formposam.htm

As filed with the Securities and Exchange Commission on July 24, 2012

Registration No. 333-144865

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 2 TO FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

eMagin Corporation

(Name of small business issuer in its charter)

|

Delaware

|

|

3679

|

|

56-1764501

|

|

(State or other Jurisdiction of

|

|

(Primary Standard Industrial

|

|

(I.R.S. Employer

|

|

Incorporation or Organization)

|

|

Classification Code Number)

|

|

Identification No.)

|

3006 Northup Way, Suite 103,

Bellevue, WA 98004

(425)-284-5200

(Address and telephone number of principal executive offices and principal place of business)

Andrew G. Sculley, Chief Executive Officer

eMagin Corporation

3006 Northup Way, Suite 103,

Bellevue, WA 98004

(425)-284-5200

(Name, address and telephone number of agent for service)

Copies to:

Richard A. Friedman, Esq.

David B. Manno, Esq.

Sichenzia Ross Friedman Ference LLP

61 Broadway, 32nd Flr.

New York, New York 10006

(212) 930-9700

(212) 930-9725 (fax)

APPROXIMATE DATE OF PROPOSED SALE TO THE PUBLIC:

From time to time after this Registration Statement becomes effective.

If any securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

Indicate by check mark whether registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| |

Large accelerated filer

|

o

|

Accelerated Filer

|

þ

|

| |

Non-accelerated filer

|

o

|

Smaller reporting company

|

o

|

Note Regarding Registration Fees:

All fees for the registration of the shares registered on this Post-Effective Amendment No. 2 were paid upon the initial filing of the previously filed registration statements covering such shares. No additional shares are registered and accordingly, no additional fees are payable.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This registration statement is filed by the registrant as a post-effective amendment on Form S-1 to update the Post- Effective Registration Statement on Form S-1 SEC file No 333-144865, as amended, which was declared effective by the Securities and Exchange Commission on December 27, 2011. The registrant is not seeking to register any additional shares pursuant to this Registration Statement.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION, DATED July 24, 2012

eMagin Corporation

11,646,723 SHARES OF

COMMON STOCK

This prospectus relates to the resale by the selling stockholders of up to 11,646,723 shares of our common stock. The selling stockholders may sell common stock from time to time in the principal market on which the stock is traded at the prevailing market price or in negotiated transactions. We will pay the expenses of registering these shares.

Our common stock is listed on the NYSE AMEX under the symbol “EMAN”. The last reported sales price per share of our common stock as reported by the NYSE AMEX July 19, 2012 was $3.07.

Investing in these securities involves significant risks. See “Risk Factors” beginning on page 8.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense. You should read this prospectus carefully before you invest.

The date of this prospectus is ___, 2012

The information in this Prospectus is not complete and may be changed. This Prospectus is included in the Registration Statement that was filed by eMagin Corporation with the Securities and Exchange Commission. The selling stockholders may not sell these securities until the registration statement becomes effective. This Prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the sale is not permitted.

The following summary highlights selected information contained in this prospectus. This summary does not contain all the information you should consider before investing in the securities. Before making an investment decision, you should read the entire prospectus carefully, including the “risk factors” section, the financial statements and the notes to the financial statements.

eMagin Corporation (“eMagin, “we,” “our,” or “us,”) is a leader in the manufacture of microdisplays using OLED (organic light emitting diode) technology. We design, develop, manufacture, and market OLED on silicon microdisplays, virtual imaging products which utilize OLED microdisplays, and related products. We also perform research in the OLED field. Our virtual imaging products integrate OLED technology with silicon chips to produce high-resolution microdisplays smaller than one-inch diagonally which, when viewed through a magnifier, create virtual images that appear comparable in size to that of a computer monitor or a large-screen television. Our products enable our original equipment manufacturer (“OEM”) customers to develop and market improved or new electronic products, especially products that are mobile and highly portable so that people have immediate access to information and may experience immersive forms of communications and entertainment.

We believe our OLED microdisplays offer a number of significant advantages over comparable liquid crystal microdisplays (LCDs) including greatly increased power efficiency, less weight, and dramatically higher contrast, with expected lower overall system costs relative to alternative microdisplay technologies. Using our active matrix OLED technology, many computer and electronic system functions can be built directly into the OLED microdisplay silicon backplane, resulting in compact, high resolution, power efficient systems. Already proven in military and commercial systems, our portfolio of OLED microdisplays deliver high-resolution, flicker-free virtual images, working effectively even in extreme temperatures and high-vibration conditions We have developed our own intellectual property and accumulated over 10 years of manufacturing know-how to create high performance OLED microdisplays.

eMagin Corporation was created through the merger of Fashion Dynamics Corporation ("FDC"), which was organized on January 23, 1996 under the laws of the State of Nevada and FED Corporation ("FED"), a developer and manufacturer of optical systems and microdisplays for use in the electronics industry. FDC had no active business operations other than to acquire an interest in a business. On March 16, 2000, FDC acquired FED. The merged company changed its name to eMagin Corporation. Following the merger, the business conducted by eMagin is the business conducted by FED prior to the merger.

We derive the majority of our revenue from sales of our OLED microdisplay products. We also generate revenue from sales of optics, microdisplays combined with optics (“microviewers”), and virtual imaging systems. In addition we earn revenue from both government and commercial development contracts that in some cases complement and support our internal research and development programs.

Our website is located at www.emagin.com. The contents of our website are not part of this Prospectus.

