| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as per mitte d by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

|

A LETTER FROM OUR CHAIRMAN AND CEO |

| ||||||

March 24, 2023

Dear Shareholders,

Thank you for your continued commitment to Fresh Del Monte. In 2022, we took many notable steps to increase our shareholder value, keeping you and your interests top of mind. In our previous Letter to Shareholders, I wrote to you about our reinvention toward becoming a technology-driven company. Twelve months later, I am proud to say we are making great strides on that front. It has made us stronger, smarter, and more agile.

We are weaving technology into key areas of our operations from investing in artificial intelligence (AI) for pricing and sourcing our avocados to blockchain technology that streamlines food safety and traceability to investing in technology platforms that streamline our entire logistics and transportation units, both in-land and ocean freight.

We’ve been able to make progress on these fronts because we understand what we have. Fresh Del Monte is a 135-year-old company that is rich with data, which puts us in a place to leverage and use that data to further our business and the industry.

Data is the reason why our artificial intelligence projects have reached an almost 95% predictability rate on pricing for avocados—an AI model we intend to use with our other products. It is also the reason why we, as a company, can innovate and grow, while sticking to our ethos of building A Brighter World Tomorrow™. We combine data, technology, strategy, and passion to innovate and move the needle forward.

In 2022, we applied innovation to our customer relationships. We focused on optimizing our relationships. We optimized by innovating—finding new ways to partner with our top, volume customers. We made these partnerships more efficient yet profitable and we also expanded, tailor-made S-K-U lists to work toward profitable incremental sales.

Innovation also played a role in our latest product launch. The Del Monte Zero™ pineapple is carbon-neutral certified from farm to market. The first of its kind, we achieved carbon neutrality for these select pineapples by making changes in our own processes and on our farms to reduce our greenhouse gas emissions.

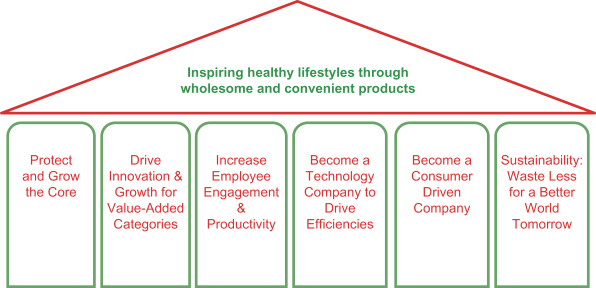

These efforts bolstered our robust sustainability program and helped us show customers and consumers that we are truly committed to bettering our planet. We continue to work towards our 2025 and 2030 sustainability goals. Notably, from our 2021 Sustainability Report released in October, we diverted 95 percent of our food waste from landfill and our overall food waste was reduced by 13 percent. We also reduced Scope 1 and 2 greenhouse gas emissions by 22 percent compared with our 2019 baseline, only 5.5 percentage points shy of our 2030 goal.

While we continue to be a leader in the produce industry, we solidified ourselves as a logistics powerhouse in 2022. We made, and continue to make—a conscious effort to leverage our assets wherever we can within our vertically-integrated network. Network Shipping, our ocean logistics arm, relaunched in 2022 offering space on our vessels to customers in the Americas. We also began applying a similar model with Tricont Trucking and Tricont Logistics, our North America-based trucking and logistics arms, offering our services and assets to customers that need hauling and temperature-controlled solutions. Within our logistics arm and beyond, we are continually improving and investing in our technology, processes, and people to keep our edge.

Overall, we closed 2022 in a strong position—stronger than 2021—due to our ability to remain flexible and agile, controlling our costs, leveraging our assets, and optimizing new and existing partnerships.

As we look forward to 2023, our focus remains on innovation and leadership in the produce industry. We will continue to pursue partnerships that allow us to optimize both our land and logistics assets, and we will continue to invest in best-in-class technology. Sustainability will always remain at the forefront. We believe it is our duty to protect the land and surrounding areas and provide for the communities we operate in. Technology can help us do this in a more efficient and effective way.

We conduct our business with the goal of creating A Brighter World Tomorrow™ and always will. This is how we drive value for our shareholders long-term. It is the foundation of Fresh Del Monte’s strategy and vision.

Thank you for your support and commitment to our business.

Regards,

Mohammad Abu-Ghazaleh

Chairman and Chief Executive Officer

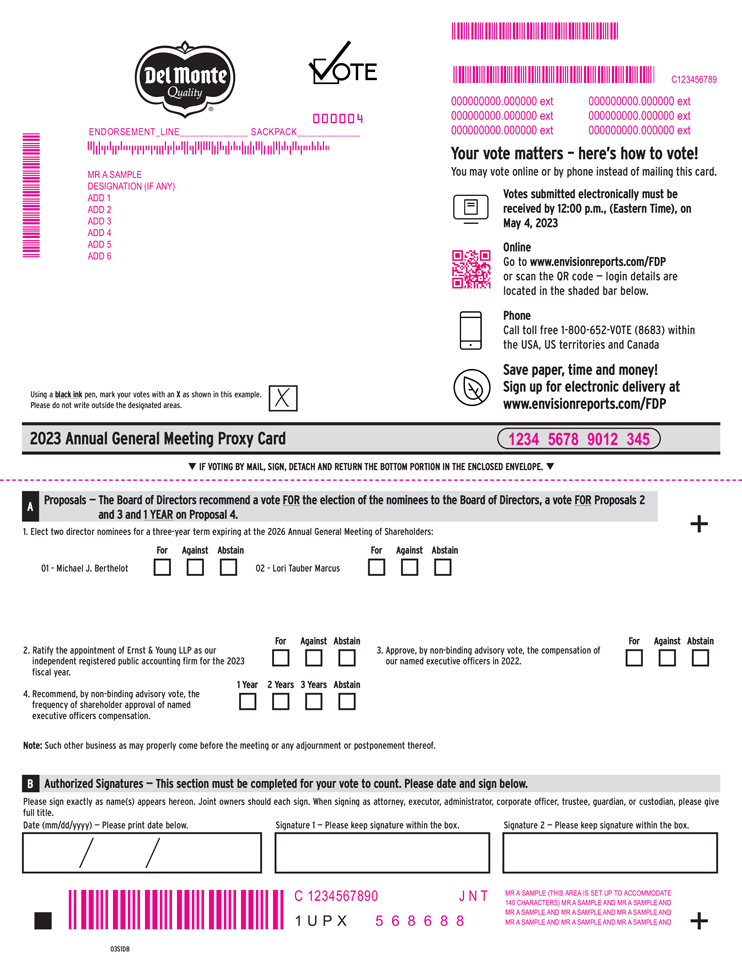

NOTICE OF 2023 ANNUAL GENERAL MEETING OF SHAREHOLDERS

DATE AND TIME:

Thursday, May 4, 2023 at 11:00 A.M., Eastern Time

PLACE:

The 2023 Annual General Meeting of Shareholders (or “Annual General Meeting”) will be held exclusively online at meetnow.global/MH54KY6 through a live internet webcast. You can find instructions on how to access the Annual General Meeting in the section of this proxy statement called “Access Instructions.”

ITEMS OF BUSINESS:

| PROPOSAL 1 |

Elect two director nominees for a three-year term expiring at the 2026 Annual General Meeting of Shareholders | |

| PROPOSAL 2 |

Ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the 2023 fiscal year | |

| PROPOSAL 3 | Approve, by non-binding advisory vote, the compensation of our named executive officers in 2022 | |

| PROPOSAL 4 |

Recommend, by non-binding advisory vote, the frequency of shareholder approval of executive compensation | |

Transact other business properly presented at the Annual General Meeting or any postponement or adjournment thereof.

RECORD DATE:

The board of directors has fixed March 7, 2023, as the record date for the Annual General Meeting. This means that only shareholders as of the close of business on that date are entitled to receive notice of and to vote at the Annual General Meeting.

It is important that your shares be represented at the Annual General Meeting, regardless of the number you may hold. Whether or not you plan to attend, please vote using the Internet, by telephone or by mail, in each case by following the instructions in our proxy statement. This will not prevent you from voting your shares in person via the virtual meeting platform if you are present.

Mohammad Abu-Ghazaleh

Chairman and Chief Executive Officer

We mailed a Notice of Internet Availability of Proxy Materials containing instructions on how to access

our proxy statement and annual report on or about March 24, 2023.

Our proxy statement and annual report are available online at www.envisionreports.com/FDP

Fresh Del Monte Produce, Inc.

