As filed with the Securities and Exchange Commission on November 15, 2011.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form F-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

|

LAN AIRLINES S.A.

|

HOLDCO II S.A.

|

|

|

(Exact name of Registrant as specified in its charter)

|

(Exact name of Registrant as specified in its charter)

|

|

The Republic of Chile

(State or other jurisdiction of

incorporation or organization)

|

|

4512

(Primary Standard Industrial

Classification Code Number)

|

|

Not Applicable

(I.R.S. Employer

Identification Number)

|

|

LAN Airlines S.A.

Presidente Riesco 5711, 20th Floor

Las Condes

Santiago, Chile

Telephone: (56-2) 565-2525

|

Holdco II S.A.

Nueva Tajamar No. 555,

4th Floor

Las Condes

Santiago, Chile

Telephone: (55) 11-5035-2555

|

|

|

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

|

||

|

LAN Airlines S.A.

970 South Dixie Highway

Miami, Florida 33156

Telephone: (305) 869-2993

|

Puglisi & Associates

850 Library Avenue, Suite 204

P.O. Box 885

Newark, Delaware 19715

(302) 738-6680

|

|

|

(Name, address, including Zip code, and telephone number, including area code, of agent for service)

|

||

Copies to:

|

Sergio Galvis

Duncan McCurrach

Sullivan & Cromwell LLP

125 Broad Street

New York, New York 10004

(212) 558-4000

|

|

José María Eyzaguirre B.

Claro y Cia.

Av. Apoquindo 3721

Piso 13, Casilla 1867

Las Condes, Santiago

Chile

(56-2) 367-3000

|

|

Flavia Turci

Turci Advogados

Rua Fidêncio Ramos, 100, 7° andar

Vila Olímpia

04551-010 São Paulo – SP

Brasil

(55) 11-2177-2177

|

|

Sarah Jones

Anand Saha

Clifford Chance US LLP

31 West 52nd Street

New York, New York 10019

(212) 878-8000

|

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective and all of the conditions to the commencement of the exchange offer have been satisfied.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨______________

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ¨

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

Securities to be Registered

|

Amount To Be

Registered

|

Proposed Maximum

Offering Price Per

Unit

|

Proposed

Maximum

Aggregate

Offering Price

|

Amount of

Registration

Fee

|

||||||||||||

|

Common stock, without par value, of LAN Airlines S.A.(1)

|

56,880,148 | (2) | $ | 19.66 | (3) | $ | 1,118,263,709.68 | (3) | $ | 128,153.02 | ||||||

|

Common stock, without par value, of Holdco II S.A.(4)

|

63,200,164 | (5) | N/A | N/A | N/A | |||||||||||

|

(1)

|

American Depositary Shares (“LAN ADSs”) representing the shares of common stock, without par value (“LAN common shares”), of LAN Airlines S.A. (“LAN”) registered hereby are being registered pursuant to a separate registration statement on Form F-6. Pursuant to the exchange offer to be made by Holdco II S.A. (“Holdco II”) and the mergers described herein, (i) LAN ADSs representing such LAN common shares will be offered and sold pursuant to this registration statement (the “US registered offering”) to holders of (x) American Depositary Shares (“TAM ADSs”) representing the non-voting preferred shares, without par value (“TAM preferred shares”), of TAM S.A. (“TAM”) and the voting common shares, without par value (“TAM common shares” and, collectively with the TAM preferred shares, the “TAM shares”), of TAM and (y) TAM preferred shares and TAM common shares, in each case to the extent that such TAM shares and TAM ADSs are tendered into the exchange offer through the US exchange agent and are acquired pursuant to the exchange offer, and (ii) Brazilian Depositary Shares (“LAN BDSs”) representing LAN common shares will be offered and sold in offerings exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”) (a) to holders of TAM shares that are not located in the United States or US persons (as such terms are defined in Regulation S under the Securities Act) pursuant to the exemption provided by Regulation S under the Securities Act (the “Regulation S offering”) and (b) to holders of TAM shares located in the United States or who are US persons that are “qualified institutional buyers” (as defined in Rule 144A under the Securities Act) pursuant to the exemption provided by Section 4(2) under the Securities Act (collectively with the Regulation S offering, the “exempt offerings”), in each case to the extent such TAM shares are tendered into the exchange offer through the auction to be conducted on the BMF&BOVESPA, the Brazilian stock exchange, and are acquired pursuant to the exchange offer.

|

|

(2)

|

Represents the maximum number of LAN common shares expected to be offered and sold in the US registered offering and a portion of the LAN common shares that are to be offered and sold outside of the United States in the Regulation S offering that may be resold from time to time in the United States or to US persons. The offers and sales of LAN common shares in the exempt offerings are not being registered in the United States.

|

|

(3)

|

Computed solely for the purpose of calculating the registration fee. The registration fee has been computed pursuant to Rule 457(c) and Rule 457(f)(1) under the Securities Act, based on the average of the high and low prices of the TAM ADSs on the New York Stock Exchange on November 10, 2011.

|

|

(4)

|

After Holdco II accepts for exchange the TAM shares and TAM ADSs tendered into the exchange offer and immediately before the settlement of the exchange offer, Holdco II will merge with and into LAN. Pursuant to this merger, LAN will continue to exist as the surviving company of the merger, Holdco II will cease to exist and each share of common stock, without par value (“Holdco II shares”), of Holdco II (including those shares to be issued pursuant to the exchange offer) will be converted into 0.90 of a LAN common share. As a result, at the settlement of the exchange offer each holder of TAM ADSs or TAM shares acquired pursuant to the exchange offer will receive (i) 0.90 of a LAN ADS for each TAM ADS or TAM share it sold in the US registered offering and (ii) 0.90 of a LAN BDS for each TAM share it sold in the exempt offerings.

|

|

(5)

|

Equals the number of LAN common shares described in footnote (2) divided by 0.90, which is the exchange ratio for the exchange offer.

|

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary offer to exchange/prospectus is not complete and may be changed. A registration statement relating to these securities has been filed with the US Securities and Exchange Commission and these securities may not be sold until the registration statement becomes effective. This preliminary offer to exchange/prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

Subject to Completion Dated November 15, 2011

Preliminary Offer to Exchange/Prospectus

Offer to Exchange

each

Common Share, Preferred Share and American Depositary Share

of

TAM S.A.

for

0.90 of a Common Share

of

LAN AIRLINES S.A.

Represented by

American Depositary Shares or Brazilian Depositary Shares

LAN Airlines S.A., a Chilean company (which we refer to as “LAN”), TAM S.A., a Brazilian company (which we refer to as “TAM”), and their respective controlling shareholders have entered into an exchange offer agreement and implementation agreement (which we refer to collectively as the “transaction agreements”) to combine LAN and TAM to form the leading Latin American airline group with the largest fleet of aircraft of any airline in Latin America. When the proposed combination is completed, LAN will be the holding company for the combined companies and will change its name to “LATAM Airlines Group S.A.” (which we refer to as “LATAM”). The parties will implement the proposed combination using the following three steps:

|

|

·

|

Holdco II S.A., a Chilean company formed in June 2011 and indirectly owned by the controlling shareholders of TAM and LAN (which we refer to as “Holdco II”), will make an exchange offer in the United States pursuant to this offer to exchange/prospectus and in Brazil and elsewhere outside of the United States pursuant to other offering documents published in Brazil and made available to all holders of TAM shares to acquire all of the issued and outstanding (i) voting common shares of TAM (which we refer to as “TAM common shares”), (ii) non-voting preferred shares of TAM (which we refer to as “TAM preferred shares” and, collectively with TAM common shares, as “TAM shares”) and (iii) American Depositary Shares representing TAM shares (each of which represents one TAM share and which we refer to as “TAM ADSs”), in each case other than any TAM shares owned by the controlling shareholders of TAM, in exchange for the same number of common shares of Holdco II (which we refer to as the “exchange offer”);

