Filed Pursuant to Rule 424(b)(2)

Registration Statement Nos. 333-202913 and 333-180300-03

Dated November 3, 2016

UNDERLYING PERFORMANCE SUPPLEMENT

TO THE UNDERLYING SUPPLEMENT

DATED OCTOBER 4, 2016, PROSPECTUS SUPPLEMENT DATED MAY 4, 2015

AND PROSPECTUS DATED MAY 4, 2015

Credit Suisse AG

Medium-Term Notes

Underlying Performance Supplement

for the

CS Retiree Consumer Expenditure 5% Blended Index Excess Return

As part of our Medium-Term Notes program, Credit Suisse AG (“Credit Suisse”) from time to time may offer certain securities (the “securities”), linked to the performance of the CS Retiree Consumer Expenditure 5% Blended Index Excess Return, which we refer to as the “index.” This prospectus supplement, which we refer to as an “underlying performance supplement,” describes the performance characteristics of the index through September 30, 2016, except as otherwise specified herein. The specific terms of each security offered will be described in the applicable pricing supplement and product supplement. The securities will not be listed on any exchange.

You should read this underlying performance supplement, the related underlying supplement, dated October 4, 2016, the prospectus and the related prospectus supplement, both dated May 4, 2015, the applicable product supplement and pricing supplement, and any applicable free writing prospectus (each, an “offering document”) carefully before you invest. If the terms described in the applicable pricing supplement are different or inconsistent with those described herein (or with those described in the underlying supplement, the prospectus, the prospectus supplement, any applicable product supplement or any applicable free writing prospectus), the terms described in the applicable pricing supplement will control.

Please refer to the “Key Risks Related to the Index” section beginning on page US-6 of this underlying performance supplement, the “Risk Factors” section in the underlying supplement, the “Risk Factors” section in the accompanying product supplement and the “Selected Risk Considerations” or “Key Risks” section in the applicable pricing supplement for risks related to an investment in the securities, as applicable.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities or determined if this underlying performance supplement or any other offering document to which it relates is truthful or complete. Any representation to the contrary is a criminal offense.

Credit Suisse

The date of this underlying performance supplement is November 3, 2016.

Underlying Performance Supplement

for the

CS Retiree Consumer Expenditure 5% Blended Index Excess Return

| TABLE OF CONTENTS | PAGE |

| Additional Information | US-2 |

| Summary – Overview of the Index | US-3 |

| Index Components | US-3 |

| Key Features of the Index | US-4 |

| Index Fees and Costs | US-4 |

| Index Performance | US-4 |

| Top Holdings of the Constituent Indices | US-6 |

| Key Risks Related to the Index | US-7 |

| Important Information Regarding Performance | US-8 |

Additional Information

You should read this underlying performance supplement together with the applicable pricing supplement, the underlying supplement dated October 4, 2016, the product supplement No. G-I dated May 13, 2015, the prospectus supplement dated May 4, 2015 and the prospectus dated May 4, 2015, relating to our Medium-Term Notes of which these securities are a part. You may access these documents on the SEC website at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

| • | Underlying supplement No. CSEARC5E dated October 4, 2016: |

https://www.sec.gov/Archives/edgar/data/1053092/000089109216017827/e71372_424b2.htm

| • | Product supplement No. G-I dated May 13, 2015: |

http://www.sec.gov/Archives/edgar/data/1053092/000095010315003885/dp56216_424b2-gi.htm

| • | Prospectus supplement and Prospectus dated May 4, 2015: |

http://www.sec.gov/Archives/edgar/data/1053092/000104746915004333/a2224570z424b2.htm

