Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08549

Oak Associates Funds

(Exact name of registrant as specified in charter)

101 Federal Street, Boston, Massachusetts 02110

(Address of principal executive offices) (Zip code)

Charles A. Kiraly

Oak Associates, ltd.

3875 Embassy Parkway, Suite 250

Akron, Ohio 44333-8334

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-888-462-5386

Date of fiscal year end: October 31

Date of reporting period: November 1, 2013 – October 31, 2014

Table of Contents

Item 1. Reports to Stockholders.

Table of Contents

WOGSX | White Oak Select Growth Fund

POGSX | Pin Oak Equity Fund

RCKSX | Rock Oak Core Growth Fund

RIVSX | River Oak Discovery Fund

ROGSX | Red Oak Technology Select Fund

BOGSX | Black Oak Emerging Technology Fund

LOGSX | Live Oak Health Sciences Fund

Table of Contents

|

Oak Associates, ltd., advisor to the Oak Associates Funds, has been managing growth-oriented portfolios for over 25 years.

We appreciate the many long-term shareholders who invest alongside us in the Oak Associates Funds. Employees and their families are among the largest shareholders in the funds. Here are our core investment philosophies. |

|

Long-term focus |

To us, the appeal of an investment is driven by the long-term fundamentals of the company and its opportunity set, rather than short-term trading factors. We believe that this long-term mindset is increasingly valuable in today’s short-term oriented market.

|

Concentrated portfolios |

We construct our portfolios with our best ideas, which means that our favorite stock ideas aren’t diluted by investments in less-favored positions. A recent study showed that managers gave up performance because they failed to concentrate in their best ideas. Concentration takes discipline, conviction and experience. We continue to adhere to a strategy of concentrated portfolios.

|

Low turnover |

Hospital wings are rarely endowed by day traders. When we invest in a company, we do so with the intention of holding that stock for several years, not a few quarters. Low turnover can have the effect of minimizing trading costs as well as tempering the natural human instinct to act upon every data point.

|

Contrarian |

Being a good investor often requires not doing what the rest of the market is doing. While it’s difficult to go against the crowd - because as humans we are psychologically wired to herd - we believe that long-term outperformance requires it. One benefit of being located in Akron, Ohio (aside from being a great place to live), is that we are removed from the financial centers in other areas of the country, minimizing our chances of being swept up by the herd mentality. We value independent thinking and believe it is beneficial to our investment perspective.

The value of a Fund’s investments will vary from day to day in response to the activities of individual companies and general market and economic conditions. Due to the limited number of underlying investments, concentrated funds are more susceptible to the price movements of any one holding and thus are generally more volatile than a more broadly diversified portfolio.

Table of Contents

| Shareholder Letter |

||

Dear Fellow Shareholder,

The fiscal year ending October 31, 2014 was another strong one for stocks, defying the bearish forecasts of many market pundits. Six of our seven funds produced double-digit returns. In many ways we are in an ideal environment for stocks, with moderate economic growth, an accommodative Federal Reserve, low inflation, and persistently high corporate profit margins.

Even though GDP (Gross Domestic Product) growth has been a bit disappointing, the employment picture has improved and is probably being underappreciated. The unemployment rate has dropped below 6%. This partly reflects a low labor participation rate, which has finally stopped declining. But it also reflects actual job growth; for nine consecutive months job creation topped 200,000, which hasn’t happened since 1995. In addition, for the twelve months through October, the economy created 2.6 million new jobs, which is a rate exceeded only one-quarter of the time over the last thirty years. Finally, unemployment claims are at a 14-year low and have been lower less than 3% of the time since 1980. Given all this, in a way it’s remarkable that the Fed has kept short-term interest rates at zero for as long as it has. Of course other factors have driven this, and the Fed, having recently ended its quantitative easing program, is expected to begin raising rates in mid-2015. Quantitative easing is a monetary policy in which the Fed increases the money supply by flooding financial institutions with capital in an effort to promote increased lending and liquidity.

The appreciating dollar has been another story worth noting. With the bull market in commodities having ended, the relative appeal of the emerging markets has waned, inducing the movement of capital back to the US, particularly given the booming shale industry domestically. Another important factor has been the change in relative monetary policy. Even though the current monetary policy of the US would be considered loose by normal standards, it is moving in the direction of tightening, whereas the monetary authorities in other large markets (Japan, China and Europe, for example) are moving toward greater easing. With global inflation largely absent and economic growth subdued, there seems to be a race to the bottom in terms of currency management. It is unclear what the future economic consequences of this will be.

Long-term interest rates have declined this year, with the ten-year Treasury now at about 2.2%. Remarkably, this looks high in relation to sovereign yields around the world. For the same ten-year maturity, the UK and Spain offer yields of 1.9%, France 1%, Germany 0.7%, and Japan 0.4%. Remember that a buyer/holder of such government debt is essentially extending a loan to these nations at those rates. Some of these countries have serious economic problems, with stagnant GDP and growing debt. It would appear to be imprudent to lend to Spain at less than 2%, or to Japan, who has seen its public debt grow to well over twice the level of GDP, at less than half a percent. These transactions provide the unattractive combination of a tiny return and large downside risk. It appears obvious that we are in a sovereign debt bubble.

The strong US dollar has helped push down oil prices, and since summer ended a steady decline has turned into a rapid descent. Oil was trading for $105 per barrel in July, and as we write this it has fallen all the way to $66. For further context recall that in 2008 oil hit $147. This decline has led to lower prices at the gas pump, which helps the consumer. One reason for the drop in oil is the boom in US production, which has doubled in just the last few years and is now at levels not seen since the 1980s. We are currently producing more oil than we import, a fact that would probably come as news to the average person on the street. Saudi Arabia is a bit frustrated by the US’s newfound impact on the global oil market and has so far chosen to not cut production. This decision, if it sticks, and the decline in price that has taken place already, could have significantly negative effects on countries that are dependent on oil revenues, such as Russia (30% of government revenue from oil), Iran (44%), Venezuela (45%) and Nigeria (64%). Many smaller middle-eastern nations source over 3⁄4 of their revenue from oil.

Table of Contents

| Shareholder Letter |

||

Over the years you have heard us talk about how productivity is the root for all that is good from an economic perspective. Doing more with less results in a higher standard of living. Technology and free trade have allowed companies to be more efficient. According to Empirical Research Partners, US manufacturers are making 40% more “stuff” than they did in 2000 with a third fewer workers. The revenue per employee for the manufacturers in the S&P 500 has climbed by almost half during that time. These are staggering numbers and are a big reason why US citizens are able to afford such a wide-range of life-enhancing products. This is good for society as a whole, but with the perception that all of the economic benefits are accruing to the owners of capital as opposed to labor, political issues are surfacing. Even if society as a whole is benefiting, a rising wealth gap causes many to call for change. The risk is that such change will cause more harm than good. Growing inequality is a complex issue that is also a philosophical one - and there are no easy answers. But as corporate profit margins remain at all-time highs and labor’s bargaining power remains low, it is easy to see this issue growing in importance.

Market volatility has been subdued over the past year, October notwithstanding, which has resulted in our being even less active from a trading standpoint than we normally are (gyrating prices and market dislocation tend to produce greater opportunities). Speaking of trading, our friends at Empirical came across some interesting findings. Researchers at the University of Notre Dame and Rutgers found that managers who outperform their benchmark tend to have two commonalities: low turnover and concentrated portfolios. Interestingly, the researchers found that it was the combination of the two that was powerful; having one but not the other led to pedestrian returns.

This was heartening to us, as low turnover and concentrated portfolios have been two of our core principles since Oak’s founding almost 30 years ago. With most of the investment world moving in the direction of short-term analysis and index-hugging, it is gratifying to see our approach validated. Of course, this approach does not guarantee success; it merely maximizes our chances of achieving it. The investment business is about stacking the odds in one’s favor, and this is a good start.

