Document

10 yearsfive yearsfalse--12-31Q320190001051470856600000093940000000.010.01600000000600000000415000000416000000165000000016500000000.010.0120000000200000002000000200000020000002000000

0001051470

2019-01-01

2019-09-30

0001051470

2018-01-01

2018-09-30

0001051470

2019-07-01

2019-09-30

0001051470

cci:A6.875MandatoryConvertiblePreferredStockMember

2019-01-01

2019-09-30

0001051470

us-gaap:CommonStockMember

2019-01-01

2019-09-30

0001051470

2019-11-01

0001051470

2019-09-30

0001051470

2018-12-31

0001051470

2018-07-01

2018-09-30

0001051470

us-gaap:AccumulatedTranslationAdjustmentMember

2018-07-01

2018-09-30

0001051470

us-gaap:AccumulatedTranslationAdjustmentMember

2018-01-01

2018-09-30

0001051470

2018-09-30

0001051470

2017-12-31

0001051470

us-gaap:AccumulatedTranslationAdjustmentMember

2018-09-30

0001051470

us-gaap:AdditionalPaidInCapitalMember

2018-01-01

2018-09-30

0001051470

us-gaap:RetainedEarningsMember

2018-01-01

2018-09-30

0001051470

us-gaap:AdditionalPaidInCapitalMember

2017-12-31

0001051470

us-gaap:CommonStockMember

2017-12-31

0001051470

cci:A6.875MandatoryConvertiblePreferredStockMember

2017-12-31

0001051470

us-gaap:CommonStockMember

2018-09-30

0001051470

us-gaap:AdditionalPaidInCapitalMember

2018-09-30

0001051470

cci:A6.875MandatoryConvertiblePreferredStockMember

2018-09-30

0001051470

us-gaap:RetainedEarningsMember

2017-12-31

0001051470

us-gaap:CommonStockMember

2018-01-01

2018-09-30

0001051470

us-gaap:RetainedEarningsMember

2018-09-30

0001051470

us-gaap:AccumulatedTranslationAdjustmentMember

2017-12-31

0001051470

cci:A6.875MandatoryConvertiblePreferredStockMember

2018-12-31

0001051470

us-gaap:CommonStockMember

2019-09-30

0001051470

us-gaap:AccumulatedTranslationAdjustmentMember

2018-12-31

0001051470

us-gaap:RetainedEarningsMember

2018-12-31

0001051470

us-gaap:AdditionalPaidInCapitalMember

2019-09-30

0001051470

cci:A6.875MandatoryConvertiblePreferredStockMember

2019-09-30

0001051470

us-gaap:RetainedEarningsMember

2019-01-01

2019-09-30

0001051470

us-gaap:AdditionalPaidInCapitalMember

2019-01-01

2019-09-30

0001051470

us-gaap:CommonStockMember

2018-12-31

0001051470

us-gaap:CommonStockMember

2019-01-01

2019-09-30

0001051470

us-gaap:RetainedEarningsMember

2019-09-30

0001051470

us-gaap:AdditionalPaidInCapitalMember

2018-12-31

0001051470

us-gaap:AccumulatedTranslationAdjustmentMember

2019-09-30

0001051470

us-gaap:AdditionalPaidInCapitalMember

2018-07-01

2018-09-30

0001051470

us-gaap:AdditionalPaidInCapitalMember

2018-06-30

0001051470

2018-06-30

0001051470

us-gaap:RetainedEarningsMember

2018-06-30

0001051470

us-gaap:CommonStockMember

2018-07-01

2018-09-30

0001051470

us-gaap:AccumulatedTranslationAdjustmentMember

2018-06-30

0001051470

us-gaap:RetainedEarningsMember

2018-07-01

2018-09-30

0001051470

cci:A6.875MandatoryConvertiblePreferredStockMember

2018-06-30

0001051470

us-gaap:CommonStockMember

2018-06-30

0001051470

us-gaap:CommonStockMember

2019-07-01

2019-09-30

0001051470

us-gaap:RetainedEarningsMember

2019-07-01

2019-09-30

0001051470

cci:A6.875MandatoryConvertiblePreferredStockMember

2019-06-30

0001051470

2019-06-30

0001051470

us-gaap:RetainedEarningsMember

2019-06-30

0001051470

us-gaap:CommonStockMember

2019-06-30

0001051470

us-gaap:AdditionalPaidInCapitalMember

2019-07-01

2019-09-30

0001051470

us-gaap:AccumulatedTranslationAdjustmentMember

2019-06-30

0001051470

us-gaap:AdditionalPaidInCapitalMember

2019-06-30

0001051470

cci:SubjecttoCapitalLeasewithSprintTMOorATTMember

2019-09-30

0001051470

srt:MinimumMember

2019-01-01

2019-09-30

0001051470

srt:MaximumMember

2019-01-01

2019-09-30

0001051470

us-gaap:OtherCurrentAssetsMember

2019-09-30

0001051470

us-gaap:DeferredRevenueArrangementTypeDomain

2019-09-30

0001051470

cci:A2018TowerRevenueNotes4.241due2048Member

2019-09-30

0001051470

cci:A2015TowerRevenueNotes3.222due2042Member

2019-09-30

0001051470

srt:MinimumMember

cci:A2016RevolverMember

2019-01-01

2019-09-30

0001051470

srt:MaximumMember

cci:CapitalLeaseObligationsAndOtherMember

2019-01-01

2019-09-30

0001051470

cci:HighYieldBondsMember

cci:February2019SeniorUnsecured5.200NotesMember

2019-03-31

0001051470

us-gaap:CommercialPaperMember

2019-01-01

2019-09-30

0001051470

cci:A2018TowerRevenueNotes3.720due2043Member

2019-09-30

0001051470

cci:A2015TowerRevenueNotes3.663due2045Member

2019-09-30

0001051470

cci:HighYieldBondsMember

cci:February2019SeniorNotesDomain

2019-03-31

0001051470

cci:HighYieldBondsMember

cci:August2019SeniorNotesDomain

2019-09-30

0001051470

cci:HighYieldBondsMember

cci:February2019SeniorUnsecured4.300NotesMember

2019-03-31

0001051470

cci:HighYieldBondsMember

cci:August2019SeniorUnsecured4.000NotesMember

2019-09-30

0001051470

cci:July2018TowerRevenueNotesMember

2019-01-01

2019-09-30

0001051470

cci:HighYieldBondsMember

cci:August2019SeniorUnsecured3.100NotesMember

2019-09-30

0001051470

cci:A2016RevolverMember

2019-09-30

0001051470

srt:MaximumMember

cci:A2016RevolverMember

2019-09-30

0001051470

cci:A2016RevolverMember

2019-04-01

2019-06-30

0001051470

srt:MaximumMember

cci:A2016RevolverMember

2019-01-01

2019-09-30

0001051470

cci:A2016RevolverMember

2019-06-30

0001051470

srt:MaximumMember

cci:CapitalLeaseObligationsAndOtherMember

2019-09-30

0001051470

srt:MinimumMember

cci:CapitalLeaseObligationsAndOtherMember

2019-01-01

2019-09-30

0001051470

us-gaap:CommercialPaperMember

2019-09-30

0001051470

srt:MinimumMember

cci:A2016RevolverMember

2019-09-30

0001051470

cci:BankDebtMember

cci:A2016RevolverMember

2019-09-30

0001051470

us-gaap:BondsMember

cci:August2017SeniorUnsecured3.200NotesMember

2018-12-31

0001051470

us-gaap:SecuredDebtMember

cci:A2018TowerRevenueNotes4.241due2048Member

2019-09-30

0001051470

us-gaap:BondsMember

cci:A4.875SeniorNotesMember

2018-12-31

0001051470

us-gaap:BondsMember

cci:August2017SeniorUnsecured3.200NotesMember

2019-09-30

0001051470

us-gaap:BondsMember

cci:A4.750SeniorUnsecuredNotesMemberMember

2019-09-30

0001051470

cci:CapitalLeaseObligationsAndOtherMember

2018-12-31

0001051470

us-gaap:BondsMember

cci:SeniorUnsecured2016Notes3.7Member

2019-09-30

0001051470

us-gaap:BondsMember

cci:A5.250SeniorNotesMember

2018-12-31

0001051470

us-gaap:BondsMember

cci:SeniorUnsecured2016Notes4.450Member

2019-09-30

0001051470

us-gaap:SecuredDebtMember

cci:A2018TowerRevenueNotes3.720due2043Member

2019-09-30

0001051470

us-gaap:BondsMember

cci:SeniorUnsecured2016Notes3.7Member

2018-12-31

0001051470

us-gaap:SecuredDebtMember

cci:FixedRateDebt2009SecuritizedNotesA1Member

