Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

| | |

(Mark One) | | |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF | |

| THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the fiscal year ended December 31, 2016 | |

OR

|

| | |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF | |

| THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the transition period from to | |

|

| | | |

| Commission file number: 001-14236 | | (FelCor Lodging Trust Incorporated) |

| Commission file number: 333-39595-01 | | (FelCor Lodging Limited Partnership) |

FelCor Lodging Trust Incorporated

FelCor Lodging Limited Partnership

(Exact Name of Registrant as Specified in Its Charter)

|

| | | | | |

| Maryland | (FelCor Lodging Trust Incorporated) | | 75-2541756 |

| Delaware | (FelCor Lodging Limited Partnership) | | 75-2544994 |

| (State or Other Jurisdiction of Incorporation or Organization) | | | (I.R.S. Employer Identification No.) |

| | |

|

| | | |

| 125 E. John Carpenter Freeway, Suite 1600, Irving, Texas | | 75062 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(972) 444-4900

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | | | | | | | | | | | | | | | | |

Title of each class | | Name of each exchange on which registered |

FelCor Lodging Trust Incorporated: | | |

Common Stock | | New York Stock Exchange |

$1.95 Series A Cumulative Convertible Preferred Stock | | New York Stock Exchange |

FelCor Lodging Limited Partnership: | | |

None | | |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

| | | | | | |

| FelCor Lodging Trust Incorporated | | þ | Yes | ¨ | No |

| FelCor Lodging Limited Partnership | | ¨ | Yes | þ | No |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

|

| | | | | | |

| FelCor Lodging Trust Incorporated | | ¨ | Yes | þ | No |

| FelCor Lodging Limited Partnership | | þ | Yes | ¨ | No |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

| | | | | | |

| FelCor Lodging Trust Incorporated | | þ | Yes | ¨ | No |

| FelCor Lodging Limited Partnership | | ¨ | Yes | þ | No |

Note: As a voluntary filer not subject to filing requirements of Section 13 or 15(d) of the Exchange Act, the registrant has filed all reports pursuant to Section 13 or 15(d) as if the registrant was subject to such filing requirements.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

| | | | | | |

| FelCor Lodging Trust Incorporated | | þ | Yes | ¨ | No |

| FelCor Lodging Limited Partnership | | þ | Yes | ¨ | No |

|

| | | | |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | |

FelCor Lodging Trust Incorporated: | | |

Large accelerated filer þ | | Accelerated filer ¨ |

Non-accelerated filer o (Do not check if a smaller reporting company) | | Smaller reporting company o |

|

| | |

FelCor Lodging Limited Partnership: | | |

Large accelerated filer o | | Accelerated filer ¨ |

Non-accelerated filer þ (Do not check if a smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

| | | | | | |

| FelCor Lodging Trust Incorporated | | o | Yes | þ | No |

| FelCor Lodging Limited Partnership | | o | Yes | þ | No |

|

| | | | | | | | | | | | | | | | | | | | |

The aggregate market value of shares of common stock held by non-affiliates of FelCor Lodging Trust Incorporated as of June 30, 2016, computed by reference to the price at which its common stock was last sold at June 30, 2016, was approximately $837 million. |

As of February 20, 2017, FelCor Lodging Trust Incorporated had issued and outstanding 138,103,326 shares of common stock. |

DOCUMENTS INCORPORATED BY REFERENCE |

Portions of FelCor Lodging Trust Incorporated’s definitive Proxy Statement pertaining to its 2017 Annual Meeting of Stockholders (the “Proxy Statement”), filed or to be filed not later than 120 days after the end of the fiscal year pursuant to Regulation 14A, is incorporated herein by reference into Part III. |

EXPLANATORY NOTE

This annual report on Form 10-K for the fiscal year ended December 31, 2016, combines the filings for FelCor Lodging Trust Incorporated, or FelCor, and FelCor Lodging Limited Partnership, or FelCor LP. Where it is important to distinguish between the two, we either refer specifically to FelCor or FelCor LP. Otherwise we use the terms “we” or “our” to refer to FelCor and FelCor LP, collectively (including their consolidated subsidiaries), unless the context indicates otherwise.

FelCor is a Maryland corporation operating as a real estate investment trust, or REIT, and is the sole general partner, and the owner of a greater than 99% partnership interest in, FelCor LP. Through FelCor LP, FelCor owns hotels and conducts business. As the sole general partner of FelCor LP, FelCor has exclusive and complete control of FelCor LP’s day-to-day management.

We believe combining periodic reports for FelCor and FelCor LP into a single combined report results in the following benefits:

| |

• | presents our business as a whole (the same way management views and operates the business); |

| |

• | eliminates duplicative disclosure and provides a more streamlined presentation (a substantial portion of our disclosure applies to both FelCor and FelCor LP); and |

| |

• | saves time and cost by preparing combined reports instead of separate reports. |

We operate the company as one enterprise. The employees of FelCor direct the management and operation of FelCor LP. With sole control of FelCor LP, FelCor consolidates FelCor LP for financial reporting purposes. FelCor has no assets other than its investment in FelCor LP and no liabilities separate from FelCor LP. Therefore, the reported assets and liabilities for FelCor and FelCor LP are substantially identical.

FelCor is a REIT with publicly-traded equity, while FelCor LP is a partnership with no publicly-traded equity. This difference is reflected in the financial statements in the equity (or partners’ capital) section of the consolidated balance sheets and in the consolidated statements of equity (or partners’ capital). Apart from the different equity treatment, the consolidated financial statements for FelCor and FelCor LP are nearly identical, except the net income (loss) attributable to redeemable noncontrolling interests in FelCor LP is deducted from FelCor’s net income (loss) in order to arrive at net income (loss) attributable to FelCor common stockholders. The noncontrolling interest is included in net income (loss) attributable to FelCor LP common unitholders. The holders of noncontrolling interests in FelCor LP are unaffiliated with FelCor and, in aggregate, hold less than 1% of the operating partnership units.

We present the sections in this report combined unless separate disclosure is required for clarity.

FELCOR LODGING TRUST INCORPORATED and

FELCOR LODGING LIMITED PARTNERSHIP

INDEX

|

| | | |

| | |

| | |

Item No. | | Page |

| | |

PART I | |

Item 1. | Business | |

Item 1A. | Risk Factors | |

Item 1B. | Unresolved Staff Comments | |

Item 2. | Properties | |

Item 3. | Legal Proceedings | |

Item 4. | Mine Safety Disclosures | |

| | |

PART II | |

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

Item 6. | Selected Financial Data | |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | |

Item 8. | Financial Statements and Supplementary Data | |

Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | |

Item 9A. | Controls and Procedures | |

| | | |

PART III | |

Item 10. | Directors, Executive Officers of the Registrant and Corporate Governance | |

Item 11. | Executive Compensation | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

Item 13. | Certain Relationships, Related Transactions and Director Independence | |

Item 14. | Principal Accountant Fees and Services | |

| | |

PART IV | |

Item 15. | Exhibits and Financial Statement Schedules | |

Item 16. | Form 10-K Summary | 126 |

SIGNATURES | | |

This Annual Report contains registered trademarks and service marks, including (but not limited to) Airbnb, DoubleTree Suites by Hilton, Embassy Suites Hotels, Fairmont, Hilton, Holiday Inn, The Knickerbocker, Marriott, Morgans, Renaissance, Royalton, Sheraton, VRBO, Walt Disney World, Wyndham and Wyndham Grand.

