Long-Term Incentive Plan

Objectives

Eagle Bancorp, Inc. (the “Company”) is committed to rewarding executive officers of the Company and its principal subsidiary EagleBank for their contributions to the Company’s success. The Company’s long-term incentive plan (LTIP) is adopted under, and constitutes the basis under which the Company will establish the equity based compensation awarded to executive officers pursuant to the Company’s then-applicable, shareholder approved, equity compensation plan (the “Stock Plan”), and is part of a total compensation package, which includes base salary, annual cash incentives (under the Senior Executive Incentive Plan — “SEIP”), long-term equity incentives and benefits. The objectives of this Long-Term Incentive Plan are to:

· Focus and reward participants for driving long-term, sustained performance.

· Align executive officers with shareholder interests.

· Enable the Company and its subsidiaries to attract and retain talent needed to drive the Company’s success.

· Ensure sound risk management by providing a balanced view of performance and aligning rewards with the time horizon of risk.

· Position EagleBank’s total compensation to be competitive with market for meeting performance goals.

· Work with the SEIP to ensure a proper balance of performance goals and time horizons for overall performance and compensation.

Participation

· Participants are the executive officers of the Company and EagleBank, as designated by the Board of Directors.

· Time-Vested Awards: New participants hired July 1 or later will not be eligible to receive awards of RS for the year in which they are hired but will become eligible for the next cycle.

· Performance-Vested Awards: New participants must be an executive officer on the first business day of the year to be eligible for performance-vested awards (made in the first quarter) relating to the forthcoming three-year period. [Participants must be an active employee as of the last day of the applicable performance period and on the date stock vests to receive the benefit of an award.

· Participant’s performance must be in good standing (minimum rating of 3) for the PRSU Performance Period and for the year of grant for Restricted Shares..

Program Components

The LTIP provides the opportunity to receive shares of time vested restricted stock (“RS”) and performance-vested restricted stock units (“PRSU”), to balance goals to reward for performance, retain executives and align executives’ interests with shareholders. Each year, participants are eligible to receive:

· Performance Shares (PSRU) (for 2019 this will be 50% of award value); PRSUs are performance-based and align executives with shareholder interests since award value is based on Company performance-based metrics. PRSUs represent the right to receive shares of the Company’s common stock upon certification of the achievement of specified performance based metrics over a three year performance and vesting cycle (the “performance period”).

· Restricted Stock (RS) (for 2019 this will be 50% of award value); RS supports executive ownership and retention objectives since there is always some value retained (even if performance metric minimums are not met).

· PRSUs are granted at target, with the potential to achieve vesting at or above a lower (50% of target) “threshold” level, or to achieve vesting up to a “stretch/maximum” (150% of target) level (with the award value is focused on achievement of future performance based on predefined performance measures). RS awards may be granted at target or could vary to allow for recognition/variation of Company and Individual performance.

The number of Restricted Stock and PRSU shares will be determined by dividing the value of the compensation award by the stock price on the date of grant (utilizing the formula contained in the applicable Stock Plan then in effect). The number of Performance Shares (PRSUs) will be granted at target but will be settled in Common Stock after the three year performance and vesting period.

Performance units promote pay for performance alignment and are intended to reward future performance since the awards are only paid out when predefined performance goals are met. Performance units are earned and cliff vest after three years. Earned performance units are paid within 75 days after the end of the Performance Period or as soon as practicable thereafter if the measurement data was not yet readily available, and vest on the date the Compensation Committee certifies the performance data..

The grants of RS and PRSUs under this Plan are under and a part of the applicable Company Stock Plan and not outside thereof, and are subject to all terms and conditions of such Plan.

Individual grant agreements will be provided to each individual upon grant and will specify the terms and conditions of the grant.

Participation in the Plan does not guarantee an award at the target levels detailed in Appendix A. The Compensation Committee of the Company (the “Committee”) will have the discretion to grant above or below target for RS to allow for appropriate reflection of the Company’s performance, business environment, risk mitigating factors, affordability and individual performance and contribution.

