|

The information in this pricing supplement is not complete and may be changed. This preliminary pricing supplement is not an offer to sell these securities, and

it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

|

Subject to completion dated April 30, 2012.

|

|

Preliminary Pricing Supplement No. U650/A*

To the Product Supplement No. U-I dated March 23, 2012,

Prospectus Supplement dated March 23, 2012 and

Prospectus dated March 23, 2012

|

Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-180300-03

April 30, 2012

|

|

$

Absolute Return Barrier Securities due November 7, 2013

Linked to the Common Stock of Cree, Inc.

|

General

|

•

|

The securities are designed for investors who seek a capped return at maturity linked to the closing price of the common stock of Cree, Inc. Investors should be willing to forgo interest and dividend payments, be willing to accept the risks of owning equities in general and the shares of Cree, Inc. in particular and, if a Knock-In Event has occurred and the Final Share Price is less than the Initial Share Price, be willing to lose some or all of their investment. If a Knock-In Event has not occurred and the Final Share Price is less than its Initial Share Price, at maturity, investors will be entitled to receive the principal amount of their securities multiplied by the sum of one plus the absolute value of the depreciation percentage of the Reference Shares from its Initial Share Price to its Final Share Price. If the Final Share Price is greater than or equal to the Initial Share Price, at maturity investors will be entitled to receive the principal amount of their securities and will have the opportunity to participate in the appreciation of the Reference Shares, subject to the Maximum Upside Return of between 48.0% and 52.0% (to be determined on the Trade Date). Any payment on the securities is subject to our ability to pay our obligations as they become due.

|

|

•

|

Senior unsecured obligations of Credit Suisse AG, acting through its Nassau Branch, maturing November 7, 2013.†

|

|

•

|

Minimum purchase of $1,000. Minimum denominations of $1,000 and integral multiples of $1,000 in excess thereof.

|

|

•

|

The securities are expected to price on or about May 4, 2012 (the “Trade Date”) and are expected to settle on or about May 9, 2012. Delivery of the securities in book-entry form only will be made through The Depository Trust Company.

|

Key Terms

|

Issuer:

|

Credit Suisse AG (“Credit Suisse”), acting through its Nassau Branch

|

|

Reference Shares:

|

The securities are linked to the common stock of Cree, Inc. (the “Reference Share Issuer”). The Reference Shares trade on the NASDAQ Global Select Market under the ticker symbol “CREE.” For additional information on the Reference Shares, see “The Reference Shares” herein.

|

|

Redemption Amount:

|

At maturity, you will be entitled to receive a Redemption Amount that will depend on the performance of the Reference Shares and whether a Knock-In Event has occurred, determined as follows:

|

|

•

|

If the Final Share Price is greater than or equal to the Initial Share Price, you will be entitled to receive a Redemption Amount in cash that will equal the principal amount of the securities you hold multiplied by the sum of 1 plus the Underlying Return, subject to the Maximum Upside Return.

|

||

|

•

|

If the Final Share Price is less than the Initial Share Price, and:

|

||

|

•

|

if a Knock-In Event has not occurred, you will be entitled to receive a Redemption Amount in cash that will equal the principal amount of the securities you hold multiplied by the sum of 1 plus the absolute value of the Underlying Return.

|

||

|

•

|

if a Knock-In Event has occurred, you will be entitled to receive the Physical Delivery Amount.

|

||

|

If a Knock-In Event has occurred and the Final Share Price is less than the Initial Share Price, you will receive the Physical Delivery Amount, which will most likely have a value substantially less than the principal amount of your securities, and may be zero. You could lose your entire investment.

|

|||

|

Any payment on the securities is subject to our ability to pay our obligations as they become due.

|

|||

|

Underlying Return:

|

The Underlying Return is expressed as a percentage and is calculated as follows:

|

||

|

Final Share Price – Initial Share Price

Initial Share Price

|

|

Physical Delivery Amount:

|

A number of Reference Shares per $1,000 principal amount of securities, rounded down to the nearest whole number and equal to the product of (i) $1,000 divided by the Initial Share Price and (ii) the share adjustment factor, plus a cash amount equal to the proportion of the Final Share Price corresponding to any fractional share. If the fractional share amount to be paid in cash is a de minimis amount, as determined by the calculation agent, the holder will not receive such amount.

|

|

Maximum Upside Return:

|

Expected to be between 48.0% and 52.0% (to be determined on the Trade Date).

|

|

Knock-In Event:

|

A Knock-In Event will occur if on any trading day during the Observation Period, the closing price of the Reference Shares is less than or equal to the Knock-In Price.

|

|

Knock-In Price:

|

Expected to be 50% of the Initial Share Price (to be determined on the Trade Date).

|

|

Initial Share Price:**

|

The closing price of the Reference Shares on the Trade Date.

|

|

Observation Period:

|

The period from but excluding the Trade Date to and including the Valuation Date.

|

|

Final Share Price:

|

The closing price of the Reference Shares on the Valuation Date.

|

|

Valuation Date:†

|

November 4, 2013

|

|

Maturity Date:†

|

November 7, 2013

|

|

Listing:

|

The securities will not be listed on any securities exchange.

|

|

CUSIP:

|

22546TTB7

|

* This amended and restated preliminary pricing supplement amends, restates and supersedes Preliminary Pricing Supplement No. U650 dated April 27, 2012. We refer to this amended and restated preliminary pricing supplement as the “pricing supplement.”

** In the event that the closing price of the Reference Shares is not available on the Trade Date, the Initial Share Price will be determined on the immediately following trading day on which a closing price is available.

† The Valuation Date is subject to postponement if such date is not an underlying business day or as a result of a market disruption event and the Maturity Date is subject to postponement if such date is not a business day or if the Valuation Date is postponed, in each case as described in the accompanying product supplement under “Description of the Securities—Market disruption events.”

Investing in the securities involves a number of risks. See “Selected Risk Considerations” beginning on page 5 of this pricing supplement and “Risk Factors” beginning on page PS-3 of the accompanying product supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities or passed upon the accuracy or the adequacy of this pricing supplement or the accompanying product supplement, the prospectus supplement and the prospectus. Any representation to the contrary is a criminal offense.

|

Price to Public

|

Underwriting Discounts and Commissions(1)

|

Proceeds to Issuer

|

|

|

Per security

|

$1,000.00

|

$

|

$

|

|

Total

|

$

|

$

|

$

|

(1) We or one of our affiliates may pay discounts and commissions of up to $15.00 per $1,000 principal amount of securities. For more detailed information, please see “Supplemental Plan of Distribution (Conflicts of Interest)” on the last page of this pricing supplement.

