further information on the Indices. |

| ETNs | Underlying Index | Underlying Index Ticker |

|

Inverse VIX Short Term ETNs, Long VIX Short Term ETNs, 2x Long VIX Short Term ETNs |

S&P 500 VIX Short-Term Futures™ Index ER | SPVXSP |

|

Inverse VIX Medium Term ETNs, Long VIX Medium Term ETNs, 2x LongVIX Medium Term ETNs |

S&P 500 VIX Mid-Term Futures™ Index ER | SPVXMP |

| The Calculation Agents, may modify, replace or adjust the Indices under certain circumstances even if the Index Sponsor continues to publish the applicable Index without modification, replacement or adjustment. See “Specific Terms of the ETNs—Discontinuance or Modification of the Index” and “Risk Factors—The Calculation Agents may modify the applicable underlying Index” in this pricing supplement for further information. | |

| Payment at Maturity: |

If your ETNs have not been previously redeemed or accelerated, on the Maturity Date you will receive for each $100 stated principal amount of your ETNs (for each $10 stated principal amount in the case of Inverse VIX Short Term ETNs; for each $12.50 stated principal amount in the case of Inverse VIX Medium Term ETNs; for each $1,000 stated principal amount in the case of Long VIX Short Term ETNs and 2x Long VIX Medium Term ETNs; and for each $2,500,000 stated principal amount in the case of 2x Long VIX Short Term ETNs) a cash payment equal to the applicable Closing Indicative Value on the Final Valuation Date (the “Final Indicative Value”), as calculated by the Calculation Agents. We refer to the amount of such payment as the “Maturity Redemption Amount.”

If the Final Indicative Value is zero, the Maturity Redemption Amount will be zero.

|

| Closing Indicative Value: |

The Closing Indicative Value for any series of ETNs on the Inception Date equaled $100 (the “Initial Indicative Value”). The Closing Indicative Value on each calendar day following the Inception Date for each series of ETNs will be equal to (1)(a) the Closing Indicative Value for that series on the immediately preceding calendar day times (b) the Daily ETN Performance for that series on such calendar day minus (2) the Daily Investor Fee for that series on such calendar day. The Closing Indicative Value will never be less than zero. The Closing Indicative Value will be zero on and subsequent to any calendar day on which the Intraday Indicative Value equals zero at any time or Closing Indicative Value equals zero. The Closing Indicative Value for each series of ETNs on each Index Business Day will be published on such Index Business Day under the applicable Indicative Value ticker set forth above. The Closing Indicative Value for each series of ETNs is not the closing price or any other trading price of such series of ETNs in the secondary market. The trading price of any series of the ETNs at any time may vary significantly from the Indicative Value of such series of ETNs at such time. See “Description of the ETNs—Intraday Indicative Value” in this pricing supplement.

The table below shows the Closing Indicative Value and closing price of each series of ETNs on August 5, 2016. |

| ETNs | Closing Price | Closing Indicative Value |

| Inverse VIX Short Term ETNs | $35.78 (exchange ticker XIV) | $36.1107 (Indicative Value Ticker XIVIV) |

| Inverse VIX Medium Term ETNs | $42.93 (exchange ticker ZIV) | $42.9569 (Indicative Value Ticker ZIVIV) |

| Long VIX Short Term ETNs | $12.85 (exchange ticker VIIX) | $12.7756 (Indicative Value Ticker VIIXIV) |

| Long VIX Medium Term ETNs | $13.40 (exchange ticker VIIZ) | $13.4381 (Indicative Value Ticker VIIZIV) |

| 2x Long VIX Short Term ETNs†† | $0.97 (exchange ticker TVIX) | $0.9490 (Indicative Value Ticker TVIXIV) |

| 2x Long VIX Medium Term ETNs | $9.50 (exchange ticker TVIZ) | $9.4693 (Indicative Value Ticker TVIZIV) |

(continued from previous page)

|

††The 2x Long VIX Short Term ETNs underwent a 1-for-25 reverse split effective August 9, 2016. The Closing Indicative Value of the 2x Long VIX Short Term ETNs on August 8, 2016 was multiplied by 25 and rounded to 8 decimal places prior to the open of trading on August 9, 2016. Since August 9, 2016, its Closing Indicative Value has been expressed in an amount per denomination and stated principal amount of $2,500,000. For additional information relating to splits and reverse splits, see “Description of the ETNs – Split or Reverse Split of the ETNs” herein.

If the ETNs undergo any subsequent splits or reverse splits, the Closing Indicative Value will be adjusted accordingly. For additional information, see “Description of the ETNs—Split or Reverse Split of the ETNs” in this pricing supplement. JD or its affiliate is responsible for computing and disseminating the Closing Indicative Value.

|

(continued on next page)

(continued from previous page)

| Daily ETN Performance: | The Daily ETN Performance for any series of ETNs on any Index Business Day will equal (1) one plus (2) the Daily Accrual for that series on such Index Business Day plus (3) the product of (a) the Daily Index Performance on such Index Business Day times (b) the Leverage Amount. The Daily ETN Performance is deemed to be one on any day that is not an Index Business Day. |

| Daily Accrual: |

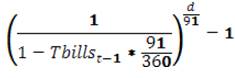

The Daily Accrual represents the rate of interest that could be earned on a notional capital reinvestment at the three month U.S. Treasury rate as reported on Bloomberg under ticker USB3MTA. The Daily Accrual for any series of ETNs on any Index Business Day will equal:

Where Tbillst-1 is the three month treasury rate reported on Bloomberg on the prior Index Business Day and d is the number of calendar days that have elapsed since the prior Index Business Day. The Daily Accrual is deemed to be zero on any day that is not an Index Business Day.

|

| Daily Index Performance: | The Daily Index Performance for any series of ETNs on any Index Business Day will equal (1)(a) the closing level of the applicable underlying Index on such Index Business Day divided by (b) the closing level of the applicable underlying Index on the immediately preceding Index Business Day minus (2) one. If a Market Disruption Event occurs and continues on any Index Business Day, the Calculation Agents will determine the Daily Index Performance on such Index Business Day based on their assessment of the level of the applicable underlying Index that would have prevailed on such Index Business Day were it not for such Market Disruption Event. The Daily Index Performance is deemed to be zero on any day that is not an Index Business Day. |

| Leverage Amount: |

The Leverage Amount for each series of ETNs is as follows:

|

| Inverse VIX Short Term ETNs: | -1 | |

| Inverse VIX Medium Term ETNs: | -1 | |

| Long VIX Short Term ETNs: | 1 | |

| Long VIX Medium Term ETNs: | 1 | |

| 2x Long VIX Short Term ETNs: | 2 | |

| 2x Long VIX Medium Term ETNs: | 2 |

| Daily Investor Fee: |

On any calendar day (the “calculation day”), the Daily Investor Fee for any series of ETNs will be equal to the product of (1) the Closing Indicative Value for that series on the immediately preceding calendar day times (2) the Daily ETN Performance for that series on the calculation day times (3)(a) the Daily Investor Fee Factor for that series divided by (b) 365.