2019-09-30

0001051470

cci:BankDebtMember

cci:A2016TermLoanAMember

2019-09-30

0001051470

us-gaap:BondsMember

cci:August2019SeniorUnsecured4.000NotesMember

2019-09-30

0001051470

us-gaap:BondsMember

cci:A3.800SeniorNotesMember

2019-09-30

0001051470

us-gaap:BondsMember

cci:A5.250SeniorNotesMember

2019-09-30

0001051470

us-gaap:BondsMember

cci:August2019SeniorUnsecured3.100NotesMember

2018-12-31

0001051470

us-gaap:SecuredDebtMember

cci:A2015TowerRevenueNotes3.222due2042Member

2019-09-30

0001051470

us-gaap:BondsMember

cci:SeniorUnsecured2016Notes3.40Member

2019-09-30

0001051470

us-gaap:BondsMember

cci:A4.875SeniorNotesMember

2019-09-30

0001051470

us-gaap:BondsMember

cci:SeniorUnsecured2016Notes3.40Member

2018-12-31

0001051470

us-gaap:SecuredDebtMember

cci:FixedRateDebt2009SecuritizedNotesA2Member

2019-09-30

0001051470

us-gaap:BondsMember

cci:A3.150SeniorNotesMember

2019-09-30

0001051470

us-gaap:BondsMember

cci:August2017SeniorUnsecured3.650NotesMember

2019-09-30

0001051470

us-gaap:BondsMember

cci:A2.250SeniorNotesMember

2019-09-30

0001051470

us-gaap:BondsMember

cci:A3.150SeniorNotesMember

2018-12-31

0001051470

us-gaap:BondsMember

cci:A4.000SeniorUnsecuredNotesMember

2019-09-30

0001051470

us-gaap:BondsMember

cci:A2.250SeniorNotesMember

2018-12-31

0001051470

us-gaap:BondsMember

cci:August2017SeniorUnsecured3.650NotesMember

2018-12-31

0001051470

cci:CapitalLeaseObligationsAndOtherMember

2019-09-30

0001051470

us-gaap:SecuredDebtMember

cci:A2015TowerRevenueNotes3.663due2045Member

2019-09-30

0001051470

us-gaap:BondsMember

cci:February2019SeniorUnsecured4.300NotesMember

2019-09-30

0001051470

us-gaap:SecuredDebtMember

cci:FixedRateDebt2009SecuritizedNotesA2Member

2018-12-31

0001051470

us-gaap:BondsMember

cci:SeniorUnsecured2016Notes4.450Member

2018-12-31

0001051470

cci:BankDebtMember

cci:A2016RevolverMember

2018-12-31

0001051470

us-gaap:UnsecuredDebtMember

2019-09-30

0001051470

us-gaap:BondsMember

cci:A3.800SeniorNotesMember

2018-12-31

0001051470

us-gaap:UnsecuredDebtMember

2018-12-31

0001051470

us-gaap:BondsMember

cci:August2019SeniorUnsecured4.000NotesMember

2018-12-31

0001051470

us-gaap:SecuredDebtMember

cci:FixedRateDebt2009SecuritizedNotesA1Member

2018-12-31

0001051470

us-gaap:BondsMember

cci:August2019SeniorUnsecured3.100NotesMember

2019-09-30

0001051470

us-gaap:CommercialPaperMember

2018-12-31

0001051470

us-gaap:BondsMember

cci:February2019SeniorUnsecured5.200NotesMember

2019-09-30

0001051470

us-gaap:BondsMember

cci:February2019SeniorUnsecured5.200NotesMember

2018-12-31

0001051470

us-gaap:BondsMember

cci:A3.849SecuredNotesMember

2019-09-30

0001051470

us-gaap:BondsMember

cci:A3.849SecuredNotesMember

2018-12-31

0001051470

us-gaap:SecuredDebtMember

2019-09-30

0001051470

cci:BankDebtMember

cci:A2016TermLoanAMember

2018-12-31

0001051470

us-gaap:SecuredDebtMember

cci:A2015TowerRevenueNotes3.222due2042Member

2018-12-31

0001051470

us-gaap:BondsMember

cci:February2019SeniorUnsecured4.300NotesMember

2018-12-31

0001051470

us-gaap:BondsMember

cci:A4.750SeniorUnsecuredNotesMemberMember

2018-12-31

0001051470

us-gaap:BondsMember

cci:A4.000SeniorUnsecuredNotesMember

2018-12-31

0001051470

us-gaap:SecuredDebtMember

cci:A2018TowerRevenueNotes3.720due2043Member

2018-12-31

0001051470

us-gaap:SecuredDebtMember

cci:A2015TowerRevenueNotes3.663due2045Member

2018-12-31

0001051470

us-gaap:SecuredDebtMember

2018-12-31

0001051470

us-gaap:SecuredDebtMember

cci:A2018TowerRevenueNotes4.241due2048Member

2018-12-31

0001051470

us-gaap:PreferredStockMember

2019-01-01

2019-09-30

0001051470

us-gaap:PropertyPlantAndEquipmentMember

2019-09-30

0001051470

us-gaap:PreferredStockMember

2018-10-01

2018-12-31

0001051470

us-gaap:PreferredStockMember

2019-07-01

2019-09-30

0001051470

us-gaap:CommonStockMember

2019-01-01

2019-03-31

0001051470

2019-01-01

2019-03-31

0001051470

us-gaap:CommonStockMember

2019-04-01

2019-06-30

0001051470

2019-04-01

2019-06-30

0001051470

us-gaap:PreferredStockMember

2019-04-01

2019-06-30

0001051470

2018-10-01

2018-12-31

0001051470

us-gaap:PreferredStockMember

2019-01-01

2019-03-31

0001051470

cci:SegmentGAsharebasedcompensationMember

2018-07-01

2018-09-30

0001051470

cci:SegmentcostofoperationssharebasedcompensationMember

2019-07-01

2019-09-30

0001051470

cci:SegmentGAsharebasedcompensationMember

2019-01-01

2019-09-30

0001051470

cci:SegmentGAsharebasedcompensationMember

2019-07-01

2019-09-30

0001051470

cci:SegmentcostofoperationssharebasedcompensationMember

2019-01-01

2019-09-30

0001051470

cci:SegmentGAsharebasedcompensationMember

2018-01-01

2018-09-30

0001051470

cci:SegmentcostofoperationssharebasedcompensationMember

2018-01-01

2018-09-30

0001051470

cci:TowersMember

2018-01-01

2018-09-30

0001051470

cci:TowersMember

2019-01-01

2019-09-30

0001051470

us-gaap:ConsolidatedEntitiesMember

2018-01-01

2018-09-30

0001051470

cci:FiberMember

2019-01-01

2019-09-30

0001051470

cci:FiberMember

2018-01-01

2018-09-30

0001051470

us-gaap:ConsolidatedEntitiesMember

2019-01-01

2019-09-30

0001051470

us-gaap:CorporateAndOtherMember

2018-01-01

2018-09-30

0001051470

us-gaap:CorporateAndOtherMember

2019-01-01

2019-09-30

0001051470

cci:TowersMember

2019-07-01

2019-09-30

0001051470

us-gaap:ConsolidatedEntitiesMember

2018-07-01

2018-09-30

0001051470

us-gaap:ConsolidatedEntitiesMember

2019-07-01

2019-09-30

0001051470

cci:TowersMember

2018-09-30

0001051470

us-gaap:CorporateAndOtherMember

2019-07-01

2019-09-30

0001051470

cci:TowersMember

2018-07-01

2018-09-30

0001051470

cci:FiberMember

2019-07-01

2019-09-30

0001051470

cci:FiberMember

2018-07-01

2018-09-30

0001051470

us-gaap:CorporateAndOtherMember

2018-07-01

2018-09-30

0001051470

cci:FiberMember

2018-09-30

0001051470

us-gaap:ConsolidatedEntitiesMember

2018-09-30

0001051470

cci:FiberMember

2019-09-30

0001051470

us-gaap:ConsolidatedEntitiesMember

2019-09-30

0001051470

cci:TowersMember

2019-09-30

0001051470

us-gaap:CorporateAndOtherMember

2019-09-30

0001051470

us-gaap:CorporateAndOtherMember

2018-09-30

0001051470

us-gaap:DividendPaidMember

2019-07-01

2019-09-30

xbrli:pure

iso4217:USD

xbrli:shares

xbrli:shares

iso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________

FORM 10-Q

___________________________________

|

| |

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2019

OR

|

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period to

Commission File Number 001-16441

____________________________________

CROWN CASTLE INTERNATIONAL CORP.

