Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 | |||

| QUANTA SERVICES, INC. | ||||

| (Name of Registrant as Specified in its Charter) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

|

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

|

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

|

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

|

| ||||

| (5) | Total fee paid: | |||

|

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

|

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

|

| ||||

| (3) | Filing Party:

| |||

|

| ||||

| (4) | Date Filed:

| |||

|

| ||||

Table of Contents

QUANTA SERVICES, INC.

2800 Post Oak Boulevard, Suite 2600

Houston, TX 77056

(713) 629-7600

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 17, 2012

To our Stockholders:

The Annual Meeting of Stockholders of Quanta Services, Inc. (“Quanta”) will be held in the Williams Tower, 2nd Floor Conference Center, Auditorium No. 1, located at 2800 Post Oak Boulevard, Houston, Texas 77056, on May 17, 2012 at 9:00 a.m. local time. At the meeting, you will be asked to consider and act upon the following matters, which are more fully described in the accompanying Proxy Statement:

1. Election of eleven directors nominated by our Board of Directors;

2. Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal year 2012;

3. Approving, by non-binding advisory vote, Quanta’s executive compensation; and

4. Acting upon any other matters that are properly brought before the meeting, or any adjournments or postponements of the meeting, by or at the direction of the Board of Directors.

Our stockholders of record at the close of business on March 19, 2012 are entitled to notice of, and to vote at, the annual meeting and any adjournments or postponements of the meeting.

By Order of the Board of Directors,

Carolyn M. Campbell

Corporate Secretary

Houston, Texas

April 10, 2012

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 17, 2012

The Notice, Proxy Statement and 2011 Annual Report to Stockholders are available at www.proxyvote.com.

YOUR VOTE IS IMPORTANT

You are cordially invited to attend the annual meeting in person. To assure your representation at the meeting, please vote promptly whether or not you expect to be present at the meeting. You can vote your shares by signing and dating the enclosed proxy card and returning it in the accompanying envelope or you may vote via the Internet or telephone. You will find specific instructions for voting via the Internet or telephone on the proxy card if that option is available for your shares. If you attend the meeting, you may revoke your proxy and vote your shares in person. If you hold your shares through a broker, bank or nominee and wish to vote at the meeting, you will need to obtain a proxy from the institution that holds your shares. If you choose to attend the meeting, you will be asked to present valid picture identification, and if you hold your shares through a broker, bank or nominee, you will be asked to present a copy of your brokerage statement showing your stock ownership as of March 19, 2012.

Table of Contents

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| What are the voting rights of the holders of Common Stock and Series F Preferred Stock? |

2 | |||

| 2 | ||||

| 2 | ||||

| What vote is required to approve each item to be voted on at the meeting? |

2 | |||

| 3 | ||||

| What is the difference between holding shares as a stockholder of record and in “street name”? |

3 | |||

| 4 | ||||

| 4 | ||||

| 4 | ||||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| INFORMATION CONCERNING THE BOARD OF DIRECTORS AND COMMITTEES |

11 | |||

| 11 | ||||

| 11 | ||||

| 11 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 20 | ||||

| 20 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

Table of Contents

| 42 | ||||

| 42 | ||||

| 44 | ||||

| 45 | ||||

| 45 | ||||

| 52 | ||||

| 53 | ||||

| 53 | ||||

| 54 | ||||

| 54 | ||||

| 55 | ||||

| PROPOSAL NO. 2: RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

56 | |||

| 57 | ||||

| 59 | ||||

| Stockholder Proposals and Nominations of Directors for the 2013 Annual Meeting |

59 | |||

| 59 | ||||

| 60 | ||||

Table of Contents

QUANTA SERVICES, INC.

2800 Post Oak Boulevard, Suite 2600

Houston, TX 77056

(713) 629-7600

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 17, 2012

We are distributing this Proxy Statement, the form of proxy and our 2011 Annual Report

beginning on or about April 10, 2012.

What is the purpose of the meeting?

The meeting will be Quanta’s regular annual meeting of stockholders, and stockholders will be asked to vote on the following matters:

| • | election of eleven directors nominated by our Board of Directors (the “Board”); |

| • | ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal year 2012; and |

| • | approval, by non-binding advisory vote, of Quanta’s executive compensation. |

How does the Board recommend that stockholders vote?

The Board recommends that stockholders vote as follows:

| • | FOR the election of all nominees as directors; |

| • | FOR ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal year 2012; and |

| • | FOR the advisory resolution approving Quanta’s executive compensation. |

Who is entitled to vote at the meeting?

Only holders of record of (A) our Common Stock, par value $0.00001 per share, and (B) our Series F Preferred Stock, par value $0.00001 per share, respectively, at the close of business on March 19, 2012, the record date for the meeting, are entitled to notice of and to vote at the annual meeting. If you were a stockholder of record on that date, you will be entitled to vote all of the shares that you held on that date at the meeting, or at any adjournments or postponements of the meeting unless a new record date is then set.

As of March 19, 2012, 207,255,983 shares of our Common Stock and one share of our Series F Preferred Stock, respectively, were outstanding and entitled to vote.

1

Table of Contents

What are the voting rights of the holders of Common Stock and Series F Preferred Stock?

Each share of Common Stock is entitled to one vote on each matter on which it may vote. The share of Series F Preferred Stock is entitled to a number of votes equal to the number of outstanding Class A non-voting exchangeable common shares of our wholly-owned subsidiary, Valard Construction Ltd., a British Columbia company and successor to Quanta Services EC Canada Ltd., on each matter on which it may vote. Valard Construction Ltd. had 3,909,110 Class A non-voting exchangeable common shares outstanding on March 19, 2012.

Holders of Common Stock and Series F Preferred Stock vote together as a single class on all matters. The required vote to approve each item to be voted on at the meeting is described below.

All stockholders of record as of March 19, 2012, or their duly appointed proxies, may attend the meeting, and each may be accompanied by one guest. Seating, however, is limited. Admission to the meeting will be on a first-come, first-served basis. Registration will begin at 8:00 a.m. and seating will begin at 8:30 a.m. Each stockholder will be asked to present valid picture identification, such as a driver’s license or passport. Cameras, recording devices and other electronic devices will not be permitted at the meeting. To obtain directions to the meeting, please contact our Corporate Secretary at 713-629-7600.

Please note that if you hold your shares in “street name” (that is, through a broker, bank or other nominee), you will need to bring a copy of a brokerage statement reflecting your stock ownership as of the record date and check in at the registration desk at the meeting.

The holders of shares representing both (i) a majority of the aggregate outstanding shares and (ii) a majority of the aggregate voting power of Common Stock and Series F Preferred Stock entitled to vote must be present, in person or by proxy, to constitute a quorum to transact business at the annual meeting.

As of March 19, 2012, 207,255,983 shares of our Common Stock with aggregate voting power of 207,255,983 votes, and one share of our Series F Preferred Stock with aggregate voting power of 3,909,110 votes, respectively, were outstanding and entitled to vote. Properly executed proxies received but marked as abstentions and broker non-votes will be counted as present for purposes of establishing a quorum at the meeting.

What vote is required to approve each item to be voted on at the meeting?

Directors are elected by a majority of the votes cast with respect to such director in uncontested elections, such that a nominee for director will be elected to the Board if the votes cast FOR the nominee’s election exceed the votes cast AGAINST such nominee’s election. Abstentions and broker non-votes are not counted as votes cast for purposes of the election of directors and, therefore, will have no effect on the outcome of such election. Even if a nominee is not re-elected, he or she will remain in office as a director until his or her earlier resignation or removal. Each of the current director nominees has signed a letter of resignation that will be effective if the nominee is not re-elected at the meeting and the Board accepts his or resignation following the meeting. If a nominee is not re-elected, the Board will decide whether to accept the director’s resignation in accordance with the procedures listed in Quanta’s Corporate Governance Guidelines, which are available on our website at www.quantaservices.com.

Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm requires the affirmative vote of a majority of the voting power of the shares of Common Stock and Series F Preferred Stock, considered together as a single class, present at the meeting in person or by proxy and entitled to vote on that proposal. Abstentions will have the same effect as a vote against the proposal. Broker non-votes will have no effect on the outcome of the vote on such proposal.

2

Table of Contents

Advisory approval of the resolution on Quanta’s executive compensation requires the affirmative vote of a majority of the voting power of the shares of Common Stock and Series F Preferred Stock, considered together as a single class, present at the meeting in person or by proxy and entitled to vote on that proposal. Abstentions will have the same effect as a vote against the resolution. Broker non-votes will have no effect on the outcome of the advisory vote. The results of this vote are not binding on the Board, whether or not the proposal is adopted by the aforementioned voting standard. In evaluating the vote on this resolution, the Board intends to consider the voting results in their entirety.

Any other matter properly brought before the meeting will be decided by the affirmative vote of a majority of the voting power of the shares of Common Stock and Series F Preferred Stock, considered together as a single class, present at the meeting in person or by proxy and entitled to vote on the matter.

You may vote your shares in any of the following manners:

| • | by signing and dating the enclosed proxy card and returning it in the accompanying envelope; |

| • | on the Internet, at the website www.proxyvote.com, by following the instructions included with your proxy card (not available to the holder of Series F Preferred Stock); |

| • | by telephone, following the instructions included with your proxy card (not available to the holder of Series F Preferred Stock); or |

| • | by written ballot at the meeting. |

If you are a stockholder of record and you attend the meeting, you may deliver your completed proxy card in person. If you hold your shares in “street name” and you wish to vote at the meeting, you will need to obtain a proxy from the broker or nominee that holds your shares.

Whether or not you plan to attend the meeting, we encourage you to vote by proxy as soon as possible.

What is the difference between holding shares as a stockholder of record and in “street name”?

Many stockholders hold their shares through a stockbroker, bank or other nominee rather than directly in their own name. This is often called holding shares in “street name.” As summarized below, there are some distinctions between record stockholders and “street name” holders.

If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, you are considered the stockholder of record for those shares, and these proxy materials are being sent directly to you.

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of those shares, and you hold your shares in “street name.” In this case, proxy materials are being forwarded to you by or on behalf of your broker, bank or nominee. As the beneficial owner, you have the right to direct your broker, bank or nominee how to vote and are also invited to attend the annual meeting. However, because you are not a stockholder of record, you may not vote these shares in person at the annual meeting unless you bring with you a proxy from your broker, bank or nominee. Your broker, bank or nominee has enclosed a voting instruction card for you to use in directing the vote of your shares.

3

Table of Contents

The New York Stock Exchange (“NYSE”) permits brokers to vote their customers’ stock held in street name on routine matters, such as the ratification of the appointment of our independent registered public accounting firm, when the brokers have not received voting instructions from their customers. However, the NYSE does not allow brokers to vote their customers’ shares held in street name on non-routine matters unless they have received voting instructions from their customers. In such cases, the uninstructed shares for which the broker is unable to vote are called broker non-votes.

What routine matters will be voted on at the meeting?

Ratification of the appointment of our independent registered public accounting firm is the only matter to be voted on at the meeting on which brokers may vote in their discretion on behalf of customers who have not provided voting instructions.

What non-routine matters will be voted on at the meeting?

Each of the election of directors and the advisory vote on executive compensation is a non-routine matter on which brokers are not allowed to vote unless they have received voting instructions from their customers.

What is the effect of not casting a vote?

If you are a stockholder of record and you do not cast your vote, no votes will be cast on your behalf on any of the matters that properly come before the meeting.

If you hold your shares in street name, it is critical that you cast your vote if you want it to count in the election of directors and the advisory vote on executive compensation to be voted on at the meeting. In prior years, if you held your shares in street name, and you did not indicate how you wanted your shares voted in the election of directors, your broker, bank or other nominee was allowed to vote those shares on your behalf in the election of directors as they felt appropriate. However, recent NYSE rule changes have eliminated the ability of your broker, bank or other nominee to vote your uninstructed shares in the election of directors on a discretionary basis. Thus, if you hold your shares in street name, and you do not instruct your broker, bank or other nominee how to vote in the election of directors or any other non-routine matter, no votes will be cast on your behalf on such matters. Therefore, your broker, bank or other nominee will not have discretion to vote your shares on the election of directors or the advisory vote on executive compensation if you do not instruct your broker, bank or other nominee how to vote on these proposals, as these are not “routine” matters under NYSE rules. Your broker, bank or other nominee will, however, continue to have discretion to vote any uninstructed shares on the ratification of the appointment of our independent registered public accounting firm.

Yes. You may revoke your proxy at any time before the voting polls are closed at the annual meeting, by the following methods:

| • | by signing, dating and delivering to the Corporate Secretary of Quanta a proxy with a later date or a written revocation of your prior proxy; |

| • | by voting at a later time on the website www.proxyvote.com, following the instructions included with your proxy card (not available to the holder of Series F Preferred Stock); |

| • | by voting at a later time by telephone, following the instructions included with your proxy card (not available to the holder of Series F Preferred Stock); or |

| • | by voting in person at the annual meeting by written ballot. |

4

Table of Contents

The powers of the proxy holders will be revoked with respect to your shares if you attend the meeting in person and vote your shares in person by completing a written ballot. Attendance at the meeting will not by itself revoke a previously granted proxy. If you hold your shares in “street name,” you may later revoke your proxy by informing the holder of record in accordance with that entity’s procedures.

What if I receive more than one proxy card?

If you hold your shares in more than one type of account or your shares are registered differently, you may receive more than one proxy card. We encourage you to vote each proxy card that you receive.

Where can I find the voting results of the meeting?

We plan to announce preliminary voting results at the meeting and publish final results in a Current Report on Form 8-K or an amendment thereto timely filed with the Securities and Exchange Commission (the “SEC”).

5

Table of Contents

BENEFICIAL OWNERS AND MANAGEMENT

Security Ownership of Certain Beneficial Owners

The following table sets forth information, as of March 19, 2012, unless otherwise indicated, with respect to each person known by us to be the beneficial owner of more than five percent of the outstanding shares of our Common Stock or Series F Preferred Stock.

