|

PRELIMINARY PRICING SUPPLEMENT No. U1086

Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-180300-03

Dated September 2, 2014

|

|

|

Investment Description

|

|

Features

|

Key Dates*

|

||

|

o Contingent Coupon — Subject to Automatic Call, you will be entitled to receive a quarterly Contingent Coupon payment if the closing level of each Underlying on the applicable Observation Date is equal to or greater than its respective Coupon Barrier. Otherwise, no coupon will be paid for that quarter.

o Automatically Callable — Credit Suisse will automatically call the Securities and you will be entitled to receive the principal amount of your Securities plus the Contingent Coupon payable for that quarter on the Coupon Payment Date immediately following the applicable Observation Date if the closing level of each Underlying on any Observation Date (quarterly, beginning after one year) is equal to or greater than its respective Initial Level. If the Securities are not called, investors may be exposed to the depreciation of the Least Performing Underlying at maturity.

o Contingent Repayment of Principal Amount at Maturity — If the Securities have not been called and a Trigger Event has not occurred, Credit Suisse will pay you the full principal amount at maturity. If a Trigger Event occurs, Credit Suisse will pay you less than your principal amount, if anything, resulting in a loss of your principal that will be proportionate to the full depreciation of the Least Performing Underlying. The Trigger Level is observed on the Final Valuation Date and the contingent repayment of your principal applies only at maturity. Any payment on the Securities, including any repayment of principal, is subject to the ability of Credit Suisse to pay its obligations as they become due.

|

Trade Date*

|

October 10, 2014

|

|

|

Settlement Date*

|

October 16, 2014

|

||

|

Observation Dates**

|

Quarterly (callable after 1 year) (see page 4)

|

||

|

Final Valuation Date**

|

October 10, 2024

|

||

|

Maturity Date**

|

October 17, 2024

|

||

|

* Expected. See page 4 for additional details.

** The determination of the closing level for each Underlying on each Observation Date, other than the Final Valuation Date, is subject to postponement if such date is not a trading day for such Underlying or as a result of a market disruption event in respect of such Underlying, as described herein under “Market Disruption Events.” The Final Valuation Date is subject to postponement in respect of each Underlying if such date is not an underlying business day for such Underlying or as a result of a market disruption event in respect of such Underlying, as described in the accompanying product supplement under “Description of the Securities—Market disruption events.” The Coupon Payment Dates (including the Maturity Date) are subject to postponement, each as described herein, if such date is not a business day or if (a) the determination of the closing level for any Underlying on the corresponding Observation Date (other than the Final Valuation Date) is postponed or (b) the Final Valuation Date is postponed, in each case because such date is not a trading day or an underlying business day for any Underlying, as applicable, or as a result of a market disruption event in respect of any Underlying

|

|||

|

NOTICE TO INVESTORS: THE SECURITIES ARE SIGNIFICANTLY RISKIER THAN CONVENTIONAL DEBT INSTRUMENTS. THE ISSUER IS NOT NECESSARILY OBLIGATED TO PAY THE FULL PRINCIPAL AMOUNT OF THE SECURITIES AT MATURITY, AND THE SECURITIES CAN EXPOSE YOUR INVESTMENT TO THE FULL DEPRECIATION OF THE LEAST PERFORMING UNDERLYING. THIS MARKET RISK IS IN ADDITION TO THE CREDIT RISK INHERENT IN PURCHASING A DEBT OBLIGATION OF CREDIT SUISSE. YOU SHOULD NOT PURCHASE THE SECURITIES IF YOU DO NOT UNDERSTAND OR ARE NOT COMFORTABLE WITH THE SIGNIFICANT RISKS INVOLVED IN INVESTING IN THE SECURITIES. YOU SHOULD CAREFULLY CONSIDER THE RISKS DESCRIBED UNDER “KEY RISKS” BEGINNING ON PAGE 8 AND UNDER “RISK FACTORS” BEGINNING ON PAGE PS-3 OF THE ACCOMPANYING PRODUCT SUPPLEMENT BEFORE PURCHASING ANY SECURITIES. EVENTS RELATING TO ANY OF THOSE RISKS, OR OTHER RISKS AND UNCERTAINTIES, COULD ADVERSELY AFFECT THE MARKET VALUE OF, AND THE RETURN ON, YOUR SECURITIES. YOU MAY LOSE SOME OR ALL OF YOUR INITIAL INVESTMENT IN THE SECURITIES. THE SECURITIES WILL NOT BE LISTED ON ANY EXCHANGE.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the Securities or passed upon the accuracy or the adequacy of this pricing supplement or the accompanying underlying supplement, the product supplement, the prospectus supplement and the prospectus. Any representation to the contrary is a criminal offense.

|

|

Security Offering

|

|

Underlyings

|

Tickers

|

Contingent

Coupon Rate

|

Initial Levels

|

Trigger Levels

|

Coupon Barriers

|

CUSIP

|

ISIN

|

|

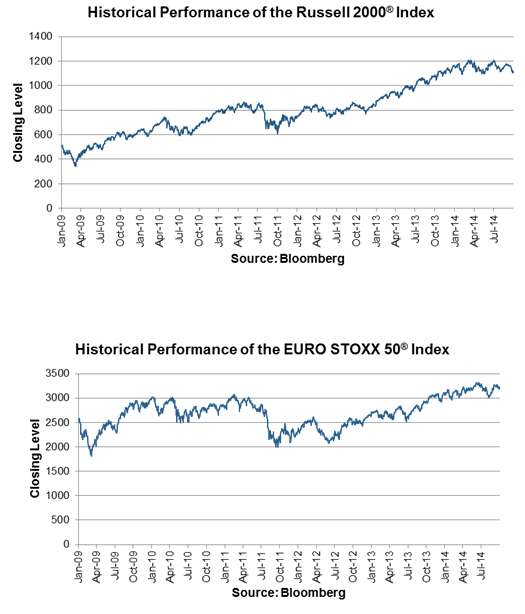

Russell 2000® Index

|

RTY

|

7.75% to 8.25% per annum

|

•

|

50% of the Initial Level

|

70% of the Initial Level

|

22547T225

|

US22547T2252

|

|

EURO STOXX 50® Index

|

SX5E

|

•

|

50% of the Initial Level

|

70% of the Initial Level

|

|

Offering of Securities

|

Price to Public

|

Underwriting Discount and Commissions(2)

