Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________

FORM 10-Q

_______________________________________

|

| |

ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2016

OR

|

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 1-13881

_______________________________________

MARRIOTT INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

_______________________________________ |

| | |

Delaware | | 52-2055918 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

| |

10400 Fernwood Road, Bethesda, Maryland (Address of principal executive offices) | | 20817 (Zip Code) |

(301) 380-3000

(Registrant’s telephone number, including area code)

_______________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

Large accelerated filer | | ý | | Accelerated filer | | ¨ |

| | | |

Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller Reporting Company | | ¨

|

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 390,479,820 shares of Class A Common Stock, par value $0.01 per share, outstanding at October 21, 2016.

MARRIOTT INTERNATIONAL, INC.

FORM 10-Q TABLE OF CONTENTS

|

| | |

| | Page No. |

| | |

Part I. | | |

| | |

Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Item 2. | | |

| | |

| | |

| | |

Item 3. | | |

| | |

Item 4. | | |

| | |

Part II. | | |

| | |

Item 1. | | |

| | |

Item 1A. | | |

| | |

Item 6. | | |

| | |

| | |

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

MARRIOTT INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

($ in millions, except per share amounts)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, 2016 |

| September 30, 2015 | | September 30, 2016 | | September 30, 2015 |

REVENUES | | | | | | | |

Base management fees | $ | 180 |

| | $ | 170 |

| | $ | 538 |

| | $ | 526 |

|

Franchise fees | 250 |

| | 227 |

| | 692 |

| | 652 |

|

Incentive management fees | 81 |

| | 68 |

| | 276 |

| | 238 |

|

Owned, leased, and other revenue | 279 |

| | 229 |

| | 771 |

| | 729 |

|

Cost reimbursements | 3,152 |

| | 2,884 |

| | 9,339 |

| | 8,635 |

|

| 3,942 |

| | 3,578 |

| | 11,616 |

| | 10,780 |

|

OPERATING COSTS AND EXPENSES | | | | | | | |

Owned, leased, and other - direct | 194 |

| | 175 |

| | 533 |

| | 552 |

|

Reimbursed costs | 3,152 |

| | 2,884 |

| | 9,339 |

| | 8,635 |

|

Depreciation, amortization, and other | 36 |

| | 31 |

| | 97 |

| | 107 |

|

General, administrative, and other | 161 |

| | 149 |

| | 470 |

| | 446 |

|

Merger-related costs and charges | 228 |

| | — |

| | 250 |

| | — |

|

| 3,771 |

| | 3,239 |

| | 10,689 |

| | 9,740 |

|

OPERATING INCOME | 171 |

| | 339 |

| | 927 |

| | 1,040 |

|

Gains and other income, net | 3 |

| | — |

| | 3 |

| | 20 |

|

Interest expense | (55 | ) | | (43 | ) | | (159 | ) | | (121 | ) |

Interest income | 9 |

| | 5 |

| | 22 |

| | 19 |

|

Equity in earnings | 3 |

| | 8 |

| | 8 |

| | 13 |

|

INCOME BEFORE INCOME TAXES | 131 |

| | 309 |

| | 801 |

| | 971 |

|

Provision for income taxes | (61 | ) | | (99 | ) | | (265 | ) | | (314 | ) |

NET INCOME | $ | 70 |

| | $ | 210 |

| | $ | 536 |

| | $ | 657 |

|

EARNINGS PER SHARE | | | | | | | |

Earnings per share - basic | $ | 0.26 |

| | $ | 0.80 |

| | $ | 2.08 |

| | $ | 2.43 |

|

Earnings per share - diluted | $ | 0.26 |

| | $ | 0.78 |

| | $ | 2.04 |

| | $ | 2.38 |

|

CASH DIVIDENDS DECLARED PER SHARE | $ | 0.30 |

| | $ | 0.25 |

| | $ | 0.85 |

| | $ | 0.70 |

|

See Notes to Condensed Consolidated Financial Statements.

MARRIOTT INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

($ in millions)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, 2016 | | September 30, 2015 | | September 30, 2016 | | September 30, 2015 |

Net income | $ | 70 |

| | $ | 210 |

| | $ | 536 |

| | $ | 657 |

|

Other comprehensive income (loss): | | | | | | | |

Foreign currency translation adjustments | 2 |

| | (28 | ) | | 27 |

| | (47 | ) |

Derivative instrument adjustments, net of tax | 1 |

| | 2 |

| | (3 | ) | | 9 |

|

Unrealized loss on available-for-sale securities, net of tax | — |

| | (3 | ) | | — |

| | (5 | ) |

Reclassification of losses (gains), net of tax | 1 |

| | (3 | ) | | 3 |

| | (7 | ) |

Total other comprehensive income (loss), net of tax | 4 |

| | (32 | ) | | 27 |

| | (50 | ) |

Comprehensive income | $ | 74 |

| | $ | 178 |

| | $ | 563 |

| | $ | 607 |

|

See Notes to Condensed Consolidated Financial Statements.

MARRIOTT INTERNATIONAL, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

($ in millions)

|

| | | | | | | |

| (Unaudited) | | |

| September 30,

2016 | | December 31,

2015 |

ASSETS | | | |

Current assets | | | |

Cash and equivalents | $ | 1,078 |

| | $ | 96 |

|

Accounts and notes receivable, net | 1,705 |

| | 1,103 |

|

Prepaid expenses | 168 |

| | 77 |

|

Other | 65 |

| | 30 |

|

Assets held for sale | 771 |

| | 78 |

|

| 3,787 |

| | 1,384 |

|

Property and equipment, net | 2,411 |

| | 1,029 |

|

Intangible assets | | | |

Brands | 6,606 |

| | 197 |

|

Contract acquisition costs and other | 3,442 |

| | 1,254 |

|

Goodwill | 7,175 |

| | 943 |

|

| 17,223 |

| | 2,394 |

|

Equity and cost method investments | 830 |

| | 165 |

|

Notes receivable, net | 240 |

| | 215 |

|

Deferred tax assets | 92 |

| | 672 |

|

Other noncurrent assets | 419 |

| | 223 |

|

| $ | 25,002 |

| | $ | 6,082 |

|

LIABILITIES AND SHAREHOLDERS’ EQUITY (DEFICIT) | | | |

Current liabilities | | | |

Current portion of long-term debt | $ | 316 |

| | $ | 300 |

|

Accounts payable | 667 |

| | 593 |

|

Accrued payroll and benefits | 1,136 |

| | 861 |

|

Liability for guest loyalty programs | 1,860 |

| | 952 |

|

Accrued expenses and other | 1,250 |

| | 527 |

|

| 5,229 |

| | 3,233 |

|

Long-term debt | 8,506 |

| | 3,807 |

|

Liability for guest loyalty programs | 2,538 |

| | 1,622 |

|

Deferred tax liabilities | 1,308 |

| | 17 |

|

Other noncurrent liabilities | 1,580 |

| | 993 |

|

Shareholders’ equity (deficit) | | | |

Class A Common Stock | 5 |

| | 5 |

|

Additional paid-in-capital | 5,740 |

| | 2,821 |

|

Retained earnings | 6,375 |

| | 4,878 |

|

Treasury stock, at cost | (6,110 | ) | | (11,098 | ) |

Accumulated other comprehensive loss | (169 | ) | | (196 | ) |

| 5,841 |

| | (3,590 | ) |

| $ | 25,002 |

| | $ | 6,082 |

|

See Notes to Condensed Consolidated Financial Statements.

