Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 10-K

__________________________

|

| |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2018

or |

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-16441

__________________________

CROWN CASTLE INTERNATIONAL CORP.

(Exact name of registrant as specified in its charter)

__________________________

|

| | |

Delaware | | 76-0470458 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

1220 Augusta Drive, Suite 600, Houston Texas 77057-2261 |

(Address of principal executive offices) (Zip Code) |

(713) 570-3000

(Registrant's telephone number, including area code)

|

| | |

Securities Registered Pursuant to Section 12(b) of the Act | | Name of Each Exchange on Which Registered |

Common Stock, $0.01 par value | | New York Stock Exchange |

6.875% Mandatory Convertible Preferred Stock, Series A, $0.01 par value | | New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act: NONE.

______________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicated by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of a "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in rule 12b-2 of the Exchange Act.

Large accelerated filer x Accelerated filer o Non-accelerated filer o Smaller reporting company o Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was approximately $44.6 billion as of June 30, 2018, the last business day of the registrant's most recently completed second fiscal quarter, based on the New York Stock Exchange closing price on that day of $107.82 per share.

Applicable Only to Corporate Registrants

As of February 22, 2019, there were 415,568,382 shares of common stock outstanding.

Documents Incorporated by Reference

The information required to be furnished pursuant to Part III of this Form 10-K will be set forth in, and incorporated by reference from, the registrant's definitive proxy statement for the annual meeting of stockholders ("2019 Proxy Statement"), which will be filed with the Securities and Exchange Commission not later than 120 days after the end of the fiscal year ended December 31, 2018.

CROWN CASTLE INTERNATIONAL CORP.

TABLE OF CONTENTS

|

| | | |

| | | Page |

| | | |

Item 1. | | | |

Item 1A. | | | |

Item 1B. | | | |

Item 2. | | | |

Item 3. | | | |

Item 4. | | | |

| | | |

Item 5. | | | |

Item 6. | | | |

Item 7. | | | |

Item 7A. | | | |

Item 8. | | | |

Item 9. | | | |

Item 9A. | | | |

Item 9B. | | | |

| | | |

Item 10. | | | |

Item 11. | | | |

Item 12. | | | |

Item 13. | | | |

Item 14. | | | |

| | | |

Item 15. | | | |

Item 16. | | | |

| |

| |

Cautionary Language Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements that are based on our management's expectations as of the filing date of this report with the Securities and Exchange Commission ("SEC"). Statements that are not historical facts are hereby identified as forward-looking statements. In addition, words such as "estimate," "anticipate," "project," "plan," "intend," "believe," "expect," "likely," "predicted," "positioned," "continue," "target," and any variations of these words and similar expressions are intended to identify forward-looking statements. Such statements include plans, projections and estimates contained in "Item 1. Business," "Item 3. Legal Proceedings," "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations" ("MD&A"), and "Item 7A. Quantitative and Qualitative Disclosures About Market Risk" herein. Such forward-looking statements include (1) expectations regarding anticipated growth in the wireless industry, carriers' investments in their networks, tenant additions, and demand for data and our communications infrastructure (as defined below), (2) expectations regarding non-renewals of tenant contracts, (3) expectations regarding our communications infrastructure and the potential benefits that may be derived therefrom, (4) the strength of the U.S. market for shared communications infrastructure, (5) availability and adequacy of cash flows and liquidity for, or plans regarding, future discretionary investments, including capital expenditures, (6) potential benefits of our discretionary investments, including acquisitions, (7) our full year 2019 outlook and the anticipated growth in our financial results, including future revenues and operating cash flows, (8) expectations regarding construction of small cells and fiber, (9) expectations regarding our capital structure and the credit markets, our availability and cost of capital, our leverage ratio and interest coverage targets, and our ability to service our debt and comply with debt covenants and the plans for and the benefits of any future refinancings, (10) expectations related to remaining qualified as a real estate investment trust ("REIT"), and the advantages, benefits or impact of, or opportunities created by, our REIT status, (11) the utilization of our net operating loss

carryforwards ("NOLs"), (12) expectations related to the impact of tenant consolidation or ownership changes, including the potential combination of T-Mobile and Sprint and (13) our dividend policy, and the timing, amount, growth or tax characterization of any dividends. All future dividends are subject to declaration by our board of directors.

Such forward-looking statements should, therefore, be considered in light of various risks, uncertainties and assumptions, including prevailing market conditions, risk factors described under "Item 1A. Risk Factors" herein and other factors. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those expected.

Interpretation

As used herein, the term "including," and any variation thereof, means "including without limitation." The use of the word "or" herein is not exclusive. Unless this Form 10-K indicates otherwise or the context otherwise requires, the terms, "we," "our," "our company," "the company" or "us" as used in this Form 10-K refer to Crown Castle International Corp. and its predecessor (organized in 1995), as applicable, each a Delaware corporation (together, "CCIC"), and their subsidiaries. Additionally, unless the context suggests otherwise, references to "U.S." are to the United States of America and Puerto Rico, collectively.

We have changed our presentation from thousands to millions and, as a result, any necessary rounding adjustments have been made to prior year disclosed amounts.

PART I

Item 1. Business

Overview

We own, operate and lease shared communications infrastructure that is geographically dispersed throughout the U.S., including (1) approximately 40,000 towers and other structures, such as rooftops (collectively, "towers"), and (2) approximately 65,000 route miles of fiber primarily supporting small cell networks ("small cells") and fiber solutions. Our towers, fiber and small cells assets are collectively referred to herein as "communications infrastructure," and our customers on our communications infrastructure are referred to herein as "tenants." Our core business is providing access, including space or capacity, to our shared communications infrastructure via long-term contracts in various forms, including lease, license, sublease and service agreements (collectively, "contracts"). We seek to increase our site rental revenues by adding more tenants on our shared communications infrastructure, which we expect to result in significant incremental cash flows due to our low incremental operating costs.

Below is certain information concerning our business:

| |

• | Over the last two decades, we have assembled a leading portfolio of towers predominately through acquisitions from large wireless carriers or their predecessors. More recently, through both acquisitions (see note 3 to our consolidated financial statements) and new construction of small cells and fiber, we have extended our communications infrastructure presence by investing significantly in our Fiber segment. Through our product offerings of towers and small cells, we seek to provide a comprehensive solution to enable our wireless tenants to expand coverage and capacity for wireless networks. Furthermore, within our Fiber segment, we are able to generate cash flow growth and stockholder return by deploying our fiber for both small cells' and fiber solutions' tenants. |

| |

• | Below is certain information regarding our Towers segment: |

| |

◦ | Approximately 56% and 71% of our towers are located in the 50 and 100 largest U.S. basic trading areas ("BTAs"), respectively. Our towers have a significant presence in each of the top 100 BTAs. |

| |

◦ | We derive approximately 40% of our Towers site rental gross margin from towers residing on land and other property interests (collectively, "land") that we own, including fee interests and perpetual easements, and we derive approximately 60% of our Towers site rental gross margin from towers residing on land that we lease, sublease, manage or license. |

| |

◦ | The contracts for the land under our towers have an average total remaining life of approximately 35 years (including all renewal terms at our option), weighted based on Towers site rental gross margin. |

| |

• | Below is certain information regarding our Fiber segment: |

| |

◦ | The majority of our small cells and fiber are located in major metropolitan areas, including a presence within every major U.S. market. |

| |

◦ | The vast majority of our fiber assets are located on public rights-of-way. |

| |

◦ | We operate as a REIT for U.S. federal income tax purposes. See "Item 1. Business—2018 Industry Highlights and Company Developments—REIT Status" and note 10 to our consolidated financial statements. |