(Exact name of registrant as specified in its charter)

|

| | | |

Delaware | 76-0470458 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | | |

1220 Augusta Drive, Suite 600, Houston, Texas 77057-2261

(Address of principal executives office) (Zip Code)

(713) 570-3000

(Registrant's telephone number, including area code)

____________________________________

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, $0.01 par value | CCI | New York Stock Exchange |

6.875% Mandatory Convertible Preferred Stock, Series A, $0.01 par value | CCI.PRA | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

| Large accelerated filer | ☒ | | Accelerated filer | ☐ | |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ | |

| | | | Emerging growth company | ☐ | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Number of shares of common stock outstanding at November 1, 2019: 415,768,468

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

INDEX

|

| | | |

| | | Page |

| | |

ITEM 1. | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

ITEM 2. | | | |

ITEM 3. | | | |

ITEM 4. | | | |

| | |

ITEM 1. | LEGAL PROCEEDINGS | | |

ITEM 1A. | | | |

ITEM 2. | UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | | |

ITEM 6. | | | |

EXHIBIT INDEX | | |

SIGNATURES | | |

Cautionary Language Regarding Forward-Looking Statements

This Quarterly Report on Form 10-Q ("Form 10-Q") contains forward-looking statements that are based on our management's expectations as of the filing date of this report with the Securities and Exchange Commission ("SEC"). Statements that are not historical facts are hereby identified as forward-looking statements. In addition, words such as "estimate," "anticipate," "project," "plan," "intend," "believe," "expect," "likely," "predicted," "positioned," "continue," "target," and any variations of these words and similar expressions are intended to identify forward-looking statements. Such statements include plans, projections and estimates contained in "Part I—Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations" ("MD&A"), "Part I—Item 3. Quantitative and Qualitative Disclosures About Market Risk" and "Part II—Item 1A. Risk Factors" herein. Such forward-looking statements include (1) benefits and opportunities stemming from our strategy, strategic position, business model and capabilities, (2) the strength and growth potential of the U.S. market for shared communications infrastructure investment, (3) expectations regarding anticipated growth in the wireless industry, tenant additions, and demand for data, including growth in demand, (4) potential benefits of our communications infrastructure and expectations regarding demand therefore, including potential benefits and continuity of and factors driving such demand, (5) expectations regarding construction and acquisition of communications infrastructure, (6) the utilization of our net operating loss carryforwards ("NOLs"), (7) expectations regarding wireless carriers' focus on improving network quality and expanding capacity, (8) expectations regarding continuation of increase in usage of high-bandwidth applications by organizations, (9) expected use of net proceeds from issuances under the commercial paper program ("CP Program"), (10) assumed conversion of preferred stock and the impact therefrom, (11) our full year 2019 and 2020 outlook and the anticipated growth in our financial results, including future revenues and operating cash flows, and the expectations regarding the level of our 2019 and 2020 capital expenditures, as well as the factors impacting expected growth in financial results and the levels of capital expenditures, (12) expectations regarding our capital structure and the credit markets, our availability and cost of capital, capital allocation, our leverage ratio and interest coverage targets, our ability to service our debt and comply with debt covenants and the plans for and the benefits of any future refinancings, (13) the utility of certain financial measures, including non-GAAP financial measures, (14) expectations related to remaining qualified as a real estate investment trust ("REIT") and the advantages, benefits or impact of, or opportunities created by, our REIT status, (15) adequacy, projected sources and uses of liquidity, (16) expected duration of our construction projects, (17) expectations related to the impact of tenant consolidation or ownership changes, including the potential combination of T-Mobile and Sprint, (18) expectations regarding non-renewals of tenant contracts and (19) our dividend policy and the timing, amount, growth or tax characterization of any dividends. All future dividends are subject to declaration by our board of directors.

Such forward-looking statements should, therefore, be considered in light of various risks, uncertainties and assumptions, including prevailing market conditions, risk factors described in "Part II—Item 1A. Risk Factors" herein and "Item 1A. Risk Factors" of our Annual Report on Form 10-K for the fiscal year ended December 31, 2018 ("2018 Form 10-K") and other factors. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those expected.

Our filings with the SEC are available through the SEC website at www.sec.gov or through our investor relations website at investor.crowncastle.com. We use our investor relations website to disclose information about us that may be deemed to be material. We encourage investors, the media and others interested in us to visit our investor relations website from time to time to review up-to-date information or to sign up for e-mail alerts to be notified when new or updated information is posted on the site.

Interpretation

As used herein, the term "including," and any variation thereof, means "including without limitation." The use of the word "or" herein is not exclusive. Unless this Form 10-Q indicates otherwise or the context otherwise requires, the terms, "we," "our," "our company," "the company" or "us" as used in this Form 10-Q refer to Crown Castle International Corp. and its predecessor (organized in 1995), as applicable, each a Delaware corporation (together, "CCIC"), and their subsidiaries. Additionally, unless the context suggests otherwise, references to "U.S." are to the United States of America and Puerto Rico, collectively.

PART I—FINANCIAL INFORMATION

| |

ITEM 1. | FINANCIAL STATEMENTS |

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEET (Unaudited)

(Amounts in millions, except par values)

|

| | | | | | | |

| September 30,

2019 | | December 31,

2018 |

ASSETS | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 182 |

| | $ | 277 |

|

Restricted cash | 138 |

| | 131 |

|

Receivables, net | 667 |

| | 501 |

|

Prepaid expenses(a)

| 99 |

| | 172 |

|

Other current assets | 167 |

| | 148 |

|

Total current assets | 1,253 |

| | 1,229 |

|

Deferred site rental receivables | 1,413 |

| | 1,366 |

|

Property and equipment, net of accumulated depreciation of $9,394 and $8,566, respectively | 14,416 |

| | 13,676 |

|

Operating lease right-of-use assets(a) | 6,112 |

| | — |

|

Goodwill | 10,078 |

| | 10,078 |

|

Other intangible assets, net(a)

| 4,968 |

| | 5,516 |

|

Long-term prepaid rent and other assets, net(a)

| 104 |

| | 920 |

|

Total assets | $ | 38,344 |

| | $ | 32,785 |

|

| | | |

LIABILITIES AND EQUITY | | | |

Current liabilities: | | | |

Accounts payable | $ | 368 |

| | $ | 313 |

|

Accrued interest | 110 |

| | 148 |

|

Deferred revenues | 525 |

| | 498 |

|

Other accrued liabilities(a)

| 335 |

| | 351 |

|

Current maturities of debt and other obligations | 100 |

| | 107 |

|

Current portion of operating lease liabilities(a) | 296 |

| | — |

|

Total current liabilities | 1,734 |

| | 1,417 |

|

Debt and other long-term obligations | 17,750 |

| | 16,575 |

|

Operating lease liabilities(a) | 5,480 |

| | — |

|

Other long-term liabilities(a)

| 2,055 |

| | 2,759 |

|

Total liabilities | 27,019 |

| | 20,751 |

|

Commitments and contingencies (note 8) | | | |

CCIC stockholders' equity: | | | |

Common stock, $0.01 par value; 600 shares authorized; shares issued and outstanding: September 30, 2019—416 and December 31, 2018—415 | 4 |

| | 4 |

|

6.875% Mandatory Convertible Preferred Stock, Series A, $0.01 par value; 20 shares authorized; shares issued and outstanding: September 30, 2019—2 and December 31, 2018—2; aggregate liquidation value: September 30, 2019—$1,650 and December 31, 2018—$1,650 | — |

| | — |

|

Additional paid-in capital | 17,829 |

| | 17,767 |

|

Accumulated other comprehensive income (loss) | (5 | ) | | (5 | ) |

Dividends/distributions in excess of earnings | (6,503 | ) | | (5,732 | ) |

Total equity | 11,325 |

| | 12,034 |

|

Total liabilities and equity | $ | 38,344 |

| | $ | 32,785 |

|

See notes to condensed consolidated financial statements.