|

|

|

·

|

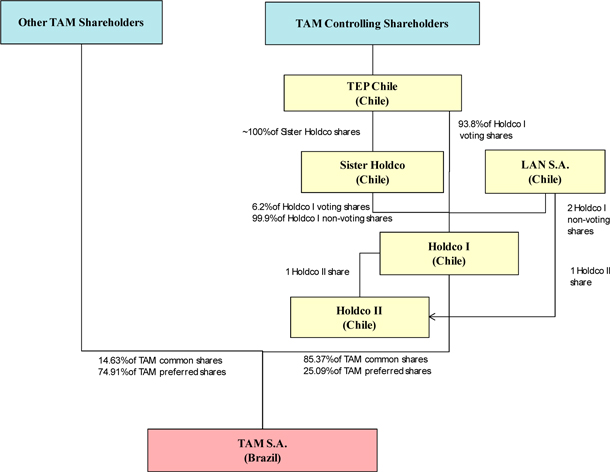

Immediately before Holdco II accepts for exchange the TAM shares and TAM ADSs tendered into the exchange offer, the controlling shareholders of TAM will contribute to TEP Chile S.A., a Chilean company formed in June 2011 that is wholly owned by the controlling shareholders of TAM (which we refer to as “TEP Chile”), all of their TAM common shares and TAM preferred shares in exchange for a number of shares of TEP Chile, which, when added to the shares of TEP Chile held by the controlling shareholders of TAM at that time, would equal 100% of the shares of TEP Chile. Thereafter, TEP Chile will contribute all of the TAM common shares contributed to it by the controlling shareholders of TAM to Holdco I S.A., a Chilean company formed in June 2011 (which we refer to as “Holdco I”), and all of the TAM preferred shares contributed to it by the controlling shareholders of TAM to Sister Holdco S.A., a Chilean company formed in June 2011 (which we refer to as “Sister Holdco”), and will receive 93.8% of the voting shares of Holdco I (TEP Chile’s percentage ownership of the outstanding voting shares of Holdco I will be reduced after the mergers described below so that the product of such ownership percentage and Holdco I’s percentage ownership of the outstanding TAM common shares will be equal to 80%), and a number of shares of Sister Holdco (which we refer to as “Sister Holdco shares”) equal to the total number of TAM shares it contributed to Holdco I and Sister Holdco; and

|

- i -

|

|

·

|

After Holdco II accepts for exchange the TAM shares and TAM ADSs tendered into the exchange offer and immediately before the settlement of the exchange offer, each of Holdco II and Sister Holdco will merge with and into LAN (which we refer to as the “Holdco II merger” and the “Sister Holdco merger,” respectively, and which we refer to collectively as the “mergers”), with LAN being the surviving company of both mergers. For more information on these transactions, see “The Transaction Agreements—Overview” section of this offer to exchange/prospectus beginning on page 159.

|

As a result of the Holdco II merger, each common share of Holdco II (including those shares to be issued pursuant to the exchange offer) will be converted into 0.90 of a common share of LAN (which we refer to as “LAN common shares”). Because the Holdco II merger will occur immediately before the settlement of the exchange offer, holders of TAM shares and TAM ADSs acquired in the exchange offer will receive 0.90 of a LAN common share for each TAM share or TAM ADS so acquired. Holders of TAM shares and TAM ADSs who tender into the exchange offer through JPMorganChase Bank, N.A., as the US exchange agent will receive such LAN common shares in the form of American Depositary Shares representing LAN common shares (each of which represents one LAN common share and which we refer to as “LAN ADSs”), which will be evidenced by American Depositary Receipts (which we refer to as “LAN ADRs”). Holders of TAM shares who tender into the exchange offer by tendering their TAM shares in the auction (which we refer to as the “Auction”) to be held on the BM&FBOVESPA stock exchange in Brazil (which we refer to as “Bovespa”) will receive such LAN common shares in the form of Brazilian Depositary Shares representing LAN common shares (each of which represents one LAN common share and which we refer to as “LAN BDSs”), which will be evidenced by Brazilian Depositary Receipts (which we refer to as “LAN BDRs”). We refer to the LAN common shares, LAN ADSs and LAN BDSs collectively as the “LAN shares”.

As a result of the Sister Holdco merger, each Sister Holdco share will be converted into 0.90 of a LAN common share. Because all of the Sister Holdco shares will be owned by the controlling shareholders of TAM indirectly through TEP Chile immediately prior to the Sister Holdco merger, they will receive LAN common shares for the TAM shares TEP Chile contributes to Holdco I and Sister Holdco at the same exchange ratio as the holders of TAM shares and TAM ADSs receive in the exchange offer and the mergers.

No fractional LAN ADSs or LAN BDSs will be issued to you in connection with the exchange offer and the mergers. Instead of any such fractional shares that you would otherwise be entitled to receive pursuant to the exchange offer and the mergers, you will receive an amount in cash in US dollars based on the closing price of LAN common shares on the Santiago Stock Exchange (which we refer to as the “SSE”) on the last trading day immediately preceding the effective time of the mergers (as reported on the SSE’s website, www.bolsadesantiago.com or, if unavailable, as reported by another authoritative source) and the “dólar observado” or “observed” exchange rate published on such last trading day immediately preceding the effective time of the mergers by Banco Central de Chile (which we refer to as the “Central Bank of Chile”). This exchange rate (which we refer to as the “Chilean observed exchange rate”) is the average exchange rate of the previous business day’s transactions in the Formal Exchange Market (banks and other entities authorized by the Central Bank of Chile) as published in the Diario Oficial (Official Gazette) by the Central Bank of Chile pursuant to number 6 of Chapter I of its Compendium of Foreign Exchange Rules.

The Chilean observed exchange rate on September 30, 2011 was CLP$ 515.14 = US$ 1.00.

THE BOARD OF DIRECTORS OF TAM HAS DETERMINED THAT THE EXCHANGE OFFER AND MERGERS ARE IN THE BEST INTERESTS OF TAM AND THE HOLDERS OF TAM SHARES AND TAM ADSs AND HAS RECOMMENDED THAT SUCH HOLDERS (OTHER THAN THE CONTROLLING SHAREHOLDERS OF TAM) TENDER THEIR TAM SHARES AND TAM ADSs INTO THE EXCHANGE OFFER.

- ii -

This offer to exchange/prospectus is being sent to all holders of TAM shares that are residents of, or located in, the United States and to all holders of TAM ADSs, wherever located. Separate offering documents relating to the exchange offer are being published in Brazil and made available to all holders of TAM shares.

The exchange offer is being made on the terms and subject to the conditions set forth in this offer to exchange/prospectus under “The Exchange Offer” beginning on page 111 and the related letter of transmittal. Among other conditions, the exchange offer is subject to the satisfaction or waiver of the following minimum conditions:

|

|

·

|

The holders of more than 66 2/3% of the qualifying minority shares shall have:

|

|

|

o

|

validly tendered such shares into, and not withdrawn them from, the exchange offer through the US exchange agent or the Auction on Bovespa and/or

|

|

|

o

|

expressly agreed with the deregistration of TAM as a public company in Brazil with Comissão de Valores Mobiliários (“CVM”) and not withdrawn such agreement (this is the minimum tender required to cause the delisting of the TAM shares from Bovespa after completion of the exchange offer under the rules of Bovespa and applicable Brazilian law).

|

For purposes of this condition, “qualifying minority shares” means all outstanding TAM shares not represented by TAM ADSs and all outstanding TAM ADSs that:

|

|

o

|

are not owned by TAM, the controlling shareholders of TAM, any of their affiliates (“pessoas vinculadas” as defined by CVM) or any director or executive officer of TAM; and

|

|

|

o

|

have been validly tendered into the exchange offer through the US exchange agent, have been validly registered to participate in the Auction on Bovespa, and/or the holders of which have expressly agreed to the deregistration of TAM as a public company in Brazil with CVM.

|

|

|

·

|

The sum of (i) the number of TAM shares and TAM ADSs validly tendered into, and not withdrawn from, the exchange offer and (ii) the number of TAM shares beneficially owned by the controlling shareholders of TAM (which represented approximately 85.37% of the outstanding TAM common shares and 25.09% of the outstanding TAM preferred shares as of September 30, 2011) represents more than 95% of the total number of issued and outstanding TAM shares (including those represented by TAM ADSs) (this is the minimum acquisition threshold required under applicable Brazilian law to give TAM the right to compulsorily redeem any TAM shares (including those represented by TAM ADSs) that were not acquired in the exchange offer and the mergers).

|

THE EXCHANGE OFFER FOR TENDERS OF TAM SHARES INTO THE EXCHANGE OFFER IN THE AUCTION ON BOVESPA WILL EXPIRE AT 12:00 (NOON), EASTERN TIME (3:00 P.M., SÃO PAULO TIME) ON __ , 2011, (AS SUCH DATE MAY BE EXTENDED, THE “EXPIRATION DATE”) UNLESS THE EXCHANGE OFFER IS EXTENDED. WITHDRAWAL RIGHTS FOR TENDERS OF TAM SHARES INTO THE EXCHANGE OFFER IN THE AUCTION ON BOVESPA WILL EXPIRE AT 9:00 A.M., EASTERN TIME (12:00 (NOON), SÃO PAULO TIME) ON THE EXPIRATION DATE. HOWEVER, YOU MAY NOT TENDER YOUR SHARES IN THE AUCTION UNLESS YOU ARE A QUALIFIED INSTITUTIONAL BUYER (AS DEFINED IN RULE 144A UNDER THE SECURITIES ACT), HOLD TAM SHARES NOT REPRESENTED BY TAM ADSs AND MAKE THE REQUIRED REPRESENTATIONS, WARRANTIES AND AGREEMENTS.