Perhaps paradoxically, with more and more investment analysts and managers playing the short-term game, there is more opportunity for those, such as Oak, who play the long-term game. What do we mean by “short-term game?” An example would be buying stocks based on how one thinks the current quarter is going or based on one macroeconomic variable, or selling because of temporary conditions that are unfavorable. By contrast, long-term investing entails evaluating a company based on its long-term fundamentals – its competitive advantages, the sustainability of its earnings, growth opportunities, valuation, etc. The problem with the short-term game is that so many people are playing it, and that so few, if any, have a true information edge. Therefore the ability to generate alpha (the excess return of the fund relative to the return of the benchmark index) from such a strategy is limited. Long-term investors try to take advantage of competitors’ shortsightedness by maintaining a longer time horizon and using patience, an increasingly rare commodity.

Bringing it back to today’s market, with so many focused on the short-term, one might say the equity yield curve has steepened, with the better opportunities coming for those who are willing to look out more than a few quarters. This is right up our alley.

Thank you for the privilege of managing your money.

Sincerely,

Oak Associates Funds

Table of Contents

| HIGHLIGHTS from the 2014 FISCAL YEAR | ||

| October 31, 2013 to October 31, 2014 (Unaudited) | ||

| December 2013 |

Kiplinger’s Personal Finance included Pin Oak Equity Fund in its list of ten top-performing funds for the 5-year period ending November 30, 2013. The personal financial publication analyzes fund performance in 12 categories for the past one-, three-, five-, 10- and 20-year periods. Pin Oak was recognized among “Midsize-Company Stock funds – 5 years.” The article titled, “Top-Performing Mutual Funds by Category” appeared on kiplinger.com. | |||||

| January 2014 |

Advisor Perspectives featured Mark Oelschlager’s First Quarter Market Commentary, “Where are Margins Headed?” January 7, 2014. | |||||

| February 2014 |

Zacks Investment Research highlighted Black Oak Emerging Technology Fund among technology funds identified as a “Strong Buy” in its article, “Zacks #1 Ranked Technology Mutual Funds.” February 14, 2014. | |||||

| March 2014 |

Bloomberg interviewed Robert Stimpson for comments on plug power. Mr. Stimpson was quoted in the article, “Bears Turn Up Plug Power Bets as Fuel Cell Hype Fades: Options.” March 21, 2014. | |||||

| April 2014 |

Advisor Perspectives featured Robert Stimpson’s Second Quarter Market Commentary, “Putin and the Naughty Chair.” April 4, 2014. | |||||

| Reuters interviewed Robert Stimpson on the former “four horsemen” tech stocks of the late 1990s in the article, “As Internet Shares Break Down, Investors See Value in Old Tech.” April 11, 2014. | ||||||

| May 2014 |

Robert Stimpson commented in Bloomberg’s report on U.S. stocks, “American Economy Seen Accelerating as ETFs Favored S&P 500.” May 2, 2014. | |||||

| The Wall Street Journal, in its monthly fund analysis, recognized River Oak Discovery Fund among “Category Kings” in its category, Small-Cap Growth. May 5, 2014. | ||||||

| June 2014 |

Bloomberg interviewed Robert Stimpson on the recent calm in US equity markets in the article, “Puts Shrink Amid Longest Run of Market Calm Since 1995.” June 16, 2014. | |||||

|

|

||||||

Table of Contents

| HIGHLIGHTS from the 2014 FISCAL YEAR | ||

| October 31, 2013 to October 31, 2014 (Unaudited) | ||

| July 2014 |

Zacks Investment Research highlighted Live Oak Health Sciences Fund among healthcare funds identified as a “Strong Buy” in its article, “Zacks #1 Ranked Technology Healthcare Funds.” July 18, 2014. | |||||

| Financial Times (www.ft.com) interviewed Robert Stimpson on the biotech sector in the article, “Investors Turn Sour on US Biotech Sector.” July 20, 2014. | ||||||

| September 2014 |

Reuters interviewed Robert Stimpson on investments by technology investors in healthcare technology companies in the article, “In Quest for Next Windfall, Tech Funds Look to Healthcare.” September 3, 2014. | |||||

| Robert Stimpson commented in Bloomberg’s report on U.S stocks, “Brent Crude Sinks Below $100 on China Data; U.S. Stocks Retreat.” September 8, 2014. | ||||||

| Bloomberg interviewed Robert Stimpson on the outlook for semiconductor stocks in the article, “Semiconductor ETFs Taking in Record Cash as Shares Soar.” September 10, 2014. | ||||||

|

|

||||||

READ MORE AT WWW.OAKFUNDS.COM

Table of Contents

| TABLE of CONTENTS | ||||||||

| Performance Update | ||||||||

| 1 | ||||||||

| 4 | ||||||||

| 6 | ||||||||

| 8 | ||||||||

| 10 | ||||||||

| 12 | ||||||||

| 14 | ||||||||

| Important Disclosures | 16 | |||||||

| Disclosure of Fund Expenses | 18 | |||||||

| Financial Statements | ||||||||

| 20 | ||||||||

| 38 | ||||||||

| 40 | ||||||||

| 42 | ||||||||

| 46 | ||||||||

| 60 | ||||||||

| 71 | ||||||||

| 72 | ||||||||

Table of Contents

|

James D. Oelschlager Co-Chief Investment Officer & Portfolio Manager

Mark W. Oelschlager, CFA Co-Chief Investment Officer (as of October 9, 2014) & Portfolio Manager

Robert D. Stimpson, CFA Portfolio Manager |

White Oak Select Growth Fund (“The Fund”) gained 12.94% for the fiscal year ended October 31, 2014, while the comparative index, the S&P 500 Index, rose 17.27%, and the Lipper Large-Cap Growth Fund Average increased 15.28%. The Fund underperformed the benchmark index and its peer group due to an increased allocation to the technology sector and underperformance of a large individual position.

The fiscal year 2014 saw stocks appreciate due to a rise in earnings and an expansion in the valuation multiple assigned by investors. The low inflation environment and stable economic outlook supported higher valuation multiples while companies maintained strong capital spending discipline. Many commodities have fallen to a 3-year low, and a slowdown in capital-intensive emerging markets has kept inflationary pressures at bay. A sharp rise in the US Dollar has added to deflationary forces.

A decline in commodity prices has also benefited the market in two ways. Commodities and oil prices can be a major input cost for manufacturers. Higher gasoline prices are also painful to consumers. Therefore, a drop in energy prices, along with $3/gallon gasoline nationwide, has been a stimulus to consumers and energy intensive businesses. Secondly, the inflation outlook boosts equity prices since investors are willing to assign higher valuations to capital that will not be devalued by high inflation.

The Fund’s performance compared to the benchmark S&P 500 Index is tied to its exposure to the technology sector and poor stock selection in the energy sector. The technology positioning has favored large-cap technology bellwethers and lacks exposure to both momentum driven social media stocks and Apple. Being underweight in the energy sector was the correct call in light of falling energy prices; however, the Fund’s position in Transocean disproportionately affected the performance.

In general, the underlying fundamentals within the portfolio’s companies remain strong, with profit margins high and healthy balance sheets. Speculation over the end of the Federal Reserve’s loose monetary policy has added to long-term concerns over the timing of interest rate increases. Fortunately, the Fed has signaled that rates will rise with clear strength in the economy.

The Fund’s top-performing holding was Broadcom, which gained 59%. The diversified semiconductor company is exposed to a wide array of technology and industrial end markets that are growing faster than the overall economy. Teva Pharmaceutical was the next best-performer, rising 56%, reflecting the mergers and acquisition driven strength seen throughout the large-cap pharma and biotechnology sectors.

Laggards included Transocean, which fell 33% during the fiscal year. The off-shore drilling company has suffered from the resurgence of US on-shore oil production. Despite the company’s attractive valuation and 11% dividend yield, it has suffered with the broader energy sector. Amazon.com was the Fund’s second worst performer and is a large position in the portfolio. After several strong years, the online retailer’s foray into smart phones with the Fire irked investors who anticipate additional spending to compete in the crowded space. |

|

Annual Report | October 31, 2014 |

1 |

Table of Contents

| White Oak Select Growth Fund |

||

The macroeconomic environment has been supportive for stocks despite various geopolitical issues affecting investor sentiment. The stock market has done an excellent job seeing past these issues and focusing on the fundamentals. Strict capital discipline over the last few years has helped companies keep profitability high, and a pattern of returning capital to shareholders has been welcomed by equity investors. The result is a low-inflation environment where corporate earnings remain healthy and valuations are attractive. While it is impossible to predict what will happen in 2014, the current environment is one that tends to favor equities.