The agent for this offering, Credit Suisse Securities (USA) LLC (“CSSU”), is our affiliate. For more information, see “Supplemental Plan of Distribution (Conflicts of Interest)” on the last page of this pricing supplement.

The securities are not deposit liabilities and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency of the United States, Switzerland or any other jurisdiction.

Credit Suisse

May , 2012

You may revoke your offer to purchase the securities at any time prior to the time at which we accept such offer on the date the securities are priced. We reserve the right to change the terms of, or reject any offer to purchase the securities prior to their issuance. In the event of any changes to the terms of the securities, we will notify you and you will be asked to accept such changes in connection with your purchase. You may also choose to reject such changes in which case we may reject your offer to purchase.

Additional Terms Specific to the Securities

You should read this pricing supplement together with the product supplement dated March 23, 2012, the prospectus supplement dated March 23, 2012 and the prospectus dated March 23, 2012, relating to our Medium-Term Notes of which these securities are a part. This preliminary pricing supplement amends, restates and supersedes Preliminary Pricing Supplement No. U650 dated April 27, 2012 in its entirety. You should rely only on the information contained in this Preliminary Pricing Supplement No. U650/A and in the documents listed below in making your decision to invest in the securities. You may access these documents on the SEC website at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

|

|

•

|

Product supplement No. U-I dated March 23, 2012:

|

|

|

•

|

Prospectus supplement dated March 23, 2012 and Prospectus dated March 23, 2012:

|

Our Central Index Key, or CIK, on the SEC website is 1053092. As used in this pricing supplement, the “Company,” “we,” “us,” or “our” refers to Credit Suisse.

This pricing supplement, together with the documents listed above, contains the terms of the securities and supersedes all other prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, fact sheets, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours. You should carefully consider, among other things, the matters set forth in “Selected Risk Considerations” in this pricing supplement and “Risk Factors” in the accompanying product supplement, as the securities involve risks not associated with conventional debt securities. You should consult your investment, legal, tax, accounting and other advisors before deciding to invest in the securities.

1

Hypothetical Redemption Amounts at Maturity

The table and examples below illustrate hypothetical Redemption Amounts payable at maturity for a $1,000 principal amount of securities for a hypothetical range of performance of the Reference Shares. The table and the examples below assume a hypothetical Initial Share Price of $30, a Knock-In Price of $15, a Maximum Upside Return of 50.0% (the midpoint of the expected range set forth on the cover page of this pricing supplement) and a share adjustment factor of 1.0. The Redemption Amounts set forth below are provided for illustration purposes only. The actual Redemption Amount applicable to a purchase of the securities will depend on whether, on any trading day during the Observation Period, the closing price of the Reference Shares is less than or equal to the Knock-In Price. It is not possible to predict whether a Knock-In Event will occur, and in the event that there is a Knock-In Event, whether and by how much the Final Share Price will decrease in comparison to the Initial Share Price. The numbers appearing in the table and the examples below have been rounded for ease of analysis. Any payment on the securities is subject to our ability to pay our obligations as they become due.

If a Knock-In Event has occurred and the Final Share Price is less than the Initial Share Price, you will be entitled to receive on the Maturity Date a Redemption Amount per $1,000 principal amount of securities that will consist of a whole number of Reference Shares plus an amount in cash corresponding to any fractional Reference Share. If the fractional share amount to be paid in cash is a de minimis amount, as determined by the calculation agent, the holder will not receive such amount.

The value of any such Redemption Amount on the Valuation Date will be less than $1,000 and may fluctuate, possibly decreasing, in the period between the Valuation Date and the Maturity Date. If a Knock-In Event has occurred and the Final Share Price is less than the Initial Share Price, you could lose your entire investment in the securities.

|

A Knock-In Event

Does Not Occur

|

A Knock-In Event

Does Occur

|

||||

|

Final Share

Price ($)

|

Percentage Change in the price of the Reference Shares

|

Return on the

Securities

|

Redemption

Amount

|

Return on the

Securities

|

Redemption

Amount

|

|

60.00

|

100.00%

|

50.00%

|

$1,500.00

|

50.00%

|

$1,500.00

|

|

57.00

|

90.00%

|

50.00%

|

$1,500.00

|

50.00%

|

$1,500.00

|

|

54.00

|

80.00%

|

50.00%

|

$1,500.00

|

50.00%

|

$1,500.00

|

|

51.00

|

70.00%

|

50.00%

|

$1,500.00

|

50.00%

|

$1,500.00

|

|

48.00

|

60.00%

|

50.00%

|

$1,500.00

|

50.00%

|

$1,500.00

|

|

45.00

|

50.00%

|

50.00%

|

$1,500.00

|

50.00%

|

$1,500.00

|

|

42.00

|

40.00%

|

40.00%

|

$1,400.00

|

40.00%

|

$1,400.00

|

|

39.00

|

30.00%

|

30.00%

|

$1,300.00

|

30.00%

|

$1,300.00

|

|

36.00

|

20.00%

|

20.00%

|

$1,200.00

|

20.00%

|

$1,200.00

|

|

33.00

|

10.00%

|

10.00%

|

$1,100.00

|

10.00%

|

$1,100.00

|

|

30.00

|

0.00%

|

0.00%

|

$1,000.00

|

0.00%

|

$1,000.00

|

|

27.00

|

−10.00%

|

10.00%

|

$1,100.00

|

−10.00%

|

33 shares + $9.00

|

|

24.00

|

−20.00%

|

20.00%

|

$1,200.00

|

−20.00%

|

33 shares + $8.00

|

|

21.00

|

−30.00%

|

30.00%

|

$1,300.00

|

−30.00%

|

33 shares + $7.00

|

|

18.00

|

−40.00%

|

40.00%

|

$1,400.00

|

−40.00%

|

33 shares + $6.00

|

|

15.01

|

−49.99%

|

49.99%

|

$1,499.99

|

−49.99%

|

33 shares + $5.00

|

|

15.00

|

−50.00%

|

N/A

|

N/A

|

−50.00%

|

33 shares + $5.00

|

|

12.00

|

−60.00%

|

N/A

|

N/A

|

−60.00%

|

33 shares + $4.00

|

|

9.00

|

−70.00%

|

N/A

|

N/A

|

−70.00%

|

33 shares + $3.00

|

|

6.00

|

−80.00%

|

N/A

|

N/A

|

−80.00%

|

33 shares + $2.00

|

|

3.00

|

−90.00%

|

N/A

|

N/A

|

−90.00%

|

33 shares + $1.00

|

2

The following examples illustrate how the Redemption Amount is calculated.

