Filed by Lan Airlines S.A.

pursuant to Rule 425 under the

Securities Act of 1933, as amended.

Subject of the offer: TAM S.A.

(Commission File No.:333-177984)

EXPERT REPORT ON THE MERGER BY ABSORPTION INTO LAN AIRLINES S.A.

OF SISTER HOLDCO S.A. AND HOLDCO II S.A.

Free translation of the original in Spanish.

Santiago, December 1, 2011

To the Directors and Shareholders of

LAN Airlines S.A., Sister Holdco S.A. y Holdco II S.A.

|

I.

|

PURPOSE OF THE REPORT

|

As requested by the Boards of LAN Airlines S.A., Sister Holdco S.A. and Holdco II S.A., this report is issued regarding the proposed merger between LAN Airlines S.A., Sister Holdco S.A. and Holdco II S.A. according to the requirements set out within article 99 of Law No. 18.046 related to Stock Corporations (Ley de Sociedades Anónimas).

This expert report will present the financial position of the surviving entity as a result of the merger of Sister Holdco S.A. and Holdco II S.A. with and into LAN Airlines S.A., as set out within International Financial Reporting Standard No. 3 (revised in 2008), IFRS 3, if all the conditions the merger is limited by are met.

For these purposes, this expert will take into consideration the equity position that Holdco II S.A. and Sister Holdco S.A. would have if the conditions necessary for the completion of the merger are met, so that this report can adequately show the equity position of LAN Airlines S.A. in the event the merger is completed.

|

II.

|

OUTLINE OF THE TRANSACTION

|

According to the Implementation Agreement and the Exchange Offer Agreement, both signed on January 18, 2011, reviewed by this expert and that will serve as the base of the merger proposition that will be presented for approval at the Shareholders’ meeting, the merger can only be completed if each and all of the following conditions are met:

1. That the Shareholders’ meetings of LAN Airlines S.A., Sister Holdco S.A. and Holdco II S.A. approve the merger, with Holdco II S.A. and Sister Holdco S.A. merging with and into LAN Airlines S.A.;

1

2. That no more than 2.5% of LAN Airlines S.A. shareholders exercise their appraisal rights (derecho a retiro) after the merger is approved, not withstanding LAN Airlines S.A.´s right to waive this condition;

3. That once the merger has been approved, Holdco II S.A. will make a tender offer to acquire up to 85,557,560 TAM S.A. shares, this is, 83,368,921 subscribed and paid shares at September 30, 2011, and 2,188,639 shares that can be issued under stock option programs that at the same date have not been subscribed and paid, if before the merger is completed they are subscribed and paid, that will be paid by exchanging Holdco II S.A. shares on a 1:1 ratio.

This expert observes that these shares represent 14.6264% of TAM S.A.´s voting shares and 74.9127% of TAM S.A.´s non voting shares.

4. That as a result of the tender offer, Holdco II S.A. acquires sufficient shares that, after the consummation of the merger and together with TEP Chile S.A. and its related entities, LAN Airlines S.A. will control at least 95% of TAM S.A.´s shares.

It must be noted that, as was informed to this expert, according to Brazilian legislation LAN Airlines S.A. would have the right to acquire, after consummation of the mergers, the 5% of TAM S.A. shares that were not tendered into the exchange, paying for them an amount in cash equivalent to the product of a) the number of LAN Airlines S.A. shares that would have been delivered had the exchange been accepted, and b) the closing price of LAN Airlines S.A. shares published by the Santiago Stock Exchange (Bolsa de Comercio de Santiago) on the transaction closing date.

This expert reminds the shareholders that in the event LAN Airlines S.A. does not exercise the aforementioned right, the financial statements of the merged entity will need to reflect the non-controlling interest that relates to the TAM S.A. shares that were not tendered into the exchange.

Similarly, and exceptionally, LAN Airlines S.A. can waive the condition mentioned in this section, accepting the consummation of the merger, if the exchange offer was accepted by a percentage that is equal or higher than two thirds of the shares subject to the tender offer and that, according to Brazilian legislation, TAM S.A.´s delisting from the Bovespa has been approved, reflecting the corresponding non-controlling interest; and,

5. That once the exchange offer conditions mentioned previously have been met by Holdco II S.A., the shareholders of Sister Holdco S.A. subscribe and pay the statutory capital of the entity by contributing 47,652,705 non voting shares of the Chilean open stock entity Holdco I S.A., equivalent to 99.999996% of the non voting shares, 62 voting shares of Holdco I S.A., equivalent to 6.2% of the voting shares, and 25,185,155 non voting shares of TAM S.A., equivalent to 25.0873% of the non voting shares.

This expert notes that according to the agreements and other documents reviewed, the entity Holdco I S.A. will receive as a capital contribution 47,652,705 voting shares of TAM S.A., equivalent to 85.3736% of the voting shares.

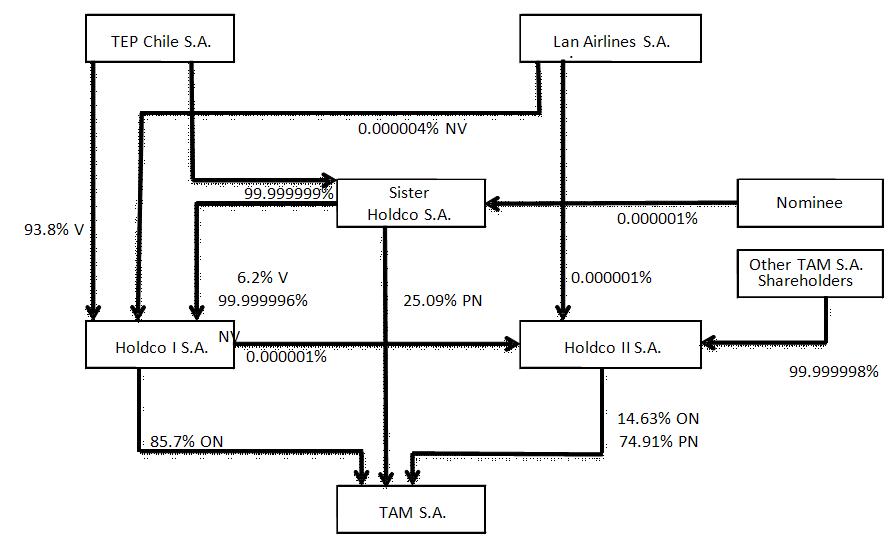

Once each and all of the conditions described have been met, and under the assumption that none of the TAM S.A. shares pending subscription and payment under stock options were issued, and that no shareholder of any of the participating entities exercised his appraisal rights (derecho a retiro), the situation of the participating entities immediately before the consummation of the merger would be the following:

2

Situation immediately before the merger of Sister Holdco S.A. and Holdco II S.A.

with and into Lan Airlines S.A.

Notes:

V: Voting shares of Holdco I S.A.

NV: Non voting shares of Holdco I S.A.

ON: Voting shares of TAM S.A.

PN: Non voting shares of TAM S.A.

It was assumed for the purposes of this diagram that Holdco II S.A.´s exchange offer was accepted by 100% of the shareholders.

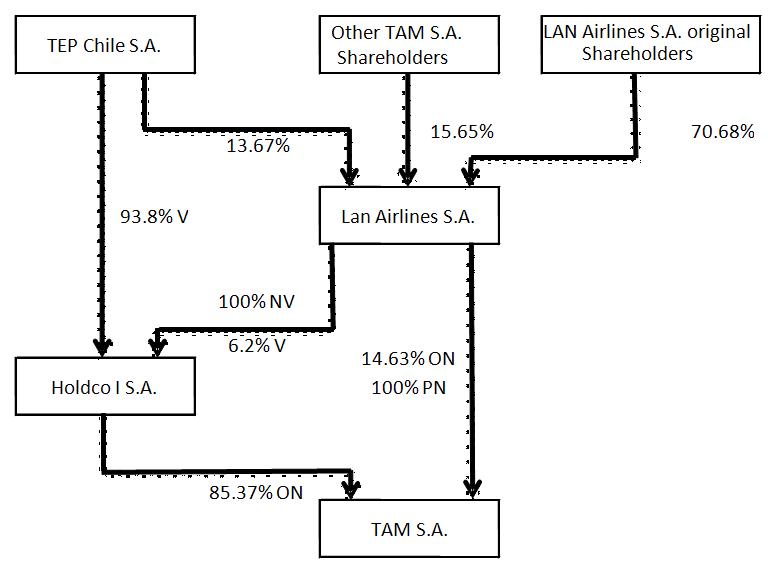

Once the merger approved by the Shareholders’ meetings is consummated, the result of the transaction would be the following:

Situation immediately after the mergers

According to what was previously presented, this expert report is issued assuming that each and all of the conditions necessary for the consummation of the merger have been met and that once merged, 100% of TAM S.A.´s subscribed and paid shares offered to be acquired by Holdco II S.A. will be owned by LAN Airlines S.A.

