UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSR

Investment Company Act file number: 811-08599

DWS Equity Trust

(Exact Name of Registrant as Specified in Charter)

345 Park Avenue

New York, NY 10154-0004

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (201) 593-6408

Paul Schubert

100 Plaza One

Jersey City, NJ 07311

(Name and Address of Agent for Service)

|

Date of fiscal year end:

|

8/31

|

|

Date of reporting period:

|

8/31/2011

|

|

ITEM 1.

|

REPORT TO STOCKHOLDERS

|

|

AUGUST 31, 2011

Annual Report

to Shareholders

|

|

DWS Disciplined Market Neutral Fund

|

|

Contents

|

4 Portfolio Management Review

9 Performance Summary

12 Information About Your Fund's Expenses

14 Portfolio Summary

16 Investment Portfolio

27 Statement of Assets and Liabilities

29 Statement of Operations

30 Statement of Changes in Net Assets

31 Financial Highlights

35 Notes to Financial Statements

44 Report of Independent Registered Public Accounting Firm

45 Tax Information

46 Summary of Management Fee Evaluation by Independent Fee Consultant

50 Board Members and Officers

54 Account Management Resources

|

This report must be preceded or accompanied by a prospectus. To obtain a summary prospectus, if available, or prospectus for any of our funds, refer to the Account Management Resources information provided in the back of this booklet. We advise you to consider the fund's objectives, risks, charges and expenses carefully before investing. The summary prospectus and prospectus contain this and other important information about the fund. Please read the prospectus carefully before you invest.

While market neutral funds may outperform the market during periods of severe downturn, they may also underperform the market during periods of market rallies. Short sales — which involve selling borrowed securities in anticipation of a price decline, then returning an equal number of the securities at some point in the future — could magnify losses and increase volatility. Stocks may decline in value. See the prospectus for details.

DWS Investments is part of Deutsche Bank's Asset Management division and, within the US, represents the retail asset management activities of Deutsche Bank AG, Deutsche Bank Trust Company Americas, Deutsche Investment Management Americas Inc. and DWS Trust Company.

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE NOT A DEPOSIT NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Market Overview and Fund Performance

Performance is historical and does not guarantee future results. Investment return and principal fluctuate, so your shares may be worth more or less when redeemed. Current performance may differ from performance data shown. Please visit www.dws-investments.com for the fund's most recent month-end performance. Fund performance includes reinvestment of all distributions. Unadjusted returns do not reflect sales charges and would have been lower if they had.

The US equity market as represented by the Standard & Poor's 500® Index (S&P 500) registered a gain during the fund's 12-month reporting period ending August 31, 2011, but the positive performance came with a large dose of volatility.1 Stocks delivered the bulk of their return in the first half of the year, during which an environment of strong corporate earnings, improving economic growth and accommodative US Federal Reserve Board (the Fed) policy helped fuel a hearty appetite for risk among investors.

As winter turned to spring, however, the outlook became less favorable — and market performance grew more unsteady as a result. Investors became concerned by a sudden drop-off in economic data and the end of the Fed's stimulative quantitative easing — or "QE2" — policy.2 The backdrop overseas also became less favorable, with the Japanese earthquake and the resurgence of the European debt crisis rattling the world markets. These factors contributed to heightened volatility, modest corrections in both March and May, and a severe 15% sell-off in the final month of the period. For the full year, the Russell 1000® Index finished with a return of 19.06%.3

In this environment, the fund — which holds a roughly equal dollar amount in long and short positions and therefore isn't designed to keep pace with rising markets — produced a positive total return of 1.06% (Class A shares unadjusted for sales charge) and outpaced the 0.12% return of its benchmark, the Citigroup 3-Month T-Bill Index.4,5 On a three-year basis, the fund's average annual return of 1.19% (Class A shares, unadjusted for sales charges) compares favorably with the 0.25% return of the benchmark. (Past performance is no guarantee of future results. Please see pages 9 through 11 for the performance of other share classes and for more complete performance information.)

Our investment process — which blends behavioral finance with traditional fundamental research — takes a dynamic approach to stock selection by comparing and ranking the stocks in the Russell 1000 Index based on four main factors: valuation, quality, growth and sentiment. The strategy establishes long positions in 100 to 150 of the most attractive stocks and sells short an approximately equal dollar amount of those deemed to be least attractive.

The net result of the offsetting long and short positions is "market neutrality," which means that stock selection — and not the direction of the broader market — is the primary driver of fund performance. This process proved effective during the past year, as the value of our long positions rose more than the value of our short positions declined.

Positive Contributors to Fund Performance

In terms of factor categories, our valuation and growth factors both added value during the past year ending August 31, 2011, and more than made up for the modest shortfall in the other two categories. We take a dynamic approach to the emphasis we put on these factors, which allows us to make adjustments in the fund's positioning as the investment environment changes. For instance, we boosted the weighting toward sentiment factors in June and July, when uncertainty about the US debt ceiling led to increased market volatility. Such shifts are based on our long-term research on investor behavior and investment cycles, which help identify what factors tend to perform best in certain types of environments.

With regard to stock selection, the fund's performance benefited from our ability to generate gains on both the long and short sides of the market within certain industries. Of the 23 industry groups into which we divide the Russell 1000 Index, our stock selection process worked best in the pharmaceuticals/biotechnology industry. Here, both our long and short positions generated a positive return. The leading contributor among individual positions was our short in Dendreon Corp., which plunged in August after the company reported worse-than-expected earnings and lowered its full-year forecast. Our model ranked Dendreon as the worst stock in the pharmaceuticals/biotech industry based on several factors relating to fundamentals and valuation, and this was borne out when earnings missed expectations. We also generated strong performance from a short in Human Genome Sciences, Inc., which fell from $27 to $12 after we established our bearish position on the stock. On the long side, our performance in pharmaceuticals/biotechnology was propelled by Biogen Idec, Inc. and King Pharmaceuticals.*

Media was another industry in which we added value on both sides of the market. Among our long positions, we benefited from a rally in Netflix, Inc.* during the time in which it was held in the fund; while on the short side the largest contributor was Dolby Laboratories, Inc.

Software/services, real estate and hotels/restaurants/leisure were also areas in which our stock selection process worked well.

Negative Contributors to Fund Performance

Our stock selection process was least effective in the capital goods industry, where the decline in the dollar value of our short positions outweighed the gains produced by our longs. The leading individual detractors were our shorts in Fluor Corp., an engineering and construction company, and Westinghouse Air Brake Technologies Corp.* ("Wabtec"), a maker of components for locomotives and freight cars.

The story was the same in utilities, where the positive impact from our longs was not enough to offset the losses in our short positions. ONEOK, Inc.,* an Oklahoma-based natural gas distributor, was our largest detractor within the group. Our stock selection was also weak in the automobiles/components, energy and insurance industries.

Outlook and Positioning

As always, we want to emphasize that the fund — due to its market-neutral nature — is unlikely to keep pace with the broader equity indices when the market produces a double-digit return. Instead, the role of this fund is to provide investors with a source of diversification within their traditional portfolios. Of course, diversification cannot guarantee a profit or eliminate a loss.

On that count, we believe the fund continues to achieve its objective. Since its inception in October 2006, the fund's correlation with the S&P 500 Index is -0.11%.6 The fund also exhibited a low correlation of 0.08% with the US bond market, as represented by the Barclays Capital US Aggregate Bond Index.7 In addition, the fund has been less than one third as volatile as the broader market in the period since inception, while the S&P 500 Index experienced volatility of 18.3%, the fund's volatility was just 2.2%.8 Keeping in mind that past performance is no guarantee of future results, we are gratified that the fund has not only succeeded in providing investors with a source of diversification and absolute returns, but it has done so in a four-year period characterized by extremely volatile market conditions.

The fund's relatively low volatility suggests that it could be a potential option for investors seeking to add another layer of diversification to their investment portfolios. While the fund has exhibited the same level of risk as the domestic bond market (as represented by the Barclays Capital US Aggregate Bond Index), its performance does not have the same vulnerability to rising interest rates as a typical fixed-income investment. As a result, the fund can play an important role for investors who are seeking an alternative to equities, but who also want to guard against the possibility that higher inflation could lead to lower bond prices in the months and years ahead.

Investment Advisor

Deutsche Investment Management Americas Inc. ("DIMA" or the "Advisor"), which is part of Deutsche Asset Management, is the investment advisor for DWS Disciplined Market Neutral Fund. DIMA and its predecessors have more than 80 years of experience managing mutual funds and DIMA provides a full range of investment advisory services to both institutional and retail clients.

DIMA is an indirect, wholly owned subsidiary of Deutsche Bank AG. Deutsche Bank AG is a major global banking institution engaged in a wide variety of financial services, including investment management, retail, private and commercial banking, investment banking and insurance.