Example 1: The price of the Reference Shares increases from the Initial Share Price of $30 to a Final Share Price of $48. Since the Final Share Price is greater than the Initial Share Price and because the percentage change from the Initial Share Price to the Final Share Price is greater than the Maximum Upside Return, the Redemption Amount per $1,000 principal amount of securities is equal to the principal amount of the securities multiplied by the sum of 1 plus the Underlying Return, subject to the Maximum Upside Return, calculated as follows:

|

Redemption Amount

|

=

|

$1,000 × [1 + (Final Share Price – Initial Share Price) / (Initial Share Price)],

subject to the Maximum Upside Return

|

|

=

|

$1,000 × [1 + ($48 – $30) / $30], subject to the Maximum Upside Return

|

|

|

=

|

$1,000 × (1 + 0.50)

|

|

|

$1,000 × 1.50

|

||

|

=

|

$1,500

|

In this example, at maturity you would be entitled to receive a Redemption Amount equal to $1,500 per $1,000 principal amount of securities based on the based on the percentage change of the Reference Shares from the Initial Share Price to the Final Share Price, subject to the Maximum Upside Return, regardless of whether or not a Knock-In Event has occurred.

Example 2: The price of the Reference Shares increases from the Initial Share Price of $30 to a Final Share Price of $36. Since the Final Share Price is greater than the Initial Share Price, the Redemption Amount per $1,000 principal amount of securities is equal to the principal amount of the securities multiplied by the sum of 1 plus the Underlying Return, subject to the Maximum Upside Return, calculated as follows:

|

Redemption Amount

|

=

|

$1,000 × [1 + (Final Share Price – Initial Share Price) / (Initial Share Price)],

subject to the Maximum Upside Return

|

|

=

|

$1,000 × [1 + ($36 – $30) / $30], subject to the Maximum Upside Return

|

|

|

=

|

$1,000 × (1 + 0.20)

|

|

|

=

|

$1,200

|

In this example, at maturity you would be entitled to receive a Redemption Amount equal to $1,200 per $1,000 principal amount of securities based on the percentage change of the Reference Shares from the Initial Share Price to the Final Share Price, regardless of whether or not a Knock-In Event has occurred.

Example 3: The price of the Reference Shares decreases from the Initial Share Price of $30 to a Final Share Price of $27 and a Knock-In Event has not occurred. Since the Final Share Price is less than the Initial Share Price and a Knock-In Event has not occurred, the Redemption Amount per $1,000 principal amount of securities is equal to the principal amount of the securities multiplied by the sum of 1 plus the absolute value of the percentage change of the Reference Shares from the Initial Share Price to the Final Share Price, calculated as follows:

|

Redemption Amount

|

=

|

$1,000 × [1 + (Final Share Price – Initial Share Price) / (Initial Share Price)]

|

|

=

|

$1,000 × [1 + │($27 – $30) / $30│]

|

|

|

=

|

$1,000 × (1 + │–0.10│)

|

|

|

=

|

$1,000 × (1 + 0.10)

|

|

|

=

|

$1,100

|

In this example, at maturity you would be entitled to receive a Redemption Amount equal to $1,100 per $1,000 principal amount of securities based on the absolute value of the percentage change of the Reference Shares from the Initial Share Price to the Final Share Price.

3

Example 4: The price of the Reference Shares decreases from the Initial Share Price of $30 to a Final Share Price of $15 and a Knock-In Event has occurred. Since the Final Share Price is less than the Initial Share Price and a Knock-In Event has occurred, the Redemption Amount is equal to the Physical Delivery Amount, calculated as follows:

|

Physical Delivery Amount

|

=

|

$1,000/Initial Share Price

|

+

|

a cash amount equal to the proportion of the

Final Share Price corresponding to any fractional share

|

|

=

|

$1,000/$30 + cash amount

|

|||

|

=

|

33 Reference Shares (33.3333333333 rounded down) + (0.3333333333 × $15)

|

|||

|

=

|

33 Reference Shares + $5

|

|||

In this example, at maturity you would be entitled to receive a Redemption Amount consisting of 33 Reference Shares and a cash payment of $5. The value of the Redemption Amount on the Valuation Date, which is the date on which the Final Share Price is determined, is $500, calculated as follows:

|

Value of Redemption Amount

|

=

|

(33 Reference Shares × Final Share Price) + $5

|

|

=

|

(33 Reference Shares × $15) + $5

|

|

|

=

|

$495 + $5

|

|

|

=

|

$500

|

In these circumstances, you will participate in any depreciation in the price of the Reference Shares from the Initial Share Price to the Final Share Price.

4

Selected Risk Considerations

An investment in the securities involves significant risks. Investing in the securities is not equivalent to investing directly in the Reference Shares. These risks are explained in more detail in the “Risk Factors” section of the accompanying product supplement.

|

|

•

|

YOU MAY RECEIVE LESS THAN THE PRINCIPAL AMOUNT AT MATURITY — You may receive less at maturity than you originally invested in the securities, or you may receive nothing. If the Final Share Price is less than the Initial Share Price and the closing price of the Reference Shares is less than or equal to the Knock-In Price on any trading day during the Observation Period, you will be fully exposed to any depreciation in the Reference Shares. In this case, the Redemption Amount you will be entitled to receive will have a value as of the Valuation Date that will be less than the principal amount of the securities, and you could lose your entire investment. It is not possible to predict whether a Knock-In Event will occur, and in the event that there is a Knock-In Event, whether and by how much the Final Share Price will decrease in comparison to the Initial Share Price. Any payment on the securities is subject to our ability to pay our obligations as they become due.

|

|

|

•

|

THE SECURITIES ARE SUBJECT TO THE CREDIT RISK OF CREDIT SUISSE — Although the return on the securities will be based on the performance of the Reference Shares, the payment of any amount due on the securities, including the Redemption Amount, is subject to the credit risk of Credit Suisse. Investors are dependent on our ability to pay all amounts due on the securities, and therefore, investors are subject to our credit risk. In addition, any decline in our credit ratings, any adverse changes in the market’s view of our creditworthiness or any increase in our credit spreads is likely to adversely affect the value of the securities prior to maturity.

