Exhibit 10.2

400 MARKET STREET

OFFICE LEASE

INDEX

|

ARTICLE 1 |

DEMISED PREMISES |

|

ARTICLE 2 |

TERM |

|

ARTICLE 3 |

MINIMUM RENT |

|

ARTICLE 4 |

INCREASES IN TAXES, OPERATING COSTS AND COST OF LIVING |

|

ARTICLE 5 |

SECURITY DEPOSIT |

|

ARTICLE 6 |

SERVICES |

|

ARTICLE 7 |

CARE OF DEMISED PREMISES |

|

ARTICLE 8 |

SUBLETTING AND ASSIGNING |

|

ARTICLE 9 |

DELAY IN POSSESSION |

|

ARTICLE 10 |

FIRE OR OTHER CASUALTY |

|

ARTICLE 11 |

LIABILITY |

|

ARTICLE 12 |

EMINENT DOMAIN |

|

ARTICLE 13 |

INSOLVENCY |

|

ARTICLE 14 |

DEFAULT |

|

ARTICLE 15 |

SUBORDINATION/MORTGAGEE RIGHTS |

|

ARTICLE 16 |

NOTICES |

|

ARTICLE 17 |

HOLDING OVER |

|

ARTICLE 18 |

MISCELLANEOUS |

|

ARTICLE 19 |

TENANT PLAN |

|

ARTICLE 20 |

LANDLORD IMPROVEMENTS |

|

ARTICLE 21 |

WAIVER OF SUBROGATION |

|

ARTICLE 22 |

RENT TAX |

|

ARTICLE 23 |

PRIOR AGREEMENTS, AMENDMENTS |

|

ARTICLE 24 |

CAPTIONS |

|

ARTICLE 25 |

MECHANICS LIEN |

|

ARTICLE 26 |

LANDLORD’S RIGHT TO CURE |

|

ARTICLE 27 |

PUBLIC LIABILITY INSURANCE |

|

ARTICLE 28 |

ESTOPPEL STATEMENT |

|

ARTICLE 29 |

SUBMISSION OF LEASE |

|

ARTICLE 30 |

USE AND OCCUPANCY TAX |

|

ARTICLE 31 |

LANDLORD’S CONSENT |

|

ARTICLE 32 |

GOVERNMENTAL REGULATIONS |

|

ARTICLE 33. |

WASTE AND HAZARDOUS MATERIAL |

|

ARTICLE 34. |

NO WAIVER |

|

ARTICLE 35 |

OFAC CERTIFICATION |

|

ARTICLE 36 |

PRIOR LEASES |

|

ARTICLE 37 |

PARKING |

400 MARKET STREET

OFFICE LEASE

LEASE, made as of this 27th day of February, 2015, by and between 400 MARKET L.P., a Pennsylvania Limited Partnership (hereinafter called “Landlord”) and ALTEVA, INC., A NEW YORK CORPORATION (hereinafter called “Tenant”).

WITNESSETH THAT:

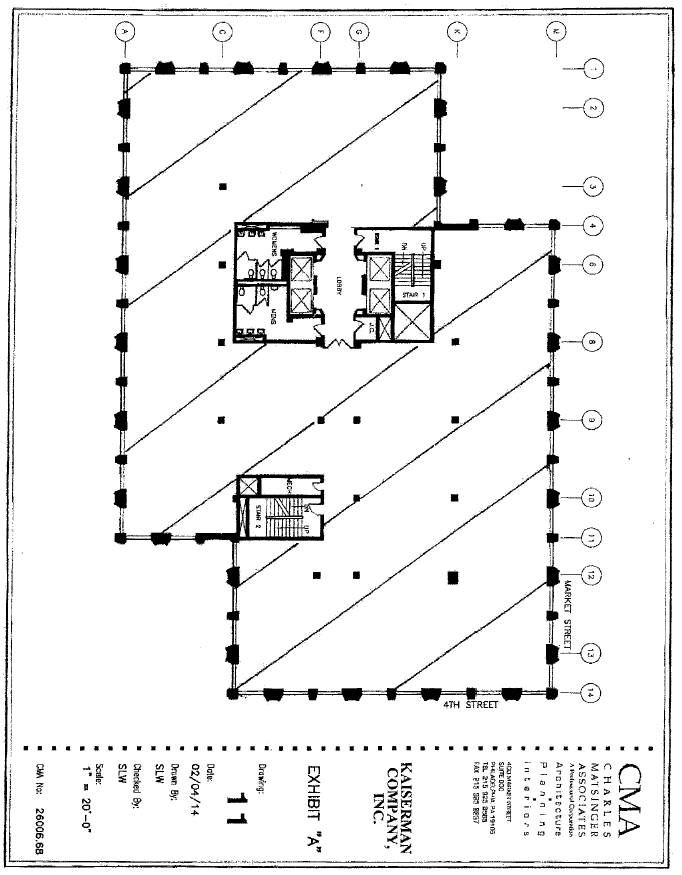

1. DEMISED PREMISES. Landlord, for the term and subject to the provisions and conditions hereof, leases to Tenant, and Tenant accepts from Landlord, the space (hereinafter referred to as the “Demised Premises” and more particularly described by the cross-hatched area on the floor plan annexed hereto as Exhibit “A”) deemed to consist of Fifteen Thousand Five Hundred Thirty (15,530) rentable square feet of space on the 11th floor of the building (the said building and the land and appurtenances thereto are hereinafter referred to as the “Building” or “Landlord’s Property”) known as 400 Market Street, situate at 400 Market Street, Philadelphia, Pennsylvania, to be used by Tenant for the purpose of general office use and for no other purpose. The Demised Premises are also known as Suite 1100.

2. TERM. (A). The term of the Lease shall commence on the Rental Commencement Date (as hereinafter defined) and end (unless sooner terminated as herein provided) at 11:59 P.M., on the date which is ten (10) full years from the “Rental Commencement Date” plus the period, if any, between the “Rental Commencement Date” and the first day of the next calendar month. The “Rental Commencement Date”, except as modified herein, shall be defined as either (i) the date when Landlord’s improvements to the Demised Premises as required by the provisions of Exhibit “D” (“Landlord’s Work”) are substantially completed, (ii) the date Tenant begins operating from within the Demised Premises, or (iii) the date Tenant has moved in to the Demised Premises, whichever date is earlier. Should the “Rental Commencement Date” occur on the first day of a calendar month, then such date will be the first day of such ten (10) full year period. For purposes of this Lease, the term substantially completed is defined as the date Landlord’s Work is completed to the condition (other than punch list/minor items) so that Tenant is able to commence construction work, if any, and/or install its trade fixtures, furniture, phone and office equipment.

B. Within thirty (30) days after the Rental Commencement Date, a supplement to this Lease, in the form attached hereto as “Supplement 1”, fixing the definite date of the ending of the term in accordance with Article 2A of this Lease, shall be executed by all parties and attached to and made a part of this Lease.

C. Notwithstanding anything to the contrary hereunder, Landlord shall permit Tenant to move into the Demised Premises no more than forty (40) days or less than twenty (20) days prior to the intended substantial completion of such space, which the parties agree is expected to be the one hundredth (100th) day following the later of (i) Tenant’s execution of this Lease, or (ii) final approval by both Tenant and Landlord of Construction Documents provided Tenant’s move in and occupancy does not materially interfere with Landlord’s ability to substantially complete the Demised Premises and/or does not increase the cost of Landlord’s Work (the term “Landlord’s Work” is defined in Section 20(a) of this Lease). If Tenant’s early occupancy will increase the cost to perform Landlord’s Work, Landlord will advise Tenant its estimate of such additional cost within five (5) days of Tenant’s request to move in; Tenant agrees to pay such amount on the 15th day after the Demised Premises are substantially completed. In the event Tenant’s early occupancy causes additional costs not contemplated prior to moving in, Landlord shall promptly advise Tenant; such additional cost to be paid by Tenant on the 15th day after the Demised Premises are substantially completed.

If Tenant occupies the Demised Premises before the Demised Premises is substantially completed:

1. Tenant acknowledges that Landlord shall require access to the Demised Premises to perform Landlord’s Work. Landlord, its employees, agents, contractors and subcontractor shall have the right from time to time without Landlord being subject to any liability to Tenant and without being in breach of any covenant in the Lease, to enter the Demised Premises to perform Landlord’s Work.

