|

Pricing Supplement No. U1121

Product Supplement No. U-I dated March 23, 2012,

Prospectus Supplement dated March 23, 2012 and

Prospectus dated March 23, 2012

|

Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-180300-03

November 18, 2014

|

|

|

|

|

|

Financial

Products

|

|

|

|

$2,255,000

|

||

|

13.50% per annum Contingent Coupon Autocallable Yield Notes due November 21, 2016

Linked to the Performance of the Common Stock of Keurig Green Mountain, Inc.

|

General

|

•

|

The securities are designed for investors who are mildly bearish or neutral on the Reference Shares. Investors should be willing to lose some or all of their investment if a Knock-In Event occurs. Any payment on the securities is subject to our ability to pay our obligations as they become due.

|

|

•

|

Subject to Automatic Redemption, if, for any contingent coupon period, a Coupon Barrier Event does not occur, we will pay a contingent coupon at a Contingent Coupon Rate of 13.50% per annum. If a Coupon Barrier Event occurs, no contingent coupon will be paid for the corresponding contingent coupon period. Contingent coupons will be calculated on a 30/360 basis from and including the Settlement Date to and excluding the earlier of the Automatic Redemption Date and the Maturity Date, as applicable.

|

|

•

|

If a Trigger Event occurs, the securities will be automatically redeemed and you will be entitled to receive a cash payment equal to the principal amount of the securities you hold and the contingent coupon payable on the corresponding Contingent Coupon Payment Date. No further payments will be made in respect of the securities.

|

|

•

|

Senior unsecured obligations of Credit Suisse AG, acting through its London Branch, maturing November 21, 2016.†

|

|

•

|

Minimum purchase of $1,000. Minimum denominations of $1,000 and integral multiples of $1,000 in excess thereof.

|

|

•

|

The securities priced on November 18, 2014 (the “Trade Date”) and are expected to settle on November 21, 2014 (the “Settlement Date”). Delivery of the securities in book-entry form only will be made through The Depository Trust Company.

|

Key Terms

|

Issuer:

|

Credit Suisse AG (“Credit Suisse”), acting through its London Branch

|

|||||

|

Reference Shares:

|

The common stock of Keurig Green Mountain, Inc. (the “Reference Share Issuer”). The Reference Shares are identified in the table below, together with their Bloomberg ticker symbol, Initial Share Price, Coupon Barrier Price, Knock-In Price and Trigger Price:

|

|||||

|

Reference Shares

|

Ticker

|

Initial Share Price

|

Coupon Barrier Price

|

Knock-In Price

|

Trigger Price

|

|

|

The common stock of Keurig Green Mountain, Inc.

|

GMCR UW <Equity>

|

$157.100

|

$109.970

|

$109.970

|

$157.100

|

|

Contingent Coupon Rate:

|

Subject to Automatic Redemption, the Contingent Coupon Rate is 13.50% per annum for any contingent coupon period. If a Coupon Barrier Event occurs, no contingent coupon will be paid for the corresponding contingent coupon period. Contingent coupons will be calculated on a 30/360 basis from and including the Settlement Date to and excluding the earlier of the Automatic Redemption Date and the Maturity Date, as applicable.

|

|||||

|

Coupon Barrier Event:

|

A Coupon Barrier Event will occur with respect to a contingent coupon period if on the Observation Date for that contingent coupon period the closing price of the Reference Shares is less than the Coupon Barrier Price.

|

|||||

|

Coupon Barrier Price:

|

As set forth in the table above.

|

|||||

|

Contingent Coupon Payment Dates:†

|

Subject to Automatic Redemption, unless a Coupon Barrier Event occurs, contingent coupons will be paid quarterly in arrears on February 23, 2015, May 21, 2015, August 21, 2015, November 23, 2015, February 22, 2016, May 23, 2016, August 22, 2016 and the Maturity Date, subject to the modified following business day convention. No contingent coupons will be payable following an Automatic Redemption. Contingent coupons will be payable to the holders of record at the close of business on the business day immediately preceding the applicable Contingent Coupon Payment Date, provided that the contingent coupon payable on the Automatic Redemption Date or Maturity Date, as applicable, will be payable to the person to whom the Automatic Redemption Amount or the Redemption Amount, as applicable, is payable.

|

|||||

Investing in the securities involves a number of risks. See “Selected Risk Considerations” in this pricing supplement and “Risk Factors” beginning on page PS-3 of the accompanying product supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities or passed upon the accuracy or the adequacy of this pricing supplement, the product supplement, the prospectus supplement and the prospectus. Any representation to the contrary is a criminal offense.

|

Price to Public(1)

|

Underwriting Discounts and Commissions(2)

|

Proceeds to Issuer

|

|

|

Per security

|

$1,000.00

|

$31.25

|

$968.75

|

|

Total

|

$2,255,000.00

|

$70,468.75

|

$2,184,531.25

|

(1) Certain fiduciary accounts may pay a purchase price of at least $968.75 per $1,000 principal amount of securities, and the placement agent will forgo any fees with respect to such sales.

(2) Incapital LLC will act as placement agents for the securities. The placement agents will receive a fee from Credit Suisse or one of our affiliates of $31.25 per $1,000 principal amount of securities. For more detailed information, please see “Supplemental Plan of Distribution” on the last page of this pricing supplement.

Credit Suisse currently estimates the value of each $1,000 principal amount of the securities on the Trade Date is $952.65 (as determined by reference to our pricing models and the rate we are currently paying to borrow funds through issuance of the securities (our “internal funding rate”)). See “Selected Risk Considerations” in this pricing supplement.

The securities are not deposit liabilities and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency of the United States, Switzerland or any other jurisdiction.

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities Offered

|

Maximum Aggregate Offering Price

|

Amount of Registration Fee

|

|

Notes

|

$2,255,000.00

|

$262.03

|

Incapital LLC

Placement Agent

| November 18, 2014 |

(continued on next page)

|

(continued from previous page)

|

Redemption Amount:

|

At maturity, the Redemption Amount you will be entitled to receive will depend on the performance of the Reference Shares and whether a Knock-In Event occurs. Subject to Automatic Redemption, the Redemption Amount will be determined as follows:

|

|

|

•

|

If a Knock-In Event occurs, the Redemption Amount will equal the principal amount of the securities you hold multiplied by the sum of one plus the Underlying Return. In this case, the Redemption Amount will be equal to or less than $700 per $1,000 principal amount of securities. You could lose your entire investment.

|

|

|

•

|

If a Knock-In Event does not occur, the Redemption Amount will equal the principal amount of the securities you hold.

|

|

|

Any payment on the securities is subject to our ability to pay our obligations as they become due.

|

||

|

Automatic Redemption:

|

If a Trigger Event occurs, the securities will be automatically redeemed and you will be entitled to receive a cash payment equal to the principal amount of the securities you hold (the “Automatic Redemption Amount”) and the contingent coupon payable on the corresponding Contingent Coupon Payment Date. No further payments will be made in respect of the securities. Payment will be made in respect of such Automatic Redemption on the Contingent Coupon Payment Date immediately following the relevant Trigger Observation Date (the “Automatic Redemption Date”). Any payment on the securities is subject to our ability to pay our obligations as they become due.

|

|

|

Trigger Event:

|

A Trigger Event will occur on any Trigger Observation Date if the closing price of the Reference Shares is equal to or greater than the Trigger Price.