241 Sevilla Avenue, Coral Gables, FL 33134

|

Table of Contents

| 1 | ||||

| 6 | ||||

| 10 | ||||

| 12 | ||||

| 13 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| 19 | ||||

| 19 | ||||

| 21 | ||||

| 22 | ||||

| Insider Trading Policy and Restrictions on Pledging and Hedging |

23 | |||

| 23 | ||||

| 25 | ||||

| 25 | ||||

| 26 | ||||

| 26 | ||||

| 27 | ||||

| Sustainability and Social Responsibility at Fresh Del Monte Produce |

28 | |||

| PROPOSAL 2—RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

33 | |||

| 36 | ||||

| 38 | ||||

| 40 | ||||

| 40 | ||||

| 53 | ||||

| 55 | ||||

| 56 | ||||

| 56 | ||||

| 57 | ||||

| 58 | ||||

| Option Exercises and Stock Vested Table for the 2022 Fiscal Year |

59 | |||

| 60 | ||||

| 62 | ||||

| 66 | ||||

| 67 | ||||

| 68 | ||||

| 70 | ||||

| 71 | ||||

| 71 | ||||

| 71 | ||||

| Shareholder Proposals and Director Nominations for 2024 Annual General Meeting |

71 | |||

| 71 | ||||

| 72 | ||||

| 72 | ||||

| 72 |

|

2023 Proxy Statement | Table of Contents | i |

PROXY SUMMARY

This proxy summary highlights information contained elsewhere in this proxy statement, which is first being sent or made available to shareholders on or about March 24,2023. You should read the entire proxy statement carefully before voting. For more information regarding our 2022 performance, please review our annual report on Form 10-K for the 2022 fiscal year.

2023 ANNUAL GENERAL MEETING OF SHAREHOLDERS

| Date and Time: | Thursday, May 4, 2023 at 11:00 A.M. Eastern Time | |

| Record Date: | March 7, 2023 | |

| Place: |

The Annual General Meeting will be held exclusively online at meetnow.global/MH54KY6 through a live internet webcast. There will be no physical meeting, so you will not be able to attend in person. |

VOTING MATTERS AND BOARD RECOMMENDATIONS

| Proposal | Board’s Recommendation | |

Page Reference (for more details |

) | ||

| 1. Election of Directors | FOR Each Director |

10 | ||||

| 2. Ratification of Ernst & Young, LLP as Auditors | FOR | 33 | ||||

| 3. Advisory Approval of Executive Compensation | FOR | 38 | ||||

| 4. Advisory Approval of the Frequency of Shareholder Approval of Executive Compensation | ONE YEAR | 70 | ||||

VOTING AT THE VIRTUAL MEETING

If you hold your Ordinary Shares with our transfer agent, Computershare, then you or your proxyholder may attend the virtual-only Annual General Meeting, participate, vote, ask questions, and examine a list of the shareholders of record entitled to vote at the Annual General Meeting by accessing meetnow.global/MH54KY6 and entering the 15-digit control number on your proxy card.

If you hold your Ordinary Shares through an intermediary, like a broker or a bank, you must register in advance to attend the virtual-only Annual General Meeting. To register, you must obtain a legal proxy, executed in your favor, from the record holder of your Ordinary Shares and submit proof of your legal proxy reflecting the number of Ordinary Shares you held as of the record date, as well as your name and email address, to Computershare. Please refer to the section entitled “Questions and Answers About Our Annual General Meeting” below and the question “How Do I Vote?” for more information. Your request must be received no later than 5:00 P.M. Eastern Time on May 1, 2023.

|

2023 Proxy Statement | Proxy Summary | 1 |

VISION AND GOALS

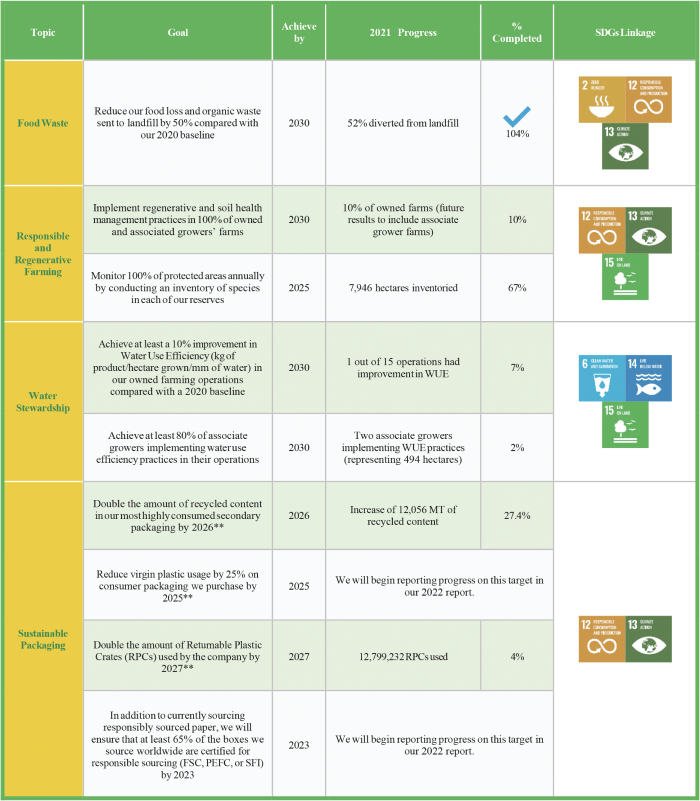

Our vision is to inspire healthy lifestyles through wholesome and convenient products. During 2022 we continued to execute against our 5-year strategic plan implemented in 2019. Our long-term strategy is founded on six strategic goals:

|

PROTECT AND GROW OUR CORE BUSINESS

| |||

|

DRIVE INNOVATION AND EXPAND GROWTH ON VALUE-ADDED CATEGORIES

| |||

|

EVOLVE OUR CULTURE TO INCREASE EMPLOYEE ENGAGEMENT AND PRODUCTIVITY

| |||

|

BECOME A TECHNOLOGY-DRIVEN COMPANY TO DRIVE EFFICIENCIES

| |||

|

BECOME A CONSUMER-DRIVEN COMPANY

| |||

|

LEAD THROUGH SUSTAINABILITY FOR A BRIGHTER WORLD TOMORROW

| |||

| 2 | Proxy Summary |

2023 Proxy Statement |

|

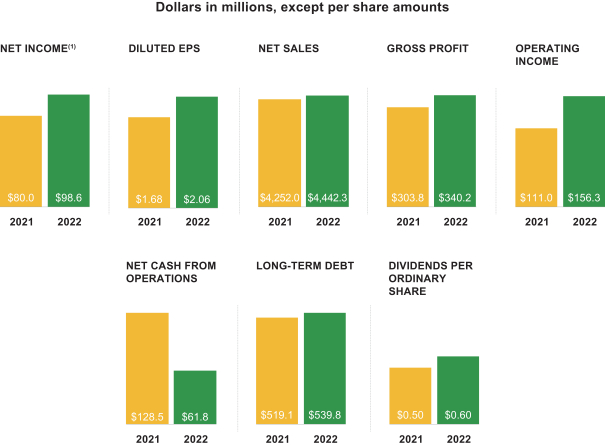

2022 FINANCIAL HIGHLIGHTS

We closed 2022 in a much stronger position than 2021. This reflects our commitment to remaining flexible and agile, controlling our costs, leveraging our assets, and optimizing our customer relationships. Although it was a challenging macroeconomic environment for our business as costs of packaging materials, fertilizers, transportation, and labor remained elevated throughout the year, we focused our efforts on adapting quickly and being flexible. We leveraged our assets within our vertically-integrated network. We focused on capital improvements to our banana and pineapple operations in Central America and enhancements to improve our efficiency in our production facilities across our operations. Overall, we made meaningful progress on our long-term strategy of growing our core business, increasing the reach of higher-margin value-added categories, implementing, and leveraging technology solutions and expanding our global business.

| (1) | Attributable to Fresh Del Monte Produce Inc. |

|

2023 Proxy Statement | Proxy Summary | 3 |

OVERVIEW OF OUR DIRECTORS

| Director |

Director Since |

Age | Background | Committee Memberships | ||||

| Mohammad Abu-Ghazaleh | 1996 | 81 | Chairman and Chief Executive Officer Fresh Del Monte Produce Inc. | |||||

| Amir Abu-Ghazaleh | 1996 | 76 | General Manager, Abu-Ghazaleh & Sons Co. Ltd. | |||||

| Ahmad Abu-Ghazaleh | 2018 | 46 | Vice Chairman and Chief Executive Officer, Royal Jordanian Air Academy, Arab Wings, and Queen Noor Technical College | |||||

| Charles Beard, Jr. | 2020 | 60 | Partner, Chief Operating Officer, Guidehouse, Inc. | Governance (Chair) Compensation | ||||

| Michael J. Berthelot (Lead Independent Director) |

2006 | 72 | Chief Executive Officer, Cito Capital Corporation | Compensation Audit | ||||

| Mary Ann Cloyd | 2019 | 68 | Retired Senior Partner, PricewaterhouseCoopers LLP | Audit (Chair) Governance | ||||

| Kristen Colber-Baker | 2021 | 59 | Global Director, Diversity, Equity and Inclusion, Mars, Inc. | Compensation (Chair) Audit | ||||

| Lori Tauber Marcus | 2021 | 60 | Founder of Courtyard Connections, LLC, Board Advisor and Retired Chief Marketing Officer | Audit Governance | ||||

