elme-20220930000010489412/312022Q3falsehttp://fasb.org/us-gaap/2022#RealEstateMemberhttp://fasb.org/us-gaap/2022#RealEstateMember1100001048942022-01-012022-09-3000001048942022-10-24xbrli:shares00001048942022-09-30iso4217:USD00001048942021-12-31iso4217:USDxbrli:shares00001048942021-07-012021-09-3000001048942022-07-012022-09-3000001048942021-01-012021-09-300000104894us-gaap:CommonStockMember2021-12-310000104894us-gaap:AdditionalPaidInCapitalMember2021-12-310000104894us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2021-12-310000104894us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000104894us-gaap:ParentMember2021-12-310000104894us-gaap:NoncontrollingInterestMember2021-12-310000104894us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2022-01-012022-09-300000104894us-gaap:ParentMember2022-01-012022-09-300000104894us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-09-300000104894us-gaap:NoncontrollingInterestMember2022-01-012022-09-300000104894us-gaap:CommonStockMember2022-01-012022-09-300000104894us-gaap:AdditionalPaidInCapitalMember2022-01-012022-09-300000104894us-gaap:CommonStockMember2022-09-300000104894us-gaap:AdditionalPaidInCapitalMember2022-09-300000104894us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2022-09-300000104894us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-300000104894us-gaap:ParentMember2022-09-300000104894us-gaap:NoncontrollingInterestMember2022-09-300000104894us-gaap:CommonStockMember2020-12-310000104894us-gaap:AdditionalPaidInCapitalMember2020-12-310000104894us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2020-12-310000104894us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310000104894us-gaap:ParentMember2020-12-310000104894us-gaap:NoncontrollingInterestMember2020-12-3100001048942020-12-310000104894us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2021-01-012021-09-300000104894us-gaap:ParentMember2021-01-012021-09-300000104894us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-09-300000104894us-gaap:NoncontrollingInterestMember2021-01-012021-09-300000104894us-gaap:CommonStockMember2021-01-012021-09-300000104894us-gaap:AdditionalPaidInCapitalMember2021-01-012021-09-300000104894us-gaap:CommonStockMember2021-09-300000104894us-gaap:AdditionalPaidInCapitalMember2021-09-300000104894us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2021-09-300000104894us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-09-300000104894us-gaap:ParentMember2021-09-300000104894us-gaap:NoncontrollingInterestMember2021-09-3000001048942021-09-300000104894us-gaap:CommonStockMember2022-06-300000104894us-gaap:AdditionalPaidInCapitalMember2022-06-300000104894us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2022-06-300000104894us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300000104894us-gaap:ParentMember2022-06-300000104894us-gaap:NoncontrollingInterestMember2022-06-3000001048942022-06-300000104894us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2022-07-012022-09-300000104894us-gaap:ParentMember2022-07-012022-09-300000104894us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-300000104894us-gaap:NoncontrollingInterestMember2022-07-012022-09-300000104894us-gaap:CommonStockMember2022-07-012022-09-300000104894us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-300000104894us-gaap:CommonStockMember2021-06-300000104894us-gaap:AdditionalPaidInCapitalMember2021-06-300000104894us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2021-06-300000104894us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-06-300000104894us-gaap:ParentMember2021-06-300000104894us-gaap:NoncontrollingInterestMember2021-06-3000001048942021-06-300000104894us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2021-07-012021-09-300000104894us-gaap:ParentMember2021-07-012021-09-300000104894us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-07-012021-09-300000104894us-gaap:NoncontrollingInterestMember2021-07-012021-09-300000104894us-gaap:CommonStockMember2021-07-012021-09-300000104894us-gaap:AdditionalPaidInCapitalMember2021-07-012021-09-300000104894elme:TaxableReitSubsidiaryMember2022-09-300000104894elme:TaxableReitSubsidiaryMember2021-12-31elme:segment0000104894srt:MultifamilyMemberelme:AcquisitionGroup2022Memberelme:CarlyleOfSandySpringsMember2022-09-30elme:home0000104894srt:MultifamilyMemberelme:CarlyleOfSandySpringsMember2022-01-012022-09-30xbrli:pure0000104894srt:MultifamilyMemberelme:MariettaCrossingMemberelme:AcquisitionGroup2022Member2022-09-300000104894srt:MultifamilyMemberelme:MariettaCrossingMember2022-01-012022-09-300000104894srt:MultifamilyMemberelme:AcquisitionGroup2022Memberelme:AlderParkMember2022-09-300000104894srt:MultifamilyMemberelme:AlderParkMember2022-01-012022-09-300000104894srt:MultifamilyMemberelme:AcquisitionGroup2022Member2022-09-300000104894srt:MultifamilyMember2022-01-012022-09-300000104894us-gaap:LandMember2022-01-012022-09-300000104894us-gaap:BuildingMember2022-01-012022-09-300000104894elme:LeasingCommissionsAbsorptionCostsMember2022-01-012022-09-300000104894elme:RiversideDevelopmentsMember2022-09-300000104894us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberelme:OfficePortfolioMemberelme:TwoThousandTwentyOnePropertiesSoldGroupMembersrt:OfficeBuildingMember2021-07-26utr:sqft0000104894us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberelme:OfficePortfolioMemberelme:TwoThousandTwentyOnePropertiesSoldGroupMembersrt:OfficeBuildingMember2021-07-262021-07-260000104894elme:RetailProfileMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberelme:TwoThousandTwentyOnePropertiesSoldGroupMembersrt:RetailSiteMember2021-09-220000104894elme:RetailProfileMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberelme:TwoThousandTwentyOnePropertiesSoldGroupMembersrt:RetailSiteMember2021-09-222021-09-220000104894us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberelme:TwoThousandTwentyOnePropertiesSoldGroupMember2021-12-310000104894us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberelme:TwoThousandTwentyOnePropertiesSoldGroupMember2021-01-012021-12-310000104894srt:OfficeBuildingMember2021-07-26elme:property0000104894srt:RetailSiteMember2021-09-220000104894us-gaap:RevolvingCreditFacilityMember2021-09-300000104894elme:A2018TermLoanMemberus-gaap:LoansPayableMember2021-09-300000104894us-gaap:RevolvingCreditFacilityMember2021-07-012021-09-30elme:extension_option0000104894elme:CreditAgreementAmendedAndRestatedMember2021-09-300000104894us-gaap:RevolvingCreditFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMembersrt:MinimumMember2021-07-012021-09-300000104894us-gaap:RevolvingCreditFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMembersrt:MaximumMember2021-07-012021-09-300000104894us-gaap:BaseRateMemberus-gaap:RevolvingCreditFacilityMembersrt:MinimumMember2021-07-012021-09-300000104894us-gaap:BaseRateMemberus-gaap:RevolvingCreditFacilityMembersrt:MaximumMember2021-07-012021-09-300000104894us-gaap:RevolvingCreditFacilityMemberus-gaap:FederalFundsEffectiveSwapRateMember2021-07-012021-09-300000104894us-gaap:RevolvingCreditFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMember2021-07-012021-09-300000104894us-gaap:RevolvingCreditFacilityMembersrt:MinimumMember2021-07-012021-09-300000104894us-gaap:RevolvingCreditFacilityMembersrt:MaximumMember2021-07-012021-09-300000104894us-gaap:RevolvingCreditFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMember2022-07-012022-09-300000104894us-gaap:RevolvingCreditFacilityMember2022-09-300000104894us-gaap:RevolvingCreditFacilityMember2022-07-012022-09-300000104894elme:A2016TermLoanMemberus-gaap:LoansPayableMember2016-07-220000104894us-gaap:LondonInterbankOfferedRateLIBORMemberelme:A2018TermLoanMembersrt:MinimumMemberus-gaap:LoansPayableMember2021-07-012021-09-300000104894us-gaap:LondonInterbankOfferedRateLIBORMembersrt:MaximumMemberelme:A2018TermLoanMemberus-gaap:LoansPayableMember2021-07-012021-09-300000104894us-gaap:BaseRateMemberelme:A2018TermLoanMembersrt:MinimumMemberus-gaap:LoansPayableMember2021-07-012021-09-300000104894us-gaap:BaseRateMembersrt:MaximumMemberelme:A2018TermLoanMemberus-gaap:LoansPayableMember2021-07-012021-09-300000104894elme:A2018TermLoanMember2021-09-272021-09-270000104894elme:A2018TermLoanBMemberus-gaap:InterestRateSwapMember2021-09-2700001048942022-01-012022-03-3100001048942022-04-012022-06-300000104894us-gaap:RevolvingCreditFacilityMember2022-06-300000104894us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:MortgagesMemberelme:MariettaCrossingMember2022-05-310000104894us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:MortgagesMemberelme:MariettaCrossingMember2022-05-310000104894us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:MortgagesMemberelme:AlderParkMember2022-05-310000104894us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:MortgagesMemberelme:AlderParkMember2022-05-3100001048942022-09-012022-09-010000104894us-gaap:InterestRateSwapMember2022-09-30elme:arrangement0000104894elme:A2018TermLoanAMemberus-gaap:InterestRateSwapMember2022-09-300000104894us-gaap:AccountsPayableAndAccruedLiabilitiesMemberelme:A2018TermLoanAMemberus-gaap:InterestRateSwapMember2022-09-300000104894us-gaap:AccountsPayableAndAccruedLiabilitiesMemberelme:A2018TermLoanAMemberus-gaap:InterestRateSwapMember2021-12-310000104894us-gaap:InterestRateSwapMember2022-01-012022-09-300000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2022-09-300000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2022-09-300000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2022-09-300000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2022-09-300000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2021-12-310000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2021-12-310000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2021-12-310000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2021-12-310000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2022-09-300000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:InterestRateSwapMember2022-09-300000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwapMember2022-09-300000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateSwapMember2022-09-300000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2021-12-310000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:InterestRateSwapMember2021-12-310000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwapMember2021-12-310000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateSwapMember2021-12-310000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2022-09-300000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2022-09-300000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberus-gaap:FairValueInputsLevel2Member2022-09-300000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2022-09-300000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2021-12-310000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2021-12-310000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberus-gaap:FairValueInputsLevel2Member2021-12-310000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2021-12-310000104894us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-09-300000104894us-gaap:EstimateOfFairValueFairValueDisclosureMember2022-09-300000104894us-gaap:CarryingReportedAmountFairValueDisclosureMember2021-12-310000104894us-gaap:EstimateOfFairValueFairValueDisclosureMember2021-12-310000104894elme:WashingtonRealEstateInvestmentTrust2016OmnibusIncentivePlanMember2022-09-300000104894elme:WashingtonRealEstateInvestmentTrust2016OmnibusIncentivePlanMember2022-01-012022-09-300000104894elme:RestrictedShareAwardsMember2022-01-012022-09-300000104894elme:RestrictedShareAwardsMember2021-01-012021-09-300000104894elme:RestrictedShareAwardsMember2022-09-3000001048942021-04-012021-06-300000104894srt:OfficeBuildingMember2022-09-300000104894elme:ResidentialSegmentMember2022-07-012022-09-300000104894us-gaap:CorporateAndOtherMember2022-07-012022-09-300000104894elme:ResidentialSegmentMember2022-09-300000104894us-gaap:CorporateAndOtherMember2022-09-300000104894elme:ResidentialSegmentMember2021-07-012021-09-300000104894us-gaap:CorporateAndOtherMember2021-07-012021-09-300000104894elme:ResidentialSegmentMember2021-09-300000104894us-gaap:CorporateAndOtherMember2021-09-300000104894elme:ResidentialSegmentMember2022-01-012022-09-300000104894us-gaap:CorporateAndOtherMember2022-01-012022-09-300000104894elme:ResidentialSegmentMember2021-01-012021-09-300000104894us-gaap:CorporateAndOtherMember2021-01-012021-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________________________

