UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[x] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2018

OR

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to | |

Commission file number 001-14157

TELEPHONE AND DATA SYSTEMS, INC.

(Exact name of Registrant as specified in its charter)

Delaware | 36-2669023 | ||||||||||||||||

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | ||||||||||||||||

30 North LaSalle Street, Suite 4000, Chicago, Illinois 60602

(Address of principal executive offices) (Zip code)

Registrant’s telephone number, including area code: (312) 630-1900

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | ||||||||||||||||

Common Shares, $.01 par value | New York Stock Exchange | ||||||||||||||||

6.625% Senior Notes due 2045 | New York Stock Exchange | ||||||||||||||||

6.875% Senior Notes due 2059 | New York Stock Exchange | ||||||||||||||||

7.000% Senior Notes due 2060 | New York Stock Exchange | ||||||||||||||||

5.875% Senior Notes due 2061 | New York Stock Exchange | ||||||||||||||||

Securities registered pursuant to Section 12(g) of the Act: None

Yes | No | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | [x] | [ ] |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. | [ ] | [x] |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | [x] | [ ] |

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). | [x] | [ ] |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. | [ ] | |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act. | |||||

Large accelerated filer | [x] | Accelerated filer | [ ] | ||

Non-accelerated filer | [ ] | Smaller reporting company | [ ] | ||

Emerging growth company | [ ] | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | [ ] | ||||

Yes | No | ||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | [ ] | [x] | |||

As of June 30, 2018, the aggregate market values of the registrant’s Common Shares and Series A Common Shares held by non-affiliates were approximately $2 billion and $2 million, respectively. For purposes hereof, it was assumed that each director, executive officer and holder of 10% or more of any class of voting equity security of Telephone and Data Systems, Inc. (TDS) is an affiliate. The June 30, 2018, closing price of the Common Shares was $27.42 as reported by the New York Stock Exchange. Because trading in the Series A Common Shares is infrequent, the registrant has assumed for purposes hereof that each Series A Common Share has a market value equal to one Common Share because the Series A Common Shares are convertible on a share-for-share basis into Common Shares.

The number of shares outstanding of each of the registrant’s classes of common stock, as of January 31, 2019, is 106,539,000 Common Shares, $.01 par value, and 7,284,900 Series A Common Shares, $.01 par value.

DOCUMENTS INCORPORATED BY REFERENCE

Those sections or portions of the registrant's 2018 Annual Report to Shareholders (Annual Report), filed as Exhibit 13 hereto, and of the registrant’s Notice of Annual Meeting of Shareholders and Proxy Statement (Proxy Statement) to be filed prior to April 30, 2019, for the 2019 Annual Meeting of Shareholders scheduled to be held May 23, 2019, are herein incorporated by reference into Parts II and III of this report.

Telephone and Data Systems, Inc.

Annual Report on Form 10-K

For the Period Ended December 31, 2018

TABLE OF CONTENTS

Page No. | ||||

Telephone and Data Systems, Inc. 30 NORTH LASALLE STREET, SUITE 4000, CHICAGO, ILLINOIS 60602 TELEPHONE (312) 603-1900 |  |

PART I

Item 1. Business

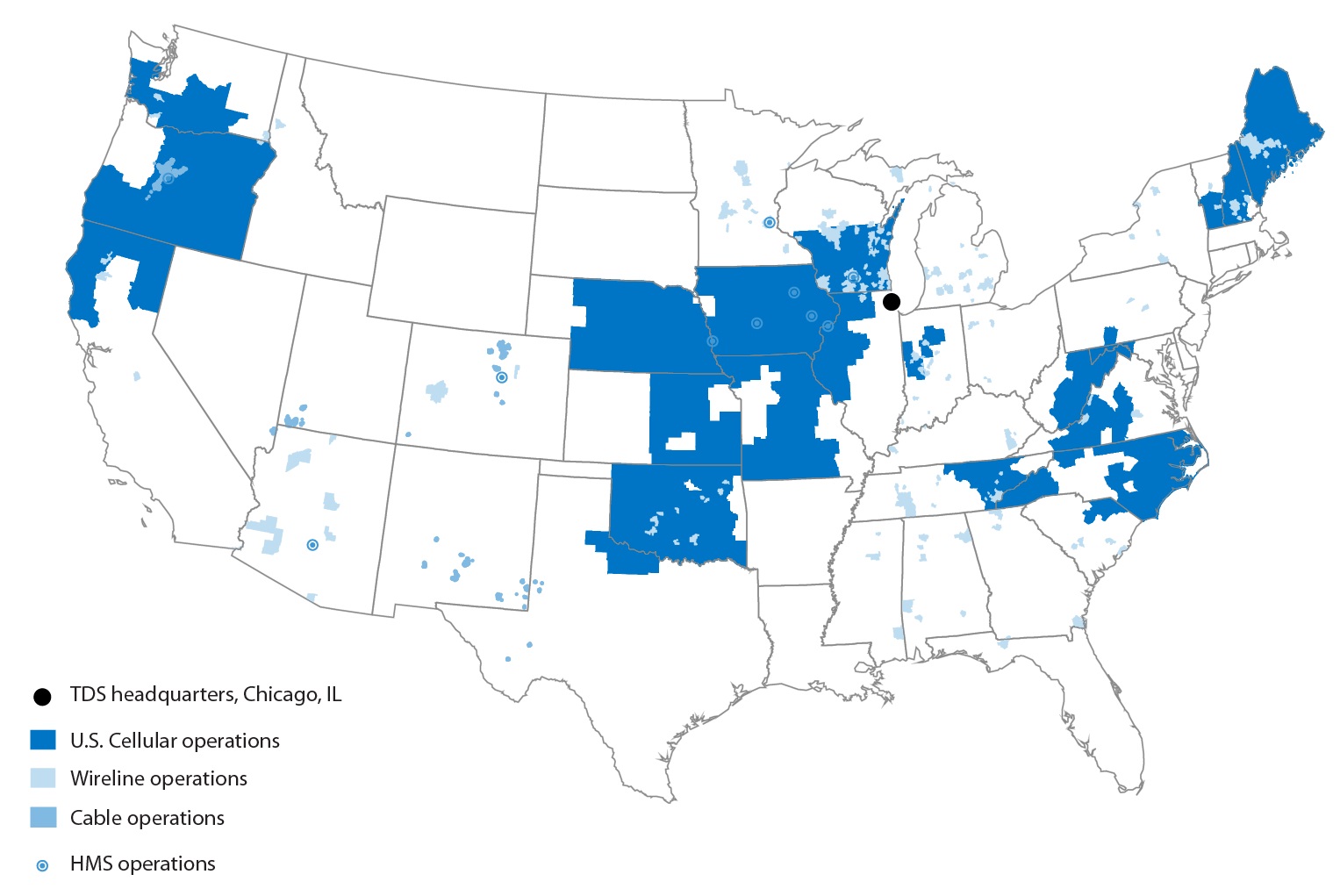

Telephone and Data Systems, Inc. (TDS) is a diversified telecommunications company providing high-quality communications services to customers with 5.0 million wireless connections and 1.2 million wireline and cable connections at December 31, 2018. TDS conducts all of its wireless operations through its majority-owned subsidiary, United States Cellular Corporation (U.S. Cellular). As of December 31, 2018, TDS owned 82% of the combined total of the outstanding Common Shares and Series A Common Shares of U.S. Cellular and controlled 96% of the combined voting power of both classes of U.S. Cellular common stock. TDS provides broadband, video and voice services through its wholly-owned subsidiary, TDS Telecommunications LLC (TDS Telecom). TDS was incorporated in 1968 and is incorporated in Delaware. TDS Common Shares trade under the ticker symbol “TDS” on the New York Stock Exchange (NYSE). U.S. Cellular Common Shares trade on the NYSE under the ticker symbol “USM.”