| Name and Address of Beneficial Owner |

Title of Class | Number of

Shares Beneficially Owned |

Percent of Class(1) |

|||||||

| T. Rowe Price Associates, Inc. |

Common Stock | 20,949,519 | (2) | 10.1 | % | |||||

| 100 E. Pratt Street |

||||||||||

| Baltimore, Maryland 21202 |

||||||||||

| BlackRock, Inc. |

Common Stock | 14,564,460 | (3) | 7.0 | % | |||||

| 40 East 52nd Street |

||||||||||

| New York, New York 10022 |

||||||||||

| The Vanguard Group Inc. |

Common Stock | 10,878,942 | (4) | 5.2 | % | |||||

| 100 Vanguard Blvd. |

||||||||||

| Malvern, PA 19355 |

||||||||||

| Victor Budzinski, Trustee |

Series F | 1 | (5) | 100.0 | % | |||||

| 708 Hollingsworth Green |

Preferred Stock | |||||||||

| Edmonton, Alberta T6R 3G6 |

||||||||||

| (1) | The percent of class beneficially owned is calculated based on 207,255,983 shares of our Common Stock, with aggregate voting power of an equal number of votes, and (B) one share of our Series F Preferred Stock, with aggregate voting power of 3,909,110 votes, respectively, issued and outstanding as of March 19, 2012. In addition, if a person has the right to acquire beneficial ownership of shares within 60 days following March 19, 2012, those shares are deemed beneficially owned by that person as of that date and are deemed to be outstanding solely for the purpose of determining the percentage of common stock that he or she owns. Those shares are not included in the computations for any other person. |

| (2) | Based on Schedule 13G/A (Amendment No. 5) filed on February 13, 2012 by T. Rowe Price Associates, Inc. (“Price Associates”), which has sole voting power over 4,977,073 of such shares and sole dispositive power over all such shares. The Schedule 13G/A (Amendment No. 5) further indicates that these securities are owned by various individual and institutional investors for which Price Associates serves as an investment adviser with power to direct investments and/or sole power to vote the securities. For purposes of the reporting requirements of the Securities Exchange Act of 1934, Price Associates is deemed to be a beneficial owner of such securities; however, Price Associates expressly disclaims that it is, in fact, the beneficial owner of such securities. |

| (3) | Based on Schedule 13G/A (Amendment No. 2) filed on February 10, 2012 by BlackRock, Inc., a parent holding company for a number of investment management subsidiaries, which has sole voting and dispositive power over all such shares. |

| (4) | Based on Schedule 13G/A (Amendment No. 1) filed on February 10, 2012 by The Vanguard Group Inc., an investment adviser, which has sole voting power and shared dispositive power over 292,065 of such shares and sole dispositive power over 10,586,877 of such shares. |

| (5) | As of March 19, 2012, the one issued and outstanding share of our Series F Preferred Stock had voting rights equivalent to 3,909,110 shares, or 1.9%, of our Common Stock. |

6

Table of Contents

Security Ownership of Management

The following table sets forth, as of March 19, 2012, the number of shares of Common Stock beneficially owned by (i) each of our directors and director nominees, (ii) each of our named executive officers listed in the Summary Compensation Table (the “NEOs”) and (iii) all of our directors and executive officers as a group.

| Shares of Common

Stock Beneficially Owned |

||||||||

| Name |

Number | Percent of Class(1) | ||||||

| John R. Colson |

1,391,876 | (2) | * | |||||

| Vincent D. Foster |

258,862 | (3) | * | |||||

| James H. Haddox |

254,434 | * | ||||||

| Earl C. Austin Jr. |

119,708 | * | ||||||

| Derrick A. Jensen |

116,695 | * | ||||||

| James F. O’Neil III |

110,138 | * | ||||||

| Kenneth W. Trawick |

93,329 | * | ||||||

| Louis C. Golm |

81,631 | (4) | * | |||||

| James R. Ball |

77,305 | (5) | * | |||||

| Bruce Ranck |

65,592 | * | ||||||

| Bernard Fried |

50,204 | * | ||||||

| Pat Wood, III |

26,438 | * | ||||||

| Ralph R. DiSibio |

23,068 | * | ||||||

| J. Michal Conaway |

22,127 | * | ||||||

| Worthing F. Jackman |

20,517 | * | ||||||

| All directors and executive officers as a group (19 persons) |

2,824,517 | (6) | 1.4 | % | ||||

| * | Percentage of shares does not exceed 1%. |

| (1) | The percent of class beneficially owned is calculated based on (A) 207,255,983 shares of our Common Stock, with aggregate voting power of an equal number of votes, issued and outstanding as of March 19, 2012. In addition, if a person has the right to acquire beneficial ownership of shares within 60 days following March 19, 2012, those shares are deemed beneficially owned by that person as of that date and are deemed to be outstanding solely for the purpose of determining the percentage of common stock that he or she owns. Those shares are not included in the computations for any other person. |

| (2) | Includes 804,142 shares pledged as collateral. |

| (3) | Includes 7,500 shares of Common Stock that may be acquired by Mr. Foster upon the exercise of stock options. |

| (4) | Includes 10,000 shares of Common Stock that may be acquired by Mr. Golm upon the exercise of stock options. |

| (5) | Includes 7,500 shares of Common Stock that may be acquired by Mr. Ball upon the exercise of stock options. |

| (6) | Includes 25,000 shares of Common Stock that may be acquired upon the exercise of stock options. |

7

Table of Contents

ELECTION OF DIRECTORS

The Board currently consists of eleven directors, whose current terms of office all expire at the 2012 annual meeting. The Board proposes that the following eleven nominees be elected for a new term of one year or until their successors are duly elected and qualified or until their earlier death, resignation or removal. Each of the nominees has consented to serve if elected. If a nominee becomes unavailable to serve as a director, the Board may designate a substitute nominee. In that case, the persons named as proxies will vote for the substitute nominee designated by the Board. Proxies cannot be voted for a greater number of persons than the number of nominees named below.

The director nominees standing for election are:

| Name |

Age | Position(s) with Quanta |

Director Since | |||||||

| James R. Ball |

69 | Director | 1998 | |||||||

| John R. Colson |

64 | Executive Chairman and Director |

1998 | |||||||

| J. Michal Conaway |

63 | Director | 2007 | |||||||

| Ralph R. DiSibio |

70 | Director | 2006 | |||||||

| Vincent D. Foster |

55 | Director | 1998 | |||||||

| Bernard Fried |

55 | Director | 2004 | |||||||

| Louis C. Golm |

70 | Director | 2002 | |||||||

| Worthing F. Jackman |

47 | Director | 2005 | |||||||

| James F. O’Neil III |

53 | President, Chief Executive Officer and Director |

2011 | |||||||

| Bruce Ranck |

63 | Director | 2005 | |||||||

| Pat Wood, III |

49 | Director | 2006 | |||||||

James R. Ball has been a member of the Board of Directors since 1998 and is a private investor. He previously served in various management positions with Vista Chemical Company for over twenty-five years, most recently as Chief Executive Officer and President from 1992 until his retirement in 1995. He also previously served as a director of Kraton Polymers, LLC from 2004 to 2008, ABS Group Inc. from 2003 to 2005, The Carbide/Graphite Group, Inc. from 1994 to 2002, and Rexene Corporation from 1996 to 1997. Mr. Ball holds a Bachelor of Science in Mathematics degree and a Master of Science in Management degree. The Board believes Mr. Ball’s qualifications to serve on the Board include his over twenty-five years of management experience, including three years as a chief executive officer, his years of service on boards of other public companies, and his extensive experience with corporate governance, financial analysis, business strategy and management.

John R. Colson has been a member of the Board of Directors since 1998 and has served as Executive Chairman of the Board of Directors since May 2011. Mr. Colson previously served as our Chairman of the Board from 2002 to May 2011 and as our Chief Executive Officer from December 1997 to May 2011. He joined PAR Electrical Contractors, Inc. (PAR), an electrical specialty contractor and now a subsidiary of Quanta, in 1971 and served as its President from 1991 until December 1997. He served as a director of U.S. Concrete, Inc. from 1999 to 2006. He is currently a member of the National Electrical Contractors Association (NECA) and the Academy of Electrical Contracting, a director of the Missouri Valley Chapter of NECA, and a regent of the Electrical Contracting Foundation. The Board believes Mr. Colson’s qualifications to serve on the Board include his significant contributions and service to Quanta since its inception, including his day-to-day leadership of Quanta as its Chief Executive Officer, his four decades of electric power industry experience, as well as his years of service as a director of other public companies.

