Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the Fiscal Year Ended September 30, 2014

| Commission File Number |

Exact name of registrant as specified in its charter and principal office address and telephone number |

State of Incorporation |

I.R.S. Employer Identification No. | |||

| 1-16163 |

WGL Holdings, Inc. 101 Constitution Ave., N.W. Washington, D.C. 20080 (703) 750-2000 |

Virginia | 52-2210912 | |||

| 0-49807 |

Washington Gas Light Company 101 Constitution Ave., N.W. Washington, D.C. 20080 (703) 750-4440 |

District of Columbia and Virginia |

53-0162882 |

| Securities registered pursuant to Section 12(b) of the Act (as of September 30, 2014): | ||

| Title of each class | Name of each exchange on which registered | |

| WGL Holdings, Inc. common stock, no par value |

New York Stock Exchange | |

| Securities registered pursuant to Section 12(g) of the Act (as of September 30, 2014): | ||

| Title of each class | Name of each exchange on which registered | |

| Washington Gas Light Company preferred stock, cumulative, without par value: |

||

| $4.25 Series |

Over-the-Counter Bulletin Board | |

| $4.80 Series |

Over-the-Counter Bulletin Board | |

|

$5.00 Series |

Over-the-Counter Bulletin Board | |

Indicate by check mark if each registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

| WGL Holdings, Inc. |

Yes [X] No [ ] | |

| Washington Gas Light Company |

Yes [ ] No [X] |

Indicate by check mark if each registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether each registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrants were required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrants’ knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

WGL Holdings, Inc.:

| Large Accelerated Filer [X] |

Accelerated Filer [ ] | Non-Accelerated Filer [ ] |

Smaller Reporting Company [ ] | |||

| (Do not check if a smaller reporting company) | ||||||

Washington Gas Light Company:

| Large Accelerated Filer [ ] |

Accelerated Filer [ ] | Non-Accelerated Filer [X] |

Smaller Reporting Company [ ] | |||

| (Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether each registrant is a shell company (as defined in Rule 12b-2 of the Act): Yes [ ] No [X]

The aggregate market value of the voting common equity held by non-affiliates of the registrant, WGL Holdings, Inc., amounted to $2,064,823,797 as of March 31, 2014.

WGL Holdings, Inc. common stock, no par value outstanding as of October 31, 2014: 49,708,750 shares.

All of the outstanding shares of common stock ($1 par value) of Washington Gas Light Company were held by WGL Holdings, Inc. as of October 31, 2014.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of WGL Holdings, Inc.’s definitive Proxy Statement and Washington Gas Light Company’s definitive Information Statement in connection with the 2015 Annual Meeting of Shareholders, to be filed with the Securities and Exchange Commission pursuant to Regulation 14A and 14C not later than 120 days after September 30, 2014, are incorporated in Part III of this report.

Table of Contents

Washington Gas Light Company

For the Fiscal Year Ended September 30, 2014

Table of Contents

| PART I |

||||||

|

|

||||||

| Introduction | ||||||

| 1 | ||||||

| 1 | ||||||

| 3 | ||||||

| Item 1. |

5 | |||||

| 5 | ||||||

| 5 | ||||||

| 14 | ||||||

| 14 | ||||||

| Item 1A. |

15 | |||||

| Item 1B. |

19 | |||||

| Item 2. |

20 | |||||

| Item 3. |

21 | |||||

| Item 4. |

22 | |||||

| 23 | ||||||

|

PART II |

||||||

|

|

||||||

| Item 5. |

24 | |||||

| Item 6. |

25 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

27 | ||||

| Item 7A. |

70 | |||||

| Item 8. |

70 | |||||

| 71 | ||||||

| 77 | ||||||

| 83 | ||||||

| Supplementary Financial Information—Quarterly Financial Data (Unaudited) |

144 | |||||

| Item 9. |

Changes In and Disagreements with Accountants on Accounting and Financial Disclosure |

145 | ||||

| Item 9A. |

145 | |||||

| Item 9B. |

148 | |||||

|

PART III |

||||||

|

|

||||||

| Item 10. |

Directors, Executive Officers and Corporate Governance of the Registrants |

149 | ||||

| Item 11. |

149 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

149 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

149 | ||||

| Item 14. |

149 | |||||

|

PART IV |

||||||

|

|

||||||

| Item 15. |

150 | |||||

| 156 | ||||||

(i)

Table of Contents

WGL Holdings, Inc.

Washington Gas Light Company

This annual report on Form 10-K is a combined report being filed by two separate registrants: WGL Holdings, Inc. (WGL) and Washington Gas Light Company (Washington Gas). Except where the content clearly indicates otherwise, any reference in the report to “WGL,” “we,” “us” or “our” is to the holding company or the consolidated entity of WGL Holdings and all of its subsidiaries, including Washington Gas which is a distinct registrant that is a wholly owned subsidiary of WGL.

The Management’s Discussion and Analysis of Financial Condition and Results of Operations (Management’s Discussion) included under Item 7 is divided into two major sections for WGL and Washington Gas. The Consolidated Financial Statements of WGL and the Financial Statements of Washington Gas are included under Item 8 as well as the Notes to Consolidated Financial Statements that are presented on a combined basis for both WGL and Washington Gas.

SAFE HARBOR FOR FORWARD-LOOKING STATEMENTS

Certain matters discussed in this report, excluding historical information, include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the outlook for earnings, revenues and other future financial business performance or strategies and expectations. Forward-looking statements are typically identified by words such as, but not limited to, “estimates,” “expects,” “anticipates,” “intends,” “believes,” “plans,” and similar expressions, or future or conditional verbs such as “will,” “should,” “would” and “could.” Although the registrants, WGL and Washington Gas, believe such forward-looking statements are based on reasonable assumptions, they cannot give assurance that every objective will be achieved. Forward-looking statements speak only as of today, and the registrants assume no duty to update them. The following factors, among others, could cause actual results to differ materially from forward-looking statements or historical performance:

| • | the level and rate at which costs and expenses are incurred and the extent to which they are allowed to be recovered from customers through the regulatory process in connection with constructing, operating and maintaining Washington Gas’ distribution system; |

| • | the availability of natural gas supply and interstate pipeline transportation and storage capacity; |

| • | the ability of natural gas producers, pipeline gatherers and natural gas processors to deliver natural gas into interstate pipelines for delivery by those interstate pipelines to the entrance points of Washington Gas’ distribution system as a result of factors beyond our control; |

| • | changes and developments in economic, competitive, political and regulatory conditions; |

| • | changes in capital and energy commodity market conditions; |

| • | changes in credit ratings of debt securities of WGL or Washington Gas that may affect access to capital or the cost of debt; |

| • | changes in credit market conditions and creditworthiness of customers and suppliers; |

| • | changes in relevant laws and regulations, including tax, environmental, pipeline integrity and employment laws and regulations; |

| • | legislative, regulatory and judicial mandates or decisions affecting business operations or the timing of recovery of costs and expenses; |

| • | the timing and success of business and product development efforts and technological improvements; |

| • | the pace of deregulation efforts and the availability of other competitive alternatives to our products and services; |

| • | changes in accounting principles; |

| • | new commodity purchase and sales contracts or financial contracts and modifications in the terms of existing contracts that may materially affect fair value calculations under derivative accounting requirements; |

| • | the ability to manage the outsourcing of several business processes; |

1

Table of Contents

| • | acts of nature; |

| • | terrorist activities and |

| • | other uncertainties. |

The outcome of negotiations and discussions that the registrants may hold with other parties from time to time regarding utility and energy-related investments and strategic transactions that are both recurring and non-recurring may also affect future performance. All such factors are difficult to predict accurately and are generally beyond the direct control of the registrants. Accordingly, while they believe that the assumptions are reasonable, the registrants cannot ensure that all expectations and objectives will be realized. Readers are urged to use care and consider the risks, uncertainties and other factors that could affect the registrants’ business as described in this annual report on Form 10-K. All forward-looking statements made in this report rely upon the safe harbor protections provided under the Private Securities Litigation Reform Act of 1995.