MARRIOTT INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

($ in millions)

(Unaudited)

|

| | | | | | | |

| Nine Months Ended |

| September 30, 2016 | | September 30, 2015 |

OPERATING ACTIVITIES | | | |

Net income | $ | 536 |

| | $ | 657 |

|

Adjustments to reconcile to cash provided by operating activities: | | | |

Depreciation, amortization, and other | 97 |

| | 107 |

|

Share-based compensation | 117 |

| | 84 |

|

Income taxes | 1 |

| | 120 |

|

Liability for guest loyalty programs | 179 |

| | 119 |

|

Merger-related charges | 172 |

| | — |

|

Working capital changes | (47 | ) | | (77 | ) |

Other | 77 |

| | 70 |

|

Net cash provided by operating activities | 1,132 |

| | 1,080 |

|

INVESTING ACTIVITIES | | | |

Acquisition of a business, net of cash acquired | (2,412 | ) | | (137 | ) |

Capital expenditures | (132 | ) | | (218 | ) |

Dispositions | 53 |

| | 612 |

|

Loan advances | (24 | ) | | (12 | ) |

Loan collections | 61 |

| | 21 |

|

Contract acquisition costs | (55 | ) | | (89 | ) |

Redemption of debt security | — |

| | 121 |

|

Other | 22 |

| | 75 |

|

Net cash (used in) provided by investing activities | (2,487 | ) | | 373 |

|

FINANCING ACTIVITIES | | | |

Commercial paper/Credit Facility, net | 1,657 |

| | (274 | ) |

Issuance of long-term debt | 1,483 |

| | 790 |

|

Repayment of long-term debt | (296 | ) | | (7 | ) |

Issuance of Class A Common Stock | 22 |

| | 39 |

|

Dividends paid | (257 | ) | | (189 | ) |

Purchase of treasury stock | (248 | ) | | (1,821 | ) |

Other | (24 | ) | | — |

|

Net cash provided by (used in) financing activities | 2,337 |

| | (1,462 | ) |

INCREASE (DECREASE) IN CASH AND EQUIVALENTS | 982 |

| | (9 | ) |

CASH AND EQUIVALENTS, beginning of period | 96 |

| | 104 |

|

CASH AND EQUIVALENTS, end of period | $ | 1,078 |

| | $ | 95 |

|

See Notes to Condensed Consolidated Financial Statements.

MARRIOTT INTERNATIONAL, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. BASIS OF PRESENTATION

The condensed consolidated financial statements present the results of operations, financial position, and cash flows of Marriott International, Inc. (“Marriott,” and together with its consolidated subsidiaries, “we,” “us,” or “the Company”). We also refer throughout to (i) our Condensed Consolidated Financial Statements as our “Financial Statements,” (ii) our Condensed Consolidated Statements of Income as our “Income Statements,” (iii) our Condensed Consolidated Balance Sheets as our “Balance Sheets,” (iv) our properties, brands, or markets in the United States (“U.S.”) and Canada as “North America” or “North American,” and (v) our properties, brands, or markets outside of the U.S. and Canada as “International.” References throughout to numbered “Footnotes” refer to the numbered Notes in these Notes to Condensed Consolidated Financial Statements, unless otherwise noted.

These Financial Statements have not been audited. We have condensed or omitted certain information and footnote disclosures normally included in financial statements presented in accordance with U.S. generally accepted accounting principles (“GAAP”). The financial statements in this report should be read in conjunction with the consolidated financial statements and notes thereto in our Annual Report on Form 10-K for the fiscal year ended December 31, 2015 (“2015 Form 10-K”). Certain terms not otherwise defined in this Form 10-Q have the meanings specified in our 2015 Form 10-K.

Preparation of financial statements that conform with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities as of the date of the financial statements, the reported amounts of revenues and expenses during the reporting periods, and the disclosures of contingent liabilities. Accordingly, ultimate results could differ from those estimates.

The accompanying Financial Statements reflect all normal and recurring adjustments necessary to present fairly our financial position as of September 30, 2016 and December 31, 2015, the results of our operations for the three and nine months ended September 30, 2016 and September 30, 2015, and cash flows for the nine months ended September 30, 2016 and September 30, 2015. Interim results may not be indicative of fiscal year performance because of seasonal and short-term variations. We have eliminated all material intercompany transactions and balances between entities consolidated in these Financial Statements. We have made certain reclassifications of our prior year amounts to conform to our current presentation of “Brands” and “Deferred tax liabilities” in our Balance Sheets and “Merger-related costs and charges” in our Income Statements.

Acquisition of Starwood Hotels & Resorts Worldwide

On September 23, 2016, we completed the acquisition of Starwood Hotels & Resorts Worldwide, LLC, formerly known as Starwood Hotels & Resorts Worldwide, Inc. (“Starwood”) through a series of transactions, after which Starwood became an indirect wholly-owned subsidiary of the Company (the “Starwood Combination”). The Financial Statements in this report include Starwood’s results of operations for the eight days ended September 30, 2016 and reflect the financial position of our combined company at September 30, 2016. We refer to our business associated with brands that existed prior to the Starwood Combination as “Legacy-Marriott” and to Starwood’s business and brands that we acquired as “Legacy-Starwood.” See Footnote No. 2, “Acquisitions and Dispositions” for more information on the Starwood Combination.

New Accounting Standards

Accounting Standards Update No. 2014-09 - “Revenue from Contracts with Customers” (“ASU No. 2014-09”)

ASU No. 2014-09 supersedes the revenue recognition requirements in Topic 605, Revenue Recognition, as well as most industry-specific guidance, and significantly enhances comparability of revenue recognition practices across entities and industries by providing a principles-based, comprehensive framework for addressing revenue recognition issues. In order for a provider of promised goods or services to recognize as revenue the consideration that it expects to receive in exchange for the promised goods or services, the provider should apply the following

five steps: (1) identify the contract with a customer(s); (2) identify the performance obligations in the contract; (3) determine the transaction price; (4) allocate the transaction price to the performance obligations in the contract; and (5) recognize revenue when (or as) the entity satisfies a performance obligation. ASU No. 2014-09 also specifies the accounting for some costs to obtain or fulfill a contract with a customer and provides enhanced disclosure requirements. The Financial Accounting Standards Board (“FASB”) has deferred ASU No. 2014-09 for one year, and with that deferral, the standard will be effective for annual reporting periods beginning after December 15, 2017, including interim periods within that reporting period, which for us will be our 2018 first quarter. We are permitted to use either the retrospective or the modified retrospective method when adopting ASU No. 2014-09. We are still assessing the potential impact that ASU No. 2014-09 will have on our financial statements and disclosures, but we believe that there could be changes to the revenue recognition of real estate sales, franchise fees, and incentive management fees.

Accounting Standards Update No. 2016-02 - “Leases” (“ASU No. 2016-02”)

In February 2016, the FASB issued ASU No. 2016-02, which introduces a lessee model that brings substantially all leases onto the balance sheet. Under the new standard, a lessee will recognize on its balance sheet a lease liability and a right-of-use asset for all leases, including operating leases, with a term greater than 12 months. The new standard will also distinguish leases as either finance leases or operating leases. This distinction will affect how leases are measured and presented in the income statement and statement of cash flows. ASU No. 2016-02 is effective for annual and interim periods in fiscal years beginning after December 15, 2018. We are still assessing the potential impact that ASU No. 2016-02 will have on our financial statements and disclosures.

Accounting Standards Update No. 2016-09 - “Stock Compensation” (“ASU No. 2016-09”)

In March 2016, the FASB issued ASU No. 2016-09, which involves several aspects of the accounting for share-based payments. The new guidance will require excess tax benefits to be recorded as income tax expense (or benefit) in the income statement. Currently, excess tax benefits are recorded in additional paid-in-capital in the balance sheet. In the statement of cash flows, the new guidance requires both excess tax benefits and employee tax withholdings to be presented as operating inflows rather than as financing inflows. ASU No. 2016-09 is effective for annual and interim periods beginning after December 15, 2016. We are still assessing the potential impact that ASU No. 2016-09 will have on our financial statements and disclosures, but we believe that, during periods when our stock price increases, it will generally result in (1) a decrease to our income tax expense and effective tax rate and (2) an increase to our cash flows from operating activities.

2. ACQUISITIONS AND DISPOSITIONS

Acquisition

On September 23, 2016 (the “Merger Date”), we completed the Starwood Combination. Starwood is a leading hospitality company. The combination of our brands creates a more comprehensive portfolio, enhances our global market distribution, and provides opportunities for cost efficiencies. Our combined company now operates or franchises nearly 6,000 properties with over 1.1 million rooms, representing 30 leading brands from the moderate-tier to luxury in 120 countries and territories.

