False0001050743DEF 14A00010507432021-01-012021-12-310001050743pgc:YearEndFairValueOfEquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfYearMemberecd:NonPeoNeoMember2023-01-012023-12-310001050743ecd:NonPeoNeoMemberpgc:ChangeInFairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedEquityAwardsMember2023-01-012023-12-310001050743ecd:NonPeoNeoMemberpgc:AverageInclusionOfEquityValuesMember2023-01-012023-12-31000105074372023-01-012023-12-31000105074362023-01-012023-12-31000105074322023-01-012023-12-310001050743ecd:NonPeoNeoMemberpgc:AverageExclusionOfStockAwardsAndOptionAwardsMember2023-01-012023-12-310001050743ecd:PeoMemberpgc:ChangeInFairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedEquityAwardsMember2023-01-012023-12-3100010507432022-01-012022-12-31000105074332023-01-012023-12-31000105074342023-01-012023-12-310001050743pgc:YearEndFairValueOfEquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfYearMemberecd:PeoMember2023-01-012023-12-3100010507432023-01-012023-12-310001050743ecd:NonPeoNeoMemberpgc:ChangeInFairValueFromLastDayOfPriorYearToVestingDateOfUnvestedEquityAwardsThatVestedMember2023-01-012023-12-310001050743pgc:ExclusionOfStockAwardsMemberecd:PeoMember2023-01-012023-12-31000105074312023-01-012023-12-31000105074382023-01-012023-12-310001050743ecd:PeoMemberpgc:ChangeInFairValueFromLastDayOfPriorYearToVestingDateOfUnvestedEquityAwardsThatVestedMember2023-01-012023-12-310001050743pgc:InclusionOfEquityValuesMemberecd:PeoMember2023-01-012023-12-3100010507432020-01-012020-12-31000105074352023-01-012023-12-31xbrli:pureiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

Peapack-Gladstone Financial Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

PEAPACK-GLADSTONE FINANCIAL CORPORATION

500 HILLS DRIVE

BEDMINSTER, NEW JERSEY 07921

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON TUESDAY, APRIL 30, 2024

To Our Shareholders:

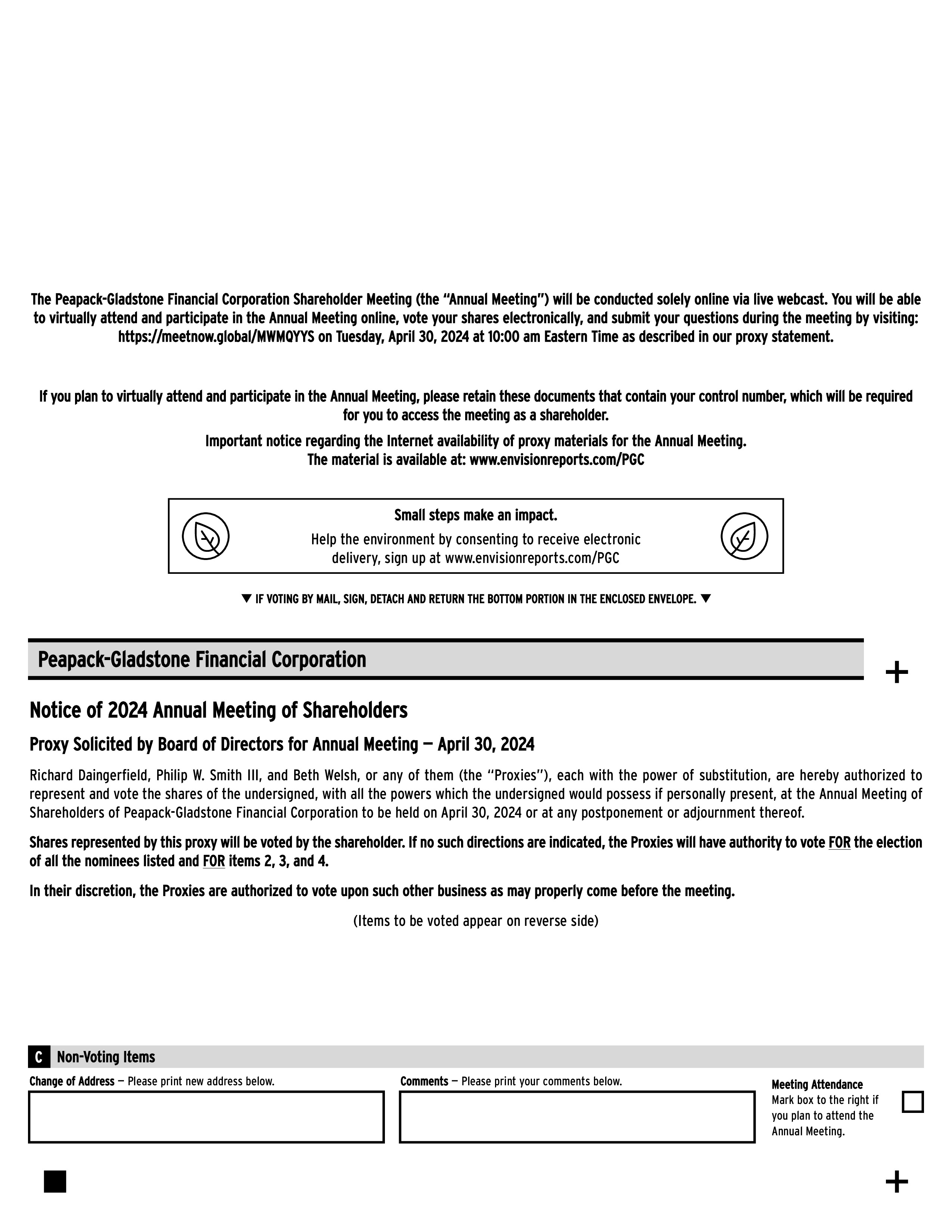

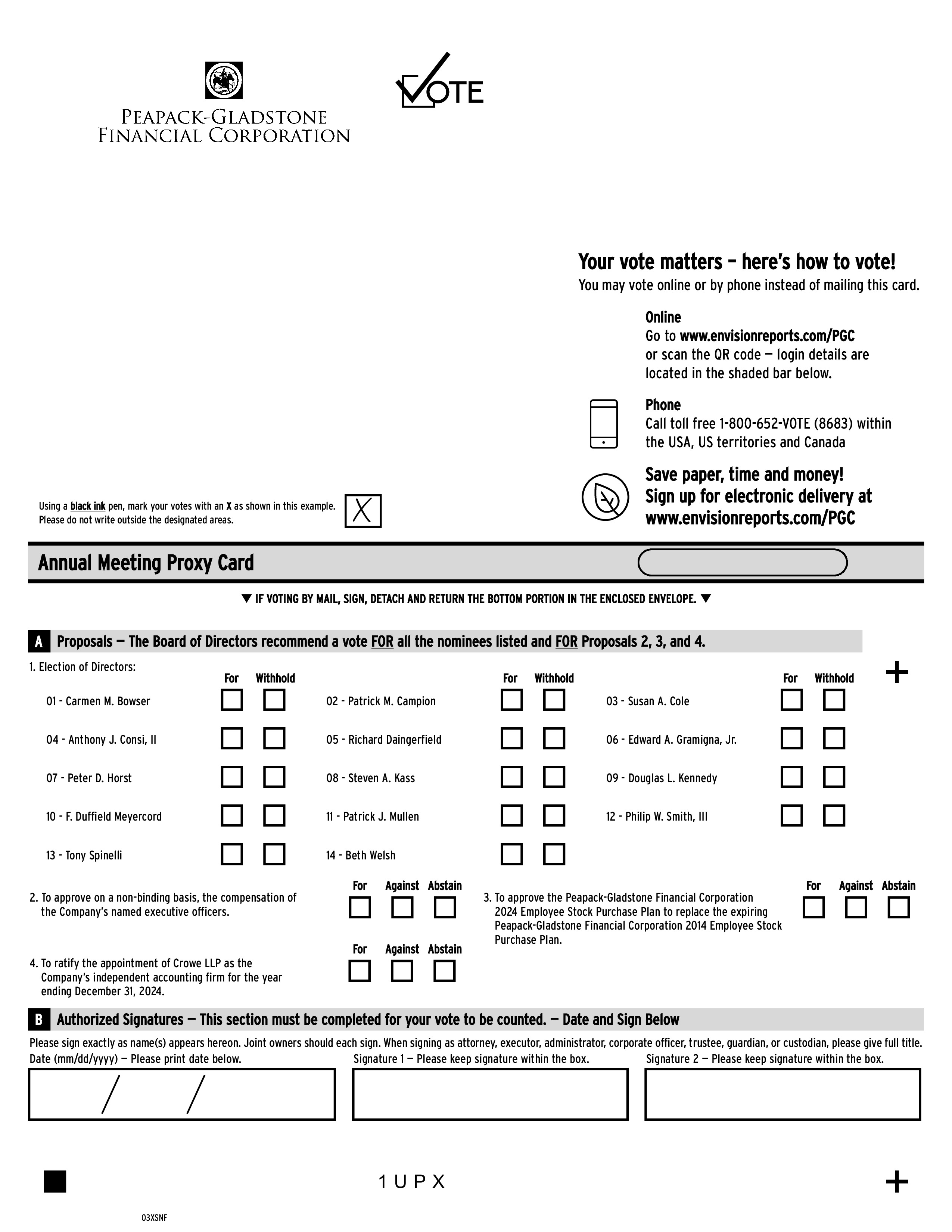

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of Peapack-Gladstone Financial Corporation (the “Company”) will be held online on Tuesday, April 30, 2024 at 10:00 a.m., Eastern time. The Annual Meeting will be held in a virtual format only. You will not be able to attend the Annual Meeting physically. At the meeting, shareholders will be asked to consider and vote:

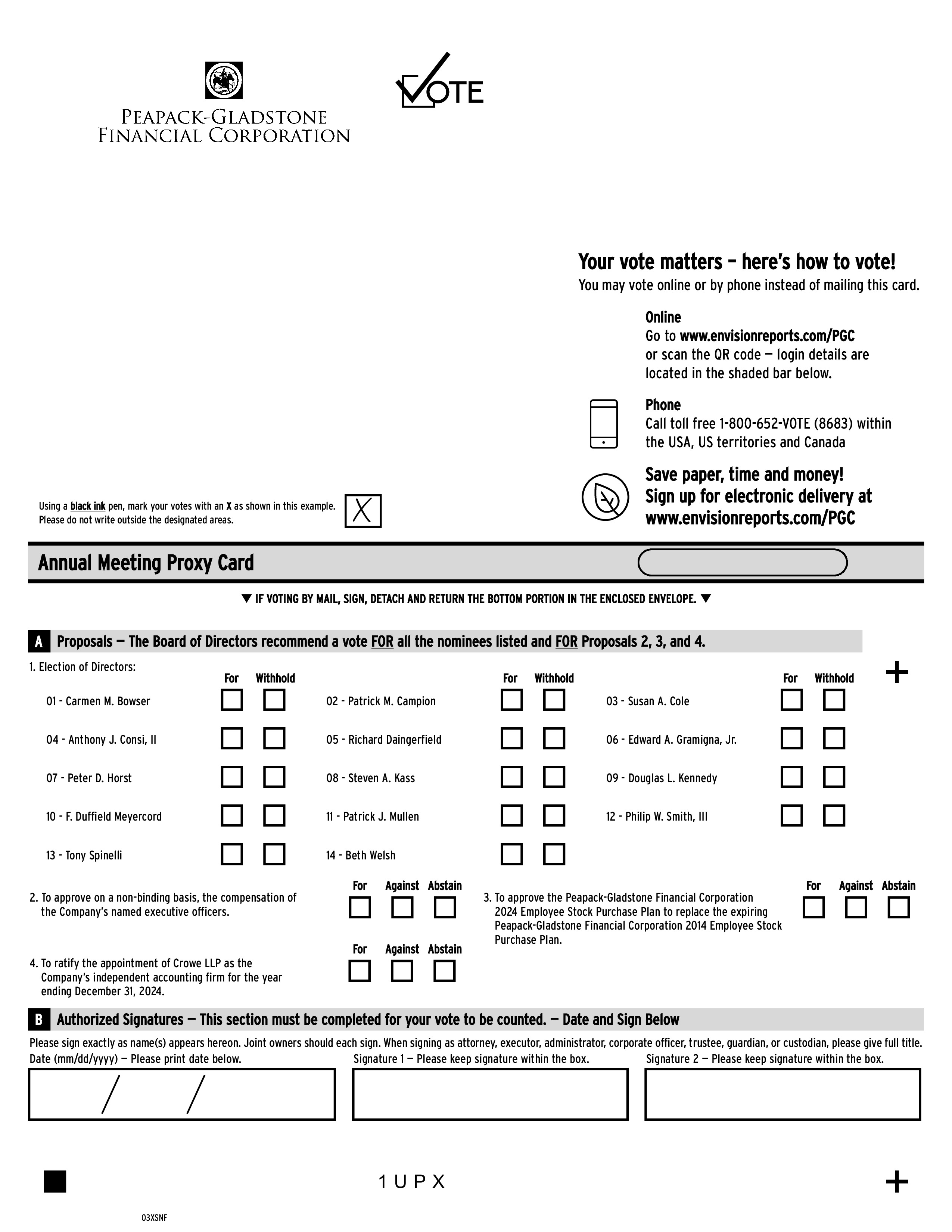

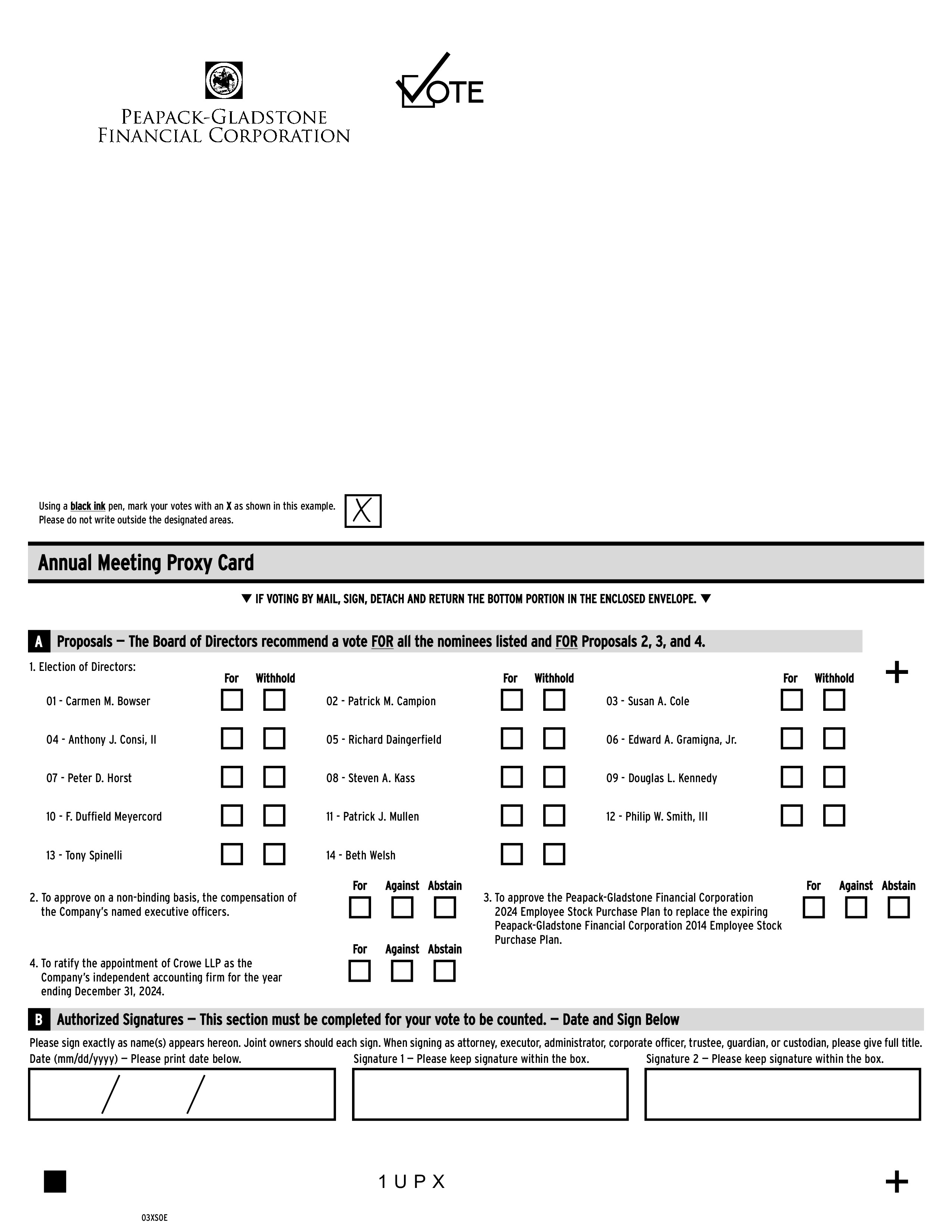

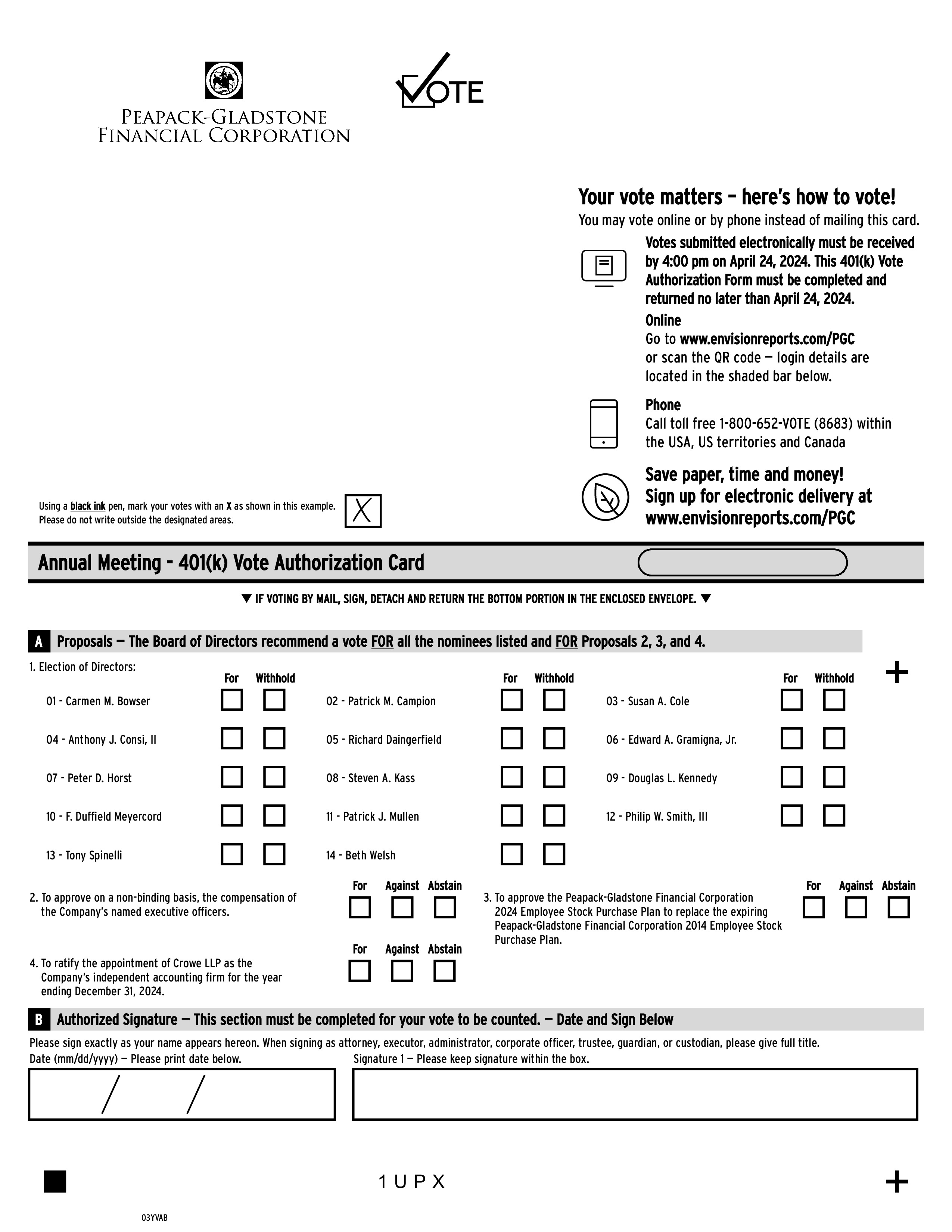

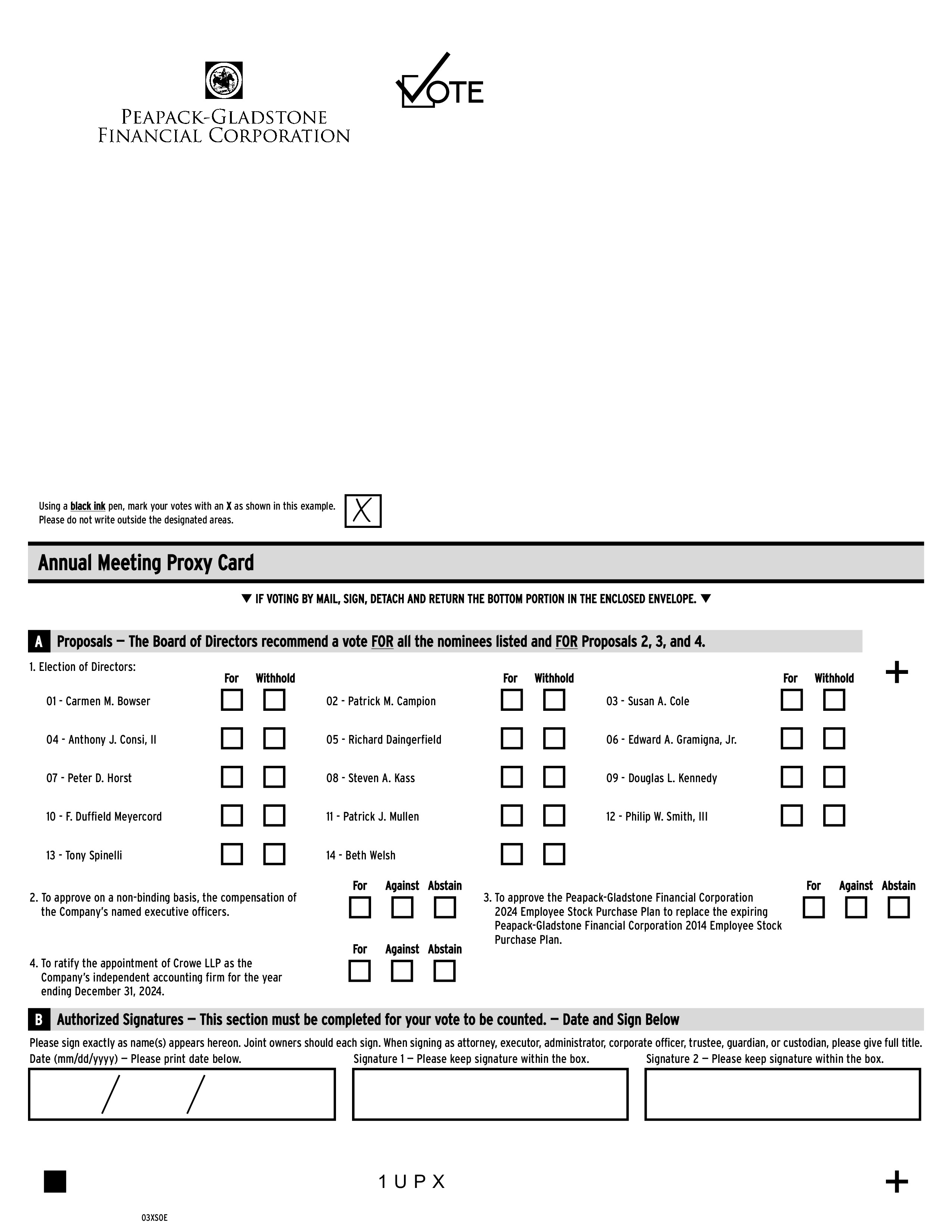

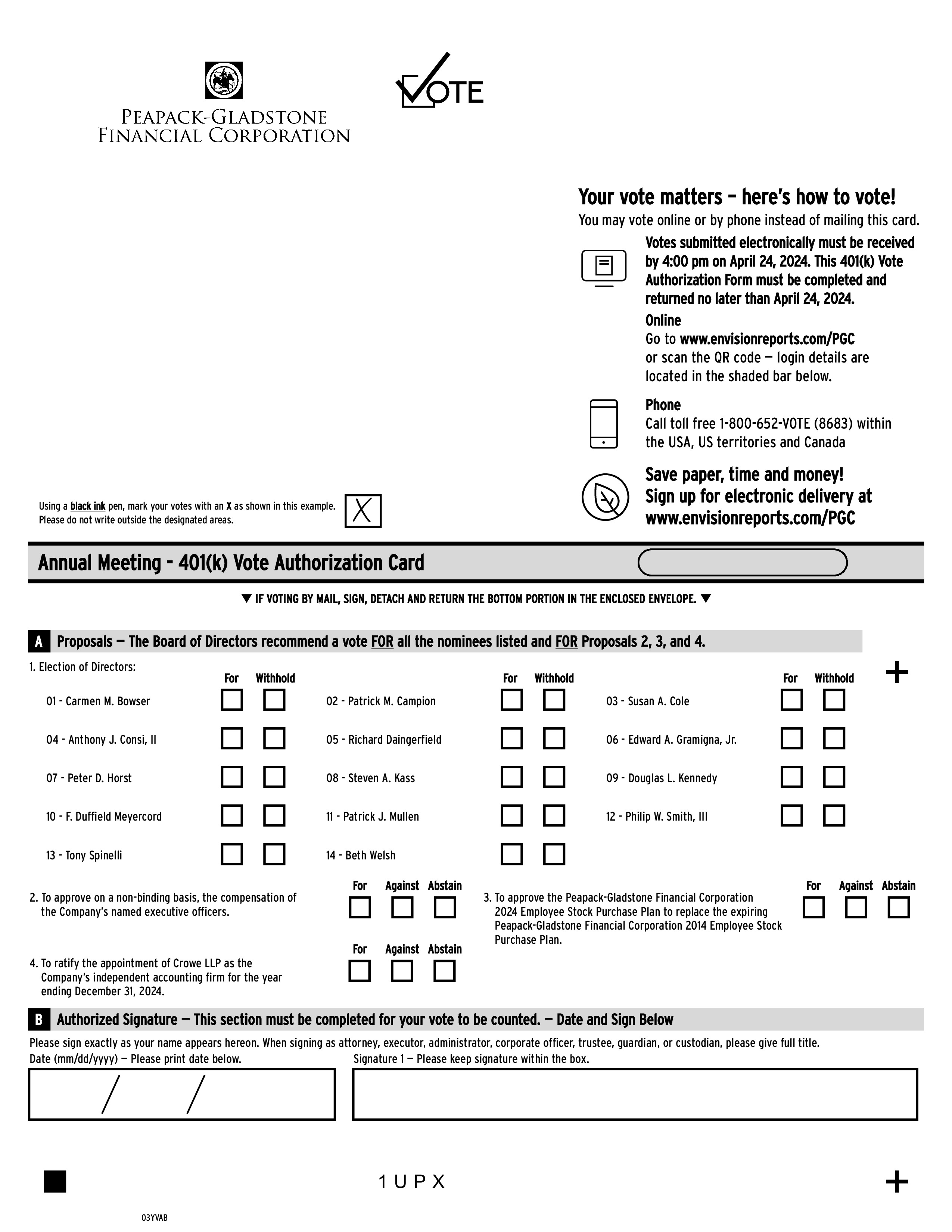

1.To elect fourteen directors to serve for a one-year term and until their successors shall have been duly elected and qualified.

2.To approve, on a non-binding basis, the compensation of the Company’s named executive officers.

3.To approve the Peapack-Gladstone Financial Corporation 2024 Employee Stock Purchase Plan to replace the expiring Peapack-Gladstone Financial Corporation 2014 Employee Stock Purchase Plan.

4.To ratify the appointment of Crowe LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2024.

5.Such other business as may properly come before the meeting or any adjournment thereof.

Only shareholders of record at the close of business on March 6, 2024 are entitled to receive notice of, and to vote at, the meeting.

You are urged to carefully read the attached proxy statement relating to the meeting.

Whether or not you expect to attend the virtual meeting, we urge you to exercise your right to vote as promptly as possible.

By Order of the Board of Directors

Kenneth Geiger

Corporate Secretary

Bedminster, New Jersey

March 19, 2024

YOUR VOTE IS IMPORTANT.

PLEASE SIGN AND RETURN THE ENCLOSED PROXY IN THE ENVELOPE PROVIDED

OR VOTE BY TELEPHONE OR VIA THE INTERNET.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE SHAREHOLDER MEETING TO BE HELD ON APRIL 30, 2024

This Proxy Statement and our Annual Report on Form 10-K are available at

www.edocumentview.com/PGC

Peapack-Gladstone Financial Corporation

Table of Contents

PEAPACK-GLADSTONE FINANCIAL CORPORATION

500 HILLS DRIVE

BEDMINSTER, NEW JERSEY 07921

PROXY STATEMENT

This proxy statement is furnished to the shareholders of Peapack-Gladstone Financial Corporation (“Peapack-Gladstone” or the “Company”) in connection with the solicitation by the Board of Directors of Peapack-Gladstone of proxies for use at the Annual Meeting of Shareholders to be held virtually on Tuesday, April 30, 2024 at 10:00 a.m., Eastern time.

The Annual Meeting will be held in a virtual format only. You will not be able to attend the Annual Meeting physically.

This proxy statement is first being made available to shareholders on approximately March 19, 2024.

ATTENDING THE MEETING

The annual meeting will be a completely virtual meeting of shareholders, which will be conducted exclusively by webcast. No physical meeting will be held. You are entitled to participate in the annual meeting only if , as of the close of business on March 6, 2024, you were a shareholder of record of the Company (a “Registered Holder”) or if you are a beneficial holder and hold your shares through an intermediary, such as a bank or broker (a “Beneficial Holder”) and hold a valid legal proxy for the Annual Meeting.