Thank you for your investment with Oak Associates Funds.

Mutual fund investing involves risk, including the possible loss of principal. The value of the Fund’s investments will vary from day to day in response to the activities of individual companies and general market and economic conditions. Due to the limited number of underlying investments, the Fund is more susceptible to the price movements of any one holding and thus may be more volatile than a more broadly diversified portfolio.

|

2 |

1-888-462-5386 | www.oakfunds.com |

Table of Contents

| Manager Discussion & Analysis | ||

| All data below as of October 31, 2014 (Unaudited) |

| ^ | Percentages are based on net assets. Holdings are subject to change. |

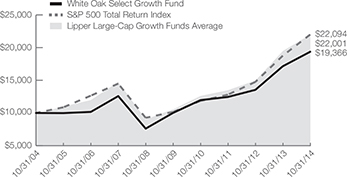

Growth of $10,000 Chart

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Average Annual Total Return

| ||||||||||

| 1 Year Return |

3 Year Return |

5 Year Return |

10 Year Return |

Inception to Date | ||||||

| White Oak Select Growth Fund |

12.94% | 15.86% | 14.10% | 6.83% | 8.58%* | |||||

| S&P 500® Total Return Index1 |

17.27% | 19.77% | 16.69% | 8.20% | 9.42%* | |||||

| Lipper Large-Cap Growth Funds Average2 |

15.28% | 17.99% | 15.70% | 8.25% | 8.54%** | |||||

| *Since 08/03/1992 **Since 07/31/1992 |

Gross/Net Expense Ratio (per the current prospectus): 1.12% | |||||||||

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end, please visit www.oakfunds.com or call 1-888-462-5386.

1 Standard & Poor’s is the source and owner of the S&P Index data. 2 Lipper Inc. is the source and owner of the Lipper Classification data. See Pages 16 and 17 for additional disclosure.

|

Annual Report | October 31, 2014 |

3 |

Table of Contents

|

Mark W. Oelschlager, CFA Co-Chief Investment Officer (as of October 9, 2014) & Portfolio Manager |

Pin Oak Equity Fund (“The Fund”) returned 16.25% for the fiscal year ended October 31, 2014, while the S&P 500 Index gained 17.27%, and the Lipper Multi-Cap Core Fund Average returned 13.34%. For the last ten years, the Fund’s cumulative return was 165.98%, versus 120.01% for the S&P 500 and 118.22% for the Lipper.

This was the sixth consecutive fiscal year of positive returns for the Fund, a streak that started in the aftermath of the financial crisis, which illustrates the importance for an investor of hanging in there when times are tough. Five of the last six years the Fund has returned at least 15%. As we have said before, we feel that these robust returns cannot continue in perpetuity, and we have positioned the Fund for the days of more moderate returns.

One of the ways in which we have built the portfolio for the long run is by focusing on sustainability of a company’s earnings. The value of a company (and hence its stock) is a function of its profits – for all future years, not just next year. Meteoric growth stories that lack competitive advantages usually see their stocks crash as profit expectations are adjusted downward. An attractively priced sustainable growth story holds more appeal | |

| to us. In addition, we would rather invest in companies that are under-earning than over-earning. This is counterintuitive, but the key is that the market sometimes prices companies based on current, transitory conditions. If our research tells us that conditions are likely to change and that such a change would lead to a dramatic improvement in profits, we are interested. | ||

A perfect example of this is the financial sector, a major area of investment for the Fund. Because interest rates are depressed, which has led to compression in the spread between loan yields and deposit rates, lenders and various capital markets-exposed firms are earning far less on their assets than they normally do. As interest rates rise, we believe the profitability of these companies will improve dramatically.

One of the major advantages of the Fund is that we are afforded a large degree of flexibility in how we invest. Not only are we able to take a position in any sector, but we can also invest in companies of any size. During the financial crisis we increased the small-cap weighting of the portfolio, which benefited performance as small caps outperformed for several years thereafter. This outperformance eventually tilted the risk-reward back toward large companies, and going into the last fiscal year we had significantly reduced our small-cap exposure, which paid off as small-caps lagged over the past twelve months.

For the year the Fund’s gains were remarkably broad-based, as 32 of the 35 holdings posted positive returns. Standout performers included aerospace giant Lockheed Martin, as it boosted margins and free cash flow, and technology behemoth Microsoft, which transitioned to a new CEO, giving investors hope of better capital allocation.

The two poorest performers, miner Teck Resources and drilling contractor Diamond Offshore, came from the commodity area, which is being negatively affected by weak global growth and a strong dollar. We had trimmed shares of Diamond at higher prices, which helped limit the impact of the decline.

Thank you for your investment with Oak Associates Funds.

Mutual fund investing involves risk, including the possible loss of principal. The value of the Fund’s investments will vary from day to day in response to the activities of individual companies and general market and economic conditions.

The following has been provided to you for informational purposes only, and should not be considered tax advice. Please consult your tax advisor for further assistance.

|

4 |

1-888-462-5386 | www.oakfunds.com |

Table of Contents

| Manager Discussion & Analysis | ||

| All data below as of October 31, 2014 (Unaudited) |

| ^ | Percentages are based on net assets. Holdings are subject to change. |

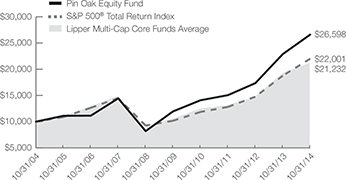

Growth of $10,000 Chart

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Average Annual Total Return

| ||||||||||

| 1 Year Return |

3 Year Return |

5 Year Return |

10 Year Return |

Inception to Date | ||||||

| Pin Oak Equity Fund |

16.25% | 20.90% | 17.34% | 10.28% | 7.74%* | |||||

| S&P 500® Total Return Index1 |

17.27% | 19.77% | 16.69% | 8.20% | 9.42%* | |||||

| Lipper Multi-Cap Core Funds Average2 |

13.34% | 18.08% | 15.26% | 7.82% | 9.38%** | |||||

| *Since 08/03/1992 **Since 07/31/1992 |

Gross/Net Expense Ratio (per the current prospectus): 1.16% | |||||||||

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end, please visit www.oakfunds.com or call 1-888-462-5386.

1 Standard & Poor’s is the source and owner of the S&P Index data. 2 Lipper Inc. is the source and owner of the Lipper Classification data. See Pages 16 and 17 for additional disclosure.

|

Annual Report | October 31, 2014 |

5 |

Table of Contents

|

Robert D. Stimpson, CFA Portfolio Manager |

Rock Oak Core Growth Fund (“The Fund”) rose 15.89% for the fiscal year ended October 31, 2014. The Fund’s performance compares to the benchmark S&P 500 Index’s gain of 17.27%. Despite underperforming the S&P 500, the Fund outperformed the Lipper Multi-Cap Growth Fund Average’s gain of 13.51%.

The fiscal year 2014 saw US stocks benefit from the combination of earnings growth and an expansion in the valuation multiple assigned by investors. A drop in energy and commodity prices, due to weakness in emerging markets and a strong US Dollar, has dismissed any immediate threat of inflation. The risk of inflation is a common concern after several years into an economic recovery and due to the loose monetary environment promoted by global central banks. With low inflation, however, the present value of corporate cash flows are worth more to investors and falling prices act as an additional source of consumer stimulus.

Throughout the year, the economic recovery progressed but at a tepid rate. Job growth slowly materialized, driving the unemployment rate to under 6% and back to mid-2008 levels. Inflationary pressures remain low due to | |

| the strong US Dollar and economic weakness from capital intensive economies in Asia. Gasoline and heating oil can be a meaningful expense for consumers, and their falling prices acts as an incremental stimulus to consumer spending. | ||

Geopolitical events failed to distract investors from rising equity prices during the year. Russia’s annexation of Crimea and intrusion into Ukraine has threatened to reignite the Cold War. Meanwhile, the Eurozone economies have fretted with uncertainty over natural gas supplies from Russia, as well as their own struggling economies. The Federal Reserve’s end to its bond buying program was well telegraphed and mostly absorbed by investors. Intermittent weakness developed surrounding the timing of interest rate increase, but their effects were no more troublesome than the usual Fed speculation regarding interest rate policy changes.