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS AND

COMPREHENSIVE INCOME (LOSS) (Unaudited)

(Amounts in millions, except per share amounts)

|

| | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2019 | | 2018 | | 2019 | | 2018 |

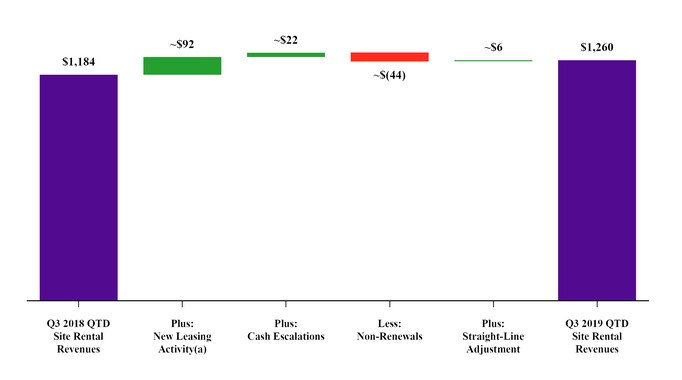

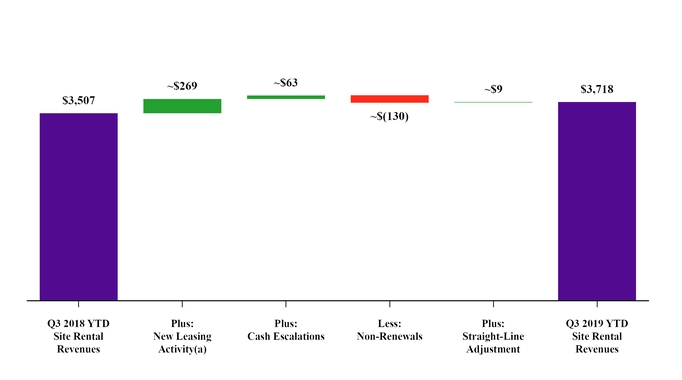

Net revenues: | | | | | | | |

Site rental | $ | 1,260 |

| | $ | 1,184 |

| | $ | 3,718 |

| | $ | 3,507 |

|

Services and other | 254 |

| | 191 |

| | 700 |

| | 497 |

|

Net revenues | 1,514 |

| | 1,375 |

| | 4,418 |

| | 4,004 |

|

Operating expenses: | | | | | | | |

Costs of operations(a): | | | | | | | |

Site rental | 369 |

| | 355 |

| | 1,095 |

| | 1,057 |

|

Services and other | 147 |

| | 119 |

| | 410 |

| | 304 |

|

Selling, general and administrative | 150 |

| | 145 |

| | 457 |

| | 418 |

|

Asset write-down charges | 2 |

| | 8 |

| | 13 |

| | 18 |

|

Acquisition and integration costs | 4 |

| | 4 |

| | 10 |

| | 18 |

|

Depreciation, amortization and accretion | 389 |

| | 385 |

| | 1,176 |

| | 1,138 |

|

Total operating expenses | 1,061 |

| | 1,016 |

| | 3,161 |

| | 2,953 |

|

Operating income (loss) | 453 |

| | 359 |

| | 1,257 |

| | 1,051 |

|

Interest expense and amortization of deferred financing costs | (173 | ) | | (160 | ) | | (510 | ) | | (478 | ) |

Gains (losses) on retirement of long-term obligations | — |

| | (32 | ) | | (2 | ) | | (106 | ) |

Interest income | 2 |

| | 1 |

| | 5 |

| | 4 |

|

Other income (expense) | (5 | ) | | 1 |

| | (6 | ) | | — |

|

Income (loss) before income taxes | 277 |

| | 169 |

| | 744 |

| | 471 |

|

Benefit (provision) for income taxes | (5 | ) | | (5 | ) | | (15 | ) | | (13 | ) |

Net income (loss) attributable to CCIC stockholders | 272 |

| | 164 |

| | 729 |

| | 458 |

|

Dividends/distributions on preferred stock | (28 | ) | | (28 | ) | | (85 | ) | | (85 | ) |

Net income (loss) attributable to CCIC common stockholders | $ | 244 |

| | $ | 136 |

| | $ | 644 |

| | $ | 373 |

|

Net income (loss) | $ | 272 |

| | $ | 164 |

| | $ | 729 |

| | $ | 458 |

|

Other comprehensive income (loss): | | | | | | | |

Foreign currency translation adjustments | — |

| | — |

| | — |

| | (1 | ) |

Total other comprehensive income (loss) | — |

| | — |

| | — |

| | (1 | ) |

Comprehensive income (loss) attributable to CCIC stockholders | $ | 272 |

| | $ | 164 |

| | $ | 729 |

| | $ | 457 |

|

Net income (loss) attributable to CCIC common stockholders, per common share: | | | | | | | |

Net income (loss) attributable to CCIC common stockholders—basic | $ | 0.59 |

| | $ | 0.33 |

| | $ | 1.55 |

| | $ | 0.90 |

|

Net income (loss) attributable to CCIC common stockholders—diluted | $ | 0.58 |

| | $ | 0.33 |

| | $ | 1.54 |

| | $ | 0.90 |

|

Weighted-average common shares outstanding: | | | | | | | |

Basic | 416 | | 415 |

| | 416 | | 413 |

Diluted | 418 | | 416 |

| | 418 | | 414 |

See notes to condensed consolidated financial statements.

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS (Unaudited)

(In millions of dollars)

|

| | | | | | | |

| Nine Months Ended September 30, |

| 2019 | | 2018 |

Cash flows from operating activities: | | | |

Net income (loss) | $ | 729 |

| | $ | 458 |

|

Adjustments to reconcile net income (loss) to net cash provided by (used for) operating activities: | | | |

Depreciation, amortization and accretion | 1,176 |

| | 1,138 |

|

(Gains) losses on retirement of long-term obligations | 2 |

| | 106 |

|

Amortization of deferred financing costs and other non-cash interest | 1 |

| | 5 |

|

Stock-based compensation expense | 91 |

| | 79 |

|

Asset write-down charges | 13 |

| | 18 |

|

Deferred income tax (benefit) provision | 2 |

| | 2 |

|

Other non-cash adjustments, net | 4 |

| | 2 |

|

Changes in assets and liabilities, excluding the effects of acquisitions: | | | |

Increase (decrease) in accrued interest | (38 | ) | | (31 | ) |

Increase (decrease) in accounts payable | 37 |

| | 31 |

|

Increase (decrease) in other liabilities | 102 |

| | 144 |

|

Decrease (increase) in receivables | (166 | ) | | (74 | ) |

Decrease (increase) in other assets | (62 | ) | | (103 | ) |

Net cash provided by (used for) operating activities | 1,891 |

| | 1,775 |

|

Cash flows from investing activities: | | | |

Payments for acquisitions, net of cash acquired | (15 | ) | | (26 | ) |

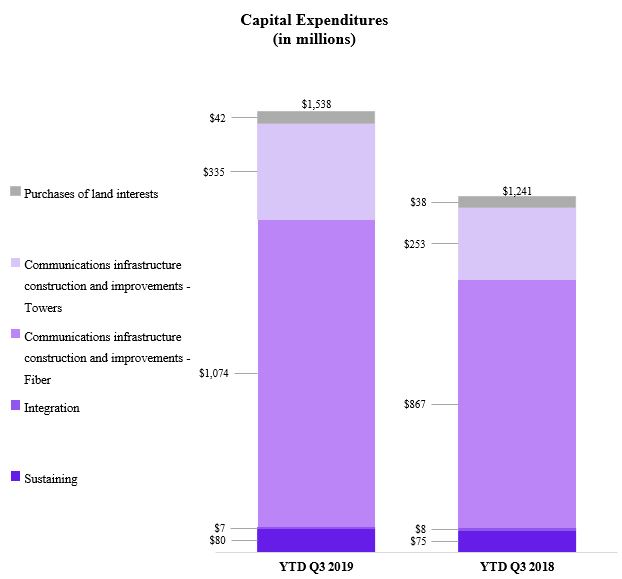

Capital expenditures | (1,538 | ) | | (1,241 | ) |

Other investing activities, net | 3 |

| | (14 | ) |

Net cash provided by (used for) investing activities | (1,550 | ) | | (1,281 | ) |

Cash flows from financing activities: | | | |

Proceeds from issuance of long-term debt | 1,895 |

| | 2,743 |

|

Principal payments on debt and other long-term obligations | (59 | ) | | (76 | ) |

Purchases and redemptions of long-term debt | (12 | ) | | (2,346 | ) |

Borrowings under revolving credit facility | 1,585 |

| | 1,290 |

|

Payments under revolving credit facility | (2,270 | ) | | (1,465 | ) |

Payments for financing costs | (24 | ) | | (33 | ) |

Net proceeds from issuance of common stock | — |

| | 841 |

|

Purchases of common stock | (44 | ) | | (34 | ) |

Dividends/distributions paid on common stock | (1,415 | ) | | (1,315 | ) |

Dividends/distributions paid on preferred stock | (85 | ) | | (85 | ) |

Net cash provided by (used for) financing activities | (429 | ) | | (480 | ) |

Net increase (decrease) in cash, cash equivalents, and restricted cash | (88 | ) | | 14 |

|

Effect of exchange rate changes | — |

| | (1 | ) |

Cash, cash equivalents, and restricted cash at beginning of period | 413 |

| | 440 |

|

Cash, cash equivalents, and restricted cash at end of period | $ | 325 |

| | $ | 453 |

|

See notes to condensed consolidated financial statements.