2

Table of Contents

WGL Holdings, Inc.

Washington Gas Light Company

Part I

GLOSSARY OF KEY TERMS AND DEFINITIONS

| Active Customer Meters: Natural gas meters that are physically connected to a building structure within the Washington Gas distribution system and that receive active service.

Accelerated Pipe Replacement Programs: Programs focused on replacement activities, targeting specific piping materials, installed years and/or locations which are undertaken on an expedited basis in an effort to improve safety, system reliability and to reduce potential greenhouse gas emissions.

Asset Optimization Program: A program to optimize the value of Washington Gas’ long-term natural gas transportation and storage capacity resources during periods when these resources are not being used to physically serve customers.

Bundled Service: Service in which customers purchase both the natural gas commodity and the distribution or delivery of the commodity from the local regulated utility. When customers purchase bundled service from Washington Gas, no mark-up is applied to the cost of the natural gas commodity that is passed through to customers.

Business Process Outsourcing (BPO) Agreement: An agreement whereby a service provider performs certain functions that have historically been performed by Washington Gas employees and resources.

Conservation and Ratemaking Efficiency (CARE Plan): A decoupling rate mechanism designed to adjust the actual non-gas distribution revenues to the level of allowed distribution revenues authorized in the Company’s most recent rate case proceeding and provides cost effective conservation and energy efficient programs.

City Gate: A point or measuring station at which a gas distribution company such as Washington Gas receives natural gas from an unaffiliated pipeline or transmission system.

Cooling Degree Day (CDD): A measure of the variation in weather based on the extent to which the daily average temperature is above 65 degrees Fahrenheit.

CARE Ratemaking Adjustment (CRA): A billing mechanism in the state of Virginia that is designed to minimize the effect of factors such as conservation on utility net revenues.

Commercial Energy Systems: Formerly known as the “design-build energy systems” segment, the commercial energy systems segment includes the operations of Washington Gas Energy Systems, Inc. and WGSW, Inc.

Delivery Service: The regulated distribution or delivery of natural gas to retail customers. Washington Gas provides delivery service to retail customers in Washington, D.C. and parts of Maryland and Virginia.

Design Day: Washington Gas’ design day represents the maximum anticipated demand on Washington Gas’ distribution system during a 24-hour period assuming a five-degree Fahrenheit average temperature and 17 miles per hour average wind, considered to be the coldest conditions expected to be experienced in the Washington, D.C. region.

Distributed Generation Assets: Assets that use renewable energy sources including Solar Photovoltaic (Solar PV) systems, combined heat and power plants, and natural gas fuel cells to generate electricity near the point of consumption.

Federal Energy Regulatory Commission (FERC): An independent agency of the federal government that regulates the interstate transmission of electricity, natural gas, and oil. The FERC also reviews proposals to build liquefied natural gas terminals and interstate natural gas pipelines. |

Financial Contract: A contract in which no commodity is transferred between parties and only cash payments are exchanged in amounts equal to the financial benefit of holding the contract.

Firm Customers: Customers whose gas supply will not be disrupted to meet the needs of other customers. Typically, this class of customer comprises residential customers and most commercial customers.

Generally Accepted Accounting Principles (GAAP): A standard framework of accounting rules used to prepare, present and report financial statements in the United States of America.

Gross Margin: A non-GAAP measure calculated as operating revenues, less the associated cost of natural gas or electricity and revenue taxes. Used to measure the success of the retail energy-marketing segment’s core strategy for the sale of natural gas and electricity.

Heating Degree Day (HDD): A measure of the variation in weather based on the extent to which the daily average temperature falls below 65 degrees Fahrenheit.

Heavy Hydrocarbons (HHCs): Compounds, such as hexane, that Washington Gas is injecting into its distribution system to treat vaporized liquefied natural gas or domestic sources of gas that have had such HHCs removed as a result of liquids processing.

Interruptible Customers: Large commercial customers whose service can be temporarily interrupted in order for the regulated utility to meet the needs of firm customers. These customers pay a lower delivery rate than firm customers and they must be able to readily substitute an alternate fuel for natural gas.

Liquefied Natural Gas (LNG): The liquid form of natural gas.

Lower of Cost or Market: The process of adjusting the value of inventory to reflect the lesser of its original cost or its current market value.

Mark-to-Market: The process of adjusting the carrying value of a position held in a physical or financial derivative to reflect its current fair value.

Midstream Energy Services: Formerly known as the wholesale energy solutions segment, the midstream energy services segment includes the operations of WGL Midstream, Inc.

New Customer Meters Added: Natural gas meters that are newly connected to a building structure within the Washington Gas distribution system. Service may or may not have been activated.

Normal Weather: A forecast of expected HDDs or CDDs based on the previous 30 years of historical HDD or CDD data. |

3

Table of Contents

WGL Holdings, Inc.

Washington Gas Light Company

Part I

| PSC of DC: The Public Service Commission of the District of Columbia is a three-member board that regulates Washington Gas’ distribution operations in the District of Columbia.

PSC of MD: The Maryland Public Service Commission is a five-member board that regulates Washington Gas’ distribution operations in Maryland.

Purchased Gas Charge (PGC): The purchased gas charge represents the cost of gas, gas transportation, gas storage services purchased and other gas related costs. The purchased gas charge is collected from customers through tariffs established by the regulatory commissions that have jurisdiction over Washington Gas.

Regulated Utility Segment: Includes the operations of Washington Gas that are regulated by regulatory commissions located in the District of Columbia, Maryland and Virginia, and the operations of Hampshire Gas Company that are regulated by the Federal Energy Regulatory Commission.

Retail Energy-Marketing Segment: Unregulated sales of natural gas and electricity to end users by our subsidiary, Washington Gas Energy Services, Inc.

Return on Average Common Equity: Net income divided by average common shareholders’ equity.

Revenue Normalization Adjustment (RNA): A regulatory billing mechanism in the state of Maryland designed to stabilize the level of net revenues collected from customers by eliminating the effect of deviations in customer usage caused by variations in weather from normal levels, and other factors such as conservation.

Steps to Advance Virginia’s Energy Plan (SAVE Plan): A plan that provides for accelerated recovery mechanisms for costs of eligible infrastructure replacement programs in the state of Virginia.

SCC of VA: The Commonwealth of Virginia State Corporation Commission is a three-member board that regulates Washington Gas’ distribution operations in Virginia.

Service Area: The region in which Washington Gas operates. The service area includes the District of Columbia, and the surrounding metropolitan areas in Maryland and Virginia.

Solar Renewable Energy Credits (SREC): a certificate representing the “green attributes” of one megawatt-hour (MWh) of electricity generated from solar energy.

Sendout: The total gas that is produced, purchased, or withdrawn from storage within a certain interval of time. Gas sendout is comprised of natural gas sales, exchanges, deliveries, natural gas used by the company and unaccounted-for gas.

Strategic Infrastructure Development and Enhancement Plan (STRIDE Plan): A plan to recover the reasonable and prudent costs associated with infrastructure replacements through monthly surcharges in the state of Maryland.

Tariffs: Documents approved by the regulatory commission in each jurisdiction that set the prices Washington Gas may charge and the practices it must follow when providing utility service to its customers.