3

Therefore, to determine the equity position of the participating entities, the following financial statements will be used: the audited financial statements of LAN Airlines S.A. at September 30, 2011, presented within Appendix 2 of this report, the audited financial statements of Sister Holdco S.A. at September 30, 2011, presented within Appendix 3 of this report, the proforma financial statements of Sister Holdco S.A. at September 30, 2011, presented within Appendix 3.1 of this report, the audited financial statements of Holdco II S.A. at September 30, 2011, presented within Appendix 4 of this report, and the proforma financial statements of Holdco II S.A. at September 30, 2011, presented within Appendix 4.1 of this report.

The proforma financial statements of Sister Holdco S.A. and Holdco II S.A. mentioned in the previous paragraph have been prepared considering that the contributions described in this section have been made and that none of the participating entities prior to the merger will consolidate their balance sheet with TAM S.A. because neither Holdco II S.A. or Sister Holdco S.A. would control, individually, that entity.

However, once the merger is complete, LAN Airlines S.A. will consolidate TAM S.A. Because of this, and for a better understanding of the shareholders, the audited financial statements of TAM S.A. at September 30, 2011 have been included within Appendix 5 of this report. Further, Appendix 5.1. to this report presents certain reclassifications made to the TAM S.A. balance sheet so that it conforms to LAN Airlines S.A.´s balance sheet, and Appendix 5.2 to this report presents the fair value adjustments of TAM S.A.´s assets and liabilities.

Lastly, this expert report has been issued considering the proposals made by the Boards of the participating entities and that will be presented to the respective Shareholder’s meetings, the Implementation Agreement and the Exchange Offer Agreement, both signed on January 18, 2011, and each and all of the conditions required for the consummation of the proposed merger.

To determine the proforma financial situation of the merger at September 30, 2011, the method described within IFRS 3 will be used, performing the adjustments to the financial statements and balances of the participating entities described within Appendix 1 of this report.

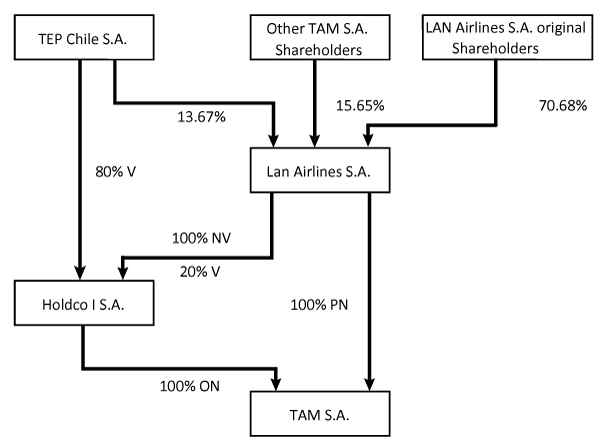

It must be noted that according to the information reviewed, after the merger has been completed, LAN Airlines S.A. will subscribe and pay enough voting shares in Holdco I S.A. to enable it to own up to 20% of the voting shares of that entity. Those shares shall be paid through the contribution of all TAM S.A.´s voting shares that LAN Airlines S.A. will own as a result of the consummation of the merger. Such situation is shown in the following diagram:

Situation by the End of the Merger

Notes:

V: Voting shares of Holdco I S.A.

NV: Non voting shares of Holdco I S.A.

ON: Voting shares of TAM S.A.

PN: Non voting shares of TAM S.A.

It was assumed for the purposes of this diagram that Holdco II S.A.´s exchange offer was accepted by 100% of the shareholders.

Situation immediately after the mergers

APPENDIX 3.1

APPENDIX 4.1

For a complete understanding of the assumptions used by this expert, Appendix 6 to this report contains a summary of the transaction prepared by the management of the participating entities.

|

III.

|

EXCHANGE RATIO

|

The consummation of the merger will occur through the incorporation of all the shareholders of Sister Holdco S.A. and Holdco II S.A. into LAN Airlines S.A., with the corresponding incorporation of all the equity of those entities into the surviving entity.

According to the information reviewed by this expert, the Boards of the participating entities have agreed to an exchange ratio of 0.90 LAN Airlines S.A. shares for each Sister Holdco S.A. and Holdco II S.A. share involved in the transaction. As has been informed to this expert, said exchange ratio was determined using the economic and market values of the participating entities, as was set forth in a report issued by JP Morgan, which has been made available for the understanding of the shareholders and public in general, on LAN Airlines S.A.´s web page www.lan.com, investor relations section.

4

According to the above, and under the assumption that each and all the conditions mentioned previously have been met and, especially, that the exchange offer made by Holdco II S.A. was accepted by 100% of its addressees, LAN Airlines S.A. will show an equity increase in the amount of ThUS$ 2,963,366 issuing 140,586,107 shares, incorporating the assets and liabilities, and all the shareholders of Sister Holdco S.A. and Holdco II S.A. into the surviving entity. To determine the number of shares to be issued, only subscribed and paid shares of TAM S.A. at September 30, 2011, were considered, excluding for these purposes shares pending subscription and payment under stock option programs of that entity. In the event that at the closing date of the merger these shares are subscribed and paid, and that they accept the exchange offer made by Holdco II S.A., the number of shares to be issued by LAN Airlines S.A. will need to increase up to a total of 142,555,882. Finally, the increase in the number of LAN Airlines S.A. shares considers the 2 shares already subscribed and paid at September 30, 2011 of Sister Holdco S.A. and the 2 shares already subscribed and paid at September 30, 2011, of Holdco II S.A.

Therefore, after the consummation of the merger, the shareholders of Sister Holdco S.A. will exchange their shares for 0.90 new shares of LAN Airlines S.A., acquiring a total of 65,554,076 new shares of LAN Airlines S.A. representing 13.67% of the total shares into which the equity is divided.

On the other hand, after the consummation of the merger, the shareholders of Holdco II S.A. will exchange their shares for 0.90 new shares of LAN Airlines S.A., acquiring a total of 75,032,031 new shares of LAN Airlines S.A. representing 15.65% of the total shares into which the equity is divided.

Notwithstanding the above, this expert notes that the total number of shares that will be delivered will depend on the total number of Holdco II S.A. shares that are subscribed and paid as a result of the exchange offer. Therefore, once the total number of shares involved in the transaction is known, the real equity effect for the merged LAN Airlines S.A. will be determined, as will the number of shares to be issued as a result of the merger.

|

IV.

|

ACCOUNTING FRAMEWORK

|

This expert report has been issued using the accounting framework within IFRS 3. This accounting framework requires, firstly, the identification of the acquiring entity, the remaining entities deemed the acquired ones. In this case it has been determined that LAN Airlines S.A. will be the acquiring entity and Sister Holdco S.A. and Holdco II S.A. the acquired ones.

According to IFRS 3, the acquiring entity must incorporate the acquired entities at the fair values of their assets and liabilities.

The assets and liabilities of Sister Holdco S.A. and Holdco II S.A. are comprised exclusively of the investment they would hold in TAM S.A. as has been mentioned previously within this report. At the consummation of the merger, those assets will become part of LAN Airlines S.A.´s assets, as the surviving entity, therefore, it is necessary to determine if the investment in TAM S.A. should be registered using the equity method, in case LAN Airlines S.A. holds significant influence, or if LAN Airlines S.A. should consolidate TAM S.A., in the case it has control.

According to the information that this technical expert has considered, and only from the perspective of accounting, there are technical factors that determine LAN Airlines S.A’s consolidation of TAM S.A. based on the following criteria (both due to direct investment in TAM S.A. shares as well as indirectly via Holdco I S.A.):

|

|

·

|

LAN Airlines S.A. will receive 100% of the economic benefits generated by TAM S.A., meaning that it is substantially exposed to the totality of risks and benefits associated with ownership. This is the case because LAN Airlines S.A. will substantially receive - either directly as a shareholder in TAM S.A. or as owner of nonvoting stock in Holdco I S.A. (the company that will concentrate the TAM S.A. shares with voting rights) - the totality of dividends paid by TAM S.A., in addition to any future distribution or reduction in assents that said institution might undertake.

|

|

|

·

|

Existence of shareholder agreements to develop the activities of TAM S.A., in particular the pacts on corporate governance of (i) Holdco I S.A., between LAN Airlines S.A., TEP Chile S.A. and Holdco I S.A., and (ii) TAM S.A., between LAN Airlines S.A., TAM S.A., TEP Chile S.A. and Holdco I S.A., which establish special quorums on the board level (5 of 6 board members) and for shareholders meetings (95% in Holdco I S.A. and 85% in TAM S.A.), which provide effective protection to LAN Airlines S.A. in the operative and financial decisions of Holdco I S.A. and TAM S.A., respectively. The contents of this paragraph are consistent with the consolidation requirements presented in NIC 27 “Consolidated Financial Statements”.

|

|

|

·

|

The intention to operatively combine the two companies’ operations, as can be inferred from the aforementioned pacts.

|

In addition, this technical expert notes that LAN Airlines S.A. retains the option of swapping its nonvoting stock in Holdco I S.A. for voting stock in the same company, an option that can be exercised at any time on the condition that Brazilian legislation allows it.

