|

Pricing Supplement No. U475 |

Filed Pursuant to

Rule 424(b)(2) |

$2,520,000 6 Month 11.50% per annum (approximately 5.75% for the term of the securities) Callable Yield Notes due February 22, 2012 Linked to the Performance of the S&P 500® Index, the Russell 2000® Index and the Market Vectors Gold Miners ETF |

|||

| Financial Products |

|||

General

- The securities are designed for investors who are mildly bearish, neutral or mildly bullish on the Underlyings. Investors should be willing to lose some or all of their investment if a Knock-In Event occurs with respect to any Underlying. Any payment on the securities is subject to our ability to pay our obligations as they become due.

- Interest will be paid in arrears at a rate of 11.50% per annum (approximately 5.75% for the term of the securities), subject to Early Redemption. Interest will be calculated on a 30/360 basis.

- The Issuer may redeem the securities, in whole but not in part, on any Interest Payment Date scheduled to occur on or after October 24, 2011. No interest will accrue or be payable following an Early Redemption.

- Senior unsecured obligations of Credit Suisse AG, acting through its Nassau Branch, maturing February 22, 2012.†

- Minimum purchase of $1,000. Minimum denominations of $1,000 and integral multiples of $1,000 in excess thereof.

- The securities priced on August 17, 2011 (the “Trade Date”) and are expected to settle on August 22, 2011. Delivery of the securities in book-entry form only will be made through The Depository Trust Company.

Key Terms

|

Issuer: |

Credit Suisse AG (“Credit Suisse”), acting through its Nassau Branch |

|||

|

Underlyings: |

Each Underlying is identified in the table below, together with its Bloomberg ticker symbol, Initial Level and Knock-In Level: |

|||

|

|

Underlying |

Ticker |

Initial Level |

Knock-In Level |

|

|

S&P 500® Index (“SPX”) |

SPX |

1,193.89 |

895.4175 |

|

|

Russell 2000® Index (“RTY”) |

RTY |

704.03 |

528.0225 |

|

|

Market Vectors Gold Miners ETF (“GDX”) |

GDX UP |

60.74 |

45.5550 |

|

Interest Rate: |

11.50% per annum (approximately 5.75% for the term of the securities). Interest will be calculated on a 30/360 basis. |

|||

|

Interest |

Unless redeemed earlier, interest will be paid in arrears on October 24, 2011, December 22, 2011 and the Maturity Date, subject to the modified following business day convention. No interest will accrue or be payable following an Early Redemption. |

|||

|

Redemption |

At maturity, the Redemption Amount you will be entitled to receive will depend on the individual performance of each Underlying and whether a Knock-In Event occurs. If the securities are not subject to Early Redemption, the Redemption Amount will be determined as follows: |

|||

|

|

|

|||

|

|

|

|||

|

|

Any payment on the securities is subject to our ability to pay our obligations as they become due. |

|||

|

Early |

The Issuer may redeem the securities in whole, but not in part, on any Interest Payment Date scheduled to occur on or after October 24, 2011 upon at least three business days notice at 100% of the principal amount of the securities, together with the interest payable on that Interest Payment Date. |

|||

|

Knock-In Event: |

A Knock-In Event will occur if the closing level of any Underlying reaches or falls below the Knock-In Level for that Underlying on any trading day during the Observation Period. |

|||

|

Knock-In Level: |

For each Underlying, as set forth in the table above. |

|||

|

Lowest |

The Underlying with the lowest Underlying Return. |

|||

|

Underlying |

For each Underlying, the Underlying Return will be calculated as follows: |

|||

| Final Level –

Initial Level Initial Level |

; subject to a maximum of zero | |||

|

Initial Level: |

For each Underlying, as set forth in the table above. |

|||

|

Final Level: |

For each Underlying, the closing level of such Underlying on the Valuation Date. |

|||

|

Observation |

The period from but excluding the Trade Date to and including the Valuation Date. |

|||

|

Valuation Date:† |

February 17, 2012 |

|||

|

Maturity Date:† |

February 22, 2012 |

|||

|

Listing: |

The securities will not be listed on any securities exchange. |

|||

|

CUSIP: |

22546TDB4 |

|||

† The Valuation Date for any Underlying is subject to postponement if such date is not an underlying business day for such Underlying or as a result of a market disruption event in respect to such Underlying and the Maturity Date is subject to postponement if such date is not a business day or if the Valuation Date for any Underlying is postponed, in each case as described in the accompanying product supplement under “Description of the Securities-Market disruption events.”