THE EXCHANGE OFFER AND WITHDRAWAL RIGHTS FOR TENDERS OF TAM SHARES AND TAM ADSs INTO THE EXCHANGE OFFER THROUGH THE US EXCHANGE AGENT WILL EXPIRE AT 5:00 P.M., EASTERN TIME (8:00 P.M., SÃO PAULO TIME) ON THE DAY IMMEDIATELY PRECEDING THE EXPIRATION DATE, WHICH WILL BE __ , 2011 UNLESS THE EXCHANGE OFFER IS EXTENDED.

- iii -

The mergers have already been approved by the shareholders of LAN, Holdco II and Sister Holdco and no other shareholder or board approvals are required by any of those entities to authorize or complete the mergers, other than the formality of the board of directors of LAN approving the delivery of LAN common shares issuable in the mergers. Accordingly, LAN and Holdco II are not requesting, and you should not send to LAN or Holdco II, a proxy or other approval from you with respect to the mergers other than the acknowledgment and ratification of the approval of the Holdco II merger contained in the letter of transmittal you will use to tender your TAM shares or TAM ADSs into the exchange offer or to agree with the deregistration of TAM as a public company in Brazil with CVM.

LAN common shares are listed on the SSE under the symbol “LAN” and the LAN ADSs are listed on the NYSE under the symbol “LFL.” The TAM preferred shares are listed on Bovespa under the symbol “TAMM4,” the TAM common shares are listed on Bovespa under the symbol “TAMM3” and the TAM ADSs are listed on the NYSE under the symbol “TAM.” The depositary for LAN’s ADR program has submitted an application to list the LAN ADSs that will be issued pursuant to the exchange offer and the mergers on the NYSE.

This offer to exchange/prospectus incorporates by reference important business and financial information about LAN and TAM that is contained in their filings with the SEC and not included in, or delivered with, this offer to exchange/prospectus. This information is available on the SEC’s website at www.sec.gov and from other sources. For more information about how to obtain copies of these documents, see the “Where You Can Find More Information” section of this offer to exchange/prospectus beginning on page 13. LAN will also make copies of this information available to you without charge upon your written or oral request to _____________ at _________________________. In order to receive timely delivery of these documents, you must make such a request no later than five business days before the then scheduled expiration date of the exchange offer.

See the “Risk Factors” section of this offer to exchange/prospectus beginning on page 39 for a discussion of various risk factors that you should consider before deciding whether or not to tender your TAM shares or TAM ADSs into the exchange offer.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued in the transactions described in this offer to exchange/prospectus or passed upon the adequacy or accuracy of this offer to exchange/prospectus. Any representation to the contrary is a criminal offense.

The Dealer Manager for the exchange offer in the United States is

J.P. Morgan Securities LLC

The date of this offer to exchange/prospectus is , 2011.

- iv -

TABLE OF CONTENTS

|

1

|

||

|

13

|

||

|

14

|

||

|

15

|

||

|

18

|

||

|

20

|

||

|

22

|

||

|

39

|

||

|

48

|

||

|

50

|

||

|

57

|

||

|

66

|

||

|

67

|

||

|

72

|

||

|

82

|

||

|

85

|

||

|

87

|

||

|

89

|

||

|

103

|

||

|

111

|

||

|

159

|

||

|

183

|

||

|

190

|

||

|

201

|

||

|

256

|

||

|

382

|

||

|

447

|

||

|

447

|

||

|

447

|

||

|

|

454

|

- v -

The summary term sheet in question and answer format set forth below highlights selected information about the exchange offer and the mergers that is included elsewhere in this offer to exchange/prospectus. It does not, however, contain all of the information included in, or incorporated by reference into, this offer to exchange/prospectus and the related letter of transmittal and you should read and consider all such information carefully before deciding whether or not to tender your TAM shares (as defined below) or TAM ADSs (as defined below) into the exchange offer.

|

Q.

|

What are LAN and TAM proposing to do?

|

|

A.

|

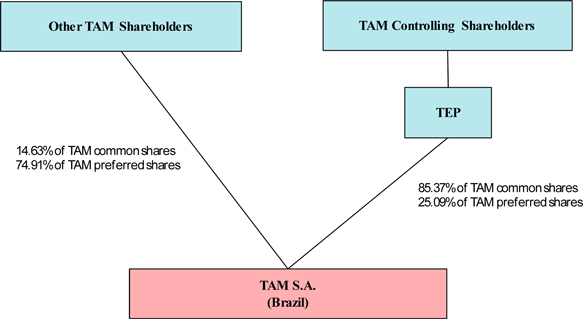

LAN Airlines S.A., a Chilean company (which we refer to as “LAN”), and TAM S.A., a Brazilian company (which we refer to as “TAM”), are proposing to combine to form the leading Latin American airline group with the largest fleet of aircraft of any airline in Latin America. When the proposed combination is completed, LAN will be the holding company of the combined companies and will change its name to “LATAM Airlines Group S.A.” (which we refer to as “LATAM”). The proposed combination will be implemented pursuant to the terms and conditions of the implementation agreement and the exchange offer agreement entered into on January 18, 2011 (which we refer to collectively as the “transaction agreements”) by LAN, TAM, the controlling shareholders of LAN under Chilean law (Costa Verde Aeronáutica S.A. and Inversiones Mineras del Cantábrico S.A., which we refer to individually as “Costa Verde Aeronáutica and “Mineras del Cantábrico,” respectively and collectively as the “LAN controlling shareholders”), the controlling shareholders of TAM under Brazilian law (Noemy Almeida Oliveira Amaro, Maria Cláudia Oliveira Amaro, Maurício Rolim Amaro and João Francisco Amaro, whom we refer to collectively as the “TAM controlling shareholders”), and TAM Empreendimentos e Participações S.A, a company through which the TAM controlling shareholders held their TAM shares (as defined below) at that time (which we refer to as “TEP”).

|

|

Q.

|

How will LAN and TAM combine?

|

|

A.

|

The parties will implement the combination using the following three steps:

|

|

|

·

|

Holdco II, a Chilean company formed in June 2011 and indirectly owned by the TAM controlling shareholders and LAN (which we refer to as “Holdco II”), will make an exchange offer in the United States pursuant to this offer to exchange/prospectus and in Brazil and elsewhere outside the United States pursuant to offering documents to be published in Brazil and made available to holders of TAM shares to acquire all of the issued and outstanding (i) voting common shares, without par value, of TAM (which we refer to as “TAM common shares”), (ii) non-voting preferred shares, without par value, of TAM (which we refer to as “TAM preferred shares” and, collectively with the TAM common shares, the “TAM shares”) and (iii) American Depositary Shares representing TAM shares (each of which represents one TAM share and which we refer to as “TAM ADSs”), in each case other than any TAM shares owned by the TAM controlling shareholders, in exchange for the same number of common shares, without par value, of Holdco II (which shares we refer to as “Holdco II shares” and which exchange offer we refer to as the “exchange offer”);

|

|

|

·

|

Immediately before Holdco II accepts for exchange the TAM shares and TAM ADSs tendered into the exchange offer, the TAM controlling shareholders will contribute to TEP Chile S.A., a Chilean company formed in June 2011 that is wholly owned by the TAM controlling shareholders (which we refer to as “TEP Chile”), all of their TAM common shares and TAM preferred shares in exchange for a number of shares of TEP Chile, which, when added to the shares of TEP Chile held by the TAM controlling shareholders at that time, would equal 100% of the shares of TEP Chile. Thereafter, TEP Chile will contribute all of the TAM common shares contributed to it by the TAM controlling shareholders to Holdco I S.A., a Chilean company formed in June 2011 (which we refer to as “Holdco I”), and all of the TAM preferred shares contributed to it by the TAM controlling shareholders to Sister Holdco S.A., a Chilean company formed in June 2011 (which we refer to as “Sister Holdco”), and will receive 93.8% of the voting shares of Holdco I (TEP Chile’s percentage ownership of the outstanding voting shares of Holdco I will be reduced after the mergers described below so that the product of such ownership percentage and Holdco I’s percentage ownership of the outstanding TAM common shares will be equal to 80%), and a number of shares, without par value, of Sister Holdco (which we refer to as “Sister Holdco shares”) equal to the total number of TAM shares it contributed to Holdco I and Sister Holdco; and

|

-1-

|

|

·

|

After Holdco II accepts for exchange the TAM shares and TAM ADSs tendered into the exchange offer and immediately before the settlement of the exchange offer, each of Holdco II and Sister Holdco will merge with and into LAN (which we refer to as the “Holdco II merger” and the “Sister Holdco merger,” respectively, and which we refer to collectively as the “mergers”), with LAN being the surviving company of both mergers. For a further discussion of these transactions, see “The Transaction Agreements—Overview” section of this offer to exchange/prospectus beginning on page 159.