Third Party Marketer: Unregulated companies that sell natural gas and electricity directly to retail customers. Washington Gas Energy Services, Inc., an affiliate of Washington Gas and a wholly owned subsidiary company of Washington Gas Resources Corporation, is a third-party marketer. |

Therm: A natural gas unit of measurement that includes a standard measure for heating value. We report our natural gas sales and deliveries in therms. A therm of gas contains 100,000 British thermal units of heat, or the energy equivalent of burning approximately 100 cubic feet of natural gas under normal conditions. Ten million therms equal approximately one billion cubic feet of natural gas.

Unbundling: The separation of the delivery of natural gas or electricity from the sale of these commodities and related services that, in the past, were provided only by a regulated utility.

Utility Net Revenues: A non-GAAP measure calculated as operating revenues less the associated cost of energy and applicable revenue taxes. Used to analyze the profitability of the regulated utility segment, as the cost of gas associated with sales to customers and revenue taxes are generally pass through amounts.

Value-At-Risk: A risk measurement that estimates the largest expected loss over a specified period of time under normal market conditions within a specified probabilistic confidence interval.

Washington Gas: Washington Gas Light Company is a subsidiary of WGL Holdings, Inc. that sells and delivers natural gas primarily to retail customers in accordance with tariffs approved by the PSC of DC, the PSC of MD and the SCC of VA.

Washington Gas Resources: Washington Gas Resources Corporation is a subsidiary of WGL Holdings, Inc. that owns the majority of the non-utility subsidiaries.

Weather Derivative: A financial instrument that provides financial protection from the effects of variations from normal weather.

Weather Normalization Adjustment (WNA): A billing adjustment mechanism that is designed to minimize the effect of variations from normal weather on utility net revenues.

WGESystems: Washington Gas Energy Systems, Inc. is a subsidiary of Washington Gas Resources Corporation, which provides commercial energy efficient and sustainable solutions to government and commercial clients.

WGL: WGL Holdings, Inc. is a holding company that is the parent company of Washington Gas Light Company and other subsidiaries.

WGL Midstream: WGL Midstream, Inc. is a subsidiary of Washington Gas Resources that engages in acquiring and optimizing natural gas storage and transportation assets.

WGEServices: Washington Gas Energy Services, Inc. is a subsidiary of Washington Gas Resources Corporation that sells natural gas and electricity to retail customers on an unregulated basis.

WGSW: WGSW, Inc. is a subsidiary of Washington Gas Resources Corporation that was formed to invest in certain renewable energy projects. |

4

Table of Contents

WGL Holdings, Inc.

Washington Gas Light Company

Part I

Item 1. Business

WGL HOLDINGS, INC.

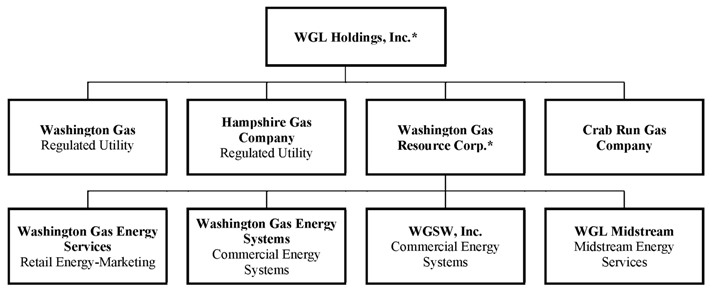

WGL Holdings, Inc. (WGL) was established on November 1, 2000 as a Virginia corporation. Through our wholly owned subsidiaries, we sell and deliver natural gas and provide energy-related products and services to customers primarily in the District of Columbia and the surrounding metropolitan areas in Maryland and Virginia, though our non-utility segments provide various energy services in 31 states and the District of Columbia. WGL promotes the efficient use of clean natural gas and renewable energy to improve the environment for the benefit of customers, investors, employees, and the communities it serves. WGL owns all of the shares of common stock of Washington Gas Light Company (Washington Gas), Washington Gas Resources, Hampshire Gas Company (Hampshire) and Crab Run Gas Company (Crab Run). Washington Gas Resources owns four unregulated subsidiaries that include Washington Gas Energy Services, Inc. (WGEServices), Washington Gas Energy Systems, Inc. (WGESystems), WGL Midstream, Inc. (WGL Midstream) and WGSW, Inc. (WGSW).

| *Holding company whose | stand alone results are reported in “other activities”. |

Our segments include Regulated Utility, Retail Energy-Marketing, Commercial Energy Systems and Midstream Energy Services. Transactions and activities not specifically identified in one of these four segments are reported as “Other Activities.” The four segments are described below.

5

Table of Contents

WGL Holdings, Inc.

Washington Gas Light Company

Part I

Item 1. Business (continued)

REGULATED UTILITY SEGMENT

Washington Gas Light Company

The regulated utility segment consists of Washington Gas and Hampshire and represents approximately 82% of WGL’s total assets. Washington Gas is a regulated public utility that sells and delivers natural gas to retail customers in accordance with tariffs approved by regulatory commissions in the District of Columbia and adjoining areas in Maryland, Virginia and several cities and towns in the northern Shenandoah Valley of Virginia. Washington Gas has been engaged in the natural gas distribution business since its incorporation by an Act of Congress in 1848. Washington Gas has been a Virginia corporation since 1953 and a corporation of the District of Columbia since 1957.

Washington Gas sells natural gas to customers who have elected not to purchase natural gas from unregulated third party marketers (refer to the section entitled “Natural Gas Unbundling”). Washington Gas recovers the cost of the natural gas

purchased to serve firm customers through recovery mechanisms as approved in jurisdictional tariffs. Any difference between gas costs incurred on behalf of firm customers and the gas costs recovered from those customers is deferred on the balance sheet as an amount to be collected from or refunded to customers in future periods. Therefore, increases or decreases in the cost of gas associated with sales made to firm customers have no direct effect on Washington Gas’ net revenues and net income.

Washington Gas, under its asset optimization program, makes use of storage and transportation capacity resources when those assets are not required to serve utility customers. The objective of this program is to derive a profit to be shared with its utility customers by entering into commodity-related physical and financial contracts with third parties (refer to the section entitled “Asset Optimization” for further discussion of the asset optimization program). Unless otherwise noted, therm deliveries reported for the regulated utility segment do not include those related to the asset optimization program.

At September 30, 2014, Washington Gas’ service area had a population estimated at 5.8 million and included almost 2.2 million households and commercial structures. Washington Gas operations are such that the loss of any one customer or group of customers would not have a significant adverse effect on its business. The following table lists the number of active customer meters and therms delivered by jurisdiction as of and for the year ended September 30, 2014 and 2013, respectively.

| Active Customer Meters and Therms Delivered by Jurisdiction | ||||||||||||||||

| Jurisdiction | Active Customer Meters as of September 30, 2014 |

Millions of Therms Delivered Fiscal Year Ended September 30, 2014 |

Active Customer Meters as of September 30, 2013 |

Millions of Therms Delivered Fiscal Year Ended September 30, 2013 |

||||||||||||

| District of Columbia |

155,993 | 317.8 | 154,982 | 300.4 | ||||||||||||

| Maryland |

454,273 | 891.7 | 448,916 | 865.7 | ||||||||||||

| Virginia |

506,777 | 679.4 | 501,225 | 614.8 | ||||||||||||

| Total |

1,117,043 | 1,888.9 | 1,105,123 | 1,780.9 | ||||||||||||

For additional information about gas deliveries and meter statistics, refer to the section entitled “Results of Operations” in Management’s Discussion and Analysis for Washington Gas.

Hampshire Gas Company

Hampshire owns full and partial interests in underground natural gas storage facilities, including pipeline delivery facilities located in and around Hampshire County, West Virginia, and operates those facilities to serve Washington Gas, which purchases all of the storage services of Hampshire. Washington Gas includes the cost of these services in the bills sent to its customers. Hampshire operates under a “pass-through” cost of service-based tariff approved by the FERC, and adjusts its billing rates to Washington Gas on a periodic basis to account for changes in its investment in utility plant and associated expenses.