|

|

|

•

|

THE SECURITIES DO NOT PAY INTEREST — We will not pay interest on the securities. You may receive less at maturity than you could have earned on ordinary interest-bearing debt securities with similar maturities, including other of our debt securities, since the Redemption Amount is based on the performance of the Reference Shares. Because the Redemption Amount may be less than the amount originally invested in the securities, the return on the securities (the effective yield to maturity) may be negative. Even if it is positive, the return payable on each security may not be enough to compensate you for any loss in value due to inflation and other factors relating to the value of money over time.

|

|

|

•

|

YOUR MAXIMUM GAIN ON THE UPSIDE PARTICIPATION OF THE SECURITIES IS LIMITED TO THE MAXIMUM UPSIDE RETURN —Regardless of whether a Knock-In Event has occurred, if the Final Share Price is greater than or equal to the Initial Share Price, for each $1,000 principal amount of securities, you will receive at maturity $1,000 plus an additional amount that will not exceed a predetermined percentage of the principal amount, regardless of the appreciation in the Reference Shares, which may be significant. We refer to this percentage as the Maximum Upside Return, which will be set on the Trade Date and will not be less than a percentage between 48.0% and 52.0% (to be determined on the Trade Date). Accordingly, the maximum amount payable at maturity if the Final Share Price is greater than or equal to the Initial Share Price is expected to be between $1,480 and $1,520 per $1,000 principal amount of securities (to be determined on the Trade Date). Any payment on the securities is subject to our ability to pay our obligations as they become due.

|

|

|

•

|

IF THE FINAL SHARE PRICE IS LESS THAN THE INITIAL SHARE PRICE AND A KNOCK-IN EVENT HAS NOT OCCURRED, THE REDEMPTION AMOUNT WILL BE SUBJECT TO AN EMBEDDED CAP — If the Final Share Price is less than the Initial Share Price and a Knock-In Event has not occurred, the Redemption Amount payable at maturity will equal the principal amount of the securities you hold multiplied by the sum of one plus the absolute value of the Underlying Return. However, because a Knock-In Event will occur if the closing price of the Reference Shares on any trading day during the Observation Period is less than or equal to its Knock-In Level, if the Final Share Price is less than the Initial Share Price and a Knock-In Event has not occurred, the maximum possible Redemption Amount of the securities is expected to be $1,499.99 per $1,000 principal amount of securities. Any payment on the securities is subject to our ability to pay our obligations as they become due.

|

5

|

|

•

|

THE REDEMPTION AMOUNT WILL BE AFFECTED BY THE FINAL SHARE PRICE AND THE OCCURRENCE OF A KNOCK-IN EVENT — If the closing price of the Reference Shares on any trading day during the Observation Period is less than or equal to the Knock-In Price, a Knock-In Event will occur. If a Knock-In Event has occurred and the Final Share Price is less than the Initial Share Price, the Redemption Amount will consist of a number of Reference Shares plus an amount in cash corresponding to any fractional share, as described above. Under these circumstances, the Redemption Amount will most likely be significantly less than the principal amount of the securities and may be zero.

|

|

|

•

|

IF THE REDEMPTION AMOUNT CONSISTS OF THE PHYSICAL DELIVERY AMOUNT, THE VALUE OF SUCH REDEMPTION AMOUNT COULD BE LESS ON THE MATURITY DATE THAN ON THE VALUATION DATE — If a Knock-In Event has occurred and the Final Share Price is less than the Initial Share Price, you will be entitled to receive on the Maturity Date the Physical Delivery Amount, which will consist of a whole number of Reference Shares plus an amount in cash corresponding to any fractional share. The value of the Physical Delivery Amount on the Valuation Date will be less than $1,000 per $1,000 principal amount of securities and could fluctuate, possibly decreasing, in the period between the Valuation Date and the Maturity Date. We will make no adjustments to the Physical Delivery Amount to account for any such fluctuation and you will bear the risk of any decrease in the value of the Physical Delivery Amount between the Valuation Date and the Maturity Date.

|

|

|

•

|

CERTAIN BUILT-IN COSTS ARE LIKELY TO ADVERSELY AFFECT THE VALUE OF THE SECURITIES PRIOR TO MATURITY — While the Redemption Amount described in this pricing supplement is based on the full principal amount of your securities, the original issue price of the securities includes the agent’s commission and the cost of hedging our obligations under the securities through one or more of our affiliates. As a result, the price, if any, at which Credit Suisse (or its affiliates), will be willing to purchase securities from you in secondary market transactions, if at all, will likely be lower than the original issue price, and any sale prior to the Maturity Date could result in a substantial loss to you. The securities are not designed to be short-term trading instruments. Accordingly, you should be able and willing to hold your securities to maturity.

|

|

|

•

|

NO OWNERSHIP RIGHTS IN THE REFERENCE SHARES — You return on the securities will not reflect the return you would realize if you actually owned the Reference Shares. The return on your investment, which is based on the percentage change in the Reference Shares, is not the same as the total return based on a purchase of the Reference Shares.

|

|

|

•

|

NO DIVIDEND PAYMENTS OR VOTING RIGHTS — As a holder of the securities, you will not have any ownership interest or rights in the Reference Shares, such as voting rights or dividend payments. In addition, the issuer of the Reference Shares will not have any obligation to consider your interests as a holder of the securities in taking any corporate action that might affect the value of the Reference Shares and therefore, the value of the securities.

|

|

|

•

|

LACK OF LIQUIDITY — The securities will not be listed on any securities exchange. Credit Suisse (or its affiliates) intends to offer to purchase the securities in the secondary market but is not required to do so. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the securities when you wish to do so. Because other dealers are not likely to make a secondary market for the securities, the price at which you may be able to trade your securities is likely to depend on the price, if any, at which Credit Suisse (or its affiliates) is willing to buy the securities. If you have to sell your securities prior to maturity, you may not be able to do so or you may have to sell them at a substantial loss.