8

Table of Contents

J. Michal Conaway has been a member of the Board of Directors since August 2007. He has served as the Chief Executive Officer of Peregrine Group, LLC, an executive consulting firm, since 2002. Mr. Conaway has been providing consulting and advisory services since 2000. Prior to 2000, Mr. Conaway held various management and executive positions, including serving as Chief Financial Officer of Fluor Corporation, an engineering, procurement, construction and maintenance services provider. Since 2008, Mr. Conaway has served as a director of GT Advanced Technologies, Inc., formerly known as GT Solar International, Inc. He previously served as a director of InfraSource Services, Inc. from February 2006 to August 2007 and Cherokee International Corporation from April 2008 to November 2008. Mr. Conaway holds an M.B.A. degree and is a Certified Public Accountant. The Board believes Mr. Conaway’s qualifications to serve on the Board include his prior service as the chief financial officer of multiple public corporations, including those within Quanta’s line of business, his years of service on boards of other public and private companies, his extensive financial and accounting expertise, and his advisory experience in strategic, operational and financial matters.

Ralph R. DiSibio has been a member of the Board of Directors since May 2006. He has been a senior consultant to Washington Group International, Inc., an integrated engineering, construction and management services provider, since April 2004. He served as President of Energy & Environment Business Unit, an engineering, construction and environmental services operating unit of Washington Group International, Inc., from November 2001 until April 2004, and Executive Vice President — Business Development of Washington Group Power, a power generation engineering, design and construction services operating unit of Washington Group International, Inc., from March 2001 until November 2001. Mr. DiSibio holds a Doctor of Education in Administration degree. The Board believes Mr. DiSibio’s qualifications to serve on the Board include his executive management experience, including at companies within Quanta’s line of business, as well as his extensive operational and risk management experience in the power industry.

Vincent D. Foster has been a member of the Board of Directors since 1998. He has served as Chairman of the Board and Chief Executive Officer of Main Street Capital Corporation, a specialty investment company, since March 2007. He also has served as Senior Managing Director of Main Street Capital Partners, LLC (and its predecessor firms), a private investment firm, since 1997. Since 2005, Mr. Foster has served as a director of Team Industrial Services, Inc. Mr. Foster previously served as a director of U.S. Concrete, Inc. from 1999 to 2010 and Carriage Services, Inc. from 1999 to 2011. Mr. Foster holds a J.D. degree and is a Certified Public Accountant. The Board believes Mr. Foster’s qualifications to serve on the Board include his significant contributions and service to Quanta since its inception, his experience as chief executive officer of a public corporation, his many years of service on boards of other public companies and his extensive tax, accounting, merger and acquisitions, financial and corporate governance expertise.

Bernard Fried has been a member of the Board of Directors since March 2004. Since March 2011, he has served as the Executive Chairman of Energy Solutions International, a software provider to the pipeline industry, and he has also been an independent consultant. He previously served as Chief Executive Officer and President of Siterra Corporation, a software services provider, from May 2005 to March 2011. From November 2003 until May 2005, he served as an independent consultant to the financial and software services industries. Mr. Fried served as Chief Executive Officer and President of Citadon, Inc., a software services provider, from 2001 until November 2003, and Chief Financial Officer and Managing Director of Bechtel Enterprises, Inc., a financing and development subsidiary of Bechtel Group, Inc., from 1997 until 2000. Mr. Fried holds a Bachelor of Engineering degree and an M.B.A. degree. The Board believes Mr. Fried’s qualifications to serve on the Board include his executive management experience, including at companies within Quanta’s line of business, his years of service on boards of public and private companies, and his extensive executive-level experience in operations, finance and international business.

Louis C. Golm has been a member of the Board of Directors since July 2002 and from May 2001 until May 2002. He has been an independent consultant and senior advisor to the telecommunications and information management industries since 1999. Mr. Golm holds a Master of Science in Management degree and an M.B.A. degree. The Board believes Mr. Golm’s qualifications to serve on the Board include his numerous years of

9

Table of Contents

executive management experience, including as chief executive officer of a large telecommunications company, his years of service as a director of other public and private companies, his insight regarding accounting/finance, risk mitigation and strategic development, and his telecommunications industry expertise.

Worthing F. Jackman has been a member of the Board of Directors since May 2005. He has served as Executive Vice President — Chief Financial Officer of Waste Connections, Inc., an integrated solid waste services company, since September 2004 and served as its Vice President — Finance and Investor Relations from April 2003 until August 2004. From 1991 until April 2003, Mr. Jackman held various positions with Deutsche Bank Securities, Inc., an investment banking firm, most recently serving as a Managing Director, Global Industrial and Environmental Services Group. Mr. Jackman holds an M.B.A. degree. The Board believes Mr. Jackman’s qualifications to serve on the Board include his experience as the chief financial officer of a public corporation and his investment banking experience, as well as his extensive financial and accounting expertise.

James F. O’Neil III has been a member of the Board of Directors and has served as our President and Chief Executive Officer since May 2011. He previously served as our President and Chief Operating Officer from October 2008 to May 2011, our Senior Vice President of Operations Integration and Audit from December 2002 to October 2008, and our Vice President of Operations Integration from August 1999 to December 2002. Mr. O’Neil holds a Bachelor of Science in Civil Engineering degree. The Board believes Mr. O’Neil’s qualifications to serve on the Board include his significant contributions to Quanta in strategy, mergers and acquisitions and internal audit, his operational and safety leadership service with Quanta, including as its President and Chief Operating Officer, his technical expertise, and his extensive knowledge of the industries Quanta serves.

Bruce Ranck has been a member of the Board of Directors since May 2005. He has been a partner with Bayou City Partners, a venture capital firm, since 1999. Mr. Ranck served as Chief Executive Officer of Tartan Textile Services, Inc., a healthcare linen services provider, from August 2003 until April 2006. From 1970 until 1999, he held various positions with Browning-Ferris Industries, Inc., a provider of waste management services, most recently as Chief Executive Officer and President. Mr. Ranck served as a director of Dynamex Inc. from 2002 until February 2011. The Board believes Mr. Ranck’s qualifications to serve on the Board include his executive management experience, including as chief executive officer of a large public corporation, his extensive acquisition integration experience, and his years of service on boards of other public and private companies.

Pat Wood, III has been a member of the Board of Directors since May 2006. He has served as a Principal of Wood3 Resources, an energy infrastructure developer, since July 2005. From 2001 until July 2005, Mr. Wood served as chairman of the Federal Energy Regulatory Commission. From 1995 until 2001, he chaired the Public Utility Commission of Texas. Prior to 1995, Mr. Wood was an attorney with Baker & Botts, a global law firm, and an associate project engineer with Arco Indonesia, an oil and gas company, in Jakarta. Mr. Wood has served as a director of SunPower Corporation since 2005 and as a director of First Wind Holdings Inc. since 2010. Mr. Wood holds a Bachelor of Science in Civil Engineering degree and a J.D. degree. The Board believes Mr. Wood’s qualifications to serve on the Board include his significant strategic and operational management experience, his unique perspective and extensive knowledge with regard to the regulatory process and policy development at the government level, his years of service as a director of other public and private companies, and his energy infrastructure development expertise.

The Board of Directors unanimously recommends a vote FOR the election of each of the director nominees.

10

Table of Contents

INFORMATION CONCERNING THE BOARD OF DIRECTORS AND COMMITTEES

During the year ended December 31, 2011, the Board held nine meetings. All directors attended at least 75% of the meetings of the Board and the committees of the Board, if any, on which they served during the periods for which they have served as a director. We encourage, but do not require, the members of the Board to attend the annual meeting of stockholders. Last year, all of our directors attended the annual meeting of stockholders.

As of the date of this Proxy Statement, the Board is composed of eleven directors.