FORM 10-Q

___________________________________________________

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For quarterly period ended September 30, 2022

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

COMMISSION FILE NO. 1-6622

| | |

ELME COMMUNITIES |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | |

| Maryland | | 53-0261100 |

| (State of incorporation) | | (IRS Employer Identification Number) |

1775 EYE STREET, NW, SUITE 1000, WASHINGTON, DC 20006

(Address of principal executive office) (Zip code)

Registrant’s telephone number, including area code: (202) 774-3200

___________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Shares of Beneficial Interest | ELME | NYSE |

___________________________________________________

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large Accelerated Filer | ☒ | Accelerated Filer | ☐ |

| Non-accelerated Filer | ☐ | Smaller Reporting Company | ☐ |

| | Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of October 24, 2022, 87,517,479 common shares were outstanding.

ELME COMMUNITIES

INDEX

| | | | | | | | |

| | | Page |

| |

| | |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| | |

| Item 3. | | |

| | |

| Item 4. | | |

| |

| |

| | |

| Item 1. | | |

| | |

| Item 1A. | | |

| | |

| Item 2. | | |

| | |

| Item 3. | | |

| | |

| Item 4. | | |

| | |

| Item 5. | | |

| | |

| Item 6. | | |

| | |

| | |

PART I

FINANCIAL INFORMATION

ITEM 1: FINANCIAL STATEMENTS

The information furnished in the accompanying unaudited Consolidated Balance Sheets, Condensed Consolidated Statements of Operations, Condensed Consolidated Statements of Comprehensive Income (Loss), Consolidated Statements of Equity and Consolidated Statements of Cash Flows reflects all adjustments, consisting of normal recurring items, which are, in the opinion of management, necessary for a fair presentation of the financial position, results of operations and cash flows for the interim periods. The accompanying financial statements and notes thereto should be read in conjunction with the financial statements and notes for the three years ended December 31, 2021 included in our 2021 Annual Report on Form 10-K filed on February 18, 2022.

ELME COMMUNITIES AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(IN THOUSANDS, EXCEPT PER SHARE DATA)

| | | | | | | | | | | |

| September 30, 2022 | | December 31, 2021 |

| (Unaudited) | |

| Assets | | | |

| Land | $ | 373,171 | | | $ | 322,623 | |

| Income producing property | 1,882,235 | | | 1,642,147 | |

| 2,255,406 | | | 1,964,770 | |

| Accumulated depreciation and amortization | (461,293) | | | (402,560) | |

| Net income producing property | 1,794,113 | | | 1,562,210 | |

| Properties under development or held for future development | 31,232 | | | 30,631 | |

| Total real estate held for investment, net | 1,825,345 | | | 1,592,841 | |

| | | |

| Cash and cash equivalents | 8,436 | | | 233,600 | |

| Restricted cash | 1,437 | | | 620 | |

| Rents and other receivables | 16,088 | | | 15,067 | |

| Prepaid expenses and other assets | 28,228 | | | 33,866 | |

| | | |

| Total assets | $ | 1,879,534 | | | $ | 1,875,994 | |

| Liabilities | | | |

| Notes payable, net | $ | 497,247 | | | $ | 496,946 | |

| | | |

| Line of credit | 43,000 | | | — | |

| Accounts payable and other liabilities | 36,219 | | | 40,585 | |

| Dividend payable | 14,919 | | | 14,650 | |

| Advance rents | 1,489 | | | 2,082 | |

| Tenant security deposits | 5,461 | | | 4,669 | |

| | | |

| Total liabilities | 598,335 | | | 558,932 | |

| Equity | | | |

| Shareholders’ equity | | | |

Preferred shares; $0.01 par value; 10,000 shares authorized; no shares issued or outstanding | — | | | — | |

Shares of beneficial interest, $0.01 par value; 150,000 and 100,000 shares authorized; 87,504 and 86,261 shares issued and outstanding, as of September 30, 2022 and December 31, 2021, respectively | 875 | | | 863 | |

| Additional paid in capital | 1,728,840 | | | 1,697,477 | |

| Distributions in excess of net income | (434,539) | | | (362,494) | |

| Accumulated other comprehensive loss | (14,278) | | | (19,091) | |

| Total shareholders’ equity | 1,280,898 | | | 1,316,755 | |

| Noncontrolling interests in subsidiaries | 301 | | | 307 | |

| Total equity | 1,281,199 | | | 1,317,062 | |

| Total liabilities and equity | $ | 1,879,534 | | | $ | 1,875,994 | |

See accompanying notes to the consolidated financial statements.