|

Proceeds to Credit Suisse AG

|

|||

|

Total

|

Per Security

|

Total

|

Per Security

|

Total

|

Per Security

|

|

|

Securities linked to the least performing index between the Russell 2000® Index and the EURO STOXX 50® Index

|

$•

|

$10.00

|

$•

|

$0.35

|

$•

|

$9.65

|

|

Additional Information about Credit Suisse and the Securities

|

|

¨

|

Underlying supplement dated July 29, 2013:

|

|

¨

|

Product supplement No. U-I dated March 23, 2012:

|

|

¨

|

Prospectus supplement and Prospectus dated March 23, 2012:

|

|

Investor Suitability

|

|

The Securities may be suitable for you if:

|

The Securities may not be suitable for you if:

|

|

|

¨ You fully understand the risks inherent in an investment in the Securities, including the risk of loss of your entire initial investment.

¨ You can tolerate a loss of all or a substantial portion of your investment and are willing to make an investment that may be exposed to the depreciation of the Least Performing Underlying.

¨ You understand that your return will be based on the Underlying Return of the Least Performing Underlying, you will not benefit from the performance of any other Underlying, and you will be fully exposed to the risk of fluctuations in the level of each Underlying.

¨ You believe the closing level of each Underlying will be equal to or greater than its respective Coupon Barrier on each of the Observation Dates, and you believe a Trigger Event will not occur, meaning each Underlying will close at or above its respective Trigger Level on the Final Valuation Date.

¨ You understand and accept that you will not participate in any appreciation in the levels of the Underlyings, which may be significant, and that your potential return is limited to the Contingent Coupon payments, if any.

¨ You would be willing to invest in the Securities if the Contingent Coupon Rate were set equal to the bottom of the range indicated on the cover hereof (the actual Contingent Coupon Rate will be set on the Trade Date).

¨ You are willing to forgo any dividends paid on the equity securities included in the Underlyings.

¨ You do not seek guaranteed current income from your investment.

¨ You are willing to invest in securities that are subject to potential Automatic Call after one year, and you are otherwise willing to hold such securities to maturity and accept that there may be little or no secondary market for the Securities.

¨ You seek an investment with exposure to companies in the Eurozone and small market capitalization companies in the United States.

¨ You are willing to assume the credit risk of Credit Suisse for all payments under the Securities, and understand that the payment of any amount due on the Securities is subject to the credit risk of Credit Suisse.

|

¨ You do not fully understand the risks inherent in an investment in the Securities, including the risk of loss of your entire initial investment.

¨ You seek an investment designed to provide a full return of principal at maturity.

¨ You cannot tolerate a loss of all or a substantial portion of your investment, and you are not willing to make an investment that may be exposed to the depreciation of the Least Performing Underlying.

¨ You are unwilling to accept that your return will be based on the Least Performing Underlying, you will not benefit from the performance of any other Underlying and you will be fully exposed to the risk of fluctuations in the level of each Underlying.

¨ You believe that any one of the Underlyings will close below its Coupon Barrier on the Observation Dates or you believe a Trigger Event will occur, meaning the closing level of any one of the Underlyings will be below its Trigger Level on the Final Valuation Date.

¨ You seek an investment that participates in the full appreciation in the level of the Underlyings, and whose return is not limited to the Contingent Coupon payments, if any.

¨ You would not be willing to invest in the Securities if the Contingent Coupon Rate were set equal to the bottom of the range indicated on the cover hereof (the actual Contingent Coupon Rate will be set on the Trade Date).

¨ You seek guaranteed current income from your investment.

¨ You prefer to receive the dividends paid on the equity securities included in the Underlyings.

¨ You are unable or unwilling to hold securities that are subject to potential Automatic Call after one year or are otherwise unable or unwilling to hold such securities to maturity or you seek an investment for which there will be an active secondary market for the Securities.

¨ You do not seek an investment with exposure to companies in the Eurozone and small market capitalization companies in the United States.

¨ You are unwilling to assume the credit risk of Credit Suisse for all payments under the Securities.

|

|

Indicative Terms

|

|

Issuer

|

Credit Suisse AG (“Credit Suisse”), acting through its London Branch.

|

||

|

Principal

Amount

|

$10.00 per Security

|

||

|

Term(1)

|

Approximately 10 years, unless called earlier. In the event that we make any change to the expected Trade Date and Settlement Date, the calculation agent may adjust (i) the Observation Dates to ensure that the term between each Observation Date remains the same and/or (ii) Final Valuation Date and Maturity Date to ensure that the stated term of the Securities remains the same.

|

||

|

Underlyings

|

The Russell 2000® Index and the EURO STOXX 50® Index.

|

||

|

Contingent

Coupon

|

If the closing level of each Underlying is equal to or greater than its respective Coupon Barrier on any Observation Date, Credit Suisse will pay you the Contingent Coupon applicable to such Observation Date.