The Offering

Common stock offered by selling stockholders

|

|

Up to 11,646,723 shares, consisting of the following:

|

| |

|

|

| |

|

· up to 1,000,000 shares of common stock issuable upon the exercise of common stock purchase warrants at an exercise price of $1.03 per share and 663,294 shares of common stock issued upon the cashless exercise of common stock purchase warrants*;

|

| |

|

|

| |

|

· 1,000,000 shares of common stock issued upon the exercise of common stock purchase warrants at an exercise price of $0.48 per share**;

|

| |

|

|

| |

|

· 1,438,096 shares of common stock, consisting of (i) 1,428,572 shares issued upon conversion of the note (“Stillwater Note”) issued to Stillwater Holdings LLC (f/k/a Stillwater LLC) (“Stillwater”) representing $500,000 of the principal amount of the Stillwater Note and (ii) 9,524 shares issued for accrued and unpaid interest under the Stillwater Note***; and

|

| |

|

|

| |

|

· up to 7,545,333 shares of common stock issuable upon the conversion of Series B Convertible Preferred Stock.

|

| |

|

Common Stock to be outstanding after the offering

|

|

32,088,186 shares assuming the full exercise of the warrants and full conversion of Series B Convertible Preferred Stock underlying shares which are included in this prospectus.****

|

| |

|

|

|

|

|

We will not receive any proceeds from the sale of the common stock; however, we will receive proceeds from the exercise of our warrants.

|

| |

|

|

|

|

|

|

| |

|

|

|

|

On April 14, 2010, Stillwater elected to exercise 875,467 of its common stock purchase warrants on a cashless basis and received 663,294 shares of common stock.

|

|

|

On July 18, 2011, Stillwater elected to exercise its common stock purchase warrants at an exercise price of $0.48 per share and received 1,000,000 shares of common stock.

|

|

|

On July, 23 2007, Stillwater elected to convert $252,166.50 of the Stillwater Note, then outstanding, representing $250,000 of the principal amount of the Note due on July 23, 2007 and $2,166.50 of accrued and unpaid interest into shares of common stock. Stillwater received 720,476 shares of the common stock at the conversion price of $0.35. On December 22, 2008, Stillwater elected to convert the $251,166.67 of the remaining Stillwater Note representing $250,000 of the principal amount of the Note due on December 22, 2008, and $1,166.67 of accrued and unpaid interest, into shares of common stock. Stillwater received 717,620 shares of the common stock at the conversion price of $0.35.

|

|

|

The information above regarding the common stock to be outstanding after the offering is based on 23,542,853 shares of the Company’s common stock outstanding as of June 15, 2012.

|

SUMMARY CONSOLIDATED FINANCIAL DATA

The following selected consolidated financial data should be read in conjunction with our consolidated financial statements and related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

The following selected consolidated financial data should be read in conjunction with our consolidated financial statements and related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. The consolidated statements of operations data for the years ended December 31, 2011, 2010 and 2009 and the balance sheet data at December 31, 2011 and 2010 are derived from our audited financial statements which are included elsewhere in this prospectus. The consolidated statements of operations data for the years ended December 31, 2008 and 2007 and the balance sheet data at December 31, 2009, 2008 and 2007 are derived from our audited financial statements which are not included in this prospectus. The statements of operations data for the three months ended March 31, 2012 and 2011 and the balance sheet data at March 31, 2012 are derived from our unaudited condensed consolidated interim financial statements filed with the Securities and Exchange Commission on May 10, 2012 which are included elsewhere in this prospectus. The balance sheet data at March 31, 2011was derived from our unaudited condensed consolidated interim financial statements filed with the Securities and Exchange Commission on October 11, 2011 which is not included in this prospectus. The historical results are not necessarily indicative of results to be expected for future periods. The following information is presented in thousands, except per share data.

Consolidated Statements of Operations Data:

| |

|

For the Year Ended December 31,

|

|

For the Three Months

Ended March 31,

|

|

| |

|

2011

|

|

2010

|

|

|

2009

|

|

|

2008

|

|

|

2007

|

|

2012

|

|

2011

|

|

| |

|

(In thousands, except per share data)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$

|

29,181

|

|

|

$

|

30,458

|

|

|

$

|

23,822

|

|

|

$

|

18,739

|

|

|

$

|

17,554

|

|

$

|

6,137

|

|

$

|

5,441

|

|

|

Cost of goods sold

|

|

|

13,707

|

|

|

|

12,018

|

|

|

|

10,175

|

|

|

|

10,673

|

|

|

|

12,628

|

|

|

3,456

|

|

|

3,195

|

|

|

Gross profit (loss)

|

|

|

15,474

|

|

|

|

18,440

|

|

|

|

13,647

|

|

|

|

8,066

|

|

|

|

4,926

|

|

|

2,681

|

|

|

2,246

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

3,063

|

|

|

|

2,370

|

|

|

|

1,996

|

|

|

|

2,081

|

|

|

|

2,949

|

|

|

1,140

|

|

|

532

|

|

|

Selling, general and administrative

|

|

|

9,136

|

|

|

|

10,055

|

|

|

|

6,900

|

|

|

|

6,254

|

|

|

|

6,591

|

|

|

2,263

|

|

|

2,141

|

|

|

Total operating expenses

|

|

|

12,199

|

|

|

|

12,425

|

|

|

|

8,896

|

|

|

|

8,335

|

|

|

|

9,540

|

|

|

3,403

|

|

|

2,673

|

|

|

Income (loss) from operations

|

|

|

3,275

|

|

|

|

6,015

|

|

|

|

4,751

|

|

|

|

(269

|

)

|

|

|

(4,614

|

)

|

|

(722

|

)

|

|

(427

|

)

|

|

Other income (expense), net

|

|

|

2,486

|

|

|

|

(16,086

|

)

|

|

|

(6,932

|

)

|

|

|

(1,590

|

)

|

|

|

(13,874

|

)

|

|

4

|

|

|

(3,070

|

)

|

|

Net income (loss) prior to income tax provision

|

|

|

5,761

|

|

|

|

(10,071

|

)

|

|

|

(2,181

|

)

|

|

|

(1,859

|

)

|

|

|

(18,488

|

)

|

|

(718

|

)

|

|

(3,497

|

)

|

|

Income tax expense (benefit)

|

|

|

795

|

|

|

|

(8,931

|

)

|

|

|

90

|

|

|

|

—

|

|

|

|

—

|

|

|

(266

|

)

|

|

(158

|

)

|

|

Net income (loss)

|

|

$

|

4,966

|

|

|

$

|

(1,140

|

)

|

|

$

|

(2,271

|

)

|

|

$

|

(1,859

|

)

|

|

$

|

(18,488

|

)

|

$

|

(452

|

)

|

$

|

(3,339

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) per share, basic

|

|

$

|

0.17

|

|

|

$

|

(0.06

|

)

|

|

$

|

(0.14

|

)

|

|

$

|

(0.13

|

)

|

|

$

|

(1.59

|

)

|

$

|

(0.02

|

)

|

|

(0.16

|

)

|

|

Income (loss) per share, diluted

|

|

$

|

0.07

|

|

|

$

|

(0.06

|

)

|

|

$

|

(0.14

|

)

|

|

$

|

(0.13

|

)

|

|

$

|

(1.59

|

)

|

$

|

(0.02

|

)

|

|

(0.16

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares used in calculation of income (loss) per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