2. Tenant further acknowledges that Landlord’s Work may inconvenience Tenant and possibly disrupt Tenant’s business. Landlord agrees to use reasonable measures to perform Landlord’s Work so as to not unreasonably interfere with the conduct of Tenant’s business.

3. If Tenant does not provide Landlord with sufficient access to the Demised Premises, as reasonably determined by Landlord, Landlord obligation to perform Landlord’s Work will be delayed until Landlord has been afforded sufficient access to perform the Landlord’s Work.

The foregoing access rights shall only be applicable to the period that Landlord is performing Landlord’s Work.

D. Upon execution of this Lease by Landlord and Tenant, this Lease shall be considered a binding contract, provided, however, Tenant shall not be obligated to perform any of its monetary obligations hereunder, including the payment of minimum rent and additional rent items until the Rental

Commencement Date (except for the payment of its Security Deposit pursuant to Article 5). On and after the date Tenant, its agents, employees, contractors, subcontractors or invitees enter upon the Building or the Demised Premises to inspect, construct or install any telecommunications and/or computer lines, system furniture, trade fixtures or furnishings, until the Rental Commencement Date (i) Tenant shall not be obligated to perform its non-monetary obligations hereunder and (ii) the release and liability provisions of Section 11 and the insurance and indemnity provisions of Section 27 shall not be invoked so long as all required insurance remains in force as evidenced by certificate(s) of insurance. Notwithstanding anything contained in this subparagraph D to the contrary, Tenant shall not be relieved from any of its non-monetary obligations required by Article 19 and/or any other provision or clause of this Lease which is expressly, or by its nature is intended to be addressed or performed before the Rental Commencement Date.

3. MINIMUM RENT.

A. Tenant shall pay to Landlord, commencing on the Rental Commencement Date and continuing until the end of the term, a minimum rent in the amount set forth and collectable below:

|

|

|

|

|

|

|

RENT PER RENTABLE |

| |||

|

|

|

ANNUAL |

|

|

|

SQUARE FOOT OF |

| |||

|

|

|

OR FRACTION |

|

|

|

FLOOR SPACE PER |

| |||

|

|

|

THEREOF |

|

MONTHLY |

|

YEAR. |

| |||

|

Rental Commencement Date - the last day of the initial partial calendar month: |

|

$ |

949.06 PER DIEM |

|

|

|

|

| ||

|

First-Full-Twelve-Month-Period: |

|

$ |

341,660.00 |

|

$ |

28,471.67 |

|

$ |

22.00 |

|

|

Second-Full-Twelve-Month-Period: |

|

$ |

350,201.50 |

|

$ |

29,183.46 |

|

$ |

22.55 |

|

|

Third-Full-Twelve-Month-Period: |

|

$ |

358,956.54 |

|

$ |

29,913.04 |

|

$ |

23.11 |

|

|

Fourth-Full-Twelve-Month-Period: |

|

$ |

367,930.45 |

|

$ |

30,660.87 |

|

$ |

23.69 |

|

|

Fifth-Full-Twelve-Month-Period: |

|

$ |

377,128.71 |

|

$ |

31,427.39 |

|

$ |

24.28 |

|

|

Sixth-Full-Twelve-Month-Period: |

|

$ |

386,556.93 |

|

$ |

32,213.08 |

|

$ |

24.89 |

|

|

Seventh-Full-Twelve-Month-Period: |

|

$ |

396,220.85 |

|

$ |

33,018.40 |

|

$ |

25.51 |

|

|

Eighth-Full-Twelve-Month-Period: |

|

$ |

406,126.37 |

|

$ |

33,843.86 |

|

$ |

26.15 |

|

|

Ninth-Full-Twelve-Month-Period: |

|

$ |

416,279.53 |

|

$ |

34,689.96 |

|

$ |

26.80 |

|

|

Tenth-Full-Twelve-Month-Period: |

|

$ |

426,686.52 |

|

$ |

35,557.21 |

|

$ |

27.47 |

|

(B). The above sums shall be payable during the term hereof, in advance, in monthly installments. Further, all payments shall be made on the first day of each calendar month during said term.

(C). If the Rental Commencement Date begins on a day other than the first day of a month, rent from such day until the first day of the following month shall be prorated [at the rate of one-thirtieth (1/30) of the fixed monthly rent for each day] and shall be payable, in arrears, on the first day of the first full calendar month of the term hereof (and, in such event, the installment of rent paid at execution hereof shall be applied to the rent due for the first full calendar month of the term hereof).

(D). All rent and other sums due to Landlord hereunder shall be payable at the office of Landlord, Suite 300, The Rittenhouse Claridge, 18th and Walnut Streets, Philadelphia, Pennsylvania 19103, or to such other party or at such other address as Landlord may designate, from time to time, by written notice to Tenant, without demand and without deduction, set-off or counterclaim (except to the extent demand or deduction shall be expressly provided for herein).

(E). If Landlord, at any time or times, shall accept said rent or any other sum due to it hereunder after the same shall become due and payable, such acceptance shall not excuse delay upon subsequent occasions, or constitute, or be construed as, a waiver of any of Landlord’s rights hereunder.

The provisions under this entire Article shall survive the expiration or earlier termination of this Lease.

4. INCREASES IN TAXES AND OPERATING COSTS

A. As used in this Section 4, the following terms shall be defined as hereinafter set forth:

(1). (a). “Taxes” shall mean all real estate taxes and assessments, general or special, ordinary or extraordinary, foreseen or unforeseen, imposed upon the Building or with respect to the ownership thereof and the appurtenances and parcel of land appurtenant thereto more fully described on Exhibit “A-1” attached hereto. Taxes shall include without limitation, any assessment imposed by any public or private entity by reason of the Building being located in a special services district or similar designation. If, due to a future change in the method of taxation, any franchise, income, profit or other tax,

however designated, shall be levied or imposed in substitution, in whole or in part, for (or in lieu of) any tax which would otherwise be included within the definition of Taxes, such other tax shall be deemed to be included within Taxes as defined herein. “Taxes” shall also include Landlord’s costs and expenses (including statutory interest, if any) in obtaining or attempting to obtain any refund, reduction or deferral of Taxes for any year following the Base Year.

(b). For purposes of subparagraph 4(A)1(a) above, any assessment upon which Tenant’s share of Taxes is based shall be deemed to be the amount initially assessed until such time as an abatement, refund, rebate or increase, if any (retroactive or otherwise), shall be finally determined to be due, and upon such final determination, Landlord shall promptly notify Tenant of the amount, if any, due to Tenant or Landlord, as the case may be, as a result of the adjustment, and appropriate payment to Landlord or Tenant, as the case may be, shall thereafter be promptly made. Landlord shall have no duty to Tenant to contest, appeal or otherwise challenge any Taxes.

(2). “Base Year for Taxes” shall mean the twelve (12) month period commencing on the first day of January 2015.

(3). “Base Year for Operating Expenses” shall mean the twelve-month period commencing on the first day of January 2015.

(4). (a) “Tenant’s Proportionate Share” is Nine and Six Thousand Five Hundred Thirty-Four Ten-Thousandths Percent ( 9.6534 %); which is based on the rentable square feet of space of the Building excluding the portion of the Building leasable as retail space.

(b) “Tenant’s Taxes Proportionate Share” is Nine and One Thousand Six Hundred Fourteen Ten-Thousandths Percent ( 9.1614%); which is based on the rentable square feet of space of the Building.