If the closing level of any Underlying is less than its respective Coupon Barrier on any Observation Date, the Contingent Coupon applicable to such Observation Date will not accrue or be payable and you will not be entitled to receive any payment on the relevant Coupon Payment Date.

Contingent Coupons will be calculated on a 30/360 basis from and including the Settlement Date to and excluding the earlier of the Automatic Call Date and the Maturity Date, as applicable. The table below sets forth a hypothetical Contingent Coupon amount (based on a hypothetical Contingent Coupon Rate of 8.00% per annum) that would be applicable to each Observation Date on which the closing level of each Underlying is greater than or equal to its respective Coupon Barrier.

|

||

|

Contingent Coupon (per Security)

Russell 2000® Index and EURO STOXX 50® Index

|

|||

|

$0.20

|

|||

|

Contingent Coupon payments on the Securities are not guaranteed. Credit Suisse will not pay you the Contingent Coupon for any Observation Date on which the closing level of any Underlying is less than its Coupon Barrier.

|

|||

|

Trigger Event

|

A Trigger Event will occur if the Final Level of any Underlying is less than its Trigger Level.

In this case, you will be fully exposed to any depreciation in the level of the Least Performing Underlying from the Trade Date to the Final Valuation Date.

|

||

|

Contingent

Coupon

Rate

|

The Contingent Coupon rate is expected to be between 7.75% to 8.25% per annum for Securities linked to the Least Performing Underlying between the Russell 2000® Index and the EURO STOXX 50® Index. The actual Contingent Coupon Rate will be determined on the Trade Date.

|

||

|

Automatic Call

Feature

|

The Securities will be automatically called if the closing level of each Underlying on any Observation Date (quarterly, beginning October 14, 2015) is equal to or greater than its respective Initial Level.

If the Securities are called on any Observation Date (quarterly, beginning October 14, 2015), on the Coupon Payment Date immediately following the relevant Observation Date (the “Automatic Call Date”), you will be entitled to receive a cash payment per Security equal to your principal amount plus the Contingent Coupon payable on that Coupon Payment Date. No further amounts will be owed to you under the Securities.

The Securities will not be subject to an Automatic Call on an Observation Date (quarterly, beginning October 14, 2015) if the closing level of any Underlying on such Observation Date is below its Initial Level.

|

|||

|

Payment

at

Maturity (per Security)

|

If the Securities are not called, a Trigger Event does not occur, and the Final Level of each Underlying is equal to or greater than its respective Coupon Barrier, on the Maturity Date Credit Suisse will pay you a cash payment per Security equal to $10.00 plus the contingent coupon payable.

If the Securities are not called, a Trigger Event does not occur and the Final Level of any Underlying is less than its Coupon Barrier, on the Maturity Date Credit Suisse will pay you a cash payment per Security equal to $10.00.

If the Securities are not called and a Trigger Event occurs, on the Maturity Date, Credit Suisse will pay you less than the principal amount, if anything, resulting in a loss on your initial investment that is proportionate to the depreciation in the Underlying Return of the Least Performing Underlying, for an amount equal to:

$10.00 + ($10.00 x Underlying Return of the Least Performing Underlying)

You will lose some or all of your principal amount if the Securities are not called and a Trigger Event occurs.

|

|||

|

Indicative Terms

|

|

Least Performing Underlying

|

The Underlying with the lowest Underlying Return.

|

||

|

Underlying Return

|

For each Underlying, calculated as follows:

Final Level – Initial Level

Initial Level

|

||

|

Trigger Level

|

A percentage of the Initial Level of each Underlying, as specified on the first page of this pricing supplement.

|

||

|

Coupon Barrier

|

A percentage of the Initial Level of each Underlying, as specified on the first page of this pricing supplement.

|

||

|

Initial Level

|

The closing level of each Underlying on the Trade Date. In the event that the closing level for any Underlying is not available on the Trade Date, the Initial Level for such Underlying will be determined on the immediately following trading day on which a closing level is available.

|

|

Final Level

|

The closing level of each Underlying on the Final Valuation Date, as determined by the calculation agent.

|

|

Observation Dates

|

The first Observation Date will occur on or about January 14, 2015; Observation Dates will occur quarterly thereafter as listed in the “Observation Dates/Coupon Payment Dates” section below. The final Observation Date, October 10, 2024, will be the “Final Valuation Date.”

|

|

Coupon Payment Dates

|

Three business days following each Observation Date, except that the Coupon Payment Date for the Final Valuation Date is the Maturity Date.

|

|

Product Supplement Defined Term

|

Pricing Supplement Defined Term

|

|

Knock-In Level

|

Trigger Level

|

|

Knock-In Event

|

Trigger Event

|

|

Lowest Performing Underlying

|

Least Performing Underlying

|

|

Valuation Date

|

Final Valuation Date

|

|

Investment Timeline

|

|

Trade Date

|

The Contingent Coupon Rate is set, the Initial Level of each Underlying is observed, and the Trigger Level and Coupon Barrier for each Underlying are determined.

|

|

|

|

Quarterly

(callable after 1 year)

|

If the closing level of each Underlying is equal to or greater than its respective Coupon Barrier on any Observation Date, Credit Suisse will pay you a Contingent Coupon on the applicable Coupon Payment Date.

The Securities will be called if the closing level of each Underlying on any Observation Date on or after October 14, 2015 is equal to or greater than its respective Initial Level. If the Securities are called, Credit Suisse will pay you a cash payment per Security equal to $10.00 plus the Contingent Coupon payable on the Automatic Call Date.

|

|

|

|

Maturity date

|

The Final Level of each Underlying is observed on the Final Valuation Date.