|

As a result of the Holdco II merger, each Holdco II share (including those shares to be issued pursuant to the exchange offer) will be converted into 0.90 of a common share, without par value, of LAN (which we refer to as “LAN common shares”). Because the Holdco II merger will occur immediately before the settlement of the exchange offer, holders of TAM shares and TAM ADSs acquired in the exchange offer will receive 0.90 of a LAN common share for each TAM share or TAM ADS so acquired. Holders of TAM shares and TAM ADSs who tender into the exchange offer through JPMorgan Chase Bank, N.A., as the US exchange agent (which we refer to as the “US exchange agent”) will receive such LAN common shares in the form of American Depositary Shares representing LAN common shares (each of which represents one LAN common share and which we refer to as “LAN ADSs”), which will be evidenced by American Depositary Receipts (which we refer to as “LAN ADRs”). Holders of TAM shares who tender into the exchange offer by tendering their TAM shares in the auction (which we refer to as the “Auction”) to be held on the BM&FBOVESPA stock exchange in Brazil (which we refer to as “Bovespa”) will receive such LAN common shares in the form of Brazilian Depositary Shares representing LAN common shares (each of which represents one LAN common share and which we refer to as “LAN BDSs”), which will be evidenced by Brazilian Depositary Receipts (which we refer to as “LAN BDRs”). We refer to the LAN common shares, LAN ADSs and LAN BDSs collectively in this offer to exchange/prospectus as the “LAN shares.”

As a result of the Sister Holdco merger, each Sister Holdco share will be converted into 0.90 of a LAN common share. Because all of the Sister Holdco shares will be owned by the TAM controlling shareholders indirectly through TEP Chile immediately prior to the Sister Holdco merger, they will receive LAN common shares for the TAM shares TEP Chile contributes to Holdco I and Sister Holdco at the same exchange ratio as the holders of TAM shares and TAM ADSs receive in the exchange offer and the mergers.

|

Q.

|

Does the board of directors of TAM support the combination?

|

|

A.

|

Yes. The board of directors of TAM has determined that the exchange offer and the mergers are in the best interests of TAM and the holders of TAM shares and TAM ADSs and has recommended that such holders (other than the TAM controlling shareholders) tender their TAM shares and TAM ADSs into the exchange offer.

|

|

Q.

|

Does the board of directors of LAN support the combination?

|

|

A.

|

Yes. The board of directors of LAN recommended that the shareholders of LAN approve the mergers and the other transactions contemplated by the transaction agreements, which the shareholders of LAN have already done.

|

|

Q.

|

Can I tender my TAM shares and/or my TAM ADSs into the exchange offer?

|

|

A.

|

Yes. You can tender your TAM common shares, your TAM preferred shares and/or your TAM ADSs into the exchange offer and the same consideration per share will be paid for each class and type of shares. Holders of TAM shares and TAM ADSs who tender their TAM shares and/or TAM ADSs into the exchange offer through the US exchange agent will receive such consideration in the form of LAN ADSs, while holders of TAM shares who tender their TAM shares into the exchange offer through the Auction will receive such consideration in the form of LAN BDSs.

|

-2-

|

Q.

|

If Holdco II acquires my TAM shares and/or TAM ADSs pursuant to the exchange offer, is it possible that the mergers will not be completed?

|

|

A.

|

No. The mergers have already been approved by the shareholders of LAN, Holdco II and Sister Holdco and no other shareholder or board approvals are required by any of those entities to authorize or complete the mergers other than the formality of the board of directors of LAN approving the delivery of LAN common shares issuable in the mergers. The mergers will become effective after Holdco II becomes contractually obligated to acquire TAM shares and TAM ADSs pursuant to the exchange offer, which will occur at the expiration of the exchange offer if all the exchange offer conditions (as defined under “The Exchange Offer—Conditions to Completion of the Exchange Offer” section of this offer to exchange/prospectus beginning on page 116) have been satisfied or waived and immediately before the settlement of the exchange offer.

|

|

Q.

|

If Holdco II acquires my TAM shares and/or TAM ADSs pursuant to the exchange offer, is it possible that I will receive Holdco II shares instead of LAN ADSs or LAN BDSs?

|

|

A.

|

No. The mergers will become effective immediately before the settlement of the exchange offer and as a result of the Holdco II merger each Holdco II share you would otherwise receive pursuant to the exchange offer will be converted into 0.90 of a LAN common share. Holders of TAM shares and TAM ADSs who tender their TAM shares and/or TAM ADSs into the exchange offer through the US exchange agent will receive such LAN common shares in the form of LAN ADSs, while holders of TAM shares who tender their TAM shares into the exchange offer through the Auction on Bovespa will receive such LAN common shares in the form of LAN BDSs. As a result of the Holdco II merger, if your TAM shares or TAM ADSs are acquired in the exchange offer, you will receive LAN ADSs or LAN BDSs instead of Holdco II shares upon settlement of the exchange offer.

|

|

Q.

|

What will I receive if the exchange offer is completed?

|

|

A.

|

If the exchange offer is completed, you will receive 0.90 of a LAN common share for each TAM share or TAM ADS you tender into, and do not withdraw from, the exchange offer. Holders of TAM shares and TAM ADSs who tender their TAM shares and/or TAM ADSs into the exchange offer through the US exchange agent will receive such LAN common shares in the form of LAN ADSs, while holders of TAM shares who tender their TAM shares into the exchange offer through the Auction on Bovespa will receive such LAN common shares in the form of LAN BDSs.

|

|

Q.

|

Will I receive fractional LAN ADSs or LAN BDSs?

|

|

A.

|

No fractional LAN ADSs or LAN BDSs will be issued to you in connection with the exchange offer and the mergers. Instead of any such fractional shares that you would otherwise be entitled to receive pursuant to the exchange offer and the mergers, you will receive an amount in cash in US dollars based on the closing price of the LAN common shares on the Santiago Stock Exchange (which we refer to as the “SSE”) on the last trading day immediately preceding the time at which the mergers become effective (which we refer to as the “effective time”) (as reported on the SSE’s website, www.bolsadesantiago.com or, if unavailable, as reported by another authoritative source) and the “dólar observado” or “observed” exchange rate published on such last trading day immediately preceding the effective time of the mergers by Banco Central de Chile (which we refer to as the “Central Bank of Chile”). This exchange rate (which we refer to as the “Chilean observed exchange rate”) is the average exchange rate of the previous business day’s transactions in the Formal Exchange Market (banks and other entities authorized by the Central Bank of Chile) as published in the Diario Oficial (Official Gazette) by the Central Bank of Chile pursuant to number 6 of Chapter I of its Compendium of Foreign Exchange Rules.

|

The Chilean observed exchange rate on September 30, 2011 was CLP$515.14 = US$1.00.

