UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

(Mark One)

| £ |

|

ANNUAL REPORT UNDER SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

or

| £ |

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from

to

Commission File No. 0-27443

BAYOU CITY EXPLORATION, INC.

(Exact name of registrant as specified in

its charter)

| |

|

|

| NEVADA |

|

61-1306702 |

|

(State or other jurisdiction of incorporation

or organization)

|

|

(I.R.S. Employer Identification No.) |

| |

|

|

| 632 Adams Street — Suite 700, Bowling Green, KY |

|

42101 |

|

(Address of principal executive offices)

|

|

(Zip Code) |

Registrant’s telephone number, including area code: (270)

842-2421

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Name of each exchange on which registered |

| |

|

|

| |

|

|

Securities registered pursuant to section

12(g) of the Act:

Common Stock, $0.005 par value

(Title of

class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in rule 405 of the Securities Act. Yes o No þ

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes £ No þ

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of

delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained in this form,

and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated

by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions

of “large accelerated filer,” “accelerated Filer” and “smaller reporting company” in Rule

12b-2 of the Exchange Act.

| Large accelerated filer o |

Accelerated filer o |

| Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company þ |

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

The aggregate market value of the voting

and non-voting common equity held by non-affiliates of the registrant as of June 30, 2012, the last day of the registrant’s

most recently completed second quarter, was $870,129.

As of March 21, 2013 the registrant had

990,230 shares of Common Stock, par value $0.005 per share, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE None.

FORM 10-K

TABLE OF CONTENTS

| PART I |

|

2 |

| ITEM 1. |

BUSINESS |

2 |

| ITEM 1A. |

RISK FACTORS |

7 |

| ITEM 1B. |

UNRESOLVED STAFF COMMENTS |

7 |

| ITEM 2. |

PROPERTIES |

7 |

| ITEM 3. |

LEGAL PROCEEDINGS |

11 |

| ITEM 4. |

MINE SAFETY DISCLOSURES |

11 |

| PART II |

|

11 |

| ITEM 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

11 |

| ITEM 6. |

SELECTED FINANCIAL DATA |

12 |

| ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

13 |

| ITEM 7A. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

16 |

| ITEM 8. |

FINANCIAL STATEMENTS and supplementary data |

16 |

| ITEM 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

16 |

| ITEM 9a. |

CONTROLS AND PROCEDURES |

16 |

| ITEM 9B. |

OTHER INFORMATION |

18 |

| PART III |

|

18 |

| ITEM 10. |

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

18 |

| ITEM 11. |

EXECUTIVE COMPENSATION |

19 |

| ITEM 12. |

SECURITIES OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

21 |

| ITEM 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

22 |

| ITEM 14. |

PRINCIPAL ACCOUNTANTing FEES AND SERVICES |

23 |

| ITEM 15. |

EXHIBITS, FINANCIAL STATEMENT SCHEDULES |

23 |

| SIGNATURES |

26 |

INTRODUCTORY COMMENT

Throughout this Annual Report on Form 10-K

(this "Report”), the terms “we,” “us,” “our,” or the “Company” refers

to Bayou City Exploration, Inc., a Nevada corporation.

FORWARD

LOOKING STATEMENTS

When used in this Report, the words “may,”

“will,” “expect,” “anticipate,” “continue,” “estimate,” “intend,”

and similar expressions are intended to identify forward-looking statements within the meaning of Section 27A of the Securities

Act of 1933, as amended (the “Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”) regarding events, conditions and financial trends which may affect the Company’s future plans of operations,

business strategy, operating results and financial position. Such statements are not guarantees of future performance and are subject

to risks and uncertainties described herein and actual results may differ materially from those included within the forward-looking

statements. Additional factors are described in the Company’s other public reports and filings with the Securities

and Exchange Commission (the “SEC”). Readers are cautioned not to place undue reliance on these forward-looking statements,

which speak only as of the date made. The Company undertakes no obligation to publicly release the result of any revision of these

forward-looking statements to reflect events or circumstances after the date they are made or to reflect the occurrence of unanticipated

events.

This Report contains certain estimates

and plans related to us and the industry in which we operate, which assume certain events, trends and activities will occur and

the projected information based on those assumptions. We do not know that all of our assumptions are accurate. If our assumptions

are wrong about any events, trends and activities, then our estimates for future growth for our business may also be wrong. There

can be no assurance that any of our estimates as to our business growth will be achieved.

The following discussion and analysis should

be read in conjunction with our financial statements and the notes associated with them contained elsewhere in this Report. This

discussion should not be construed to imply that the results discussed in this Report will necessarily continue into the future

or that any conclusion reached in this Report will necessarily be indicative of actual operating results in the future. The discussion

represents only the best assessment of management.

PART I

ITEM

1. business

Development of the Company

Bayou City Exploration, Inc., a Nevada

corporation (the “Company”), was organized in November 1994, as Gem Source, Incorporated and in June 1996 changed its

name to Blue Ridge Energy, Inc. On June 8, 2005, the Company again changed its name to Bayou City Exploration, Inc.

Overview of Business

The Company is primarily engaged in the

oil and gas exploration business, and focuses its operations in the gulf coast of Texas, east Texas, south Texas, and Louisiana.

The Company also serves as the Managing Member and Investment Manager of funds organized as limited liability companies to acquire

portfolios of mortgage notes and land contracts secured by real estate (the “Mortgage Notes and Land Contracts”). Nevertheless,

most of our business resources are focused upon the management of partnerships created to explore and develop oil and gas reserves.

We manage partnerships that purchase interests in exploratory wells and/or interests in producing oil and gas properties with undrilled

reserves. Our growth strategy is based on sponsoring partnerships in which third party investors purchase an interest. These partnerships

then assume the costs associated with the drilling of oil and gas wells in exchange for units in a partnership that holds a portion

of the working interest derived from the wells they finance. We act as the managing general partner for these partnerships and

typically maintain a 10% interest in such partnerships, but may also maintain a working interest position outside of the partnership

in each program for which we pay our proportionate share of the actual cost of drilling, testing, and completing the project and

subsequent operating expenses to the extent that we retain a portion of the working interest. We believe this strategy allows for

a reduction of financial risk associated with drilling new wells, while enabling us to earn income from present production in addition

to income from any successful new drilling.

Oil and Gas Drilling Partnerships

and Properties

When we undertake a drilling project, a

calculation is made to estimate the costs associated with drilling the project well(s). The Company then forms and sells interest

in a partnership that will acquire working interest in the wells and undertake drilling operations. We typically enter into turnkey

contracts with the partnerships we manage, pursuant to which we agree to undertake the drilling and completion of the partnerships’

well(s), for a fixed price, to a specific formation or depth (each, a “Turnkey Agreement”). As such, each partnership

essentially prepays a fixed amount for the drilling and completion of a specified number of wells, which we record as revenue.

As of December 31, 2012, we served as the

managing general partner of eight limited partnerships formed for the purpose of oil and gas exploration and drilling. The Company

has entered into Turnkey Agreements with each of these partnerships pursuant to which we receive turnkey fees for drilling the

partnerships’ wells and, if applicable, completing the wells (the “Turnkey Fees”).

The 2011 Bayou City Two Well Drilling Program,

L.P. (the “2011 Drilling Program”) was formed in Kentucky on January 10, 2011, and planned to acquire up to a 2.125%

working interest in two oil and gas wells known as the Miller Prospect Well and the Squeeze Box Prospect Well in Colorado County,

Texas. The 2011 Drilling Program has acquired a 1.78% working interest in the wells. The Company paid for and holds a 10% interest

in this partnership and receives management fees equal to the excess, if any, of the Turnkey Fees over the total cost to the Company

of drilling and if applicable, completing the partnership wells.

The 2011-B Bayou City Two Well Drilling

Program, L.P. (the “2011-B Drilling Program”) was formed in Kentucky on March 4, 2011 to acquire a 5% working interest

in two oil wells, in what is known as the Friesian Well, located in Colorado County, Texas and the Little Chenier Well, located

in Cameron Parish, Louisiana. The Company paid for and holds a 10% interest in this partnership and receives management fees equal

to the excess, if any, of the Turnkey Fees over the total cost to the Company of drilling and if applicable, completing the partnership

wells.