|

6

|

|

•

|

POTENTIAL CONFLICTS — We and our affiliates play a variety of roles in connection with the issuance of the securities, including acting as calculation agent and hedging our obligations under the securities. In performing these duties, the economic interests of the calculation agent and other affiliates of ours are potentially adverse to your interests as an investor in the securities. We and/or our affiliates may also currently or from time to time engage in business with the Reference Share Issuer, including extending loans to, or making equity investments in, the Reference Share Issuer or providing advisory services to the Reference Share Issuer. In addition, one or more of our affiliates may publish research reports or otherwise express opinions with respect to the Reference Share Issuer and these reports may or may not recommend that investors buy or hold the Reference Shares. As a prospective purchaser of the securities, you should undertake an independent investigation of the Reference Share Issuer that in your judgment is appropriate to make an informed decision with respect to an investment in the securities.

|

|

|

•

|

ANTI-DILUTION PROTECTION IS LIMITED — The calculation agent will make anti-dilution adjustments to the share adjustment factor applicable to the Reference Shares for certain events affecting the Reference Shares. However, an adjustment will not be required in response to all events that could affect the Reference Shares. If such an event occurs that does not require the calculation agent to make an adjustment, or if an adjustment is made but such adjustment does not fully reflect the economics of such event, the value of the securities may be materially and adversely affected. For additional information, see “Description of the Securities—Adjustments—For equity securities of a reference share issuer” in the accompanying product supplement.

|

|

|

•

|

MANY ECONOMIC AND MARKET FACTORS WILL AFFECT THE VALUE OF THE SECURITIES — In addition to the price of the Reference Shares on any trading day during the Observation Period, the value of the securities will be affected by a number of economic and market factors that may either offset or magnify each other, including:

|

|

|

o

|

the expected volatility of the Reference Shares;

|

|

|

o

|

the time to maturity of the securities;

|

|

|

o

|

the dividend rate on the Reference Shares;

|

|

|

o

|

interest and yield rates in the market generally;

|

|

|

o

|

investors’ expectations with respect to the rate of inflation;

|

|

|

o

|

events affecting companies engaged in the electronics industry;

|

|

|

o

|

geopolitical conditions and a variety of economic, financial, political, regulatory or judicial events that affect the Reference Share Issuer or markets generally and which may affect the price of the Reference Shares; and

|

|

|

o

|

our creditworthiness, including actual or anticipated downgrades in our credit ratings.

|

Some or all of these factors may influence the price that you will receive if you choose to sell your securities prior to maturity. The impact of any of the factors set forth above may enhance or offset some or all of any change resulting from another factor or factors.

Supplemental Use of Proceeds and Hedging

We intend to use the proceeds of this offering for our general corporate purposes, which may include the refinancing of existing debt outside Switzerland. Some or all of the proceeds we receive from the sale of the securities may be used in connection with hedging our obligations under the securities through one or more of our affiliates. Such hedging or trading activities on or prior to the Trade Date and during the term of the securities (including on the Valuation Date) could adversely affect the value of the Reference Shares and, as a result, could decrease the amount you may receive on the securities at maturity. For further information, please refer to “Supplemental Use of Proceeds and Hedging” in the accompanying product supplement.

7

The Reference Shares

All information contained herein with respect to the Reference Shares and on Cree, Inc. is derived from publicly available sources and is provided for informational purposes only. Companies with securities registered under the Exchange Act are required to periodically file certain financial and other information specified by the SEC. Information provided to or filed with the SEC by a Reference Share Issuer pursuant to the Exchange Act can be located by reference to the SEC file number provided below. According to its publicly available filings with the SEC, Cree, Inc. develops and manufactures lighting-class light emitting diodes (LEDs), LED lighting and semiconductor solutions for wireless and power applications intended for applications such as general illumination, video displays, automotive, electronic signs and signals, variable-speed motors and wireless systems. The common stock of Cree, Inc., par value $0.00125 per share, is listed on The NASDAQ Global Select Market. Cree, Inc.’s SEC file number is 0-21154 and can be accessed through www.sec.gov. We do not make any representation that these publicly available documents are accurate or complete.

Historical Information

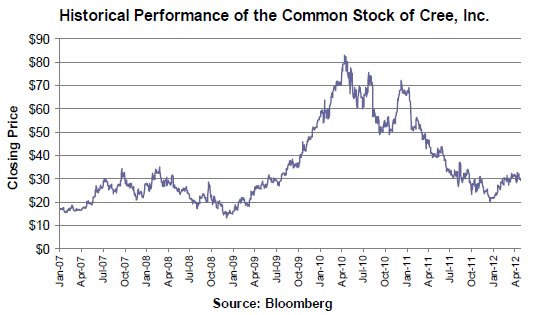

The following graph sets forth the historical performance of the Reference Shares based on the closing prices of the Reference Shares from January 1, 2007 through April 24, 2012. The closing price of the Reference Shares on April 24, 2012 was $29.78. We obtained the closing prices below from Bloomberg, without independent verification. The closing prices and this other information may be adjusted by Bloomberg for corporate actions such as public offerings, mergers and acquisitions, spin-offs, delistings and bankruptcy. We make no representation or warranty as to the accuracy or completeness of the information obtained from Bloomberg. The price source for determining the Final Share Price will be the Bloomberg page “CREE” or any successor page.

The historical prices of the Reference Shares should not be taken as an indication of future performance, and no assurance can be given as to the closing price of the Reference Shares on any trading day during the Observation Period, including on the Valuation Date. The closing price of the Reference Shares may decrease so that a Knock-In Event occurs and at maturity you will be entitled to receive a Redemption Amount that is less than the principal amount of the securities. We cannot give you assurance that the performance of the Reference Shares will result in the return of any of your initial investment.

For additional information about the Reference Shares, see the information set forth under “The Reference Shares” herein.

8

Material U.S. Federal Income Tax Considerations

The following discussion summarizes material U.S. federal income tax consequences of owning and disposing of securities that may be relevant to holders of securities that acquire their securities from us as part of the original issuance of the securities. This discussion applies only to holders that hold their securities as capital assets within the meaning of the Internal Revenue Code of 1986, as amended (the “Code”). Further, this discussion does not address all of the U.S. federal income tax consequences that may be relevant to you in light of your individual circumstances or if you are subject to special rules, such as if you are:

|

|

·

|

a financial institution,

|

|

|

·

|

a mutual fund,

|

|

|

·

|

a tax-exempt organization,

|

|

|

·

|

a grantor trust,

|

|

|

·

|

certain U.S. expatriates,

|

|

|

·

|

an insurance company,

|

|

|

·

|

a dealer or trader in securities or foreign currencies,

|

|

|

·

|

a person (including traders in securities) using a mark-to-market method of accounting,

|

|

|

·

|

a person who holds securities as a hedge or as part of a straddle with another position, constructive sale, conversion transaction or other integrated transaction, or

|

|

|

·

|

an entity that is treated as a partnership for U.S. federal income tax purposes.

|

The discussion is based upon the Code, law, regulations, rulings and decisions, in each case, as available and in effect as of the date hereof, all of which are subject to change, possibly with retroactive effect. Tax consequences under state, local and foreign laws are not addressed herein. No ruling from the U.S. Internal Revenue Service (the “IRS”) has been or will be sought as to the U.S. federal income tax consequences of the ownership and disposition of securities, and the following discussion is not binding on the IRS.