|

|

|

Trigger Price:

|

As set forth in the table above.

|

|

|

Knock-In Event:

|

A Knock-In Event will occur if the Final Share Price is equal to or less than the Knock-In Price.

|

|

|

Knock-In Price:

|

As set forth in the table above.

|

|

|

Underlying Return:

|

The Underlying Return will be calculated as follows:

|

|

|

Final Share Price − Initial Share Price

Initial Share Price

|

, subject to a maximum of zero

|

|

|

Initial Share Price:

|

As set forth in the table above.

|

|

Final Share Price:

|

The closing price of the Reference Shares on the Valuation Date.

|

|

Trigger Observation Dates:†

|

February 18, 2015, May 18, 2015, August 18, 2015, November 18, 2015, February 17, 2016, May 18, 2016 and August 17, 2016

|

|

Observation Dates:†

|

February 18, 2015, May 18, 2015, August 18, 2015, November 18, 2015, February 17, 2016, May 18, 2016, August 17, 2016 and the Valuation Date.

|

|

Valuation Date:†

|

November 16, 2016

|

|

Maturity Date:†

|

November 21, 2016

|

|

Listing:

|

The securities will not be listed on any securities exchange.

|

|

CUSIP:

|

22547QWX0

|

† The determination of the closing price for the Reference Shares on each Observation Date and Trigger Observation Date, other than the Valuation Date, is subject to postponement if such date is not a trading day or as a result of a market disruption event, as described herein under “Market Disruption Events.” The Valuation Date is subject to postponement if such date is not an underlying business day or as a result of a market disruption event, as described in the accompanying product supplement under “Description of the Securities—Market disruption events.” The Contingent Coupon Payment Dates (including the Maturity Date) are subject to postponement, each as described herein, if such date is not a business day or if (a) the determination of the closing price on the corresponding Observation Date or Trigger Observation Date (other than the Valuation Date) is postponed or (b) the Valuation Date is postponed, in each case because such date is not a trading day or an underlying business day, as applicable, or as a result of a market disruption event.

Additional Terms Specific to the Securities

You should read this pricing supplement together with the product supplement dated March 23, 2012, the prospectus supplement dated March 23, 2012 and the prospectus dated March 23, 2012, relating to our Medium-Term Notes of which these securities are a part. You may access these documents on the SEC website at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

|

|

•

|

Product supplement No. U-I dated March 23, 2012:

|

|

|

•

|

Prospectus supplement and Prospectus dated March 23, 2012:

|

Our Central Index Key, or CIK, on the SEC website is 1053092. As used in this pricing supplement, the “Company,” “we,” “us,” or “our” refers to Credit Suisse.

This pricing supplement, together with the documents listed above, contains the terms of the securities and supersedes all other prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, fact sheets, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours. We may, without the consent of the registered holder of the securities and the owner of any beneficial interest in the securities, amend the securities to conform to its terms as set forth in this pricing supplement and the documents listed above, and the trustee is authorized to enter into any such amendment without any such consent. You should carefully consider, among other things, the matters set forth in “Risk Factors” in the product supplement and “Selected Risk Considerations” in this pricing supplement, as the securities involve risks not associated with conventional debt securities. You should consult your investment, legal, tax, accounting and other advisors before deciding to invest in the securities.

1

Hypothetical Redemption Amounts and Total Payments on the Securities

The tables and examples below illustrate, for a $1,000 investment in the securities, hypothetical Redemption Amounts payable at maturity for a hypothetical range of Underlying Returns and, in the case of Table 2, total contingent coupon payments over the term of the securities, which will depend on the number of Coupon Barrier Events that have occurred over the term of the securities. The tables and examples below reflect that the Contingent Coupon Rate is 13.50% per annum and assume that (i) the securities are not automatically redeemed prior to maturity, (ii) the term of the securities is exactly 2 years, (iii) the Coupon Barrier Price is 70% of the Initial Share Price and (iv) the Knock-In Price is 70% of the Initial Share Price. The examples are intended to illustrate hypothetical calculations of only the Redemption Amount and do not illustrate the calculation or payment of any individual contingent coupon payment.

The hypothetical Redemption Amounts and total coupon payments set forth below are for illustrative purposes only. The actual Redemption Amounts and total coupon payments applicable to a purchaser of the securities will depend on whether a Coupon Barrier Event occurs on one or more Observation Dates, whether a Knock-In Event occurs and on the Final Share Price. It is not possible to predict how many Coupon Barrier Events will occur, if any, or whether a Knock-In Event will occur, and, in the event that there is a Knock-In Event, by how much the Final Share Price will decrease in comparison to the Initial Share Price. Furthermore, it is not possible to predict whether a Trigger Event will occur. If a Trigger Event occurs, the securities will be automatically redeemed for a cash payment equal to the principal amount of the securities you hold and the contingent coupon payable and no further payments will be made in respect of the securities.

You will not be entitled to participate in any appreciation in the Reference Shares. You should consider carefully whether the securities are suitable to your investment goals. Any payment on the securities is subject to our ability to pay our obligations as they become due. The numbers appearing in the tables and examples below have been rounded for ease of analysis.

TABLE 1: Hypothetical Redemption Amounts

|

Percentage Change

from the Initial Share Price

to the Final Share Price

|

Underlying Return

|

Redemption Amount (excluding contingent coupon payments, if any)

|

Total Contingent Coupon Payments

|

|

100.00%

|

0.00%

|

$1,000.00

|

(See table below)

|

|

90.00%

|

0.00%

|

$1,000.00

|

|

|

80.00%

|

0.00%

|

$1,000.00

|

|

|

70.00%

|

0.00%

|

$1,000.00

|

|

|

60.00%

|

0.00%

|

$1,000.00

|

|

|

50.00%

|

0.00%

|

$1,000.00

|

|

|

40.00%

|

0.00%

|

$1,000.00

|

|

|

30.00%

|

0.00%

|

$1,000.00

|

|

|

20.00%

|

0.00%

|

$1,000.00

|

|

|

10.00%

|

0.00%

|

$1,000.00

|

|

|

0.00%

|

0.00%

|

$1,000.00

|

|

|

−10.00%

|

−10.00%

|

$1,000.00

|

|

|

−20.00%

|

−20.00%

|

$1,000.00

|

|

|

−29.99%

|

−29.99%

|

$1,000.00

|

|

|

−30.00%

|

−30.00%

|

$700.00

|

|

|

−40.00%

|

−40.00%

|

$600.00

|

|

|

−50.00%

|

−50.00%

|

$500.00

|

|

|

−60.00%

|

−60.00%

|

$400.00

|

|

|

−70.00%

|

−70.00%

|

$300.00

|

|

|

−80.00%

|

−80.00%

|

$200.00

|

|

|

−90.00%

|

−90.00%

|

$100.00

|

|

|

−100.00%

|

−100.00%

|

$0.00

|

2

TABLE 2: The expected total contingent coupon payments will depend on how many Coupon Barrier Events occur.

|

Number of Coupon Barrier Events

|

Total Contingent Coupon Payments

|

|

A Coupon Barrier Event does not occur

|

$270.00

|

|

A Coupon Barrier Event occurs on 1 Observation Date

|

$236.25

|

|

A Coupon Barrier Event occurs on 2 Observation Dates

|

$202.50

|

|

A Coupon Barrier Event occurs on 3 Observation Dates

|

$168.75

|

|

A Coupon Barrier Event occurs on 4 Observation Dates

|

$135.00

|

|

A Coupon Barrier Event occurs on 5 Observation Dates

|

$101.25

|

|

A Coupon Barrier Event occurs on 6 Observation Dates

|

$67.50

|

|

A Coupon Barrier Event occurs on 7 Observation Dates

|

$33.75

|

|

A Coupon Barrier Event occurs on 8 Observation Dates

|

$0.00

|

The total payment on the securities will be equal to the Redemption Amount applicable to an investor plus the total contingent coupon payments on the securities.