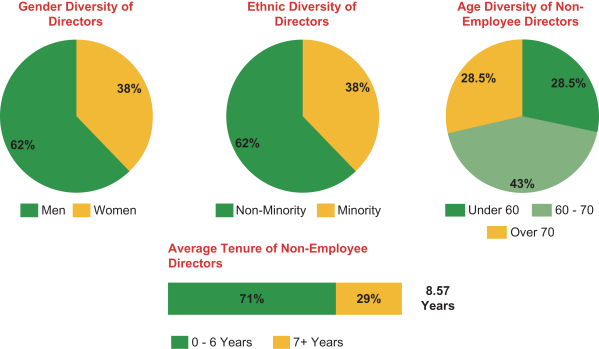

We seek to have a Board of independent directors that bring to us a wide range of viewpoints and experiences. Our Board consists of directors with a diversity of age, gender and ethnicity and a range of tenure, with our longer-serving directors providing important institutional knowledge and experience and our newer directors bringing fresh perspectives to deliberations.

| 4 | Proxy Summary |

2023 Proxy Statement |

|

GOVERNANCE AND EXECUTIVE COMPENSATION HIGHLIGHTS

Our corporate governance practices and executive compensation standards include:

| • | Our latest Global Sustainability Report was published in October 2022 demonstrating our long-standing commitment to doing business in a sustainable way. (Page 28) |

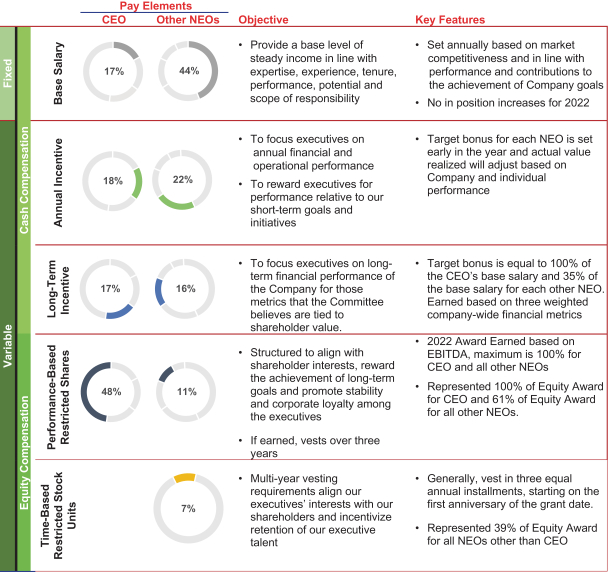

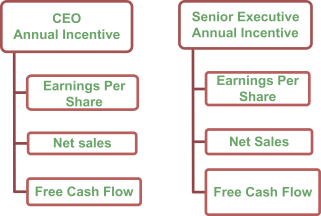

| • | Executive compensation is tied to financial and operating performance. (Page 42) |

| • | Robust employee compensation recoupment or “clawback” policy. (Page 21) |

| • | Directors and officers are subject to rigorous Stock Ownership Guidelines. (Page 53) |

| • | 83% of our CEO’s target total compensation and an average of 56% of our other named executive officers’ target total compensation is at-risk or performance based. (Page 42) |

| • | Advisory vote on executive compensation is conducted annually. (Page 38) |

| • | Executives are prohibited from short-sale transactions, hedging any shares and are prohibited from pledging shares that are subject to the Stock Ownership Guidelines. (Page 23) |

| • | Board conducts annual self-evaluation to determine effective functioning. (Page 18) |

| • | Director resignation policy for all director nominees. (Page 18) |

| • | Directors regularly attend continuing education programs. |

| • | Board includes members with gender and ethnic diversity, including that 37.5% of our board members are women and 37.5% of our board members are ethnically diverse. |

|

2023 Proxy Statement | Proxy Summary | 5 |

PROXY STATEMENT

QUESTIONS AND ANSWERS ABOUT OUR ANNUAL GENERAL MEETING

What am I voting on?

At the Annual General Meeting, you will be asked to vote on the following proposals. Our Board recommendation for each of these proposals is set forth below.

| Proposal | Board Recommendation | |

| 1. To elect two director nominees for a three-year term expiring at the 2026 Annual General Meeting of Shareholders. |

FOR each Director | |

| 2. To ratify the appointment of Ernst & Young LLP (“EY”) as our independent registered public accounting firm for the 2023 fiscal year. |

FOR | |

| 3. To approve, by non-binding advisory vote, the compensation of our named executive officers in 2022, which we refer to as “Say on Pay.” |

FOR | |

| 4. To recommend, by non-binding advisory vote, the frequency of shareholder approval of executive compensation, which we refer to as the “Say on Frequency.” |

ONE YEAR | |

We also will consider other business that properly comes before the meeting in accordance with the laws of the Cayman Islands and our Second Amended and Restated Memorandum and Articles of Association. However, the Board is not aware of any other matters to be presented for action at the Annual General Meeting.

Who can vote?

Holders of our Ordinary Shares at the close of business on March 7, 2023, are entitled to vote their Ordinary Shares at the Annual General Meeting. As of March 7, 2023, there were 47,866,032 Ordinary Shares issued, outstanding and entitled to vote. Each Ordinary Share issued and outstanding is entitled to one vote.

What constitutes a quorum, and why is a quorum required?

We are required to have a quorum of shareholders present to conduct business at the meeting. The presence at the meeting, in person or by proxy (which includes attending the Annual General Meeting via the internet webcast), of the holders of a majority of the 47,866,032 issued and outstanding Ordinary Shares on March 7, 2023, will constitute a quorum, permitting us to conduct the business of the meeting. Abstentions and broker non-votes are counted as present for purposes of determining a quorum, if the shareholder or proxy representing the shareholder is present at the meeting. Ordinary Shares for which we have received executed proxies will be counted for purposes of establishing a quorum at the meeting, regardless of how or whether such Ordinary Shares are voted on any specific proposal.

What is the difference between a “shareholder of record” and a “street name” holder?

If your Ordinary Shares are registered directly in your name with our transfer agent, Computershare Investor Services, you are considered a “shareholder of record” or a “registered shareholder” of those Ordinary Shares. In this case, your Notice of Internet Availability of Proxy Materials (“Notice”) has been sent to you directly by us.

If your Ordinary Shares are held in a stock brokerage account or by a bank, trust or other nominee or custodian, you are considered the “beneficial owner” of those shares, which are held in “street name.” A Notice has been forwarded to you by or on behalf of your broker or other nominee, who is considered the shareholder of record of those shares. As the beneficial owner, you have the right to direct your broker or other nominee how to vote your Ordinary Shares by following the instructions for voting set forth in the Notice.

Why did I receive a Notice of Internet Availability of Proxy Materials in the mail instead of a paper copy of the proxy materials?

Pursuant to the rules adopted by the Securities and Exchange Commission, or the SEC, we have elected to provide shareholders access to our proxy materials over the Internet. We believe that the e-proxy process will expedite our shareholders’ receipt of proxy materials, lower the costs of distribution and reduce the environmental impact of our Annual General Meeting. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials, which we refer to as the “Notice,” to our shareholders on or about March 24, 2023, at the close of business. The Notice contains instructions on

| 6 | Questions and Answers About Our Annual Meeting |

2023 Proxy Statement |

|

how to access our proxy statement and annual report and vote online. If you received a Notice and would like to receive a printed copy of our proxy materials from us instead of downloading a printable version from the Internet, please follow the instructions included in the Notice for requesting such materials at no charge.

How do I vote?

If you hold your Ordinary Shares in your own name as a holder of record with our transfer agent, Computershare, you may vote at the Annual General Meeting or by proxy as follows:

| • | At the virtual-only meeting. You may attend and vote online during the virtual-only Annual General Meeting by visiting meetnow.global/MH54KY6 and entering the control number found on your proxy card and clicking on the vote option link before the polls close. |

| • | Via the internet. You may vote by proxy before the Annual General Meeting via the internet by visiting www.envisionreports.com/FDP and login using the control number found on your proxy card and clicking on the “Cast Your Vote” link. |

| • | By telephone. You may vote by proxy before the meeting by calling toll-free 1-800-652-VOTE (8683) within the USA, US territories and Canada. |

| • | By mail. You may vote by proxy before the meeting by filling out your proxy card and sending it back in the envelope provided. |

If your Ordinary Shares are held in “street name” through a broker, bank or other nominee, you will receive instructions from that organization that you must follow in order to have your shares voted. If you want to attend and vote at the virtual-only meeting, you must obtain a legal proxy from your broker, bank or other nominee, register to attend and access the meeting. Please forward the email you receive from your broker or bank, or send an image of your legal proxy, to legalproxy@computershare.com. You may also send it to Computershare by mail at:

Computershare

Fresh Del Monte Produce Inc. Legal Proxy

P.O. Box 43001

Providence, RI 02940-3001

You must label your request to register as “Legal Proxy.” Your request must be received no later than 5:00 P.M. Eastern Time on May 1, 2023. You will then receive a confirmation of your registration, with a control number, by email from Computershare. At the time of the meeting, go to meetnow.global/MH54KY6 and enter your control number.

What are the requirements to elect the director nominees and to approve each of the proposals in this proxy statement?