5 (i). “Operating Expenses” shall mean Landlord’s actual out of pocket expenses in respect of the operation, maintenance and management of the Building excluding the portion of the Building leasable as retail space and shall include, without limitation: (a) wages and salaries (and taxes imposed upon employers with respect to such wages and salaries) and fringe benefits paid to persons employed by Landlord for rendering service in the normal operation, maintenance and repair of the Building (other than the leasable retail space within), excluding any overtime wages or salaries paid for providing extra services for any tenants which are separately billed to those tenants; (b) contract costs of independent contractors hired for the operation, maintenance and repair of the Building (other than the leasable retail space within); (c) costs of electricity, steam, water, sewer and other utilities chargeable to the operation and maintenance of the Building (other than the leasable retail space within); (d) cost of insurance for the Building (other than the leasable retail space within), including fire and extended coverage, elevator, boiler, sprinkler leakage, water damage, public liability and property damage, plate glass, and rent protection and all other insurance required by the holder of any mortgage secured on the Building (other than the leasable retail space within) or deemed proper by Landlord, but excluding any charge for increased premiums due to acts or omissions of other occupants of the Building because of extra risk which are reimbursed to Landlord by such other occupants; (e) fuel; (f) supplies; and (g) management, leasing and professional fees; and (h) any and all sums for landscaping, ground maintenance, sanitation control, cleaning, lighting, snow removal, parking area and driveway resurfacing, fire protection, policing, security, public liability and property damage insurance, and other expenses for the upkeep, maintenance and operation of the Building, payable in respect of or allocable to the Building by virtue of the ownership thereof appropriately reduced due to allocation (by Landlord in its reasonable discretion) of any item(s) in whole or in part allocable to the leasable retail portion of the Building. The term “Operating Expenses” shall not include: (a) the cost of redecorating not provided on a regular basis to tenants of the Building; (b) wages, salaries or fees paid to executive personnel of Landlord, if any; (c) the cost of any repair or replacement item which, by standard accounting practice, should be capitalized, except the cost of repairs and/or capital improvements designed to protect the health and safety of the tenants in the Building; (d) any charge for depreciation, interest or rents paid or incurred by Landlord, except for (I) machinery and equipment used or useful in the operation of the Building or (ii) with respect to the cost of repairs and/or capital improvements designed to protect the health and safety of the tenants in the Building; (e) subject to the provisions of Section 4.A(1) hereof, any charge for Landlord’s income tax, excess profit taxes, franchise taxes or similar taxes on Landlord’s business; (f) Taxes.

(ii). In determining Operating Expenses for any year, if less than 95% of the Building rentable area (excluding the leasable retail space within) shall have been occupied by tenants at any time during such year, Operating Expenses shall be deemed for such year to be an amount equal to the like expenses which Landlord reasonably determines would normally be incurred had such occupancy been 95% throughout such year, except that in no event shall Operating Expenses for any year be based upon a percentage of occupancy less than that utilized for the Base Year for Operating Expenses.

(iii). If, after the Base Year for Operating Expenses, Landlord shall eliminate any

component of Operating Expenses, as a result of the introduction of a labor saving device or other capital improvements, the corresponding item of Operating Expenses shall be deducted from the Operating Expenses expended by Landlord in said Base Year for purposes of calculating Tenant’s Proportionate Share of any increased Operating Expenses. Similarly, if after the Base Year for Operating Expenses, any particular component of Operating Expenses shall be reduced as a result of a labor saving device and/or any capital expenditure incurred in connection with the conversion or upgrade of a facility within or servicing the Building to a different type or more efficient type of facility (as for example but not limited to the conversion of steam heat to boilers, or the replacement of a chiller with a smaller sized, more efficient unit), the corresponding item of expense in the Base Year for Operating Expenses shall be replaced by the amount of the new expense for the first twelve (12) months following the conversion or upgrade.

B. For and with respect to each calendar year of the term of this Lease (and any renewals or extensions thereof) subsequent to the Base Year for Taxes, Tenant shall pay to Landlord, as additional rent, Tenant’s Taxes Proportionate Shares of the increase, if any, of Taxes for such year over those payable for the Base Year for Taxes (appropriately prorated for any partial calendar year included within the beginning and end of the term). Tenant’s Taxes Proportionate Share of such increase shall be paid during each calendar year in one or more installments, as Landlord shall determine, within twenty (20) days after receipt of a statement or statements prepared by Landlord setting forth the basis for the amount due, but in no event shall any payment on account of Taxes be due more than sixty (60) days prior to the date the underlying tax (or component thereof) upon which Tenant’s share is based is due to the taxing authority.

C. (i). For and with respect to each calendar year of the term of this Lease (and any renewals or extensions thereof) subsequent to the Base Year for Operating Expenses, there shall accrue, as additional rent, Tenant’s Proportionate Share of the increase, if any, of Operating Expenses for such year over those payable for the Base Year for Operating Expenses (appropriately prorated for any partial calendar year included within the beginning and end of the term).

(ii). Landlord shall furnish to Tenant on or before April 30 of each calendar year of the term hereof subsequent to the Base Year for Operating Expenses:

(A). A statement (the “Expense Statement”) prepared by Landlord setting forth (1) Operating Expenses for said Base Year, (2) Operating Expenses for the previous calendar year (if different from said Base Year), and (3) Tenant’s Proportionate Share of the increase, if any, in Operating Expenses for the previous calendar year; and

(B). A statement of Landlord’s good faith estimate of Operating Expenses for the current calendar year, and Tenant’s proportionate Share of the increase thereof over said Base Year (the “Estimated Share”) for the current calendar year.

(iii). On the first day of the first calendar month [but in no event sooner than ten (10) days] following delivery of the foregoing statements to Tenant, Tenant shall pay to Landlord, on account of its share of Operating Expenses (or Landlord shall pay to Tenant, if the following quantity is negative):

(A). One-Twelfth (1/12) of the Estimated Share multiplied by the number of full or partial calendar months elapsed during the current calendar year up to and including the month payment is made, plus any amounts due from Tenant to Landlord on account of Operating Expenses for prior periods of time, less:

(B). The amount, if any, by which the aggregate of payments made by Tenant on account of Operating Expenses for the previous calendar year exceed those actually due as specified in the Expense Statement.

(iv). On the first day of each succeeding month up to the time Tenant shall receive a new Expense Statement and statement of Tenant’s Estimated Share, Tenant shall pay to Landlord, on account of its share of Operating Expenses, one-twelfth (1/12) of the then current Estimated Share. Any payment due from Tenant to Landlord, or any refund due from Landlord to Tenant, on account of Operating Expenses not yet determined as of the expiration of the term hereof shall be made within twenty (20) days after submission to Tenant of the next Expense Statement.

D. DELETED:

The provisions under this entire Article shall survive the expiration or earlier termination of this Lease.

5. SECURITY DEPOSIT. As additional security for the full and prompt performance by Tenant of the terms and covenants of this Lease, Tenant agrees to deposit with the Landlord on execution hereof

the sum of Fifty-Six Thousand Nine Hundred Forty-Three Dollars and Thirty-Four Cents ($56,943.34), which shall not constitute rent for any month (unless so applied by Landlord on account of Tenant’s default). Tenant shall, upon demand, restore any portion of said security deposit which may be applied by Landlord to the cure of any default by Tenant hereunder. To the extent that Landlord has not applied said sum on account of a default, the security deposit shall be returned (without interest) to Tenant upon request within thirty (30) days after termination of this Lease.

6. SERVICES. Landlord agrees that it shall:

A. Furnish heat and air conditioning necessary, for comfortable occupancy of the Demised Premises, Monday through Friday from 8:00 A.M. to 6:00 P.M., and on Saturday from 8:00 A.M. to 1:00 P.M., holidays, excepted. Heat and air conditioning required by Tenant at other times shall be supplied upon reasonable prior notice, and shall be paid for by Tenant, promptly upon billing, at such rates as Landlord shall specify to cover the additional costs incurred. The Building’s heating and air conditioning systems is designed to accommodate one (1) person per one hundred (100) square feet of usable space; such system is designed to maintain 78° FBS fifty percent (50%) RH inside design conditions at 95 FDB 78° outside conditions and the heating system will maintain 68° FDB inside design conditions at 0 degree FDB outside design conditions.

B. Provide passenger elevator service to the Demised Premises during all working days (Sundays and holidays excepted) from 8:00 A.M. to 7:00 P.M., and on Saturdays from 8:00 A.M. to 1:00 P.M., with one elevator subject to call at all other times. Tenant and its employees and agents shall have access to the Demised Premises at all times, subject to compliance with such security measures as shall be in effect for the Building. The holidays above referred to are New Year’s Day, Good Friday, Memorial Day, July 4th, Labor Day, Thanksgiving, Christmas, or any day set aside to celebrate such holidays;

C. Provide janitorial service to the Demised Premises as specified on Exhibit “B” annexed hereto. Any and all additional or specialized janitorial service desired by Tenant shall be contracted for by Tenant directly with Landlord’s janitorial agent and the cost and payment thereof shall be and remain the sole responsibility of Tenant; Tenant acknowledges cleaning up and trash removal after professional business events/parties is not a normal janitorial function and will be surcharged as needed.