Certain information concerning our tenant and site rental contracts is as follows:

| |

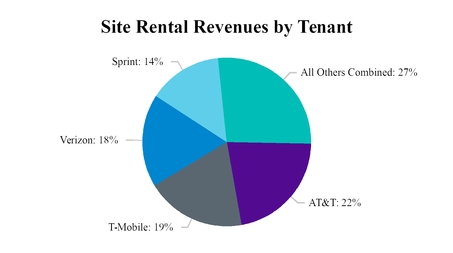

• | Our largest tenants include AT&T, T-Mobile, Verizon Wireless and Sprint, which collectively accounted for 73% of our 2018 site rental revenues. |

| |

• | Site rental revenues represented 87% of our 2018 consolidated net revenues, of which approximately 66% and 34% were from our Towers segment and our Fiber segment, respectively. |

| |

• | The vast majority of our site rental revenues are of a recurring nature and are subject to long-term contracts with our tenants. |

| |

• | Our site rental revenues derived from wireless tenants typically result from long-term contracts with (1) initial terms of five to 15 years, (2) multiple renewal periods at the option of the tenant of five to 10 years each, (3) limited termination rights for our tenants, and (4) contractual escalations of the rental price and, in some cases, an additional upfront payment. |

| |

• | Our site rental revenues derived from our fiber solutions tenants (including from organizations with high-bandwidth and multi-location demands), typically result from contracts with (1) initial terms that generally vary between three to 20 years and (2) a fixed monthly recurring fee and, in some cases, an additional upfront payment. |

| |

• | Exclusive of renewals at the tenants' option, our tenant contracts have a weighted-average remaining life of approximately five years and represent $23 billion of expected future cash inflows. |

As part of our effort to provide comprehensive communications infrastructure solutions, we also offer certain services primarily relating to our towers and small cells, predominately consisting of (1) site development services relating to existing or new tenant equipment installations, including: site acquisition, architectural and engineering, or zoning and permitting (collectively,

"site development services") and (2) tenant equipment installation or subsequent augmentations (collectively, "installation services"). The large majority of our services revenues relate to our Towers segment.

Strategy

As a leading provider of shared communications infrastructure in the U.S., our strategy is to create long-term stockholder value via a combination of (1) growing cash flows generated from our existing portfolio of communications infrastructure, (2) returning a meaningful portion of our cash provided by operating activities to our common stockholders in the form of dividends and (3) investing capital efficiently to grow cash flows and long-term dividends per share. Our U.S. focused strategy is based, in part, on our belief that the U.S. is the most attractive market for shared communications infrastructure investment with the greatest long-term growth potential. We measure our efforts to create "long-term stockholder value" by the combined payment of dividends to stockholders and growth in our per share results. The key elements of our strategy are to:

| |

• | Grow cash flows from our existing communications infrastructure. We seek to maximize our site rental cash flows by working with our tenants to provide them quick access to our existing communications infrastructure and entering into long-term contracts. Tenant additions or modifications of existing tenant equipment (collectively, "tenant additions") enable our tenants to expand coverage and capacity in order to meet increasing demand for data, while generating high incremental returns for our business. We believe our product offerings of towers and small cells provide a comprehensive solution to our wireless tenants' growing network needs through our shared communications infrastructure model, which is an efficient and cost-effective way to serve our tenants. Additionally, we believe our ability to share our fiber assets across multiple tenants to deploy both small cells and offer fiber solutions allows us to generate cash flows and increase stockholder return. We also believe that there will be considerable future demand for our communications infrastructure based on the location of our assets and the rapid growth in demand for data. |

| |

• | Return cash provided by operating activities to common stockholders in the form of dividends. We believe that distributing a meaningful portion of our cash provided by operating activities appropriately provides common stockholders with increased certainty for a portion of expected long-term stockholder value while still retaining sufficient flexibility to invest in our business and deliver growth. We believe this decision reflects the translation of the high-quality, long-term contractual cash flows of our business into stable capital returns to common stockholders. |

| |

• | Invest capital efficiently to grow cash flows and long-term dividends per share. In addition to adding tenants to existing communications infrastructure, we seek to invest our available capital, including the net cash provided by our operating activities and external financing sources, in a manner that will increase long-term stockholder value on a risk-adjusted basis. These investments include constructing and acquiring new communications infrastructure that we expect will generate future cash flow growth and attractive long-term returns by adding tenants to those assets over time. Our historical investments have included the following (in no particular order): |

| |

◦ | construction of towers, fiber and small cells; |

| |

◦ | acquisitions of towers, fiber and small cells; |

| |

◦ | acquisitions of land interests (which primarily relate to land assets under towers); |

| |

◦ | improvements and structural enhancements to our existing communications infrastructure; |

| |

◦ | purchases of shares of our common stock from time to time; and |

| |

◦ | purchases, repayments or redemptions of our debt. |

Our strategy to create long-term stockholder value is based on our belief that additional demand for our communications infrastructure will be created by the expected continued growth in the demand for data. We believe that such demand for our communications infrastructure will continue, will result in growth of our cash flows due to tenant additions on our existing communications infrastructure, and will create other growth opportunities for us, such as demand for newly-constructed or acquired communications infrastructure, as described above.

Company Developments, REIT Status and Industry Updates

Company Developments. See "Item 1. Business—Overview," "Item 1. Business—The Company," "Item 7. MD&A" and our consolidated financial statements for a discussion of certain recent developments, activities, and results, including the increase in our quarterly common stock dividend and our recent debt and equity financing activities.

REIT Status. We commenced operating as a REIT for U.S. federal income tax purposes effective January 1, 2014. As a REIT, we are generally entitled to a deduction for dividends that we pay and therefore are not subject to U.S. federal corporate income tax on our net taxable income that is currently distributed to our stockholders. We may also be subject to certain federal, state, local, and foreign taxes on our income or assets, including (1) taxes on any undistributed income, (2) taxes related to our taxable REIT subsidiaries ("TRSs"), (3) franchise taxes, (4) property taxes and (5) transfer taxes. In addition, we could, in certain

circumstances, be required to pay an excise or penalty tax, which could be significant in amount, in order to utilize one or more relief provisions under the Internal Revenue Code of 1986, as amended ("Code"), to maintain qualification for taxation as a REIT.

The Tax Cuts and Jobs Act, enacted in 2018 ("Tax Reform Act"), made substantial changes to the Code. Among the many changes impacting corporations are a significant reduction in the corporate income tax rate, the repeal of the corporate alternative minimum tax for years beginning in 2018 and limitations on the deductibility of interest expense. In addition, under the Tax Reform Act, qualified REIT dividends (within the meaning of Section 199A(e)(3) of the Code) constitute a part of a non-corporate taxpayer's "qualified business income amount" and thus our non-corporate U.S. stockholders may be eligible to take a qualified business income deduction in an amount equal to 20% of such dividends received from us. Without further legislative action, the 20% deduction applicable to qualified REIT dividends will expire on January 1, 2026. The Tax Reform Act has not had a material impact on the Company.