The 2011 Bayou City Drilling & Production

Program, L.P. (the “Drilling and Production Program”) was formed on March 18, 2011 to acquire a 2.875% working interest

in the same two wells as the 2011 and 2011-B Drilling Programs. The Company paid for and holds a 10% interest in this partnership

and receives management fees equal to the excess, if any, of the Turnkey Fees over the total cost to the Company of drilling and

if applicable, completing the partnership wells.

The 2011-C Bayou City Offset Drilling Program,

L.P. (the “2011-C Drilling Program”) was formed in Kentucky on April 12, 2011 to acquire up to a 5% working interest

in the Kleimann #1 Well, located in Colorado County, Texas. The 2011-C Drilling Program ended up only acquiring a 2.625% working

interest in the Kleimann #1 well. The Company paid for and holds a 10% interest in this partnership and receives management fees

equal to the excess, if any, of the Turnkey Fees over the total cost to the Company of drilling and if applicable, completing the

partnership well.

The 2011-D Bayou City Two Well Drilling

Program, L.P. (the “2011-D Drilling Program”) was formed in Kentucky on May 10, 2011 to acquire a 5% working interest

in the Prairie Bell West Prospect Well and the Prairie Bell East Prospect Well located in Colorado County, Texas. The

Company paid for and holds a 10% interest in this partnership and receives management fees equal to the excess, if any, of the

Turnkey Fees over the total cost to the Company of drilling and if applicable, completing the partnership wells.

The 2011 Bayou City Year End Drilling Program,

L.P. (“2011 Year End Program”) was formed in Kentucky on September 13, 2011 to acquire a 6.48% working interest in

the Loma Blanca Well located in Brooks County, Texas. The Company paid for and holds a 10% interest in this partnership

and receives management fees equal to the excess, if any, of the Turnkey Fees over the total cost to the Company of drilling and

if applicable, completing the partnership well.

The 2012-A Bayou City Year Drilling Program,

L.P. (“2012-A Program”) was formed in Kentucky on December 13, 2011 to acquire an 8.33% working interest in the Altair

Well located in Colorado County, Texas. The Company paid for and holds a 10% interest in this partnership and receives

management fees equal to the excess, if any, of the Turnkey Fees over the total cost to the Company of drilling and if applicable,

completing the partnership well.

The 2012 Bayou City Squeezebox Offset Program,

L.P. (“2012 Squeezebox Offset”) was formed in Kentucky on March 13, 2012 to acquire up to a 5% working interest in

the Squeezebox Shallow well located in Cameron Parrish, Louisiana. The Company paid for and holds a 10% interest in this partnership

and receives management fees equal to the excess, if any, of the Turnkey Fees over the total cost to the Company of drilling and

if applicable, completing the partnership well.

The Opportunity Funds and Affiliated Partners

In April 2011, the Company acquired a 25%

ownership interest in Affiliated Partners, a general partnership formed for the purpose of holding an 80% interest in Loanmod,

LLC, a Delaware limited liability company (“Loanmod”). Affiliated Partners is also owned by our President, Chief Executive

Officer, Chief Financial Officer and director, Stephen Larkin (50%) and our other director, Travis Creed (25%). The Company acquired

its interest in Affiliated Partners in exchange for its agreement to serve as the managing member and investment manager of the

Opportunity Fund VII, LLC, a Delaware limited liability company (the “Opportunity Fund VII”), which invests in mortgage

notes and land contracts secured by real estate. The Company also serves as the managing member and investment manager of the BYCX

Opportunity Fund I (“BYCX Fund I”), established in June 2011, and the Opportunity Fund VIII, LLC (the “Opportunity

Fund VIII,” and collectively with the other managed funds, the “Opportunity Funds”), established in February

2013, both of which are also Delaware limited liability company that invest in Mortgage Notes and Land Contracts.

The purchases of Mortgage Notes and Land Contracts by the Opportunity Funds are facilitated primarily by Loanmod, which receives

income as a result in connection with its acquisition of Mortgage Notes and Land Contracts for the Opportunity Funds. In the event

that the Opportunity Funds acquire Mortgage Notes and Land Contracts from an unaffiliated party, Loanmod is entitled to a transaction

fee from such Opportunity Fund equal to 2.5% of the purchase price of all Mortgage Notes and Land Contracts acquired from such

third party.

The BYCX Fund I was organized on June 28,

2011 with the objective of investing in a managed portfolio comprised of Mortgage Notes and Land Contracts secured by real estate

to provide members with quarterly cash distributions. The subscription periods in which units were offered for sale in the

Opportunity Funds have closed. Fund VI, BYCX Fund I and Opportunity Fund VII are participants in a “Holding Fund” called

2011-12 Opportunity Fund 6-1, LLC, which is managed by the Company and Blue Ridge Group, Inc. As of January 2013, Fund VI owns

approximately 52% of the Holding Fund, BYCX Fund I owns approximately 28% of the Holding Fund and Opportunity Fund VII owns approximately

20% of the Holding Fund. The Holding Fund has acquired 437 Mortgage Notes and Land Contracts with unpaid balances totaling approximately

$15,807,695. The Holding Fund was capitalized with approximately $10,632,660 as of December 31, 2012. The first quarterly distributions

from the Holding Fund were made in January 2012 and as of January 2013 a total of approximately $838,634 has been distributed to

Holding Fund members.

Competition, Markets and Regulations

Competition in the Oil and Gas industry:

The oil and gas industry is highly competitive in all its phases. The sale of interests in oil and gas projects, like those sponsored

by the Company, is also very competitive. Major and independent oil and gas companies actively bid for desirable oil and gas prospects.

Many of our competitors are substantially larger than we are and possess substantially greater financial resources, personnel,

and budgets than we do, which may affect our ability to compete.

Competition in the Mortgage Notes and

Land Contracts Industry: Our success depends, in large part, on our ability to acquire assets at favorable spreads

over our borrowing costs. In acquiring mortgage-related investments, we compete with mortgage REITs, mortgage finance and specialty

finance companies, savings and loan associations, banks, mortgage bankers, insurance companies, mutual funds, institutional investors,

investment banking firms, other lenders, governmental bodies and other entities. These entities and others that may be organized

in the future may have similar asset acquisition objectives and increase competition for the available supply of mortgage assets

suitable for purchase. Additionally, our investment strategy is dependent on the amount of financing available to us in the repurchase

agreement market, which may also be impacted by competing borrowers. Our investment strategy will be adversely impacted if we

are not able to secure financing on favorable terms, if at all.

Oil and Gas Markets: The price obtainable

for oil and gas production from our properties and the oil and gas partnerships we manage is affected by market factors beyond

our control. Such factors include the extent of domestic production, the level of imports of foreign oil and gas, the general level

of market demand on a regional, national and worldwide basis, domestic and foreign economic conditions that determine levels of

industrial production, political events in foreign oil-producing regions, variations in governmental regulations and tax laws and

the imposition of new governmental requirements upon the oil and gas industry. There can be no assurance that oil and gas prices

will not decrease in the future, thereby decreasing net revenues from our properties. Changes in oil and gas prices can impact

our determination of proved reserves as well as our calculation of the standardized measure of discounted future net cash flows

relating to oil and gas reserves. In addition, demand for oil and gas in the United States and worldwide may affect the levels

of production obtained by our properties. From time to time, a surplus of gas or oil supplies may exist, the effect of which may

be to reduce the amount of hydrocarbons that we may produce and sell, while such an oversupply exists. In recent years, initial

steps have been taken to provide additional gas pipelines from Canada to the United States. If additional Canadian gas is brought

to the United States market, it could create downward pressure on United States gas prices.

Mortgage Notes and Land Contracts Market:

There are a number of firms, institutions and individuals who buy Mortgage Notes and Land Contracts similar to those purchased

by the Opportunity Funds. Some of the buyers have substantially greater financial, technical and other resources than the Opportunity

Funds.