Under the laws of the Cayman Islands and our Second Amended and Restated Memorandum and Articles of Association, directors are elected and the ratification of auditors is deemed approved when they are approved by an “Ordinary Resolution” which is defined as simple majority of the votes cast by such Shareholders on such matter as, being entitled to do so, in person or by proxy. Proposals 3 and 4 are non-binding advisory votes. This means that while we ask shareholders to approve a resolution regarding Say on Pay and select the Say on Frequency, it is not an action that requires shareholder approval.

| Proposal | Vote Requirement | |

| Election of Director | Majority of the Votes Cast | |

| Ratification of Auditors | Majority of the Votes Cast | |

| “Say on Pay” | Majority of the Votes Cast | |

| “Say on Frequency” | Majority of the Votes Cast | |

Abstentions will have no effect on the outcome of the vote for any of the Proposals under Cayman Islands law.

What if I am a beneficial owner and do not give the nominee voting instructions?

If you are a beneficial owner and your shares are held in “street name,” the broker is bound by the rules of the New York Stock Exchange, or NYSE, regarding whether or not it can exercise discretionary voting power for any particular proposal if the broker has not received voting instructions from you. Brokers have the authority to vote shares for which their customers do not provide voting instructions on certain routine matters. A broker non-vote occurs when a broker returns a proxy but does not vote on a particular proposal because the broker does not have discretionary authority to vote on the

|

2023 Proxy Statement | Questions and Answers About Our Annual Meeting | 7 |

proposal and has not received specific voting instructions for the proposal from the beneficial owner of the shares. Broker non-votes are considered to be present at the meeting for purposes of determining the presence of a quorum, but are not counted as votes cast.

The table below sets forth, for each proposal on the ballot, whether a broker can exercise discretion and vote your shares absent your instructions and, if not, the impact of such broker non-vote on the approval of the proposal.

| Proposal | Can Brokers Vote Absent Instructions? |

Impact of Broker Non-Vote | ||||||||

| 1. Election of Directors |

No |

None | ||||||||

| 2. Ratification of Auditors |

Yes |

Not Applicable | ||||||||

| 3. Say on Pay |

No |

None | ||||||||

| 4. Say on Frequency |

No |

None | ||||||||

What if I sign and return my proxy without making any selections?

If you sign and return your proxy without making any selections, your shares will be voted “FOR” each of the director nominees in Proposal 1, “FOR” Proposals 2 and 3 and “ONE YEAR” for Proposal 4. If other matters properly come before the meeting, the proxy holders will have the authority to vote on those matters for you in their discretion.

How do I change my vote?

A shareholder of record may revoke his or her proxy by giving written notice of revocation to our Corporate Secretary, Fresh Del Monte Produce Inc., c/o Del Monte Fresh Produce Company, 241 Sevilla Avenue, Coral Gables, Florida 33134, before the meeting, by delivering a later-dated proxy (either in writing, by telephone or over the Internet), provided that the new proxy card is received by Computershare Investor Services, P.O. Box 505000, Louisville, Kentucky, 40233 prior to the closing of the polls at the Annual General Meeting, or by attending and voting at the virtual-only Annual General Meeting.

If your shares are held in “street name,” you may change your vote by following your broker’s or other nominee’s procedures for revoking or changing your proxy.

What shares are covered by my proxy card?

Your proxy reflects all shares owned by you at the close of business on March 7, 2023.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, it means that you hold shares in more than one account. To ensure that all of your shares are voted, you should sign and return each proxy card. Alternatively, if you vote by telephone or via the Internet, you will need to vote once for each proxy card and voting instruction card you receive.

Who can attend the Annual General Meeting?

Only shareholders as of March 7, 2023, the record date, and our invited guests are permitted to attend the Annual General Meeting. If you held your Ordinary Shares as of the record date as a shareholder of record, then you or your proxyholder may attend the virtual-only Annual General Meeting, participate, vote, ask questions, and examine a list of the shareholders of record entitled to vote at the Annual General Meeting by accessing meetnow.global/MH54KY6 and entering the 15-digit control number on your proxy card.

If you held your Ordinary Shares as of the record date in “street name” through an intermediary, like a broker or a bank, you must register in advance to attend the virtual-only Annual General Meeting. To register, you must obtain a legal proxy, executed in your favor, from the record holder of your Ordinary Shares and submit proof of your legal proxy reflecting the number of Ordinary Shares you held as of the record date, as described above under “How Do I Vote?”

Can I attend the Annual General Meeting if I don’t have a legal proxy or have lost my control number?

Yes. If you have misplaced your control number, you may access the meeting as a guest by going to meetnow.global/MH54KY6, but you will not be able to vote during the Annual General Meeting or ask questions.

Will I be able to ask questions at the Annual General Meeting?

Shareholders of record and beneficial owners who have logged in to the Annual General Meeting with a control number as described above may submit questions any time before or during the Annual General Meeting by clicking on the

| 8 | Questions and Answers About Our Annual Meeting |

2023 Proxy Statement |

|

message icon in the upper right-hand corner of the broadcast screen. After the business portion of the Annual General Meeting concludes, we will answer questions that have been submitted that are pertinent to the items being brought before the shareholder vote at the Annual General Meeting, as time permits and in accordance with our Rules of Conduct for the Annual General Meeting.

If I plan to attend the Annual General Meeting, should I still vote by proxy?

Yes. Casting your vote in advance does not affect your right to attend the Annual General Meeting. If you send in your proxy card and also attend the Annual General Meeting, you do not need to vote again at the Annual General Meeting, unless you want to change your vote. You may attend and vote online during the virtual-only Annual General Meeting by accessing the Annual General Meeting as described above and clicking on the vote option link before the polls close.

Where can I find the voting results of the Annual General Meeting?

We will announce the results for the proposals voted upon at the Annual General Meeting and publish the final detailed voting results in a Form 8-K filed within four business days after the Annual General Meeting.

Who should I call with other questions?

If you have additional questions about this proxy statement or the meeting or would like additional copies of this proxy statement or our annual report, please contact: Fresh Del Monte Produce Inc., c/o Del Monte Fresh Produce Company, 241 Sevilla Avenue, Coral Gables, Florida 33134, Attention: Investor Relations, Telephone: (305) 520-8433.

|

2023 Proxy Statement | Questions and Answers About Our Annual Meeting | 9 |

PROPOSAL 1—ELECTION OF DIRECTORS

PROPOSAL SUMMARY

What Are You Voting On?

We are asking our shareholders to elect the following two director nominees to serve on the Board. Information about the Board and each director nominated is included in this section.

| Class II Director Nominees Three-Year Term Ending 2026 Michael J. Berthelot Lori Tauber Marcus |

Voting Recommendation

The Board recommends that you vote “FOR” each director nominee listed above. After consideration of the individual qualifications, skills and experience of each of our director nominees, the Board believes these two director nominees would contribute to a well-balanced and effective Board.

Each of the Class II directors elected at the Annual General Meeting will hold office until the annual general meeting of shareholders to be held in 2026 or until his or her successor has been elected and qualified, or until his or her earlier death, resignation, removal or disqualification. Michael J. Berthelot and Lori Tauber Marcus currently serve as Class II members of the Board of Directors.

Unless contrary instructions are given, the shares represented by a properly executed proxy will be voted “FOR” each of the directors presented below. If, at the time of the meeting, one or more of the director nominees has become unavailable to serve, shares represented by proxies will be voted for the remaining director nominees and for any substitute director nominee or nominees designated by the Board of Directors, unless the size of the Board is reduced. The Board knows of no reason why any of the director nominees will be unavailable or unable to serve. Proxies cannot be voted for a greater number of persons than the director nominees listed.

|

The Board of Directors recommends a vote “FOR” each nominee for director |

| 10 | Election of Directors |

2023 Proxy Statement |

|

ELECTION OF DIRECTORS

Introduction

Our Second Amended and Restated Memorandum of Association provides that our Board must consist of between three and nine directors. Our Corporate Governance Guidelines require that a majority of our board shall be directors who meet the independence standards of the NYSE with one of the independent directors serving as the lead independent director. Our Board currently consists of five independent directors (ID), and three non-independent directors for a total of eight directors and is divided into three classes. The non-independent directors represent the largest single owner of FDP shares. We believe that the classified board is the most effective way for the Board to be organized because it ensures a greater level of certainty of continuity from year to year, provides stability in near term operational performance balanced with long term investments, and allows for the refresh of experience to meet the evolving needs of the company. As a result of the three classes, at each annual general meeting, directors are elected for a three-year term. Class terms expire on a rolling basis so that one class of directors is elected each year.

Our current directors and classifications are as follows:

| Class II – Expiring 2023 Michael J. Berthelot (ID) Lori Tauber Marcus (ID) |

|

Class III – Expiring 2024 Mohammad Abu-Ghazaleh Ahmad Abu-Ghazaleh Kristen Colber-Baker (ID) |

|

Class I – Expiring 2025 Amir Abu-Ghazaleh Mary Ann Cloyd (ID) Charles Beard, Jr. (ID) | ||||

The terms of the two current Class II directors expire at the Annual General Meeting. The Governance Committee has nominated and the Board has recommended that Michael J. Berthelot and Lori Tauber Marcus be nominated for re-election.