-3-

|

Q.

|

Does TAM have ADR programs for both the TAM preferred shares and the TAM common shares?

|

|

A.

|

Yes. In addition to the ADR program for the TAM preferred shares (which we refer to as the “TAM preferred ADR program”) established in 2006, TAM has recently established an ADR program for the TAM common shares (which we refer to as the “TAM common ADR program”). Each TAM ADS issued under the TAM preferred ADR program (which we refer to as a “TAM preferred ADS”) represents one TAM preferred share and is evidenced by an American Depositary Receipt (which we refer to as a “TAM preferred ADR”), and each TAM ADS issued under the TAM common ADR program (which we refer to as a “TAM common ADS”) represents one TAM common share and is evidenced by an American Depositary Receipt (which we refer to as a “TAM common ADR”). We refer to the TAM preferred ADR program and TAM common ADR program collectively as the “TAM ADR programs,” the TAM preferred ADSs and the TAM common ADSs collectively as the “TAM ADSs” and the TAM preferred ADRs and TAM common ADRs collectively as the “TAM ADRs”.

|

|

Q.

|

If I hold TAM shares and would like to tender my TAM shares in the exchange offer, which method should I use to tender my TAM shares?

|

|

A.

|

If you hold TAM shares, there are three possible ways to tender them into the exchange offer:

|

|

|

·

|

You can tender your TAM shares through the US exchange agent, who will receive and hold tendered TAM shares on behalf of Holdco II and, if the exchange offer is completed, will exchange such TAM shares for LAN ADSs,

|

|

|

·

|

You can deposit your TAM shares into the applicable TAM ADR program, receive TAM ADSs representing your deposited TAM shares and tender those TAM ADSs through the US exchange agent, or

|

|

|

·

|

If (but only if) you are a “qualified institutional buyer” (as defined in Rule 144A under the Securities Act and which we refer to as a “QIB”), you can tender your TAM shares in the Auction on Bovespa if you make the representations, warranties and agreements described below in this section.

|

In deciding which method you should use to tender your TAM shares into the exchange offer, you should consider the following:

|

|

·

|

If you tender your TAM shares through the US exchange agent:

|

|

|

o

|

You will have to convert your investment in your TAM shares in Brazil from an investment made in the financial and capital markets, regulated by Resolution No. 2,689/00 of the Conselho Monetário Nacional (which law we refer to as “Resolution No. 2,689/00” and which investment we refer to as a “2,689 investment”) to a direct investment outside of the financial and capital markets, regulated by Law 4,131/62 (which law we refer to as “Law 4,131/62” and which investment we refer to as a “4,131 investment”),

|

|

|

o

|

You will receive LAN ADSs and will not have to pay any deposit fees to the depositary for the LAN ADSs (which we refer to as the “LAN ADS depositary”),

|

|

|

o

|

You will not have to pay any fees to Bovespa or Central Depositária da BM&FBovespa (which we refer to as “CD”),

|

|

|

o

|

You will not have to pay any Imposto Sobre Operações Financeiras, a tax imposed on foreign exchange, securities/bonds, credit and insurance transactions under Brazilian law (which we refer to as “IOF”), and

|

-4-

|

|

o

|

You may have to pay capital gains tax in Brazil.

|

|

|

·

|

If you deposit your TAM shares into the applicable TAM ADR program, receive TAM ADSs representing your deposited TAM shares and tender those TAM ADSs through the US exchange agent:

|

|

|

o

|

You will receive LAN ADSs,

|

|

|

o

|

You will not have to pay any deposit fees to the TAM depositary or the LAN ADS depositary,

|

|

|

o

|

You will not have to pay any fees to Bovespa or CD,

|

|

|

o

|

You will have to pay IOF in Brazil at the rate of 1.5% of the value of the TAM shares you deposit, and

|

|

|

o

|

You may have to pay capital gains tax in Brazil.

|

|

|

·

|

If you are a QIB and tender your TAM shares in the Auction on Bovespa:

|

|

|

o

|

You will receive LAN BDSs instead of LAN ADSs,

|

|

|

o

|

You will not have to pay any deposit fees to the depositary for LAN BDSs (which we refer to as the “LAN BDS depositary”),

|

|

|

o

|

You will have to pay IOF in Brazil at the rate of 0.38% of the value of the LAN BDSs you receive,

|

|

|

o

|

You will have to pay a combined fee to Bovespa and the CD in an amount equal to 0.0345% of the value of the exchange transaction,

|

|

|

o

|

You will have to represent and warrant that you and any person on whose behalf you hold your TAM shares are QIBs,

|

|

|

o

|

You will have to agree that for six months after the settlement date of the exchange offer you will only resell your LAN BDSs or the LAN common shares they represent in compliance with the applicable requirements of Rule 904 of Regulation S under the Exchange Act of 1934, as amended (which we refer to as the “Exchange Act”) (which may be difficult because Bovespa is not a “designated offshore securities market” as defined in Rule 902 of Regulation S), and

|

|

|

o

|

If you want to withdraw the LAN common shares represented by the LAN BDSs you receive in connection with the exchange offer, you will have to pay a withdrawal fee to the LAN BDS depositary of between R$ 0.02 and R$ 0.05 per LAN common share (depending on how many LAN common shares you withdraw).

|

For more information on the Brazilian and US tax consequences of the various methods of tendering your TAM ADSs or TAM shares, see “The Exchange Offer—Tax Consequences” section of this offer to exchange/prospectus beginning on page 132.

-5-

|

Q.

|

How do I accept the exchange offer?

|

|

A.

|

The steps you must take to tender your TAM shares and/or TAM ADSs into the exchange offer will depend on whether you hold TAM shares or TAM ADSs and whether you hold such TAM shares or TAM ADSs directly or indirectly through a broker, dealer, commercial bank, trust company or other nominee. If you hold TAM shares, you will need to choose among the different ways you may tender your TAM shares. For more information on how to tender your TAM shares and/or TAM ADSs in the exchange offer, see “The Exchange Offer—Procedure for Tendering” section of this offer to exchange/prospectus beginning on page 119. If all of the conditions to completion of the exchange offer are satisfied and your TAM shares or TAM ADSs are validly tendered into, and not withdrawn, from the exchange offer prior to the expiration of the exchange offer, your TAM shares and TAM ADS will be accepted by Holdco II for exchange in the exchange offer.

|

|

|

·

|

If you hold TAM ADSs and would like to tender them into the exchange offer, you must tender them to the US exchange agent prior to 5:00 p.m., Eastern time (8:00 p.m., São Paulo time) (which we refer to as the “US Tender Deadline”), on the day immediately preceding the expiration date of the exchange offer (which is currently _______________, 2011 but which may be extended from time to time) and you must take the following actions:

|

|

|

o

|

If you hold your TAM ADSs directly in the form of TAM ADRs, you must complete and sign the letter of transmittal included with this offer to exchange/prospectus and return it together with your TAM ADRs and any required documentation to the US exchange agent at the appropriate address specified on the back cover page of this offer to exchange/prospectus.

|

|

|

o

|

If you hold your TAM ADSs in book-entry form, you must tender your TAM ADSs in book-entry form through the US exchange agent by using the automated tender system (which we refer to as the “ATOP system”) of The Depository Trust Company (which we refer to as “DTC”).

|

|

|

o

|

If you hold your TAM ADSs indirectly through a broker, dealer, commercial bank, trust company or other nominee, you should instruct your broker, dealer, commercial bank, trust company or other nominee to tender your TAM ADSs to the US exchange agent on your behalf.

|

|

|

·

|

If you or your nominee holds TAM ADSs and you want to tender the TAM shares represented by those TAM ADSs using one of the methods described below in this section, then you or your nominee must withdraw the TAM shares represented by those TAM ADSs by surrendering your TAM ADSs to the custodian of J.P. Morgan Chase Bank, N.A., as the depositary for the TAM ADSs (which we refer to as the “TAM depositary”), and pay any applicable taxes or other governmental charges payable in connection with such withdrawal. Prior to surrendering your TAM ADSs to the TAM depositary for withdrawal and receiving the TAM shares represented by your TAM ADSs, you must register the TAM shares to be withdrawn at CD and you will need to obtain a foreign investor registration under Resolution No. 2,689/00 of the Conselho Monetário Nacional (which we refer to as “Resolution No. 2,689/00”) if you are a QIB and intend to tender such TAM shares in the Auction on Bovespa or as a direct investment outside the financial and capital markets under Law 4,131/62 if you intend to tender such TAM shares into the exchange offer through the US exchange agent. In addition, if you are a QIB and want to tender your TAM shares in the Auction on Bovespa, you must appoint a Brazilian representative for purposes of Resolution No. 2,689/00 and make arrangements for that representative to tender your TAM shares on your behalf. You will need to take these steps sufficiently in advance of the applicable Tender Deadline (as defined in this section below) so as to allow your Brazilian representative to effect such tender. There are potential disadvantages to withdrawing the TAM shares represented by your TAM ADSs and tendering those TAM shares in the exchange offer which are described below under “The Exchange Offer—Procedures for Tendering—Holders of TAM ADSs” section of this offer to exchange/prospectus. For more information about this registration process, see “The Exchange Offer—Certain Legal and Regulatory Matters—Registering Under Resolution No. 2,689/00 and Law 4,131/62” section of this offer to exchange/prospectus beginning on page 151.

