UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

o Preliminary Proxy Statement |

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

þ Definitive Proxy Statement |

o Definitive Additional Materials |

o Soliciting Material Pursuant to §240.14a-12 |

Remy International, Inc. |

(Name of Registrant as Specified in Its Charter) |

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

þ | No fee required. | |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

(1) | Title of each class of securities to which transaction applies: | |

(2) | Aggregate number of securities to which transaction applies: | |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

(4) | Proposed maximum aggregate value of transaction: | |

(5) | Total fee paid: | |

o | Fee paid previously with preliminary materials: | |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

(1) | Amount previously paid: | |

(2) | Form, Schedule or Registration Statement No.: | |

(3) | Filing Party: | |

(4) | Date Filed: | |

REMY INTERNATIONAL, INC.

April 30, 2015

Dear Stockholder:

On behalf of the Board of Directors, I cordially invite you to attend the 2015 Annual Meeting of Stockholders of Remy International, Inc. The meeting will be held on Wednesday, June 10, 2015 at 10:00 a.m., Eastern Time, at our principal executive offices located at 600 Corporation Drive, Pendleton, Indiana 46064. The formal Notice of Annual Meeting and Proxy Statement for this meeting follows this letter.

The Notice of Annual Meeting and Proxy Statement contain more information about the Annual Meeting, including:

• | who can vote; and |

• | the different methods you can use to vote, including the telephone, Internet and traditional paper proxy card. |

Whether or not you plan to attend the Annual Meeting, please vote by one of these outlined methods to ensure that your shares are represented and voted in accordance with your wishes.

On behalf of the Board of Directors, I thank you for your cooperation.

Sincerely, | |

| |

John J. Pittas | |

President and Chief Executive Officer | |

1

REMY INTERNATIONAL, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The 2015 Annual Meeting of Stockholders of Remy International, Inc., a Delaware corporation, will be held at 10:00 a.m., Eastern Time, on Wednesday, June 10, 2015, at our principal executive offices located at 600 Corporation Drive, Pendleton, Indiana 46064 for the following purposes:

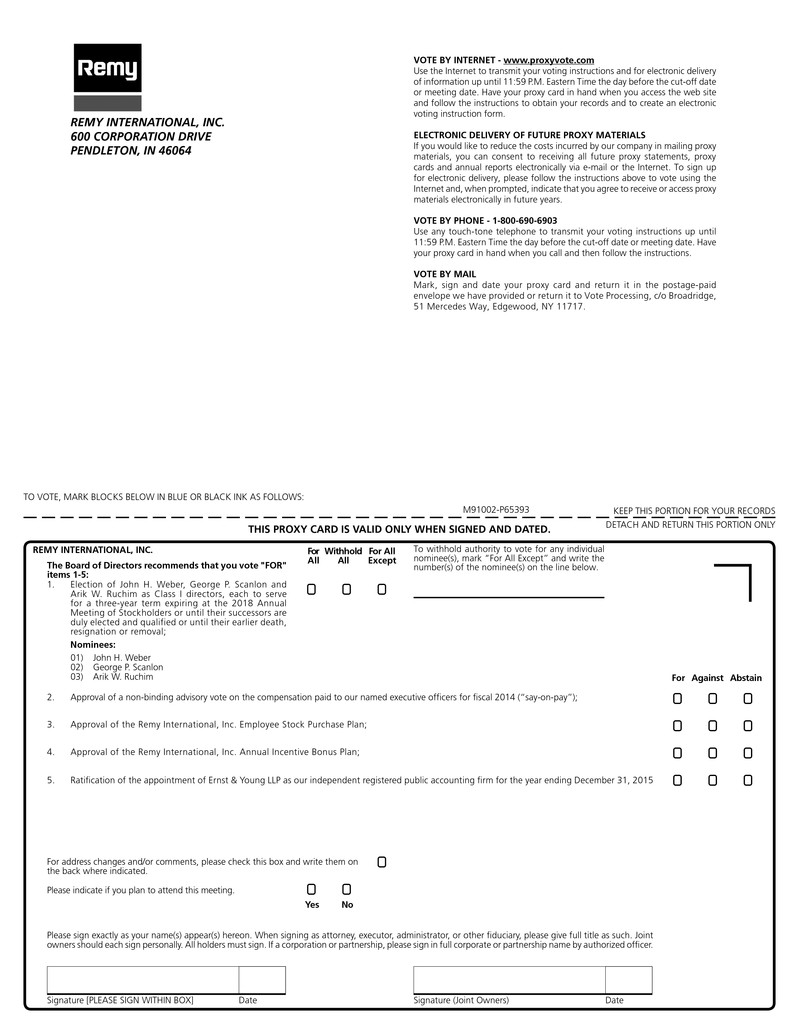

1. | To elect John H. Weber, George P. Scanlon and Arik W. Ruchim as Class I directors, each to serve for a three-year term expiring at the 2018 Annual Meeting of Stockholders or until their successors are duly elected and qualified or until their earlier death, resignation or removal; |

2. | To provide a non-binding advisory vote on the compensation paid to our named executive officers for fiscal 2014 (“say-on-pay”); |

3. | To approve the Remy International, Inc. Employee Stock Purchase Plan; |

4. | To approve the Remy International, Inc. Annual Incentive Bonus Plan; |

5. | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2015; and |

6. | To transact such other business as may properly come before the meeting or any adjournment thereof. |

The Board of Directors has set April 15, 2015 as the record date for the meeting. This means that stockholders of Remy International, Inc. common stock at the close of business on that date are entitled to receive notice of the meeting and vote at the meeting and any adjournments or postponements of the meeting.

All stockholders are cordially invited to attend the Annual Meeting and vote in person. To ensure your representation at the meeting, however, we urge you to vote by proxy as promptly as possible over the Internet or by phone as instructed in the Notice of Internet Availability of Proxy Materials. If you received paper copies of the proxy materials by mail, you can also vote by mail by following the instructions on the proxy card. You may vote in person at the meeting even if you have previously returned a proxy.

Sincerely, | |

| |

Jeremiah J. Shives | |

Vice President, Deputy General Counsel and Corporate Secretary | |

Pendleton, Indiana | |

April 30, 2015 | |

2

Table of Contents

3

REMY INTERNATIONAL, INC.

600 Corporation Drive

Pendleton, IN 46064

2015 Annual Proxy Statement

VOTING AND OTHER MATTERS

General Information About Remy International, Inc. and the Annual Meeting

Remy International, Inc., a Delaware corporation, or the "Company", "Remy", "we", "us", or "our", is a leading global vehicular parts designer, manufacturer, remanufacturer, marketer and distributor of aftermarket and original equipment electrical components for automobiles, light trucks, heavy-duty trucks and other vehicles. We sell our products worldwide primarily under the “Delco Remy”, “Remy”, “World Wide Automotive”, "Maval" and "USA Industries" brand names and our customers' widely recognized private label brand names. Our products include new and remanufactured, light-duty and heavy-duty starters and alternators for both original equipment and aftermarket applications, hybrid power technology, and multi-line products, such as constant velocity ("CV") axles, disc brake calipers, and steering gears. These products are principally sold or distributed to original equipment manufacturers (“OEMs”) for both original equipment manufacturing and aftermarket operations, as well as to warehouse distributors and retail automotive parts chains for the aftermarket. We sell our products principally in North America, Europe, South America and Asia.

The accompanying proxy is solicited on behalf of Remy by the Board of Directors, or the "Board", for use at our 2015 Annual Meeting of Stockholders to be held at 10:00 a.m. Eastern Time on Wednesday, June 10, 2015, or at any adjournment thereof, for the purposes set forth in this proxy statement and in the accompanying notice. The meeting will be held at our principal executive offices located at 600 Corporation Drive, Pendleton, Indiana 46064.