The Fund’s best performing stock was Illumina, which rose 105%. The genomics tool-maker has benefited from a strong year for the biotechnology sector and its mergers and acquisition driven momentum. Illumina was a top performer in 2013 as well. The Fund’s second best performing holding was Broadcom, which rose 59%. The semiconductor company saw both earnings growth and multiple expansion drive its shares higher. The Fund’s largest laggard was Transocean, dropping 33%. The company specializes in deep water oil wells and drilling in highly-technical areas. The shares have fallen due to weak oil prices and the US supply growth due to the shale revolution domestically.

Going forward, the Rock Oak Fund remains focused on attractively valued companies with strong growth prospects that have also demonstrated a commitment to creation of shareholder value. Over the course of the year, the Fund has reduced its market cap exposure, preferring opportunity and value in out-of-favor areas of the market. The outlook for US stocks remains attractive due to the low inflation, stable growth environment. The Fed continues to telegraph that rates will not increase until the second half of 2015. Until then, there seems plenty of room for earnings to grow and valuations to expand further.

Thank you for your investment with Oak Associates Funds.

Mutual fund investing involves risk, including the possible loss of principal. The value of the Fund’s investments will vary from day to day in response to the activities of individual companies and general market and economic conditions.

|

6 |

1-888-462-5386 | www.oakfunds.com |

Table of Contents

| Manager Discussion & Analysis | ||

| All data below as of October 31, 2014 (Unaudited) |

^ Percentages are based on net assets. Holdings are subject to change.

Growth of $10,000 Chart

|

This chart represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Fee waivers are in effect; if they had not been in effect, performance would have been lower. |

| Average Annual Total Return | ||||||||||

| 1 Year Return |

3 Year Return |

5 Year Return |

10 Year Return |

Inception to Date* | ||||||

| Rock Oak Core Growth Fund |

15.89% | 14.95% | 14.23% | — | 6.44% | |||||

| S&P 500® Total Return Index1 |

17.27% | 19.77% | 16.69% | — | 7.55% | |||||

| Lipper Multi-Cap Growth Funds Average2 |

13.51% | 17.68% | 16.36% | — | 7.90% | |||||

| *Since 12/31/2004 |

Gross/Net Expense Ratio (per the current prospectus): 1.66%/1.26% | |||||||||

The Adviser has contractually agreed through February 28, 2015, to waive all or a portion of its fee for the Fund (and to reimburse expenses to the extent necessary) in order to limit Fund total operating expenses (excluding Acquired Fund Fees and Expenses) to an annual rate of not more than 1.25% of average daily net assets. This contractual fee waiver may only be terminated subject to approval by the Board of Trustees of the Trust.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end, please visit www.oakfunds.com or call 1-888-462-5386.

1 Standard & Poor’s is the source and owner of the S&P Index data. 2 Lipper Inc. is the source and owner of the Lipper Classification data. See Pages 16 and 17 for additional disclosure.

|

Annual Report | October 31, 2014 |

7 |

Table of Contents

|

Robert D. Stimpson, CFA Portfolio Manager |

River Oak Discovery Fund (“The Fund”) rose 8.75% for the fiscal year ended October 31, 2014, while the benchmark Russell 2000 Growth Index gained 8.26%. The Fund also outperformed the Lipper Small-Cap Growth Fund Average’s 5.73% rise. Since inception on June 30, 2005, the Fund has risen 7.75% annually.

US stocks posted strong gains in fiscal year 2014. Solid earnings and an increase in the valuation multiple assigned to companies by investors drove prices higher. A combination of low inflation and stable growth produced an environment very favorable to equity investments, although investors showed a distinct preference for large-cap stocks. As a result, smaller companies rose, but underperformed their larger brethren. Faltering international markets and concerns over the end of the Federal Reserve’s bond purchase program added to risk aversion, appearing as a predilection for large-cap holdings. | |

| Throughout the fiscal year, economic data showed marginal improvement while job growth drove the unemployment rates gradually lower. Nationwide, the unemployment rate has now fallen to under 6%, returning to | ||

| mid-2008 levels. Lower energy and fuel costs have helped boost the outlook for many companies, particularly those that depend on consumer spending. The drop in these key commodity prices also suppresses inflation. Stocks tend to enjoy a low inflation environment, and investors often assign higher valuation multiples to companies if it appears their capital will not be devalued by the threat of inflation. | ||

The macroeconomic and geopolitical landscape periodically rattled markets and probably supported the preference for large-cap stocks. Russia invasion into Ukraine, the Ebola outbreak in Africa, the potential secession of Scotland from the United Kingdom, and slowing growth in Asia provided plenty of fodder for 24-hour news media. Speculation over interest rates following the end of the Fed’s quantitative easing efforts also worried investors. Thus far, Chairman Yellen continues to balance investor concerns with a stated desire to reset the Fed’s toolbox. Interest rates remain a key policy tool for the Fed, and a normalized level should remain a near-term goal.

The Fund’s strongest performer this fiscal year was Strayer Education Inc. The for-profit education company rose 75% and was the third largest contributor to returns. The stock, along with several other for-profit education companies, was purchased at an attractive valuation during a period of peak pessimism towards the group. Once speculation over the proposed changes to government-backed funding disappeared, the sector soared. The Fund has since exited the sector after the investment thesis towards the group reached fruition and the current valuation appropriately reflected the opportunity and additional risk of regulation. Janus Capital was the Fund’s second best performing holding, gaining 56%. The investment company rallied after world renowned fixed-income fund manager Bill Gross left PIMCO to join Janus.

The Fund’s two worst-performing stocks were Leapfrog Enterprises and Exone. Leapfrog fell 37% despite a very attractive valuation on concerns growth in tablet apps would threaten its tech-based educational products and toys. Exone is a global provider of 3-D printers to industrial customers. Its stock fell 30% after momentum driving the 3D sector capitulated. The position was sold due to the high valuation and missed expectations.

Looking into 2015, many of the issues overhanging the stock market are related to geopolitical factors. Given the domestic focus of smaller companies, continued improvements in the US economy, fueled by further job growth, low inflation, and rising consumer spending, should provide a supportive environment for small-cap stocks. The Fund is committed to seeking out niche companies with a strong commitment to creation of shareholder value.

Thank you for your investment with Oak Associates Funds.

Mutual fund investing involves risk, including the possible loss of principal. Funds that emphasize investments in smaller companies generally will experience greater price volatility.

|

8 |

1-888-462-5386 | www.oakfunds.com |

Table of Contents

| Manager Discussion & Analysis | ||

| All data below as of October 31, 2014 (Unaudited) |

^ Percentages are based on net assets. Holdings are subject to change.

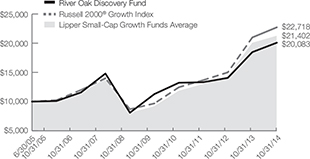

Growth of $10,000 Chart

|

This chart represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Fee waivers are in effect; if they had not been in effect, performance would have been lower. |

| Average Annual Total Return | ||||||||||

| 1 Year Return |

3 Year Return |

5 Year Return |

10 Year Return |

Inception to Date* | ||||||

| River Oak Discovery Fund |

8.75% | 14.67% | 12.22% | — | 7.75% | |||||

| Russell 2000® Growth Index1 |

8.26% | 18.42% | 18.61% | — | 9.19% | |||||

| Lipper Small-Cap Growth Funds Average2 |

5.73% | 16.76% | 17.76% | — | 8.33% | |||||

| *Since 06/30/2005 |

Gross/Net Expense Ratio (per the current prospectus): 1.53%/1.36% | |||||||||

The Adviser has contractually agreed through February 28, 2015, to waive all or a portion of its fee for the Fund (and to reimburse expenses to the extent necessary) in order to limit Fund total operating expenses (excluding Acquired Fund Fees and Expenses) to an annual rate of not more than 1.35% of average daily net assets. This contractual fee waiver may only be terminated subject to approval by the Board of Trustees of the Trust.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end, please visit www.oakfunds.com or call 1-888-462-5386.