5

According to the above, and that once the merger is completed LAN Airlines S.A. will be in a position to consolidate its accounting records with TAM S.A., the fair value adjustments mentioned previously will be performed on the assets and liabilities of TAM S.A. and not Sister Holdco S.A. and Holdco II S.A. as the only asset these entities have is their direct or indirect investment in TAM S.A.

Therefore, Appendix 1 to this report has been prepared as follows:

|

|

a.

|

The audited financial statements of LAN Airlines S.A. at September 30, 2011, presented within Appendix 2 to this report, have been used;

|

|

|

b.

|

The proforma financial statements at September 30, 2011, of Sister Holdco S.A. have also been used. These represent the investment in TAM S.A. and Holdco I S.A. immediately before the consummation of the merger, using as a reference the average market price of the TAM S.A. shares at September 30, 2011, and the market price of the Holdco I S.A. shares at the same date using as a reference the average market price of TAM S.A. shares at the same date as these are the main asset of that entity. These financial statements are included within Appendix 3.1 to this report;

|

|

|

c.

|

The proforma financial statements at September 30, 2011, of Holdco II S.A. have also been used. These represent the investment in TAM S.A. immediately before the consummation of the merger, using as a reference the average market price of the TAM S.A. shares at September 30, 2011. These financial statements are included within Appendix 4.1 to this report;

|

|

|

d.

|

The following adjustments have been included to determine the merged balance sheet:

|

|

|

i.

|

The equity of Sister Holdco S.A. and Holdco II S.A. have been eliminated;

|

|

|

ii.

|

LAN Airlines S.A.´s share issuance and other equity adjustments that reflect the number of shares to be issued has been included; and

|

|

|

iii.

|

As a result of the accounting consolidation of TAM S.A., the investments in TAM S.A. recorded by Sister Holdco S.A. and Holdco II S.A. have been eliminated, incorporating, on a line by line basis, the assets and liabilities of TAM S.A. at their fair values, recording goodwill appropriately and also other consolidation adjustments.

|

In order to reflect the acquisition under IFRS 3, the purchase price has been estimated at ThUS$ 2,963,366 in accordance with the information contained in all the documents reviewed by this expert, especially considering that the exchange ratio is 0.90 LAN Airlines S.A. shares for each Holdco II S.A. or Sister Holdco S.A. share involved in the merger.

6

|

|

i.

|

Holdco II S.A. shares involved in the merger at September 30, 2011: 83,368,923. This number of shares represents 100% of the subscribed and paid shares of TAM S.A. at September 30, 2011, that would be exchanged through the tender, excluding for these calculations the shares pending subscription and payment under stock option programs. It also considers the 2 shares already subscribed and paid at September 30, 2011 of Holdco II S.A.

|

|

|

ii.

|

Sister Holdco S.A. shares involved in the merger at September 30, 2011: 72,837,862. This number of shares considers the number of shares issued by Sister Holdco S.A. as a result of the contribution of 47,652,705 non voting shares in Holdco I S.A., the contribution of 62 voting shares of Holdco I S.A. and the contribution of 25,185,155 non voting shares of TAM S.A. It also considers 2 shares already subscribed and paid at September 30, 2011 of Sister Holdco S.A.

|

|

|

iii.

|

Exchange ratio: 0.9 LAN Airlines S.A. shares for each Holdco II S.A. and Sister Holdco S.A. share.

|

|

|

iv.

|

Number of LAN Airlines S.A. shares to be issued: 140,586,107

|

|

|

v.

|

Price per share: US$ 21.07866

|

|

|

vi.

|

Purchase price: ThUS$ 2,963,366

|

Based on the above, the financial position of the entities to be merged, after the consummation of the merger, is the consolidated balance sheet and corresponding adjustments presented within Appendix 1 to this report.

|

V.

|

DOCUMENTS REVIEWED

|

The following documents have been reviewed and have served to prepare the proforma financial situation at September 30, 2011 of the merger of Sister Holdco S.A. and Holdco II S.A. with and into LAN Airlines S.A.:

|

|

·

|

Extraordinary Board meeting of LAN Airlines S.A. dated August 13, 2010, and the communication sent to the Superintendencia de Valores y Seguros, regarding such Extraordinary Board meeting, in the form of an Hecho Esencial, dated August 13, 2010.

|

|

|

·

|

Extraordinary Board meeting of LAN Airlines S.A. dated January 18, 2011, and the communication sent to the Superintendencia de Valores y Seguros, regarding such Extraordinary Board meeting, in the form of an Hecho Esencial, dated January 19, 2010.

|

|

|

·

|

The consolidated financial statements of LAN Airlines S.A. audited by PricewaterhouseCoopers Consultores, Auditores y Compañía Limitada at September 30, 2011.

|

|

|

·

|

The consolidated financial statements of TAM S.A. audited by PricewaterhouseCoopers Auditores Independentes at September 30, 2011.

|

|

|

·

|

The financial statements of Sister Holdco S.A. audited by PricewaterhouseCoopers Consultores, Auditores y Compañía Limitada at September 30, 2011.

|

|

|

·

|

The proforma financial statements at September 30, 2011, of Sister Holdco S.A.

|

|

|

·

|

The financial statements of Holdco II S.A. audited by PricewaterhouseCoopers Consultores, Auditores y Compañía Limitada at September 30, 2011 and the shareholders agreements annexed to the Implementation Agreement.

|

|

|

·

|

The proforma financial statements at September 30, 2011, of Holdco II S.A.

|

|

|

·

|

Implementation Agreement dated January 18, 2011.

|

|

|

·

|

Exchange Offer Agreement dated January 18, 2011.

|

7

|

|

·

|

Consolidated proforma balance sheet prepared by the participating entities at September 30, 2011.

|

This expert declares that he has reviewed the balance sheet for the merger prepared by management of the participating entities, agreeing on the notes and criteria used, and that he has performed such other procedures deemed reasonable under the circumstances, considering that these reasonably represent the accounting principles used by LAN Airlines S.A.

|

VI.

|

LEGAL TAX AND ACCOUNTING CONSIDERATIONS

|

The merger by incorporation with and into LAN Airlines S.A., RUT N° 89.862.200-2 (continuing entity) of Sister Holdco S.A. RUT N° 76.153.047-K and Holdco II S.A. RUT N° 76.153.208-1 (entities that will dissolve), will be completed once they are approved by the Shareholders’ meeting of each of the participating entities and only if each and all of the conditions of the mergers are met.

Once the merger is completed, the asset and liability accounts of Sister Holdco S.A. and Holdco II S.A., that will represent the TAM S.A. shares, will be incorporated into LAN Airlines S.A.´s equity at their fair values, having to control the tax values of the assets and liabilities according to article 64, fourth paragraph, of the Tax Code and administrative jurisprudence of the Internal Revenue Service (Servicio de Impuestos Internos).

Taking into consideration that the final amount of assets to be incorporated as a result of Holdco II S.A. will only be known at the completion of the merger, LAN Airlines S.A. will have to perform the necessary adjustments to reflect the real equity and stock position.

|

VII.

|

CONCLUSION

|

In the opinion of the signatory, the financial situation of the entities that are intended to merge presented within Appendix 1 to this report, reflects the equity situation of the entities according to IFRS 3, in the event that each and all the conditions necessary for the completion of the merger described in this report are met. Therefore, if the assumptions are not met, the conclusions of this report could vary substantially.

As was informed to this expert, the exchange ratio was determined by agreement of the Boards of the participating entities according to the economic value of the entities involved.

Therefore, if the assumptions used to prepare this report are met, that is that the conditions necessary for the completion of the merger are achieved, that the contributions described are made, and that Holdco II S.A.´s exchange offer is accepted by 100% of the currently subscribed and paid shares, in the opinion of the signatory, LAN Airlines S.A. would need to issue 140.586.107 new shares to incorporate as new shareholders the shareholders of Sister Holdco S.A. and Holdco II S.A., delivering 0,9 LAN Airlines S.A. shares for each share they owned in the absorbed entities.

However, this expert notes that given the characteristics of the merger, the final number of shares to be issued and delivered in exchange will be determined once the conditions are met and the merger is consummated.

For this reason, only once the merger is consummated, will the equity absorbed, the adjustments and, consequently, the consolidated equity of LAN Airlines S.A. reflecting the exact increase in capital and other equity adjustments in the merged LAN Airlines S.A., the total number of shares delivered in exchange and their value and goodwill, and any non-controlling interest that could arise as a consequence of not acquiring 100% of the TAM S.A. shares through the exchange offer made by Holdco II S.A., will be known.

8

|

VIII.

|

STATEMENT OF THE EXPERT

|

The signatory declares that he has reviewed all the information referred to in this report, and presents it to the shareholders of LAN Airlines S.A., Sister Holdco S.A. and Holdco II S.A. with the sole purpose of helping them in the definition of the terms and conditions of the merger.