As a Registered Holder, you will be able to attend the Annual Meeting online, submit your questions online and vote by visiting https://meetnow.global/MWMQYYS and following the instructions on your Notice proxy card voting instruction form.

If you are a Beneficial Holder and want to attend the Annual Meeting online with the ability to submit your questions online and/or vote, you must submit proof of your proxy power from your broker or bank reflecting your Peapack-Gladstone Financial Corporation stock holdings (“Legal Proxy”) along with your name and e-mail address to Computershare.

Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on April 25, 2024. You will receive confirmation of your registration by e-mail after we receive your registration materials.

Requests for registration should be directed to us at the following:

By e-mail: Forward the e-mail from your broker granting you a Legal Proxy, or attach an image of your Legal Proxy, to legalproxy@computershare.com.

|

|

By mail: |

Computershare Peapack-Gladstone Financial Corporation Legal Proxy

P.O. Box 43001

Providence, RI 02940-3001 |

VOTING INFORMATION

Outstanding Securities and Voting Rights

The record date for determining shareholders entitled to notice of, and to vote at, the meeting is March 6, 2024. Only shareholders of record as of the record date will be entitled to notice of, and to vote at, the meeting.

On the record date, 17,652,341 shares of Peapack-Gladstone’s common stock, no par value, were outstanding and eligible to vote at the meeting. Each share of Peapack-Gladstone’s common stock is entitled to one vote.

Delivery of Proxy Materials

The 2024 notice of annual meeting of shareholders, this proxy statement, the Company’s 2023 annual report on Form 10-K and the proxy card or voting instruction form are referred to as our “proxy materials.” Pursuant to the rules of the Securities and Exchange Commission (the “SEC”), we are furnishing our proxy materials to certain shareholders over the Internet. Most shareholders are receiving by mail a Notice of Internet Availability of Proxy Materials (an “E-Proxy Notice”), which provides general information about the annual meeting, the matters to be voted on at the annual meeting, the website where our proxy statement and annual report are available for review, downloading and printing, and instructions on how to submit proxy votes. The E-Proxy Notice also provides instructions on how to request a paper copy of the proxy materials and how to elect to receive either a paper copy or an electronic copy of the proxy materials for future meetings.