The “Daily Investor Fee Factor” will be equal to (i) 0.0089 for each of the Long ETNs, (ii) 0.0135 for each of the Inverse ETNs and (iii) 0.0165 for each of the 2x Long ETNs.

If the level of the Index decreases or does not increase sufficiently in the case of the Long ETNs or 2x Long ETNs or if it increases or does not decrease sufficiently in the case of the Inverse ETNs (in each case in addition to the Daily Accrual) to offset the sum of the Daily Investor Fees (and in the case of Early Redemption, the Early Redemption Charge) over the term of the ETNs, you will receive less than the initial investment amount of your ETNs at maturity or upon early redemption or acceleration of the ETNs. See “Risk Factors — Even if the closing level of the Index on the applicable Valuation Date exceeds (or is less than in the case of the Inverse ETNs) the initial closing level of the applicable underlying Index on the date of your investment, you may receive less than the initial investment amount of your ETNs” and “Hypothetical Examples” in this pricing supplement for additional information on how the Daily Investor Fee affects the overall value of the ETNs.

|

| Intraday Indicative Value: |

The “Intraday Indicative Value” for each series of ETNs is designed to approximate the economic value of such series of ETNs at a given time. It is calculated using the same formula as the Closing Indicative Value, except that instead of using the closing level of the applicable underlying Index, the calculation is based on the most recent intraday level of such Index at the particular time. The Intraday Indicative Value of the ETNs will be calculated every 15 seconds on each Index Business Day during the period when a Market Disruption Event has not occurred or is not continuing and disseminated over the Consolidated Tape, or other major market data vendor. If the Intraday Indicative Value is equal to or less than zero at any time or the Closing Indicative Value is equal to zero on any Index Business Day, the Closing Indicative Value on that day, and all future days, will be zero. See “Description of the ETNs—Intraday Indicative Value” in this pricing supplement. JD or its affiliate is responsible for computing and disseminating the Intraday Indicative Value.

The Intraday Indicative Value is a calculated value and is not the same as the trading price of the ETNs and is not a price at which you can buy or sell the ETNs in the secondary market. The Intraday Indicative Value does not take into account the factors that influence the trading price of the ETNs, such as imbalances of supply and demand, lack of liquidity and credit considerations. The actual trading price of the ETNs in the secondary market may vary significantly from their Intraday Indicative Value.

Investors can compare the trading price of the ETNs (if such concurrent price is available) against the Intraday Indicative Value to determine whether the ETNs are trading in the secondary market at a premium or a discount to the economic value of the ETNs at any given time. Investors are cautioned that paying a premium purchase price over the Intraday Indicative Value at any time could lead to the loss of any premium in the event the investor sells the ETNs when the premium is no longer present in the marketplace or when the ETNs are accelerated (including at our option, which we have the discretion to do at any time). It is also possible that the ETNs will trade in the secondary market at a discount below the Intraday Indicative Value and that investors would receive less than the Intraday Indicative Value if they had to sell their ETNs in the market at such time. |

(continued on next page)

(continued from previous page)

| Valuation Dates: | November 30, 2030 or, if such date is not an Index Business Day, the next following Index Business Day (the “Final Valuation Date”), any Early Redemption Valuation Date and the Accelerated Valuation Date. |

| Early Redemption: |

Prior to maturity, you may, subject to certain restrictions described below, offer the applicable minimum number of your ETNs to us for redemption on an Early Redemption Date during the term of the ETNs until November 28, 2030. If you elect to offer your ETNs for redemption, and the requirements for acceptance by us are met, you will receive a cash payment per ETN on the Early Redemption Date equal to the Early Redemption Amount.

You must offer for redemption at least 25,000 ETNs or integral multiples in excess thereof (or with respect to the Long VIX Short Term ETNs and the 2x Long VIX Medium Term ETNs, 2,500 ETNs, and with respect to the 2x Long VIX Short Term ETNs, 1 ETN or integral multiples in excess thereof, respectively) at one time in order to exercise your right to cause us to redeem your ETNs on any Early Redemption Date (the “Minimum Redemption Amount”); provided that we or Credit Suisse International (“CSI”) as one of the Calculation Agents, may from time to time reduce, in part or in whole, the Minimum Redemption Amount. Any such reduction will be applied on a consistent basis for all holders of the relevant series of ETNs at the time the reduction becomes effective. If the ETNs undergo a split or reverse split, the minimum number of ETNs needed to exercise your right to redeem may remain the same.

|

| Early Redemption Mechanics: |

You may exercise your early redemption right by causing your broker or other person with whom you hold your ETNs to deliver a Redemption Notice (as defined herein) to the Redemption Agent (as defined herein). If your Redemption Notice is delivered prior to 4:00 p.m., New York City time, on any Business Day, the immediately following Index Business Day will be the applicable “Early Redemption Valuation Date”. Otherwise, the second following Index Business Day will be the applicable Early Redemption Valuation Date. See “Specific Terms of the ETNs—Redemption Procedures” in this pricing supplement.

Because the Early Redemption Amount you will receive for each ETN will not be calculated until the Index Business Day (or the second following Index Business Day) immediately following the Business Day you offer your ETNs for redemption, you will not know the applicable Early Redemption Amount at the time you exercise your early redemption right and will bear the risk that your ETNs will decline in value between the time of your exercise and the time at which the Early Redemption Amount is determined.

|

| Early Redemption Date: | The third Business Day following an Early Redemption Valuation Date. An Early Redemption Date will be postponed if a Market Disruption Event occurs and is continuing on the applicable Early Redemption Valuation Date. No interest or additional payment will accrue or be payable as a result of any postponement of any Early Redemption Date. See “Specific Terms of the ETNs—Market Disruption Events.” |

| Early Redemption Amount: | A cash payment per ETN equal to the greater of (A) zero and (B) (1) the Closing Indicative Value on the Early Redemption Valuation Date minus (2) the Early Redemption Charge. |

| Early Redemption Charge: | The Early Redemption Charge will be equal to 0.05% times the Closing Indicative Value on the Early Redemption Valuation Date. |