This report is for the exclusive use and knowledge of the management, board and shareholders of LAN Airlines S.A., Sister Holdco S.A. and Holdco II S.A., and has been prepared with the sole purpose mentioned previously and, therefore, should not be used for any other purpose without the express knowledge of the signatory.

Finally, as required by article N° 22 of the Rules of the Corporation Law, this expert declares he is responsible for the statements contained within this report.

Enrique Cid Corral

RUT N° 12.290.415-6

R. Aud. Ext. SVS N° 663

This technical report is issued on 1 December 2011 and complemented on 20 December 2011 according to the requirements of the Securities and Insurance Superintendence

***********

Forward-Looking Statements

This document contains forward-looking statements, including with respect to the negotiation, implementation and effects of the proposed combination. Such statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “would” or other similar expressions. Forward-looking statements are statements that are not historical facts, including statements about our beliefs and expectations.

These statements are based on current plans, estimates and projections, and, therefore, you should not place undue reliance on them. Forward-looking statements involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. These factors and uncertainties include in particular those described in the documents we have filed with the U.S. Securities and Exchange Commission. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update publicly any of them, whether in light of new information, future events or otherwise.

9

ADDITIONAL INFORMATION ABOUT THE PROPOSED BUSINESS COMBINATION AND WHERE TO FIND IT:

This document relates to a proposed business combination between Lan Airlines S.A. (“LAN”) and TAM S.A. (“TAM”), which is the subject of a registration statement and prospectus filed with the SEC by LAN and a new entity formed in connection with the combination. This document is not a substitute for the registration statement, prospectus and offering materials that LAN and the new entity filed with the SEC or any other documents that they may file with the SEC or send to shareholders in connection with the proposed combination. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, PROSPECTUS, EXCHANGE OFFER DOCUMENTS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED BUSINESS COMBINATION. All such documents, if filed, would be available free of charge at the SEC’s website (www.sec.gov) or by directing a request to LAN Investor Relations, at 56-2-565-8785 or by e-mail at investor.relations@lan.com, or to TAM Investor Relations, at 55-11-5582-9715 or by e-mail at invest@tam.com.br.

10

APPENDIX 1

PROFORMA CONSOLIDATED FINANCIAL STATEMENTS

|

Holdco II S.A.

|

Sister Holdco

|

Elimination of the

|

Proforma

|

Proforma

|

||||||||||||||||||||

|

LAN Airlines S.A.

|

Proforma

|

S.A. Proforma

|

investment

|

Adjustments

|

Combined

|

|||||||||||||||||||

|

THUS$

|

THUS$

|

THUS$

|

THUS$

|

THUS$

|

THUS$

|

|||||||||||||||||||

|

CURRENT ASSETS:

|

||||||||||||||||||||||||

|

Cash and cash equivalents

|

233,461 | - | - | 277,741 | 511,202 | |||||||||||||||||||

|

Other financial assets

|

228,527 | 763,820 | 992,347 | |||||||||||||||||||||

|

Other non-financial assets

|

33,275 | 16,987 | 50,262 | |||||||||||||||||||||

|

Trade and other accounts receivable

|

527,315 | 1,098,850 | 1,626,165 | |||||||||||||||||||||

|

Accounts receivable from related entities

|

1,324 | - | 1,324 | |||||||||||||||||||||

|

Inventories

|

66,211 | 91,431 | 157,642 | |||||||||||||||||||||

|

Tax Assets

|

115,416 | 326,452 | 441,868 | |||||||||||||||||||||

|

Total current assets

|

1,205,529 | - | - | - | 2,575,281 | 3,780,810 | ||||||||||||||||||

|

Current assets held for sale

|

4,398 | 10,534 | 14,932 | |||||||||||||||||||||

|

Total current assets

|

1,209,927 | - | - | - | 2,585,815 | 3,795,742 | ||||||||||||||||||

|

NON-CURRENT ASSETS:

|

||||||||||||||||||||||||

|

Other financial assets

|

21,876 | 152,860 | 174,736 | |||||||||||||||||||||

|

Other non-financial assets

|

36,337 | 321,474 | 357,811 | |||||||||||||||||||||

|

Rights receivable

|

7,533 | 1,753 | 9,286 | |||||||||||||||||||||

|

Equity accounted investments

|

1,118 | - | 1,118 | |||||||||||||||||||||

|

Other investments

|

- | 1,314,260 | 1,121,096 | (2,435,356 | ) | - | - | |||||||||||||||||

|

Intangible assets other than goodwill

|

59,263 | 1,578,858 | 1,638,121 | |||||||||||||||||||||

|

Goodwill

|

164,721 | 1,160,898 | 1,325,619 | |||||||||||||||||||||

|

Property, plant and equipment

|

5,513,256 | 4,848,504 | 10,361,760 | |||||||||||||||||||||

|

Deferred tax assets

|

58,470 | 115,120 | 173,590 | |||||||||||||||||||||

|

Total non-current assets

|

5,862,574 | 1,314,260 | 1,121,096 | (2,435,356 | ) | 8,179,467 | 14,042,041 | |||||||||||||||||

|

Total Assets

|

7,072,501 | 1,314,260 | 1,121,096 | (2,435,356 | ) | 10,765,282 | 17,837,783 | |||||||||||||||||

|

Holdco II S.A.

|

Sister Holdco

|

Elimination of the

|

Proforma

|

Proforma

|

||||||||||||||||||||

|

LAN Airlines S.A.

|

Proforma

|

S.A. Proforma

|

investment

|

Adjustments

|

Combined

|

|||||||||||||||||||

|

THUS$

|

THUS$

|

THUS$

|

THUS$

|

THUS$

|

THUS$

|

|||||||||||||||||||

|

LIABILITIES:

|

||||||||||||||||||||||||

|

Other financial liabilities

|

604,853 | 1,025,980 | 1,630,833 | |||||||||||||||||||||

|

Trade and other accounts payable

|

593,356 | 776,206 | 1,369,562 | |||||||||||||||||||||

|

Accounts payable to related entities

|

444 | - | 444 | |||||||||||||||||||||

|

Other provisions

|

1,116 | - | 1,116 | |||||||||||||||||||||

|

Tax liabilities

|

27,067 | 81,098 | 108,165 | |||||||||||||||||||||

|

Other non-financial liabilities

|

878,230 | 845,515 | 1,723,745 | |||||||||||||||||||||

|

Total current liabilities

|

2,105,066 | - | - | - | 2,728,799 | 4,833,865 | ||||||||||||||||||

|

NON-CURRENT LIABILITIES:

|

||||||||||||||||||||||||

|

Other financial liabilities

|

2,823,334 | 3,848,325 | 6,671,659 | |||||||||||||||||||||

|

Other accounts payable

|

416,735 | 255,659 | 672,394 | |||||||||||||||||||||

|

Other provisions

|

34,507 | 209,561 | 244,068 | |||||||||||||||||||||

|

Deferred tax liabilities

|

343,370 | 489,861 | 833,231 | |||||||||||||||||||||

|

Employee benefits

|

12,145 | - | 12,145 | |||||||||||||||||||||

|

Other non-current liabilities

|

- | 231,283 | 231,283 | |||||||||||||||||||||

|

Total non-current liabilities

|

3,630,091 | - | - | - | 5,034,689 | 8,664,780 | ||||||||||||||||||

| - | - | |||||||||||||||||||||||

|

Total liabilities

|

5,735,157 | - | - | - | 7,763,488 | 13,498,645 | ||||||||||||||||||

|

EQUITY:

|

||||||||||||||||||||||||

|

Share capital

|

461,975 | 765,740 | 651,899 | (1,417,639 | ) | 1,417,639 | 1,879,614 | |||||||||||||||||

|

Share premium

|

- | 548,520 | 469,197 | (1,017,717 | ) | - | ||||||||||||||||||

|

Other reserves

|

1,083,584 | - | 1,083,584 | |||||||||||||||||||||

|

Other equity interests

|

2,886 | 1,545,727 | 1,548,613 | |||||||||||||||||||||

|

Other reserves

|

(215,227 | ) | - | (215,227 | ) | |||||||||||||||||||

|

Equity attributable to owners of parent

|

1,333,218 | 1,314,260 | 1,121,096 | (2,435,356 | ) | 2,963,366 | 4,296,584 | |||||||||||||||||

|

Non-controlling interest

|

4,126 | 38,428 | 42,554 | |||||||||||||||||||||

|

Total equity

|

1,337,344 | 1,314,260 | 1,121,096 | (2,435,356 | ) | 3,001,794 | 4,339,138 | |||||||||||||||||

| - | - | |||||||||||||||||||||||

|

Total liabilities and equity

|

7,072,501 | 1,314,260 | 1,121,096 | (2,435,356 | ) | 10,765,282 | 17,837,783 | |||||||||||||||||

NOTES TO THE PREPARATION OF THE PROFORMA BALANCE SHEET

The proforma balance sheet gives effect to the merger of Sister Holdco S.A. and Holdco II S.A. with and into LAN Airlines S.A. according to IFRS 3, in the event each and all the conditions and assumptions used to prepare this report are met.