In accordance with rules adopted by the U.S. Securities and Exchange Commission, or the "SEC", that allow publicly-traded companies to furnish their proxy materials over the Internet, we are mailing a Notice of Internet Availability of Proxy Materials instead of a paper copy of this 2015 Annual Proxy Statement and our 2014 Annual Report to most of our stockholders. The Notice of Internet Availability of Proxy Materials contains instructions on how to access those documents and vote over the Internet. The Notice of Internet Availability of Proxy Materials also contains instructions on how to request a paper copy of our proxy materials, including this 2015 Annual Proxy Statement, our 2014 Annual Report, and a form of proxy card. We believe this process will allow us to provide our stockholders the information they need in a more timely manner, while reducing the environmental impact and lowering our costs of printing and delivering the proxy materials.

These proxy solicitation materials were first distributed on or about April 30, 2015 to all Remy stockholders entitled to vote at the meeting.

Why Did I Receive This Proxy Statement?

The Board is soliciting your proxy to vote at the Annual Meeting because you were a Remy stockholder at the close of business on April 15, 2015, which we refer to as the record date, and therefore you are entitled to vote at the Annual Meeting. This Annual Proxy Statement contains information about the matters to be voted on at the Annual Meeting, and the voting process, as well as information about the Company's directors and executive officers.

4

Who is Entitled to Vote?

All stockholders of record of Remy International, Inc. common stock as of the close of business on April 15, 2015 are entitled to receive notice of, and to vote at, the Annual Meeting. On the record date, 32,214,940 shares of our common stock were issued and outstanding and eligible to vote. Each holder of common stock voting at the meeting, either in person or by proxy, may cast one vote per share of common stock held on all matters to be voted on at the meeting.

If, at the close of business on April 15, 2015, your shares were registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy card or vote by proxy over the telephone or on the Internet as instructed on the enclosed proxy card to ensure your vote is counted. Even if you have submitted a proxy before the meeting, you may still attend the meeting and vote in person.

If, at the close of business on April 15, 2015, your shares were held in an account at a brokerage firm, bank, or similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the meeting. As a beneficial owner, you have the right to direct your broker, bank, or other nominee on how to vote the shares in your account. You should have received voting instructions with these proxy materials from that organization rather than from us. You should follow the instructions provided by that organization to submit your vote. You are also invited to attend the meeting in person. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you obtain a “legal proxy” from the broker, bank, or other nominee that holds your shares giving you the right to vote the shares at the meeting.

How Can I Access the Proxy Materials over the Internet?

You can view the proxy materials for the Annual Meeting on the Internet at www.proxyvote.com. Please have your 12 digit control number available, which can be found on your Notice of Internet Availability of Proxy Materials or on your proxy card or voting instruction form. Our proxy materials are also available on our website at www.remyinc.com.

What is the Purpose of the Annual Meeting?

You will be asked to consider the following proposals at the Annual Meeting:

• | Proposal No. 1 asks you to elect John H. Weber, George P. Scanlon and Arik W. Ruchim as Class I directors, each to serve for a three-year term expiring at the 2018 Annual Meeting of Stockholders or until their successors are duly elected and qualified or until their earlier death, resignation or removal. |

• | Proposal No. 2 asks you to provide a non-binding advisory vote on the compensation paid to our named executive officers for fiscal 2014 (“say-on-pay”). |

• | Proposal No. 3 asks you to approve the Remy International, Inc. Employee Stock Purchase Plan. |

• | Proposal No. 4 asks you to approve the Remy International, Inc. Annual Incentive Bonus Plan. |

• | Proposal No. 5 asks you to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2015. |

How Does the Board Recommend I Vote on These Proposals?

The Board recommends that you vote:

1. | "FOR" the election of John H. Weber, George P. Scanlon and Arik W. Ruchim as Class I directors, each to serve for a three-year term expiring at the 2018 Annual Meeting of Stockholders or until their successors are duly elected and qualified or until their earlier death, resignation or removal; |

2. | "FOR" the approval of the non-binding advisory vote on the compensation paid to our named executive officers for fiscal 2014; |

3. | "FOR" the approval of the Remy International, Inc. Employee Stock Purchase Plan; |

4. | "FOR" the approval of the Remy International, Inc. Annual Incentive Bonus Plan; and |

5

5. | "FOR" the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2015. |

How Do I Vote?

You may vote using any of the following methods:

• | In person at the Annual Meeting. All stockholders may vote in person at the Annual Meeting, even if they have previously returned a proxy, by bringing the enclosed proxy card or proof of identification, but if you are a beneficial owner (as opposed to a stockholder of record), you must obtain a legal proxy from your broker, bank or nominee and present it to the inspectors at the Annual Meeting with your ballot when you vote at the meeting; or |

• | By proxy. There are three ways to vote by proxy: |

1. | by mail, using the enclosed proxy card and return envelope; |

2. | by telephone, using the telephone number printed on the proxy card and following the instructions on the proxy card; or |

3. | by the Internet, using a unique password printed on your proxy card and following the instructions on the proxy card. |

Even if you expect to attend the Annual Meeting, please vote by proxy to assure that your shares will be represented.

What Does It Mean to Vote by Proxy?

It means that you give someone else the right to vote your shares in accordance with your instructions. In this case, we are asking you to give your proxy to John J. Pittas and Albert E. VanDenBergh, who are sometimes referred to as the “proxy holders.” By giving your proxy to the proxy holders, you assure that your vote will be counted even if you are unable to attend the Annual Meeting. If you give your proxy but do not include specific instructions on how to vote on a particular proposal described in this proxy statement, the proxy holders will vote your shares in accordance with the recommendation of the Board for such proposal.

When a proxy is properly executed and returned, the shares it represents will be voted at the meeting as directed. If no specification is indicated, the shares will be voted:

• | “FOR” John H. Weber, George P. Scanlon and Arik W. Ruchim as Class I directors, each to serve for a three-year term expiring at the 2018 Annual Meeting of Stockholders or until their successors are duly elected and qualified or until their earlier death, resignation or removal; |

• | “FOR” the non-binding approval of the compensation paid to our named executive officers for fiscal 2014; |

• | “FOR” the approval of the Remy International, Inc. Employee Stock Purchase Plan; |

• | “FOR” the approval of the Remy International, Inc. Annual Incentive Bonus Plan; |

• | “FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2015; and |

• | as the proxy holders deem advisable on such other matters as may properly come before the meeting. |

How Many Votes Must Each Proposal Receive to be Adopted?

The following must be received:

• | For Proposal No. 1 regarding the election of director nominees, a plurality of votes of the common stock entitled to vote in person or represented by proxy is required to elect a director. This means that the three people receiving the largest number of votes cast by the shares entitled to vote at the Annual Meeting will be elected as directors. Abstentions and broker non-votes, as discussed below, will have no effect. |

• | For Proposal No. 2 regarding a non-binding advisory vote on the compensation of our named executive officers for fiscal 2014, the affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote would be required for approval. Even though your vote is advisory and therefore will not be binding on the Company, the Board will review the voting result and take it into consideration when making future decisions regarding the compensation |

6

paid to our named executive officers. Abstentions will have the effect of a vote against this proposal and broker non-votes will have no effect.