| Acceleration at Our Option or Upon Acceleration Event: | We will have the right to accelerate the ETNs of any series in whole but not in part on any Business Day occurring on or after the Inception Date (an “Optional Acceleration”). In addition, if an Acceleration Event (as defined herein) occurs at any time with respect to any series of the ETNs, we will have the right, and under certain circumstances as described herein the obligation, to accelerate all of the outstanding ETNs of such series (an “Event Acceleration”). In either case, upon acceleration you will receive a cash payment in an amount (the “Accelerated Redemption Amount”) equal to the Closing Indicative Value on the Accelerated Valuation Date. In the case of an Optional Acceleration, the “Accelerated Valuation Date” shall be an Index Business Day specified in our notice of Optional Acceleration, which Index Business Day shall be at least 5 Business Days after the date on which we give you notice of such Optional Acceleration. In the case of an Event Acceleration, the Accelerated Valuation Date shall be the day on which we give notice of such Event Acceleration (or, if such day is not an Index Business Day, the next following Index Business Day). The Accelerated Redemption Amount will be payable on the third Business Day following the Accelerated Valuation Date (such third Business Day the “Acceleration Date”). The Acceleration Date will be postponed if a Market Disruption Event occurs and is continuing on the Accelerated Valuation Date. No interest or additional payment will accrue or be payable as a result of any postponement of the Acceleration Date. See “Specific Terms of the ETNs—Market Disruption Events.” We will give you notice of any acceleration of the ETNs through customary channels used to deliver notices to holders of exchange traded notes. |

| Acceleration Event: | As discussed in more detail under “Specific Terms of the ETNs—Acceleration at Our Option or Upon an Acceleration Event” in this pricing supplement, an Acceleration Event includes any event that adversely affects our ability to hedge or our rights in connection with the ETNs, including, but not limited to, if the Intraday Indicative Value is equal to or less than 20% of the prior day’s Closing Indicative Value. |

| Business Day: | Any day that is not (a) a Saturday or Sunday or (b) a day on which banking institutions generally are authorized or obligated by law or executive order to close in New York. |

| Index Business Day: | An Index Business Day, with respect to the applicable underlying Index, is a day on which (i) trading is generally conducted on the CBOE, (ii) the applicable underlying Index is published by S&P and (iii) trading is generally conducted on NYSE Arca, in each case as determined by JD, as one of the Calculation Agents. |

| Calculation Agents: | CSI and JD. See “Specific Terms of the ETNs—Role of Calculation Agents” in this pricing supplement. |

TABLE OF CONTENTS

Page

| Summary | PS-1 |

| Risk Factors | PS-14 |

| The Indices | PS-29 |

| Description of the ETNs | PS-38 |

| Specific Terms of the ETNs | PS-41 |

| Clearance and Settlement | PS-49 |

| Supplemental Use of Proceeds and Hedging | PS-49 |

| Material United States Federal Income Tax Considerations | PS-50 |

| Supplemental Plan of Distribution (Conflicts of Interest) | PS-56 |

| Benefit Plan Investor Considerations | PS-58 |

| Legal Matters | PS-59 |

| Annex A | A-1 |

| Hypothetical Examples | B-1 |

You should read this pricing supplement together with the accompanying prospectus supplement dated May 4, 2015 and the prospectus dated May 4, 2015, relating to our Medium-Term Notes of which these ETNs are a part. You may access these documents on the SEC website at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

| · | Prospectus supplement and Prospectus dated May 4, 2015 |

http://www.sec.gov/Archives/edgar/data/1053092/000104746915004333/a2224570z424b2.htm

Our Central Index Key, or CIK, on the SEC website is 1053092.

This pricing supplement, together with the documents listed above, contains the terms of the ETNs of any series and supersedes all other prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, fact sheets, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours. You should carefully consider, among other things, the matters set forth in “Risk Factors” in this pricing supplement, “Foreign Currency Risks” in the accompanying prospectus, and any risk factors we describe in the combined Annual Report on Form 20-F of Credit Suisse Group AG and us incorporated by reference therein, and any additional risk factors we describe in future filings we make with the SEC under the Securities Exchange Act of 1934, as amended, as the ETNs of any series involve risks not associated with conventional debt securities. You should consult your investment, legal, tax, accounting and other advisors before deciding to invest in the ETNs of any series. You should rely only on the information contained in this document or in any documents to which we have referred you. We have not authorized anyone to provide you with information that is different. This document may only be used where it is legal to sell these ETNs. The information in this document may only be accurate on the date of this document.

The distribution of this pricing supplement and the accompanying prospectus supplement and prospectus and the offering of the ETNs of any series in some jurisdictions may be restricted by law. If you possess this pricing supplement, you should find out about and observe these restrictions.

In this pricing supplement and the accompanying prospectus supplement and prospectus, unless otherwise specified or the context otherwise requires, references to “Credit Suisse”, the “Company”, “we”, “us” and “our” are to Credit Suisse AG, acting through its Nassau Branch, and references to “dollars” and “$” are to United States dollars.

i

Summary

The following is a summary of terms of the ETNs, as well as a discussion of risks and other considerations you should take into account when deciding whether to invest in any of the series of the ETNs. References to the “prospectus” mean our accompanying prospectus, dated May 4, 2015 and references to the “prospectus supplement” mean our accompanying prospectus supplement, dated May 4, 2015.

We may, without providing you notice or obtaining your consent, create and issue ETNs of each series in addition to those offered by this pricing supplement having the same terms and conditions as the ETNs of such series. We may consolidate the additional ETNs to form a single class with the outstanding ETNs of such series. However, we are under no obligation to sell additional ETNs of any series at any time, and if we do sell additional ETNs of any series, we may limit or restrict such sales, and we may stop and subsequently resume selling additional ETNs of such series at any time. Any limitation or suspension on the issuance of the ETNs may materially and adversely affect the price and liquidity of the ETNs in the secondary market. Alternatively, the decrease in supply may cause an imbalance in the market supply and demand, which may cause the ETNs to trade at a premium over the Indicative Value of the ETNs. Unless we indicate otherwise, if we suspend selling additional ETNs, we reserve the right to resume selling additional ETNs at any time, which might result in the reduction or elimination of any premium in the trading price. Any premium may be reduced or eliminated at any time. Paying a premium purchase price over the Indicative Value of the ETNs could lead to significant losses in the event the investor sells such ETNs at a time when such premium is no longer present in the market place or such ETNs are accelerated (including at our option, which we have the discretion to do at any time), in which case investors will receive a cash payment in an amount equal to the Closing Indicative Value on the Accelerated Valuation Date. Investors should consult their financial advisors before purchasing or selling the ETNs, especially for ETNs trading at a premium over their Indicative Value.

Additionally, a suspension of additional issuances of the ETNs could result in a significant reduction in the number of outstanding ETNs if investors subsequently exercise their right to have the ETNs redeemed by us. Accordingly, the number of outstanding ETNs could vary substantially over the term of the ETNs and adversely affect the liquidity of the ETNs.

What are the ETNs and how do they work?