Environmental Regulation

As the managing general partner of the

Company’s drilling partnerships, our operations are subject to environmental protection regulations established by federal,

state, and local agencies that may necessitate significant capital outlays that, in turn, would materially affect our financial

position and business operations. These regulations, enacted to protect against waste, conserve natural resources and prevent pollution,

could necessitate spending funds on environmental protection measures, rather than on drilling operations. Because these laws and

regulations change frequently and are becoming increasingly more stringent, the costs to the Company of compliance with existing

and future environmental regulations and the overall impact on our operations or financial condition cannot be predicted, but are

likely to increase. Furthermore, if any penalties or prohibitions were imposed upon us for violating such regulations, our operations

would be adversely affected.

The oil and gas partnerships we sponsor

and manage hold interests in properties upon which each partnership has or intends to explore for and produce oil and natural gas.

Such properties and the wastes disposed thereon may be subject to the Comprehensive Environmental Response, Compensation and Liability

Act (“CERCLA”), the Resource Conservation and Recovery Act (“RCRA”) and

analogous state laws, as well as state laws governing the management of oil and natural gas wastes. Under such laws, the Company

and the partnerships we manage could be required to remove or remediate previously disposed wastes (including wastes disposed of

or released by prior owners or operators) or property contamination (including groundwater contamination) or to perform remedial

plugging operations to prevent future contamination.

CERCLA and similar state laws impose liability,

without regard to fault or the legality of the original conduct, on certain classes of persons that are considered to have contributed

to the release of a “hazardous substance” into the environment. These persons include the owner or operator of the

disposal site or sites where the release occurred and companies that disposed of or arranged for the disposal of the hazardous

substances found at the site. Persons who are or were responsible for the waste of hazardous substances under CERCLA may be subject

to joint and several liability for the costs of cleaning up the hazardous substances that have been released into the environment

and for damages to natural resources, and it is not uncommon for neighboring landowners and third parties to file claims for personal

injury and property damage allegedly caused by the hazardous substances released into the environment.

Climate Change Legislation and Greenhouse

Gas Regulation.

Studies in recent years have indicated

that emissions of certain gases may be contributing to warming of the Earth’s atmosphere. Many nations have agreed to limit

emissions of greenhouse gases (“GHGs”) pursuant to the United Nations Framework Convention on Climate Change, and the

Kyoto Protocol. Methane, a primary component of natural gas, and carbon dioxide, a byproduct of the burning of crude oil, natural

gas, and refined petroleum products, are considered GHGs regulated by the Kyoto Protocol. Although the United States is currently

not participating in the Kyoto Protocol, several states have adopted legislation and regulations to reduce emissions of GHGs. Restrictions

on emissions of methane or carbon dioxide that may be imposed in various states could adversely affect our operations and demand

for crude oil and natural gas. On December 7, 2009, the Environmental Protection Agency (“EPA”) issued a finding

that serves as the foundation under the Clean Air Act to issue rules that would result in federal GHGs regulations and emissions

limits under the Clean Air Act, even without Congressional action. On September 29, 2009, the EPA also issued a GHG monitoring

and reporting rule that requires certain parties, including participants in the oil and gas industry, to monitor and report

their GHG emissions, including methane and carbon dioxide, to the EPA. The emissions will be published on a register to be made

available on the Internet. These regulations may apply to the operations engaged in by our managed oil and gas partnerships. The

EPA has proposed two other rules that would regulate GHGs, one of which would regulate GHGs from stationary sources, and may

affect the oil and gas exploration and production industry and the pipeline industry. The EPA’s finding, the GHG reporting

rule, and the proposed rules to regulate the emissions of GHGs would result in federal regulation of carbon dioxide emissions

and other GHGs, and may affect the outcome of other climate change lawsuits pending in United States federal courts in a manner

unfavorable to the oil and gas industry.

Proposed Regulation.

Various legislative proposals are being

considered in Congress and in the legislatures of various states, which, if enacted, may significantly and adversely affect the

petroleum and gas industries. Such proposals involve, among other things, the imposition of price controls on all categories of

natural gas production, the imposition of land use controls, such as prohibiting drilling activities on certain federal and state

lands in protected areas, as well as other measures. At the present time, it is impossible to predict what proposals, if any, will

actually be enacted by Congress or the various state legislatures and what effect, if any, such proposals will have on our operations.

Federal Regulation of Natural Gas

The transportation and sale of natural

gas in interstate commerce is heavily regulated by agencies of the federal government. The following discussion is intended only

as a summary of the principal statutes, regulations and orders that may affect the production and sale of natural gas from our

oil and gas holdings.

Federal Energy Regulatory Commission

Orders

Several major regulatory changes have been

implemented by the Federal Energy Regulatory Commission (“FERC”) from 1985 to the present that affect the economics

of natural gas production, transportation and sales. In addition, the FERC continues to promulgate revisions to various aspects

of the rules and regulations affecting those segments of the natural gas industry that remain subject to the FERC’s jurisdiction.

In April 1992, the FERC issued Order No. 636 pertaining to pipeline restructuring. This rule requires interstate pipelines

to unbundle transportation and sales services by separately stating the price of each service and by providing customers only the

particular service desired, without regard to the source for purchase of the gas. The rule also requires pipelines to (i) provide

nondiscriminatory “no-notice” service allowing firm commitment shippers to receive delivery of gas on demand up to

certain limits without penalties, (ii) establish a basis for release and reallocation of firm upstream pipeline capacity and (iii) provide

non-discriminatory access to capacity by firm transportation shippers on a downstream pipeline. The rule requires interstate pipelines

to use a straight fixed variable rate design. The rule imposes these same requirements upon storage facilities. FERC Order No. 500

affects the transportation and marketability of natural gas. Traditionally, natural gas has been sold by producers to pipeline

companies, which then resell the gas to end-users. FERC Order No. 500 alters this market structure by requiring interstate

pipelines that transport gas for others to provide transportation service to producers, distributors and all other shippers of

natural gas on a nondiscriminatory, “first-come, first-served” basis (“open access transportation”), so

that producers and other shippers can sell natural gas directly to end-users. FERC Order No. 500 contains additional provisions

intended to promote greater competition in natural gas markets.

It is not anticipated that the marketability

of and price obtainable for natural gas production from our oil and gas interests will be significantly affected by FERC Order

No. 500. Gas produced from our properties normally will be sold to intermediaries who have entered into transportation arrangements

with pipeline companies. These intermediaries will accumulate gas purchased from a number of producers and sell the gas to end-users

through open access pipeline transportation.

Regulation of Mortgage Notes and

Land Contracts

The U.S. Government, through the U.S. Federal

Reserve, the Federal Housing Administration (“FHA”), and the Federal Deposit Insurance Corporation, has implemented

a number of federal programs designed to assist homeowners, including the Home Affordable Modification Program, or HAMP, which

provides homeowners with assistance in avoiding residential mortgage loan foreclosures, the Hope for Homeowners Program, or H4H

Program, which allows certain distressed borrowers to refinance their mortgages into FHA-insured loans in order to avoid residential

mortgage loan foreclosures, and the Home Affordable Refinance Program, or HARP, which applies to loans sold or guaranteed by government-sponsored

enterprises on or prior to May 31, 2009, allows borrowers who are current on their mortgage payments to refinance and reduce their

monthly mortgage payments, with no current loan-to-value ratio upper limit and without requiring new mortgage insurance. HAMP,

the H4H Program and other loss mitigation programs may involve, among other things, the modification of mortgage loans to reduce

the principal amount of the Mortgage Notes and Land Contracts held by the Opportunity Funds (through forbearance and/or forgiveness)

and/or the rate of interest payable on the loans, or the extension of payment terms of the loans. A significant number of loan

modifications with respect to loans in the Opportunity Funds’ portfolios that have not already been modified could result

in increased prepayment rates and negatively impact the realized yields and cash flows on such loans. These loan modification programs,

future legislative or regulatory actions, including possible amendments to the bankruptcy laws, which result in the modification

of outstanding residential mortgage loans, as well as changes in the requirements necessary to qualify for refinancing mortgage

loans with Fannie Mae, Freddie Mac or Ginnie Mae, may adversely affect the value of, and the returns on, residential Mortgage Notes

and Land Contracts held by the Opportunity Funds.