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF EQUITY

(Amounts in millions) (Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | 6.875% Mandatory Convertible Preferred Stock | | | | Accumulated Other Comprehensive Income (Loss) ("AOCI") | | | | |

| Shares | | ($0.01 Par) | | Shares | | ($0.01 Par) | | Additional paid-in capital | | Foreign Currency Translation Adjustments | | Dividends/Distributions in Excess of Earnings | | Total |

Balance, June 30, 2019 | 416 |

| | $ | 4 |

| | 2 |

| | $ | — |

| | $ | 17,801 |

| | $ | (5 | ) | | $ | (6,277 | ) | | $ | 11,523 |

|

Stock-based compensation related activity, net of forfeitures | — |

| | — |

| | — |

| | — |

| | 29 |

| | — |

| | — |

| | 29 |

|

Purchases and retirement of common stock | — |

| | — |

| | — |

| | — |

| | (1 | ) | | — |

| | — |

| | (1 | ) |

Common stock dividends/distributions(a) | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (470 | ) | | (470 | ) |

Preferred stock dividends/distributions(a) | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (28 | ) | | (28 | ) |

Net income (loss) | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 272 |

| | 272 |

|

Balance, September 30, 2019 | 416 |

| | $ | 4 |

| | 2 |

| | $ | — |

| | $ | 17,829 |

| | $ | (5 | ) | | $ | (6,503 | ) | | $ | 11,325 |

|

| |

(a) | See note 7 for information regarding common and preferred stock dividends declared per share. |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | 6.875% Mandatory Convertible Preferred Stock | | | | AOCI | | | | |

| Shares | | ($0.01 Par) | | Shares | | ($0.01 Par) | | Additional

paid-in

capital | | Foreign Currency Translation Adjustments | | Dividends/Distributions in Excess of Earnings | | Total |

Balance, June 30, 2018 | 415 |

| | $ | 4 |

| | 2 |

| | $ | — |

| | $ | 17,711 |

| | $ | (5 | ) | | $ | (5,144 | ) | | $ | 12,566 |

|

Stock-based compensation related activity, net of forfeitures | — |

| | — |

| | — |

| | — |

| | 32 |

| | — |

| | — |

| | 32 |

|

Purchases and retirement of common stock | — |

| | — |

| | — |

| | — |

| | (1 | ) | | — |

| | — |

| | (1 | ) |

Net proceeds from issuance of common stock | — |

| | — |

| | — |

| | — |

| | 1 |

| | — |

| | — |

| | 1 |

|

Common stock dividends/distributions(a) | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (439 | ) | | (439 | ) |

Preferred stock dividends/distributions(a) | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (28 | ) | | (28 | ) |

Net income (loss) | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 164 |

| | 164 |

|

Balance, September 30, 2018 | 415 |

| | $ | 4 |

| | 2 |

| | $ | — |

| | $ | 17,743 |

| | $ | (5 | ) | | $ | (5,447 | ) | | $ | 12,295 |

|

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF EQUITY

(Amounts in millions) (Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | 6.875% Mandatory Convertible Preferred Stock | | | | AOCI | | | | |

| Shares | | ($0.01 Par) | | Shares | | ($0.01 Par) | | Additional paid-in capital | | Foreign Currency Translation Adjustments | | Dividends/Distributions in Excess of Earnings | | Total |

Balance, December 31, 2018 | 415 |

| | $ | 4 |

| | 2 |

| | $ | — |

| | $ | 17,767 |

| | $ | (5 | ) | | $ | (5,732 | ) | | $ | 12,034 |

|

Stock-based compensation related activity, net of forfeitures | 1 |

| | — |

| | — |

| | — |

| | 106 |

| | — |

| | — |

| | 106 |

|

Purchases and retirement of common stock | — |

| | — |

| | — |

| | — |

| | (44 | ) | | — |

| | — |

| | (44 | ) |

Common stock dividends/distributions(a) | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (1,415 | ) | | (1,415 | ) |

Preferred stock dividends/distributions(a) | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (85 | ) | | (85 | ) |

Net income (loss) | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 729 |

| | 729 |

|

Balance, September 30, 2019 | 416 |

| | $ | 4 |

| | 2 |

| | $ | — |

| | $ | 17,829 |

| | $ | (5 | ) | | $ | (6,503 | ) | | $ | 11,325 |

|

| |

(a) | See note 7 for information regarding common and preferred stock dividends declared per share. |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | 6.875% Mandatory Convertible Preferred Stock | | | | AOCI | | | | |

| Shares | | ($0.01 Par) | | Shares | | ($0.01 Par) | | Additional

paid-in

capital | | Foreign Currency Translation Adjustments | | Dividends/Distributions in Excess of Earnings | | Total |

Balance, December 31, 2017 | 406 |

| | $ | 4 |

| | 2 |

| | $ | — |

| | $ | 16,844 |

| | $ | (4 | ) | | $ | (4,505 | ) | | $ | 12,339 |

|

Stock-based compensation related activity, net of forfeitures | 1 |

| | — |

| | — |

| | — |

| | 92 |

| | — |

| | — |

| | 92 |

|

Purchases and retirement of common stock | — |

| | — |

| | — |

| | — |

| | (34 | ) | | — |

| | — |

| | (34 | ) |

Net proceeds from issuance of common stock | 8 |

| | — |

| | — |

| | — |

| | 841 |

| | — |

| | — |

| | 841 |

|

Other comprehensive income (loss)(b) | — |

| | — |

| | — |

| | — |

| | — |

| | (1 | ) | | — |

| | (1 | ) |

Common stock dividends/distributions(a) | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (1,315 | ) | | (1,315 | ) |

Preferred stock dividends/distributions(a) | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (85 | ) | | (85 | ) |

Net income (loss) | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 458 |

| | 458 |

|

Balance, September 30, 2018 | 415 |

| | $ | 4 |

| | 2 |

| | $ | — |

| | $ | 17,743 |

| | $ | (5 | ) | | $ | (5,447 | ) | | $ | 12,295 |

|

| |

(a) | See note 7 for information regarding common and preferred stock dividends declared per share. |

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-Unaudited

(Tabular dollars in millions, except per share amounts)

The information contained in the following notes to the condensed consolidated financial statements is condensed from that which would appear in the annual consolidated financial statements; accordingly, the condensed consolidated financial statements included herein should be reviewed in conjunction with the consolidated financial statements for the fiscal year ended December 31, 2018, and related notes thereto, included in the 2018 Form 10-K filed by Crown Castle International Corp. ("CCIC") with the SEC. Capitalized terms used but not defined in these notes to the condensed consolidated financial statements have the same meaning given to them in our 2018 Form 10-K. References to the "Company" include CCIC and its predecessor, as applicable, and their subsidiaries, unless otherwise indicated or the context indicates otherwise. As used herein, the term "including," and any variation thereof means "including without limitation." The use of the word "or" herein is not exclusive. Unless the context suggests otherwise, references to "U.S." are to the United States of America and Puerto Rico, collectively.

The Company owns, operates and leases shared communications infrastructure that is geographically dispersed throughout the U.S., including (1) towers and other structures, such as rooftops (collectively, "towers"), and (2) fiber primarily supporting small cell networks ("small cells") and fiber solutions. The Company's towers, fiber and small cells assets are collectively referred to herein as "communications infrastructure," and the Company's customers on its communications infrastructure are referred to herein as "tenants."

The Company's core business is providing access, including space or capacity, to its shared communications infrastructure via long-term contracts in various forms, including lease, license, sublease and service agreements (collectively, "contracts").

The Company's operating segments consist of (1) Towers and (2) Fiber. See note 11.

As part of the Company's effort to provide comprehensive communications infrastructure solutions, the Company offers certain services primarily relating to the Company's towers and small cells, predominately consisting of (1) site development services primarily relating to existing or new tenant equipment installations, including: site acquisition, architectural and engineering, or zoning and permitting (collectively, "site development services") and (2) tenant equipment installation or subsequent augmentations (collectively, "installation services"). The vast majority of the Company's services relate to its Towers segment.

The Company operates as a REIT for U.S. federal income tax purposes. In addition, the Company has certain taxable REIT subsidiaries ("TRSs"). See note 6.

53% of the Company's towers are leased or subleased or operated and managed under master leases, subleases, and other agreements with AT&T, Sprint and T-Mobile. The Company has the option to purchase these towers at the end of their respective lease terms. The Company has no obligation to exercise such purchase options.