22,448

|

|

|

|

19,240

|

|

|

|

16,344

|

|

|

|

14,175

|

|

|

|

11,633

|

|

|

23,507

|

|

|

21,523

|

|

|

Diluted

|

|

|

25,575

|

|

|

|

19,240

|

|

|

|

16,344

|

|

|

|

14,175

|

|

|

|

11,633

|

|

|

23,507

|

|

|

21,523

|

|

Consolidated Balance Sheet Data:

(In thousands)

| |

|

December 31,

|

|

|

|

March 31,

|

| |

|

2011

|

|

|

2010

|

|

|

2009

|

|

|

2008

|

|

|

2007

|

|

|

|

2012

|

|

|

2011

|

|

Cash and cash equivalents

|

|

$

|

7,571

|

|

|

$

|

7,796

|

|

|

$

|

5,295

|

|

|

$

|

2,404

|

|

|

$

|

713

|

|

|

$

|

5,832

|

|

|

$

|

7,763

|

|

|

Working capital (deficit)

|

|

$

|

18,839

|

|

|

$

|

5,881

|

|

|

$

|

8,581

|

|

|

$

|

3,300

|

|

|

$

|

(4,708

|

)

|

|

$

|

18,624

|

|

|

$

|

6,217

|

|

|

Total assets

|

|

$

|

37,932

|

|

|

$

|

32,702

|

|

|

$

|

13,980

|

|

|

$

|

10,104

|

|

|

$

|

6,648

|

|

|

$

|

37,589

|

|

|

$

|

33,288

|

|

|

Long-term obligations

|

|

$

|

—

|

|

|

$

|

5,158

|

|

|

$

|

6,844

|

|

|

$

|

—

|

|

|

$

|

60

|

|

|

$

|

—

|

|

|

$

|

5,966

|

|

|

Total shareholders’ equity (capital deficit)

|

|

$

|

34,111

|

|

|

$

|

14,697

|

|

|

$

|

2,893

|

|

|

$

|

3,661

|

|

|

$

|

(4,170

|

)

|

|

$

|

34,437

|

|

|

$

|

14,725

|

|

You should carefully consider the following risk factors and the other information included herein as well as the information included in other reports and filings made with the SEC before investing in our common stock. The following factors, as well as other factors affecting our operating results and financial condition, could cause our actual future results and financial condition to differ materially from those projected. The trading price of our common stock could decline due to any of these risks, and you may lose part or all of your investment.

RISKS RELATED TO OUR FINANCIAL RESULTS

We have had losses in the past and may incur losses in the future.

Our accumulated deficit is approximately $187 million as of March 31, 2012. We have been EBITDA positive every quarter for 16 consecutive quarters since the second quarter of 2008. We can give no assurances that we will continue to be profitable in the future. We cannot assure investors that we will sustain profitability or that we will not incur operating losses in the future.

We may not be able to execute our business plan due to a lack of cash from operations.

We anticipate that our cash from operations will be sufficient to meet our requirements over the next twelve months. In the event that cash flow from operations is less than anticipated and we are unable to secure additional funding to cover our expenses, in order to preserve cash, we may have to reduce expenditures and effect reductions in our corporate infrastructure, either of which could have a material adverse effect on our ability to continue our current level of operations. No assurance can be given that if additional financing is necessary, that it will be available, or if available, will be on acceptable terms.

Our operating results have significant fluctuations.

In addition to the variability resulting from the short-term nature of commitments from our customers, other factors contribute to significant periodic quarterly fluctuations in results of operations. These factors include, but are not limited to, the following:

|

·

|

the receipt and timing of orders and the timing of delivery of orders;

|

|

·

|

the inability to adjust expense levels or delays in adjusting expense levels, in either case in response to lower than expected revenues or gross margins;

|

|

|

·

|

the volume of orders relative to our manufacturing capacity;

|

|

|

|

|

·

|

product introductions and market acceptance of new products or new generations of products;

|

|

|

|

·

|

changes in cost and availability of labor and components;

|

|

|

|

|

|

·

|

product mix;

|

|

|

|

|

|

·

|

variation in operating expenses; regulatory requirements and changes in duties and tariffs;

|

|

|

|

|

|

·

|

pricing and availability of competitive products and services; and

|

|

|

|

|

|

·

|

changes, whether or not anticipated, in economic conditions.

|

|

|

|

|

Accordingly, the results of any past periods should not be relied upon as an indication of our future performance.

RISKS RELATED TO MANUFACTURING

The manufacture of active matrix OLED microdisplays continues to evolve as better methods are discovered and employed and therefore we may encounter manufacturing issues or delays.

Ours is an evolving technology and we are pioneers in this active matrix OLED microdisplay manufacturing technique. As such, we cannot assure you that we will be able to produce our products in sufficient quantity and quality to maintain existing customers and attract new customers. In addition, we cannot assure you that we will not experience manufacturing problems which could result in delays in delivery of orders or product introductions.

We are dependent on a single manufacturing line.

We currently manufacture our products on a single manufacturing line. If we experience any significant disruption in the operation of our manufacturing facility or a serious failure of a critical piece of equipment, we may be unable to supply microdisplays to our customers. For this reason, some OEMs may also be reluctant to commit a broad line of products to our microdisplays without a second production facility in place. However, we try to maintain product inventory to fill the requirements under such circumstances. Interruptions in our manufacturing could be caused by manufacturing equipment problems, the introduction of new equipment into the manufacturing process or delays in the delivery of new manufacturing equipment. Lead-time for delivery, installation and testing of manufacturing equipment can be extensive. No assurance can be given that we will not lose potential sales or be unable to meet production orders due to production interruptions in our manufacturing line.

We rely on key sole source and limited source suppliers.

