| Annual Report Pursuant to Section 13 or 15(d) of the Securities and Exchange Act of 1934 |

| Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

ORIDA |

||

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| ☒ | Accelerated filer | ☐ | ||||

| Non-accelerated filer | ☐ | Smaller reporting company | ||||

| Emerging growth company | ||||||

Page |

||||||

| PART I |

||||||

| Item 1. |

3 |

|||||

| Item 1A. |

13 |

|||||

| Item 1B. |

18 |

|||||

| Item 2. |

18 |

|||||

| Item 3. |

18 |

|||||

| Item 4. |

18 |

|||||

| PART II |

||||||

| Item 5. |

18 |

|||||

| Item 6. |

20 |

|||||

| Item 7. |

20 |

|||||

| Item 7A. |

20 |

|||||

| Item 8. |

20 |

|||||

| Item 9. |

20 |

|||||

| Item 9A. |

20 |

|||||

| Item 9B. |

21 |

|||||

| Item 9C. |

21 |

|||||

| PART III |

||||||

| PART IV |

||||||

| Item 15. |

21 |

|||||

| Item 16. |

24 |

|||||

25 |

||||||

| • | general economic conditions, both in the United States and in the international markets we serve; |

| • | competitive factors within the HVAC/R industry; |

| • | effects of supplier concentration; |

| • | fluctuations in certain commodity costs; |

| • | consumer spending; |

| • | consumer debt levels; |

| • | the continued impact of the COVID-19 pandemic; |

| • | new housing starts and completions; |

| • | capital spending in the commercial construction market; |

| • | access to liquidity needed for operations; |

| • | seasonal nature of product sales; |

| • | weather patterns and conditions; |

| • | insurance coverage risks; |

| • | federal, state, and local regulations impacting our industry and products; |

| • | prevailing interest rates; |

| • | foreign currency exchange rate fluctuations; |

| • | international risk; |

| • | cybersecurity risk; and |

| • | the continued viability of our business strategy. |

ITEM 1. |

BUSINESS |

| The markets we serve are as follows: |

% of Revenues for the Year Ended December 31, 2021 |

Number of Locations as of December 31, 2021 |

||||||

| United States |

90 | % | 611 | |||||

| Canada |

6 | % | 36 | |||||

| Latin America and the Caribbean |

4 | % | 24 | |||||

| |

|

|

|

|||||

| Total |

100 |

% |

671 |

|||||

| |

|

|

|

|||||

| Florida |

103 | |||

| Texas |

88 | |||

| North Carolina |

48 | |||

| California |

37 | |||

| Louisiana |

35 | |||

| Georgia |

33 | |||

| South Carolina |

31 | |||

| Virginia |

26 | |||

| Tennessee |

24 | |||

| Pennsylvania |

21 | |||

| Illinois |

17 | |||

| New York |

16 | |||

| New Jersey |

15 | |||

| Alabama |

10 | |||

| Massachusetts |

10 | |||

| Arizona |

9 | |||

| Mississippi |

9 | |||

| Missouri |

9 | |||

| Connecticut |

8 | |||

| Kansas |

7 | |||

| Maryland |

7 | |||

| Indiana |

5 | |||

| Oklahoma |

5 | |||

| Utah |

5 | |||

| Arkansas |

4 | |||

| Minnesota |

3 | |||

| West Virginia |

3 | |||

| Colorado |

2 | |||

| Iowa |

2 | |||

| Kentucky |

2 | |||

| Maine |

2 | |||

| Nebraska |

2 | |||

| Nevada |

2 | |||

| South Dakota |

2 | |||

| Wisconsin |

2 | |||

| Delaware |

1 | |||

| Michigan |

1 | |||

| New Hampshire |

1 | |||

| New Mexico |

1 | |||

| North Dakota |

1 | |||

| Rhode Island |

1 | |||

| Vermont |

1 | |||

| |

|

|||

| United States |

611 | |||

| Canada |

36 | |||

| Mexico |

12 | |||

| Puerto Rico |

12 | |||

| |

|

|||

| Total |

671 | |||

| |

|

ITEM 1A. |

RISK FACTORS |

| • | the ability to identify and consummate transactions with complementary acquisition candidates; |

| • | the successful operation and/or integration of acquired companies; |

| • | diversion of management’s attention from other daily functions; |

| • | issuance by us of equity securities that would dilute ownership of our existing shareholders; |

| • | incurrence and/or assumption of significant debt and contingent liabilities; and |

| • | possible loss of key employees and/or customer relationships of the acquired companies. |

| • | fluctuations in our operating results; |

| • | a decision by the Board of Directors to reduce or eliminate cash dividends on our common stock; |

| • | changes in recommendations or earnings estimates by securities analysts; |

| • | general market conditions in our industry or in the economy as a whole; and |

| • | political instability, natural disasters, war and/or events of terrorism. |