You should consult your tax advisor as to the specific tax consequences to you of owning and disposing of securities, including the application of federal, state, local and foreign income and other tax laws based on your particular facts and circumstances.

IRS CIRCULAR 230 REQUIRES THAT WE INFORM YOU THAT ANY TAX STATEMENT HEREIN REGARDING ANY U.S. FEDERAL TAX IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED, BY ANY TAXPAYER FOR THE PURPOSE OF AVOIDING ANY PENALTIES. ANY SUCH STATEMENT HEREIN WAS WRITTEN TO SUPPORT THE MARKETING OR PROMOTION OF THE TRANSACTION(S) OR MATTER(S) TO WHICH THE STATEMENT RELATES. A PROSPECTIVE INVESTOR (INCLUDING A TAX-EXEMPT INVESTOR) IN THE SECURITIES SHOULD CONSULT ITS OWN TAX ADVISOR IN DETERMINING THE TAX CONSEQUENCES OF AN INVESTMENT IN THE SECURITIES, INCLUDING THE APPLICATION OF STATE, LOCAL OR OTHER TAX LAWS AND THE POSSIBLE EFFECTS OF CHANGES IN FEDERAL OR OTHER TAX LAWS.

Characterization of the Securities

There are no statutory provisions, regulations, published rulings, or judicial decisions addressing the characterization for U.S. federal income tax purposes of securities with terms that are substantially the same as those of your securities. Thus, the characterization of the securities is not certain. Our special tax counsel, Orrick, Herrington & Sutcliffe LLP, has advised that the securities should be treated, for U.S. federal income tax purposes, as a prepaid financial contract, with respect to the Reference Shares, that is eligible for open transaction treatment. In the absence of an administrative or judicial ruling to the contrary, we and, by acceptance of the securities, you agree to treat your securities for all tax purposes in accordance with such characterization. In light of the fact that we agree to treat the securities as a prepaid financial contract, the balance of this discussion assumes that the securities will be so treated.

You should be aware that the characterization of the securities as described above is not certain, nor is it binding on the IRS or the courts. Thus, it is possible that the IRS would seek to characterize your securities in a manner that results in tax consequences to you that are different from those described above. For example, the IRS might

9

assert that securities with a term of more than one year constitute debt instruments that are “contingent payment debt instruments” that are subject to special tax rules under the applicable Treasury regulations governing the recognition of income over the term of your securities. If the securities were to be treated as contingent payment debt instruments, you would be required to include in income on an economic accrual basis over the term of the securities an amount of interest that is based upon the yield at which we would issue a non-contingent fixed-rate debt instrument with other terms and conditions similar to your securities, or the comparable yield. The characterization of securities as contingent payment debt instruments under these rules is likely to be adverse. However, if the securities had a term of one year or less, the rules for short-term debt obligations would apply rather than the rules for contingent payment debt instruments. Under Treasury regulations, a short-term debt obligation is treated as issued at a discount equal to the difference between all payments on the obligation and the obligation’s issue price. A cash method U.S. Holder that does not elect to accrue the discount in income currently should include the payments attributable to interest on the security as income upon receipt. Under these rules, any contingent payment would be taxable upon receipt by a cash basis taxpayer as ordinary interest income. You should consult your tax advisor regarding the possible tax consequences of characterization of the securities as contingent payment debt instruments or short-term debt obligations. It is also possible that the IRS would seek to characterize your securities as options, and thus as Code section 1256 contracts in the event that they are listed on a securities exchange. In such case, the securities would be marked-to-market at the end of the year and 40% of any gain or loss would be treated as short-term capital gain or loss, and the remaining 60% of any gain or loss would be treated as long-term capital gain or loss. We are not responsible for any adverse consequences that you may experience as a result of any alternative characterization of the securities for U.S. federal income tax or other tax purposes.

You should consult your tax advisor as to the tax consequences of such characterization and any possible alternative characterizations of your securities for U.S. federal income tax purposes.

U.S. Holders

For purposes of this discussion, the term “U.S. Holder,” for U.S. federal income tax purposes, means a beneficial owner of securities that is (1) a citizen or resident of the United States, (2) a corporation (or an entity treated as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the United States or any state thereof or the District of Columbia, (3) an estate, the income of which is subject to U.S. federal income taxation regardless of its source, or (4) a trust, if (a) a court within the United States is able to exercise primary supervision over the administration of such trust and one or more U.S. persons have the authority to control all substantial decisions of the trust or (b) such trust has in effect a valid election to be treated as a domestic trust for U.S. federal income tax purposes. If a partnership (or an entity treated as a partnership for U.S. federal income tax purposes) holds securities, the U.S. federal income tax treatment of such partnership and a partner in such partnership will generally depend upon the status of the partner and the activities of the partnership. If you are a partnership, or a partner of a partnership, holding securities, you should consult your tax advisor regarding the tax consequences to you from the partnership’s purchase, ownership and disposition of the securities.

In accordance with the agreed-upon tax treatment described above, if the security provides for the payment of the redemption amount in cash based on the return of the Reference Shares, upon receipt of the redemption amount of the security from us, a U.S. Holder will recognize gain or loss equal to the difference between the amount of cash received from us and the U.S. Holder’s tax basis in the security at that time. For securities with a term of more than one year, such gain or loss will be long-term capital gain or loss if the U.S. Holder has held the security for more than one year at maturity. For securities with a term of one year or less, such gain or loss will be short-term capital gain or loss. If the security provides for the payment of the redemption amount in physical shares or units of the Reference Shares, the U.S. Holder should not recognize any gain or loss with respect to the security (other than with respect to cash received in lieu of fractional shares or units, as described below). A U.S. Holder should have a tax basis in all physical shares or units received (including for this purpose any fractional shares or units) equal to its tax basis in the security (generally its cost). A U.S. Holder’s holding period for any physical shares or units received should start on the day after the delivery of the physical shares or units. A U.S. Holder should generally recognize short-term capital gain or loss with respect to cash received in lieu of fractional shares or units in an amount equal to the difference between the amount of such cash received and the U.S. Holder’s basis in the fractional shares or units, which should be equal to the U.S. Holder’s basis in all of the reference shares or units (including the fractional shares or units), multiplied by a fraction, the numerator of which is the fractional shares or units and the denominator of which is all of the physical shares or units (including fractional shares or units).

