|

Term Sheet ARN-9

(To the Prospectus dated March 23, 2012, the Prospectus Supplement dated March 23, 2012, and the Product Supplement EQUITY INDICES ARN-1 dated October 23, 2012)

|

Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-180300-03

|

|

Per Unit

|

Total

|

|||||||

|

Public offering price

|

$ | 10.00 | $ | 25,252,940.00 | ||||

|

Underwriting discount

|

$ | 0.20 | $ | 505,058.80 | ||||

|

Proceeds, before expenses, to Credit Suisse

|

$ | 9.80 | $ | 24,747,881.20 | ||||

|

Are Not FDIC Insured

|

Are Not Bank Guaranteed

|

May Lose Value

|

|

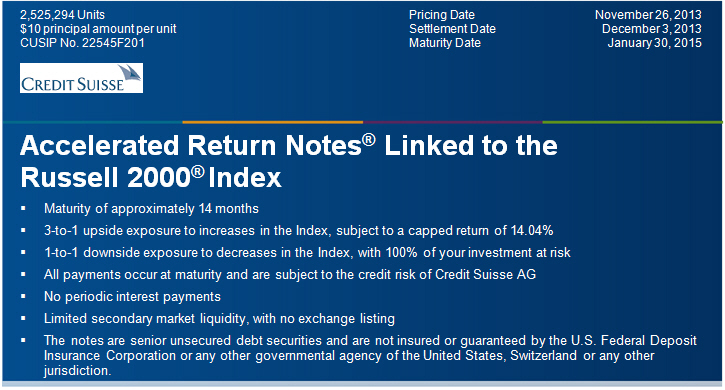

Accelerated Return Notes®

Linked to the Russell 2000® Index, due January 30, 2015

|

|

Terms of the Notes

|

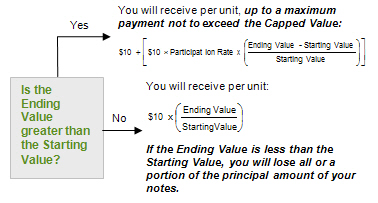

Redemption Amount Determination

|

|

|

Issuer:

|

Credit Suisse AG (“Credit Suisse”), acting through its London Branch.

|

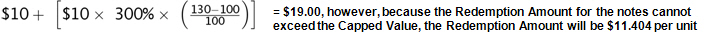

On the maturity date, you will receive a cash payment per unit determined as follows:

|

|

Principal Amount:

|

$10.00 per unit

|

|

|

Term:

|

Approximately 14 months

|

|

|

Market Measure:

|

The Russell 2000® Index (Bloomberg symbol: “RTY”), a price return index.

|

|

|

Starting Value:

|

1,134.53

|

|

|

Ending Value:

|

The average of the closing levels of the Market Measure on each scheduled calculation day occurring during the maturity valuation period. The calculation days are subject to postponement in the event of Market Disruption Events, as described beginning on page PS-17 of product supplement EQUITY INDICES ARN-1.

|

|

|

Capped Value:

|

$11.404 per unit of the notes, which represents a return of 14.04% over the principal amount.

|

|

|

Maturity Valuation Period:

|

January 21, 2015, January 22, 2015, January 23, 2015, January 26, 2015 and January 27, 2015

|

|

|

Participation Rate:

|

300%

|

|

|

Fees and Charges:

|

The underwriting discount of $0.20 per unit listed on the cover page and the hedging related charge of $0.075 per unit described in “Structuring the Notes” on page TS-14.

|

|

|

Joint Calculation Agents:

|

Credit Suisse International and Merrill Lynch, Pierce, Fenner & Smith Incorporated (“MLPF&S”), acting jointly.

|

|

|

Accelerated Return Notes®

|

TS-2

|

|

Accelerated Return Notes®

Linked to the Russell 2000® Index, due January 30, 2015

|

|

|

§

|

Product supplement EQUITY INDICES ARN-1 dated October 23, 2012:

|

|

|

§

|

Prospectus supplement and prospectus dated March 23, 2012:

|

|

You may wish to consider an investment in the notes if:

|

The notes may not be an appropriate investment for you if:

|

|

|

§ You anticipate that the Index will increase moderately from the Starting Value to the Ending Value.

§ You are willing to risk a loss of principal and return if the Index decreases from the Starting Value to the Ending Value.