The vast majority of our assets and revenues are in the REIT. See note 10 to our consolidated financial statements. Additionally, we have included in TRSs certain other assets and operations. Those TRS assets and operations will continue to be subject, as applicable, to federal and state corporate income taxes or to foreign taxes in the jurisdictions in which such assets and operations are located.

Our foreign assets and operations (including our tower operations in Puerto Rico) most likely will be subject to foreign income taxes in the jurisdictions in which such assets and operations are located, regardless of whether they are included in a TRS.

To remain qualified and be taxed as a REIT, we will generally be required to annually distribute to our stockholders at least 90% of our REIT taxable income, after the utilization of our NOLs (determined without regard to the dividends paid deduction and excluding net capital gain) (see notes 2 and 10 to our consolidated financial statements). Our quarterly common stock dividend will delay the utilization of our NOLs and may cause certain of the NOLs to expire without utilization.

Industry Update. Consumer demand for data continues to grow due to increases in data consumption and increased penetration of bandwidth-intensive devices. This increase in data consumption is driven by growth in factors such as (1) mobile entertainment (such as mobile video, mobile applications, and social networking), (2) mobile internet usage (such as email and web browsing), (3) machine-to-machine applications or the "Internet of Things" (such as smart city technologies), and (4) the adoption of other bandwidth-intensive applications (such as cloud services and video communications). As a result, consumer wireless devices are trending toward bandwidth-intensive devices, including smartphones, laptops, tablets and other emerging devices, and, during the next several years, U.S. wireless carriers are expected to be among the first carriers in the world to offer commercial 5th Generation ("5G") mobile cellular communications services to further support such growth.

We expect the following anticipated factors to contribute to potential demand for our communications infrastructure:

| |

• | Consumers' growing wireless data consumption likely resulting in major wireless carriers continuing to upgrade and enhance their networks, including through the use of both towers and small cells, in an effort to improve network quality and capacity and tenant retention or satisfaction; |

| |

• | Prior and future potential spectrum auctioned, licensed or made available by the Federal Communications Commission ("FCC") enabling additional wireless carrier network development; |

| |

• | Next generation technologies and new uses for wireless communications may potentially result in new entrants or increased demand in the wireless industry, which may include companies involved in the continued evolution and deployment of the Internet of Things (such as connected cars, smart cities and virtual reality); and |

| |

• | The continued adoption of bandwidth-intensive applications could result in demand for high-capacity, multi-location, fiber-based network solutions. |

The Company

Virtually all of our operations are located in the U.S. Our operating segments consists of Towers and Fiber. For more information about our operating segments, see "Item 7. MD&A—General Overview" and note 15 to our consolidated financial statements. Our core business is providing access, including space or capacity, to our shared communications infrastructure in the U.S. We believe our communications infrastructure is integral to our tenants' networks and organizations. See "Item 1. Business—Strategy."

Towers Segment. We believe towers are the most efficient and cost-effective solution for providing coverage and capacity for wireless carrier network deployments. We acquired ownership interests or exclusive rights to the majority of our towers directly or indirectly from the four largest wireless carriers (or their predecessors) through transactions consummated since 1999, including transactions with (1) AT&T in 2013 ("AT&T Acquisition"), (2) T-Mobile in 2012 ("T-Mobile Acquisition"), (3) Global Signal Inc. in 2007 ("Global Signal Acquisition"), which had originally acquired the majority of its towers from Sprint, (4) companies now part of Verizon Wireless during 1999 and 2000 and (5) companies now part of AT&T during 1999 and 2000.

We generally receive monthly rental payments from our Towers tenants, payable under long-term contracts. We generally negotiate initial contract terms of five to 15 years, with multiple renewal periods of five to 10 years each at the option of the tenant, and our contracts typically include fixed escalations (which generally exceed expected non-renewals, as discussed below) and, in some cases, an additional upfront payment. We continue to endeavor to negotiate with our existing tenant base for longer contractual terms, which often contain fixed escalation rates.

Our Towers tenant contracts have historically had a high renewal rate. With limited exceptions, our Towers tenant contracts may not be terminated prior to the end of their current term, and non-renewals have averaged approximately 2.5% of site rental revenues over the last five years (inclusive of non-renewals as a result of the decommissioning of the former Leap Wireless, MetroPCS and Clearwire networks ("Acquired Networks")). In general, each tenant contract which is renewable will automatically renew at the end of its term unless the tenant provides prior notice of its intent not to renew. See note 4 to our consolidated financial statements for a tabular presentation of the minimum rental cash payments due to us by tenants pursuant to lease agreements without consideration of tenant renewal options.

The average monthly rental payment from a new tenant added to towers can vary based on (1) aggregate tenant volume, (2) the different regions in the U.S., or (3) the physical size, weight and shape of the antenna installation or related equipment. When possible, we seek to receive rental payment increases in connection with contract amendments, pursuant to which our tenants add additional antennas or other equipment to our towers on which they already have equipment pursuant to preexisting contracts.

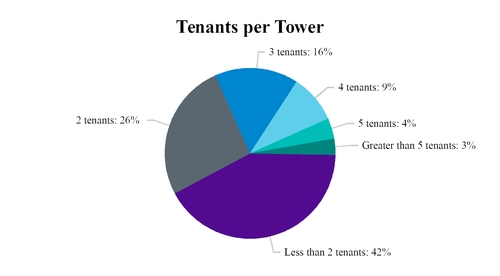

As of December 31, 2018, the average number of tenants (calculated as a unique license together with any related amendments thereto) per tower is approximately 2.2. The following chart sets forth the number of existing tenants per tower as of December 31, 2018 (see "Item 7. MD&A—Accounting and Reporting Matters—Critical Accounting Policies and Estimates" for a discussion of our impairment evaluation and our towers with no tenants).

Fiber Segment. Our Fiber segment includes both small cells and fiber solutions.

| |

• | We offer certain fiber solutions to organizations with high-bandwidth and multi-location demands, such as enterprise, government, education, healthcare, wholesale, financial, legal, media and entertainment, content distribution, and energy and utilities tenants. Our fiber solutions provide essential connectivity resources needed to create integrated networks and support organizations. |

| |

• | Our small cells offload data traffic from towers and bolster capacity in the areas of wireless networks where data demand is the greatest. Our small cells are typically attached to public right-of-way infrastructure, including utility poles and street lights. |

Our fiber assets include those acquired from: (1) NextG Networks, Inc. in 2012 ("NextG Acquisition"), (2) Quanta Fiber Networks, Inc. in 2015 ("Sunesys Acquisition"), (3) FPL FiberNet Holdings, LLC and certain other subsidiaries of NextEra Energy, Inc. in 2017 ("FiberNet Acquisition"), (4) Wilcon Holdings LLC in 2017 ("Wilcon Acquisition") and (5) LTS Group Holdings LLC in 2017 ("Lightower Acquisition"). The FiberNet Acquisition, Wilcon Acquisition, and Lightower Acquisition are collectively referred to herein as the "2017 Acquisitions."