D. (i). Make all structural repairs to the Building other than those structural repairs to the Demised Premises required to be performed to comply with the law commonly known as the “Americans with Disabilities Act” and the 1997 Philadelphia Building code, as amended (collectively, the “ADA Code”) after Landlord initially delivers possession of the Demised Premises in accordance with the Lease. Landlord also agrees that it shall make all repairs, which may be needed to the mechanical, electrical and plumbing systems in the Demised Premises other than those repairs which are required to be performed by the ADA Code after Landlord initially delivers possession of the Demised Premises in accordance with the Lease. In any event, Landlord shall not make structural repairs to any non-building standard fixtures or other improvements installed or made by or at the request of Tenant and requiring unusual or special maintenance. In the event that any repair is required by reason of the negligence or abuse of Tenant or its agents, employees, invitees or of any other person using the Demised Premises with Tenant’s consent, express or implied, Landlord may make such reasonable repair and add the reasonable cost thereof to the first installment of rent which will thereafter become due, unless Landlord shall have actually recovered such cost through insurance proceeds. The foregoing obligation of Tenant however shall not permit Tenant to make any changes to the Demised Premises which otherwise would require Landlord’s approval by virtue of this Lease. Tenant shall instruct its architect or designer to prepare Tenant’s plans for the Demised Premises so as to assure that the Demised Premises will be in compliance with such Act. Anything contained herein to the contrary notwithstanding, at the time of delivery of the Demised Premises to Tenant, the Demised Premises shall, at Landlord’s expense, be fully compliant with the ADA Code.

(ii). Tenant acknowledges that freon based equipment is utilized within the Building’s heating, ventilating and air-conditioning (HVAC) system, and that future law might require its removal. In the event such system is renovated, replaced or changed to meet local, state or federal codes any interferences or interruption caused shall not be deemed a constructive eviction nor be cause for a minimum rent abatement.

E. Provide water for drinking, lavatory and toilet purposes drawn through fixtures installed by Landlord (in common areas);

F. Furnish the Demised Premises with electric current for lighting and normal office use on an 24/7 basis, and for heating and air-conditioning Monday through Friday from 8:00 A.M. to 6:00 P.M. and on Saturday from 8:00 A.M. to 1:00 P.M., holidays excepted, and replace, at Tenant’s sole cost and expense, light bulbs and tubes when required. Tenant shall not install or operate in the Demised Premises any electrically operated equipment or other machinery, other than computers, servers, copiers, typewriters, adding machines and other machinery and equipment normally used in modern offices and/or used by Tenant in its normal day-to-day business operation, or any plumbing fixtures, without first obtaining the prior written consent of the Landlord, which consent shall not be unreasonably withheld or delayed. Landlord may condition such consent upon the payment by Tenant of additional rent as compensation for the additional consumption of water and/or electricity occasioned by the operation of said equipment, fixtures or machinery. Tenant shall not install any equipment of any kind or nature

whatsoever which would or might necessitate any changes, replacements or additions to the water system, plumbing system, heating system, air conditioning system or the electrical system servicing the Demised Premises or any other portion of the Building without the prior written consent of the Landlord, and in the event such consent is granted, such replacements, changes or additions shall be paid for by Tenant.

Landlord, at its option, may install sub-meters in locations on each floor designated by Landlord to measure electrical consumption within the Demised Premises, and Tenant shall pay Landlord, within fifteen (15) days after the rendition of a bill or bills therefor, at such intervals as Landlord shall determine, additional rent on account of all electricity consumption within the Demised Premises, based upon the actual rate paid by Landlord for the consumption of electricity measured by said sub-meter. Operating Expenses, as hereinbefore defined, shall not include charges for electricity to the extent such charges are separately metered. In addition, so long as Landlord shall sub-meter the entire Demised Premises’ electric service and charge Tenant for electricity with respect to the entire Demised Premises, there shall be deducted from Operating Expenses Tenant’s share, as determined by Landlord, of the costs of electricity for the Base Year for Operating Expenses and associated management or administrative fee added by Landlord to such cost of electricity, if any.

Landlord shall have the right at any time and from time to time during the term of the Lease to either contract for service from a different company or companies other than that company (“Electric Service Provider”) currently providing electricity service (each such company shall hereinafter be referred to as “Alternate Service Provider”) or continue to contract for service from the Electric Service Provider. Tenant shall cooperate with Landlord, the Electric Service Provider, and any Alternate Service Provider at all times and, as reasonably necessary, shall allow Landlord, Electric Service Provider, and any Alternate Service Provider reasonable access to 400 Market Street’s electric lines, feeders, risers, wiring and any other machinery within the Demised Premises. Except as provided in Section 6.H. below, Landlord shall in no way be liable or responsible for any loss, damage, or expenses that Tenant may sustain or incur by reason of any change, failure, interference, disruption, or defect in the supply or character of the electric energy furnished to the Demised Premises, or if the quantity or character of the electric energy supplied by the Electric Service Provider or any Alternate Service Provider is no longer available or suitable for Tenant’s requirements, and no such changes, failure, defect, unavailability, or unsuitability shall constitute an actual or constructive eviction, in whole or in part, or entitle Tenant to any abatement or diminution of rent, or relieve Tenant from any of its obligations under the Lease. Landlord shall also have the right, if permitted by law, at any time and from time to time during the term hereof to contract for any other utility services (such as but not limited to natural gas, water & sewer, telephone) with the currently existing utility provider or from a different company or companies providing such service(s). Should Landlord contract for service with an utility service provider other than a current utility service provider for a service other than electricity, except as provided in Section 6.H. below, Landlord shall in no way be liable or responsible for any loss, damage or expenses that Tenant may sustain or incur by reason of any change, failure, interference, disruption, or defect in the supply or character or quality of such other utility service; and

G. It is understood that Landlord does not warrant that any of the services referred to in this Article 6 will be free from interruption from causes beyond the reasonable control of Landlord. No interruption of service shall ever be deemed an eviction or disturbance of Tenant’s use and possession of the Demised Premises or any part thereof or render Landlord liable to Tenant for damages by abatement of rent or otherwise or relieve Tenant from performance of Tenant’s obligations under this Lease, unless Landlord, after reasonable notice, shall willfully and without cause fail or refuse to take action within its control to restore such service.

H. Notwithstanding anything in this Lease to the contrary, if an interruption of a service to be provided under this Article 6 occurs which is not beyond the reasonable control of Landlord, is not subject to force majeure (as that term is defined in Section 18.K hereof) and causes Tenant to be unable to reasonably operate its business in the Demised Premises or a portion thereof, then, if Tenant’s inability to operate its business in the Demised Premises or a portion thereof continues for at least five (5) consecutive days from Landlord receipt of Tenant’s notice (the “Interruption Notice”) to Landlord advising that it has closed its all or part of its operation at the Demised Premises, which Interruption Notice must specify the service failure in reasonable detail and explain the nature and extent of the failure, then the minimum rent and additional rent payable by Tenant hereunder shall be abated on a per-diem basis proportionately with respect to the affected portion of the Demised Premises beginning on the sixth (6th) day from receipt of the Interruption Notice and shall continue to abate until the earlier of (y) the date such service is restored, or such interruption or discontinuance ceases or is cured, and Tenant is granted access to the affected portion of the Demised Premises, as the case may be, or (z) the date Tenant resumes occupancy and the conduct of business in the affected portion of the Demised Premises. Tenant acknowledges that Landlord shall not be liable or responsible for any service interruption caused by Tenant or Tenant’s agents, employees, contractors or invitees (including, but not limited to Tenant’s inability to properly maintain its equipment and/or meeting its financial obligations), or by the interruption, stoppage or suspension of any utility caused (partially or wholly) by the public service or utility company (especially if any such problem originates off-site as opposed to on the Building).