§ You accept that the return on the notes, if any, will be capped.

§ You are willing to forgo the interest payments that are paid on traditional interest bearing debt securities.

§ You are willing to forgo dividends or other benefits of owning the stocks included in the Index.

§ You are willing to accept a limited market for sales prior to maturity, and understand that the market prices for the notes, if any, will be affected by various factors, including our actual and perceived creditworthiness, our internal funding rate and fees and charges on the notes.

§ You are willing to assume our credit risk, as issuer of the notes, for all payments under the notes, including the Redemption Amount.

|

§ You believe that the Index will decrease from the Starting Value or that it will not increase sufficiently over the term of the notes to provide you with your desired return.

§ You seek principal protection or preservation of capital.

§ You seek an uncapped return on your investment.

§ You seek interest payments or other current income on your investment.

§ You want to receive dividends or other distributions paid on the stocks included in the Index.

§ You seek an investment for which there will be a liquid secondary market.

§ You are unwilling or are unable to take market risk on the notes or to take our credit risk as issuer of the notes.

|

|

Accelerated Return Notes®

|

TS-3

|

|

Accelerated Return Notes®

Linked to the Russell 2000® Index, due January 30, 2015

|

|

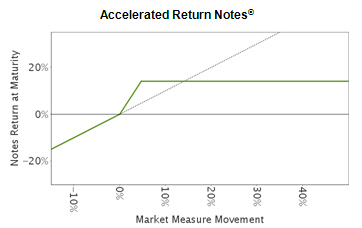

This graph reflects the returns on the notes, based on the Participation Rate of 300% and the Capped Value of $11.404. The green line reflects the returns on the notes, while the dotted gray line reflects the returns of a direct investment in the stocks included in the Index, excluding dividends.

This graph has been prepared for purposes of illustration only.

|

|

Ending Value

|

Percentage Change from the Starting Value to the Ending Value

|

Redemption Amount per Unit

|

Total Rate of Return on the Notes

|

|

0.00

|

-100.00%

|

$0.00

|

-100.00%

|

|

50.00

|

-50.00%

|

$5.00

|

-50.00%

|

|

80.00

|

-20.00%

|

$8.00

|

-20.00%

|

|

90.00

|

-10.00%

|

$9.00

|

-10.00%

|

|

94.00

|

-6.00%

|

$9.40

|

-6.00%

|

|

97.00

|

-3.00%

|

$9.70

|

-3.00%

|

|

100.00(1)

|

0.00%

|

$10.00

|

0.00%

|

|

102.00

|

2.00%

|

$10.60

|

6.00%

|

|

105.00

|

5.00%

|

$11.404(2)

|

14.04%

|

|

110.00

|

10.00%

|

$11.404

|

14.04%

|

|

120.00

|

20.00%

|

$11.404

|

14.04%

|

|

130.00

|

30.00%

|

$11.404

|

14.04%

|

|

140.00

|

40.00%

|

$11.404

|

14.04%

|

|

150.00

|

50.00%

|

$11.404

|

14.04%

|

|

160.00

|

60.00%

|

$11.404

|

14.04%

|

|

(1)

|

The hypothetical Starting Value of 100 used in these examples has been chosen for illustrative purposes only. The actual Starting Value is 1,134.53, which was the closing level of the Market Measure on the pricing date.

|

|

(2)

|

The Redemption Amount per unit cannot exceed the Capped Value.

|

|

Accelerated Return Notes®

|

TS-4

|

|

Accelerated Return Notes®

Linked to the Russell 2000® Index, due January 30, 2015

|

|

Example 1

|

|

|

The Ending Value is 80.00, or 80.00% of the Starting Value:

|

|

|

Starting Value: 100.00

|

|

|

Ending Value: 80.00

|

|

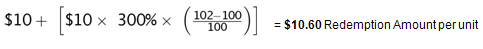

Example 2

|

|

|

The Ending Value is 102.00, or 102.00% of the Starting Value:

|

|

|

Starting Value: 100.00

|

|

|

Ending Value: 102.00

|

|

Example 3

|

|

|

The Ending Value is 130.00, or 130.00% of the Starting Value:

|

|

|

Starting Value: 100.00

|

|

|

Ending Value: 130.00

|

|

Accelerated Return Notes®

|

TS-5

|

|

Accelerated Return Notes®

Linked to the Russell 2000® Index, due January 30, 2015

|

|

|

§

|

Depending on the performance of the Index as measured shortly before the maturity date, your investment may result in a loss; there is no guaranteed return of principal.