DWS Investments is the retail brand name in the US for the asset management activities of Deutsche Bank AG and DIMA. As such, DWS is committed to delivering the investing expertise, insight and resources of this global investment platform to American investors.

Subadvisor

QS Investors, LLC ("QS Investors"), New York, New York, is the subadvisor for the fund. QS Investors manages and advises assets on behalf of institutional clients and retail funds, providing global expertise in research, portfolio management and quantitative analysis.

Portfolio Management Team

Robert Wang

Russell Shtern, CFA

Portfolio Managers, QS Investors, LLC

The views expressed reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The management team's views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Past performance is no guarantee of future results. Current and future portfolio holdings are subject to risk.

1 The Standard & Poor's 500 (S&P 500) Index is an unmanaged, capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

2 QE2 (Quantitative Easing 2) was an asset purchase program initiated by the US Federal Reserve as a means to jump-start the sluggish US economy.

3 The Russell 1000 Index is an unmanaged index that measures the performance of the 1,000 largest companies in the Russell 3000® Index, which represents approximately 92% of the total market capitalization of the Russell 3000 Index. Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

4 The unmanaged Citigroup 3-Month T-Bill Index is representative of the 3-month Treasury market. Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

5 Short positions represent the borrowing then selling of a security with the expectation that the security will fall in value. The security can then be purchased and the borrow repaid at a lower price.

6 A correlation of 1.0 indicates a perfect positive correlation between the performance of two assets, while a correlation of -1.0 indicates a perfect negative correlation. A correlation of zero means the performance of two assets has no correlation whatsoever.

7 The Barclays Capital US Aggregate Bond Index is an unmanaged, market-value- weighted measure of Treasury issues, corporate bond issues and mortgage securities. Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

8 As measured by standard deviation. Standard deviation is often used to represent the volatility of an investment. It depicts how widely an investment's returns vary from the investment's average return over a certain period.

* Not held in portfolio as of August 31, 2011.

|

Average Annual Total Returns as of 8/31/11

|

|||

|

Unadjusted for Sales Charge

|

1-Year

|

3-Year

|

Life of Fund*

|

|

Class A

|

1.06%

|

1.19%

|

0.63%

|

|

Class C

|

0.32%

|

0.46%

|

-0.15%

|

|

Adjusted for the Maximum Sales Charge

|

|||

|

Class A (max 5.75% load)

|

-4.75%

|

-0.79%

|

-0.58%

|

|

Class C (max 1.00% CDSC)

|

0.32%

|

0.46%

|

-0.15%

|

|

No Sales Charges

|

|||

|

Class S

|

1.27%

|

1.42%

|

0.82%

|

|

Institutional Class

|

1.47%

|

1.54%

|

0.92%

|

|

Citigroup 3-Month T-Bill Index+

|

0.12%

|

0.25%

|

1.58%

|

* The Fund commenced operations on October 16, 2006. Index returns began on October 31, 2006.

Performance in the Average Annual Total Returns table above and the Growth of an Assumed $10,000 Investment line graph that follows is historical and does not guarantee future results. Investment return and principal fluctuate so your shares may be worth more or less when redeemed. Current performance may differ from performance data shown. Please visit www.dws-investments.com for the Fund's most recent month-end performance. Fund performance includes reinvestment of all distributions. Unadjusted returns do not reflect sales charges and would have been lower if they had.

The gross expense ratios of the Fund, as stated in the fee table of the prospectus dated December 1, 2010 are 3.67%, 4.42%, 3.54% and 3.30% for Class A, Class C, Class S and Institutional Class shares, respectively, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report.

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

Performance figures do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

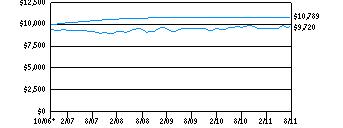

Growth of an Assumed $10,000 Investment (Adjusted for Maximum Sales Charge)

|

|

[] DWS Disciplined Market Neutral Fund — Class A

[] Citigroup 3-Month T-Bill Index+

|

|

The Fund's growth of an assumed $10,000 investment is adjusted for the maximum sales charge of 5.75%. This results in a net initial investment of $9,425.

The growth of $10,000 is cumulative.

Performance of other share classes will vary based on the sales charges and the fee structure of those classes.

* The Fund commenced operations on October 16, 2006. Index returns began on October 31, 2006.

+ The unmanaged Citigroup 3-Month T-Bill Index is representative of the 3-month Treasury market.

|

Net Asset Value and Distribution Information

|

||||||||||||||||

|

Class A

|

Class C

|

Class S

|

Institutional Class

|

|||||||||||||

|

Net Asset Value:

8/31/11

|

$ | 9.49 | $ | 9.22 | $ | 9.54 | $ | 9.58 | ||||||||

|

8/31/10

|

$ | 9.48 | $ | 9.29 | $ | 9.51 | $ | 9.53 | ||||||||

|

Distribution Information:

Twelve Months as of 8/31/11:

Capital Gain Distributions

|

$ | .08 | $ | .08 | $ | .08 | $ | .08 | ||||||||

|

Lipper Rankings — Equity Market Neutral Funds Category as of 8/31/11

|

||||

|

Period

|

Rank

|

Number of Fund Classes Tracked

|

Percentile Ranking (%)

|

|

|

Class A

1-Year

|

55

|

of

|

85

|

64

|

|

3-Year

|

18

|

of

|

51

|

35

|

|

Class C

1-Year

|

62

|

of

|

85

|

73

|

|

3-Year

|

19

|

of

|

51

|

37

|

|

Class S

1-Year

|

53

|

of

|

85

|

62

|

|

3-Year

|

17

|

of

|

51

|

33

|

|

Class Institutional

1-Year

|

49

|

of

|

85

|

57

|

|

3-Year

|

16

|

of

|

51

|

31

|

Source: Lipper Inc. Rankings are historical and do not guarantee future results. Rankings are based on total return unadjusted for sales charges with distributions reinvested. If sales charges had been included, rankings might have been less favorable.

As an investor of the Fund, you incur two types of costs: ongoing expenses and transaction costs. Ongoing expenses include management fees, distribution and service (12b-1) fees and other Fund expenses. Examples of transaction costs include sales charges (loads), redemption fees and account maintenance fees, which are not shown in this section. The following tables are intended to help you understand your ongoing expenses (in dollars) of investing in the Fund and to help you compare these expenses with the ongoing expenses of investing in other mutual funds. In the most recent six-month period, Class S shares limited these expenses; had it not done so, expenses would have been higher. The example in the table is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period (March 1, 2011 to August 31, 2011).

The tables illustrate your Fund's expenses in two ways:

•Actual Fund Return. This helps you estimate the actual dollar amount of ongoing expenses (but not transaction costs) paid on a $1,000 investment in the Fund using the Fund's actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the "Expenses Paid per $1,000" line under the share class you hold.

• Hypothetical 5% Fund Return. This helps you to compare your Fund's ongoing expenses (but not transaction costs) with those of other mutual funds using the Fund's actual expense ratio and a hypothetical rate of return of 5% per year before expenses. Examples using a 5% hypothetical fund return may be found in the shareholder reports of other mutual funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in these tables are meant to highlight your ongoing expenses only and do not reflect any transaction costs. The "Expenses Paid per $1,000" line of the tables is useful in comparing ongoing expenses only and will not help you determine the relative total expense of owning different funds. An account maintenance fee of $6.25 per quarter for Class S shares may apply for certain accounts whose balances do not meet the applicable minimum initial investment. This fee is not included in these tables. If it was, the estimate of expenses paid for Class S shares during the period would be higher, and account value during the period would be lower, by this amount.

|

Expenses and Value of a $1,000 Investment for the six months ended August 31, 2011

|

||||||||||||||||

|

Actual Fund Return

|

Class A

|

Class C

|

Class S

|

Institutional Class

|

||||||||||||

|

Beginning Account Value 3/1/11

|

$ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | ||||||||

|

Ending Account Value 8/31/11

|

$ | 1,021.50 | $ | 1,017.70 | $ | 1,022.50 | $ | 1,023.50 | ||||||||

|

Expenses Paid per $1,000*

|

$ | 17.83 | $ | 21.56 | $ | 16.57 | $ | 15.91 | ||||||||

|

Hypothetical 5% Fund Return

|

Class A

|

Class C

|

Class S

|

Institutional Class

|

||||||||||||

|

Beginning Account Value 3/1/11

|

$ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | ||||||||

|

Ending Account Value 8/31/11

|

$ | 1,007.56 | $ | 1,003.83 | $ | 1,008.82 | $ | 1,009.48 | ||||||||

|

Expenses Paid per $1,000*

|

$ | 17.71 | $ | 21.42 | $ | 16.46 | $ | 15.80 | ||||||||

* Expenses are equal to the Fund's annualized expense ratio for each share class, multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by 365.

|

Annualized Expense Ratios

|

Class A

|

Class C

|

Class S

|

Institutional Class

|

|

DWS Disciplined Market Neutral Fund+

|

3.50%

|

4.24%

|

3.25%

|

3.12%

|

+ Includes interest and dividend expense on securities sold short of 1.68% for each class.