In response to the financial issues affecting

the banking system and financial markets and going concern threats to commercial banks, investment banks and other financial institutions,

the Emergency Economic Stabilization Act, or EESA, was enacted by the U.S. Congress in 2008. There can be no assurance that the

EESA or any other U.S. Government actions will have a beneficial impact on the financial markets. To the extent the markets do

not respond favorably to any such actions by the U.S. Government or such actions do not function as intended, our business may

not receive the anticipated positive impact from the legislation and such result may have broad adverse market implications.

In July 2010, the U.S. Congress enacted

the Dodd Frank Wall Street Reform and Consumer Protection Act, or the Dodd-Frank Act, in part to impose significant investment

restrictions and capital requirements on banking entities and other organizations that are significant to U.S. financial markets.

For instance, the Dodd-Frank Act imposes significant restrictions on the proprietary trading activities of certain banking entities

and subjects other systemically significant organizations regulated by the U.S. Federal Reserve to increased capital requirements

and quantitative limits for engaging in such activities. The Dodd-Frank Act also seeks to reform the asset-backed securitization

market (including the mortgage-backed securities market) by requiring the retention of a portion of the credit risk inherent in

a pool of securitized assets and by imposing additional registration and disclosure requirements. Certain of the new requirements

and restrictions exempt agency securities, other government issued or guaranteed securities, or other securities. Nonetheless,

the Dodd-Frank Act also imposes significant regulatory restrictions on the origination of residential mortgage loans and will impact

the formation of new issuances of non-agency securities. The Dodd-Frank Act has also created a new regulatory bureau, the Consumer

Financial Protection Bureau, or the CFPB, which now oversees many of the core laws which regulate the mortgage industry, including

among others, the Real Estate Settlement Procedures Act and the Truth in Lending Act. While the full impact of the Dodd-Frank Act

and the role of the CFPB cannot be assessed until all implementing regulations are released, the Dodd-Frank Act's extensive requirements

may have a significant effect on the financial markets, and may affect the availability of mortgage pools being traded and the

prices at which loans are purchased and sold. Restrictions on loan trading could have an adverse effect on the Opportunity Funds

and the the Mortgage Notes and Land Contracts held by them.

State Regulations

Production of oil and gas from our oil

and gas holdings is affected by state regulations. States in which we operate have statutory provisions regulating the production

and sale of oil and gas, including provisions regarding deliverability. Such statutes, and the regulations promulgated in connection

therewith, are generally intended to prevent waste of oil and gas and to protect correlative rights to produce oil and gas between

owners of a common reservoir. State regulatory authorities also regulate the amount of oil and gas produced by assigning allowable

rates of production to each well or proration unit.

Operating Hazards and Insurance

General: The oil and gas business

involves a variety of operating risks, including the risk of fire, explosions, blow-outs, pipe failure, casing collapse, abnormally

pressured formations and environmental hazards such as oil spills, gas leaks, ruptures and discharges of toxic gases. The occurrence

of any of these events could result in substantial losses due to severe damage to or destruction of property, natural resources

and equipment, pollution or other environmental damage, clean-up responsibilities, regulatory investigation and penalties and suspension

of operations. The occurrence of a significant event could materially and adversely affect our future revenues from any given prospect.

Recent Terrorist Activities and the

Potential for Military and Other Actions: The continued threat of terrorism and the impact of retaliatory military and other

action by the United States and its allies might lead to increased political, economic and financial market instability and volatility

in prices for oil and natural gas, which could affect the market for our exploration and production operations. In addition, future

acts of terrorism could be directed against companies operating in the United States, and it has been reported that terrorists

might be targeting domestic energy facilities. While we believe that the risk to our energy assets is minimal, there is no assurance

that we can completely secure our assets or completely protect them against a terrorist attack. These developments have subjected

our operations to increased risks and, depending on their ultimate magnitude, could have a material adverse effect on our business.

In particular, we might experience increased capital or operating costs to implement increased security for our energy assets.

Employees

We currently have one employee, Stephen

C. Larkin, our President, Chief Executive Officer and Chief Financial Officer, who is employed by the Company full time. From time

to time we may engage outside consultants to perform service on the Company’s behalf. In addition, we often utilize the resources

of Blue Ridge Group, Inc., with whom we share common management. See “Item 13. Certain Relationships and Related Transactions,

and Director Independence.”

Additional Information

We are required to file annual reports

on Form 10-K and quarterly reports on Form 10-Q with the Securities and Exchange Commission (the “SEC”) on a regular

basis, and are required to disclose certain material events in a current report on Form 8-K. The public

may read and copy any materials that we file with the SEC at the Public Reference Room at the SEC located at 100 F Street NE, Washington,

DC 20549, on official business days during the hours of 10 a.m. to 3 p.m. The public may also obtain information on the operation

of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy

and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov.

In addition, our periodic reports may be found on our website, www.bcexploration.com. We will make available to any stockholder,

without charge, copies of any filings not otherwise available on our website. For copies of any other filings, please contact:

Stephen C. Larkin at Bayou City Exploration, Inc., 632 Adams Street — Suite 700, Bowling Green, Kentucky 42101 or call

(270) 842-2421.

ITEM

1A. RISK FACTORS

The Company is a “smaller reporting

company” as defined by Rule 12b-2 of the Exchange Act,

and as such, is not required to provide the information required under this Item.

ITEM

1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Principal Office

Our principal office is located at 632

Adams Street — Suite 700, Bowling Green, Kentucky 42101, in office space leased from GC Royalty, LLC and shared with

Blue Ridge Group, Inc. (“Blue Ridge Group”), which has common employees with the Company. GC Royalty, LLC is owned

by Robert and Doris Burr, who collectively beneficially own 29.79% of the Company’s Common Stock. For the year ended December

31, 2012, the space we occupy, which encompasses 24,205 square feet of office and general storage space, was leased by Blue Ridge

Group, and used by the Company pursuant to a management arrangement pursuant to which the Company paid Blue Ridge approximately

$44,000 per year for use of office space and certain general and administrative duties. In November 2012, the Company executed

a new lease for this same space, which became effective January 1, 2013 for a base monthly rent of $15,000. The new lease will

expire at the end of 2016. While we believe comparable office space would be available to us on commercially reasonable terms,

in the event we were not able to continue to use our current office space, it is likely new space would be acquired on substantially

different terms.

During 2011, the Company leased two office

suited located at 303 S. Jupiter Road, Allen, Texas 75002. On October 10, 2011, the Company signed an agreement with RMB Jupiter

Office Park, Ltd. (the “Landlord”), wherein the Company agreed to move from the two office suites previously leased

into one larger suite of approximately 2,041 square feet for $2,891.50 per month. The lease, which was amended on October 10, 2011,

extends a lease previously held by the Company and is for a five (5) year term that began November 1, 2011. In the event this office

space becomes unavailable, we believe comparable office space would be available on substantially similar terms.

Disclosure of Reserves

Net Proved Oil and Gas Reserves

In January 2009, the SEC adopted new rules

related to modernizing reserve calculation and disclosure requirements for oil and gas companies, which became effective prospectively

for annual reporting periods ending on or after December 31, 2009. In addition to expanding the definition and disclosure

requirements for crude oil and natural gas reserves, the new rule changes the requirements for determining quantities of crude

oil and natural gas reserves. The new rule requires disclosure of crude oil and natural gas proved reserves by significant geographic

area, using the un-weighted arithmetic average of the first-day-of-the-month commodity prices over the preceding 12-month period,

rather than end-of-period prices, and allows the use of reliable technologies to estimate proved crude oil and natural gas reserves,

if those technologies have been demonstrated to result in reliable conclusions about reserves volumes. Reserve and related information

for 2012 is presented consistent with the requirements of the new rule.