7. CARE OF DEMISED PREMISES. Tenant agrees, on behalf of itself, its employees and agents, that it shall:

A. Comply at all times with any and all Federal, state, and local statutes, regulations, ordinances, and other requirements of any of the constituted public authorities relating to its use, occupancy or alteration of the Demised Premises; Notwithstanding the foregoing or anything elsewhere contained in this Lease, the parties agree that:

· Landlord shall be responsible for ADA Title III compliance in the common areas, except as provided below;

· If Tenant performs any work within or to the Demised Premises after its occupancy of the Demised Premises commences, Tenant shall be responsible for ADA Title III compliance in the Demised Premises, including any leasehold improvements or other work to be performed in the Demised; provided however (i) Tenant shall not be required to make any structural changes required by ADA Title III unless such leasehold improvement or other work was constructed by Tenant or on its behalf by its contractor(s), and (ii); so long as Tenant does not perform any work within the Demised Premises it shall be the obligation of Landlord (and not Tenant) to comply with all laws of general applicability to real estate of the kind or class of the Demised Premises and/or the Building

· Landlord may perform, or require that Tenant perform, and Tenant shall be responsible for the cost of, ADA Title III “path of travel” requirements triggered by alterations in the Demised Premises performed by Tenant, or on its behalf by its contractor(s); and

· Tenant shall be solely responsible for requirements under Title I of the ADA relating to Tenant’s employees;

B. Give Landlord access to the Demised Premises at all reasonable times, without charge or diminution of rent, to enable Landlord (I) to examine the same and to make such repairs, additions and alterations as Landlord may be permitted to make hereunder or as Landlord may deem advisable for the preservation of the integrity, safety and good order of the Building or any part thereof, provided, however, that the foregoing shall be done after prior written notice to Tenant and during off-hours and with minimal interruption to Tenant’s business operation unless deemed an emergency; and (ii) with reasonable prior notice to show the Demised Premises to prospective mortgagees and purchasers, and, during the six (6) months prior to expiration of the term, to prospective tenants;

C. Keep the Demised Premises in good order and condition (including insurance company findings known to Tenant) and replace all glass broken by Tenant, its agents, employees or invitees, with glass of the same quality as that broken, except for glass broken by fire and extended coverage type risks, and commit no waste in or upon the Demised Premises;

D. Upon the termination of this Lease in any manner whatsoever, remove Tenant’s goods and effects and those of any other person claiming under Tenant, and quit and deliver up the Demised Premises to Landlord peaceably and quietly in as good order and condition as at the inception of the term of this Lease or as the same hereafter may be improved by Landlord or Tenant, reasonable use and wear thereof, damage from fire and extended coverage type risks, and repairs which are Landlord’s obligation excepted. Goods and effects not removed by Tenant at the termination of this Lease, however terminated, shall be considered abandoned and Landlord may dispose of and/or store the same as it deems expedient, the reasonable cost thereof to be charged to Tenant. The provisions under this entire Section D shall survive the expiration or earlier termination of this Lease.

E. Not place signs on the Demised Premises except on doors and then only of a type and with lettering and text reasonably approved by Landlord. Identification of Tenant and Tenant’s location shall be provided in a directory in the Building lobby at Landlord’s expense;

F. Not overload, damage or deface the Demised Premises or do any act which might make void or voidable any insurance on the Demised Premises or the Building or which may render an increased or extra premium payable for insurance (and without prejudice to any right or remedy of Landlord regarding this subparagraph, Landlord shall have the right to collect from Tenant, upon demand, any such increase or extra premium);

G. Not make any alteration of, or addition to, the Demised Premises without the prior written approval of Landlord (except for painting, carpeting work of a decorative nature); or any other non structural alteration project which does not exceed $25,000 in the aggregate, provided that such alteration does not materially and adversely affect the Building’s mechanical, electrical, electronic, life safety and/or structural systems;

H. Not install or authorize the installation of any coin operated vending machines, except for the dispensing of coffee, and similar items to the employees of Tenant for consumption upon the Demised Premises but Tenant shall be permitted to operate no more than two (2) candy machines and nor more than one (1) soda machine within the Demised Premises at any one time; and

I. Observe the rules and regulations annexed hereto as Exhibit “C”, as the same may from time to time be amended by Landlord for the general safety, comfort and convenience of Landlord, occupants and tenants of the Building.

8. SUBLETTING AND ASSIGNING. Tenant shall not assign this Lease or sublet all or any portion of the Demised Premises without first obtaining Landlord’s prior written consent thereto, which will not be unreasonably withheld, conditioned or delayed, but such consent, if given, will not release Tenant from its obligations hereunder nor will such consent be deemed to be a consent to any further subletting or assignment. If Landlord consents to any such subletting or assignment, it shall nevertheless be a condition to the effectiveness thereof that a sublease or assignment instrument shall be executed and delivered to Landlord in form and substance reasonably satisfactory to Landlord, and that any assignee shall assume in writing all obligations of Tenant with respect to the portion of the Demised Premised assigned (but not with respect to Tenant’s remaining rentable square footage within the Demised Premises, if any). Tenant acknowledges it is not permitted nor is it deemed reasonable to assign or sublease any portion of the Demised Premises to an existing tenant or occupant of the Building and/or an affiliate thereof [the term affiliate means a corporation or other business entity that directly or indirectly controls, is controlled by, or is under common control (as defined below) with such occupant], nor is it reasonable to assume Landlord would permit the assignee to have a net worth, financial standing and credit standing materially inferior to Tenant’s financial standing at the time of the proposed assignment. Each time Tenant requests Landlord to consent to an assignment of this Lease Assignor or Assignee shall pay to Landlord Two Thousand Five Hundred Dollars ($2,500.00) to defray Landlord’s administrative costs, overhead and counsel fees in connection with the consideration, review and document preparation of any agreement, plus any payment(s) required to be made to the Holder of the Security Documents (including but not limited to its administrative fee and any out of pocket legal expenses) in connection with the consideration and review of any agreement pursuant to this Article 8; a copy of Landlord’s form of assignment/assumption of this Lease is attached here to as Exhibit “ G”; in the event the proposed assignment is not consummated for any or no reason, upon notification of such failure by Tenant Landlord shall credit Tenant’s rental account $1,500 of the $2,500 received and collected regarding any one request of Landlord to consent to an assignment of this Lease. Tenant agrees that such form is acceptable to Tenant, but Landlord acknowledges that an assignee may request (and be granted) reasonable non-material modifications, subject to Landlord’s then Holder(s) review/approval/consent rights pursuant to any Security Documents (the terms Holder and Security Documents are defined in Section 15 of this Lease). Tenant shall be responsible for the reimbursement of Landlord’s reasonable legal expenses in connection with the consideration, review and preparation of any “sublease” consent agreement pursuant to this Article 8; Landlord represents that currently (as of November 2014) the legal expense to review and preparation of any “sublease” consent agreement does not exceed $500, per event. Tenant shall not mortgage or encumber this Lease.

9. DELAY IN POSSESSION. If Landlord shall be unable to deliver possession of the Demised Premises to Tenant on the date Landlord anticipated to be the Rental Commencement Date hereof because the Building has not been sufficiently renovated to make the Demised Premises ready for occupancy, or because a certificate of occupancy has not been procured or because of the holding over or retention of possession of any tenant or occupant, or if repairs, improvements or decoration of the Demised Premises, or of the Building are not completed, or for any other reason, Landlord shall not be subject to any liability to Tenant. Under such circumstances, the rent reserved and covenanted to be paid herein shall not commence until possession of Demised Premises is given or the Demised Premises are available for occupancy by Tenant, in accordance with the requirements of the Lease, and no such failure to give possession shall in any other respect affect the validity of this Lease or any obligation of the Tenant hereunder (except as to the date of accrual of rent), nor shall same be construed to extend the term of this Lease.

10. FIRE OR OTHER CASUALTY. In case of damage to the Demised Premises or the Building by fire or other casualty, Tenant shall give immediate notice thereof to Landlord. Landlord shall thereupon cause the damage to be repaired with reasonable speed, at the expense of the Landlord, subject to delays which may arise by reason of adjustment of loss under insurance policies and for delays beyond the reasonable control of Landlord. To the extent and for the time that the Demised Premises are thereby rendered untenantable, the rent shall proportionately abate. In the event the damage shall be so extensive that Landlord shall decide not to repair or rebuild, this Lease shall, at the option of Landlord, exercisable by written notice to Tenant given within thirty (30) days after Landlord is notified of the casualty, be terminated as of a date specified in such notice [which shall not be more than ninety (90) days, thereafter], and the rent (taking into account any abatement as aforesaid) shall be adjusted to the casualty date and Tenant shall thereupon promptly vacate the Demised Premises.