|

-6-

|

|

·

|

If you or your nominee holds TAM shares directly in your own name and you would like to tender them through the US exchange agent in the form of TAM ADSs, you must first deposit your TAM shares with the custodian of the TAM depositary for the applicable TAM ADR program and pay any applicable taxes or other governmental charges payable in connection with such deposit. The TAM ADSs representing your TAM shares will be delivered to you or your nominee in the form of TAM ADRs or TAM ADSs in book-entry form and may be tendered through the US exchange agent using the procedures described below under “The Exchange Offer—Procedures for Tendering —Holders of TAM ADSs.” The TAM depositary has agreed to waive any deposit fees otherwise payable in connection with such deposit. You will need to take these steps sufficiently in advance of the US Tender Deadline so that the TAM ADSs representing your TAM shares may be tendered through the US exchange agent.

|

|

|

·

|

If you hold TAM shares indirectly through a broker, dealer, commercial bank, trust company or other nominee and you would like to tender them through the US exchange agent in the form of TAM ADSs, you must instruct your broker, dealer, commercial bank, trust company or other nominee to arrange for your TAM shares to be deposited with the custodian of the TAM depositary for the applicable TAM ADR program and thereafter to tender the TAM ADSs representing your TAM shares on your behalf through the US exchange agent using the procedures described below under “The Exchange Offer—Procedures for Tendering—Holders of TAM ADSs” section of this offer to exchange/prospectus. You must ensure that your broker, dealer, commercial bank, trust company or other nominee receives your instructions and any required documentation sufficiently in advance of the US Tender Deadline so that it can effect such tender on your behalf prior to the US Tender Deadline and pay any fees or commissions charged by such broker, dealer, commercial bank, trust company or other nominee to make such tender.

|

|

|

·

|

If you hold TAM shares directly and you would like to tender them through the US exchange agent, you must first convert your investment in your TAM shares in Brazil from a 2,689 investment to a 4,131 investment. Once your investment in your TAM shares has been effectively converted to a 4,131 investment, you can tender your TAM shares through the US exchange agent at any time prior to the US Tender Deadline by taking the following actions: ____1

|

|

|

·

|

If you hold your TAM shares indirectly through a broker, dealer, commercial bank, trust company or other nominee and you would like to tender them through the US exchange agent, you should instruct your broker, dealer, commercial bank, trust company or other nominee to arrange for your investment in your TAM shares to be converted in Brazil from a 2,689 investment to a 4,131 investment and thereafter to tender your TAM shares on your behalf through the US exchange agent using the procedures described in the preceding bullet point and sub-bullet points.

|

|

|

·

|

If you are a QIB and you hold TAM shares directly in your own name and would like to tender your TAM shares in the Auction to be held on Bovespa, then you must, personally or by means of a duly authorized proxy, contact a broker authorized to conduct trades on Bovespa, present the documentation described in “The Exchange Offer—Procedure for Tendering—Holders of TAM Shares—Tenders of TAM Shares in the Auction” section of this offer to exchange/prospectus beginning on page 125 and request that the broker tender your TAM shares on your behalf in the Auction. In order to tender your TAM shares in the Auction, your broker must, no later than 12:00 (noon), Eastern time (3:00 p.m., São Paulo time) (which we refer to as the “Auction Tender Deadline” and collectively with the US Tender Deadline as the “Tender Deadlines”), on the expiration date of the exchange offer, present a sell order on your behalf in the Auction. You must ensure that you give your broker your instructions and any required documents sufficiently in advance of the Auction Tender Deadline so that your broker can effect such tender prior to the Auction Tender Deadline and you must pay any fees or commissions your broker charges to make such tender.

|

|

1.

|

Note: Mechanics for electronically tendering TAM shares held in book-entry form are still being discussed with the relevant regulators in Brazil.

|

-7-

|

|

·

|

If you are a QIB and you hold TAM shares indirectly through a broker, dealer, commercial bank, trust company or other nominee and would like to tender your TAM shares in the Auction to be held on Bovespa, then you must instruct your broker, dealer, commercial bank, trust company or other nominee to tender your TAM shares in the Auction on your behalf (as provided under “The Exchange Offer—Procedure for Tendering—Holders of TAM Shares—Tenders of TAM Shares in the Auction” section of this offer to exchange/prospectus beginning on page 125) no later than the Auction Tender Deadline. You must ensure that your broker, dealer, commercial bank, trust company or other nominee receives your instructions and any required documentation sufficiently in advance of the Auction Tender Deadline in order to effect such tender prior to the Auction Tender Deadline and pay any fees or commissions charged by such broker, dealer, commercial bank, trust company or other nominee to make such tender.

|

For more information on the procedure for tendering, the timing of the exchange offer, extensions of the exchange offer and your rights to withdraw your TAM shares and/or TAM ADSs from the exchange offer prior to the US Tender Deadline (if you are tendering TAM shares and/or TAM ADSs through the US exchange agent) or the Auction Withdrawal Deadline (as defined below in this section) (if you are tendering TAM shares in the Auction on Bovespa), see “The Exchange Offer” section of this offer to exchange/prospectus beginning on page 111.

|

Q.

|

Will I have to pay any fees or commissions for tendering my TAM shares or TAM ADSs?

|

|

A.

|

If you are a QIB and tender your TAM shares into the exchange offer through the Auction on Bovespa, you must pay a combined fee to Bovespa and the CD in an amount equal to 0.0345% of the value of the exchange transaction. In addition, if your TAM shares or TAM ADSs are tendered into the exchange offer by your broker, dealer, commercial bank, trust company or other nominee, you will be responsible for any fees or commissions they may charge you in connection with such tender. Finally, you will be responsible for all governmental charges and taxes payable in connection with tendering your TAM shares and/or TAM ADSs.

|

|

Q.

|

How much time do I have to decide whether to tender?

|

|

A.

|

You may tender your TAM ADSs or TAM shares into the exchange offer through the US exchange agent at any time prior to the US Tender Deadline, which is 5:00 p.m., Eastern time (8:00 p.m., São Paulo time), on the day immediately preceding the expiration date of the exchange offer (which is currently ____, 2011 but will change if the expiration date of the exchange offer is extended). If you are a QIB, hold TAM shares that are not represented by TAM ADSs, and make the required representations, warranties and agreements, you may tender your TAM shares in the Auction on Bovespa at any time prior to the Auction Tender Deadline, which is 12:00 (noon), Eastern time (3:00 p.m., São Paulo time) on the expiration date of the exchange offer (which is currently ___, 2011, but which may be extended from time to time).

|

|

Q.

|

Can the exchange offer be extended?

|

|

A.

|

Yes. Subject to the applicable rules, regulations and approval of the Commissão de Valores Mobiliários (which we refer to as the “CVM”) in Brazil and/or the SEC, LAN and, in certain cases, the TAM controlling shareholders may cause Holdco II to extend the expiration date of the exchange offer if at the time the exchange offer is scheduled to expire any of the conditions to the completion of the exchange offer that are waivable by LAN or, if applicable, the TAM controlling shareholders are not satisfied or waived and the expiration date of the exchange offer will be extended if required by such rules and regulations. LAN and TAM will announce any extension of the exchange offer by issuing a press release no later than 9:00 a.m., Eastern time (12:00 (noon), São Paulo time), on the next business day following the then-scheduled expiration date of the exchange offer on, among others, the Dow Jones News Service. In addition, LAN will post a notice of any extension on the websites www.latamairlines.com and www.lan.com. The information on LAN’s website and LATAM’s website is not a part of this offer to exchange/prospectus and is not incorporated by reference herein.

|

-8-

|

Q.

|

Can I withdraw TAM shares or TAM ADSs that I have tendered?

|

|

A.

|

You may withdraw any TAM shares or TAM ADSs tendered into the exchange offer through the US exchange agent at any time prior to the US Tender Deadline. If you are a QIB and you tendered your TAM shares in the Auction on Bovespa, you may withdraw such TAM shares at any time prior to 9:00 a.m., Eastern time, 12:00 (noon), São Paulo time) (which we refer to as the “Auction Withdrawal Deadline” and collectively with the US Tender Deadline, as the “Withdrawal Deadlines”) on the expiration date. In addition, in accordance with the US securities laws, you may withdraw your tendered TAM shares or TAM ADSs if they have not been accepted for exchange within 60 days after the date of this offer to exchange/prospectus.

|

|

Q.

|

What percentage of LAN common shares will holders of TAM shares and TAM ADSs own after completion of the proposed combination?

|

|

A.