The ETNs are medium-term notes of Credit Suisse AG (“Credit Suisse”), the return on which is linked to the performance of either the S&P 500 VIX Short-Term Futures™ Index ER or the S&P 500 VIX Mid-Term Futures™ Index ER (each such index, an “Index” and collectively the “Indices”).

We will not pay you interest during the term of the ETNs. The ETNs do not have a minimum payment at maturity or acceleration amount and are fully exposed to any decline or increase, as applicable, in the applicable underlying Index.

If you invest in the Long ETNs or the 2x Long ETNs, depreciation of the applicable underlying Index will reduce your payment at maturity, upon redemption or acceleration, and you could lose your entire investment.

If you invest in the Inverse ETNs, appreciation of the applicable underlying Index will reduce your payment at maturity, upon redemption or acceleration, and you could lose your entire investment.

The ETNs, and in particular the 2x Long ETNs, are intended to be trading tools for sophisticated investors to manage daily trading risks. They are designed to achieve their stated investment objectives on a daily basis, but their performance over longer periods of time can differ significantly from their stated daily objectives. The ETNs are riskier than securities that have intermediate or long-term investment objectives, and may not be suitable for investors who plan to hold them for longer than one day. Accordingly, the ETNs should be purchased only by knowledgeable investors who understand the potential consequences of investing in volatility indices and of seeking inverse or leveraged investment results, as applicable. Investors should actively and frequently monitor their investments in the ETNs, even intra-day.

PS-1

As explained in “Risk Factors” in this pricing supplement, because of the way in which the Closing Indicative Value of the ETNs and the underlying Indices are calculated, the amount payable at maturity or upon redemption or acceleration is likely to be less than the amount of your initial investment in the ETNs, and you are likely to lose part or all of your initial investment. In almost any potential scenario the Closing Indicative Value (as defined below) of your ETNs is likely to be close to zero after 20 years and we do not intend or expect any investor to hold the ETNs from inception to maturity.

For a description of how the payment at maturity, upon redemption or upon acceleration is calculated, please refer to the “Specific Terms of the ETNs—Payment at Maturity,” “—Payment Upon Early Redemption” and “—Acceleration at Our Option or Upon an Acceleration Event” sections herein.

For information on the prior splits and reverse splits of the ETNs, see “Description of the ETNs – Split or Reverse Split of the ETNs” herein. ETNs may be issued at a price higher or lower than the stated principal amount, based on the most recent Intraday Indicative Value or Closing Indicative Value of the ETNs. You will not have the right to receive physical certificates evidencing your ownership except under limited circumstances. Instead, we will issue the ETNs in the form of a global certificate, which will be held by DTC or its nominee. Direct and indirect participants in DTC will record beneficial ownership of the ETNs by individual investors. Accountholders in the Euroclear or Clearstream Banking clearance systems may hold beneficial interests in the ETNs through the accounts those systems maintain with DTC. You should refer to the section “Description of Notes—Book-Entry, Delivery and Form” in the accompanying prospectus supplement and the section “Description of Debt Securities—Book-Entry System” in the accompanying prospectus.

What are the Indices and who publishes the level of the Indices?

The Indices are designed to provide investors with exposure to one or more maturities of futures contracts on the CBOE Volatility Index® (the “VIX Index”), which reflect implied volatility of the S&P 500® Index at various points along the volatility forward curve. The calculation of the level of the VIX Index is based on prices of put and call options on the S&P 500® Index. Futures contracts on the VIX Index allow investors the ability to invest in forward volatility based on their view of the future direction of movement of the VIX Index. Each Index is intended to reflect the returns that are potentially available through an unleveraged investment in the relevant futures contract or contracts on the VIX Index. The S&P 500 VIX Short-Term Futures™ Index ER targets a constant weighted average futures maturity of one month and the S&P 500 VIX Mid-Term Futures™ Index ER targets a constant weighted average futures maturity of five months.

The Indices were created by S&P Dow Jones Indices LLC (“S&P” or the “Index Sponsor”). The Index Sponsor calculates the level of the relevant Index daily when the Chicago Board Options Exchange, Incorporated (the “CBOE”) is open (excluding holidays and weekends) and publishes it on the Bloomberg pages specified herein as soon as practicable thereafter. Each Index, or any successor index to such Index, may be modified, replaced or adjusted from time to time, as determined by the Calculation Agents as set forth below. See “The Indices” in this pricing supplement for further information on the Indices.

| ETNs | Underlying Index | Underlying Index Ticker |

|

Inverse VIX Short Term, Long VIX Short Term, 2x VIX Short Term |

S&P 500 VIX Short-Term Futures™ Index ER | SPVXSP |

|

Inverse VIX Medium-Term, Long VIX Medium Term, 2xVIX Medium Term |

S&P 500 VIX Medium-Term Futures™ Index ER | SPVXMP |

The Calculation Agents, may modify, replace or adjust the Indices under certain circumstances even if the Index Sponsor continues to publish the applicable Index without modification, replacement or adjustment. See “Specific Terms of the ETNs—Discontinuation or Modification of the Index” and “Risk Factors—The Calculation Agents may modify the Indices” in this pricing supplement for further information.

PS-2

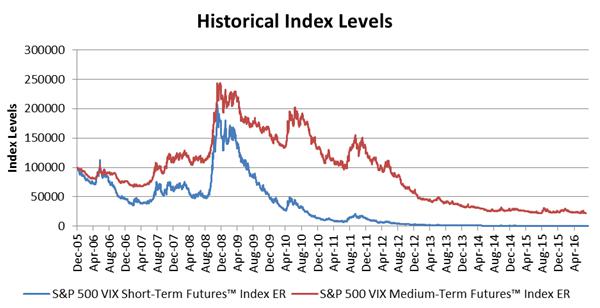

How have the Indices performed historically?

The inception date for the Indices is January 22, 2009 at the market close. The Indices were not in existence prior to that date. The chart below shows the closing level of each Index since the base date, December 20, 2005 through August 5, 2016. The historical performance is presented from January 22, 2009 through August 5, 2016. The closing levels from the base date of December 20, 2005 through January 22, 2009 represents hypothetical values determined by S&P, as the Index Sponsor, as if the relevant Index had been established on December 20, 2005 each with a base value of 100,000 on such date and calculated according to the methodology described below since that date. The closing levels from January 22, 2009 through August 5, 2016 represent the actual closing levels of the Indices as calculated on such dates. The closing levels of the S&P 500 VIX Short-Term Futures™ Index and the S&P 500 VIX Medium-Term Futures™ Index on August 5, 2016 were 223.87 and 20803.90, respectively. We obtained the levels below from Bloomberg, without independent verification. We have derived all information regarding each of the Indices contained in this pricing supplement, including, without limitation, their make-up, method of calculation and changes to their components, from publicly available information, and we have not participated in the preparation of, or verified, such publicly available information. Such information reflects the policies of, and is subject to change by the Index Sponsor. The hypothetical and historical Index performance should not be taken as an indication of future performance, and no assurance can be given as to the level of either Index on any given date. See “The Indices” in this pricing supplement for more information on the Indices.