Award Opportunities

Each participant will have a target equity award that reflects being a part of a competitive total compensation package for his/her role. LTIP targets will be communicated to each participant at the start of each performance period. (See Appendix A for current target opportunities.) LTIP targets are estimates only, subject to adjustment as set forth herein and are not committed amounts until awards are actually made and vested.

Restricted Stock (Time Vested) Shares — How They Work

RS grants are awarded based on a holistic view of performance that recognizes individual and Company performance. Actual awards can vary +/- 25% from target to reflect performance. Once awarded, RS vests one-third per year for three years, beginning on the first anniversary after the grant date.

Performance Shares — How they Work

Performance Period

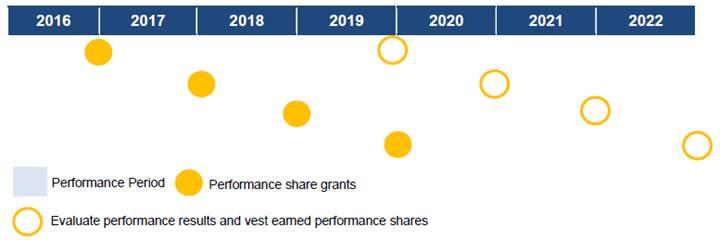

Each performance cycle (i.e., performance period) is three years. Performance goals and target opportunities are communicated at the start of each performance period. For the 2018 Plan, the performance period will be January 1, 2019 to December 31, 2021. The payout of the award is contingent on actual performance of pre-defined measures at the end of the performance period. The result is a rolling series of annual awards, each earned over three years.

The diagram below shows how the annual award process results in overlapping cycles.

Performance Measures

The Committee shall establish one or more Performance Goals for each grant of PRSUs. The selected performance measures are intended to reflect the Company’s strategic plan as well as shareholder expectations.

It is intended that target goals will reflect performance that is attainable with reasonable stretch. Stretch (maximum) goals will reflect challenge goals that require superior performance. Performance of each goal is measured independently.

Actual payout after three years will be interpolated on a straight-line basis between threshold, target and maximum to reward incremental performance. Performance will range from 50% of target for achieving threshold performance to 150% of target for achieving stretch performance.

The table below establishes two performance goals and ranges for 2018.

|

Measures |

|

Weight |

|

Threshold |

|

Target |

|

Stretch/Maximum |

|

Earnings per Share compared to approved Budget |

|

50% |

|

75% of Budget |

|

At Budget |

|

125% of Budget |

|

Net Interest Margin (NIM) based on KRX |

|

50% |

|

Median |

|

62.5% Percentile |

|

75% Percentile |

|

Payout Range (% of Target) |

|

100% |

|

50% |

|

100% |

|

150% |

The Index is the KBW Regional Bank Index (KRX) .

EPS shall be measured (after adjustment for intervening share issuances) by determining each year’s EPS and then averaging the comparison to budget over the three years.

NIM shall be measured using the KBW Bank Index (KRX).

Awards Payouts

The Company’s performance in respect of each of the performance measures will be calculated following the end of each performance cycle to determine the portion of an award of PRSUs that has vested. Vested PRSUs will be settled in the Company’s common stock.

In light of extraordinary regional economic or business circumstances of a force majeure nature (such as a result of a terrorist act or new government sequestration), the grant may provide that the Committee retains

the right to apply positive discretion to vesting as appropriate to normalize for such extraordinary regional circumstance. The factors listed above will be considered before vesting is approved by the Committee.

Terms and Conditions

This section provides a general overview of the major terms and conditions for the Long-Term Incentive Plan. Information represented below is subject to change and does not constitute a binding agreement.