Investing in the securities involves a number of risks. See “Selected Risk Considerations” in this pricing supplement and “Risk Factors” beginning on page PS-3 of the accompanying product supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities or passed upon the accuracy or the adequacy of this pricing supplement or the accompanying underlying supplement, the product supplement, the prospectus supplement and the prospectus. Any representation to the contrary is a criminal offense.

|

|

Price to Public |

Underwriting Discounts and Commissions (1) |

Proceeds to Issuer |

|

Per security |

$1,000.00 |

$15.00 |

$985.00 |

|

Total |

$2,520,000.00 |

$37,800.00 |

$2,482,200.00 |

(1) We

or one of our affiliates will pay discounts and commissions of $15.00 per

$1,000 principal amount of securities. In addition, an affiliate of ours may

pay referral fees of up to $5.50 per $1,000 principal amount of securities. For

more detailed information, please see “Supplemental Plan of Distribution

(Conflicts of Interest)” on the last page of this pricing supplement.

The agent for this offering, Credit Suisse Securities (USA) LLC (“CSSU”), is

our affiliate. For more information, see “Supplemental Plan of Distribution

(Conflicts of Interest)” on the last page of this pricing supplement.

The securities are not deposit liabilities and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency of the United States, Switzerland or any other jurisdiction.

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities Offered |

Maximum Aggregate Offering Price |

Amount of Registration Fee |

|

Notes |

$2,520,000 |

$292.57 |

Credit Suisse

August 17, 2011

Additional Terms Specific to the Securities

You should read this pricing supplement together with the underlying supplement dated June 24, 2010, the product supplement dated October 18, 2010, the prospectus supplement dated March 25, 2009 and the prospectus dated March 25, 2009 relating to our Medium Term Notes of which these securities are a part. You may access these documents on the SEC website at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

-

Underlying supplement dated June 24, 2010:

http://www.sec.gov/Archives/edgar/data/1053092/000104746910006110/a2199225z424b2.htm -

Product supplement No. U-I dated October 18, 2010:

http://www.sec.gov/Archives/edgar/data/1053092/000095010310003007/dp19604_424b2-ui.htm -

Prospectus supplement dated March 25, 2009:

http://www.sec.gov/Archives/edgar/data/1053092/000104746909003093/a2191799z424b2.htm -

Prospectus dated March 25, 2009:

http://www.sec.gov/Archives/edgar/data/1053092/000104746909003289/a2191966z424b2.htm

Our Central Index Key, or CIK, on the SEC website is 1053092. As used in this pricing supplement, the “Company,” “we,” “us,” or “our” refers to Credit Suisse.

This pricing supplement, together with the documents listed above, contains the terms of the securities and supersedes all other prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, fact sheets, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours. You should carefully consider, among other things, the matters set forth in “Risk Factors” in the product supplement and “Selected Risk Considerations” in this pricing supplement, as the securities involve risks not associated with conventional debt securities. You should consult your investment, legal, tax, accounting and other advisors before deciding to invest in the securities.