US-2

CS

Retiree Consumer Expenditure 5%

Blended Index Excess Return

Summary – Overview of the Index

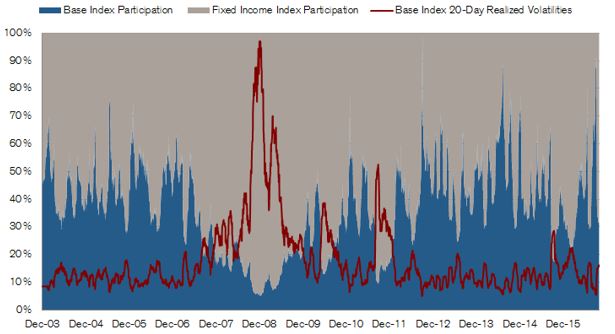

The CS Retiree Consumer Expenditure 5% Blended Index Excess Return (the “Index”) is a rules-based index that seeks to broadly mirror the overall consumer expenditure patterns of retirees in the United States. Using data from the Consumer Expenditure Survey (“CEX”) published by the U.S. Department of Labor’s Bureau of Labor Statistics, the Index assigns category weights by computing the percentage that each of the fourteen CEX consumer spending categories represents of the total consumer expenditure of the age group classified as “65 years and older” (“retirees”). These weights are applied to a notional basket of seven equity indices intended to represent the CEX spending categories to construct the “base index.” The base index is rebalanced each year to reflect the new annual CEX data made available to the public the same year. The Index has exposure to the base index while also employing a mechanism that targets an annualized realized volatility of 5% by using a 20-day lookback period to adjust its level of participation in the base index daily. The volatility targeting mechanism may result in the Index having an exposure to the base index between 0% and 150%. If the actual volatility of the base index over the 20-day lookback period is

more than 5%, the Index will have an exposure to the base index of less than 100%, and if such volatility over such period is less than 5%, the Index will have an exposure to the base index of greater than 100% (to a maximum of 150%). The level of the Index will reflect returns from exposure to the base index and (to the extent that such exposure is less than 100%) to the S&P 2Y US Treasury Note Futures Index Excess Return (the “Fixed Income Index”). The Index is calculated on an excess return basis, so the return of its base index exposure is reduced by 3-month USD LIBOR plus 40 basis points. The Index incorporates the daily deduction of a fee of 0.5% per annum and a daily notional cost of 0.02% applied to the effective change in notional exposures to its components, representing the notional cost of the daily rebalancing to adjust toward the target volatility of 5%.

Index Components

Construction of the Base Index

| • | The base index is comprised of exposure to the seven equity sector indices set forth below (each, a “Constituent Index”), which are intended to correspond to expenditure categories from the U.S. Department of Labor’s Bureau of Labor Statistics’ annual Consumer Expenditure Survey (“CEX”) for those within the “65 and older” age group. | • | Each Constituent Index is intended to represent a distinct CEX category, with the exception of the consumer discretionary index which is intended to represent eight CEX categories. |

| Constituent Index Name | Bloomberg Ticker | CEX Categories Represented |

| S&P 500 Real Estate (Sector) Index Total Return1 | SPTRRLST | Housing |

| S&P Transportation Select Industry Index Total Return | SPSITNTR | Transportation |

| S&P Food & Beverage Select Industry Index Total Return | SPSIFBUT | Food |

| S&P 500 Health Care (Sector) Index Total Return | SPTRHLTH | Healthcare |

| S&P 500 Consumer Discretionary (Sector) Index Total Return | SPTRCOND | Alcoholic beverages, Entertainment, Personal care products and services, Reading, Education, Tobacco products and smoking supplies, Miscellaneous, Cash contributions |

| S&P 500 Apparel Retail (Sub-Industry) Index Total Return | S5APRETR | Apparel and services |

| S&P Insurance Select Industry Index Total Return | SPSIINST | Personal insurance & pensions |

1 Effective September 19, 2016, S&P removed the real estate industry group from the financials sector and established the newly created real estate sector. As of the date of this underlying performance supplement, the real estate sector contains only the real estate industry group. The Index includes the S&P 500 Real Estate (Industry Group) Index Total Return (Bloomberg ticker SPTR5EST) from inception to, and including, September 30, 2016 and the S&P 500 Real Estate (Sector) Index Total Return (Bloomberg ticker SPTRRLST) from, and including, October 3, 2016. The closing levels of SPTRRLST and SPTR5EST on September 30, 2016 were both 375.83.

Hypothetical and Historical Base Index and Fixed Income Index Participation and Historical Volatilities*

*The graph above sets forth the actual historical volatility, participation of the base index of CSEARC5E and participation of the Fixed Income Index from February 27, 2015 to September 30, 2016, and the hypothetical back-tested volatility, participation of the base index of CSEARC5E and participation of the Fixed Income Index from December 4, 2003 to February 26, 2015. Hypothetical and historical index participation or volatility is not indicative of future performance or volatility. The above graph does not reflect any index participation or volatility of any products linked to the Index or include any investor fees associated with any product linked to the Index. Please see “Important Information Regarding Performance” for additional information.