For more information, please refer to the Fund's prospectus.

|

Long Position Sector Diversification (As a % of Long Common Stocks)

|

8/31/11

|

8/31/10

|

|

Health Care

|

17%

|

11%

|

|

Financials

|

16%

|

18%

|

|

Consumer Discretionary

|

16%

|

14%

|

|

Information Technology

|

11%

|

11%

|

|

Industrials

|

11%

|

10%

|

|

Energy

|

10%

|

10%

|

|

Materials

|

7%

|

6%

|

|

Consumer Staples

|

7%

|

9%

|

|

Telecommunications Services

|

3%

|

5%

|

|

Utilities

|

2%

|

6%

|

|

100%

|

100%

|

|

Ten Largest Long Equity Holdings at August 31, 2011 (11.7% of Net Assets)

|

|

|

1. CF Industries Holdings, Inc.

Manufactures and distributes nitrogen and phosphate fertilizers

|

1.3%

|

|

2. Humana, Inc.

Provider of managed health plans

|

1.2%

|

|

3. Bristol-Myers Squibb Co.

Producer of diversified pharmaceuticals and other products

|

1.2%

|

|

4. Priceline.com, Inc.

Enables consumers to use the Internet to save money on a variety of products and serives

|

1.2%

|

|

5. Wynn Resorts Ltd.

Owns and operates luxury hotels, casinos and resorts

|

1.2%

|

|

6. Verizon Comminications, Inc.

Integrated telecommunications company

|

1.2%

|

|

7. Polaris Industries, Inc.

Designs, engineers and manufactures snowmobiles, ATVs and motorcycles

|

1.1%

|

|

8. IAC/lnterActiveCorp.

Operates Internet businesses

|

1.1%

|

|

9. Rayonier, Inc.

Producer and seller of cellulosic fibers, standing timbers and real estate

|

1.1%

|

|

10. Aetna, Inc.

Diversified health care benefits company that provides health care and related benefits

|

1.1%

|

Sector diversification and portfolio holdings are subject to change.

|

Securities Sold Short Position Sector Diversification (As a % of Common Stocks Sold Short)

|

8/31/11

|

8/31/10

|

|

Financials

|

17%

|

18%

|

|

Health Care

|

14%

|

8%

|

|

Industrials

|

14%

|

13%

|

|

Consumer Discretionary

|

13%

|

8%

|

|

Information Technology

|

12%

|

14%

|

|

Consumer Staples

|

10%

|

10%

|

|

Energy

|

8%

|

10%

|

|

Materials

|

6%

|

7%

|

|

Telecommunications Services

|

5%

|

5%

|

|

Utilities

|

1%

|

7%

|

|

100%

|

100%

|

|

Ten Largest Securities Sold Short Equity Holdings at August 31, 2011 (11.6% of Net Assets)

|

|

|

1. Coca-Cola Co.

Bottler and distributor of soft drinks

|

1.2%

|

|

2. Amazon.com, Inc.

An online retailer; sells books, music and videotapes

|

1.2%

|

|

3. DreamWorks Animation SKG, lnc.

Develops and produces computer-generated animated feature films for a broad movie-going audience

|

1.2%

|

|

4. The Sherwin-Williams Co.

Manufacturer of paints, coatings and related products

|

1.2%

|

|

5. PepsiCo, Inc.

Provider of soft drinks, snack foods and food services

|

1.2%

|

|

6. Tidewater, Inc.

Provides offshore supply vessels and marine support services

|

1.2%

|

|

7. ResMed, Inc.

Develops, manufactures and markets medical equipment

|

1.1%

|

|

8. Boston Properties, Inc.

Developer of commercial and industrial real estate

|

1.1%

|

|

9. PPL Corp.

Provider of electricity in Pennsylvania and the United Kingdom

|

1.1%

|

|

10. Silicon Laboratories, lnc.

Designer and developer of analog-intensive mixed-signal integrated circuits

|

1.1%

|

Sector diversification and portfolio holdings are subject to change.

For more complete details about the Fund's investment portfolio, see page 16. A quarterly Fact Sheet is available upon request. Please see the Account Management Resources section for contact information.

Following the Fund's fiscal first and third quarter-end, a complete portfolio holdings listing is filed with the SEC on Form N-Q. The form will be available on the SEC's Web site at www.sec.gov, and it also may be reviewed and copied at the SEC's Public Reference Room in Washington, D.C. Information on the operation of the SEC's Public Reference Room may be obtained by calling (800) SEC-0330. The Fund's portfolio holdings are also posted on www.dws-investments.com from time to time. Please see the Fund's current prospectus for more information.

|

Shares

|

Value ($)

|

|||||||

|

Long Positions 103.1%

|

||||||||

|

Common Stocks 88.8%

|

||||||||

|

Consumer Discretionary 14.1%

|

||||||||

|

Auto Components 1.0%

|

||||||||

|

Autoliv, Inc. (a)

|

31,200 | 1,741,584 | ||||||

|

TRW Automotive Holdings Corp.* (a)

|

43,600 | 1,817,684 | ||||||

| 3,559,268 | ||||||||

|

Automobiles 0.2%

|

||||||||

|

Harley-Davidson, Inc. (a)

|

23,600 | 912,376 | ||||||

|

Diversified Consumer Services 0.9%

|

||||||||

|

Weight Watchers International, Inc. (a)

|

53,400 | 3,231,768 | ||||||

|

Hotels Restaurants & Leisure 1.5%

|

||||||||

|

Brinker International, Inc. (a)

|

54,000 | 1,219,320 | ||||||

|

Wynn Resorts Ltd. (a)

|

27,800 | 4,301,216 | ||||||

| 5,520,536 | ||||||||

|

Household Durables 1.1%

|

||||||||

|

Tempur-Pedic International, Inc.* (a)

|

42,900 | 2,498,496 | ||||||

|

Tupperware Brands Corp. (a)

|

21,700 | 1,443,050 | ||||||

| 3,941,546 | ||||||||

|

Internet & Catalog Retail 1.2%

|

||||||||

|

Priceline.com, Inc.* (a)

|

8,100 | 4,351,806 | ||||||

|

Leisure Equipment & Products 1.7%

|

||||||||

|

Mattel, Inc. (a)

|

82,300 | 2,211,401 | ||||||

|

Polaris Industries, Inc. (a)

|

37,900 | 4,164,073 | ||||||

| 6,375,474 | ||||||||

|

Media 1.7%

|

||||||||

|

CBS Corp. "B" (a)

|

155,800 | 3,902,790 | ||||||

|

Liberty Media-Starz "A"* (a)

|

10,400 | 716,248 | ||||||

|

Virgin Media, Inc. (a)

|

66,000 | 1,673,760 | ||||||

| 6,292,798 | ||||||||

|

Multiline Retail 0.9%

|

||||||||

|

Dillard's, Inc. "A" (a)

|

38,200 | 1,767,896 | ||||||

|

Macy's, Inc. (a)

|

54,800 | 1,422,060 | ||||||

| 3,189,956 | ||||||||

|

Specialty Retail 3.4%

|

||||||||

|

Aaron's, Inc. (a)

|

57,800 | 1,539,792 | ||||||

|

AutoZone, Inc.* (a)

|

6,100 | 1,872,700 | ||||||

|

Foot Locker, Inc. (a)

|

94,600 | 1,974,302 | ||||||

|

Limited Brands, Inc. (a)

|

103,100 | 3,890,994 | ||||||

|

Sally Beauty Holdings, Inc.* (a)

|

51,300 | 866,970 | ||||||

|

Signet Jewelers Ltd.* (a)

|

24,500 | 954,030 | ||||||

|

Williams-Sonoma, Inc. (a)

|

37,900 | 1,254,869 | ||||||

| 12,353,657 | ||||||||

|

Textiles, Apparel & Luxury Goods 0.5%

|

||||||||

|

Fossil, Inc.* (a)

|

7,300 | 705,253 | ||||||

|

VF Corp. (a)

|

8,600 | 1,006,716 | ||||||

| 1,711,969 | ||||||||

|

Consumer Staples 5.8%

|

||||||||

|

Beverages 0.8%

|

||||||||

|

Coca-Cola Enterprises, Inc. (a)

|

106,800 | 2,949,816 | ||||||

|

Food & Staples Retailing 0.5%

|

||||||||

|

Whole Foods Market, Inc. (a)

|

24,100 | 1,591,323 | ||||||

|

Food Products 2.6%

|

||||||||

|

Bunge Ltd. (a)

|

18,100 | 1,171,251 | ||||||

|

Corn Products International, Inc. (a)

|

41,300 | 1,931,188 | ||||||

|

Dean Foods Co.* (a)

|

95,000 | 820,800 | ||||||

|

Smithfield Foods, Inc.* (a)