1

Hypothetical Redemption Amounts and Total Payments on the Securities

The tables and examples below illustrate hypothetical Redemption Amounts payable at maturity and, in the case of the tables, total payments over the term of the securities (which include both payments at maturity and the total interest paid on the securities) on a $1,000 investment in the securities for a range of Underlying Returns for the Lowest Performing Underlying, both in the event a Knock-In Event does not occur and in the event a Knock-In Event does occur. The tables and examples reflect that the Interest Rate applicable to the securities is 11.50% per annum (approximately 5.75% for the term of the securities), and assume that (i) the securities are not redeemed prior to maturity, (ii) the term of the securities is exactly 6 months and (iii) the Knock-In Level for each Underlying is 75.00% of the Initial Level for such Underlying. In addition, the examples below assume that the Initial Level is 1,194 for SPX, 704 for RTY and $61 for GDX. The examples are intended to illustrate hypothetical calculations of only the Redemption Amount and do not illustrate the calculation or payment of any individual interest payment. The Redemption Amounts and total payment amounts set forth below are provided for illustration purposes only. The actual Redemption Amounts and total payments applicable to a purchaser of the securities will depend on several variables, including, but not limited to (a) whether the closing level of any Underlying is less than or equal to its respective Knock-In Level on any trading day during the Observation Period and (b) the Final Level of the Lowest Performing Underlying determined on the Valuation Date. It is not possible to predict whether a Knock-In Event will occur, and in the event that there is a Knock-In Event, whether and by how much the Final Level of the Lowest Performing Underlying will decrease in comparison to its Initial Level. Any payment on the securities is subject to our ability to pay our obligations as they become due. The numbers appearing in the following tables and examples have been rounded for ease of analysis.

TABLE 1: A Knock-In Event DOES NOT occur during the Observation Period.

|

Percentage |

Underlying |

Redemption Amount per |

Total Interest |

Total |

|

50% |

0% |

$1,000 |

$57.50 |

$1,057.50 |

|

40% |

0% |

$1,000 |

$57.50 |

$1,057.50 |

|

30% |

0% |

$1,000 |

$57.50 |

$1,057.50 |

|

20% |

0% |

$1,000 |

$57.50 |

$1,057.50 |

|

10% |

0% |

$1,000 |

$57.50 |

$1,057.50 |

|

0% |

0% |

$1,000 |

$57.50 |

$1,057.50 |

|

-10% |

-10% |

$1,000 |

$57.50 |

$1,057.50 |

|

-20% |

-20% |

$1,000 |

$57.50 |

$1,057.50 |

|

-24.99% |

-24.99% |

$1,000 |

$57.50 |

$1,057.50 |

2

TABLE 2: A Knock-In Event DOES occur during the Observation Period.

|

Percentage |

Underlying |

Redemption Amount per |

Total Interest |

Total |

|

50% |

0% |

$1,000 |

$57.50 |

$1,057.50 |

|

40% |

0% |

$1,000 |

$57.50 |

$1,057.50 |

|

30% |

0% |

$1,000 |

$57.50 |

$1,057.50 |

|

20% |

0% |

$1,000 |

$57.50 |

$1,057.50 |

|

10% |

0% |

$1,000 |

$57.50 |

$1,057.50 |

|

0% |

0% |

$1,000 |

$57.50 |

$1,057.50 |

|

-10% |

-10% |

$900 |

$57.50 |

$957.50 |

|

-20% |

-20% |

$800 |

$57.50 |

$857.50 |

|

-30% |

-30% |

$700 |

$57.50 |

$757.50 |

|

-40% |

-40% |

$600 |

$57.50 |

$657.50 |

|

-50% |

-50% |

$500 |

$57.50 |

$557.50 |

Example 1: A Knock-In Event occurs because the closing level of one Underlying reaches its Knock-In Level during the Observation Period; and the Final Level of the Lowest Performing Underlying is less than its Initial Level.

|

Underlying |

Initial Level |

Lowest closing level of the Underlying |

Final Level on the Valuation Date |

|

SPX |

1,194 |

1,194.00 (100% of Initial Level) |

1,313.40 (110% of Initial Level) |

|

RTY |

704 |

633.60 (90% of Initial Level) |

774.40 (110% of Initial Level) |

|

GDX |

$61 |

$45.75 (75% of Initial Level) |

$45.75 (75% of Initial Level) |

Since the closing level of GDX reaches its Knock-In Level during the Observation Period, a Knock-In Event occurs. GDX is also the Lowest Performing Underlying.