The consolidated merger balance sheet presented in the previous table is constructed as follows:

|

|

1.

|

The LAN Airlines S.A. consolidated balance sheet at September 30, 2011 is presented in the first column, as obtained from its financial statements presented within Appendix 2 to this report.

|

|

|

2.

|

The Holdco II S.A. proforma balance sheet at September 30, 2011 is presented in the second column, as obtained from its proforma financial statements presented within Appendix 4.1 to this report.

|

|

|

3.

|

The Sister Holdco S.A. proforma balance sheet at September 30, 2011 is presented in the third column, as obtained from its proforma financial statements presented within Appendix 3.1 to this report.

|

|

|

4.

|

The fourth column reflects the elimination of Sister Holdco S.A. and Holdco II S.A.´s investment in TAM S.A. and Holdco I S.A. against the equity accounts. As has been described within this report, once the merger is completed and in accordance with International Financial Reporting Standards (IFRS), LAN Airlines S.A. will begin consolidating TAM S.A., therefore, it is necessary to eliminate the financial investment and begin recognising the assets and liabilities, adjustment that will be incorporated in the next column of the table.

|

|

|

5.

|

According to the aforementioned N° 4, the next column incorporates, on a line by line basis, the assets and liabilities of TAM S.A. at their fair values, which have been determined as described within Appendix 5.2 to this report. Additionally, the same column incorporates the capital and other equity accounts increase that LAN Airlines S.A. records as a result of the issuance of shares to deliver in order to complete the merger. Lastly, it incorporates the goodwill generated by the merger.

|

|

|

6.

|

The last column shows the financial position resulting from the merger.

|

The purchase price, equivalent to the capital and other equity accounts increase registered by LAN Airlines S.A. referred to in the aforementioned number 5, is determined as follows:

|

|

i.

|

Holdco II S.A. shares involved in the merger at September 30, 2011: 83,368,923. This number of shares represents 100% of the subscribed and paid shares of TAM S.A. at September 30, 2011, that would be exchanged through the tender, excluding for these calculations the shares pending subscription and payment under stock option programs. It also considers the 2 shares already subscribed and paid at September 30, 2011 of Holdco II S.A.

|

|

|

ii.

|

Sister Holdco S.A. shares involved in the merger at September 30, 2011: 72,837,862. This number of shares considers the number of shares issued by Sister Holdco S.A. as a result of the contribution of 47,652,705 non voting shares in Holdco I S.A., the contribution of 62 voting shares of Holdco I S.A. and the contribution of 25,185,155 non-voting shares of TAM S.A. It also considers 2 shares already subscribed and paid at September 30, 2011 of Sister Holdco S.A.

|

|

|

iii.

|

Exchange ratio: 0.9 LAN Airlines S.A. shares for each Holdco II S.A. and Sister Holdco S.A. share.

|

|

|

iv.

|

Number of LAN Airlines S.A. shares to be issued: 140,586,107

|

|

|

v.

|

Price per share: US$ 21.07866

|

|

|

vi.

|

Purchase price: ThUS$ 2,963,366

|

As has been informed to this expert, it will be proposed to the Shareholders’ meeting that LAN Airlines S.A. increase its capital in the amount of ThUS$ 1,417,639, which equals the sum of the statutory capital of Sister Holdco S.A. and Holdco II S.A.

Therefore, the purchase price will be distributed as follows:

|

|

i.

|

As a capital increase in the amount of ThUS$ 1,417,639;

|

|

|

ii.

|

As an adjustment to the equity reserve denominated “Other equity interests” in the amount of ThUS$ 1,545,727.

|

The goodwill that is generated and referred to in the aforementioned number 5 is obtained the following way:

Purchase price: ThUS$ 2,963,366

(Less) Fair value of assets and liabilities acquired: ThUS$ 1,861,529

(Plus) TAM S.A.´s non-controlling interest: ThUS$ 38,428

Goodwill: ThUS$ 1,140,265

A description of certain reclassifications of asset and liability accounts made to TAM S.A.´s balance sheet so that it conforms to LAN Airlines S.A.´s balance sheet can be found within Appendix 5.1 to this report.

In order to prepare the proforma consolidated balance sheet presented in the previous table, Holdco II S.A.´s exchange offer has been assumed 100% successful. The following table presents, for illustrative purposes only, the equity, non-controlling interest and goodwill that would arise if only 95% accept the exchange, minimum condition to complete the merger.

|

Acceptance percentage

|

||||||||

|

Effect on

|

100 | % | 95 | % | ||||

|

ThUS$

|

ThUS$

|

|||||||

|

Goodwill generated by the transaction

|

1,140,265 | 1,085,174 | ||||||

|

Purchase price

|

2,963,366 | 2,815,198 | ||||||

|

Non-controlling interest

|

38,428 | 131,504 | ||||||

APPENDIX 2

AUDITED FINANCIAL STATEMENTS OF LAN AIRLINES S.A. AT SEPTEMBER 30, 2011

LAN AIRLINES S.A. AND SUBSIDIARIES

INTERIM CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2011

|

CONTENTS

|

|

|

Interim Consolidated Statement of Financial Position

|

5 |

|

Interim Consolidated Statement of Income by Function

|

7 |

|

Interim Consolidated Statement of Comprehensive Income

|

8 |

|

Interim Consolidated Statement of Changes in Equity

|

9 |

|

Interim Consolidated Statement of Cash Flows - Direct Method

|

11 |

|

Notes to the Consolidated Financial Statements

|

12 |

|

CLP

|

- CHILEAN PESO

|

|

ARS

|

- ARGENTINE PESO

|

|

US$

|

- UNITED STATES DOLLAR

|

|

THUS$

|

- THOUSANDS OF UNITED STATES DOLLARS

|

1

REPORT OF INDEPENDENT AUDITORS

Santiago, November 11, 2011

To the Board of Directors and Shareholders of Lan Airlines S.A.

|

1

|

We have reviewed the accompanying interim consolidated statement of financial position of Lan Airlines S.A. and its subsidiaries as of September 30, 2011, and the related interim consolidated statements of income by function and comprehensive income for the nine and three-month periods ended September 30, 2011 and 2010, and the changes in equity and cash flows for the nine month periods ended on those dates. Management of Lan Airlines S.A. is responsible for the preparation and fair presentation of these interim consolidated financial statements and related notes in accordance with IAS 34 “Interim Financial Reporting” incorporated in the International Financial Reporting Standards (IFRS). Our responsibility is to issue a report on these consolidated interim financial statements based on our review.

|

|

2

|

We conducted our review in accordance with audit standards established in Chile for a review of interim financial statements. A review of interim financial statements consists of making inquiries, primarily of persons responsible for financial and accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in accordance with generally accepted auditing standards in Chile, for which the objective is to express an opinion on the consolidated financial statements. Accordingly, we do not express an audit opinion.

|

|

3

|

Based on our review, we have no knowledge of any significant modification that should be made to the interim consolidated financial statements referred to above for them to be in accordance with IAS 34 incorporated in the International Financial Reporting Standards.

|

|

4

|

On March 1, 2011, we issued an unqualified opinion on the consolidated financial statements as of December 31, 2010 and 2009 of Lan Airlines S.A. and its subsidiaries, which include the statement of financial position as of December 31, 2010 presented in the accompanying consolidated financial statements, in addition to the corresponding notes.

|

Renzo Corona Spedaliere

RUT: 6.373.028-9

2

Contents of the notes to the consolidated financial statements of Lan Airlines S.A. and Subsidiaries.

|

Notes

|

Page

|

|

|

1

|

General information

|

12

|

|

2

|

Summary of significant accounting policies

|

16

|

|

2.1.

|

Preparation

|

16

|

|

2.2.

|

Consolidation

|

17

|

|

2.3.

|

Foreign currency transactions

|

18

|

|

2.4.

|

Property, plant and equipment

|

19

|

|

2.5.

|

Intangible assets

|

20

|

|

2.6.

|

Goodwill

|

20

|

|

2.7.

|

Borrowing costs

|

20

|

|

2.8.

|

Losses for impairment of non-financial assets

|

20

|

|

2.9.

|

Financial assets

|

20

|

|

2.10.

|

Derivative financial instruments and hedging activities

|

22

|

|

2.11.

|

Inventories

|

23

|

|

2.12.

|

Trade and other accounts receivable

|

23

|

|

2.13.

|

Cash and cash equivalents

|

23

|

|

2.14.

|

Capital

|

23

|

|

2.15.

|

Trade and other accounts payable

|

23

|

|

2.16.

|

Interest-bearing loans

|

24

|

|

2.17.

|

Deferred taxes

|

24

|

|

2.18.

|

Employee benefits

|

24

|

|

2.19.

|

Provisions

|

25

|

|

2.20.

|

Revenue recognition

|

25

|

|

2.21.

|

Leases

|

26

|

|

2.22.

|

Non-current assets (or disposal groups) classified as held for sale

|

26

|

|

2.23.