Both Michael J. Berthelot and Lori Tauber Marcus have consented to serve if elected. If any director nominee is unable or unwilling to serve at the time of the election, the proxy holders may vote for another person, or persons, in their discretion. A director nominee who fails to receive a majority of the votes cast will be required to submit his or her resignation as a director. The Board will then consider all the facts and circumstances relative to the continued service of such director before accepting or declining such resignation.

We believe that each of our directors and director nominees possesses the experience, skills and qualities to fully perform his or her duties as a director and contribute to our success. Our director nominees were nominated because each is of high ethical character, highly accomplished in his or her field with superior credentials and recognition, has a reputation, both personal and professional, that is consistent with our image and reputation, has the ability to exercise sound business judgment, and is able to dedicate sufficient time to fulfilling his or her obligations as a director. Our directors as a group complement each other and each of their respective experiences, skills and qualities so that collectively the Board operates in an effective, collegial and responsive manner.

|

2023 Proxy Statement | Election of Directors | 11 |

ELECTION OF DIRECTORS

Director Skills, Experience and Background

The Board regularly reviews the skills, experience, and background that it believes are desirable to be represented on the Board and that align with our strategic vision, business and operations. The following is a summary and description of some of the skills, experience and background that our continuing directors and director nominees bring to the Board. The directors’ biographies note each director’s relevant skills, experience and qualifications relative to this list.

| LEADERSHIP EXPERIENCE

|

Experience serving as a CEO, CFO, senior executive or functional leader within an organization |

|||||||||||||||||

|

|

8 of 8 | |||||||||||||||||

| PUBLIC COMPANY BOARD EXPERIENCE

|

Experience serving on the boards of other U.S. or international public companies and familiarity with key corporate governance matters |

|||||||||||||||||

|

|

6 of 8 |

|||||||||||||||||

| INDUSTRY EXPERTISE

|

Experience in key aspects of our businesses and industry, including food/agribusiness, distribution, transportation/shipping, retail and innovation/research & development |

|||||||||||||||||

|

|

6 of 8 |

|||||||||||||||||

| FINANCE/ACCOUNTING

|

Experience or expertise in financial accounting and reporting or the financial management of an organization |

|||||||||||||||||

|

|

5 of 8 |

|||||||||||||||||

| INTERNATIONAL EXPERIENCE

|

Experience doing business internationally or focusing on international issues and operations or with multinational companies |

|||||||||||||||||

|

|

7 of 8 |

|||||||||||||||||

| ERM/RISK MANAGEMENT

|

Experience overseeing risk management matters |

|||||||||||||||||

|

|

4 of 8 |

|||||||||||||||||

| M&A/INTEGRATION

|

Experience leading growth through acquisitions and other business combinations and ability to evaluate operational integration plans |

|||||||||||||||||

|

|

6 of 8 |

|||||||||||||||||

| OPERATIONS/HUMAN CAPITAL

|

Experience managing compensation and diversity and inclusion efforts, and implementing succession planning and talent development |

|||||||||||||||||

|

|

5 of 8 |

|||||||||||||||||

| 12 | Election of Directors |

2023 Proxy Statement |

|

ELECTION OF DIRECTORS

Director/Director Nominee Biographies

Each director and director nominee’s principal occupation and other pertinent information about particular experiences, qualifications, attributes and skills that led the Board to conclude that such person should serve as a director appears on the following pages.

Director Nominees

Class II Directors

Term to Expire at the 2026 Annual General Meeting

|

Lori Tauber Marcus Director Since: 2021 Age: 60

Founder of Courtyard Connections, LLC, Board Advisor and Retired Chief Marketing Officer

Biography: Ms. Marcus is an experienced Chief Marketing Officer with over 35 years of experience in consumer-facing industries. Ms. Marcus is the founder of Courtyard Connections, LLC, an advisory firm focused on marketing and leadership in consumer goods, retail, food service, and consumer technology. From 2017 to 2020, Ms. Marcus worked with the Harvard Business School’s Kraft Precision Medicine Accelerator as Chair of Direct to Patient Initiative. In 2016, Ms. Marcus served as Interim Chief Marketing Officer for Peloton Interactive, Inc., a publicly-traded fitness platform. From 2013 to 2015, Ms. Marcus was the Executive Vice President and Chief Global Brand and Product Officer at Keurig Green Mountain, Inc., a publicly-traded coffee and coffee machine company. From 2011 to 2012, she was Chief Marketing Officer at The Children’s Place, a publicly-traded children’s clothing company. Ms. Marcus previously spent 24 years with PepsiCo in marketing & general management positions of increasing responsibility, culminating in her appointment as Senior Vice President, Marketing Activation for PepsiCo Beverages, North America.

Since January 2021, Ms. Marcus has served on the board of 24-Hour Fitness, a privately-held fitness company. Ms. Marcus was a board director for Phunware, Inc, a publicly-traded enterprise software company from December 2018 to September 2021. Ms. Marcus previously served on the boards of the following privately-held companies: Golub Corporation; DNA Diagnostics Center; and Talalay Global. Since 2004, Ms. Marcus has served on the board of the Multiple Myeloma Research Foundation.

Skills & Qualifications: Ms. Marcus brings to the Board strategic vision, strong business and general management acumen with direct-to-consumer expertise in e-commerce, digital marketing and social media to grow consumer-facing businesses worldwide. |

Experience Highlights: Leadership, Public Company Board, Industry, International, Operations/Human Capital

Independent

Committees: Audit Governance | |

|

2023 Proxy Statement | Election of Directors | 13 |

ELECTION OF DIRECTORS

|

Michael J. Berthelot Director Since: 2006 Age: 72

Chief Executive Officer, Cito Capital Corporation

Biography: Since 2004, Mr. Berthelot has served as the Chief Executive Officer of Cito Capital Corporation, a strategic consulting firm, and, since 2010, as Managing Principal and founder of Corporate Governance Advisors Inc., a consulting firm that provides board evaluation and advisory services. Mr. Berthelot is a Certified Public Accountant. Mr. Berthelot is also a faculty member of the University of California San Diego’s Rady School of Management, where he teaches corporate governance in the MBA program.

From February 2019 until June 2020, Mr. Berthelot served on the board of PenChecks Inc., a privately held financial services company. From 1992 to 2003, he served as Chairman and Chief Executive Officer of TransTechnology Corporation, a publicly-traded multinational manufacturing firm, and from 2003 until 2006, he continued to serve as its non-executive Chairman. From 2009 to 2013, Mr. Berthelot served on the board of directors of Pro-Dex, Inc., a medical device manufacturer, where he also served as the Chief Executive Officer and President from 2012 to 2013.

Skills & Qualifications: Mr. Berthelot brings to the Board extensive management and operating experience, including in his previous role as a chief executive officer of a publicly-traded multinational manufacturing and distribution business, as well as significant experience and corporate governance matters as well as accounting and financial reporting. |

Experience Highlights: Leadership, Public Company Board, Finance/Accounting, International, ERM/Risk Management, M&A/Integration

Lead Independent Director

Committees: Compensation Audit | |

Class I Directors

Term To Expire at the 2025 Annual General Meeting

|

Amir Abu-Ghazaleh Director Since: 1996 Age: 76

General Manager, Abu-Ghazaleh & Sons Co. Ltd.

Biography: Since 1987, Mr. Abu-Ghazaleh has served as the General Manager of Ahmed Abu-Ghazaleh & Sons Co. Ltd., a marketer and distributor of fresh fruit and vegetables. Mr. Abu-Ghazaleh serves on the boards of directors of Clemenceau Medical Center, Arab Wings and Royal Jordanian Air Academy. He also serves as the Chairman of Abu-Ghazaleh Investments (AGI). He previously served on the board of International General Insurance Co. Ltd in Jordan. Mr. Abu-Ghazaleh and Mr. Mohammad Abu-Ghazaleh are brothers, and Mr. Abu-Ghazaleh is the uncle of Mr. Ahmad Abu-Ghazaleh.

Skills & Qualifications: Mr. Abu-Ghazaleh brings to the Board over 20 years of executive, management and operating experience in the wholesale fresh fruit-related businesses, experience in marketing, finance, corporate governance matters and international business with extensive knowledge of the Middle East markets. |

Experience Highlights: Leadership, Public Company Board, Finance/Accounting, Industry, International, M&A/Integration | |

| 14 | Election of Directors |

2023 Proxy Statement |

|

ELECTION OF DIRECTORS

|

Mary Ann Cloyd Director Since: 2019 Age: 68

Former Senior Partner, PricewaterhouseCoopers LLP

Biography: From 1990 until her retirement in June 2015, Ms. Cloyd was a senior Partner with PricewaterhouseCoopers LLP, a global accounting firm. During her 25 years as a partner at PwC, Ms. Cloyd served in multiple leadership positions, including leading from 2011 until her retirement from PwC’s Center for Board Governance. Ms. Cloyd is a retired Certified Public Accountant. Ms. Cloyd has served as a director of Bellerophon Therapeutics, Inc., a publicly-traded clinical-stage biotherapeutics company, since 2016 and as a director of Ekso Bionics Holdings, Inc., a publicly-traded company focused on exoskeleton technology since 2020. In 2021, Ms. Cloyd was appointed as a director of Angel Pond Holdings Corporation, a publicly-traded special purpose acquisition company. Since April 2018, she has served as a director of NCMIC Group, Inc., a private mutual insurance and financial services company. Between 2004 and 2013, Ms. Cloyd served on both PwC’s Global and U.S. Boards of Partners and Principals. Ms. Cloyd also is on the Board of Directors for the Geffen Playhouse, the Caltech Associates Board, and the Advisory Board of the UCLA Iris Cantor Women’s Health Center.