1 Russell Investments is the source and owner of the Russell Index data. 2 Lipper Inc. is the source and owner of the Lipper Classification data. See Pages 16 and 17 for additional disclosure.

|

Annual Report | October 31, 2014 |

9 |

Table of Contents

|

Mark W. Oelschlager, CFA Co-Chief Investment Officer (as of October 9, 2014) & Portfolio Manager |

Red Oak Technology Fund (“The Fund”) posted a return of 18.54% for the fiscal year ended October 31, 2014, while the Lipper Science and Technology Average rose 18.23%. The NASDAQ Composite Index, which includes holdings within sectors beyond just technology, rose 24.73% for the fiscal year. For the last ten years, the Fund’s cumulative return was 159.28%, versus 146.80% for the Lipper.

Technology stocks as a group performed about in line with the broader market for the past year. Many of the high-growth stocks, which we have largely avoided, took investors on a wild ride, as the market digested news about Fed policy and changing rates of global economic growth.

Tech companies have been some of the biggest beneficiaries of the globalization of production trend, as they have outsourced manufacturing to foreign markets, thereby reducing costs. This has allowed profit margins, which many have expected to inevitably decline, to stay high. The strong profitability, combined with restrained capital spending, has led to strong free cash flow, which has allowed companies to buy back stock and boost | |

| dividends. When one thinks of tech stocks, one doesn’t normally think of dividends, but the growth in such payouts has been one of the best-kept secrets in the sector. Here are just a few examples of the growth rate in dividends per share over the past year (all of these are current Fund holdings): Western Digital 40%; Qualcomm 20%; Lexmark 20%; Xilinx 16%; IBM 16%; Computer Sciences 15%; EMC 15%; Nvidia 13%; Cisco Systems 12%. In many cases these increases continue a multi-year trend for that company. When investors think about the difference between a stock and a bond they tend to focus on the potential for capital appreciation with a stock versus the stability of a bond. Often overlooked is the aforementioned growth in payout of a stock versus the fixed payout of a bond. | ||

In spite of these higher payouts by tech companies, balance sheets remain quite healthy. In fact, Empirical Research Partners tells us that for the large-cap segment of the sector, cash as a share of total assets is at a 60-year high. This is a testament to the current profitability of the sector and the conservatism of management in spending on new equipment.

Winners for the past year included computer/printer maker Hewlett-Packard, who announced it would split into two companies, and Apple, who managed to maintain high margins on iPhone sales.

Disappointments included online retailer Amazon, who continues to spend more aggressively than investors would like, and infrastructure software company CA, who reduced sales expectations.

Thank you for your investment with Oak Associates Funds.

Mutual fund investing involves risk, including the possible loss of principal. Funds that emphasize investments in technology generally will experience greater price volatility. There are additional risks associated with investing in a single-sector fund, including greater sensitivity to economic, political, or regulatory developments impacting the sector.

|

10 |

1-888-462-5386 | www.oakfunds.com |

Table of Contents

| Manager Discussion & Analysis | ||

| All data below as of October 31, 2014 (Unaudited) |

^ Percentages are based on net assets. Holdings are subject to change.

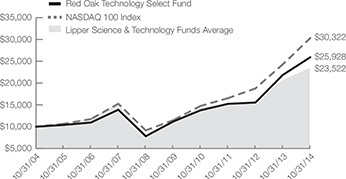

Growth of $10,000 Chart

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Average Annual Total Return | ||||||||||

| 1 Year Return |

3 Year Return |

5 Year Return |

10 Year Return |

Inception to Date* | ||||||

| Red Oak Technology Select Fund |

18.54% | 19.38% | 18.33% | 10.00% | 3.15% | |||||

| NASDAQ 100 Index1 |

24.73% | 22.39% | 21.40% | 11.73% | 5.88% | |||||

| Lipper Science & Technology Funds Average2 |

18.23% | 16.62% | 15.82% | 8.93% | 4.89% | |||||

| *Since 12/31/1998 |

Gross/Net Expense Ratio (per the current prospectus): 1.23% | |||||||||

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end, please visit www.oakfunds.com or call 1-888-462-5386.

1 NASDAQ is the source and owner of the NASDAQ Index data. 2 Lipper Inc. is the source and owner of the Lipper Classification data. See Pages 16 and 17 for additional disclosure.

|

Annual Report | October 31, 2014 |

11 |

Table of Contents

|

Robert D. Stimpson, CFA Portfolio Manager |

Black Oak Emerging Technology Fund (“The Fund”) rose 18.72% during the fiscal year ended October 31, 2014. During the same period, the Lipper Science & Technology Average gained 18.23%. The NASDAQ Composite Index, which includes holdings within sectors beyond just technology, rose 24.73% for the fiscal year. When compared to the Russell 2000 Technology Index, another market indicator, the portfolio significantly outper- formed. The Russell 2000 Technology Index climbed 10.26% for the fiscal year. Over the last five years, the Fund has achieved an annualized return of 11.97% per year.

US equities rallied in 2014 on continued earnings growth and an expansion in the valuation multiple assigned to stocks by investors. Despite a lack-luster economic backdrop, companies continue to benefit from the lean operations, high profit margins established following the 2008 sub-prime crisis, and the low inflation environment. Low inflation boosts valuation multiples, lowers operating costs, and stimulates consumer spending. Stocks tend to thrive under this combination, and 2014 was no exception. |

Global macro issues dominated news headlines for much of 2014 but failed to distract investors from the improving financial situation of US companies. Russia’s annexation of Crimea and foray into Ukrainian sovereignty rattled markets periodically. The Federal Reserve’s tapering of its bond purchase program and potential interest rate hikes also added to investor concerns. However, these fears simply tempered ebullient optimism from developing. With continued economic stagnation in Europe and a slowing of growth in China, pessimists found fodder to focus upon. Meanwhile, stocks climbed the wall of worry.

The domestic US economy continues to improve, although at an underwhelming rate. Inflation appears a distant risk due to a sharp drop in oil prices and weakness in capital intensive markets in Asia. The US unemployment rate has dropped to under 6%, returning to mid-2008 levels. Year-over-year GDP growth has hovered around 4% for the past two years, a respectable level. While not spectacular, the modest expansion helps low inflation persist and allows companies to exploit economic growth while margins remain high.

The Fund’s top performing stock for the year was Palo Alto Networks, which rose 150%. The network security company saw business grow as IT budgets continue to prioritize security spending to address the persistent threat of cyber attacks and network vulnerabilities. Genomics sequencing company Illumina was the second best performing holding and largest contributor to returns, rising 105% in the fiscal year. The biotechnology sector has been driven by a mergers and acquisitions boom that has fueled momentum and carried much of the space higher. Companies that are viewed as safer ways to invest in the growth of the biotechnology industry have also benefited.

The Fund’s worst performing stock was 3D Systems. The 3-dimensional printing manufacturer was the top performing holding in 2013, but fell in 2014 as valuations and missed earnings expectations caused momentum to reverse. The sector, which could potentially help revolutionize manufacturing, has always been a small position in the Fund due to its volatility and momentum risk.

Going forward, the Black Oak Fund will continue to seek niche technology companies with solid earnings prospects that are trading at favorable valuations. Within the Technology Sector, excess cash flow has traditionally been aggressively reinvested in the business. Yet with a renewed interest in shareholder-friendly capital allocation practices, firms which demonstrate a commitment to shareholder value - and have the strong cash flow to support it- may attract the first wave of investors looking for high growth stocks.

Thank you for your investment with Oak Associates Funds.

Mutual fund investing involves risk, including the possible loss of principal. Funds that emphasize investments in technology generally will experience greater price volatility. There are additional risks associated with investing in a single-sector fund with a limited number of holdings versus a more broadly diversified portfolio, including greater sensitivity to economic, political, or regulatory developments impacting the sector. Funds that emphasize investments in smaller or mid-sized companies may experience greater price volatility.

|

12 |

1-888-462-5386 | www.oakfunds.com |

Table of Contents

| Manager Discussion & Analysis | ||

| All data below as of October 31, 2014 (Unaudited) |

^ Percentages are based on net assets. Holdings are subject to change.