The following examples illustrate how the Redemption Amount is calculated.

Example 1: The price of the Reference Shares increases by 20% from the Initial Share Price to the Final Share Price. Since a Knock-In Event has not occurred, the Redemption Amount is equal to the principal amount and the investor is entitled to receive at maturity a payment in cash equal to $1,000 per $1,000 principal amount of securities.

Example 2: The price of the Reference Shares decreases by 10% from the Initial Share Price to the Final Share Price. Since a Knock-In Event has not occurred, the Redemption Amount is equal to the principal amount even though the Final Share Price is less than the Initial Share Price and the investor is entitled to receive at maturity a payment in cash equal to $1,000 per $1,000 principal amount of securities.

Example 3: The price of the Reference Shares decreases by 60% from the Initial Share Price to the Final Share Price, so a Knock-In Event occurs. Since a Knock-In Event has occurred, the investor is entitled to receive at maturity a payment in cash equal to $400 per $1,000 principal amount of securities, calculated as follows:

The Redemption Amount = principal amount of the securities × (1 + Underlying Return)

= $1,000 × (1 – 0.60) = $400

3

Selected Risk Considerations

An investment in the securities involves significant risks. Investing in the securities is not equivalent to investing directly in the Reference Shares. These risks are explained in more detail in the “Risk Factors” section of the accompanying product supplement.

|

|

•

|

YOU MAY RECEIVE LESS THAN THE PRINCIPAL AMOUNT AT MATURITY — You may receive less at maturity than you originally invested in the securities, or you may receive nothing, excluding any contingent coupons, if any. If the Final Share Price is equal to or less than the Knock-In Price, you will be fully exposed to any depreciation in the Reference Shares. In this case, the Redemption Amount you will be entitled to receive will be less than the principal amount of the securities, and you could lose your entire investment. It is not possible to predict whether a Knock-In Event will occur, and in the event that there is a Knock-In Event, by how much the Final Share Price will decrease in comparison to the Initial Share Price. Any payment on the securities is subject to our ability to pay our obligations as they become due.

|

|

|

•

|

THE SECURITIES WILL NOT PAY MORE THAN THE PRINCIPAL AMOUNT, PLUS CONTINGENT COUPON, IF ANY, AT MATURITY OR UPON AUTOMATIC REDEMPTION — The securities will not pay more than the principal amount, plus contingent coupon, if any, at maturity or upon Automatic Redemption. Even if the Final Share Price is greater than the Initial Share Price, you will not participate in the appreciation of the Reference Shares. Assuming the securities are held to maturity and the term of the securities is exactly 2 years, the maximum amount payable with respect to the securities is $1,270 for each $1,000 principal amount of the securities.

|

|

|

•

|

THE SECURITIES ARE SUBJECT TO THE CREDIT RISK OF CREDIT SUISSE — Although the return on the securities will be based on the performance of the Reference Shares, the payment of any amount due on the securities, including any applicable contingent coupon payments, if any, Automatic Redemption payment and payment at maturity, is subject to the credit risk of Credit Suisse. Investors are dependent on our ability to pay all amounts due on the securities and, therefore, investors are subject to our credit risk. In addition, any decline in our credit ratings, any adverse changes in the market’s view of our creditworthiness or any increase in our credit spreads is likely to adversely affect the value of the securities prior to maturity.

|

|

|

•

|

IF A COUPON BARRIER EVENT OCCURS ON ANY OBSERVATION DATE, YOU WILL NOT RECEIVE ANY CONTINGENT COUPON PAYMENT FOR THE CORRESPONDING CONTINGENT COUPON PERIOD — If a Coupon Barrier Event occurs on an Observation Date, you will not receive any contingent coupon payment for the corresponding contingent coupon period. For example, if a Coupon Barrier Event occurs on every Observation Date, you will not receive any contingent coupon payments during the term of the securities.

|

|

|

•

|

THE SECURITIES ARE SUBJECT TO A POTENTIAL AUTOMATIC REDEMPTION, WHICH WOULD LIMIT YOUR OPPORTUNITY TO BE PAID CONTINGENT COUPONS OVER THE FULL TERM OF THE SECURITIES —The securities are subject to a potential Automatic Redemption. If a Trigger Event occurs, the securities will be automatically redeemed and you will be entitled to receive a cash payment equal to the principal amount of the securities you hold and the contingent coupon payable on that Contingent Coupon Payment Date, and no further payments will be made in respect of the securities. In this case, you will lose the opportunity to continue to be paid contingent coupons from the date of Automatic Redemption to the scheduled Maturity Date. If the securities are automatically redeemed prior to the Maturity Date, you may be unable to invest in other securities with a similar level of risk that yield as much as the securities.

|

|

|

·

|

NO AFFILIATION WITH THE REFERENCE SHARE ISSUER — We are not affiliated with the Reference Share Issuer. You should make your own investigation into the Reference Shares and the Reference Share Issuer. In connection with the offering of the securities, neither we nor our affiliates have participated in the preparation of any publicly available documents or made any due diligence inquiry with respect to the Reference Share Issuer.

|

4

|

|

•

|

HEDGING AND TRADING IN THE REFERENCE SHARES — While the securities are outstanding, we or any of our affiliates may carry out hedging activities related to the securities, including in the Reference Shares or instruments related to the Reference Shares. We or our affiliates may also trade in the Reference Shares or instruments related to the Reference Shares from time to time. Any of these hedging or trading activities as of the Trade Date and during the term of the securities could adversely affect our payment to you at maturity.

|

|

|

•

|

THE ESTIMATED VALUE OF THE SECURITIES ON THE TRADE DATE MAY BE LESS THAN THE PRICE TO PUBLIC — The initial estimated value of your securities on the Trade Date (as determined by reference to our pricing models and our internal funding rate) may be significantly less than the original Price to Public. The Price to Public of the securities includes the agent’s discounts or commissions as well as transaction costs such as expenses incurred to create, document and market the securities and the cost of hedging our risks as issuer of the securities through one or more of our affiliates (which includes a projected profit). These costs will be effectively borne by you as an investor in the securities. These amounts will be retained by Credit Suisse or our affiliates in connection with our structuring and offering of the securities (except to the extent discounts or commissions are reallowed to other broker-dealers or any costs are paid to third parties).

|

|

|

On the Trade Date, we value the components of the securities in accordance with our pricing models. These include a fixed income component valued using our internal funding rate, and individual option components valued using mid-market pricing. Our option valuation models are proprietary. They take into account factors such as interest rates, volatility and time to maturity of the securities, and they rely in part on certain assumptions about future events, which may prove to be incorrect.

|

|

|

Because Credit Suisse’s pricing models may differ from other issuers’ valuation models, and because funding rates taken into account by other issuers may vary materially from the rates used by Credit Suisse (even among issuers with similar creditworthiness), our estimated value at any time may not be comparable to estimated values of similar securities of other issuers.