We generally receive monthly recurring payments from our Fiber tenants and, in some cases, receive upfront payments, payable pursuant to contracts. The amount of the monthly payments can also be influenced by the amount or cost of (1) construction for initial and subsequent tenants, (2) fiber strand requirements and supply, (3) equipment at the site and (4) any upfront payment received.

Additional site rental information. For both of our Towers and Fiber segments, we have existing master agreements with our largest tenants, including AT&T, T-Mobile, Verizon Wireless and Sprint; such agreements provide certain terms (including economic terms) that govern our tenants' right to utilize our communications infrastructure entered into by such carriers during the term of their master agreements.

Approximately half of our site rental cost of operations consists of Towers ground lease expenses, and the remainder includes fiber access expenses (primarily leases of fiber assets and other access agreements to facilitate our communications infrastructure), property taxes, repairs and maintenance, employee compensation or related benefit costs, and utilities. Assuming current leasing activity levels, our cash operating expenses generally tend to escalate at approximately the rate of inflation. The addition of new tenants to existing communications infrastructure assets is achieved at a low incremental operating cost, delivering high incremental returns to our business. Once constructed, our communications infrastructure portfolio requires minimal sustaining capital expenditures, including maintenance or other non-discretionary capital expenditures, which are typically approximately 2% of net revenues. See note 14 to our consolidated financial statements for a tabular presentation of the rental cash payments owed by us to landlords pursuant to our contractual agreements.

Services. As part of our effort to provide comprehensive communications infrastructure solutions, we also offer certain services primarily relating to our towers and small cells, predominately consisting of (1) site development services and (2) installation services. The large majority of our service revenues relate to our Towers segment. For 2018, approximately 60% of our services and other revenues related to installation services, and the remainder predominately related to site development services. We seek to grow our service revenues by capitalizing on increased volumes that may result from carrier network upgrades, promoting site development services, expanding the scope of our services, and focusing on tenant service and deployment speed. We have the capability and expertise to install, with the assistance of our network of subcontractors, equipment or antenna systems for our tenants. We do not always provide the installation services or site development services for our tenants on our communications infrastructure as third parties also provide these services (see also "—Competition" below). These activities are typically non-recurring and highly competitive, with a number of local competitors in most markets. Typically, our installation services are billed on a cost-plus profit basis and site development services are billed on a fixed fee basis.

Customers. Our Towers customers are primarily comprised of large wireless carriers that operate national networks.

Our Fiber customers are generally large wireless carriers and organizations with high-bandwidth and multi-location demands, such as enterprise, government, education, healthcare, wholesale, financial, legal, media and entertainment, content distribution, and energy and utilities customers.

Our four largest tenants are AT&T, T-Mobile, Verizon Wireless and Sprint. Collectively, these four tenants accounted for 73% of our 2018 site rental revenues. Also see "Item 1A. Risk Factors" and note 15 to our consolidated financial statements. For 2018, our site rental revenues by tenant were as follows:

Sales and Marketing. Our sales organization markets our communications infrastructure with the objective of contracting access with tenants to existing communications infrastructure or to new communications infrastructure prior to construction. We seek to become the critical partner and preferred independent communications infrastructure provider for our tenants and increase tenant satisfaction relative to our peers by leveraging our (1) existing unique communications infrastructure footprint, (2) tenant relationships, (3) process-centric approach, (4) technological tools and (5) construction capabilities and expertise.

Our sales team is organized based on a variety of factors, including tenant type (such as wireless carriers and organizations) and geography. A team of national account directors maintains our relationships with our largest tenants. These directors work to develop communications infrastructure contracts, as well as to ensure that tenants' communications infrastructure needs are efficiently translated into new contracts on our communications infrastructure. Sales personnel in our local offices develop and maintain relationships with our tenants that are expanding their networks, entering new markets, seeking new or additional communication infrastructure offerings, bringing new technologies to market or requiring maintenance or add-on business. In addition to our full-time sales or marketing staff, a number of senior-level employees spend a significant portion of their time on sales and marketing activities and call on existing or prospective tenants.

Competition. We face competition for site rental tenants from various sources, including (1) other independent communications infrastructure owners or operators, including competitors that own, operate, or manage towers, rooftops, broadcast towers, utility poles, fiber (including non-traditional competitors such as cable providers) or small cells, (2) tenants who elect to self-perform or (3) new alternative deployment methods for communications infrastructure.

Some of the larger companies with which we compete for Towers segment business opportunities include American Tower Corporation and SBA Communications Corporation. Our Fiber segment business competitors can vary significantly based on geography. Some of the larger companies with which we compete for Fiber segment business opportunities include other owners of fiber, as well as recent and potential entrants into small cells and fiber solutions. We believe that location, existing communications infrastructure footprint, deployment speed, quality of service, expertise, reputation, capacity and price have been and will continue to be the most significant competitive factors affecting our businesses. See "Item 1A. Risk Factors."

Competitors to our services offering include site acquisition consultants, zoning consultants, real estate firms, right-of-way consulting firms, construction companies, tower owners or managers, radio frequency engineering consultants, telecommunications equipment vendors who can provide turnkey site development services through multiple subcontractors or our tenants' internal staff. We believe that our tenants base their decisions on the outsourcing of services on criteria such as a company's experience, record of accomplishment, reputation, price and time for completion of a project.

Employees

At January 31, 2019, we employed approximately 5,000 people. We are not a party to any collective bargaining agreements. We have not experienced any strikes or work stoppages, and management believes that our employee relations are satisfactory.

Regulatory and Environmental Matters

We are required to comply with a variety of federal, state, and local regulations and laws in the U.S., including FCC and Federal Aviation Administration ("FAA") regulations and those discussed under "—Environmental" below. To date, we have not incurred any material fines or penalties or experienced any material adverse effects to our business as a result of any domestic or international regulations. The summary below is based on regulations currently in effect, and such regulations are subject to review or modification by the applicable governmental authority from time to time. If we fail to comply with applicable laws and regulations, we may be fined or even lose our rights to conduct some of our business.

Federal Regulations. Both the FCC and the FAA regulate towers used for wireless communications, radio, or television broadcasting. Such regulations control the siting, lighting, or marking of towers and may, depending on the characteristics of particular towers, require the registration of tower facilities with the FCC and the issuance of determinations confirming no hazard to air traffic. Wireless communications devices operating on towers are separately regulated and independently licensed based upon the particular frequency used. In addition, the FCC and the FAA have developed standards to consider proposals for new or modified tower or antenna structures based upon the height or location, including proximity to airports. Proposals to construct or to modify existing tower or antenna structures above certain heights are reviewed by the FAA to ensure the structure will not present a hazard to aviation, which determination may be conditioned upon compliance with lighting or marking requirements. The FCC requires its licensees to operate communications devices only on towers that comply with FAA rules and are registered with the FCC, if required by its regulations. Where tower lighting is required by FAA regulation, tower owners bear the responsibility of notifying the FAA of any tower lighting outage and ensuring the timely restoration of such outages. Failure to comply with the applicable requirements may lead to civil penalties.