|

103,600 | 2,270,912 | ||||||

|

The Hershey Co. (a)

|

35,800 | 2,099,670 | ||||||

|

Tyson Foods, Inc. "A" (a)

|

64,400 | 1,125,068 | ||||||

| 9,418,889 | ||||||||

|

Personal Products 0.9%

|

||||||||

|

Herbalife Ltd. (a)

|

61,000 | 3,403,800 | ||||||

|

Tobacco 1.0%

|

||||||||

|

Philip Morris International, Inc. (a)

|

53,200 | 3,687,824 | ||||||

|

Energy 8.9%

|

||||||||

|

Energy Equipment & Services 3.1%

|

||||||||

|

National Oilwell Varco, Inc. (a)

|

23,600 | 1,560,432 | ||||||

|

Oceaneering International, Inc. (a)

|

33,100 | 1,413,039 | ||||||

|

Patterson-UTI Energy, Inc. (a)

|

97,100 | 2,373,124 | ||||||

|

RPC, Inc. (a)

|

42,400 | 1,098,160 | ||||||

|

SEACOR Holdings, Inc. (a)

|

39,800 | 3,531,852 | ||||||

|

Superior Energy Services, Inc.* (a)

|

37,900 | 1,338,628 | ||||||

| 11,315,235 | ||||||||

|

Oil, Gas & Consumable Fuels 5.8%

|

||||||||

|

Cabot Oil & Gas Corp. (a)

|

10,900 | 826,874 | ||||||

|

Chevron Corp. (a)

|

37,100 | 3,669,561 | ||||||

|

ConocoPhillips (a)

|

54,400 | 3,703,008 | ||||||

|

HollyFrontier Corp. (a)

|

25,000 | 1,794,000 | ||||||

|

Marathon Oil Corp. (a)

|

137,400 | 3,698,808 | ||||||

|

Tesoro Corp.* (a)

|

147,000 | 3,536,820 | ||||||

|

Valero Energy Corp. (a)

|

167,000 | 3,794,240 | ||||||

| 21,023,311 | ||||||||

|

Financials 14.8%

|

||||||||

|

Capital Markets 0.8%

|

||||||||

|

American Capital Ltd.* (a)

|

344,300 | 2,998,853 | ||||||

|

Commercial Banks 3.9%

|

||||||||

|

KeyCorp (a)

|

435,500 | 2,891,720 | ||||||

|

M&T Bank Corp. (a)

|

26,600 | 2,023,462 | ||||||

|

Regions Financial Corp. (a)

|

703,500 | 3,193,890 | ||||||

|

SunTrust Banks, Inc. (a)

|

146,400 | 2,913,360 | ||||||

|

Zions Bancorp. (a)

|

183,000 | 3,191,520 | ||||||

| 14,213,952 | ||||||||

|

Consumer Finance 1.6%

|

||||||||

|

Capital One Financial Corp. (a)

|

85,100 | 3,918,855 | ||||||

|

Discover Financial Services (a)

|

78,500 | 1,975,060 | ||||||

| 5,893,915 | ||||||||

|

Diversified Financial Services 1.5%

|

||||||||

|

JPMorgan Chase & Co. (a)

|

102,300 | 3,842,388 | ||||||

|

The NASDAQ OMX Group, Inc.* (a)

|

68,200 | 1,615,658 | ||||||

| 5,458,046 | ||||||||

|

Insurance 1.1%

|

||||||||

|

American International Group, Inc.* (a)

|

112,000 | 2,836,960 | ||||||

|

Reinsurance Group of America, Inc. (a)

|

22,300 | 1,190,151 | ||||||

| 4,027,111 | ||||||||

|

Real Estate Investment Trusts 5.1%

|

||||||||

|

American Capital Agency Corp. (REIT) (a)

|

104,400 | 2,976,444 | ||||||

|

CommonWealth REIT (REIT) (a)

|

32,750 | 673,340 | ||||||

|

Hospitality Properties Trust (REIT) (a)

|

55,400 | 1,300,792 | ||||||

|

Public Storage (REIT) (a)

|

30,400 | 3,761,392 | ||||||

|

Rayonier, Inc. (REIT) (a)

|

97,050 | 4,070,277 | ||||||

|

SL Green Realty Corp. (REIT) (a)

|

39,800 | 2,875,152 | ||||||

|

Vornado Realty Trust (REIT) (a)

|

34,800 | 2,989,668 | ||||||

| 18,647,065 | ||||||||

|

Real Estate Management & Development 0.2%

|

||||||||

|

Jones Lang LaSalle, Inc. (a)

|

11,000 | 736,010 | ||||||

|

Thrifts & Mortgage Finance 0.6%

|

||||||||

|

People's United Financial, Inc. (a)

|

169,200 | 1,988,100 | ||||||

|

Health Care 15.0%

|

||||||||

|

Biotechnology 1.5%

|

||||||||

|

Biogen Idec, Inc.* (a)

|

41,400 | 3,899,880 | ||||||

|

United Therapeutics Corp.* (a)

|

34,500 | 1,488,675 | ||||||

| 5,388,555 | ||||||||

|

Health Care Equipment & Supplies 1.0%

|

||||||||

|

Boston Scientific Corp.* (a)

|

262,600 | 1,780,428 | ||||||

|

The Cooper Companies, Inc. (a)

|

22,800 | 1,716,156 | ||||||

| 3,496,584 | ||||||||

|

Health Care Providers & Services 7.8%

|

||||||||

|

Aetna, Inc. (a)

|

100,300 | 4,015,009 | ||||||

|

AMERIGROUP Corp.* (a)

|

27,800 | 1,375,266 | ||||||

|

AmerisourceBergen Corp. (a)

|

45,900 | 1,816,722 | ||||||

|

CIGNA Corp. (a)

|

57,700 | 2,696,898 | ||||||

|

Coventry Health Care, Inc.* (a)

|

118,200 | 3,886,416 | ||||||

|

Health Management Associates, Inc. "A"* (a)

|

117,000 | 961,740 | ||||||

|

Humana, Inc. (a)

|

57,700 | 4,479,828 | ||||||

|

McKesson Corp. (a)

|

21,800 | 1,742,474 | ||||||

|

UnitedHealth Group, Inc. (a)

|

84,200 | 4,001,184 | ||||||

|

WellPoint, Inc. (a)

|

56,100 | 3,551,130 | ||||||

| 28,526,667 | ||||||||

|

Pharmaceuticals 4.7%

|

||||||||

|

Bristol-Myers Squibb Co. (a)

|

149,600 | 4,450,600 | ||||||

|

Forest Laboratories, Inc.* (a)

|

35,900 | 1,229,216 | ||||||

|

Merck & Co., Inc. (a)

|

92,200 | 3,053,664 | ||||||

|

Pfizer, Inc. (a)

|

205,900 | 3,907,982 | ||||||

|

Warner Chilcott PLC "A" (a)

|

65,700 | 1,120,842 | ||||||

|

Watson Pharmaceuticals, Inc.* (a)

|

51,700 | 3,470,104 | ||||||

| 17,232,408 | ||||||||

|

Industrials 9.6%

|

||||||||

|

Aerospace & Defense 1.6%

|

||||||||

|

General Dynamics Corp. (a)

|

43,900 | 2,813,112 | ||||||

|

Northrop Grumman Corp. (a)

|

53,600 | 2,927,632 | ||||||

| 5,740,744 | ||||||||

|

Construction & Engineering 2.9%

|

||||||||

|

Chicago Bridge & Iron Co. NV (a)

|

40,800 | 1,458,600 | ||||||

|

Fluor Corp. (a)

|

52,100 | 3,163,512 | ||||||

|

KBR, Inc. (a)

|

115,000 | 3,455,750 | ||||||

|

URS Corp.* (a)

|

67,100 | 2,353,197 | ||||||

| 10,431,059 | ||||||||

|

Electrical Equipment 0.5%

|

||||||||

|

Roper Industries, Inc. (a)

|

23,900 | 1,839,105 | ||||||

|

Machinery 3.6%

|

||||||||

|

Caterpillar, Inc. (a)

|

38,400 | 3,494,400 | ||||||

|

Cummins, Inc. (a)

|

32,500 | 3,019,900 | ||||||

|

Eaton Corp. (a)

|

21,300 | 914,835 | ||||||

|

Gardner Denver, Inc. (a)

|

17,300 | 1,363,067 | ||||||

|

Joy Global, Inc. (a)

|

23,500 | 1,961,075 | ||||||

|

Timken Co. (a)

|

63,400 | 2,494,790 | ||||||

| 13,248,067 | ||||||||

|

Road & Rail 1.0%

|

||||||||

|

J.B. Hunt Transport Services, Inc. (a)

|

35,200 | 1,414,688 | ||||||

|

Ryder System, Inc. (a)