Information regarding the Audit, Compensation and Governance and Nominating Committees of the Board are as follows:

| Committee |

Current Members |

Number of Meetings During 2011 |

Duties of the Committee Include: | |||||

| Audit Committee |

Bernard Fried* James R. Ball J. Michal Conaway Worthing F. Jackman |

Eight | • Monitoring the quality and integrity of Quanta’s financial statements

• Appointing and compensating the independent registered public accounting firm

• Considering the independence and assessing the qualifications of the independent registered public accounting firm

• Reviewing the performance of Quanta’s internal audit function and the independent registered public accounting firm | |||||

| Compensation Committee |

Louis C. Golm* Ralph R. DiSibio Vincent D. Foster Bruce Ranck |

Eight | • Overseeing the administration of Quanta’s incentive compensation plans, including the issuance of awards pursuant to equity-based incentive plans

• Reviewing and approving salaries, bonuses, equity-based awards and other compensation of all executive officers and other management of Quanta and its subsidiaries

• Reviewing and approving executive officer employment agreements | |||||

| * | Chairman |

11

Table of Contents

| Committee |

Current Members |

Number of Meetings During 2011 |

Duties of the Committee Include: | |||||

| Governance and Nominating Committee |

Bruce Ranck* J. Michal Conaway Louis C. Golm Pat Wood, III |

Six | • Developing and recommending corporate governance principles applicable to the Board and Quanta

• Establishing qualifications for membership on the Board and its committees

• Making recommendations regarding persons to be nominated for election or re-election to the Board and appointment to its committees

• Evaluating policies regarding the recruitment of directors

• Making recommendations regarding persons to be elected as executive officers by the Board | |||||

| * | Chairman |

12

Table of Contents

We are committed to having sound corporate governance practices that maximize stockholder value in a manner consistent with legal requirements and the highest standard of integrity. In that regard, the Board has adopted guidelines that provide a framework for the governance of Quanta. In addition, we continually review these guidelines and regularly monitor developments in the area of corporate governance. Our Corporate Governance Guidelines are posted on our website at www.quantaservices.com under the heading “Corporate Governance.”

The Board has determined that Messrs. Ball, Conaway, DiSibio, Foster, Fried, Golm, Jackman, Ranck and Wood have no material relationship with Quanta (either directly or as a partner, shareholder or officer of an organization that has a relationship with Quanta) and are “independent” within the meaning of the NYSE’s corporate governance listing standards. The Board has made this determination based in part on its finding that these independent directors meet the categorical standards for director independence set forth in our Corporate Governance Guidelines and in the NYSE corporate governance listing standards. Our Corporate Governance Guidelines, which include our categorical standards for director independence, are posted on our website at www.quantaservices.com under the heading “Corporate Governance.”

The Board believes that Quanta’s Executive Chairman is best situated to serve as Chairman of the Board because, as an executive officer, he possesses detailed and in-depth knowledge of the issues, opportunities and challenges facing Quanta and its business and is thus best positioned to develop agendas that ensure that the Board’s time and attention are focused on the most critical matters. The Board believes that an executive officer serving as Chairman of the Board promotes strategy development and execution and fosters decisive leadership, clear accountability and effective decision-making. The Board believes that it has in place sound counter-balancing measures to ensure that Quanta maintains high standards of corporate governance and proper independent oversight. For instance, the Board holds executive sessions of the independent directors at every regularly scheduled Board meeting and, with nine of the Board’s eleven directors deemed independent, maintains a percentage of independent directors serving on the Board that is substantially above the NYSE requirement that a majority of directors be independent.

Additionally, given that the Chairman of the Board is not independent under the categorical standards for director independence set forth in Quanta’s Corporate Governance Guidelines, the Board considers it useful and appropriate to designate a Lead Independent Director to coordinate the activities of the other independent directors, preside over the Board when the Chairman of the Board is not present, and perform such other duties and responsibilities as the Board may determine. Accordingly, the independent members of the Board appoint, by majority vote, one of the independent members of the Board to serve as Lead Independent Director for a term continuing through the next annual Board meeting. The duties of the Lead Independent Director include presiding over executive sessions or other meetings of the independent directors and consulting with the Chairman of the Board as to agenda items for Board and committee meetings. In May 2011, the independent directors appointed James R. Ball to serve as Lead Independent Director, to serve as such until his successor is duly elected and qualified at the next annual meeting of the Board or until his earlier resignation or removal.

The Board’s Role in Risk Oversight

The Board oversees an enterprise-wide approach to risk management, designed to support the achievement of long-term organizational objectives and enhance stockholder value. The annual enterprise risk management assessment, led by Quanta’s President and Chief Executive Officer, provides visibility to the Board about the identification, assessment and management of critical risks and management’s risk mitigation strategies. In this process, risk is assessed throughout the business, including operational, financial, legal, regulatory, strategic and

13

Table of Contents

reputational risks. A fundamental part of risk management is not only understanding the risks a company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for the company. The involvement of the full Board in setting Quanta’s business strategy, both short-term and long-term, is a key part of its understanding of Quanta’s risks and what constitutes an appropriate level of risk for Quanta as well as how such risks are managed. While the Board has the ultimate oversight responsibility for the risk management process, various committees of the Board also have responsibility for risk management. Specifically, the Audit Committee focuses on risks relating to financial reporting, internal controls and compliance with legal and regulatory requirements. In addition, the Compensation Committee focuses on risks relating to Quanta’s compensation policies and programs and, in setting compensation, strives to create incentives that are aligned with Quanta’s risk management profile. Finally, Quanta’s Governance and Nominating Committee focuses on risks relating to Quanta’s corporate governance and Board membership and structure and also conducts an annual assessment of the risk management process and reports its findings to the Board.

The Board has examined the composition of the Audit Committee and has determined that each of the members of the Audit Committee is “independent” within the meaning of SEC regulations, NYSE rules governing audit committees and our Corporate Governance Guidelines. The Audit Committee is established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee operates under a formal charter adopted by the Board that governs its responsibilities. The Audit Committee Charter is posted on our website at www.quantaservices.com under the heading “Corporate Governance.” The membership and number of meetings held during the last fiscal year and the primary responsibilities of the Audit Committee are described in “Committees of the Board” above. The Board has determined that Messrs. Conaway and Jackman are “audit committee financial experts” within the meaning of SEC regulations.

The Board has determined that each of the members of the Compensation Committee is “independent” within the meaning of NYSE corporate governance listing standards and our Corporate Governance Guidelines. The Compensation Committee operates under a formal charter adopted by the Board that governs its responsibilities. The Compensation Committee Charter is posted on our website at www.quantaservices.com under the heading “Corporate Governance.” The membership and number of meetings held during the last fiscal year and the primary responsibilities of the Compensation Committee are described in “Committees of the Board” above. For additional information on the Compensation Committee, including a description of its processes and procedures for the consideration and determination of NEO compensation, please see “Compensation Discussion and Analysis — Compensation Committee” below.

Governance and Nominating Committee

The Board has determined that each of the members of the Governance and Nominating Committee is “independent” within the meaning of NYSE corporate governance listing standards and our Corporate Governance Guidelines. The Governance and Nominating Committee operates under a formal charter adopted by the Board that governs its responsibilities. The Governance and Nominating Committee Charter is posted on our website at www.quantaservices.com under the heading “Corporate Governance.” The membership and number of meetings held during the last fiscal year and the primary responsibilities of the Governance and Nominating Committee are described in “Committees of the Board” above.