We depend on a number of sole source or limited source suppliers for certain raw materials, components, and services. These include circuit boards, graphic integrated circuits, passive components, materials and chemicals, and equipment support. We maintain several single-source supplier relationships, either because alternative sources are not available or because the relationship is advantageous due to performance, quality, support, delivery, capacity, or price considerations. Even where alternative sources of supply are available, qualification of the alternative suppliers and establishment of reliable supplies could result in delays and a possible loss of sales, which could be detrimental to operating results. We do not manufacture the silicon integrated circuits on which we incorporate our OLED technology. Instead, we provide the design layouts to a sole semiconductor contract manufacturer who manufactures the integrated circuits on silicon wafers. Our inability to obtain sufficient quantities of components and other materials or services on a timely basis could result in manufacturing delays, increased costs and ultimately in reduced or delayed sales or lost orders which could materially and adversely affect our operating results. Generally, we do not have long term contracts or written agreements with our source suppliers, but instead operate on the basis of short term purchase orders.

Our results of operations, financial condition, and business would be harmed if we were unable to balance customer demand and capacity.

As customer demand for our products changes, and as we enter new markets which may require higher volume mass production, we must be able to ramp up or adjust our production capacity to meet demand. We are continually taking steps to address our manufacturing capacity needs for our products. If we are not able to expand or if we increase our capacity too quickly, our prospects may be limited and our business and results of operations could be adversely impacted. If we experience delays or unforeseen costs associated with adjusting our capacity levels, we may not be able to achieve our financial targets. For some of our products, vendor lead times exceed our customers’ required delivery time causing us to order to forecast rather than order based on actual demand. Ordering raw material and building finished goods based on forecasts exposes us to numerous risks including potential inability to service customer demand in an acceptable timeframe, holding excess inventory or having unabsorbed manufacturing overhead.

Variations in our production yields impact our ability to reduce costs and could cause our margins to decline and our operating results to suffer.

All of our products are manufactured using technologies that are highly complex. The number of usable items, or yield, from our production processes may fluctuate as a result of many factors, including but not limited to the following:

|

·

|

variability in our process repeatability and control;

|

|

|

|

|

|

|

·

|

contamination of the manufacturing environment or equipment;

|

|

|

|

|

·

|

equipment failure, power outages, or variations in the manufacturing process;

|

|

|

·

|

lack of consistency and adequate quality and quantity of piece parts and other raw materials;

|

|

·

|

defects in packaging either within or without our control; and

|

|

|

|

|

|

·

|

any transitions or changes in our production process, planned or unplanned.

|

|

|

We could experience manufacturing interruptions, delays, or inefficiencies if we are unable to timely and reliably procure components from single-sourced suppliers.

We maintain several single-source supplier relationships, either because alternative sources are not available or because the relationship is advantageous due to performance, quality, support, delivery, capacity, or price considerations. If the supply of a critical single-source material or component is delayed or curtailed, we may not be able to ship the related product in desired quantities and in a timely manner. Even where alternative sources of supply are available, qualification of the alternative suppliers and establishment of reliable supplies could result in delays and a possible loss of sales, which could harm operating results.

RISKS RELATED TO OUR INTELLECTUAL PROPERTY

We may not be successful in protecting our intellectual property and proprietary rights.

We rely on a combination of patents, trade secret protection, licensing agreements and other arrangements to establish and protect our proprietary technologies. If we fail to successfully enforce our intellectual property rights, our competitive position could suffer, which could harm our operating results. Patents may not be issued for our current patent applications, third parties may challenge, invalidate or circumvent any patent issued to us, unauthorized parties could obtain and use information that we regard as proprietary despite our efforts to protect our proprietary rights, rights granted under patents issued to us may not afford us any competitive advantage, others may independently develop similar technology or design around our patents, and protection of our intellectual property rights may be limited in certain foreign countries. On April 30, 2007, the U.S. Supreme Court, in KSR International Co. vs. Teleflex, Inc., mandated a more expansive and flexible approach towards a determination as to whether a patent is obvious and invalid, which may make it more difficult for patent holders to secure or maintain existing patents. Any future infringement or other claims or prosecutions related to our intellectual property could have a material adverse effect on our business. Any such claims, with or without merit, could be time consuming to defend, result in costly litigation, divert management's attention and resources, or require us to enter into royalty or licensing agreements. Such royalty or licensing agreements, if required, may not be available on terms acceptable to us, if at all. Protection of intellectual property has historically been a large yearly expense for eMagin. For a period prior to 2008, we were not in a financial position to properly protect all of our intellectual property, and may not be in a position to properly protect our position or stay ahead of competition in new research and the protecting of the resulting intellectual property.

In addition to patent protection, we also rely on trade secrets and other non-patented proprietary information relating to our product development and manufacturing activities. We try to protect this information through appropriate efforts to maintain its secrecy, including requiring employees and third parties to sign confidentiality agreements. We cannot be sure that these efforts will be successful or that the confidentiality agreements will not be breached. We also cannot be sure that we would have adequate remedies for any breach of such agreements or other misappropriation of our trade secrets or that our trade secrets and proprietary know-how will not otherwise become known or be independently discovered by others.

RISKS RELATED TO THE MICRODISPLAY INDUSTRY

The commercial success of the microdisplay industry depends on the widespread market acceptance of microdisplay systems products.

The commercial market for microdisplays is still emerging. Our long-term success may depend on consumer acceptance of microdisplays as well as the success of the commercialization of the microdisplay market. As an OEM supplier, our customer's products must also be well accepted. At present, it is difficult to assess or predict with any assurance the potential size, timing and viability of market opportunities for our technology in this market.

The microdisplay systems business is intensely competitive.

We do business in intensely competitive markets that are characterized by rapid technological change, changes in market requirements and competition from both other suppliers and our potential OEM customers. Such markets are typically characterized by price erosion. This intense competition could result in pricing pressures, lower sales, reduced margins, and lower market share. Our ability to compete successfully will depend on a number of factors, both within and outside our control. We expect these factors to include the following:

|

·

|

our success in designing, manufacturing and delivering expected new products, including those implementing new technologies on a timely basis;

|

|

·

|

our ability to address the needs of our customers and the quality of our customer services;

|

|

|

·

|

the quality, performance, reliability, features, ease of use and pricing of our products;

|

|

|

|

·

|

successful expansion of our manufacturing capabilities;

|

|

|

|

|

|

·

|

our efficiency of production, and ability to manufacture and ship products on time;

|

|

|

|

|

·

|

the rate at which original equipment manufacturing customers incorporate our product solutions into their own products;

|

|

·

|

the market acceptance of our customers' products; and

|

|

|

|

|

|

|

|

·

|

product or technology introductions by our competitors.

|

|

|

|

|

|

Our competitive position could be damaged if one or more potential OEM customers decide to manufacture their own microdisplays, using OLED or alternate technologies. In addition, our customers may be reluctant to rely on a relatively small company such as eMagin for a critical component. We cannot assure you that we will be able to compete successfully against current and future competition, and the failure to do so would have a materially adverse effect upon our business, operating results and financial condition.