Shareholders of Starwood received 0.80 shares of our Class A Common Stock and $21.00 in cash for each share of Starwood common stock. The following table presents the fair value of each class of consideration transferred. |

| | | |

(in millions, except per share amounts) | |

Equivalent shares of Marriott common stock issued in exchange for Starwood outstanding shares | 134.4 |

|

Marriott common stock price as of Merger Date | $ | 68.44 |

|

Fair value of Marriott common stock issued in exchange for Starwood outstanding shares | 9,198 |

|

Cash consideration to Starwood shareholders, net of cash acquired of $1,116 | 2,412 |

|

Fair value of Marriott equity-based awards issued in exchange for vested Starwood equity-based awards | 88 |

|

Total consideration transferred, net of cash acquired | $ | 11,698 |

|

Preliminary Fair Values of Assets Acquired and Liabilities Assumed

The following table presents our preliminary estimates of fair values of the assets that we acquired and the liabilities that we assumed. Our preliminary estimates are based on the information that was available as of the Merger Date, and we are continuing to evaluate the underlying inputs and assumptions used in our valuations. Accordingly, these preliminary estimates are subject to change during the measurement period, which is up to one year from the Merger Date.

|

| | | |

($ in millions) | |

Working capital | $ | (115 | ) |

Property and equipment | 2,045 |

|

Identified intangible assets | 8,573 |

|

Equity and cost method investments | 648 |

|

Other noncurrent assets | 207 |

|

Deferred income taxes, net | (1,845 | ) |

Guest loyalty program | (1,647 | ) |

Debt | (1,876 | ) |

Other noncurrent liabilities | (518 | ) |

Net assets acquired | 5,472 |

|

Goodwill (1) | 6,226 |

|

| $ | 11,698 |

|

| |

(1) | Goodwill is calculated as total consideration transferred, net of cash acquired, less identified net assets acquired, and it primarily represents the value that we expect to obtain from synergies and growth opportunities from our combined operations. We have not completed the assignment of goodwill to our reporting units as of the date of this report, and it is not deductible for tax purposes. |

Property and Equipment

We acquired property and equipment, which primarily consists of 15 owned hotels. We provisionally estimated the value of the properties using a combination of the income, cost, and market approaches, which are primarily based on significant Level 2 and Level 3 assumptions, such as estimates of future income growth, capitalization rates, discount rates, and capital expenditure needs of the hotels. We are continuing to assess the marketplace assumptions and property conditions, which could result in changes to these provisional values.

Identified Intangible Assets

The following table presents our preliminary estimates of the fair values of Starwood’s identified intangible assets and their related estimated useful lives.

|

| | | | | | |

| | Estimated Fair Value (in millions) | | Estimated Useful Life (in years) |

Brands | | $ | 6,400 |

| | indefinite |

Management and Operating Lease Agreements | | 1,394 |

| | 20-30 |

Franchise Agreements | | 729 |

| | 20-80 |

Loyalty Program Marketing Rights | | 50 |

| | 25-30 |

| | $ | 8,573 |

| | |

We provisionally estimated the value of Starwood’s brands using the relief-from-royalty method, which applies an estimated royalty rate to forecasted future cash flows, discounted to present value. We estimated the value of management, franchise, and lease agreements using the multi-period excess earnings method, which is a variation of the income approach. This method estimates an intangible asset’s value based on the present value of the incremental after-tax cash flows attributable to the intangible asset. These valuation approaches utilize Level 3 inputs, and we continue to review Starwood’s contracts and historical performance in addition to evaluating the inputs, including the discount rates and growth assumptions, which could result in changes to these provisional values.

Franchise agreements include an exclusive, 80-year global license agreement with Vistana Signature Experiences, Inc. (“Vistana”), Starwood’s former vacation ownership business that is now part of Interval Leisure Group, Inc. (“ILG”), for the use of the Westin and Sheraton brands in vacation ownership. In addition, ILG has the non-exclusive license for the existing St. Regis and The Luxury Collection vacation ownership properties. Under this agreement, we will receive a fixed annual license fee, adjusted for inflation, of $30 million plus certain variable fees based on sales volumes.

Investments

Our provisional estimate of the fair value of the equity method investments that we acquired was $647 million. This value exceeded our share of the book value of the investees' net assets by $501 million, primarily due to the value that we assigned to land and buildings owned by the investees. We provisionally estimated the value of the investees’ real estate using the same methods as for property and equipment described above. Excluding the amount attributable to land, we amortize the difference on a straight-line basis over the underlying assets' estimated useful lives when calculating equity method earnings attributable to us. We are continuing to review the terms of the partnership and joint venture agreements, assess the conditions of the properties, and evaluate the discount rates, any discounts for lack of marketability and control as appropriate, and growth assumptions used in valuing these investments, which could result in changes to our provisional values.

Deferred Income Taxes

Deferred income taxes primarily relate to the fair value of noncurrent assets and liabilities acquired from Starwood, including property and equipment, intangible assets, equity and cost method investments, and long-term debt. We provisionally estimated deferred income taxes based on statutory rates in the jurisdictions of the legal entities where the acquired noncurrent assets and liabilities are recorded. We are continuing to assess the tax rates used, and we will update our estimate of deferred income taxes based on changes to our provisional valuations of

the related assets and liabilities and refinement of the effective tax rates, which could result in changes to these provisional values.

Guest Loyalty Program

The Starwood Preferred Guest (SPG) program is Starwood’s frequent traveler, customer loyalty, and multi-brand marketing program. Members can earn and redeem points for room stays, room upgrades, and airline flights. As of the Merger Date, we assumed the fair value of this liability equals Starwood’s historical book value in establishing a provisional estimate for this liability. We are in the process of obtaining an actuarial valuation of the future redemption obligations, which could result in changes to these provisional values.

Debt and Lease Obligations

We primarily valued debt using quoted market prices, which are considered Level 1 inputs as they are observable in the market. For more information on Starwood debt, see Footnote No. 8 “Long-Term Debt.”

The following table presents the future minimum lease obligations that we assumed and for which we are the primary obligor as of September 30, 2016:

|

| | | | | | | |

($ in millions) | Operating Leases | | Capital Leases |

2016, remaining | $ | 16 |

| | $ | 3 |

|

2017 | 64 |

| | 11 |

|

2018 | 61 |

| | 12 |

|

2019 | 57 |

| | 12 |

|

2020 | 55 |

| | 12 |

|

Thereafter | 630 |

| | 203 |

|

Total minimum lease payments | $ | 883 |

| | $ | 253 |

|

Less: amount representing interest | | | (86 | ) |

Present value of minimum lease payments | | | $ | 167 |

|

Most leases have initial terms of up to 20 years, contain one or more renewals at our option, generally for five- or 10-year periods, and generally contain fixed and variable components. The variable components of leases of land or building facilities are primarily based on operating performance of the leased property.

Pro Forma Results of Operations

The following unaudited pro forma information presents the combined results of operations of Marriott and Starwood as if we had completed the Starwood Combination on January 1, 2015, but using our preliminary fair values of assets and liabilities as of the Merger Date. As required by GAAP, these unaudited pro forma results do not reflect any cost saving synergies from operating efficiencies. Accordingly, these unaudited pro forma results are presented for informational purposes only and are not necessarily indicative of what the actual results of operations of the combined company would have been if the Starwood Combination had occurred at the beginning of the period presented, nor are they indicative of future results of operations.

|

| | | | | | | |

| Nine Months Ended |

($ in millions) | September 30, 2016 | | September 30, 2015 |

Revenues | $ | 15,038 |

| | $ | 14,373 |

|

Net income | $ | 853 |

| | $ | 675 |

|

The unaudited pro forma results include $54 million of integration costs for the nine months ended September 30, 2016 and $320 million of transaction and employee termination costs for the nine months ended September 30, 2015.

Starwood Results of Operations

The following table presents the results of Starwood operations included in our Income Statements for the eight days from the Merger Date through the end of the 2016 third quarter.

|

| | | | |

($ in millions) | | September 23, 2016 - September 30, 2016 |

Revenue | | $ | 168 |

|

Net loss | | $ | (131 | ) |

Dispositions and Planned Dispositions

At the end of the 2016 third quarter, we held $741 million of assets classified as “Assets held for sale” and $37 million of liabilities recorded under “Accrued expenses and other” on our Balance Sheets, both related to hotels that we acquired through the Starwood Combination.

In addition, at the end of the 2016 third quarter, we held $30 million of assets related to the remaining Miami Beach EDITION residences classified as “Assets held for sale” and $3 million of liabilities associated with those assets, which we recorded under “Accrued expenses and other” on our Balance Sheets.

In the 2016 second quarter, we sold a North American Limited-Service segment plot of land and received $46 million in cash.