Therefore, the Underlying Return of the Lowest Performing Underlying will equal:

|

Final Level of GDX — Initial Level of GDX |

; subject to a maximum of 0.00 |

||

|

|

|||

|

Initial Level of GDX |

|||

= ($45.75 – $61)/$61 = -0.250

Redemption Amount = principal amount of the securities × (1 + Underlying Return of the Lowest Performing Underlying)

= $1,000 x (1 – 0.250) = $750

3

Example 2: A Knock-In Event occurs because the closing level of one Underlying reaches its Knock-In Level during the Observation Period; the Lowest Performing Underlying never reaches or falls below its Knock-In Level during the Observation Period; and the Final Level of the Lowest Performing Underlying is less than its Initial Level.

|

Underlying |

Initial Level |

Lowest closing level of the Underlying |

Final Level on the Valuation Date |

|

SPX |

1,194 |

895.50 (75% of Initial Level) |

1,313.40 (110% of Initial Level) |

|

RTY |

704 |

633.60 (90% of Initial Level) |

774.40 (110% of Initial Level) |

|

GDX |

$61 |

$50.02 (82% of Initial Level) |

$50.02 (82% of Initial Level) |

Since the closing level of SPX reaches its Knock-In Level during the Observation Period, a Knock-In Event occurs. GDX is the Lowest Performing Underlying, even though its closing level never reaches or falls below its Knock-In Level during the Observation Period.

Therefore, the Underlying Return of the Lowest Performing Underlying will equal:

|

Final Level of GDX — Initial Level of GDX |

; subject to a maximum of 0.00 |

||

|

|

|||

|

Initial Level of GDX |

|||

= ($50.02 – $61)/$61 = -0.180

Redemption Amount = principal amount of the securities × (1 + Underlying Return of the Lowest Performing Underlying)

= $1,000 x (1 – 0.180) = $820

Example 3: A Knock-In Event occurs because the closing level of one Underlying reaches its Knock-In Level during the Observation Period; and the Final Level of the Lowest Performing Underlying is greater than its Initial Level.

|

Underlying |

Initial Level |

Lowest closing level of the Underlying |

Final Level on the Valuation Date |

|

SPX |

1,194 |

895.50 (75% of Initial Level) |

1,313.40 (110% of Initial Level) |

|

RTY |

704 |

668.80 (95% of Initial Level) |

844.80 (120% of Initial Level) |

|

GDX |

$61 |

$54.90 (90% of Initial Level) |

$73.20 (120% of Initial Level) |

Since the closing level of SPX reaches its Knock-In Level, a Knock-In Event occurs. SPX is also the Lowest Performing Underlying.

Therefore, the Underlying Return of the Lowest Performing Underlying will equal:

|

Final Level of SPX — Initial Level of SPX |

; subject to a maximum of 0.00 |

||

|

|

|||

|

Initial Level of SPX |

|||

= (1,313.40 – 1,194)/1,194 = 0.100

BUT 0.100 is greater than the maximum of 0.00, so the Underlying Return of the Lowest Performing Underlying is 0.00.

Redemption Amount = principal amount of the securities × (1 + Underlying Return of the Lowest Performing Underlying)

= $1,000 x (1 + 0.00) = $1,000

4

Example 4: A Knock-In Event does not occur.

|

Underlying |

Initial Level |

Lowest closing level of the Underlying |

Final Level on the Valuation Date |

|

SPX |

1,194 |

979.08 (82% of Initial Level) |

1,313.40 (110% of Initial Level) |

|

RTY |

704 |

591.36 (84% of Initial Level) |

774.40 (110% of Initial Level) |

|

GDX |

$61 |

$52.46 (86% of Initial Level) |

$67.10 (110% of Initial Level) |

Since the closing level of each Underlying did not reach or fall below its Knock-In Level during the Observation Period, a Knock-In Event does not occur.

Therefore, the Redemption Amount equals $1,000.

Selected Risk Considerations

An investment in the securities involves significant risks. Investing in the securities is not equivalent to investing directly in the Underlyings. These risks are explained in more detail in the “Risk Factors” section of the accompanying product supplement.

-

YOU MAY RECEIVE LESS THAN THE PRINCIPAL AMOUNT AT MATURITY — You may receive less at maturity than you originally invested in the securities, or you may receive nothing, excluding any accrued or unpaid interest. If a Knock-In Event occurs during the Observation Period and the Final Level of the Lowest Performing Underlying is less than its Initial Level, you will be fully exposed to any depreciation in the Lowest Performing Underlying. In this case, the Redemption Amount you will be entitled to receive will be less than the principal amount of the securities and you could lose your entire investment. It is not possible to predict whether a Knock-In Event will occur, and in the event that there is a Knock-In Event, whether and by how much the Final Level of the Lowest Performing Underlying will decrease in comparison to its Initial Level. Any payment on the securities is subject to our ability to pay our obligations as they become due.