Skills & Qualifications: Ms. Cloyd brings to the Board 39 years of public accounting/advisory experience, significant experience in corporate governance matters and experience in risk management and oversight. |

Experience Highlights: Leadership, Public Company Board, Finance/Accounting, ERM/Risk Management, M&A/Integration, Operations/Human Capital

Independent

Committees: Audit (Chair) Governance

Other Public Boards: Bellerophon Therapeutics, Inc. Ekso Bionics Holdings, Inc. | |||

|

Charles Beard, Jr. Director Since: 2020 Age: 60

Partner, Chief Operating Officer, Guidehouse, Inc., Retired Senior Partner, PricewaterhouseCoopers LLP

Biography: Since 2018, Mr. Beard has served as the Chief Operating Officer of global consultancy firm Guidehouse Inc. and is responsible for the day-to-day execution of the company’s enterprise services, risk and quality management strategy. He has more than 30 years of experience in professional advisory services focusing on cybersecurity and technology-enabled operational transformations. He was previously with PwC, where his practice focused on cybersecurity-related services and corporate transactions in the technology sector. He is the former General Manager of the Cybersecurity and Intelligence Unit of SAIC, where he also served as the company’s Chief Information Officer. He is the former Senior Vice President and Chief Information Officer for Science Applications International Corporation (now Leidos NYSE: LDOS), and General Manager of the Cybersecurity and Intelligence Business Unit. Previously, Mr. Beard led the global Transportation and Industrial Markets segment of KPMG consulting. Mr. Beard holds a Master of Jurisprudence from Seton Hall School of Law, an MBA from the University of Montana and a Bachelor of Science from Texas A&M University. He is a graduate of the US Air Force Space & Missile program.

Skills & Qualifications: Mr. Beard brings to the Board more than 30 years of experience in cybersecurity, digital innovation, including adoption of cloud computing infrastructure and addressing the security and control challenges inherent in digital transformation, technology management and business automation. |

Experience Highlights: Leadership, Industry Expertise, Finance/Accounting, International, ERM/Risk Management, M&A/Integration, Operations/Human Capital

Independent

Committees: Governance (Chair) Compensation | |||

|

2023 Proxy Statement | Election of Directors | 15 |

ELECTION OF DIRECTORS

Class III Continuing Directors

Term To Expire at the 2024 Annual General Meeting

|

Mohammad Abu-Ghazaleh Director Since: 1996 Age: 81

Chairman and Chief Executive Officer, Fresh Del Monte Produce Inc.

Biography: Since 1996, Mr. Abu-Ghazaleh has served as our Chairman and Chief Executive Officer. He serves as the Chairman of the Royal Jordanian Air Academy, Arab Wings, and Queen Noor Civil Aviation Technical College. Mr. Abu-Ghazaleh also serves as Chairman of the Abdali Clemenceau Hospital project, a $290 million development project in Amman, Jordan. He is a founding shareholder of Clemenceau Medical Center in Beirut, Lebanon. Mr. Abu-Ghazaleh currently serves on the board of directors of United Cable Industries Company, a Jordanian public company.

Previously, Mr. Abu-Ghazaleh served as Chairman of International General Insurance Co. until its listing on the NASDAQ in 2020. He served on the board of directors of Bank Misr Liban from 2007 to 2018 and Jordan Kuwait Bank from 2004 to 2011. Mr. Abu-Ghazaleh and Mr. Amir Abu-Ghazaleh are brothers. Mr. Abu-Ghazaleh is Mr. Ahmad Abu-Ghazaleh’s father.

Skills & Qualifications: Mr. Abu-Ghazaleh brings to the Board a unique understanding of our strategies and operations gained through over 20 years of executive leadership of our Company and over 45 years of experience in the fresh produce-related businesses serving in operations, management and executive leadership roles. |

Experience Highlights: Leadership, Public Company Board, Industry, International, ERM/Risk Management, M&A/Integration, Operations/Human Capital

Other Public Boards: United Cables Industries Company (Jordan). | |

| 16 | Election of Directors |

2023 Proxy Statement |

|

ELECTION OF DIRECTORS

|

Ahmad Abu-Ghazaleh Director Since: 2018 Age: 46

Vice Chairman and Chief Executive Officer, Royal Jordanian Air Academy, Arab Wings, Queen Noor Technical College and Gulf Wings

Biography: Since 2003, Mr. Abu-Ghazaleh has served as the Vice Chairman and Chief Executive Officer of the Royal Jordanian Air Academy, a flight training academy, Arab Wings, a private jet charter and aircraft management company, Queen Noor Technical College, a private engineering college, and Gulf Wings, a private jet charter company. He also serves as the Vice Chairman and Chief Executive Officer of the Abdali Clemenceau Hospital project in Amman, Jordan. He is the founder of the MMAG Foundation campus in Amman, a free art school, exhibition space and community center. Mr. Abu-Ghazaleh is an active member of several museum councils and advisory groups. Mr. Abu-Ghazaleh currently serves on several boards of directors of private and public organizations, including Queen Rania Foundation, Endeavor Jordan and The American Center for Oriental Research (ACOR). He has served as the Chairman of United Cables Industries Company (UCIC), a Jordanian publicly-traded company, since 2013 and of Augustus Management International since July 2016. He previously served as the Chairman of National Poultry Company (NPC), a publicly traded company and on the boards of directors of Banque Misr Liban, Arab Pharmaceutical Company and Modern Pharma, both publicly traded companies that were merged and sold to Hikma Pharmaceuticals (HIK: Lon). Mr. Abu-Ghazaleh is the son of Mr. Mohammad Abu-Ghazaleh and the nephew of Mr. Amir Abu-Ghazaleh.

Skills & Qualifications: Mr. Abu-Ghazaleh brings to the Board over 15 years of management experience in global operations, as well as extensive experience in the transportation and food industries. |

Experience Highlights: Leadership, Public Company Board, Industry, International

Other Public Boards: United Cables Industries Company (Jordan). | |

|

Kristin Colber-Baker Director Since: 2021 Director Age: 59

Prior Head of Global Diversity, Equity and Inclusion, Mars, Inc.

Biography: Ms. Colber-Baker has spent the past 30 years in various leadership and executive roles in corporate finance, M&A and HR/Talent within the consumer-packaged goods, retail and restaurant industries. From 2012 through February 2022, Ms. Colber-Baker served in various executive roles in Mars, Inc., a global confectionery and food manufacturer, including from 2020 to 2022, in Global Diversity, Equity and Inclusion, from 2015 to 2020, as the Global Head of Talent and Leadership Development and from 2012 to 2015, as the Regional Head, N.A. Talent. From 2010 to 2012, Ms. Colber-Baker was Global Head, Financial Planning, Reporting and Acquisition Integration at Wrigley Corp., where she was responsible for critical post-merger integration efforts related to Mars’ acquisition of Wrigley. Since 2018, Ms. Colber-Baker has served on the Board of Directors of Compassion International, a global non-profit child development organization.

Skills & Qualifications: Ms. Colber-Baker brings to the Board extensive human capital and culture expertise, global finance expertise as well as merger and acquisition experience. |

Experience Highlights: Leadership, Industry, Finance/Accounting, International, M&A/Integration, Operations/Human Capital

Independent

Committees: Audit Compensation (Chair) | |||

|

2023 Proxy Statement | Election of Directors | 17 |

CORPORATE GOVERNANCE

Corporate Governance Guidelines

Our business and affairs are managed with oversight from our Board. Our Board believes that good corporate governance is a critical factor in achieving business success and in fulfilling the Board’s responsibilities to shareholders. Our Board has adopted Corporate Governance Guidelines that provide the framework for the governance of our Company. These guidelines are available on our website at www.freshdelmonte.com under the “Investor Relations” tab.