• | For Proposal No. 3 regarding the approval of the Remy International, Inc. Employee Stock Purchase Plan, the affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote would be required for approval. Abstentions will have the effect of a vote against this proposal. Because this proposal does not involve election of directors or executive compensation, under the rules of the NASDAQ Stock Market, brokers, banks, or other nominees may vote in their discretion on this proposal on behalf of beneficial owners who have not furnished voting instructions. |

• | For Proposal No. 4 regarding the approval of the Remy International, Inc. Annual Incentive Bonus Plan, the affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote would be required for approval. Abstentions will have the effect of a vote against this proposal and broker non-votes will have no effect. |

• | For Proposal No. 5 regarding the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2015, the affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote would be required for approval. Abstentions will have the effect of a vote against this proposal. Because this proposal does not involve election directors or executive compensation, under the rules of the NASDAQ Stock Market, brokers, banks, or other nominees may vote in their discretion on this proposal on behalf of beneficial owners who have not furnished voting instructions. |

What Constitutes a Quorum?

A quorum is present if a majority of the outstanding shares of common stock entitled to vote at the Annual Meeting are present in person or represented by proxy. Broker non-votes and abstentions will be counted for purposes of determining whether a quorum is present.

What Happens if Other Matters are Raised at the Meeting?

Although we are not aware of any matters to be presented at the Annual Meeting other than those contained in the Notice of Annual Meeting, if other matters are properly raised at the Annual Meeting in accordance with the procedures specified in our Amended and Restated Certificate of Incorporation, as currently in effect, and Amended and Restated Bylaws, all proxies given to the proxy holders will be voted in accordance with their business judgment.

Who Will Count the Votes?

Broadridge Investor Communications Services will serve as proxy tabulator and count the votes, and the results will be certified by the inspector of election.

What are Broker Non-Votes and Abstentions? If I Do Not Vote, Will My Broker Vote For Me?

Brokers, banks, or other nominees that hold shares of common stock in “street name” for a beneficial owner of those shares typically have the authority to vote at their discretion if permitted by the stock exchange or other organization of which they are members. Brokers, banks, and other nominees are generally permitted to vote the beneficial owner's proxy at their own discretion when they have not received instructions from the beneficial owner except for the election of directors or executive compensation. If a broker, bank, or other nominee votes such uninstructed shares for or against a proposal, those shares will be counted towards determining whether or not a quorum is present. However, under the rules of the NASDAQ Stock Market where a proposal involves the election of directors or executive compensation, a broker, bank, or other nominee is not permitted to exercise its voting discretion on that proposal without specific instructions from the beneficial owner. These non-voted shares are referred to as “broker non-votes” when the nominee has voted on other non-routine matters with authorization or voted on routine matters. These shares will be counted towards determining whether or not a quorum is present, but will not be considered entitled to vote on the proposals and therefore will have the effect of a “no” vote.

Since Proposal No. 1 involves the election of directors and Proposal No. 2 involves executive compensation, nominees cannot vote unless they receive voting instructions from beneficial owners. With respect to Proposal No. 1, abstentions or directions to withhold authority will not be included in vote totals but will not affect the outcome of the vote since under Delaware law directors are elected by a plurality of the votes cast. With respect to Proposal No. 2, abstentions and broker non-votes will have the effect of a vote against such proposal, since Delaware law requires that a proposal receive the affirmative vote of a majority of the shares present or represented by proxy and entitled to vote. Please be sure to give specific voting instructions to your nominee, so that your vote can be counted.

7

Please note that brokers, banks, and other nominees may not use discretionary authority to vote shares on the election of directors or the say-on-pay proposal if they have not received specific instructions from their clients. For your vote to be counted on those proposals, you will need to communicate your voting decisions to your broker, bank, or other nominee before the date of the meeting.

May I Revoke My Proxy?

Any stockholder giving a proxy may revoke the proxy at any time before its use by furnishing to us either a written notice of revocation or a duly executed proxy bearing a later date, or by attending the meeting and voting in person. Attendance at the meeting will not cause your previously granted proxy to be revoked unless you specifically so request.

Who Pays the Cost of Soliciting Proxies?

We pay the cost of the solicitation of proxies, including preparing and mailing the Notice of Annual Meeting of Stockholders, this Annual Proxy Statement and the proxy card. Following the mailing of this Annual Proxy Statement, directors, officers and employees of the Company may solicit proxies by telephone, facsimile transmission or other personal contact. Such persons will receive no additional compensation for such services. Brokerage houses and other nominees, fiduciaries and custodians who are stockholders of record of our common stock will be requested to forward proxy soliciting material to the beneficial owners of such shares and will be reimbursed by the Company for their charges and expenses in connection therewith at customary and reasonable rates.

We have engaged Georgeson Inc. ("Georgeson") to assist us in the solicitation of proxies. We have agreed to pay Georgeson a fee of $7,500 plus out-of-pocket expenses. Since this is our first annual meeting since the indirect distribution of shares of common stock of our predecessor that were held by Fidelity National Financial, Inc. ("FNF") to the holders of its Fidelity National Financial Ventures Group common stock, a tracking stock, and the conversion of those shares into shares of our common stock (the "Spin-off Transaction"), we engaged a proxy solicitor to help ensure a quorum for the Annual Meeting. Prior to the Spin-off Transaction, FNF held approximately 51% of our predecessor’s common stock.

8

CERTAIN INFORMATION ABOUT OUR DIRECTORS

Effective February 3, 2015, the Board, upon recommendation from its Nominating and Corporate Governance Committee, appointed John H. Weber, an existing director, to serve as Chairman of the Board and appointed Karl G. Glassman and Charles G. McClure to serve as directors on the Board. Mr. Glassman was designated as a Class II member of the Board to serve an initial term to expire at the Company's 2016 Annual Meeting of Stockholders or until his successor is duly elected and qualified or until his earlier death, resignation or removal. Mr. McClure was designated as a Class III member of the Board to serve an initial term to expire at the Company's 2017 Annual Meeting of Stockholders or until his successor is duly elected and qualified or until his earlier death, resignation or removal.

Also on February 3, 2015, the Board confirmed the members of the Board as follows:

Director | Class With Term Expiring | |

John H. Weber (Board Chairman) | 2015 (Class I) | |

George P. Scanlon | 2015 (Class I) | |

Lawrence F. Hagenbuch | 2016 (Class II) | |

J. Norman Stout | 2016 (Class II) | |

Karl G. Glassman | 2016 (Class II) | |

Douglas K. Ammerman | 2017 (Class III) | |

John J. Pittas | 2017 (Class III) | |

Charles G. McClure | 2017 (Class III) | |

Also on February 3, 2015, we entered into a Support Agreement by and among H Partners Management, LLC, H Partners, LP, H Partners Capital, LLC, P H Partners Ltd., H Offshore Fund Ltd., Rehan Jeffer, and Arik Ruchim (collectively, "H Partners Group"). The H Partners Group is our largest shareholder. Pursuant to the Support Agreement, the Board has nominated Arik Ruchim, a senior executive of the H Partners Group for election to the Board upon approval by Remy stockholders at the 2015 Annual Meeting. Mr. Ruchim's biography and qualifications to join our Board are listed below.

William P. Foley, Brent B. Bickett and Alan L. Stinson, who previously served as directors, each resigned from the Board effective December 31, 2014 following the completion of the Spin-off Transaction. Compensation paid to these directors in 2014 is listed below under "Compensation Discussion and Analysis- Executive and Director Compensation- Director Compensation".

Information About the Nominees for Election

The names of the nominees for election at the Annual Meeting as Class I directors of the Company and certain biographical information concerning each of them is set forth below. Expiration terms of nominees for election at the Annual Meeting are given assuming the nominees are elected.