ELME COMMUNITIES AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(IN THOUSANDS, EXCEPT PER SHARE DATA) (UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2022 | | 2021 | | 2022 | | 2021 |

| Revenue | | | | | | | |

| Real estate rental revenue | $ | 54,603 | | | $ | 42,499 | | | $ | 153,787 | | | $ | 124,403 | |

| Expenses | | | | | | | |

| Property operating and maintenance | 13,092 | | | 9,901 | | | 35,404 | | | 28,655 | |

| Real estate taxes and insurance | 6,469 | | | 5,544 | | | 19,893 | | | 16,525 | |

| Property management | 1,916 | | | 1,499 | | | 5,462 | | | 4,448 | |

| General and administrative | 6,403 | | | 7,909 | | | 20,998 | | | 19,838 | |

| Transformation costs | 2,399 | | | 1,016 | | | 6,645 | | | 4,796 | |

| Depreciation and amortization | 23,632 | | | 18,252 | | | 69,871 | | | 52,542 | |

| | | | | | | |

| | | | | | | |

| 53,911 | | | 44,121 | | | 158,273 | | | 126,804 | |

| | | | | | | |

| Real estate operating gain (loss) | 692 | | | (1,622) | | | (4,486) | | | (2,401) | |

| Other income (expense) | | | | | | | |

| Interest expense | (6,582) | | | (8,106) | | | (18,388) | | | (28,387) | |

| Loss on interest rate derivatives | — | | | (106) | | | — | | | (5,866) | |

| Loss on extinguishment of debt | (4,917) | | | (12,727) | | | (4,917) | | | (12,727) | |

| Other income | 68 | | | 231 | | | 454 | | | 3,037 | |

| | | | | | | |

| (11,431) | | | (20,708) | | | (22,851) | | | (43,943) | |

| Loss from continuing operations | (10,739) | | | (22,330) | | | (27,337) | | | (46,344) | |

| Discontinued operations: | | | | | | | |

| Income from operations of properties sold or held for sale | — | | | 7,208 | | | — | | | 23,083 | |

| Gain on sale of real estate, net | — | | | 46,441 | | | — | | | 46,441 | |

| | | | | | | |

| | | | | | | |

| Income from discontinued operations | — | | | 53,649 | | | — | | | 69,524 | |

| Net (loss) income | $ | (10,739) | | | $ | 31,319 | | | $ | (27,337) | | | $ | 23,180 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic net (loss) income per common share: | | | | | | | |

| Continuing operations | $ | (0.12) | | | $ | (0.26) | | | $ | (0.32) | | | $ | (0.55) | |

| Discontinued operations | — | | | 0.63 | | | — | | | 0.82 | |

| Basic net (loss) income per common share | $ | (0.12) | | | $ | 0.37 | | | $ | (0.32) | | | $ | 0.27 | |

| | | | | | | |

| Diluted net (loss) income per common share: | | | | | | | |

| Continuing operations | $ | (0.12) | | | $ | (0.26) | | | $ | (0.32) | | | $ | (0.55) | |

| Discontinued operations | — | | | 0.63 | | | — | | | 0.82 | |

| Diluted net (loss) income per common share | $ | (0.12) | | | $ | 0.37 | | | $ | (0.32) | | | $ | 0.27 | |

| | | | | | | |

| Weighted average shares outstanding – basic | 87,453 | | | 84,496 | | | 87,354 | | | 84,457 | |

| Weighted average shares outstanding – diluted | 87,453 | | | 84,496 | | | 87,354 | | | 84,457 | |

See accompanying notes to the consolidated financial statements.

ELME COMMUNITIES AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(IN THOUSANDS)

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2022 | | 2021 | | 2022 | | 2021 |

| Net (loss) income | $ | (10,739) | | | $ | 31,319 | | | $ | (27,337) | | | $ | 23,180 | |

| Other comprehensive income: | | | | | | | |

| Unrealized gain on interest rate hedges | 442 | | | 221 | | | 3,284 | | | 2,805 | |

| Reclassification of unrealized loss on interest rate derivatives to earnings | 509 | | | 511 | | | 1,529 | | | 7,290 | |

| Comprehensive (loss) income | $ | (9,788) | | | $ | 32,051 | | | $ | (22,524) | | | $ | 33,275 | |

| | | | | | | |

| | | | | | | |

See accompanying notes to the consolidated financial statements.

ELME COMMUNITIES AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF EQUITY

(IN THOUSANDS)

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares Issued and Out-standing | | Shares of Beneficial Interest at Par Value | | Additional Paid in Capital | | Distributions in Excess of

Net Income | | Accumulated Other Comprehensive Loss | | Total Shareholders’ Equity | | Noncontrolling Interests in Subsidiaries | | Total Equity |

| Balance, December 31, 2021 | 86,261 | | | $ | 863 | | | $ | 1,697,477 | | | $ | (362,494) | | | $ | (19,091) | | | $ | 1,316,755 | | | $ | 307 | | | $ | 1,317,062 | |

| | | | | | | | | | | | | | | |

| Net loss | — | | | — | | | — | | | (27,337) | | | — | | | (27,337) | | | — | | | (27,337) | |

| Unrealized gain on interest rate hedges | — | | | — | | | — | | | — | | | 3,284 | | | 3,284 | | | — | | | 3,284 | |

| | | | | | | | | | | | | | | |

| Amortization of swap settlements | — | | | — | | | — | | | — | | | 1,529 | | | 1,529 | | | — | | | 1,529 | |

| Distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | (6) | | | (6) | |

| | | | | | | | | | | | | | | |

Dividends ($0.51 per common share) | — | | | — | | | — | | | (44,708) | | | — | | | (44,708) | | | — | | | (44,708) | |

| Equity issuances, net of issuance costs | 1,032 | | | 10 | | | 26,841 | | | — | | | — | | | 26,851 | | | — | | | 26,851 | |

| Shares issued under Dividend Reinvestment Program | 32 | | | — | | | 777 | | | — | | | — | | | 777 | | | — | | | 777 | |

| Share grants, net of forfeitures and tax withholdings | 179 | | | 2 | | | 3,745 | | | — | | | — | | | 3,747 | | | — | | | 3,747 | |

| Balance, September 30, 2022 | 87,504 | | | $ | 875 | | | $ | 1,728,840 | | | $ | (434,539) | | | $ | (14,278) | | | $ | 1,280,898 | | | $ | 301 | | | $ | 1,281,199 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares Issued and Out-standing | | Shares of Beneficial Interest at Par Value | | Additional Paid in Capital | | Distributions in Excess of

Net Income | | Accumulated Other Comprehensive Loss | | Total Shareholders’ Equity | | Noncontrolling Interests in Subsidiaries | | Total Equity |

| Balance, December 31, 2020 | 84,409 | | | $ | 844 | | | $ | 1,649,366 | | | $ | (298,860) | | | $ | (30,563) | | | $ | 1,320,787 | | | $ | 322 | | | $ | 1,321,109 | |

| | | | | | | | | | | | | | | |

| Net income | — | | | — | | | — | | | 23,180 | | | — | | | 23,180 | | | — | | | 23,180 | |

| Unrealized gain on interest rate hedges | — | | | — | | | — | | | — | | | 2,805 | | | 2,805 | | | — | | | 2,805 | |

| Loss on interest rate derivatives | — | | | — | | | — | | | — | | | 5,760 | | | 5,760 | | | — | | | 5,760 | |

| Amortization of swap settlements | — | | | — | | | — | | | — | | | 1,530 | | | 1,530 | | | — | | | 1,530 | |

| Distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | (13) | | | (13) | |

Dividends ($0.77 per common share) | — | | | — | | | — | | | (65,372) | | | — | | | (65,372) | | | — | | | (65,372) | |

| Equity issuances, net of issuance costs | 24 | | | — | | | 467 | | | — | | | — | | | 467 | | | — | | | 467 | |

| Shares issued under Dividend Reinvestment Program | 65 | | | — | | | 1,468 | | | — | | | — | | | 1,468 | | | — | | | 1,468 | |

| Share grants, net of forfeitures and tax withholdings | 130 | | | 2 | | | 5,520 | | | — | | | — | | | 5,522 | | | — | | | 5,522 | |

| Balance, September 30, 2021 | 84,628 | | | $ | 846 | | | $ | 1,656,821 | | | $ | (341,052) | | | $ | (20,468) | | | $ | 1,296,147 | | | $ | 309 | | | $ | 1,296,456 | |

See accompanying notes to the consolidated financial statements.