3. MERGER-RELATED COSTS AND CHARGES

The following table presents pre-tax merger-related costs and other charges that we incurred in connection with the Starwood Combination.

|

| | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

($ in millions) | September 30, 2016 | | September 30, 2015 | | September 30, 2016 | | September 30, 2015 |

Merger-related costs and charges | | | | | | | |

Transaction costs | $ | 18 |

| | $ | — |

| | $ | 31 |

| | $ | — |

|

Employee termination costs | 186 |

| | — |

| | 186 |

| | — |

|

Integration costs | 24 |

| | — |

| | 33 |

| | — |

|

| 228 |

| | — |

| | 250 |

| | — |

|

Interest expense | 9 |

| | — |

| | 22 |

| | — |

|

| $ | 237 |

| | $ | — |

| | $ | 272 |

| | $ | — |

|

Transaction costs represent costs related to the planning and execution of the Starwood Combination, primarily for financial advisory, legal, and other professional service fees. Employee termination costs represent employee severance, retention, and other termination benefits. Integration costs primarily represent integration employee salaries and share-based compensation, change management and legal consultants, and technology-related costs. Merger-related interest expense reflects costs that we incurred for a bridge term loan facility commitment and incremental interest expense for debt incurred prior to the Merger Date related to the Starwood Combination.

We reflect our liability at September 30, 2016 for severance and other employee termination charges in our Balance Sheets as $242 million of “Accrued expenses and other.”

4. EARNINGS PER SHARE

The table below presents the reconciliation of the earnings and number of shares used in our calculations of basic and diluted earnings per share: |

| | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

(in millions, except per share amounts) | September 30, 2016 | | September 30, 2015 | | September 30, 2016 | | September 30, 2015 |

Computation of Basic Earnings Per Share | | | | | | | |

Net income | $ | 70 |

| | $ | 210 |

| | $ | 536 |

| | $ | 657 |

|

Shares for basic earnings per share | 266.2 |

| | 262.2 |

| | 258.3 |

| | 270.7 |

|

Basic earnings per share | $ | 0.26 |

| | $ | 0.80 |

| | $ | 2.08 |

| | $ | 2.43 |

|

Computation of Diluted Earnings Per Share | | | | | | | |

Net income | $ | 70 |

| | $ | 210 |

| | $ | 536 |

| | $ | 657 |

|

Shares for basic earnings per share | 266.2 |

| | 262.2 |

| | 258.3 |

| | 270.7 |

|

Effect of dilutive securities | | | | | | | |

Employee stock option and appreciation right plans | 1.7 |

| | 2.2 |

| | 1.8 |

| | 2.3 |

|

Deferred stock incentive plans | 0.5 |

| | 0.6 |

| | 0.5 |

| | 0.6 |

|

Restricted stock units and restricted stock | 2.1 |

| | 2.3 |

| | 2.1 |

| | 2.5 |

|

Shares for diluted earnings per share | 270.5 |

| | 267.3 |

| | 262.7 |

| | 276.1 |

|

Diluted earnings per share | $ | 0.26 |

| | $ | 0.78 |

| | $ | 2.04 |

| | $ | 2.38 |

|

We compute the effect of dilutive securities using the treasury stock method and average market prices during the period. We excluded antidilutive stock options and stock appreciation rights of 0.3 million for both the 2016 third quarter and the 2015 third quarter, 0.3 million for the 2016 first three quarters, and 0.2 million for the 2015 first three quarters from our calculation of diluted earnings per share because their exercise prices were greater than the average market prices.

5. SHARE-BASED COMPENSATION

Legacy-Marriott Plans

Under our Stock and Cash Incentive Plan (the “Stock Plan”), we award: (1) stock options (our “Stock Option Program”) to purchase our Class A Common Stock (“common stock”); (2) stock appreciation rights (“SARs”) for our common stock (our “SAR Program”); (3) restricted stock units (“RSUs”) of our common stock; and (4) deferred stock units. We also issue performance-based RSUs (“PSUs”) to named executive officers and some of their direct reports under the Stock Plan. We grant awards at exercise prices or strike prices that equal the market price of our common stock on the date of grant.

We recorded share-based compensation expense for award grants of $39 million for the 2016 third quarter and $29 million for the 2015 third quarter, $98 million for the 2016 first three quarters, and $84 million for the 2015 first three quarters. Deferred compensation costs for unvested awards totaled $177 million at September 30, 2016 and $116 million at December 31, 2015.

RSUs and PSUs

We granted 1.6 million RSUs during the 2016 first three quarters to certain officers, key employees, and non-employee directors, and those units vest generally over four years in equal annual installments commencing one year after the grant date. We granted 0.2 million PSUs during the 2016 first three quarters to certain executive officers, subject to continued employment and the satisfaction of certain performance conditions based on achievement of pre-established targets for Adjusted EBITDA, RevPAR Index, room openings, and/or net administrative expense over, or at the end of, a three-year vesting period. We also granted 0.6 million PSUs during the 2016 first three quarters to certain senior leaders and members of the Company’s integration team that, subject to continued employment, vest based upon achievement of pre-established targets related to the Starwood Combination over, or at the end of, a three-year performance period. RSUs, including PSUs, granted in the 2016 first three quarters had a weighted average grant-date fair value of $63.

SARs

We granted 0.4 million SARs to officers and key employees during the 2016 first three quarters. These SARs generally expire ten years after the grant date and both vest and may be exercised in cumulative installments of one quarter at the end of each of the first four years following the grant date. The weighted average grant-date fair value of SARs granted in the 2016 first three quarters was $22 and the weighted average exercise price was $67.

We used the following assumptions as part of a binomial lattice-based valuation to determine the fair value of the SARs we granted during the 2016 first three quarters:

|

| |

Expected volatility | 30.4% |

Dividend yield | 1.3% |

Risk-free rate | 1.7 - 1.8% |

Expected term (in years) | 8 - 10 |

In making these assumptions, we base expected volatility on the historical movement of the Company’s stock price. We base risk-free rates on the corresponding U.S. Treasury spot rates for the expected duration at the date of grant, which we convert to a continuously compounded rate. The dividend yield assumption takes into consideration both historical levels and expectations of future dividend payout. The weighted average expected terms for SARs are an output of our valuation model which utilizes historical data in estimating the period of time that the SARs are expected to remain unexercised. We calculate the expected terms for SARs for separate groups of retirement eligible, non-retirement eligible employees, and non-employee directors. Our valuation model also uses historical data to estimate exercise behaviors, which include determining the likelihood that employees will exercise their SARs before expiration at a certain multiple of stock price to exercise price.

Legacy-Starwood Plans

In the Starwood Combination we assumed Starwood’s 2013 Long-Term Incentive Compensation Plan (“Starwood LTIP”) and equity awards outstanding under the Starwood LTIP and other Starwood equity plans. On the Merger Date, outstanding Starwood equity awards were converted to equity awards with respect to Marriott’s common stock, resulting in 1.1 million RSUs (“Starwood RSUs”), 1.6 million shares of Restricted Stock (“Starwood Restricted Stock”), and 0.2 million options. The awards generally vest over three years in equal annual installments, subject to a prorated adjustment for employees who are terminated under certain circumstances or who retire. The Starwood RSUs and Starwood Restricted Stock had a weighted average fair value of $68 on the Merger Date.

We recorded share-based compensation expense on these awards of $19 million for the eight days ended September 30, 2016. Deferred compensation costs for unvested awards totaled $87 million as of September 30, 2016.

6. INCOME TAXES

Our effective tax rate increased to 46.4% for the 2016 third quarter from 32.4% for the 2015 third quarter, and to 33.1% for the 2016 first three quarters from 32.4% for the 2015 first three quarters, primarily due to lower benefits from Starwood merger-related costs that were incurred in foreign jurisdictions with lower tax rates, and the portion of merger-related costs that were incurred in the U.S. that are not deductible for U.S. income tax purposes. The year-to-date increase is also due to a $5 million reserve established due to a recent examination of a tax position taken in a foreign jurisdiction, partially offset by a $15 million release of a valuation allowance related to a capital loss.

For the 2016 third quarter, our unrecognized tax benefits balance of $398 million increased by $374 million from year-end 2015, primarily reflecting $365 million of Legacy-Starwood unrecognized tax benefits recorded in connection with the Starwood Combination. The unrecognized tax benefits balance included $269 million of tax positions that, if recognized, would impact our effective tax rate. It is reasonably possible that $38 million of unrecognized tax benefits as of September 30, 2016 will be reversed within the next twelve months. We are

continuing to analyze whether or not we have properly identified all liabilities associated with tax uncertainties in jurisdictions where Starwood operates, which could result in changes to our provisional values related to our uncertain tax positions.