|

Maintenance

|

26

|

|

2.24.

|

Environment costs

|

26

|

|

3

|

Financial risk management

|

27

|

|

3.1.

|

Financial risk factors

|

27

|

|

3.2.

|

Capital risk management

|

34

|

|

3.3.

|

Estimates of fair value

|

35

|

|

4

|

Accounting estimates and judgments

|

38

|

|

5

|

Segmental Information

|

39

|

|

6

|

Cash and cash equivalents

|

41

|

|

7

|

Financial instruments

|

42

|

|

7.1.

|

Financial instruments by category

|

42

|

|

7.2.

|

Financial instruments by currency

|

44

|

|

8

|

Trade, other accounts receivable and non-current rights receivable

|

45

|

|

9

|

Accounts receivable from/payable to related entities

|

48

|

|

10

|

Inventories

|

50

|

|

11

|

Other financial assets

|

51

|

|

12

|

Other non financial assets

|

53

|

|

13

|

Non-current assets (or disposal groups) classified as held for sale

|

55

|

|

14

|

Investments in subsidiaries

|

56

|

|

15

|

Equity accounted investments

|

59

|

3

|

Notes

|

Page

|

|

|

16

|

Intangible assets other than goodwill

|

61

|

|

17

|

Goodwill

|

63

|

|

18

|

Property, plant and equipment

|

64

|

|

19

|

Income taxes

|

73

|

|

20

|

Other financial liabilities

|

80

|

|

21

|

Trade and other current accounts payable

|

85

|

|

22

|

Other provisions

|

88

|

|

23

|

Other current non-financial liabilities

|

91

|

|

24

|

Employee benefits

|

92

|

|

25

|

Other non-current accounts payable

|

94

|

|

26

|

Equity

|

95

|

|

27

|

Revenue

|

101

|

|

28

|

Costs and expenses by nature

|

102

|

|

29

|

Gains (losses) on the sale of non-current assets not classified as held for sale

|

104

|

|

30

|

Other income, by function

|

105

|

|

31

|

Foreign currency and exhange rate differences

|

106

|

|

32

|

Earnings per share

|

113

|

|

33

|

Contingencies

|

114

|

|

34

|

Commitments

|

120

|

|

35

|

Transactions with related parties

|

124

|

|

36

|

Share-based payments

|

127

|

|

37

|

The environment

|

128

|

|

38

|

Subsequent events

|

129

|

|

39

|

Business combinations

|

130

|

4

LAN AIRLINES S.A. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

|

ASSETS

|

As of

|

As of

|

||||||||||

|

September 30,

|

December 31,

|

|||||||||||

|

Note

|

2011

|

2010

|

||||||||||

|

ThUS$

|

ThUS$

|

|||||||||||

|

Current Assets

|

||||||||||||

|

Cash and cash equivalents

|

6 - 7 | 233,461 | 631,052 | |||||||||

|

Other financial assets

|

7 - 11 | 228,527 | 245,451 | |||||||||

|

Other non-financial assets

|

12 | 33,275 | 18,820 | |||||||||

|

Trade and other accounts receivable

|

7 - 8 | 527,315 | 481,350 | |||||||||

|

Accounts receivable from related entities

|

7 - 9 | 1,324 | 50 | |||||||||

|

Inventories

|

10 | 66,211 | 53,193 | |||||||||

|

Tax assets

|

115,416 | 97,656 | ||||||||||

|

Total current assets other than non-current assets (or disposal groups) classified as held for sale

|

1,205,529 | 1,527,572 | ||||||||||

|

Non-current assets (or disposal groups) classified as held for sale

|

13 | 4,398 | 5,497 | |||||||||

|

Total current assets

|

1,209,927 | 1,533,069 | ||||||||||

|

Non-current Assets

|

||||||||||||

|

Other financial assets

|

7 - 11 | 21,876 | 21,587 | |||||||||

|

Other non-financial assets

|

12 | 36,337 | 32,508 | |||||||||

|

Rights receivable

|

7 - 8 | 7,533 | 7,883 | |||||||||

|

Equity accounted investments

|

15 | 1,118 | 593 | |||||||||

|

Intangible assets other than goodwill

|

16 | 59,263 | 45,749 | |||||||||

|

Goodwill

|

17 | 164,721 | 157,994 | |||||||||

|

Property, plant and equipment

|

18 | 5,513,256 | 4,948,430 | |||||||||

|

Deferred tax assets

|

19 | 58,470 | 38,084 | |||||||||

|

Total non-current assets

|

5,862,574 | 5,252,828 | ||||||||||

|

Total assets

|

7,072,501 | 6,785,897 | ||||||||||

The accompanying Notes 1 to 39 form an integral part of these consolidated financial statements.

5

LAN AIRLINES S.A. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

|

LIABILITIES AND EQUITY

|

As of

|

As of

|

||||||||||

|

September 30,

|

December 31,

|

|||||||||||

|

Note

|

2011

|

2010

|

||||||||||

|

|

ThUS$

|

ThUS$

|

||||||||||

|

LIABILITIES

|

||||||||||||

|

Current liabilities

|

||||||||||||

|

Other financial liabilities

|

7 - 20 | 604,853 | 542,624 | |||||||||

|

Trade and other accounts payable

|

7 - 21 | 593,356 | 645,571 | |||||||||

|

Accounts payable to related entities

|

7 - 9 | 444 | 184 | |||||||||

|

Other provisions

|

22 | 1,116 | 753 | |||||||||

|

Tax liabilities

|

27,067 | 15,736 | ||||||||||

|

Other non-financial liabilities

|

23 | 878,230 | 939,151 | |||||||||

|

Total current liabilities

|

2,105,066 | 2,144,019 | ||||||||||

|

Non-current liabilities

|

||||||||||||

|

Other financial liabilities

|

7 - 20 | 2,823,334 | 2,562,348 | |||||||||

|

Other accounts payable

|

7 - 25 | 416,735 | 425,681 | |||||||||

|

Other provisions

|

22 | 34,507 | 32,120 | |||||||||

|

Deferred tax liabilities

|

19 | 343,370 | 312,012 | |||||||||

|

Employee benefits

|

24 | 12,145 | 9,657 | |||||||||

|

Total non-current liabilities

|

3,630,091 | 3,341,818 | ||||||||||

|

Total liabilities

|

5,735,157 | 5,485,837 | ||||||||||

|

EQUITY

|

||||||||||||

|

Share capital

|

26 | 461,975 | 453,444 | |||||||||

|

Retained earnings

|

26 | 1,083,584 | 949,214 | |||||||||

|

Other equity interests

|

26 | 2,886 | 5,463 | |||||||||

|

Other reserves

|

26 | (215,227 | ) | (111,307 | ) | |||||||

|

Equity attributable to owners of the parent

|

1,333,218 | 1,296,814 | ||||||||||

|

Non-controlling interests

|

4,126 | 3,246 | ||||||||||

|

Total equity

|

1,337,344 | 1,300,060 | ||||||||||

|

Total liabilities and equity

|

7,072,501 | 6,785,897 | ||||||||||

The accompanying Notes 1 to 39 form an integral part of these consolidated financial statements.

6

LAN AIRLINES S.A. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF INCOME BY FUNCTION

|

For the nine months ended

|

For the three months ended

|

|||||||||||||||||||

|

September 30,

|

September 30,

|

|||||||||||||||||||

|

Note

|

2011

|

2010

|

2011

|

2010

|

||||||||||||||||

|

ThUS$

|

ThUS$

|

ThUS$

|

ThUS$

|

|||||||||||||||||

|

Revenue

|

27 | 4,083,462 | 3,131,924 | 1,455,443 | 1,122,292 | |||||||||||||||

|

Cost of sales

|

(3,017,929 | ) | (2,171,413 | ) | (1,044,289 | ) | (766,176 | ) | ||||||||||||

|

Gross margin

|

1,065,533 | 960,511 | 411,154 | 356,116 | ||||||||||||||||

|

Other income

|

30 | 99,473 | 88,926 | 31,077 | 30,038 | |||||||||||||||

|

Distribution costs

|

(347,768 | ) | (276,144 | ) | (121,667 | ) | (97,335 | ) | ||||||||||||

|

Administrative expenses

|

(289,117 | ) | (233,339 | ) | (99,741 | ) | (87,192 | ) | ||||||||||||

|

Other expenses

|

(157,872 | ) | (127,832 | ) | (59,619 | ) | (45,012 | ) | ||||||||||||

|

Other gains/(losses)

|

(36,868 | ) | (6,172 | ) | (11,484 | ) | (3,788 | ) | ||||||||||||

|

Financial income

|

9,687 | 10,390 | 1,063 | 5,284 | ||||||||||||||||

|

Financial costs

|

28 | (104,610 | ) | (116,545 | ) | (34,398 | ) | (38,045 | ) | |||||||||||

|

Equity accounted earnings

|

15 | 471 | 153 | 508 | 34 | |||||||||||||||

|

Foreign exchange gains/(losses)