|

|

|

•

|

EFFECT OF INTEREST RATE USED IN STRUCTURING THE SECURITIES — The internal funding rate we use in structuring notes such as these securities is typically lower than the interest rate that is reflected in the yield on our conventional debt securities of similar maturity in the secondary market (our “secondary market credit spreads”). If on the Trade Date our internal funding rate is lower than our secondary market credit spreads, we expect that the economic terms of the securities will generally be less favorable to you than they would have been if our secondary market credit spread had been used in structuring the securities. We will also use our internal funding rate to determine the price of the securities if we post a bid to repurchase your securities in secondary market transactions. See “—Secondary Market Prices” below.

|

|

|

•

|

SECONDARY MARKET PRICES — If Credit Suisse (or an affiliate) bids for your securities in secondary market transactions, which we are not obligated to do, the secondary market price (and the value used for account statements or otherwise) may be higher or lower than the Price to Public and the estimated value of the securities on the Trade Date. The estimated value of the securities on the cover of this pricing supplement does not represent a minimum price at which we would be willing to buy the securities in the secondary market (if any exists) at any time. The secondary market price of your securities at any time cannot be predicted and will reflect the then-current estimated value determined by reference to our pricing models and other factors. These other factors include our internal funding rate, customary bid and ask spreads and other transaction costs, changes in market conditions and any deterioration or improvement in our creditworthiness. In circumstances where our internal funding rate is lower than our secondary market credit spreads, our secondary market bid for your securities could be more favorable than what other dealers might bid because, assuming all else equal, we use the lower internal funding rate to price the securities and other dealers might use the higher secondary market credit spread to price them. Furthermore, assuming no change in market conditions from the Trade Date, the secondary market price of your securities will be lower than the Price to Public because it will not include the agent’s discounts or commissions and hedging and other transaction costs. If you sell your securities to a dealer in a secondary market transaction, the dealer may impose an additional discount or commission, and as a result the price you receive on your securities may be lower than the price at which we may repurchase the securities from such dealer.

|

5

|

|

We (or an affiliate) may initially post a bid to repurchase the securities from you at a price that will exceed the then-current estimated value of the securities. That higher price reflects our projected profit and costs that were included in the Price to Public, and that higher price may also be initially used for account statements or otherwise. We (or our affiliate) may offer to pay this higher price, for your benefit, but the amount of any excess over the then-current estimated value will be temporary and is expected to decline over a period of approximately 90 days.

|

|

|

The securities are not designed to be short-term trading instruments and any sale prior to maturity could result in a substantial loss to you. You should be willing and able to hold your securities to maturity.

|

|

|

•

|

LACK OF LIQUIDITY — The securities will not be listed on any securities exchange. Credit Suisse (or its affiliates) intends to offer to purchase the securities in the secondary market but is not required to do so. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the securities when you wish to do so. Because other dealers are not likely to make a secondary market for the securities, the price at which you may be able to trade your securities is likely to depend on the price, if any, at which Credit Suisse (or its affiliates) is willing to buy the securities. If you have to sell your securities prior to maturity, you may not be able to do so or you may have to sell them at a substantial loss.

|

|

|

•

|

POTENTIAL CONFLICTS — We and our affiliates play a variety of roles in connection with the issuance of the securities, including acting as calculation agent, hedging our obligations under the securities and determining their estimated value. In performing these duties, the economic interests of us and our affiliates are potentially adverse to your interests as an investor in the securities. Further, hedging activities may adversely affect any payment on or the value of the securities. Any profit in connection with such hedging activities will be in addition to any other compensation that we and our affiliates receive for the sale of the securities, which creates an additional incentive to sell the securities to you. We and/or our affiliates may also currently or from time to time engage in business with the Reference Share Issuer, including extending loans to, or making equity investments in, the Reference Share Issuer or providing advisory services to the Reference Share Issuer. In addition, one or more of our affiliates may publish research reports or otherwise express opinions with respect to the Reference Share Issuer and these reports may or may not recommend that investors buy or hold the Reference Shares. As a prospective purchaser of the securities, you should undertake an independent investigation of the Reference Share Issuer that in your judgment is appropriate to make an informed decision with respect to an investment in the securities.

|

|

|

•

|

MANY ECONOMIC AND MARKET FACTORS WILL AFFECT THE VALUE OF THE SECURITIES — In addition to the price of the Reference Shares, the value of the securities will be affected by a number of economic and market factors that may either offset or magnify each other, including:

|

|

|

o

|

the expected volatility of the Reference Shares;

|

|

|

o

|

the time to maturity of the securities;

|

|

|

o

|

the Automatic Redemption feature, which would limit the value of the securities;

|

|

|

o

|

the dividend rate on the Reference Shares;

|

|

|

o

|

interest and yield rates in the market generally;

|

|

|

o

|

investors’ expectations with respect to the rate of inflation;

|

|

|

o

|

events affecting companies engaged in the coffee industry;

|

|

|

o

|

geopolitical conditions and a variety of economic, financial, political, regulatory or judicial events that affect the Reference Share Issuer or markets generally and which may affect the price of the Reference Shares; and

|

6

|

|

o

|

our creditworthiness, including actual or anticipated downgrades in our credit ratings.

|

|

|

Some or all of these factors may influence the price that you will receive if you choose to sell your securities prior to maturity. The impact of any of the factors set forth above may enhance or offset some or all of any change resulting from another factor or factors.

|

|

|

•

|

NO OWNERSHIP RIGHTS IN THE REFERENCE SHARES — Your return on the securities will not reflect the return you would realize if you actually owned the Reference Shares. The return on your investment, which is based on the percentage change in the Reference Shares, is not the same as the total return based on a purchase of the Reference Shares.

|

|

|

•

|

NO DIVIDEND PAYMENTS OR VOTING RIGHTS — As a holder of the securities, you will not have any ownership interest or rights in the Reference Shares, such as voting rights or dividend payments. In addition, the issuer of the Reference Shares will not have any obligation to consider your interests as a holder of the securities in taking any corporate action that might affect the value of the Reference Shares and therefore, the value of the securities.

|

|

|

•

|

ANTI-DILUTION PROTECTION IS LIMITED — The calculation agent will make anti-dilution adjustments for certain events affecting the Reference Shares. However, an adjustment will not be required in response to all events that could affect the Reference Shares. If an event occurs that does not require the calculation agent to make an adjustment, or if an adjustment is made but such adjustment does not fully reflect the economics of such event, the value of the securities may be materially and adversely affected. See “Description of the Securities—Adjustments—For equity securities of a reference share issuer” in the accompanying product supplement.

|

Supplemental Use of Proceeds and Hedging

We intend to use the proceeds of this offering for our general corporate purposes, which may include the refinancing of existing debt outside Switzerland. Some or all of the proceeds we receive from the sale of the securities may be used in connection with hedging our obligations under the securities through one or more of our affiliates. Such hedging or trading activities on or prior to the Trade Date and during the term of the securities (including on any Observation Date or Trigger Observation Date) could adversely affect the value of the Reference Shares and, as a result, could decrease the amount you may receive on the securities at maturity. For additional information, see “Supplemental Use of Proceeds and Hedging” in the accompanying product supplement.