ELME COMMUNITIES AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF EQUITY

(IN THOUSANDS)

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares Issued and Out-standing | | Shares of Beneficial Interest at Par Value | | Additional Paid in Capital | | Distributions in Excess of

Net Income | | Accumulated Other Comprehensive Loss | | Total Shareholders’ Equity | | Noncontrolling Interests in Subsidiaries | | Total Equity |

| Balance, June 30, 2022 | 87,392 | | | $ | 874 | | | $ | 1,727,031 | | | $ | (408,882) | | | $ | (15,229) | | | $ | 1,303,794 | | | $ | 302 | | | $ | 1,304,096 | |

| | | | | | | | | | | | | | | |

| Net loss | — | | | — | | | — | | | (10,739) | | | — | | | (10,739) | | | — | | | (10,739) | |

| Unrealized gain on interest rate hedges | — | | | — | | | — | | | — | | | 442 | | | 442 | | | — | | | 442 | |

| | | | | | | | | | | | | | | |

| Amortization of swap settlements | — | | | — | | | — | | | — | | | 509 | | | 509 | | | — | | | 509 | |

| Distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | (1) | | | (1) | |

| | | | | | | | | | | | | | | |

Dividends ($0.17 per common share) | — | | | — | | | — | | | (14,918) | | | — | | | (14,918) | | | — | | | (14,918) | |

| | | | | | | | | | | | | | | |

| Shares issued under Dividend Reinvestment Program | 12 | | | — | | | 259 | | | — | | | — | | | 259 | | | — | | | 259 | |

| Share grants, net of share grant amortization and forfeitures | 100 | | | 1 | | | 1,550 | | | — | | | — | | | 1,551 | | | — | | | 1,551 | |

| Balance, September 30, 2022 | 87,504 | | | $ | 875 | | | $ | 1,728,840 | | | $ | (434,539) | | | $ | (14,278) | | | $ | 1,280,898 | | | $ | 301 | | | $ | 1,281,199 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares Issued and Out-standing | | Shares of Beneficial Interest at Par Value | | Additional Paid in Capital | | Distributions in Excess of

Net Income | | Accumulated Other Comprehensive Loss | | Total Shareholders’ Equity | | Noncontrolling Interests in Subsidiaries | | Total Equity |

| Balance, June 30, 2021 | 84,590 | | | $ | 846 | | | $ | 1,654,409 | | | $ | (357,934) | | | $ | (21,200) | | | $ | 1,276,121 | | | $ | 314 | | | $ | 1,276,435 | |

| Net income | — | | | — | | | — | | | 31,319 | | | — | | | 31,319 | | | — | | | 31,319 | |

| Unrealized gain on interest rate hedges | — | | | — | | | — | | | — | | | 221 | | | 221 | | | — | | | 221 | |

| | | | | | | | | | | | | | | |

| Amortization of swap settlements | — | | | — | | | — | | | — | | | 511 | | | 511 | | | — | | | 511 | |

| Distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | (5) | | | (5) | |

Dividends ($0.17 per common share) | — | | | — | | | — | | | (14,437) | | | — | | | (14,437) | | | — | | | (14,437) | |

| | | | | | | | | | | | | | | |

| Shares issued under Dividend Reinvestment Program | 20 | | | — | | | 459 | | | — | | | — | | | 459 | | | — | | | 459 | |

| Share grants, net of forfeitures and tax withholdings | 18 | | | — | | | 1,953 | | | — | | | — | | | 1,953 | | | — | | | 1,953 | |

| Balance, September 30, 2021 | 84,628 | | | $ | 846 | | | $ | 1,656,821 | | | $ | (341,052) | | | $ | (20,468) | | | $ | 1,296,147 | | | $ | 309 | | | $ | 1,296,456 | |

See accompanying notes to the consolidated financial statements.

| | | | | | | | | | | |

| ELME COMMUNITIES AND SUBSIDIARIES |

| | | |

| CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (IN THOUSANDS) |

| (UNAUDITED) |

| | | |

| Nine Months Ended September 30, |

| 2022 | | 2021 |

| Cash flows from operating activities | | | |

| Net loss | $ | (27,337) | | | $ | 23,180 | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Depreciation and amortization | 69,871 | | | 75,446 | |

| Credit losses on lease related receivables | 1,816 | | | 1,631 | |

| | | |

| | | |

| (Gain) loss on sale of real estate, net | — | | | (46,441) | |

| Share-based compensation expense | 6,157 | | | 6,478 | |

| | | |

| Net amortization of debt premiums, discounts and related financing costs | 3,084 | | | 3,322 | |

| Loss on interest rate derivatives | — | | | 5,866 | |

| Loss (gain) on extinguishment of debt | 4,917 | | | 12,727 | |

| Changes in operating other assets | (952) | | | (4,720) | |

| Changes in operating other liabilities | (6,100) | | | (11,106) | |

| Net cash provided by operating activities | 51,456 | | | 66,383 | |

| Cash flows from investing activities | | | |

| Real estate acquisitions, net | (204,433) | | | (47,757) | |

| Net cash received for sale of real estate | — | | | 897,783 | |

| | | |

| Capital improvements to real estate | (19,046) | | | (18,649) | |

| Development in progress | (671) | | | (8,099) | |

| | | |

| Insurance proceeds | 2,224 | | | — | |

| Non-real estate capital improvements | (1,322) | | | (37) | |

| Net cash (used in) provided by investing activities | (223,248) | | | 823,241 | |

| Cash flows from financing activities | | | |

| Line of credit repayments, net | 43,000 | | | (42,000) | |

| Dividends paid | (44,440) | | | (76,292) | |

| Repayments of mortgage notes payable | (76,598) | | | — | |

| | | |

| Repayments of unsecured notes payable, including penalties for early extinguishment | — | | | (311,894) | |

| Repayments of unsecured term loan debt | — | | | (150,000) | |

| | | |

| Settlement of interest rate derivatives | — | | | (5,866) | |

| Payment of financing costs | (39) | | | (4,828) | |

| Distributions to noncontrolling interests | (6) | | | (13) | |

| Proceeds from dividend reinvestment program | 777 | | | 1,468 | |

| Net proceeds from equity issuances | 26,851 | | | 467 | |

| Payment of tax withholdings for restricted share awards | (2,100) | | | (554) | |

| | | |

| Net cash used in financing activities | (52,555) | | | (589,512) | |

| Net decrease in cash, cash equivalents and restricted cash | (224,347) | | | 300,112 | |

| Cash, cash equivalents and restricted cash at beginning of period | 234,220 | | | 8,290 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 9,873 | | | $ | 308,402 | |

| | | | | | | | | | | |

| ELME COMMUNITIES AND SUBSIDIARIES |

| | | |

| CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (IN THOUSANDS) |

| (UNAUDITED) |

| | | |

| Nine Months Ended September 30, |

| 2022 | | 2021 |

| | | |

| Supplemental disclosure of cash flow information: | | | |

| Cash paid for interest, net of amounts capitalized | $ | 18,386 | | | $ | 26,409 | |

| Change in accrued capital improvements and development costs | 2,510 | | | (4,885) | |

| Dividend payable | 14,919 | | | 14,440 | |

| | | |

| | | |

| Reconciliation of cash, cash equivalents and restricted cash: | | | |

| Cash and cash equivalents | $ | 8,436 | | | $ | 307,797 | |

| Restricted cash | 1,437 | | | 605 | |

| Cash, cash equivalents and restricted cash | $ | 9,873 | | | $ | 308,402 | |

See accompanying notes to the consolidated financial statements.

ELME COMMUNITIES AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2022

(UNAUDITED)

NOTE 1: NATURE OF BUSINESS

Elme Communities, a Maryland real estate investment trust, is a self-administered equity real estate investment trust, successor to a trust organized in 1960. In October 2022, the Company changed its name from Washington Real Estate Investment Trust to Elme Communities to reflect the Company’s continued transition into a focused multifamily company, and subsequent geographic expansion into Sunbelt markets. On October 20, 2022, the Company’s ticker symbol on the New York Stock Exchange changed from “WRE” to “ELME.” Our business primarily consists of the ownership of apartment communities in the greater Washington, DC metro and Sunbelt regions. Within these notes to the financial statements, we refer to the three months ended September 30, 2022 and September 30, 2021 as the “2022 Quarter” and the “2021 Quarter,” respectively, and the nine months ended September 30, 2022 and September 30, 2021 as the “2022 Period” and the “2021 Period,” respectively.

Federal Income Taxes

We believe that we qualify as a real estate investment trust (“REIT”) under Sections 856-860 of the Internal Revenue Code of 1986, as amended (the “Code”), and intend to continue to qualify as such. To maintain our status as a REIT, we are, among other things, required to distribute 90% of our REIT taxable income (determined before the deduction for dividends paid and excluding net capital gains to our shareholders) on an annual basis. When selling a property, we generally have the option of (a) reinvesting the sales proceeds of property sold in a way that allows us to defer recognition of some or all taxable gain realized on the sale, (b) distributing gains to the shareholders with no tax to us or (c) treating net long-term capital gains as having been distributed to our shareholders, paying the tax on the gain deemed distributed and allocating the tax paid as a credit to our shareholders.

Generally, and subject to our ongoing qualification as a REIT, no provisions for income taxes are necessary except for taxes on undistributed taxable income and taxes on the income generated by our taxable REIT subsidiary (“TRS”). Our TRS is subject to corporate federal and state income tax on its taxable income at regular statutory rates. As of both September 30, 2022 and December 31, 2021, our TRS had a deferred tax asset of $1.4 million that was fully reserved.