-

THE SECURITIES WILL NOT PAY MORE THAN THE PRINCIPAL AMOUNT, PLUS ACCRUED AND UNPAID INTEREST, AT MATURITY OR UPON EARLY REDEMPTION — The securities will not pay more than the principal amount, plus accrued and unpaid interest, at maturity or upon early redemption. If the Final Level of each Underlying is greater than its respective Initial Level (regardless of whether a Knock-In Event has occurred), you will not receive the appreciation of any Underlying. Assuming the securities are held to maturity and the term of the securities is exactly 6 months, the maximum amount payable with respect to the securities will not exceed $1,057.50 for each $1,000 principal amount of the securities.

-

THE SECURITIES ARE SUBJECT TO THE CREDIT RISK OF CREDIT SUISSE — Although the return on the securities will be based on the performance of the Underlyings, the payment of any amount due on the securities, including any applicable interest payments, early redemption payment or payment at maturity, is subject to the credit risk of Credit Suisse. Investors are dependent on our ability to pay all amounts due on the securities and, therefore, investors are subject to our credit risk. In addition, any decline in our credit ratings, any adverse changes in the market’s view of our creditworthiness or any increase in our credit spreads is likely to adversely affect the value of the securities prior to maturity.

-

THE REDEMPTION AMOUNT PAYABLE AT MATURITY WILL BE LESS THAN THE PRINCIPAL AMOUNT OF THE SECURITIES EVEN IF A KNOCK-IN EVENT OCCURS WITH RESPECT TO ONLY ONE UNDERLYING AND THE FINAL LEVEL OF ONLY ONE UNDERLYING FALLS BELOW ITS INITIAL LEVEL — Even if the closing level of only one Underlying reaches or falls below its Knock-In Level on any trading day during the Observation Period, a Knock-In Event will have occurred. In this case, the Redemption Amount payable at maturity will be less than the principal amount of the securities if, in addition to the occurrence of a Knock-In Event, the Final Level of just one Underlying falls below its Initial Level. This will be true even if the closing level of the Lowest Performing Underlying never reached or fell below its Knock-In Level on any trading day during the Observation Period.

5

-

THE SECURITIES ARE SUBJECT TO A POTENTIAL EARLY REDEMPTION, WHICH WOULD LIMIT YOUR ABILITY TO ACCRUE INTEREST OVER THE FULL TERM OF THE SECURITIES —The securities are subject to a potential early redemption. The securities may be redeemed on any Interest Payment Date scheduled to occur on or after October 24, 2011 upon at least three business days notice. If the securities are redeemed prior to the Maturity Date, you will be entitled to receive the principal amount of your securities and any accrued but unpaid interest payable on such Interest Payment Date. In this case, you will lose the opportunity to continue to accrue and be paid interest from the date of Early Redemption to the scheduled Maturity Date. If the securities are redeemed prior to the Maturity Date, you may be unable to invest in other securities with a similar level of risk that yield as much interest as the securities.

-

SINCE THE SECURITIES ARE LINKED TO THE PERFORMANCE OF MORE THAN ONE UNDERLYING, YOU WILL BE FULLY EXPOSED TO THE RISK OF FLUCTUATIONS IN THE LEVEL OF EACH UNDERLYING — Since the securities are linked to the performance of more than one Underlying, the securities will be linked to the individual performance of each Underlying. Because the securities are not linked to a basket, in which case the risk is mitigated and diversified among all of the components of a basket, you will be exposed to the risk of fluctuations in the levels of the Underlyings to the same degree for each Underlying. For example, in the case of securities linked to a basket, the return would depend on the weighted aggregate performance of the basket components as reflected by the basket return. Thus, the depreciation of any basket component could be mitigated by the appreciation of another basket component, to the extent of the weightings of such components in the basket. However, in the case of securities linked to the lowest performing of each of two Underlyings, the individual performance of each Underlying is not combined to calculate your return and the depreciation of either Underlying is not mitigated by the appreciation of the other Underlying. Instead, if a Knock-In Event occurs, the Redemption Amount payable at maturity will depend on the lowest performing of the two Underlyings to which the securities are linked.