ITEM 1B. |

UNRESOLVED STAFF COMMENTS |

ITEM 2. |

PROPERTIES |

ITEM 3. |

LEGAL PROCEEDINGS |

ITEM 4. |

MINE SAFETY DISCLOSURES |

ITEM 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

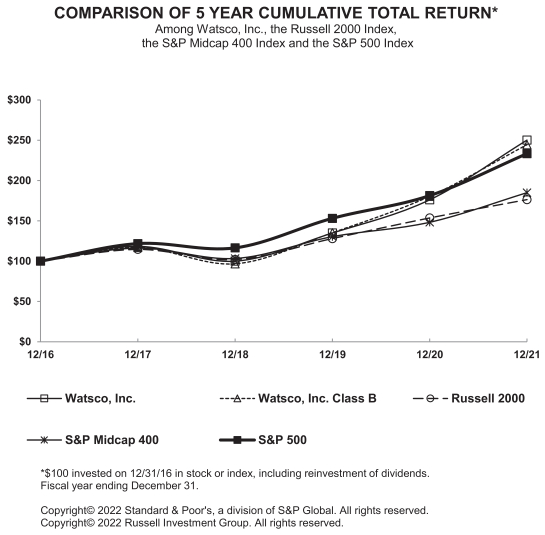

12/31/16 |

12/31/17 |

12/31/18 |

12/31/19 |

12/31/20 |

12/31/21 |

|||||||||||||||||||

| Watsco, Inc. |

100.00 | 118.36 | 99.99 | 134.94 | 176.11 | 250.19 | ||||||||||||||||||

| Watsco, Inc. Class B |

100.00 | 117.11 | 96.73 | 135.33 | 180.41 | 244.52 | ||||||||||||||||||

| Russell 2000 Index |

100.00 | 114.65 | 102.02 | 128.06 | 153.62 | 176.39 | ||||||||||||||||||

| S&P MidCap 400 Index |

100.00 | 116.24 | 103.36 | 130.44 | 148.26 | 184.96 | ||||||||||||||||||

| S&P 500 Index |

100.00 | 121.83 | 116.49 | 153.17 | 181.35 | 233.41 | ||||||||||||||||||

ITEM 6. |

[RESERVED] |

ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

ITEM 7A. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

ITEM 8. |

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

ITEM 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

ITEM 9A. |

CONTROLS AND PROCEDURES |

ITEM 9B. |

OTHER INFORMATION |

ITEM 9C. |

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS |

ITEM 15. |

EXHIBITS, FINANCIAL STATEMENT SCHEDULES |

| (a)(1) | Financial Statements . Our consolidated financial statements are incorporated by reference from our 2021 Annual Report. |

| (2) | Financial Statement Schedules . The schedules are omitted because they are not applicable or the required information is shown in the consolidated financial statements or notes thereto. |

| (3) | Exhibits . The following exhibits are submitted with this Annual Report on Form 10-K or, where indicated, incorporated by reference to other filings. |

| 32.1 | Certification of Chief Executive Officer, Executive Vice President and Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. + | |

| 101.INS | Inline XBRL Instance Document - the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document. # | |

| 101.SCH | Inline XBRL Taxonomy Extension Schema Document. # | |

| 101.CAL | Inline XBRL Taxonomy Extension Calculation Linkbase Document. # | |

| 101.DEF | Inline XBRL Taxonomy Extension Definition Linkbase Document. # | |

| 101.LAB | Inline XBRL Taxonomy Extension Label Linkbase Document. # | |

| 101.PRE | Inline XBRL Taxonomy Extension Presentation Linkbase Document. # | |

| 104 | The cover page from the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, formatted in Inline XBRL. | |

# |

filed herewith. |

| + | furnished herewith. |

| * | management contract or compensation plan or arrangement. |

ITEM 16. |

FORM 10-K SUMMARY |

| WATSCO, INC. | ||||||

| February 25, 2022 | By: | /s/ Albert H. Nahmad | ||||

| Albert H. Nahmad, Chief Executive Officer | ||||||

| February 25, 2022 | By: | /s/ Ana M. Menendez | ||||

| Ana M. Menendez, Chief Financial Officer | ||||||

| SIGNATURE |

TITLE |

DATE | ||

| / S / ALBERT H. NAHMAD Albert H. Nahmad |

Chairman of the Board and Chief Executive Officer (principal executive officer) |

February 25, 2022 | ||

| / S / ANA M. MENENDEZ Ana M. Menendez |

Chief Financial Officer (principal accounting officer and principal financial officer) |

February 25, 2022 | ||

| / S / CESAR L. ALVAREZ Cesar L. Alvarez |

Director |

February 25, 2022 | ||

| / S / J. MICHAEL CUSTER J. Michael Custer |

Director |

February 25, 2022 | ||

| / S / DENISE DICKINS Denise Dickins |

Director |

February 25, 2022 | ||

| / S / BRIAN E. KEELEY Brian E. Keeley |

Director |

February 25, 2022 | ||

| / S / JOHN A. MACDONALD John A. Macdonald |

Director |

February 25, 2022 | ||

| / S / BOB L. MOSS Bob L. Moss |

Director |

February 25, 2022 | ||

| / S / AARON J. NAHMAD Aaron J. Nahmad |

Director and President |

February 25, 2022 | ||

| / S / STEVEN RUBIN Steven Rubin |

Director |

February 25, 2022 | ||