We file income tax returns, including returns for our subsidiaries, in various jurisdictions around the world. The U.S. Internal Revenue Service (“IRS”) has examined our federal income tax returns, and has settled all issues for tax years through 2013 for Marriott and through 2006 for Starwood. Our Marriott 2014 and 2015 tax year audits are substantially complete, and our Marriott 2016 tax year audit is currently ongoing. Starwood is currently under audit by the IRS for years 2010 through 2012 and in appeals for years 2007 through 2009. Various foreign, state, and local income tax returns are also under examination by the applicable taxing authorities.

We paid cash for income taxes, net of refunds, of $243 million in the 2016 first three quarters and $161 million in the 2015 first three quarters.

7. COMMITMENTS AND CONTINGENCIES

Guarantees

We issue guarantees to certain lenders and hotel owners, chiefly to obtain long-term management contracts. The guarantees generally have a stated maximum funding amount and a term of three to ten years. The terms of guarantees to lenders generally require us to fund if cash flows from hotel operations are inadequate to cover annual debt service or to repay the loan at maturity. The terms of the guarantees to hotel owners generally require us to fund if the hotels do not attain specified levels of operating profit. Guarantee fundings to lenders and hotel owners are generally recoverable out of future hotel cash flows and/or proceeds from the sale of hotels. We also enter into project completion guarantees with certain lenders in conjunction with hotels that we or our joint venture partners are building.

We present the maximum potential amount of our future guarantee fundings and the carrying amount of our liability for guarantees for which we are the primary obligor at September 30, 2016 in the following table:

|

| | | | | | | |

($ in millions) Guarantee Type | Maximum Potential Amount of Future Fundings | | Recorded Liability for Guarantees |

Debt service | $ | 122 |

| | $ | 22 |

|

Operating profit | 121 |

| | 37 |

|

Other | 8 |

| | 1 |

|

Total guarantees where we are the primary obligor | $ | 251 |

| | $ | 60 |

|

Our liability at September 30, 2016, for guarantees for which we are the primary obligor is reflected in our Balance Sheets as $60 million of “Other noncurrent liabilities.”

Our guarantees listed in the preceding table include $14 million of debt service guarantees and $51 million of operating profit guarantees that will not be in effect until the underlying properties open and we begin to operate the properties or certain other events occur.

The table above does not include a “contingent purchase obligation,” which is not currently in effect, that we entered into in the 2014 first quarter to provide credit support to lenders for a construction loan. We entered into that agreement in conjunction with signing a management agreement for The Times Square EDITION hotel in New York City (currently projected to open in 2017), and the hotel’s ownership group obtaining acquisition financing and entering into agreements concerning future construction financing for the mixed use project (which includes both the hotel and adjacent retail space). Under the agreement, we granted the lenders the right, upon an uncured event of default by the hotel owner under, and an acceleration of, the mortgage loan, to require us to purchase the hotel component of the property for $315 million during the first two years after opening (the “put option”). Because we would acquire the building upon exercise of the put option, we have not included the amount in the table above. The lenders may extend the period during which the put option is exercisable for up to three years to complete foreclosure if the loan has been accelerated and certain other conditions are met. We do not currently expect that the lenders will require us to purchase the hotel component. We have no ownership interest in this hotel.

The preceding table also does not include the following guarantees:

| |

• | $48 million of guarantees for Senior Living Services, consisting of lease obligations of $35 million (expiring in 2019) and lifecare bonds of $13 million (estimated to expire in 2019), for which we are secondarily liable. Sunrise Senior Living, Inc. (“Sunrise”) is the primary obligor on both the leases and $2 million of the lifecare bonds; HCP, Inc., as successor by merger to CNL Retirement Properties, Inc. (“CNL”), is the primary obligor on the remaining $11 million of the lifecare bonds. Before we sold the Senior Living Services business in 2003, these were our guarantees of obligations of our then consolidated Senior Living Services subsidiaries. Sunrise and CNL have indemnified us for any fundings we may be called upon to make under these guarantees. Our liability for these guarantees had a carrying value of $2 million at September 30, 2016. In conjunction with our consent of the 2011 extension of certain lease obligations until 2018, Sunrise provided us with $1 million of cash collateral and an $85 million letter of credit issued by Key Bank to secure our continued exposure under the lease guarantees during the extension term and certain other obligations of Sunrise. The letter of credit balance was $45 million at the end of the 2016 third quarter. During the extension term, Sunrise agreed to make an annual payment to us from the cash flow of the continuing lease facilities, subject to a $1 million annual minimum. In the 2013 first quarter, Sunrise merged with Health Care REIT, Inc. (“HCN”), and Sunrise’s management business was acquired by an entity formed by affiliates of Kohlberg Kravis Roberts & Co. LP, Beecken Petty O’Keefe & Co., Coastwood Senior Housing Partners LLC, and HCN. In April of 2014, HCN and Revera Inc., a private provider of senior living services, acquired Sunrise’s management business. |

| |

• | Lease obligations, for which we became secondarily liable when we acquired the Renaissance Hotel Group N.V. in 1997, consisting of annual rent payments of approximately $4 million and total remaining rent payments through the initial term of approximately $16 million. The majority of these obligations expire by the end of 2020. CTF Holdings Ltd. (“CTF”) had originally provided €35 million in cash collateral in the event that we are required to fund under such guarantees, approximately $2 million (€2 million) of which remained at September 30, 2016. Our exposure for the remaining rent payments through the initial term will decline to the extent that CTF obtains releases from the landlords or these hotels exit our system. Since the time we assumed these guarantees, we have not funded any amounts, and we do not expect to fund any amounts under these guarantees in the future. |

| |

• | A guarantee relating to the timeshare business, which was outstanding at the time of the 2011 Timeshare spin-off and for which we became secondarily liable as part of the spin-off. The guarantee relates to a Marriott Vacations Worldwide Corporation (“MVW”) payment obligation, for which we had an exposure of $4 million (5 million Singapore Dollars) at September 30, 2016. MVW has indemnified us for this obligation, which we expect will expire in 2022. We have not funded any amounts under this obligation, and do not expect to do so in the future. Our liability for this obligation had a carrying value of $1 million at September 30, 2016. |

| |

• | A guarantee for a lease, originally entered into in 2000, for which we became secondarily liable in 2012 as a result of our sale of the ExecuStay corporate housing business to Oakwood Worldwide (“Oakwood”). Oakwood has indemnified us for the obligations under this guarantee. Our total exposure at the end of the 2016 third quarter for this guarantee was $6 million in future rent payments through the end of the lease in 2019. |

In addition to the guarantees described in the preceding paragraphs, in conjunction with financing obtained for specific projects or properties owned by us or joint ventures in which we are a party, we may provide industry standard indemnifications to the lender for loss, liability, or damage occurring as a result of the actions of the other joint venture owner or our own actions.

Commitments

In addition to the guarantees we note in the preceding paragraphs, as of September 30, 2016, we had the following commitments outstanding, which are not recorded on our Balance Sheets:

| |

• | Commitments to invest up to $9 million of equity for non-controlling interests in joint ventures. We expect to fund $2 million of these commitments over the next 12 months. We do not expect to fund the remaining $7 million of these commitments, most of which expire in 2019. |

| |

• | We have a right and under certain circumstances an obligation to acquire our joint venture partner’s remaining interests in two joint ventures over the next five years at a price based on the performance of the ventures. In conjunction with this contingent obligation, we advanced $20 million (€15 million) in deposits, $13 million (€11 million) of which are remaining. The amounts on deposit are refundable to the extent we do not acquire our joint venture partner’s remaining interests. |

| |

• | Various loan commitments totaling $58 million, of which we expect to fund $10 million in 2016, $28 million in 2017, and $20 million thereafter. |

| |

• | Various commitments to purchase information technology hardware, software, accounting, finance, and maintenance services in the normal course of business totaling $477 million. We expect to purchase goods and services subject to these commitments as follows: $58 million in 2016, $157 million in 2017, $115 million in 2018, and $147 million thereafter. The increase in purchase commitments compared to year-end 2015 is primarily due to the consolidation of $353 million of Starwood’s purchase commitments. We are evaluating the contractual nature of such commitments. |

| |

• | Several commitments aggregating $41 million, which we do not expect to fund. |

Letters of Credit

At September 30, 2016, we had $158 million of letters of credit outstanding (all outside the Credit Facility, as defined in Footnote No. 8, “Long-Term Debt”), the majority of which were for our self-insurance programs. Surety bonds issued as of September 30, 2016, totaled $154 million, the majority of which state governments requested in connection with our self-insurance programs.