|

50,200 | 2,363,416 | ||||||

| 3,778,104 | ||||||||

|

Information Technology 9.7%

|

||||||||

|

Communications Equipment 1.3%

|

||||||||

|

EchoStar Corp. "A"* (a)

|

90,600 | 2,206,110 | ||||||

|

Motorola Solutions, Inc.* (a)

|

39,100 | 1,645,719 | ||||||

|

Polycom, Inc.* (a)

|

38,400 | 913,920 | ||||||

| 4,765,749 | ||||||||

|

Computers & Peripherals 0.3%

|

||||||||

|

Lexmark International, Inc. "A"* (a)

|

35,700 | 1,140,972 | ||||||

|

Electronic Equipment, Instruments & Components 1.5%

|

||||||||

|

Tech Data Corp.* (a)

|

40,000 | 1,883,200 | ||||||

|

Vishay Intertechnology, Inc.* (a)

|

295,600 | 3,369,840 | ||||||

| 5,253,040 | ||||||||

|

Internet Software & Services 1.1%

|

||||||||

|

IAC/InterActiveCorp.* (a)

|

104,600 | 4,134,838 | ||||||

|

IT Services 0.6%

|

||||||||

|

Alliance Data Systems Corp.* (a)

|

24,400 | 2,279,204 | ||||||

|

Semiconductors & Semiconductor Equipment 3.1%

|

||||||||

|

Altera Corp. (a)

|

92,700 | 3,373,353 | ||||||

|

Cypress Semiconductor Corp.* (a)

|

106,600 | 1,688,544 | ||||||

|

Fairchild Semiconductor International, Inc.* (a)

|

102,700 | 1,361,802 | ||||||

|

KLA-Tencor Corp. (a)

|

94,900 | 3,480,932 | ||||||

|

LSI Corp.* (a)

|

220,600 | 1,502,286 | ||||||

| 11,406,917 | ||||||||

|

Software 1.8%

|

||||||||

|

Fortinet, Inc.* (a)

|

60,100 | 1,149,713 | ||||||

|

Symantec Corp.* (a)

|

231,600 | 3,971,940 | ||||||

|

TIBCO Software, Inc.* (a)

|

62,400 | 1,396,512 | ||||||

| 6,518,165 | ||||||||

|

Materials 6.0%

|

||||||||

|

Chemicals 4.8%

|

||||||||

|

CF Industries Holdings, Inc. (a)

|

25,100 | 4,588,782 | ||||||

|

E.I. du Pont de Nemours & Co. (a)

|

58,600 | 2,828,622 | ||||||

|

Eastman Chemical Co. (a)

|

37,000 | 3,061,010 | ||||||

|

Huntsman Corp. (a)

|

123,800 | 1,623,018 | ||||||

|

LyondellBasell Industries NV "A" (a)

|

51,000 | 1,767,150 | ||||||

|

Rockwood Holdings, Inc.* (a)

|

42,800 | 2,182,800 | ||||||

|

W.R. Grace & Co.* (a)

|

35,800 | 1,411,236 | ||||||

| 17,462,618 | ||||||||

|

Metals & Mining 0.2%

|

||||||||

|

Walter Energy, Inc. (a)

|

7,600 | 621,224 | ||||||

|

Paper & Forest Products 1.0%

|

||||||||

|

Domtar Corp. (a)

|

45,800 | 3,678,656 | ||||||

|

Telecommunication Services 2.8%

|

||||||||

|

Diversified Telecommunication Services 1.2%

|

||||||||

|

Verizon Communications, Inc. (a)

|

117,600 | 4,253,592 | ||||||

|

Wireless Telecommunication Services 1.6%

|

||||||||

|

MetroPCS Communications, Inc.* (a)

|

112,400 | 1,254,384 | ||||||

|

Telephone & Data Systems, Inc. (a)

|

117,800 | 3,019,214 | ||||||

|

United States Cellular Corp.* (a)

|

34,500 | 1,491,780 | ||||||

| 5,765,378 | ||||||||

|

Utilities 2.1%

|

||||||||

|

Independent Power Producers & Energy Traders 1.3%

|

||||||||

|

AES Corp.* (a)

|

318,700 | 3,461,082 | ||||||

|

NRG Energy, Inc.* (a)

|

59,604 | 1,397,118 | ||||||

| 4,858,200 | ||||||||

|

Multi-Utilities 0.8%

|

||||||||

|

Ameren Corp. (a)

|

92,700 | 2,805,101 | ||||||

|

Total Common Stocks (Cost $327,665,233)

|

323,419,351 | |||||||

|

Cash Equivalents 14.3%

|

||||||||

|

Central Cash Management Fund, 0.09% (b) (Cost $52,043,721)

|

52,043,721 | 52,043,721 | ||||||

|

% of Net Assets

|

Value ($)

|

|||||||

|

Total Long Positions (Cost $379,708,954)+

|

103.1 | 375,463,072 | ||||||

|

Other Assets and Liabilities, Net

|

84.2 | 306,894,808 | ||||||

|

Securities Sold Short

|

(87.3 | ) | (318,009,446 | ) | ||||

|

Net Assets

|

100.0 | 364,348,434 | ||||||

+ The cost for federal income tax purposes was $381,088,853. At August 31, 2011, net unrealized depreciation for all securities based on tax cost was $5,625,781. This consisted of aggregate gross unrealized appreciation for all securities in which there was an excess of value over tax cost of $23,900,528 and aggregate gross unrealized depreciation for all securities in which there was an excess of tax cost over value of $29,526,309.

|

Shares

|

Value ($)

|

|||||||

|

Common Stocks Sold Short 87.3%

|

||||||||

|

Consumer Discretionary 11.0%

|

||||||||

|

Auto Components 0.3%

|

||||||||

|

Johnson Controls, Inc.

|

36,700 | 1,169,996 | ||||||

|

Automobiles 0.4%

|

||||||||

|

Thor Industries, Inc.

|

64,700 | 1,438,281 | ||||||

|

Diversified Consumer Services 0.3%

|

||||||||

|

DeVry, Inc.

|

21,800 | 963,124 | ||||||

|

Hotels Restaurants & Leisure 1.5%

|

||||||||

|

Bally Technologies, Inc.

|

74,200 | 2,328,396 | ||||||

|

WMS Industries, Inc.

|

150,300 | 3,279,546 | ||||||

| 5,607,942 | ||||||||

|

Household Durables 1.7%

|

||||||||

|

D.R. Horton, Inc.

|

162,600 | 1,710,552 | ||||||

|

Lennar Corp. "A"

|

52,900 | 777,630 | ||||||

|

PulteGroup, Inc.

|

392,500 | 1,884,000 | ||||||

|

Toll Brothers, Inc.

|

103,700 | 1,782,603 | ||||||

| 6,154,785 | ||||||||

|

Internet & Catalog Retail 1.2%

|

||||||||

|

Amazon.com, Inc.

|

20,200 | 4,348,858 | ||||||

|

Leisure Equipment & Products 0.3%

|

||||||||

|

Hasbro, Inc.

|

24,600 | 953,004 | ||||||

|

Media 1.5%

|

||||||||

|

Cablevision Systems Corp. (New York Group) "A"

|

76,300 | 1,377,978 | ||||||

|

DreamWorks Animation SKG, Inc. "A"

|

201,900 | 4,264,128 | ||||||

| 5,642,106 | ||||||||

|

Multiline Retail 1.6%

|

||||||||

|

Family Dollar Stores, Inc.

|

50,300 | 2,685,517 | ||||||

|

J.C. Penney Co., Inc.

|

41,700 | 1,110,471 | ||||||

|

Target Corp.

|

39,400 | 2,035,798 | ||||||

| 5,831,786 | ||||||||

|

Specialty Retail 2.2%

|

||||||||

|

Staples, Inc.

|

214,600 | 3,163,204 | ||||||

|

The Gap, Inc.

|

71,900 | 1,187,788 | ||||||

|

Urban Outfitters, Inc.

|

135,100 | 3,536,242 | ||||||

| 7,887,234 | ||||||||

|

Consumer Staples 8.6%

|

||||||||

|

Beverages 2.3%

|

||||||||

|

Coca-Cola Co.

|

61,900 | 4,360,855 | ||||||

|

PepsiCo, Inc.

|

65,600 | 4,226,608 | ||||||

| 8,587,463 | ||||||||

|

Food & Staples Retailing 1.5%

|

||||||||

|

Sysco Corp.

|

138,700 | 3,873,891 | ||||||

|

Wal-Mart Stores, Inc.

|

28,200 | 1,500,522 | ||||||

| 5,374,413 | ||||||||

|

Food Products 2.8%

|

||||||||

|

Campbell Soup Co.

|

79,800 | 2,543,226 | ||||||

|

Green Mountain Coffee Roasters, Inc.

|

11,300 | 1,183,562 | ||||||

|

Kellogg Co.