If the Securities are not called, a Trigger Event has not occurred and the Final Level of each Underlying is equal to or greater than its respective Coupon Barrier, on the Maturity Date Credit Suisse will pay you a cash payment per Security equal to $10.00 plus the Contingent Coupon payable.

If the Securities have not been called, a Trigger Event has not occurred and the Final Level of any Underlying is less than its Coupon Barrier, on the Maturity Date, Credit Suisse will pay you a cash payment per Security equal to $10.00.

If the Securities have not been called and a Trigger Event has occurred, Credit Suisse will pay you less than the principal amount, if anything, resulting in a loss on your initial investment proportionate to the depreciation of the Least Performing Underlying, for an amount equal to:

$10.00 + ($10.00 x Underlying Return of the Least Performing Underlying)

per Security

|

|

Observation Dates(1) and Coupon Payment Dates(2)(3)

|

|||||

|

Observation Dates

|

Coupon Payment Dates

|

Observation Dates

|

Coupon Payment Dates

|

Observation Dates

|

Coupon Payment Dates

|

|

January 14, 2015*

|

January 16, 2015*

|

July 12, 2018

|

July 16, 2018

|

January 13, 2022

|

January 18, 2022

|

|

April 14, 2015*

|

April 16, 2015*

|

October 12, 2018

|

October 16, 2018

|

April 13, 2022

|

April 18, 2022

|

|

July 14, 2015*

|

July 16, 2015*

|

January 14, 2019

|

January 16, 2019

|

July 14, 2022

|

July 18, 2022

|

|

October 14, 2015

|

October 16, 2015

|

April 12, 2019

|

April 16, 2019

|

October 13, 2022

|

October 17, 2022

|

|

January 14, 2016

|

January 19, 2016

|

July 12, 2019

|

July 16, 2019

|

January 12, 2023

|

January 17, 2023

|

|

April 14, 2016

|

April 18, 2016

|

October 14, 2019

|

October 16, 2019

|

April 13, 2023

|

April 17, 2023

|

|

July 14, 2016

|

July 18, 2016

|

January 14, 2020

|

January 16, 2020

|

July 13, 2023

|

July 17, 2023

|

|

October 13, 2016

|

October 17, 2016

|

April 14, 2020

|

April 16, 2020

|

October 12, 2023

|

October 16, 2023

|

|

January 12, 2017

|

January 17, 2017

|

July 14, 2020

|

July 16, 2020

|

January 11, 2024

|

January 16, 2024

|

|

April 12, 2017

|

April 17, 2017

|

October 14, 2020

|

October 16, 2020

|

April 12, 2024

|

April 16, 2024

|

|

July 13, 2017

|

July 17, 2017

|

January 14, 2021

|

January 19, 2021

|

July 12, 2024

|

July 16, 2024

|

|

October 12, 2017

|

October 16, 2017

|

April 14, 2021

|

April 16, 2021

|

October 10, 2024

|

October 17, 2024

|

|

January 11, 2018

|

January 16, 2018

|

July 14, 2021

|

July 16, 2021

|

||

|

April 12, 2018

|

April 16, 2018

|

October 14, 2021

|

October 18, 2021

|

||

|

*

|

The Securities are not callable until the fourth Observation Date, which is October 14, 2015.

|

|

(1)

|

The determination of the closing level for each Underlying on each Observation Date, other than the Final Valuation Date, is subject to postponement, as described herein under “Market Disruption Events.”

|

|

(2)

|

Each subject to the modified following business day convention and subject to postponement as described herein under “Market Disruption Events.”

|

|

(3)

|

Contingent Coupons will be payable to the holders of record at the close of business on the business day immediately preceding the applicable Coupon Payment Date, provided that the Contingent Coupon payable upon Automatic Call or at maturity, as applicable, will be payable to the person to whom the principal amount upon Automatic Call or the Payment at Maturity, is payable.

|

|

Key Risks

|

|

¨

|

You may receive less than the principal amount at maturity — You may receive less at maturity than you originally invested in the Securities. If the Final Level of any Underlying is less than its Trigger Level, you will be fully exposed to any depreciation in the Least Performing Underlying and will incur a loss proportionate to the Underlying Return of the Least Performing Underlying. In this case, at maturity, the amount Credit Suisse will pay you will be less than the principal amount of the Securities and you could lose your entire investment. It is not possible to predict whether a Trigger Event will occur, and in the event that there is a Trigger Event, by how much the Final Level of the Least Performing Underlying will decrease in comparison to its Initial Level. Any payment on the Securities is subject to our ability to pay our obligations as they become due.

|

|

¨

|

The Securities are subject to the credit risk of Credit Suisse — Although the return on the Securities will be based on the performance of the Underlyings, the payment of any amount due on the Securities, including any applicable Contingent Coupon payments, if any, Automatic Call payment and Payment at Maturity, is subject to the credit risk of Credit Suisse. Investors are dependent on our ability to pay all amounts due on the Securities and, therefore, investors are subject to our credit risk. In addition, any decline in our credit ratings, any adverse changes in the market’s view of our creditworthiness or any increase in our credit spreads is likely to adversely affect the value of the Securities prior to maturity.

|

|

¨

|

The Securities will not pay more than the principal amount, plus any Contingent Coupons payable by maturity or upon Automatic Call — The return potential on the Securities is limited to the Contingent Coupon Rate regardless of the potential appreciation of the Underlyings. Therefore, the Securities do not provide for a return greater than the principal amount, plus any Contingent Coupons received up to maturity or upon Automatic Call. Even if the Final Level of each Underlying is greater than its respective Initial Level, you will not participate in the appreciation of any Underlying despite the potential for full downside exposure to the Least Performing Underlying at maturity. The actual return on the Securities will depend on the number of Observation Dates on which the requirements for the Contingent Coupon are met and the amount payable per Security may be less than the amount payable on a traditional debt security that pays interest at prevailing market rates or an investment that allows for participation in any appreciation of the Underlyings.