Legal Proceedings

The Korea Fair Trade Commission recently informed us that the previously disclosed investigation of pricing practices at several of our hotels in Seoul, Korea is now closed.

In November 2015, Starwood announced a malware intrusion had affected point of sale systems at various outlets within certain Legacy-Starwood branded hotels. This resulted in the potential compromise of credit card data and associated personal information. The affected credit card companies are evaluating whether and to what extent financial penalties should be imposed. In addition, a putative class action arising from the malware intrusion was filed against Starwood on January 5, 2016 in the United States District Court for the Southern District of California. The named plaintiff, Paul Dugas, does not specify any damages sought, and a motion to dismiss the case is awaiting resolution by the Court.

On May 10, 2016, the owners of the Sheraton Grand Chicago and the Westin Times Square, New York, filed suit in the Supreme Court of New York against Starwood and Marriott seeking to enjoin the merger of Starwood and Marriott based upon alleged violations of the territorial restrictions contained in the management agreements for those two hotels arising as a result of the merger of Marriott and Starwood. While the attempt to enjoin the merger ultimately failed, the underlying suit continues as a breach of contract claim, and plaintiffs seek, among other remedies, monetary damages relating to the alleged violations.

8. LONG-TERM DEBT

We provide detail on our long-term debt balances, net of discounts, premiums, and debt issuance costs, in the following table as of the end of the 2016 third quarter and year-end 2015:

|

| | | | | | | |

| At Period End |

($ in millions) | September 30,

2016 | | December 31,

2015 |

Senior Notes: | | | |

Series H Notes, interest rate of 6.2%, face amount of $289, matured June 15, 2016

(effective interest rate of 6.3%) | $ | — |

| | $ | 289 |

|

Series I Notes, interest rate of 6.4%, face amount of $293, maturing June 15, 2017

(effective interest rate of 6.5%) | 293 |

| | 293 |

|

Series K Notes, interest rate of 3.0%, face amount of $600, maturing March 1, 2019 (effective interest rate of 4.4%) | 596 |

| | 595 |

|

Series L Notes, interest rate of 3.3%, face amount of $350, maturing September 15, 2022 (effective interest rate of 3.4%) | 348 |

| | 348 |

|

Series M Notes, interest rate of 3.4%, face amount of $350, maturing October 15, 2020

(effective interest rate of 3.6%) | 347 |

| | 347 |

|

Series N Notes, interest rate of 3.1%, face amount of $400, maturing October 15, 2021

(effective interest rate of 3.4%) | 396 |

| | 395 |

|

Series O Notes, interest rate of 2.9%, face amount of $450, maturing March 1, 2021

(effective interest rate of 3.1%) | 446 |

| | 446 |

|

Series P Notes, interest rate of 3.8%, face amount of $350, maturing October 1, 2025 (effective interest rate of 4.0%) | 344 |

| | 343 |

|

Series Q Notes, interest rate of 2.3%, face amount of $750, maturing January 15, 2022

(effective interest rate of 2.5%) | 742 |

| | — |

|

Series R Notes, interest rate of 3.1%, face amount of $750, maturing June 15, 2026

(effective interest rate of 3.3%) | 742 |

| | — |

|

Commercial paper | 1,599 |

| | 938 |

|

Credit Facility | 989 |

| | — |

|

Other | 105 |

| | 113 |

|

Starwood debt: | | | |

2018 Senior Notes, interest rate of 6.8%, face amount $371, maturing May 15, 2018

(effective interest rate of 1.6%) | 403 |

| | — |

|

2019 Senior Notes, interest rate of 7.2%, face amount $210, maturing December 1, 2019

(effective interest rate of 2.2%) | 245 |

| | — |

|

2023 Senior Notes, interest rate of 3.1%, face amount $350, maturing February 15, 2023

(effective interest rate of 3.1%) | 350 |

| | — |

|

2025 Senior Notes, interest rate of 3.8%, face amount $350, maturing March 15, 2025

(effective interest rate of 2.8%) | 375 |

| | — |

|

2034 Senior Notes, interest rate of 4.5%, face amount $300, maturing October 1, 2034

(effective interest rate of 4.1%) | 317 |

| | — |

|

Capital lease obligations | 167 |

| | — |

|

Mortgages and other, interest rates ranging from non-interest bearing to 3.7%, various maturities | 18 |

| | — |

|

| 8,822 |

| | 4,107 |

|

Less: Current portion of long-term debt | (316 | ) | | (300 | ) |

| $ | 8,506 |

| | $ | 3,807 |

|

All of our long-term debt is recourse to us but unsecured. We paid cash for interest, net of amounts capitalized, of $99 million in the 2016 first three quarters and $71 million in the 2015 first three quarters.

Our long-term debt balance increased from year-end 2015 primarily due to the consolidation of Starwood’s long-term debt obligations in the 2016 third quarter and the issuance of debt to finance the cash portion of the Starwood Combination.

On the Merger Date, in accordance with the terms of the indentures governing the 2019 and 2023 Senior Notes, we initiated an offer to repurchase any or all Starwood 2019 and 2023 Senior Notes at a price of 101 percent of the aggregate principal amount, plus any accrued and unpaid interest. Upon expiration of the offer early in the 2016 fourth quarter, we extinguished less than $1 million aggregate principal amount of 2019 Senior Notes and $24 million aggregate principal amount of 2023 Senior Notes, resulting in total cash outflows of $24 million.

In the 2016 second quarter, we issued $1,500 million aggregate principal amount of 2.300 percent Series Q Notes due 2022 (the “Series Q Notes”) and 3.125 percent Series R Notes due 2026 (the “Series R Notes” and together with the Series Q Notes, the “Notes”). We received net proceeds of approximately $1,485 million from the offering of the Notes, after deducting the underwriting discount and estimated expenses. We used these proceeds, together with borrowings under our Credit Facility, as defined below, primarily to finance the cash component of the consideration paid to Starwood shareholders and certain fees and expenses we incurred in connection with the Starwood Combination.

We issued the Notes under an indenture dated as of November 16, 1998 with The Bank of New York Mellon, as successor to JPMorgan Chase Bank, N.A. (formerly known as The Chase Manhattan Bank), as trustee. We may redeem some or all of each series of the Notes prior to maturity under the terms provided in the applicable form of

Note.

In the 2016 second quarter, we amended and restated our multicurrency revolving credit agreement (the “Credit Facility”) to extend the maturity date of the Credit Facility and increase the aggregate amount of available borrowings to up to $4,000 million, up to $2,500 million of which was initially available, with the full $4,000 million becoming available to us with the closing of the Starwood Combination. The availability of the Credit Facility supports our commercial paper program and general corporate needs, including working capital, capital expenditures, share repurchases, letters of credit, and acquisitions. In addition, we used borrowings under the Credit Facility, a portion of which we later repaid with commercial paper supported by the Credit Facility, to finance part of the cash component of the consideration we paid to Starwood shareholders and certain fees and expenses we incurred in connection with the Starwood Combination. Borrowings under the Credit Facility generally bear interest at LIBOR (the London Interbank Offered Rate) plus a spread, based on our public debt rating. We also pay quarterly fees on the Credit Facility at a rate based on our public debt rating. While any outstanding commercial paper borrowings and/or borrowings under our Credit Facility generally have short-term maturities, we classify the outstanding borrowings as long-term based on our ability and intent to refinance the outstanding borrowings on a long-term basis. The Credit Facility expires on June 10, 2021. See the “Cash Requirements and Our Credit Facilities” caption later in this report in the “Liquidity and Capital Resources” section for information on our available borrowing capacity at September 30, 2016.