|

31 | 6,184 | 6,731 | (1,927 | ) | 9,117 | ||||||||||||||

|

Result of indexation units

|

52 | 22 | 2 | 36 | ||||||||||||||||

|

Income before taxes

|

245,165 | 306,701 | 114,968 | 129,253 | ||||||||||||||||

|

Income tax expense

|

19 | (40,941 | ) | (50,227 | ) | (17,661 | ) | (20,157 | ) | |||||||||||

|

NET INCOME FOR THE PERIOD

|

204,224 | 256,474 | 97,307 | 109,096 | ||||||||||||||||

|

Income attributable to owners of the parent

|

207,697 | 255,143 | 94,513 | 106,214 | ||||||||||||||||

|

Income attributable to non-controlling interests

|

(3,473 | ) | 1,331 | 2,794 | 2,882 | |||||||||||||||

|

Net income for the period

|

204,224 | 256,474 | 97,307 | 109,096 | ||||||||||||||||

|

EARNINGS PER SHARE

|

||||||||||||||||||||

|

Basic earnings per share (US$)

|

32 | 0.61218 | 0.75310 | 0.27852 | 0.31351 | |||||||||||||||

|

Diluted earnings per share (US$)

|

32 | 0.61099 | 0.75137 | 0.27802 | 0.31268 | |||||||||||||||

The accompanying Notes 1 to 39 form an integral part of these consolidated financial statements.

7

LAN AIRLINES S.A. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

|

For the nine months ended

|

For the three months ended

|

||||||||||||||||||

|

September 30,

|

September 30,

|

||||||||||||||||||

|

Note

|

2011

|

2010

|

2011

|

2010

|

|||||||||||||||

|

ThUS$

|

ThUS$

|

ThUS$

|

ThUS$

|

||||||||||||||||

|

NET INCOME

|

204,224 | 256,474 | 97,307 | 109,096 | |||||||||||||||

|

Components of other comprehensive income, before taxes

|

|||||||||||||||||||

|

Currency translation differences

|

|||||||||||||||||||

|

Gains (losses) on currency translation, before tax

|

31 | (9,507 | ) | (150 | ) | (610 | ) | 2,619 | |||||||||||

|

Other comprehensive income, before taxes, currency translation differences

|

(9,507 | ) | (150 | ) | (610 | ) | 2,619 | ||||||||||||

|

Cash flow hedges

|

|||||||||||||||||||

|

Gains (losses) on cash flow hedges before tax

|

20 | (115,913 | ) | (76,973 | ) | (80,948 | ) | 2,827 | |||||||||||

|

Other comprehensive income, before taxes, cash flow hedges

|

(115,913 | ) | (76,973 | ) | (80,948 | ) | 2,827 | ||||||||||||

|

Other components of other comprehensive income, before taxes

|

(125,420 | ) | (77,123 | ) | (81,558 | ) | 5,446 | ||||||||||||

|

Income tax relating to components of other comprehensive income

|

|||||||||||||||||||

|

Income tax related to currency translation differences in other comprehensive income

|

19 | 1,615 | 26 | 103 | (445 | ) | |||||||||||||

|

Income tax related to cash flow hedges in other comprehensive income

|

19 | 19,705 | 13,085 | 13,761 | (481 | ) | |||||||||||||

|

Amount of income taxes related to components of other comprehensive income

|

21,320 | 13,111 | 13,864 | (926 | ) | ||||||||||||||

|

Other comprehensive income

|

(104,100 | ) | (64,012 | ) | (67,694 | ) | 4,520 | ||||||||||||

|

Total comprehensive income

|

100,124 | 192,462 | 29,613 | 113,616 | |||||||||||||||

|

Comprehensive income attributable to owners of the parent

|

103,777 | 191,167 | 26,822 | 110,742 | |||||||||||||||

|

Comprehensive income attributable to non-controlling interests

|

(3,653 | ) | 1,295 | 2,791 | 2,874 | ||||||||||||||

|

TOTAL COMPREHENSIVE INCOME

|

100,124 | 192,462 | 29,613 | 113,616 | |||||||||||||||

The accompanying Notes 1 to 39 form an integral part of these consolidated financial statements.

8

LAN AIRLINES S.A. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

|

Attributable to owners of the parent

|

|||||||||||||||||||||||||||||||||||

|

Other reserves

|

Equity

|

||||||||||||||||||||||||||||||||||

|

Other

|

Currency

|

Cash flow

|

attributable to

|

Non-

|

|||||||||||||||||||||||||||||||

|

Share

|

equity

|

translation

|

hedging

|

Retained

|

owners

|

controlling

|

Total

|

||||||||||||||||||||||||||||

|

Note

|

capital

|

interests

|

reserve

|

reserve

|

earnings

|

of the parent

|

interests

|

equity

|

|||||||||||||||||||||||||||

|

ThUS$

|

ThUS$

|

ThUS$

|

ThUS$

|

ThUS$

|

ThUS$

|

ThUS$

|

ThUS$

|

||||||||||||||||||||||||||||

|

Opening balance as of January 01, 2011

|

453,444 | 5,463 | (4,257 | ) | (107,050 | ) | 949,214 | 1,296,814 | 3,246 | 1,300,060 | |||||||||||||||||||||||||

|

Changes in equity

|

|||||||||||||||||||||||||||||||||||

|

Comprehensive income

|

|||||||||||||||||||||||||||||||||||

|

Gain (losses)

|

26 | - | - | - | - | 207,697 | 207,697 | (3,473 | ) | 204,224 | |||||||||||||||||||||||||

|

Other comprehensive income

|

- | - | (7,712 | ) | (96,208 | ) | - | (103,920 | ) | (180 | ) | (104,100 | ) | ||||||||||||||||||||||

|

Total comprehensive income

|

- | - | (7,712 | ) | (96,208 | ) | 207,697 | 103,777 | (3,653 | ) | 100,124 | ||||||||||||||||||||||||

|

Transactions with shareholders

|

|||||||||||||||||||||||||||||||||||

|

Equity issuance

|

26-36 | 8,531 | - | - | - | - | 8,531 | - | 8,531 | ||||||||||||||||||||||||||

|

Dividends

|

26 | - | - | - | - | (72,696 | ) | (72,696 | ) | - | (72,696 | ) | |||||||||||||||||||||||

|

Increase (decrease) for transfers and other changes

|

26-36 | - | (2,577 | ) | - | - | (631 | ) | (3,208 | ) | 4,533 | 1,325 | |||||||||||||||||||||||

|

Total transactions with shareholders

|

8,531 | (2,577 | ) | - | - | (73,327 | ) | (67,373 | ) | 4,533 | (62,840 | ) | |||||||||||||||||||||||

|

Closing balance as of September 30, 2011

|

461,975 | 2,886 | (11,969 | ) | (203,258 | ) | 1,083,584 | 1,333,218 | 4,126 | 1,337,344 | |||||||||||||||||||||||||

The accompanying Notes 1 to 39 form an integral part of these consolidated financial statements.

9

LAN AIRLINES S.A. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

| Attributable to owners of the parent | |||||||||||||||||||||||||||||||||||

|

Other reserves

|

Equity

|

||||||||||||||||||||||||||||||||||

|

Other

|

Currency

|

Cash flow

|

attributable to

|

Non-

|

|||||||||||||||||||||||||||||||

|

Share

|

equity

|

translation

|

hedging

|

Retained

|

owners

|

controlling

|

Total

|

||||||||||||||||||||||||||||

|

Note

|

capital

|

interests

|

reserve

|

reserve

|

earnings

|

of the parent

|

interests

|

equity

|

|||||||||||||||||||||||||||

|

ThUS$

|

ThUS$

|

ThUS$

|

ThUS$

|

ThUS$

|

ThUS$

|

ThUS$

|

ThUS$

|

||||||||||||||||||||||||||||

|

Opening balance as of January 01, 2010

|

453,444 | 2,490 | (4,924 | ) | (92,230 | ) | 740,047 | 1,098,827 | 7,099 | 1,105,926 | |||||||||||||||||||||||||

|

Changes in equity

|

|||||||||||||||||||||||||||||||||||

|

Comprehensive income

|

|||||||||||||||||||||||||||||||||||

|

Net income

|

26 | - | - | - | - | 255,143 | 255,143 | 1,331 | 256,474 | ||||||||||||||||||||||||||

|

Other comprehensive income

|

- | - | (88 | ) | (63,888 | ) | - | (63,976 | ) | (36 | ) | (64,012 | ) | ||||||||||||||||||||||

|

Total comprehensive income

|

- | - | (88 | ) | (63,888 | ) | 255,143 | 191,167 | 1,295 | 192,462 | |||||||||||||||||||||||||

|

Transactions with shareholders

|

|||||||||||||||||||||||||||||||||||

|

Dividends

|

26 | - | - | - | - | (87,482 | ) | (87,482 | ) | - | (87,482 | ) | |||||||||||||||||||||||

|

Increase (decrease) for transfers and other changes

|

26-36 | - | 2,264 | - | - | (129 | ) | 2,135 | (32 | ) | 2,103 | ||||||||||||||||||||||||

|

Total transactions with shareholders

|

- | 2,264 | - | - | (87,611 | ) | (85,347 | ) | (32 | ) | (85,379 | ) | |||||||||||||||||||||||

|

Closing balance as of September 30, 2010

|

453,444 | 4,754 | (5,012 | ) | (156,118 | ) | 907,579 | 1,204,647 | 8,362 | 1,213,009 | |||||||||||||||||||||||||

The accompanying Notes 1 to 39 form an integral part of these consolidated financial statements.