Disclosure Regarding Forward Looking Statements

Our disclosure and analysis in this Form 10-K and in FelCor’s 2016 Annual Report to Stockholders may contain forward-looking statements that set forth anticipated results based on management’s plans and assumptions. From time to time, we may also provide forward-looking statements in other materials we release to the public. Such statements reflect our current expectations or forecasts of future events; they do not relate strictly to historical or current facts. We have tried, wherever possible, to identify each such statement by using words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “will,” “target,” “forecast,” “continue” or similar expressions. In particular, these forward-looking statements may include those relating to future actions (including future acquisitions or dispositions and future capital expenditure plans) and future performance or expenses.

We cannot guarantee that any future results discussed in any forward-looking statements will be realized, although we believe that we have been prudent in our plans and assumptions. Achievement of future results is subject to risks, uncertainties and potentially inaccurate assumptions, including those discussed in Item 1A, Risk Factors. Should known or unknown risks or uncertainties materialize, or should underlying assumptions prove inaccurate, actual results could differ materially from past results and those results anticipated, estimated or projected. You should bear this in mind as you consider forward-looking statements.

We undertake no obligation to update forward-looking statements publicly, whether as a result of new information, future events or otherwise. You should consult our subsequent disclosures or related discussions in our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that we file with the Securities and Exchange Commission, or the SEC. Also note that, in our risk factors, we provide a cautionary discussion of risks, uncertainties and possibly inaccurate assumptions relevant to our business. These are factors that, individually or in the aggregate, we believe could cause our actual results to differ materially from past results and those results anticipated, estimated or projected. We note these factors for investors as permitted by the Private Securities Litigation Reform Act of 1995. It is not possible to predict or identify all such risk factors. Consequently, you should not consider the risk factor discussion to be a complete discussion of all of the potential risks or uncertainties that could affect our business.

PART I

Item 1. Business

About FelCor and FelCor LP

FelCor Lodging Trust Incorporated (NYSE:FCH), or FelCor, is a Maryland corporation operating as a real estate investment trust, or REIT. FelCor is the sole general partner of, and the owner of a greater than 99.5% partnership interest in, FelCor Lodging Limited Partnership, or FelCor LP, through which we held ownership interests in 39 hotels with 11,500 rooms at December 31, 2016. At December 31, 2016, we had an aggregate of 138,600,280 shares and units outstanding, consisting of 137,990,097 shares of FelCor common stock and 610,183 units of FelCor LP limited partnership interest not owned by FelCor.

Business Strategy

Strategy and Objectives. Our goal is to deliver returns to stockholders through earnings growth, asset appreciation and sustainable dividends. We strive to achieve this goal by building a well-maintained and diversified portfolio of high quality hotels in strategic locations, leveraging our core competencies to enhance the quality and earnings potential of our hotels, and continuing to enhance our balance sheet flexibility and strength while reducing our cost of capital.

Our core portfolio consists primarily of upper-upscale and luxury hotels located in major markets and resort locations that have dynamic demand generators and high barriers-to-entry. We sell, acquire, rebrand and redevelop hotels to increase our return on invested capital, improve overall portfolio quality, enhance diversification and improve growth rates. Our long-term strategy has six critical components:

| |

• | Acquire Hotels that Further Improve our Portfolio Quality, Diversification and Earnings Growth. We seek to acquire high-quality hotels in markets with high barriers-to-entry and sustainable demand growth. We target properties that are accretive to long-term stockholder value, will provide investment returns that exceed our weighted average cost of capital and provide attractive long-term yields. Additionally, we seek properties that will improve the overall quality and diversity of our portfolio and we consider hotels that offer redevelopment and/or revenue repositioning opportunities that will further enhance returns on our investment. |

| |

• | Sell Non-Strategic Hotels or Hotels Not Expected to Meet Our Long-Term Return Hurdles. We believe opportunistically selling hotels and reallocating capital to more attractive investments enhances our long-term growth, increases our return on capital and enables management to focus on long-term investments within our target markets. We consistently review our hotels in terms of projected performance, future capital expenditure requirements, market dynamics and concentration risk, and sell those properties in markets that are not expected to offer an attractive return on our investment or are inconsistent with our long-term portfolio strategy. |

| |

• | Utilize Focused and Engaged Asset Management Approach to Maximize Returns at our Hotels. FelCor’s asset management is aggressive and hands-on. All of our asset managers have extensive hotel operating experience and thorough knowledge of the markets and overall demand dynamics where our hotels operate. With our long-standing and extensive brand relationships, we can significantly influence how their policies and procedures (most notably, brand strategy for marketing and revenue enhancement programs) affect us as hotel owners. We utilize our expertise and relationships to maximize revenue, market share, hotel operating margins and cash flow at every hotel. |

| |

• | Pursue Redevelopment and Repositioning Opportunities that Leverage our Development and Operations Expertise. We consider redevelopment and repositioning opportunities at our properties that offer attractive risk-adjusted returns. Redevelopment opportunities may include adding guest rooms, meeting space and amenities (such as spas), and developing condominiums. Repositioning opportunities typically involve upgrading a hotel’s market position through converting to a superior brand, which can be done independently or in conjunction with a redevelopment. We are currently seeking the necessary approvals and entitlements to redevelop and/or reposition several of our hotels that are located in core markets and offer attractive risk-adjusted returns that are significantly above our cost of capital. |

| |

• | Enhance Our Assets’ Long-Term Performance by Investing in High-ROI Capital Projects. We strive to spend capital prudently. Our capital strategy involves efficiently maintaining our properties over the long term and limiting future expenditure fluctuations, while maximizing our return on investment. We generally renovate several hotels each year to maintain their competitive positions and value. We routinely evaluate value-adding opportunities at our hotels, such as better use of existing space, new restaurant concepts and improved food and beverage operations. |

| |

• | Manage Our Balance Sheet. We are committed to further strengthening our balance sheet by reducing leverage, extending debt maturities and taking advantage of opportunities to lower our cost of capital. Our improved balance sheet provides the necessary flexibility and capacity to thrive throughout lodging industry cycles. We will continue to reduce our leverage by, among other things, selling non-strategic or underperforming hotels and increasing operating cash flow. We also expect to reduce our cost of capital and enhance our debt maturity profile by refinancing or repaying higher cost debt and preferred stock in the future. |

Recent Achievements. We have continued making progress toward achieving our strategic objectives.