Factors critical to the success of the regulated utility segment include: (i) operating a safe and reliable natural gas distribution system; (ii) having sufficient natural gas supplies to meet customer demands; (iii) being competitive with other sources of energy such as electricity, fuel oil and propane; (iv) having access to sources of liquidity; (v) recovering the costs and expenses of this business in the rates charged to customers and (vi) earning a just and reasonable rate of return on invested capital. The regulated utility segment reported total operating revenues related to gas sales and deliveries to external customers of approximately $1.4 billion, $1.2 billion, and $1.1 billion in fiscal years ended September 30, 2014, 2013 and 2012, respectively.

Regulatory Environment

Washington Gas is regulated by the PSC of DC, the PSC of MD and the SCC of VA which approve its terms of service and the billing rates that it charges to its customers. Hampshire is regulated by the FERC. The rates charged to utility customers are designed to recover Washington Gas’ operating expenses and natural gas commodity costs and to provide a return on its investment in the net assets used in its firm gas sales and delivery service. For a discussion of current rates and regulatory matters, refer to the section entitled “Rates and Regulatory Matters” in Management’s Discussion and Analysis for Washington Gas.

6

Table of Contents

WGL Holdings, Inc.

Washington Gas Light Company

Part I

Item 1. Business (continued)

District of Columbia Jurisdiction

The PSC of DC consists of three full-time members who are appointed by the Mayor with the advice and consent of the District of Columbia City Council. The term of each commissioner is four years with no limitations on the number of terms that can be served. The PSC of DC has no time limitation in which it must make decisions regarding modifications to base rates charged by Washington Gas to its customers; however it targets resolving pending rate cases within nine months from the date a rate case is filed.

Maryland Jurisdiction

The PSC of MD consists of five full-time members who are appointed by the Governor with the advice and consent of the Senate of Maryland. Each commissioner is appointed to a five-year term, with no limit on the number of terms that can be served.

When Washington Gas files for a rate increase, the PSC of MD may initially suspend the proposed increase for 180 days, and then has the option to extend the suspension for an additional 30 days. If action has not been taken after 210 days, the requested rates become effective subject to refund.

Virginia Jurisdiction

The SCC of VA consists of three full-time members who are elected by the General Assembly of Virginia. Each commissioner has a six-year term with no limitation on the number of terms that can be served.

Either of two methods may be used to request a modification of existing rates. Washington Gas may file an application for a general rate increase in which it may propose new adjustments to the cost of service that are different from those previously approved for Washington Gas by the SCC of VA, as well as a revised return on equity. The proposed rates under this process may take effect 150 days after the filing, subject to refund pending the outcome of the SCC of VA’s action on the application.

Alternatively, an expedited rate case procedure allows proposed rate increases to be effective 30 days after the filing date, also subject to refund. Under this procedure, Washington Gas may not propose new adjustments for issues not approved in its last general rate case, or request a change in its authorized return on common equity. Once filed, other parties may propose new adjustments or a change in the cost of capital from the level authorized in its last general rate case. The expedited rate case procedure may not be available if the SCC of VA decides that there has been a substantial change in circumstances since the last general rate case filed by Washington Gas.

Seasonality of Business Operations

Washington Gas’ business is weather-sensitive and seasonal because the majority of its business is derived from residential and small commercial customers who use natural gas for space heating. Excluding deliveries for electric generation, in fiscal year 2014 and 2013, approximately 79% and 77%, respectively, of the total therms delivered in Washington Gas’ service area occurred during its first and second fiscal quarters. Washington Gas’ earnings are typically generated during these two quarters, and Washington Gas historically incurs net losses in the third and fourth fiscal quarters. The seasonal nature of the business creates large variations in short-term cash requirements, primarily due to the fluctuations in the level of customer accounts receivable, unbilled revenues and storage gas inventories. Washington Gas finances these seasonal requirements primarily through the sale of commercial paper and unsecured short-term bank loans. For information on our management of weather risk, refer to the section entitled “Weather Risk” in Management’s Discussion and Analysis. For information about management of cash requirements, refer to the section entitled “Liquidity and Capital Resources” in Management’s Discussion and Analysis.

Natural Gas Supply and Capacity

Capacity and Supply Requirements

Washington Gas is responsible for acquiring sufficient natural gas supplies, interstate pipeline capacity and storage capacity to meet customer demand. As such, Washington Gas has adopted a diversified portfolio approach designed to address constraints on supply by using multiple supply receipt points, dependable interstate pipeline transportation and storage arrangements, and its own substantial storage and peak shaving capabilities. Washington Gas’ supply and pipeline capacity plan is based on forecasted system requirements, and takes into account estimated load growth, attrition, conservation, geographic location, interstate pipeline and storage capacity and contractual limitations and the forecasted movement of customers between bundled service and delivery service. Under reduced supply conditions, Washington Gas may implement contingency plans in order to maximize the number of customers served. Contingency plans include requests to the general population to conserve and target curtailments to specific sections of the system, consistent with curtailment tariffs approved by regulators in each of Washington Gas’ three jurisdictions.

7

Table of Contents

WGL Holdings, Inc.

Washington Gas Light Company

Part I

Item 1. Business (continued)

Washington Gas obtains natural gas supplies that originate from multiple regions throughout the United States and Canada. At September 30, 2014 and 2013, Washington Gas had service agreements with four pipeline companies that provided firm transportation and/or storage services directly to Washington Gas’ city gate. For fiscal years 2014 and 2013, these contracts have expiration dates ranging from fiscal years 2015 to 2032 and 2014 to 2029, respectively.

Transportation and Storage Additions

Washington Gas has contracted with various interstate pipeline and storage companies to add to its storage and transportation capacity. The following projects are in progress to increase Washington Gas’ transportation and/or storage capacity.

| Transportation and Storage Capacity Additions (in therms) | ||||||

| Pipeline Service Provider | Daily Capacity | Annual Capacity | In-Service Date (Fiscal Year) | |||

| Dominion Transmission Inc. Alleghany Storage |

1 million | 60 million | 2015 | |||

| Transcontinental Gas Pipe Line Company |

0.75 million | 11 million | 2015 | |||

| Transcontinental Gas Pipe Line Company, LLC Leidy Southeast |

1.65 million | 60 million | 2016 | |||

Washington Gas will continue to monitor other opportunities to acquire or participate in obtaining additional pipeline and storage capacity that will support customer growth and improve or maintain the high level of service expected by its customer base.

Asset Optimization Derivative Contracts

Under the asset optimization program, Washington Gas utilizes its storage and transportation capacity resources when they are not being used to serve its utility customers. Washington Gas executes commodity-related physical and financial contracts in the form of forwards, futures and options as part of an asset optimization program that is managed by its internal staff. These transactions are accounted for as derivatives. The objective of this program is to derive a profit to be shared with its utility customers. Washington Gas enters into these derivative transaction contracts to secure operating margins that will ultimately be shared between Washington Gas customers and shareholders. Because these sharing mechanisms are approved by our regulators in all three jurisdictions, any changes in fair value of the derivatives are recorded through earnings or as regulatory assets or liabilities if realized gains and losses will be included in the rates charged to customers.

The derivatives used under this program are subject to fair value accounting treatment which may cause significant period-to-period volatility in earnings from unrealized gains and losses associated with changes in fair value for the portion of net profits attributed to shareholders. However, this volatility does not change the secured operating margins that Washington Gas expects to realize from these transactions. All physically and financially settled contracts under our asset optimization program are reported on a net basis in the statements of income in “Utility cost of gas.” Total net margins including unrealized gains and losses recorded to “Utility cost of gas” after sharing and management fees associated with all asset optimization transactions for the year ended September 30, 2014 and the prior two fiscal years were net losses of $35.4 million and $33.2 million and a net gain of $28.3 million, respectively.