Code of Ethics and Business Conduct

The Board has adopted a Code of Ethics and Business Conduct that applies to all directors, officers and employees of Quanta and its subsidiaries, including the principal executive officer, principal financial officer and

14

Table of Contents

principal accounting officer or controller. The Code of Ethics and Business Conduct is posted on our website at www.quantaservices.com under the heading “Corporate Governance.” We intend to post at the above location on our website any amendments or waivers to the Code of Ethics and Business Conduct that are required to be disclosed pursuant to Item 5.05 of Form 8-K.

Executive Sessions of Non-Management Directors

In accordance with the NYSE corporate governance listing standards, our non-management directors, each of whom is “independent” within the meaning of NYSE corporate governance listing standards and our Corporate Governance Guidelines, meet in executive session without management at each regularly scheduled Board meeting.

Stockholders and other interested parties may communicate with one or more of our directors, including any lead independent director or our non-management directors or independent directors as a group, a committee or the full Board by writing to Corporate Secretary, Quanta Services, Inc., 2800 Post Oak Blvd., Suite 2600, Houston, Texas 77056. All communications will be reviewed by the Corporate Secretary and forwarded to one or more of our directors, as appropriate.

Our Corporate Governance Guidelines contain Board membership qualifications that the Governance and Nominating Committee considers in selecting nominees for our Board. Pursuant to these qualifications, members of the Board should possess the highest standards of personal and professional ethics, integrity and values, and be committed to representing the long-term interests of our stockholders. They must also have an inquisitive and objective perspective, practical wisdom, mature judgment, the willingness to speak their mind and the ability to challenge and stimulate management in a constructive manner. In addition, Board members should have diverse experience at policy-making levels that may include business, government, education, technology or non-profit organizations, as well as experience in areas that are relevant to our business. Further, they should have demonstrated leadership skills in the organizations with which they are or have been affiliated. Members of the Board must also be willing to devote sufficient time to carrying out their duties and responsibilities effectively and should be committed to serve on the Board for an extended period of time. The Governance and Nominating Committee also seeks directors representing a broad range of viewpoints and diverse backgrounds, including women and minorities that meet the above qualifications.

Identifying and Evaluating Nominees for Director

The Governance and Nominating Committee regularly evaluates the appropriate size of the Board and whether any vacancies on the Board are expected due to retirement or otherwise. In the event that vacancies are anticipated or otherwise arise, the Governance and Nominating Committee will consider candidates for Board membership suggested by incumbent directors, management, third-party search firms and others. The Governance and Nominating Committee will also consider director nominations by stockholders that are made in compliance with the notice provisions and procedures set forth in our bylaws. For a discussion of these requirements, see “Additional Information — Stockholder Proposals and Nomination of Directors for the 2013 Annual Meeting” below. All applications, recommendations or proposed nominations for Board membership received by Quanta will be referred to the Governance and Nominating Committee. The manner in which the Governance and Nominating Committee evaluates the qualifications of a nominee for director does not differ if the nominee is recommended by a stockholder.

The Governance and Nominating Committee has the authority to retain, at Quanta’s expense, a third-party search firm to help identify and facilitate the screening and interview process of potential director nominees, including screening candidates, conducting reference checks, preparing a biography of each candidate for the Governance and Nominating Committee to review and helping coordinate interviews.

15

Table of Contents

Once the Governance and Nominating Committee has identified a potential director nominee, the committee makes an initial determination as to whether to conduct a full evaluation of the candidate. This initial determination is based on whatever information is provided to the committee with the recommendation of the candidate, as well as the committee’s own knowledge of the candidate, which may be supplemented by inquiries to the person making the recommendation or others. The committee also may engage a third party to conduct a background check of the candidate. If the committee determines to further pursue the candidate, the committee then will evaluate the extent to which the candidate meets the Board membership qualifications described in “Director Qualifications” above.

In addition, the Governance and Nominating Committee considers other relevant factors it deems appropriate, including the current composition of the Board (including its diversity in experience, background, gender and ethnicity), the balance of management and independent directors, the need for a certain Board committee expertise, and the nature and extent of a candidate’s activities unrelated to Quanta, including service as a director on the boards of other public companies. In connection with this evaluation, the committee determines whether to interview the candidate, and, if warranted, the committee interviews the candidate in person or by telephone. The committee may also ask the candidate to meet with members of Quanta’s management or other Board members. After completing this evaluation, if the committee believes the candidate would be a valuable addition to the Board, it will recommend to the Board the candidate’s nomination for appointment or election as a director.

The Governance and Nominating Committee has the responsibility of recommending to the Board compensation and benefits for non-employee directors. The committee is guided by certain director compensation principles set forth in our Corporate Governance Guidelines. Directors who also are employees of Quanta or any of its subsidiaries do not receive additional compensation for serving as directors. Two of our directors, namely John R. Colson, Executive Chairman, and James F. O’Neil III, President and Chief Executive Officer, are employees of Quanta and thus receive no compensation for their services as directors of Quanta. The compensation received by Messrs. Colson and O’Neil as employees of Quanta is set forth in the 2011 Summary Compensation Table on page 38.

Pursuant to our director compensation policy, each non-employee director currently receives a fee for attendance at each meeting of the Board or any committee according to the following schedule: $2,000 for attendance at a board meeting in person; $1,000 for attendance at a board meeting by telephone; $1,000 for attendance at a committee meeting in person; and $500 for attendance at a committee meeting by telephone.

Upon initial election to the Board at an annual meeting of stockholders, each such initially elected non-employee director receives an annual cash retainer payment of $50,000 and an annual award of shares of restricted stock having a value of $150,000. Upon initial appointment to the Board other than at an annual meeting of stockholders, for the period from the appointment through the end of the director service year during which the appointment is made, each such initially appointed non-employee director receives a pro rata portion of both (i) an annual cash retainer payment of $50,000 and (ii) an annual award of shares of restricted stock having a value of $150,000. At every annual meeting of stockholders at which a non-employee director is re-elected or remains a director, each such re-elected or remaining non-employee director receives an annual cash retainer payment of $50,000 and an annual award of shares of restricted stock having a value of $100,000.

In addition, at every annual meeting of the Board, the non-employee directors appointed to the following positions receive the supplemental annual cash retainers set forth below; provided, however, that any individual who serves as both Lead Independent Director and as a committee chairman receives only the supplemental annual cash retainer designated for the Lead Independent Director:

| Lead Independent Director |

$ | 15,000 | ||

| Chairman of the Audit Committee |

$ | 14,000 | ||

| Chairman of the Compensation Committee |

$ | 10,000 | ||

| Chairman of the Investment Committee |

$ | 10,000 | ||

| Chairman of the Governance and Nominating Committee |

$ | 7,500 |

16

Table of Contents

Unless the director’s service is interrupted, shares of restricted stock awarded to non-employee directors vest over three years in three equal annual installments. Any unvested shares of restricted stock will vest in full if the non-employee director is not nominated for or elected to a new term or resigns at our convenience, which shall be deemed to include any resignation resulting from the non-employee director’s failure to receive a majority of the votes cast in an election for directors as required by Quanta’s bylaws. If the non-employee director voluntarily resigns or is removed for cause prior to vesting, all unvested shares of restricted stock will be forfeited. Directors are reimbursed for reasonable out-of-pocket expenses incurred in attending meetings of the Board or the committees thereof, and for other expenses reasonably incurred in their capacity as directors of Quanta. Currently, nine non-employee director nominees are standing for election at the annual meeting.