| |

• | We sold two hotels in 2016 for $108 million total gross proceeds. |

| |

• | We reduced our consolidated debt by $74 million and leverage ratio from 6.0x at December 31, 2015 to 5.6x at December 31, 2016. Moody’s upgraded our corporate credit rating in 2016 as a result of our stronger balance sheet and credit metrics. |

| |

• | In 2016, we renovated two hotels (Embassy Suites - Dallas Love Field and Embassy Suites - Orlando International Drive South/Convention Center) and began redeveloping two resort properties (The Vinoy Renaissance St. Petersburg Resort & Golf Club and Embassy Suites Myrtle Beach-Oceanfront Resort), which included the construction of significant enhancements and improvements to our resort amenities. In total, we spent $74.3 million on capital expenditure at our hotels, and believe our renovation and redevelopment projects will offer attractive returns. |

| |

• | We successfully completed negotiations with Hilton with respect to new management agreements for 18 of our properties, with four currently pending lender approval. The new management agreements shift a substantial portion of fees from fixed base fees to variable incentive fees, which are payable only after achieving a base return on our invested capital. This new fee structure better aligns Hilton’s interest with our economic interest. We also negotiated comprehensive, long-term renovation plans at the affected hotels that allow us to deploy our capital more efficiently. We are excited to extend our strong relationship with Hilton, and we are confident the new agreements will help us achieve meaningful returns on these assets. |

| |

• | We acquired the fee interest in the land at our Wyndham Houston-Medical Center Hotel & Suites that was previously leased. |

| |

• | We remain committed to the highest standards of Board accountability, corporate ethics and stockholder engagement. Accordingly, in 2016 we implemented various corporate governance enhancements, including, among others: (i) amending and restating FelCor’s 2014 Equity Compensation Plan to impose minimum vesting and post-vesting holding periods and to prohibit cash buyouts of underwater options; (ii) refreshing and enhancing the independence of the Board by appointing two independent directors to serve on the Board; (iii) adding a new section to FelCor’s Bylaws to provide proxy access to director candidates nominated by stockholders that meet certain ownership thresholds and satisfy other criteria; and (iv) amending FelCor’s Bylaws to delete a section that had reserved for the Board the exclusive power to amend FelCor’s Bylaws (stockholders will be able to propose binding amendments to FelCor’s Bylaws assuming they approve a corresponding charter amendment at this year’s annual meeting). The foregoing initiatives follow prior actions, as previously disclosed, that also strengthen our corporate governance and stockholder accountability. |

Our Industry

The United States lodging industry is diverse and fragmented, comprising a myriad of hotel types across multiple quality and service segments. The industry caters to a wide range of guests, including transient customers (both leisure and corporate), groups (both leisure and corporate) and long-term, or contract, customers. Average rates charged by hotels are dependent on multiple factors, including the potential customer mix, level of customer demand and rooms supply in the market. Many hotels are marketed under a brand or “flag,” such as Hilton and Marriott, among others. Franchisors typically receive fees in exchange for brand recognition, marketing support and their reservation systems. Other hotels operate independently, often because they do not desire to fit within the standards of a particular brand or, in some cases, because operating as an independent “boutique” hotel enhances a hotel’s appeal to targeted guests. Hotels, and the underlying real estate, are owned by both public and private companies and partnerships. Franchisors or independent management companies often operate hotels on behalf of their owners. All of our hotels are operated on our behalf, mostly by managers affiliated with international franchisors.

Hotel Classification. Smith Travel Research (STR), a leading research provider for the lodging industry, classifies hotel chains into seven distinct segments: luxury, upper-upscale, upscale, upper-midscale, midscale, economy and independent. More than 90% of our Hotel EBITDA is generated from luxury (Fairmont) and upper-upscale (Embassy Suites, Hilton, Marriott, Renaissance, Sheraton, and Wyndham) hotels. We also own upscale (Doubletree), upper-midscale (Holiday Inn) and independent (Knickerbocker, Royalton and Morgans) hotels.

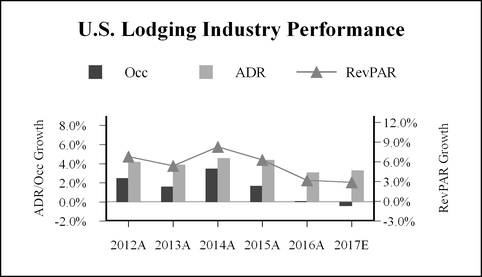

Industry Performance. The industry is cyclical, driven by changes in supply and demand. Overall economic conditions and local market factors influence demand, as do GDP growth, employment growth and corporate profits. While lodging industry fundamentals remain relatively healthy, acceleration of supply growth, coupled with a deceleration in demand growth, is expected to result in lower Revenue Per Available Room (RevPAR) growth in 2017.

For 2016, STR reported:

| |

• | RevPAR increased 3.2%, to $81.19, achieving the highest RevPAR ever recorded by STR for any year; |

| |

• | ADR increased 3.1% to $123.97, achieving the highest ADR ever recorded by STR; and |

| |

• | Occupancy increased 0.1% to 65.5%, as demand growth outpaced supply growth. |

For 2017, CBRE Hotel Horizons (formerly, PKF Hospitality Research), or CBRE, another leading provider of hospitality industry research, projects occupancy to decrease 0.4%, ADR to increase by 3.3%, contributing to a projected 2.9% RevPAR increase in 2017. In its publication Hospitality Directions US, PwC’s outlook for 2017 RevPAR is a 2.3% increase, with an ADR increase of 2.6% and an occupancy decline of 0.3%.

Competition

The lodging industry is highly competitive. Customers can choose from a variety of brands and products. The interplay between the supply of and demand for hotel rooms is cyclical and affects our industry significantly. Certain markets have low barriers-to-entry (e.g., inexpensive land, favorable zoning, etc.), making it easier to build new hotels and increase the supply of modern, high-quality hotel rooms. Lodging demand growth typically moves in tandem with the overall economy, as well as local market factors that stimulate travel to specific destinations. Economic indicators, such as GDP, business investment and employment levels, are common indicators of lodging demand. Each of our hotels competes for guests, primarily with other full service and limited service hotels in the immediate vicinity and, secondarily, with other hotels in its geographic market. Location, brand recognition, hotel quality, service levels and prices are the principal competitive factors affecting our hotels.

Environmental Matters

Under various federal, state and local environmental laws, ordinances and regulations, a current or previous owner or operator of real property may be liable for the costs of removal or remediation of hazardous or toxic substances on, under or in a property. These laws may impose liability whether or not the owner or operator knew of, or was responsible for, the presence of such hazardous or toxic substances. In addition, certain environmental laws and common law principles could be used to impose liability for release of asbestos-containing materials, and third parties may seek recovery from owners or operators of real property for personal injury associated with exposure to related asbestos-containing materials. Environmental laws also may impose restrictions on the manner in which property may be used or businesses may be operated, and these restrictions may require corrective modifications or other expenditures. In connection with our current or prior ownership or operation of hotels or other real estate, we may be liable for various environmental costs or liabilities.

We customarily obtain a Phase I environmental survey from an independent environmental consultant before acquiring a hotel. The principal purpose of a Phase I survey is to identify potential environmental contamination and, secondarily, to assess, to a limited extent, the potential for environmental regulatory compliance liabilities. The Phase I surveys of our hotels were designed to meet the requirements of the then current industry standards governing those surveys, and consistent with those requirements, none of the surveys involved testing of groundwater, soil or air. Accordingly, they do not represent evaluations of conditions at the studied sites that would be revealed only through such testing. In addition, Phase I assessments of environmental regulatory compliance issues are general in scope and not a detailed determination of a hotel’s environmental compliance. Similarly, Phase I reports do not involve comprehensive analysis of potential offsite liability. Our Phase I reports have not revealed any environmental liability that we believe would have a material adverse effect on our business, assets or results of operations, nor are we aware of any such liability. Nevertheless, it is possible that these reports do not reveal or accurately assess all material environmental conditions and that there are material environmental conditions of which we are unaware.