-

CERTAIN BUILT-IN COSTS ARE LIKELY TO ADVERSELY AFFECT THE VALUE OF THE SECURITIES PRIOR TO MATURITY — While the payment at maturity described in this pricing supplement is based on the full principal amount of your securities, the original issue price of the securities includes the agent’s commission and the cost of hedging our obligations under the securities through one or more of our affiliates. As a result, the price, if any, at which Credit Suisse (or its affiliates), will be willing to purchase securities from you in secondary market transactions, if at all, will likely be lower than the original issue price, and any sale prior to the Maturity Date could result in a substantial loss to you. The securities are not designed to be short-term trading instruments. Accordingly, you should be able and willing to hold your securities to maturity.

-

LACK OF LIQUIDITY — The securities will not be listed on any securities exchange. Credit Suisse (or its affiliates) intends to offer to purchase the securities in the secondary market but is not required to do so. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the securities when you wish to do so. Because other dealers are not likely to make a secondary market for the securities, the price at which you may be able to trade your securities is likely to depend on the price, if any, at which Credit Suisse (or its affiliates) is willing to buy the securities. If you have to sell your securities prior to maturity, you may not be able to do so or you may have to sell them at a substantial loss.

-

POTENTIAL CONFLICTS — We and our affiliates play a variety of roles in connection with the issuance of the securities, including acting as calculation agent and hedging our obligations under the securities. In performing these duties, the economic interests of the calculation agent and other affiliates of ours are potentially adverse to your interests as an investor in the securities.

6

-

MANY ECONOMIC AND MARKET FACTORS WILL AFFECT THE VALUE OF THE SECURITIES — In addition to the levels of the Underlyings on any trading day during the Observation Period, the value of the securities will be affected by a number of economic and market factors that may either offset or magnify each other, including:

-

the expected volatility of the Underlyings;

-

the time to maturity of the securities;

-

the Early Redemption feature, which is likely to limit the value of the securities;

-

interest and yield rates in the market generally;

-

global gold and silver supply and demand, which is influenced by such factors as forward selling by gold and silver producers, purchases made by gold and silver producers to unwind gold and silver hedge positions, central bank purchases and sales of gold, and production and cost levels in major gold-producing countries and in major silver-producing countries;

-

investors’ expectations with respect to the rate of inflation;

-

geopolitical conditions and a variety of economic, financial, political, regulatory or judicial events that affect the components comprising the Underlyings, or markets generally and which may affect the levels of the Underlyings; and

-

our creditworthiness, including actual or anticipated downgrades in our credit ratings.

Some or all of these factors may influence the price that you will receive if you choose to sell your securities prior to maturity. The impact of any of the factors set forth above may enhance or offset some or all of any change resulting from another factor or factors.

-

-

NO OWNERSHIP RIGHTS RELATING TO THE UNDERLYINGS — Your return on the securities will not reflect the return you would realize if you actually owned the shares of the Market Vectors Gold Miners ETF (the “Fund”) or the equity securities that comprise the Underlyings. The return on your investment, which is based on the percentage change in the Underlyings, is not the same as the total return you would receive based on the purchase of the shares of the Fund or the equity securities that comprise the Underlyings.

-

NO DIVIDEND PAYMENTS OR VOTING RIGHTS — As a holder of the securities, you will not have voting rights or rights to receive cash dividends or other distributions or other rights with respect to the shares of the Fund or the equity securities that comprise the Underlyings.

-

ANTI-DILUTION PROTECTION IS LIMITED — The calculation agent will make anti-dilution adjustments for certain events affecting the shares of the Fund. However, the calculation agent will not make an adjustment in response to all events that could affect the shares of the Fund. If an event occurs that does not require the calculation agent to make an adjustment, the value of the securities may be materially and adversely affected. See “Description of the Securities—Adjustments—For reference funds” in the accompanying product supplement for further information.