The following table presents future principal payments, net of discounts, premiums, and debt issuance costs, that are due for our debt as of the end of the 2016 third quarter:

|

| | | | |

Debt Principal Payments ($ in millions) | | Amount |

2016, remaining | | $ | 17 |

|

2017 | | 305 |

|

2018 | | 416 |

|

2019 | | 856 |

|

2020 | | 363 |

|

Thereafter | | 6,865 |

|

Balance at September 30, 2016 | | $ | 8,822 |

|

9. NOTES RECEIVABLE

The following table presents the composition of our notes receivable balances (net of reserves and unamortized discounts) at the end of the 2016 third quarter and year-end 2015:

|

| | | | | | | |

| At Period End |

($ in millions) | September 30,

2016 | | December 31,

2015 |

Senior, mezzanine, and other loans | $ | 246 |

| | $ | 221 |

|

Less current portion | (6 | ) | | (6 | ) |

| $ | 240 |

| | $ | 215 |

|

We do not have any past due notes receivable amounts at the end of the 2016 third quarter. The unamortized discounts for our notes receivable were $23 million at the end of the 2016 third quarter and $31 million at year-end 2015.

The following table presents the expected future principal repayments (net of reserves and unamortized discounts) as well as interest rates for our notes receivable as of the end of the 2016 third quarter:

|

| | | | |

Notes Receivable Principal Repayments (net of reserves and unamortized discounts) and Interest Rates ($ in millions) | | Amount |

2016, remaining | | $ | 4 |

|

2017 | | 4 |

|

2018 | | 74 |

|

2019 | | 16 |

|

2020 | | 17 |

|

Thereafter | | 131 |

|

Balance at September 30, 2016 | | $ | 246 |

|

Weighted average interest rate at September 30, 2016 | | 6.8% |

|

Range of stated interest rates at September 30, 2016 | | 0 - 18% |

|

At the end of the 2016 third quarter, our recorded investment in impaired senior, mezzanine, and other loans was $74 million, and we had $57 million allowance for credit losses, leaving $17 million of exposure to our investment in impaired loans. At year-end 2015, our recorded investment in impaired senior, mezzanine, and other loans was $72 million, and we had a $55 million allowance for credit losses, leaving $17 million of exposure to our investment in impaired loans. Our average investment in impaired notes receivable totaled $74 million for the 2016 third quarter, $73 million for the 2016 first three quarters, $71 million for the 2015 third quarter, and $67 million for the 2015 first three quarters.

10. FAIR VALUE OF FINANCIAL INSTRUMENTS

We believe that the fair values of our current assets and current liabilities approximate their reported carrying amounts. We present the carrying values and the fair values of noncurrent financial assets and liabilities that qualify as financial instruments, determined under current guidance for disclosures on the fair value of financial instruments, in the following table:

|

| | | | | | | | | | | | | | | |

| September 30, 2016 | | December 31, 2015 |

($ in millions) | Carrying Amount | | Fair Value | | Carrying Amount | | Fair Value |

Senior, mezzanine, and other loans | $ | 240 |

| | $ | 226 |

| | $ | 215 |

| | $ | 209 |

|

Marketable securities | 30 |

| | 30 |

| | 37 |

| | 37 |

|

Total noncurrent financial assets | $ | 270 |

| | $ | 256 |

| | $ | 252 |

| | $ | 246 |

|

| | | | | | | |

Senior notes | $ | (5,650 | ) | | $ | (5,828 | ) | | $ | (2,766 | ) | | $ | (2,826 | ) |

Commercial paper/ Credit Facility | (2,588 | ) | | (2,588 | ) | | (938 | ) | | (938 | ) |

Other long-term debt | (100 | ) | | (111 | ) | | (99 | ) | | (108 | ) |

Other noncurrent liabilities | (63 | ) | | (63 | ) | | (63 | ) | | (63 | ) |

Total noncurrent financial liabilities | $ | (8,401 | ) | | $ | (8,590 | ) | | $ | (3,866 | ) | | $ | (3,935 | ) |

We estimate the fair value of our senior, mezzanine, and other loans, including the current portion, by discounting cash flows using risk-adjusted rates and current market conditions, which are Level 3 inputs.

We carry our marketable securities at fair value. Our marketable securities include debt securities of the U.S. Government, its sponsored agencies and other U.S. corporations invested for our self-insurance programs, as well as shares of publicly traded companies, which we value using directly observable Level 1 inputs. The carrying value of these marketable securities was $30 million at the end of the 2016 third quarter.

We estimate the fair value of our other long-term debt, including the current portion and excluding leases, using expected future payments discounted at risk-adjusted rates, which are Level 3 inputs. We determine the fair value of our senior notes using quoted market prices, which are directly observable Level 1 inputs. As noted in Footnote No. 8, “Long-Term Debt,” even though our commercial paper borrowings and Credit Facility borrowings generally have short-term maturities of 30 days or less, we classify outstanding commercial paper borrowings and Credit Facility borrowings as long-term based on our ability and intent to refinance them on a long-term basis. As we are a frequent issuer of commercial paper, we use pricing from recent transactions as Level 2 inputs in estimating fair value. At year-end 2015, we determined that the carrying value of our commercial paper and Credit Facility borrowings approximated fair value due to the short maturity. Our other long-term liabilities largely consist of guarantees. We measure our liability for guarantees at fair value on a nonrecurring basis, which is when we issue or modify a guarantee using Level 3 internally developed inputs. At the end of the 2016 third quarter and year-end 2015, we determined that the carrying values of our guarantee liabilities approximated their fair values based on Level 3 inputs.

See the “Fair Value Measurements” caption of Footnote No. 2, “Summary of Significant Accounting Policies” of our 2015 Form 10-K for more information on the input levels we use in determining fair value.

11. OTHER COMPREHENSIVE INCOME (LOSS) AND SHAREHOLDERS' EQUITY (DEFICIT)

The following tables detail the accumulated other comprehensive income (loss) activity for the 2016 first three quarters and 2015 first three quarters:

|

| | | | | | | | | | | | | | | |

($ in millions) | Foreign Currency Translation Adjustments | | Derivative Instrument Adjustments | | Available-For-Sale Securities Unrealized Adjustments | | Accumulated Other Comprehensive Loss |

Balance at year-end 2015 | $ | (192 | ) | | $ | (8 | ) | | $ | 4 |

| | $ | (196 | ) |

Other comprehensive income (loss) before reclassifications (1) | 27 |

| | (3 | ) | | — |

| | 24 |

|

Reclassification of losses from accumulated other comprehensive loss | — |

| | 3 |

| | — |

| | 3 |

|

Net other comprehensive income | 27 |

| | — |

| | — |

| | 27 |

|

Balance at September 30, 2016 | $ | (165 | ) | | $ | (8 | ) | | $ | 4 |

| | $ | (169 | ) |

|

| | | | | | | | | | | | | | | |

($ in millions) | Foreign Currency Translation Adjustments | | Derivative Instrument Adjustments | | Available-For-Sale Securities Unrealized Adjustments | | Accumulated Other Comprehensive Loss |

Balance at year-end 2014 | $ | (72 | ) | | $ | (9 | ) | | $ | 11 |

| | $ | (70 | ) |

Other comprehensive (loss) income before reclassifications (1) | (47 | ) | | 9 |

| | (5 | ) | | (43 | ) |

Reclassification of losses (gains) from accumulated other comprehensive loss | 3 |

| | (10 | ) | | — |

| | (7 | ) |

Net other comprehensive loss | (44 | ) | | (1 | ) | | (5 | ) | | (50 | ) |

Balance at September 30, 2015 | $ | (116 | ) | | $ | (10 | ) | | $ | 6 |

| | $ | (120 | ) |

| |

(1) | Other comprehensive income (loss) before reclassifications for foreign currency translation adjustments includes intra-entity foreign currency transactions that are of a long-term investment nature. These resulted in a loss of $1 million for the 2016 first three quarters and a gain of $33 million for the 2015 first three quarters. |

The following table details the changes in common shares outstanding and shareholders’ equity (deficit) for the 2016 first three quarters:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

(in millions, except per share amounts) | | |

Common Shares Outstanding | | | Total | | Class A Common Stock | | Additional Paid-in- Capital | | Retained Earnings | | Treasury Stock, at Cost | | Accumulated Other Comprehensive Loss |