We believe that our hotels materially comply with all federal, state, and local laws and regulations regarding hazardous substances and other environmental matters, to the extent violation of such laws and regulations have a material adverse effect on us. We have not been notified by any governmental authority or private party of any noncompliance, liability or claim relating to hazardous or toxic substances or other environmental matters in connection with any of our current or former properties that we believe would have a material adverse effect on our business, assets or results of operations. However, obligations for compliance with environmental laws that arise or are discovered in the future may adversely affect our financial condition.

Tax Status

FelCor LP is a partnership for federal income tax purposes, and is not subject to federal income tax. However, under its partnership agreement, it is required to reimburse FelCor for any tax payments it is required to make. Accordingly, the tax information herein represents disclosures regarding FelCor and its taxable subsidiaries.

FelCor elected to be treated as a REIT under the U.S. Internal Revenue Code. As a REIT, FelCor generally is not subject to federal income taxation at the corporate level on taxable income that is distributed to its stockholders. FelCor may, however, be subject to certain state and local taxes on its income and property and to federal income and excise taxes on its undistributed taxable income. FelCor’s taxable REIT subsidiaries, or TRSs, formed to lease its hotels, are subject to federal, state and local income taxes. A REIT is subject to a number of organizational and operational requirements, including a requirement that it currently distribute at least 90% of its annual taxable income to its stockholders. If FelCor fails to qualify as a REIT in any taxable year for which the statute of limitations remains open, it will be subject to federal income taxes at regular corporate rates (including any applicable alternative minimum tax) for such taxable year and may not qualify as a REIT for four subsequent years. In connection with FelCor’s election to be treated as a REIT, its charter imposes restrictions on the ownership and transfer of shares of its common stock. FelCor LP expects to make distributions on its units sufficient to enable FelCor to meet its distribution obligations as a REIT. At December 31, 2016, FelCor had a federal income tax net operating loss carryforward of $534.2 million, and its TRSs had federal income tax loss carryforwards of $254.8 million.

Employees

At December 31, 2016, we had 63 full-time employees. None of our employees are involved in the day-to-day operation of our hotels.

Ownership of our Hotels

Of our 39 hotels at December 31, 2016, we owned 100% interests in 36 hotels, a 95% interest in one hotel (The Knickerbocker) and 50% interests in entities that owned two hotels. We consolidate our real estate interests in the 37 hotels in which we hold majority interests, and we record the real estate interests of the two hotels in which we hold 50% interests using the equity method. We lease 38 of the 39 hotels to our TRSs, in which we own a controlling interest. We operate one 50% owned hotel without a lease. Because we own controlling interests in our operating lessees, we consolidate our interests in all 38 leased hotels (which we refer to as our Consolidated Hotels) and reflect their operating revenues and expenses in our statements of operations. We own 50% of the real estate interest in one Consolidated Hotel (we account for our real estate interest in this hotel by the equity method) and majority real estate interests in our remaining 37 Consolidated Hotels (we consolidate our real estate interests in these hotels). Our Consolidated Hotels are located in 14 states, with concentrations in major urban markets and resort areas.

Segment Reporting

Our business is conducted in one operating segment because of the similar economic characteristics of our hotels. Other information by geographic area may be found in the footnotes to our consolidated financial statements elsewhere in this report.

Additional Information

Additional information relating to our hotels and our business, including the charters of our Executive Committee, Governance Committee, Lead Director, Compensation Committee, Finance Committee and Audit Committee; our corporate governance guidelines; and our code of business conduct and ethics can be found on our website at www.felcor.com. Information relating to our hotels and our business can also be found in the Notes to Consolidated Financial Statements located elsewhere in this report. Our annual, quarterly and current reports, and amendments to these reports, filed with the Securities and Exchange Commission, or SEC, under the Securities Exchange Act of 1934, or Exchange Act, are made available on our website, free of charge, under the “Financials” tab on our “Investor Relations” page, as soon as practicable following their filing. The public may also read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at www.sec.gov.

Item 1A. Risk Factors

The risk factors in this section describe the major risks to our business and should be considered carefully. In addition, these statements constitute our cautionary statements under the Private Securities Litigation Reform Act of 1995.

Our revenues, expenses and the value of our hotels are subject to conditions affecting both the real estate and lodging industries.

Real estate investments are subject to numerous risks. Our investment in hotels is subject to numerous risks generally associated with owning real estate, including among others:

| |

• | general economic conditions, including unemployment rates, major bank failures, unsettled capital markets and sovereign debt uncertainty; |

| |

• | changes in international, national, regional and local economic climate and real estate market conditions; |

| |

• | changes in traffic patterns and neighborhood characteristics; |

| |

• | increases in assessed property taxes from changes in valuation and real estate tax rates; |

| |

• | increases in the cost of property insurance; |

| |

• | potential for uninsured or underinsured property losses; |

| |

• | governmental regulations, including changes in immigration laws that may impact travel and labor and fiscal policies; |

| |

• | changes in interest rates and in the availability, cost and terms of debt financing; |

| |

• | the ongoing need for capital improvements; |

| |

• | changes in tax laws; and |

| |

• | other circumstances beyond our control. |

Moreover, real estate investments are substantially illiquid, and we may not be able to adjust our portfolio in a timely manner to respond to changes in economic and other conditions.

Investing in hotel assets involves special risks. We have invested in hotels and related assets, and our hotels are subject to all the risks common to the hotel industry. These risks could adversely affect hotel occupancy, operating costs and rates that can be charged for hotel rooms, and generally include:

| |

• | changes in business and leisure travel patterns; |

| |

• | decreases in demand for hotel rooms; |

| |

• | increases in lodging supply or competition, which may adversely affect demand at our hotels; |

| |

• | the effect of geopolitical disturbances, including terrorist attacks and terror alerts, that reduce business and leisure travel; |

| |

• | the appeal of our hotels to consumers relative to competing hotels; |

| |

• | seasonal fluctuations in our revenue caused by the seasonal nature of the hotel industry; |

| |

• | unforeseen events beyond our control, including organizing labor at our hotels; |

| |

• | the threat or outbreak of a pandemic or epidemic disease, including the Zika virus, and natural disasters affecting the travel industry; |

| |

• | increasing fuel costs and other travel expenses resulting in reductions of travel; |

| |

• | consolidation in the lodging industry; and |

| |

• | increased transportation security precautions affecting the travel industry. |

We are subject to risks inherent to hotel operations. We have ownership interests in the operating lessees of our hotels; consequently, we are subject to the risk of fluctuating hotel operating expenses at our hotels, including but not limited to:

| |

• | increases in operating expenses due to inflation; |

| |

• | wage and benefit costs, including hotels that employ unionized labor and minimum wage increases in states where our hotels are located; |

| |

• | repair and maintenance expenses; |

| |

• | gas and electricity costs; |

| |

• | insurance costs including health, general liability and workers compensation; and |

| |

• | other operating expenses. |

Economic conditions may reduce demand for hotel properties and adversely affect our profitability. The performance of the lodging industry is highly cyclical and has traditionally been closely linked with the performance of the general economy. We cannot predict the pace or duration of the global economic cycle or the cycles of the lodging industry. In the event conditions in the industry deteriorate or do not continue to see sustained improvement, or there is an extended period of economic weakness, our occupancy rates, revenues and profitability could be adversely affected. Furthermore, other macroeconomic factors, such as consumer confidence and conditions which negatively shape public perception of travel, may have a negative effect on the lodging industry and may adversely affect our business.