Refer to the sections entitled “Results of Operations — Regulated Utility” and “Market Risk” in Management’s Discussion and Analysis for further discussion of the asset optimization program and its effect on earnings.

Annual Sendout

As reflected in the table below, Washington Gas received natural gas from multiple sources in fiscal year 2014 and expects to use those same sources to satisfy customer demand in fiscal year 2015. Firm transportation denotes gas transported directly to the entry point of Washington Gas’ distribution system in contractual volumes. Transportation storage denotes volumes stored by a pipeline during the spring, summer and fall for withdrawal and delivery to the Washington Gas distribution system during the winter heating season to meet load requirements. Peak load requirements are met by: (i) underground natural gas storage at the Hampshire storage field; (ii) the local production of propane air plants located at Washington Gas-owned facilities in Rockville, Maryland (Rockville Station) and in Springfield, Virginia (Ravensworth Station) and (iii) other peak-shaving resources. Unregulated third party marketers acquire interstate pipeline and storage capacity and the natural gas commodity on behalf of Washington Gas’ delivery service customers under customer choice programs. Washington Gas also provides transportation, storage and peaking resources to unregulated third party marketers (refer to the section entitled “Natural Gas Unbundling”). These retail marketers have natural gas delivered to the entry point of Washington Gas’ distribution system on behalf of those utility customers that have decided to acquire their natural gas commodity on an unbundled basis, as discussed below.

8

Table of Contents

WGL Holdings, Inc.

Washington Gas Light Company

Part I

Item 1. Business (continued)

Excluding the sendout of sales and deliveries of natural gas used for electric generation, the following table outlines total sendout of the system. The sources of delivery and related volumes that were used to satisfy the requirements of fiscal year 2014 and those projected for pipeline year 2015 are shown in the following table.

|

Sources of Delivery for Annual Sendout |

||||||||||||||||

| (In millions of therms) | Fiscal Year

|

|||||||||||||||

| Sources of Delivery | Actual 2013 |

Actual 2014 (a) |

Projected 2015 (b) |

|||||||||||||

| Firm Transportation |

613 | 622 | 604 | |||||||||||||

| Transportation Storage |

261 | 269 | 252 | |||||||||||||

| Hampshire Storage, Company-Owned Propane-Air Plants, and other Peak-Shaving Resources |

18 | 20 | 19 | |||||||||||||

| Unregulated Third Party Marketers |

759 | 851 | 775 | |||||||||||||

| Total |

1,651 | 1,762 | 1,650 | |||||||||||||

(a) Higher 2014 sendouts is the result of colder weather than 2013.

(b) Based on normal weather.

Design Day Sendout

The effectiveness of Washington Gas’ capacity resource plan is largely dependent on the sources used to satisfy forecasted and actual customer demand requirements for its design day. For planning purposes, Washington Gas assumes that all interruptible customers will be curtailed on the design day. Washington Gas’ forecasted design day demand for the 2014-2015 winter season is 19.0 million therms and Washington Gas’ projected sources of delivery for design day sendout is 20.0 million therms. This provides a reserve margin of approximately 5.2%. Washington Gas plans for the optimal utilization of its storage and peaking capacity to reduce its dependency on firm transportation and to lower pipeline capacity costs. The following table reflects the sources of delivery that are projected to be used to satisfy the forecasted design day sendout estimate for fiscal year 2015.

| Projected Sources of Delivery for Design Day Sendout | ||||||||

| (In millions of therms) | Fiscal Year 2015 | |||||||

| Sources of Delivery | Volumes | Percent | ||||||

| Firm Transportation |

5.2 | 26 | % | |||||

| Transportation Storage |

8.5 | 43 | % | |||||

| Hampshire Storage, Company-Owned Propane-Air Plants and other Peak-Shaving Resources |

6.1 | 30 | % | |||||

| Unregulated Third Party Marketers |

0.2 | 1 | % | |||||

| Total |

20.0 | 100 | % | |||||

Natural Gas Unbundling

At September 30, 2014, customer choice programs for natural gas customers were available to all of Washington Gas’ regulated utility customers in the District of Columbia, Maryland and Virginia. These programs allow customers to purchase their natural gas from unregulated third party marketers, rather than purchasing this commodity as part of a bundled service from the local utility. Of Washington Gas’ 1.1 million active customers at September 30, 2014, approximately 182,000 customers purchased their natural gas commodity from unregulated third party marketers.

9

Table of Contents

WGL Holdings, Inc.

Washington Gas Light Company

Part I

Item 1. Business (continued)

The following table provides the status of customer choice programs in Washington Gas’ jurisdictions at September 30, 2014.

| Participation in Customer Choice Programs | ||||||||||

| At September 30, 2014 | ||||||||||

| Jurisdiction | Customer Class | Eligible Customers | ||||||||

| Total | % Participating | |||||||||

| District of Columbia |

Firm: |

|||||||||

| Residential |

143,268 | 12 | % | |||||||

| Commercial |

12,539 | 33 | % | |||||||

| Interruptible |

186 | 94 | % | |||||||

| Maryland |

Firm: |

|||||||||

| Residential |

424,152 | 22 | % | |||||||

| Commercial |

29,906 | 43 | % | |||||||

| Interruptible |

213 | 99 | % | |||||||

| Electric Generation |

2 | 100 | % | |||||||

| Virginia |

Firm: |

|||||||||

| Residential |

477,873 | 10 | % | |||||||

| Commercial |

28,660 | 32 | % | |||||||

| Interruptible |

244 | 80 | % | |||||||

| Total |

1,117,043 | |||||||||

When customers choose to purchase the natural gas commodity from unregulated third party marketers, Washington Gas’ net income is not affected because Washington Gas charges its customers the cost of gas without any mark-up. When customers select an unregulated third party marketer as their gas supplier, Washington Gas continues to charge these customers to deliver natural gas through its distribution system at rates identical to the delivery portion of the bundled sales service customers.

Competition

The Natural Gas Delivery Function

The natural gas delivery function, the core business of Washington Gas, continues to be regulated by local and state regulatory commissions. In developing this core business, Washington Gas has invested $ 4.3 billion as of September 30, 2014 to construct and operate a safe and reliable distribution system. Because of the high fixed costs and significant safety and environmental considerations associated with building and operating a distribution system, Washington Gas expects to continue being the only owner and operator of a distribution system in its current franchise area for the foreseeable future. The nature of Washington Gas’ customer base and the distance of most customers from interstate pipelines mitigate the threat of bypass of its facilities by other potential delivery service providers.

Competition with Other Energy Products

Washington Gas faces competition based on customers’ preference for other energy products and the prices of those products compared to natural gas. In the residential market, which generates a significant portion of Washington Gas’ net income, the most significant product competition occurs between natural gas and electricity. Because the cost of electricity is affected by the cost of fuel used to generate electricity, such as natural gas, Washington Gas generally maintains a price advantage over competitive electricity supply in its service area for traditional residential uses of energy such as heating, water heating and cooking. Washington Gas continues to attract the majority of the new residential construction market in its service territory, and consumers’ continuing preference for natural gas allows Washington Gas to maintain a strong market presence. The following table lists the new customer meters added by jurisdiction and major rate class for the year ended September 30, 2014.

| New Customer Meters by Area | ||||||||||||||||

| Residential |

Commercial and |

Group Meter Apartments |

Total | |||||||||||||

| Maryland |

5,490 | 296 | 8 | 5,794 | ||||||||||||

| Virginia |

5,600 | 404 | 4 | 6,008 | ||||||||||||

| District of Columbia |

1,371 | 130 | 24 | 1,525 | ||||||||||||

| Total |

12,461 | 830 | 36 | 13,327 | ||||||||||||

In the interruptible market, fuel oil is the prevalent energy alternative to natural gas. Washington Gas’ success in this market depends largely on the relationship between natural gas and oil prices. The supply of natural gas primarily is derived from domestic sources, and the relationship between supply and demand generally has the greatest impact on natural gas prices. Since the source of a large portion of oil comes from foreign countries, political events and foreign currency conversion rates can influence oil supplies and prices to domestic consumers.