NOTE 2: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND BASIS OF PRESENTATIONS

Significant Accounting Policies

We have prepared our consolidated financial statements using the accounting policies described in our Annual Report on Form 10-K for the year ended December 31, 2021.

Principles of Consolidation and Basis of Presentation

The accompanying unaudited consolidated financial statements include the consolidated accounts of Elme Communities, our majority-owned subsidiaries and entities in which Elme Communities has a controlling interest. All intercompany balances and transactions have been eliminated in consolidation.

We have prepared the accompanying unaudited financial statements pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”). Certain information and note disclosures normally included in annual financial statements prepared in accordance with Generally Accepted Accounting Principles (“GAAP”) have been condensed or omitted pursuant to those rules and regulations, although we believe that the disclosures made are adequate to make the information presented not misleading. In addition, in the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation of the results for the periods presented have been included. These unaudited financial statements should be read in conjunction with the financial statements and notes included in our Annual Report on Form 10-K for the year ended December 31, 2021.

Held for Sale and Discontinued Operations

We classify properties as held for sale when they meet the necessary criteria, which include: (a) senior management commits to a plan to sell the assets; (b) the assets are available for immediate sale in their present condition subject only to terms that are usual and customary for sales of such assets; (c) an active program to locate a buyer and other actions required to complete the plan to sell the assets has been initiated; (d) the sale of the assets is probable and transfer of the assets is expected to qualify for recognition as a completed sale within one year; (e) the assets are being actively marketed for sale at a price that is reasonable in relation to its current fair value; and (f) actions required to complete the plan indicate that it is unlikely that significant changes to the plan will be made or that the plan will be withdrawn. Depreciation on these properties is discontinued at the time they are classified as held for sale, but operating revenues, operating expenses and interest expense continue to be recognized until the date of sale.

Revenues and expenses of properties that are either sold or classified as held for sale are presented as discontinued operations for all periods presented in the consolidated statements of operations if the dispositions represent a strategic shift that has (or will have) a major effect on our operations and financial results. If the dispositions do not represent a strategic shift that has (or will have) a major effect on our operations and financial results, then the revenues and expenses of the properties that are classified as sold or held for sale are presented as continuing operations in the consolidated statements of operations for all periods presented.

Lessee Accounting

For leases where we are the lessee, primarily our corporate office operating lease, we recognize a right-of-use asset and a lease liability in accordance with Accounting Standards Codification (“ASC”) Topic 842. The right-of-use asset and associated liability is equal to the present value of the minimum lease payments, applying our incremental borrowing rate. Our borrowing rate is computed based on observable borrowing rates taking into consideration our credit quality and adjusting to a secured borrowing rate for similar assets and term. As of September 30, 2022, our balance sheet included $1.1 million in a right-of-use asset and liability, net of amortization. During the 2022 Quarter, we remeasured the the right-of-use asset and liability due to a decrease in the estimated term of our corporate office operating lease, resulting in a $2.0 million decrease in both the asset and the liability.

Lease expense for the operating lease is recognized on a straight-line basis over the expected lease term and is included in General and administrative expense on the consolidated statements of operations.

Restricted Cash

Restricted cash includes funds held in escrow for tenant security deposits and mortgage escrows.

Transformation Costs

Transformation costs include costs related to the strategic shift away from the commercial sector to the residential sector, including the allocation of internal costs, consulting, advisory and termination benefits.

Use of Estimates in the Financial Statements

The preparation of financial statements in conformity with GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

NOTE 3: REAL ESTATE

Acquisitions

We acquired the following properties during the 2022 Period: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Acquisition Date | | Property | | Type | | # of homes | | Ending Occupancy (1) | | Contract

Purchase Price

(in thousands) |

| February 1, 2022 | | Carlyle of Sandy Springs | | Residential | | 389 | | 93.1% | | $ | 105,586 | |

| May 5, 2022 | | Marietta Crossing | | Residential | | 420 | | 94.5% | | 107,900 | |

| May 5, 2022 | | Alder Park | | Residential | | 270 | | 95.2% | | 69,750 | |

| | | | | | 1,079 | | | | $ | 283,236 | |

______________________________

(1) As of September 30, 2022.

The results of operations from the acquired operating properties are included in the condensed consolidated statements of operations as of their acquisition date and were as follows (in thousands): | | | | | | | | | | | |

| Three Months Ended September 30, 2022 | | Nine Months Ended September 30, 2022 |

| Real estate rental revenue | $ | 4,897 | | | $ | 9,623 | |

| Net loss | (7,427) | | | (11,034) | |

We accounted for the 2022 acquisitions as asset acquisitions. We measured the value of the acquired physical assets (land and building), in-place leases (absorption costs) and mortgage notes by allocating the total cost of the acquisition on a relative fair value basis.

The total cost of the 2022 acquisitions was as follows (in thousands): | | | | | |

| Contract purchase price | $ | 283,236 | |

| |

| Capitalized acquisition costs | 478 | |

| Total | $ | 283,714 | |

We have recorded the 2022 acquisitions as follows (in thousands): | | | | | | | |

| Land | | | $ | 50,547 | |

| Building | | | 220,825 | |

| Absorption costs | | | 7,300 | |

| Aggregate discount on assumed mortgages | | | 5,042 | |

| Total acquisition cost | | | 283,714 | |

| Outstanding balance on assumed mortgages | | | (76,554) | |

| Total carrying amounts recorded | | | $ | 207,160 | |

The weighted remaining average life for the absorption costs is two months.

The difference in the total acquisition cost of $283.7 million for the 2022 acquisitions and the cash paid for the acquisitions per the consolidated statements of cash flows of $204.4 million is due to the assumption of two mortgage notes secured by Marietta Crossing and Alder Park for an aggregate outstanding balance of $76.6 million and credits received at settlement totaling $2.8 million. In September 2022, we extinguished the liabilities associated with the two mortgage notes though defeasance arrangements.

Development/Redevelopment

We have properties under development/redevelopment and held for current or future development. As of September 30, 2022, we have invested $30.4 million, including the cost of acquired land, in a residential development adjacent to Riverside Apartments. During the second quarter of 2022, we paused development activities at the aforementioned property and ceased associated capitalization of interest on spending and real estate taxes. However, we continue to capitalize qualifying costs on

several other projects with minor development activity necessary to ready each project for its intended use.

Properties Sold and Held for Sale

We intend to hold our properties for investment with a view to long-term appreciation, to engage in the business of acquiring, developing and owning our properties and to make occasional sales of properties that no longer meet our long-term strategy or return objectives and where market conditions for sale are favorable. The proceeds from the sales may be reinvested into other properties, used to fund development operations or to support other corporate needs or distributed to our shareholders. Depreciation on these properties is discontinued at the time they are classified as held for sale, but operating revenues, operating expenses and interest expense continue to be recognized until the date of sale.

We did not sell or classify any properties as held for sale during the 2022 Period. We sold the following properties during 2021 ($ in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Disposition Date | | Property Name | | Property Type | | Rentable Square Feet | | Contract Sales Price | | (Loss) Gain on Sale |

| July 26, 2021 | | Office Portfolio (1) | | Office | | 2,370,000 | | | $ | 766,000 | | | $ | (11,220) | |

| September 22, 2021 | | Retail Portfolio (2) | | Retail | | 693,000 | | | 168,314 | | | 57,661 | |

| | | | Total 2021 | | 3,063,000 | | $ | 934,314 | | | $ | 46,441 | |

______________________________

(1) Consists of twelve office properties: 1901 Pennsylvania Avenue, 515 King Street, 1220 19th Street, 1600 Wilson Boulevard, Silverline Center, Courthouse Square, 2000 M Street, 1140 Connecticut Avenue, Army Navy Club, 1775 Eye Street, Fairgate at Ballston and Arlington Tower.

(2) Consists of eight retail properties: Takoma Park, Westminster, Concord Centre, Chevy Chase Metro Plaza, 800 S. Washington Street, Randolph Shopping Center, Montrose Shopping Center and Spring Valley Village.

We have fully transferred control of the assets sold in 2021 and do not have continuing involvement in their operations.

The dispositions of the Office Portfolio and the Retail Portfolio represent a strategic shift that had a major effect on our financial results and we have accordingly reported the Office Portfolio and Retail Portfolio as discontinued operations.

As of September 30, 2022, we assessed our properties, including assets held for development, for impairment and did not recognize any impairment charges during the 2022 Period. We applied reasonable estimates and judgments in evaluating each of the properties as of September 30, 2022. Should external or internal circumstances change requiring the need to shorten holding periods or adjust future estimated cash flows from our properties, we could be required to record impairment charges in the future.