11. LIABILITY. Tenant agrees that Landlord and its building manager and their officers, employees and agents shall not be liable to Tenant, and Tenant hereby releases said parties, for any personal injury or damage to or loss of personal property in the Demised Premises from any cause whatsoever unless such damage, loss or injury is the result of the willful and gross negligence of Landlord, its building manager, or their officers, employees or agents, and Landlord and its building manager and their officers or employees shall not be liable to Tenant for any such damage or loss whether or not the result of their willful and gross negligence to the extent Tenant is compensated therefor by Tenant’s insurance. Tenant shall and does hereby indemnify and hold Landlord harmless of and from all loss or liability incurred by Landlord in connection with any failure of Tenant to fully perform its obligations under

this Lease and/or in connection with any personal injury or damage of any type or nature resulting out of Tenant’s use of the Demised Premises, unless due to gross and willful negligence of Landlord, its building manager, or their officers, employees or agents.

12. EMINENT DOMAIN. If the whole or a substantial part of the Building shall be taken or condemned for a public or quasi public use under any statute or by right of eminent domain or private purchase in lieu thereof by any competent authority, Tenant shall have no claim against Landlord and shall not have any claim or right to any portion of the amount that may be awarded as damages or paid as a result of any such condemnation or purchase; and all rights of the Tenant to damages therefor are hereby assigned by Tenant to Landlord. The foregoing shall not, however, deprive Tenant of any separate award for moving expenses or for any other award which would not reduce the award payable to Landlord. Upon the date the right to possession shall vest in the condemning authority, this Lease shall cease and terminate with rent adjusted to such date and Tenant shall have no claim against Landlord for the value of any unexpired term of this Lease.

13. INSOLVENCY. (1) The appointment of a receiver or trustee to take possession of all or a portion of the assets of Tenant, or (2) an assignment by Tenant for the benefit of creditors, or (3) the institution by or against Tenant of any proceedings for bankruptcy or reorganization under any state or federal law (unless, in the case of involuntary proceedings, the same shall be dismissed within ninety (90) days after institution), or (4) any execution issued against Tenant which is not stayed or discharged within thirty (30) days after issuance or any execution sale of the assets of Tenant shall constitute a breach of this Lease by Tenant. Landlord, in the event of such a breach, shall have, without need of further notice, the rights enumerated in Section 14 herein.

14. DEFAULT.

A. If Tenant shall fail to pay rent or any other sum payable to Landlord hereunder when due, and such default shall continue for five (5) days after written notice thereof by Landlord, or if Tenant shall fail to perform or observe any of the other covenants, terms or conditions contained in this Lease within fifteen (15) business days (or such longer period as is reasonably required to correct any such default, provided Tenant promptly commences and diligently continues to effectuate a cure (but in any event within thirty (30) business days) after written notice thereof by Landlord, or if any of the events specified in Section 13 occur, or if Tenant vacates or abandons the Demised Premises during the term hereof or removes or manifests an intention to remove any of Tenant’s goods or property therefrom other than in the ordinary and usual course of Tenant’s business and ceases to pay rent or, if Tenant shall fail to commence business in the Demised Premises upon the commencement of the term hereof, then, and in any of said cases (notwithstanding any prior breach of covenant or waiver thereof in a prior instance), Landlord, in addition to all other rights and remedies available to it by law or equity or by any other provisions hereof, may at any time thereafter:

(i). upon three (3) days’ prior written notice to Tenant, declare to be immediately due and payable, on account of the rent and other charges herein reserved for the balance of the term of this Lease (taken without regard to any early termination of said term on account of default), a sum equal to the Accelerated Rent Component (as hereinafter defined), and Tenant shall remain liable to Landlord as hereinafter provided; and/or

(ii). whether or not Landlord has elected to recover the Accelerated Rent Component, terminate this Lease on at least five (5) days’ prior written notice to Tenant and, on the date specified in said notice, this Lease and the term hereby demised and all rights of Tenant hereunder shall expire and terminate and Tenant shall thereupon quit and surrender possession of the Demised Premises to Landlord in the condition elsewhere herein required and Tenant shall remain liable to Landlord as hereinafter provided.

B. For purposes hereof, the Accelerated Rent Component shall mean the aggregate of:

(1). all rent and other charges, payments, costs and expenses due from Tenant to Landlord and in arrears at the time of the election of Landlord to recover the Accelerated Rent Component;

(2). the minimum rent reserved for the then entire unexpired balance of the term of this Lease (taken without regard to any early termination of the term by virtue of any default), plus all other charges, payments, costs and expenses herein agreed to be paid by Tenant up to the end of said term which shall be capable of precise determination at the time of Landlord’s election to recover the Accelerated Rent Components less any rent reduction to be provided in accordance with sections D(1) and (2) below; and

(3). Landlord’s good faith estimate of all charges, payments, costs and expenses herein agreed to be paid by Tenant up to the end of said term which shall not be capable of precise determination as aforesaid (and for such purposes no estimate of any component of additional rent to accrue pursuant to the provisions of Article 4 hereof shall be less than the amount which would be due if each such component continued at the highest monthly rate or amount in effect during the twelve (12) months immediately preceding the default).

C. In any case in which this Lease shall have been terminated, or in any case in which Landlord shall have elected to recover the Accelerated Rent Component and any portion of such sum shall remain unpaid, Landlord may, without further notice, enter upon and repossess the Demised Premises, by an action for ejectment or otherwise to dispossess Tenant and remove Tenant and all other persons and property from the Demised Premises and may have, hold and enjoy the Demised Premises and the rents and profits therefrom. Landlord, may, in its own name, as agent for Tenant, if this Lease has not been terminated, or in its own behalf, if this Lease has been terminated, relet the Demised Premises or any part thereof for such term or terms (which may be greater or less than the period which would otherwise have constituted the balance of the term of this Lease) and on such terms (which may include concessions or free rent) as Landlord in its sole discretion may determine. Landlord may, in connection with any such reletting, cause the Demised Premises to be redecorated, altered, divided, consolidated with other space or otherwise changed or prepared for reletting. No reletting shall be deemed a surrender and acceptance of the Demised Premises. In accordance with Section 505.1 (b) of the Pennsylvania Landlord and Tenant Act, as amended, Tenant shall have ten (10) days after Landlord has repossessed the Demised Premises to advise Landlord regarding Tenant’s intent to remove any personal property from the Demised Premises. If Tenant does not advise Landlord within such ten (10) day period, Landlord may, at Landlord’s sole discretion, dispose of all such personal property.

D. Tenant shall, with respect to all periods of time up to and including the expiration of the term of this Lease (or what would have been the expiration date in the absence of default or breach) remain liable to Landlord as follows:

(1) In the event of termination of this Lease on account of Tenant’s default or breach, Tenant shall remain liable to Landlord for damages equal to the rent and other charges payable under this Lease by Tenant as if this Lease were still in effect, less the net proceeds of any reletting after deducting all costs incident thereto (including without limitation all repossession costs, brokerage and management commissions, operating and legal expenses and fees, alteration costs and expenses of preparation for reletting) and to the extent such damages shall not have been recovered by Landlord by virtue of payment by Tenant of the Accelerated Rent Component (but without prejudice to the right of Landlord to demand and receive the Accelerated Rent Component), such damages shall be payable to Landlord monthly upon presentation to Tenant of a bill for the amount due.

(2). In the event and so long as this Lease shall not have been terminated after default or breach by Tenant, the rent and all other charges payable under this Lease shall be reduced by the net proceeds of any reletting by Landlord (after deducting all costs incident thereto as above set forth) and by any portion of the Accelerated Rent Component paid by Tenant to Landlord, and any amount due to Landlord shall be payable monthly upon presentation to Tenant of a bill for the amount due.

E. In the event Landlord shall, after default or breach by Tenant, recover the Accelerated Rent Component from Tenant and it shall be determined at the expiration of the term of this Lease (taken without regard to early termination for default) that a credit is due Tenant because the net proceeds of reletting, as aforesaid, plus the amounts paid to Landlord by Tenant exceed the aggregate of rent and other charges accrued in favor of Landlord to the end of said term, Landlord shall refund such excess to Tenant, without interest, promptly after such determination.

F. Landlord shall in no event be responsible or liable for any failure to relet the Demised Premises or any part thereof, or for any failure to collect any rent due upon a reletting; provided however, Landlord will use commercially reasonable efforts (based on all relevant facts and circumstances, including by way of illustration and not limitation, then existing market conditions) to re-lease the Demised Premises (at the then existing market rent) in the event of Tenant’s default after applicable (if any) notice and cure period having expired], after Tenant physically vacates the Demised Premises, in the event Tenant attempts to defend itself in any legal proceeding(s) brought by Landlord and/or challenges Landlord efforts (as not being commercially reasonable), Tenant shall have the burden of proving that Landlord’s efforts were not commercially reasonable (based on then existing market conditions) and were the primary cause of the Demised Premises not being rerented (at the then existing market rent).