Growth of $10,000 Chart

|

|

This chart represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Fee waivers are in effect; if they had not been in effect, performance would have been lower. |

| Average Annual Total Return | ||||||||||

| 1 Year Return |

3 Year Return |

5 Year Return |

10 Year Return |

Inception to Date | ||||||

| Black Oak Emerging Technology Fund |

18.72% | 15.20% | 14.18% | 7.41% | -6.00%* | |||||

| NASDAQ 100 Index1 |

24.73% | 22.39% | 21.40% | 11.73% | 4.89%* | |||||

| Lipper Science & Technology Funds Average2 |

18.23% | 16.62% | 15.82% | 8.93% | 2.69%** | |||||

| *Since 12/29/2000 **Since 12/31/2000 |

Gross/Net Expense Ratio (per the current prospectus): 1.40%/1.36% | |||||||||

The Adviser has contractually agreed through February 28, 2015, to waive all or a portion of its fee for the Fund (and to reimburse expenses to the extent necessary) in order to limit Fund total operating expenses (excluding Acquired Fund Fees and Expenses) to an annual rate of not more than 1.35% of average daily net assets. This contractual fee waiver may only be terminated subject to approval by the Board of Trustees of the Trust.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end, please visit www.oakfunds.com or call 1-888-462-5386.

1 NASDAQ is the source and owner of the NASDAQ Index data. 2 Lipper Inc. is the source and owner of the Lipper Classification data. See Pages 16 and 17 for additional disclosure.

|

Annual Report | October 31, 2014 |

13 |

Table of Contents

|

Mark W. Oelschlager, CFA Co-Chief Investment Officer (as of October 9, 2014) |

Live Oak Health Sciences Fund rose 23.36% for the year ended October 31, 2014, while the comparative index, the S&P 500 Health Care Index, gained 29.71%, and the Lipper Health and Biotech Average rose 32.51%.

This was the sixth consecutive fiscal year that the Fund posted a positive return, with the two worst years in that stretch being 9.02% and 14.46%. The cumulative return for the six years is over 192%. As we believe these returns simply cannot continue forever, we have positioned the portfolio for the days of more moderate returns. It has been difficult to watch the biotech stocks, most of which we do not own, continue to reach new peaks, but we believe the better risk-reward lies elsewhere in the sector.

Over the past year, the Obama Administration delayed the implementation of the employer and individual mandates that were part of the Affordable Care Act (ACA), and as of mid-October fewer than seven million people had signed up for insurance plans through state and federal exchanges. The law has been watered down to an extent, and it may be further altered now that the Republicans have gained control of both | |

| chambers of Congress. A repeal of the medical device tax is quite possible, as is a change in the number of hours (from 30 to 40) that defines a full-time workweek. The Supreme Court has agreed to rule on the legality of subsidies on certain state exchanges, and such a ruling could also have a material impact on the law. While changes to the law may be significant, we do not expect a full repeal of the ACA. | ||

A prominent theme in 2014 that has contributed to the run in healthcare stocks is corporate inversion, which entails a US company moving its headquarters overseas by acquiring a foreign company, thereby lowering its tax rate. The healthcare sector has been the most popular one for this strategy, and many stocks have been bid up either in response to or anticipation of such action. Rather than making US tax policy more competitive (the US is one of the few countries that tax profits earned abroad), the government has chosen to deal with this controversial practice by publicly criticizing those that employ it and by enacting laws that make such a strategy less appealing.

Standout performers for the year included institutional pharmacy company Pharmerica, which rose over 94% amid continued consolidation in the industry. Teva Pharmaceutical also benefited the portfolio, as its new formulation of Copaxone, a Multiple Sclerosis therapy, gained traction with physicians.

European pharma companies GlaxoSmithKline and Sanofi both declined on disappointing drug sales.

Thank you for your investment with Oak Associates Funds.

Mutual fund investing involves risk, including the possible loss of principal. Funds that emphasize investments in health care generally will experience greater price volatility. There are additional risks associated with investing in a single-sector fund versus a more broadly diversified portfolio, including greater sensitivity to economic, political, or regulatory developments impacting the sector.

|

14 |

1-888-462-5386 | www.oakfunds.com |

Table of Contents

| Manager Discussion & Analysis | ||

| All data below as of October 31, 2014 (Unaudited) |

^ Percentages are based on net assets. Holdings are subject to change.

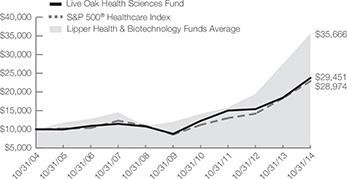

Growth of $10,000 Chart

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Average Annual Total Return | ||||||||||

| 1 Year Return |

3 Year Return |

5 Year Return |

10 Year Return |

Inception to Date | ||||||

| Live Oak Health Sciences Fund |

23.36% | 22.32% | 20.37% | 11.41% | 7.97%* | |||||

| S&P 500® Healthcare Index1 |

29.71% | 28.67% | 21.54% | 11.22% | 7.63%* | |||||

| Lipper Health & Biotechnology Funds Average2 |

32.51% | 31.43% | 24.83% | 13.56% | 10.01%** | |||||

| *Since 06/29/2001 **Since 06/30/2001 |

Gross/Net Expense Ratio (per the current prospectus): 1.15% | |||||||||

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end, please visit www.oakfunds.com or call 1-888-462-5386.

1 Standard & Poor’s is the source and owner of the S&P Index data. 2 Lipper Inc. is the source and owner of the Lipper Classification data. See Pages 16 and 17 for additional disclosure.

|

Annual Report | October 31, 2014 |

15 |

Table of Contents

| As of October 31, 2014 (Unaudited) |

Index Definitions and Disclosures

All indices are unmanaged and index performance figures include reinvestment of dividends but do not reflect any fees, expenses or taxes. Investors cannot invest directly in an index.

NASDAQ 100 Index – The NASDAQ 100 Index includes 100 of the largest domestic and international non-financial securities listed on The Nasdaq Stock Market based on market capitalization.

Russell 2000 Growth Index – The Russell 2000 Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values.

Russell 2000 Technology Index – The Russell 2000 Technology Index is a capitalization-weighted index of companies that serve the electronics and computer technology industries or that manufacture products based on the latest applied science.

S&P 500 Health Care Index – The S&P 500 Health Care Index is a capitalization-weighted index that encompasses two main industry groups. The first includes companies who manufacture health care equipment and supplies or provide health care related services, including distributors of health care products, providers of basic health care services, and owners and operators of health care facilities and organizations. The second group consists of companies primarily involved in the research, development, production and marketing of pharmaceuticals and biotechnology products.

S&P 500 Index – The S&P 500 Index is a commonly recognized, market capitalization weighted index of 500 widely held equity securities, designed to measure broad U.S. equity performance.

Lipper Multi-Cap Core Funds – Funds that, by portfolio practice, invest in a variety of market-capitalization ranges without concentrating 75% of their equity assets in any one market-capitalization range over an extended period of time. Multi-cap core funds typically have average characteristics compared to the S&P SuperComposite 1500 Index.

Lipper Health/Biotechnology Funds – Funds that invest primarily in the equity securities of domestic companies engaged in health care, medicine, and biotechnology.

Lipper Large-Cap Growth Funds – Funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) above Lipper’s USDE large-cap floor. Large-cap growth funds typically have an above-average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value, compared to the S&P 500 Index.

Lipper Multi-Cap Growth Funds – Funds that, by portfolio practice, invest in a variety of market capitalization ranges without concentrating 75% of their equity assets in any one market capitalization range over an extended period of time. Multi-cap growth funds typically have an above-average price-to-earnings ratio, price-to-book ratio, and three-year sales per-share growth value, compared to the S&P SuperComposite 1500 Index.

Lipper Science & Technology Funds – Funds that invest primarily in the equity securities of domestic companies engaged in science and technology.

|

16 |

1-888-462-5386 | www.oakfunds.com |

Table of Contents

| Important Disclosures | ||

| As of October 31, 2014 (Unaudited) |

Lipper Small-Cap Growth Funds – Funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) below Lipper’s USDE small-cap ceiling. Small-cap growth funds typically have an above-average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value, compared to the S&P Small-Cap 600 Index.

Lipper, a Thomson Reuters Company, is the source and owner of the Lipper Classification data contained in this material and all trademarks and copyrights related thereto. Any further dissemination or redistribution is strictly prohibited. Lipper Inc. is not responsible for the formatting or configuration of this material or for any inaccuracy in Oak Associates Funds presentation thereof.