Under listing standards of the NYSE, TDS is a “controlled company” as such term is defined by the NYSE. TDS is a controlled company because over 50% of the voting power for the election of directors of TDS is held by the trustees of the TDS Voting Trust.

TDS has three business segments: U.S. Cellular and TDS Telecom’s Wireline and Cable. TDS operations also include the operations of its wholly-owned hosted and managed services (HMS) subsidiary, which operates under the OneNeck IT Solutions brand, and its wholly-owned printing subsidiary Suttle-Straus, Inc. (Suttle-Straus). HMS' and Suttle-Straus’ financial results were not significant to TDS’ operations. All of TDS’ segments operate only in the United States, except for HMS, which includes an insignificant foreign operation.

TDS re-evaluated internal reporting roles with regard to its HMS business unit and, as a result, changed its reportable segments. Effective January 1, 2018, HMS was considered a non-reportable segment and is no longer being reported under TDS Telecom. Additional information about TDS’ segments is incorporated herein by reference from Note 18 — Business Segment Information in TDS’ Annual Report to Shareholders, filed as Exhibit 13 hereto.

The map below highlights TDS’ consolidated areas of operations:

1

U.S. CELLULAR OPERATIONS

General

U.S. Cellular, incorporated under the state laws of Delaware in 1983, provides wireless telecommunications services to customers with 5.0 million connections in 22 states collectively representing a total population of 31 million. U.S. Cellular operates in one reportable segment, and all of its wireless operating markets are in the United States. U.S. Cellular’s strategy is to attract and retain wireless customers through a value proposition comprised of a high-quality network, outstanding customer service, and competitive devices, plans, and pricing, all provided with a local focus.

Customers, Services and Products

Customers. U.S. Cellular provides service to postpaid and prepaid customers from a variety of demographic segments. U.S. Cellular focuses on retail consumers, government entities, and small-to-mid-size business customers in industries such as construction, retail, agriculture, professional services and real estate. These customers are served primarily through U.S. Cellular’s retail and direct sales channels. U.S. Cellular builds customer loyalty by offering high-quality network services, outstanding customer-focused support services, competitive pricing, and other benefits as discussed further in “Marketing, Customer Service, and Sales and Distribution Channels” below.

Services. U.S. Cellular’s customers are able to choose from a variety of national plans with voice, messaging and data usage options and pricing that are designed to fit different customer needs, usage patterns and budgets. Helping a customer find the right plan is an important element of U.S. Cellular’s brand positioning. In 2018, U.S. Cellular introduced the Unlimited with Payback plan that provides a monthly bill credit to postpaid customers if they have used less than 3 gigabytes of data per line. U.S. Cellular’s national plans price all domestic calls as local calls, regardless of where they are made or received in the United States, with no long distance or roaming charges, made possible by roaming agreements with other wireless carriers. See “Network Technology, Roaming, and System Design” section below for further discussion related to roaming.

U.S. Cellular’s portfolio of smartphones, tablets and other connected devices is a key part of its strategy to deliver wireless devices that allow customers to stay productive, entertained and connected on the go; these devices are backed by U.S. Cellular’s high-speed fourth generation (4G) Long-Term Evolution (LTE) network. U.S. Cellular’s 4G LTE network features smartphone messaging, data and internet services that allow customers to access the internet; text, picture and video message; utilize GPS navigation; and browse and download thousands of applications to customize their wireless devices to fit their lifestyles. U.S. Cellular’s Voice over Long-Term Evolution (VoLTE) technology, which has been launched successfully in multiple markets, enables customers to utilize the 4G LTE network for both voice and data services, and offers enhanced services such as high definition voice and simultaneous voice and data sessions. U.S. Cellular also offers advanced wireless solutions to consumers and business and government customers, including a growing suite of connected machine-to-machine (M2M) solutions and software applications across the categories of monitor and control (e.g., sensors and cameras), business automation/operations (e.g., e-forms), communication (e.g., enterprise messaging, back-up router for business continuity services) and asset management (e.g., telematics, fleet management). U.S. Cellular intends to continue to further enhance these offerings for customers in 2019 and beyond.

Devices and Products. U.S. Cellular offers a comprehensive range of wireless devices such as handsets, tablets, mobile hotspots, home phones and routers for use by its customers. U.S. Cellular offers wireless devices that are compatible with its 4G LTE and third generation (3G) networks and are compliant with the Federal Communications Commission (FCC) enhanced wireless 911 requirements. In addition, U.S. Cellular also offers a wide range of accessories, including wireless essentials such as cases, screen protectors, chargers, and memory cards as well as an assortment of consumer electronics such as headphones, smart speakers, wearables and home automation products (e.g., cameras, sensors, and thermostats).

Throughout 2018, new postpaid handset sales to retail consumers were made primarily under equipment installment plans (EIP); business and government customers may continue to purchase equipment under alternative plans subject to a service contract. For certain installment plans, after a specified period of time or number of payments, the customer may have the right to upgrade to a new device prior to reaching the end of the installment term, thus enabling customers to access the latest smartphones and provide a better overall customer experience.

U.S. Cellular also offers accessories for purchase on installment plans. These plans allow new and existing postpaid customers to purchase certain accessories payable over a specified time period. These accessory installment plans are available through U.S. Cellular company-owned retail stores, telesales channels, and agent channels using direct fulfillment with U.S. Cellular’s inventory.

U.S. Cellular continues to offer device service programs that provide customers a simple process to replace a defective device. U.S. Cellular also offers its Trade-In program where U.S. Cellular buys consumers’ used equipment, Device Protection+ program, which includes overnight delivery of a replacement device for damaged, lost and stolen devices, Device Protection+ Advanced program, which includes 100GB of data backup, TechSupport+, and AppleCare services for Apple iOS customers.

U.S. Cellular offers a full array of iconic smartphones with options for both Android and iOS customers. U.S. Cellular continues to bolster its expanding smartphone portfolio with the Samsung Galaxy S® 9/9+ and Note 9, the iPhone® XS/XS Max and XR, the LG V40 ThinQ, and the Motorola Z3 Play. Along with the iconic devices, U.S. Cellular supports the larger ecosystem of Samsung and Apple devices, such as the Samsung Galaxy Watch, the Samsung Gear Sport and the Apple Watch Series 4. For tablets, U.S. Cellular offers the full complement of iPads and the Samsung Galaxy Tab series. U.S. Cellular’s smartphone offerings play a significant role in attracting customers and driving data service usage and revenues. U.S. Cellular also offers additional services and products that utilize U.S. Cellular's network, including feature phones, mobile hotspots, LTE wireless routers, LTE wireless cameras, and home phones.

2

U.S. Cellular purchases wireless devices and accessory products from a number of original equipment manufacturers and distributors, including Samsung, Apple, Motorola, LG, Kyocera, Inseego, Netgear, Tessco, Voicecomm and Superior. U.S. Cellular manages relationships with its suppliers to ensure best possible pricing and identifies opportunities for promotional support. U.S. Cellular does not own significant product warehousing and distribution infrastructure; rather, it contracts with third party providers for the majority of its product warehousing, distribution and direct customer fulfillment activities. U.S. Cellular also contracts with third party providers for services related to its device service programs.

U.S. Cellular continuously monitors the financial condition of its wireless device and accessory suppliers. Since U.S. Cellular has a diversified portfolio of products from more than one supplier, U.S. Cellular does not expect the financial condition of any single supplier to affect its ability to offer a competitive portfolio of wireless devices and accessories for sale to customers.

Marketing, Customer Service, and Sales and Distribution Channels

Marketing and Advertising. U.S. Cellular’s marketing plan is focused on acquiring, retaining and growing customer relationships by maintaining a high-quality wireless network, providing outstanding customer service, and offering a comprehensive portfolio of services and products built around customer needs at fair prices with a local focus. U.S. Cellular believes that creating positive relationships with its customers enhances their wireless experience and builds customer loyalty. U.S. Cellular currently offers several customer-centric programs and services to customers.