We could face increased competition. Each of our hotels competes with other hotels in its geographic area. In addition to competing with traditional hotels and lodging facilities, we compete with alternative lodging, including third party providers of short-term rental properties, such as Airbnb and VRBO. A number of additional hotel rooms have been, or may be, built in a number of the geographic areas in which our hotels are located, which could adversely affect both occupancy and rates in those markets. A significant increase in the supply of upscale and upper-upscale hotel rooms, or if demand fails to increase at least proportionately, could have a material adverse effect on our business, financial condition and results of operations.

The lodging business is seasonal in nature. Generally, hotel revenues for our hotel portfolio are greater in the second and third calendar quarters than in the first and fourth calendar quarters. Revenues for hotels in tourist areas are generally substantially greater during tourist season than other times of the year. We expect that seasonal variations in revenue at our hotels will cause quarterly fluctuations in our revenues.

Actions by organized labor may adversely affect our business. We believe that unions are increasingly aggressive about organizing workers at hotels in certain locations. If workers employed by our hotel management companies organize in the future, increased labor activity at our hotels could impact the labor, administrative, legal, and other expenses of our management companies, which would negatively effect our profitability.

Compliance with environmental laws may adversely affect our financial condition. Owners of real estate are subject to numerous federal, state and local environmental laws and regulations. Under these laws and regulations, a current or former owner of real estate may be liable for the costs of remediating hazardous substances found on its property, whether or not they were responsible for its presence. In addition, if an owner of real property arranges for the disposal of hazardous substances at another site, it may also be liable for the costs of remediating the disposal site, even if it did not own or operate the disposal site. Such liability may be imposed without regard to fault or the legality of a party’s conduct and may, in certain circumstances, be joint and several. A property owner may also be liable to third parties for personal injuries or property damage sustained as a result of its release of hazardous or

toxic substances, including asbestos-containing materials, into the environment. Environmental laws and regulations may require us to incur substantial expenses and limit the use of our properties. We could have substantial liability for a failure to comply with applicable environmental laws and regulations, which may be enforced by the government or, in certain instances, by private parties. The existence of hazardous substances at a property can also adversely affect the value of, and the owner’s ability to use, sell or borrow against the property.

We cannot provide assurances that future or amended laws or regulations, or more stringent interpretations or enforcement of existing environmental requirements, will not impose any material environmental liability, or that the environmental condition or liability relating to our hotels will not be affected by new information or changed circumstances, by the condition of properties in the vicinity of such hotels, such as the presence of leaking underground storage tanks, or by the actions of unrelated third parties.

Compliance with the Americans with Disabilities Act may adversely affect our financial condition. Under the Americans with Disabilities Act of 1990, as amended, or the ADA, all public accommodations, including hotels, are required to meet certain federal requirements for access and use by disabled persons. Various state and local jurisdictions have also adopted requirements relating to the accessibility of buildings to disabled persons. We make every reasonable effort to ensure that our hotels substantially comply with the requirements of the ADA and other applicable laws. However, we could be liable for both governmental fines and payments to private parties if it were determined that our hotels are not in compliance with these laws. We also may be subject to future changes in these laws. If we were required to make unanticipated major modifications to our hotels to comply with the requirements of the ADA and similar laws, it could materially adversely affect our ability to make distributions to our stockholders and to satisfy our other obligations.

System security risks, data protection breaches, cyber-attacks and systems integration issues could disrupt our internal operations or service provided to guests at our hotels, and any such disruption could reduce our expected revenue, increase our expenses, damage the reputation of our hotels and adversely affect our stock price. Experienced computer programmers and hackers may be able to penetrate our network security or the network security of our third-party managers and franchisors, and misappropriate or compromise our confidential information or that of our hotel guests, create system disruptions or cause the shutdown of our hotels. Computer programmers and hackers also may be able to develop and deploy viruses, worms and other malicious software programs that attack our computer systems or the computer systems operated by our third-party managers and franchisors, or otherwise exploit any security vulnerabilities of our respective networks. In addition, sophisticated hardware and operating system software and applications that we and our third-party managers or franchisors may procure from outside companies may contain defects in design or manufacture, including “bugs” and other problems that could unexpectedly interfere with our internal operations or the operations at our hotels. The costs to us to eliminate or alleviate cyber or other security problems, bugs, viruses, worms, malicious software programs and security vulnerabilities could be significant, and our efforts to address these problems may not be successful and could result in interruptions, delays, cessation of service and loss of existing or potential business at our hotels.

Portions of our information technology infrastructure or the information technology infrastructure of our independent managers and franchisors also may experience interruptions, delays or cessations of service or produce errors in connection with systems integration or migration work that takes place from time to time. We, or our third-party managers and franchisors, may not be successful in implementing new systems and transitioning data, which could cause business disruptions and be more expensive, time consuming, disruptive and resource-intensive. Such disruptions could adversely impact the ability of our third-party managers and franchisors to fulfill reservations for guestrooms and other services offered at

our hotels. Delayed sales or bookings, lower margins or lost guest reservations resulting from these disruptions could adversely affect our financial results, stock price and the reputation of our hotels.

We seek to minimize the impact of these attacks through various technologies, processes and practices designed to protect our networks, systems, computers and data from attack, damage or unauthorized access. However, there are no guaranties that our cyber-security practices will be sufficient to thwart all attacks. While we carry property, business interruption and cyber risk insurance, we may not be sufficiently compensated for all losses we may incur. These losses include not only a loss of revenues but also potential litigation, fines or regulatory action against us. Furthermore, we may also incur substantial remediation costs to repair system damage as well as satisfy liabilities for stolen assets or information that may further reduce our profits.

If we (or our independent managers or franchisors) fail to comply with applicable privacy laws and regulations, we could be subject to payment of fines, damages or face restrictions on our use of guest data. Our managers and franchisors collect information relating to our guests for various business purposes, including marketing and promotional purposes. Collecting and using personal data is governed by U.S. and other privacy laws and regulations. Privacy regulations continue to evolve and may be inconsistent from one jurisdiction to another. Compliance with applicable privacy regulations may increase our operating costs and/or adversely impact our managers’ ability to market our products, properties and services to our guests. In addition, non-compliance (or in some circumstances non-compliance by third parties engaged by us (including our managers and franchisors)) or a breach of security in systems storing privacy data, may result in fines, payment of damages or restrictions on our (or our managers’ or franchisors’) use or transfer of data.

Future terrorist activities and political instability may adversely affect, and create uncertainty in, our business. Terrorism in the United States or elsewhere could have an adverse effect on our business, although the degree of impact will depend on a number of factors, including the United States and global economies and global financial markets. Previous terrorist attacks in the United States and subsequent terrorism alerts have adversely affected the travel and hospitality industries in the past. Such attacks, or the threat of such attacks, could have a material adverse effect on our business, our ability to finance our business, our ability to insure our properties, and/or our results of operations and financial condition, as a whole.

Furthermore, most of our hotels are classified as upper-upscale or upscale. In an economic downturn, these types of hotels may be more susceptible to a decrease in revenue, as compared to hotels in other categories that have lower room rates. This characteristic may result from the fact that upper-upscale and upscale hotels generally target business and high-end leisure travelers. In periods of economic difficulties, business and leisure travelers may seek to reduce travel costs by limiting travel or seeking to reduce costs on their trips. In addition, in periods of weak demand, as may occur during a general economic recession, profitability is negatively affected by the relatively high fixed costs of operating luxury, upper-upscale and upscale hotels. Consequently, any uncertainty in the general economic environment could adversely affect our business.