|

|

¨

|

The Securities are subject to a potential Automatic Call prior to maturity, which would limit your opportunity to accrue Contingent Coupons over the full term of the Securities —If the closing level of each Underlying on any Observation Date after one year is equal to or greater than its Initial Level, the Securities will be called and you will be entitled to receive a cash payment equal to the principal amount of the Securities you hold plus the Contingent Coupon payable on that Coupon Payment Date, and no further payments will be made in respect of the Securities. If the Securities are called prior to maturity, you will lose the opportunity to continue to accrue and be paid Contingent Coupons from the date of Automatic Call to the scheduled Maturity Date and you may be unable to invest in other Securities with a similar level of risk that yield as much as the Securities.

|

|

¨

|

You may not receive any Contingent Coupons — Credit Suisse will not necessarily make periodic coupon payments on the Securities. If the closing level of any one of the Underlyings on an Observation Date is less than its respective Coupon Barrier, Credit Suisse will not pay you the Contingent Coupon applicable to such Observation Date. If the closing level of any one of the Underlyings is less than its respective Coupon Barrier on each of the Observation Dates, Credit Suisse will not pay you any Contingent Coupons during the term of, and you will not receive a positive return on, your Securities.

|

|

¨

|

Higher contingent coupon rates are generally associated with a greater risk of loss — Greater expected volatility with respect to the Underlyings reflects a higher expectation as of the Trade Date that the level of any Underlying could close below its respective Trigger Level on the Final Valuation Date of the Securities. This greater expected risk will generally be reflected in a higher Contingent Coupon Rate for that Security. However, while the Contingent Coupon Rate will be a fixed amount, the volatilities of the Underlyings can change significantly over

|

|

|

the term of the Securities. The levels of the Underlyings for your Securities could fall sharply, which could result in a significant loss of principal.

|

|

¨

|

The Payment at Maturity will be less than the principal amount of the Securities even if a Trigger Event occurs with respect to only one Underlying – Even if the Final Level of only one Underlying is less than its Trigger Level, a Trigger Event will have occurred. In this case, the Payment at Maturity will be less than the principal amount of the Securities.

|

|

¨

|

Your return will be based on the individual return of each Underlying —If the closing level of any Underlying is less than its respective Coupon Barrier on any Observation Date, even with respect to only one Underlying, you will not receive any Contingent Coupon payment for the corresponding quarter. Additionally, because the Payment at Maturity will be based on the Underlying Return of the Least Performing Underlying, you will not benefit from the performance of any other Underlying. If a Trigger Event occurs, even with respect to only one Underlying, the Underlying Return of the Least Performing Underlying will be negative and you will receive less than the principal amount of your securities at maturity.

|

|

¨

|

Since the Securities are linked to the performance of more than one Underlying, you will be fully exposed to the risk of fluctuations in the level of each Underlying — Since the Securities are linked to the performance of more than one Underlying, the Securities will be linked to the individual performance of each Underlying. Because the Securities are not linked to a basket, in which case the risk is mitigated and diversified among all of the components of a basket, you will be exposed to the risk of fluctuations in the levels of the Underlyings to the same degree for each Underlying. For example, in the case of Securities linked to a basket, the return would depend on the weighted aggregate performance of the basket components as reflected by the basket return. Thus, the depreciation of any basket component could be mitigated by the appreciation of another basket component, to the extent of the weightings of such components in the basket. However, in the case of Securities linked to the least performing Underlying, the individual performance of each Underlying is not combined to calculate your return and the depreciation of any Underlying is not mitigated by the appreciation of any other Underlying. Instead, if a Trigger Event occurs, the Payment at Maturity will be based on the least performing of the Underlyings to which the Securities are linked. Likewise, if on any Observation Date, the closing level of any Underlying is less than its Coupon Barrier, no Contingent Coupon will be paid for the corresponding quarter. Because the Securities are linked to the individual performance of more than one Underlying, it is more likely that one of the Underlyings will close below its Coupon Barrier on an Observation Date, and below its Trigger Level on the Final Valuation Date, thereby making it more likely that you will not receive a Contingent Coupon and will lose some or all of your investment at maturity.

|

|

¨

|

The Securities are linked to the Russell 2000® Index and are subject to the risks associated with small-capitalization companies — The Russell 2000® Index is composed of equity securities issued by companies with relatively small market capitalization. These equity securities often have greater stock price volatility, lower trading volume and less liquidity than the equity securities of large-capitalization companies, and are more vulnerable to adverse business and economic developments than those of large-capitalization companies. In addition, small-capitalization companies are typically less established and less stable financially than large-capitalization companies. These companies may depend on a small number of key personnel, making them more vulnerable to loss of personnel. Such companies tend to have smaller revenues, less diverse product lines, smaller shares of their product or service markets, fewer financial resources and less competitive strengths than large-capitalization companies and are more susceptible to adverse developments related to their products. Therefore, the Russell 2000® Index may be more volatile than it would be if it were composed of equity securities issued by large-capitalization companies.

|

|

¨

|

The closing level of the EURO STOXX 50® Index will not be adjusted for changes in exchange rates relative to the U.S. dollar even though the index constituent stocks are traded in a foreign currency and the Securities are denominated in U.S. dollars — The value of your Securities will not be adjusted for exchange rate fluctuations between the U.S. dollar and the currencies in which the index constituent stocks of the EURO STOXX 50® Index are based. Therefore, if the applicable currencies appreciate or depreciate relative to the U.S. dollar over the term of the Securities, you will not receive any additional payment or incur any reduction in your return, if any, at maturity.