10

Table of Contents

WGL Holdings, Inc.

Washington Gas Light Company

Part I

Item 1. Business (continued)

RETAIL ENERGY-MARKETING SEGMENT

Description

The retail energy-marketing segment consists of the operations of WGEServices, which competes with regulated utilities and other unregulated third party marketers to sell natural gas and/or electricity directly to residential, commercial and industrial customers in Maryland, Virginia, Delaware, Pennsylvania and the District of Columbia. WGEServices buys natural gas and electricity with the objective of earning a profit through competitively priced sales contracts with end-users. These commodities are delivered to retail customers through the distribution systems owned by regulated utilities. Washington Gas is one of several utilities that delivers gas to/on behalf of WGEServices and unaffiliated electric utilities deliver all of the electricity sold. Additionally, WGEServices bills its customers either independently or through the billing services of the regulated utilities that deliver its commodities. Refer to Note 18—Related Party Transactions of the Notes to Consolidated Financial Statements for further discussion of our purchase of receivables program.

WGEServices also sells wind and other renewable energy credits and carbon offsets to retail customers. WGEServices does not own or operate any other natural gas, production, transmission or distribution assets.

At September 30, 2014, WGEServices served approximately 157,000 residential, commercial and industrial natural gas customer accounts and approximately 162,000 residential, commercial and industrial electricity customer accounts located in Maryland, Virginia, Delaware, Pennsylvania and the District of Columbia. Its customer concentration is such that the loss of any one customer or group of customers would not have a significant adverse effect on its business.

Factors critical to managing the retail energy-marketing segment include:

| • | managing the market risk of the difference between the price committed to customers under sales contracts and the cost of natural gas and electricity needed to satisfy these commitments, including capacity and transmission costs and costs to meet renewable portfolio standards; |

| • | managing credit risks associated with customers and suppliers; |

| • | having sufficient deliverability of natural gas and electric supplies and transportation to serve the demand of its customers which can be affected by the ability of natural gas producers, pipeline gatherers, natural gas processors, interstate pipelines, electricity generators and regional electric transmission operators to deliver the respective commodities; |

| • | access to sources of financial liquidity; |

| • | controlling the level of selling, general and administrative expenses, including customer acquisition expenses and |

| • | the ability to access markets through customer choice programs or other forms of deregulation. |

The retail energy-marketing segment’s total operating revenues from external customers were $1.3 billion for the fiscal years ended September 30, 2014, 2013, and 2012.

Seasonality of Business Operations

The operations of WGEServices are seasonal, with larger amounts of electricity being sold in the summer months and larger amounts of natural gas being sold in the winter months. Working capital requirements can vary significantly during the year and these variations are financed through internally generated funds and WGL’s issuance of commercial paper and unsecured short-term bank loans. WGEServices accesses these funds through the WGL money pool. For a discussion of the WGL money pool, refer to the section entitled “Money Pool” in Management’s Discussion and Analysis.

Natural Gas and Electricity Supply

On February 20, 2013, WGEServices entered into a five-year secured supply arrangement with Shell Energy North America (US), LP (Shell Energy). Under this arrangement, WGEServices has the ability to purchase the majority of its power, natural gas and related products from Shell Energy in a structure that reduces WGEServices’ cash flow risk from collateral posting requirements. While Shell is intended to be the majority provider of natural gas and electricity, WGEServices retains the right to purchase supply from other providers.

Natural gas supplies are delivered to WGEServices’ market territories through several interstate natural gas pipelines. To supplement WGEServices’ natural gas supplies during periods of high customer demand, WGEServices maintains gas storage inventory in storage facilities that are assigned by natural gas utilities such as Washington Gas. This storage inventory enables WGEServices to meet daily and monthly fluctuations in demand and to minimize the effect of market price volatility.

11

Table of Contents

WGL Holdings, Inc.

Washington Gas Light Company

Part I

Item 1. Business (continued)

The PJM Interconnection (PJM) is a regional transmission organization that regulates and coordinates generation supply and the wholesale delivery of electricity in the states and jurisdictions where WGEServices operates. WGEServices buys wholesale and sells retail electricity in the PJM market territory, subject to its rules and regulations. PJM requires that its market participants have sufficient load capacity to serve their customers’ load requirements.

Competition

Natural Gas

WGEServices competes with regulated gas utilities and other third party marketers to sell natural gas to customers both inside and outside of the Washington Gas service area. Marketers of natural gas compete largely on price; therefore, gross margins are relatively small. To provide competitive pricing to its retail customers and in adherence to its risk management policies and procedures, WGEServices manages its natural gas contract portfolio by closely matching the commitments for gas deliveries from wholesale suppliers with requirements to serve retail sales customers. For a discussion of WGEServices’ exposure to and management of price risk, refer to the section entitled “Market Risk—Price Risk Related to the Retail Energy-Marketing Segment” in Management’s Discussion and Analysis.

Electricity

WGEServices competes with regulated electric utilities and other third party marketers to sell electricity to customers. Marketers of electric supply compete largely on price; therefore, gross margins are relatively small. To provide competitive pricing to its retail customers and in adherence to its risk management policies and procedures, WGEServices manages its electricity contract portfolio by closely matching the commitment for electricity deliveries from suppliers with requirements to serve sales customers. For a discussion of WGEServices’ exposure to and management of price risk, refer to the section entitled “Market Risk—Price Risk Related to the Retail Energy-Marketing Segment” in Management’s Discussion and Analysis.

WGEServices’ residential and small commercial electric customer growth opportunities are significantly affected by the price for Standard Offer Service (SOS) offered by electric utilities. These rates are periodically reset for each customer class based on the regulatory requirements in each jurisdiction. Customer growth opportunities either expand or contract due to the relationship of these SOS rates to current market prices.

COMMERCIAL ENERGY SYSTEMS SEGMENT

Description

The commercial energy systems segment consists of the operations of WGESystems, WGSW and the results of operations of affiliate owned commercial distributed energy projects. This segment focuses on clean and energy efficient solutions for its customers, driving earnings through (i) owning and operating distributed generation assets such as Solar Photovoltaic (solar PV) systems, combined heat and power plants, and natural gas fuel cells (ii) upgrading the mechanical, electrical, water and energy-related infrastructure of large governmental and commercial facilities by implementing both traditional and alternative energy technologies; and (iii) passive investments in residential and commercial retail solar PV companies. This segment has assets and activities in 15 different states and the District of Columbia.

12

Table of Contents

WGL Holdings, Inc.

Washington Gas Light Company

Part I

Item 1. Business (continued)

As of September 30, 2014 and 2013, this segment owned $242.7 million and $87.8 million, respectively, of operating distributed generation assets, generating a total of 85,141 megawatts in fiscal year 2014 and 33,526 megawatts in fiscal year 2013, respectively. Additionally, as of September 30, 2014, there was $107.9 million of signed projects under construction. These assets drive revenue through individual purchased power agreements and the sale of renewable energy credits. As of September 30, 2014, the assets in service have generated $66.4 million in investment tax credits and clean energy grants. These credits and grants are recognized as reductions in expense by amortizing them over the useful life of the underlying assets, typically 30 years.