NASDAQ is the source and owner of the NASDAQ Index data contained in this material and all trademarks and copyrights related thereto. Any further dissemination or redistribution is strictly prohibited. NASDAQ is not responsible for the formatting or configuration of this material or for any inaccuracy in Oak Associates Funds’ presentation thereof.

Russell Investments is the source and owner of the Russell Index data contained in this material and all trademarks and copyrights related thereto. Any further dissemination or redistribution is strictly prohibited. Russell Investments is not responsible for the formatting or configuration of this material or for any inaccuracy in Oak Associates Funds’ presentation thereof.

Standard & Poor’s is the source and owner of the S&P Index data contained in this material and all trademarks and copyrights related thereto. Any further dissemination or redistribution is strictly prohibited. Standard & Poor’s is not responsible for the formatting or configuration of this material or for any inaccuracy in Oak Associates Funds’ presentation thereof.

|

Annual Report | October 31, 2014 |

17 |

Table of Contents

| As of October 31, 2014 (Unaudited) |

All mutual funds have operating expenses. As a shareholder of a fund, your investment is affected by these ongoing costs, which include (among others) costs for portfolio management, administrative services, and shareholder reports like this one. It is important for you to understand the impact of these costs on your investment returns.

Operating expenses such as these, are deducted from the Fund’s gross income and directly reduce your final investment return. These expenses are expressed as a percentage of the Fund’s average net assets; this percentage is known as the Fund’s expense ratio.

The following examples use the expense ratio and are intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The table on the next page illustrates your Fund’s costs in two ways:

Actual Fund Return. This section helps you to estimate the actual expenses after fee waivers that your Fund incurred over the period. The “Expenses Paid During Period” column shows the actual dollar expense cost incurred by a $1,000 investment in the Fund, and the “Ending Account Value” number is derived from deducting that expense cost from the Fund’s gross investment return.

You can use this information, together with the actual amount you invested in the Fund, to estimate the expenses you paid over that period. Simply divide your actual account value by $1,000 to arrive at a ratio (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply that ratio by the number shown for your Fund under “Expenses Paid During Period”.

Hypothetical 5% Return. This section helps you compare your Fund’s costs with those of other mutual funds. It assumes that the Fund had an annual 5% return before expenses during the year, but that the expense ratio (Column 3) for the period is unchanged. This example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to make this 5% calculation. You can assess your Fund’s comparative cost by comparing the hypothetical result for your Fund in the “Expense Paid During Period” column with those that appear in the same charts in the shareholder reports for other funds.

Note: Because the return is set at 5% for comparison purposes — NOT your Fund’s actual return—the account values shown may not apply to your specific investment.