Shareholders that have previously elected to receive proxy materials via electronic delivery will receive an e-mail with the proxy statement, annual report and instructions on how to vote. Shareholders who previously elected to receive paper copies of the proxy materials will receive a physical copy of the proxy statement, annual report and instructions on how to vote.

Householding

When more than one holder of our common stock shares the same address, we may deliver only one E-Proxy Notice or set of proxy materials, as applicable, to that address unless we have received contrary instructions from one or more of those shareholders. Similarly, brokers and other intermediaries holding shares of our common stock in “street name” for more than one beneficial owner with the same address may deliver only one E-Proxy Notice or set of proxy materials, as applicable, to that address if they have received consent from the beneficial owners of the stock.

We will deliver promptly upon written demand or oral request a separate copy of the E-Proxy Notice or set of proxy materials, as applicable, to any shareholder of record at a shared address to which a single copy of those documents was delivered. To receive additional copies, you may write to or call Kenneth Geiger, Corporate Secretary of Peapack-Gladstone, 500 Hills Drive, Suite 300, P.O. Box 700, Bedminster, New Jersey 07921 or (908) 443-5388. If your shares are held in “street name,” you should contact the broker or other intermediary who holds the shares on your behalf to request an additional copy of the E-Proxy Notice or proxy materials.

If you are a shareholder of record and are either receiving multiple E-Proxy Notices or multiple paper copies of the proxy materials and wish to request future delivery of a single copy or are receiving a single E-Proxy Notice or copy of the proxy materials and wish to request future delivery of multiple copies, please contact Kenneth Geiger, Corporate Secretary at the address or telephone number above. If your shares are held in “street name,” you should contact the broker or other intermediary who holds the shares on your behalf.

Required Vote

The presence, online or by proxy, of a majority of the shares entitled to vote is necessary to constitute a quorum at the meeting. Abstentions and broker non-votes are counted to determine a quorum. A broker non-vote occurs when a broker holding shares for a beneficial holder does not vote on a particular proposal because the broker does not have discretionary power to vote with respect to that item and has not received voting instructions from the beneficial owner.

The election of directors requires the affirmative vote of a plurality of Peapack-Gladstone’s common stock voted at the meeting, whether voted online or by proxy. This means that the nominees receiving the greatest number of votes will be elected. Abstentions and broker non-votes will have no impact on the election of directors.

The approval (1) on a non-binding basis, of the compensation of the Company’s named executive officers, (2) of the Peapack-Gladstone Financial Corporation 2024 Employee Stock Purchase Plan to replace the Company's 2014 Employee Stock Purchase Plan and (3) of the ratification of the appointment of Crowe LLP each requires the affirmative vote of a majority of the votes cast at the meeting, whether voted online or by proxy. Abstentions and broker non-votes will have no impact on the approval of these proposals.

All shares represented by valid proxies received pursuant to this solicitation will be voted as follows, unless the shareholder specifies a different choice by means of the proxy or revokes the proxy prior to the time it is exercised:

•Proposal 1 – "FOR" the election of the 14 nominees for director;

•Proposal 2 – "FOR" the approval, on a non-binding basis, of the compensation of the Company’s named executive officers;

•Proposal 3 – "FOR" the approval of the Peapack-Gladstone Financial Corporation 2024 Employee Stock Purchase Plan to replace the Company's 2014 Employee Stock Purchase Plan; and

•Proposal 4 – "FOR" the ratification of the appointment of Crowe LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2024.

Should any other matter properly come before the meeting, the persons named as proxies will vote upon such matters in their discretion.

Voting

We are offering you four alternative ways to vote your shares:

Internet. If you wish to vote using the Internet, you can access the webpage at www.envisionreports.com/PGC and follow the on-screen instructions or scan the QR code on your E-Proxy Notice or proxy card with your smartphone. Have your proxy card available when you access the webpage.

Telephone. If you wish to vote by telephone, call, toll free, 1-800-652-VOTE(8683) and follow the instructions. Have your proxy card available when you call.

Mail. If you wish to vote by mail, please sign your name exactly as it appears on your proxy card, date and mail your proxy card in the envelope provided as soon as possible.

Online at the Meeting. The method by which you vote will not limit your right to vote online at the meeting if you decide to attend virtually. To be admitted to the Annual Meeting, you must go online to https://meetnow.global/MWMQYYS and enter the control number found on your proxy card. You may vote during the Annual Meeting by following the instructions available on the meeting website during the meeting.

Revocability of Proxy

Any shareholder giving a proxy has the right to attend the meeting virtually and to vote online at the meeting in person. A proxy may be revoked prior to the meeting by submitting a later-dated proxy or by submitting a written revocation to Kenneth Geiger, Corporate Secretary, Peapack-Gladstone, 500 Hills Drive, Suite 300, P.O. Box 700, Bedminster, New Jersey, 07921. A proxy may be revoked at the meeting by voting online at the meeting. Attendance at the meeting will not in itself constitute revocation of a proxy.

Participants in the Peapack-Gladstone Bank Employee Savings and Investment Plan (the "401(k) Plan")

If you hold shares of Company common stock in the 401(k) Plan, you will receive a vote authorization card that reflects all shares that you may direct the 401(k) Plan trustee to vote on your behalf under the 401(k) Plan. Under the terms of the 401(k) Plan, you may direct the 401(k) Plan trustee how to vote the shares allocated to your account. If the 401(k) Plan trustee does not receive your voting instructions, the 401(k) Plan trustee will be instructed to vote your shares in the same proportion as the voting instructions received from other 401(k) Plan participants.

The deadline for returning your vote authorization card is April 24, 2024.

Solicitation of Proxies

This proxy solicitation is being made by the Board of Peapack-Gladstone and the cost of the solicitation will be borne by Peapack-Gladstone. In addition to the use of the mails, proxies may be solicited personally or by telephone, e-mail or facsimile transmission by directors, officers and employees of Peapack-Gladstone and its subsidiaries or Laurel Hill Advisory Group LLC, a proxy solicitor firm. Directors, officers and employees will not be compensated for such solicitation activities. Peapack-Gladstone will pay $5,500 plus certain out of pocket costs to Laurel Hill Advisory Group LLC for its proxy solicitation services. Peapack-Gladstone will also make arrangements with brokers, dealers, nominees, custodians and fiduciaries to forward proxy soliciting materials to the beneficial owners of shares held of record by such persons, and Peapack-Gladstone will reimburse them for their reasonable expenses incurred in forwarding the materials.

CORPORATE GOVERNANCE

General and Corporate Governance Principles

The business and affairs of Peapack-Gladstone are managed under the direction of the Board of Directors. Members of the Board are kept informed of Peapack-Gladstone’s business through discussions with our President and Chief Executive Officer (the "CEO") and Peapack-Gladstone’s other officers, by reviewing materials provided to them and by participating in meetings of the Board and its committees. All members of the Board also served as directors of Peapack-Gladstone’s subsidiary bank, Peapack-Gladstone Bank (the “Bank”), during 2023. The Board of Directors of Peapack-Gladstone and Peapack-Gladstone Bank each held 12 meetings during 2023. During 2023, each director of Peapack-Gladstone attended at least 75% of the total number of meetings of Peapack-Gladstone’s Board and committees on which such director served.

The Board has adopted Corporate Governance Principles, which are intended to provide guidelines for the governance of Peapack-Gladstone, including: the qualification and selection of the Board of Directors and its committees; convening executive sessions of independent directors; the Board of Directors’ interaction with management and third parties; director compensation; orientation and continuing education; and the evaluation of the performance of the CEO. The Corporate Governance Principles are available in the Government Documents portion of the Investor Relations section of Peapack-Gladstone’s website located at www.pgbank.com.

Board Leadership Structure and Role in Risk Oversight

Our Board of Directors is comprised of 14 members, all of whom are independent directors under applicable NASDAQ Stock Market (“NASDAQ”) rules, except for Douglas L. Kennedy, our CEO. The Company maintains a Risk Committee, which, along with our Board of Directors, is responsible for overseeing the Company’s risk management. The Board receives and reviews a company-wide risk assessment annually. While the Risk Committee and the Board oversee the Company’s risk management, management is responsible for day-to-day risk management processes. We believe this division of responsibilities is appropriate for addressing the risks facing the Company. Our independent directors conduct separate executive sessions to discuss Company affairs on at least a semi-annual basis and more frequently as necessary. The Chair of the Board, who is independent, presides over these sessions. If in the future our Board Chair is not independent, our bylaws require the appointment of an independent lead director.

We believe that having a separate Chair and CEO, independent chairs and membership for each of our Audit, Compensation and Nominating Committees and holding executive sessions of independent directors provides the right form of leadership for the Company. Separating the Chair and CEO positions allows the CEO to better focus on his responsibilities of running the Company, enhancing shareholder value and better positioning the Company for future growth, while our experienced independent directors provide oversight of Company operations and provide different perspectives based on the directors’ experience, oversight and expertise.

Director Independence

The Board has determined that a majority of the directors and all current members of the Nominating, Compensation, and Audit Committees are “independent” in accordance with NASDAQ rules. The Board has determined that the members of the Audit Committee are also “independent” under the heightened standards of independence under Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Board’s conclusion follows a review by the Nominating Committee and management of the responses of the directors and executive officers to questions regarding employment history, transactions with the Bank, affiliations and family and other relationships.

To assist it in making determinations of independence, the Board has concluded that the following relationships are immaterial and that a director whose only relationships with Peapack-Gladstone fall within these categories is independent absent any other relationship that would interfere with the director’s exercise of independent judgment in carrying out the responsibilities of a director:

•A loan made by the Bank to a director, his or her immediate family member or an entity affiliated with a director or his or her immediate family member, or a loan personally guaranteed by such persons, if such loan (1) complies with state and federal regulations on insider loans, where applicable; (2) is not classified as substandard, doubtful or loss; and (3) is on customary and usual market terms and conditions.

•A deposit, trust, insurance brokerage, securities brokerage or similar customer relationship between Peapack-Gladstone or its subsidiaries and a director, his or her immediate family member or an affiliate of his or her immediate family member if such relationship is on customary and usual market terms and conditions.

•The employment by Peapack-Gladstone or its subsidiaries of any immediate family member of the director if the employee serves below the level of senior vice president.

•Annual contributions by Peapack-Gladstone or its subsidiaries to any charity or non-profit corporation with which a director is affiliated if the contributions do not exceed $20,000 in any calendar year and the contribution is made in the name of Peapack-Gladstone.

•Purchases of goods or services by Peapack-Gladstone or any of its subsidiaries from a business in which a director or his or her immediate family member is a partner, shareholder or officer, if the director or his or her immediate family member owns five percent or less of the equity interests of that business and does not serve as an executive officer of the business.