2011 Director Compensation Table

The following table sets forth the compensation for each non-employee director during the 2011 fiscal year.

| Name |

Fees Earned or Paid in Cash ($) |

Stock Awards ($)(1) |

Option Awards ($)(2) |

Non-Equity Incentive Plan Compensation ($) |

Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) |

All Other Compensation ($) |

Total ($) |

|||||||||||||||||||||

| James R. Ball |

96,000 | 100,000 | — | — | — | — | 196,000 | |||||||||||||||||||||

| J. Michal Conaway |

72,500 | 100,000 | — | — | — | — | 172,500 | |||||||||||||||||||||

| Ralph R. DiSibio |

71,000 | 100,000 | — | — | — | — | 171,000 | |||||||||||||||||||||

| Vincent D. Foster |

72,000 | 100,000 | — | — | — | — | 172,000 | |||||||||||||||||||||

| Bernard Fried |

91,500 | 100,000 | — | — | — | — | 191,500 | |||||||||||||||||||||

| Louis C. Golm |

86,500 | 100,000 | — | — | — | — | 186,500 | |||||||||||||||||||||

| Worthing F. Jackman |

70,000 | 100,000 | — | — | — | — | 170,000 | |||||||||||||||||||||

| Bruce Ranck |

89,500 | 100,000 | — | — | — | — | 189,500 | |||||||||||||||||||||

| Pat Wood, III |

69,500 | 100,000 | — | — | — | — | 169,500 | |||||||||||||||||||||

| (1) | The amounts shown under “Stock Awards” reflect the aggregate grant date fair value (based on the closing price of Quanta’s common stock on the date of grant) of restricted stock granted during the fiscal year ended December 31, 2011, calculated in accordance with Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 718. The value ultimately realized by the director upon the actual vesting of the award(s) may or may not be equal to this determined value. As of December 31, 2011, each of the non-employee directors identified in the table above held 9,502 shares of outstanding and unvested restricted stock. |

| (2) | As of December 31, 2011, three of the non-employee directors identified in the table above had aggregate outstanding stock options, all of which were vested, as follows: Mr. Ball — options to purchase 7,500 shares; Mr. Foster — options to purchase 7,500 shares; and Mr. Golm — options to purchase 10,000 shares. |

Compensation Committee Interlocks and Insider Participation

Until May 19, 2011, James R. Ball, Ralph R. DiSibio, Louis C. Golm and Bruce Ranck served as members of the Compensation Committee. Following May 19, 2011, Louis C. Golm, Ralph R. DiSibio, Vincent D. Foster and Bruce Ranck served as members of the Compensation Committee. None of these persons served as an employee or officer of Quanta or any of its subsidiaries during 2011, was formerly an officer of Quanta or any of its subsidiaries, or had any relationship with Quanta requiring disclosure herein as a related party transaction, except that Quanta employed David J. Ball, the son of James R. Ball, during 2011, as more particularly described in “Certain Transactions,” and Vincent D. Foster served as president of Quanta on an interim basis from December 1, 1997 to December 19, 1997. Additionally, no executive officers served on the compensation committee or as a director of another company, one of whose executive officers served on Quanta’s Compensation Committee or as a director of Quanta.

17

Table of Contents

Our current executive officers are as follows:

| Name |

Age | Position(s) with Quanta | ||||

| John R. Colson |

64 | Executive Chairman and Director | ||||

| James F. O’Neil III |

53 | President, Chief Executive Officer and Director | ||||

| James H. Haddox |

63 | Chief Financial Officer | ||||

| Kenneth W. Trawick |

64 | President — Telecommunications and Renewables Division | ||||

| Earl C. Austin, Jr. |

42 | President — Electric Power Division and Natural Gas and Pipeline Division | ||||

| Derrick A. Jensen |

41 | Senior Vice President – Finance and Administration and Chief Accounting Officer | ||||

| Benadetto G. Bosco |

54 | Senior Vice President — Business Development and Outsourcing | ||||

| Tana L. Pool |

52 | Vice President and General Counsel | ||||

| Nicholas M. Grindstaff |

49 | Vice President — Finance and Treasurer | ||||

| Darren B. Miller |

52 | Vice President — Information Technology and Administration | ||||

For a description of the business background of Messrs. Colson and O’Neil, see “Election of Directors” above.

James H. Haddox has served as our Chief Financial Officer since November 1997. He previously served as our Secretary from December 1997 until March 1999 and as our Treasurer from December 1997 until September 1999. Mr. Haddox is a Certified Public Accountant.

Kenneth W. Trawick has served as our President of the Telecommunications and Renewables Division since June 2004. He previously served as President of Trawick Construction Company, Inc., a telecommunications specialty contractor and now a subsidiary of Quanta, from April 2003 until May 2004, and as a Vice President of Quanta from June 2001 until March 2003. Mr. Trawick joined Trawick Construction Company, Inc. in 1974 and served as its Executive Vice President from January 2000 until May 2001.

Earl C. Austin, Jr. has served as our President of the Electric Power Division and Natural Gas and Pipeline Division since May 2011. He previously served as President of the Natural Gas and Pipeline Division from October 2009 to May 2011 and as President of North Houston Pole Line, L.P., an electric and natural gas specialty contractor and now a subsidiary of Quanta, from 2001 until September 2009. He is currently a director of the Southwest Line Chapter of NECA. Mr. Austin holds a Bachelor of Arts in Business Management degree.

Derrick A. Jensen has served as our Senior Vice President — Finance and Administration and Chief Accounting Officer since March 2011. He previously served as our Vice President and Chief Accounting Officer from March 1999 to March 2011, and our Controller from December 1997 until March 2009. Mr. Jensen became a Certified Public Accountant in the State of Texas in 1997.

Benadetto G. Bosco has served as our Senior Vice President of Business Development and Outsourcing since May 2004. He previously served as our Senior Vice President of Outsourcing from April 2003 until April 2004 and as our Vice President of Outsourcing from July 2002 until April 2003. From 1997 until joining Quanta, he was Vice President of Network/National Sales for Exelon Infrastructure Services, Inc., a provider of transmission and distribution infrastructure services to electrical, gas, telecommunications and cable industries. Mr. Bosco holds an M.B.A. degree.

Tana L. Pool has served as our Vice President and General Counsel since January 2006. Ms. Pool served as Senior Counsel with the law firm of Akin Gump Strauss Hauer & Feld LLP from August 2004 until December 2005 and as Counsel with the law firm of King & Spalding LLP from May 2001 until July 2004. Ms. Pool holds a J.D. degree and is a Certified Public Accountant.

Nicholas M. Grindstaff has served as our Vice President — Finance since May 2011 and our Treasurer since October 1999. He previously served as a Vice President from March 2010 to May 2011 and as Assistant Treasurer from March 1999 until September 1999. Mr. Grindstaff holds a Master of Science in Accounting degree.

18

Table of Contents

Darren B. Miller has served as our Vice President of Information Technology and Administration since October 2003. From 1996 until May 2003, Mr. Miller held various positions with Encompass Services Corporation, a provider of facilities systems and services to the construction, healthcare, commercial realty and technology industries, most recently serving as Senior Vice President and Chief Financial Officer. Encompass Services Corporation filed for Chapter 11 bankruptcy in November 2002.