Nominees for Class I Directors - Term Expiring 2018

Name | Positions held | Age(1) | Director since |

John H. Weber | Director, Chairman of the Board and Chairman of the Compensation Committee | 59 | 2006 |

George P. Scanlon | Director | 57 | 2012 |

Arik W. Ruchim | 35 | — | |

(1) As of April 30, 2015

John H. Weber. Mr. Weber has served on our Board of Directors since January 2006 and as Chairman of the Board and Chairman of the Compensation Committee since February 3, 2015. He served as Chief Executive Officer of VIA Motors from November 2013 to October 2014. Prior to that, Mr. Weber served as our Chief Executive Officer and President from 2006 to February 2013. Prior to joining us, Mr. Weber served as President, Chief Executive Officer and Director of EaglePicher Incorporated from July 2001 to 2005. Prior to that, he had executive positions with GE, Allied Signal, McKinsey, Honeywell, Vickers and Shell. Mr. Weber also serves on the Board of Directors of Enphase Energy, Inc., since June 2013, and is Chairman of its Compensation Committee and a member of its Audit Committee. Mr. Weber holds a Master of Business Administration from Harvard University and a Bachelor of Applied Science in mechanical engineering from the University of Toronto. Mr. Weber provides our Board of

9

Directors with more than seven years of experience as our President and Chief Executive Officer; intimate knowledge and experience with all aspects of the business, operations, opportunities, and challenges of our company; and a good understanding of our culture, personnel, and strategies.

George P. Scanlon. Mr. Scanlon has served on our Board of Directors since October 18, 2012 and served as a member of the Nominating and Corporate Governance Committee from October 2012 to December 2014. Mr. Scanlon currently is a consultant and private investor. Mr. Scanlon has been a director of Cyndx Holdco, LLC, a technology company that operates an open digital network where growth companies can connect with capital providers and C-suite executives, since January 1, 2015. Previously, he served as Chief Executive Officer of FNF from October 2010 to December 2013. Prior to that, Mr. Scanlon served in various senior executive roles with FNF and its affiliates from February 2008 to October 2010 including Chief Operating Officer of FNF, Chief Financial Officer of FIS, and Corporate Executive Vice President, Finance of FIS. Prior to joining FIS, Mr. Scanlon served as Executive Vice President and Chief Financial Officer of Woodbridge Holdings Corporation (formerly known as Levitt Corporation) since August 2004 and Executive Vice President and Chief Financial Officer of BFC Financial Corporation since April 2007. On November 9, 2007, Levitt and Sons LLC, a wholly-owned subsidiary of Levitt Corporation, of which Mr. Scanlon was also an executive officer, voluntarily commenced a case under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court, Southern District of Florida. Prior to joining Levitt, Mr. Scanlon was the Chief Financial Officer of Datacore Software Corporation, an independent software vendor, from December 2001 to August 2004. Prior to joining Datacore, Mr. Scanlon was the Chief Financial Officer at Seisint, Inc., a technology company specializing in providing data search and processing products, from November 2000 to September 2001. Prior to that, Mr. Scanlon worked at Ryder System, Inc. from 1982 to 2000, most recently as Senior Vice President of Planning and Controller. In such capacity, he was responsible for accounting and financial reporting, as well as corporate planning, portfolio analysis and development. During his 18 year tenure at Ryder, Mr. Scanlon held various key financial and corporate finance positions, and was intimately involved in the company's strategic acquisition and divestiture activities. Mr. Scanlon's qualifications bring to our Board of Directors significant expertise in various senior management positions and managing large public companies and will benefit us as we continue to develop and implement our strategic initiatives.

Arik W. Ruchim. Mr. Ruchim is a Partner at H Partners Management, LLC, an investment management firm. Prior to joining H Partners in 2008, Mr. Ruchim worked at Creative Artists Agency and Cruise-Wagner Productions. Mr. Ruchim served as a Director of Dick Clark Productions from May 2010 until the company was sold in September 2012. He currently serves as a member of the University of Michigan's Victors for Michigan Tri-State Campaign Leadership Council, a group dedicated to enhancing the educational opportunities for undergraduate and graduate students. Mr. Ruchim has a B.A. in Business Administration with Distinction from the University of Michigan. Mr. Ruchim brings to our Board of Directors a track record of improved shareholder value at companies where has served as a director and experience in designing management incentive plans that lead to improved operating performance and increased shareholder value.

Information About our Directors Continuing in Office

The names of the incumbent directors of the Company who are not up for election at the annual meeting and certain biographical information concerning each of them are set forth below. Expiration terms of the incumbent directors are also provided.

Incumbent Class II Directors - Term Expiring 2016

Name | Positions held | Age(1) | Director since |

Lawrence F. Hagenbuch | Director and Member of the Compensation Committee and Audit Committee | 48 | 2008 |

J. Norman Stout | Director, Chairman of the Nominating and Corporate Governance Committee and Member of the Audit Committee and Compensation Committee | 57 | 2007 |

Karl G. Glassman | Director and Member of Nominating and Corporate Governance Committee | 56 | 2015 |

(1) As of April 30, 2015

Lawrence F. Hagenbuch. Mr. Hagenbuch has served on our Board of Directors since November 18, 2008 and currently serves as a member of the Audit Committee since November 1, 2013 and member of the Compensation Committee. Mr. Hagenbuch is currently the Chief Operating Officer for J. Hilburn, Inc. Mr. Hagenbuch has served in senior management positions for SunTx Capital Partners, AlixPartners, GE / GE Capital, and American National Can. Mr. Hagenbuch has extensive experience in supply chain, operational and profitability improvements, and through his background as a consultant and in senior management roles at various companies, he brings to our Board of Directors considerable experience in implementing lean manufacturing discipline and in creating innovative business and marketing strategies.

10

J. Norman Stout. Mr. Stout has served on our Board of Directors since December 7, 2007, and currently serves as Chairman of the Nominating and Corporate Governance since February 2015 and as a member of the Audit Committee and Compensation Committee. Mr. Stout served as Chairman of the Compensation Committee from May 2011 to December 2014. Since November 2011, Mr. Stout has served as an investment professional with True North Venture Partners. In January 2015, Mr. Stout became an executive of Desert Island Restaurants, LLC, an owner and operator of full service restaurants. From August 2010 to March 2014, Mr. Stout served as a director and Chairman of the Board of Directors of EF Johnson Technologies, Inc., and he served as interim Chief Executive Officer from August 2010 to November 2010. He previously served as Executive Chairman of Hypercom Corporation from December 2007 until August 2009 and Chairman until the company was sold in August 2011. Mr. Stout served as Chief Executive Officer of Mitel USA from August 2007 through June 2008. He previously served as Chief Executive Officer of Inter-Tel from February 2006 through August 2007 when Inter-Tel was acquired by Mitel USA. Mr. Stout had been with Inter-Tel since June 1998, and had served as Chief Strategy Officer and Chief Administrative Officer prior to becoming Chief Executive Officer. Mr. Stout's qualifications bring to our Board of Directors over 25 years of experience in senior management positions concentrating on strategic business growth and maximizing profitability.

Karl G. Glassman. Mr. Glassman was appointed to our Board of Directors on February 3, 2015 and currently serves as a member of the Nominating and Corporate Governance Committee. He was appointed President of Leggett & Platt, Incorporated in 2013 and has served as Chief Operating Officer since 2006. He previously served as Executive Vice President from 2002 to 2013, President of the Residential Furnishings Segment from 1999 to 2006, Senior Vice President from 1999 to 2002, and in various capacities since 1982. He has also served as a management director of Leggett & Platt since 2002. Mr. Glassman also serves on the board of directors of the National Association of Manufacturers. Mr. Glassman holds a B.A. degree in Business Management and Finance from California State University–Long Beach. Mr. Glassman brings valuable manufacturing experience and a global perspective to our Board of Directors having held senior executive positions with a diversified manufacturer like Leggett & Platt and serving on the Board of Directors of the National Association of Manufacturers (NAM).