Local Regulations. The U.S. Telecommunications Act of 1996 amended the Communications Act of 1934 to preserve state and local zoning authorities' jurisdiction over the siting of communications towers and small cells. The law, however, limits local zoning authority by prohibiting actions by local authorities that discriminate between different service providers of wireless communications or ban altogether the provision of wireless communications. Additionally, the law prohibits state and local restrictions based on the environmental effects of radio frequency emissions to the extent the facilities comply with FCC regulations.

Local regulations include city and other local ordinances (including subdivision and zoning ordinances), approvals for construction, modification and removal of towers and small cells, and restrictive covenants imposed by community developers. These regulations vary greatly, but typically require us to obtain approval from local officials prior to tower construction. Local zoning authorities may render decisions that prevent the construction or modification of towers or place conditions on such construction or modifications that are responsive to community residents' concerns regarding the height, visibility, or other characteristics of the towers. Over the last several years, there have been several developments related to FCC regulations and legislation that assist in expediting and streamlining the deployment of wireless networks, including establishing timeframes for reviews by local and state governments. Notwithstanding such legislative and FCC actions, decisions of local zoning authorities may also adversely affect the timing or cost of communications infrastructure construction or modification.

Certain of our Fiber related subsidiaries hold authorizations to provide intrastate telecommunication services as competitive local exchange carriers ("CLEC") in numerous states and to provide domestic interstate telecommunication services as authorized by the FCC. These Fiber subsidiaries are primarily regulated by state public service commissions. CLEC status, in certain cases, helps promote access to public rights-of-way, which is beneficial to the deployment of our small cells on a timely basis. Status as a CLEC often allows us to deploy our small cells in locations where zoning restrictions might otherwise delay, restrict, or prevent building or expanding traditional wireless tower sites or traditional wireless rooftop sites. See "Item 1A. Risk Factors."

Environmental. We are required to comply with a variety of federal, state, and local environmental laws and regulations protecting environmental quality, including air and water quality and wildlife protection. To date, we have not incurred any material fines or penalties or experienced any material adverse effects to our business as a result of any domestic or international environmental regulations or matters. See "Item 1A. Risk Factors."

The construction of new towers and small cells or, in some cases, the modification of existing towers in the U.S. may be subject to environmental review under the National Environmental Policy Act of 1969, as amended ("NEPA"), which requires federal agencies to evaluate the environmental impact of major federal actions. The FCC has promulgated regulations implementing NEPA, which require applicants to investigate the potential environmental impact of the proposed tower or small cells construction. Should the proposed tower or small cells construction present a significant environmental impact, the FCC must prepare an environmental impact statement, subject to public comment. If the proposed construction or modification of a tower poses a significant impact on the environment, the FCC's approval of the construction or modification could be significantly delayed.

Our operations are subject to federal, state, and local laws and regulations relating to the management, use, storage, disposal, emission, or remediation of, or exposure to, hazardous or non-hazardous substances, materials, or wastes. As an owner, lessee, or operator of real property, we are subject to certain environmental laws that impose strict, joint-and-several liability for the

cleanup of on-site or off-site contamination relating to existing or historical operations; or we could also be subject to personal injury or property damage claims relating to such contamination. In general, our tenant contracts prohibit our tenants from using or storing any hazardous substances on our communications infrastructure sites in violation of applicable environmental laws and require our tenants to provide notice of certain environmental conditions caused by them.

As licensees and communications infrastructure owners, we are also subject to regulations and guidelines that impose a variety of operational requirements relating to radio frequency emissions. As employers, we are subject to Occupational Safety and Health Administration and similar guidelines regarding employee protection from radio frequency exposure. The potential connection between radio frequency emissions and certain negative health effects, including some forms of cancer, has been the subject of substantial study by the scientific community in recent years.

We have compliance programs and monitoring projects to help assure that we are in substantial compliance with applicable environmental laws and regulations. Nevertheless, there can be no assurance that the costs of compliance with existing or future environmental laws will not have a material adverse effect on us.

Other Regulations. We hold, through certain of our subsidiaries, spectrum licenses, which are subject to additional regulation by the FCC. We also hold a nationwide FCC license relating to the 1670-1675 MHz spectrum ("1670-1675 Spectrum"), which we have leased to a third party through 2023, subject to the lessee's option to purchase the 1670-1675 Spectrum.

Available Information

We maintain a website at www.crowncastle.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K (and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended ("Exchange Act")), proxy statements and other information about us are made available, free of charge, through the investor relations section of our website at http://investor.crowncastle.com and at the SEC's website at http://sec.gov as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

In addition, our corporate governance guidelines, business practices, ethics policy and financial code of ethics and the charters of our Audit Committee, Compensation Committee and Nominating & Corporate Governance Committee are available through the investor relations section of our website at http://www.crowncastle.com/investor/corporateGovernance.aspx, and such information is also available in print to any stockholder who requests it. We intend to post to our website any amendments to or waivers from each of the ethics policy and financial code of ethics applicable to our Chief Executive Officer, Chief Financial Officer and Controller that are required to be disclosed.

Item 1A. Risk Factors

You should carefully consider all of the risks described below, as well as the other information contained in this document, when evaluating your investment in our securities.

Risks Relating to Our Business

Our business depends on the demand for our communications infrastructure, driven primarily by demand for data, and we may be adversely affected by any slowdown in such demand. Additionally, a reduction in the amount or change in the mix of network investment by our tenants may materially and adversely affect our business (including reducing demand for our communications infrastructure or services).

Tenant demand for our communications infrastructure depends on the demand for data. The willingness of our tenants to utilize our communications infrastructure, or renew or extend existing contracts on our communications infrastructure, is affected by numerous factors, including:

| |

• | consumers' and organizations' demand for data; |

| |

• | availability or capacity of our communications infrastructure or associated land interests; |

| |

• | location of our communications infrastructure; |

| |

• | financial condition of our tenants, including their profitability and availability or cost of capital; |

| |

• | willingness of our tenants to maintain or increase their network investment or changes in their capital allocation strategy; |

| |

• | need for integrated networks and organizations; |

| |

• | availability and cost of spectrum for commercial use; |

| |

• | increased use of network sharing, roaming, joint development, or resale agreements by our tenants; |

| |

• | mergers or consolidations by and among our tenants; |

| |

• | changes in, or success of, our tenants' business models; |

| |

• | governmental regulations and initiatives, including local or state restrictions on the proliferation of communications infrastructure; |

| |

• | cost of constructing communications infrastructure; |

| |

• | our market competition, including tenants that may elect to self-perform; |

| |

• | technological changes, including those (1) affecting the number or type of communications infrastructure needed to provide data to a given geographic area or which may otherwise serve as substitute or alternative to our communications infrastructure or (2) resulting in the obsolescence or decommissioning of certain existing wireless networks; and |

| |

• | our ability to efficiently satisfy our tenants' service requirements. |

A slowdown in demand for data or our communications infrastructure may negatively impact our growth or otherwise have a material adverse effect on us. If our tenants or potential tenants are unable to raise adequate capital to fund their business plans, as a result of disruptions in the financial and credit markets or otherwise, they may reduce their spending, which could adversely affect our anticipated growth or the demand for our communications infrastructure or services.