|

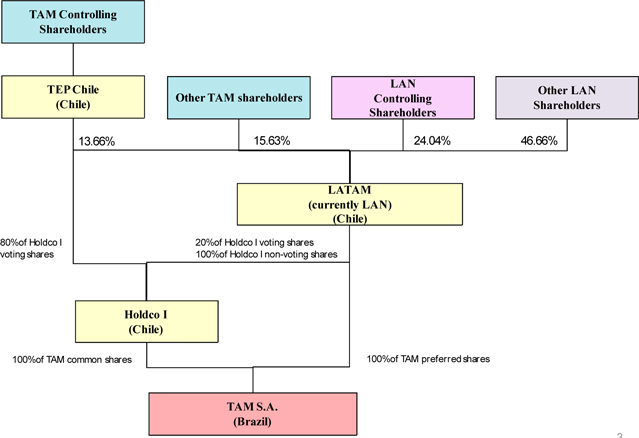

If all holders of TAM shares and TAM ADSs other than the TAM controlling shareholders validly tender their TAM shares and TAM ADSs into, and do not withdraw them from, the exchange offer, TEP Chile pays for the subscriptions of Sister Holdco shares and Holdco I shares by, directly or indirectly, contributing to Holdco I and Sister Holdco all of the TAM shares contributed to it by the TAM controlling shareholders, no shareholders of LAN exercise their appraisal rights (derecho a retiro) under Chilean law in connection with approval of the mergers and no TAM shares (including those represented by TAM ADSs) or LAN common shares (including those represented by LAN ADSs and LAN BDSs) are issued after the date of this offer to exchange/prospectus other than the LAN common shares to be issued pursuant to the exchange offer and the mergers (which will be represented by LAN ADSs and LAN BDSs), then immediately after the completion of the exchange offer and the mergers the former holders of TAM shares and TAM ADSs would own approximately 30% of the outstanding LAN common shares (including those represented by LAN ADSs and LAN BDSs).

|

|

Q.

|

What are the most significant conditions to the exchange offer?

|

|

A.

|

The exchange offer is subject to the conditions set forth in “The Exchange Offer—Conditions to Completion of the Exchange Offer” section of this offer to exchange/prospectus beginning on page 116. The most significant of these conditions are:

|

|

|

·

|

The holders of more than 66 2/3% of the qualifying minority shares shall have:

|

|

|

o

|

validly tendered such shares into, and not withdrawn them from, the exchange offer through the US exchange agent or the Auction on Bovespa and/or

|

|

|

o

|

expressly agreed with the deregistration of TAM as a public company with CVM and not withdrawn such agreement (we refer to this condition as the “delisting condition”).

|

For purposes of this condition, “qualifying minority shares” means all outstanding TAM shares not represented by TAM ADSs and all outstanding TAM ADSs that:

|

|

o

|

are not owned by TAM, the TAM controlling shareholders, any of their affiliates (“pessoas vinculadas” as defined by CVM) or any director or executive officer of TAM; and

|

|

|

o

|

have been validly tendered into the exchange offer through the US exchange agent, have been validly registered to participate in the Auction on Bovespa, and/or the holders of which have expressly agreed to the deregistration of TAM as a public company with CVM.

|

|

|

·

|

The sum of (i) the number of TAM shares and TAM ADSs validly tendered into, and not withdrawn from, the exchange offer and (ii) the number of TAM shares beneficially owned by the TAM controlling shareholders (which represented approximately 85.37% of the outstanding TAM common shares and 25.09% of the outstanding TAM preferred shares as of September 30, 2011) represents more than 95% of the total number of issued and outstanding TAM shares (including those represented by TAM ADSs) (we refer to this condition as the “squeeze-out condition”); and

|

-9-

|

|

·

|

The absence of certain actions, events or circumstances that, individually or in the aggregate, have had an adverse effect on the businesses, revenues, operations or financial condition of TAM and its subsidiaries, taken as a whole, in all material respects.

|

The obligations of the TAM controlling shareholders to make and pay for the subscription of TEP Chile shares by contributing all of their TAM shares to TEP Chile, and for TEP Chile to pay for the subscriptions for Holdco I shares and Sister Holdco shares by contributing to Holdco I and Sister Holdco all of the TAM shares contributed to it by the TAM controlling shareholders are conditioned on, among other things, the absence of certain actions, events or circumstances relating to LAN that, individually or in the aggregate, have had a material adverse effect on the business, revenues, operations or financial condition of LAN and its subsidiaries, taken as a whole, in all material respects. Payment of such subscriptions is a condition to the completion of the exchange offer. For further discussion of these subscriptions, see “The Transaction Agreements—Conditions to the Subscriptions” section of this offer to exchange/prospectus beginning on page 174.

|

Q.

|

What will happen if the delisting condition and the squeeze-out condition are satisfied?

|

|

A.

|

If the delisting condition is satisfied, the TAM shares will be automatically delisted from Bovespa after completion of the exchange offer. If the squeeze-out condition is satisfied, TAM will compulsorily redeem any TAM shares (including those represented by TAM ADSs) that were not acquired pursuant to the exchange offer and the mergers.

|

The delisting condition may only be waived with the prior consent of LAN and the TAM controlling shareholders, and the squeeze-out condition may only be waived with the prior consent of LAN. For further discussion of the delisting condition and the squeeze-out condition, see “The Exchange Offer—Conditions to Completion of the Exchange Offer” section of this offer to exchange/prospectus beginning on page 116.

|

Q.

|

Will tendered shares be subject to proration?

|

|

A.

|

No. Subject to the terms and conditions of the exchange offer, Holdco II will acquire any and all TAM shares and TAM ADSs validly tendered into, and not withdrawn from, the exchange offer.

|

|

Q.

|

Do I need to do anything if I want to retain my TAM shares or TAM ADSs?

|

|

A.

|

No. If you want to retain your TAM shares or TAM ADSs, you do not need to take any action.

|

|

Q.

|

Will I have appraisal rights in connection with the exchange offer or the mergers?

|

|

A.

|

No. There are no appraisal or similar rights available to holders of TAM shares and TAM ADSs in connection with the exchange offer or the mergers. For more information about appraisal rights of holders of TAM shares and TAM ADSs, see “The Exchange Offer—Appraisal Rights” section of this offer to exchange/prospectus beginning on page 147.

|

|

Q.

|

How and where will the outcome of the exchange offer be announced?

|

|

A.

|

LAN will announce the outcome of the exchange offer by issuing a press release no later than 9:00 a.m., Eastern time (12:00 (noon), São Paulo time) on the next business day following the expiration of the exchange offer on, among others, the Dow Jones News Service. In addition, LAN will post a notice of the results of the exchange offer on www.latamairlines.com and www.lan.com. The information on www.latamairlines.com and www.lan.com is not a part of this offer to exchange/prospectus and is not incorporated by reference herein. If the exchange offer is completed, you will receive the LAN ADSs or LAN BDSs you are entitled to receive pursuant to the exchange offer and the mergers no later than the third business day following the expiration date of the exchange offer.

|

-10-

|

Q.

|

When are the exchange offer and the mergers expected to be completed?

|

|

A.

|

LAN expects to complete the exchange offer and the mergers in the first quarter of 2012.

|

|

Q.

|

What are the tax consequences if I participate in the exchange offer?

|

|

A.

|

As there is no clear guidance in the Brazilian legislation regarding the tax consequences of an exchange offer involving a non-Brazilian holder (as defined below under “The Exchange Offer—Tax Consequences—Brazilian Tax Consequences” section of this offer to exchange/prospectus), there is a risk that the Brazilian tax authorities may assert that the transaction is subject to capital gains tax in Brazil in connection with the exchange offer. Please note, however, that there are arguments that this transaction is not taxable in Brazil.

|

For more information on the Chilean, Brazilian and US tax consequences of the exchange offer, see “The Exchange Offer―Tax Consequences” section of this offer to exchange/prospectus beginning on page 132. You should consult your own tax advisor on the tax consequences to you of tendering your TAM shares and/or TAM ADSs in the exchange offer. If you are not located in the United States or a US person (as such terms are defined in Regulation S under the Securities Act), you should consult the separate offering documents relating to the exchange offer that are being published in Brazil and made available to all holders of TAM shares.

|

Q.

|

Who can I call with questions?

|

|

A.

|

If you have more questions about the exchange offer, you should contact _________________ at ____.

|

|

Q.

|

If my TAM shares or TAM ADSs are acquired in the exchange offer, how will my rights as a TAM shareholder or as a holder of TAM ADSs change?

|

|

A.