To attract potential new customers and retain existing customers, and increase their usage of U.S. Cellular’s services, U.S. Cellular’s advertising is directed at increasing the public awareness of the U.S. Cellular brand, knowledge of the outstanding network that works in places where other carriers do not have coverage, and understanding of the wireless services it offers. U.S. Cellular supplements its advertising with a focused public relations program that improves overall brand sentiment and awareness, encourages engagement, supports sales of services and products, and builds preference and loyalty for the U.S. Cellular brand. The approach combines national and local media relations in mainstream and social media channels with market-wide activities, events, and sponsorships.

U.S. Cellular focuses its charitable giving on initiatives relevant to consumers in its service areas. These initiatives include programs that focus on STEM (Science, Technology, Engineering and Math) activities for youth in the communities U.S. Cellular serves and often involve collaboration with organizations such as the Boys and Girls Clubs of America.

Customer Service. U.S. Cellular manages customer retention by focusing on outstanding customer service through the development of processes that are customer-friendly, extensive training of frontline sales and support associates and the implementation of retention programs.

U.S. Cellular currently operates four regional customer care centers in its operating markets with personnel who are responsible for customer service activities, and a national financial services center with personnel who perform credit and other customer payment activities. U.S. Cellular also contracts with third parties that provide additional customer care and financial services support.

Sales and Distribution Channels. U.S. Cellular supports a multi-faceted distribution program, including retail sales, direct sales, third-party national retailers, and independent agents, plus a website and telesales.

Company retail store locations are designed to market wireless services and products to the consumer and small business segments in a setting familiar to these types of customers. As of December 31, 2018, retail sales associates work in 259 U.S. Cellular-operated retail stores and kiosks. Direct sales representatives sell traditional wireless services as well as Internet of Things (IoT) and M2M products and solutions to medium- and large-sized businesses and government entities. Additionally, the U.S. Cellular website enables customers to purchase wireless devices online.

U.S. Cellular maintains an ongoing training program to improve the effectiveness of retail sales associates and direct sales representatives by focusing their efforts on obtaining customers by facilitating the sale of appropriate packages for the customer’s expected usage and value-added services that meet the individual needs of the customer.

U.S. Cellular has relationships with exclusive and non-exclusive agents (collectively “agents”), which are independent businesses that obtain customers for U.S. Cellular on a commission basis. At December 31, 2018, U.S. Cellular had contracts with these businesses aggregating 436 locations. U.S. Cellular provides support and training to its agents to increase customer satisfaction and to ensure a consistent customer experience. U.S. Cellular’s agents are generally in the business of selling wireless devices, wireless service packages and other related products. No single agent accounted for 10% or more of U.S. Cellular’s operating revenues during the past three years.

U.S. Cellular services and products also are offered through third-party national and on-line retailers. Wal-Mart, Sam’s Club, Family Dollar and Dollar General offer U.S. Cellular services and products at select retail locations in U.S. Cellular’s service areas. U.S. Cellular continues to explore new relationships with additional third-party retailers as part of its strategy to expand distribution.

Seasonality. Seasonality in operating expenses may cause operating income to vary from quarter to quarter. U.S. Cellular’s operating expenses tend to be higher in the fourth quarter due to increased marketing and promotional activities during the holiday season.

3

Competition

The wireless telecommunication industry is highly competitive. U.S. Cellular competes directly with several wireless service providers in each of its markets. In general, there are between two and four competitors in each wireless market in which U.S. Cellular provides service, excluding resellers and mobile virtual network operators (MVNO). In its footprint, U.S. Cellular competes to varying degrees against each of the national wireless companies: Verizon Wireless, AT&T Mobility, Sprint, and T-Mobile USA, in addition to a few smaller regional carriers in specific areas of its footprint. All of the national competitors have substantially greater financial and other resources than U.S. Cellular. In addition, U.S. Cellular competes with other companies that use alternative communication technology and services to provide similar services and products.

Since each of these wireless competitors operates on systems using spectrum licensed by the FCC and has comparable technology and facilities, competition among wireless service providers for customers is principally on the basis of types of services and products, price, size of area covered, network quality, network speed and responsiveness of customer service. U.S. Cellular employs a customer satisfaction strategy that includes maintaining an outstanding wireless network throughout its markets. U.S. Cellular owns and operates low-band spectrum (less than 1 GHz) that covers the majority of its footprint and enables more efficient coverage in rural areas (compared to spectrum above 1 GHz), which strengthens its network quality positioning. To the extent existing competitors or new entrants hold or acquire such spectrum in U.S. Cellular markets, U.S. Cellular could face increased competition over time. In addition, industry deployment of fifth generation (5G) technology could introduce increased competition from industry participants on bases such as network speed and new product offerings.

The use of national advertising and promotional programs by the top four wireless service providers is a source of additional competitive and pricing pressures in all U.S. Cellular markets, even if those operators do not provide direct service in a particular market. Over the past year, competition among top carriers has continued to be robust, with the top four carriers offering unlimited plans as well as device price reductions. In addition, in the current wireless environment, U.S. Cellular’s ability to compete depends on its ability to continue to offer national voice and data plans. U.S. Cellular provides wireless services comparable to the national competitors, but the national wireless companies operate in a wider geographic area and are able to provide such services over a wider area on their own networks than U.S. Cellular can offer on its network. Although U.S. Cellular offers similar coverage area as these competitors, U.S. Cellular incurs roaming charges for data sessions and calls made in portions of the coverage area which are not part of its network, thereby increasing its cost of operations. U.S. Cellular depends on roaming agreements with other wireless carriers to provide voice and data roaming capabilities in areas not covered by U.S. Cellular’s network. Similarly, U.S. Cellular provides roaming services on its network to other wireless carriers’ customers who travel within U.S. Cellular’s coverage areas and receives revenue from other carriers for the provision of these services.

Convergence of connectivity is taking place on many levels, including wireless devices that can act as wireless or wireline replacement devices and the incorporation of wireless “hot spot” technology in wireless devices making internet access seamless regardless of location. Although less directly a substitute for other wireless services, wireless data services such as Wi-Fi may be adequate for those who do not need mobile wide-area roaming or full two-way voice services. If the trend toward convergence continues, U.S. Cellular is at a competitive disadvantage to larger competitors, including the national wireless carriers, traditional cable companies, MVNOs and other potential large new entrants with much greater financial and other resources in adapting to such convergence. Cable companies have begun to compete in the wireless market. Most notably, Comcast and Charter currently offer wireless services.

U.S. Cellular’s approach in 2019 and in future years will be to focus on the unique needs and attitudes of its customers towards wireless service. U.S. Cellular will deliver high-quality services and products at competitive prices and intends to continue to differentiate itself by seeking to provide an overall outstanding customer experience, founded on a high-quality network. U.S. Cellular’s ability to compete successfully in the future will depend upon its ability to anticipate and respond to changes related to new service offerings, consumer preferences, competitors’ pricing strategies and new product offerings, technology, demographic trends, economic conditions and its access to adequate spectrum resources.

Network Technology, Roaming, and System Design

Technology. Wireless telecommunication systems transmit voice, data, graphics and video through the transmission of signals over networks of radio towers using radio spectrum licensed by the FCC. Access to local, regional, national and worldwide telecommunications networks is provided through system interconnections. A high-quality network, supported by continued investments in that network, will remain an important factor for U.S. Cellular to remain competitive.

VoLTE technology allows customers to utilize a 4G LTE network for both voice and data services, and offers enhanced services such as high definition voice and simultaneous voice and data sessions. In addition, the deployment of VoLTE technology expands U.S. Cellular’s ability to offer roaming services to other wireless carriers. VoLTE technology has been launched successfully in California, Iowa, Oregon, Washington and Wisconsin, and deployments in several additional operating markets will occur in 2019.