Will I receive interest on the ETNs?

You will not receive any interest payments on your ETNs. The ETNs are not designed for investors who are looking for periodic cash payments. Instead, the ETNs are designed for investors who are willing to forgo cash payments and, if the applicable underlying Index declines or does not increase enough (or increases or does not decline enough in the case of the Inverse ETNs) to offset the effect of the Daily Investor Fee as described below, are willing to lose some or all of the their principal.

How will payment at maturity, at redemption or upon acceleration be determined for the ETNs?

Unless your ETNs have been previously redeemed or accelerated, the ETNs will mature on December 4, 2030 (the “Maturity Date”).

PS-3

Payment at Maturity

If your ETNs have not been previously redeemed or accelerated, on the Maturity Date you will receive a cash payment per ETN equal to the applicable Closing Indicative Value on the Final Valuation Date (the “Final Indicative Value”), as calculated by the Calculation Agents. We refer to the amount of such payment as the “Maturity Redemption Amount.” If the scheduled Maturity Date is not a Business Day, the Maturity Date will be postponed to the first Business Day following the scheduled Maturity Date. If the scheduled Final Valuation Date is not an Index Business Day, the Final Valuation Date will be postponed to the next following Index Business Day, in which case the Maturity Date will be postponed to the third Business Day following the Final Valuation Date as so postponed. No interest or additional payment will accrue or be payable as a result of any postponement of the Maturity Date.

If the Final Indicative Value is zero, the Maturity Redemption Amount will be zero.

The “Closing Indicative Value” for any given series of ETNs on any given calendar day will be calculated in the following manner: The Closing Indicative Value on the Inception Date was $100 (the “Initial Indicative Value”). The Closing Indicative Value on each calendar day following the Inception Date for each series of ETNs will be equal to (1)(a) the Closing Indicative Value for that series on the immediately preceding calendar day times (b) the Daily ETN Performance for that series on such calendar day minus (2) the Daily Investor Fee for that series on such calendar day. The Closing Indicative Value will never be less than zero. The Closing Indicative Value will be zero on and subsequent to any calendar day on which the Intraday Indicative Value equals zero at any time or Closing Indicative Value equals zero.

For information on the prior splits and reverse splits of the ETNs, see “Description of the ETNs – Split or Reverse Split of the ETNs” herein. If the ETNs undergo any subsequent splits or reverse splits, the Closing Indicative Value will be adjusted accordingly (see “Description of ETNs—Split or Reverse Split of the ETNs” herein). Janus Distributors LLC or its affiliate is responsible for computing and disseminating the Closing Indicative Value.

The “Daily ETN Performance” for any series of ETNs on any Index Business Day will equal (1) one plus (2) the Daily Accrual for that series on such Index Business Day plus (3) the product of (a) the Daily Index Performance on such Index Business Day times (b) the Leverage Amount. The Daily ETN Performance is deemed to be one on any day that is not an Index Business Day.

An “Index Business Day”, with respect to the applicable underlying Index, is a day on which (i) trading is generally conducted on the CBOE, (ii) the applicable underlying Index is published by S&P and (iii) trading is generally conducted on NYSE Arca, in each case as determined by JD, as one of the Calculation Agents.

The “Daily Accrual” represents the rate of interest that could be earned on a notional capital reinvestment at the three month U.S. Treasury rate as reported on Bloomberg under ticker USB3MTA. The Daily Accrual for any series of ETNs on any Index Business Day will equal:

Where Tbillst-1 is the three month treasury rate reported on Bloomberg on the prior Index Business Day and d is the number of calendar days which have elapsed since the prior Index Business Day. The Daily Accrual is deemed to be zero on any day which is not an Index Business Day.

The “Daily Index Performance” for any series of ETNs on any Index Business Day will equal (1)(a) the closing level of the applicable underlying Index for that series on such Index Business Day divided by (b) the closing

PS-4

level of the applicable underlying Index for that series on the immediately preceding Index Business Day minus (2) one. If a Market Disruption Event occurs and continues on any Index Business Day, the Calculation Agents will determine the Daily Index Performance on such Index Business Day based on their assessment of the level of the applicable underlying Index that would have prevailed on such Index Business Day were it not for such Market Disruption Event. The Daily Index Performance is deemed to be zero on any day that is not an Index Business Day.

The “Leverage Amount” for each series of ETNs is as follows:

| Daily Inverse VIX Short Term ETN: | -1 | |

| Daily Inverse VIX Medium Term ETN: | -1 | |

| VIX Short Term ETN: | 1 | |

| VIX Medium Term ETN: | 1 | |

| Daily 2x VIX Short Term ETN: | 2 | |

| Daily 2x VIX Medium Term ETN: | 2 |

On any calendar day (the “calculation day”), the “Daily Investor Fee” for any series of ETNs will be equal to the product of (1) the Closing Indicative Value for that series on the immediately preceding calendar day times (2) the Daily ETN Performance for that series on the calculation day times (3)(a) the Daily Investor Fee Factor for that series divided by (b) 365.

The “Daily Investor Fee Factor” will be equal to (i) 0.0089 for each of the Long ETNs, (ii) 0.0135 for each of the Inverse ETNs and (iii) 0.0165 for each of the 2x Long ETNs.

If the level of the applicable underlying Index decreases or does not increase sufficiently in the case of the Long or 2x Long ETNs or if it increases or does not decrease sufficiently in the case of the Inverse ETNs (in each case in addition to Daily Accrual) to offset the sum of the Daily Investor Fees (and in the case of Early Redemption, the Early Redemption Charge) over the term of the ETNs, you will receive less than the initial investment amount of your ETNs at maturity, upon early redemption or acceleration of the ETNs. See “Risk Factors—Even if the closing level of the Index on the applicable Valuation Date exceeds (or is less than in the case of the Inverse ETNs) the initial closing level of the Index on the date of your investment, you may receive less than the initial investment amount of your ETNs” and “Hypothetical Examples” in this pricing supplement for additional information on how the Daily Investor Fee affects the overall value of the ETNs.

The closing level of the applicable underlying Index on any Index Business Day will be the closing level reported by the Index Sponsor on the applicable Bloomberg page as set forth in the table below or any successor page on Bloomberg or any successor service, as applicable, as determined by the Calculation Agents, provided that in the event a Market Disruption Event is continuing on an Index Business Day, the Calculation Agents will determine the closing level of the applicable underlying Index for such Index Business Day according to the methodology described below in “Specific Terms of the ETNs—Market Disruption Events.”

| Index | Bloomberg Page Ticker |

| S&P 500 VIX Short-Term Futures™ Index ER | SPVXSP |

| S&P 500 VIX Mid-Term Futures™ Index ER | SPVXMP |

Any payment you will be entitled to receive is subject to our ability to pay our obligations as they become due.