|

70,700 | 3,840,424 | ||||||

|

Kraft Foods, Inc. "A"

|

70,900 | 2,482,918 | ||||||

| 10,050,130 | ||||||||

|

Household Products 1.3%

|

||||||||

|

Clorox Co.

|

32,800 | 2,286,160 | ||||||

|

Procter & Gamble Co.

|

39,900 | 2,540,832 | ||||||

| 4,826,992 | ||||||||

|

Personal Products 0.7%

|

||||||||

|

Avon Products, Inc.

|

109,600 | 2,472,576 | ||||||

|

Energy 7.2%

|

||||||||

|

Energy Equipment & Services 2.7%

|

||||||||

|

Cameron International Corp.

|

69,500 | 3,611,220 | ||||||

|

Rowan Companies, Inc.

|

53,700 | 1,936,959 | ||||||

|

Tidewater, Inc.

|

78,400 | 4,202,240 | ||||||

| 9,750,419 | ||||||||

|

Oil, Gas & Consumable Fuels 4.5%

|

||||||||

|

Continental Resources, Inc.

|

36,500 | 2,039,985 | ||||||

|

EOG Resources, Inc.

|

34,200 | 3,166,578 | ||||||

|

Exxon Mobil Corp.

|

18,500 | 1,369,740 | ||||||

|

Forest Oil Corp.

|

80,000 | 1,557,600 | ||||||

|

Kinder Morgan, Inc.

|

37,500 | 969,375 | ||||||

|

SandRidge Energy, Inc.

|

122,100 | 896,214 | ||||||

|

Spectra Energy Corp.

|

128,400 | 3,334,548 | ||||||

|

Ultra Petroleum Corp.

|

90,500 | 3,031,750 | ||||||

| 16,365,790 | ||||||||

|

Financials 15.2%

|

||||||||

|

Capital Markets 3.6%

|

||||||||

|

Charles Schwab Corp.

|

282,200 | 3,479,526 | ||||||

|

Northern Trust Corp.

|

96,100 | 3,693,123 | ||||||

|

TD Ameritrade Holding Corp.

|

232,800 | 3,580,464 | ||||||

|

The Goldman Sachs Group, Inc.

|

19,300 | 2,243,046 | ||||||

| 12,996,159 | ||||||||

|

Commercial Banks 2.2%

|

||||||||

|

Bank of Hawaii Corp.

|

21,200 | 881,284 | ||||||

|

Cullen/Frost Bankers, Inc.

|

45,700 | 2,330,243 | ||||||

|

TCF Financial Corp.

|

293,900 | 3,068,316 | ||||||

|

US Bancorp.

|

82,200 | 1,907,862 | ||||||

| 8,187,705 | ||||||||

|

Insurance 1.8%

|

||||||||

|

Brown & Brown, Inc.

|

44,400 | 932,844 | ||||||

|

Genworth Financial, Inc. "A"

|

445,000 | 3,074,950 | ||||||

|

Old Republic International Corp.

|

92,600 | 920,444 | ||||||

|

Progressive Corp.

|

85,300 | 1,636,054 | ||||||

| 6,564,292 | ||||||||

|

Real Estate Investment Trusts 5.9%

|

||||||||

|

Alexandria Real Estate Equities, Inc. (REIT)

|

9,800 | 713,538 | ||||||

|

Boston Properties, Inc. (REIT)

|

40,200 | 4,192,458 | ||||||

|

BRE Properties, Inc. (REIT)

|

23,800 | 1,196,188 | ||||||

|

Corporate Office Properties Trust (REIT)

|

111,000 | 2,973,690 | ||||||

|

Federal Realty Investment Trust (REIT)

|

13,600 | 1,231,480 | ||||||

|

Health Care REIT, Inc. (REIT)

|

40,000 | 2,038,400 | ||||||

|

Prologis, Inc. (REIT)

|

84,200 | 2,292,766 | ||||||

|

Regency Centers Corp. (REIT)

|

59,900 | 2,471,474 | ||||||

|

UDR, Inc. (REIT)

|

101,100 | 2,700,381 | ||||||

|

Weyerhaeuser Co. (REIT)

|

97,400 | 1,756,122 | ||||||

| 21,566,497 | ||||||||

|

Thrifts & Mortgage Finance 1.7%

|

||||||||

|

First Niagara Financial Group, Inc.

|

109,100 | 1,173,916 | ||||||

|

Hudson City Bancorp., Inc.

|

337,400 | 2,095,254 | ||||||

|

New York Community Bancorp., Inc.

|

214,800 | 2,751,588 | ||||||

| 6,020,758 | ||||||||

|

Health Care 12.5%

|

||||||||

|

Biotechnology 2.8%

|

||||||||

|

BioMarin Pharmaceutical, Inc.

|

99,100 | 2,931,874 | ||||||

|

Dendreon Corp.

|

112,900 | 1,386,412 | ||||||

|

Human Genome Sciences, Inc.

|

204,300 | 2,629,341 | ||||||

|

Pharmasset, Inc.

|

19,300 | 2,534,476 | ||||||

|

Vertex Pharmaceuticals, Inc.

|

20,200 | 914,454 | ||||||

| 10,396,557 | ||||||||

|

Health Care Equipment & Supplies 2.9%

|

||||||||

|

Alere, Inc.

|

34,100 | 851,477 | ||||||

|

Edwards Lifesciences Corp.

|

32,400 | 2,444,580 | ||||||

|

Gen-Probe, Inc.

|

33,400 | 2,002,998 | ||||||

|

ResMed, Inc.

|

135,500 | 4,196,435 | ||||||

|

St. Jude Medical, Inc.

|

26,300 | 1,197,702 | ||||||

| 10,693,192 | ||||||||

|

Health Care Providers & Services 4.9%

|

||||||||

|

Express Scripts, Inc.

|

82,000 | 3,849,080 | ||||||

|

Laboratory Corp. of America Holdings

|

25,800 | 2,155,074 | ||||||

|

Lincare Holdings, Inc.

|

61,400 | 1,321,942 | ||||||

|

Medco Health Solutions, Inc.

|

13,200 | 714,648 | ||||||

|

Patterson Companies, Inc.

|

53,700 | 1,569,114 | ||||||

|

Quest Diagnostics, Inc.

|

82,600 | 4,135,782 | ||||||

|

Universal Health Services, Inc. "B"

|

28,400 | 1,181,440 | ||||||

|

VCA Antech, Inc.

|

159,600 | 2,954,196 | ||||||

| 17,881,276 | ||||||||

|

Health Care Technology 0.8%

|

||||||||

|

Allscripts Healthcare Solutions, Inc.

|

166,100 | 2,982,325 | ||||||

|

Life Sciences Tools & Services 0.4%

|

||||||||

|

Illumina, Inc.

|

24,800 | 1,292,080 | ||||||

|

Pharmaceuticals 0.7%

|

||||||||

|

Hospira, Inc.

|

53,600 | 2,476,320 | ||||||

|

Industrials 12.1%

|

||||||||

|

Aerospace & Defense 1.6%

|

||||||||

|

Rockwell Collins, Inc.

|

79,500 | 4,011,570 | ||||||

|

Spirit AeroSystems Holdings, Inc. "A"

|

113,100 | 1,897,818 | ||||||

| 5,909,388 | ||||||||

|

Air Freight & Logistics 2.1%

|

||||||||

|

C.H. Robinson Worldwide, Inc.

|

45,300 | 3,193,650 | ||||||

|

United Parcel Service, Inc. "B"

|

46,200 | 3,113,418 | ||||||

|

UTI Worldwide, Inc.

|

110,700 | 1,499,432 | ||||||

| 7,806,500 | ||||||||

|

Building Products 2.0%

|

||||||||

|

Lennox International, Inc.

|

122,600 | 3,827,572 | ||||||

|

Masco Corp.

|

381,000 | 3,379,470 | ||||||

| 7,207,042 | ||||||||

|

Commercial Services & Supplies 0.9%

|

||||||||

|

Avery Dennison Corp.

|

48,300 | 1,406,013 | ||||||

|

Waste Management, Inc.

|

59,700 | 1,972,488 | ||||||

| 3,378,501 | ||||||||

|

Construction & Engineering 1.3%

|

||||||||

|

Quanta Services, Inc.

|

66,600 | 1,278,054 | ||||||

|

Shaw Group, Inc.

|

146,700 | 3,419,577 | ||||||

| 4,697,631 | ||||||||

|

Electrical Equipment 0.4%

|

||||||||

|

Emerson Electric Co.

|

32,800 | 1,526,840 | ||||||

|

Industrial Conglomerates 0.9%

|

||||||||

|

3M Co.

|

40,100 | 3,327,498 | ||||||

|

Machinery 2.4%

|

||||||||

|

Flowserve Corp.

|

13,000 | 1,226,420 | ||||||

|

Illinois Tool Works, Inc.