•Purchases of goods or services by Peapack-Gladstone, or any of its subsidiaries, from a business in which the director or his or her immediate family member is a partner, shareholder or officer if the annual aggregate purchases of goods or services from the director, his or her immediate family member or such business in the last calendar year does not exceed the greater of $60,000 or two percent of the gross revenues of the business.

•Fixed retirement benefits paid or payable to a director either currently or on retirement.

The following categories or types of transactions, relationships or arrangements were considered by the Board in determining that each listed director is independent in accordance with the NASDAQ rules.

|

|

|

Independent Director |

|

Category or Type |

|

|

|

Susan A. Cole |

|

Wealth Management |

|

|

|

Anthony J. Consi, II |

|

Deposits |

|

|

|

Richard Daingerfield |

|

Loans, Deposits, Wealth Management |

|

|

|

Edward A. Gramigna |

|

Deposits, Wealth Management |

|

|

|

Peter D. Horst |

|

Deposits |

|

|

|

F. Duffield Meyercord |

|

Loans, Deposits, Wealth Management |

|

|

|

Philip W. Smith |

|

Loans, Deposits, Wealth Management, Employment of Immediate Family Member* |

|

|

|

Beth Welsh |

|

Loans, Deposits |

* Mr. Smith’s sister in-law, Anne Smith was promoted to Senior Managing Director in 2017. Anne Smith is not an executive officer of the Company.

Board Diversity Matrix

The table below provides the composition of our board members. Under NASDAQ rules, each NASDAQ-listed company must have, or explain why it does not have, at least two members of its Board of Directors who are "Diverse," including (1) at least one Diverse director who self-identifies as Female; and (2) at least one Diverse director who self-identifies as an "Underrepresented Minority" or LGBTQ+. Diverse means an individual who self-identifies as female, an Underrepresented Minority, or LGBTQ+. Each of the categories listed in the below table has the meaning as it is used in NASDAQ Rule 5605(f).

|

|

|

|

|

|

|

|

|

|

|

Board Diversity Matrix |

|

|

December 31, 2022 |

|

December 31, 2023 |

Total Number of Directors |

|

13 |

|

14 |

|

|

Female |

|

Male |

|

Female |

|

Male |

Gender Identity |

|

|

|

|

|

|

|

|

Directors |

|

3 |

|

10 |

|

3 |

|

11 |

Demographic Background |

|

|

|

|

|

|

|

|

African American or Black |

|

1 |

|

- |

|

1 |

|

- |

Alaskan Native or Native American |

|

- |

|

- |

|

- |

|

- |

Asian |

|

- |

|

- |

|

- |

|

- |

Hispanic or Latino |

|

- |

|

- |

|

- |

|

- |

Native Hawaiian or Pacific Islander |

|

- |

|

- |

|

- |

|

- |

White |

|

2 |

|

10 |

|

2 |

|

10 |

Two or More Races or Ethnicities |

|

- |

|

- |

|

- |

|

- |

LGBTQ+ |

|

- |

|

- |

|

- |

|

1 |

Did Not Disclose Demographic Background |

|

- |

|

- |

|

- |

|

- |

Shareholder Communication with Directors

The Board of Directors has established the following procedures for shareholder communications with the Board of Directors or the Chair, who presides over the independent director sessions:

•Shareholders wishing to communicate with the Board of Directors or the Chair should send any communication to either the Board of Directors or the Presiding Director of Independent Director Sessions, Peapack-Gladstone Financial Corporation, c/o Kenneth Geiger, Corporate Secretary, 500 Hills Drive, Suite 300, P.O. Box 700, Bedminster, New Jersey, 07921. Any such communication should state the number of shares owned by the shareholder.

•The Corporate Secretary will forward such communication to the Board of Directors, the Chair or as appropriate to the particular Committee Chair, unless the communication is a personal or similar grievance, an abusive or inappropriate communication, or a communication not related to the duties or responsibilities of the Board of Directors, in which case the Corporate Secretary has the authority to disregard the communication. All such communications will be kept confidential to the extent possible.

•The Corporate Secretary will maintain a log of, and copies of, all communications, for inspection and review by any Board member, and will regularly review all such communications with the Board, the Chair or the appropriate Committee Chair.

Committees of the Board of Directors

The Board of Directors maintains an Audit Committee, a Compensation Committee, a Nominating Committee, and a Risk Committee. The following table identifies the members of each of these committees as of March 6, 2024. All members of each committee are independent in accordance with the NASDAQ listing requirements. Each committee operates under a written charter that is approved by the Board of Directors that governs its composition, responsibilities and operations. Each committee reviews and reassesses the adequacy of its charter at least annually. The charters are available in the Governance Documents portion of the Investor Relations section of the Company’s web site (www.pgbank.com).

|

|

|

|

|

|

|

|

|

Director |

|

Audit

Committee |

|

Compensation

Committee |

|

Nominating

Committee |

|

Risk

Committee |

Carmen M. Bowser |

|

|

|

|

|

X |

|

X |

Patrick M. Campion |

|

|

|

X |

|

|

|

|

Susan A. Cole |

|

|

|

|

|

|

|

|

Anthony J. Consi, II |

|

X |

|

X |

|

|

|

X |

Richard Daingerfield |

|

X |

|

|

|

|

|

X* |

Edward A. Gramigna, Jr. |

|

X |

|

|

|

X* |

|

|

Peter D. Horst |

|

|

|

|

|

X |

|

|

Steven A. Kass |

|

X* |

|

|

|

|

|

X |

Douglas L. Kennedy |

|

|

|

|

|

|

|

|

F. Duffield Meyercord |

|

|

|

X* |

|

X |

|

|

Patrick J. Mullen |

|

X |

|

|

|

|

|

X |

Philip W. Smith, III |

|

|

|

|

|

X |

|

|

Tony Spinelli |

|

|

|

X |

|

|

|

X |

Beth Welsh |

|

X |

|

|

|

|

|

X |

Number of meetings in 2023 |

|

8 |

|

7 |

|

2 |

|

7 |

|

|

|

|

|

|

|

|

|

* Chairperson |

|

|

|

|

|

|

|

|

Audit Committee

The Board of Directors has determined that Messrs. Consi and Kass meet the SEC criteria of an “audit committee financial expert.”

The Audit Committee charter provides the Audit Committee with the authority and responsibility for the appointment, retention, compensation and oversight of our independent auditors, including pre-approval of all audit and non-audit services to be performed by our independent auditors. Other responsibilities of the Audit Committee include: reviewing the scope and results of the audit with our independent auditors; reviewing with management and our independent auditors, Peapack-Gladstone’s interim and year-end operating results, including earnings releases; considering the appropriateness of the internal accounting and auditing procedures of Peapack-Gladstone; considering our auditors’ independence; reviewing examination reports by bank regulatory agencies; reviewing audit reports prepared by the Internal Audit Department of Peapack-Gladstone; reviewing audit reports prepared by any outside firm that may conduct internal audit functions for Peapack-Gladstone; and reviewing the response of management to those reports. The Audit Committee reports to the Board pertinent matters coming before it.

Compensation Committee

The Compensation Committee recommends to the independent members of the Board the CEO’s compensation, sets specific compensation for executive officers (other than the CEO) and ratifies general compensation levels for all other officers and employees. It also administers our long-term stock incentive plans, including the phantom stock plan and makes awards under those plans. The Compensation Committee also recommends Board compensation. In setting compensation levels, the Compensation Committee thoroughly analyzes and considers overall Company performance, individual job performance, the overall need of the Company to attract, retain and incentivize executive talent, the total cost of the compensation programs, and peer compensation.

The Compensation Committee has the authority to and responsibility for the appointment, retention, compensation and oversight of compensation consulting and advisory firms as it deems appropriate to its role. In 2023, the Compensation Committee engaged the services of McLagan, part of the rewards solutions practice at Aon PLC, an independent compensation consulting firm specializing in executive compensation, which provided an updated competitive market analysis and peer group data and assisted with the Pay versus Performance disclosures. McLagan reports directly to the Compensation Committee and carries out its responsibilities to the Compensation Committee in coordination with the Human Resources Department as requested by the Compensation Committee.

Risk Committee

The Risk Committee provides oversight and guidance for the Bank’s Enterprise Risk Management initiatives, including risk governance structure, risk management and risk assessment guidelines, policies and procedures, and the evaluation of market, credit, operational and reputational risks and the Bank’s risk tolerance. Risk assessment and risk management are the responsibility of the Bank’s management. The Committee’s responsibility consists of oversight and review.

Nominating Committee

The Nominating Committee reviews the qualifications of and recommends to the Board candidates for election as directors of Peapack-Gladstone and the Bank, recommends committee assignments, and discusses management succession for the Chair and the CEO positions. The Nominating Committee is also charged with reviewing the Board’s adherence to the Corporate Governance Principles and the Code of Business Conduct and Conflict of Interest Policy. The Nominating Committee reviews recommendations from shareholders regarding director candidates and any shareholder proposals. The procedure for submitting recommendations of director candidates is set forth below under the caption “Nomination of Directors.”

Nomination of Directors

Nominations for director may be made only by the Board of Directors, a committee of the Board or by a shareholder of record. The Board of Directors has established minimum criteria for members of the Board, which include:

•Stock ownership in compliance with the Company’s stock ownership guidelines.

•Being respected members of their communities and of high ethical and moral standards and having sound personal finances.

•Not serving on the board of directors of any other bank that serves the same market area as Peapack-Gladstone.

•An appropriate mix of educational background, professional background and business experience to make a significant contribution to the overall composition of the Board.

•The candidate being able to read and understand fundamental financial statements and being financially sophisticated as described in the NASDAQ rules, or considered to be an audit committee financial expert as defined pursuant to the SEC rules.

•Being independent under the NASDAQ rules.

•Demonstrated character and reputation, both personal and professional.

•Willingness to apply sound and independent business judgment.

•Ability to work productively with the other members of the Board.

•Availability for the substantial duties and responsibilities of a Peapack-Gladstone director.

The Nominating Committee considers diversity of experience, both of the individual under consideration and of the Board as a whole, as a factor in identifying nominees for director.

The Nominating Committee has adopted a policy regarding consideration of director candidates recommended by shareholders. Shareholders wishing to submit a director candidate for consideration by the Nominating Committee must submit such director candidate recommendations to the Nominating Committee, c/o the Corporate Secretary, 500 Hills Drive, Suite 300, P.O. Box 700, Bedminster, New Jersey 07921, in writing, not less than 120 nor more than 150 days prior to the first anniversary date of the prior year’s annual meeting. For our annual meeting in 2024, we must have received this notice between December 3, 2023 and January 2, 2024. The Nominating Committee has the right to require any additional background or other information from any director candidate or the recommending shareholder as it may deem appropriate. Shareholders who wish to nominate a director must also follow the requirements in our bylaws. For information regarding shareholder nominations of director candidates, see “Shareholder Proposals” below.

You can obtain a copy of our policy regarding shareholder recommendations for director candidates by writing to Kenneth Geiger, Corporate Secretary, Peapack-Gladstone Financial Corporation, 500 Hills Drive, Suite 300, P.O. Box 700, Bedminster, New Jersey 07921.