Discontinued Operations

The results of the Office Portfolio and Retail Portfolio are classified as discontinued operations and are summarized as follows (amounts in thousands, except for share data):

| | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, 2021 | | | | Nine Months Ended September 30, 2021 |

| Real estate rental revenue | | | $ | 10,932 | | | | | $ | 70,519 | |

| Expenses | | | | | | | |

| Property operating and maintenance | | | (1,870) | | | | | (11,201) | |

| Real estate taxes and insurance | | | (1,476) | | | | | (11,136) | |

| Property management | | | (378) | | | | | (2,195) | |

| Depreciation and amortization | | | — | | | | | (22,904) | |

| | | | | | | |

| | | | | | | |

| Gain on sale of real estate, net | | | 46,441 | | | | | 46,441 | |

| Income from discontinued operations | | | $ | 53,649 | | | | | $ | 69,524 | |

| | | | | | | |

| Basic net income per share | | | $ | 0.63 | | | | | $ | 0.82 | |

| Diluted net income per share | | | $ | 0.63 | | | | | $ | 0.82 | |

| | | | | | | |

| Capital expenditures | | | $ | 833 | | | | | $ | 3,316 | |

All assets and liabilities related to the Office Portfolio and Retail Portfolio were sold as of December 31, 2021.

NOTE 4: UNSECURED LINE OF CREDIT PAYABLE

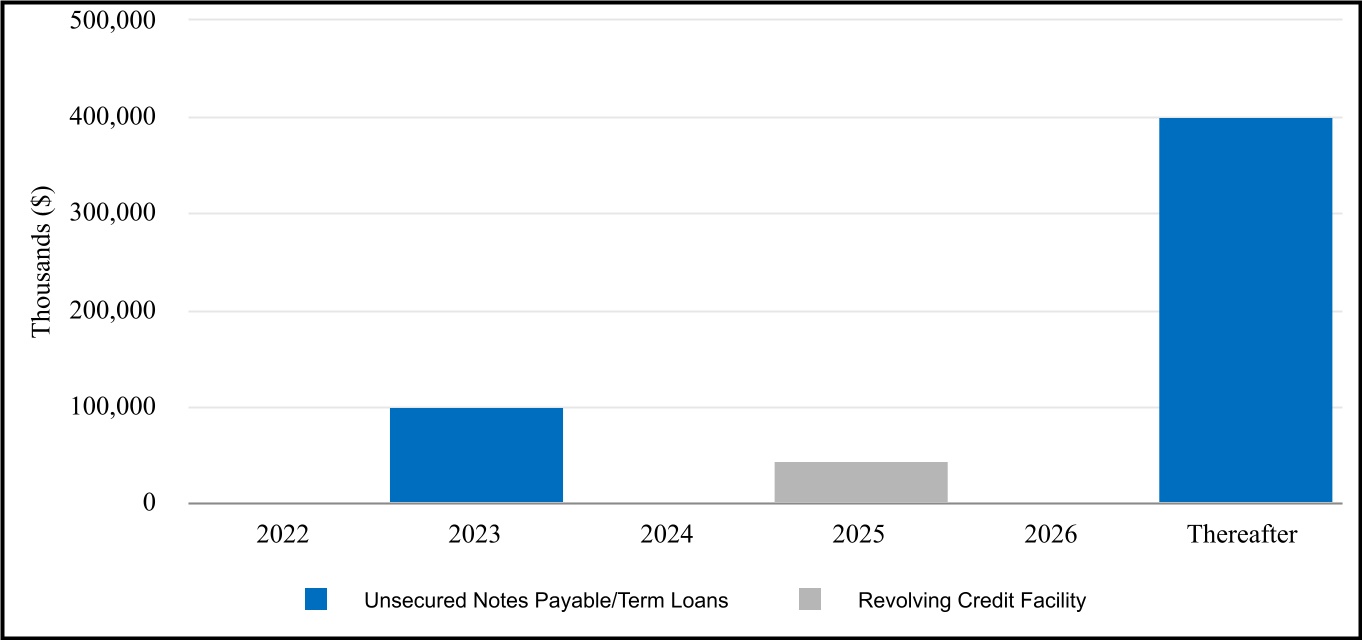

During the third quarter of 2021, we entered into an amended and restated credit agreement (“Credit Agreement”) which provides for a $700.0 million unsecured revolving credit facility (“Revolving Credit Facility”) and the continuation of an existing $250.0 million unsecured term loan (“2018 Term Loan”). The Revolving Credit Facility has a four-year term ending in August 2025, with two six-month extension options. The Credit Agreement has an accordion feature that allows us to increase the aggregate facility to $1.5 billion, subject to the lenders’ agreement to provide additional revolving loan commitments or term loans.

The Revolving Credit Facility bears interest at a rate of either one month LIBOR plus a margin ranging from 0.70% to 1.40% or the base rate plus a margin ranging from 0.0% to 0.40% (in each case depending upon Elme Communities’ credit rating). The base rate is the highest of the administrative agent’s prime rate, the federal funds rate plus 0.50% and the LIBOR market index rate plus 1.0%. In addition, the Revolving Credit Facility requires the payment of a facility fee ranging from 0.10% to 0.30% (depending on Elme Communities’ credit rating) on the $700.0 million committed revolving loan capacity, without regard to usage. As of September 30, 2022, the interest rate on the Revolving Credit Facility is one month LIBOR plus 0.85%, the one month LIBOR is 3.14% and the facility fee is 0.20%.

All outstanding advances for the Revolving Credit Facility are due and payable upon maturity in August 2025, unless extended pursuant to one or both of the two six-month extension options. Interest only payments are due and payable generally on a monthly basis.

The 2018 Term Loan increased and replaced the $150.0 million unsecured term loan, initially entered into on July 22, 2016 (“2016 Term Loan”), that was scheduled to mature in July 2023. The 2018 Term Loan is scheduled to mature in July 2023 and bears interest at a rate of either one month LIBOR plus a margin ranging from 0.85% to 1.75% or the base rate plus a margin ranging from 0.0% to 0.75% (in each case depending upon Elme Communities’ credit rating). We used the $100.0 million of additional proceeds from the 2018 Term Loan primarily to repay outstanding borrowings on the Revolving Credit Facility.

On September 27, 2021, we prepaid a $150.0 million portion of the 2018 Term Loan using proceeds from the sale of the Office Portfolio and Retail Portfolio (see note 3). We currently expect to hold the remaining $100.0 million portion of the 2018 Term Loan until maturity.

The amount of the Revolving Credit Facility’s unsecured line of credit unused and available at September 30, 2022 was as follows (in thousands):

| | | | | |

| Committed capacity | $ | 700,000 | |

| Borrowings outstanding | (43,000) | |

| |

| Unused and available | $ | 657,000 | |

In the first and second quarters of 2022, there were no borrowings or repayments on the Revolving Credit Facility. We executed borrowings and repayments on the Revolving Credit Facility during the 2022 Quarter as follows (in thousands):

| | | | | | | | | | | | | | |

| Balance at June 30, 2022 | $ | — | |

| Borrowings | 65,000 | |

| Repayments | (22,000) | |

| Balance at September 30, 2022 | $ | 43,000 | |

NOTE 5: MORTGAGE NOTES PAYABLE

In May 2022, we assumed a $42.8 million mortgage note in connection with the acquisition of Marietta Crossing. This mortgage note bears interest at 3.36% per annum. The effective interest rate on this mortgage note is 4.50% based on quotes obtained for similar loans. We recorded the mortgage note at its estimated fair value of $40.0 million. Principal and interest are payable monthly until May 1, 2030, at which time all unpaid principal and interest are payable in full.

In May 2022, we assumed a $33.7 million mortgage note in connection with the acquisition of Alder Park. This mortgage note bears interest at 2.93% per annum. The effective interest rate on this mortgage note is 4.00% based on quotes obtained for similar loans. We recorded the mortgage note at its estimated fair value of $31.5 million. Principal and interest are payable monthly until May 1, 2030, at which time all unpaid principal and interest are payable in full.

In September 2022, we extinguished the liabilities associated with both of the mortgage notes through defeasance arrangements, recognizing aggregate losses on extinguishment of debt of $4.9 million.

NOTE 6: DERIVATIVE INSTRUMENTS

We have one interest rate swap arrangement with a notional amount of $100.0 million that effectively fixes the remaining $100.0 million portion of the 2018 Term Loan. The interest rate swap arrangement is recorded at fair value in accordance with GAAP, based on discounted cash flow methodologies and observable inputs. We record the effective portion of changes in fair value of the cash flow hedge in Other comprehensive income (loss). We assess the effectiveness of a cash flow hedge both at inception and on an ongoing basis. If a cash flow hedge is no longer expected to be effective, hedge accounting is discontinued. Hedge ineffectiveness of our cash flow hedges is recorded in earnings.