|

|

|

§

|

Your return on the notes may be less than the yield you could earn by owning a conventional fixed or floating rate debt security of comparable maturity.

|

|

|

§

|

Payments on the notes are subject to our credit risk, and actual or perceived changes in our creditworthiness are expected to affect the value of the notes. If we become insolvent or are unable to pay our obligations, you may lose your entire investment.

|

|

|

§

|

Your investment return, if any, is limited to the return represented by the Capped Value and may be less than a comparable investment directly in the stocks included in the Index.

|

|

|

§

|

The initial estimated value of the notes is an estimate only, determined as of a particular point in time by reference to our proprietary pricing models. These pricing models consider certain factors, such as our internal funding rate on the pricing date, interest rates, volatility and time to maturity of the notes, and they rely in part on certain assumptions about future events, which may prove to be incorrect. Because our pricing models may differ from other issuers’ valuation models, and because funding rates taken into account by other issuers may vary materially from the rates used by us (even among issuers with similar creditworthiness), our estimated value may not be comparable to estimated values of similar notes of other issuers.

|

|

|

§

|

Our internal funding rate for market-linked notes is typically lower than our secondary market credit rates, as further described in “Structuring the Notes” on page TS-14. Because we use our internal funding rate to determine the value of the theoretical bond component, the initial estimated value of the notes may be greater than if we had used our secondary market credit rates in valuing the notes.

|

|

|

§

|

The public offering price you pay for the notes will exceed the initial estimated value. This is due to, among other transaction costs, the inclusion in the public offering price of the underwriting discount and the hedging related charge, as further described in “Structuring the Notes” on page TS-14.

|

|

|

§

|

Assuming no change in market conditions or other relevant factors after the pricing date, the market value of your notes may be lower than the price you paid for them and lower than the initial estimated value. This is due to, among other things, the inclusion in the public offering price of the underwriting discount and the hedging related charge and the internal funding rate we used in pricing the notes, as further described in "Structuring the Notes" on page TS-14. These factors, together with customary bid ask spreads, other transaction costs and various credit, market and economic factors over the term of the notes, including changes in the level of the Index, are expected to reduce the price at which you may be able to sell the notes in any secondary market and will affect the value of the notes in complex and unpredictable ways.

|

|

|

§

|

A trading market is not expected to develop for the notes. Neither we nor MLPF&S is obligated to make a market for, or to repurchase, the notes. The initial estimated value does not represent a minimum or maximum price at which we, MLPF&S or any of our affiliates would be willing to purchase your notes in any secondary market (if any exists) at any time. MLPF&S has advised us that any repurchases by them or their affiliates will be made at prices determined by reference to their pricing models and at their discretion, and these prices will include MLPF&S’s trading commissions and mark-ups. If you sell your notes to a dealer other than MLPF&S, the dealer may impose its own discount or commission. MLPF&S has also advised us that, at its discretion and for your benefit, assuming no changes in market conditions from the pricing date, any purchase price paid by MLPF&S in the secondary market may exceed the initial estimated value of the notes for a short initial period after the issuance of the notes. That higher price reflects costs that were included in the public offering price of the notes, and that higher price may also be initially used for account statements or otherwise. There is no assurance that any party will be willing to purchase your notes at any price in any secondary market.

|

|

|

§

|

Our business, hedging and trading activities, and those of MLPF&S and our respective affiliates (including trading in shares of companies included in the Index), and any hedging and trading activities we, MLPF&S or our respective affiliates engage in for our clients’ accounts, may affect the market value and return of the notes and may create conflicts of interest with you.

|

|

|

§

|

The Index sponsor may adjust the Index in a way that affects its level, and has no obligation to consider your interests.

|

|

|

§

|

You will have no rights of a holder of the securities represented by the Index, and you will not be entitled to receive securities or dividends or other distributions by the issuers of those securities.

|

|

|

§

|

While we, MLPF&S or our respective affiliates may from time to time own securities of companies included in the Index, we, MLPF&S and our respective affiliates do not control any company included in the Index, and are not responsible for any disclosure made by any other company.