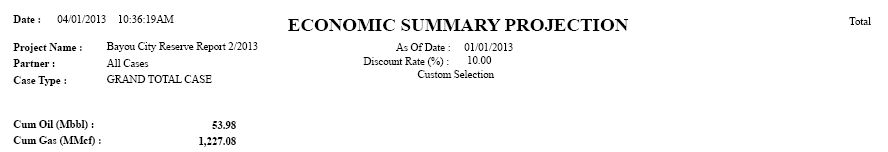

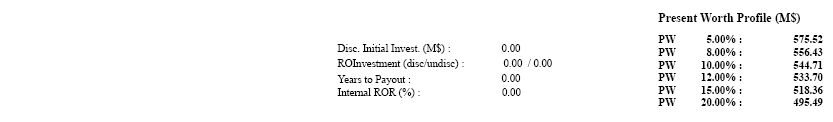

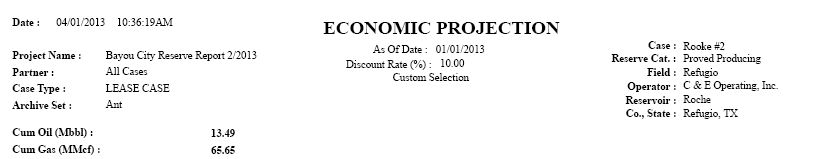

Presented below are the estimates of the

Company’s proved oil and natural gas reserves as of December 31, 2012, based upon a report prepared by Pressler Petroleum

Consultants, Inc. (“PPC”). All of the Company’s proved reserves are located in the United States.

Summary of Oil and Gas Reserves as of

December 31, 2012

| | |

Future Net Revenue, $ | |

Reserve

Category | |

Oil

(Bbls*) | | |

Gas

(Mcf**) | | |

Undiscounted | | |

Present Worth

at 10% | |

| Proved Developed Producing | |

| 5,400 | | |

| 68,180 | | |

$ | 612,240 | | |

$ | 544,710 | |

| Proved Developed Non-Producing | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total Net Proved Reserves | |

| 5,400 | | |

| 68,180 | | |

$ | 612,240 | | |

$ | 544,710 | |

*Bbls: Barrels of oil

**Mcf: Thousand cubic feet of gas

As specified by the SEC regulations, when

calculating economic producibility, the base product price must be the 12-month average price, calculated as the un-weighted arithmetic

average of the first-day-of-the-month price for each month within the prior 12-month period. The benchmark base prices used for

this evaluation were $94.71 per barrel of oil for West Texas Intermediate oil at Cushing, Oklahoma, and $2.849 per thousand standard

cubic feet of natural gas at Henry Hub, Louisiana. The oil and gas prices were adjusted on each well based on deductions such

as quality, energy content, and basis differential, as appropriate. Prices for oil and natural

gas were held constant throughout the remaining life of the properties.

Qualifications of

Technical Persons and Internal Controls Over the Reserves Estimation Process

Reserve engineering is inherently a subjective

process of estimating underground accumulations of oil and natural gas that cannot be measured exactly. The accuracy

of any reserve estimate is a function of the quality of available data and engineering and geological interpretation and judgment. Accordingly,

reserve estimates may vary from the quantities of oil and natural gas that are ultimately recovered. Future prices received

for production may vary, perhaps significantly, from the prices assumed for the purposes of estimating the standardized measure

of discounted future net cash flows. The standardized measure of discounted future net cash flows should not be construed

as the market value of the reserves at the date shown. The 10% discount factor required to be used under the provisions

of applicable accounting standards may not be the most appropriate discount factor based on interest rates in effect from time

to time and risks associated with the Company or the oil and natural gas industry. The standardized measure of discounted

future net cash flows is materially affected by assumptions about the timing of future production, which may prove to be inaccurate.

The reserve estimates reported herein were

prepared by independent engineers of PPC. The process performed by PPC engineers to prepare reserve amounts included

their estimation of reserve quantities, future producing rates, future net revenue and the present value of such future net revenue,

based in part on data provided by the Company. The estimates of reserves were determined by accepted industry methods.

Methods utilized by PPC in preparing the estimates include extrapolation of historical production trends and analogy to similar

producing properties. PPC believes the assumptions, data, methods and procedures utilized in preparing the estimates were appropriate

for the purpose served by their report, and that it utilized all methods and procedures it considered necessary to prepare their

report.

The Company’s internal control over

the preparation of reserve estimates is a process designed to provide reasonable assurance regarding the reliability of the Company’s

reserve estimates in accordance with SEC regulations. The preparation of reserve estimates are created by a third party

consultant, PPC, and overseen by the Company’s Director, President Chief Executive Officer and Chief Financial Officer, Stephen

C. Larkin. Mr. Larkin has been working with oil and gas companies since he began his position with Blue Ridge Group, Inc. in 2008.

PPC performs evaluations based on accepted engineering standards. Reserves were determined by decline curve projection in the case

of established production. For behind the pipe zones, reserves were calculated based on production and review of offset wells in

the area and by reviewing calculated volumetric data. These specific reserve estimates were performed by Mr. Stan S.

Valdez, P.E. and Mr. Andrew Tharp, E.I.T. of PPC. Mr. Valdez has over 16 years of practical experience in the estimation and evaluation

of petroleum reserves, as well as continuing education concerning the estimating and auditing of oil and gas reserves. He holds

a B.S. in Petroleum Engineering from Texas A&M University. Mr. Reis is a qualified reserves estimator as set forth in the “Standards

Pertaining to the Estimating and Auditing of Oil and Gas Reserves Information” promulgated by the Society of Petroleum

Engineers. Mr. Tharp has over one year of practical experience in the estimation and evaluation of oil and gas reserves and holds

a B.S. in Petroleum Engineering from the University of Texas at Austin.

Proved Undeveloped Reserves.

At this time the Company has no undeveloped properties under

lease.

Oil and Gas Production, Production

Prices and Production Costs.

The following table summarizes the sales

volumes of the Company’s net oil and gas production expressed in barrels of oil. Equivalent barrels of oil were obtained

by converting gas to oil on the basis of their relative energy content — six thousand cubic feet of gas equals one barrel

of oil. During 2012, 2011, and 2010 the average selling price for natural gas was $3.66, $5.06, and $4.44 per Mcf, respectively,

and the average selling price for oil was $92.45, $75.69, and $58.47 per barrel, respectively.

| | |

Net | | |

Net | | |

Net | |

| | |

Production | | |

Production | | |

Production | |

| | |

For the Year | | |

For the Year | | |

For the Year | |

| | |

12/31/2012 | | |

12/31/2011 | | |

12/31/2010 | |

| Net Volumes (Equivalent Barrels) | |

| 5,277 | | |

| 2,412 | | |

| 7,489 | |

| Average Sales Price per Equivalent Barrel | |

$ | 26.47 | | |

$ | 54.17 | | |

$ | 33.79 | |

| Average Production Cost per Equivalent Barrel (includes production taxes) | |

$ | 15.72 | | |

$ | 20.01 | | |

$ | 6.79 | |

The Average Production Cost per Equivalent

Barrel represents the Lease Operating Expenses divided by the Net Volumes in equivalent barrels. Lease Operating Expenses include

normal operating costs such as pumper fees, operator overhead, salt water disposal, repairs and maintenance, chemicals, equipment

rentals, production taxes and ad valorem taxes.

Drilling and Other Exploratory and

Development Activities.

In 2012, three partnerships were formed

that are managed by the Company and they drilled a total of one exploratory well and one developmental well, one of which is currently

in production, and one of which was determined to be a dry hole. There was also one exploratory well drilled in 2012 outside of

the managed partnerships that started into production in October 2012. In 2011, the six partnerships managed by the Company drilled

a total of seven exploratory wells and one developmental well, four of which are currently in production, one was determined to

be in dry hole, and two produced for a short period of time and then became unviable. In 2010, the one partnership managed by the

Company at the time drilled one exploratory well that was determined to be a dry hole and the Company drilled one developmental

well outside of the managed partnerships that is currently in production.