10

LAN AIRLINES S.A. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CASH FLOWS DIRECT – METHOD

|

For the nine months ended

|

||||||||||||

|

September 30,

|

||||||||||||

|

Note

|

2011

|

2010

|

||||||||||

|

ThUS$

|

ThUS$

|

|||||||||||

|

Cash flows from operating activities

|

||||||||||||

|

Cash collection from operating activities

|

||||||||||||

|

Proceeds from sales of goods and services

|

4,276,530 | 3,302,635 | ||||||||||

|

Other cash receipts from operating activities

|

40,375 | 33,816 | ||||||||||

|

Payments for operating activities

|

||||||||||||

|

Payments to suppliers for goods and services

|

(3,172,799 | ) | (2,178,869 | ) | ||||||||

|

Payments to and on behalf of employees

|

(683,142 | ) | (461,157 | ) | ||||||||

|

Other payments for operating activities

|

(84,133 | ) | (18,000 | ) | ||||||||

|

Interest paid

|

(4,679 | ) | (387 | ) | ||||||||

|

Interest received

|

7,140 | 6,291 | ||||||||||

|

Income taxes refunded (paid)

|

2,836 | (7,074 | ) | |||||||||

|

Other cash inflows (outflows)

|

(4,982 | ) | (94,773 | ) | ||||||||

|

Net cash flows from operating activities

|

377,146 | 582,482 | ||||||||||

|

Cash flows used in investing activities

|

||||||||||||

|

Cash flows from disposal of subsidiaries

|

47,337 | 1,491 | ||||||||||

|

Cash flows used for acquisition of subsidiaries

|

(3,541 | ) | - | |||||||||

|

Other cash receipts from sales of equity or debt instruments of other entities

|

8,159 | 11,134 | ||||||||||

|

Amounts raised from sale of property, plant and equipment

|

87,888 | 45 | ||||||||||

|

Purchases of property, plant and equipment

|

(868,886 | ) | (633,256 | ) | ||||||||

|

Amounts raised from sale of intangible assets

|

6,189 | - | ||||||||||

|

Purchases of intangible assets

|

(19,338 | ) | (11,373 | ) | ||||||||

|

Dividends received

|

79 | 111 | ||||||||||

|

Interest received

|

2,223 | 3,632 | ||||||||||

|

Other cash inflows (outflows)

|

(19,155 | ) | (15,999 | ) | ||||||||

|

Net cash flow used in investing activities

|

(759,045 | ) | (644,215 | ) | ||||||||

|

Cash flows from (used in) financing activities

|

||||||||||||

|

Amounts raised from issuance of shares

|

8,532 | - | ||||||||||

|

Amounts raised from long-term loans

|

591,592 | 472,906 | ||||||||||

|

Amounts raised from short-term loans

|

284,500 | - | ||||||||||

|

Loan Payments

|

(690,334 | ) | (350,856 | ) | ||||||||

|

Payments of finance lease liabilities

|

(43,247 | ) | (43,988 | ) | ||||||||

|

Dividends paid

|

(192,118 | ) | (155,407 | ) | ||||||||

|

Interest paid

|

(93,301 | ) | (94,444 | ) | ||||||||

|

Other cash inflows (outflows)

|

118,730 | 39,785 | ||||||||||

|

Net cash flows from (used in) financing activities

|

(15,646 | ) | (132,004 | ) | ||||||||

|

Net increase (decrease) in cash and cash equivalents before the effect of changes in the exchange rate

|

(397,545 | ) | (193,737 | ) | ||||||||

|

Effects of variation in the exchange rate on cash and cash equivalents

|

(46 | ) | 66 | |||||||||

|

Net increase (decrease) in cash and cash equivalents

|

(397,591 | ) | (193,671 | ) | ||||||||

|

CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD

|

6 | 631,052 | 731,497 | |||||||||

|

CASH AND CASH EQUIVALENTS AT END OF PERIOD

|

6 | 233,461 | 537,826 | |||||||||

The accompanying Notes 1 to 39 form an integral part of these consolidated financial statements.

11

LAN AIRLINES S.A. AND SUBSIDIARIES

NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2011

NOTE 1 - GENERAL INFORMATION

Lan Airlines S.A. (the “Company” or “LAN”) is a public company registered with the Chilean Superintendency of Securities and Insurance (SVS), under No.306, whose shares are quoted in Chile on the Valparaíso Stock Exchange, the Chilean Electronic Exchange and the Santiago Stock Exchange; it is also quoted on the New York Stock Exchange (NYSE) in the form of American Depositary Receipts (ADRs). Its principal business is passenger and cargo air transportation, both in the domestic markets of Chile, Peru, Argentina, Colombia and Ecuador and a series of regional and international routes in America, Europe and Oceania. These businesses are performed directly or through its subsidiaries in different countries. In addition, the company has subsidiaries operating in the freight business in Mexico, Brazil and Colombia.

On August 13, 2010, LAN Airlines S.A. and TAM S.A. (TAM) announced they have signed a non-binding Memorandum of Understanding (MOU) in which the companies agree to proceed with their intention of carrying out their operations jointly under one parent company, to be named LATAM Airlines Group. The proposed partnership of LAN with TAM would be within the world’s 10 largest airline groups. LATAM will provide transport services for passengers and cargo to more than 115 destinations in 23 countries, operating with a fleet of over 280 aircraft, with over 40,000 employees. Both airlines will continue operating independently with their current operating licenses and brands. Within the group, TAM will continue operating as a Brazilian company with its own structure. The current holding of LAN Airlines S.A. will operate as an independent business unit within the group. On October 20, 2010, LAN Airlines and TAM announced that the operating subsidiaries of TAM had presented the structure of the transaction to the Brazilian Civil Aviation Agency (ANAC), which was approved by this agency on March 01, 2011.

On January 18, 2011 the parties of the MOU (1) and Mrs. Maria Cláudia Oliveira Amaro, Maurício Rolim Amaro, Noemy Almeida Olivera Amaro and Joao Francisco Amaro (“Amaro Family”), as the only shareholders of TEP, signed (a) an Implementation Agreement and (b) a binding Exchange Offer Agreement ("Contracts Signed") containing the final terms and conditions of the proposed partnership between LAN and TAM.

(1) On August 13, 2010 LAN reported as a significant matter to the Superintendency of Securities and Insurance that LAN, Costa Verde Aeronáutica S.A. and Inversiones Mineras del Cantábrico S.A. (the last two, "Cueto subsidiaries”), TAM S.A. (“TAM”) and TAM Empreendimentos e Participacoes S.A. (“TEP”) signed a non-binding Memorandum of Understanding ("MOU") for which the primary terms were outlined.

On September 21, 2011, the Court of Defense of Free Competition ("TDLC") approved the merger between LAN and TAM, establishing fourteen mitigation measures. On October 3, LAN and TAM filed an appeal to the Supreme Court objecting three of the mitigation measures.

The Company is located in Santiago, Chile, at Avenida Américo Vespucio Sur 901, Renca.

12

Corporate Governance practices of the Company are set in accordance with Securities Market Law 18,045 the Corporations Law 18,046 and its regulations, and the regulations of the SVS and the laws and regulations of the United States of America and the U.S. Securities and Exchange Commission (SEC) with respect to the issuance of ADRs, and the Federal Republic of Brazil and the Comissão de Valores Mobiliários (“CVM) of that country, as it pertains to the issuance of Brazilian Depositary Receipts (“BDRs”).

The Board of the Company is composed of nine members who are elected every two years by the ordinary shareholders meeting. The Board meets in regular monthly sessions and in extraordinary sessions as the corporate needs demand. Of the nine board members, three form part of its Directors’ Committee which fulfills both the role foreseen in the Corporations Law and the functions of the Audit Committee required by the Sarbanes Oxley Act of the United States of America and the respective regulations of the SEC.

The majority shareholder of the Company is the Cueto Group, which through Costa Verde Aeronáutica S.A. and Inversiones Mineras del Cantábrico S.A. owns 34.01% of the shares issued by the Company, as is the controller of the Company in accordance with the provisions of the letter b) of Article 97 and Article 99 of the Securities Market Law, attended that despite not meeting the majority of votes at shareholder meetings and to elect the majority of the directors of the Company, has a decisive influence in its administration.

As of September 30, 2011, the Company had a total of 1,672 registered shareholders, and 3.69% of the Company’s share capital was in the form of ADRs.