7

The Reference Shares

Companies with securities registered under the Securities Exchange Act of 1934 (the “Exchange Act”) are required to periodically file certain financial and other information specified by the SEC. Information provided to or filed with the SEC by the Reference Share Issuer pursuant to the Exchange Act can be located by reference to the SEC file number provided below. According to its publicly available filings with the SEC, Keurig Green Mountain, Inc. sells Keurig® Single Cup brewers and roasts Arabica bean coffees for use with its Keurig® Single Cup brewers. It also offers traditional whole bean and ground coffee in other package types including bags, fractional packages and cans. In addition, it produces and sells other specialty beverages in portion packs including hot apple cider, hot and iced teas, iced coffees, iced fruit brews, hot cocoa and other dairy-based beverages. The common stock of Keurig Green Mountain, Inc., par value $0.10 per share, is listed on The NASDAQ Global Select Market. Keurig Green Mountain, Inc.’s SEC file number is 1-12340 and can be accessed through www.sec.gov.

This pricing supplement relates only to the securities offered hereby and does not relate to the Reference Shares or other securities of the Reference Share Issuer. We have derived all disclosures contained in this pricing supplement regarding the Reference Shares and the Reference Share Issuer from the publicly available documents described in the preceding paragraph. In connection with the offering of the securities, neither we nor our affiliates have participated in the preparation of such documents or made any due diligence inquiry with respect to the Reference Share Issuer.

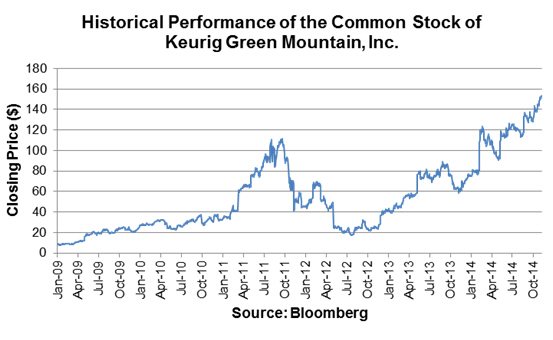

Historical Information

The following graph sets forth the historical performance of the Reference Shares based on the closing prices of the Reference Shares from January 5, 2009 through November 18, 2014. The closing price of the Reference Shares on November 18, 2014 was $157.10. We obtained the historical information below from Bloomberg, without independent verification.

You should not take the historical prices of the Reference Shares as an indication of future performance of the Reference Shares or the securities. Any historical trend in the price of the Reference Shares during any period set forth below is not an indication that the price of the Reference Shares is more or less likely to increase or decrease at any time over the term of the securities.

For additional information on the Reference Shares, see “The Reference Shares” herein.

8

Market Disruption Events

If the calculation agent determines that on any Observation Date or Trigger Observation Date, other than the Valuation Date, a market disruption event (as defined in the accompanying product supplement under “Description of the Securities—Market disruption events—For a reference share”) exists or if such day is not a trading day (as defined in the accompanying product supplement under “Description of the Securities—Certain definitions”), then the determination of the closing price for the Reference Shares on such Observation Date or Trigger Observation Date will be postponed to the first succeeding trading day on which the calculation agent determines that no market disruption event exists, unless the calculation agent determines that a market disruption event exists on each of the five trading days immediately following such Observation Date or Trigger Observation Date, as applicable. In that case, the closing price for the Reference Shares on such Observation Date or Trigger Observation Date, as applicable, will be determined as of the fifth succeeding trading day following such Observation Date or Trigger Observation Date, as applicable (such fifth trading day, the “calculation date”), notwithstanding the market disruption event, and the calculation agent will determine the closing price on that calculation date using its good faith estimate of the settlement price of the Reference Shares that would have prevailed on the relevant exchange but for the occurrence of a market disruption event (subject to the provisions described under “Description of the Securities—Changes to the calculation of a reference share” in the accompanying product supplement).

If the determination of the closing price on an Observation Date or Trigger Observation Date other than the Valuation Date is postponed as a result of a market disruption event as described above, or because such Observation Date or Trigger Observation Date, as applicable, is not a trading day, to a date on or after the corresponding Contingent Coupon Payment Date, then such corresponding Contingent Coupon Payment Date will be postponed to the business day following the latest date to which such determination is so postponed.

If the Valuation Date is postponed as a result of a market disruption event as described in the accompanying product supplement or because the scheduled Valuation Date is not an underlying business day, then the Maturity Date will be postponed to the fifth business day following the latest Valuation Date.

9

Material U.S. Federal Income Tax Considerations

The following discussion summarizes material U.S. federal income tax consequences of owning and disposing of the securities that may be relevant to holders of the securities that acquire their securities from us as part of the original issuance of the securities. This discussion applies only to holders that hold their securities as capital assets within the meaning of the Internal Revenue Code of 1986, as amended (the “Code”). Further, this discussion does not address all of the U.S. federal income tax consequences that may be relevant to you in light of your individual circumstances or if you are subject to special rules, such as if you are:

|

|

·

|

a financial institution,

|

|

|

·

|

a mutual fund,

|

|

|

·

|

a tax-exempt organization,

|

|

|

·

|

a grantor trust,

|

|

|

·

|

certain U.S. expatriates,

|

|

|

·

|

an insurance company,

|

|

|

·

|

a dealer or trader in securities or foreign currencies,

|

|

|

·

|

a person (including traders in securities) using a mark-to-market method of accounting,

|

|

|

·

|

a person who holds the securities as a hedge or as part of a straddle with another position, constructive sale, conversion transaction or other integrated transaction, or

|

|

|

·

|

an entity that is treated as a partnership for U.S. federal income tax purposes.

|

The discussion is based upon the Code, law, regulations, rulings and decisions, in each case, as available and in effect as of the date hereof, all of which are subject to change, possibly with retroactive effect. Tax consequences under state, local and foreign laws are not addressed herein. No ruling from the U.S. Internal Revenue Service (the “IRS”) has been sought as to the U.S. federal income tax consequences of the ownership and disposition of the securities, and the following discussion is not binding on the IRS.

You should consult your tax advisor as to the specific tax consequences to you of owning and disposing of the securities, including the application of federal, state, local and foreign income and other tax laws based on your particular facts and circumstances.

Characterization of the Securities

There are no statutory provisions, regulations, published rulings, or judicial decisions addressing the characterization for U.S. federal income tax purposes of securities with terms that are substantially the same as those of your securities. Thus, the characterization of the securities is not certain. Due to the terms of the securities and the uncertainty of the tax law with respect to the characterization of the securities, our special tax counsel, Orrick, Herrington & Sutcliffe LLP, believes that it is reasonable to treat the securities, for U.S. federal income tax purposes, as prepaid financial contracts with respect to the Reference Shares that are eligible for open transaction treatment in part, but is unable to opine that this characterization is more likely than not to be upheld. In the absence of an administrative or judicial ruling to the contrary, we intend to treat the securities and, by acceptance of the securities, you agree to treat the securities for all tax purposes in accordance with such characterization. The possible alternative characterizations and risks to investors of such characterizations are discussed below. In light of the fact that we agree to treat the securities as prepaid financial contracts, the balance of this discussion assumes that the securities will be so treated.