US-3

Key Features of the Index

| • | The base index seeks to track an investment in equities of companies that reflect the overall spending patterns of retirees (persons aged 65 and older) in the US. | • | The Index is constructed using US equity sector and industry indices as well as (to the extent that the Index is less than 100% exposed to such indices) the S&P 2Y US Treasury Note Futures Index Excess Return. | |

| • | The base index seeks to map its constituent equity indices to the primary drivers of retirement costs based on 14 CEX consumer spending categories, including housing, transportation, food and beverages and medical care, using weights derived from the CEX. | • | The Index employs a mechanism intended to target an annualized realized volatility of 5%. | |

| • | Index levels are published on Bloomberg under the ticker CSEARC5E. |

Index Fees and Costs

| • |

The Index return is calculated on an excess return basis and is reduced by 3-month USD LIBOR plus 40 basis points.

|

the target volatility of 5%. Historically, over each calendar year, the notional transaction cost has decreased the hypothetical performance of the index by between 0.05% and 0.25% per annum.* |

| • | The Index has a daily deduction of a 0.5% per annum fee and a daily notional cost of 0.02% applied to the effective change in notional exposures to its components, representing the notional cost of the daily rebalancing to adjust toward | *The historical analysis of the notional transaction costs should not be taken as an indication of future costs. |

Index Performance

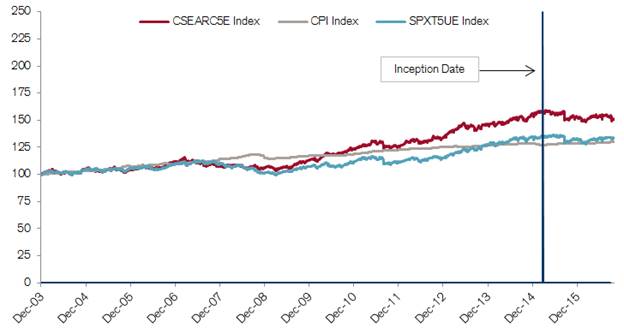

Hypothetical and Historical Performance*

A retrospectively-calculated historical simulation of the Index from December 4, 2003 to September 30, 2016 results in:

| · | Historical annualized return of around 3.3% |

| · | Historical annualized volatility of around 5.4% |

The historical results of the Index from its inception date, February 27, 2015, to September 30, 2016 results in:

| · | Historical return for the period of around -4.7% |

| · | Historical annualized volatility of around 6.1% |

The Bloomberg tickers used in the charts represent the following indices:

| · | CSEARC5E: CS Retiree Consumer Expenditure 5% Blended Index Excess Return |

| · | CPI: Consumer Price Index |

| · | SPXT5UE: S&P 500® Daily Risk Control 5% Excess Return Index |

*The preceding graph sets forth the actual historical performance of the Index from February 27, 2015 to September 30, 2016, and the hypothetical back-tested performance of the Index from December 4, 2003 to February 26, 2015. Hypothetical and historical performance is not indicative of future performance. The above graph does not reflect any performance of any products linked to the Index or include any investor fees associated with any product linked to the Index. Please see “Important Information Regarding Performance” for additional information.

US-4

Index Performance continued

Table 1: Hypothetical and Historical Performance*

| Historical Performance6 |

Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Full Year7 |

| 2016 | -1.27% | 0.13% | 2.25% | -0.47% | 0.26% | -0.06% | 1.01% | -1.48% | -1.26% | -0.94% | |||

| 2015 | 0.38% | 0.82% | 0.06% | -1.86% | 0.48% | -0.85% | 1.56% | -3.98% | -0.10% | 1.82% | -0.45% | -0.44% | -2.65% |

| 2014 | -0.88% | 1.33% | -0.05% | 0.09% | 1.71% | 0.86% | -0.87% | 2.05% | -2.02% | 1.73% | 2.45% | -0.04% | 6.43% |

| 2013 | 2.66% | 0.57% | 2.05% | 1.61% | -0.70% | -0.51% | 0.75% | -2.55% | 1.80% | 1.61% | 0.47% | 0.44% | 8.42% |

| 2012 | 1.86% | 0.25% | 1.89% | 0.14% | -1.81% | 0.64% | 0.23% | 0.60% | 1.18% | 0.18% | 0.42% | 1.06% | 6.80% |

| 2011 | 0.60% | 1.57% | 0.05% | 2.56% | 0.44% | -1.29% | -0.56% | -2.16% | -1.37% | 1.71% | -0.22% | 0.55% | 1.79% |