-

THERE ARE RISKS ASSOCIATED WITH THE FUND — Although shares of the Fund are listed for trading on a national securities exchange and a number of similar products have been traded on various national securities exchanges for varying periods of time, there is no assurance that an active trading market will continue for the shares of the Fund or that there will be liquidity in the trading market. The Fund is subject to management risk, which is the risk that a fund’s investment strategy, the implementation of which is subject to a number of constraints, may not produce the intended results. Pursuant to the Fund’s investment strategy or otherwise, the Fund’s investment advisor may add, delete or substitute the equity securities held by the Fund it advises. Any of these actions could adversely affect the price of the shares of the Fund and consequently the value of the securities. For further information on the Fund, please refer to the accompanying underlying supplement.

7

-

THE PERFORMANCE OF THE FUND MAY NOT CORRELATE TO THE PERFORMANCE OF ITS TRACKED INDEX — The Fund will generally invest in all of the equity securities included in the index tracked by the Fund (the “Tracked Index”). There may, however, be instances where the Fund’s investment advisor may choose to overweight a stock in the Tracked Index, purchase securities not included in the Tracked Index that the investment advisor believes are appropriate to substitute for a security included in the Tracked Index or utilize various combinations of other available investment techniques in seeking to track accurately the Tracked Index. In addition, the performance of the Fund will reflect additional transaction costs and fees that are not included in the calculation of the Tracked Index. Also, corporate actions with respect to the equity securities included in the Tracked Index (such as mergers and spin-offs) may impact the variance between the Fund and the Tracked Index. Finally, because the shares of the Fund are traded on a national securities exchange and are subject to market supply and investor demand, the market value of one share of the Fund may differ from the net asset value per share of the Fund. For all of the foregoing reasons, the performance of the Fund may not correlate with the performance of the Tracked Index.

-

RISKS ASSOCIATED WITH INVESTMENTS IN SECURITIES WITH CONCENTRATION IN A SINGLE INDUSTRY — The stocks comprising the NYSE Arca Gold Miners Index and that are generally tracked by the Market Vectors Gold Miners ETF are stocks of companies primarily engaged in the mining of gold or silver. The shares of the Market Vectors Gold Miners ETF may be subject to increased price volatility as they are linked to a single industry, market or sector and may be more susceptible to adverse economic, market, political or regulatory occurrences affecting that industry, market or sector. Because the Market Vectors Gold Miners ETF primarily invests in stocks and ADRs of companies that are involved in the gold mining industry, and to a lesser extent the silver mining industry, the shares of the Market Vectors Gold Miners ETF are subject to certain risks associated with such companies.

Gold mining companies are highly dependent on the price of gold and subject to competition pressures that may have a significant effect on their financial condition. Gold prices are subject to volatile price movements over short periods of time and are affected by numerous factors. These include economic factors, including, among other things, the structure of and confidence in the global monetary system, expectations of the future rate of inflation, the relative strength of, and confidence in, the U.S. dollar (the currency in which the price of gold is generally quoted), interest rates and gold borrowing and lending rates, and global or regional economic, financial, political, regulatory, judicial or other events. Gold prices may also be affected by industry factors such as industrial and jewelry demand, lending, sales and purchases of gold by the official sector, including central banks and other governmental agencies and multilateral institutions which hold gold, levels of gold production and production costs, and short-term changes in supply and demand because of trading activities in the gold market.

Silver mining companies are highly dependent on the price of silver. Silver prices can fluctuate widely and may be affected by numerous factors. These include general economic trends, technical developments, substitution issues and regulation, as well as specific factors including industrial and jewelry demand, expectations with respect to the rate of inflation, the relative strength of the U.S. dollar (the currency in which the price of silver is generally quoted) and other currencies, interest rates, central bank sales, forward sales by producers, global or regional political or economic events, and production costs and disruptions in major silver producing countries such as Peru, Mexico and China.

8

Supplemental Use of Proceeds and Hedging

We intend to use the proceeds of this offering for our general corporate purposes, which may include the refinancing of existing debt outside Switzerland. Some or all of the proceeds we receive from the sale of the securities may be used in connection with hedging our obligations under the securities through one or more of our affiliates. Such hedging or trading activities on or prior to the Trade Date and during the term of the securities (including on the Valuation Date) could adversely affect the value of the Underlyings and, as a result, could decrease the amount you may receive on the securities at maturity. For further information, please refer to “Use of Proceeds and Hedging” in the accompanying product supplement.