Hedging Policy

The Company maintains a policy prohibiting our executives and directors from hedging shares, including buying or selling puts or calls, short sales, or engaging in any other transaction designed to hedge or offset any decrease in the market value of the Company’s stock.

Code of Business Conduct and Conflict of Interest Policy

Peapack-Gladstone maintains a Code of Business Conduct and Conflict of Interest Policy, which applies to Peapack-Gladstone’s directors, officers and employees. The Code of Business Conduct and Conflict of Interest Policy is available in the Government Documents portion of the Investor Relations section of Peapack-Gladstone’s website located at www.pgbank.com. Peapack-Gladstone will disclose any substantive amendments to or waiver from provisions of the Code of Business Conduct and Conflict of Interest Policy on its website as may be required and within the time period specified under applicable SEC and NASDAQ rules.

DIRECTOR COMPENSATION

The following table summarizes the compensation of the non-employee directors of Peapack-Gladstone in 2023. Douglas L. Kennedy, as a full-time employee, was not compensated for his service rendered as a director.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fees Earned |

|

Name |

|

Cash (1) |

|

|

Stock Awards (2) |

|

|

Total |

|

Carmen M. Bowser |

|

$ |

55,000 |

|

|

$ |

49,474 |

|

|

$ |

104,474 |

|

Patrick M. Campion (3) |

|

|

16,800 |

|

|

|

- |

|

|

|

16,800 |

|

Susan A. Cole |

|

|

36,700 |

|

|

|

49,474 |

|

|

|

86,174 |

|

Anthony J. Consi, II |

|

|

87,000 |

|

|

|

49,474 |

|

|

|

136,474 |

|

Richard Daingerfield |

|

|

109,000 |

|

|

|

76,998 |

|

|

|

185,998 |

|

Edward A. Gramigna, Jr. |

|

|

96,700 |

|

|

|

71,487 |

|

|

|

168,187 |

|

Peter D. Horst |

|

|

38,000 |

|

|

|

49,474 |

|

|

|

87,474 |

|

Steven A. Kass |

|

|

119,000 |

|

|

|

87,988 |

|

|

|

206,988 |

|

F. Duffield Meyercord |

|

|

160,000 |

|

|

|

164,986 |

|

|

|

324,986 |

|

Patrick J. Mullen |

|

|

70,000 |

|

|

|

49,474 |

|

|

|

119,474 |

|

Philip W. Smith, III |

|

|

38,000 |

|

|

|

49,474 |

|

|

|

87,474 |

|

Tony Spinelli |

|

|

64,000 |

|

|

|

49,474 |

|

|

|

113,474 |

|

Beth Welsh |

|

|

68,000 |

|

|

|

49,474 |

|

|

|

117,474 |

|

(1)In 2023, Peapack-Gladstone paid its directors a $10,000 annual retainer for service on the Board, $900 for each Trust Committee meeting attended, and $2,000 for each regular Board, Executive or other committee meeting they attended. The Chair received an additional $80,000 annual retainer. The Audit Committee Chair received an additional $25,000 annual retainer, the Risk Committee Chair received an additional $15,000 annual retainer and the Nominating Committee Chair received an additional $10,000 annual retainer.

(2)The following table represents the number of restricted shares awarded to each director during 2023 and the grant date fair market value of these awards computed in accordance with ASC 718 based on the Peapack-Gladstone stock price on the date of grant of $30.96. The shares vest in one installment on March 20, 2024. The table below also shows the aggregate number of restricted stock units outstanding at December 31, 2023 for each director. None of the directors had outstanding options at December 31, 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

Number of

Shares of

Restricted Stock Units

Awarded in 2023 |

|

|

|

Grant Date Fair

Market Value of

Stock Units Awarded |

|

|

|

Aggregate

Number of

Restricted Stock Shares/Units

Outstanding at

12/31/2023 |

|

Carmen M. Bowser |

|

|

1,598 |

|

|

|

$ |

49,474 |

|

|

|

|

2,209 |

|

Patrick M. Campion |

|

|

- |

|

|

|

|

- |

|

|

|

|

- |

|

Susan A. Cole |

|

|

1,598 |

|

|

|

|

49,474 |

|

|

|

|

2,209 |

|

Anthony J. Consi, II |

|

|

1,598 |

|

|

|

|

49,474 |

|

|

|

|

2,209 |

|

Richard Daingerfield |

|

|

2,487 |

|

|

|

|

76,998 |

|

|

|

|

3,438 |

|

Edward A. Gramigna, Jr. |

|

|

2,309 |

|

|

|

|

71,487 |

|

|

|

|

3,192 |

|

Peter D. Horst |

|

|

1,598 |

|

|

|

|

49,474 |

|

|

|

|

2,209 |

|

Steven A. Kass |

|

|

2,842 |

|

|

|

|

87,988 |

|

|

|

|

3,929 |

|

F. Duffield Meyercord |

|

|

5,329 |

|

|

|

|

164,986 |

|

|

|

|

7,367 |

|

Patrick J. Mullen |

|

|

1,598 |

|

|

|

|

49,474 |

|

|

|

|

2,209 |

|

Philip W. Smith, III |

|

|

1,598 |

|

|

|

|

49,474 |

|

|

|

|

2,209 |

|

Tony Spinelli |

|

|

1,598 |

|

|

|

|

49,474 |

|

|

|

|

2,209 |

|

Beth Welsh |

|

|

1,598 |

|

|

|

|

49,474 |

|

|

|

|

2,209 |

|

(3) Mr. Campion was appointed as a director, effective June 22, 2023.

BENEFICIAL OWNERSHIP OF COMMON STOCK

Certain Beneficial Owners

The following table sets forth as of March 6, 2024 certain information as to beneficial ownership of each person known to Peapack-Gladstone to own beneficially more than five percent of the outstanding common stock of Peapack-Gladstone.

|

|

|

|

|

|

|

|

|

Name and Address

of Beneficial Owner |

|

Amount of Beneficial

Ownership |

|

|

Percent of Class |

|

|

|

|

|

|

|

|

BlackRock Inc. (1)

55 East 52d Street

New York, NY 10055 |

|

|

1,558,197 |

|

|

|

8.83 |

% |

|

|

|

|

|

|

|

Dimensional Fund Advisors LP (2)

Building One

6300 Bee Cave Road

Austin, TX 78746 |

|

|

1,269,472 |

|

|

|

7.19 |

% |

|

|

|

|

|

|

|

James M. Weichert (3)

1625 State Highway 10

Morris Plains, NJ 07950 |

|

|

1,070,480 |

|

|

|

6.06 |

% |

|

|

|

|

|

|

|

The Vanguard Group (4)

100 Vanguard Boulevard

Malvern, PA 19355 |

|

|

893,102 |

|

|

|

5.06 |

% |

(1)Based on a Schedule 13G/A filed with the SEC on January 25, 2024.

(2)Based on a Schedule 13G/A filed with the SEC on February 9, 2024.

(3)Based on a Schedule 13D/A filed with the SEC on April 30, 2014.

(4)Based on a Schedule 13G/A filed with the SEC on February 13, 2024.

Stock Ownership of Directors and Executive Officers

The following table sets forth as of March 6, 2024 the number of shares of Peapack-Gladstone’s common stock, beneficially owned by each of the directors and the executive officers of Peapack-Gladstone for whom individual information is required to be set forth in this proxy statement (the “named executive officers”), and by all directors and executive officers as a group.

|

|

|

|

|

|

|

|

|

|

|

Name of Beneficial Owner |

|

Amount of Beneficial

Ownership (1) |

|

Percent of Class (2) |

|

John P. Babcock |

|

|

140,282 |

|

|

(3) |

|

|

0.79 |

|

Carmen M. Bowser |

|

|

12,687 |

|

|

(4) |

|

* |

|

Patrick Campion |

|

|

340 |

|

|

|

|

* |

|

Frank A. Cavallaro |

|

|

7,452 |

|

|

(5) |

|

* |

|

Dr. Susan A. Cole |

|

|

11,260 |

|

|

(4) |

|

* |

|

Anthony J. Consi, II |

|

|

108,761 |

|

|

(4) |

|

|

0.61 |

|

Richard Daingerfield |

|

|

22,885 |

|

|

(6) |

|

* |

|

Edward A. Gramigna, Jr. |

|

|

23,124 |

|

|

(7) |

|

* |

|

Peter D. Horst |

|

|

15,102 |

|

|

(4) |

|

* |

|

Steven A. Kass |

|

|

20,227 |

|

|

(8) |

|

* |

|

Douglas L. Kennedy |

|

|

278,993 |

|

|

(9) |

|

|

1.58 |

|

F. Duffield Meyercord |

|

|

133,951 |

|

|

(10) |

|

|

0.76 |

|

Patrick J. Mullen |

|

|

7,942 |

|

|

(4) |

|

* |

|

Robert Plante |

|

|

58,423 |

|

|

(11) |

|

* |

|

Gregory M. Smith |

|

|

26,740 |

|

|

(12) |

|

* |

|

Philip W. Smith, III |

|

|

74,965 |

|

|

(13) |

|

* |

|

Anthony Spinelli |

|

|

12,067 |

|

|

(4) |

|

* |

|

Beth Welsh |

|

|

14,411 |

|

|

(4) |

|

* |

|

All directors and executive

officers as a group (27 persons) |

|

|

1,267,356 |

|

|

|

|

|

7.18 |

% |

|

|

|

|

|

|

|

|

|

* Less than one-half of one percent

(1)Beneficially owned shares include shares over which the named person exercises either sole or shared voting or investment power. It also includes shares owned (i) by a spouse, minor children or by relatives sharing the same home, (ii) by entities owned or controlled by the named person and (iii) all shares over which the named person has the right to acquire such shares within 60 days by the exercise of any right or option. Unless otherwise noted, all shares are owned of record or beneficially by the named person.

(2)The number of shares of common stock used in calculating the percentage of the class owned by all directors and executive officers as a group includes 17,652,341 shares of common stock outstanding as of March 6, 2024, and 165,525 restricted stock units vesting within 60 days.

(3)Includes 22,672 restricted stock units.

(4)Includes 2,209 restricted stock units.

(5)Includes 1,614 restricted stock units.

(6)Includes 3,438 restricted stock units.

(7)Includes 3,192 restricted stock units.

(8)Includes 2,500 shares owned by a family partnership, 1,000 shares owned by Mr. Kass’ wife, and 3,929 restricted stock units.

(9)Includes 9,550 shares purchased under the Employee Stock Purchase Plan and 32,263 restricted stock units.

(10)Includes 7,367 restricted stock units.

(11)Includes 2,929 shares purchased under the Employee Stock Purchase Plan and 9,893 restricted stock units.

(12)Includes 11,002 restricted stock units.

(13)Includes 8,437 shares owned by Mr. Smith’s wife, 1,335 shares owned by Mr. Smith’s management company, and 2,209 restricted stock units.