Incumbent Class I Directors - Term Expiring 2017

Name | Positions held | Age(1) | Director since |

Douglas K. Ammerman | Director and Chairman of the Audit Committee | 63 | 2013 |

John J. Pittas | Director, President and Chief Executive Officer | 60 | 2014 |

Charles G. McClure | Director and Member of Nominating and Corporate Governance Committee | 61 | 2015 |

(1) As of April 30, 2015

Douglas K. Ammerman. Mr. Ammerman has served on our Board of Directors since January 31, 2013, and currently serves as Chairman of the Audit Committee since November 1, 2013. Mr. Ammerman's business career includes almost three decades of service with KPMG LLP until his retirement in 2002. Since 2005, Mr. Ammerman has served as a member of the Board of Directors of FNF, where he also serves as Chairman of the Audit Committee. He is a member of the Board of Stantec Inc. and serves on the Audit and Risk Committee. He also is a member of the Boards of El Pollo Loco, Inc. and William Lyon Homes, Inc., both of which he serves as Chairman of the Audit Committee. From 2005 through March 2012, Mr. Ammerman served as a member of the Board of Directors of Quiksilver, Inc., where he served as Chairman of the Audit Committee and a member of both the Compensation and Nominating and Corporate Governance committees. Mr. Ammerman's qualifications, including 18 years as a partner with KPMG LLP, and experience on the board of directors of other companies provide our Board of Directors with operational, financial, accounting and strategic planning expertise.

John J. Pittas. Mr. Pittas was appointed to our Board of Directors in December 2014. He joined Remy in August 2006 and held various senior management positions before being appointed to his current position as our President and Chief Executive Officer in March 2013. Mr. Pittas has over 37 years of experience. Before joining Remy, Mr. Pittas served as President of the Wolverine Gasket business for Eagle Picher Industries. Prior affiliations include Honeywell, Fisher Controls, ARI Technologies and UOP Inc. Mr. Pittas holds a B.S. degree in Chemical Engineering from the University of Notre Dame. Mr. Pittas also serves as a member of the Board of Directors of the National Association of Manufacturers (NAM), as a member of the Board of Directors of the Motor & Equipment Manufacturers Association (MEMA), and as a member of the Board of Trustees' Executive Committee of the Manufacturers Alliance for Productivity and Innovation (MAPI). Mr. Pittas' qualifications provides our Board of Directors with more than nine years of experience as a member of our senior management team, currently as our President and Chief Executive Officer; intimate knowledge and experience with all aspects of the business, operations, opportunities, and challenges of our company; and a good understanding of our culture, personnel, and strategies.

11

Charles G. McClure. Mr. McClure was appointed to our Board of Directors on February 3, 2015 and currently serves as a member of the Nominating and Corporate Governance Committee. He is co-founder of Michigan Capital Partners, LP, a private equity fund that aids small to mid-sized suppliers in Michigan. He is also a member of the board of directors of DTE Energy Company since 2012. He previously served as the Chairman of the Board, Chief Executive Officer and President of Meritor, Inc. from 2004 through May 2013. Prior to this position, he served as Chief Executive Officer, President and a member of the board of directors of Federal-Mogul Corp. He joined Federal-Mogul in 2001 as President, Chief Operating Officer and a member of the board of directors. He also served as President, Chief Executive Officer and a member of the board of directors of Detroit Diesel. Prior to that, Mr. McClure held a variety of management roles of increasing responsibility with Johnson Controls, Hoover Universal and Ford Motor Company. From 1975 to 1979, Mr. McClure served as an officer on a U.S. Navy destroyer. He is also a director of Penske Corporation, the Detroit Regional Chamber of Commerce, Invest Detroit, Cornell University Council and a director, member or trustee of many community and professional organizations. He is a past director of R. L. Polk and Company, the National Association of Manufacturers, Business Leaders for Michigan and The Business Roundtable. Mr. McClure holds a B.S. in Mechanical Engineering from Cornell University and an MBA from the University of Michigan. Mr. McClure brings strong, global knowledge of the automotive industry having previously held board and senior executive positions with Meritor, Inc., Federal-Mogul and Detroit Diesel.

12

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws provide that the number of directors shall be fixed from time to time by resolution of our Board of Directors. Presently, the number of directors is fixed at nine, and that number of directors is divided into three classes, with one class standing for election each year for a three-year term. The Board of Directors has nominated John H. Weber, George P. Scanlon and Arik W. Ruchim for election as Class I directors for a three-year term expiring at the 2018 Annual Meeting of Stockholders or until their respective successors have been elected and qualified or until their earlier death, resignation or removal.

Unless otherwise instructed, the proxy holders will vote the proxies received by them for each of the nominees named above. Messrs. Weber and Scanlon are existing directors, and Mr. Ruchim is being nominated as a director for the first time. In the event that any nominee is unable or declines to serve as a director at the time of the meeting, the proxies will be voted for any nominee designated by the current Board of Directors to fill the vacancy. It is not expected that the nominees will be unable or will decline to serve as directors.

OUR BOARD OF DIRECTORS RECOMMENDS STOCKHOLDERS VOTE “FOR” THE ELECTION OF EACH OF THE LISTED NOMINEES.

13

PROPOSAL NO. 2

ADVISORY VOTE ON EXECUTIVE COMPENSATION (“SAY-ON-PAY”)

In accordance with Section 14A of the Securities Exchange Act of 1934 and Rule 14a-21(a) promulgated thereunder, we are asking our stockholders to provide, in a non-binding advisory vote, a vote on the compensation of our named executive officers as disclosed in this proxy statement pursuant to Item 402 of Regulation S-K. This advisory vote on executive compensation is commonly referred to as a “say-on-pay" vote.

Summary

We currently hold our say-on-pay vote every year. During our 2014 annual meeting, our “say-on-pay” proposal was approved with 99% of the votes cast. As discussed in the “Compensation Discussion and Analysis and Executive and Director Compensation” section of this proxy statement, the Board and the Compensation Committee of the Board (which we refer to as the Compensation Committee) believe that our current executive compensation programs directly link the compensation of our named executive officers to our financial performance and aligns the interests of our named executive officers with those of our stockholders. Our compensation philosophy is described in detail in the “Compensation Discussion and Analysis and Executive and Director Compensation” section of this proxy statement.

Accordingly, we ask our stockholders to vote on the following resolution at the Annual Meeting:

“RESOLVED, that the Company's stockholders approve, on a non-binding, advisory basis, the compensation of the named executive officers, as disclosed in the Company's Proxy Statement for the 2015 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis and Executive and Director Compensation section of the 2015 proxy statement, the 2014 Summary Compensation Table and the other related tables and disclosure.”

The vote on this resolution is not intended to address any specific element of compensation; rather, the vote relates to the compensation of our named executive officers, as described in this proxy statement in accordance with the compensation disclosure rules of the SEC. Approval of this resolution requires the affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote. However, as this is an advisory vote, the results will not be binding on the Company, the Board of Directors or the Compensation Committee, and will not require us to take any action. The final decision on the compensation of our named executive officers remains with our Compensation Committee and the Board of Directors, although the Compensation Committee and the Board of Directors will consider the outcome of this vote when making compensation decisions.

OUR BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” ADOPTION OF THE ABOVE RESOLUTION APPROVING, ON AN ADVISORY BASIS, THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS FOR THE YEAR ENDED DECEMBER 31, 2014, AS DESCRIBED IN THE COMPENSATION DISCUSSION AND ANALYSIS AND EXECUTIVE AND DIRECTOR COMPENSATION SECTION AND THE RELATED TABULAR AND NARRATIVE DISCLOSURE SET FORTH IN THIS PROXY STATEMENT.