The display industry may be cyclical.

Our business strategy is dependent on OEM manufacturers building and selling products that incorporate our OLED displays as components into those products. Industry-wide fluctuations could cause significant harm to our business. The OLED microdisplay sector may experience overcapacity, if and when all of the facilities presently in the planning stage come on line, leading to a difficult market in which to sell our products.

Our competitors have many advantages over us.

As the microdisplay market develops, we expect to experience intense competition from numerous domestic and foreign companies including well-established corporations possessing worldwide manufacturing and production facilities, greater name recognition, larger retail bases and significantly greater financial, technical, and marketing resources than us, as well as from emerging companies who may be subsidized by their governments. We cannot assure you that we will be able to compete successfully against current and future competition, and the failure to do so would have a materially adverse effect upon our business, operating results and financial condition.

Our products are subject to lengthy OEM development periods.

We sell most of our microdisplays to OEMs who will incorporate them into products they sell. OEMs determine during their product development phase whether they will incorporate our products. The time elapsed between initial sampling of our products by OEMs, the custom design of our products to meet specific OEM product requirements, and the ultimate incorporation of our products into OEM consumer products is significant, often with a duration of between one and three years. If our products fail to meet our OEM customers' cost, performance or technical requirements or if unexpected technical challenges arise in the integration of our products into OEM consumer products, our operating results could be significantly and adversely affected. Long delays in achieving customer qualification and incorporation of our products could adversely affect our business.

In order to increase or maintain our profit margins we may have to continuously develop new products, product enhancements and new technologies.

In some markets, prices of established products tend to decline over time. In order to increase or maintain our profit margins over the long term, we believe that we will need to continuously develop new products, product enhancements and new technologies that will either slow price declines of our products or reduce the cost of producing and delivering our products. While we anticipate many opportunities to reduce production costs over time, there can be no assurance that these cost reduction plans will be successful, that we will have the resources to fund the expenditures necessary to implement certain cost-saving measures, or that our costs can be reduced as quickly as any reduction in unit prices. We may also attempt to offset the anticipated decrease in our average selling price by introducing new products with higher selling prices that may or may not offset price declines in more mature products. If we fail to do so, our results of operations could be materially and adversely affected.

RISKS RELATED TO OUR BUSINESS

Our success depends on attracting and retaining highly skilled and qualified technical and consulting personnel.

We must hire highly skilled technical personnel as employees and as independent contractors in order to develop our products. The competition for skilled technical employees is intense and we may not be able to retain or recruit such personnel. We must compete with companies that possess greater financial and other resources than we do, and that may be more attractive to potential employees and contractors. To be competitive, we may have to increase the compensation, bonuses, stock options and other fringe benefits offered to employees in order to attract and retain such personnel. The costs of attracting and retaining new personnel may have a materially adverse affect on our business and our operating results.

Our success depends in a large part on the continuing service of key personnel.

Changes in management could have an adverse effect on our business. We are dependent upon the active participation of several key management personnel and will also need to recruit additional management in order to expand according to our business plan. The failure to attract and retain additional management or personnel could have a material adverse effect on our operating results and financial performance.

Our operating results are substantially dependent on the development and acceptance of new products and technology innovations.

Our future success may depend on our ability to develop new and lower cost solutions for existing and new markets and for customers to accept those solutions. We must introduce new products in a timely and cost-efficient manner, and we must secure production orders for those products from our customers. The development of new products is a highly complex process, and we historically have experienced delays in completing the development and introduction of new products. Some or all of those technologies or products may not successfully make the transition from the research and development lab. Even when we successfully complete a research and development effort with respect to a particular product or technology, it may fail to gain market acceptance. The successful development and introduction of these products depends on a number of factors, including the following:

|

·

|

achievement of technology breakthroughs required to make commercially viable devices;

|

|

|

|

|

·

|

the accuracy of our predictions of market requirements;

|

|

|

|

|

|

|

|

·

|

acceptance of our new product designs;

|

|

|

|

|

|

|

|

|

|

|

·

|

acceptance of new technology in certain markets;

|

|

|

|

|

|

|

|

|

|

·

|

the availability of qualified research and development and product development personnel;

|

|

|

|

·

|

our timely completion of product designs and development;

|

|

|

|

|

|

|

·

|

our ability and available resources to expand sales;

|

|

|

|

|

|

|

|

|

·

|

our ability to develop repeatable processes to manufacture new products in sufficient quantities and at low enough costs for commercial sales;

|

|

·

|

our customers’ ability to develop competitive products incorporating our products; and

|

|

|

·

|

acceptance of our customers’ products by the market.

|

|

|

|

|

If any of these or other factors become problematic, we may not be able to develop and introduce these new products in a timely or cost-effective manner.

If government agencies or companies discontinue or curtail their funding for our research and development programs our business may suffer.

Changes in federal budget priorities could adversely affect our contract and display product revenue. Historically, government agencies have funded a significant part of our research and development activities. Our funding has the risk of being redirected to other programs when the government changes budget priorities, such as in time of war or for other reasons. Government contracts are also subject to the risk that the government agency may not appropriate and allocate all funding contemplated by the contract. In addition our government contracts generally permit the contracting authority to terminate the contract for the convenience of the government. The full value of the contracts would not be realized if they were prematurely terminated. We may be unable to incur sufficient allowable costs to generate the full estimated contract values. Furthermore, the research and development and product procurement contracts of the customers we supply may be similarly impacted. If the government funding is discontinued or reduced, our ability to develop or enhance products could be limited and our business results or operations and financial conditions could be adversely affected.

Our business depends on new products and technologies.

The market for our products is characterized by rapid changes in product, design and manufacturing process technologies. Our success depends to a large extent on our ability to develop and manufacture new products and technologies to match the varying requirements of different customers in order to establish a competitive position and become profitable. Furthermore, we must adopt our products and processes to technological changes and emerging industry standards and practices on a cost-effective and timely basis. Our failure to accomplish any of the above could harm our business and operating results.

We generally do not have long-term contracts with our customers.