Historical Information

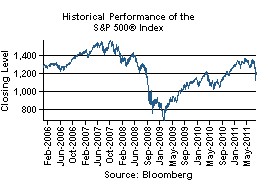

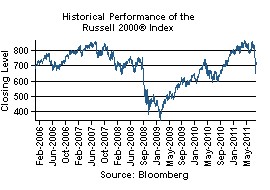

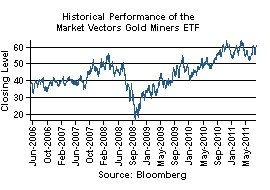

The following graphs set forth the historical performance of the S&P 500® Index based on the closing levels of such Underlying from January 1, 2006 through August 17, 2011, the historical performance of the Russell 2000® Index based on the closing levels of such Underlying from January 1, 2006 through August 17, 2011 and the historical performance of the Market Vectors Gold Miners ETF based on the closing levels of one share of such Underlying from May 22, 2006 through August 17, 2011. The closing level of the S&P 500® Index on August 17, 2011 was 1193.89. The closing level of the Russell 2000® Index on August 17, 2011 was 704.03. The closing level of one share of the Market Vectors Gold Miners ETF on August 17, 2011 was $60.74. We obtained the closing levels below from Bloomberg, without independent verification. We make no representation or warranty as to the accuracy or completeness of the information obtained from Bloomberg. You should not take the historical levels of the Underlyings as an indication of future performance of the Underlyings or the securities. The levels of any of the Underlyings may decrease so that a Knock-In Event occurs and at maturity you will receive a Redemption Amount equal to less than the principal amount of the securities. Any payment on the securities is subject to our ability to pay our obligations as they become due. We cannot give you any assurance that the closing levels of the Underlyings will remain above their respective Knock-In Levels during the Observation Period. If the closing level of any Underlying reaches or falls below its Knock-In Level on any trading day during the Observation Period, and the closing level of the Lowest Performing Underlying on the Valuation Date is less than its Initial Level, then you will lose money on your investment.

For further information on the Underlyings, please refer to the accompanying underlying supplement.

9

Supplemental Information Regarding Certain United States Federal Income Tax Considerations

The amount of the stated interest rate on the security that constitutes interest on the Deposit (as defined in the accompanying product supplement) equals 0.3320%, and the remaining balance constitutes the Option Premium (as defined in the accompanying product supplement). Please refer to “Certain U.S. Federal Income Tax Considerations” in the accompanying product supplement.

Supplemental Plan of Distribution (Conflicts of Interest)

Under the terms and subject to the conditions contained in a distribution agreement dated May 7, 2007, as amended, which we refer to as the distribution agreement, we have agreed to sell the securities to CSSU. The distribution agreement provides that CSSU is obligated to purchase all of the securities if any are purchased.

CSSU proposes to offer the securities at the offering price set forth on the cover page of this pricing supplement and will receive underwriting discounts and commissions of $15.00 per $1,000 principal amount of securities. CSSU may re-allow some or all of the discount on the principal amount per security on sales of such securities by other brokers or dealers. If all of the securities are not sold at the initial offering price, CSSU may change the public offering price and other selling terms.

In addition, Credit Suisse International, an affiliate of Credit Suisse may pay referral fees of up to $5.50 per $1,000 principal amount of securities in connection with the distribution of the securities. An affiliate of Credit Suisse has paid or may pay in the future a fixed amount to broker-dealers in connection with the costs of implementing systems to support these securities.

The agent for this offering, CSSU, is our affiliate. In accordance with FINRA Rule 5121, CSSU may not make sales in this offering to any of its discretionary accounts without the prior written approval of the customer. A portion of the net proceeds from the sale of the securities will be used by CSSU or one of its affiliates in connection with hedging our obligations under the securities. For further information, please refer to “Underwriting (Conflicts of Interest)” in the accompanying product supplement.

10

Credit Suisse