10

Upon the sale or other taxable disposition of a security, a U.S. Holder generally will recognize gain or loss equal to the difference between the amount realized on the sale or other taxable disposition and the U.S. Holder’s tax basis in the security (generally its cost). For securities with a term of more than one year, such gain or loss will be long-term capital gain or loss if the U.S. Holder has held the security for more than one year at the time of disposition. For securities with a term of one year or less, such gain or loss will be short-term capital gain or loss.

Securities Held Through Foreign Accounts

Under the “Hiring Incentives to Restore Employment Act” (the “Act”) and recently proposed regulations, a 30% withholding tax is imposed on “withholdable payments” and certain “passthru payments” made to foreign financial institutions (and their more than 50% affiliates) unless the payee foreign financial institution agrees, among other things, to disclose the identity of any U.S. individual with an account at the institution (or the institution’s affiliates) and to annually report certain information about such account. “Withholdable payments” include (1) payments of interest (including original issue discount), dividends, and other items of fixed or determinable annual or periodical gains, profits, and income (“FDAP”), in each case, from sources within the United States, and (2) gross proceeds from the sale of any property of a type which can produce interest or dividends from sources within the United States. “Passthru payments” generally are certain payments attributable to withholdable payments. The Act also requires withholding agents making withholdable payments to certain foreign entities that do not disclose the name, address, and taxpayer identification number of any substantial U.S. owners (or certify that they do not have any substantial United States owners) to withhold tax at a rate of 30%. We will treat payments on the securities as withholdable payments for these purposes.

Withholding under the Act described above will apply to all withholdable payments and certain passthru payments without regard to whether the beneficial owner of the payment is a U.S. person, or would otherwise be entitled to an exemption from the imposition of withholding tax pursuant to an applicable tax treaty with the United States or pursuant to U.S. domestic law. Unless a foreign financial institution is the beneficial owner of a payment, it will be subject to refund or credit in accordance with the same procedures and limitations applicable to other taxes withheld on FDAP payments provided that the beneficial owner of the payment furnishes such information as the IRS determines is necessary to determine whether such beneficial owner is a United States owned foreign entity and the identity of any substantial United States owners of such entity. Pursuant to the proposed regulations, the Act’s withholding regime generally will apply to (i) withholdable payments (other than gross proceeds of the type described above) made after December 31, 2013, (ii) payments of gross proceeds of the type described above with respect to a sale or disposition occurring after December 31, 2014, and (iii) passthru payments made after December 31, 2016. Additionally, the provisions of the Act discussed above generally will not apply to obligations (other than an instrument that is treated as equity for U.S. tax purposes or that lacks a stated expiration or term) that are outstanding on January 1, 2013. Thus, if you hold your securities through a foreign financial institution or foreign corporation or trust, a portion of any of your payments made after December 31, 2013 may be subject to 30% withholding.

Non-U.S. Holders Generally

In the case of a holder of the securities that is not a U.S. Holder and has no connection with the United States other than holding its securities (a “Non-U.S. Holder”), payments made with respect to the securities will not be subject to U.S. withholding tax, provided that such Non-U.S. Holder complies with applicable certification requirements. Any gain realized upon the sale or other disposition of the securities by a Non-U.S. Holder generally will not be subject to U.S. federal income tax unless (1) such gain is effectively connected with a U.S. trade or business of such Non-U.S. Holder or (2) in the case of an individual, such individual is present in the United States for 183 days or more in the taxable year of the sale or other disposition and certain other conditions are met. Any effectively connected gains described in clause (1) above realized by a Non-U.S. Holder that is, or is taxable as, a corporation for U.S. federal income tax purposes may also, under certain circumstances, be subject to an additional branch profits tax at a 30% rate or such lower rate as may be specified by an applicable income tax treaty. Non-U.S. Holders should consult their tax advisors regarding the possibility that any portion of the return with respect to the securities could be characterized as dividend income and be subject to U.S. withholding tax.

Non-U.S. Holders that are subject to U.S. federal income taxation on a net income basis with respect to their investment in the securities should refer to the discussion above relating to U.S. Holders.

11

Substitute Dividend and Dividend Equivalent Payments

The Act and recently proposed and temporary regulations treat a “dividend equivalent” payment as a dividend from sources within the United States. Under the Act, unless reduced by an applicable tax treaty with the United States, such payments generally will be subject to U.S. withholding tax. A “dividend equivalent” payment is (i) a substitute dividend payment made pursuant to a securities lending or a sale-repurchase transaction that (directly or indirectly) is contingent upon, or determined by reference to, the payment of a dividend from sources within the United States, (ii) a payment made pursuant to a “specified notional principal contract” that (directly or indirectly) is contingent upon, or determined by reference to, the payment of a dividend from sources within the United States, and (iii) any other payment determined by the IRS to be substantially similar to a payment described in the preceding clauses (i) and (ii). Proposed regulations provide criteria for determining whether a notional principal contract will be a specified notional principal contract, effective for payments made after December 31, 2012.

Proposed regulations address whether a payment is a dividend equivalent. The proposed regulations provide that an equity-linked instrument that provides for a payment that is a substantially similar payment is treated as a notional principal contract for these purposes. An equity-linked instrument is a financial instrument or combination of financial instruments that references one or more underlying securities to determine its value, including a futures contract, forward contract, option, or other contractual arrangement. Although it is not certain, an equity-linked instrument could include instruments treated as indebtedness for U.S. federal income tax purposes. The proposed regulations consider any payment, including the payment of the purchase price or an adjustment to the purchase price, to be a substantially similar payment (and, therefore, a dividend equivalent payment) if made pursuant to an equity-linked instrument that is contingent upon or determined by reference to a dividend (including payments pursuant to a redemption of stock that gives rise to a dividend) from sources within the United States. The rules for equity-linked instruments under the proposed regulations will be effective for payments made after the rules are finalized. Where the securities reference an interest in a fixed basket of securities or a “customized index,” each security or component of such basket or customized index is treated as an underlying security in a separate notional principal contract for purposes of determining whether such notional principal contract is a specified notional principal contract or an amount received is a substantially similar payment.