Our business has primarily operated on the basis of short-term purchase orders. We receive some longer term purchase agreements, and procurement contracts, but we cannot guarantee that we will continue to do so. Our current purchase agreements can be cancelled or revised without penalty, depending on the circumstances. We plan production primarily on the basis of internally generated forecasts of demand based on communications with customers, and available industry data which makes it difficult to accurately forecast revenues. If we fail to accurately forecast operating results, our business may suffer and the value of your investment in eMagin may decline.

Our business strategy may fail if we cannot continue to form strategic relationships with companies that manufacture and use products that could incorporate our active matrix OLED technology.

Our prospects could be significantly affected by our ability to develop strategic alliances with OEMs for incorporation of our active matrix OLED microdisplay technology into their products. While we intend to continue to establish strategic relationships with manufacturers of electronic consumer products, personal computers, chipmakers, lens makers, equipment makers, material suppliers and/or systems assemblers, there is no assurance that we will be able to continue to establish and maintain strategic relationships on commercially acceptable terms, or that the alliances we do enter in to will realize their objectives. Failure to do so could have a material adverse effect on our business.

Our business depends to some extent on international transactions.

We purchase needed materials from companies located abroad and may be adversely affected by political and currency risk, as well as the additional costs of doing business with foreign entities. Some customers in other countries have longer receivable periods or warranty periods. In addition, many of the foreign OEMs that are the most likely long-term purchasers of our microdisplays expose us to additional political and currency risk. We may find it necessary to locate manufacturing facilities abroad to be closer to our customers which could expose us to various risks, including management of a multi-national organization, the complexities of complying with foreign laws and customs, political instability and the complexities of taxation in multiple jurisdictions.

Our business may expose us to product liability claims.

Our business may expose us to potential product liability claims. Although no such claims have been brought against us to date, and to our knowledge no such claim is threatened or likely, we may face liability to product users for damages resulting from the faulty design or manufacture of our products. While we plan to maintain product liability insurance coverage, there can be no assurance that product liability claims will not exceed coverage limits, fall outside the scope of such coverage, or that such insurance will continue to be available at commercially reasonable rates, if at all.

Our business is subject to environmental regulations and possible liability arising from potential employee claims of exposure to harmful substances used in the development and manufacture of our products.

We are subject to various governmental regulations related to toxic, volatile, experimental and other hazardous chemicals used in our design and manufacturing process. Our failure to comply with these regulations could result in the imposition of fines or in the suspension or cessation of our operations. Compliance with these regulations could require us to acquire costly equipment or to incur other significant expenses. We develop, evaluate and utilize new chemical compounds in the manufacture of our products. While we attempt to ensure that our employees are protected from exposure to hazardous materials, we cannot assure you that potentially harmful exposure will not occur or that we will not be liable to employees as a result.

Some of our business is subject to U.S. government procurement laws and regulations.

We must comply with certain laws and regulations relating to the formation, administration and performance of federal government contracts. These laws and regulations affect how we conduct business with our federal government contracts, including the business that we do as a subcontractor. In complying with these laws and regulations, we may incur additional costs, and non-compliance may lead to the assessment of fines and penalties, including contractual damages, or the loss of business.

Our business is subject to export laws and regulations.

We engage in international work falling under the jurisdiction of U.S. export control laws. Failure to comply with these control regimes can lead to severe penalties, both civil and criminal, and can include debarment from contracting with the U.S. government.

Current adverse economic conditions may adversely impact our business, operating results and financial condition.

The current economic conditions and market instability may affect our customers and suppliers. Any adverse financial or economic impact to our customers may impact their ability to pay timely, or result in their inability to pay. It may also impact their ability to fund future purchases, or increase the sales cycles which could lead to a reduction in revenue and accounts receivable. Our suppliers may increase their prices or may be unable to supply needed raw materials on a timely basis which could result in our inability to meet customers’ demand or affect our gross margins. Our suppliers may, also, impose more stringent payment terms on us. The timing and nature of any recovery in the credit and financial markets remains uncertain, and there can be no assurance that market conditions will improve in the near future or that our results will not be materially and adversely affected.

RISKS RELATED TO OUR STOCK

The substantial number of shares that are or will be eligible for sale could cause our common stock price to decline even if eMagin is successful.

Sales of significant amounts of common stock in the public market, or the perception that such sales may occur, could materially affect the market price of our common stock. These sales might also make it more difficult for us to sell equity or equity-related securities in the future at a time and price that we deem appropriate. As of June 15, 2012, we have outstanding common shares of 23,542,853 plus (i) options to purchase 4,857,516 shares, (ii) warrants to purchase 1,000,000 shares and (iii) convertible preferred stock to purchase 7,545,333 shares of common stock.

Changes in internal controls or accounting guidance could cause volatility in our stock price.

Guidance regarding implementation and interpretation of the provisions of Section 404 of the Sarbanes-Oxley Act continues to be issued by the standards-setting community. In July 2010, smaller reporting companies were granted permanent exemption from having to obtain an auditors’ report on management’s assertion of the effectiveness of its internal control over financial reporting. We became an accelerated filer as of December 31, 2011 and are subject to an audit of our internal controls. As a result of the ongoing interpretation of new guidance and the audit testing which may be required to be completed in the future, our internal controls over financial reporting may include an unidentified material weakness which would result in receiving an adverse opinion on our internal controls over financial reporting from our independent registered public accounting firm. This could result in significant additional expenditures responding to the Section 404 internal control audit, heightened regulatory scrutiny and potentially an adverse effect to the price of our stock.

In addition, due to increased regulatory scrutiny surrounding publicly traded companies, the possibility exists that a restatement of past financial results could be necessitated by an alternative interpretation of present accounting guidance and practice. Although management does not currently anticipate that this will occur, a potential result of such interpretation could be an adverse effect on our stock price.

The market price of our common stock may be volatile.

The market price of our common stock has been subject to wide fluctuations. Since January 1, 2012, the closing price of our stock ranged from $2.70 to $4.71. The market price of our common stock in the future is likely to continue to be subject to wide fluctuations in response to various factors, including, but not limited to, the following:

|

·

|

variations in our operating results and financial conditions;

|

|

|

|

·

|

actual or anticipated announcements of technical innovations, new product developments, or design wins by us or our competitors;

|

|

·

|

general conditions in the semiconductor and flat panel display industries; and

|

|

|

·

|

worldwide economic and financial conditions.

|

|

|

|

In addition, the public stock markets have experienced extreme price and volume fluctuations that have particularly affected the market price for many technology companies and that have often been unrelated to the operating performance of these companies. The broad market fluctuations and other factors may continue to adversely affect the market price of our common stock.