14

PROPOSAL NO. 3

APPROVAL OF THE REMY INTERNATIONAL, INC.

EMPLOYEE STOCK PURCHASE PLAN

On April 29, 2015, the Board of Directors, upon the recommendation of the Compensation Committee, approved the 2015 Non-Qualified Employee Stock Purchase Plan (the “ESPP”). The ESPP is intended to provide employees with the opportunity to purchase our common shares, par value $0.0001, at a discount from the market value of our common shares at the time of purchase.

The Company’s stockholders are being asked to approve the ESPP and the Board's reservation of 600,000 shares of our common stock for issuance under the ESPP (representing approximately 1.9% of our outstanding coming stock as of April 15, 2015). The principal features of the ESPP are summarized below. The following summary of the ESPP does not purport to be a complete description of all of the provisions of the ESPP and is qualified in its entirety by reference to the full text of the ESPP, which is annexed to this Proxy Statement as Annex A.

Summary of the ESPP

General. The purpose of the ESPP is to provide an incentive for eligible employees of the Company and its designated subsidiaries (together, “participating companies”) to acquire or increase a proprietary interest in the Company through the purchase of common shares of the Company. We believe this plan will help us retain employees and align the interests of our employees with those of our stockholders.

The aggregate number of shares that may be issued under the ESPP is six hundred thousand shares (600,000) subject to adjustment under certain circumstances as described below, for issuance to employees. It will be administered by an Administrative Committee appointed by the Compensation Committee. It is governed by Delaware law to the extent not governed by the Internal Revenue Code (the "Code"), and all questions of interpretation or application of the ESPP are determined by the Committee.

Subject to shareholder approval, the ESPP will be effective subsequent to the Company filing a Registration Statement under the Securities Act of 1933, as amended, covering the shares of common stock to be issued under the ESPP which is expected to occur for the Purchase Period to begin no sooner than January 1, 2016.

Eligibility. Employees (including officers and employee directors) of the Company and its subsidiaries designated from time to time by the Administrative Committee are eligible to participate in the ESPP, subject to certain limitations imposed by applicable local law and the plan itself. For example, an employee who owns directly or indirectly 5% or more of the total voting power or value of all classes of stock of the Company or our subsidiaries may not participate in the ESPP. Non-employee directors are not eligible to participate in the ESPP.

Participation in an Offering. Eligible employees become participants in the ESPP by enrolling in the manner prescribed by the Administrative Committee. Each participating employee must authorize contributions pursuant to the ESPP, which will generally be collected through payroll deductions. Such payroll deductions may be any whole percentage that is not less than 1% or more than 25% of a participant's eligible compensation.

Eligible compensation means an employee’s regular straight-time earnings or base salary, determined before giving effect to any elective salary reduction or deferral agreements and including vacation, sick time and short-term disability pay, but excluding overtime, incentive compensation, bonuses, special payments, commissions, severance pay, long-term disability pay, geographical coefficients, shift differential and any other items of compensation. If local law requires an inclusion of a broader range of compensation or the above exclusions are prohibited, the local law requirements shall apply.

Common stock is purchased under the ESPP on the last trading day of each purchase period, which we refer to as a “purchase date,” unless the participant becomes ineligible, withdraws or terminates employment earlier. During a purchase period, a participant may elect to change the rate of or to stop deductions from his or her compensation by instructing the Administrative Committee to reduce or increase contributions during a purchase period at a time and in a manner prescribed by the Administrative Committee. Such instructions will not be effective until the next purchase period. The Administrative Committee may, in its discretion, limit the number of contribution rate changes during a purchase period.

Each eligible employee is automatically granted an option to purchase shares under the ESPP. The option expires at the end of the purchase period and is generally exercised at the end of each purchase period to the extent of the contributions accumulated during such purchase period. The number of shares that may be purchased by an employee in any purchase period may not exceed the number determined by the Administrative Committee before the respective effective date. In addition, no participant will be permitted to contribute more than twenty-five thousand dollars ($25,000) for each calendar year in to purchase shares.

15

Purchase Price. The purchase price at which each share may be acquired in a purchase period upon the exercise of all or any portion of a purchase right will be established by the Administrative Committee. However, the purchase price on each purchase date will not be less than eighty-five percent (85%) of the fair market value of a share on the purchase date. Unless otherwise provided by the Administrative Committee, the purchase price for each purchase period will be eighty-five percent (85%) of the fair market value of a share of common stock on the purchase date.

Nontransferability of Purchase Rights. A purchase right granted under the ESPP may not be transferred by a participant and may be exercised only by such participant during the participant’s lifetime.

Termination of Employment; Cessation of Participation. Termination of a participant’s employment for any reason, cancels his or her option to purchase and terminates his or her participation in the ESPP immediately. In such event, the payroll deductions credited to the participant’s account will be returned to him or her or, in the case of death, to his or her estate or beneficiary. If a participant discontinues his or her payroll deduction or ceases to be eligible to participate in the ESPP (but remains an employee), all payroll deductions during the pending Purchase Period will be applied to purchase shares at the end of the Purchase Period, and the employee must re-enroll in the ESPP to participate in future Purchase Periods.

Adjustments. Whenever any change is made in the common shares of the Company, by reason of a stock dividend or by reason of subdivision, stock split, reverse stock split, recapitalization, reorganization, combination, reclassification of shares or other similar change, appropriate action will be taken to adjust any or all of (a) the number and type of shares subject to the ESPP, (b) the number and type of shares subject to outstanding purchase rights and (c) the purchase price with respect to any of the foregoing as shall be equitable to prevent dilution or enlargement of such rights.

Change in Control. Subject to applicable laws and regulations, in the event of a Change in Control (as defined in the ESPP), unless a successor corporation assumes or substitutes new stock purchase rights (within the meaning of Section 424(a) of the Internal Revenue Code) for all purchase rights then outstanding, (i) the purchase date for all purchase rights then outstanding shall be accelerated to a date fixed by the Administrative Committee prior to the effective date of the Change in Control and (ii) upon such effective date any unexercised purchase rights shall expire and the Company promptly shall refund to each participant the amount of such participant’s contributions under the ESPP which have not yet been used to purchase shares.

Amendment and Termination of the Plan. The Board may at any time amend or terminate the ESPP without the approval of stockholders or employees. We will seek stockholder approval of any plan amendment where stockholder approval is required under applicable law or stock exchange rules, including if we seek to increase the number of shares of common stock reserved for issuance under the ESPP.

U.S. Federal Income Tax Consequences

The following is a general summary of the effect of U.S. federal income taxation upon participants and the Company with respect to the ESPP based on the U.S. Federal income tax laws in effect as of the date of this proxy statement. It is not intended to be exhaustive and does not discuss the tax consequences arising in the context of the employee's death or the income tax laws of any municipality, state or foreign country in which the employee's income or gain may be taxable or the gift, estate, or any tax law other than U.S. federal income tax law. Because individual circumstances may vary, the Company advises all recipients to consult their own tax advisor concerning the tax implications of participation in the ESPP.

Participants should not be subject to tax at the time a purchase right is granted to them. At the time of exercise of the purchase right, participants will be subject to tax on the difference between the fair market value of our common shares and the purchase price. Any additional gain or loss on such sale or disposition will be long-term or short-term capital gain or loss, depending on the holding period.

The Company is entitled to a deduction for amounts taxed as ordinary income at the time of purchase.