|

If your TAM shares or TAM ADRs are acquired in the exchange offer, you will become a holder of LAN ADSs or LAN BDSs, each of which will represent one LAN common share deposited with the applicable depositary. Your rights as a holder of LAN ADSs or LAN BDSs will be determined by the applicable deposit agreement. The rights of a holder of the LAN common shares represented by your LAN ADSs or LAN BDSs will be governed by LAN’s by-laws, the Chilean corporation law (which we refer to as "Chilean Corporation Law") and the Chilean corporation regulations. For a summary of the rights of holders of LAN common shares compared to the rights of holders of TAM shares, see the “Comparison of Rights of Holders of LAN Securities and TAM Securities” section of this offer to exchange/prospectus beginning on page 201. For a summary of the rights of holders of LAN ADSs compared to the rights of holders of TAM ADSs, see the “Comparison of Rights of Holders of LAN Securities and TAM Securities” section of this offer to exchange/prospectus beginning on page 201. For a summary of the rights of holders of LAN ADSs compared to the rights of holders of LAN BDSs, see the “Comparison of Rights of Holders of LAN Securities and TAM Securities” section of this offer to exchange/prospectus beginning on page 201.

|

|

Q.

|

When will I receive my LAN shares?

|

|

A.

|

If the exchange offer is completed, you will receive the LAN ADSs and LAN BDSs you are entitled to receive pursuant to the exchange offer and the mergers no later than the third business day following the expiration date of the exchange offer.

|

-11-

|

Q.

|

Can I tender less than all the TAM shares or TAM ADSs that I own into the exchange offer?

|

|

A.

|

You may elect to tender all or a portion of the TAM shares or TAM ADSs that you own into the exchange offer. However, if the exchange offer is completed and a sufficient number of TAM shares and TAM ADSs are acquired in the exchange offer so that the squeeze-out condition is satisfied, TAM intends to institute proceedings in accordance with Brazilian law to compulsorily redeem any TAM shares (including those represented by TAM ADSs) that were not acquired pursuant to the exchange offer and the mergers. In this redemption, the holders of TAM shares and TAM ADSs not acquired pursuant to the exchange offer will have the right to receive cash in an amount equal to the product of (i) the number of LAN ADSs and/or LAN BDSs they would have received pursuant to the exchange offer in respect of their TAM shares and/or TAM ADSs and (ii) the closing price of the LAN common shares on the SSE on the date the exchange offer is completed, duly adjusted by the Central Bank of Brazil’s overnight lending rate. For further discussion of the squeeze-out procedure, see “The Transaction Agreements—Effects of the Mergers—Statutory Squeeze-Out” section of this offer to exchange/prospectus beginning on page 179.

|

-12-

Each of LAN and TAM files with, and furnishes to, the SEC reports and other information. You may read and copy these reports and other information at the SEC’s Public Reference Room located at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the SEC’s public reference room by calling the SEC at 1-800-SEC-0330. You may also obtain copies of these reports and other information by mail from the SEC at the above address at prescribed rates or at the Internet website maintained by the SEC, which contains reports, proxy and information statements regarding issuers that file electronically with the SEC, at www.sec.gov. You may also inspect certain reports and other information concerning LAN and TAM at the offices of the New York Stock Exchange LLC (which we refer to as the “NYSE”) located at 20 Broad Street, New York, New York 10005. In addition, you may find more information on LAN’s website at www.lan.com, LATAM’s website at www.latamairlines.com and TAM’s website at www.tam.com.br. The information provided on LAN’s website and TAM’s website is not a part of this offer to exchange/prospectus and is not incorporated by reference herein.

LAN has filed with the SEC a registration statement on Form F-4 to register under the Securities Act the offer and sale of Holdco II common shares and LAN common shares pursuant to the exchange offer and the Holdco II merger to holders of TAM ADSs and holders of TAM shares to be tendered into the exchange offer through the US exchange agent (which we refer to as the “Registration Statement”). This offer to exchange/prospectus forms a part of that Registration Statement. LAN has also filed with the SEC a statement on Schedule TO pursuant to Rule 14d-3 under the Exchange Act furnishing certain information with respect to the exchange offer. In addition, J.P. Morgan Chase Bank, N.A., the LAN ADS depositary, has filed a registration statement on Form F-6, No. 333-177513, as amended, to register with the SEC the LAN ADSs to be issued in connection with the exchange offer. The Registration Statement, the Schedule TO and the Form F-6 and any amendments thereto will be available for inspection and copying as set forth above.

DOCUMENTS INCORPORATED BY REFERENCE ARE ALSO AVAILABLE FROM LAN WITHOUT CHARGE UPON REQUEST TO ________, _________, _________, NEW YORK, NEW YORK______, ONLINE AT______, COLLECT AT (212) ___-__ OR TOLL FREE AT __-__-___. IN ORDER TO ENSURE TIMELY DELIVERY, ANY REQUEST SHOULD BE SUBMITTED NO LATER THAN FIVE BUSINESS DAYS PRIOR TO THE EXPIRATION DATE OF THE EXCHANGE OFFER (WHICH IS CURRENTLY _____, 2011 BUT WHICH MAY BE EXTENDED FROM TIME TO TIME). IF YOU REQUEST ANY INCORPORATED DOCUMENTS FROM LAN, LAN WILL MAIL THEM TO YOU BY FIRST CLASS MAIL, OR OTHER EQUALLY PROMPT MEANS, WITHIN ONE BUSINESS DAY AFTER LAN RECEIVES YOUR REQUEST.

LAN has not authorized anyone to give any information or make any representation about the exchange offer that is different from, or in addition to, the information contained in this offer to exchange/prospectus or in any materials incorporated by reference into this offer to exchange/prospectus. If you are in a jurisdiction where offers to exchange or sell, or solicitations of offers to exchange or purchase, the securities offered by this offer to exchange/prospectus are unlawful, or if you are a person to whom it is unlawful to direct these types of activities, then the exchange offer presented in this offer to exchange/prospectus does not extend to you. The information contained in this offer to exchange/prospectus speaks only as of the date of this offer to exchange/prospectus unless the information specifically indicates that another date applies.

-13-

As allowed by the SEC, this offer to exchange/prospectus does not contain all of the information that is deemed to be included in this offer to exchange/prospectus. This is because the SEC allows LAN and Holdco II to “incorporate by reference” into this offer to exchange/prospectus certain reports and other documents that LAN and TAM file with, or furnish to, the SEC both before and after the date of this offer to exchange/prospectus. The reports and other documents incorporated by reference into this offer to exchange/prospectus contain important information concerning LAN and TAM and the information contained in those reports and other documents incorporated by reference herein (except to the extent superseded by information expressly contained herein) is deemed to form part of this offer to exchange/prospectus even though such information is not physically included herein.

This offer to exchange/prospectus incorporates by reference the following documents filed with, or furnished to, the SEC by LAN or TAM prior to the date of this offer to exchange/prospectus:

|

|

·

|

LAN’s Annual Report on Form 20-F for the fiscal year ended December 31, 2010, filed on May 5, 2011 (which we refer to as the “LAN 2010 Form 20-F”);

|

|

|

·

|

The description of the LAN common shares under the heading “Description of our Shares of Common Stock” and the description of the LAN ADSs under the heading “Description of the American Depositary Shares” in LAN’s registration statement under the Securities Act on Form F-3, filed on May 7, 2007, and as amended on May 21, 2007 (which we refer to as the “LAN Form F-3”);

|

|

|

·

|

TAM’s Annual Report on Form 20-F for the fiscal year ended December 31, 2010, filed on May 13, 2011 (which we refer to as the “TAM 2010 Form 20-F”); and

|

|

|

·

|

The description of the TAM shares under the heading “Description of our Capital Stock” and the description of the TAM ADSs under the heading “Description of American Depositary Shares” in TAM’s registration statement under the Securities Act on Form F-1, filed on February 17, 2006, and as amended on February 22, 2006, March 2, 2006 and March 9, 2006 (which we refer to as the “TAM Form F-1”).

|

In addition, all annual reports on Form 20-F that LAN and TAM file with the SEC and all reports on Form 6-K that LAN and TAM furnish to the SEC indicating that they are so incorporated by reference into this offer to exchange/prospectus in each case after the date of this offer to exchange/prospectus and prior to the expiration or termination of the exchange offer will also be incorporated by reference into this offer to exchange/prospectus. Any information contained in, or incorporated by reference into, this offer to exchange/prospectus prior to the filing with, or furnishing to, the SEC of any such report after the date of this offer to exchange/prospectus shall be deemed to be modified or superseded to the extent that the disclosure in such report modifies or supersedes such information.

All information contained in this offer to exchange/prospectus relating to TAM, the TAM controlling shareholders, TEP, TEP Chile, Holdco I, Holdco II and Sister Holdco has been provided by TAM and/or the TAM controlling shareholders.