Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________

FORM 10-Q

_______________________________________

|

| |

ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2017

OR

|

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 1-13881

_________________________________________________

MARRIOTT INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

_______________________________________ |

| | |

Delaware | | 52-2055918 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

| |

10400 Fernwood Road, Bethesda, Maryland (Address of principal executive offices) | | 20817 (Zip Code) |

(301) 380-3000

(Registrant’s telephone number, including area code)

_______________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

Large accelerated filer | | ý | | Accelerated filer | | ¨ |

Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller Reporting Company | | ¨ |

| | | | Emerging growth company | | ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨ |

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 372,420,122 shares of Class A Common Stock, par value $0.01 per share, outstanding at July 25, 2017.

MARRIOTT INTERNATIONAL, INC.

FORM 10-Q TABLE OF CONTENTS

|

| | |

| | Page No. |

| | |

Part I. | | |

| | |

Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Item 2. | | |

| | |

| | |

| | |

Item 3. | | |

| | |

Item 4. | | |

| | |

Part II. | | |

| | |

Item 1. | | |

| | |

Item 1A. | | |

| | |

Item 2. | | |

|

|

|

Item 5. | | |

| | |

Item 6. | | |

| | |

| | |

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

MARRIOTT INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

($ in millions, except per share amounts)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, 2017 |

| June 30, 2016 | | June 30, 2017 | | June 30, 2016 |

REVENUES | | | | | | | |

Base management fees | $ | 285 |

| | $ | 186 |

| | $ | 549 |

| | $ | 358 |

|

Franchise fees | 416 |

| | 273 |

| | 781 |

| | 523 |

|

Incentive management fees | 148 |

| | 94 |

| | 301 |

| | 195 |

|

| 849 |

| | 553 |

| | 1,631 |

| | 1,076 |

|

Owned, leased, and other revenue | 458 |

| | 207 |

| | 897 |

| | 411 |

|

Cost reimbursements | 4,488 |

| | 3,142 |

| | 8,828 |

| | 6,187 |

|

| 5,795 |

| | 3,902 |

| | 11,356 |

| | 7,674 |

|

OPERATING COSTS AND EXPENSES | | | | | | | |

Owned, leased, and other - direct | 355 |

| | 173 |

| | 713 |

| | 339 |

|

Reimbursed costs | 4,488 |

| | 3,142 |

| | 8,828 |

| | 6,187 |

|

Depreciation, amortization, and other | 85 |

| | 30 |

| | 150 |

| | 61 |

|

General, administrative, and other | 226 |

| | 154 |

| | 436 |

| | 309 |

|

Merger-related costs and charges | 21 |

| | 14 |

| | 72 |

| | 22 |

|

| 5,175 |

| | 3,513 |

| | 10,199 |

| | 6,918 |

|

OPERATING INCOME | 620 |

| | 389 |

| | 1,157 |

| | 756 |

|

Gains and other income, net | 25 |

| | — |

| | 25 |

| | — |

|

Interest expense | (73 | ) | | (57 | ) | | (143 | ) | | (104 | ) |

Interest income | 8 |

| | 7 |

| | 15 |

| | 13 |

|

Equity in earnings | 12 |

| | 5 |

| | 23 |

| | 5 |

|

INCOME BEFORE INCOME TAXES | 592 |

| | 344 |

| | 1,077 |

| | 670 |

|

Provision for income taxes | (178 | ) | | (97 | ) | | (298 | ) | | (204 | ) |

NET INCOME | $ | 414 |

| | $ | 247 |

| | $ | 779 |

| | $ | 466 |

|

EARNINGS PER SHARE | | | | | | | |

Earnings per share - basic | $ | 1.09 |

| | $ | 0.97 |

| | $ | 2.04 |

| | $ | 1.83 |

|

Earnings per share - diluted | $ | 1.08 |

| | $ | 0.96 |

| | $ | 2.02 |

| | $ | 1.80 |

|

CASH DIVIDENDS DECLARED PER SHARE | $ | 0.33 |

| | $ | 0.30 |

| | $ | 0.63 |

| | $ | 0.55 |

|

See Notes to Condensed Consolidated Financial Statements.

MARRIOTT INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

($ in millions)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, 2017 | | June 30, 2016 | | June 30, 2017 | | June 30, 2016 |

Net income | $ | 414 |

| | $ | 247 |

| | $ | 779 |

| | $ | 466 |

|

Other comprehensive income (loss): | | | | | | | |

Foreign currency translation adjustments | 162 |

| | 3 |

| | 350 |

| | 25 |

|

Derivative instrument adjustments, net of tax | (6 | ) | | 1 |

| | (8 | ) | | (4 | ) |

Unrealized loss on available-for-sale securities, net of tax | (1 | ) | | (1 | ) | | (2 | ) | | — |

|

Reclassification of losses, net of tax | 1 |

| | 1 |

| | 1 |

| | 2 |

|

Total other comprehensive income, net of tax | 156 |

| | 4 |

| | 341 |

| | 23 |

|

Comprehensive income | $ | 570 |

| | $ | 251 |

| | $ | 1,120 |

| | $ | 489 |

|

See Notes to Condensed Consolidated Financial Statements.

MARRIOTT INTERNATIONAL, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

($ in millions)

|

| | | | | | | |

| (Unaudited) | | |

| June 30,

2017 | | December 31,

2016 |

ASSETS | | | |

Current assets | | | |

Cash and equivalents | $ | 498 |

| | $ | 858 |

|

Accounts and notes receivable, net | 1,804 |

| | 1,695 |

|

Prepaid expenses and other | 243 |

| | 230 |

|

Assets held for sale | 285 |

| | 588 |

|

| 2,830 |

| | 3,371 |

|

Property and equipment, net | 2,102 |

| | 2,335 |

|

Intangible assets | | | |

Brands | 5,906 |

| | 6,509 |

|

Contract acquisition costs and other | 2,863 |

| | 2,761 |

|

Goodwill | 8,582 |

| | 7,598 |

|

| 17,351 |

| | 16,868 |

|

Equity and cost method investments | 762 |

| | 728 |

|

Notes receivable, net | 275 |

| | 245 |

|

Deferred tax assets | 119 |

| | 116 |

|

Other noncurrent assets | 442 |

| | 477 |

|

| $ | 23,881 |

| | $ | 24,140 |

|

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

Current liabilities | | | |

Current portion of long-term debt | $ | 402 |

| | $ | 309 |

|

Accounts payable | 650 |

| | 687 |

|

Accrued payroll and benefits | 1,054 |

| | 1,174 |

|

Liability for guest loyalty programs | 1,948 |

| | 1,866 |

|

Accrued expenses and other | 1,309 |

| | 1,111 |

|

| 5,363 |

| | 5,147 |

|

Long-term debt | 7,911 |

| | 8,197 |

|

Liability for guest loyalty programs | 2,801 |

| | 2,675 |

|

Deferred tax liabilities | 994 |

| | 1,020 |

|

Other noncurrent liabilities | 1,911 |

| | 1,744 |

|

Shareholders’ equity | | | |

Class A Common Stock | 5 |

| | 5 |

|

Additional paid-in-capital | 5,712 |

| | 5,808 |

|

Retained earnings | 7,040 |

| | 6,501 |

|

Treasury stock, at cost | (7,700 | ) | | (6,460 | ) |

Accumulated other comprehensive loss | (156 | ) | | (497 | ) |

| 4,901 |

| | 5,357 |

|

| $ | 23,881 |

| | $ | 24,140 |

|

See Notes to Condensed Consolidated Financial Statements.

MARRIOTT INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

($ in millions)

(Unaudited)

|

| | | | | | | |

| Six Months Ended |

| June 30, 2017 | | June 30, 2016 |

OPERATING ACTIVITIES | | | |

Net income | $ | 779 |

| | $ | 466 |

|

Adjustments to reconcile to cash provided by operating activities: | | | |

Depreciation, amortization, and other | 150 |

| | 61 |

|

Share-based compensation | 95 |

| | 59 |

|

Income taxes | 96 |

| | 61 |

|

Liability for guest loyalty programs | 204 |

| | 131 |

|

Merger-related charges | (98 | ) | | — |

|

Working capital changes | (6 | ) | | 19 |

|

Other | 82 |

| | 65 |

|

Net cash provided by operating activities | 1,302 |

| | 862 |

|

INVESTING ACTIVITIES | | | |

Capital expenditures | (104 | ) | | (78 | ) |

Dispositions | 482 |

| | 53 |

|

Loan advances | (48 | ) | | (24 | ) |

Loan collections | 10 |

| | 2 |

|

Contract acquisition costs | (91 | ) | | (37 | ) |

Other | (16 | ) | | 12 |

|

Net cash provided by (used in) investing activities | 233 |

| | (72 | ) |

FINANCING ACTIVITIES | | | |

Commercial paper/Credit facility, net | 105 |

| | (941 | ) |

Issuance of long-term debt | 1 |

| | 1,483 |

|

Repayment of long-term debt | (301 | ) | | (294 | ) |

Issuance of Class A Common Stock | 3 |

| | 16 |

|

Dividends paid | (240 | ) | | (140 | ) |

Purchase of treasury stock | (1,328 | ) | | (249 | ) |

Other | (135 | ) | | (82 | ) |

Net cash used in financing activities | (1,895 | ) | | (207 | ) |

(DECREASE) INCREASE IN CASH AND EQUIVALENTS | (360 | ) | | 583 |

|

CASH AND EQUIVALENTS, beginning of period | 858 |

| | 96 |

|

CASH AND EQUIVALENTS, end of period | $ | 498 |

| | $ | 679 |

|

See Notes to Condensed Consolidated Financial Statements.