Plan Benefits

Benefits under the ESPP will depend on employees' elections to participate and the fair market value of the Company’s common shares at various future dates. Therefore, it is not possible to determine the benefits that will be received by executive officers and other employees if the ESPP is approved by our stockholders.

Accounting Treatment

Based on ASC Topic 718, the Company recognizes compensation expense in connection with options outstanding under the ESPP. So long as the Company continues issuing shares under the ESPP with a purchase price at a discount to the fair market value of its stock, the Company will recognize compensation expense which will be determined by the level of participation in the ESPP.

The Board of Directors recommends that the stockholders vote “FOR” approval of the Remy International, Inc. Employee Stock Purchase Plan.

16

PROPOSAL NO. 4

APPROVAL OF THE REMY INTERNATIONAL, INC.

ANNUAL INCENTIVE BONUS PLAN

On April 29, 2015, the Board of Directors, upon the recommendation of the Compensation Committee, approved the Remy International, Inc. Annual Incentive Bonus Plan (the “AIBP”). Upon approval by stockholders, the AIBP will replace the Company's current Annual Incentive Bonus Plan, which expires by its terms as of the date of the 2015 Annual Meeting. The purpose of the AIBP is to enhance the Company’s ability to attract and retain highly qualified employees and to provide such employees with additional financial incentives to promote the success of the Company and its Subsidiaries.

Stockholder approval of the AIBP is being sought so that any bonuses we pay qualify as deductible performance-based compensation under Section 162(m) of the Internal Revenue Code. The principal features of the AIBP are summarized below. The following summary of the AIBP is not a complete description of all provisions of the AIBP and is qualified in its entirety by reference to the full text of the AIBP, a copy of which is annexed to this Proxy Statement as Annex B.

Eligible Participants. Any employee of the Company or its subsidiaries selected by the Compensation Committee are eligible to participate in the AIBP.

Awards. Each participant will have a target annual incentive award opportunity determined by the Compensation Committee and calculated as a percentage of the participant’s base salary. The Compensation Committee will also establish annual performance objectives for the Company. Each participant’s annual incentive award will be such participant’s target opportunity multiplied by a percentage up to a maximum of 150% based on the Company’s achievement of the annual performance objectives, with such percentage based on (i) in the case of an incentive award that is intended to qualify as performance-based compensation under Section 162(m) of the Internal Revenue Code, the objective formula or standard established in writing by the Compensation Committee, and (ii) in the case of any other incentive award, such factors as the Compensation Committee shall determine.

Performance objectives and awards made under the AIBP to our named executive officers for 2014 are reported in the Summary Compensation Table appearing below and are discussed in the Compensation Discussion and Analysis section below. Amounts, if any, payable under the AIBP for 2015 and future years are dependent on performance and are therefore not determinable at this time.

Award Adjustment. The Compensation Committee may increase the award to our Chief Executive Officer and any of his or her direct reports (other than a participant subject to the Internal Revenue Code Section 162(m) limitation) up to 200% of the formula-based award, or decrease any formula-based award, in its discretion, provided that following a change in control of the Company, the Compensation Committee may not decrease an award. Our chief executive officer has similar discretion for any participant who does not report directly to him or her.

Award Limit. The maximum award to any participant is $4,000,000.

Payments on Termination. If a participant’s employment is terminated without “cause” or a participant terminates his or her employment with “good reason”, as such terms are defined in the AIBP, then such participant is entitled to receive a prorated bonus under the AIBP. If a participant’s employment is terminated with “cause” or a participant terminates his or her employment without good reason, then such participant will not receive any bonus.

Administration. The AIBP is administered by the Compensation Committee. If a member of the Compensation Committee is not an “outside director” within the meaning of Internal Revenue Code Section 162(m), then the AIBP will be administered by a subcommittee of the Compensation Committee consisting of all outside directors with respect to any bonus intended to qualify as performance-based compensation under Internal Revenue Code Section 162(m). The Compensation Committee has the authority to interpret the AIBP, to prescribe, amend and rescind rules and regulations relating to it and to make all other determinations deemed necessary or advisable for the administration of the AIBP. The determinations of the Compensation Committee pursuant to its authority under the AIBP shall be conclusive and binding.

Amendment and Termination. The Compensation Committee, subject to the approval of the Board where required, may alter, amend, suspend or terminate the AIBP at any time, but any amendment to the AIBP shall be approved by our stockholders if approval is necessary for annual bonuses to continue qualifying as performance-based compensation under Internal Revenue Code Section 162(m).

17

Certain Federal Income Tax Consequences. Generally, and subject to Internal Revenue Code Section 162(m), we will be entitled to a federal income tax deduction when amounts paid under the AIBP are included in employee income. Internal Revenue Code Section 162(m) limits the deductibility of bonus payments to $1 million for any person unless the AIBP qualifies as “performance-based compensation”. As stated above, the AIBP is being submitted for stockholder approval at the 2015 Annual Meeting so that payments under the AIBP can qualify for deductibility by the Company under Internal Revenue Code Section 162(m). However, stockholder approval of the AIBP is only one of several requirements under Internal Revenue Code Section 162(m) that must be satisfied for amounts payable under the AIBP to qualify for the performance-based compensation exemption, and approval of the AIBP by stockholders should not be viewed as a guarantee that all amounts paid under the AIBP will in practice be deductible by the Company.

Our Board of Directors recommends that stockholders vote “FOR” approval of the Remy International, Inc. Annual Incentive Bonus Plan.

18

PROPOSAL NO. 5

RATIFICATION OF APPOINTMENT OF THE

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our Audit Committee has appointed Ernst & Young LLP, or "EY", our independent registered public accounting firm, to audit our consolidated financial statements for the year ending December 31, 2015. Although stockholder ratification of the appointment of our independent registered public accounting firm is not required by our Amended and Restated Bylaws or otherwise, as a matter of good corporate governance, we are submitting the selection of EY to our stockholders for ratification of such appointment. If our stockholders do not ratify the Audit Committee's selection, the Audit Committee will take that fact into consideration, together with such other factors it deems relevant, in determining its next selection of our independent registered public accounting firm. We anticipate that representatives of EY will be present at the Annual Meeting, will have the opportunity to make a statement if they desire, and will be available to respond to appropriate questions.

Aggregate fees billed by EY for services rendered to us during fiscal years ended December 31, 2014 and 2013 were as follows:

(In thousands of dollars) | 2014 | 2013 | ||||||

Audit Fees | $ | 3,393 | $ | 3,092 | ||||

Audit-Related Fees | 67 | 191 | ||||||

Tax Fees | 203 | 102 | ||||||

All Other Fees | 2 | 3 | ||||||

Audit Fees. Audit fees consisted principally of fees associated with the annual audit of our consolidated financial statements included in our Annual Report on Form 10-K, audit of our consolidated financial statements included in the Registration Statement on Form S-4 filed in connection with the Spin-off Transaction, audit of our internal control over financial reporting as required by the Sarbanes-Oxley Act of 2002, the review of consolidated financial statements included in the Quarterly Reports on Form 10-Q filed by our predecessor prior to the Spin-off Transaction, and for services that are normally provided by the independent registered public accounting firm in connection with statutory and regulatory filings or engagements, including billings for out of pocket expenses incurred.

Audit-Related Fees. Audit-related fees consisted principally of fees for assurance and related services that were reasonably related to the performance of the audit or review of our consolidated financial statements.

Tax Fees. Tax fees consisted principally of fees for tax compliance, tax advice and tax planning services.

All Other Fees. All other fees represented fees for any services not included in the first three categories, which related to a subscription to EY's accounting research tool.