The amount, timing, and mix of our tenants' network investment is variable and can be significantly impacted by the various matters described in these risk factors. Changes in tenant network investment typically impact the demand for our communications infrastructure. As a result, changes in tenant plans such as delays in the implementation of new systems, new and emerging technologies (including small cells and fiber solutions), or plans to expand coverage or capacity may reduce demand for our communications infrastructure. Furthermore, the industries in which our tenants operate (particularly those in the wireless industry) could experience a slowdown or slowing growth rates as a result of numerous factors, including a reduction in consumer demand (including demand for wireless connectivity) or general economic conditions. There can be no assurances that weakness or uncertainty in the economic environment will not adversely impact our tenants or their industries, which may materially and adversely affect our business, including by reducing demand for our communications infrastructure or services. In addition, a slowdown may increase competition for site rental tenants or services. Such an industry slowdown or a reduction in tenant network investment may materially and adversely affect our business.

A substantial portion of our revenues is derived from a small number of tenants, and the loss, consolidation or financial instability of any of such tenants may materially decrease revenues or reduce demand for our communications infrastructure and services.

Our four largest tenants are AT&T, T-Mobile, Verizon Wireless and Sprint. Collectively, these four tenants accounted for 73% of our 2018 site rental revenues. The loss of any one of our large tenants as a result of consolidation, merger, bankruptcy, insolvency, network sharing, roaming, joint development, resale agreements by our tenants or otherwise may result in (1) a material decrease in our revenues, (2) uncollectible account receivables, (3) an impairment of our deferred site rental receivables, communications infrastructure assets, intangible assets, or (4) other adverse effects to our business. We cannot guarantee that contracts with our major tenants will not be terminated or that these tenants will renew their contracts with us. In addition to our four largest tenants, we also derive a portion of our revenues and anticipated future growth from (1) fiber solutions tenants and (2) new entrants offering or contemplating offering wireless services. Such tenants (including those dependent on government funding) may be smaller or have less financial resources than our four largest tenants, may have business models which may not be successful, or may require additional capital.

Consolidation among our tenants will likely result in duplicate or overlapping parts of networks, for example, where they are co-residents on a tower, which may result in the termination, non-renewal or re-negotiation of tenant contracts and negatively impact revenues from our communications infrastructure. Due to the long-term nature of tenant contracts, we expect that any termination of tenant contracts as a result of this potential consolidation would be spread over multiple years. Such consolidation may result in a reduction in such tenants' future network investment in the aggregate because their expansion plans may be similar. Tenant consolidation could decrease the demand for our communications infrastructure, which in turn may result in a reduction in our revenues or cash flows.

In April 2018, T-Mobile and Sprint entered into a definitive agreement to merge, subject to regulatory approval and other closing conditions. This potential transaction may result in a decrease or delay in demand for our communications infrastructure and services, as a result of the anticipated integration of the T-Mobile and Sprint networks and related duplicate or overlapping parts of their networks, which may lead to a reduction in our revenues or cash flows and may trigger a review for impairment of certain long-lived assets. For the year ended December 31, 2018, T-Mobile and Sprint represented approximately 19% and 14%, respectively, of the Company's consolidated site rental revenues. Further, the Company derived approximately 6% of its consolidated site rental revenues from each of T-Mobile and Sprint on communications infrastructure where both carriers currently reside, inclusive of approximately 1% impact from previously disclosed expected non-renewals from the anticipated decommissioning of portions of T-Mobile's MetroPCS and Sprint's Clearwire networks. In addition, there is an average of approximately five years and six years of current term remaining on all lease agreements with T-Mobile and Sprint, respectively. See also "Item 1. Business—The Company" and note 15 to our consolidated financial statements.

The expansion or development of our business, including through acquisitions, increased product offerings or other strategic growth opportunities, may cause disruptions in our business, which may have an adverse effect on our business, operations or financial results.

We seek to expand and develop our business, including through acquisitions, increased product offerings (such as small cells and fiber solutions), or other strategic growth opportunities. In the ordinary course of our business, we review, analyze and evaluate various potential transactions or other activities in which we may engage. Such transactions or activities could be a complex, costly, time-consuming process, or cause disruptions in, increase risk or otherwise negatively impact our business. Among other things, such transactions and activities may:

| |

• | disrupt our business relationships with our tenants, depending on the nature of or counterparty to such transactions and activities; |

| |

• | divert the time or attention of management away from other business operations, including as a result of post-transaction integration activities; |

| |

• | fail to achieve revenue or margin targets, operational synergies or other benefits contemplated; |

| |

• | increase operational risk or volatility in our business; |

| |

• | not result in the benefits management had expected to realize from such expansion and development activities, or those benefits may take longer to realize than expected (including the 2017 Acquisitions); |

| |

• | impact our cost structure and result in the need to hire additional employees; |

| |

• | increase demands on current employees or result in current or prospective employees experiencing uncertainty about their future roles with us, which might adversely affect our ability to retain or attract key employees; or |

| |

• | result in the need for additional TRSs or contributions of certain assets to TRSs, which are subject to federal and state corporate income taxes. |

Our Fiber segment has expanded rapidly, and the Fiber business model contains certain differences from our Towers business model, resulting in different operational risks. If we do not successfully operate our Fiber business model or identify or manage the related operational risks, such operations may produce results that are less than anticipated.

In recent years, we have allocated a significant amount of capital to our Fiber business, which is a much less mature business for us than our Towers business (which we have operated since 1994). Our Fiber segment represented 34% and 21% of our site rental revenues for the years ended December 31, 2018 and 2017, respectively. The business model for our Fiber operations contains certain differences from our business model for our Towers operations, including certain differences relating to tenant base, competition, contract terms (including requirements for service level agreements regarding network performance and maintenance), upfront capital requirements, landlord demographics, ownership of certain network assets, operational oversight requirements, government regulations, growth rates and applicable laws.

While our Fiber operations have certain risks that are similar to our Towers operations, they also have certain operational risks (including the scalability of processes) that are different from our Towers business, including:

| |

• | the use of public rights-of-way and franchise agreements; |

| |

• | use of poles and conduits owned solely by, or jointly with, third parties; |

| |

• | risks relating to overbuilding; |

| |

• | risks relating to the specific markets that we choose to operate in or plan to operate in; |

| |

• | risks relating to construction management and construction-related billings to tenants; |

| |

• | risks relating to wireless carriers building their own small cell networks, or tenants utilizing their own or alternative fiber assets; |

| |

• | risk of failing to optimize the use of our finite supply of fiber strands; |

| |

• | damage to our assets and the need to maintain, repair, upgrade and periodically replace our assets; |

| |

• | the risk of failing to properly maintain or operate highly specialized hardware and software; |

| |

• | network data security risks; |

| |

• | the risk of new technologies that could enable tenants to realize the same benefits with less utilization of our fiber; |

| |

• | potential damage to our overall reputation as a communications infrastructure provider; and |

| |

• | the use of competitive local exchange carrier status, which we refer to as "CLEC" status. |

In addition, the rate at which tenants adopt or prioritize small cells and fiber solutions may be lower or slower than we anticipate or may cease to exist altogether. Our Fiber operations will also expose us to different safety or liability risks or hazards than our Towers business as a result of numerous factors, including the location or nature of the assets involved. There may be risks and challenges associated with small cells and fiber solutions being comparatively new and emerging technologies that are continuing to evolve, and there may be other risks related to small cells and fiber solutions of which we are not yet aware.