MARRIOTT INTERNATIONAL, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. BASIS OF PRESENTATION

The condensed consolidated financial statements present the results of operations, financial position, and cash flows of Marriott International, Inc. and subsidiaries (referred to in this report as “we,” “us,” “Marriott,” or “the Company”). In order to make this report easier to read, we also refer throughout to (i) our Condensed Consolidated Financial Statements as our “Financial Statements,” (ii) our Condensed Consolidated Statements of Income as our “Income Statements,” (iii) our Condensed Consolidated Balance Sheets as our “Balance Sheets,” (iv) our Condensed Consolidated Statements of Cash Flows as our “Statements of Cash Flows,” (v) our properties, brands, or markets in the United States (“U.S.”) and Canada as “North America” or “North American,” and (vi) our properties, brands, or markets outside of the U.S. and Canada as “International.” In addition, references throughout to numbered “Footnotes” refer to the numbered Notes in these Notes to Condensed Consolidated Financial Statements, unless otherwise noted.

These Financial Statements have not been audited. We have condensed or omitted certain information and footnote disclosures normally included in financial statements presented in accordance with U.S. generally accepted accounting principles (“GAAP”). The financial statements in this report should be read in conjunction with the consolidated financial statements and notes thereto in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016 (“2016 Form 10-K”). Certain terms not otherwise defined in this Form 10-Q have the meanings specified in our 2016 Form 10-K.

Preparation of financial statements that conform with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities as of the date of the financial statements, the reported amounts of revenues and expenses during the reporting periods, and the disclosures of contingent liabilities. Accordingly, ultimate results could differ from those estimates.

The accompanying Financial Statements reflect all normal and recurring adjustments necessary to present fairly our financial position as of June 30, 2017 and December 31, 2016, the results of our operations for the three and six months ended June 30, 2017 and June 30, 2016, and cash flows for the six months ended June 30, 2017 and June 30, 2016. Interim results may not be indicative of fiscal year performance because of seasonal and short-term variations. We have eliminated all material intercompany transactions and balances between entities consolidated in these Financial Statements. We have made certain reclassifications of our prior year amounts to conform to our current presentation of “Merger-related costs and charges” in our Income Statements.

Beginning in the 2017 first quarter, we reclassified branding fees for third-party residential sales and credit card licensing to the “Franchise fees” caption from the “Owned, leased, and other revenue” caption on our Income Statements, as we believe branding fees are more akin to franchise royalties than owned and leased hotel profits. Branding fees totaled $67 million for the three months ended June 30, 2017 and $127 million for the six months ended June 30, 2017. We reclassified the prior period amounts, which totaled $38 million for the three months ended June 30, 2016 and $81 million for the six months ended June 30, 2016, to conform to our current presentation.

In the 2017 first quarter, our Asia Pacific operating segment met the applicable accounting criteria to be a reportable segment. Our Europe, Middle East and Africa, and Caribbean and Latin America operating segments do not individually meet the criteria for separate disclosure as reportable segments, and accordingly we combined them into an “all other category” which we refer to as “Other International.” We reclassified prior period amounts to conform to our current presentation. See Footnote 11 “Business Segments.”

Acquisition of Starwood Hotels & Resorts Worldwide

On September 23, 2016 (the “Merger Date”), we completed the acquisition of Starwood Hotels & Resorts Worldwide, LLC, formerly known as Starwood Hotels & Resorts Worldwide, Inc. (“Starwood”), through a series of transactions (the “Starwood Combination”), after which Starwood became an indirect wholly-owned subsidiary of

the Company. Accordingly, our Income Statements include Starwood’s results of operations in the three and six months ended June 30, 2017, but exclude Starwood’s results of operations in the three and six months ended June 30, 2016 as these periods were prior to the Merger Date. We refer to our business associated with brands that were in our portfolio before the Starwood Combination as “Legacy-Marriott” and to the Starwood business and brands that we acquired as “Legacy-Starwood.” See Footnote 2 “Acquisitions and Dispositions” for more information on the Starwood Combination.

New Accounting Standards

Accounting Standards Update No. 2014-09 - “Revenue from Contracts with Customers” (“ASU 2014-09”)

ASU 2014-09 supersedes the revenue recognition requirements in Topic 605, Revenue Recognition, as well as most industry-specific guidance, and significantly enhances comparability of revenue recognition practices across entities and industries by providing a principles-based, comprehensive framework for addressing revenue recognition issues. In order for a provider of promised goods or services to recognize as revenue the consideration that it expects to receive in exchange for the promised goods or services, the provider should apply the following five steps: (1) identify the contract with a customer(s); (2) identify the performance obligations in the contract; (3) determine the transaction price; (4) allocate the transaction price to the performance obligations in the contract; and (5) recognize revenue when (or as) the entity satisfies a performance obligation. ASU 2014-09 also specifies the accounting for some costs to obtain or fulfill a contract with a customer and provides enhanced disclosure requirements. The Financial Accounting Standards Board (“FASB”) has deferred ASU 2014-09 for one year, and with that deferral, the standard will be effective for annual reporting periods beginning after December 15, 2017, including interim periods within that reporting period, which for us will be our 2018 first quarter. We are permitted to use either the retrospective or the modified retrospective method when adopting ASU 2014-09, and we are evaluating the available adoption methods. We are still assessing the potential impact that ASU 2014-09 will have on our financial statements and disclosures, but we believe that recognition of base management fees, franchise royalty fees, and owned and leased revenues will remain unchanged. We expect to recognize gains from the sale of real estate assets when control of the asset is transferred to the buyer, generally at the time the sale closes. Under current guidance, we defer gains on sales of real estate assets if we maintain substantial continuing involvement. We do not expect that this change will have a material impact on our Financial Statements, as we typically do not have transactions that require us to defer significant gains. There likely will be changes to our revenue recognition policies related to our loyalty programs and the following:

| |

• | We expect to recognize franchise application and relicensing fees over the term of the franchise contract rather than at hotel opening. |

| |

• | We expect to present the amortization of contract acquisition costs paid to customers as a reduction of revenue rather than as an amortization expense. |

| |

• | We expect to recognize incentive management fees throughout the year to the extent that we determine that it is probable that a significant reversal will not occur as a result of future hotel profits or cash flows. This may result in a different pattern of recognition for incentive management fees from quarter to quarter than under the current guidance, but we do not expect a material impact on the total incentive management fees we will recognize during the full fiscal year. |

Accounting Standards Update No. 2016-02 - “Leases” (“ASU 2016-02”)

In February 2016, the FASB issued ASU 2016-02, which introduces a lessee model that brings substantially all leases onto the balance sheet. Under the new standard, a lessee will recognize on its balance sheet a lease liability and a right-of-use asset for all leases, including operating leases, with a term greater than 12 months. The new standard will also distinguish leases as either finance leases or operating leases. This distinction will affect how leases are measured and presented in the income statement and statement of cash flows. ASU 2016-02 is effective for annual and interim periods in fiscal years beginning after December 15, 2018, which for us will be our 2019 first quarter. We are still assessing the potential impact that ASU 2016-02 will have on our financial statements and disclosures.