For a further description of how your payment at maturity will be calculated, see “Hypothetical Examples” and “Specific Terms of the ETNs” in this pricing supplement.

Payment Upon Early Redemption

PS-5

Prior to maturity, you may, subject to certain restrictions described below, offer the applicable Minimum Redemption Amount or more of your ETNs to us for redemption on an Early Redemption Date during the term of the ETNs until November 28, 2030. If you elect to offer your ETNs for redemption, and the requirements for acceptance by us are met, you will receive a cash payment per ETN on the Early Redemption Date equal to the Early Redemption Amount.

You may exercise your early redemption right by causing your broker or other person with whom you hold your ETNs to deliver a Redemption Notice (as defined herein) to the Redemption Agent (as defined herein). If your Redemption Notice is delivered prior to 4:00 p.m., New York City time, on any Business Day, the immediately following Index Business Day will be the applicable “Early Redemption Valuation Date”. Otherwise, the second following Index Business Day will be the applicable Early Redemption Valuation Date. See “Specific Terms of the ETNs—Redemption Procedures” in this pricing supplement.

You must offer for redemption at least 25,000 ETNs or integral multiples in excess thereof (or with respect to the Long VIX Short Term ETNs and the 2x Long VIX Medium Term ETNs, 2,500 ETNs, and with respect to the 2x Long VIX Short Term ETNs, 1 ETN or integral multiples in excess thereof, respectively) at one time in order to exercise your right to cause us to redeem your ETNs on any Early Redemption Date (the “Minimum Redemption Amount”); provided that we or CSI as one of the Calculation Agents may from time to time reduce, in part or in whole, the Minimum Redemption Amount. Any such reduction will be applied on a consistent basis for all holders of the relevant series of ETNs at the time the reduction becomes effective. If the ETNs undergo a split or reverse split, the minimum number of ETNs needed to exercise your right to redeem may remain the same.

The “Early Redemption Date” is the third Business Day following an Early Redemption Valuation Date.*

The “Early Redemption Charge” is equal to 0.05% times the Closing Indicative Value on the Early Redemption Valuation Date.

The “Early Redemption Amount” is a cash payment per ETN equal to the greater of (A) zero and (B) (1) the Closing Indicative Value on the Early Redemption Valuation Date minus (2) the Early Redemption Charge and will be calculated by the Calculation Agents.

Payment Upon Acceleration

We will have the right to accelerate the ETNs of any series in whole but not in part on any Business Day occurring on or after the Inception Date (an “Optional Acceleration”). In addition, if an Acceleration Event (as defined herein) occurs at any time with respect to any series of the ETNs, we will have the right, and under certain circumstances as described herein the obligation, to accelerate all of the outstanding ETNs of such series (an “Event Acceleration”). In either case, upon acceleration you will receive a cash payment in an amount (the “Accelerated Redemption Amount”) equal to the Closing Indicative Value on the Accelerated Valuation Date. In the case of an Optional Acceleration, the “Accelerated Valuation Date” shall be an Index Business Day specified in our notice of Optional Acceleration, which Index Business Day shall be at least 5 Business Days after the date on which we give you notice of such Optional Acceleration. In the case of an Event Acceleration, the Accelerated Valuation Date shall be the day on which we give notice of such Event Acceleration (or, if such day is not an Index Business Day, the next following Index Business Day). The Accelerated Redemption Amount will be payable on the third Business Day following the Accelerated Valuation Date (such third Business Day the “Acceleration Date”).* We will give you notice of any acceleration of the ETNs through customary channels used to deliver notices to holders of exchange traded notes. See “Specific Terms of the ETNs—Acceleration at Our Option or Upon an Acceleration Event” in this pricing supplement.

* An Early Redemption Date will be postponed if a Market Disruption Event occurs and is continuing on the applicable Early Redemption Valuation Date. No interest or additional payment will accrue or be payable as a result of any postponement of any Early Redemption Date. See “Specific Terms of the ETNs—Market Disruption Events”.

* The Acceleration Date will be postponed if a Market Disruption Event occurs and is continuing on the Accelerated Valuation Date. No interest or additional payment will accrue or be payable as a result of any postponement of the Acceleration Date. See “Specific Terms of the ETNs—Market Disruption Events”.

PS-6

Any ETNs previously redeemed by us at your or our option or accelerated following an Acceleration Event will be cancelled on the Early Redemption Date or the Acceleration Date, as applicable. Consequently, as of such Early Redemption Date or the Acceleration Date, as applicable, the redeemed ETNs will no longer be considered outstanding.

Any payment you will be entitled to receive is subject to our ability to pay our obligations as they become due.

For a further description of how your payment at maturity, on redemption or upon acceleration will be calculated, see “Hypothetical Examples” and “Specific Terms of the ETNs” in this pricing supplement.

Understanding the value of the ETNs

The Initial Indicative Value was determined on the Inception Date. The Initial Indicative Value, Intraday Indicative Value and Closing Indicative Value are not the same as the trading price, which is the price at which you may be able to sell your ETNs in the secondary market, the Early Redemption Amount, which is the amount that you will receive from us in the event that you choose to have your ETNs redeemed by us, or the Accelerated Redemption Amount, which is the amount you will receive from us in the event of an Optional Acceleration or an Event Acceleration. The Intraday Indicative Value and Closing Indicative Value for each series of ETNs will be published on each Index Business Day under the applicable Indicative Value ticker for such series of ETNs, as set forth on the cover of this pricing supplement. The trading price of each series of ETNs will be published on each Index Business Day under the applicable exchange ticker for such series of ETNs, as set forth on the cover of this pricing supplement, and reflects the last reported trading price of such series of ETNs, regardless of the date and time of such trading price.

An explanation of each valuation is set forth below.

Closing Indicative Value

The Closing Indicative Value for each series of ETNs is designed to reflect the end-of-day economic value of such series of ETNs. The Closing Indicative Value for each series of ETNs on the Inception Date was $100. The Closing Indicative Value for any given series of ETNs on any given calendar day following the Inception Date will be equal to (1)(a) the Closing Indicative Value for that series on the immediately preceding calendar day times (b) the Daily ETN Performance for that series on such calendar day minus (2) the Daily Investor Fee for that series on such calendar day. The Closing Indicative Value will never be less than zero. The Closing Indicative Value will be zero on and subsequent to any calendar day on which the Intraday Indicative Value equals zero at any time or Closing Indicative Value equals zero.