We will treat any portion of a payment on the securities that is substantially similar to a dividend as a dividend equivalent payment, which will be subject to U.S. withholding tax, unless reduced by an applicable tax treaty and a properly executed IRS Form W-8 (or other qualifying documentation) is provided. Investors should consult their tax advisors regarding whether payments on the securities constitute dividend equivalent payments.

U.S. Federal Estate Tax Treatment of Non-U.S. Holders

The securities may be subject to U.S. federal estate tax if an individual Non-U.S. Holder holds the securities at the time of his or her death. The gross estate of a Non-U.S. Holder domiciled outside the United States includes only property situated in the United States. Individual Non-U.S. Holders should consult their tax advisors regarding the U.S. federal estate tax consequences of holding the securities at death.

IRS Notice on Certain Financial Transactions

On December 7, 2007, the IRS and the Treasury Department issued Notice 2008-2, in which they stated they are considering issuing new regulations or other guidance on whether holders of an instrument such as the securities should be required to accrue income during the term of the instrument. The IRS and Treasury Department also requested taxpayer comments on (1) the appropriate method for accruing income or expense (e.g., a mark-to-market methodology or a method resembling the noncontingent bond method), (2) whether income and gain on such an instrument should be ordinary or capital, and (3) whether foreign holders should be subject to withholding tax on any deemed income accrual. Additionally, unofficial statements made by IRS officials have indicated that they will soon be addressing the treatment of prepaid forward contracts in proposed regulations.

Accordingly, it is possible that regulations or other guidance may be issued that require holders of the securities to recognize income in respect of the securities prior to receipt of any payments thereunder or sale thereof. Any regulations or other guidance that may be issued could result in income and gain (either at maturity or upon sale) in respect of the securities being treated as ordinary income. It is also possible that a Non-U.S. Holder of the securities could be subject to U.S. withholding tax in respect of the securities under such regulations or other guidance. It is not possible to determine whether such regulations or other guidance will apply to your securities (possibly on a retroactive basis). You are urged to consult your tax advisor regarding Notice 2008-2 and its possible impact on you.

12

Information Reporting Regarding Specified Foreign Financial Assets

The Act and temporary and proposed regulations generally require individual U.S. Holders (“specified individuals”) and “specified domestic entities” with an interest in any “specified foreign financial asset” to file an annual report on new IRS Form 8938 with information relating to the asset, including the maximum value thereof, for any taxable year in which the aggregate value of all such assets is greater than $50,000 on the last day of the taxable year or $75,000 at any time during the taxable year. Certain individuals are permitted to have an interest in a higher aggregate value of such assets before being required to file a report. The proposed regulations relating to specified domestic entities apply to taxable years beginning after December 31, 2011. Under the proposed regulations, “specified domestic entities” are domestic entities that are formed or used for the purposes of holding, directly or indirectly, specified foreign financial assets. Generally, specified domestic entities are certain closely held corporations and partnerships that meet passive income or passive asset tests and, with certain exceptions, domestic trusts that have a specified individual as a current beneficiary and exceed the reporting threshold. Specified foreign financial assets include any depository or custodial account held at a foreign financial institution; any debt or equity interest in a foreign financial institution if such interest is not regularly traded on an established securities market; and, if not held at a financial institution, (i) any stock or security issued by a non-U.S. person, (ii) any financial instrument or contract held for investment where the issuer or counterparty is a non-U.S. person, and (iii) any interest in an entity which is a non-U.S. person.

Depending on the aggregate value of your investment in specified foreign financial assets, you may be obligated to file an IRS Form 8938 under this provision if you are an individual U.S. Holder. Specified domestic entities are not required to file Form 8938 until the proposed regulations are final. Penalties apply to any failure to file IRS Form 8938. Additionally, in the event a U.S. Holder (either a specified individual or specified domestic entity) does not file such form, the statute of limitations on the assessment and collection of U.S. federal income taxes of such U.S. Holder for the related tax year may not close before the date which is three years after the date such information is filed. You should consult your own tax advisor as to the possible application to you of this information reporting requirement and related statute of limitations tolling provision.

Backup Withholding and Information Reporting

A holder of the securities (whether a U.S. Holder or a Non-U.S. Holder) may be subject to backup withholding with respect to certain amounts paid to such holder unless it provides a correct taxpayer identification number, complies with certain certification procedures establishing that it is not a U.S. Holder or establishes proof of another applicable exemption, and otherwise complies with applicable requirements of the backup withholding rules. Backup withholding is not an additional tax. You can claim a credit against your U.S. federal income tax liability for amounts withheld under the backup withholding rules, and amounts in excess of your liability are refundable if you provide the required information to the IRS in a timely fashion. A holder of the securities may also be subject to information reporting to the IRS with respect to certain amounts paid to such holder unless it (1) is a Non-U.S. Holder and provides a properly executed IRS Form W-8 (or other qualifying documentation) or (2) otherwise establishes a basis for exemption.

13

Supplemental Plan of Distribution (Conflicts of Interest)

Under the terms and subject to the conditions contained in a distribution agreement dated May 7, 2007, as amended, which we refer to as the distribution agreement, we have agreed to sell the securities to CSSU.

The distribution agreement provides that CSSU is obligated to purchase all of the securities if any are purchased.

CSSU proposes to offer the securities at the offering price set forth on the cover page of this pricing supplement and may receive underwriting discounts and commissions of up to $15.00 per $1,000 principal amount of securities. CSSU may re-allow some or all of the discount on the principal amount per security on sales of such securities by other brokers or dealers. If all of the securities are not sold at the initial offering price, CSSU may change the public offering price and other selling terms.

The agent for this offering, CSSU, is our affiliate. In accordance with FINRA Rule 5121, CSSU may not make sales in this offering to any of its discretionary accounts without the prior written approval of the customer. A portion of the net proceeds from the sale of the securities will be used by CSSU or one of its affiliates in connection with hedging our obligations under the securities.

For further information, please refer to “Underwriting (Conflicts of Interest)” in the accompanying product supplement

14

Credit Suisse