Basis of Presentation

The condensed consolidated financial statements included herein are unaudited; however, they include all adjustments (consisting only of normal recurring adjustments) which, in the opinion of management, are necessary to state fairly the consolidated financial position of the Company at September 30, 2019, the condensed consolidated results of operations for both the three and nine months ended September 30, 2019 and 2018, and the condensed consolidated cash flows for the nine months ended September 30, 2019 and 2018. The year-end condensed consolidated balance sheet data was derived from audited financial statements, but does not include all disclosures required by GAAP. The results of operations for the interim periods presented are not necessarily indicative of the results to be expected for the full year.

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities as of the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-Unaudited (Continued)

(Tabular dollars in millions, except per share amounts)

| |

2. | Summary of Significant Accounting Policies |

Recently Adopted Accounting Pronouncements

Lease Accounting — Summary of Adoption Impact. Effective January 1, 2019, the Company adopted new guidance on the recognition, measurement, presentation and disclosure of leases (commonly referred to as "ASC 842" or the "new lease standard").

The new lease standard requires lessees to recognize a lease liability, initially measured at the present value of the lease payments for all leases, and a corresponding right-of-use ("ROU") asset. The accounting for lessors remained largely unchanged from previous guidance.

Due to the recognition of the lease liability and a corresponding ROU asset, the new lease standard had a material impact on the Company's condensed consolidated balance sheet. Additionally, certain amounts related to our lessee arrangements that were previously reported separately have been de-recognized and reclassified into "Operating lease right-of-use assets" on the Company's condensed consolidated balance sheet. These amounts include (1) the Company's liability related to straight-line expense, formerly referred to as "Deferred ground lease payable" and previously included in "Other accrued liabilities" and "Other long-term liabilities," (2) prepaid rent expense previously included in "Prepaid expenses" and "Long-term prepaid rent and other assets, net," (3) below market leases previously included in "Other intangible assets, net," and (4) above market leases previously included in "Other long-term liabilities."

Notwithstanding the material impact to the Company's condensed consolidated balance sheet, the Company's adoption of the new lease standard did not have a material impact on the Company's condensed consolidated statement of operations or statement of cash flows. Additionally, the adoption of this guidance had no impact on the Company's operating practices, cash flows, contractual arrangements, or debt agreements (including compliance with any applicable covenants).

Lease Accounting — General. The Company adopted the new lease standard using a modified retrospective approach as of the effective date (i.e., January 1, 2019), without adjusting the comparative periods. The Company's adoption of the new lease standard did not result in a cumulative-effect adjustment being recognized to the opening balance of retained earnings. The new lease standard provides a package of practical expedients, whereby companies can elect not to reassess (if applicable), (1) whether existing contracts contain leases under the new definition of a lease, (2) lease classification for expired or existing leases and (3) whether previously capitalized initial direct costs would qualify for capitalization under ASC 842. The Company elected the package of practical expedients upon adoption.

The Company evaluates whether a contract meets the definition of a lease whenever a contract grants a party the right to control the use of an identified asset for a period of time in exchange for consideration. To the extent the identified asset is able to be shared among multiple parties, the Company has determined that one party does not have control of the identified asset and the contract is not considered a lease. The Company accounts for contracts that do not meet the definition of a lease under other relevant accounting guidance (such as ASC 606 for revenue from contracts with customers).

Lease Accounting — Lessee. For its Tower segment, the Company's lessee arrangements primarily consist of ground leases for land under towers. Ground leases for land are specific to each site, generally contain an initial term of five to 10 years and are renewable (and cancelable after a notice period) at the Company's option. The Company also enters into term easements and ground leases in which it prepays the entire term. For its Fiber segment, the Company's lessee arrangements primarily include leases of fiber assets to support the Company's small cells and fiber solutions.

The majority of the Company's lease agreements have certain termination rights that provide for cancellation after a notice period and multiple renewal options at the Company's option. The Company includes renewal option periods in its calculation of the estimated lease term when it determines the options are reasonably certain to be exercised. When such renewal options are deemed to be reasonably certain, the estimated lease term determined under ASC 842 will be greater than the non-cancelable term of the contractual arrangement. Although certain renewal periods are included in the estimated lease term, the Company would have the ability to terminate or elect to not renew a particular lease if business conditions warrant such a decision.

The Company classifies its lessee arrangements at inception as either operating leases or finance leases. A lease is classified as a finance lease if at least one of the following criteria is met: (1) the lease transfers ownership of the underlying asset to the lessee, (2) the lease grants the lessee an option to purchase the underlying asset that the lessee is reasonably certain to exercise, (3) the lease term is for a major part of the remaining economic life of the underlying asset, (4) the present value of the sum of the lease payments equals or exceeds substantially all of the fair value of the underlying asset, or (5) the underlying asset is of such a

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-Unaudited (Continued)

(Tabular dollars in millions, except per share amounts)

specialized nature that it is expected to have no alternative use to the lessor at the end of the lease term. A lease is classified as an operating lease if none of the five criteria described above for finance lease classification is met.

ROU assets associated with operating leases are included in "Operating lease right-of-use assets" on the Company's condensed consolidated balance sheet. Current and long-term portions of lease liabilities related to operating leases are included in "Current portion of operating lease liabilities" and "Operating lease liabilities" on the Company's condensed consolidated balance sheet. ROU assets represent the Company's right to use an underlying asset for the lease term and lease liabilities represent the Company's present value of its future lease payments. In assessing its leases and determining its lease liability at lease commencement or upon modification, the Company was not able to readily determine the rate implicit for its lessee arrangements, and thus has used its incremental borrowing rate on a collateralized basis to determine the present value of the lease payments. The Company's ROU assets are measured as the balance of the lease liability plus any prepaid or accrued lease payments and any unamortized initial direct costs. For both the Towers and Fiber segments, operating lease expenses are recognized on a ratable basis, regardless of whether the payment terms require the Company to make payments annually, quarterly, monthly, or for the entire term in advance. Certain of the Company's ground lease and fiber lease agreements contain fixed escalation clauses (such as fixed dollar or fixed percentage increases) or inflation-based escalation clauses (such as those tied to the change in CPI). If the payment terms include fixed escalator provisions, the effect of such increases is recognized on a straight-line basis. The Company calculates the straight-line expense over the contract's estimated lease term, including any renewal option periods that the Company deems reasonably certain to be exercised.

Lease agreements may also contain provisions for a contingent payment based on (1) the revenues derived from the communications infrastructure located on the leased asset, (2) the change in CPI or (3) the usage of the leased asset. The Company's contingent payments are considered variable lease payments and are (1) not included in the initial measurement of the ROU asset or lease liability due to the uncertainty of the payment amount and (2) recorded as expense in the period such contingencies are resolved.

ROU assets associated with finance leases are included in "Property and equipment, net" on the Company's condensed consolidated balance sheet. Lease liabilities associated with finance leases are included in "Current maturities of debt and other obligations" and "Debt and other long-term obligations" on the Company's condensed consolidated balance sheet. For both its Towers and Fiber segments, the Company measures the lease liability for finance leases using the effective interest method. The initial lease liability is increased to reflect interest on the liability and decreased to reflect payments made during the period. Interest on the lease liability is determined each period during the lease term as the amount that results in a constant periodic discount rate on the remaining balance of the liability. The Company measures ROU assets for finance leases on a ratable basis over the applicable lease term.

Lease Accounting — Lessor. The Company's lessor arrangements primarily include contracts for dedicated space (including dedicated fiber) on its shared communications infrastructure. The Company classifies its leases at inception as operating, direct financing or sales-type leases. A lease is classified as a sales-type lease if at least one of the following criteria is met: (1) the lease transfers ownership of the underlying asset to the lessee, (2) the lease grants the lessee an option to purchase the underlying asset that the lessee is reasonably certain to exercise, (3) the lease term is for a major part of the remaining economic life of the underlying asset, (4) the present value of the sum of the lease payments equals or exceeds substantially all of the fair value of the underlying assets or (5) the underlying asset is of such a specialized nature that it is expected to have no alternative use to the lessor at the end of the lease term. Furthermore, when none of the above criteria is met, a lease is classified as a direct financing lease if both of the following criteria are met: (1) the present value of the of the sum of the lease payments and any residual value guaranteed by the lessee, that is not already reflected in the lease payments, equals or exceeds the fair value of the underlying asset and (2) it is probable that the lessor will collect the lease payments plus any amount necessary to satisfy a residual value guarantee. A lease is classified as an operating lease if it does not qualify as a sales-type or direct financing lease. Currently, the Company classifies all of its lessor arrangements as operating leases.

Site rental revenues from the Company’s lessor arrangements are recognized on a straight-line, ratable basis over the fixed, non-cancelable term of the relevant contract, regardless of whether the payments from the tenant are received in equal monthly amounts during the life of a contract. Certain of the Company's contracts contain fixed escalation clauses (such as fixed-dollar or fixed-percentage increases) or inflation-based escalation clauses (such as those tied to the change in CPI). If the payment terms call for fixed elements, such as fixed escalations, upfront payments, or rent-free periods, the rental revenue is recognized on a straight-line basis over the fixed, non-cancelable term of the agreement. When calculating straight-line site rental revenues, the Company considers all fixed elements of tenant contractual escalation provisions.