|

|

Accelerated Return Notes®

|

TS-6

|

|

Accelerated Return Notes®

Linked to the Russell 2000® Index, due January 30, 2015

|

|

|

§

|

There may be potential conflicts of interest involving the calculation agent. We have the right to appoint and remove the calculation agent.

|

|

|

§

|

The U.S. federal income tax consequences of the notes are uncertain, and may be adverse to a holder of the notes. See “Material U.S. Federal Income Tax Considerations” below and “Material U.S. Federal Income Tax Consequences” beginning on page PS-25 of product supplement EQUITY INDICES ARN-1.

|

|

Accelerated Return Notes®

|

TS-7

|

|

Accelerated Return Notes®

Linked to the Russell 2000® Index, due January 30, 2015

|

|

Accelerated Return Notes®

|

TS-8

|

|

Accelerated Return Notes®

Linked to the Russell 2000® Index, due January 30, 2015

|

|

|

§

|

ESOP or LESOP shares that comprise 10% or more of the shares outstanding are adjusted;

|

|

|

§

|

Cross ownership by another Russell 3000E™ Index or Russell Global® Index member: Shares held by another member of a Russell index (including Russell global indices) is considered cross ownership, and all shares will be adjusted regardless of percentage held;

|

|

|

§

|

Large corporate and private holdings: Shares held by another listed company (non-member) or by private individuals will be adjusted if they are greater than 10% of shares outstanding. Not included in this class are institutional holdings, including investment companies, partnerships, insurance companies, mutual funds, banks or venture capital firms;

|

|

|

§

|

Unlisted share classes: Classes of common stock that are not traded on a U.S. exchange are adjusted;

|

|

|

§

|

IPO lock-ups: Shares locked up during an IPO that are not available to the public and will be excluded from the market value at the time the IPO enters the index; and

|

|

|

§

|

Government Holdings:

|

|

|

§

|

Direct government holders: Those holdings listed as “government of” are considered unavailable and will be removed entirely from available shares.

|

|

|

§

|

Indirect government holders: Shares held by government investment boards and/or investment arms will be treated similar to large private holdings and removed if the holding is greater than 10%.

|

|

|

§

|

Government pensions: Any holding by a government pension plan is considered institutional holdings and will not be removed from available shares.

|

|

|

§

|

“No Replacement” Rule: Securities that leave a Russell U.S. Index for any reason (e.g., mergers, acquisitions or other similar corporate activity) are not replaced. Thus, the number of securities in a Russell U.S. Index over the year will fluctuate according to corporate activity.

|

|

|

§

|

Mergers and Acquisitions: Mergers and Acquisitions (M&A) result in changes to the membership and to the weighting of members within a Russell U.S. Index. M&A activity is applied to a Russell U.S. Index after the action is determined to be final. If both companies involved are included in the Russell 3000E™ Index or the Russell Global Index, the acquired company is deleted and its market capitalization is moved to the acquiring company’s stock, according to the merger terms. If only one company is included in the Russell 3000E™ Index, there may be two forms of merger or acquisition: if the acquiring company is a member, the acquiring company’s shares will be adjusted at month end, and if the acquiring company is not a member, the acquired company will be deleted after the action is determined as final.

|

|

Accelerated Return Notes®

|

TS-9

|

|

Accelerated Return Notes®

Linked to the Russell 2000® Index, due January 30, 2015

|

|

|

§

|

Reverse Mergers: When a Russell 3000 Index member is acquired or merged with a private, non-publicly-traded company or OTC company, Russell will review the action to determine whether it is considered a reverse merger. If it is determined that the action is a reverse merger, the newly formed entity will be placed in the appropriate market capitalization index after the close of the day following the completion of the merger and the acquired company will be simultaneously removed from the current index.

|

|

|

§

|

Reincorporations: Members that are reincorporated to another country are analyzed for country assignment the following year during reconstitution, as long as they continue to trade in the U.S. Companies that reincorporate and are no longer trade in the U.S. are immediately deleted from the U.S. indexes and placed in the appropriate country within the Russell Global Index.

|

|

|

§

|

Reclassification: The class of a member’s securities included in the Index will not be assessed or changed outside of a reconstitution period unless the existing class ceases to exist.