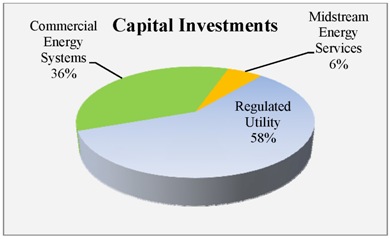

The commercial energy systems segment made up 36% of the total WGL expenditures for capital investments for the year ended September 30, 2014 as shown in the chart below:

Competition

There are many competitors in this business segment. Within the government sector, competitors primarily include companies contracting with customers under Energy Savings Performance Contracting (ESPC) as well as utilities providing services under Utility Energy Saving Contracts (UESC). In the renewable energy and distributed generation market, competitors primarily include other developers, tax equity investors, distributed generation asset owner firms and lending institutions. WGESystems competes on the basis of strong customer relationships developed over many years of implementing successful projects, developing and maintaining strong supplier relationships, and focusing in areas where it can bring relevant expertise.

Critical Factors

Factors critical to the success of the commercial energy systems segment include: (i) generating adequate sales commitments from the government and private sectors in the facility construction and retrofit markets; (ii) generating adequate sales commitments from distributed generation channel partners and customers; (iii) building a stable base of customer relationships; (iv) estimating and managing fixed-price contracts with contractors; (v) managing selling, general and administrative expenses; (vi) managing price and operational risk associated with distributed energy projects and (vii) successful operation and optimization of all commercial assets.

MIDSTREAM ENERGY SERVICES SEGMENT

Description

The Midstream Energy Services segment, which consists of the operations of WGL Midstream, engages in developing, acquiring, managing and optimizing natural gas storage and transportation assets. WGL Midstream enters into both physical and financial derivative transactions to mitigate risks while maximizing potential profits from the optimization of assets under its management. These derivatives may cause significant period-to-period volatility in earnings as recorded under GAAP; however, this volatility will not change the operating margins that WGL Midstream will ultimately realize from sales to customers or counterparties. WGL Midstream’s risk management policy requires it to closely match its forward physical and financial positions with its asset base, thereby minimizing its price risk exposure. For a discussion of WGL Midstream’s exposure to and management of price risk, refer to the section entitled “Market Risk—Price Risk Related to the Other Non-Utility Segment” in Management’s Discussion and Analysis.

WGL Midstream provides customized energy solutions to its customers and counterparties including producers, utilities, local distribution companies, power generators, wholesale energy suppliers, pipelines and storage facilities. In May 2013, WGL Midstream entered into an equity investment in Constitution Pipeline Company, LLC for an estimated $72.0 million. The pipeline is designed to transport at least 650,000 dekatherms of natural gas per day from the Marcellus region in northern Pennsylvania to major northeastern markets. In February 2014, WGL Midstream entered into an equity investment in a regulated pipeline project called Central Penn Pipeline (Central Penn) for an estimated $410.0 million. Central Penn will be an approximately 177-mile pipeline originating in Susquehanna County, Pennsylvania and extending to Lancaster County, Pennsylvania that will have the capacity to transport and deliver up to approximately 1.7 million dekatherms per day of natural gas. See Note 17—Other Investments for further details regarding these projects.

13

Table of Contents

WGL Holdings, Inc.

Washington Gas Light Company

Part I

Item 1. Business (concluded)

Competition

WGL Midstream competes with other midstream infrastructure and energy services companies, wholesale energy suppliers, producers and other non-utility affiliates of regulated utilities for the acquisition of natural gas storage and transportation assets.

Critical Factors

Factors critical to the success of WGL Midstream’s operations include: (i) adhering to strong internal risk management policies; (ii) winning business in a competitive marketplace; (iii) managing credit risks associated with customers and counterparties; (iv) expertise in managing commodity markets; (v) accessing sources of financial liquidity and (vi) managing the level of general and administrative expenses.

OTHER ACTIVITIES

Activities and transactions that are not significant enough on a stand-alone basis to warrant treatment as an operating segment, and that do not fit into one of our other operating segments, are aggregated as “Other activities” and are included as part of non-utility operations in the operating segment financial information. Administrative and business development activity costs associated with WGL and Washington Gas Resources are included in this segment.

We are subject to federal, state and local laws and regulations related to environmental matters. These laws and regulations may require expenditures over a long timeframe to control environmental effects. Almost all of the environmental liabilities we have recorded are for costs expected to be incurred to remediate sites where we or a predecessor affiliate operated manufactured gas plants (MGPs). Estimates of liabilities for environmental response costs are difficult to determine with precision because of the various factors that can affect their ultimate level. These factors include, but are not limited to, the following:

| • | the complexity of the site; |

| • | changes in environmental laws and regulations at the federal, state and local levels; |

| • | the number of regulatory agencies or other parties involved; |

| • | new technology that renders previous technology obsolete or experience with existing technology that proves ineffective; |

| • | the level of remediation required and |

| • | variations between the estimated and actual period of time that must be dedicated to respond to an environmentally-contaminated site. |

Washington Gas has identified up to ten sites where it or its predecessors may have operated MGPs. Washington Gas’ last use of an MGP was in 1984. In connection with these operations, we are aware that coal tar and certain other by-products of the gas manufacturing process are present at or near some former sites, and may be present at others. Based on the information available to us, we have concluded that none of the sites are likely to present an unacceptable risk to human health or the environment, and either the appropriate remediation is being undertaken, or Washington Gas believes no remediation is necessary. The impact of these matters is not expected to have a material effect on Washington Gas’ financial position, cash flows, capital expenditures, earnings or competitive position. See Note 12—Environmental Matters of the Notes to Consolidated Financial Statements for further discussion of environmental response costs.

At September 30, 2014, we had 1,444 employees comprising 1,332 utility and 112 non-utility employees.

Our code of conduct, corporate governance guidelines, and charters for the governance, audit and human resources committees of the Board of Directors are available on the corporate Web site www.wglholdings.com under the “Corporate Governance” link, and any changes or amendments to these documents will also be posted to this section of our Web site. Copies may be obtained by request to the Corporate Secretary at WGL Holdings, Inc., 101 Constitution Ave., N.W., Washington, D.C. 20080. Also on the corporate web site is additional information about WGL Holdings and free access to our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments filed with or furnished to the Securities and Exchange Commission.

Our Chairman and Chief Executive Officer certified to the New York Stock Exchange (NYSE) on March 31, 2014 that, as of that date, he was unaware of any violation by WGL of the NYSE’s corporate governance listing standards.

Our research and development costs during fiscal years 2014, 2013 and 2012 were not material.

14

Table of Contents

WGL Holdings, Inc.

Washington Gas Light Company

Part I

Item 1A. Risk Factors

The risk factors described below should be read in conjunction with other information included or incorporated by reference in this annual report on Form 10-K, including an in-depth discussion of these risks in the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The risks and uncertainties described below are not the only risks and uncertainties facing us that could adversely affect our results of operations, cash flows and financial condition.

WGL HOLDINGS, INC.

Our business may be adversely affected if we are unable to pay dividends on our common stock and principal and interest on our outstanding debt.

WGL is a holding company whose assets consist primarily of investments in subsidiaries. Accordingly, we conduct all of our operations through our subsidiaries. Our ability to pay dividends on our common stock and to pay principal and accrued interest on our outstanding debt depends on the payment of dividends to us by certain of our subsidiaries or the repayment of funds to us by our principal subsidiaries. The extent to which our subsidiaries do not pay dividends or repay funds to us may adversely affect our ability to pay dividends to holders of our common stock and principal and interest to holders of our debt.

If we are unable to access sources of liquidity or capital, or the cost of funds increases significantly, our subsidiaries’ businesses may be adversely affected.