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-Unaudited (Continued)

(Tabular dollars in millions, except per share amounts)

Certain of the Company's arrangements with tenants in its Fiber segment contain both lease and non-lease components. In such circumstances, the Company has determined (1) the timing and pattern of transfer for the lease and non-lease component are the same, and (2) the stand-alone lease component would be classified as an operating lease. As such, the Company has aggregated certain non-lease components with lease components and has determined that the lease components (generally dedicated fiber) represent the predominant component of the arrangement.

See notes 3 and 9 for further information.

Recent Accounting Pronouncements Not Yet Adopted

No new accounting pronouncements issued but not yet adopted are expected to have a material impact on the Company's condensed consolidated financial statements.

Site rental revenues

The Company generates site rental revenues from its core business by providing tenants with access, including space or capacity, to its shared communications infrastructure via long-term contracts in various forms, including lease, license, sublease and service agreements. Providing such access over the length of the contract term represents the Company’s sole performance obligation under its site rental contracts.

Site rental revenues from the Company’s contracts are recognized on a straight-line, ratable basis over the fixed, non-cancelable term of the relevant contract, which generally ranges from five to 15 years for wireless tenants and three to 20 years related to the Company's fiber solutions tenants (including from organizations with high-bandwidth and multi-location demands), regardless of whether the payments from the tenant are received in equal monthly amounts during the life of a contract. Certain of the Company's contracts contain (1) fixed escalation clauses (such as fixed-dollar or fixed-percentage increases) or inflation-based escalation clauses (such as those tied to the consumer price index), (2) multiple renewal periods at the tenant's option, and (3) only limited termination rights at the applicable tenant's option through the current term. If the payment terms call for fixed escalations, upfront payments, or rent-free periods, the revenue is recognized on a straight-line basis over the fixed, non-cancelable term of the agreement. When calculating straight-line rental revenues, the Company considers all fixed elements of tenant contractual escalation provisions, even if such escalation provisions contain a variable element in addition to a minimum. The Company's assets related to straight-line site rental revenues include current amounts of $107 million included in "Other current assets" and non-current amounts of $1.4 billion included in "Deferred site rental receivables" as of September 30, 2019. Amounts billed or received prior to being earned are deferred and reflected in "Deferred revenues" and "Other long-term liabilities." Amounts to which the Company has an unconditional right to payment, which are related to both satisfied or partially satisfied performance obligations, are recorded within "Receivables, net" on the Company's condensed consolidated balance sheet.

Services and other revenues

As part of the Company’s effort to provide comprehensive communications infrastructure solutions, the Company offers certain services, primarily relating to its towers and small cells, predominately consisting of (1) site development services and (2) installation services. Upon contract commencement, the Company assesses its services to tenants and identifies performance obligations for each promise to provide a distinct service.

The Company may have multiple performance obligations for site development services, which primarily include: structural analysis, zoning, permitting and construction drawings. For each of the above performance obligations, service revenues are recognized at completion of the applicable performance obligation, which represents the point at which the Company believes it has transferred goods or services to the tenant. The revenue recognized is based on an allocation of the transaction price among the performance obligations in a respective contract based on estimated standalone selling price. The volume and mix of site development services may vary among contracts and may include a combination of some or all of the above performance obligations. Payments generally are due within 45 to 60 days and generally do not contain variable-consideration provisions. The Company has one performance obligation for installation services, which is satisfied at the time of the respective installation or augmentation.

Since performance obligations are typically satisfied prior to receiving payment from tenants, the unconditional right to payment is recorded within "Receivables, net" on the Company’s condensed consolidated balance sheet. The vast majority of the Company's services relates to the Company's Towers segment, and generally have a duration of one year or less.

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-Unaudited (Continued)

(Tabular dollars in millions, except per share amounts)

Additional information on revenues

As of both January 1, 2019 and September 30, 2019, $2.3 billion of unrecognized revenue was reported in "Deferred revenues" and "Other long-term liabilities" on our condensed consolidated balance sheet. During the nine months ended September 30, 2019, approximately $320 million of the January 1, 2019 unrecognized revenue balance was recognized as revenue. During the nine months ended September 30, 2018, approximately $310 million of the January 1, 2018 unrecognized revenue balance was recognized as revenue.

The following table is a summary of the non-cancelable contracted amounts owed to the Company by tenants pursuant to site rental contracts in effect as of September 30, 2019.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ending December 31, | | Years Ending December 31, | | | | |

| | 2019 | | 2020 | | 2021 | | 2022 | | 2023 | | Thereafter | | Total |

Contracted amounts(a) | | $ | 1,119 |

| | $ | 4,085 |

| | $ | 3,889 |

| | $ | 3,659 |

| | $ | 3,051 |

| | $ | 8,655 |

| | $ | 24,458 |

|

See note 11 for further information regarding the Company's operating segments and note 9 for further discussion regarding the Company's lessor arrangements.

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-Unaudited (Continued)

(Tabular dollars in millions, except per share amounts)

| |

4. | Debt and Other Obligations |

The table below sets forth the Company's debt and other obligations as of September 30, 2019.

|

| | | | | | | | | | | | | | | |

| Original Issue Date | | Contractual Maturity Date(a) | | Balance as of September 30, 2019 | | Balance as of December 31, 2018 | | Stated Interest Rate as of September 30, 2019(a) | |

Secured Notes, Series 2009-1, Class A-1 | July 2009 | | Aug. 2019 | | $ | — |

| | $ | 12 |

| | N/A |

| |

3.849% Secured Notes | Dec. 2012 | | Apr. 2023 | | 995 |

| | 994 |

| | 3.9 | % | |

Secured Notes, Series 2009-1, Class A-2 | July 2009 | | Aug. 2029 | | 69 |

| | 70 |

| | 9.0 | % | |

Tower Revenue Notes, Series 2015-1 | May 2015 | | May 2042 | (b) | 298 |

| | 298 |

| | 3.2 | % | |

Tower Revenue Notes, Series 2018-1 | July 2018 | | July 2043 | (b) | 248 |

| | 247 |

| | 3.7 | % | |

Tower Revenue Notes, Series 2015-2 | May 2015 | | May 2045 | (b) | 694 |

| | 693 |

| | 3.7 | % | |

Tower Revenue Notes, Series 2018-2 | July 2018 | | July 2048 | (b) | 742 |

| | 742 |

| | 4.2 | % | |

Finance leases and other obligations | Various | | Various | (c) | 233 |

| | 227 |

| | Various | |

Total secured debt | | | | | $ | 3,279 |

| | 3,283 |

| | | |

2016 Revolver | Jan. 2016 | | June 2024 | (h) | $ | 390 |

| (d) | $ | 1,075 |

| | 3.1 | % | (e) |

2016 Term Loan A | Jan. 2016 | | June 2024 | (h) | 2,325 |

| | 2,354 |

| | 3.2 | % | (e) |

2019 Commercial Paper Notes | N/A | (g) | N/A | (g) | — |

| | — |

| | N/A | |

3.400% Senior Notes | Feb./May 2016 | | Feb. 2021 | | 850 |

| | 850 |

| | 3.4 | % | |

2.250% Senior Notes | Sept. 2016 | | Sept. 2021 | | 698 |

| | 697 |

| | 2.3 | % | |

4.875% Senior Notes | Apr. 2014 | | Apr. 2022 | | 845 |

| | 844 |

| | 4.9 | % | |

5.250% Senior Notes | Oct. 2012 | | Jan. 2023 | | 1,643 |

| | 1,641 |

| | 5.3 | % | |

3.150% Senior Notes | Jan. 2018 | | July 2023 | | 744 |

| | 742 |

| | 3.2 | % | |

3.200% Senior Notes | Aug. 2017 | | Sept. 2024 | | 744 |

| | 743 |

| | 3.2 | % | |

4.450% Senior Notes | Feb. 2016 | | Feb. 2026 | | 893 |

| | 892 |

| | 4.5 | % | |

3.700% Senior Notes | May 2016 | | June 2026 | | 744 |

| | 744 |

| | 3.7 | % | |

4.000% Senior Notes | Feb. 2017 | | Mar. 2027 | | 495 |

| | 494 |

| | 4.0 | % | |

3.650% Senior Notes | Aug. 2017 | | Sept. 2027 | | 993 |

| | 992 |

| | 3.7 | % | |

3.800% Senior Notes | Jan. 2018 | | Feb. 2028 | | 989 |

| | 988 |

| | 3.8 | % | |

4.300% Senior Notes | Feb. 2019 | | Feb. 2029 | (f) | 592 |

| | — |

| | 4.3 | % | |

3.100% Senior Notes | Aug. 2019 | | Nov. 2029 | (i) | 543 |

| | — |

| | 3.1 | % | |

4.750% Senior Notes | May 2017 | | May 2047 | | 343 |

| | 343 |

| | 4.8 | % | |

5.200% Senior Notes | Feb. 2019 | | Feb. 2049 | (f) | 395 |

| | — |

| | 5.2 | % | |

4.000% Senior Notes | Aug. 2019 | | Nov. 2049 | (i) | 345 |

| | — |

| | 4.0 | % | |

Total unsecured debt | | | | | $ | 14,571 |

| | $ | 13,399 |

| | | |

Total debt and other obligations | | | | | 17,850 |

| | 16,682 |

| | | |

Less: current maturities and short-term debt and other current obligations | | | | | 100 |

| | 107 |

| | | |

Non-current portion of long-term debt and other long-term obligations | | | | | $ | 17,750 |

| | $ | 16,575 |

| | | |

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-Unaudited (Continued)