256.3 |

| | Balance at year-end 2015 | $ | (3,590 | ) | | $ | 5 |

| | $ | 2,821 |

| | $ | 4,878 |

| | $ | (11,098 | ) | | $ | (196 | ) |

— |

| | Net income | 536 |

| | — |

| | — |

| | 536 |

| | — |

| | — |

|

— |

| | Other comprehensive income | 27 |

| | — |

| | — |

| | — |

| | — |

| | 27 |

|

— |

| | Cash dividends ($0.85 per share) | (257 | ) | | — |

| | — |

| | (257 | ) | | — |

| | — |

|

1.8 |

| | Employee stock plan | 64 |

| | — |

| | 26 |

| | (20 | ) | | 58 |

| | — |

|

(3.7 | ) | | Purchase of treasury stock | (225 | ) | | — |

| | — |

| | — |

| | (225 | ) | | — |

|

136.1 |

| | Starwood Combination (1) | 9,286 |

| | — |

| | 2,893 |

| | 1,238 |

| | 5,155 |

| | — |

|

390.5 |

| | Balance at September 30, 2016 | $ | 5,841 |

| | $ | 5 |

| | $ | 5,740 |

| | $ | 6,375 |

| | $ | (6,110 | ) | | $ | (169 | ) |

| |

(1) | Represents Marriott common stock and equity-based awards issued in the Starwood Combination, which also resulted in the depletion of our accumulated historical losses on reissuances of treasury stock in Retained Earnings. |

12. BUSINESS SEGMENTS

We are a diversified global lodging company with operations in the following three reportable business segments, which included the following brands at the end of the 2016 third quarter:

| |

• | North American Full-Service, which includes The Ritz-Carlton, EDITION, JW Marriott, Autograph Collection Hotels, Renaissance Hotels, Marriott Hotels, Delta Hotels and Resorts, and Gaylord Hotels located in the United States and Canada; |

| |

• | North American Limited-Service, which includes AC Hotels by Marriott, Courtyard, Residence Inn, SpringHill Suites, Fairfield Inn & Suites, TownePlace Suites, and Moxy Hotels properties located in the United States and Canada; and |

| |

• | International, which includes The Ritz-Carlton, Bulgari Hotels & Resorts, EDITION, JW Marriott, Autograph Collection Hotels, Renaissance Hotels, Marriott Hotels, Marriott Executive Apartments, AC Hotels by Marriott, Courtyard, Residence Inn, Fairfield Inn & Suites, Protea Hotels, and Moxy Hotels located outside the United States and Canada. |

Due to the timing of the Starwood Combination, it was not practicable to allocate Starwood’s results to our operating segments for the 2016 third quarter. As a result, we included the results of Starwood’s operations for the eight days ended September 30, 2016 in “Other unallocated corporate.”

Our North American Full-Service and North American Limited-Service segments meet the applicable accounting criteria to be reportable business segments. The following four operating segments do not meet the criteria for separate disclosure as reportable business segments: Asia Pacific, Caribbean and Latin America, Europe, and Middle East and Africa, and accordingly, we combined these four operating segments into an “all other category” which we refer to as “International.”

We evaluate the performance of our operating segments using “segment profits” which is based largely on the results of the segment without allocating corporate expenses, income taxes, indirect general, administrative, and other expenses, or merger-related costs and charges. We allocate gains and losses, equity in earnings or losses from our joint ventures, and direct general, administrative, and other expenses to each of our segments. The caption “Other unallocated corporate” in the subsequent discussion represents a portion of our revenues, general, administrative, and other expenses, merger-related costs and charges, equity in earnings or losses, and other gains or losses that we do not allocate to our segments. It also includes license fees we receive from our credit card programs, fees from vacation ownership licensing agreements, and the results of Starwood’s operations for the eight days ended September 30, 2016. See Footnote No. 2, “Acquisitions and Dispositions” for more information on the Starwood Combination.

Our chief operating decision maker monitors assets for the consolidated company but does not use assets by operating segment when assessing performance or making operating segment resource allocations.

Segment Revenues |

| | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

($ in millions) | September 30, 2016 |

| September 30, 2015 | | September 30, 2016 | | September 30, 2015 |

North American Full-Service Segment | $ | 2,222 |

| | $ | 2,128 |

| | $ | 6,903 |

| | $ | 6,555 |

|

North American Limited-Service Segment | 936 |

| | 846 |

| | 2,675 |

| | 2,405 |

|

International | 545 |

| | 532 |

| | 1,672 |

| | 1,623 |

|

Total segment revenues | 3,703 |

| | 3,506 |

| | 11,250 |

| | 10,583 |

|

Other unallocated corporate | 239 |

| | 72 |

| | 366 |

| | 197 |

|

Total consolidated revenues | $ | 3,942 |

| | $ | 3,578 |

| | $ | 11,616 |

| | $ | 10,780 |

|

Segment Profits |

| | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

($ in millions) | September 30, 2016 | | September 30, 2015 | | September 30, 2016 | | September 30, 2015 |

North American Full-Service Segment | $ | 148 |

| | $ | 126 |

| | $ | 506 |

| | $ | 424 |

|

North American Limited-Service Segment | 193 |

| | 180 |

| | 539 |

| | 510 |

|

International | 67 |

| | 69 |

| | 217 |

| | 203 |

|

Total segment profits | 408 |

| | 375 |

| | 1,262 |

| | 1,137 |

|

Other unallocated corporate | (231 | ) | | (28 | ) | | (324 | ) | | (64 | ) |

Interest expense, net of interest income | (46 | ) | | (38 | ) | | (137 | ) | | (102 | ) |

Income taxes | (61 | ) | | (99 | ) | | (265 | ) | | (314 | ) |

Net income | $ | 70 |

| | $ | 210 |

| | $ | 536 |

| | $ | 657 |

|

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Acquisition of Starwood Hotels & Resorts Worldwide

On September 23, 2016 (the “Merger Date”), we completed the Starwood Combination. Our Income Statements reflect a net loss of $131 million for Starwood’s results of operations for the eight days ended September 30, 2016, including merger-related costs and charges, net of tax, of $145 million. See both Footnote No. 2, “Acquisitions and Dispositions” and Footnote No. 3, “Merger-related costs and charges” for more information. We did not allocate Starwood’s results to any of our business segments.

Our discussion and analysis of our results of operations in Item 2 generally begins with a discussion of the impact of the Starwood Combination on our results and is followed by a discussion of other factors primarily relating to our Legacy-Marriott operations except where otherwise noted.

Forward-Looking Statements

We make forward-looking statements in Management’s Discussion and Analysis of Financial Condition and Results of Operations and elsewhere in this report based on the beliefs and assumptions of our management and on information currently available to us. Forward-looking statements include information about our possible or assumed future results of operations, which follow under the headings “Business and Overview,” “Liquidity and Capital Resources,” and other statements throughout this report preceded by, followed by or that include the words “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates,” or similar expressions.

Any number of risks and uncertainties could cause actual results to differ materially from those we express in our forward-looking statements, including the risks and uncertainties we describe below and other factors we describe from time to time in our periodic filings with the U.S. Securities and Exchange Commission (the “SEC”). We therefore caution you not to rely unduly on any forward-looking statement. The forward-looking statements in this report speak only as of the date of this report, and we undertake no obligation to update or revise any forward-looking statement, whether as a result of new information, future developments, or otherwise.

In addition, see the “Item 1A. Risk Factors” caption in the “Part II-OTHER INFORMATION” section of this report.

BUSINESS AND OVERVIEW

We are a worldwide operator, franchisor, and licensor of hotels and timeshare properties in 120 countries and territories under 30 brand names at the end of the 2016 third quarter. We also develop, operate, and market residential properties and provide services to home/condominium owner associations. Under our business model, we typically manage or franchise hotels, rather than own them. We report our operations in three segments: North American Full-Service, North American Limited-Service, and International.

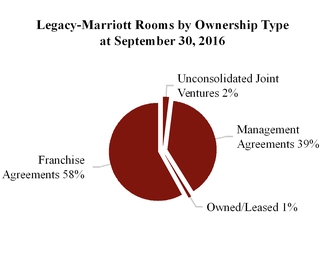

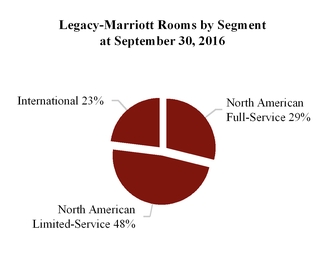

The following charts present our rooms by ownership type and by segment for our Legacy-Marriott business.