G. As an additional and cumulative remedy of Landlord in the event of termination of this Lease by Landlord following any breach or default by Tenant, Landlord, at its option, shall be entitled to recover damages for such breach in an amount equal to the Accelerated Rent Component (determined from and after the date of Landlord’s election under this subsection G) less the fair rental value of the Demised Premises for the remainder of the term of this Lease (taken without regard to the early termination), and such damage shall be payable by Tenant upon demand. Nothing contained in this Lease shall limit or prejudice the right of Landlord to prove for and obtain as damages incident to a termination of this Lease, in any bankruptcy, reorganization or other court proceedings, the maximum amount allowed by any statute or rule of law in effect when such damages are to be proved.

H. DELETED

I. Tenant waives the right to any notices to quit as may be specified in the Landlord and Tenant Act of Pennsylvania, as amended, and agrees that ten (10) days’ notice shall be sufficient in any case where a longer period may be statutorily specified.

J. Any sum accruing to Landlord under the terms and provisions of this Lease which shall not be paid by the fourth (4th) day after the date due shall bear a late charge, as additional rent, of five cents ($.05) for each one dollar ($1.00) due to cover the extra expense involved in handling delinquent payments to which shall be added a 15% attorney collection fee should an outside attorney (not an employee of Landlord) participate in the matter. Tenant shall, in addition, pay a late charge of $50.00 for processing of late payments, or should any payment be unable to be collected by Landlord’s bank then Tenant shall be charged $150.00 for processing such payment. Tenant agrees and acknowledges that all late fees, any attorney collection fees or processing fees are Additional Rent under the terms of this Lease.

15. SUBORDINATION/MORTGAGEE’S RIGHTS. (a) Tenant agrees that this Lease shall be subject and subordinate (i) to all ground or underlying leases of the entire Building, (ii) to any mortgage, deed to secure debt or other security interest now encumbering the Building and to all advances which may be hereafter made, to the full extent of all debts and charges secured thereby and to all renewals or extensions of any part thereof, and to any mortgage, deed to secure debt or other security interest which any owner of the Building may hereafter, at any time, elect to place on the Building; (iii) to any assignment of Landlord’s interest in the leases and rents from the Building or Building which includes the Lease which now exists or which any owner of the Building may hereafter, at any time, elect to place on the Building; and (iv) to any Uniform Commercial Code Financing Statement covering the personal property rights of Landlord or any owner of the Building which now exists or any owner of the Building may hereafter, at any time, elect to place on the foregoing personal property (all of the foregoing instruments set forth in (ii), (iii) and (iv) above being hereafter collectively referred to as “Security Documents”). Tenant agrees upon reasonable request of the holder of any Security Documents (“Holder”) to hereafter execute any documents which the counsel for Landlord or Holder may deem necessary to evidence the subordination of the Lease to the Security Documents.

(b) In the event of a foreclosure pursuant to any Security Documents, Tenant shall at the election of the Landlord, thereafter remain bound pursuant to the terms of this Lease as if a new and identical Lease between the purchaser at such foreclosure (“Purchaser”), as landlord, and Tenant, as tenant, had been entered into for the remainder of the Term hereof and Tenant shall attorn to the Purchaser upon such foreclosure sale and shall recognize such Purchaser as the Landlord under the Lease. Such attornment shall be effective and self-operative without the execution of any further instrument on the part of any of the parties hereto. Tenant agrees, however, to execute and deliver at any time and from time to time, upon the reasonable request of Landlord or of Holder, any instrument or certificate that may be necessary or appropriate in any such foreclosure proceeding or otherwise to evidence such attornment.

(c) If the Holder of any Security Document or the Purchaser upon the foreclosure of any of the Security Documents shall succeed to the interest of Landlord under the Lease, such Holder or Purchaser shall have the same obligations as Landlord under the Lease as well as the same remedies, by entry, action or otherwise for the non-performance of any agreement contained in the Lease, for the recovery of minimum rent and/or additional rent or for any other default or event of default hereunder that Landlord had or would have had if any such Holder or Purchaser had not succeeded to the interest of Landlord. Any such Holder or Purchaser which succeeds to the interest of Landlord hereunder, shall not be (a) liable for any act or omission of any prior Landlord (including Landlord); or (b) subject to any offsets or defenses which Tenant might have against any prior Landlord (including Landlord); or (c) bound by any minimum rent and/or additional rent which Tenant might have paid for more than the current month to any prior Landlord (including Landlord); or (d) bound by any amendment or modification of the Lease made without its consent if the Security Document required Lendor’s consent but Landlord failed to obtain Lender’s consent; or (iv) be liable for any security deposit unless actually received by it; or (e) be liable in any event except to the extent of the Holder’s interest in the Building.

(d) Tenant hereby acknowledges that if the interest of Landlord hereunder is covered by an assignment of Landlord’s interest in Lease, upon notification of the exercise of the rights thereunder by the Holder thereof (but not before), Tenant shall pay all minimum rent and/or additional rent due and payable under the Lease directly to the Holder of the assignment of Landlord’s interest in Lease.

(e) Notwithstanding anything to the contrary set forth in this Article 15, the Holder of any Security Documents shall have the right, at any time, to elect to make this Lease superior and prior to its Security Document. No documentation, other than written notice to Tenant, shall be required to evidence that the Lease has been made superior and prior to such Security Documents, but Tenant hereby agrees to execute any documents reasonably requested by Landlord or Holder to acknowledge that the Lease has been made superior and prior to the Security Documents.

16. NOTICES. All bills, statements, notices or communications which Landlord may desire or be required to give to Tenant shall be deemed sufficiently given or rendered if in writing and either delivered to an officer of Tenant or sent by registered or certified mail or sent by a nationally recognized overnight courier service addressed to Tenant at the Building, and the time of the giving of such notice or communication shall be deemed to be the time when the same is delivered to Tenant or deposited in the mail, as the case may be. Any notice by Tenant to Landlord must be served by registered or certified mail or sent by a nationally recognized overnight courier service addressed to Landlord at the address where the last previous rental hereunder was payable, or in the case of subsequent change upon notice given, to the latest address furnished. Additionally, all notices shall be deemed effectively given if sent by Landlord and Tenant’s respective counsel.

17. HOLDING OVER. If Tenant fails to surrender the Demised Premises at the expiration or earlier termination of this Lease, occupancy of the Demised Premises after the termination or expiration shall be that of a tenancy at sufferance. Tenant’s occupancy of the Demised Premises during the holdover shall be subject to all the terms and provisions of this Lease and Tenant shall pay an amount (on a per month basis without reduction for partial months during the holdover) equal to one hundred fifty percent (150%) of the minimum rent and additional rent items payable for last month of the term of this Lease. No holdover by Tenant or payment by Tenant after the expiration or early termination of this Lease shall be construed to extend the term or prevent Landlord from immediate recover of possession of the Demised Premises by summary proceedings or otherwise. In addition to the payment of the amounts provided above, if Landlord is unable to deliver possession of the Demised Premises to a new tenant, or to perform improvements for a new tenant, as a result of Tenant’s holdover and Tenant failing to vacate the Demised Premises within five (5) days after Landlord notifies Tenant in writing of Landlord’s inability to deliver possession, or perform improvements, Tenant shall indemnify and hold Landlord harmless from any and all loss, liability or damage, including, without limitation, consequential damages, that Landlord suffers from the holdover.

18. MISCELLANEOUS.

A. Tenant represents and warrants that it has not employed any broker or agent as its representative in the negotiation for or the obtaining of this Lease, and agrees to indemnify and hold Landlord harmless from any and all cost or liability for compensation claimed by any broker or agent with whom it has dealt.

B. The word “Tenant” as used in this Lease shall be construed to mean tenants in all cases where there is more than one tenant, and the necessary grammatical changes, required to make the provisions hereof apply to corporations, partnerships or individuals, men or women, shall in all cases be assumed as though in each case fully expressed. Each provision hereof shall extend to and shall, as the case may require, bind and inure to the benefit of Tenant and its heirs, legal representatives, successors, and assigns, provided that this Lease shall not inure to the benefit of any assignee, heir, legal representative, transferee or successor of Tenant except upon the express written consent or election of Landlord.