Accounting Standards Update No. 2016-09 - “Stock Compensation” (“ASU 2016-09”)

We adopted ASU 2016-09 in the 2017 first quarter, which involves several aspects of the accounting for share-based payments. The new guidance had the following impacts on our Financial Statements:

| |

• | We now record excess tax benefits (or deficiencies) as income tax benefit (or expense) in our Income Statements. Previously, we recorded excess tax benefits (deficiencies) in additional paid-in-capital in our Balance Sheets. As required, we prospectively applied this amendment in our Income Statements, which resulted in a benefit of $56 million to our provision for income taxes, approximately $0.15 per diluted share, for the six months ended June 30, 2017. |

| |

• | We now classify excess tax benefits (or deficiencies) along with other income taxes in operating activities in our Statements of Cash Flows. ASU 2016-09 allowed for this amendment to be applied either prospectively or retrospectively. For consistency with our application of ASU 2016-09 in our Income Statements, we applied this amendment prospectively in our Statements of Cash Flows. For the six months ended June 30, 2017, operating activities in our Statements of Cash Flows include $56 million from excess tax benefits. For the six months ended June 30, 2016, we classified $16 million of excess tax benefits as financing inflows. |

| |

• | We now classify cash paid to taxing authorities when we withhold shares for employee tax-withholding purposes as a financing activity. As required, we retrospectively applied this amendment in our Statements of Cash Flows, and accordingly we reclassified $64 million of cash outflows from operating activities to financing activities for the six months ended June 30, 2016. |

Accounting Standards Update No. 2017-01 - “Clarifying the Definition of a Business” (“ASU 2017-01”)

We prospectively adopted ASU 2017-01 in the 2017 first quarter, which clarifies the definition of a business to help companies evaluate whether transactions should be accounted for as acquisitions or disposals of assets or businesses. We expect that under this new guidance, our hotel sales will generally qualify as asset disposals, with the result that no goodwill of the reporting unit will be assigned to the carrying value of the asset when calculating the gain or loss on sale.

2. ACQUISITIONS AND DISPOSITIONS

Starwood Combination

The following table presents the fair value of each class of consideration that we transferred in the Starwood Combination.

|

| | | |

(in millions, except per share amounts) | |

Equivalent shares of Marriott common stock issued in exchange for Starwood outstanding shares | 134.4 |

|

Marriott common stock price as of Merger Date | $ | 68.44 |

|

Fair value of Marriott common stock issued in exchange for Starwood outstanding shares | 9,198 |

|

Cash consideration to Starwood shareholders, net of cash acquired of $1,116 | 2,412 |

|

Fair value of Marriott equity-based awards issued in exchange for vested Starwood equity-based awards | 71 |

|

Total consideration transferred, net of cash acquired | $ | 11,681 |

|

Preliminary Fair Values of Assets Acquired and Liabilities Assumed. Our preliminary estimates of fair values of the assets that we acquired and the liabilities that we assumed are based on the information that was available as of the Merger Date, and we are continuing to evaluate the underlying inputs and assumptions used in our valuations. Accordingly, these preliminary estimates are subject to change during the measurement period, which is up to one year from the Merger Date. During the 2017 first half, we refined our valuation models related to certain acquired IT systems, our assumptions for capital expenditure needs of owned and leased hotels, certain assumptions related to operating lease agreements, and our assumptions related to certain brands and management and franchise agreements, including contract terms, tax rates, and royalty rates used in the relief-from-royalty valuation models.

The following table presents our preliminary estimates of fair values of the assets that we acquired and the liabilities that we assumed on the Merger Date as previously reported at year-end 2016 and at the end of the 2017 second quarter.

|

| | | | | | | | | | | |

($ in millions) | September 23, 2016

(as reported at December 31, 2016) | | Adjustments | | September 23, 2016

(as adjusted at June 30, 2017) |

Working capital | $ | (180 | ) | | $ | (27 | ) | | $ | (207 | ) |

Property and equipment, including assets held for sale | 1,999 |

| | (79 | ) | | 1,920 |

|

Identified intangible assets | 7,957 |

| | (659 | ) | | 7,298 |

|

Equity and cost method investments | 579 |

| | (6 | ) | | 573 |

|

Other noncurrent assets | 224 |

| | (24 | ) | | 200 |

|

Deferred income taxes, net | (1,516 | ) | | (8 | ) | | (1,524 | ) |

Guest loyalty program | (1,631 | ) | | (7 | ) | | (1,638 | ) |

Debt | (1,871 | ) | | — |

| | (1,871 | ) |

Other noncurrent liabilities | (654 | ) | | (60 | ) | | (714 | ) |

Net assets acquired | 4,907 |

| | (870 | ) | | 4,037 |

|

Goodwill (1) | 6,774 |

| | 870 |

| | 7,644 |

|

| $ | 11,681 |

| | $ | — |

| | $ | 11,681 |

|

| |

(1) | Goodwill primarily represents the value that we expect to obtain from synergies and growth opportunities from our combined operations, and it is not deductible for tax purposes. See Footnote 11 “Business Segments” for our preliminary assignment of goodwill by reportable segment. |

Property and Equipment. We provisionally estimated the value of the acquired land, building, and furniture and equipment using a combination of the income, cost, and market approaches, which are primarily based on significant Level 2 and Level 3 assumptions, such as estimates of future income growth, capitalization rates, discount rates, and capital expenditure needs of the hotels. We are continuing to assess the marketplace assumptions and property conditions, which could result in changes to these provisional values.

Identified Intangible Assets. The following table presents our preliminary estimates of the fair values of Starwood’s identified intangible assets and their related estimated useful lives.

|

| | | | | | |

| | Estimated Fair Value ($ in millions) | | Estimated Useful Life (in years) |

Brands | | $ | 5,712 |

| | indefinite |

Management agreements and lease contract intangibles | | 754 |

| | 10 - 25 |

Franchise agreements | | 755 |

| | 10 - 80 |

Loyalty program marketing rights | | 77 |

| | 30 |

| | $ | 7,298 |

| | |

We provisionally estimated the value of Starwood’s brands using the relief-from-royalty method, which applies an estimated royalty rate to forecasted future cash flows, discounted to present value. We estimated the value of management and franchise agreements using the multi-period excess earnings method, which is a variation of the income approach. This method estimates an intangible asset’s value based on the present value of the incremental after-tax cash flows attributable to the intangible asset. We valued the lease contract intangibles using an income approach. These valuation approaches utilize Level 3 inputs, and we continue to review Starwood’s contracts and historical performance in addition to evaluating the inputs, including the discount rates, growth assumptions, and contract terms, which could result in changes to these provisional values.

Equity Method Investments. Our equity method investments consist primarily of partnership and joint venture interests in entities that own hotel real estate. We provisionally estimated the value of the underlying real estate using the same methods as for property and equipment described above. We continue to review the terms of the partnership and joint venture agreements, assess the conditions of the properties, and evaluate the discount rates, any discounts for lack of marketability and control as appropriate, and growth assumptions used in valuing these investments, which could result in changes to our provisional values.

Deferred Income Taxes. We provisionally estimated deferred income taxes based on statutory tax rates in the jurisdictions of the legal entities where the acquired noncurrent assets and liabilities are taxed. We continue to assess the tax rates used, and we will continue to update our estimate of deferred income taxes based on any changes to our provisional valuations of the related assets and liabilities and refinement of the relevant tax rates, which could result in changes to these provisional values.

Guest Loyalty Program. As of the Merger Date, we assumed the fair value of this liability equals Starwood’s historical book value in establishing a provisional estimate for this liability. We are reviewing assumptions utilized in an actuarial valuation of the future redemption obligations, which could result in changes to the provisional value of the program liability.

Debt, Leases, and Other Contractual Obligations or Contingencies. We primarily valued debt using quoted market prices, which are considered Level 1 inputs as they are observable in the market.

We identified certain unfavorable provisions within a few of the acquired management and other agreements. We valued liabilities associated with these provisions using an income approach and Level 3 inputs, including cash flows, discount rates, and growth assumptions. In the 2017 second quarter, we settled with the owner of several North American Full-Service properties to resolve certain of these unfavorable provisions. The settlement includes a contingent purchase obligation, granting the owner a one-time right, exercisable in 2022, to require us to purchase the Sheraton Grand Chicago hotel for $300 million, and a guarantee to provide operating support up to a maximum funding amount of $65 million. We continue to review and evaluate Starwood’s agreements, historical hotel operating performance, capitalization rates, discount rates, and growth assumptions, which could result in further changes to these provisional values.

In connection with the Starwood Combination, we are currently assessing various regulatory compliance matters at several foreign Legacy-Starwood locations, including compliance with the U.S. Foreign Corrupt Practices Act. The results of this assessment may give rise to contingencies that could require us to record balance sheet liabilities or accrue expenses. While any such amounts are not currently estimable, we will review our provisional assessment of these contingencies as we gather more information.

Dispositions and Planned Dispositions

In the 2017 second quarter, we sold a North American Full-Service hotel and received $169 million in cash. We recognized a $24 million gain in the “Gains and other income, net” caption of our Income Statements.

In the 2017 first quarter, we sold a North American Full-Service hotel, which we had acquired in the Starwood Combination and previously classified as “Assets held for sale,” and received $306 million in cash. In conjunction with the sale, we also transferred the associated ground lease, as a result of which our future minimum operating lease obligations decreased by approximately $194 million as of the date of the sale as follows: $3 million in 2017, $4 million in 2018, $4 million in 2019, $4 million in 2020, $4 million in 2021, and $175 million thereafter.