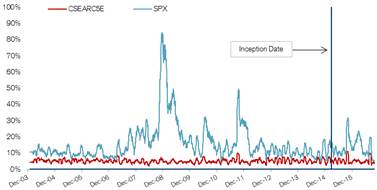

Graph 1: Hypothetical and Historical 20-day Realized Volatilities*

| · | CSEARC5E: CS Retiree Consumer Expenditure 5% Blended Index Excess Return |

| · | SPX: S&P 500® Index |

Table 2: Comparative Hypothetical and Historical Annualized Returns, Annualized Volatility and Correlation*

| One Year Annualized Return1 |

One Year Annualized Volatility2 |

One Year Correlation4 |

Three Years Annualized Return1 |

Five Years Annualized Return1 |

Ten Years Annualized Return1 | |

|

CS Consumer Expenditure

5% |

-0.1% | 6.0% | 100.0% | 1.6% | 3.9% | 3.4% |

| Consumer Price Index | 1.48% | 0.70% | -17.51% | 1.04% | 1.24% | 1.69% |

| S&P 500® Daily Risk Control 5% Excess Return Index (SPXT5UE) |

2.7% | 4.8% | 86.2% | 2.4% | 4.0% | 2.2% |

Table 3: Hypothetical and Historical Correlation*

|

Correlations (Since December, 2003) |

CS Consumer Expenditure 5% Blended Index Excess Return |

S&P 500® Index | Consumer Price Index |

S&P 500® Daily Risk Control 5% Excess Return Index (SPXT5UE) |

| CS Consumer Expenditure 5% Blended Index Excess Return | 100% | 68.2% | -12.1% | 79.7% |

| S&P 500® Index (SPX) | 100% | 11.8% | 87.1% | |

| Consumer Price Index (CPI) | 100% | 1.7% | ||

| S&P 500® Daily Risk Control 5% Excess Return Index (SPXT5UE) | 100% |

* Table 1 above sets forth the actual historical performance of the Index from February 27, 2015 to September 30, 2016, and the hypothetical back-tested performance of the Index from December 4, 2003 to February 26, 2015. Graph 1 above sets forth the actual historical volatility of performance of the Index from February 27, 2015 to September 30, 2016, and the hypothetical back-tested volatility of performance of the Index from December 4, 2003 to February 26, 2015. Table 2 above sets forth the actual historical performance, volatility and correlation of the Index from February 27, 2015 to September 30, 2016, and the hypothetical back-tested performance, volatility and correlation of the Index from December 4, 2003 to February 26, 2015. Table 3 above sets forth the actual historical correlation of performance of the Index from February 27, 2015 to September 30, 2016, and the hypothetical back-tested correlation of performance of the Index from December 4, 2003 to February 26, 2015. Hypothetical and historical performance, volatility or correlation are not indicative of future performance, volatility or correlation, respectively. The above tables and graph do not reflect any performance of any products linked to the Index or include any investor fees associated with any product linked to the Index. Please see “Important Information Regarding Performance” for additional information.

Table 4: Base Index Composition**

| Recent Base Index Composition | S&P 500 Apparel Retail (Sub- Industry) Index Total Return |

S&P Food & Beverage Select Industry Index Total Return |

S&P Insurance Select Industry Index Total Return |

S&P Transportation Select Industry Index Total Return |

S&P 500 Real Estate (Sector) Total Return1 |

S&P 500 Consumer Discretionary (Sector) Index Total Return |

S&P 500 Health Care (Sector) Index Total Return |

| S5APRETR | SPSIFBUT | SPSIINST | SPSITNTR | SPTRRLST | SPTRCOND | SPTRHLTH | |

| Nov 2015 | 2.52% | 12.52% | 5.15% | 15.91% | 33.87% | 16.62% | 13.40% |

| Nov 2014 | 2.47% | 12.54% | 5.79% | 16.33% | 34.31% | 16.33% | 12.24% |

| Nov 2013 | 2.53% | 12.52% | 4.97% | 16.18% | 34.23% | 16.90% | 12.67% |

| Nov 2012 | 2.88% | 13.17% | 5.07% | 14.68% | 34.99% | 17.04% | 12.17% |

| Nov 2011 | 2.62% | 12.39% | 5.09% | 14.24% | 35.36% | 17.14% | 13.16% |

**The above table represents the hypothetical back-tested base index weights as of each of the most recent base index rebalance dates. Base index rebalancing dates are the first business day in November each year. Hypothetical and historical index weights are not indicative of future index weights. Please see “Important Information Regarding Performance” for additional information.