Effective Date

This LTIP is effective initially to reflect a performance period of January 1, 2019 to December 31, 2021. The LTIP will be reviewed annually by the Company’s Compensation Committee of the Board to ensure proper alignment with the Company’s business objectives. The Company retains the rights as described below to amend, modify or discontinue the Plan at any time during the specified period regarding future grants. The Plan will remain in effect until outstanding awards are vested.

Plan Administration

The LTIP is authorized by the Board and administered by the Compensation Committee. The Compensation Committee has the sole authority to interpret the LTIP and to make or nullify any rules and procedures, as necessary, for proper administration of the LTIP. The Compensation Committee will make all final determinations regarding long-term incentive awards to participants. Any determinations by the Compensation Committee will be final and binding on all participants. The Compensation Committee may, in its sole discretion, terminate or modify the LTIP, however, no amendment or termination of this LTIP will adversely affect an outstanding award.

Plan Changes or Discontinuance

The Company has developed the LTIP on the basis of existing business, market and economic conditions; current services; and staff assignments. If substantial changes occur that affect these conditions, services, assignments, or forecasts (for example, mergers, dispositions or other corporate transactions, changes in laws or accounting principles or other events that would in the absence of some adjustment, frustrate the intended operation of this arrangement), the Company may add to, amend, modify or discontinue any of the terms or conditions of the LTIP at any time regarding future grants.

Termination of Employment

To encourage executive retention, a participant must be an active employee of the Company or Bank on the vesting date. (See exceptions for death, disability, retirement, termination for good reason or without cause and change in control below). PRSUs will be forfeited by participants who terminate employment during the performance cycle except as otherwise set forth in this LTIP.

Death, Disability, Retirement

If a participant ceases to be employed by the Company or Bank due to death, disability or retirement (as defined in the applicable Stock Plan), his/her RS shares will immediately vest, and his/her performance-vested PRSUs vesting will be the greater of (i) based on actual performance measured on the most recent completed fiscal quarter, without proration or (ii) based on an assumed “at target” performance for the entire Performance Period, but then prorated for the period between grant and DDR. Pro ration shall be computed based on full months, including any partial month of service.

Change in Control (CIC)

Upon a change in control (as defined in, and subject to any conditions contained in, the Stock Plan then in effect), (a) an executive’s RS shares will vest and (b) his/her performance-vested PRSUs vesting will be the greater of (i) based on actual performance measured on the most recent completed fiscal quarter, without proration or (ii) based on an assumed “at target” performance for the entire Performance Period, but then prorated for the period between grant and CIC. Pro ration shall be computed based on full months, including any partial month of service.

Clawback

All awards under this Plan are subject to clawback in accordance with the requirements of the applicable award agreement and applicable Stock plan, applicable law and regulation and the listing requirements of any exchange on which the Company’s common stock is listed for trading.

Ethics and Interpretation

If there is any ambiguity as to the meaning of any terms or provisions of the Plan or any questions as to the correct interpretation of any information contained therein, the interpretation expressed by the Compensation Committee will be final and binding.

The altering, inflating, and/or inappropriate manipulation of performance/financial results or any other infraction of recognized ethical business standard, will subject a participant to disciplinary action up to and including termination of employment. In addition, any incentive compensation under the Plan to which the participant would otherwise be entitled may be revoked.

Miscellaneous

The LTIP will not be deemed to give any participant the right to be retained in the employ of the Bank, nor will the LTIP interfere with the right of the Company or Bank to discharge any participant at any time for any reason. Receipt of an award in one year does not guarantee the eligibility of a participant to receive, or entitle a participant to receive, an award in any subsequent year.

Each provision in this LTIP is severable, and if any provision is held to be invalid, illegal, or unenforceable, the validity, legality and enforceability of the remaining provisions shall not, in any way, be affected or impaired thereby.

This incentive plan and the transactions and payments hereunder shall, in all respects, be governed by, and construed and enforced in accordance with the laws of the state of Maryland (without regard to its conflicts of laws provisions).