At the end of the 2017 second quarter, we held $285 million of assets classified as “Assets held for sale” on our Balance Sheets related to a North American Full-Service hotel acquired in the Starwood Combination and the remaining Miami Beach EDITION residences.

3. MERGER-RELATED COSTS AND CHARGES

The following table presents pre-tax merger-related costs and other charges that we incurred in connection with the Starwood Combination.

|

| | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

($ in millions) | June 30, 2017 | | June 30, 2016 | | June 30, 2017 | | June 30, 2016 |

Merger-related costs and charges | | | | | | | |

Transaction costs | $ | 3 |

| | $ | 6 |

| | $ | 10 |

| | $ | 13 |

|

Employee termination costs | (9 | ) | | — |

| | 12 |

| | — |

|

Integration costs | 27 |

| | 8 |

| | 50 |

| | 9 |

|

| 21 |

| | 14 |

| | 72 |

| | 22 |

|

Interest expense | — |

| | 11 |

| | — |

| | 13 |

|

| $ | 21 |

| | $ | 25 |

| | $ | 72 |

| | $ | 35 |

|

Transaction costs represent costs related to the planning and execution of the Starwood Combination, primarily for financial advisory, legal, and other professional service fees. Employee termination costs represent charges, or adjustments to prior period charges, for employee severance, retention, and other termination related benefits. Integration costs primarily represent integration employee salaries and share-based compensation, change management consultants, and technology-related costs. Merger-related interest expense in the 2016 first half reflects costs that we incurred for a bridge term loan facility commitment related to the Starwood Combination.

In connection with the Starwood Combination, we initiated a restructuring program to achieve cost synergies from our combined operations. We did not allocate costs associated with our restructuring program to any of our business segments. The following table presents our restructuring reserve activity during the 2017 first half:

|

| | | |

($ in millions) | Employee termination costs |

Balance at year-end 2016 | $ | 192 |

|

Charges | — |

|

Cash payments | (91 | ) |

Adjustments (1) | (4 | ) |

Balance at June 30, 2017, classified in “Accrued expenses and other” | $ | 97 |

|

| |

(1) | Adjustments primarily reflect the reversal of accruals for certain employees who accepted other positions at the Company or resigned and the impact of cumulative translation adjustments. |

4. EARNINGS PER SHARE

The table below presents the reconciliation of the earnings and number of shares used in our calculations of basic and diluted earnings per share:

|

| | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

(in millions, except per share amounts) | June 30, 2017 | | June 30, 2016 | | June 30, 2017 | | June 30, 2016 |

Computation of Basic Earnings Per Share | | | | | | | |

Net income | $ | 414 |

| | $ | 247 |

| | $ | 779 |

| | $ | 466 |

|

Shares for basic earnings per share | 378.5 |

| | 254.3 |

| | 381.7 |

| | 254.3 |

|

Basic earnings per share | $ | 1.09 |

| | $ | 0.97 |

| | $ | 2.04 |

| | $ | 1.83 |

|

Computation of Diluted Earnings Per Share | | | | | | | |

Net income | $ | 414 |

| | $ | 247 |

| | $ | 779 |

| | $ | 466 |

|

Shares for basic earnings per share | 378.5 |

| | 254.3 |

| | 381.7 |

| | 254.3 |

|

Effect of dilutive securities | | | | | | | |

Share-based compensation | 4.5 |

| | 3.7 |

| | 4.8 |

| | 4.4 |

|

Shares for diluted earnings per share | 383.0 |

| | 258.0 |

| | 386.5 |

| | 258.7 |

|

Diluted earnings per share | $ | 1.08 |

| | $ | 0.96 |

| | $ | 2.02 |

| | $ | 1.80 |

|

5. SHARE-BASED COMPENSATION

We recorded share-based compensation expense of $47 million in the 2017 second quarter and $31 million in the 2016 second quarter, $95 million for the 2017 first half, and $59 million for the 2016 first half. Deferred compensation costs for unvested awards totaled $254 million at June 30, 2017 and $192 million at December 31, 2016.

RSUs and PSUs

We granted 1.7 million RSUs during the 2017 first half to certain officers, key employees, and non-employee directors, and those units vest generally over four years in equal annual installments commencing one year after the grant date. We granted 0.2 million PSUs in the 2017 first half to certain executive officers, subject to continued employment and the satisfaction of certain performance conditions based on achievement of pre-established targets for Adjusted EBITDA, RevPAR Index, room openings, and/or net administrative expense over, or at the end of, a three-year performance period. RSUs, including PSUs, granted in the 2017 first half had a weighted average grant-date fair value of $84.

SARs

We granted 0.3 million SARs to officers and key employees during the 2017 first half. These SARs generally expire ten years after the grant date and both vest and may be exercised in four equal annual installments commencing one year following the grant date. The weighted average grant-date fair value of SARs granted in the 2017 first half was $30, and the weighted average exercise price was $88.

We used the following assumptions as part of a binomial lattice-based valuation model to estimate the fair value of the SARs we granted during the 2017 first half:

|

| | |

Expected volatility | 30.9 | % |

Dividend yield | 1.3 | % |

Risk-free rate | 2.4 | % |

Expected term (in years) | 8 |

|

6. INCOME TAXES

Our effective tax rate increased to 30.0% for the 2017 second quarter from 28.3% for the 2016 second quarter primarily due to an increase in taxable income at a higher tax rate as a result of the Starwood Combination, an unfavorable comparison to the 2016 release of a valuation allowance, and the gain on the sale of a North American Full-Service hotel. The increase was partially offset by a tax benefit of $13 million from the adoption of ASU 2016-09 and the release of a tax reserve of $12 million due to the favorable settlement of an uncertain tax position.

Our effective tax rate decreased to 27.6% for the 2017 first half from 30.5% for the 2016 first half, primarily due to a tax benefit of $56 million from the adoption of ASU 2016-09 and the release of a tax reserve of $12 million due to the favorable settlement of an uncertain tax position. The decrease was partially offset by a tax provision of $20 million related to an increase in taxable income at a higher tax rate as a result of the Starwood Combination, $15 million from an unfavorable comparison to the 2016 release of a valuation allowance, and $9 million from the gain on the sale of a North American Full-Service hotel.

We paid cash for income taxes, net of refunds, of $201 million in the 2017 first half and $128 million in the 2016 first half.

7. COMMITMENTS AND CONTINGENCIES

Guarantees

We present the maximum potential amount of our future guarantee fundings and the carrying amount of our liability for guarantees for which we are the primary obligor at June 30, 2017 in the following table:

|

| | | | | | | | |

($ in millions) Guarantee Type | | Maximum Potential Amount of Future Fundings | | Recorded Liability for Guarantees |

Debt service | | $ | 149 |

| | $ | 27 |

|

Operating profit | | 106 |

| | 31 |

|

Other | | 8 |

| | 1 |

|

Total guarantees where we are the primary obligor | | $ | 263 |

| | $ | 59 |

|

See the “Debt, Leases, and Other Contractual Obligations or Contingencies” caption of Footnote 2 “Acquisitions and Dispositions” for a description of additional guarantees relating to the Starwood Combination.

Legal Proceedings

In November 2015, Starwood announced a malware intrusion had affected point of sale systems at various outlets within certain Legacy-Starwood branded hotels. This resulted in the potential compromise of credit card data and associated personal information. MasterCard imposed penalties as a result of the breach. Visa has not yet done so, but this may be under consideration. We do not expect the penalties to have a material impact on our consolidated results of operations. In addition, a putative class action arising from the malware intrusion was filed against Starwood on January 5, 2016 in the United States District Court for the Southern District of California. The named plaintiff, Paul Dugas, did not specify any damages. On June 28, 2017, the Court dismissed the case in its entirety. Plaintiffs have informed us that they are not going to pursue the case further.

On May 10, 2016, the owners of the Sheraton Grand Chicago and the Westin Times Square, New York, filed suit in the Supreme Court of New York against Starwood and Marriott seeking to enjoin the merger of the two companies. The complaint alleged violations of the territorial restrictions contained in the management agreements for those two hotels arising as a result of the merger of Marriott and Starwood. Several attempts at enjoining the merger failed and the case continued as a breach of contract claim. The parties ultimately commenced settlement discussions, and the case was settled and dismissed in early June 2017.

Other Contingencies

See a description of certain contingencies relating to the Starwood Combination in Footnote 2 “Acquisitions and Dispositions.”