See “How will payment at maturity, at redemption or upon acceleration be determined for the ETNs?— Payment at Maturity” in this pricing supplement.

Intraday Indicative Value

The “Intraday Indicative Value” for each series of ETNs is designed to reflect the economic value of such series of ETNs at a given time. It is calculated using the same formula as the Closing Indicative Value, except that instead of using the the closing level of the applicable underlying Index, the calculation is based on the most recent intraday level of such Index at the particular time. The Intraday Indicative Value of each series of ETNs will be calculated every 15 seconds on each Index Business Day during the period when a Market Disruption Event has not occurred or is not continuing and disseminated over the Consolidated Tape, or other major market data vendor, and will be published under the applicable Indicative Value ticker for such series of ETNs, as set forth on the cover of this pricing supplement. If the Intraday Indicative Value is equal to or less than zero at any time or the Closing Indicative Value is equal to zero on any Index Business Day, the Closing Indicative Value on that day, and all future days, will be zero.

PS-7

See “Description of the ETNs—Intraday Indicative Value” in this pricing supplement. JD or its affiliate is responsible for computing and disseminating the Intraday Indicative Value.

Trading Price

The market value of the ETNs at any given time, which we refer to as the trading price, is the price at which you may be able to sell your ETNs in the secondary market at such time, if one exists. In the absence of an active secondary market for the ETNs, the last reported trading price may not reflect the actual price at which you may be able to sell your ETNs at a particular time. The trading price of the ETNs in the secondary market is not the same as the Indicative Value of the ETNs at any time, even if a concurrent trading price in the secondary market were available at such time. The trading price of any series of the ETNs at any time may vary significantly from the Indicative Value of such ETNs at such time because the market value reflects investor supply and demand for the ETNs. Any premium may be reduced or eliminated at any time. Paying a premium purchase price over the Indicative Value of the ETNs could lead to significant losses in the event the investor sells such ETNs at a time when such premium is no longer present in the market place or such ETNs are accelerated (including at our option, which we have the discretion to do at any time), in which case investors will receive a cash payment in an amount equal to the Closing Indicative Value on the Accelerated Valuation Date. Investors should consult their financial advisors before purchasing or selling the ETNs, especially for ETNs trading at a premium over their Indicative Value.

See “Risk Factors—The Intraday Indicative Value and the Closing Indicative Value, the Early Redemption Amount and the Accelerated Redemption Amount are not the same as the closing price or any other trading price of the ETNs in the secondary market” in this pricing supplement.

Early Redemption Amount

If you elect to offer your ETNs for redemption, and the requirements for acceptance by us are met, you will receive a cash payment per ETN on the Early Redemption Date equal to the Early Redemption Amount. The Early Redemption Amount, if applicable, will equal to the greater of (A) zero and (B) (1) the Closing Indicative Value on the Early Redemption Valuation Date minus (2) the Early Redemption Charge, which is equal to 0.05% times the Closing Indicative Value on the Early Redemption Valuation Date, and will be calculated by the Calculation Agents.

See “How will payment at maturity, at redemption or upon acceleration be determined for the ETNs?— Payment Upon Early Redemption” in this pricing supplement.

Accelerated Redemption Amount

We will have the right to accelerate the ETNs of any series in whole but not in part on any Business Day occurring on or after the Inception Date. In addition, if an Acceleration Event (as defined herein) occurs at any time with respect to any series of the ETNs, we will have the right, and under certain circumstances as described herein the obligation, to accelerate all of the outstanding ETNs of such series. In either case, upon acceleration you will receive the Accelerated Redemption Amount. The Accelerated Redemption Amount will be equal to the Closing Indicative Value on the Accelerated Valuation Date.

See “How will payment at maturity, at redemption or upon acceleration be determined for the ETNs?— Payment Upon Early Redemption” in this pricing supplement.

Payment at Maturity

If your ETNs have not been previously redeemed or accelerated, on the Maturity Date you will receive a cash payment per ETN equal to the applicable Closing Indicative Value on the Final Valuation Date, as calculated by the Calculation Agents. If the scheduled Maturity Date is not a Business Day, the Maturity Date will be postponed to the first Business Day following the scheduled Maturity Date. If the scheduled Final Valuation Date is not an Index Business Day, the Final Valuation Date will be postponed to the next following Index Business Day, in which case the Maturity Date will be postponed to the third Business Day following the Final Valuation Date as so

PS-8

postponed. No interest or additional payment will accrue or be payable as a result of any postponement of the Maturity Date.

See “How will payment at maturity, at redemption or upon acceleration be determined for the ETNs?— Payment at Maturity” in this pricing supplement.

How do you sell your ETNs?

We have listed each series of the ETNs on The NASDAQ Stock Market under the exchange ticker symbols as set forth on the cover of this pricing supplement. As long as an active secondary market in the ETNs exists, we expect that investors will purchase and sell the ETNs primarily in this secondary market. We have no obligation to maintain any listing on The NASDAQ Stock Market or any other exchange or quotation system.

How do you offer your ETNs for redemption by Credit Suisse?

If you wish to offer your ETNs to Credit Suisse for redemption, your broker must follow the following procedures:

| · | Deliver a notice of redemption, in substantially the form as Annex A (the “Redemption Notice”), to JD (the “Redemption Agent”) via email or other electronic delivery as requested by the Redemption Agent. If your Redemption Notice is delivered prior to 4:00 p.m., New York City time, on any Business Day, the immediately following Index Business Day will be the applicable “Early Redemption Valuation Date”. Otherwise, the second following Index Business Day will be the applicable Early Redemption Valuation Date. If the Redemption Agent receives your Redemption Notice no later than 4:00 p.m., New York City time, on any Business Day, the Redemption Agent will respond by sending your broker an acknowledgment of the Redemption Notice accepting your redemption request by 7:30 p.m., New York City time, on the Business Day prior to the applicable Early Redemption Valuation Date. The Redemption Agent or its affiliate must acknowledge to your broker acceptance of the Redemption Notice in order for your redemption request to be effective; |

| · | Cause your DTC custodian to book a delivery vs. payment trade with respect to the ETNs on the applicable Early Redemption Valuation Date at a price equal to the applicable Early Redemption Amount, facing us; and |

| · | Cause your DTC custodian to deliver the trade as booked for settlement via DTC at or prior to 10:00 a.m. New York City time, on the applicable Early Redemption Date (the third Business Day following the Early Redemption Valuation Date). |

You are responsible for (i) instructing or otherwise causing your broker to provide the Redemption Notice and (ii) your broker satisfying the additional requirements as set forth in the second and third bullet above in order for the redemption to be effected. Different brokerage firms may have different deadlines for accepting instructions from their customers. Accordingly, you should consult the brokerage firm through which you own your interest in the ETNs in respect of such deadlines. If the Redemption Agent does not (i) receive the Redemption Notice from your broker by 4:00 p.m. and (ii) deliver an acknowledgment of such Redemption Notice to your broker accepting your redemption request by 7:30 p.m., on the Business Day prior to the applicable Early Redemption Valuation Date, such notice will not be effective for such Business Day and the Redemption Agent will treat such Redemption Notice as if it was received on the next Business Day. Any redemption instructions for which the Redemption Agent receives a valid confirmation in accordance with the procedures described above will be irrevocable.