Stock Ownership Guidelines

The Company maintains Stock Ownership Guidelines, which apply to the Board of Directors, the Chief Executive Officer and the executive officers of the Company and impose the following requirements:

•All new members elected to the Board must own a minimum of $10,000 in Company stock at the time of his or her appointment;

•Directors must maintain five times the amount of the annual Company Board retainer for service on the Board in Company stock;

•The Chief Executive Officer must maintain three times his or her base salary in Company stock; and

•Executive officers must maintain one time his or her base salary in Company stock.

Individuals can count shares owned in a Company benefit plan towards the stock ownership requirement. There is no set compliance period to meet the guidelines, with the exception of the minimum ownership requirement applicable to new Board members, which must be met at the time of a new Board member’s appointment. However, until the guidelines are achieved, individuals will be required to retain 100% of any net shares received through a Company grant under the 2021 Long-Term Incentive Plan.

PROPOSAL 1

ELECTION OF DIRECTORS

The Board has 14 members. Peapack-Gladstone’s Nominating Committee has recommended to the Board that the 14 current directors be re-elected for one-year terms expiring at Peapack-Gladstone’s 2025 Annual Meeting of Shareholders or until their successors shall have been duly elected and qualified. If, for any reason, any of the nominees become unavailable for election, the proxy solicited by the Board may be voted for a substitute nominee selected by the Board. The Board has no reason to believe that any of the named nominees will be unavailable for election or will not serve if elected.

Unless a shareholder indicates otherwise on the proxy, the proxy will be voted for the persons named in the table below to serve until the expiration of their terms, and thereafter until their successors have been duly elected and qualified.

The following table sets forth the names and ages of the Board’s nominees for election, the nominees’ positions with Peapack-Gladstone (if any), the principal occupation or employment of each nominee for the past five years and the period during which each nominee has served as a director of Peapack-Gladstone. In addition, described below is each director nominee’s particular experience, qualifications, attributes or skills that have led the Board to conclude that the person should serve as a director.

NOMINEES FOR ELECTION AS DIRECTORS

|

|

|

|

|

|

|

Name and Position With Peapack-Gladstone |

|

Age |

|

Director Since |

|

Principal Occupation or Employment for the Past Five Years; Other Company Directorships |

Carmen M. Bowser |

|

69 |

|

2017 |

|

Retired; former Managing Vice President, Commercial Real Estate Division, Capital One Bank. Ms. Bowser is qualified to serve on the Board of Directors because of her extensive experience in the commercial real estate market, which includes serving as Managing Vice President, Commercial Real Estate Division at Capital One Bank and as Managing Director for Prudential Mortgage Capital Company. Her expertise and leadership experience is invaluable to the oversight of the Bank’s real estate portfolio. |

Patrick M. Campion |

|

62 |

|

2023 |

|

Retired; former Americas Region Head-Wealth Management at Deutsche Bank. Mr. Campion is qualified to serve on the Board of Directors because of his extensive experience in the wealth management business, which includes serving as an executive for more than 20 years leading US regional and international wealth management businesses at Deutsche Bank, HSBC, and Citi Private Bank, driving both financial and cultural transformations. Mr. Campion led successful strategies for business growth, sales and performance management, client experience and regulatory compliance. |

Dr. Susan A. Cole |

|

81 |

|

2014 |

|

Retired; former President of Montclair State University. Dr. Cole is qualified to serve on the Board of Directors because of her 23 years as President of Montclair State University (the second largest university in New Jersey, with approximately 20,000 students), which provides invaluable experience in the oversight of Bank operations. |

Anthony J. Consi, II |

|

78 |

|

2000 |

|

Retired; previously Senior Vice President of Finance and Operations, Weichert Realtors. Mr. Consi is qualified to serve on the Board of Directors because of his 15 years of public accounting experience at Coopers & Lybrand and his 22 years of finance and operations leadership at Weichert Realtors. |

Richard Daingerfield |

|

70 |

|

2014 |

|

Retired; Executive Vice President and General Counsel of Citizens Financial Group, Inc., Boston, Massachusetts from 2010 to 2014. Mr. Daingerfield is qualified to serve on the Board of Directors because of his expertise in corporate governance, executive management, risk management, corporate banking and commercial banking. His broad legal experience with commercial and retail banking, including international and domestic private banking, are invaluable to his role as Risk Committee Chair. |

Edward A. Gramigna, Jr. |

|

63 |

|

2012 |

|

Partner and Member of the Management Board of Faegre Drinker Biddle & Reath LLP. Mr. Gramigna is qualified to serve on the Board of Directors because of his 32 years of experience in trust, estate planning and estate administration, which is invaluable in the oversight of our wealth management division. |

Peter D. Horst |

|

62 |

|

2019 |

|

Retired; previously Chief Executive Officer of PSB, a global research-based consultancy. Mr. Horst also had over 31 years of experience as a Chief Marketing Officer across diverse industries in consumer and business products, services and technology for market leaders such as General Mills, US West, Hershey, Capital One and Ameritrade. Mr. Horst is qualified to serve on the Board of Directors because of his extensive marketing experience, which is invaluable in introducing our expanding wealth management brand to new markets. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Position With Peapack-Gladstone |

|

Age |

|

Director Since |

|

Principal Occupation or Employment for the Past Five Years; Other Company Directorships |

Steven A. Kass |

|

67 |

|

2018 |

|

Retired; previously senior partner of KPMG from 2014 to 2016. Mr. Kass was Chief Executive Officer of Rothstein Kass, an accounting firm that specialized in audit, tax and advisory services to hedge fund, private equity and venture capital clients, before it was sold to KPMG in 2014. Mr. Kass is qualified to serve on the Board of Directors and as Audit Committee Chair because of his public company accounting and management level experience. |

Douglas L. Kennedy Chief Executive Officer |

|

67 |

|

2012 |

|

President and CEO of Peapack-Gladstone and the Bank since 2012. Prior to joining the Company, Mr. Kennedy served as Executive Vice President and Market President at Capital One Bank/North Fork and held key executive level positions with Summit Bank and Bank of America/Fleet Bank. Mr. Kennedy, who began his career in commercial banking in 1978, is qualified to serve on the Board of Directors because of his over 47 years of commercial banking experience, demonstrated business leadership, judgment and vision. |

F. Duffield Meyercord |

|

77 |

|

1991 |

|

Chairman of the Board of Peapack-Gladstone and the Bank; Managing Partner of Carl Marks Advisory Group, LLC; President, Meyercord Advisors, Inc. Mr. Meyercord is qualified to serve on the Board of Directors because of his 47 years of experience in directing strategic projects and providing operational advisory services to numerous businesses, which is invaluable to the Board’s oversight of corporate strategy. |

Patrick J. Mullen |

|

78 |

|

2019 |

|

Retired; previously served as the Director of Banking, for the New Jersey Department of Banking and Insurance. Mr. Mullen was responsible for the examination and supervision of all state-chartered banks and credit unions and state-licensed non-bank financial institutions in New Jersey. Mr. Mullen is qualified to serve on the Board of Directors because of his financial services background, which provides invaluable oversight of Bank operations. |

Philip W. Smith, III |

|

68 |

|

1995 |

|

President, Phillary Management, Inc., a real estate management company. Mr. Smith is qualified to serve on the Board of Directors because of his 35 years of experience in commercial real estate agency and management, which is invaluable to the Board’s oversight of the Company’s real estate loan portfolio. |

Tony Spinelli |

|

56 |

|

2017 |

|

Chief Information Officer for Urban One, a multi-media company. Mr. Spinelli also served as Senior Vice President, Chief Information Security Officer, Capital One Bank and as Chief Operating Officer and President, Cyberdivision for Fractal Industries, Inc. Mr. Spinelli is qualified to serve on the Board of Directors because of his expertise in cybersecurity, security engineering and compliance, which provides insight into emerging threats to the Company and our clients. |

Beth Welsh |

|

65 |

|

2012 |

|

General Manager of Bassett Associates, a real estate management company in Summit, New Jersey. Ms. Welsh is qualified to serve on the Board of Directors because of her 27 years of experience in the commercial real estate market as well as her past banking experience, which is invaluable to the Board’s oversight of the Bank’s real estate lending and small business banking. |

The members of our Board of Directors collectively demonstrate appropriate leadership skills, experience and judgment in areas that are relevant to our business. We believe that their collective ability to challenge and stimulate management and their dedication to the affairs of the Company serve the interests of the Company and its shareholders.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE

DIRECTORS INCLUDED IN PROPOSAL 1.

PROPOSAL 2

ADVISORY VOTE ON COMPENSATION OF NAMED EXECUTIVE OFFICERS

We believe that our compensation policies and procedures are competitive, are focused on pay-for-performance principles and are strongly aligned with the long-term interests of our shareholders. We also believe that both the Company and our shareholders benefit from responsive corporate governance policies and constructive and consistent dialogue. The proposal described below, commonly known as a “Say on Pay” proposal, gives you, as a shareholder of Peapack-Gladstone, the opportunity to endorse or disapprove the compensation for our named executive officers.

Shareholders are provided an opportunity to approve on an advisory, or non-binding basis, the compensation of our named executive officers. Accordingly, we are asking you to vote on the compensation of Peapack-Gladstone’s named executive officers as described under the section “Compensation Discussion and Analysis” and in the tabular disclosure (together with the accompanying narrative disclosure) in this proxy statement. Your vote is advisory and will not be binding upon the Board. However, the Compensation Committee will take into account the outcome of the vote when considering future executive compensation arrangements.

The following summarizes the backgrounds of the named executive officers.

•Douglas L. Kennedy joined the Bank in 2012 as Chief Executive Officer. He is a career banker with over 45 years of commercial banking experience. Previously, Mr. Kennedy served as Executive Vice President and Market President at Capital One Bank/North Fork and held key executive level positions with Summit Bank and Bank of America/Fleet Bank. Mr. Kennedy has a Bachelor’s Degree in Economics and an M.B.A. from Sacred Heart University in Fairfield, Connecticut.

•Frank A. Cavallaro joined the Bank in October 2022 as Senior Executive Vice President. He became the Chief Financial Officer in November 2022. Prior to joining the Bank, Mr. Cavallaro served as Executive Vice President and Chief Financial Officer at Republic Bank since 2009. Mr. Cavallaro has more than 30 years of experience, where he has held senior level positions at several financial institutions and CPA firms. Mr. Cavallaro has a Bachelor of Science Degree in Accounting from Rutgers University School of Business in Camden, New Jersey and is a Certified Public Accountant.

•Robert A. Plante joined the Bank in 2017 as Chief Operating Officer. Mr. Plante previously served as Chief Operating Officer at Israel Discount Bank New York. Mr. Plante also served as Chief Information Officer at CIT Group and also held senior leadership positions at GE Capital Global Consumer Finance and with the Geary Corporation, a privately held IT consulting company. Mr. Plante has a Bachelor of Science in Business Administration in Finance from the University of Vermont.