8. LONG-TERM DEBT

We provide detail on our long-term debt balances, net of discounts, premiums, and debt issuance costs, in the following table at the end of the 2017 second quarter and year-end 2016:

|

| | | | | | | |

| At Period End |

($ in millions) | June 30, 2017 | | December 31, 2016 |

Senior Notes: | | | |

Series I Notes, interest rate of 6.4%, face amount of $293, matured June 15, 2017

(effective interest rate of 6.5%) | $ | — |

| | $ | 293 |

|

Series K Notes, interest rate of 3.0%, face amount of $600, maturing March 1, 2019

(effective interest rate of 4.4%) | 597 |

| | 597 |

|

Series L Notes, interest rate of 3.3%, face amount of $350, maturing September 15, 2022

(effective interest rate of 3.4%) | 348 |

| | 348 |

|

Series M Notes, interest rate of 3.4%, face amount of $350, maturing October 15, 2020

(effective interest rate of 3.6%) | 347 |

| | 347 |

|

Series N Notes, interest rate of 3.1%, face amount of $400, maturing October 15, 2021

(effective interest rate of 3.4%) | 396 |

| | 396 |

|

Series O Notes, interest rate of 2.9%, face amount of $450, maturing March 1, 2021

(effective interest rate of 3.1%) | 447 |

| | 446 |

|

Series P Notes, interest rate of 3.8%, face amount of $350, maturing October 1, 2025

(effective interest rate of 4.0%) | 344 |

| | 344 |

|

Series Q Notes, interest rate of 2.3%, face amount of $750, maturing January 15, 2022

(effective interest rate of 2.5%) | 743 |

| | 742 |

|

Series R Notes, interest rate of 3.1%, face amount of $750, maturing June 15, 2026

(effective interest rate of 3.3%) | 742 |

| | 742 |

|

Series S Notes, interest rate of 6.8%, face amount of $324, maturing May 15, 2018

(effective interest rate of 1.7%) | 338 |

| | 346 |

|

Series T Notes, interest rate of 7.2%, face amount of $181, maturing December 1, 2019

(effective interest rate of 2.3%) | 201 |

| | 206 |

|

Series U Notes, interest rate of 3.1%, face amount of $291, maturing February 15, 2023

(effective interest rate of 3.1%) | 291 |

| | 291 |

|

Series V Notes, interest rate of 3.8%, face amount of $318, maturing March 15, 2025

(effective interest rate of 2.8%) | 339 |

| | 340 |

|

Series W Notes, interest rate of 4.5%, face amount of $278, maturing October 1, 2034

(effective interest rate of 4.1%) | 293 |

| | 293 |

|

Commercial paper | 2,431 |

| | 2,311 |

|

Credit Facility | — |

| | — |

|

Capital lease obligations | 173 |

| | 173 |

|

Other | 283 |

| | 291 |

|

| 8,313 |

| | 8,506 |

|

Less: Current portion of long-term debt | (402 | ) | | (309 | ) |

| $ | 7,911 |

| | $ | 8,197 |

|

We paid cash for interest, net of amounts capitalized, of $123 million in the 2017 first half and $65 million in the 2016 first half.

We are party to a multicurrency revolving credit agreement (the “Credit Facility”) that provides for up to $4,000 million of aggregate effective borrowings. See the “Cash Requirements and Our Credit Facility” caption later in this report in the “Liquidity and Capital Resources” section for further information on our Credit Facility and available borrowing capacity at June 30, 2017.

9. FAIR VALUE OF FINANCIAL INSTRUMENTS

We believe that the fair values of our current assets and current liabilities approximate their reported carrying amounts. We present the carrying values and the fair values of noncurrent financial assets and liabilities that qualify as financial instruments, determined under current guidance for disclosures on the fair value of financial instruments, in the following table:

|

| | | | | | | | | | | | | | | |

| June 30, 2017 | | December 31, 2016 |

($ in millions) | Carrying Amount | | Fair Value | | Carrying Amount | | Fair Value |

Senior, mezzanine, and other loans | $ | 275 |

| | $ | 260 |

| | $ | 245 |

| | $ | 231 |

|

Total noncurrent financial assets | $ | 275 |

| | $ | 260 |

| | $ | 245 |

| | $ | 231 |

|

| | | | | | | |

Senior Notes | $ | (5,088 | ) | | $ | (5,155 | ) | | $ | (5,438 | ) | | $ | (5,394 | ) |

Commercial paper | (2,431 | ) | | (2,431 | ) | | (2,311 | ) | | (2,311 | ) |

Other long-term debt | (224 | ) | | (227 | ) | | (280 | ) | | (284 | ) |

Total noncurrent financial liabilities | $ | (7,743 | ) | | $ | (7,813 | ) | | $ | (8,029 | ) | | $ | (7,989 | ) |

See the “Fair Value Measurements” caption of Footnote 2 “Summary of Significant Accounting Policies” of our 2016 Form 10-K for more information on the input levels we use in determining fair value.

10. OTHER COMPREHENSIVE (LOSS) INCOME AND SHAREHOLDERS' EQUITY

The following tables detail the accumulated other comprehensive (loss) income activity for the 2017 first half and 2016 first half:

|

| | | | | | | | | | | | | | | | | | | |

($ in millions) | Foreign Currency Translation Adjustments | | Derivative Instrument Adjustments | | Available-For-Sale Securities Unrealized Adjustments | | Pension and Postretirement Adjustments | | Accumulated Other Comprehensive Loss |

Balance at year-end 2016 | $ | (503 | ) | | $ | (5 | ) | | $ | 6 |

| | $ | 5 |

| | $ | (497 | ) |

Other comprehensive income (loss) before reclassifications (1) | 350 |

| | (8 | ) | | (2 | ) | | — |

| | 340 |

|

Amounts reclassified from accumulated other comprehensive loss | — |

| | 1 |

| | — |

| | — |

| | 1 |

|

Net other comprehensive income (loss) | 350 |

| | (7 | ) | | (2 | ) | | — |

| | 341 |

|

Balance at June 30, 2017 | $ | (153 | ) | | $ | (12 | ) | | $ | 4 |

| | $ | 5 |

| | $ | (156 | ) |

|

| | | | | | | | | | | | | | | | | | | |

($ in millions) | Foreign Currency Translation Adjustments | | Derivative Instrument Adjustments | | Available-For-Sale Securities Unrealized Adjustments | | Pension and Postretirement Adjustments | | Accumulated Other Comprehensive Loss |

Balance at year-end 2015 | $ | (192 | ) | | $ | (8 | ) | | $ | 4 |

| | $ | — |

| | $ | (196 | ) |

Other comprehensive income (loss) before reclassifications (1) | 25 |

| | (4 | ) | | — |

| | — |

| | 21 |

|

Amounts reclassified from accumulated other comprehensive loss | — |

| | 2 |

| | — |

| | — |

| | 2 |

|

Net other comprehensive income (loss) | 25 |

| | (2 | ) | | — |

| | — |

| | 23 |

|

Balance at June 30, 2016 | $ | (167 | ) | | $ | (10 | ) | | $ | 4 |

| | $ | — |

| | $ | (173 | ) |

| |

(1) | Other comprehensive income before reclassifications for foreign currency translation adjustments includes losses on intra-entity foreign currency transactions that are of a long-term investment nature of $106 million for the 2017 first half and $3 million for the 2016 first half. |

The following table details the changes in common shares outstanding and shareholders’ equity for the 2017 first half:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

(in millions, except per share amounts) | | |

Common Shares Outstanding | | | Total | | Class A Common Stock | | Additional Paid-in- Capital | | Retained Earnings | | Treasury Stock, at Cost | | Accumulated Other Comprehensive Loss |

386.1 |

| | Balance at year-end 2016 | $ | 5,357 |

| | $ | 5 |

| | $ | 5,808 |

| | $ | 6,501 |

| | $ | (6,460 | ) | | $ | (497 | ) |

— |

| | Net income | 779 |

| | — |

| | — |

| | 779 |

| | — |

| | — |

|

— |

| | Other comprehensive income | 341 |

| | — |

| | — |

| | — |

| | — |

| | 341 |

|

— |

| | Dividends ($0.63 per share) | (240 | ) | | — |

| | — |

| | (240 | ) | | — |

| | — |

|

1.9 |

| | Employee stock plan | (36 | ) | | — |

| | (96 | ) | | — |

| | 60 |

| | — |

|

(14.0 | ) | | Purchase of treasury stock | (1,300 | ) | | — |

| | — |

| | — |

| | (1,300 | ) | | — |

|

374.0 |

| | Balance at June 30, 2017 | $ | 4,901 |

| | $ | 5 |

| | $ | 5,712 |

| | $ | 7,040 |

| | $ | (7,700 | ) | | $ | (156 | ) |

11. BUSINESS SEGMENTS

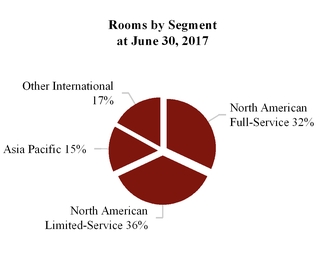

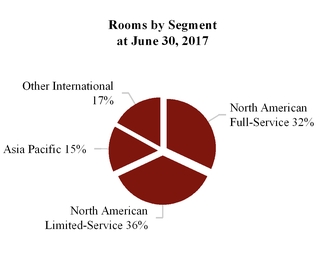

We are a diversified global lodging company with operations in the following reportable business segments:

| |

• | North American Full-Service, which includes our Luxury and Premium brands located in the United States and Canada; |

| |

• | North American Limited-Service, which includes our Select brands located in the United States and Canada; |

| |

• | Asia Pacific, which includes all brand tiers in our Asia Pacific region; and |

| |

• | Other International, which includes all brand tiers in our Europe, Middle East and Africa, and Caribbean and Latin America regions. |

Our North American Full-Service, North American Limited-Service, and Asia Pacific segments meet the applicable accounting criteria to be reportable segments. Our Europe, Middle East and Africa, and Caribbean and Latin America operating segments individually do not meet the criteria for separate disclosure as reportable segments, and accordingly we combined them into an “all other category” which we refer to as “Other International.”