1

Effective September 19, 2016, S&P removed the real estate industry group from the financials sector and established the

newly created real estate sector. As of the date of this underlying performance supplement, the real estate sector contains only

the real estate industry group. The Index includes the S&P 500 Real Estate (Industry Group) Index Total Return (Bloomberg ticker

SPTR5EST) from inception to, and including, September 30, 2016 and the S&P 500 Real Estate (Sector) Index Total Return (Bloomberg

ticker SPTRRLST) from, and including, October 3, 2016. The closing levels of SPTRRLST and SPTR5EST on September 30, 2016 were both

375.83. With respect to the S&P 500 Real Estate (Sector) Total Return, the above table represents the hypothetical back-tested

base index weights for the S&P 500 Real Estate (Industry Group) Index Total Return as of each of the most recent base index

rebalance dates.

US-5

Top Holdings of the Constituent Indices (as of September 30, 2016)

S&P 500 Real Estate (Sector) Index Total Return1

| Company | Weight* |

| Simon Property Group A | 11.34% |

| American Tower Corp A | 8.41% |

| Public Storage | 5.80% |

| Crown Castle Intl Corp | 5.55% |

| ProLogis Inc | 4.92% |

| Welltower Inc | 4.67% |

| Equinix Inc | 4.46% |

| Ventas Inc | 4.33% |

| AvalonBay Communities Inc | 4.26% |

| Weyerhaeuser Co | 4.17% |

S&P Food & Beverage Select Industry Index Total Return

| Company | Weight* |

| B&G Foods Inc | 1.86% |

| ConAgra Foods Inc | 1.85% |

| Molson Coors Brewing Co B | 1.84% |

| Supervalu Inc | 1.80% |

| Sprouts Farmers Markets Inc | 1.79% |

| Hormel Foods Corp | 1.79% |

| PepsiCo Inc | 1.78% |

| Mondelez International Inc | 1.78% |

| PriceSmart Inc | 1.77% |

| Fresh Del Monte Produce | 1.77% |

S&P Transportation Select Industry Index Total Return

| Company | Weight* |

| XPO Logistics Inc | 2.94% |

| Spirit Airlines Inc. | 2.93% |

| Kirby Corp | 2.93% |

| CSX Corporation | 2.89% |

| FedEx Corp | 2.87% |

| Norfolk Southern Corp | 2.82% |

| JetBlue Airways Corp | 2.81% |

| Union Pacific Corp | 2.78% |

| Delta Air Lines | 2.75% |

| Hunt J.B. Transport Services | 2.75% |

S&P Insurance Select Industry Index Total Return

| Company | Weight* |

| Willis Towers Watson PLC | 2.72% |

| Principal Financial Group | 2.66% |

| Hartford Finl Services Group | 2.61% |

| Gallagher Arthur J. & Co | 2.59% |

| Assurant Inc | 2.58% |

| Aon plc | 2.58% |

| Prudential Financial Inc | 2.58% |

| Marsh & McLennan Companies | 2.55% |

| Allstate Corp | 2.54% |

| Metlife Inc | 2.53% |

S&P 500 Apparel Retail (Sub-Industry) Index Total Return

| Company | Weight* |

| TJX Cos Inc | 45.17% |

| Ross Stores Inc | 23.46% |

| L Brands Inc | 15.64% |

| Foot Locker Inc | 8.43% |

| Gap Inc | 4.48% |

| Urban Outfitters | 2.83% |

S&P 500 Health Care (Sector) Index Total Return

| Company | Weight* |

| Johnson & Johnson | 11.75% |

| Pfizer Inc | 7.47% |

| Merck & Co Inc | 6.27% |

| Unitedhealth Group Inc | 4.85% |

| Amgen Inc | 4.54% |

| Medtronic plc | 4.34% |

| Gilead Sciences Inc | 3.80% |

| AbbVie Inc. | 3.73% |

| Allergan plc | 3.32% |

| Bristol-Myers Squibb | 3.28% |

S&P 500 Consumer Discretionary (Sector) Index Total Return

| Company | Weight* |

| Amazon.com Inc | 14.03% |

| Comcast Corp A | 6.79% |

| Home Depot Inc | 6.77% |

| Walt Disney Co | 5.85% |

| McDonald's Corp | 4.19% |

| Starbucks Corp | 3.38% |

| The Priceline Group Inc | 3.11% |

| NIKE Inc B | 3.02% |

| Lowe's Cos Inc | 2.69% |

| Time Warner Inc | 2.64% |

*Weight reflects the weight of the equity securities that comprise such Constituent Index and not the base index or the Index.

1 Effective September 19, 2016, S&P removed the real estate industry group from the financials sector and established the newly created real estate sector. As of the date of this underlying performance supplement, the real estate sector contains only the real estate industry group. The Index includes the S&P 500 Real Estate (Industry Group) Index Total Return (Bloomberg ticker SPTR5EST) from inception to, and including, September 30, 2016 and the S&P 500 Real Estate (Sector) Index Total Return (Bloomberg ticker SPTRRLST) from, and including, October 3, 2016. The closing levels of SPTRRLST and SPTR5EST on September 30, 2016 were both 375.83.