Alternative Characterizations of the Securities

You should be aware that the characterization of the securities as described above is not certain, nor is it binding on the IRS or the courts. Thus, it is possible that the IRS would seek to characterize your securities in a manner that results in tax consequences to you that are different from those described below. For example, the IRS might characterize a security as a notional principal contract (an “NPC”). In general, payments on an NPC are accrued ratably (as ordinary income or deduction, as the case may be) over the period to which they relate income regardless of an investor’s usual method of tax accounting. Payments made to terminate an NPC (other than perhaps a final scheduled payment) are capital in nature. Deductions for NPC payments may be limited in certain cases. Certain payments under an NPC may be treated as U.S. source income. The IRS could also seek to

10

characterize your securities as options, and thus as Code section 1256 contracts in the event that they are listed on a securities exchange. In such case, the securities would be marked-to-market at the end of the year and 40% of any gain or loss would be treated as short-term capital gain or loss, and the remaining 60% of any gain or loss would be treated as long-term capital gain or loss. If the securities have a term of one year or less, it is also possible that the IRS would assert that the securities constitute short-term debt obligations. Under Treasury regulations, a short-term debt obligation is treated as issued at a discount equal to the difference between all payments on the obligation and the obligation’s issue price. A cash method U.S. Holder that does not elect to accrue the discount in income currently should include the payments attributable to interest on the security as income upon receipt. Under these rules, any contingent payment would be taxable upon receipt by a cash basis taxpayer as ordinary interest income. If the securities have a term of more than one year, the IRS might assert that the securities constitute debt instruments that are “contingent payment debt instruments” that are subject to special tax rules under the applicable Treasury regulations governing the recognition of income over the term of your securities. If the securities were to be treated as contingent payment debt instruments, you would be required to include in income on an economic accrual basis over the term of the securities an amount of interest that is based upon the yield at which we would issue a non-contingent fixed-rate debt instrument with other terms and conditions similar to your securities, or the comparable yield. The characterization of securities as contingent payment debt instruments under these rules is likely to be adverse. You should consult your tax advisor regarding the possible tax consequences of characterization of the securities as debt instruments. We are not responsible for any adverse consequences that you may experience as a result of any alternative characterization of the securities for U.S. federal income tax or other tax purposes.

You should consult your tax advisor as to the tax consequences of such characterization and any possible alternative characterizations of your securities for U.S. federal income tax purposes.

U.S. Holders

For purposes of this discussion, the term “U.S. Holder,” for U.S. federal income tax purposes, means a beneficial owner of securities that is (1) a citizen or resident of the United States, (2) a corporation (or an entity treated as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the United States or any state thereof or the District of Columbia, (3) an estate, the income of which is subject to U.S. federal income taxation regardless of its source, or (4) a trust, if (a) a court within the United States is able to exercise primary supervision over the administration of such trust and one or more U.S. persons have the authority to control all substantial decisions of the trust or (b) such trust has in effect a valid election to be treated as a domestic trust for U.S. federal income tax purposes. If a partnership (or an entity treated as a partnership for U.S. federal income tax purposes) holds securities, the U.S. federal income tax treatment of such partnership and a partner in such partnership will generally depend upon the status of the partner and the activities of the partnership. If you are a partnership, or a partner of a partnership, holding securities, you should consult your tax advisor regarding the tax consequences to you from the partnership’s purchase, ownership and disposition of the securities.

In accordance with the agreed-upon tax treatment described above, a U.S. Holder will treat any coupon payment received in respect of a security as ordinary income includible in such U.S. Holder’s income in accordance with the U.S. Holder’s method of accounting. If the security provides for the payment of the redemption amount in cash based on the return of the Reference Shares, upon receipt of the redemption amount of the securities from us, a U.S. Holder will recognize gain or loss equal to the difference between the amount of cash received from us and the U.S. Holder’s tax basis in the security at that time. For securities with a term of more than one year, such gain or loss will be long-term capital gain or loss if the U.S. Holder has held the security for more than one year at maturity. For securities with a term of one year or less, such gain or loss will be short-term capital gain or loss. If the security provides for the payment of the redemption amount in physical shares or units of the Reference Shares, the U.S. Holder should not recognize any gain or loss with respect to the security (other than with respect to cash received in lieu of fractional shares or units, as described below). A U.S. Holder should have a tax basis in all physical shares or units received (including for this purpose any fractional shares or units) equal to its tax basis in the security (generally its cost). A U.S. Holder’s holding period for any physical shares or units received should start on the day after the delivery of the physical shares or units. A U.S. Holder should generally recognize short-term capital gain or loss with respect to cash received in lieu of fractional shares or units in an amount equal to the difference between the amount of such cash received and the U.S. Holder’s basis in the fractional shares or units, which should be equal to the U.S. Holder’s basis in all of the physical shares or units (including the fractional shares or units), multiplied by a fraction, the numerator of which is the fractional shares or units and the denominator of which is all of the physical shares or units (including fractional shares or units).

11

Upon the sale or other taxable disposition of a security, a U.S. Holder generally will recognize gain or loss equal to the difference between the amount realized on the sale or other taxable disposition and the U.S. Holder’s tax basis in the security (generally its cost). For securities with a term of more than one year, such gain or loss will be long-term capital gain or loss if the U.S. Holder has held the security for more than one year at the time of disposition. For securities with a term of one year or less, such gain or loss will be short-term capital gain or loss. It is possible that a portion of the amount realized from the sale or taxable disposition of the securities prior to the payment date attributable to an expected coupon could be treated as ordinary income. You should consult your tax advisor regarding this possibility and the consequences of such treatment to you.

Medicare Tax

Certain U.S. Holders that are individuals, estates, and trusts must pay a 3.8% tax (the “Medicare Tax”) on the lesser of the U.S. person’s (1) “net investment income” or “undistributed net investment income” in the case of an estate or trust and (2) the excess of modified adjusted gross income over a certain specified threshold for the taxable year. “Net investment income” generally includes income from interest, dividends, and net gains from the disposition of property (such as the securities) unless such income or net gains are derived in the ordinary course of a trade or business (other than a trade or business that is a passive activity with respect to the taxpayer or a trade or business of trading in financial instruments or commodities). Net investment income may be reduced by allowable deductions properly allocable to such gross income or net gain. Any interest earned or deemed earned on the securities and any gain on sale or other taxable disposition of the securities will be subject to the Medicare Tax. If you are an individual, estate, or trust, you are urged to consult with your tax advisor regarding application of Medicare Tax to your income and gains in respect of your investment in the securities.

Securities Held Through Foreign Entities

Under the “Hiring Incentives to Restore Employment Act” (“FATCA” or the “Act”) and recently finalized regulations, a 30% withholding tax is imposed on “withholdable payments” and certain “passthru payments” made to “foreign financial institutions” (as defined in the regulations or an applicable intergovernmental agreement) (and their more than 50% affiliates) unless the payee foreign financial institution agrees, among other things, to disclose the identity of any U.S. individual with an account at the institution (or the institution’s affiliates) and to annually report certain information about such account. The term “withholdable payments” generally includes (1) payments of fixed or determinable annual or periodical gains, profits, and income (“FDAP”), in each case, from sources within the United States, and (2) gross proceeds from the sale of any property of a type which can produce interest or dividends from sources within the United States. “Passthru payments” means any withholdable payment and any foreign passthru payment. To avoid becoming subject to the 30% withholding tax on payments to them, we and other foreign financial institutions may be required to report information to the IRS regarding the holders of the securities and, in the case of holders who (i) fail to provide the relevant information, (ii) are foreign financial institutions who have not agreed to comply with these information reporting requirements, or (iii) hold the securities directly or indirectly through such non-compliant foreign financial institutions, we may be required to withhold on a portion of payments under the securities. FATCA also requires withholding agents making withholdable payments to certain foreign entities that do not disclose the name, address, and taxpayer identification number of any substantial U.S. owners (or certify that they do not have any substantial United States owners) to withhold tax at a rate of 30%. If payments on the securities are determined to be from sources within the United States, we will treat such payments as withholdable payments for these purposes.