|

86,600 | 4,030,364 | ||||||

|

Ingersoll-Rand PLC

|

34,800 | 1,166,148 | ||||||

|

Terex Corp.

|

131,100 | 2,114,643 | ||||||

| 8,537,575 | ||||||||

|

Professional Services 0.5%

|

||||||||

|

Dun & Bradstreet Corp.

|

25,600 | 1,712,384 | ||||||

|

Information Technology 10.5%

|

||||||||

|

Communications Equipment 1.7%

|

||||||||

|

Cisco Systems, Inc.

|

187,500 | 2,940,000 | ||||||

|

Juniper Networks, Inc.

|

38,000 | 795,340 | ||||||

|

Motorola Mobility Holdings, Inc.

|

41,500 | 1,565,380 | ||||||

|

Tellabs, Inc.

|

225,200 | 918,816 | ||||||

| 6,219,536 | ||||||||

|

Electronic Equipment, Instruments & Components 1.5%

|

||||||||

|

Dolby Laboratories, Inc. "A"

|

86,500 | 2,906,400 | ||||||

|

FLIR Systems, Inc.

|

93,000 | 2,405,910 | ||||||

| 5,312,310 | ||||||||

|

Internet Software & Services 1.6%

|

||||||||

|

Akamai Technologies, Inc.

|

147,400 | 3,233,956 | ||||||

|

Equinix, Inc.

|

16,800 | 1,579,872 | ||||||

|

WebMD Health Corp.

|

33,500 | 1,183,890 | ||||||

| 5,997,718 | ||||||||

|

IT Services 0.5%

|

||||||||

|

MasterCard, Inc. "A"

|

5,400 | 1,780,434 | ||||||

|

Semiconductors & Semiconductor Equipment 4.8%

|

||||||||

|

Advanced Micro Devices, Inc.

|

263,900 | 1,802,437 | ||||||

|

Broadcom Corp. "A"

|

100,700 | 3,589,955 | ||||||

|

Cree, Inc.

|

128,200 | 4,157,526 | ||||||

|

Intersil Corp. "A"

|

157,900 | 1,773,217 | ||||||

|

MEMC Electronic Materials, Inc.

|

260,200 | 1,816,196 | ||||||

|

Silicon Laboratories, Inc.

|

120,600 | 4,169,142 | ||||||

| 17,308,473 | ||||||||

|

Software 0.4%

|

||||||||

|

Adobe Systems, Inc.

|

58,900 | 1,486,636 | ||||||

|

Materials 4.9%

|

||||||||

|

Chemicals 1.2%

|

||||||||

|

The Sherwin-Williams Co.

|

56,000 | 4,241,440 | ||||||

|

Containers & Packaging 1.9%

|

||||||||

|

Bemis Co., Inc.

|

128,300 | 3,984,998 | ||||||

|

Sonoco Products Co.

|

21,100 | 666,549 | ||||||

|

Temple-Inland, Inc.

|

102,500 | 2,480,500 | ||||||

| 7,132,047 | ||||||||

|

Metals & Mining 1.8%

|

||||||||

|

Carpenter Technology Corp.

|

23,300 | 1,175,951 | ||||||

|

Royal Gold, Inc.

|

17,800 | 1,364,904 | ||||||

|

Titanium Metals Corp.

|

159,100 | 2,550,373 | ||||||

|

United States Steel Corp.

|

45,300 | 1,364,436 | ||||||

| 6,455,664 | ||||||||

|

Telecommunication Services 4.2%

|

||||||||

|

Diversified Telecommunication Services 1.6%

|

||||||||

|

Frontier Communications Corp.

|

493,000 | 3,692,570 | ||||||

|

Windstream Corp.

|

172,000 | 2,184,400 | ||||||

| 5,876,970 | ||||||||

|

Wireless Telecommunication Services 2.6%

|

||||||||

|

American Tower Corp. "A"

|

62,000 | 3,339,320 | ||||||

|

Crown Castle International Corp.

|

45,900 | 1,993,437 | ||||||

|

SBA Communications Corp. "A"

|

108,600 | 4,103,994 | ||||||

| 9,436,751 | ||||||||

|

Utilities 1.1%

|

||||||||

|

Electric Utilities 1.1%

|

||||||||

|

PPL Corp.

|

144,600 | 4,176,048 | ||||||

|

Total Common Stocks Sold Short (Proceeds $360,401,292)

|

318,009,446 | |||||||

* Non-income producing security.

(a) All or a portion of these securities are pledged as collateral for short sales.

(b) Affiliated fund managed by Deutsche Investment Management Americas Inc. The rate shown is the annualized seven-day yield at period end.

REIT: Real Estate Investment Trust

Fair Value Measurements

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used as of August 31, 2011 in valuing the Fund's investments. For information on the Fund's policy regarding the valuation of investments, please refer to the Security Valuation section of Note A in the accompanying Notes to Financial Statements.

|

Assets

|

Level 1

|

Level 2

|

Level 3

|

Total

|

||||||||||||

|

Common Stocks (c)

|

$ | 323,419,351 | $ | — | $ | — | $ | 323,419,351 | ||||||||

|

Short-Term Investments

|

52,043,721 | — | — | 52,043,721 | ||||||||||||

|

Total

|

$ | 375,463,072 | $ | — | $ | — | $ | 375,463,072 | ||||||||

|

Liabilities

|

||||||||||||||||

|

Investments Sold Short, at Value (c)

|

$ | (318,009,446 | ) | $ | — | $ | — | $ | (318,009,446 | ) | ||||||

|

Total

|

$ | (318,009,446 | ) | $ | — | $ | — | $ | (318,009,446 | ) | ||||||

There have been no transfers between Level 1 and Level 2 fair value measurements during the year ended August 31, 2011.

(c) See Investment Portfolio for additional detailed categorizations.

The accompanying notes are an integral part of the financial statements.

|

as of August 31, 2011

|

||||

|

Assets

|

||||

|

Investments:

Investments in non-affiliated securities, at value (cost $327,665,233)

|

$ | 323,419,351 | ||

|

Investment in Central Cash Management Fund (cost $52,043,721)

|

52,043,721 | |||

|

Total investments in securities, at value (cost $379,708,954)

|

375,463,072 | |||

|

Cash

|

10,000 | |||

|

Deposits with broker for securities sold short

|

306,444,869 | |||

|

Receivable for Fund shares sold

|

1,206,549 | |||

|

Dividends receivable

|

426,990 | |||

|

Interest receivable

|

3,583 | |||

|

Other assets

|

50,503 | |||

|

Total assets

|

683,605,566 | |||

|

Liabilities

|

||||

|

Payable for securities sold short, at value (proceeds of $360,401,292)

|

318,009,446 | |||

|

Payable for Fund shares redeemed

|

150,222 | |||

|

Dividends payable for securities sold short

|

466,983 | |||

|

Accrued management fee

|

381,182 | |||

|

Other accrued expenses and payables

|

249,299 | |||

|

Total liabilities

|

319,257,132 | |||

|

Net assets, at value

|

$ | 364,348,434 | ||

|

Net Assets Consist of

|

||||

|

Net unrealized appreciation (depreciation) on:

Investments

|

(4,245,882 | ) | ||

|

Securities sold short

|

42,391,846 | |||

|

Accumulated net realized gain (loss)

|

(25,050,541 | ) | ||

|

Paid-in capital

|

351,253,011 | |||

|

Net assets, at value

|

$ | 364,348,434 | ||

The accompanying notes are an integral part of the financial statements.

|

Statement of Assets and Liabilities as of August 31, 2011 (continued)

|

||||

|

Net Asset Value

|

||||

|

Class A

Net Asset Value and redemption price per share ($81,694,783 ÷ 8,609,845 outstanding shares of beneficial interest, $.01 par value, unlimited number of shares authorized)

|

$ | 9.49 | ||

|

Maximum offering price per share (100 ÷ 94.25 of $9.49)

|

$ | 10.07 | ||

|

Class C

Net Asset Value, offering and redemption price (subject to contingent deferred sales charge) per share ($24,123,163 ÷ 2,616,314 outstanding shares of beneficial interest, $.01 par value, unlimited number of shares authorized)

|

$ | 9.22 | ||

|

Class S

Net Asset Value, offering and redemption price per share ($61,045,246 ÷ 6,398,017 outstanding shares of beneficial interest, $.01 par value, unlimited number of shares authorized)

|

$ | 9.54 | ||

|

Institutional Class

Net Asset Value, offering and redemption price per share ($197,485,242 ÷ 20,623,449 outstanding shares of beneficial interest, $.01 par value, unlimited number of shares authorized)

|

$ | 9.58 | ||

The accompanying notes are an integral part of the financial statements.

|

for the year ended August 31, 2011

|

||||

|

Investment Income

|

||||

|

Income:

Dividends (net of foreign taxes withheld of $2,242)

|

$ | 5,843,461 | ||

|

Income distributions — Central Cash Management Fund

|

33,250 | |||

|

Total income

|

5,876,711 | |||

|

Expenses:

Management fee

|

4,801,219 | |||

|

Administration fee

|

384,116 | |||

|

Services to shareholders

|

344,992 | |||

|

Distribution and service fees

|

432,618 | |||

|

Custodian fee

|

23,141 | |||

|

Professional fees

|

70,011 | |||

|

Reports to shareholders

|

44,207 | |||

|

Registration fees

|

86,063 | |||

|

Trustees' fees and expenses

|

13,551 | |||

|

Interest expense on securities sold short

|

418,359 | |||

|

Dividend expense on securities sold short

|

6,384,093 | |||

|

Other

|

22,067 | |||

|

Total expenses before expense reductions

|

13,024,437 | |||

|

Expense reductions

|

(47,072 | ) | ||

|

Total expenses after expense reductions

|

12,977,365 | |||

|

Net investment income (loss)

|

(7,100,654 | ) | ||

|

Realized and Unrealized Gain (Loss)

|

||||

|

Net realized gain (loss) from:

Investments

|

75,297,067 | |||

|

Securities sold short

|

(77,770,011 | ) | ||

|

Capital gain dividends received

|

195,620 | |||

|

Foreign currency

|

6,861 | |||

|

Payments by affiliates (see Note G)

|

4,810 | |||

| (2,265,653 | ) | |||

|

Change in net unrealized appreciation (depreciation) on:

Investments

|

(14,534,643 | ) | ||

|

Securities sold short

|

26,350,502 | |||

| 11,815,859 | ||||

|

Net gain (loss)

|

9,550,206 | |||

|

Net increase (decrease) in net assets resulting from operations

|

$ | 2,449,552 | ||

The accompanying notes are an integral part of the financial statements.

|

Years Ended August 31,

|

||||||||

|

Increase (Decrease) in Net Assets

|

2011

|

2010

|

||||||

|

Operations:

Net investment income (loss)

|

$ | (7,100,654 | ) | $ | (6,900,383 | ) | ||

|

Net realized gain (loss)

|

(2,265,653 | ) | (12,394,527 | ) | ||||

|

Change in net unrealized appreciation (depreciation)

|

11,815,859 | 21,751,142 | ||||||

|

Net increase (decrease) in net assets resulting from operations

|

2,449,552 | 2,456,232 | ||||||

|

Distributions to shareholders from:

Net realized gains:

Class A

|

(757,165 | ) | (663,082 | ) | ||||

|

Class C

|

(219,903 | ) | (151,869 | ) | ||||

|

Class C

|

(219,903 | ) | (151,869 | ) | ||||

|

Class S

|

(769,232 | ) | (611,243 | ) | ||||

|

Institutional Class

|

(1,654,316 | ) | (1,077,388 | ) | ||||

|

Total distributions

|

(3,400,616 | ) | (2,503,582 | ) | ||||

|

Fund share transactions:

Proceeds from shares sold

|

218,604,533 | 227,423,685 | ||||||

|

Reinvestment of distributions

|

2,791,211 | 2,143,801 | ||||||

|

Payments for shares redeemed

|

(199,626,583 | ) | (133,924,796 | ) | ||||

|

Net increase (decrease) in net assets from Fund share transactions

|

21,769,161 | 95,642,690 | ||||||

|

Increase (decrease) in net assets

|

20,818,097 | 95,595,340 | ||||||

|

Net assets at beginning of period

|

343,530,337 | 247,934,997 | ||||||

|

Net assets at end of period

|

$ | 364,348,434 | $ | 343,530,337 | ||||

The accompanying notes are an integral part of the financial statements.

|

Years Ended August 31,

|

Period Ended 8/31/07a | |||||||||||||||||||

|

Class A

|

2011

|

2010

|

2009

|

2008

|

||||||||||||||||

|

Selected Per Share Data

|

||||||||||||||||||||

|

Net asset value, beginning of period

|

$ | 9.48 | $ | 9.52 | $ | 9.65 | $ | 9.64 | $ | 10.00 | ||||||||||

|

Income (loss) from investment operations:

Net investment income (loss)b

|

(.19 | ) | (.24 | ) | (.11 | ) | .07 | .28 | ||||||||||||

|

Net realized and unrealized gain (loss)

|

.28 | .28 | .32 | .12 | (.53 | ) | ||||||||||||||

|

Total from investment operations

|

.09 | .04 | .21 | .19 | (.25 | ) | ||||||||||||||

|

Less distributions from:

Net investment income

|

— | — | (.01 | ) | (.18 | ) | (.08 | ) | ||||||||||||

|

Net realized gains

|

(.08 | ) | (.08 | ) | (.34 | ) | — | (.03 | ) | |||||||||||

|

Total distributions

|

(.08 | ) | (.08 | ) | (.35 | ) | (.18 | ) | (.11 | ) | ||||||||||

|

Redemption fees

|

— | — | .01 | .00 | *** | .00 | *** | |||||||||||||

|

Net asset value, end of period

|

$ | 9.49 | $ | 9.48 | $ | 9.52 | $ | 9.65 | $ | 9.64 | ||||||||||

|

Total Return (%)c

|

1.06 | .38 | d | 2.14 | d | 2.12 | d | (2.54 | )d** | |||||||||||

|

Ratios to Average Net Assets and Supplemental Data

|

||||||||||||||||||||

|

Net assets, end of period ($ millions)

|

82 | 79 | 81 | 21 | 6 | |||||||||||||||

|

Ratio of expenses before expense reductions (including interest expense and dividend expense for securities sold short) (%)

|

3.56 | 3.67 | 3.09 | 3.25 | 4.23 | * | ||||||||||||||

|

Ratio of expenses after expense reductions (including interest expense and dividend expense for securities sold short) (%)

|

3.56 | 3.64 | 2.95 | 2.95 | 2.99 | * | ||||||||||||||

|

Ratio of expenses after expense reductions (excluding interest expense and dividend expense for securities sold short) (%)

|

1.79 | 1.80 | 1.75 | 1.65 | 2.11 | * | ||||||||||||||

|

Ratio of net investment income (loss) (%)

|

(2.04 | ) | (2.53 | ) | (1.19 | ) | .67 | 3.31 | * | |||||||||||

|

Portfolio turnover rate (%)

|

481 | 393 | 525 | 967 | 1,009 | ** | ||||||||||||||

|

a For the period from October 16, 2006 (commencement of operations) to August 31, 2007.

b Based on average shares outstanding during the period.

c Total return does not reflect the effect of any sales charges.

d Total return would have been lower had certain expenses not been reduced.

* Annualized

** Not annualized

*** Amount is less than $.005.

|

||||||||||||||||||||

|

Years Ended August 31,

|

Period Ended 8/31/07a | |||||||||||||||||||

|

Class C

|

2011

|

2010

|

2009

|

2008

|

||||||||||||||||

|

Selected Per Share Data

|

||||||||||||||||||||

|

Net asset value, beginning of period

|

$ | 9.29 | $ | 9.40 | $ | 9.59 | $ | 9.59 | $ | 10.00 | ||||||||||

|

Income (loss) from investment operations:

Net investment income (loss)b

|

(.25 | ) | (.30 | ) | (.18 | ) | (.01 | ) | .22 | |||||||||||

|

Net realized and unrealized gain (loss)

|

.26 | .27 | .32 | .12 | (.54 | ) | ||||||||||||||

|

Total from investment operations

|

.01 | (.03 | ) | .14 | .11 | (.32 | ) | |||||||||||||

|

Less distributions from:

Net investment income

|

— | — | — | (.11 | ) | (.06 | ) | |||||||||||||

|

Net realized gains

|

(.08 | ) | (.08 | ) | (.34 | ) | — | (.03 | ) | |||||||||||

|

Total distributions

|

(.08 | ) | (.08 | ) | (.34 | ) | (.11 | ) | (.09 | ) | ||||||||||

|

Redemption fees

|

— | — | .01 | .00 | *** | .00 | *** | |||||||||||||

|

Net asset value, end of period

|

$ | 9.22 | $ | 9.29 | $ | 9.40 | $ | 9.59 | $ | 9.59 | ||||||||||

|

Total Return (%)c

|

.32 | (.47 | )d | 1.54 | d | 1.15 | d | (3.20 | )d** | |||||||||||

|

Ratios to Average Net Assets and Supplemental Data

|

||||||||||||||||||||

|

Net assets, end of period ($ millions)

|

24 | 23 | 15 | 3 | 4 | |||||||||||||||

|

Ratio of expenses before expense reductions (including interest expense and dividend expense for securities sold short) (%)

|

4.31 | 4.42 | 3.84 | 4.06 | 4.97 | * | ||||||||||||||

|

Ratio of expenses after expense reductions (including interest expense and dividend expense for securities sold short) (%)

|

4.31 | 4.40 | 3.70 | 3.77 | 3.73 | * | ||||||||||||||

|