|

|

¨

|

Risks associated with investments in securities linked to the performance of foreign equity securities — The equity securities included in one of the Underlyings are issued by foreign companies and trade in foreign

|

|

|

securities markets. Investments in securities linked to the value of foreign equity securities involve risks associated with the securities markets in those countries, including the risk of volatility in those markets, governmental intervention in those markets and cross-shareholdings in companies in certain countries. Foreign companies are subject to accounting, auditing and financial reporting standards and requirements different from those applicable to U.S. reporting companies.

|

|

¨

|

The estimated value of the Securities on the Trade Date may be less than the Price to Public — The initial estimated value of your Securities on the Trade Date (as determined by reference to our pricing models and our internal funding rate) may be significantly less than the original Price to Public. The Price to Public of the Securities includes the agent’s discounts or commissions as well as transaction costs such as expenses incurred to create, document and market the Securities and the cost of hedging our risks as issuer of the Securities through one or more of our affiliates (which includes a projected profit). These costs will be effectively borne by you as an investor in the Securities. These amounts will be retained by Credit Suisse or our affiliates in connection with our structuring and offering of the Securities (except to the extent discounts or commissions are reallowed to other broker-dealers or any costs are paid to third parties).

|

|

|

On the Trade Date, we value the components of the Securities in accordance with our pricing models. These include a fixed income component valued using our internal funding rate, and individual option components valued using mid-market pricing. Our option valuation models are proprietary. They take into account factors such as interest rates, volatility and time to maturity of the Securities, and they rely in part on certain assumptions about future events, which may prove to be incorrect.

|

|

¨

|

Effect of interest rate used in structuring the Securities — The internal funding rate we use in structuring notes such as these Securities is typically lower than the interest rate that is reflected in the yield on our conventional debt securities of similar maturity in the secondary market (our “secondary market credit spreads”). If on the Trade Date our internal funding rate is lower than our secondary market credit spreads, we expect that the economic terms of the Securities will generally be less favorable to you than they would have been if our secondary market credit spread had been used in structuring the Securities. We will also use our internal funding rate to determine the price of the Securities if we post a bid to repurchase your Securities in secondary market transactions. See “—Secondary Market Prices” below.

|

|

¨

|

Secondary market prices — If Credit Suisse (or an affiliate) bids for your Securities in secondary market transactions, which we are not obligated to do, the secondary market price (and the value used for account statements or otherwise) may be higher or lower than the Price to Public and the estimated value of the Securities on the Trade Date. The estimated value of the Securities on the cover of this pricing supplement does not represent a minimum price at which we would be willing to buy the Securities in the secondary market (if any exists) at any time. The secondary market price of your Securities at any time cannot be predicted and will reflect the then-current estimated value determined by reference to our pricing models and other factors. These other factors include our internal funding rate, customary bid and ask spreads and other transaction costs, changes in market conditions and any deterioration or improvement in our creditworthiness. In circumstances where our internal funding rate is lower than our secondary market credit spreads, our secondary market bid for your Securities could be more favorable than what other dealers might bid because, assuming all else equal, we use the lower internal funding rate to price the Securities and other dealers might use the higher secondary market credit spread to price them. Furthermore, assuming no change in market conditions from the Trade Date, the secondary market price of your Securities will be lower than the Price to Public because it will not include the agent’s discounts or commissions and hedging and other transaction costs. If you sell your Securities to a dealer in a secondary market transaction, the dealer may impose an additional discount or commission, and as a result the price you receive on your Securities may be lower than the price at which we may repurchase the Securities from such dealer.

|

|

|

We (or an affiliate) may initially post a bid to repurchase the Securities from you at a price that will exceed the then-current estimated value of the Securities. That higher price reflects our projected profit and costs that were included in the Price to Public, and that higher price may also be initially used for account statements or

|

|

|

otherwise. We (or our affiliate) may offer to pay this higher price, for your benefit, but the amount of any excess over the then-current estimated value will be temporary and is expected to decline over a period of approximately 12 months.

|

|

|

The Securities are not designed to be short-term trading instruments and any sale prior to maturity could result in a substantial loss to you. You should be willing and able to hold your Securities to maturity.

|

|

¨

|

Lack of liquidity — The Securities will not be listed on any securities exchange. Credit Suisse (or its affiliates) intends to offer to purchase the Securities in the secondary market but is not required to do so. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the Securities when you wish to do so. Because other dealers are not likely to make a secondary market for the Securities, the price at which you may be able to trade your Securities is likely to depend on the price, if any, at which Credit Suisse (or its affiliates) is willing to buy the Securities. If you have to sell your Securities prior to maturity, you may not be able to do so or you may have to sell them at a substantial loss. The full repayment of principal is contingent upon an Automatic Call or, if the Securities are not called, a Trigger Event not occurring. Because a Trigger Event is determined by observing the Trigger Levels only on the Final Valuation Date, if you are able to sell your Securities prior to maturity in the secondary market, you may have to sell them at a loss even if the levels of all of the Underlyings are above their respective Trigger Levels at that time.

|

|

¨

|

Potential conflicts — We and our affiliates play a variety of roles in connection with the issuance of the Securities, including acting as calculation agent, hedging our obligations under the Securities and determining their estimated value. In performing these duties, the economic interests of us and our affiliates are potentially adverse to your interests as an investor in the Securities. Further, hedging activities may adversely affect any payment on or the value of the Securities. Any profit in connection with such hedging activities will be in addition to any other compensation that we and our affiliates receive for the sale of the Securities, which creates an additional incentive to sell the Securities to you.