Failure to timely and efficiently execute on our construction projects could adversely affect our business.

Our construction projects and related contracts, particularly in our Fiber business, can be long-term, complex in nature, and challenging to execute. The quality of our performance on such construction projects depends in large part upon our ability to manage (1) the associated tenant relationship and (2) the project itself by timely deploying and properly managing appropriate internal and external project resources. In connection with our construction projects, we generally bear the risk of cost over-runs, labor availability and productivity, and contractor pricing and performance. Additionally, contracts with our tenants for these projects typically specify delivery dates, performance criteria and penalties for our failure to perform. Further, investments in newly-constructed communications infrastructure may result in lower initial returns compared to returns on our existing communications infrastructure or us not being able to to realize future tenant additions at anticipated levels. Our failure to manage such tenant relationships, project resources, and project milestones in a timely and efficient manner could have a material adverse effect on our business.

Our substantial level of indebtedness could adversely affect our ability to react to changes in our business, and the terms of our debt instruments and our 6.875% Convertible Preferred Stock limit our ability to take a number of actions that our management might otherwise believe to be in our best interests. In addition, if we fail to comply with our covenants, our debt could be accelerated.

We have a substantial amount of indebtedness (approximately $16.7 billion as of February 22, 2019). See "Item 7. MD&A—Liquidity and Capital Resources" for a tabular presentation of our contractual debt maturities. As a result of our substantial indebtedness:

| |

• | we may be more vulnerable to general adverse economic or industry conditions; |

| |

• | we may find it more difficult to obtain additional financing to fund discretionary investments or other general corporate requirements or to refinance our existing indebtedness; |

| |

• | we are or will be required to dedicate a substantial portion of our cash flows from operations to the payment of principal or interest on our debt, thereby reducing the available cash flows to fund other projects, including the discretionary investments discussed in "Item 1. Business" and "Item 7. MD&A—Liquidity and Capital Resources"; |

| |

• | we may have limited flexibility in planning for, or reacting to, changes in our business or in the industry; |

| |

• | we may have a competitive disadvantage relative to other companies in our industry with less debt; |

| |

• | we may be adversely impacted by changes in interest rates; |

| |

• | we may be adversely impacted by changes to credit ratings related to our debt instruments; |

| |

• | we may be required to issue equity securities or securities convertible into equity or sell some of our assets, possibly on unfavorable terms, in order to meet payment obligations; |

| |

• | we may be limited in our ability to take advantage of strategic business opportunities, including communications infrastructure development or mergers and acquisitions; and |

| |

• | we could fail to remain qualified for taxation as a REIT as a result of limitations on our ability to declare and pay dividends to stockholders as a result of restrictive covenants in our debt instruments or the terms of our 6.875% Mandatory Convertible Preferred Stock, Series A, par value $0.01 per share ("6.875% Convertible Preferred Stock"). |

Currently we have debt instruments in place that limit in certain circumstances our ability to incur additional indebtedness, pay dividends, create liens, sell assets, or engage in certain mergers and acquisitions, among other things. In addition, the credit agreement governing our senior unsecured credit facility ("2016 Credit Facility") contains financial maintenance covenants. Our ability to comply with these covenants or to satisfy our debt obligations will depend on our future operating performance. If we violate the restrictions in our debt instruments or fail to comply with our financial maintenance covenants, we will be in default under those instruments, which in some cases would cause the maturity of a substantial portion of our long-term indebtedness to be accelerated. Furthermore, if the limits on our ability to pay dividends prevent us from satisfying our REIT distribution requirements, we could fail to remain qualified for taxation as a REIT. If these limits do not jeopardize our qualification for taxation as a REIT but nevertheless prevent us from distributing 100% of our REIT taxable income, we will be subject to federal and state corporate income taxes, and potentially a nondeductible excise tax, on our undistributed taxable income. If our operating subsidiaries were to default on their debt, the trustee could seek to foreclose the collateral securing such debt, in which case we could lose the communications infrastructure and the revenues associated with such communications infrastructure. See "Item 7. MD&A—Liquidity and Capital Resources—Debt Covenants" for a further discussion of our debt covenants.

CCIC is a holding company that conducts all of its operations through its subsidiaries. Accordingly, CCIC's sources of cash to pay interest or principal on its outstanding indebtedness are distributions relating to its respective ownership interests in its subsidiaries from the net earnings and cash flows generated by such subsidiaries or from proceeds of debt or equity offerings. Earnings and cash flows generated by CCIC's subsidiaries are first applied by such subsidiaries to conduct their operations, including servicing their respective debt obligations, after which any excess cash flows generally may be paid to such holding company, in the absence of any special conditions such as a continuing event of default. However, CCIC's subsidiaries are legally distinct from the holding company and, unless they guarantee such debt, have no obligation to pay amounts due on their debt or to make funds available to us for such payment.

If we fail to pay scheduled dividends on our 6.875% Convertible Preferred Stock, in cash, common stock, or any combination of cash and common stock, we will be prohibited from paying dividends on our common stock, which may jeopardize our status as a REIT.

We have a substantial amount of indebtedness. In the event we do not repay or refinance such indebtedness, we could face substantial liquidity issues and might be required to issue equity securities or securities convertible into equity securities, or sell some of our assets to meet our debt payment obligations.

We have a substantial amount of indebtedness, which, upon final maturity, we will need to refinance or repay. See "Item 7. MD&A—Liquidity and Capital Resources" for a tabular presentation of our contractual debt maturities. There can be no assurances we will be able to refinance our indebtedness (1) on commercially reasonable terms, (2) on terms, including with respect to interest rates, as favorable as our current debt, or (3) at all.

Economic conditions and the credit markets have historically experienced, and may continue to experience, periods of volatility, uncertainty, or weakness that could impact the availability or cost of debt financing, including any refinancing of the obligations described above or on our ability to draw the full amount of our $4.25 billion senior unsecured revolving credit facility under our 2016 Credit Facility ("2016 Revolver"), that, as of February 22, 2019, has $4.1 billion of undrawn availability.

Borrowings under our 2016 Credit Facility generally bear an interest rate based on the London interbank offered rate ("LIBOR") per annum plus a credit spread based on our senior unsecured credit rating. In July 2017, the United Kingdom's Financial Conduct Authority, which regulates LIBOR, announced that it will stop compelling banks to submit rates for the calculation of LIBOR after 2021. It is not possible to predict the effect of these changes, other reforms or the establishment of

alternative reference rates. The discontinuation or modification of LIBOR could result in interest rate increases on our debt, which could adversely affect our cash flow and operating results.

If we are unable to repay or refinance our debt, we cannot guarantee that we will be able to generate enough cash flows from operations or that we will be able to obtain enough capital to service our debt, fund our planned capital expenditures or pay future dividends. In such an event, we could face substantial liquidity issues and might be required to issue equity securities or securities convertible into equity securities, or sell some of our assets to meet our debt payment obligations. Failure to repay or refinance indebtedness when required could result in a default under such indebtedness. If we incur additional indebtedness, any such indebtedness could exacerbate the risks described above.