5G technology is expected to help address customers’ growing demand for data services as well as create opportunities for new services requiring high speed and reliability as well as low latency. U.S. Cellular is committed to continuous technology innovation and continues to prepare for deployment of 5G technology beginning in 2019, including commencing a trial utilizing 5G standards and equipment on its core LTE network in the fourth quarter of 2018. U.S. Cellular is partnering with leading companies in the wireless infrastructure and handset ecosystem to provide rich 5G experiences for customers. In addition, in the markets where U.S. Cellular commercially deploys 5G technology, which will include communities of various sizes, customers using U.S. Cellular’s 4G LTE network will experience increased network speed due to U.S. Cellular's modernization efforts. The deployment of 5G technology will require substantial investments in spectrum and U.S. Cellular’s networks to remain competitive.

4

Roaming. A secondary source of revenue for U.S. Cellular is from customers of other wireless operators who roam on its network. Inter-carrier roaming agreements are negotiated between the wireless operators to enable customers who are in a wireless service area other than the customer’s home service area to place or receive a call or text message, or to use data services, in that service area. U.S. Cellular has entered into reciprocal roaming agreements with operators of other wireless systems covering virtually all systems with Code Division Multiple Access (CDMA) technology in the United States. In addition, U.S. Cellular has entered into reciprocal 4G LTE roaming agreements with national wireless companies and, as a result, a majority of U.S. Cellular customers currently have access to nationwide 4G LTE service.

Another digital technology, Global System for Mobile Communication (GSM), has a larger installed base of customers worldwide. U.S. Cellular customers now have the ability to roam on GSM carriers with voice, data and text messaging in Canada, Mexico and internationally. Both CDMA and GSM technologies are being succeeded by 4G LTE, VoLTE and 5G technology.

System Design and Construction. U.S. Cellular designs and constructs its systems in a manner it believes will permit it to provide high-quality service to substantially all types of compatible wireless devices. Designs are based on engineering studies which relate to specific markets, in support of the larger network. Network reliability is given careful consideration and extensive backup redundancy is employed in many aspects of U.S. Cellular’s network design. Route diversity, redundant equipment, ring topology and extensive use of emergency standby power also are used to enhance network reliability and minimize service disruption from any particular network element failure.

In accordance with its strategy of building and strengthening its operating market areas, U.S. Cellular has selected high-capacity, carrier-class digital wireless switching systems that are capable of serving multiple markets through a single mobile telephone switching office. Centralized equipment, used for network and data management, is located in high-availability facilities supported by multiple levels of power and network redundancy. U.S. Cellular’s systems are designed to incorporate Internet Protocol (IP) packet-based Ethernet technology, which allows for increased data capacity and a more efficient network. Interconnection between the mobile telephone switching office and the cell sites utilizes Ethernet technology for nearly all 4G LTE sites, over fiber or microwave links.

As a result of increasing demand for high–speed data and the deployment of 5G technology, U.S. Cellular expects to acquire additional spectrum licenses and to make significant investments in its network to provide sufficient capacity and throughput.

Construction of wireless systems is capital-intensive, requiring substantial investment for land and improvements, buildings, towers, mobile telephone switching offices, cell site equipment, transport equipment, engineering and installation. U.S. Cellular primarily uses its own personnel to engineer each wireless system it owns and operates, and engages contractors to construct the facilities.

The costs (inclusive of the costs to acquire licenses) to develop the systems which U.S. Cellular operates have historically been financed primarily through proceeds from debt offerings, with cash generated by operations, and proceeds from the sales of wireless interests and other non-strategic assets.

Business Development Strategy

U.S. Cellular operates a regional wireless network. U.S. Cellular’s interests in wireless licenses include both direct interests whereby U.S. Cellular is the licensee and investment interests in entities which are licensees; together, these direct and investment interests involve operating and non-operating licenses covering 30 states and a total population of approximately 50 million at December 31, 2018.

U.S. Cellular’s business development strategy is to obtain interests in or access to wireless licenses in its current operating markets and in areas that are adjacent to or in close proximity to its other wireless licenses, thereby building larger geographic operating market areas. U.S. Cellular believes that the acquisition of additional licenses within its current operating markets will enhance its network capacity and speed to meet its customers’ growing demand for data services. From time to time, U.S. Cellular has divested outright or included in exchanges for other wireless interests certain consolidated and investment interests that were considered less essential to its current and expected future operations. As part of its business development strategy, U.S. Cellular may periodically be engaged in negotiations relating to the acquisition, exchange or disposition of companies, strategic properties, investment interests or wireless spectrum.

The FCC conducts auctions through which additional spectrum is made available for the provision of wireless services. Historically, U.S. Cellular has participated in certain FCC auctions both directly and indirectly through its limited partnership interests. At its open meeting on August 2, 2018, the FCC adopted a public notice establishing procedures for two auctions of Millimeter Wave spectrum licenses in the 28 GHz and 24 GHz bands. The 28 GHz auction (Auction 101), which commenced on November 14, 2018 and closed on January 24, 2019, offered two 425 MHz licenses in the 28 GHz band over portions of the United States that do not have incumbent licensees. The 24 GHz auction (Auction 102) will offer up to seven 100 MHz licenses in the 24 GHz band in Partial Economic Areas covering most of the United States. Upfront payments for Auction 102 were due by February 19, 2019, and bidding in Auction 102 is scheduled to begin on March 14, 2019. U.S. Cellular filed applications to participate in both auctions on September 18, 2018, and was announced as a qualified bidder for Auction 101 on October 31, 2018. The FCC has not announced qualified bidders for Auction 102. Also, at the open meeting on August 2, 2018, the FCC adopted a Further Notice of Proposed Rulemaking in preparation for an additional Millimeter Wave auction offering licenses in the 37, 39 and 47 GHz bands. FCC statements indicate plans to hold this auction in the second half of 2019. The spectrum auctioned in each of these Millimeter Wave auctions is expected to be used primarily to deliver 5G technology.

5

TDS TELECOM OPERATIONS

General

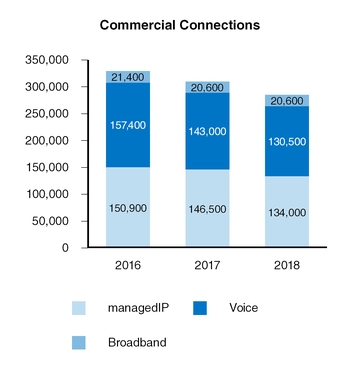

TDS Telecom operates Wireline and Cable subsidiaries that provide communications services to 1.2 million connections. TDS Telecom’s business objective is to provide a wide range of communications services to both residential and commercial customers.

Growth Strategy

Both Wireline and Cable share a common growth strategy to provide high-speed data services bundled with video entertainment and voice services. In Wireline, TDS Telecom is focused on investing in fiber to the home technologies to provide high-speed internet services of up to 1 Gigabit per second (Gbps) to new and existing markets. Increased fiber deployment provides the opportunity to deliver more robust residential and commercial products which drives future growth. Fiber builds in locations outside of its current markets allows TDS Telecom to target the most attractive markets to increase its total footprint. TDS Telecom has completed the construction of a fiber network in an initial out-of-territory market which has provided the basis for expanding this strategy. Therefore, several additional new locations are currently being built with fiber to expand its footprint into attractive markets that are underserved today. Similarly, in its Cable markets, TDS Telecom is also focused on providing high-speed data services, offering up to 600 Megabits per second (Mbps) data speeds over its DOCSIS 3.0 network, and investing in fiber-to-home construction in new housing developments in these fast growing markets.

TDS Telecom may also seek to grow its operations through the acquisition of businesses that support and complement its existing markets or create entirely new clusters of markets where TDS Telecom can succeed. TDS Telecom intends to avoid markets served by other fiber overbuilders or municipalities which have constructed their own networks with fiber to the home.