Because the Early Redemption Amount you will receive for each ETN will not be calculated until the Index Business Day (or the second following Index Business Day) immediately following the Business Day you offer your ETNs for redemption, you will not know the applicable Early Redemption Amount at the time you exercise your early redemption right and will bear the risk that your ETNs will decline in value between the time of your exercise and the time at which the Early Redemption Amount is determined.

PS-9

What are some of the risks of the ETNs?

An investment in the ETNs involves risks. Some of these risks are summarized here, but we urge you to read the more detailed explanation of risks in “Risk Factors” in this pricing supplement.

| · | Uncertain Repayment of Initial Investment—The ETNs are designed for investors who seek exposure to the applicable underlying Index. The ETNs do not guarantee any return of your initial investment at maturity. For each ETN, investors will receive a cash payment at maturity, upon early redemption or upon acceleration by us that will be linked to the performance of the applicable underlying Index, plus a Daily Accrual and less a Daily Investor Fee. If the applicable underlying Index declines or increases, as applicable, investors should be willing to lose up to 100% of their investment. Any payment on the ETNs is subject to our ability to pay our obligations as they become due. As explained in “Risk Factors” in this pricing supplement, because of the way in which the underlying Indices are calculated, the amount payable at maturity or upon redemption or acceleration is likely to be less than the amount of your initial investment in the ETNs, and you are likely to lose part or all of your initial investment. In almost any potential scenario the Closing Indicative Value (as defined below) of your ETNs is likely to be close to zero after 20 years and we do not intend or expect that any investor to hold the ETNs from inception to maturity. |

| · | Credit Risk of the Issuer—Any payments you are entitled to receive on your ETNs are subject to the ability of Credit Suisse to pay its obligations as they become due. |

| · | Market and Volatility Risk—The return on each series of ETNs is linked to the performance of an applicable underlying Index which, in turn is linked to the performance of one or more futures contracts on the VIX Index. The VIX Index measures the 30-day forward volatility of the S&P 500® Index as calculated based on the prices of certain put and call options on the S&P 500® Index. The level of the S&P 500® Index, the prices of options on the S&P 500® Index, and the level of the VIX Index may change unpredictably, affecting the value of futures contracts on the VIX Index and, consequently, the level of each Index and the value of your ETNs in unforseeable ways. |

| · | No Interest Payments—You will not receive any periodic interest payments on the ETNs. |

| · | Long Holding Period Risk—The ETNs, and in particular the 2x Long ETNs, are intended to be trading tools for sophisticated investors to manage daily trading risks. They are designed to achieve their stated investment objectives on a daily basis, but their performance over longer periods of time can differ significantly from their stated daily objectives. The ETNs are riskier than securities that have intermediate or long-term investment objectives, and may not be suitable for investors who plan to hold them for longer than one day. Accordingly, the ETNs should be purchased only by knowledgeable investors who understand the potential consequences of investing in volatility indices and of seeking inverse or leveraged investment results, as applicable. Investors should actively and frequently monitor their investments in the ETNs, even intra-day. |

| · | A Trading Market for the ETNs May Not Continue Over the Term of the ETNs—Although the ETNs are currently listed on The NASDAQ Stock Market, a trading market for your ETNs may not continue for the term of the ETNs. We are not required to maintain any listing of the ETNs on The NASDAQ Stock Market or any other exchange or quotation system. |

| · | Requirements on Redemption by Credit Suisse—You must offer at least the applicable Minimum Redemption Amount to Credit Suisse and satisfy the other requirements described herein for your offer for redemption to be considered. |

| · | Your Offer for Redemption Is Irrevocable—You will not be able to rescind your offer for redemption after it is received by the Redemption Agent, so you will be exposed to market risk in the event market conditions change after the Redemption Agent receives your offer. Upon exercise of your |

PS-10

right to require Credit Suisse to redeem your ETNs you will incur an Early Redemption Charge of 0.05% per ETN which will reduce the Early Redemption Amount.

| · | Uncertain Tax Treatment— No ruling is being requested from the Internal Revenue Service (“IRS”) with respect to the tax consequences of the ETNs. There is no direct authority dealing with securities such as the ETNs, and there can be no assurance that the IRS will accept, or that a court will uphold, the tax treatment described in this pricing supplement. In addition, you should note that the IRS and the U.S. Treasury Department have announced a review of the tax treatment of prepaid forward contracts. Accordingly, no assurance can be given that future tax legislation, regulations or other guidance may not change the tax treatment of the ETNs. Potential investors should consult their tax advisors regarding the United States federal income tax consequences of an investment in the ETNs, including possible alternative treatments. |

| · | Acceleration Feature—Your ETNs may be accelerated by us at any time on or after the Inception Date or accelerated by us at any time if an Acceleration Event occurs. Upon any such acceleration you may receive less, and possibly significantly less, than your original investment in the ETNs. |

Is this the right investment for you?

The ETNs may be a suitable investment for you if:

| · | You seek an investment with a return linked to the performance of the applicable underlying Index. |

| · | You are willing to accept the risk of fluctuations in volatility in general and in the level of the applicable underlying Index in particular. |

| · | You are a sophisticated investor seeking to manage daily trading risk using a short-term investment, and are knowledgeable and understand the potential consequences of investing in volatility indices and of seeking inverse or leveraged investment results, as applicable. |

| · | You believe the level of the applicable underlying Index will increase (if you invest in the Long ETNs or 2x Long ETNs) or decline (if you invest in the Inverse ETNs) by an amount, and at a time or times, sufficient to offset the sum of the Daily Investor Fees (and in the case of Early Redemption, the Early Redemption Charge) over your intended holding period of the ETNs and to provide you with a satisfactory return on your investment during the time you hold the ETNs. |

| · | You do not seek current income from this investment. |

| · | You do not seek a guaranteed return of your initial investment. |

| · | You are a sophisticated investor using the ETNs to manage daily trading risks and you understand that the ETNs are designed to achieve their stated investment objectives on a daily basis, but their performance over longer periods of time can differ significantly from their stated daily objectives. |

| · | You understand that the Daily Investor Fees and the Early Redemption Charge will reduce your return (or increase your loss, as applicable) on your investment. |