Concentration of ownership of our stock may enable one shareholder or a small number of shareholders to significantly influence matters requiring shareholder approval.

Stillwater Holdings LLC (f/k/a Stillwater LLC) currently owns approximately 31.9% of our outstanding voting stock and the sole member of Stillwater Holdings LLC is the investment manager of Rainbow Gate Corporation, which currently owns approximately 5.5% of our outstanding voting stock. Together such shareholders currently own approximately 37.4% of our outstanding voting stock. As a result, these shareholders, if they act together, may be able to exert a significant degree of influence over matters requiring shareholder approval, including the election of directors and approval of significant corporate transactions. Further, if these shareholders act together with another shareholder, Ginola Limited, which has common directors with Mount Union Corp., Chelsea Trust Company and Crestflower Corporation, they would collectively represent approximately 46.5% of our outstanding voting stock. This concentration of ownership may facilitate or hinder a change of control and might affect the market price of our common stock. Furthermore, the interests of this concentration of ownership may not always coincide with our interests or the interests of other shareholders. Nevertheless, the ability to influence the election of the Board of Directors or otherwise have influence does not modify the fiduciary duties of the Board of Directors to represent the interests of all shareholders.

We and our representatives may from time to time make written or oral statements that are “forward-looking,” including statements contained in this prospectus and other filings with the Securities and Exchange Commission, reports to our stockholders and news releases. All statements that express expectations, estimates, forecasts or projections are forward-looking statements. In addition, other written or oral statements which constitute forward-looking statements may be made by us or on our behalf. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “projects,” “forecasts,” “may,” “should,” variations of such words and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and involve risks, uncertainties, and assumptions which are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in or suggested by such forward-looking statements. Among the important factors on which such statements are based are assumptions concerning our ability to obtain additional funding, our ability to compete against our competitors, our ability to integrate our acquisitions and our ability to attract and retain key employees.

This prospectus relates to shares of our common stock that may be offered and sold from time to time by the selling stockholders. We will not receive any proceeds from the sale of shares of common stock in this offering. However, we will receive the sale price of any common stock we sell to the selling stockholders upon exercise of the warrants owned by the selling stockholders. We expect to use the proceeds received from the exercise of the warrants, if any, for general working capital purposes. We have not declared or paid any dividends and do not currently expect to do so in the near future.

During 2009 and until May 17, 2010, our common stock was quoted on the OTC Bulletin Board under the symbol "EMAN". As of May 18, 2010, our common stock trades on the NYSE Amex under the symbol “EMAN”. The following table sets forth the range of high and low prices per share of our common stock for each period indicated.

| |

|

High

|

|

|

Low

|

|

|

Fiscal 2010

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

$

|

3.90

|

|

|

$

|

1.47

|

|

|

Second Quarter

|

|

$

|

5.49

|

|

|

$

|

2.88

|

|

|

Third Quarter

|

|

$

|

3.65

|

|

|

$

|

1.91

|

|

|

Fourth Quarter

|

|

$

|

6.00

|

|

|

$

|

3.00

|

|

| |

|

|

|

|

|

|

|

|

|

Fiscal 2011

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

$

|

9.31

|

|

|

$

|

5.91

|

|

|

Second Quarter

|

|

$

|

8.94

|

|

|

$

|

4.41

|

|

|

Third Quarter

|

|

$

|

6.49

|

|

|

$

|

2.60

|

|

|

Fourth Quarter

|

|

$

|

4.94

|

|

|

$

|

2.28

|

|

| |

|

|

|

|

|

|

|

|

|

Fiscal 2012

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

$

|

4.74

|

|

|

$

|

2.93

|

|

|

Second Quarter

|

|

$

|

3.34

|

|

|

$

|

2.70

|

|

As of June 30, 2012, there were 299 holders of record of our common stock. Because brokers and other institutions hold many of the shares on behalf of shareholders, we are unable to determine the actual number of shareholders represented by these record holders.

Dividends

We have never declared or paid cash dividends on our common stock. We currently anticipate that we will retain all future earnings to fund the operation of our business and do not anticipate paying dividends on our common stock in the foreseeable future.

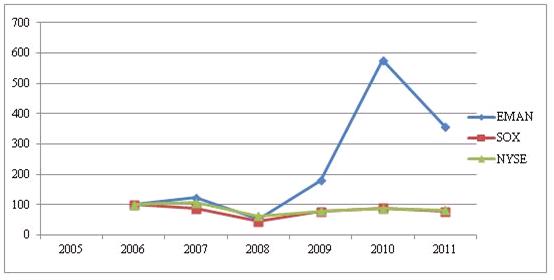

Stock Performance

The following graph shows the comparison of total stockholder return for holders of our common stock (EMAN), the New York Stock Exchange Composite Index (NYSE) and the Philadelphia Stock Exchange Semiconductor Index (SOX) from December 31, 2006 through December 31, 2011. The graph and table assume that $100 was invested on December 31, 2006 in each of our common stock, the NASDAQ Composite Index and the Philadelphia Stock Exchange Semiconductor Index and that all dividends are reinvested. The comparisons in the table are required by the SEC and are not intended to forecast or be indicative of possible future performance of the Company’s common stock.

| |

|

2006

|

|

|

2007

|

|

|

2008

|

|

|

2009

|

|

|

2010

|

|

|

2011

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMAN

|

|

$

|

100.00

|

|

|

$

|

123.08

|

|

|

$

|

51.92

|

|

|

$

|

180.77

|

|

|

$

|

576.92

|

|

|

$

|

355.77

|

|

|

NYSE

|

|

$

|

100.00

|

|

|

$

|

87.37

|

|

|

$

|

45.40

|

|

|

$

|

77.09

|

|

|

$

|

88.22

|

|

|

$

|

77.94

|

|

|

SOX

|

|

$

|

100.00

|

|

|

$

|

106.58

|

|

|

$

|

62.99

|

|

|

$

|

78.61

|

|

|

$

|

87.14

|

|

|

$

|

81.81

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity Compensation Plan Information