Core Network

In order to provide IP-based services, TDS Telecom has developed and deployed an inter-regional data routing infrastructure using owned and leased fiber capacity which allows it to leverage its multi-terabit core network in both Wireline and Cable operations. This configuration, along with the continued development of an IP network that interconnects substantially all the existing service territories, allows for next generation IP service offerings.

The TDS Telecom core network continues to standardize equipment and processes to increase efficiency in maintaining its network. TDS Telecom utilizes centralized monitoring and management of its network to reduce costs and improve service reliability. Network standardization has aided TDS Telecom in operating its 24-hours-a-day / 7-days-per-week Network Management Center, which continuously monitors the network in an effort to proactively identify and correct network faults prior to any customer impact.

Wireline

Operations

TDS Telecom is a broadband-centric telecommunications company that operates as an Incumbent Local Exchange Carrier (ILEC) in 25 states and as a Competitive Local Exchange Carrier (CLEC) in Illinois, Michigan, Minnesota, New Hampshire, and Wisconsin. Wireline operations provide telecommunications services to both residential and commercial customers. Wireline also provides services to wholesale customers, which are primarily interexchange carriers (companies that provide long-distance telephone and data services between local exchange areas) and wireless carriers that compensate TDS Telecom for the use of its facilities to originate and terminate their voice and data transmissions. Wireline operations are located across nearly 900 rural, suburban, and metropolitan communities within the U.S, with the largest concentrations of customers in the Upper Midwest and the Southeast.

Customers, Services and Products

Wireline generates revenues by providing the following services and products:

▪ | Broadband: Fiber technology is being deployed to select markets to provide internet speeds of up to 1 Gbps. In certain non-fiber markets, TDS Telecom is deploying fiber-to-the-node and copper-based vectoring / pair bonding technology to increase data speeds reaching up to 100 Mbps. Premium security and support services are available to enhance the customers’ high-speed internet experience. |

▪ | Video: TDS TV is a comprehensive all-digital TV service available in select TDS markets that provides customers with connected-home digital video recorders (DVR), video-on-demand (VOD), TV Everywhere (TVE) and other enhanced applications and features. Where TDS TV is not available, TDS Telecom partners with a satellite TV provider to offer digital television. |

▪ | Voice: Call plans include local and long-distance telephone service, VoIP and enhanced services like find me follow me, collaboration, instant messaging and more. Many features are bundled with calling plans to give customers the best value. |

▪ | Network access services are provided to interexchange and wireless carriers for transporting data and voice traffic on TDS Telecom’s network. |

6

Wireline is focusing its investments on broadband as the core growth component of its service offerings. Wireline believes that its residential and business customers have a strong preference to purchase complementary telecommunications services from a single provider. The Wireline residential customer strategy is to provide broadband, video and voice services either individually or through value-added bundling of these services. Wireline has found that by delivering the best broadband speeds combined with a robust video experience, it can build customer loyalty and promote growth. The commercial focus is to provide a suite of advanced IP-based data and voice services to customers primarily ranging in size from sole proprietors to small- and medium-sized businesses.

To attract and retain customers in the video business, TDS Telecom is developing a next generation video platform called TDS TV+ which will enhance the customer experience by adding interfaces to mobile devices, personalized content recommendations, and network-based DVR functionality. TDS TV+ will be offered in its Wireline and Cable operations and will offer video content and features not available on existing TDS platforms.

Residential. Wireline residential customer operations provide high-speed data, video and voice services. TDS Telecom features a wide range of reliable, affordable speeds to fit every lifestyle and every budget, including 1 Gbps internet. In selected residential markets, Wireline’s marketing and promotional strategies include a focus on its Internet Protocol Television (IPTV) service offering under the brand TDS TV. This IP based video offering is intended to counter intensifying competition for video services. In markets where IPTV is not offered, TDS Telecom has partnered with a satellite TV provider to allow for triple or double play bundling. Approximately 78% of ILEC customers have at least two services.

Commercial. Wireline commercial customer operations provide broadband, IP-based services, and hosted voice and collaboration services to small- to medium-sized businesses. Wireline operations provide commercial customers with secure and reliable internet access, data connections and advanced voice service with VoIP features. TDS Telecom's commercial service focus is to lead with superior broadband bundled with a voice product from a suite of solutions.

Wholesale. Wireline operations continue to provide a high level of service to traditional interexchange and wireless carriers. Wireline’s wholesale market focus is on access revenues, which is the compensation received from the interexchange carriers for carrying data and voice traffic on TDS Telecom’s networks. Federal Connect America Fund (CAF) and state Universal Service Fund (USF) revenues, which support the cost of providing telecommunication services in underserved high cost areas, are also included in wholesale service revenues.

In 2017, TDS began receiving $75 million per year for 10 years (with incremental funding for transition in the early years for certain states) for operating and maintaining its network along with the obligation to provide broadband service at various speeds to about 160,000 locations. In 2018, the FCC authorized and issued an order for TDS Telecom to receive an additional $3 million of support per year for ten years retroactive to January 2017. Continuing regulatory changes may affect the amounts of future Wireline wholesale revenues. See additional information in Risk Factors and information incorporated by reference from Exhibit 13 to this Form 10-K, Annual Report section “Regulatory Matters”.

Access Technology and System Design

Wireline operates an integrated, highly-reliable network that consists of central office host and remote sites, primarily equipped with digital and IP switches. Fiber optic and copper cable connect the host central offices with remote switches and ultimately with end customers. Wireline continues to upgrade and expand its telecommunications network to respond to the needs of its customers for greater bandwidth and advanced technologies. Broadband service is provided to 96% of Wireline’s ILEC service addresses. The network is transitioning from its legacy circuit-switched network to a highly reliable IP-based broadband network to facilitate the integration of broadband, video and voice services.

Wireline pursues a plan to deploy fiber-to-the-home technology, which enables significantly greater broadband speeds to selected residential subdivisions and to commercial customers, when the investment is economically justified. Fiber technology is deployed to provide internet speeds of up to 1 Gbps. In addition, in non-fiber markets, data speeds are increased through the use of fiber-to-the-node and copper bonding / vectoring technology. Approximately 49% of Wireline service addresses were capable of 25 Mbps or greater broadband speeds at the end of 2018.

Competition

The competitive environment in the telecommunications industry has changed significantly as a result of technological advances, customer expectations, and changes to regulation. Wireline continues to seek to develop and maintain an efficient cost structure to ensure that it can compete with price-based initiatives from competitors. Wireline faces significant challenges, including competition from cable, low-cost voice providers, other wireline and wireless providers as well as decreases in compensation received for the use of TDS Telecom’s networks.

Wireline has experienced customer connection and access minute declines due to competition from wireless carriers offering local and nationwide voice and data plans, from cable providers offering voice and data services via cable modems, from fiber overbuilders, and from other low cost voice providers.

7

Cable companies have developed technological improvements that have allowed them to extend their competitive operations beyond major markets and have enabled them to provide a broader range of data and voice services over their cable networks. Cable companies have aggressively pursued the bundling of data, video and voice products at discounted prices to attract customers from traditional telephone companies. In addition, cable companies continue to add value to their internet offerings by increasing speeds at little to no additional cost to the customer. Wireline estimates that 80% of its ILEC service addresses face active competition from cable providers at December 31, 2018. Cable companies are increasingly targeting commercial customers.

Wireless telephone service providers offering feature-rich wireless devices and improved network quality constitute a significant source of voice and broadband competition. A growing segment of customers have chosen to completely forego the use of traditional wireline telephone service and instead rely solely on wireless service for voice communications services. This trend is more pronounced among residential customers, which comprise approximately 66% of Wireline connections as of December 31, 2018. Some small businesses have followed the residential path by choosing wireless service and disconnecting wireline voice service.