We face reduced insurance coverages and increasing premiums. Our property insurance has a $100,000 “all-risk” deductible, as well as a 5% deductible (insured value) for named windstorm and California earthquake coverage. Substantial uninsured or under-insured losses would have a material adverse impact on our operating results, cash flows and financial condition. Catastrophic losses could make the cost of insuring against these types of losses prohibitively expensive or difficult to find. In an effort to limit the cost of insurance, we purchase catastrophic insurance coverage based on probable maximum losses based on 250-year events. We have established a self-insured retention of $250,000 per

occurrence for general liability insurance with regard to 32 of our hotels. The remainder of our hotels participate in general liability programs sponsored by our managers, with no deductible.

We could have uninsured or under-insured property losses. Our property policies provide that all of the claims from each of our properties resulting from a particular insurable event must be combined together for purposes of evaluating whether the aggregate limits and sub-limits contained in our policies have been exceeded. Therefore, if an insurable event occurs that affects more than one of our hotels, the claims from each affected hotel will be added together to determine whether the aggregate limit or sub-limits, depending on the type of claim, have been reached, and each affected hotel may only receive a proportional share of the amount of insurance proceeds provided for under the policy if the total value of the loss exceeds the aggregate limits available. We may incur losses in excess of insured limits, and as a result, we may be even less likely to receive sufficient coverage for risks that affect multiple properties such as earthquakes or catastrophic terrorist acts. Risks such as war, catastrophic terrorist acts, nuclear, biological, chemical or radiological attacks and some environmental hazards may be deemed to fall completely outside the general coverage limits of our policies or may be uninsurable or may be too expensive to justify insuring against.

We may also encounter disputes concerning whether an insurance provider will pay a particular claim that we believe is covered under our policy. Should a loss in excess of insured limits or an uninsured loss occur or should we be unsuccessful in perfecting a claim from an insurance carrier, we could lose all, or a portion of, the capital we have invested in a property, as well as the anticipated future revenue from the hotel. In that event, we might nevertheless remain obligated for any mortgage debt or other financial obligations related to the property.

We obtain terrorism insurance as well as general liability and directors’ and officers’ policies. However, our all-risk policies have limitations, such as per-occurrence limits and sub-limits, that might have to be shared proportionally across participating hotels under certain loss scenarios. Also, all-risk insurers only have to provide terrorism coverage to the extent mandated by the Terrorism Risk Insurance Act, or TRIA, for “certified” acts of terrorism - namely those that are committed on behalf of non-United States persons or interests. Furthermore, we do not have full replacement coverage at all of our hotels for acts of terrorism committed on behalf of United States persons or interests (“non-certified” events) as our coverage for such incidents is subject to sub-limits and/or annual aggregate limits. In addition, property damage related to war and to nuclear, biological and chemical incidents is excluded under our policies. While TRIA will reimburse insurers for losses resulting from nuclear, biological and chemical perils, TRIA does not require insurers to offer coverage for these perils and, to date, insurers are not willing to provide this coverage, even with government reinsurance. Additionally, Congress may not renew TRIA in the future, which would eliminate the federal subsidy for terrorism losses. As a result of the above, the extent and adequacy of terrorism coverage that will be available in the future to protect our interests in the event of future terrorist attacks that impact our properties is uncertain.

We have geographic concentrations that may create risks from regional or local economic, seismic or weather conditions. At December 31, 2016, approximately 56% of our same-store hotel rooms were located in, and 62% of our 2016 Hotel EBITDA was generated from, three states: California (31% of our same-store hotel rooms and 37% of our Hotel EBITDA); Florida (16% of our same-store hotel rooms and 16% of our Hotel EBITDA); and Massachusetts (8% of our same-store hotel rooms and 10% of our Hotel EBITDA). Additionally, at December 31, 2016, we had concentrations in five major metropolitan areas which together represented approximately 50% of our Hotel EBITDA for the year ended December 31, 2016 (the San Francisco Bay area (19%), Boston (10%), South Florida (8%), Los Angeles area (7%) and Myrtle Beach (6%)). Therefore, adverse economic, seismic or weather conditions in these states or metropolitan areas may have a greater adverse effect on us than on the industry as a whole.

Transfers and/or termination of franchise licenses and management agreements may occur. Hotel managers and franchise licensors may have the right to terminate their agreements or suspend their services in the event of default under such agreements or under other third-party agreements such as ground leases and mortgages, upon the loss of liquor licenses, or in the event of the sale or transfer of the hotel. When franchise licenses expire by their terms, we may not be able to obtain replacement franchise licenses.

If a management agreement or franchise license were terminated under certain circumstances (such as the sale of a hotel), we could be liable for liquidated damages (which may be guaranteed by us or certain of our subsidiaries). In addition, we may need to obtain a different franchise and/or engage a different manager, and the costs and disruption associated with those changes could be significant (and materially adverse to the value of the affected hotel) because of the loss of associated name recognition, marketing support and centralized reservation systems provided by the franchise licensor or operations management provided by the manager. Additionally, most of our management agreements restrict our ability to encumber our interests in the applicable hotels under certain circumstances without the managers’ consent, which can make it more difficult to obtain secured financing on acceptable terms.

We are subject to possible adverse effects of management, franchise and license agreement requirements. All of our hotels are operated under existing management, franchise or license agreements with nationally recognized hotel companies. Each agreement requires that the hotel be maintained and operated in accordance with specific standards and restrictions. Compliance with these standards, and changes in these standards, could require us to incur significant expenses or capital expenditures, which could adversely affect our results of operations and ability to pay dividends to our stockholders and service our debt.

Our ownership of hotels through ground leases exposes us to the risk of losing a hotel upon breach of the terms of a ground lease, selling a hotel for a discounted price and not renewing a ground lease. As of December 31, 2016, 10 of our hotels were subject to ground leases. If we default under one or more of our ground leases and are unable to cure the default in a timely manner, we may be liable for damages and could lose our leasehold interest in the applicable property and interest in the hotel on the applicable property. If any events of default occur and are not cured timely, our business could be materially and adversely affected. Our ground leases also generally require the lessor’s consent prior to transferring our interest in the ground lease. These provisions may impact our ability to sell or finance our hotels or our ability to sell the property at a higher price. Furthermore, there is no guaranty that we will be able to extend the terms of our ground leases or purchase the underlying fee interest at the end of the leasehold. Accordingly, we would lose the ability to use the hotel and derive income from it, which could materially and adversely affect us.

The operation and management of our hotels is concentrated. We are subject to the potential risks associated with the concentration of our hotels under a limited number of brands and management companies. A negative public image or other adverse event that becomes associated with a brand or management company could adversely affect hotels operated under that brand or by that management company. If any brands under which we operate hotels or any management company suffer a significant decline in appeal to the traveling public, the revenues and profitability of such hotels could be adversely affected. At December 31, 2016, 18 hotels (comprising 45% of our same-store hotel rooms) were flagged as Embassy Suites, and we derived approximately 44% of our 2016 Hotel EBITDA from those hotels. Furthermore, at December 31, 2016, subsidiaries of Hilton managed 20 of our hotels, and we derived approximately 50% of our 2016 Hotel EBITDA from those hotels.