Highlights of our Corporate Governance Guidelines are described below:

| • | a majority of directors of the Board must be independent as defined by NYSE corporate governance listing standards, or NYSE Listing Standards; |

| • | if the Chairman of the Board is not an independent director, the Board will appoint a lead independent director; |

| • | the Board will have an Audit Committee, Compensation Committee and Governance Committee; together, the Committees and each of their members will be independent as defined by the NYSE Listing Standards and applicable SEC rules. The Board may designate one or more additional Committees or create ad hoc Committees from time to time; |

| • | a current director nominee who fails to receive a majority of the votes cast must submit his or her resignation to the Board. The Board will then consider all the facts and circumstances relative to the continued service of the director before accepting or declining his or her resignation; |

| • | the Governance Committee will oversee an annual self-evaluation of the Board and its Committees as prepared by its members to consider how each has performed relative to its goals, objectives, and charter; and |

| • | directors should not serve simultaneously on the boards of more than four other public companies and Audit Committee members should not serve on more than two additional audit committees. |

Board Leadership Structure

Our Board has not adopted a formal policy regarding the need to separate or combine the offices of Chairman of the Board and CEO and instead the Board remains free to make this determination from time to time in a manner that seems most appropriate for our Company. Our CEO, Mohammad Abu-Ghazaleh, is also the Chairman of our Board. The Board currently believes that our Company and our shareholders are best served by having Mr. Abu-Ghazaleh hold both of these positions, given that he has the primary responsibility for managing our day-to-day operations and therefore has a detailed and in-depth knowledge of the issues, opportunities and challenges facing us and our businesses. Our Board also believes that the CEO serving as Chairman of the Board further promotes information flow between management and the Board and enhances the quality of the Board’s overall decision-making process.

Lead Independent Director

Our Corporate Governance Guidelines provide that if the position of Chair of the Board is held by the Chief Executive Officer or any other non-independent director, then the independent directors shall, upon recommendation of the Governance Committee and by majority vote of independent directors, appoint a lead independent director. Mr. Berthelot currently serves as our lead independent director. The duties of the lead independent director include:

| • | Presiding over executive sessions of the independent directors and Board meetings at which the Chair is not present; |

| • | Serving as liaison between the Chair and the independent directors; |

| • | Approving Board meeting agendas and schedules and the subject matter of the information to be sent to the Board; |

| • | Having authority to call meetings of the independent directors and/or the non-management directors; |

| • | Ensuring he or she is available for consultation and direct communication if requested by major shareholders; and |

| • | Performing such other duties as the Board deems appropriate. |

| 18 | Corporate Governance |

2023 Proxy Statement |

|

CORPORATE GOVERNANCE

Director Independence

Our Corporate Governance Guidelines provide that the Board must have a majority of directors who are independent as required by NYSE Listing Standards. Each year, the Board undertakes a review of director independence, which includes a review of each director’s or nominee’s responses to questionnaires asking about any relationships with us. This review is designed to identify and evaluate any transactions or relationships between a director or nominee or any member of his or her immediate family and us, or members of our senior management or other members of our Board, and all relevant facts and circumstances regarding any such transactions or relationships. Consistent with these considerations, our Board has affirmatively determined that the directors listed below are independent.

|

• Charles Beard, Jr.

• Michael J. Berthelot

• Mary Ann Cloyd

• Kristin Colber-Baker

• Lori Tauber Marcus

|

Meetings of the Board

The Board held 5 meetings during 2022. Each incumbent director attended at least 75% of the aggregate of (1) the total number of meetings of the Board during the period in which he or she was a director and (2) the total number of meetings of all Committees on which he or she served during the period in which he or she was a director. It is the policy of the Board to encourage its members to attend our Annual General Meeting. All members of the Board in 2022 were present at our 2022 Annual General Meeting of Shareholders.

All of our non-employee directors meet in executive session (without management present) in connection with each scheduled Board meeting. Mr. Berthelot currently serves as the presiding director over all executive sessions of the non-employee directors. In addition, our independent directors meet separately, without the participation of directors who do not qualify as independent directors.

Board Committees

The Board has the following three standing Committees: Audit, Compensation and Governance. The Board has adopted a written charter for each of these Committees. Committee charters are available on our website at www.freshdelmonte.com under the “Investor Relations” tab. Each Committee conducts at least an annual review of and revises its respective charter, if necessary. The following table shows the members of each of the Board’s Committees and the number of Committee meetings held during the 2022 fiscal year.

| Director | Audit Committee |

Compensation Committee |

Governance Committee | |||

| MichaelJ. Berthelot (LeadIndependent Director) |

Member Financial Expert |

Member |

||||

| CharlesBeard, Jr. IndependentDirector |

Member |

Chair | ||||

| MaryAnn Cloyd IndependentDirector |

Chair Financial Expert |

Member | ||||

| LoriTauber Marcus IndependentDirector |

Member |

Member | ||||

| KristinColber-Baker IndependentDirector |

Member Financial Expert |

Chair |

||||

| Meetingsin 2022 | 4 | 6 | 5 | |||

|

2023 Proxy Statement | Corporate Governance | 19 |

CORPORATE GOVERNANCE

Audit Committee

| Members | Primary Responsibilities | |

| Mary Ann Cloyd (Chair) Michael J. Berthelot Lori Tauber Marcus Kristin Colber-Baker

The Board determined that each member of the Audit Committee meets the independence requirements of the NYSE Listing Standards and the enhanced independence standards for Audit Committee members required by the SEC. |

• Oversees the quality and integrity of our financial statements and financial reporting process

• Oversees our systems of internal controls over financial reporting and disclosure controls and procedures

• Oversees the performance of our internal audit services function

• Engages the independent auditors and evaluates their qualifications, independence, and performance

• Establish hiring policies for employees or former employees of the independent auditor

• Oversees the compliance by the Company with legal and regulatory requirements including the Company’s Code of Ethics Policy

• Establishes procedures for the receipt, retention, and treatment of complaints regarding accounting, internal accounting controls or auditing matters

• Monitors the effectiveness of the Company’s information system controls and security |

Financial Expertise. The Board determined that each member of the Audit Committee is financially literate, knowledgeable and qualified to review financial statements. In addition, the Board has determined that Mary Ann Cloyd, Michael J. Berthelot and Kristin Colber-Baker each qualifies as an “audit committee financial expert” as defined by SEC rules.

Compensation Committee

| Members | Primary Responsibilities | |

| Kristin Colber-Baker (Chair) Michael J. Berthelot Charles Beard, Jr.

The Board determined that each member of the Compensation Committee meets the independence requirements of the NYSE Listing Standards including the enhanced independence standards for Compensation Committee members. |

• Reviews our general compensation structure and policies

• Reviews and sets the corporate goals and objectives for the Chief Executive Officer (“CEO”) and evaluates the CEO’s performance in light of such goals and objectives

• Evaluates, determines, and recommends CEO compensation, subject to approval by the independent directors

• Recommends the compensation of our other executive officers and the terms of any new executive compensation programs

• Reviews the compensation structure and policies applicable to the Board and recommends proposed changes

• Administers our executive incentive plans, including approving awards under such plans

• Reviews and discusses with management each year the Compensation Discussion and Analysis included in our annual proxy statement

• Oversees our risk assessment and risk management relative to our compensation structure, benefits, and incentive plans’ administration

• Oversees our compliance with SEC rules and regulations regarding shareholder approval of certain executive compensation matters.

• Serves as a liaison to our Chief Human Resources Officer to advise and provide insights and best practices regarding various human resource issues |

Role of Independent Compensation Consultant. The Compensation Committee has the sole authority to retain compensation consultants or advisors to assist it in fulfilling its responsibilities, including evaluating and determining executive and director compensation, and in fulfilling its other responsibilities. In 2022, the Compensation Committee engaged Willis Towers Watson (“WTW”) as its independent compensation consultant. WTW’s work with the Committee included analyses, advice, guidance and recommendations on executive and director compensation levels versus peers, market trends and incentive plan designs. In addition, in 2022, WTW conducted a review of our current peer group to ensure that it continues to serve as an appropriate benchmark for executive and director compensation levels and practices for 2023. WTW also reviewed our long-term incentive practices and provided updates on executive compensation trends and developments. WTW will continue to work with the Committee to provide it with analyses,

| 20 | Corporate Governance |

2023 Proxy Statement |

|

CORPORATE GOVERNANCE

advice, guidance and recommendations on executive and director compensation versus peers, market trends and incentive plan designs. WTW was engaged exclusively by the Compensation Committee on executive and director compensation matters and does not have any other consulting arrangements with the Company. The Committee took into consideration the consultant’s analyses, advice, guidance and recommendations in recommending changes to Board and executive compensation. The Committee considered the independence of WTW and determined that no conflicts of interest exist. For more information regarding the role of the compensation consultant, see the disclosure under “Compensation Setting Process—Role of Independent Compensation Consultant.”

Compensation Committee Interlocks and Insider Participation. During the 2022 fiscal year, Michael J. Berthelot, Kristin Colber-Baker and Charles Beard, Jr. served as Compensation Committee members. None of these individuals were, during 2022, an officer or employee of our Company, or was formerly an officer of our Company. There were no transactions in 2022 between us and any directors who served as Compensation Committee members for any part of 2022 that would require disclosure by us under SEC rules requiring disclosure of certain relationships and related party transactions. During 2022, none of our executive officers served as a director of another entity, one of whose executive officers served on the Compensation Committee, and none of our executive officers served as a member of the compensation committee of another entity, whose executive officers served as a member of our Board.