•John P. Babcock joined the Bank in 2014 as Senior Executive Vice President of the Bank and President of Private Wealth Management. Mr. Babcock has over 42 years of experience in commercial and wealth management/private bank businesses in New York City and regional markets. Prior to joining the Bank, Mr. Babcock was the managing director of the Northeast Mid-Atlantic region for the HSBC Private Bank. Mr. Babcock graduated from Tulane University’s A.B. Freeman School of Business and has an M.B.A. from Fairleigh Dickinson University. Mr. Babcock holds FINRA Series 7, 63 and 24 securities licenses.

•Gregory M. Smith joined the Bank in 2019 as Executive Vice President, Head of Commercial Banking. Mr. Smith was promoted to President of Commercial Banking in 2021 and oversees commercial banking across the organization including lending, equipment finance, investment banking and corporate advisory, the Bank’s platinum service team and professional services group, the small business administration team, and treasury management and escrow services. Prior to joining the Bank, Mr. Smith served as group sales executive for the Northeast and Mid-Atlantic regions for Capital One Bank and was also a senior regional vice president for Summit Bank. Mr. Smith has a Bachelor of Science in Finance from Fairleigh Dickinson University and an M.B.A in Business Administration from Rider University.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE NON-BINDING APPROVAL OF THE COMPENSATION OF THE NAMED EXECUTIVE OFFICERS.

PROPOSAL 3

APPROVAL OF THE

PEAPACK-GLADSTONE FINANCIAL CORPORATION

2024 EMPLOYEE STOCK PURCHASE PLAN

TO REPLACE THE COMPANY'S 2014 EMPLOYEE STOCK PURCHASE PLAN

We are asking shareholders to approve the Peapack-Gladstone Financial Corporation 2024 Employee Stock Purchase Plan (the “ESPP”) to replace the Company’s 2014 Employee Stock Purchase Plan which is scheduled to expire in April 2024 in accordance with its terms.

The Board of Directors (the “Board”) adopted the ESPP, subject to shareholder approval at the Annual Meeting. The Board believes that the adoption of the ESPP is advisable and in the best interests of our shareholders. If shareholders approve the ESPP, it will become effective as of the date of shareholder approval.

The following summary of the material provisions of the ESPP does not purport to be complete and is qualified in its entirety by reference to the ESPP. For purposes of this summary, any reference to the Company includes the Company, Peapack-Gladstone Bank and any subsidiary (within the meaning of Section 424(f) of the Internal Revenue Code) of the Company that has been designated by the Committee (as defined below) as eligible to participate in the ESPP. A copy of the ESPP is attached as Exhibit A.

Purpose

The purpose of the ESPP is to provide eligible employees of the Company an opportunity to use payroll deductions to purchase shares of Company’s common stock (“Common Stock”) with an incentive that such shares can be purchased at a discount from its market price. The ESPP is intended to be an “employee stock purchase plan” within the meaning of Section 423 of the Internal Revenue Code.

Shares Reserved for Issuance

The maximum aggregate number of shares of the Company’s Common Stock available for purchase pursuant to the ESPP will be 150,000 shares, subject to adjustment as set forth in the ESPP. The share pool for the ESPP represents approximately 0.8% of the total number of shares of the Company’s Common Stock outstanding as of the record date.

In the event of a stock dividend, split-up, share combination, recapitalization or other change in the Company’s capitalization, a proportionate adjustment will be made in the number and kind of shares that may be delivered under the ESPP. Adjustments also may be made in the event of a merger, reorganization, consolidation, separation or liquidation of the Company.

The following table shows information at December 31, 2023 for all equity compensation plans under which shares of our common stock may be issued:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of Securities to |

|

|

|

|

|

Number of Securities |

|

|

|

Be Issued Upon |

|

|

|

|

|

Remaining |

|

|

|

Exercise of Outstanding |

|

|

Weighted Average |

|

|

Available for |

|

Plan |

|

Options and Rights |

|

|

Exercise Price |

|

|

Issuance Under Plan |

|

Equity compensation plans approved by security holders |

|

|

1,400 |

|

|

$ |

19.15 |

|

|

|

1,158,699 |

|

Equity compensation plans not approved by security holders |

|

|

— |

|

|

|

— |

|

|

|

— |

|

Total |

|

|

1,400 |

|

|

$ |

19.15 |

|

|

|

1,158,699 |

|

The number of securities remaining available for issuance shown in the above table includes 604,132 shares under the dividend reinvestment plan, 60,616 shares under the 2014 employee stock purchase plan, 85,428 shares under the 401(k) plan, and 408,523 shares under the 2021 Incentive Plan.

Administration

The Compensation Committee or other committee appointed by the Board (the “Committee”) will administer the ESPP and will have full and exclusive authority to interpret the terms of the ESPP, determine eligibility to participate, determine which Company subsidiaries are eligible to participate, amend and revoke rules for participation, suspend or terminate the ESPP, and exercise such powers and perform such actions as it deems necessary to carry out the intent of the ESPP, subject to the conditions of the ESPP. All determinations and decisions made by the Board or the Committee are final and binding upon the Company and all participants.

Eligibility and Participation

Generally, any employee (including any officer) who has been continuously employed by the Company, and certain designated subsidiaries including the Bank, as of the commencement of an offering period under the ESPP and who has been employed for at least 20 hours per week and more than five months in a calendar year is eligible to participate in the offering period.

No employee may participate in an offering period if, upon the employee’s purchase of the largest number of shares available to the employee for purchase during the offering period, the employee would own (or be deemed to own under certain attribution rules in the Internal Revenue Code) stock and/or hold outstanding options to purchase stock, possessing 5% or more of the total combined voting power or value of all classes of the Company’s stock.

As of the record date, approximately 513 employees would be eligible to participate in the ESPP.

Offering Periods

Pursuant to the terms of the ESPP, on the first trading day of an offering period, each eligible employee will be granted an option to purchase shares of the Company’s Common Stock on the last day of such offering period. The Committee will determine the length of each offering period, provided that no offering period may exceed 27 months in length.

Contributions and Payroll Deductions

The ESPP permits each participant to purchase shares of the Company’s Common Stock through payroll deductions of either a fixed dollar amount or percentage of their eligible compensation; provided, however, that the Committee may limit a participant’s purchase to a specific maximum number of shares or maximum amount of compensation. In no event may participants elect to purchase more than 500 shares of Common Stock on any single purchase date or Common Stock with a fair market value in excess of $25,000 (determined as of the first day of the offering period) in a single calendar year. No interest will accrue on a participant’s contributions to purchase stock under the ESPP. During an offering period, a participant may withdraw by submitting written notice of withdrawal to the Company and may decrease (but not increase) their contributions.

Purchases

Unless a participant terminates employment or withdraws from the ESPP or an offering period before the last trading day of an offering period, the participant’s option will automatically be exercised on the last trading day of each offering period. The number of shares of the Company’s Common Stock purchased will be determined by dividing the payroll contributions accumulated in the participant’s account by the applicable purchase price, subject to the maximum share limit discussed above.

The purchase price of the shares is expected to be 85% of the fair market value of the Company’s Common Stock on the purchase date unless the Compensation Committee selects a different purchase price, provided that the purchase price may not be less than 85% of the lower of the fair market value of the Company’s Common Stock on the first trading day of each offering period or on the last trading day of each offering period. The fair market value of the Company’s Common Stock on a given date is the closing sale price of the Common Stock on such date. As of March 6, 2024, the fair market value of the Common Stock as reported on the Nasdaq Global Select Market was $24.20.

Withdrawals

A participant may end its participation in the ESPP at any time during an offering period and all of the participant’s accrued contributions not yet used to purchase shares of the Company’s Common Stock will be returned to the participant. If a participant withdraws from an offering period, the participant must re-enroll in the ESPP before a future offering period begins to re-commence participation.

Termination of Employment

If a participant ceases to be an employee of the Company for any reason, the participant will be deemed to have elected to withdraw from the ESPP and the participant’s contributions not yet used to purchase shares of the Company’s Common Stock will be returned to the participant, without interest. The transfer of an employee between any of the Company or certain of its designated subsidiaries will not be deemed to be a withdrawal from the ESPP.

Corporate Transactions

In the event of a proposed change of control of the Company (as set forth in the ESPP), each then-outstanding option under the ESPP will be assumed or an equivalent substitute option substituted by the successor corporation will be issued, unless the Board elects in lieu of that treatment to simply terminate the ESPP or shorten the offering period then in progress and allow each outstanding option to be automatically exercised on a specified date preceding the closing of the transaction. If the Board sets an earlier purchase date in connection with a corporate transaction, the offering period then in progress will terminate on that purchase date.

Transferability

A participant may not assign, transfer, pledge or otherwise dispose of in any way (other than by will or the laws of descent and distribution) the participant’s rights with regard to options granted under the ESPP or contributions credited to the participant’s account.

Term, Amendment and Termination

The Board may at any time and for any reason amend or terminate the ESPP. Any amendment will be subject to shareholder approval to the extent required by applicable law, including if such amendment would increase the number of shares that may be issued under the ESPP or expand the designation of employees (or class of employees) eligible to participate in the ESPP.

Effectiveness and Term

The ESPP will become effective when approved by shareholders. The ESPP will continue in effect for a term of ten years following the effective date unless earlier terminated because all Common Stock authorized for issuance under the ESPP has been issued, or the ESPP is otherwise terminated by the Board.

Certain Federal Tax Information

The following summary briefly describes U.S. federal income tax consequences of options granted under the ESPP, but is not a detailed or complete description of all U.S. federal tax laws or regulations that may apply, and does not address any local, state or foreign country laws. Therefore, you should not rely on this summary for individual tax compliance, planning or decisions. Participants in the ESPP should consult their own professional tax advisors concerning tax aspects of options granted under the ESPP.

The ESPP is intended to qualify as an “employee stock purchase plan” meeting the requirements of Section 423 of the Internal Revenue Code. Under these provisions, a participant will not recognize taxable income until they sell or otherwise dispose of the shares purchased under the ESPP.

If a participant disposes of the shares acquired under the ESPP more than two years from the option grant date and more than one year from the date the stock is purchased, then the participant will recognize ordinary income in the amount equal to the lesser of (i) excess of the fair market value of the shares at the time of disposition over the price the participant paid for the shares, or (ii) the excess of the fair market value of the shares at the option grant date over the price the participant paid for the shares. Any gain in addition to this amount will be treated as a long-term capital gain. If a participant

holds shares at the time of their death, the holding period requirements are automatically deemed to have been satisfied. The Company will not be allowed a deduction for any amount if the holding period requirements are satisfied.

If a participant disposes of shares before expiration of two years from the date of grant and one year from the date of exercise (other than after death), then the participant will recognize ordinary income equal to the excess of the fair market value of the shares on the purchase date over the purchase price. Any additional gain or loss will be treated as long-term or short-term capital gain or loss, as the case may be. The Company will be allowed a deduction equal to the amount of ordinary income recognized by the participant.