Present Activities.

The Company formed three new oil and gas

drilling partnerships in 2012. The partnerships drilled four wells, one began producing in 2012, one was deemed a dry hole, and

the remaining two wells began production in January 2013.

Delivery Commitments.

The Company is not currently committed

to providing a fixed and determinable quantity of oil or gas under any existing contract or agreement.

Oil and Gas Properties, Wells, Operations

and Acreage.

During 2012, the Company participated in

the drilling of three new wells, one of which was determined to be a dry hole and has been plugged and abandoned. See “Drilling

and Other Exploratory and Development Activities” above.

As of December 31, 2012, the Company

owned a direct working interest in six producing wells, including the Rooke #2, the Squeeze Box #1, the Kleimann #1, the Prairie

Bell East, the Loma Blanca, and the Koehn #2. Two other wells in which the Company owns working interest have been drilled, one

was a dry hole and the other produced for nine months and dried up in October 2012. The Company drilled one dry hole that was plugged

and abandoned. The Rooke #1, which stopped producing in October 2010, was converted into a salt water disposal well in 2011 and

has yet to be plugged and abandoned.

The following tables summarize by geographic

area the Company’s developed acreage and gross and net interests in producing oil and gas wells as of December 31, 2012.

The Company did not hold any undeveloped acreage at December 31, 2012. Productive wells are producing wells and wells mechanically

capable of production. Wells that are dually completed in more than one producing horizon are counted as one well.

DEVELOPED AND UNDEVELOPED ACREAGE

| | |

Developed Acreage | | |

Undeveloped Acreage | |

| Geographic Area: | |

Gross Acres | | |

Net Acres | | |

Gross Acres | | |

Net Acres | |

| | |

| | |

| | |

| | |

| |

| Louisiana | |

| 319.52 | | |

| 2.49 | | |

| -0- | | |

| -0- | |

| | |

| | | |

| | | |

| | | |

| | |

| Texas | |

| 2,117.44 | | |

| 76.52 | | |

| -0- | | |

| -0- | |

| | |

| | | |

| | | |

| | | |

| | |

| Totals | |

| 2,436.96 | | |

| 79.01 | | |

| -0- | | |

| -0- | |

PRODUCTIVE WELLS

| | |

Gross Wells | | |

Net Wells | |

| Geographic Area: | |

Oil | | |

Gas | | |

Oil | | |

Gas | |

| | |

| | |

| | |

| | |

| |

| Louisiana | |

| 0 | | |

| 1 | | |

| 0 | | |

| .01 | |

| | |

| | | |

| | | |

| | | |

| | |

| Texas | |

| 2 | | |

| 3 | | |

| .02 | | |

| .21 | |

| | |

| | | |

| | | |

| | | |

| | |

| Totals | |

| 2 | | |

| 4 | | |

| .02 | | |

| .22 | |

Key Properties

The working interest owned by the Company,

either directly or through the partnerships we manage, is owned jointly with other working interest partners. Management does not

believe any of these burdens materially detract from the value of the properties or materially interfere with their use. The following

are the primary properties held by the Company as of December 31, 2012.

Developed Properties

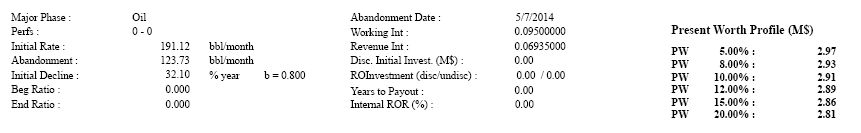

Rooke #2: The Company owns a 9.5%

working interest in one well located in Refugio County, Texas, which began production in May 2010. The well produces about six

Bbls per day.

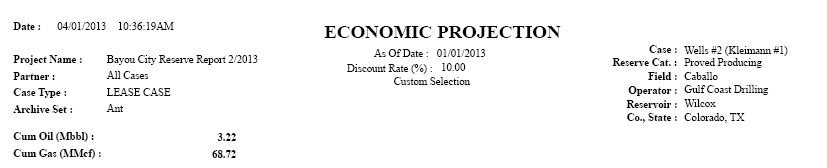

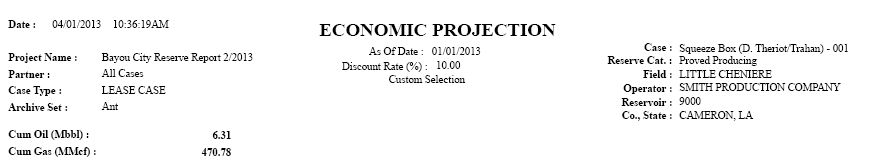

Kleimann

#1: The Company owns a 0.26% working interest in the Kleimann #1, a well located in Colorado

County, Texas. Production started on March 6, 2012 and the well is currently producing approximately 250 Mcf and six Bbls per day.

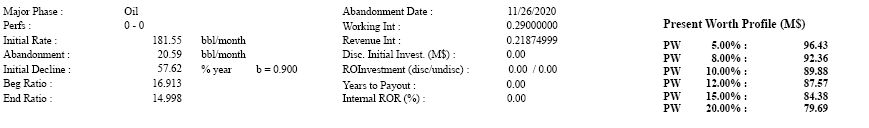

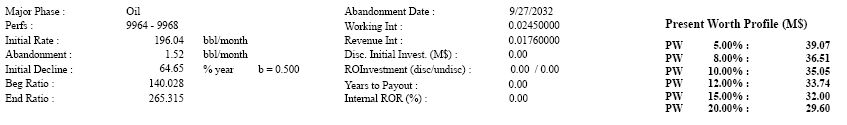

Squeeze

Box: The Company owns a 0.78% working interest in the Squeezebox well. This gas well is

located in Cameron Parish, Louisiana, and began production in November 2011. The well produces about 1,286 Mcf and 12 Bbls per

day.

Prairie

Bell East: The Company owns a 0.49% working interest in the Prairie Bell East well, a gas well is located in

Colorado County, Texas. The well has been in production since February 27, 2012 and has been producing approximately 1,522 Mcf

and 53 Bbls per day.

Loma

Blanca: The Company owns a 0.59% working interest in the Loma Blanca well, which well is located in Brookes County,

Texas. The well has been in production since August 2012. The well produces about 112 Mcf per day.

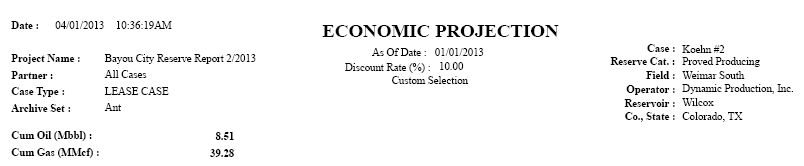

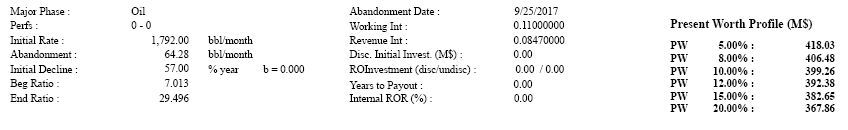

Koehn #2: The Company owns an 11.00%

working interest in the Koehn #2 well, which is located in Colorado County, Texas. This well has been in production since October

2012. The well produces about 93 Bbls and 533 Mcf per day.

Key Undeveloped Properties

On August 29, 2011, the Company invested

$190,000 and entered into the Next Energy Illinois Basin Oil & Gas Lease Development JV (“Next Energy JV”), a joint

venture with Next Energy, LLC and other industry participants to evaluate, test and purchase mineral leases in the Illinois Basin.

The venture is targeting up to 300,000 net acres of oil and gas leases. The investment entitles the Company to 0.005% of the joint

venture. The Company does not own a direct interest in any of the acreage, but rather an interest in a joint venture that holds

undeveloped acreage.