The fair values of the interest rate swap as of September 30, 2022 and December 31, 2021, were as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | |

| | | | Fair Value |

| | | | Derivative Assets (Liabilities) |

| Derivative Instrument | Aggregate Notional Amount | Effective Date | Maturity Date | September 30, 2022 | | December 31, 2021 |

| Interest rate swap | $ | 100,000 | | March 31, 2017 | July 21, 2023 | $ | 2,463 | | | $ | (821) | |

| | | | | | |

| | | | | | |

| | | | | | |

We record interest rate swaps on our consolidated balance sheets within Prepaid expenses and other assets when in a net asset position and within Accounts payable and other liabilities when in a net liability position. The net unrealized gains or losses on the effective swaps were recognized in Other comprehensive income (loss), as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2022 | | 2021 | | 2022 | | 2021 |

| Unrealized gain on interest rate hedges | $ | 442 | | | $ | 221 | | | $ | 3,284 | | | $ | 2,805 | |

Amounts reported in Accumulated other comprehensive loss related to effective cash flow hedges will be reclassified to interest expense as interest payments are made on our variable-rate debt. The gains or losses reclassified from Accumulated other comprehensive loss into interest expense for the three and nine months ended September 30, 2022 and 2021, were as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2022 | | 2021 | | 2022 | | 2021 |

| Loss reclassified from accumulated other comprehensive loss into interest expense | $ | 509 | | | $ | 511 | | | $ | 1,529 | | | $ | 1,530 | |

During the next twelve months, we estimate that an additional $2.5 million will be reclassified as a decrease to interest expense.

We have agreements with each of our derivative counterparties that contain a provision whereby we could be declared in default on our derivative obligations if repayment of the underlying indebtedness is accelerated by the lender due to our default on the indebtedness. As of September 30, 2022, the fair value of derivative assets, including accrued interest, was $2.5 million and we did not have any derivatives in a liability position. As of September 30, 2022, we have not posted any collateral related to these agreements.

Derivative instruments expose us to credit risk in the event of non-performance by the counterparty under the terms of the interest rate hedge agreements. We believe that we minimize our credit risk on these transactions by dealing with major, creditworthy financial institutions. We monitor the credit ratings of counterparties and our exposure to any single entity, thus minimizing our credit risk concentration.

NOTE 7: FAIR VALUE DISCLOSURES

Assets and Liabilities Measured at Fair Value

For assets and liabilities measured at fair value on a recurring basis, quantitative disclosures about the fair value measurements are required to be disclosed separately for each major category of assets and liabilities, as follows:

Level 1: Quoted prices in active markets for identical assets

Level 2: Significant other observable inputs

Level 3: Significant unobservable inputs

The only assets or liabilities we had at September 30, 2022 and December 31, 2021 that are recorded at fair value on a recurring basis are the assets held in the Supplemental Executive Retirement Plan (“SERP”), which primarily consist of investments in mutual funds, and the interest rate derivatives (see note 6).

We base the valuations related to the SERP on assumptions derived from significant other observable inputs and accordingly these valuations fall into Level 2 in the fair value hierarchy.

The valuation of the interest rate derivatives is determined using widely accepted valuation techniques, including discounted cash flow analysis on the expected cash flows of each interest rate derivative. This analysis reflects the contractual terms of the interest rate derivatives, including the period to maturity, and uses observable market-based inputs, including interest rate curves and implied volatilities. The fair values of interest rate derivatives are determined using the market standard methodology of netting the discounted future fixed cash payments (or receipts) and the discounted expected variable cash receipts (or payments). The variable cash payments (or receipts) are based on an expectation of future interest rates (forward curves) derived from observable market interest rate curves. To comply with the provisions of ASC 820, Fair Value Measurement, we incorporate credit valuation adjustments in the fair value measurements to appropriately reflect both our own nonperformance risk and the respective counterparty’s nonperformance risk. These credit valuation adjustments were concluded to not be significant inputs for the fair value calculations for the periods presented. In adjusting the fair value of our derivative contracts for the effect of nonperformance risk, we have considered the impact of netting and any applicable credit enhancements, such as the posting of collateral, thresholds, mutual puts and guarantees. The valuation of interest rate derivatives fall into Level 2 in the fair value hierarchy.

The fair values of these assets and liabilities at September 30, 2022 and December 31, 2021 were as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | September 30, 2022 | | December 31, 2021 |

| | Fair

Value | | Level 1 | | Level 2 | | Level 3 | | Fair

Value | | Level 1 | | Level 2 | | Level 3 |

| Assets: | | | | | | | | | | | | | | | |

| SERP | $ | 1,969 | | | $ | — | | | $ | 1,969 | | | $ | — | | | $ | 2,566 | | | $ | — | | | $ | 2,566 | | | $ | — | |

| Interest rate derivatives | 2,463 | | | — | | | 2,463 | | | — | | | — | | | — | | | — | | | — | |

| Liabilities: | | | | | | | | | | | | | | | |

| Interest rate derivatives | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | (821) | | | $ | — | | | $ | (821) | | | $ | — | |

Financial Assets and Liabilities Not Measured at Fair Value

The following disclosures of estimated fair value were determined by management using available market information and established valuation methodologies, including discounted cash flow models. Many of these estimates involve significant judgment. The estimated fair value disclosed may not necessarily be indicative of the amounts we could realize on disposition of the financial instruments. The use of different market assumptions or estimation methodologies could have an effect on the estimated fair value amounts. In addition, fair value estimates are made at a point in time and thus, estimates of fair value subsequent to September 30, 2022 may differ significantly from the amounts presented. The valuations of cash and cash equivalents and restricted cash fall into Level 1 in the fair value hierarchy and the valuations of debt instruments fall into Level 3 in the fair value hierarchy.

As of September 30, 2022 and December 31, 2021, the carrying values and estimated fair values of our financial instruments were as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| | September 30, 2022 | | December 31, 2021 |

| Carrying Value | | Fair Value | | Carrying Value | | Fair Value |

| Cash and cash equivalents | $ | 8,436 | | | $ | 8,436 | | | $ | 233,600 | | | $ | 233,600 | |

| Restricted cash | 1,437 | | | 1,437 | | | 620 | | | 620 | |

| | | | | | | |

| Line of credit | 43,000 | | | 43,000 | | | — | | | — | |

| Notes payable, net | 497,247 | | | 459,725 | | | 496,946 | | | 515,341 | |

NOTE 8: STOCK BASED COMPENSATION

Elme Communities maintains short-term (“STIP”) and long-term (“LTIP”) incentive plans that allow for stock-based awards to officers and non-officer employees. Stock based awards are provided to officers and non-officer employees, as well as trustees, under the Washington Real Estate Investment Trust 2016 Omnibus Incentive Plan which allows for awards in the form of restricted shares, restricted share units, options and other awards up to an aggregate of 2,400,000 shares over the ten-year period in which the plan will be in effect. Restricted share units are converted into shares of our stock upon full vesting through the issuance of new shares.

Total Compensation Expense

Total compensation expense recognized in the consolidated financial statements for all outstanding share-based awards was $1.9 million and $2.7 million for the 2022 Quarter and 2021 Quarter, respectively and $6.2 million and $6.5 million for the 2022 and 2021 Period, respectively.

Restricted Share Awards

The total fair values of restricted share awards vested was $4.8 million and $1.6 million for the 2022 Period and 2021 Period, respectively.

The total unvested restricted share awards at September 30, 2022 was 401,416 shares, which had a weighted average grant date fair value of $23.51 per share. As of September 30, 2022, the total compensation cost related to unvested restricted share awards was $5.8 million, which we expect to recognize over a weighted average period of 32 months.

NOTE 9: EARNINGS PER COMMON SHARE

We determine “Basic earnings per share” using the two-class method as our unvested restricted share awards and units have non-forfeitable rights to dividends, and are therefore considered participating securities. We compute basic earnings per share by dividing net income less the allocation of undistributed earnings to unvested restricted share awards and units by the weighted-average number of common shares outstanding for the period.

We also determine “Diluted earnings per share” as the more dilutive of the two-class method or the treasury stock method with respect to the unvested restricted share awards. We further evaluate any other potentially dilutive securities at the end of the period and adjust the basic earnings per share calculation for the impact of those securities that are dilutive. Our dilutive earnings per share calculation includes the dilutive impact of operating partnership units under the if-converted method and our share based awards with performance conditions prior to the grant date and all market condition awards under the contingently issuable method.