US-6

Key Risks Related to the Index

The Index may not perform as anticipated The Index methodology may not be successful. The Index may not effectively track retiree consumer spending. The Index methodology may not outperform any alternative strategy that might be employed in respect of the underlying indices. In addition, the Index performance may be negatively affected by various market and structural factors.

The Index may not achieve its target volatility Volatility can fluctuate significantly, even during a single day, future volatility may differ from past volatility, and the Index will not adjust exposure based on the most current volatility. As a result, the Index may not achieve its target volatility at any given time.

Fees and costs will lower the level of the Index The Index is calculated on an excess return basis, so the return of its base index exposure is reduced by 3-month USD LIBOR plus 40 basis points. The Index has a daily deduction of a 0.5% per annum fee and a daily notional cost of 0.02% applied to the effective change in notional exposures of the base index and the S&P 2-Year US Treasury Note Excess Return Index, representing the notional cost of daily rebalancing to adjust toward the target volatility of 5%. Historically, over each calendar year, the notional transaction cost has decreased the hypothetical performance of the index by between 0.05% and 0.25% per annum. The historical analysis of the notional transaction costs should not be taken as an indication of future costs. These fees and costs will lower the level of the Index and as a result may reduce the value of and your return on an investment linked to the Index. Such reduction may be significant.

Changes in the value of the Index components may offset each other Because the Index tracks the performance of the Index components, which collectively represent a diverse set of securities and asset classes, price movements between the Index components representing different asset classes or market sectors or industries may not correlate with each other. At a time when the value of an Index component representing a particular asset class or market sector or industry increases, the value of other Index components representing a different asset class or market sector or industry may not increase as much or may decline. Therefore, in calculating the level of the Index, increases in the values of some of the Index components may be moderated, or more than offset, by lesser increases or declines in the values of other Index components.

No ownership interest in the Index components The Index comprises equity and fixed income indices, each of which comprise notional assets only. There is no actual portfolio of assets to which any person is entitled or in which any person has any ownership interest. Holders of an investment linked to the Index will not have voting rights or other rights with respect to the securities that comprise the Index components. Although the performance of the Index components will include cash dividends and other distributions in respect of the equity securities that comprise such indices, you will not have the right to receive such dividends or other distributions.

Limited history of the Index The Index was established on February 27, 2015 and therefore has a limited operating history, and may perform in unanticipated ways. Past performance should not be considered indicative of future performance.

One or more of the Index components may not effectively track consumer spending in the United States The fourteen broad categories of consumer spending identified in the CEX are represented by the Index components. Each Index component tracks the performance of a basket of stocks of United States companies in the market sector or industry of the S&P 500® Index or the S&P Total Market Index that was chosen to correspond to the consumer spending category. However, the universe of assets available for the Constituent Indices to track is finite and limited. There is no guarantee that the selected Constituent Indices and assets they track reflect the best possible, or even an effective, mix of constituents to track consumer spending by retirees in the United States.