Dry Holes and Abandonment of Properties

during 2012

In 2012, the Company incurred $128,344

in dry hole or abandonment expenses. The expenses incurred were from a dry hole drilled by one of the partnerships managed by the

Company in 2011, the Company also had a large direct interest in the well.

Title to Properties

In the normal course of business, the operator

of each lease has the responsibility of examining the title on behalf of all working interest partners. Titles to all significant

producing properties of the Company have been examined by various attorneys. The properties are subject to royalty, overriding

royalty and other interests customary in the industry.

The working interest owned by the Company,

either directly or through the partnerships we manage, is owned jointly with other working interest partners or is subject to various

royalty and overriding royalty interest, which generally range in total between 20%-30% on each property. Management does not believe

any of these burdens materially detract from the value of the properties or materially interfere with their use.

| ITEM

3. |

LEGAL

PROCEEDINGS |

There are no material pending legal or

governmental proceedings relating to our Company or properties to which we are a party, and to our knowledge, there are no material

proceedings to which any of our directors, executive officers, affiliates or stockholders are a party adverse to us or have a material

interest adverse to us.

| ITEM

4. |

MINE

SAFETY DISCLOSURES |

Not applicable.

PART II

| ITEM 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information

The Common Stock of the Company is quoted

on the OTC Market Groups, Inc. OTCQB (the “OTCQB”) under the symbol “BYCX.” The following table shows the

high and low bid information for our Common Stock for each quarter ended during the last two fiscal years. This information has

been obtained from the OTC Bulletin Board. The quotations below reflect inter-dealer prices, without retail mark-up, mark-down

or commission, and may not necessarily represent actual transactions.

| | | |

High Bid | | |

Low Bid |

| March 31, 2011 | | |

$ | 0.00 | | |

$0.00 |

| June 30, 2011 | | |

| 0.00 | | |

0.00 |

| September 30, 2011 | | |

| 0.00 | | |

0.00 |

| December 31, 2011 | | |

| 0.00 | | |

0.00 |

| | | |

| | |

| March 31, 2012 | | |

$ | 0.035 | | |

$0.025 |

| June 30, 2012 | | |

| 0.045 | | |

0.012 |

| September 30, 2012 | | |

| 1.15 | | |

0.10 |

| December 31, 2012 | | |

| 0.60 | | |

0.36 |

According to OTC Market Groups, Inc., there

were no bid or ask prices for our Common Stock during the 2011 fiscal years. The closing bid prices for the quarters ended September

30 and December 31, 2012, reflect prices following the Company’s 1 for 100 reverse stock split, which occurred on July 26,

2012.

Stockholder Information

As of March 21, 2013, there were 549 stockholders

of record of the Company’s Common Stock. The number of registered stockholders excludes any estimate by us of the number

of beneficial owners of shares of Common Stock held in “street name.”

Dividend Information

No cash dividends have been declared or

paid on our Common Stock since inception. The Company has not paid, nor does it intend to pay, cash dividends on its Common Stock

in the foreseeable future. We intend to retain earnings, if any, for the future operation and development of our business. Our

dividend policy will be subject to any restrictions placed on it in connection with any debt offering or significant long-term

borrowing.

Recent Sales of Unregistered Securities

All of the Company’s recent sales

of unregistered securities within the past three years have been previously reported in Quarterly Reports on Form 10-Q and current

reports on Form 8-K.

Securities authorized for issuance

under equity compensation plans

The following

table sets forth certain information, as of December 31, 2012, concerning securities authorized for issuance under the Company’s

2005 Stock Option and Incentive Plan.

| Plan category | |

Number of securities to be issued upon exercise of outstanding options, warrants and rights

(a) | | |

Weighted-average exercise price of outstanding options, warrants and rights

(b) | | |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

(c) | |

| Equity compensation plans approved by security holders | |

| 20,000 | | |

$ | 1.00 | | |

| 21,500 | |

| Equity compensation plans not approved by security holders | |

| – | | |

| – | | |

| – | |

| Total | |

| 20,000 | | |

$ | 1.00 | | |

| 21,500 | |

ITEM

6. selected financial data

The Company is a “smaller reporting

company” as defined by Rule 12b-2 of the Exchange Act,

and as such, is not required to provide the information required under this Item.

ITEM

7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion is intended to

assist in an understanding of the Company’s financial position and results of operations for each of the yearly periods ended

December 31, 2012 and 2011. The financial statements and the notes thereto contain detailed information that should be referred

to in conjunction with the following discussion.

Recently Issued Accounting Pronouncements

During the year ended December 31, 2012

and through April 11, 2013, there were several new accounting pronouncements issued by the Financial Accounting Standards Board

(FASB). Each of these pronouncements, as applicable, has been or will be adopted by the Company. Management does not believe

the adoption of any of these accounting pronouncements has had or will have a material impact on the Company’s consolidated

financial statements.

Consolidation Policy

The Company consolidates its interest in

joint ventures and partnerships in the oil and gas industry using the ‘proportionate consolidation’ method provided

for in Accounting Standards Codification (ASC) Topic 810-10-45-14, Consolidation – Other Presentation Matters.

A proportionate consolidation is permitted when the Company does not control the joint venture or partnership but nonetheless exercises

significant influence. Under this method, the Company recognizes their proportionate share of each partnership’s assets,

liabilities, revenues and expenses, which are included in the appropriate classifications on the Company’s consolidated financial

statements.

All significant intercompany transactions

of its consolidated subsidiary and the limited partnerships are eliminated.

Critical Accounting Policies and

Estimates

Financial Statements and Use of Estimates:

In preparing financial statements, management is required to select appropriate accounting policies and make estimates and assumptions

that affect the reported amounts of assets, liabilities, revenues and expenses. Actual results could differ from those estimates.

Stock Options: Effective January 1,

2006, the Company accounts for stock options in accordance with revised Statement of Financial Accounting Standards (SFAS) No. 123,

Share-Based Payment (SFAS 123(R) (ASC 718 and 505). Accordingly, there was no stock compensation expense to be recognized

in the year ended December 31, 2012 and stock compensation expense of $11,008 was required to be recognized in the year ended

December 31, 2011.

Under SFAS 123(R) (ASC 718 and 505), the

fair value of options is estimated at the date of grant using a Black-Scholes-Merton (“Black-Scholes”) option-pricing

model, which requires the input of highly subjective assumptions including the expected stock price volatility. Volatility is determined

using historical stock prices over a period consistent with the expected term of the option. The Company utilizes the guidelines

of Staff Accounting Bulletin No. 107 (SAB 107) of the Securities and Exchange Commission relative to “plain vanilla”

options in determining the expected term of option grants. SAB 107 permits the expected term of “plain vanilla” options

to be calculated as the average of the option’s vesting term and contractual period. The Company has used this method in

determining the expected term of all options. The Company has several awards that provide for graded vesting. The Company recognizes

compensation cost for awards with graded vesting on a straight-line basis over the requisite service period for the entire award.

The amount of compensation expense recognized at any date is at least equal to the portion of the grant date value of the award

that is vested at that date.

Oil and Gas Activities: The accounting

for upstream oil and gas activities (exploration and production) is subject to special accounting rules that are unique to the

oil and gas business. There are two methods to account for oil and gas business activities, the successful efforts method and the

full cost method. The Company has elected to use the successful efforts method. A description of our policies for oil and gas properties,

impairment and direct expenses is located in Note 1 to our financial statements.

The successful efforts method reflects

the volatility that is inherent in exploring for oil and gas resources in that costs of unsuccessful exploratory efforts are charged

to expense as they are incurred. These costs primarily include seismic costs (G&G costs), other exploratory costs (carrying

costs) and exploratory dry hole costs. Under the full cost method, these costs would be capitalized and then expensed (depreciated/amortized)

over time.