The increasing use of Internet travel intermediaries by consumers may adversely affect our profitability. Some of our hotel rooms may be booked through Internet travel intermediaries. As these

Internet bookings increase, these intermediaries may be able to obtain higher commissions, reduced room rates or other significant contract concessions from us and our management companies. Moreover, some of these Internet travel intermediaries offer hotel rooms as a putative commodity, by increasing the importance of price and general indicators of quality (such as “three-star downtown hotel”) at the expense of brand identification. These agencies hope that consumers will eventually develop brand loyalties to their reservations system rather than to the brands under which our hotels are franchised. If the number or percentage of sales made through Internet travel intermediaries increases significantly, room revenues may flatten or decrease and our profitability may be adversely affected.

If revenue declines faster than operating expenses, our margins may shrink materially. We are subject to the risks of a decline in Hotel EBITDA margins, which occur when hotel operating expenses increase disproportionately to revenues or fail to shrink at least as fast as revenues decline. These operating expenses and Hotel EBITDA margins are controlled by independent third-party managers over whom we have limited influence.

Our business may be adversely affected by consolidation in the lodging industry. Consolidation among companies in the lodging industry may increase the resulting companies’ negotiating power relative to ours, and decrease competition among those companies for franchisees and management contracts. Consolidation could result in increased franchise or management fees. To the extent that consolidation among hotel brand companies adversely affects the loyalty reward program offered by one or more of our hotels, customer loyalty to those hotels may suffer and demand for guestrooms may decrease. Furthermore, because each hotel brand company relies on its own network of reservation systems, hotel management systems and customer databases, the integration of two or more networks may result in a disruption to operations of these systems, such as disruptions in processing guest reservations, delayed bookings or sales, or lost guest reservations, which could adversely affect our financial condition and results of operations.

We have substantial financial leverage.

At December 31, 2016, our consolidated debt ($1.3 billion) represented approximately 49% of our total enterprise value. Declining revenues and cash flow may adversely affect our public debt ratings and may limit our access to additional debt. Historically, we have incurred debt for acquisitions and to fund our renovation, redevelopment and rebranding programs. If our access to additional debt financing is limited, our ability to fund these programs or acquire hotels in the future could be adversely affected. Also, we can make no assurances that we will be able to refinance any of our debt on a timely basis or on satisfactory terms, if at all.

Financial leverage could have negative consequences. For example, it could:

| |

• | limit our ability to obtain additional financing for working capital, renovation, redevelopment and rebranding plans, acquisitions, debt service requirements and other purposes; |

| |

• | limit our ability to refinance existing debt; |

| |

• | limit our ability to pay dividends, invest in unconsolidated joint ventures, etc.; |

| |

• | require us to agree to additional restrictions and limitations on our business operations and capital structure to obtain financing; |

| |

• | enhance the impact of adverse economic and industry conditions and of interest rate fluctuations; |

| |

• | require us to dedicate a substantial portion of our cash flow from operations to payments on our debt, thereby reducing funds available for capital expenditures, future business opportunities, paying dividends or other purposes; |

| |

• | limit our flexibility to make, or react to, changes in our business and our industry; and |

| |

• | place us at a competitive disadvantage when compared to our competitors that have less leverage. |

Compliance with, or failure to comply with, our financial covenants may adversely affect our financial position and results of operations.

The agreements governing our senior secured notes require that we satisfy total leverage, secured leverage and interest coverage tests in order, among other things, to: (i) incur certain additional indebtedness, except to refinance maturing debt with replacement debt, as defined under our indentures; (ii) pay dividends other than to maintain FelCor’s REIT status; (iii) repurchase FelCor’s capital stock; or (iv) merge. In addition, our 5.625% senior secured notes are secured by a combination of first lien mortgages and related security interests on nine hotels, as well as pledges of equity interests in certain subsidiaries of FelCor LP, and the 6.00% senior unsecured notes require us to maintain a minimum amount of unencumbered assets. These restrictions may adversely affect our ability to finance our operations or engage in other business activities that may be in our best interest.

Various political, economic, social or business risks, uncertainties and events beyond our control could affect our ability to comply with these covenants and financial thresholds. Failure to comply with any of the covenants in our existing or future financing agreements could result in a default under those agreements and under other agreements containing cross-default provisions. A default could permit lenders to accelerate the maturity of obligations under these agreements and to foreclose upon any collateral securing those obligations. Under these circumstances, we might not have sufficient funds or other resources to satisfy all of our obligations. In addition, the limitations imposed by financing agreements on our ability to incur additional debt and to take other actions could significantly impair our ability to obtain other financing. We cannot assure you that we will be granted waivers or amendments if for any reason we are unable to comply with these agreements, or that we will be able to refinance our debt on terms acceptable to us, or at all.

Certain of our subsidiaries have been formed as special purpose entities, or SPEs. These SPEs have incurred mortgage debt secured by the assets of those SPEs, which debt is non-recourse to us, except in connection with certain customary recourse “carve-outs,” including fraud, misapplication of funds, etc., in which case this debt could become fully recourse to us.

Our debt agreements will allow us to incur additional debt that, if incurred, could exacerbate the other risks described herein.

We may incur substantial debt in the future. Although the instruments governing our debt contain restrictions on the incurrence of additional debt, these restrictions are subject to a number of qualifications and exceptions and, under certain circumstances, debt incurred in compliance with these restrictions could be substantial. If we add incremental debt, the leverage-related risks described above would intensify.

Our ability to achieve our long-term objectives is subject to various risks and uncertainties, and we may be unable to execute some or all of those objectives as contemplated, or at all.

Our long-term strategy contemplates: (i) redeveloping hotels in our portfolio, including potentially rebranding and enhancing facilities, to enhance hotel performance and improve returns on our investment; (ii) acquiring additional hotels in our target markets that meet our investment criteria and/or present redevelopment opportunities similar to hotels already in our portfolio; and (iii) recycling capital invested in our portfolio by selling hotels that no longer meet our investment criteria, or are significantly more valuable as single assets than as part of a larger portfolio, and reinvesting the proceeds in hotels that meet or exceed our investment criteria. For example, while we intend to recycle capital invested in hotels that no longer meet our investment criteria, there is no assurance that we will be able to sell such hotels at acceptable prices, or at all, and we can provide no assurance that the capital recycled from selling hotels will, when reinvested, generate targeted returns. Similarly, we can provide no assurance that current and

future redevelopment opportunities will proceed as contemplated, or at all, or whether, if they do proceed, they will be successful and achieve or exceed targeted returns. In addition, while we contemplate acquiring hotels in our target markets, we can provide no assurances that we will successfully identify appropriate acquisition opportunities that meet our investment criteria or that we will be able to act on those opportunities and acquire hotels that will contribute to the long-term growth of our portfolio and deliver incremental stockholder value, or that our assumptions about the benefits of our target markets (growth rates and potential returns, among others) will prove correct. If we are unable to execute our plans, we may be unable to realize the growth underlying our strategy, and our future business operations or financial performance could be adversely affected.

We may be unable to execute our deleveraging strategy successfully if we are unable to sell hotels designated to be sold, or at all, or sell them for satisfactory pricing or if we are unable to grow our cash flow.