Employee Compensation Recoupment Policy

We have adopted the Employee Compensation Recoupment or “Clawback” Policy (the “Recoupment Policy”), which covers all our current and former employees (the “Covered Employees”). The Recoupment Policy allows the Company to cancel and/or recover severance and other separation benefits and short-term and long-term incentive awards granted, payable or paid to Covered Employees in the event of:

| • | any inaccurate financial statement – inaccurate financial statement means an inaccurate financial statement of the Company or any inaccurate calculation or determination of performance criteria with respect to the Company or a subsidiary (whether or not contained in a financial statement), regardless of whether such inaccuracy is the result of covered conduct or the subject of an accounting restatement, or |

| • | any covered conduct by any Covered Employees – covered conduct means gross negligence, intentional misconduct, fraud or embezzlement (referred to as serious misconduct), failure to comply with our Code of Ethics Policy or any other employee policy, self-dealing or other breach of the duty of loyalty, failure to comply with non-compete, non-solicit or confidentiality provisions or any other restrictive covenants contained in any employment agreements or behavior that is detrimental to the business or reputation of our Company. |

If the Compensation Committee determines that a Covered Employee was paid or awarded during a three-year lookback period more than he or she would have been paid or awarded absent the inaccurate financial statement (other than as a result of serious misconduct), then the Compensation Committee may, to the extent permitted by applicable law, seek to recover such excess compensation from short-term or long-term incentive awards. If the Compensation Committee determines that during a three-year lookback period any serious misconduct occurred (including if such serious misconduct resulted in an inaccurate financial statement), the Compensation Committee may cancel and/or recover any short-term or long-term incentive awards and any severance or other separation benefits granted, payable or paid to a Covered Employee, with no limit to the amount that it may cancel or recover.

|

2023 Proxy Statement | Corporate Governance | 21 |

CORPORATE GOVERNANCE

Governance Committee

| Members | Primary Responsibilities | |

| Charles Beard, Jr. (Chair) Mary Ann Cloyd Lori Tauber Marcus

The Board determined that each member of the Governance Committee meets the independence requirements of the NYSE Listing Standards. |

• Identifies individuals qualified to become members of the Board, consistent with criteria approved by the Board

• Develops and recommends to the Board criteria for selecting new directors

• Recommends director nominees for approval by the Board and the shareholders, and considers and recruits candidates to fill vacancies on the Board

• Reviews director candidates recommended by shareholders for election

• Assesses the contributions of incumbent directors, including in light of selection criteria and Board needs

• Advises the Board with respect to Committee membership and operations

• Oversees preparation of the CEO succession plan and reviews succession plans for directors, Committee members and Committee chairs

• Reviews with senior management our major risk exposures, as well as our risk management practices and our guidelines, policies and processes for risk assessment and risk management

• Oversees compliance with legal and regulatory requirements, including the Company’s cybersecurity policy

• Develops and recommends to the Board corporate governance guidelines

• Oversees the Company’s environmental, social and governance program |

The Nomination Process

In considering each director nominee for the Annual General Meeting, the Board and the Governance Committee evaluate such person’s background, qualifications, attributes and skills to serve as a director. The Board and the Governance Committee also evaluate each of the director’s contributions to the Board and role in the operation of the Board as a whole.

Consideration of Director Nominees. The Governance Committee considers possible candidates for nominees for directors from many sources, including management and shareholders. The Governance Committee evaluates the suitability of potential candidates nominated by shareholders in the same manner as director nominees and other candidates recommended to the Governance Committee, in accordance with the following criteria:

| • | their reputation for honesty and ethical conduct in their personal and professional activities and their strength of character and judgment; |

| • | their ability and willingness to devote sufficient time to Board duties; |

| • | their educational and industry background, as well as their business and professional achievements and experience, particularly in light of the Company’s business and its size, complexity and strategic challenges and whether they have demonstrated, by significant accomplishment in their fields, an ability to make a meaningful contribution to the Board’s oversight of the business and affairs of the Company; |

| • | their potential contribution to the diversity and culture of the Board; and |

| • | their independence from management under requirements of applicable law and listing standards. |

In connection with the selection of any new director nominee, the Governance Committee will assess the skills and experience of the Board, as a whole, and of each of the individual directors. The Governance Committee will then seek to identify those qualifications and experience sought in any new candidate in light of the criteria described above that will maintain a balance of knowledge, experience and skills on the Board and produce an effective Board. The Governance Committee has the authority to engage the services of executive search firms to assist the Governance Committee and the Board in identifying and evaluating potential director candidates. Following the identification of director candidates, such individuals will be interviewed by the Chairman and CEO and a majority of the Governance Committee members. The Governance Committee will consider the results of the interviews and will decide whether to recommend, and the Board will decide whether to approve, the candidate’s appointment as a director.

| 22 | Corporate Governance |

2023 Proxy Statement |

|

CORPORATE GOVERNANCE

While the Board does not have a formal diversity policy, as a matter of practice, the Board considers diversity in the context of the Board as a whole and takes into account, among other factors, considerations relating to ethnicity, gender, cultural diversity and the range of perspectives that the directors bring to their work.

Shareholder Nominations of Director Candidates. Our Governance Committee has adopted policies addressing the procedures by which shareholders may recommend director nominees. A shareholder desiring the Governance Committee to consider any person for nomination for election to the Board must deliver a written submission to the Governance Committee in care of the Secretary, Fresh Del Monte Produce Inc., c/o Del Monte Fresh Produce Company, 241 Sevilla Avenue, Coral Gables, Florida 33134. Such submission must include (i) the candidate’s name and contact information; (ii) a detailed resume of the candidate and a statement explaining the qualifications of the candidate that, in the view of the candidate and/or the shareholder, would make such person a suitable director and a description of the candidate’s reasons for seeking election as a director, which description must include any plans or proposals that such person or the shareholder may have that relate to, or would result in any of the actions described in Item 4 of Schedule 13D (or any successor provision) under the Exchange Act; (iii) a statement of whether the candidate meets applicable law and listing requirements pertaining to director independence; (iv) a description of all direct and indirect compensation and other material monetary agreements, arrangements and understandings during the past three years, and other material relationships, between or among the candidate, the shareholder (and/or any beneficial owner on whose behalf the recommendation is made) and its affiliates and associates, or others acting in concert therewith, on the one hand, and the candidate and his or her respective affiliates and associates, or others acting in concert therewith; (v) any information relating to the candidate, the shareholder and their respective affiliates or associates that would be required to be disclosed in a proxy solicitation for the election of directors of the Company pursuant to Regulation 14A under the Exchange Act or otherwise be required to be provided pursuant to our Second Amended and Restated Memorandum and Articles of Association; and (vi) the written consent of the candidate to serve as a director, if elected.

The submission should include an undertaking to submit to the Secretary of the Company a statement amending any of the foregoing information promptly after any material change occurs in such information as previously submitted. The Governance Committee may require additional information from the nominee to perform its evaluation of the eligibility of the nominee to serve as an independent director of the Company or that could be material to a reasonable shareholder’s understanding of the independence, or lack thereof, of such nominee. In addition to the foregoing, any nomination by a shareholder of any person for election to the Board must comply with the advance notice requirements of our Second Amended and Restated Memorandum and Articles of Association. For more information regarding the advance notice requirements, see “Shareholder Proposals and Director Nominations for 2024 Annual General Meeting” in this proxy statement.

Insider Trading Policy and Restrictions on Pledging and Hedging

Our Insider Trading Policy prohibits all directors, officers and employees from engaging in transactions in our common stock while in possession of material non-public information and restricts directors, officers and other “designated insiders” from engaging in most transactions involving our Class A common stock during periods, that we have determined, that those individuals are most likely to be aware of material, non-public information. Our Insider Trading Policy also prohibits all our directors and employees, including our executive officers, or any of their designees, family members or entities that they influence or control, from purchasing financial instruments (including prepaid variable forward contracts, equity swaps, collars, and exchange funds), or otherwise engaging in transactions, that hedge or offset, or are designed to hedge or offset, any decrease in the market value of our equity securities that were granted to the director or employee as part of their compensation or that are held, directly or indirectly, by any such persons. Furthermore our Insider Trading Policy requires that insiders structure any pledge or shares held in a margin account to ensure that the executive and any documentation regarding the arrangement are in compliance with applicable securities laws and prohibits officers from pledging any stock which is subject to our Stock Ownership Guidelines.

Code of Ethics/Conduct

Code of Conduct and Business Ethics Policy

We have adopted a Code of Conduct and Business Ethics Policy, or the Code of Conduct, which applies to all of our directors, officers, employees, agents and representatives. The Code of Conduct is designed to ensure that our business

|

2023 Proxy Statement | Corporate Governance | 23 |

CORPORATE GOVERNANCE

is conducted in a consistently legal and ethical manner, including the handling of related party transactions. Our Code of Conduct contains our Related Party Transactions Policy, which is described in “Related Party Transactions Policy ” below. Additionally, our Code of Conduct includes policies on political contributions, labor and human rights and workplace practices.

Code of Ethics Policy