(Tabular dollars in millions, except per share amounts)

5.200% senior unsecured notes due February 2049. The Company used the net proceeds of the February 2019 Senior Notes offering to repay a portion of the outstanding borrowings under the 2016 Revolver.

Contractual Maturities

The following are the scheduled contractual maturities of the total debt and other long-term obligations of the Company outstanding as of September 30, 2019. These maturities reflect contractual maturity dates and do not consider the principal payments that will commence following the anticipated repayment dates on the Tower Revenue Notes.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ending December 31, | | Years Ending December 31, | | | | | | Unamortized Adjustments, Net | | Total Debt and Other Obligations Outstanding |

| 2019 | | 2020 | | 2021 | | 2022 | | 2023 | | Thereafter | | Total Cash Obligations | | |

Scheduled contractual maturities | $ | 28 |

| | $ | 99 |

| | $ | 1,674 |

| | $ | 998 |

| | $ | 3,603 |

| | $ | 11,566 |

| | $ | 17,968 |

| | $ | (118 | ) | | $ | 17,850 |

|

Interest Expense and Amortization of Deferred Financing Costs

The components of interest expense and amortization of deferred financing costs are as follows:

|

| | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2019 | | 2018 | | 2019 | | 2018 |

Interest expense on debt obligations | $ | 173 |

| | $ | 158 |

| | $ | 509 |

| | $ | 473 |

|

Amortization of deferred financing costs and adjustments on long-term debt | 5 |

| | 5 |

| | 15 |

| | 16 |

|

Other, net of capitalized interest | (5 | ) | | (3 | ) | | (14 | ) | | (11 | ) |

Total | $ | 173 |

| | $ | 160 |

| | $ | 510 |

| | $ | 478 |

|

|

| | | | | | | | | | | | | | | | | |

| Level in Fair Value Hierarchy | | September 30, 2019 | | December 31, 2018 |

| | Carrying Amount | | Fair Value | | Carrying Amount | | Fair Value |

Assets: | | | | | | | | | |

Cash and cash equivalents | 1 | | $ | 182 |

| | $ | 182 |

| | $ | 277 |

| | $ | 277 |

|

Restricted cash, current and non-current | 1 | | 143 |

| | 143 |

| | 136 |

| | 136 |

|

Liabilities: | | | | | | | | | |

Total debt and other obligations | 2 | | 17,850 |

| | 18,908 |

| | 16,682 |

| | 16,562 |

|

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-Unaudited (Continued)

(Tabular dollars in millions, except per share amounts)

The fair value of cash and cash equivalents and restricted cash approximate the carrying value. The Company determines the fair value of its debt securities based on indicative, non-binding quotes from brokers. Quotes from brokers require judgment and are based on the brokers' interpretation of market information, including implied credit spreads for similar borrowings on recent trades or bid/ask prices or quotes from active markets if available. Since December 31, 2018, there have been no changes in the Company's valuation techniques used to measure fair values.

The Company operates as a REIT for U.S. federal income tax purposes. As a REIT, the Company is generally entitled to a deduction for dividends that it pays and therefore is not subject to U.S. federal corporate income tax on its net taxable income that is currently distributed to its stockholders. The Company also may be subject to certain federal, state, local and foreign taxes on its income and assets, including (1) taxes on any undistributed income, (2) taxes related to the TRSs, (3) franchise taxes, (4) property taxes, and (5) transfer taxes. In addition, the Company could in certain circumstances be required to pay an excise or penalty tax, which could be significant in amount, in order to utilize one or more relief provisions under the Internal Revenue Code of 1986, as amended, to maintain qualification for taxation as a REIT.

The Company's TRS assets and operations will continue to be subject, as applicable, to federal and state corporate income taxes or to foreign taxes in the jurisdictions in which such assets and operations are located. The Company's foreign assets and operations (including its tower operations in Puerto Rico) are subject to foreign income taxes in the jurisdictions in which such assets and operations are located, regardless of whether they are included in a TRS or not.

For the nine months ended September 30, 2019 and 2018, the Company's effective tax rate differed from the federal statutory rate predominately due to the Company's REIT status, including the dividends paid deduction.

Basic net income (loss) attributable to CCIC common stockholders, per common share, excludes dilution and is computed by dividing net income (loss) attributable to CCIC common stockholders by the weighted-average number of common shares outstanding during the period. For the three and nine months ended September 30, 2019 and 2018, diluted net income (loss) attributable to CCIC common stockholders, per common share, is computed by dividing net income (loss) attributable to CCIC common stockholders by the weighted-average number of common shares outstanding during the period, plus any potential dilutive common share equivalents, including shares issuable upon (1) the vesting of restricted stock units as determined under the treasury stock method and (2) conversion of the Company's 6.875% Mandatory Convertible Preferred Stock, as determined under the if-converted method.

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-Unaudited (Continued)

(Tabular dollars in millions, except per share amounts)

|

| | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2019 | | 2018 | | 2019 | | 2018 |

Net income (loss) attributable to CCIC stockholders | $ | 272 |

| | $ | 164 |

| | $ | 729 |

| | $ | 458 |

|

Dividends on preferred stock | (28 | ) | | (28 | ) | | (85 | ) | | (85 | ) |

Net income (loss) attributable to CCIC common stockholders for basic and diluted computations | $ | 244 |

| | $ | 136 |

| | $ | 644 |

| | $ | 373 |

|

| | | | | | | |

Weighted-average number of common shares outstanding (in millions): | | | | | | | |

Basic weighted-average number of common stock outstanding | 416 |

| | 415 |

| | 416 |

| | 413 |

|

Effect of assumed dilution from potential issuance of common shares relating to restricted stock units | 2 |

| | 1 |

| | 2 |

| | 1 |

|

Diluted weighted-average number of common shares outstanding | 418 |

| | 416 |

| | 418 |

| | 414 |

|

| | | | | | | |

Net income (loss) attributable to CCIC common stockholders, per common share: | | | | | | | |

Basic | $ | 0.59 |

| | $ | 0.33 |

| | $ | 1.55 |

| | $ | 0.90 |

|

Diluted | $ | 0.58 |

| | $ | 0.33 |

| | $ | 1.54 |

| | $ | 0.90 |

|

| | | | | | | |

Dividends/distributions declared per share of common stock | $ | 1.125 |

| | $ | 1.05 |

| | $ | 3.375 |

| | $ | 3.15 |

|

Dividends/distributions declared per share of preferred stock | $ | 17.1875 |

| | $ | 17.1875 |

| | $ | 51.5625 |

| | $ | 51.5625 |

|

During the nine months ended September 30, 2019, the Company granted one million restricted stock units. For both the three and nine months ended September 30, 2019, 14 million common share equivalents related to the 6.875% Mandatory Convertible Preferred Stock were excluded from the dilutive common shares because the impact of such conversion would be anti-dilutive, based on the Company's common stock price as of September 30, 2019.

| |

8. | Commitments and Contingencies |

The Company is involved in various claims, lawsuits or proceedings arising in the ordinary course of business. While there are uncertainties inherent in the ultimate outcome of such matters and it is impossible to presently determine the ultimate costs or losses that may be incurred, if any, management believes the resolution of such uncertainties and the incurrence of such costs should not have a material adverse effect on the Company's condensed consolidated financial position or results of operations. Additionally, the Company and certain of its subsidiaries are contingently liable for commitments or performance guarantees arising in the ordinary course of business, including certain letters of credit or surety bonds. In addition, the Company has the option to purchase 53% of the Company's towers at the end of their respective lease terms. The Company has no obligation to exercise such purchase options.

Other Matter