Our ability to obtain adequate and cost effective financing depends on our credit ratings as well as the liquidity of financial markets. Our credit ratings depend largely on the financial performance of our subsidiaries, and a material downgrade in our current credit ratings to below investment grade could adversely affect our access to sources of liquidity and capital, as well as our borrowing costs.

We have credit risk that could adversely affect our results of operations, cash flows and financial condition.

We extend credit to counterparties. While we have prudent risk management policies in place, including credit policies, netting arrangements and margining provisions incorporated in contractual agreements, the risk exists that we may not be able to collect amounts owed to us.

Derivatives legislation and implementing rules could have an adverse impact on our ability to hedge risks associated with our business.

The Dodd-Frank Act regulates derivative transactions, which include certain instruments used in our risk management activities. The Dodd-Frank Act requires that most swaps be cleared through a registered clearing facility and traded on a designated exchange or swap execution facility with certain exceptions for entities that use swaps to hedge or mitigate commercial risk. Although the Dodd-Frank Act includes significant new provisions regarding the regulation of derivatives, the impact of those requirements have not been fully implemented by both the SEC and the Commodities Futures Trading Commission. The law and any new regulations could increase the operational and transactional cost of derivatives contracts and affect the number and/or creditworthiness of available counterparties.

Cyber attacks, including cyber-terrorism or other information technology security breaches, could disrupt our business operations and/or result in the loss or exposure of confidential or sensitive information.

Security breaches of our information technology infrastructure, including cyber attacks and cyber-terrorism, could lead to disruptions of our distribution or otherwise adversely impact our ability to safely operate our pipeline systems and serve our customers effectively. An attack on or failure of information technology systems could result in the unauthorized release of customer, employee or other confidential or sensitive data. The foregoing events could adversely affect our business reputation, diminish customer confidence, subject us to financial liability or increased regulation, increase our costs and expose us to material legal claims and liability and adversely affect our operations and financial results. WGL closely monitors both preventive and detective measures to manage these risks and maintains cyber risk insurance to mitigate a significant portion, but not all, of these risks and losses. To the extent that the occurrence of any of these cyber events is not fully covered by insurance, it could adversely affect WGL’s financial condition and results of operations.

Natural disasters and catastrophic events, including terrorist acts, may adversely affect our business.

Catastrophic events such as fires, earthquakes, explosions, floods, tornados, terrorist acts, or other similar occurrences could adversely affect Washington Gas’ facilities and operations. Washington Gas has emergency planning and training programs in place to respond to events that could cause business interruptions. However, unanticipated events or a combination of events, failure in resources needed to respond to events, or a slow or an inadequate response to events

15

Table of Contents

WGL Holdings, Inc.

Washington Gas Light Company

Part I

Item 1A. Risk Factors (continued)

may have an adverse impact on the operations, financial condition, and results of operations of Washington Gas. The availability of insurance covering catastrophic events may be limited or may result in higher deductibles, higher premiums, and more restrictive policy terms.

WGEServices’ business, earnings and cash requirements are highly weather sensitive and seasonal.

The operations of WGEServices, our retail energy-marketing subsidiary, are weather sensitive and seasonal, with a significant portion of revenues derived from the sale of natural gas to retail customers for space heating during the winter months, and from the sale of electricity to customers for cooling during the summer months. Weather conditions directly influence the volume of natural gas and electricity delivered to customers. Weather conditions can also affect the short-term pricing of energy supplies that WGEServices may need to procure to meet the needs of its customers. Deviations in weather from normal levels and the seasonal nature of WGEServices’ business can create large variations in earnings and short-term cash requirements.

The ability of WGEServices to meet customers’ natural gas and electricity requirements may be impaired if contracted supply is not available or delivered in a timely manner.

Sufficient capability to deliver natural gas and electric supplies to serve the demand of WGEServices’ customers is dependent upon the ability of natural gas producers, pipeline gatherers, natural gas processors, interstate pipelines, suppliers of electricity and regional electric transmission operators to meet these requirements. If WGEServices is unable to secure adequate supplies in a timely manner, either due to the failure of its suppliers to deliver the contracted commodity or the inability to secure additional quantities during significant abnormal weather conditions, it may be unable to meet its customer requirements. Such inability to meet its delivery obligations to customers could result in WGEServices experiencing defaults on contractual terms with its customers, penalties and financial damage payments, the loss of certain licenses and operating authorities, and/or a need to return customers to the regulated utility companies, such as Washington Gas.

The risk management strategies and related hedging activities of WGEServices and WGL Midstream may not be effective in managing risks and may cause increased volatility in its earnings.

WGEServices and WGL Midstream are exposed to commodity price risk to the extent their natural gas and electricity commodity purchases and obligations are not closely matched to their sales commitments in terms of volume and pricing. In addition, WGEServices is exposed to pricing of certain ancillary services provided or required by the power pool in which it operates. WGEServices and WGL Midstream attempt to manage their exposure to commodity price risk, as well as their exposure to weather and delivery risks by hedging, setting risk limits, customer pricing terms and employing other risk management tools and procedures. These risk management activities may not be as effective as planned, and cannot eliminate all of WGEServices’ and WGL Midstream’s risks.

WGEServices and WGL Midstream rely on guarantees and access to cash collateral from WGL.

The ability of WGEServices to purchase natural gas and electricity from suppliers is partly dependent upon guarantees issued on its behalf by WGL, and upon access to cash collateral through the issuance of commercial paper and unsecured short-term bank loans by WGL. Likewise, the ability of WGL Midstream to purchase natural gas from suppliers is dependent upon guarantees issues on its behalf by WGL, and upon access to cash collateral through the issuance of commercial paper and unsecured short-term bank loans by WGL. Should WGL not renew such guarantees, provide access to cash collateral, or if WGL’s credit ratings are downgraded, the ability of WGEServices and WGL Midstream to make commodity purchases at reasonable prices may be impaired.

Regulatory developments may negatively affect WGEServices and WGL Midstream.

The regulations that govern the conduct of competitive energy marketers are subject to change as the result of legislation or regulatory proceedings. Changes in these regulatory rules could reduce customer growth opportunities for WGEServices, or could reduce the profit opportunities associated with certain groups of existing or potential new customers. In addition, WGL Midstream’s pipeline investments are subject to Federal Energy Regulatory Commission (FERC) regulation and approval. Should FERC deny or delay approval for the midstream projects or enact additional regulations related to these activities, Midstream is at risk of loss for those investments.

Competition may negatively affect WGEServices and WGL Midstream.

WGEServices competes with other non-regulated retail suppliers of natural gas and electricity, as well as with the commodity rate offerings of electric and gas utilities. Increases in competition including utility commodity rate offers that are below prevailing market rates may result in a loss of sales volumes or a reduction in growth opportunities. WGL Midstream competes with other midstream infrastructure and energy services companies, wholesale energy suppliers and other non-utility affiliates of regulated utilities for the acquisition of natural gas storage and transportation assets.

Investing in certain non-controlling interests in investments may limit our ability to manage risks associated with these investments.

We have, and may acquire additional, non-controlling interests in investments. We may not have the right or power to direct the management of these interests in investments. In addition, other participants may become bankrupt or have other economic or business objectives that could negatively impact our investments.

16

Table of Contents

WGL Holdings, Inc.

Washington Gas Light Company

Part I

Item 1A. Risk Factors (continued)

Investments in renewable energy projects are subject to substantial risks and uncertainty.

Returns on investments in renewable energy projects depend upon current regulatory and tax incentives, which are subject to uncertainty with respect to their extent and future availability. As a result, investments in renewable energy projects face the risk that the current incentives will expire or become modified in the future thereby adversely affecting existing projects, economic performance and future potential for growth in this area.

Delays in the Federal Government budget appropriations may negatively impact WGESystems earnings.