Sales or issuances of a substantial number of shares of our common stock or securities convertible into shares of our common stock may adversely affect the market price of our common stock.

Future sales or issuances of common stock or other equity related securities may adversely affect the market price of our common stock, including any shares of our common stock issued to finance capital expenditures, finance acquisitions or repay debt. Our business strategy contemplates access to external financing to fund certain discretionary investments, which may include issuances of common stock or other equity related securities. We maintain an "at-the-market" stock offering program ("2018 ATM Program") through which we may, from time to time, issue and sell shares of our common stock having an aggregate gross sales price of up to $750 million to or through sales agents. As of February 22, 2019, we had approximately $750 million of gross sales of common stock remaining under our 2018 ATM Program. From time to time, we may refresh or implement a new "at-the-market" stock offering program. See note 11 to our consolidated financial statements. As of February 22, 2019, we had approximately 416 million shares of common stock outstanding.

We have reserved 10 million and 17 million shares of common stock, respectively, for issuance in connection with awards granted under our various stock compensation plans and our 6.875% Convertible Preferred Stock, which will automatically convert into common stock on August 1, 2020. See "Item 7. MD&A—Liquidity and Capital Resources—Mandatory Convertible Preferred Stock." The dividends on our 6.875% Convertible Preferred Stock may also be paid in cash or, subject to certain limitations, shares of common stock or any combination of cash and shares of common stock.

Further, a small number of common stockholders own a significant percentage of our outstanding common stock. If any one of these common stockholders, or any group of our common stockholders, sells a large quantity of shares of our common stock, or the public market perceives that existing common stockholders might sell a large quantity of shares of our common stock, the market price of our common stock may significantly decline.

As a result of competition in our industry, we may find it more difficult to negotiate favorable rates on our new or renewing tenant contracts.

Our growth is dependent on our entering into new tenant contracts (including amendments to contracts upon modification of an existing tower, fiber, or small cell installation), as well as renewing or renegotiating tenant contracts when existing tenant contracts terminate. Competition in our industry may make it more difficult for us to attract new tenants, maintain or increase our gross margins, or maintain or increase our market share. In addition, competition (primarily in our fiber solutions business) may, in certain circumstances, cause us to renegotiate certain existing tenant contracts to avoid early contract terminations. We face competition for site rental tenants and associated contractual rates from various sources, including (1) other independent communications infrastructure owners or operators, including those that own, operate, or manage towers, rooftops, broadcast towers, utility poles, fiber (including non-traditional competitors such as cable providers) or small cells, or (2) new alternative deployment methods for communications infrastructure.

Our Fiber operations may have different competitors than our Towers business, including other owners of fiber, as well as new entrants into small cells and fiber solutions, some of which may have larger networks or greater financial resources than we have.

New technologies may reduce demand for our communications infrastructure or negatively impact our revenues.

Improvements in the efficiency, architecture, and design of communication networks may reduce the demand for our communications infrastructure. For example, new technologies that may promote network sharing, joint development, wireless backhaul, or resale agreements by our tenants, such as signal combining technologies or network functions virtualization, may reduce the need for our communications infrastructure. In addition, other technologies, such as WiFi, Distributed Antenna Systems ("DAS"), femtocells, other small cells, or satellite (such as low earth orbiting) and mesh transmission systems may, in the future, serve as substitutes for, or alternatives to, leasing on communications infrastructure that might otherwise be anticipated or expected had such technologies not existed. In addition, new technologies that enhance the range, efficiency, and capacity of communication equipment could reduce demand for our communications infrastructure. Any significant reduction in demand for our

communications infrastructure resulting from the new technologies may negatively impact our revenues or otherwise have a material adverse effect on us.

If we fail to retain rights to our communications infrastructure, including the land interests under our towers and the right-of-way and other agreements related to our small cells and fiber solutions, our business may be adversely affected.

The property interests, on which our communications infrastructure resides, including the land interests under our towers, consist of leasehold and sub-leasehold interests, fee interests, easements, licenses, and rights-of-way. A loss of these interests may interfere with our ability to conduct our business or generate revenues. For various reasons, we may not always have the ability to access, analyze, or verify all information regarding titles or other issues prior to acquiring communications infrastructure. Further, we may not be able to renew ground leases or other agreements on commercially viable terms.

Our ability to retain rights to the land interests on which our towers reside depends on our ability to purchase such land, including fee interests and perpetual easements, or renegotiate or extend the terms of the leases relating to such land. Approximately 10% of our Towers site rental gross margin for the year ended December 31, 2018 was derived from towers where the leases for the interests under such towers had final expiration dates of less than 10 years. If we are unable to retain rights to the property interests on which our communications infrastructure resides, our business may be adversely affected.

As of December 31, 2018, approximately 53% of our towers were leased or subleased or operated and managed under master leases, subleases, or other agreements with AT&T, Sprint, and T-Mobile. We have the option to purchase these towers at the end of their respective lease terms. We have no obligation to exercise such purchase options. We may not have the required available capital to exercise our right to purchase some or all of these towers at the time these options are exercisable. Even if we do have available capital, we may choose not to exercise our right to purchase these towers or some or all of the T-Mobile or AT&T towers for business or other reasons. In the event that we do not exercise these purchase rights, or are otherwise unable to acquire an interest that would allow us to continue to operate these towers after the applicable period, we will lose the cash flows derived from such towers, which may have a material adverse effect on our business. In the event that we decide to exercise these purchase rights, the benefits of the acquisition of these towers may not exceed the costs, which could adversely affect our business. Additional information concerning these towers and the applicable purchase options as of December 31, 2018 is as follows:

| |

• | 22% of our towers are leased or subleased or operated and managed under a master prepaid lease or other related agreements with AT&T for a weighted-average initial term of approximately 28 years, weighted on Towers site rental gross margin. We have the option to purchase the leased and subleased towers from AT&T at the end of the respective lease or sublease terms for aggregate option payments of approximately $4.2 billion, which payments, if exercised, would be due between 2032 and 2048. |

| |

• | 16% of our towers are leased or subleased or operated and managed for an initial period of 32 years (through May 2037) under master leases, subleases or other agreements with Sprint. We have the option to purchase in 2037 all (but not less than all) of the leased and subleased Sprint towers from Sprint for approximately $2.3 billion. |

| |

• | 15% of our towers are leased or subleased or operated and managed under a master prepaid lease or other related agreements with T-Mobile for a weighted-average initial term of approximately 28 years, weighted on Towers site rental gross margin. We have the option to purchase the leased and subleased towers from T-Mobile at the end of the respective lease or sublease terms for aggregate option payments of approximately $2.0 billion, which payments, if exercised, would be due between 2035 and 2049. In addition, through the T-Mobile Acquisition, there are another 1% of our towers subject to a lease and sublease or other related arrangements with AT&T. We have the option to purchase these towers that we do not otherwise already own at the end of their respective lease terms for aggregate option payments of up to approximately $405 million, which payments, if exercised, would be due prior to 2032 (less than $10 million would be due before 2025). |