Our ability to sell hotels is at least partially dependent on potential buyers obtaining financing. If adequate financing is not available or is only available at undesirable terms, we may be unable to sell hotels or sell them for desired pricing. If we are unable to sell hotels or if we sell them below desired pricing, it could affect our ability to repay and refinance debt and slow the execution of our strategic plan. If we sell a mortgaged hotel for less than its outstanding debt balance, we would be required to use cash to make up the shortfall or substitute an unencumbered hotel as collateral, which would restrict future flexibility when refinancing debt or restrict us from using cash for other purposes. Similarly, if we are unsuccessful in growing the cash flow at our hotels, our deleveraging strategy could be frustrated.

We depend on external sources of capital for future growth, and we may be unable to access capital when necessary.

As a REIT, our ability to finance our growth must largely be funded by external sources of capital because we are required to distribute to our stockholders at least 90% of our taxable income (other than net capital gains) including, in some cases, taxable income we recognize for federal income tax purposes but with regard to which we do not receive corresponding cash. Our ability to obtain the external capital we require could be limited by a number of factors, many of which are outside our control, including general market conditions, unfavorable market perception of our future prospects, lower current and/or estimated future earnings, excessive cash distributions or a lower market price for our common stock.

Our ability to access additional capital also may be limited by the terms of our existing debt, which, under certain circumstances, restrict our incurrence of debt and the payment of distributions. Any of these factors, individually or in combination, could prevent us from being able to obtain the external capital we require on terms that are acceptable to us, or at all. If our future cash flow from operations and external sources of capital are insufficient to pay our obligations as they mature or to fund our liquidity needs, we may be forced to reduce or delay our business activities and capital expenditures, sell assets, obtain additional equity capital or restructure or refinance all or a portion of our debt on or before maturity. Failing to obtain necessary external capital could have a material adverse effect on our ability to finance our future growth. We may have only a limited number of unencumbered hotels and limited resources to raise additional capital or we may have difficulties obtaining consent of an applicable lessor on any of our hotels subject to a ground lease.

Our ability to pay dividends may be limited or prohibited by the terms of our debt or preferred stock.

We are currently party to agreements and instruments that can restrict or prevent the payment of dividends on our common and preferred stock (except, to some degree, as necessary to retain REIT status). Under the agreements governing our senior notes, dividend payments are permitted only to the

extent that, at the time of the distribution, we can satisfy certain financial thresholds (concerning leverage and fixed charges) and meet other requirements. Under the terms of our outstanding preferred stock, we are not permitted to pay dividends on our common stock unless all accrued preferred dividends then payable have been paid. While our preferred dividends are current, if we fail to pay future dividends on our preferred stock for any reason, including to comply with the terms of our senior secured notes, our preferred dividends will accrue, and we will be prohibited from paying any common dividends until all such accrued but unpaid preferred dividends have been paid.

Our business could be negatively affected as a result of actions by activist stockholders.

Stockholder campaigns to effect changes in publicly-traded companies are sometimes led by activist investors through various corporate actions, including proxy contests. Responding to these actions can disrupt our operations by diverting the attention of management and our employees as well as our financial resources. Stockholder activism could create perceived uncertainties as to our future direction, which could result in the loss of potential business opportunities and make it more difficult to attract and retain qualified personnel and business partners. Furthermore, the election of individuals to our Board with a specific agenda could adversely affect our ability to effectively and timely implement our strategic plans.

Departure of key personnel would deprive us of the institutional knowledge, expertise and leadership they provide.

Members of our management team generally possess institutional knowledge about our organization and the hospitality or real estate industries, have significant expertise in their fields and possess leadership skills that are important to our operations. The loss of any of our executives or other long-tenured officers and our inability to find suitable replacements could adversely affect our ability to execute our business strategy.

As a REIT, we are subject to specific tax laws and regulations, the violation of which could subject us to significant tax liabilities.

The federal income tax laws governing REITs are complex. We have operated, and intend to continue to operate, in a manner that enables us to qualify as a REIT under the federal income tax laws. The REIT qualification requirements are extremely complicated, and interpretations of the federal income tax laws governing qualification as a REIT are limited. Accordingly, we cannot be certain that we have been, or will continue to be, successful in operating so as to qualify as a REIT.

The federal income tax laws governing REITs are subject to change. At any time, the federal income tax laws governing REITs or the administrative interpretations of those laws may be amended. These new laws, interpretations or court decisions may change the federal income tax laws relating to, or the federal income tax consequences of, qualification as a REIT. Any of these new laws or interpretations may take effect retroactively and could adversely affect us, or you as a stockholder.

Failure to make required distributions would subject us to tax. Each year, a REIT must pay out to its stockholders at least 90% of its taxable income, other than any net capital gain. To the extent that we satisfy the 90% distribution requirement, but distribute less than 100% of our taxable income, we will be subject to federal corporate income tax on our undistributed taxable income. In addition, we will be subject to a 4% non-deductible tax if the actual amount we pay out to our stockholders in a calendar year is less than the minimum amount specified under federal tax laws. Our only source of funds to make such distributions comes from distributions from FelCor LP. Accordingly, we may be required to borrow

money or sell assets to enable us to pay out enough of our taxable income to satisfy the distribution requirements and to avoid corporate income tax and the 4% tax in a particular year.

Failure to qualify as a REIT would subject us to federal income tax. If we fail to qualify as a REIT in any taxable year for which the statute of limitations remains open we would be subject to federal income tax at regular corporate rates (including any applicable alternative minimum tax) for such taxable year and may not qualify as a REIT for four subsequent years. We might need to borrow money or sell hotels in order to obtain the funds necessary to pay any such tax. If we cease to be a REIT, we no longer would be required to distribute most of our taxable income to our stockholders. Unless our failure to qualify as a REIT was excused under federal income tax laws, we could not re-elect REIT status until the fifth calendar year following the year in which we failed to qualify.

We lack control over the management and operations of our hotels. Because federal income tax laws restrict REITs and their subsidiaries from operating hotels, we do not manage our hotels. Instead, we depend on third-party managers to operate our hotels pursuant to management agreements. As a result, we are unable to directly implement strategic business decisions for the operation and marketing of our hotels, such as setting room rates, establishing salary and benefits provided to hotel employees, conducting food and beverage operations and similar matters. While our taxable REIT subsidiaries monitor the third-party manager’s performance, we have limited specific recourse under our management agreements if we believe the third-party managers are not performing adequately. Failure by our third-party managers to fully perform the duties agreed to in our management agreements could adversely affect our results of operations. In addition, our third-party managers, or their affiliates, manage hotels that compete with our hotels, which may result in conflicts of interest. As a result, our third-party managers may have in the past made, and may in the future make, decisions regarding competing lodging facilities that are not or would not be in our best interests.

Complying with REIT requirements may cause us to forgo attractive opportunities that could otherwise generate strong risk-adjusted returns and instead pursue less attractive opportunities, or none at all.

To continue to qualify as a REIT for federal income tax purposes, we must continually satisfy tests concerning, among other things, the sources of our income, the nature of our assets, the amounts we distribute to our stockholders and the ownership of our stock. Thus, compliance with the REIT requirements may hinder our ability to operate solely on the basis of generating strong risk-adjusted returns on invested capital for our stockholders.

Complying with REIT requirements may force us to liquidate otherwise attractive investments, which could result in an overall loss on our investments.