|

|

¨

|

Many economic and market factors will affect the value of the Securities — In addition to the levels of the Underlyings, the value of the Securities will be affected by a number of economic and market factors that may either offset or magnify each other, including:

|

|

|

o

|

the expected volatility of the Underlyings;

|

|

|

o

|

the time to maturity of the Securities;

|

|

|

o

|

the Automatic Call feature, which would limit the value of the Securities;

|

|

|

o

|

interest and yield rates in the market generally;

|

|

|

o

|

geopolitical conditions and a variety of economic, financial, political, regulatory or judicial events that affect the components comprising the Underlyings or markets generally and which may affect the levels of the Underlyings; and

|

|

|

o

|

our creditworthiness, including actual or anticipated downgrades in our credit ratings.

|

|

¨

|

No ownership rights relating to the Underlyings — Your return on the Securities will not reflect the return you would realize if you actually owned the assets that comprise the Underlyings. The return on your investment, which is based on the percentage change in the Underlyings, is not the same as the total return you would receive based on the purchase of the equity securities that comprise the Underlyings.

|

|

¨

|

No dividend payments or voting rights — As a holder of the Securities, you will not have voting rights or rights to receive cash dividends or other distributions or other rights with respect to the equity securities that comprise the Underlyings. Further, the performance of the Underlyings will not include these dividends or distributions and does not contain a "total return" feature.

|

|

Hypothetical Examples of How the Securities Might Perform

|

|

Principal Amount:

|

$10.00

|

|

Term:

|

Approximately 10 years

|

|

Contingent Coupon Rate:

|

8.00% per annum (or 2.00% per quarter)

|

|

Contingent Coupon:

|

$0.20 per quarter

|

|

Observation Dates:

|

Quarterly (callable after 1 year)

|

|

Initial Level:

|

|

|

Underlying A:

|

1100.00

|

|

Underlying B:

|

3200.00

|

|

Coupon Barrier:

|

|

|

Underlying A:

|

770.00 (70% of the Initial Level)

|

|

Underlying B:

|

2240.00 (70% of the Initial Level)

|

|

Trigger Level:

|

|

|

Underlying A:

|

550.00 (50% of the Initial Level)

|

|

Underlying B:

|

1600.00 (50% of the Initial Level)

|

|

Date

|

Closing Level

|

Payment (per Security)

|

|

First Observation Date

|

Underlying A: 1500.00 (at or above Initial Level and Coupon Barrier)

Underlying B: 3300.00 (at or above Initial Level and Coupon Barrier)

|

Securities NOT callable; Contingent Coupon payment equals $0.20 on first Coupon Payment Date.

|

|

Second Observation Date

|

Underlying A: 1600.00 (at or above Initial Level and Coupon Barrier)

Underlying B: 3400.00 (at or above Initial Level and Coupon Barrier)

|

Securities NOT callable; Contingent Coupon payment equals $0.20 on second Coupon Payment Date.

|

|

Third Observation Date

|

Underlying A: 1400.00 (at or above Initial Level and Coupon Barrier)

Underlying B: 3300.00 (at or above Initial Level and Coupon Barrier)

|

Securities NOT callable; Contingent Coupon payment equals $0.20 on third Coupon Payment Date.

|

|

Fourth Observation Date

|

Underlying A: 1600.00 (at or above Initial Level and Coupon Barrier)

Underlying B: 3250.00 (at or above Initial Level and Coupon Barrier)

|

Securities called; holder entitled to principal plus Contingent Coupon payment of $0.20 on Automatic Call Date.

|

|

Total Payment (per $10.00 Security)

|

$10.8000 (8.0000% total return)

|

|

Date

|

Closing Level

|

Payment (per Security)

|

|

First Observation Date

|

Underlying A: 1000.00 (at or above Coupon Barrier; below Initial Level)

Underlying B: 3000.00 (at or above Coupon Barrier; below Initial Level)

|

Securities NOT callable; Contingent Coupon payment equals $0.20 on first Coupon Payment Date.

|

|

Second Observation Date

|

Underlying A: 1300.00 (at or above Initial Level and Coupon Barrier)

Underlying B: 3400.00 (at or above Initial Level and Coupon Barrier)

|

Securities NOT callable; Contingent Coupon payment equals $0.20 on second Coupon Payment Date.

|

|

Third Observation Date

|

Underlying A: 1400.00 (at or above Initial Level and Coupon Barrier)

Underlying B: 2000.00 (below Initial Level and Coupon Barrier)

|

Securities NOT callable; Issuer DOES NOT pay Contingent Coupon on third Coupon Payment Date.

|

|

Fourth through Thirty-ninth Observation Dates

|

Underlying A: Various (all at or above Coupon Barrier; below Initial Level)

Underlying B: Various (all below Coupon Barrier)

|

Securities NOT callable; Issuer DOES NOT pay Contingent Coupon payment on any Coupon Payment Date immediately following the fourth through thirty-ninth Observation Date.

|

|

Final Valuation Date

|

Underlying A: 1000.00 (at or above Coupon Barrier and Trigger Level; below Initial Level)

Underlying B: 3000.00 (at or above Coupon Barrier and Trigger Level; below Initial Level)

|

Securities NOT callable; holder is entitled to receive principal plus Contingent Coupon payment of $0.20 on Maturity Date.

|

|

Total Payment (per $10.00 Security)

|

$10.6000 (6.0000% total return)

|

|

Date

|

Closing Level

|

Payment (per Security)

|

|

First Observation Date

|

Underlying A: 1000.00 (at or above Coupon Barrier; below Initial Level)

Underlying B: 3000.00 (at or above Coupon Barrier; below Initial Level)

|

Securities NOT callable; Contingent Coupon payment equals $0.20 on first Coupon Payment Date.