19

Table of Contents

EXECUTIVE COMPENSATION AND OTHER MATTERS

Compensation Discussion and Analysis

Executive Summary

This Compensation Discussion and Analysis (“CD&A”) describes Quanta’s executive compensation program for 2011. We use this program to attract, motivate and retain the employees who lead our business. In particular, this CD&A explains how the Compensation Committee made its compensation decisions for our named executive officers, or NEOs, for 2011 and describes how this compensation fits within the Compensation Committee’s guiding principles with respect to NEO compensation. The following individuals are our NEOs for 2011:

| • | John R. Colson, who served as our Chief Executive Officer until May 19, 2011 and as Executive Chairman thereafter; |

| • | James F. O’Neil III, who served as our President and Chief Operating Officer until May 19, 2011 and as President and Chief Executive Officer thereafter; |

| • | James H. Haddox, our Chief Financial Officer; |

| • | Kenneth W. Trawick, our President — Telecommunications and Renewables Division; |

| • | Earl C. Austin, Jr., our President — Electric Power Division and Natural Gas and Pipeline Division; and |

| • | Derrick A. Jensen, our Senior Vice President — Finance and Administration and Chief Accounting Officer. |

Quanta’s NEO compensation is primarily comprised of base salary, annual short-term incentives and long-term incentives. Our compensation philosophy links executive compensation to both individual and company performance. Base salaries are generally targeted at or near the median of our competitive market. Target annual incentives reflect competitive market levels and practices, with significant upside opportunity for performance above company performance target levels. Target award levels are designed to achieve total cash compensation slightly above the market median for superior performance, and performance measures are chosen to align the interests of executives with stockholders. Finally, long-term incentives, typically paid with equity, are designed to focus executives on the long-term financial performance of the company, along with achievement of strategic objectives.

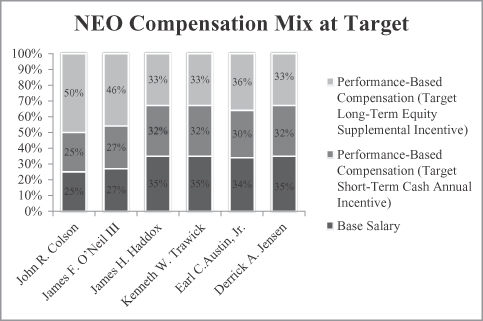

The Compensation Committee believes that a significant portion of the target total direct compensation of the NEOs should be performance-based and, therefore, at risk.

| • | Approximately 75% of target total direct compensation in 2011 for the Executive Chairman and 73% of the target total direct compensation in 2011 for the Chief Executive Officer was “at risk” performance-based compensation pursuant to the incentive compensation plans described below, with the largest percentage in equity awards. |

| • | Approximately 65%, on average, of target total direct compensation in 2011 for the remaining NEOs was “at risk” compensation contingent upon performance outcomes. |

20

Table of Contents

The following graph sets forth the mix of target total direct compensation of our NEOs in 2011:

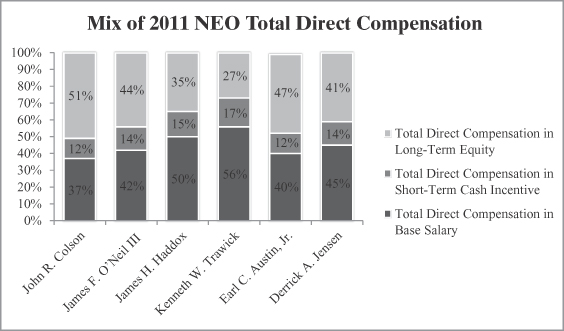

We continued to operate in a challenging business environment during 2011, with increasing regulatory requirements and only gradual recovery in the economy and capital markets from recessionary levels. The individual and company short-term and long-term performance goals against which we measured performance were partially met in 2011, resulting in below-target awards to each NEO. Despite reduced incentive payouts in 2011 due to overall performance being below target, equity-based incentive awards for 2011 nevertheless represented a substantial portion of each NEO’s compensation as a percentage of total direct compensation (base, short-term cash incentive and long-term equity incentive).

| • | Of the total direct compensation of the Executive Chairman for 2011, approximately 51% was in equity, 37% was in base salary and 12% was in short-term cash incentive; |

| • | Of the total direct compensation of the Chief Executive Officer for 2011, approximately 44% was in equity, 42% was in base salary and 14% was in short-term cash incentive; and |

| • | Of the total direct compensation of the remaining NEOs on average, approximately 38% was in equity, 48% was in base salary and 14% was in short-term cash incentive. |

21

Table of Contents

The following graph sets forth the mix of total direct compensation of our NEOs in 2011:

Equity-based awards will continue to play an important role in this challenging economic environment because they provide incentives for the creation of stockholder value and promote an ownership culture. As Quanta moves forward into 2012, the Compensation Committee is aware of the difficult business environment, the continuing uncertainty in the marketplace, and the resulting challenges with respect to executive compensation. The Compensation Committee continues to monitor trends and developments to ensure that Quanta provides the appropriate executive compensation incentives and remains competitively positioned for executive talent, while not encouraging excessive risk-taking by management.

Compensation Committee

Overview

The Compensation Committee administers the compensation programs for all of our NEOs. As described above under “Corporate Governance – Compensation Committee,” the Board has determined that each member of the Compensation Committee is “independent” within the meaning of the NYSE corporate governance listing standards and our Corporate Governance Guidelines. The Compensation Committee’s guiding principles with respect to NEO compensation are:

| • | to align our NEOs’ incentives with short-term and long-term stockholder value creation; |

| • | to attract, motivate and retain the best possible executive officer talent by maintaining competitive compensation programs; |

| • | to tie cash and stock incentives to the achievement of measurable company, business unit and individual performance goals that are linked to our long-term strategic plans; and |

| • | to promote an ownership culture. |

In the first quarter of each fiscal year, the Compensation Committee meets to discuss our prior year’s financial performance, to evaluate the performance of our NEOs relative to applicable performance goals, and to

22

Table of Contents

determine the amounts, if any, that will be awarded to each NEO under our annual, supplemental and discretionary incentive plans (each of which is described below) for the prior fiscal year. In addition, the Compensation Committee establishes the current fiscal year’s company financial performance goals and individual strategic performance goals that will be used in evaluating the performance of each NEO under our incentive plans and establishes compensation targets for each NEO for the upcoming fiscal year. The Compensation Committee seeks to maintain the competitiveness of our executive compensation levels with those of our peers and competitors and considers various factors in determining overall compensation and the individual components of compensation of each NEO, including (i) the results of compensation benchmarking studies and published compensation survey data, (ii) economic and market conditions, (iii) the effects of inflation, (iv) changes in our business operations, (v) changes in the compensation practices of our competitors, (vi) the executive officer’s position, experience, length of service and performance, (vii) company performance and (viii) the judgment of each member of the Compensation Committee based upon prior experiences with executive compensation matters. The influence of these factors on NEO compensation is discussed further below.

Use of Compensation Benchmarking Studies and Published Compensation Survey Data

One of the Compensation Committee’s guiding principles is to attract, motivate and retain the best possible executive officer talent, which is important to the success of our business. Consistent with this guiding principle, the Compensation Committee desires to provide target total direct compensation for our NEOs within +/-15% of the median for comparable officers in our peer group. To determine competitive market pay levels, the Compensation Committee utilizes a compensation benchmarking study and published compensation survey data for our industry that are prepared and compiled for the committee by outside consultants. This data assists the Compensation Committee in establishing the overall compensation levels for our NEOs and determining the relative weighting of individual components of compensation.

Although the compensation benchmarking studies play an important role in establishing competitive compensation practices, the Compensation Committee uses such studies only as a point of reference and not as a determinative factor for our NEOs’ compensation. The compensation benchmarking studies do not supplant the significance of individual and company performance that the Compensation Committee considers when making compensation decisions. Because the information provided by a compensation benchmarking study is just one piece of information utilized in setting executive compensation, the Compensation Committee exercises discretion in determining the nature and extent of its use.

The Compensation Committee Charter grants to the Compensation Committee the authority to retain, at Quanta’s expense, advisors and compensation consultants and to approve their compensation. These advisors report directly to the Compensation Committee.