We evaluate the performance of our operating segments using “segment profits” which is based largely on the results of the segment without allocating corporate expenses, income taxes, indirect general, administrative, and other expenses, or merger-related costs and charges. We assign gains and losses, equity in earnings or losses from our joint ventures, and direct general, administrative, and other expenses to each of our segments. “Other unallocated corporate” represents a portion of our revenues, general, administrative, and other expenses, merger-related costs and charges, equity in earnings or losses, and other gains or losses that we do not allocate to our segments. It also includes license fees we receive from our credit card programs and fees from vacation ownership licensing agreements, which we present in the “Franchise fees” caption of our Income Statements.

Our President and Chief Executive Officer, who is our chief operating decision maker, monitors assets for the consolidated company but does not use assets by operating segment when assessing performance or making operating segment resource allocations.

Segment Revenues |

| | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

($ in millions) | June 30, 2017 |

| June 30, 2016 | | June 30, 2017 | | June 30, 2016 |

North American Full-Service | $ | 3,619 |

| | $ | 2,360 |

| | $ | 7,195 |

| | $ | 4,681 |

|

North American Limited-Service | 1,032 |

| | 906 |

| | 1,956 |

| | 1,739 |

|

Asia Pacific | 319 |

| | 146 |

| | 631 |

| | 287 |

|

Other International | 676 |

| | 425 |

| | 1,278 |

| | 840 |

|

Total segment revenues | 5,646 |

| | 3,837 |

| | 11,060 |

| | 7,547 |

|

Other unallocated corporate | 149 |

| | 65 |

| | 296 |

| | 127 |

|

Total consolidated revenues | $ | 5,795 |

| | $ | 3,902 |

| | $ | 11,356 |

| | $ | 7,674 |

|

Segment Profits |

| | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

($ in millions) | June 30, 2017 | | June 30, 2016 | | June 30, 2017 | | June 30, 2016 |

North American Full-Service | $ | 332 |

| | $ | 173 |

| | $ | 621 |

| | $ | 358 |

|

North American Limited-Service | 224 |

| | 191 |

| | 401 |

| | 346 |

|

Asia Pacific | 67 |

| | 27 |

| | 149 |

| | 54 |

|

Other International | 98 |

| | 48 |

| | 184 |

| | 96 |

|

Total segment profits | 721 |

| | 439 |

| | 1,355 |

| | 854 |

|

Other unallocated corporate | (64 | ) | | (45 | ) | | (150 | ) | | (93 | ) |

Interest expense, net of interest income | (65 | ) | | (50 | ) | | (128 | ) | | (91 | ) |

Income taxes | (178 | ) | | (97 | ) | | (298 | ) | | (204 | ) |

Net income | $ | 414 |

| | $ | 247 |

| | $ | 779 |

| | $ | 466 |

|

Goodwill

|

| | | | | | | | | | | | | | | | | | | |

($ in millions) | North American Full-Service | | North American Limited-Service | | Asia Pacific | | Other International | | Total Goodwill |

Year-end 2016 balance: | | | | | | | | | |

Goodwill | $ | 2,905 |

| | $ | 1,558 |

| | $ | 1,572 |

| | $ | 1,617 |

| | $ | 7,652 |

|

Accumulated impairment losses | — |

| | (54 | ) | | — |

| | — |

| | (54 | ) |

| 2,905 |

| | 1,504 |

| | 1,572 |

| | 1,617 |

| | 7,598 |

|

| | | | | | | | | |

Adjustments (1) | $ | 370 |

| | $ | 162 |

| | $ | 213 |

| | $ | 125 |

| | $ | 870 |

|

Foreign currency translation | 8 |

| | 3 |

| | 40 |

| | 63 |

| | 114 |

|

| | | | | | | | | |

June 30, 2017 balance: | | | | | | | | | |

Goodwill | $ | 3,283 |

| | $ | 1,723 |

| | $ | 1,825 |

| | $ | 1,805 |

| | $ | 8,636 |

|

Accumulated impairment losses | — |

| | (54 | ) | | — |

| | — |

| | (54 | ) |

| $ | 3,283 |

| | $ | 1,669 |

| | $ | 1,825 |

| | $ | 1,805 |

| | $ | 8,582 |

|

| |

(1) | The table reflects adjustments to our preliminary estimate of goodwill from the Starwood Combination. Because we have not yet finalized the fair values of assets acquired and liabilities assumed, the assignment of goodwill to our reporting units may continue to change during the measurement period. See Footnote 2 “Acquisitions and Dispositions” for more information. |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

We make forward-looking statements in Management’s Discussion and Analysis of Financial Condition and Results of Operations and elsewhere in this report based on the beliefs and assumptions of our management and on information currently available to us. Forward-looking statements include information about our possible or assumed future results of operations, which follow under the headings “Business and Overview,” “Liquidity and Capital Resources,” and other statements throughout this report preceded by, followed by, or that include the words “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates,” or similar expressions.

Any number of risks and uncertainties could cause actual results to differ materially from those we express in our forward-looking statements, including the risks and uncertainties we describe below and other factors we describe from time to time in our periodic filings with the U.S. Securities and Exchange Commission (the “SEC”). We therefore caution you not to rely unduly on any forward-looking statement. The forward-looking statements in this report speak only as of the date of this report, and we undertake no obligation to update or revise any forward-looking statement, whether as a result of new information, future developments, or otherwise.

In addition, see the “Item 1A. Risk Factors” caption in the “Part II-OTHER INFORMATION” section of this report.

BUSINESS AND OVERVIEW

We are a worldwide operator, franchisor, and licensor of hotels and timeshare properties in 125 countries and territories under 30 brand names at the end of the 2017 second quarter. We also develop, operate, and market residential properties and provide services to home/condominium owner associations. Under our business model, we typically manage or franchise hotels, rather than own them. We report our operations in four segments: North American Full-Service, North American Limited-Service, Asia Pacific, and Other International.

We earn base management fees and in many cases incentive management fees from the properties that we manage, and we earn franchise fees on the properties that others operate under franchise agreements with us. In most markets, base fees typically consist of a percentage of property-level revenue while incentive fees typically consist of a percentage of net house profit adjusted for a specified owner return. In the Middle East and Asia, incentive fees typically consist of a percentage of gross operating profit without adjustment for a specified owner return. Net house profit is calculated as gross operating profit (house profit) less non-controllable expenses such as insurance, real estate taxes, and capital spending reserves.

Our emphasis on long-term management contracts and franchising tends to provide more stable earnings in periods of economic softness, while adding new hotels to our system generates growth, typically with little or no investment by the Company. This strategy has driven substantial growth while minimizing financial leverage and

risk in a cyclical industry. In addition, we believe minimizing our capital investments and adopting a strategy of recycling our investments maximizes and maintains our financial flexibility.

We remain focused on doing the things that we do well; that is, selling rooms, taking care of our guests, and making sure we control costs both at company-operated properties and at the corporate level (“above-property”). Our brands remain strong as a result of skilled management teams, dedicated associates, superior customer service with an emphasis on guest and associate satisfaction, significant distribution, our Loyalty Programs (Marriott Rewards and The Ritz-Carlton Rewards, and Starwood Preferred Guest, which we refer to collectively as “Loyalty Programs”), multichannel reservation systems, and desirable property amenities. We strive to effectively leverage our size and broad distribution.

We, along with owners and franchisees, continue to invest in our brands by means of new, refreshed, and reinvented properties, new room and public space designs, and enhanced amenities and technology offerings. We address, through various means, hotels in our system that do not meet standards. We continue to enhance the appeal of our proprietary, information-rich, and easy-to-use websites, and of our associated mobile smartphone applications, through functionality and service improvements, and we expect to continue capturing an increasing proportion of property-level reservations via this cost-efficient channel.