|

18 |

1-888-462-5386 | www.oakfunds.com |

Table of Contents

| Disclosure of Fund Expenses | ||

| As of October 31, 2014 (Unaudited) |

| Beginning Account Value 05/01/2014 |

Ending Account Value 10/31/2014 |

Annualized Expense Ratio |

Expenses Paid During the Period(a) | |||||

| White Oak Select Growth Fund |

||||||||

| Actual Return |

$1,000.00 | $1,083.70 | 1.11% | $5.83 | ||||

| Hypothetical 5% Return |

$1,000.00 | $1,019.61 | 1.11% | $5.65 | ||||

| Pin Oak Equity Fund |

||||||||

| Actual Return |

$1,000.00 | $1,069.40 | 1.13% | $5.89 | ||||

| Hypothetical 5% Return |

$1,000.00 | $1,019.51 | 1.13% | $5.75 | ||||

| Rock Oak Core Growth Fund |

||||||||

| Actual Return |

$1,000.00 | $1,051.80 | 1.25% | $6.46 | ||||

| Hypothetical 5% Return |

$1,000.00 | $1,018.90 | 1.25% | $6.36 | ||||

| River Oak Discovery Fund |

||||||||

| Actual Return |

$1,000.00 | $1,010.50 | 1.35% | $6.84 | ||||

| Hypothetical 5% Return |

$1,000.00 | $1,018.40 | 1.35% | $6.87 | ||||

| Red Oak Technology Select Fund |

||||||||

| Actual Return |

$1,000.00 | $1,065.00 | 1.17% | $6.09 | ||||

| Hypothetical 5% Return |

$1,000.00 | $1,019.31 | 1.17% | $5.96 | ||||

| Black Oak Emerging Technology Fund |

||||||||

| Actual Return |

$1,000.00 | $1,106.80 | 1.32% | $7.01 | ||||

| Hypothetical 5% Return |

$1,000.00 | $1,018.55 | 1.32% | $6.72 | ||||

| Live Oak Health Sciences Fund |

||||||||

| Actual Return |

$1,000.00 | $1,118.10 | 1.13% | $6.03 | ||||

| Hypothetical 5% Return |

$1,000.00 | $1,019.51 | 1.13% | $5.75 |

| (a) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

|

Annual Report | October 31, 2014 |

19 |

Table of Contents

| White Oak Select Growth Fund | ||

| As of October 31, 2014 |

| Security Description | Shares | Value | ||||||

| COMMON STOCKS (99.3%) |

||||||||

| CONSUMER DISCRETIONARY (3.5%) |

||||||||

| Internet & Catalog Retail (3.5%) |

||||||||

| Amazon.com, Inc.(a) |

29,600 | $9,041,616 | ||||||

|

|

|

|||||||

| ENERGY (6.0%) |

||||||||

| Energy Equipment & Services (2.3%) |

||||||||

| Transocean, Ltd. |

195,000 | 5,816,850 | ||||||

|

|

|

|||||||

| Oil, Gas & Consumable Fuels (3.7%) |

||||||||

| Exxon Mobil Corp. |

98,000 | 9,477,580 | ||||||

|

|

|

|||||||

| FINANCIALS (31.5%) |

||||||||

| Capital Markets (10.5%) |

||||||||

| The Charles Schwab Corp. |

465,000 | 13,331,550 | ||||||

| US Bancorp |

320,000 | 13,632,000 | ||||||

|

|

|

|||||||

| 26,963,550 | ||||||||

|

|

|

|||||||

| Commercial Banks (9.3%) |

||||||||

| CIT Group, Inc. |

182,400 | 8,924,832 | ||||||

| M&T Bank Corp. |

60,000 | 7,330,800 | ||||||

| TCF Financial Corp. |

487,000 | 7,524,150 | ||||||

|

|

|

|||||||

| 23,779,782 | ||||||||

|

|

|

|||||||

| Diversified Financial Services (6.8%) |

||||||||

| JPMorgan Chase & Co. |

289,400 | 17,502,912 | ||||||

|

|

|

|||||||

| Insurance (4.9%) |

||||||||

| ACE, Ltd. |

114,000 | 12,460,200 | ||||||

|

|

|

|||||||

| HEALTH CARE (24.6%) |

||||||||

| Biotechnology (6.8%) |

||||||||

| Amgen, Inc. |

108,000 | 17,515,440 | ||||||

|

|

|

|||||||

| Health Care Equipment & Supplies (10.4%) |

||||||||

| CR Bard, Inc. |

92,200 | 15,118,034 | ||||||

| Stryker Corp. |

130,000 | 11,378,900 | ||||||

|

|

|

|||||||

| 26,496,934 | ||||||||

|

|

|

|||||||

| Health Care Providers & Services (3.0%) |

||||||||

| Express Scripts Holding Co.(a) |

101,000 | 7,758,820 | ||||||

|

|

|

|||||||

| Pharmaceuticals (4.4%) |

||||||||

| Teva Pharmaceutical Industries, Ltd. - ADR |

197,000 | 11,124,590 | ||||||

|

|

|

|||||||

|

20 |

1-888-462-5386 | www.oakfunds.com |

Table of Contents

| White Oak Select Growth Fund |

Schedules of Investments | |

| As of October 31, 2014 |

| Security Description | Shares | Value | ||||||

| INFORMATION TECHNOLOGY (33.7%) |

||||||||

| Communications Equipment (8.8%) |

||||||||

| Cisco Systems, Inc. |

603,000 | $14,755,410 | ||||||

| Qualcomm, Inc. |

99,100 | 7,780,341 | ||||||

|

|

|

|||||||

| 22,535,751 | ||||||||

|

|

|

|||||||

| Computers & Peripherals (3.6%) |

||||||||

| International Business Machines Corp. |

56,900 | 9,354,360 | ||||||

|

|

|

|||||||

| Internet Software & Services (7.1%) |

||||||||

| Google, Inc. - Class A(a) |

15,850 | 9,000,740 | ||||||

| Google, Inc. - Class C(a) |

16,450 | 9,196,866 | ||||||

|

|

|

|||||||

| 18,197,606 | ||||||||

|

|

|

|||||||

| IT Services (3.9%) |

||||||||

| Cognizant Technology Solutions Corp. - Class A(a) |

207,000 | 10,111,950 | ||||||

|

|

|

|||||||

| Semiconductors & Semiconductor Equipment (5.7%) |

||||||||

| Broadcom Corp. - Class A |

6,000 | 251,280 | ||||||

| KLA-Tencor Corp. |

179,800 | 14,231,170 | ||||||

|

|

|

|||||||

| 14,482,450 | ||||||||

|

|

|

|||||||

| Software (4.6%) |

||||||||

| Salesforce.com, Inc.(a) |

85,400 | 5,464,746 | ||||||

| Symantec Corp. |

250,000 | 6,205,000 | ||||||

|

|

|

|||||||

| 11,669,746 | ||||||||

|

|

|

|||||||

| TOTAL COMMON STOCKS (Cost $233,556,840) |

254,290,137 | |||||||

|

|

|

|||||||

| SHORT TERM INVESTMENTS (0.6%) |

||||||||

| Fidelity Institutional Money Market Government Portfolio - Class I (7 day yield 0.010%) |

1,633,433 | 1,633,433 | ||||||

|

|

|

|||||||

| TOTAL SHORT TERM INVESTMENTS (Cost $1,633,433) |

1,633,433 | |||||||

|

|

|

|||||||

| TOTAL INVESTMENTS - (99.9%) (Cost $235,190,273) |

$255,923,570 | |||||||

| Assets in Excess of Other Liabilities - (0.1%) |

296,986 | |||||||

|

|

|

|||||||

| NET ASSETS - (100.0%) |

$256,220,556 | |||||||

|

|

|

|||||||

| (a) | Non-income producing security. |

Common Abbreviations:

ADR - American Depositary Receipt.

Ltd. - Limited.

The accompanying notes are an integral part of the financial statements.

|

Annual Report | October 31, 2014 |

21 |

Table of Contents

| Schedules of Investments |

Pin Oak Equity Fund | |

| As of October 31, 2014 |

| Security Description | Shares | Value | ||||||

| COMMON STOCKS (98.6%) |

||||||||

| CONSUMER DISCRETIONARY (10.3%) |

||||||||

| Auto Components (2.2%) |

||||||||

| Visteon Corp.(a) |

22,300 | $2,093,970 | ||||||

|

|

|

|||||||

| Internet & Catalog Retail (1.8%) |

||||||||

| Amazon.com, Inc.(a) |

5,550 | 1,695,303 | ||||||

|

|

|

|||||||

| Media (6.3%) |

||||||||

| The Interpublic Group of Cos., Inc. |

110,000 | 2,132,900 | ||||||

| Twenty-First Century Fox, Inc. - Class A |

109,000 | 3,758,320 | ||||||

|

|

|

|||||||

| 5,891,220 | ||||||||

|

|

|

|||||||

| CONSUMER STAPLES (5.6%) |

||||||||

| Beverages (3.2%) |

||||||||

| PepsiCo, Inc. |

31,800 | 3,058,206 | ||||||

|

|

|

|||||||

| Household Products (2.4%) |

||||||||

| Energizer Holdings, Inc. |

18,500 | 2,269,025 | ||||||

|

|

|

|||||||

| ENERGY (6.9%) |

||||||||

| Energy Equipment & Services (4.9%) |

||||||||

| Diamond Offshore Drilling, Inc. |

31,829 | 1,200,271 | ||||||

| Nabors Industries, Ltd. |

192,100 | 3,428,985 | ||||||

|

|

|

|||||||

| 4,629,256 | ||||||||

|

|

|

|||||||

| Oil, Gas & Consumable Fuels (2.0%) |

||||||||

| Royal Dutch Shell PLC - ADR |

26,781 | 1,922,608 | ||||||

|

|

|

|||||||

| FINANCIALS (37.8%) |

||||||||

| Capital Markets (8.0%) |

||||||||

| The Bank of New York Mellon Corp. |

86,000 | 3,329,920 | ||||||

| The Charles Schwab Corp. |

147,551 | 4,230,287 | ||||||

|

|

|

|||||||

| 7,560,207 | ||||||||

|

|

|

|||||||

| Commercial Banks (18.3%) |

||||||||

| CIT Group, Inc. |

62,500 | 3,058,125 | ||||||

| First Bancorp |

50,135 | 908,446 | ||||||

| Great Southern Bancorp, Inc. |

55,845 | 2,122,669 | ||||||

| International Bancshares Corp. |

99,500 | 2,822,815 | ||||||

| SunTrust Banks, Inc. |

57,000 | 2,230,980 | ||||||

| Wells Fargo & Co. |

115,000 | 6,105,350 | ||||||

|

|

|

|||||||

| 17,248,385 | ||||||||

|

|

|

|||||||

| Consumer Finance (4.6%) |

||||||||

| Capital One Financial Corp. |

52,400 | 4,337,148 | ||||||

|

|

|

|||||||

| Insurance (6.9%) |

||||||||

| Assurant, Inc. |

14,000 | 955,080 | ||||||

|

22 |

1-888-462-5386 | www.oakfunds.com |

Table of Contents

| Pin Oak Equity Fund |

Schedules of Investments | |

| As of October 31, 2014 |

| Security Description | Shares | Value | ||||||

| Insurance (continued) |

||||||||

| Everest Re Group, Ltd. |

14,100 | $ | 2,406,165 | |||||

| The Travelers Cos., Inc. |

31,000 | 3,124,800 | ||||||

|

|

|

|||||||

| 6,486,045 | ||||||||

|

|

|

|||||||

| INDUSTRIALS (8.4%) |

||||||||

| Aerospace & Defense (7.7%) |

||||||||

| Lockheed Martin Corp. |

14,100 | 2,687,037 | ||||||

| Raytheon Co. |

44,000 | 4,570,720 | ||||||

|

|

|

|||||||

| 7,257,757 | ||||||||

|

|

|

|||||||

| Machinery (0.7%) |

||||||||

| Parker-Hannifin Corp. |

5,000 | 635,150 | ||||||

|

|

|

|||||||

| INFORMATION TECHNOLOGY (28.9%) |

||||||||

| Electronic Equipment & Instruments (2.5%) |

||||||||

| Flextronics International, Ltd.(a) |

220,000 | 2,358,400 | ||||||

|

|

|

|||||||

| Internet Software & Services (6.5%) |

||||||||

| Google, Inc. - Class A(a) |

3,500 | 1,987,545 | ||||||

| Google, Inc. - Class C(a) |

3,500 | 1,956,780 | ||||||

| IAC/InterActive Corp. |

32,256 | 2,183,409 | ||||||

|

|

|

|||||||

| 6,127,734 | ||||||||

|

|

|

|||||||

| IT Services (9.9%) |

||||||||

| Amdocs, Ltd. |

101,672 | 4,833,487 | ||||||

| Paychex, Inc. |

43,049 | 2,020,720 | ||||||

| The Western Union Co. |

147,000 | 2,493,120 | ||||||

|

|

|

|||||||

| 9,347,327 | ||||||||

|

|

|

|||||||

| Semiconductors & Semiconductor Equipment (4.4%) |

||||||||

| KLA-Tencor Corp. |

21,800 | 1,725,470 | ||||||

| Xilinx, Inc. |

53,500 | 2,379,680 | ||||||

|

|

|

|||||||

| 4,105,150 | ||||||||

|

|

|

|||||||

| Software (5.6%) |

||||||||

| Microsoft Corp. |

113,300 | 5,319,435 | ||||||

|

|

|