C. The term “Landlord” as used in this Lease means the fee owner of the Building or, if different, the party holding and exercising the right, as against all others (except space tenants of the Building) to possession of the Building or the agent thereof. In the event of the voluntary or involuntary transfer of such ownership or right to a successor-in-interest of Landlord, Landlord shall be freed and relieved of all liability and obligation hereunder which shall thereafter accrue (and, as to any unapplied portion of Tenant’s security deposit, Landlord shall be relieved of all liability therefor upon transfer of such portion to its successor in interest) but Tenant shall look solely to the estate and property of Landlord in the land and buildings comprising the Building of which the Demised Premises forms a part for the satisfaction of Tenant’s remedies, and no other assets of Landlord or any principal of Landlord shall be subject to levy, execution or other judicial process for the satisfaction of Tenant’s claim and in the event Tenant obtains a judgment against Landlord, the judgment docket shall be so noted. Notwithstanding the foregoing, no mortgagee or ground lessor which shall succeed to the interest of Landlord hereunder, (either in terms of ownership or possessory rights) shall (i) be liable for any previous act or omission of a prior landlord, (ii) be subject to any rental offsets or defenses against a prior landlord, (iii) be bound by any amendment of this Lease made without any mortgagee’s or ground lessee’s written consent, or by payment by Tenant of rent in advance in excess of one (1) month’s rent, or (iv) be liable for any security deposit unless actually received by it. Subject to the foregoing, the provisions hereof shall be binding upon and inure to the benefit of the successors and assigns of Landlord.

D. (i). In the event Tenant is a corporation, the persons executing this Lease on behalf of Tenant hereby covenant and warrant that: Tenant is a duly constituted corporation qualified to do business in Pennsylvania, all Tenant’s franchise and corporate taxes have been paid to date; all future forms, reports, fees and other documents necessary for Tenant to comply with applicable laws will be filed by Tenant when due; and such persons are duly authorized by the board of directors of such corporation to execute and deliver this Lease on behalf of the corporation binding the corporation.

(ii). In the event Tenant is a partnership, the persons executing this Lease on behalf of Tenant hereby covenant and warrant that: Tenant is qualified to do business in Pennsylvania and such person(s)

is (are) duly authorized as general partner(s) to execute and deliver this Lease on behalf of the partnership, binding the partnership.

E. Landlord and Tenant understand, agree and acknowledge that:

(i). This Lease has been freely negotiated by both parties; and

(ii). That, in any controversy, dispute, or contest over the meaning, interpretation, validity, or enforceability of this Lease or any of its terms or conditions, there shall be no inference, presumption or conclusion drawn whatsoever against either party by virtue of that party having drafted this Lease or any portion thereof.

F. Under no circumstances shall Landlord be liable to Tenant, its invitees, licensees, guests, employees and agents for consequential, incidental, special, punitive or exemplary damages.

G. All of Tenant’s representations, warranties and indemnities contained in this Lease shall survive the expiration or early termination of this Lease.

H. 1.(a) Landlord may elect to either remove or keep the electrical and/or communication wires installed by or on behalf of Tenant (as opposed to electrical wiring installed by or on behalf of Landlord) within fifteen (15) days after the expiration or sooner termination of the Lease. Landlord may elect (“Election”) by written notice to Tenant:

(i). To retain any or all wiring, cables, risers, and similar installations appurtenant thereto installed by Tenant within the Demised Premises, common hallway plenums, communications closets, or in the risers of the Building/ Landlord’s Property (“Wiring”);

(ii). To remove any or all such Wiring and restore the Demised Premises, plenums, communications closets and risers to their condition existing prior to the installation of the Wiring (“Wire Restoration Work”); or

(iii). To require Tenant to perform the Wire Restoration Work at Tenant’s sole cost and expense.

(b). Landlord’s failure to make an Election within thirty (30) days after the expiration or sooner termination of the Lease shall be deemed to mean that Landlord has elected to retain the Wiring.

2. The provisions of this subsection 18H. shall survive the expiration or sooner termination of the Lease.

3. In the event Landlord elects (or is deemed to elect) to retain the Wiring (pursuant to subsection 18H. 1a(i) hereof), Tenant covenants that:

(i). Tenant shall be the sole owner of such Wiring, that Tenant shall have good right to surrender such Wiring, and that such Wiring shall be free of all liens and encumbrances; and

(ii). All wiring shall be left by Tenant in its “as is” condition.

5. In the event Tenant fails or refuses to completed the Wiring Restoration Work and Landlord is required to perform such work, Tenant shall, within twenty (20) days of Tenant’s receipt of Landlord’s notice requesting Tenant’s reimbursement for or payment of such costs, pay such sums and if Tenant fails to do so, Landlord may apply any portion of Tenant’s security deposit toward the payment of such unpaid costs relative to the Wiring Restoration Work.

I. Any time and from time to time but only if Tenant is not a publically listed company: upon not less than sixty (60) days’ prior written request from Landlord, Tenant shall deliver to Landlord: (i) balance sheet of Tenant (dated no more than sixty (60) days prior to such request), including profit and loss statement, cash flow summary, and all accounting footnotes, all prepared in accordance with generally accepted accounting principles in the United States of America consistently applied and certified by the Chief Financial Officer of Tenant to be a fair and true presentation of Tenant’s current financial position; (ii) Tenant agrees that its failure to strictly comply with this Clause shall constitute a material Event of Default by Tenant under this Lease.

J. Landlord reserves the absolute right, without liability of any type to Tenant, to alter the layout, design and/or use of the Building and/or Landlord’s Property, in such manner as Landlord, in its sole discretion, deems appropriate, so long as the general character as a rental complex of Landlord’s Property is not materially and adversely affected.

Landlord may from time to time without prior notice to or consent of Tenant, alter, expand, decrease or change the location, number or dimensions of the walkways, entrances, parking areas or driveways, or other facilities and improvements constituting the common areas of the Building in such manner as Landlord deems proper. All common areas and facilities not within the Demised Premises,

which Tenant may be permitted to use and occupy, are to be used and occupied under a revocable license and if the amount of such areas be diminished, Landlord shall not be subject to any liability nor shall Tenant be entitled to any compensation or diminution or abatement of rent, nor shall such diminution of such areas be deemed constructive or actual eviction.

Landlord reserves the right without liability nor compensation to Tenant, to make alterations or additions to, or to build additional stories on the Building and/or to decrease, expand or add buildings elsewhere in Landlord’s Property. Landlord further reserves the right without liability nor compensation to Tenant, to increase/decrease the amount of retail and/or service establishments and/or add or convert a portion of the Building to residential space and/or increase/decrease the amount of office and/or professional establishments within the Building.

Landlord may from time to time, without liability nor compensation to Tenant and without prior notice to or consent of Tenant, add or substitute property to or withdraw property from Landlord’s Property or eliminate, add or substitute any improvements, or change, enlarge or consent to a change in the shape, size, location, number, height or extent of the improvements to Landlord’s Property or any part thereof, including, without limitation adding additional levels to the Building. Any property so added shall thereafter be subject to the terms of this Lease and shall be included in the term “Building” as used in this Lease, and any property so withdrawn by Landlord shall thereafter not be subject to the terms of this Lease and shall be excluded from the term “Building” as used in this Lease.

None of the foregoing shall unreasonably interfere with Tenant’s ability to use and occupy the Demised Premises and operate its business operation therein.

K. Force Majeure. Landlord and/or Tenant shall be excused for the period of any delay and shall not be deemed in default with respect to the performance of any of the terms, covenants and conditions of this Lease, when prevented from so doing by cause or causes beyond Landlord and/or Tenant’s control, which shall include, without limitation, all labor disputes, civil commotion, or warlike operations, invasions, rebellion, hostilities, military or usurped power, sabotage, governmental regulations or controls, fire or other casualty, inability to obtain any material, services, or financing, acts of God, or any other cause, whether similar or dissimilar to the foregoing, not within the reasonable control of the Landlord and/or Tenant. The provisions of this Section 18 K. shall not excuse Tenant from the prompt payment of minimum rent, additional rent or any other payments required by the terms of this Lease.

L. Separability. If any clause or provision of this Lease is illegal, invalid, or unenforceable under present or future laws, then the remainder of this Lease shall not be affected thereby and in lieu of such clause or provision, there shall be added as a part of this Lease a clause or provision as similar in terms to such illegal, invalid, or unenforceable clause or provision as may be possible and be legal, valid, and enforceable.