Oil and

Gas Reserves: The term proved oil and gas reserves is defined by the SEC in Rule 4-10(a)

(22) of Regulation S-X adopted under the Securities Act of 1933, as amended (the “Act”). In general, proved oil and

gas reserves are the estimated quantities of crude oil, natural gas and natural gas and natural gas liquids that geological or

engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic

and operating conditions, i.e., prices based on an unweighted 12-month average and costs as of the date the estimate is made. Prices

include consideration of changes in existing prices provided only by contractual arrangements, but not on escalations based on

future conditions.

Our estimates of proved reserves materially

impact depletion expense. If proved reserves decline, then the rate at which we record depletion expense increases. A decline in

estimates of proved reserves may result from lower prices, new information obtained from development drilling and production history;

mechanical problems on our wells; and catastrophic events such as explosions, hurricanes and floods. Lower prices also may make

it uneconomical to drill wells or produce from fields with high operating costs. In addition, a decline in proved reserves may

impact our assessment of our oil and natural gas properties for impairment.

Our proved reserves estimates are a function

of many assumptions, all of which could deviate materially from actual results. As such, reserves estimates may vary materially

from the ultimate quantities of crude oil and natural gas actually produced.

Capitalized Prospect Costs: The

Property and Equipment balance on the Company’s balance sheets, if any, include oil and gas property costs that are excluded

from capitalized costs being amortized. These amounts represent investments in undeveloped leasehold acreage and work-in-progress

exploratory wells. The Company excludes these costs on a property-by-property basis until proved reserves are found, until the

lease term expires, or if it is determined that the costs are impaired. All costs excluded are reviewed annually to determine if

any of these conditions have occurred; if so, the capitalized amount is transferred to abandonment expense and recorded to the

statement of operations.

Impairments: In accordance with

FASB ASC 360-10-35, long lived assets, such as oil and gas properties and equipment are reviewed for impairment whenever events

or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be

held and used is measured by a comparison of the carrying amount of an asset to estimated undiscounted future cash flows expected

to be generated by the asset. If the carrying amount of an asset exceeds its estimated future cash flows, an impairment charge

is recognized by the amount by which the carrying amount of the asset exceeds the fair value of the asset. Assets to be disposed

of would be separately presented in the balance sheet and reported at the lower of the carrying amount of the fair value less costs

to sell and are no longer depreciated or depleted.

The application of this guidance did not

result in any impairment of the oil and gas properties of the Company for the periods presented.

Results of Operations

The

Company reported a net income of $816,410 in 2012, as compared to a net income of $257,114 in 2011. The $559,296 increase in net

income resulted from the Company recording $1,339,503 more in total operating revenues, offset by $882,004 more in operating costs

and a net increase in other income of $134,669 in 2012 as compared to 2011. On a per share basis the Company had a net

income of $0.95 per share in 2012 and a net income of $0.89 per share in 2011.

Operating Revenues: Operating revenues

totaled $3,312,772 in 2012 as compared to $1,973,269 in 2011, a 67.9% increase for the year. The increase in total operating revenue

was primarily a result of a change in the Company’s business focus during 2011, wherein $3,132,676 of the Company’s

revenues were derived from net turnkey drilling contract revenue in 2012, while in 2011, the Company had $1,839,915 of turnkey

drilling contract revenue. In 2012, the Company’s revenues from oil and gas sales also increased $46,742 compared to 2011

which was a result of increased production primarily from the Koehn #2 well, which began production in the October 2012.

Direct Operating Costs: Direct operating

costs for the producing oil and gas wells, which include lease operating expenses and production taxes, totaled $47,021 in 2011

compared to $75,527 in 2012. This 60.6% increase in expense is primarily due to increased lease operating expenses on the Coastal

Plains wells’ which are approaching the end of their useful life.

Other

Operating Expenses: Other operating expenses include abandonment and dry hole costs, marketing costs, depreciation, depletion,

and amortization expense, turnkey drilling contract costs and marketing. Other operating expenses decreased to $420,607 in 2012

compared to $434,852 in 2011. This decrease of $14,245 was a result of a $33,217decrease in depletion and amortization, and a

$74,337 decrease in marketing costs, offset by an increase of $93,309 in abandonment and dry hole costs.

General

and Administrative Costs: General and administrative costs were $716,124 in 2012 compared to $636,995 for 2011, an increase

of $79,129, or approximately 12.42%. The increase was primarily attributable to increases office rent with related costs, and

legal and audit fees related to the SEC filings and review of the Company’s limited partnership offerings, and includes

a quarterly management fee of approximately $11,000 payable to Blue Ridge Group, Inc., with whom we share office space and utilize

various accounting-related and administrative services.

Other

Income: The Company’s Other Income increased $119,931 during the year ended December 31, 2012. This increase in other

income was primarily a result of $150,099 in equity earnings received by the Company for its holdings in Affiliated Partners,

which was purchased during 2012, offset by $22,799 in miscellaneous expenses. In contrast, during 2011, the Company had net other

expense of $7,369 including $631 worth of miscellaneous income and $8,000 of interest expense.

Income Taxes: In 2012 the Company

had $32,872 in federal or state income tax liability and no income tax liability or benefit in 2011 as a result of a large net

operating loss carry forward from years 2011 and prior. Based on the amount of net losses in 2011 and prior, a full valuation allowance

has been recorded against the deferred tax assets associated with the net operating loss carry forwards. The Company had an estimated

net operating loss carry forward of $7,264,508 and $8,004,196 as of December, 31, 2012 and 2011, respectively. However, the

Company had an ownership change in March, 2012 with the issuance of additional shares in a private placement transaction.

This resulted in an Internal Revenue Code (IRC) Section 382 limitation on the availability of the Company’s net operating

losses immediately before the ownership change to operational periods following the date of the ownership change. The Section

382 limitation rule limits the use of the Company’s current net operating loss carry forward to $30,193 per year in future

years. This annual limitation was allocated in the year 2012 to the period following the change date and resulted in net

operating losses available for the time period of April through December, 2012, being limited to $22,645 and the above tax liability

for 2012 of $32,872.

Balance Sheet Review

Assets: The Company’s total

assets increased $977,203 from $2,218,336 as of December 31, 2011 to $3,195,539 as of December 31, 2012. The increase

was primarily attributable to a $591,439 increase in current assets during 2012, from $1,778,140 as of December 31, 2011 to

$2,369,579 as of December 31, 2012. The increase was attributable to an $827,546 increase in cash received from Turnkey Agreements

entered into between the Company and partnerships we sponsored, as well as increases in accounts receivable of $151,179. The increase

in total current assets was offset in part by a $387,286 decrease in pre-paid expenses from 2011 to 2012. The $385,764 additional

increase in the Company’s assets was a result of a $184,015 increase in oil and gas properties as compared to 2011, a $57,017

increase in other investments at cost during 2012, and a $150,099 investment in an unconsolidated affiliate company in which we

did not hold an interest during 2011, partially offset by decrease in the Company’s other fixed assets, which deceased a

$5,367, from $25,047 during 2011 to $19,680 for the year ended December 31, 2012.

Liabilities: The Company’s

liabilities decreased $197,207 in 2012 to $1,384,913 as of December 31, 2012 compared to $1,582,120 as of December 31,

2011. The majority of this decrease is the result of a $659,763 decrease in turnkey partnership obligations, due to a decrease

in the number of limited partnerships formed, from six in 2011 to only three in 2012. There was also a $100,752 decrease in accounts

payable and accrued expenses, offset by a $530,611 accounts payable to related parties and $32,697 in federal income taxes payable

during 2012. The Company did not owe income taxes for 2011. The accounts payable to related parties is attributable to the amounts

received by the Company as the result of Turnkey Agreements it has with the partnerships it sponsors and manages. The amounts received

under such Turnkey Agreements are booked as revenue, but considered a deferred liability until such time as the Company has completed

all its responsibilities under the Turnkey Agreements.

There was $84,906 in deferred liability

and a $100,000 note payable obligation to a minority stockholder remained unchanged from period to period.

Stockholders’ Equity: Total

stockholder’s equity of the Company increased $1,174,410, from $636,216 at December 31, 2011 to $1,810,626 at December 31,