The computations of basic and diluted earnings per share for the three and nine months ended September 30, 2022 and 2021 were as follows (in thousands, except per share data):

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2022 | | 2021 | | 2022 | | 2021 |

| Numerator: | | | | | | | |

| Loss from continuing operations | $ | (10,739) | | | $ | (22,330) | | | $ | (27,337) | | | $ | (46,344) | |

| | | | | | | |

| Allocation of earnings to unvested restricted share awards | (68) | | | 121 | | | (191) | | | (349) | |

| Adjusted net loss from continuing operations | (10,807) | | | (22,209) | | | (27,528) | | | (46,693) | |

| Income from discontinued operations | — | | | 53,649 | | | — | | | 69,524 | |

| Allocation of earnings from discontinued operations to unvested restricted share awards | — | | | (283) | | | — | | | — | |

| Adjusted income from discontinuing operations | — | | | 53,366 | | | — | | | 69,524 | |

| Adjusted net (loss) income | $ | (10,807) | | | $ | 31,157 | | | $ | (27,528) | | | $ | 22,831 | |

| Denominator: | | | | | | | |

| Weighted average shares outstanding – basic and diluted | 87,453 | | | 84,496 | | | 87,354 | | | 84,457 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Earnings per common share, basic: | | | | | | | |

| Continuing operations | $ | (0.12) | | | $ | (0.26) | | | $ | (0.32) | | | $ | (0.55) | |

| Discontinued operations | — | | | 0.63 | | | — | | | 0.82 | |

| Basic net (loss) income per common share | $ | (0.12) | | | $ | 0.37 | | | $ | (0.32) | | | $ | 0.27 | |

| Earnings per common share, diluted: | | | | | | | |

| Continuing operations | $ | (0.12) | | | $ | (0.26) | | | $ | (0.32) | | | $ | (0.55) | |

| Discontinued operations | — | | | 0.63 | | | — | | | 0.82 | |

| Diluted net( loss) income per common share | $ | (0.12) | | | $ | 0.37 | | | $ | (0.32) | | | $ | 0.27 | |

| | | | | | | |

| Dividends declared per common share | $ | 0.17 | | | $ | 0.17 | | | $ | 0.51 | | | $ | 0.77 | |

NOTE 10: SEGMENT INFORMATION

We operate in a single reportable segment which includes the ownership, development, redevelopment and acquisition of apartment communities. None of our operating properties meet the criteria to be considered separate operating segments on a stand-alone basis. Within the residential segment, we do not distinguish or group our consolidated operations based on size (only one community, Riverside Apartments, comprises more than 10% of consolidated revenues), type (all assets in the segment are residential) or geography (all but five communities are within the Washington, DC metro region). Further, our apartment communities have similar long-term economic characteristics and provide similar products and services to our residents. As a result, our operating properties are aggregated into a single reportable segment: residential.

Prior to the end of the second quarter of 2021, we had two reportable segments: office and residential. During the third quarter of 2021, we closed on the sales of the Office Portfolio and the Retail Portfolio (see note 3), and following such sales, we have one remaining office property, Watergate 600, which does not meet the criteria for a reportable segment, and has been classified within “Other” on our segment disclosure tables.

We evaluate performance based upon net operating income (“NOI”) of the combined properties in the segment. Our reportable operating segment consolidates similar properties. GAAP requires that segment disclosures present the measure(s) used by the chief operating decision maker for purposes of assessing each segment’s performance. NOI is a key measurement of our segment profit and loss and is defined as real estate rental revenue less real estate expenses.

The following tables present revenues, NOI, capital expenditures and total assets for the three and nine months ended September 30, 2022 and 2021 from our Residential segment as well as Other, and reconcile NOI to net income (loss) as reported (in thousands):

| | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2022 |

| | Residential | | Other (1) | | Consolidated |

| Real estate rental revenue | 49,889 | | | 4,714 | | | $ | 54,603 | |

| Real estate expenses | 18,198 | | | 1,363 | | | 19,561 | |

| Net operating income | $ | 31,691 | | | $ | 3,351 | | | $ | 35,042 | |

| Other income (expense): | | | | | |

| Property management expenses | | | | | (1,916) | |

| General and administrative expenses | | | | | (6,403) | |

| Transformation costs | | | | | (2,399) | |

| Depreciation and amortization | | | | | (23,632) | |

| | | | | |

| Interest expense | | | | | (6,582) | |

| | | | | |

| Loss on extinguishment of debt | | | | | (4,917) | |

| Other income | | | | | 68 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Net loss | | | | | $ | (10,739) | |

| | | | | |

| | | | | |

| Capital expenditures | $ | 7,764 | | | $ | 567 | | | $ | 8,331 | |

| Total assets | $ | 1,694,750 | | | $ | 184,784 | | | $ | 1,879,534 | |

| | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2021 |

| | Residential | | Other (1), (2) | | Consolidated |

| Real estate rental revenue | 38,046 | | | 4,453 | | | $ | 42,499 | |

| Real estate expenses | 14,146 | | | 1,299 | | | 15,445 | |

| Net operating income | $ | 23,900 | | | $ | 3,154 | | | $ | 27,054 | |

| Other income (expense): | | | | | |

| Property management expenses | | | | | (1,499) | |

| General and administrative expenses | | | | | (7,909) | |

| Transformation costs | | | | | (1,016) | |

| Depreciation and amortization | | | | | (18,252) | |

| | | | | |

| Interest expense | | | | | (8,106) | |

| Loss on interest rate derivatives | | | | | (106) | |

| Loss on extinguishment of debt | | | | | (12,727) | |

| Other income | | | | | 231 | |

| | | | | |

| | | | | |

| | | | | |

| Discontinued operations: | | | | | |

| Income from operations of properties sold or held for sale | | | | | 7,208 | |

| Gain on sale of real estate | | | | | 46,441 | |

| | | | | |

| | | | | |

| Net income | | | | | $ | 31,319 | |

| | | | | |

| | | | | |

| Capital expenditures | $ | 7,283 | | | $ | 1,002 | | | $ | 8,285 | |

| Total assets | $ | 1,355,893 | | | $ | 496,917 | | | $ | 1,852,810 | |

______________________________

(1) Other represents Watergate 600, an office property that does not meet the qualitative or quantitative criteria for a reportable segment.

(2) Total assets and capital expenditures include office and retail properties classified as discontinued operations.

| | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2022 |

| Residential | | Other (1) | | Consolidated |

| Real estate rental revenue | $ | 139,869 | | | 13,918 | | | $ | 153,787 | |

| Real estate expenses | 51,411 | | | 3,886 | | | 55,297 | |

| Net operating income | $ | 88,458 | | | $ | 10,032 | | | $ | 98,490 | |

| Other income (expense): | | | | | |

| Property management expenses | | | | | (5,462) | |

| General and administrative expenses | | | | | (20,998) | |

| Transformation costs | | | | | (6,645) | |

| Depreciation and amortization | | | | | (69,871) | |

| | | | | |

| Interest expense | | | | | (18,388) | |

| | | | | |

| Loss on extinguishment of debt | | | | | (4,917) | |

| Other income | | | | | 454 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Net loss | | | | | $ | (27,337) | |

| | | | | |

| | | | | |

| Capital expenditures | $ | 17,623 | | | $ | 2,745 | | | $ | 20,368 | |

| | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2021 |

| Residential | | Other (1), (2) | | Consolidated |

| Real estate rental revenue | 111,075 | | | 13,328 | | | $ | 124,403 | |

| Real estate expenses | 41,440 | | | 3,740 | | | 45,180 | |

| Net operating income | $ | 69,635 | | | $ | 9,588 | | | $ | 79,223 | |

| Other income (expense): | | | | | |

| Property management expenses | | | | | (4,448) | |

| General and administrative expenses | | | | | (19,838) | |

| Transformation costs | | | | | (4,796) | |

| Depreciation and amortization | | | | | (52,542) | |

| | | | | |

| Interest expense | | | | | (28,387) | |

| Other income | | | | | 3,037 | |

| Loss on extinguishment of debt | | | | | (12,727) | |

| Loss on interest rate derivatives | | | | | (5,866) | |

| | | | | |

| | | | | |

| | | | | |

| Discontinued operations: | | | | | |

| Income from operations of properties sold or held for sale | | | | | 23,083 | |

| Gain on sale of real estate | | | | | 46,441 | |

| Net income | | | | | $ | 23,180 | |

| | | | | |

| | | | | |

| Capital expenditures | $ | 15,082 | | | $ | 3,604 | | | $ | 18,686 | |

______________________________

(1) Other represents Watergate 600, an office property that does not meet the qualitative or quantitative criteria for a reportable segment.

(2) Total assets and capital expenditures include office and retail properties classified as discontinued operations.

NOTE 11: SHAREHOLDERS' EQUITY