Withholding under FATCA will apply to all withholdable payments and certain passthru payments without regard to whether the beneficial owner of the payment is a U.S. person, or would otherwise be entitled to an exemption from the imposition of withholding tax pursuant to an applicable tax treaty with the United States or pursuant to U.S. domestic law. Unless a foreign financial institution is the beneficial owner of a payment, it will be subject to refund or credit in accordance with the same procedures and limitations applicable to other taxes withheld on FDAP payments provided that the beneficial owner of the payment furnishes such information as the IRS determines is necessary to determine whether such beneficial owner is a United States owned foreign entity and the identity of any substantial United States owners of such entity.

Pursuant to the recently finalized regulations described above and IRS Notice 2013-43, and subject to the exceptions described below, FATCA’s withholding regime generally will apply to (i) withholdable payments (other than gross proceeds of the type described above) made after June 30, 2014 (other than certain payments made with respect to a “preexisting obligation,” as defined in the regulations); (ii) payments of gross proceeds of the type described above with respect to a sale or disposition occurring after December 31, 2016; and (iii) foreign

12

passthru payments made after the later of December 31, 2016, or the date that final regulations defining the term ”foreign passthru payment” are published. Notwithstanding the foregoing, the provisions of FATCA discussed above generally will not apply to (a) any obligation (other than an instrument that is treated as equity for U.S. tax purposes or that lacks a stated expiration or term) that is outstanding on July 1, 2014 (a “grandfathered obligation”); (b) any obligation that produces withholdable payments solely because the obligation is treated as giving rise to a dividend equivalent pursuant to Code section 871(m) and the regulations thereunder that is outstanding at any point prior to six months after the date on which obligations of its type are first treated as giving rise to dividend equivalents; and (c) any agreement requiring a secured party to make payments with respect to collateral securing one or more grandfathered obligations (even if the collateral is not itself a grandfathered obligation). Thus, if you hold your securities through a foreign financial institution or foreign entity, a portion of any of your payments made after June 30, 2014, may be subject to 30% withholding.

Non-U.S. Holders Generally

The U.S. federal income tax treatment of the coupon payments is unclear. Except as provided under “Securities Held Through Foreign Entities” and “Substitute Dividend and Dividend Equivalent Payments,” we currently do not intend to withhold any tax on any coupon payments made to a holder of the securities that is not a U.S. Holder (a “Non-U.S. Holder”) and that has no connection with the United States other than holding its securities, provided that such Non-U.S. Holder complies with applicable certification requirements. However, it is possible that the IRS could assert that such payments are subject to U.S. withholding tax, or that we or another withholding agent may otherwise determine that withholding is required, in which case we or the other withholding agent may withhold up to 30% on such payments (subject to reduction or elimination of such withholding tax pursuant to an applicable income tax treaty). We will not pay any additional amounts in respect of such withholding.

Except as provided under “Securities Held Through Foreign Entities” and “Substitute Dividend and Dividend Equivalent Payments,” payment of the redemption amount by us in respect to the securities (except to the extent of the coupons) to a Non-U.S. Holder that has no connection with the United States other than holding its securities will not be subject to U.S. withholding tax, provided that such Non-U.S. Holder complies with applicable certification requirements. Any gain realized upon the sale or other disposition of the securities by a Non-U.S. Holder generally will not be subject to U.S. federal income tax unless (1) such gain is effectively connected with a U.S. trade or business of such Non-U.S. Holder or (2) in the case of an individual, such individual is present in the United States for 183 days or more in the taxable year of the sale or other disposition and certain other conditions are met. Any effectively connected gains described in clause (1) above realized by a Non-U.S. Holder that is, or is taxable as, a corporation for U.S. federal income tax purposes may also, under certain circumstances, be subject to an additional branch profits tax at a 30% rate or such lower rate as may be specified by an applicable income tax treaty.

Non-U.S. Holders that are subject to U.S. federal income taxation on a net income basis with respect to their investment in the securities should refer to the discussion above relating to U.S. Holders.

Substitute Dividend and Dividend Equivalent Payments

The Act and regulations thereunder treat a “dividend equivalent” payment as a dividend from sources within the United States. Under the Act, unless reduced by an applicable tax treaty with the United States, such payments generally will be subject to U.S. withholding tax. A “dividend equivalent” payment is (i) a substitute dividend payment made pursuant to a securities lending or a sale-repurchase transaction that (directly or indirectly) is contingent upon, or determined by reference to, the payment of a dividend from sources within the United States, (ii) a payment made pursuant to a “specified notional principal contract” (a “specified NPC”) that (directly or indirectly) is contingent upon, or determined by reference to, the payment of a dividend from sources within the United States, and (iii) any other payment determined by the IRS to be substantially similar to a payment described in the preceding clauses (i) and (ii). For payments made before January 1, 2016, the regulations provide that a specified NPC is any NPC if (a) in connection with entering into the contract, any long party to the contract transfers the underlying security to any short party to the contract, (b) in connection with the termination of the contract, any short party to the contract transfers the underlying security to any long party to the contract, (c) the underlying security is not readily tradable on an established securities market, or (d) in connection with entering into the contract, the underlying security is posted as collateral by any short party to the contract with any long party to the contract.

13

Proposed regulations provide that a dividend equivalent is (i) any payment of a substitute dividend made pursuant to a securities lending or sale-repurchase transaction that references the payment of a dividend from an underlying security, (ii) any payment made pursuant to a specified NPC that references the payment of a dividend from an underlying security, (iii) any payment made pursuant to a specified equity-linked instrument (a “specified ELI”) that references the payment of a dividend from an underlying security, or (iv) any other substantially similar payment. An underlying security is any interest in an entity taxable as a domestic corporation if a payment with respect to that interest could give rise to a U.S. source dividend. An ELI is a financial instrument (other than a securities lending or sale-repurchase transaction or an NPC) or combination of financial instruments that references one or more underlying securities to determine its value, including a futures contract, forward contract, option, contingent payment debt instrument, or other contractual arrangement. For payments made after December 31, 2015, a specified NPC is any NPC that has a delta of 0.70 or greater with respect to an underlying security at the time of acquisition. A specified ELI is any ELI issued on or after 90 days after the date the proposed regulations are finalized that has a delta of 0.70 or greater with respect to an underlying security at the time of acquisition. The delta of an NPC or ELI is the ratio of the change in the fair market value of the contract to the change in the fair market value of the property referenced by the contract. If an NPC or ELI references more than one underlying security, a separate delta must be determined with respect to each underlying security without taking into account any other underlying security or other property or liability. If an NPC (or ELI) references more than one underlying security, the NPC (or ELI) is a specified NPC (or specified ELI) only with respect to underlying securities for which the NPC (or ELI) has a delta of 0.70 or greater at the time that the long party acquires the NPC (or ELI). The proposed regulations provide an exception for qualified indices that satisfy certain criteria; however, it is not entirely clear how the proposed regulations will apply to securities that are linked to certain indices or baskets. The proposed regulations provide that a payment includes a dividend equivalent payment whether there is an explicit or implicit reference to a dividend with respect to the underlying security.