Potential conflicts We and our affiliates play a variety of roles in connection with the Index and any investment linked to the Index, including acting as calculation agent, hedging our obligations under any investment linked to the index and determining their estimated value. In addition, our affiliate, Credit Suisse International is the Index sponsor and Index calculation agent and may amend or adjust the Index in a way that may have a negative impact on its level. In performing these duties, our economic interests and those of our affiliates are potentially adverse to your interests as an investor in an investment linked to the Index.

The risks identified above are not exhaustive. You should also review carefully the related “Risk Factors” section in any relevant product supplement, underlying supplement, term sheet or pricing supplement.

US-7

Important Information Regarding

Performance

1. Effective September 19, 2016, S&P removed the real estate industry group from the financials sector and established the newly created real estate sector. As of the date of this underlying performance supplement, the real estate sector contains only the real estate industry group. The Index includes the S&P 500 Real Estate (Industry Group) Index Total Return (Bloomberg ticker SPTR5EST) from inception to, and including, September 30, 2016 and the S&P 500 Real Estate (Sector) Index Total Return (Bloomberg ticker SPTRRLST) from, and including, October 3, 2016. The closing levels of SPTRRLST and SPTR5EST on September 30, 2016 were both 375.83.

2. Retrospective performance measures: Represents the performance of the Index based on the hypothetical back-tested closing levels from December 4, 2003 through February 26, 2015, and actual performance from February 27, 2015 to September 30, 2016, as well as the actual performance of the S&P 500® Index and the Consumer Price Index over the same periods. For purposes of these examples, each index was set equal to 100 at the beginning of the relevant measurement period and returns are calculated arithmetically (not compounded). The “S&P 500® Index” and the “Consumer Price Index” refer to published third-party indices. There is no guarantee the CS Retiree Consumer Expenditure 5% Blended Index Excess Return will outperform the S&P 500® Index, the Consumer Price Index or any alternative investment strategy.

3. Volatility: the annualized standard deviation of the relevant index’s arithmetic daily returns as of December 4, 2003. Volatility levels are calculated from the hypothetical back-tested and actual historical returns, as applicable to the relevant measurement period, of the CS Retiree Consumer Expenditure 5% Blended Index Excess Return, the S&P 500® Index and the Consumer Price Index.

4. Correlation: the performance of the relevant index to the CS Retiree Consumer Expenditure 5% Blended Index Excess Return, calculated based on the hypothetical back-tested and actual historical daily returns since December 4, 2003.

5. The hypothetical back-tested annualized volatility and index returns have inherent limitations. These volatility and return results do not represent the results of actual trading and were achieved by means of a retroactive application of back-tested models designed with the benefit of hindsight. No representation is made that in the future the relevant indices will have the volatility or returns shown. Alternative modeling techniques or assumptions might produce significantly different results and may prove to be more appropriate. Actual annualized volatilities and returns may vary materially from this analysis.

6. Hypothetical back-tested and actual historical performance measures: Represents the monthly and full calendar year performance of the Index based on, as applicable to the relevant measurement period, the hypothetical back tested daily closing levels from December 4, 2003 through February 26, 2015 and the actual historical performance of the Index based on daily closing levels from February 27, 2015, through September 30, 2016. YTD reflects the year to date hypothetical and historic performance of the Index from the last business day of the previous calendar year through, and including September 30, 2016. The hypothetical back-tested data was constructed by applying, retroactively, the methodology of the Index. The hypothetical back-tested values above have not been verified by an independent third party. The back-tested, hypothetical back-tested results above have inherent limitations. These back-tested results are achieved by means of a retroactive application of a back-tested model designed with the benefit of hindsight. No representation is made that an investment linked to the Index will or is likely to achieve returns similar to those shown. Alternative modelling techniques or assumptions would produce different hypothetical back-tested information that might prove to be more appropriate and that might differ significantly from the hypothetical back-tested information in the table. Actual results will vary, perhaps materially, from the analysis implied in the hypothetical back-tested information that forms part of the information contained in the table.

7. For 2016, full year is as calculated through September 30, 2016. Please see “Key Risks Related to the Index” on page US-6 for additional information.

Copyright ©2016 CREDIT SUISSE AG and/or its affiliates. All rights reserved.

US-8