|

|

|

§

|

Rights offerings: Russell will not apply poison pill rights or entitlements that give shareholders the right to purchase ineligible securities such as convertible debt. Russell will only adjust the Index to account for a right if the subscription price of the right is at a discount to the market price of the stock. Provided Russell is aware of the rights offer prior to the ex-date, a price adjustment will be applied before the open on the ex-date to account for the value of the rights, and shares increased according to the terms of the offering. If Russell is unable to provide prior notice, the price adjustment and share increase will be delayed until appropriate notice is given. In these circumstances the price of the stock involved is adjusted to delay the performance due to the rights issue.

|

|

|

§

|

Changes to shares outstanding: Changes to shares outstanding due to buybacks (including Dutch auctions), secondary offerings, merger activity with a non-index member and other potential changes are updated at the end of the month in which the change is reflected in vendor-supplied updates and are verified by Russell by use of an SEC filing. For a change in shares to occur, the cumulative change to available shares must be greater than 5%. These share changes are communicated three trading days prior to month-end and include shares provided by the vendor and verified by Russell four days prior to month-end. The float factor determined at reconstitution is applied to the new shares issued or bought back.

|

|

|

§

|

Spin-offs: Spin-off companies are added to the parent company’s index and capitalization tier of membership, if the spin-off company is large enough. To be eligible, the spun-off company’s total market capitalization must be greater than the market adjusted total market capitalization of the smallest security in the Russell 3000E™ Index at the latest reconstitution.

|

|

|

§

|

Tender offers: In the case of a cash tender offer, the target company will be removed from the index when: the offer period completes (initial, extension or subsequent); shareholders have validly tendered, not withdrawn, the shares have been accepted for payment; all regulatory requirements have been fulfilled; and the acquiring company is able to finalize the acquisition via short-form merger, top-up option or other compulsory mechanism. If the requirements have been fulfilled except where the acquirer is unable to finalize the acquisition through a compulsory mechanism, an adjustment will be applied to the target company’s float-adjusted shares if they have decreased by 30% or more, and the tender offer has fully complete and closed. The adjustment will occur on a date pre-announced by Russell.

|

|

|

§

|

Delisting: Only companies listed on U.S. exchanges are included in the Russell U.S. Indices. Therefore, when a company is delisted from a U.S. exchange and moved to OTC, the company is removed from the Russell U.S. Index either at the close of the current day or the following day.

|

|

|

§

|

Bankruptcies and Voluntary Liquidations: Companies filing for Chapter 7 bankruptcy or that have filed a liquidation plan will be removed from the Russell U.S. Indices at the time of filing. Companies filing for Chapter 11 reorganization bankruptcy will remain members of the Russell U.S. Indices, unless the companies are delisted from the primary exchange and then normal delisting rules will apply.

|

|

|

§

|

Change of Company Structure: In the event a company changes its corporate designation from that of a Business Development Company, Russell will remove the member as ineligible for index inclusion and provide two-days’ notice of its removal.

|

|

|

§

|

Stock Distributions: Stock distributions can take two forms: (1) a stated amount of stock distributed on the ex-date, or (2) an undetermined amount of stock based on earnings and profits to be distributed at a future date. In both cases, a price adjustment is done on the ex-date of the distribution. Shares are increased on the ex-date for category (1) and on the pay-date for category (2).

|

|

|

§

|

Halted securities: When a stock’s trading has been halted, Russell holds the security at its most recent closing price until trading is resumed or is officially delisted.

|

|

Accelerated Return Notes®

|

TS-10

|

|

Accelerated Return Notes®

Linked to the Russell 2000® Index, due January 30, 2015

|

|

Accelerated Return Notes®

|

TS-11

|

|

Accelerated Return Notes®

Linked to the Russell 2000® Index, due January 30, 2015

|

|

Accelerated Return Notes®

|

TS-12

|

|

Accelerated Return Notes®

Linked to the Russell 2000® Index, due January 30, 2015

|

|

Accelerated Return Notes®

|

TS-13

|

|

Accelerated Return Notes®

Linked to the Russell 2000® Index, due January 30, 2015

|

|

Accelerated Return Notes®

|

TS-14

|

|

Accelerated Return Notes®

Linked to the Russell 2000® Index, due January 30, 2015

|

|

Accelerated Return Notes®

|

TS-15

|