Our profitability, as well as that of owners and franchisees, has benefited from our approach to property-level and above-property productivity. Properties in our system continue to maintain very tight cost controls. We also control above-property costs, some of which we allocate to hotels, by remaining focused on systems, processing, and support areas.

Performance Measures

We believe Revenue per Available Room (“RevPAR”), which we calculate by dividing room sales for comparable properties by room nights available for the period, is a meaningful indicator of our performance because it measures the period-over-period change in room revenues for comparable properties. RevPAR may not be comparable to similarly titled measures, such as revenues. We also believe occupancy and average daily rate (“ADR”), which are components of calculating RevPAR, are meaningful indicators of our performance. Occupancy, which we calculate by dividing occupied rooms by total rooms available, measures the utilization of a property’s available capacity. ADR, which we calculate by dividing property room revenue by total rooms sold, measures average room price and is useful in assessing pricing levels.

Our RevPAR statistics for the 2017 first half and second quarter, and for 2017 periods compared to the corresponding 2016 periods, include Legacy-Starwood comparable properties for both periods even though Marriott did not own the Legacy-Starwood brands before the Starwood Combination. Therefore, our RevPAR statistics include Legacy-Starwood properties for periods during which fees from the Legacy-Starwood properties are not included in our Income Statements. We provide these RevPAR statistics as an indicator of the performance of our brands and to allow for comparison to industry metrics, and they should not be viewed as necessarily correlating with our fee revenue. For the properties located in countries that use currencies other than the U.S. dollar, the comparisons to the prior year period are on a constant U.S. dollar basis. We calculate constant dollar statistics by applying exchange rates for the current period to the prior comparable period.

We define our comparable properties as our properties, including those that we acquired through the Starwood Combination, that were open and operating under one of our Legacy-Marriott or Legacy-Starwood brands since the beginning of the last full calendar year (since January 1, 2016 for the current period) and have not, in either the current or previous year: (i) undergone significant room or public space renovations or expansions, (ii) been converted between company-operated and franchised, or (iii) sustained substantial property damage or business interruption.

We also believe company-operated house profit margin, which is the ratio of property-level gross operating profit to total property-level revenue, is a meaningful indicator of our performance because this ratio measures our overall ability as the operator to produce property-level profits by generating sales and controlling the operating expenses over which we have the most direct control. House profit includes room, food and beverage, and other revenue and the related expenses including payroll and benefits expenses, as well as repairs and maintenance,

utility, general and administrative, and sales and marketing expenses. House profit does not include the impact of management fees, furniture, fixtures and equipment replacement reserves, insurance, taxes, or other fixed expenses.

Business Trends

Our 2017 first half results reflected a year-over-year increase in the number of properties in our system, including those from the Starwood Combination, favorable demand for our brands in many markets around the world, and slow but steady economic growth. For the three months ended June 30, 2017, comparable worldwide systemwide RevPAR increased 2.2 percent to $120.69, ADR increased 1.2 percent on a constant dollar basis to $159.33, and occupancy increased 0.7 percentage points to 75.7 percent, compared to the same period a year ago. For the six months ended June 30, 2017, comparable worldwide systemwide RevPAR increased 2.7 percent to $114.78, ADR increased 0.9 percent on a constant dollar basis to $158.26, and occupancy increased 1.2 percentage points to 72.5 percent, compared to the same period a year ago.

In North America, 2017 first half RevPAR increased, partially driven by higher demand in Washington, D.C., growth in transient leisure business, and stronger demand from group business in the early part of the year. RevPAR growth was particularly strong in Canada and Hawaii during the 2017 first half but was constrained in certain markets by new lodging supply and only moderate GDP growth.

Our Europe region experienced higher demand in the 2017 first half across most countries, led by strong transient business in the U.K. and Spain. In our Asia Pacific region in the 2017 first half, RevPAR growth was strong in India, Indonesia, and mainland China. Middle East demand continued to be impacted by geopolitical instability, oversupply in Dubai and Qatar, political sanctions on Qatar, and lower oil prices. In South Africa, results were favorable in the 2017 first half, reflecting higher international tourism attracted by the weak South African Rand. Growth in the Caribbean and Latin America reflected strength in Mexico and improving leisure demand in the Caribbean but was also constrained by weak economic conditions in many markets in South America.

We monitor market conditions and provide the tools for our hotels to price rooms daily in accordance with individual property demand levels, generally adjusting room rates as demand changes. Our hotels modify the mix of business to improve revenue as demand changes. For our company-operated properties, we continue to focus on enhancing property-level house profit margins and making productivity improvements.

In the 2017 first half compared to the 2016 first half, worldwide company-operated house profit margins at comparable properties, including comparable Legacy-Starwood properties, increased by 70 basis points, and worldwide comparable house profit per available room (“HP-PAR”) increased by 4.6 percent on a constant U.S. dollar basis, reflecting improved productivity, solid cost controls and procurement savings, higher occupancy, and rate increases. North American company-operated house profit margins increased by 40 basis points, and HP-PAR increased by 2.8 percent. International company-operated house profit margins increased by 120 basis points, and HP-PAR increased by 7.2 percent.

System Growth and Pipeline

During the 2017 first half, we added 203 properties (32,756 rooms) while 29 properties (5,466 rooms) exited our system, increasing our total properties to 6,254 (1,217,608 rooms). Approximately 38 percent of added rooms are located outside North America, and 15 percent of the room additions are conversions from competitor brands.

Since the end of the 2016 first half, we added 1,745 properties (448,793 rooms), including 1,342 properties (381,440 rooms) from the Starwood Combination on the Merger Date, and 45 properties (8,827 rooms) exited our system.

At the end of the 2017 second quarter, we had more than 440,000 rooms in our development pipeline, which includes hotel rooms under construction, hotel rooms under signed contracts, and roughly 42,000 hotel rooms approved for development but not yet under signed contracts. More than half of the rooms in our development pipeline are outside North America.

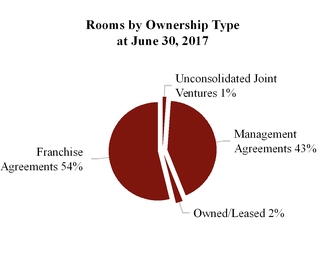

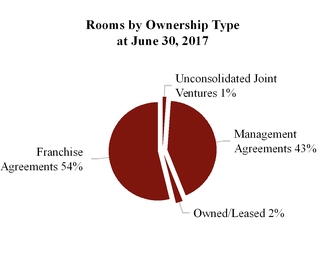

Properties and Rooms

At June 30, 2017, we operated, franchised, and licensed the following properties and rooms:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Managed | | Franchised/Licensed | | Owned/Leased | | Other (1) | | Total |

| Properties | | Rooms | | Properties | | Rooms | | Properties | | Rooms | | Properties | | Rooms | | Properties | | Rooms |

North American Full-Service | 403 |

| | 183,989 |

| | 641 |

| | 189,785 |

| | 11 |

| | 6,600 |

| | — |

| | — |

| | 1,055 |

| | 380,374 |

|

North American Limited-Service | 421 |

| | 66,311 |

| | 3,080 |

| | 352,484 |

| | 20 |

| | 3,006 |

| | 19 |

| | 3,315 |

| | 3,540 |

| | 425,116 |

|

Asia Pacific | 502 |

| | 155,501 |

| | 79 |

| | 22,946 |

| | 4 |

| | 953 |

| | — |

| | — |

| | 585 |

| | 179,400 |

|

Other International | 512 |

| | 120,904 |

| | 349 |

| | 69,275 |

| | 33 |

| | 9,072 |

| | 93 |

| | 11,744 |

| | 987 |

| | 210,995 |

|

| | | | | | | | | | | | | | | | | | | |

Timeshare | — |

| | — |

| | 87 |

| | 21,723 |

| | — |

| | — |

| | — |

| | — |

| | 87 |

| | 21,723 |

|

Total | 1,838 |

| | 526,705 |

| | 4,236 |

| | 656,213 |

| | 68 |

| | 19,631 |

| | 112 |

| | 15,059 |

| | 6,254 |

| | 1,217,608 |

|

| |

(1) | Other represents unconsolidated equity method investments, which we present in the “Equity in earnings” caption of our Income Statements. |

Segment and Brand Statistics

The following tables present RevPAR, occupancy, and ADR statistics for comparable properties, including Legacy-Starwood comparable properties even though Marriott did not own the Legacy-Starwood brands before the Starwood Combination. Systemwide statistics include data from our franchised properties, in addition to our company-operated properties.