The following table sets forth the aggregate information of our equity compensation plans in effect as of December 31, 2011:

|

Plan

|

|

Number of

securities to be

issued upon exercise

of outstanding options

and rights

|

|

|

Weighted-average

exercise price of

outstanding options and rights

|

|

|

Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities reflected

in first column)

|

|

|

Equity compensation plans approved by security holders – 2011 Incentive Stock Plan

|

|

|

473,499

|

|

|

$

|

4.03

|

|

|

|

926,501

|

|

|

Equity compensation plans approved by security holders – Amended and Restated 2003 Employee Stock Option Plan

|

|

|

2,939,238

|

|

|

$

|

4.26

|

|

|

|

125,978

|

|

|

Equity compensation plans not approved by security holders – 2008 Incentive Stock Plan

|

|

|

829,514

|

|

|

$

|

2.70

|

|

|

|

45,500

|

|

The following selected consolidated financial data should be read in conjunction with our consolidated financial statements and related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. The consolidated statements of operations data for the years ended December 31, 2011, 2010 and 2009 and the balance sheet data at December 31, 2011, and 2010 are derived from our audited financial statements which are included elsewhere in this prospectus. The consolidated statements of operations data for the years ended December 31, 2008 and 2007 and the balance sheet data at December 31, 2009, 2008 and 2007 are derived from our audited financial statements which are not included in this prospectus. The historical results are not necessarily indicative of results to be expected for future periods. The following information is presented in thousands, except per share data.

Consolidated Statements of Operations Data:

| |

|

For the Year Ended December 31,

|

|

For the Three Months

Ended March 31,

|

|

| |

|

2011

|

|

2010

|

|

|

2009

|

|

|

2008

|

|

|

2007

|

|

2012

|

|

2011

|

|

| |

|

(In thousands, except per share data)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$

|

29,181

|

|

|

$

|

30,458

|

|

|

$

|

23,822

|

|

|

$

|

18,739

|

|

|

$

|

17,554

|

|

$

|

6,137

|

|

$

|

5,441

|

|

|

Cost of goods sold

|

|

|

13,707

|

|

|

|

12,018

|

|

|

|

10,175

|

|

|

|

10,673

|

|

|

|

12,628

|

|

|

3,456

|

|

|

3,195

|

|

|

Gross profit (loss)

|

|

|

15,474

|

|

|

|

18,440

|

|

|

|

13,647

|

|

|

|

8,066

|

|

|

|

4,926

|

|

|

2,681

|

|

|

2,246

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

3,063

|

|

|

|

2,370

|

|

|

|

1,996

|

|

|

|

2,081

|

|

|

|

2,949

|

|

|

1,140

|

|

|

532

|

|

|

Selling, general and administrative

|

|

|

9,136

|

|

|

|

10,055

|

|

|

|

6,900

|

|

|

|

6,254

|

|

|

|

6,591

|

|

|

2,263

|

|

|

2,141

|

|

|

Total operating expenses

|

|

|

12,199

|

|

|

|

12,425

|

|

|

|

8,896

|

|

|

|

8,335

|

|

|

|

9,540

|

|

|

3,403

|

|

|

2,673

|

|

|

Income (loss) from operations

|

|

|

3,275

|

|

|

|

6,015

|

|

|

|

4,751

|

|

|

|

(269

|

)

|

|

|

(4,614

|

)

|

|

(722

|

)

|

|

(427

|

)

|

|

Other income (expense), net

|

|

|

2,486

|

|

|

|

(16,086

|

)

|

|

|

(6,932

|

)

|

|

|

(1,590

|

)

|

|

|

(13,874

|

)

|

|

4

|

|

|

(3,070

|

)

|

|

Net income (loss) prior to income tax provision

|

|

|

5,761

|

|

|

|

(10,071

|

)

|

|

|

(2,181

|

)

|

|

|

(1,859

|

)

|

|

|

(18,488

|

)

|

|

(718

|

)

|

|

(3,497

|

)

|

|

Income tax expense (benefit)

|

|

|

795

|

|

|

|

(8,931

|

)

|

|

|

90

|

|

|

|

—

|

|

|

|

—

|

|

|

(266

|

)

|

|

(158

|

)

|

|

Net income (loss)

|

|

$

|

4,966

|

|

|

$

|

(1,140

|

)

|

|

$

|

(2,271

|

)

|

|

$

|

(1,859

|

)

|

|

$

|

(18,488

|

)

|

$

|

(452

|

)

|

$

|

(3,339

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) per share, basic

|

|

$

|

0.17

|

|

|

$

|

(0.06

|

)

|

|

$

|

(0.14

|

)

|

|

$

|

(0.13

|

)

|

|

$

|

(1.59

|

)

|

$

|

(0.02

|

)

|

|

(0.16

|

)

|

|

Income (loss) per share, diluted

|

|

$

|

0.07

|

|

|

$

|

(0.06

|

)

|

|

$

|

(0.14

|

)

|

|

$

|

(0.13

|

)

|

|

$

|

(1.59

|

)

|

$

|

(0.02

|

)

|

|

(0.16

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares used in calculation of income (loss) per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

22,448

|

|

|

|

19,240

|

|

|

|

16,344

|

|

|

|

14,175

|

|

|

|

11,633

|

|

|

23,507

|

|

|

21,523

|

|

|

Diluted

|

|

|

25,575

|

|

|

|

19,240

|

|

|

|

16,344

|

|

|

|

14,175

|

|

|

|

11,633

|

|

|

23,507

|

|

|

21,523

|

|

Consolidated Balance Sheet Data:

(In thousands)

| |

|

December 31,

|

|

|

|

March 31,

|

| |

|

2011

|

|

|

2010

|

|

|

2009

|

|

|

2008

|

|

|

2007

|

|

|

|

2012

|

|

|

2011

|

|

Cash and cash equivalents

|

|

$

|

7,571

|

|

|

$

|

7,796

|

|

|

$

|

5,295

|

|

|

$

|

2,404

|

|

|

$

|

713

|

|

|

$

|

5,832

|

|

|

$

|

7,763

|

|

|

Working capital (deficit)

|

|

$

|

18,839

|

|

|

$

|

5,881

|

|

|

$

|

8,581

|

|

|

$

|

3,300

|

|

|

$

|

(4,708

|

)

|

|

$

|