|

|

Second Observation Date

|

Underlying A: 1400.00 (at or above Initial Level and Coupon Barrier)

Underlying B: 3300.00 (at or above Initial Level and Coupon Barrier)

|

Securities NOT callable; Contingent Coupon payment equals $0.20 on second Coupon Payment Date.

|

|

Third Observation Date

|

Underlying A: 1300.00 (at or above Initial Level and Coupon Barrier)

Underlying B: 2100.00 (below Initial Level and Coupon Barrier)

|

Securities NOT callable; Issuer DOES NOT pay Contingent Coupon on third Coupon Payment Date.

|

|

Fourth through Thirty-ninth Observation Dates

|

Underlying A: Various (all at or above Coupon Barrier; below Initial Level)

Underlying B: Various (all below Coupon Barrier)

|

Securities NOT callable; Issuer DOES NOT pay Contingent Coupon payment on any Coupon Payment Date immediately following the fourth through the thirty-ninth Observation Dates.

|

|

Final Valuation Date

|

Underlying A: 750.00 (at or above Trigger Level; below Initial Level and Coupon Barrier)

Underlying B: 2000.00 (at or above Trigger Level; below Initial Level and Coupon Barrier)

|

Securities NOT callable; holder is entitled to receive the principal amount on Maturity Date.

|

|

Total Payment (per $10.00 Security)

|

$10.4000 (4.0000% total return)

|

|

Date

|

Closing Level

|

Payment (per Security)

|

|

First Observation Date

|

Underlying A: 1000.00 (at or above Coupon Barrier; below Initial Level)

Underlying B: 3000.00 (at or above Coupon Barrier; below Initial Level)

|

Securities NOT callable; Contingent Coupon payment equals $0.20 on first Coupon Payment Date.

|

|

Second Observation Date

|

Underlying A: 900.00 (at or above Coupon Barrier; below Initial Level)

Underlying B: 2900.00 (at or above Coupon Barrier; below Initial Level)

|

Securities NOT callable; Contingent Coupon payment equals $0.20 on second Coupon Payment Date.

|

|

Third Observation Date

|

Underlying A: 1400.00 (at or above Initial Level and Coupon Barrier)

Underlying B: 2000.00 (below Initial Level and Coupon Barrier)

|

Securities NOT callable Issuer DOES NOT pay Contingent Coupon on third Coupon Payment Date.

|

|

Fourth through Thirty-ninth Observation Dates

|

Underlying A: Various (all at or above Coupon Barrier; below Initial Level)

Underlying B: Various (all below Coupon Barrier)

|

Securities NOT callable; Issuer DOES NOT pay Contingent Coupon payment on any Coupon Payment Date immediately following the fourth through the thirty-ninth Observation Dates.

|

|

Final Valuation Date

|

Underlying A: 1400.00 (at or above Initial Level and Coupon Barrier)

Underlying B: 1280.00 (below Coupon Barrier and Trigger Level)

|

Securities NOT callable; Issuer DOES NOT pay Contingent Coupon payment on Maturity Date, and holder will be entitled to receive less than the principal amount resulting in a loss proportionate to the depreciation of the Least Performing Underlying.

|

|

Total Payment (per $10.00 Security)

|

$4.4000 (56.0000% loss)

|

|

Percentage Change

from the Initial Level

to the Final Level of the Least Performing Underlying

|

Underlying Return of the Least Performing Underlying

|

Payment at Maturity (excluding Contingent Coupon payments, if any)

|

|

100.00%

|

N/A

|

$10.00

|

|

90.00%

|

N/A

|

$10.00

|

|

80.00%

|

N/A

|

$10.00

|

|

70.00%

|

N/A

|

$10.00

|

|

60.00%

|

N/A

|

$10.00

|

|

50.00%

|

N/A

|

$10.00

|

|

40.00%

|

N/A

|

$10.00

|

|

30.00%

|

N/A

|

$10.00

|

|

20.00%

|

N/A

|

$10.00

|

|

10.00%

|

N/A

|

$10.00

|

|

0.00%

|

0.00%

|

$10.00

|

|

−10.00%

|

−10.00%

|

$10.00

|

|

−20.00%

|

−20.00%

|

$10.00

|

|

−30.00%

|

−30.00%

|

$10.00

|

|

−40.00%

|

−40.00%

|

$10.00

|

|

−50.00%

|

−50.00%

|

$10.00

|

|

−50.01%

|

−50.01%

|

$4.99

|

|

−60.00%

|

−60.00%

|

$4.00

|

|

−70.00%

|

−70.00%

|

$3.00

|

|

−80.00%

|

−80.00%

|

$2.00

|

|

−90.00%

|

−90.00%

|

$1.00

|

|

−100.00%

|

−100.00%

|

$0.00

|

|

Market Disruption Events

|

|

Credit Suisse AG; Supplemental Use of Proceeds and Hedging

|

|

The Underlyings

|

|

What Are the Tax Consequences of the Securities?

|

|

|

·

|

a financial institution,

|

|

|

·

|

a mutual fund,

|

|

|

·

|

a tax-exempt organization,

|

|

|

·

|

a grantor trust,

|

|

|

·

|

certain U.S. expatriates,

|

|

|

·

|

an insurance company,

|

|

|

·

|

a dealer or trader in securities or foreign currencies,

|

|

|

·

|

a person (including traders in securities) using a mark-to-market method of accounting,

|

|

|

·

|

a person who holds the securities as a hedge or as part of a straddle with another position, constructive sale, conversion transaction or other integrated transaction, or

|

|

|

·

|

an entity that is treated as a partnership for U.S. federal income tax purposes.

|

|

Supplemental Plan of Distribution

|