We will treat any portion of a payment or deemed payment on the securities (including, if appropriate, the payment of the purchase price) that is substantially similar to a dividend as a dividend equivalent payment, which will be subject to U.S. withholding tax unless reduced by an applicable tax treaty and a properly executed IRS Form W-8 (or other qualifying documentation) is provided. If withholding applies, we will not be required to pay any additional amounts with respect to amounts withheld. The proposed regulations are extremely complex. Non-U.S. Holders should consult their tax advisors regarding the U.S. federal income tax consequences to them of these proposed regulations and whether payments or deemed payments on the securities constitute dividend equivalent payments.

U.S. Federal Estate Tax Treatment of Non-U.S. Holders

The securities may be subject to U.S. federal estate tax if an individual Non-U.S. Holder holds the securities at the time of his or her death. The gross estate of a Non-U.S. Holder domiciled outside the United States includes only property situated in the United States. Individual Non-U.S. Holders should consult their tax advisors regarding the U.S. federal estate tax consequences of holding the securities at death.

IRS Notice and Proposed Legislation on Certain Financial Transactions

In Notice 2008-2, the IRS and the Treasury Department stated they are considering issuing new regulations or other guidance on whether holders of an instrument such as the securities should be required to accrue income during the term of the instrument. The IRS and Treasury Department also requested taxpayer comments on (1) the appropriate method for accruing income or expense (e.g., a mark-to-market methodology or a method resembling the noncontingent bond method), (2) whether income and gain on such an instrument should be ordinary or capital, and (3) whether foreign holders should be subject to withholding tax on any deemed income accrual. Additionally, unofficial statements made by IRS officials have indicated that they will soon be addressing the treatment of prepaid forward contracts in proposed regulations.

Accordingly, it is possible that regulations or other guidance may be issued that require holders of the securities to recognize income in respect of the securities prior to receipt of any payments thereunder or sale thereof. Any regulations or other guidance that may be issued could result in income and gain (either at maturity or upon sale) in respect of the securities being treated as ordinary income. It is also possible that a Non-U.S. Holder of the securities could be subject to U.S. withholding tax in respect of the securities under such regulations or other guidance. It is not possible to determine whether such regulations or other guidance will apply to your securities (possibly on a retroactive basis). You are urged to consult your tax advisor regarding Notice 2008-2 and its possible impact on you.

14

More recently, on February 26, 2014, the Chairman of the House Ways and Means Committee released in draft form certain proposed legislation relating to financial instruments. If enacted as proposed, the effect of that legislation generally would be to require instruments such as the securities acquired after December 31, 2014, or any securities held after December 31, 2019, to be marked to market on an annual basis with all gains and losses to be treated as ordinary, subject to certain exceptions. You are urged to consult your tax advisor regarding the draft legislation and its possible impact on you.

Information Reporting Regarding Specified Foreign Financial Assets

The Act and temporary and proposed regulations generally require individual U.S. Holders (“specified individuals”) and “specified domestic entities” with an interest in any “specified foreign financial asset” to file an annual report on IRS Form 8938 with information relating to the asset, including the maximum value thereof, for any taxable year in which the aggregate value of all such assets is greater than $50,000 on the last day of the taxable year or $75,000 at any time during the taxable year. Certain individuals are permitted to have an interest in a higher aggregate value of such assets before being required to file a report. The proposed regulations relating to specified domestic entities apply to taxable years beginning after December 31, 2011. Under the proposed regulations, “specified domestic entities” are domestic entities that are formed or used for the purposes of holding, directly or indirectly, specified foreign financial assets. Generally, specified domestic entities are certain closely held corporations and partnerships that meet passive income or passive asset tests and, with certain exceptions, domestic trusts that have a specified individual as a current beneficiary and exceed the reporting threshold. Specified foreign financial assets include any depository or custodial account held at a foreign financial institution; any debt or equity interest in a foreign financial institution if such interest is not regularly traded on an established securities market; and, if not held at a financial institution, (1) any stock or security issued by a non-U.S. person, (2) any financial instrument or contract held for investment where the issuer or counterparty is a non-U.S. person, and (3) any interest in an entity which is a non-U.S. person.

Depending on the aggregate value of your investment in specified foreign financial assets, you may be obligated to file an IRS Form 8938 under this provision if you are an individual U.S. Holder. Pursuant to a recent IRS Notice, reporting by domestic entities of interests in specified foreign financial assets will not be required before the date specified by final regulations, which will not be earlier than taxable years beginning after December 31, 2012. Penalties apply to any failure to file IRS Form 8938. Additionally, in the event a U.S. Holder (either a specified individual or specified domestic entity) does not file such form, the statute of limitations on the assessment and collection of U.S. federal income taxes of such U.S. Holder for the related tax year may not close before the date which is three years after the date such information is filed. You should consult your tax advisor as to the possible application to you of this information reporting requirement and related statute of limitations tolling provision.

Backup Withholding and Information Reporting

A holder of the securities (whether a U.S. Holder or a Non-U.S. Holder) may be subject to backup withholding with respect to certain amounts paid to such holder unless it provides a correct taxpayer identification number, complies with certain certification procedures establishing that it is not a U.S. Holder or establishes proof of another applicable exemption, and otherwise complies with applicable requirements of the backup withholding rules. Backup withholding is not an additional tax. You can claim a credit against your U.S. federal income tax liability for amounts withheld under the backup withholding rules, and amounts in excess of your liability are refundable if you provide the required information to the IRS in a timely fashion. A holder of the securities may also be subject to information reporting to the IRS with respect to certain amounts paid to such holder unless it (1) is a Non-U.S. Holder and provides a properly executed IRS Form W-8 (or other qualifying documentation) or (2) otherwise establishes a basis for exemption.

15

Credit Suisse AG

Credit Suisse AG, London Branch (“CSLB”), was registered in England and Wales on 22 April 1993 and is, among other things, a vehicle for various funding activities of Credit Suisse AG. CSLB exists as part of Credit Suisse AG and is not a separate legal entity, although it has independent status for certain tax and regulatory purposes. CSLB is authorized and regulated by FINMA in Switzerland, is authorized by the Prudential Regulation Authority in the UK and is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority in the UK. CSLB is located at One Cabot Square, London EC14 4QJ, Tel: +44 20 7888 8888. For additional information, see “Credit Suisse AG” in the accompanying product supplement.

Credit Suisse may at any time substitute another of its branches for the branch through which it acts under the securities for all purposes under the securities.

Supplemental Plan of Distribution

Under the terms and subject to the conditions contained in a distribution agreement with Incapital LLC dated March 23, 2012, which we refer to as the distribution agreement, Incapital LLC will act as placement agent for the securities. The placement agents will receive a fee from Credit Suisse or one of our affiliates of $31.25 per $1,000 principal amount of the securities and will forgo fees for sales to fiduciary accounts. For additional information, see “Underwriting (Conflicts of Interest)” in the accompanying product supplement.

We expect to deliver the securities against payment for the securities on the Settlement Date indicated herein, which may be a date that is greater than three business days following the Trade Date. Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in three business days, unless the parties to a trade expressly agree otherwise. Accordingly, if the Settlement Date is more than three business days after the Trade Date, purchasers who wish to transact in the securities more than three business days prior to the Settlement Date will be required to specify alternative settlement arrangements to prevent a failed settlement.

16

Credit Suisse