While TDS Telecom positions itself as a high-quality telecommunications provider, it is also experiencing competition from Regional Bell Operating Companies (RBOCs) in areas where TDS Telecom competes as a CLEC. Approximately 20% of TDS Telecom's customer connections are within CLEC operations. The RBOCs are continuing to implement technological changes that could impede TDS Telecom’s access to facilities used to provide CLEC telecommunications services. In addition, the RBOCs have petitioned the FCC to stop enforcing requirements that allow CLECs to access that infrastructure at wholesale rates. To mitigate these risks, TDS Telecom has refocused the business on serving customers who do not require leased facilities.

Cable

Operations

TDS Telecom entered the cable business with TDS' acquisition of Baja Broadband in 2013. Subsequently, in 2014, TDS acquired substantially all of the assets of a group of companies operating as BendBroadband, headquartered in Bend, Oregon. TDS Telecom’s cable business leverages its Wireline core competencies in network management and customer focus, and operates under two brand names: TDS Cable in Colorado, New Mexico, Texas, and Utah; and BendBroadband in Oregon.

Similar to Wireline, the Cable strategy is to expand its broadband services and leverage that growth by bundling with video and voice services. Through investment in plant upgrades and improvements in programming and customer service levels, TDS Telecom intends to strengthen its markets and continue to grow its revenue base.

Customers, Services and Products

Residential. Cable offers advanced broadband, video and voice services. These services are actively bundled at competitive prices to encourage cross-selling within Cable’s customer base and to attract new customers. Approximately 56% of residential customers subscribe to a bundle of services.

• | Broadband: DOCSIS 3.0 technology is deployed to nearly all of Cable’s service addresses which allows it to offer enhanced transmission speeds. TDS Telecom is offering 600 Mbps in almost all its markets with up to 1 Gbps service available in select markets. Access to 24/7 technical support and security features is also provided to broadband customers. The implementation of DOCSIS 3.1 technology is currently underway and will offer significantly higher speeds of up to 1 Gbps. |

• | Video: Customers have access to basic service, premium programming and high-definition television combined with DVR service. Cable introduced “CatchTV,” a branded whole-home DVR solution. |

• | To attract and retain customers in the video business, TDS Telecom is developing a next generation video platform called TDS TV+ which will enhance the customer experience by adding interfaces to mobile devices, personalized content recommendations and network-based DVR functionality. TDS TV+ will be offered in its Wireline and Cable operations and will offer video content and features not available on existing TDS platforms. |

• | Voice: Telephony service uses IP to transport digitized voice signals over the same private network that brings cable television and broadband services to customers. All residential voice service customers have access to direct international calling and can subscribe to various long distance plans. |

Commercial. Business services are delivered over a robust network to provide broadband products, multi-line phone solutions and video. Cable provides advanced business services, including data networking, Ethernet, broadband access and VoIP services, to small- and medium-sized businesses.

Access Technology and System Design

Cable’s telecommunication systems are designed to transmit broadband, video and voice services using a hybrid fiber-coaxial network that consists of optical fiber transport from a headend facility to nodes where coaxial cable is then used to reach residential and business customers. In certain markets, Cable has an all-fiber network to the home or business. These fiber-rich networks offer substantial bandwidth capacity and, through the use of DOCSIS 3.0 and next generation DOCSIS 3.1 technology, enable Cable to offer robust broadband and voice services as well as traditional and two-way video services. All Cable markets are connected to TDS Telecom’s core network. This allows Cable to leverage existing internet connectivity, voice services, and support systems, which enhances reliability and redundancy and builds greater dependability as a service provider.

8

Competition

The strategy of the Cable segment is focused on broadband to capitalize on the data needs of consumers. Cable seeks to be the leading provider of broadband and video services in its targeted markets. From a broadband perspective, Cable competes against the incumbent local telephone providers which primarily offer DSL-based services. Cable offers a superior, higher bandwidth data product using its DOCSIS technology. Video competition is primarily from satellite providers, and on a limited basis, telephone companies that offer video services and compete for broadband and voice customers. Other telecommunications providers, including internet-based VoIP providers and wireless providers may compete directly for both residential and commercial voice and broadband service customers. Changes in consumer behavior or new technologies or both could cause consumers to reduce or cancel their cable video services and instead seek to obtain video on demand over the internet or through new technologies. Cable systems are operated under non-exclusive franchises; therefore, competing cable systems may be built in the same area.

TDS — REGULATION

TDS’ operations are subject to federal, state and local regulation. Key regulatory considerations are discussed below.

U.S. Cellular

TDS provides various wireless services, including voice and data services, pursuant to licenses granted by the FCC. The construction, operation and transfer of wireless systems in the United States are regulated to varying degrees by the FCC pursuant to the Communications Act of 1934, as amended (Communications Act). The FCC currently does not require wireless carriers to comply with a number of statutory provisions otherwise applicable to common carriers that provide, originate or terminate interstate or international telecommunications. However, the FCC has enacted regulations governing construction and operation of wireless systems, licensing (including renewal of licenses) and technical standards for the provision of wireless services under the Communications Act.

Wireless licenses segmented by geographic areas are granted by the FCC. The completion of acquisitions, involving the transfer of control of all or a portion of a wireless system, requires prior FCC approval. The FCC determines on a case-by-case basis whether an acquisition of wireless licenses is in the public interest. Wireless licenses are granted generally for a ten year term or, in some cases, for a twelve or fifteen year term. The FCC establishes the standards for conducting comparative renewal proceedings between a wireless license holder seeking renewal of its license and challengers filing competing applications. All of U.S. Cellular’s licenses for which it applied for renewal since 1995 have been renewed. U.S. Cellular expects to continue to meet the criteria of the FCC’s license renewal process.

As part of its data services, U.S. Cellular provides internet access. Such internet access services may be subject to different regulatory requirements than other wireless services.

Although the Communications Act generally pre-empts state and local governments from regulating the entry of, or the rates charged by, wireless carriers, certain state and local governments regulate other terms and conditions of wireless services, including billing, termination of service arrangements, imposition of early termination fees, advertising, network outages, the use of handsets while driving, zoning, land use, privacy, data security and consumer protection. Further, the Federal Aviation Administration also regulates the siting, lighting and construction of transmitter towers and antennae.

Wireline

The FCC generally exercises jurisdiction over all facilities of, and services offered by, TDS Telecom’s ILECs as telecommunications common carriers, to the extent they provide, originate or terminate interstate or international telecommunications. State public utility commissions generally exercise jurisdiction over intrastate telecommunications facilities and services. In addition, the Wireline business is subject to various other state and local laws, including laws relating to privacy, data security and consumer protection.

The Communications Act requires, among other things, that telecommunications common carriers offer interstate services when requested at just and reasonable rates at terms and conditions that are non-discriminatory. Maximum rates for regulated interstate services are prescribed by the FCC. In many states, local rates paid by end user customers and intrastate access charges paid by carriers continue to be subject to state commission approval.

TDS Telecom’s CLEC operations are subject to similar but reduced regulation compared to ILECs.

In addition to traditional circuit-switched voice service that is fully regulated as a telecommunications common carrier service, TDS Telecom also provides interconnected VoIP, which is currently subject to less regulation.

Cable

As a cable multiple systems operator (MSO), Cable is subject to regulation by the FCC, covering matters such as technical operations, administrative requirements, consumer protection, access by people with disabilities, customer privacy and content. The operation of cable systems requires the MSO to obtain franchises from state or local governmental authorities to occupy public rights of way with network facilities. These franchises typically are nonexclusive and limited in time, contain various conditions and limitations, and provide for the payment of fees to the local authority, determined generally as a standard percentage of revenues.

TDS’ Cable operations also provide interconnected VoIP and broadband services, including internet access. The interconnected VoIP and internet regulatory matters and issues described above under “Wireline” are substantially similar for cable providers.

9

General

Reference is made to Exhibit 13 to this Form 10-K under “Regulatory Matters” for information regarding any significant recent developments and proposals relating to the foregoing regulatory matters.