|

| | | | | | | | | | | | | | | | | | | | |

Comparable Company-Operated North American Properties |

| RevPAR | | Occupancy | | Average Daily Rate |

| Three Months Ended June 30, 2017 | | Change vs. Three Months Ended June 30, 2016 | | Three Months Ended June 30, 2017 | | Change vs. Three Months Ended June 30, 2016 | | Three Months Ended June 30, 2017 | | Change vs. Three Months Ended June 30, 2016 |

JW Marriott | $ | 189.81 |

| | 4.4 | % | | 79.6 | % | | 2.7 | % | pts. | | $ | 238.40 |

| | 0.9 | % |

The Ritz-Carlton | $ | 267.75 |

| | 4.0 | % | | 74.9 | % | | 0.6 | % | pts. | | $ | 357.45 |

| | 3.2 | % |

W Hotels | $ | 261.04 |

| | 0.1 | % | | 85.5 | % | | 0.3 | % | pts. | | $ | 305.49 |

| | (0.2 | )% |

Composite North American

Luxury (1) | $ | 251.16 |

| | 2.4 | % | | 79.0 | % | | 1.1 | % | pts. | | $ | 317.93 |

| | 1.0 | % |

Marriott Hotels | $ | 157.57 |

| | 0.5 | % | | 80.7 | % | | 0.2 | % | pts. | | $ | 195.23 |

| | 0.2 | % |

Sheraton | $ | 158.53 |

| | 1.8 | % | | 79.4 | % | | (1.1 | )% | pts. | | $ | 199.65 |

| | 3.2 | % |

Westin | $ | 186.43 |

| | 1.5 | % | | 80.5 | % | | (0.9 | )% | pts. | | $ | 231.53 |

| | 2.7 | % |

Composite North American

Upper Upscale (2) | $ | 160.28 |

| | 0.8 | % | | 79.8 | % | | (0.5 | )% | pts. | | $ | 200.76 |

| | 1.4 | % |

North American

Full-Service (3) | $ | 176.76 |

| | 1.2 | % | | 79.7 | % | | (0.2 | )% | pts. | | $ | 221.83 |

| | 1.5 | % |

Courtyard | $ | 111.78 |

| | (0.6 | )% | | 77.5 | % | | (0.9 | )% | pts. | | $ | 144.17 |

| | 0.6 | % |

Residence Inn | $ | 130.52 |

| | 3.1 | % | | 82.8 | % | | 0.5 | % | pts. | | $ | 157.67 |

| | 2.5 | % |

Composite North American

Limited-Service (4) | $ | 116.05 |

| | 0.9 | % | | 79.4 | % | | (0.4 | )% | pts. | | $ | 146.24 |

| | 1.4 | % |

North American - All (5) | $ | 157.84 |

| | 1.1 | % | | 79.6 | % | | (0.3 | )% | pts. | | $ | 198.34 |

| | 1.5 | % |

|

| | | | | | | | | | | | | | | | | | | | |

Comparable Systemwide North American Properties |

| RevPAR | | Occupancy | | Average Daily Rate |

| Three Months Ended June 30, 2017 | | Change vs. Three Months Ended June 30, 2016 | | Three Months Ended June 30, 2017 | | Change vs. Three Months Ended June 30, 2016 | | Three Months Ended June 30, 2017 | | Change vs. Three Months Ended June 30, 2016 |

JW Marriott | $ | 186.05 |

| | 2.8 | % | | 79.6 | % | | 1.4 | % | pts. | | $ | 233.81 |

| | 0.9 | % |

The Ritz-Carlton | $ | 267.75 |

| | 4.0 | % | | 74.9 | % | | 0.6 | % | pts. | | $ | 357.45 |

| | 3.2 | % |

W Hotels | $ | 261.04 |

| | 0.1 | % | | 85.5 | % | | 0.3 | % | pts. | | $ | 305.49 |

| | (0.2 | )% |

Composite North American

Luxury (1) | $ | 238.62 |

| | 2.3 | % | | 78.8 | % | | 0.8 | % | pts. | | $ | 302.92 |

| | 1.2 | % |

Marriott Hotels | $ | 135.66 |

| | 0.3 | % | | 77.0 | % | | (0.3 | )% | pts. | | $ | 176.09 |

| | 0.8 | % |

Sheraton | $ | 124.11 |

| | 0.4 | % | | 77.1 | % | | (0.8 | )% | pts. | | $ | 160.95 |

| | 1.5 | % |

Westin | $ | 167.56 |

| | 1.2 | % | | 79.8 | % | | (0.8 | )% | pts. | | $ | 209.87 |

| | 2.2 | % |

Composite North American

Upper Upscale (2) | $ | 140.41 |

| | 0.7 | % | | 77.5 | % | | (0.5 | )% | pts. | | $ | 181.19 |

| | 1.4 | % |

North American

Full-Service (3) | $ | 151.06 |

| | 1.0 | % | | 77.6 | % | | (0.4 | )% | pts. | | $ | 194.58 |

| | 1.5 | % |

Courtyard | $ | 110.27 |

| | (0.1 | )% | | 77.4 | % | | (0.4 | )% | pts. | | $ | 142.42 |

| | 0.4 | % |

Residence Inn | $ | 122.31 |

| | 1.2 | % | | 82.3 | % | | (0.6 | )% | pts. | | $ | 148.64 |

| | 2.0 | % |

Fairfield Inn & Suites | $ | 87.41 |

| | 2.7 | % | | 75.7 | % | | 1.2 | % | pts. | | $ | 115.49 |

| | 1.1 | % |

Composite North American

Limited-Service (4) | $ | 105.28 |

| | 0.9 | % | | 78.4 | % | | (0.2 | )% | pts. | | $ | 134.23 |

| | 1.1 | % |

North American - All (5) | $ | 125.71 |

| | 0.9 | % | | 78.1 | % | | (0.3 | )% | pts. | | $ | 161.01 |

| | 1.3 | % |

| |

(1) | Includes JW Marriott, The Ritz-Carlton, W Hotels, The Luxury Collection, St. Regis, and EDITION. |

| |

(2) | Includes Marriott Hotels, Sheraton, Westin, Renaissance Hotels, Autograph Collection Hotels, Delta Hotels, Gaylord Hotels, Le Méridien, and Tribute Portfolio. |

| |

(3) | Includes Composite North American Luxury and Composite North American Upper Upscale. |

| |

(4) | Includes Courtyard, Residence Inn, Fairfield Inn & Suites, SpringHill Suites, Four Points, and TownePlace Suites. Systemwide also includes Aloft Hotels and Element Hotels. |

| |

(5) | Includes North American Full-Service and Composite North American Limited-Service. |

|

| | | | | | | | | | | | | | | | | | | | |

Comparable Company-Operated International Properties |

| RevPAR | | Occupancy | | Average Daily Rate |

| Three Months Ended June 30, 2017 | | Change vs. Three Months Ended June 30, 2016 | | Three Months Ended June 30, 2017 | | Change vs. Three Months Ended June 30, 2016 | | Three Months Ended June 30, 2017 | | Change vs. Three Months Ended June 30, 2016 |

Greater China | $ | 87.83 |

| | 8.1 | % | | 71.2 | % | | 6.6 | % | pts. | | $ | 123.39 |

| | (2.0 | )% |

Rest of Asia Pacific | $ | 108.86 |

| | 6.5 | % | | 71.9 | % | | 2.9 | % | pts. | | $ | 151.34 |

| | 2.2 | % |

Asia Pacific | $ | 95.14 |

| | 7.5 | % | | 71.4 | % | | 5.3 | % | pts. | | $ | 133.18 |

| | (0.6 | )% |

Caribbean & Latin America | $ | 131.89 |

| | 7.6 | % | | 66.1 | % | | 3.0 | % | pts. | | $ | 199.54 |

| | 2.8 | % |

Europe | $ | 146.45 |

| | 6.5 | % | | 77.5 | % | | 1.3 | % | pts. | | $ | 189.00 |

| | 4.7 | % |

Middle East & Africa | $ | 96.96 |

| | 2.4 | % | | 61.9 | % | | 1.4 | % | pts. | | $ | 156.66 |

| | 0.2 | % |

Other International (1) | $ | 126.75 |

| | 5.6 | % | | 70.0 | % | | 1.6 | % | pts. | | $ | 181.07 |

| | 3.1 | % |

International - All (2) | $ | 111.14 |

| | 6.4 | % | | 70.7 | % | | 3.5 | % | pts. | | $ | 157.16 |

| | 1.2 | % |

Worldwide (3) | $ | 134.95 |

| | 3.2 | % | | 75.2 | % | | 1.6 | % | pts. | | $ | 179.37 |

| | 1.1 | % |

|

| | | | | | | | | | | | | | | | | | | | |

Comparable Systemwide International Properties |

| RevPAR | | Occupancy | | Average Daily Rate |