TDS — OTHER ITEMS

Debt Securities

The following securities trade on the NYSE: TDS’ 6.625% Senior Notes due 2045 trade under the symbol “TDI,” TDS’ 6.875% Senior Notes due 2059 trade under the symbol “TDE,” TDS’ 7.0% Senior Notes due 2060 trade under the symbol “TDJ” and TDS’ 5.875% Senior Notes due 2061 trade under the symbol “TDA.”

Employees

TDS had approximately 9,400 full-time and part-time employees as of December 31, 2018, less than 1% of whom were represented by labor organizations. TDS considers its relationship with its employees to be good.

Location and Company Information

TDS executive offices are located at 30 North LaSalle Street, Suite 4000, Chicago, Illinois 60602. TDS’ telephone number is 312-630-1900. TDS’ website address is www.tdsinc.com. TDS files with, or furnishes to, the Securities and Exchange Commission (SEC) annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, as well as various other information. Investors may access, free of charge, through the Investor Relations portion of the website, TDS' annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to such reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (Exchange Act), as soon as reasonably practical after such material is filed electronically with the SEC. The public may also view electronic filings of TDS by accessing SEC filings at www.sec.gov.

U.S. Cellular executive offices are located at 8410 West Bryn Mawr Avenue, Chicago, Illinois 60631. U.S. Cellular’s telephone number is 773-399-8900. U.S. Cellular’s website address is www.uscellular.com. U.S. Cellular files with, or furnishes to, the SEC annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, as well as various other information. Investors may access, free of charge, through the Investor Relations portion of the website, U.S. Cellular’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to such reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practical after such material is filed electronically with the SEC. The public may also view electronic filings of U.S. Cellular by accessing SEC filings at www.sec.gov.

10

Item 1A. Risk Factors

PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

SAFE HARBOR CAUTIONARY STATEMENT

This Annual Report on Form 10-K, including exhibits, contains statements that are not based on historical facts and represent forward-looking statements, as this term is defined in the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, that address activities, events or developments that TDS intends, expects, projects, believes, estimates, plans or anticipates will or may occur in the future are forward-looking statements. The words “believes,” “anticipates,” “estimates,” “expects,” “plans,” “intends,” “projects” and similar expressions are intended to identify these forward-looking statements, but are not the exclusive means of identifying them. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, events or developments to be significantly different from any future results, events or developments expressed or implied by such forward-looking statements. Such risks, uncertainties and other factors include those set forth below under “Risk Factors” in this Form 10-K. Each of the following risks could have a material adverse effect on TDS’ business, financial condition or results of operations. However, such factors are not necessarily all of the important factors that could cause actual results, performance or achievements to differ materially from those expressed in, or implied by, the forward-looking statements contained in this document. Other unknown or unpredictable factors also could have material adverse effects on future results, performance or achievements. TDS undertakes no obligation to update publicly any forward-looking statements whether as a result of new information, future events or otherwise. You should carefully consider the following risk factors and other information contained in, or incorporated by reference into, this Form 10-K to understand the material risks relating to TDS’ business.

Risk Factors

1) | Intense competition in the markets in which TDS operates could adversely affect TDS’ revenues or increase its costs to compete. |

Competition in the wireless industry is intense and is expected to intensify in the future due to multiple factors such as increasing market penetration, decreasing customer churn rates, introduction of new products, new competitors and changing prices. There is competition in pricing; handsets and other devices; network quality, coverage, speed and technologies, including 5G technology; distribution; new entrants; and other categories. In particular, wireless competition includes aggressive promotional pricing to induce customers to switch carriers, which could result in switching activity and churn. TDS’ ability to compete effectively will depend, in part, on its ability to anticipate and respond to various competitive factors affecting the telecommunications industry. In addition, unlimited plans and other data pricing constructs across the industry may limit TDS’ ability to monetize future growth in data usage. TDS anticipates that these competitive factors may cause the prices for services and products to decline and the costs to compete to increase. Most of TDS’ competitors are national or global telecommunications companies that are larger than TDS, possess greater financial and other resources, possess more extensive coverage areas and more spectrum within their coverage areas, and market other services with their communications services that TDS does not offer. TDS' competitors are actively marketing their deployment of 5G and as a result, are raising consumer awareness of the technology. If TDS cannot keep pace with its competitors in deploying 5G or other comparable offerings, or if TDS' deployment of 5G technology does not result in significant incremental revenues, TDS' financial condition, results of operations or ability to do business could be adversely affected. Further, other companies that currently are less competitive may also add more efficient low-band spectrum to become more competitive in TDS’ primary markets. In particular, to the extent that existing competitors or new entrants acquired low-band (600 MHz) spectrum or deploy newer wireless technologies in TDS markets, TDS could face increased competition over time. In addition, TDS may face competition from technologies that may be introduced in the future. New technologies, services and products that are more commercially effective than the technologies, services and products offered by TDS may be developed. Further, new technologies may be proprietary such that TDS is not able to adopt such technologies. There can be no assurance that TDS will be able to compete successfully in this environment.

Sources of competition to TDS’ wireless business typically include two to four competing wireless telecommunications service providers in each market, wireline telecommunications service providers, cable companies, resellers (including MVNO), and providers of other alternate telecommunications services. Many of TDS’ wireless competitors and other competitors have substantially greater financial, technical, marketing, sales, purchasing and distribution resources than TDS.

Sources of competition to TDS’ Wireline ILEC business include, but are not limited to, resellers of local exchange services, interexchange carriers, RBOCs, direct broadcast satellite providers, wireless communications providers, cable companies, access providers, CLECs, fiber overbuilders, VoIP providers and providers using other emerging technologies. The Wireline CLEC business sources of competition include the sources identified above as well as the ILEC in each market, which enjoys competitive advantages, including its wireline connection to virtually all of the customers and potential customers of Wireline’s CLEC business, its established brand name, its lower overhead costs, and its substantial financial resources. Wireline’s CLEC business is typically required to discount services to win potential customers. Further, this business may be negatively impacted if it cannot provide levels of bandwidth prospective customers demand due in large part to lack of availability of IP-based wholesale services at competitive prices. In the future, TDS expects the number of its physical access lines served to continue to be adversely affected by wireless voice and broadband substitution, by cable company competition, and potentially by fiber overbuilders.

11

Some of the specific risks presented by certain Wireline competitors include:

▪ | Cable companies - continued deployment of broadband technologies such as DOCSIS 3.0 and 3.1 and their further evolution that substantially increase broadband speeds, and offering these speeds to customers at relatively low prices, including speed upgrades for no additional charge, and competition for video services. |

▪ | Wireless - the trend of customers “substituting” their wireline voice and broadband connections with a wireless device and wireless voice and broadband services continues. |

▪ | RBOCs - continue to be formidable competitors given their full suite of services, experience and strong financial resources. |

▪ | VoIP providers - are able to offer voice service at a very low price point. |

▪ | Fiber overbuilders - municipalities, neighboring ILECs, or other providers offering the same or higher data speeds at similar or lower price points. |

▪ | Other providers - competition to IPTV and broadband from broadcast television, satellite providers and on-line video services. |

TDS’ Cable business also provides broadband, video and voice services. Cable’s business faces sources of competition similar to the Wireline business, but with some differences. In particular, Cable does not typically compete against another cable company for broadband services, but competes against fiber overbuilders and ILECs that primarily offer DSL-based services and may also offer fiber-based and other premium and enhanced data services. Cable provides VoIP services rather than traditional wireline voice connections and faces competition from other VoIP providers, but also faces competition from ILECs providing traditional wireline voice connections. With respect to video, Cable also competes against broadcast television, direct broadcast satellite providers, on-line video services, and wireline providers which have begun to upgrade their networks to provide video services in addition to voice and high-speed internet access services.

Sources of competition for HMS’ business primarily include large technology companies, as well as smaller independent firms that focus on mid-market companies. In addition, new entrants may emerge and grow rapidly creating additional sources of competition or companies may choose to insource their IT services. The IT services market is large and complex, with a diverse array of segments in which performance and market dynamics vary considerably. As a result of these dynamics the IT services market is a highly competitive environment. Due to the competitive environment, in order to win new customer engagements, HMS may be required to assume greater potential contractual risk obligations, such as risks relating to the consequences of data breaches or unauthorized disclosure of confidential customer information. In the event of such incidents, the HMS business could be materially adversely affected.

If TDS does not adapt to compete effectively in such a highly competitive environment, such competitive factors could result in product, service, pricing or cost disadvantages and could have an adverse effect on TDS’ business, financial condition or results of operations.

2) | A failure by TDS to successfully execute its business strategy (including planned acquisitions, spectrum acquisitions, fiber builds, divestitures and exchanges) or allocate resources or capital effectively could have an adverse effect on TDS’ business, financial condition or results of operations. |

The successful execution of business strategies, the optimal allocation within TDS’ portfolio of assets and optimal capital allocation decisions depend on various internal and external factors, many of which are not in TDS’ control. TDS’ ability to achieve projected financial results by implementing and executing its business strategies and optimally allocating its assets and capital could be affected by such factors. Such factors include but are not limited to pricing practices by competitors, relative scale, purchasing power, roaming and other strategic agreements, wireless device availability, timing of introduction of wireless devices, access to spectrum, emerging technologies, programming and retransmission costs, mid-market demand for cloud and hosted services, changes in tax or import tariff regulations and other factors. In addition, there is no assurance that U.S. Cellular’s, TDS Telecom’s or HMS' strategies will be successful. Even if TDS executes its business strategies as intended, such strategies may not be successful in the long term at achieving growth in customers, revenues, net income, or generating portfolio returns greater than TDS’ cost of capital. In addition, if at some point a change in asset allocation is desired, TDS may be unable to alter asset allocation to meet growth and return goals in a timely and efficient manner. In such case, there would be an adverse effect on TDS’ business, financial condition and results of operations. TDS’ current forecast indicates that TDS will not achieve a return on capital that exceeds its cost of capital in the foreseeable future. See Item 1. Business for additional information on TDS’ business strategy.

U.S. Cellular is a regional wireless carrier, but competes primarily against much larger national wireless carriers with much greater resources. Its business strategy in attempting to attract and retain wireless customers through a value proposition comprised of a high-quality network, outstanding customer service, and competitive devices, plans and pricing, all provided with a local focus has not resulted in, and in the future may not result in, performance that achieves returns in line with or above its cost of capital. U.S. Cellular’s current forecast indicates that U.S. Cellular will not achieve a return on capital that exceeds its cost of capital in the foreseeable future. U.S. Cellular also might be unable to adopt technologies, services and products as fast as its larger competitors. As a result, consumers who are eager to adopt new technologies, services and products more quickly may select U.S. Cellular’s competitors rather than U.S. Cellular as their service provider. To the extent that U.S. Cellular does not attract or retain these types of customers, U.S. Cellular could be at a competitive disadvantage and have a customer base that generates lower profit margins relative to its competition.

12

Wireline and Cable each provide broadband, video and voice services and, as a result, have certain risks in common, but also have certain risks that are specific to that segment. Both Wireline and Cable strive to offer the most competitive broadband connection in its markets in order to capitalize on data growth and the customers’ need for higher broadband speeds. Wireline’s DSL-based services have several limitations compared to DOCSIS technologies employed by cable companies. Where it is cost-effective, Wireline is deploying fiber technology which offers advantages over cable to provide broadband. Wireline is also faced with other significant challenges, including customer connection and access minute declines in traditional wireline voice services as well as decreases in intercarrier compensation received for the use of its networks. Wireline must continually adjust its cost structure as a result of these challenges. A failure to develop and maintain an efficient cost structure would have an adverse effect on the Wireline and Cable businesses. The inability to execute timely on its fiber deployments could have an adverse effect on Wireline’s business. In addition, failure to deploy plant upgrades and new technology could result in opportunities for overbuilders to move into Wireline and Cable territories that are not upgraded and build similar or superior networks, which could have an adverse effect on TDS’ business. Wireline and Cable’s current forecasts indicate that Wireline and Cable will not achieve returns on capital that exceed their costs of capital in the foreseeable future.

Wireline’s IPTV product and Cable’s video service have significant costs and risks relating to programming and retransmission. Such costs have been increasing and these costs may not be able to be fully passed on to customers. In addition, both businesses are limited in their ability to obtain programming at favorable costs and terms due to their small scale. If Wireline or Cable fails to negotiate agreeable costs or terms with certain broadcast TV stations and cable networks, any resulting service interruptions could have an adverse effect on TDS' business. Further, changes in consumer behavior and/or new technologies are causing consumers to reduce or cancel their video services and instead seek to obtain video on demand over the internet or through new technologies. A wide range of regulatory or other issues also affect both businesses, including matters pertaining to set-top boxes, equipment connectivity, content regulation, closed captioning, pole attachments, privacy, copyright, technical standards, and municipal entry into video and broadband.

Although Cable’s business development strategy includes evaluating opportunities for possible further acquisitions of desirable cable companies on attractive terms to increase the scale of its business, there is no assurance that such acquisitions will be available, or that this strategy will be successful.

HMS provides a wide range of IT services and has risks that are not shared with the other business segments. HMS’ business strategy is to create, deliver and support a platform of IT products and services tailored for mid-sized business customers. HMS’ current forecast indicates that it will not achieve a return on capital that exceeds its cost of capital in the foreseeable future. The HMS business is faced with a number of risks in its pursuit of its strategy, including: the rate of outsourcing IT needs and moving to the cloud by mid-sized business customers; the ability to sell recurring revenue services; the ability to attract new or retain existing customers; whether potential customers ascribe sufficient value to HMS’ more customized cloud and hosted services compared to more commodity based offerings of larger competitors; HMS’ limited scale when competing with larger competitors; and the impact of IT wage inflation on the profitability of on-shore support services.

A failure by TDS to execute its business strategies successfully or to allocate resources or capital optimally could have an adverse effect on TDS’ businesses, financial condition or results of operations.

3) | Uncertainty in TDS’ future cash flow and liquidity or the inability to access capital, deterioration in the capital markets, other changes in TDS’ performance or market conditions, changes in TDS’ credit ratings or other factors could limit or restrict the availability of financing on terms and prices acceptable to TDS, which could require TDS to reduce its construction, development or acquisition programs, reduce the amount of spectrum licenses acquired, and/or reduce or cease share repurchases and/or the payment of dividends. |

TDS and its subsidiaries operate capital-intensive businesses. Historically, TDS has used internally-generated funds and also has obtained substantial funds from external sources for general corporate purposes. In the past, TDS’ existing cash and investment balances, funds available under its revolving credit agreements, receivables securitization agreement, funds from other financing sources, including a term loan and other long-term debt, and cash flows from operating and certain investing and financing activities, including sales of assets or businesses, provided sufficient liquidity and financial flexibility for TDS to meet its normal day-to-day operating needs and debt service requirements, to finance the build-out and enhancement of markets and to fund acquisitions. There is no assurance that this will be the case in the future. It may be necessary from time to time to increase the size of the existing revolving credit agreements, to put in place new credit agreements, or to obtain other forms of financing in order to fund potential expenditures. TDS’ liquidity would be adversely affected if, among other things, TDS is unable to obtain short or long-term financing on acceptable terms, TDS makes significant spectrum license purchases, TDS makes significant capital investments, TDS makes significant business acquisitions, the Los Angeles SMSA Limited Partnership (LA Partnership) discontinues or significantly reduces distributions compared to historical levels, or Federal USF and/or other regulatory support payments decline.

13