Audit Committee Pre-Approval Policies and Procedures

In accordance with the requirements of the Sarbanes-Oxley Act of 2002, all audit and audit-related work and all non-audit work performed by EY is approved in advance by the Audit Committee, including the proposed fees for such work. Our pre-approval policy provides that, unless a type of service to be provided by EY has been generally pre-approved by the Audit Committee, it will require specific pre-approval by the Audit Committee. In addition, any proposed services exceeding pre-approved maximum fee amounts also require pre-approval by the Audit Committee. Our pre-approval policy provides that specific pre-approval authority is delegated to our Audit Committee Chairman, provided that the estimated fee for the proposed service does not exceed a pre-approved maximum amount set by the Audit Committee. Our Audit Committee Chairman must report any pre-approval decisions to the Audit Committee at its next scheduled meeting.

All of the services provided by EY described above under the captions “Audit Fees”, “Audit-Related Fees”, “Tax Fees”, and “All Other Fees” were approved by our Audit Committee pursuant to our Audit Committee's pre-approval policies.

OUR BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" THE RATIFICATION OF THE AUDIT COMMITTEE'S SELECTION OF ERNST & YOUNG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2015.

19

CORPORATE GOVERNANCE

Director Independence

Our Board of Directors has determined, after considering all the relevant facts and circumstances, that Messrs. Ammerman, Hagenbuch, Stout, Glassman and McClure are “independent” directors as defined by the SEC's independence rules and the listing standards of the NASDAQ Stock Market. Messrs. Weber, Pittas and Scanlon are not independent as they are or have been recently employed by us or have been affiliated with our former parent company FNF.

Under NASDAQ's corporate governance standards, we were previously classified as a "controlled company", because more than 50% of the voting power for the election of directors was held by FNFV, a wholly-owned subsidiary of our former parent company FNF. Since the completion of the Spin-off Transaction on December 31, 2014, we are no longer a controlled company, therefore, after an applicable cure period, we will no longer be exempt from NASDAQ requirements that a majority of our Board of Directors, our Compensation Committee and our Nominating and Corporate Governance Committee consist of independent directors. Subsequent to the completion of the Spin-off Transaction, we have taken action by appointing Messrs. Glassman and McClure, two independent directors, to our Board in February 2015, and we are recommending Mr. Ruchim, a third independent director, be nominated to our Board. We expect to meet the applicable NASDAQ requirements within the time period prescribed by the listing rules.

Classification of our Board of Directors

Our Board of Directors is divided into three classes, with one class standing for election each year for a three-year term. At each annual meeting of stockholders, directors of a particular class will be elected for three-year terms to succeed the directors of that class whose terms are expiring. Messrs. Weber and Scanlon are Class I directors whose terms will expire at the Annual Meeting, but have been nominated by our Board of Directors for re-election for three-year terms expiring in 2018. Mr. Ruchim is being nominated to our Board as a Class I director for three-year terms expiring in 2018. Mr. Ruchim's nomination is part of a Support Agreement between us and our largest stockholder, H Partners Management, LLC. Messrs. Hagenbuch, Stout and Glassman are Class II directors whose terms will expire in 2016. Messrs. Ammerman, Pittas and McClure are Class III directors whose terms will expire in 2017. There are no family relationships among any of our directors.

Committee Charters, Corporate Governance, and Code of Ethics

Our Board of Directors has adopted charters for the Audit, Compensation, and Nominating and Corporate Governance Committees describing the authority and responsibilities delegated to each committee by our Board of Directors. Our Board of Directors has also adopted a Code of Ethics and Business Conduct. We post on our website, at www.remyinc.com, the charters of our Audit, Compensation, and Nominating and Corporate Governance Committees, our Code of Ethics and Business Conduct, and any amendments or waivers thereto; and any other corporate governance materials contemplated by SEC or NASDAQ regulations. These documents are also available in print to any stockholder requesting a copy in writing from our Corporate Secretary at our executive offices set forth in this proxy statement.

Executive Sessions

Executive sessions are required to be held at least twice a year in conjunction with regularly scheduled Board meetings in which independent non-employee directors meet without the presence or participation of management or non-independent directors, in accordance with NASDAQ corporate governance standards. The Board met this requirement in 2014.

Board Committees

Our Board of Directors has three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Also during 2014, the Board established a Special Committee with the specific purpose to review and consider the Spin-off Transaction with FNF.

Audit Committee

The Audit Committee consists of Messrs. Ammerman, Hagenbuch and Stout, with Mr. Ammerman serving as the chairperson of this committee. The Board of Directors reviewed Mr. Ammerman’s service on the Audit Committee in light of his concurrent service on the audit committees of four other companies. The Board considered Mr. Ammerman’s extensive financial and accounting background and expertise as a former partner of KPMG LLP, his knowledge of our Company and understanding of our financial statements as an experienced director and audit committee member, and the fact that Mr. Ammerman is retired from active employment, and determined that Mr. Ammerman’s service on the audit committees of five public companies, including our Audit

20

Committee, would not impair his ability to effectively serve on our Audit Committee. As contemplated by its written charter, this committee is primarily focused on the accuracy and effectiveness of the audits of our financial statements by our internal audit staff and by our independent auditors.

The Audit Committee is responsible for assisting the Board of Directors' oversight of:

• | the quality and integrity of our accounting and financial reporting process, including our financial statements and related disclosure; |

• | our compliance with legal and regulatory requirements; |

• | the independent auditor's qualifications and independence; and |

• | the performance of our internal audit function and independent auditor. |

The Audit Committee believes that its members are financially literate and are capable of analyzing and evaluating our financial statements. As such, our Board of Directors has deemed each of Messrs. Ammerman, Hagenbuch and Stout to be audit committee financial experts as defined under the applicable rules of the SEC.

Compensation Committee

During 2014, the Compensation Committee consisted of Messrs. Stout, Bickett and Hagenbuch, with Mr. Stout serving as the chairperson of this committee. As mentioned previously, Mr. Bickett resigned from our Board and the Compensation Committee in connection with the Spin-off Transaction with FNF. Effective February 3, 2015, the Compensation Committee was reconstituted to consist of Messrs. Weber, Hagenbuch and Stout, with Mr. Weber serving as the chairperson of this committee. This committee's primary responsibilities, as contemplated by its written charter, are:

• | to assist the Board in discharging its responsibilities regarding the establishment and maintenance of our compensation and benefit plans, policies and programs; |

• | to review, approve, and evaluate performance against corporate goals and objectives relevant to the compensation of our Chief Executive Officer, and determine and approve the Chief Executive Officer's compensation level based on this evaluation; |

• | to make recommendations to the Board with respect to executive compensation, incentive-compensation plans and equity-based plans; and |

• | to assist the Board of Directors in discharging its responsibilities regarding compliance with the compensation rules, regulations and guidelines promulgated by NASDAQ and the SEC and with other applicable laws. |

As noted above, Messrs. Stout and Hagenbuch, who together constitute a majority of the members of the Compensation Committee, are “independent” under NASDAQ’s listing rules, but Mr. Weber is not independent due to the fact that he was employed by the Company within the past three years. The NASDAQ listing rules provide that if a compensation committee is comprised of at least three members, one director who is not independent and is not currently an executive officer or employee or a family member of an executive officer may be appointed to the compensation committee if the board, under exceptional and limited circumstances, determines that such individual's membership on the committee is required by the best interests of the corporation and its shareholders. The Board has determined that Mr. Weber’s position on the Compensation Committee is required by the best interests of the Company and its stockholders because it provides continuity and experience following the completion on December 31, 2014 of the Spin-off Transaction and the subsequent election of three new directors to the Board.

See the "Compensation Discussion and Analysis and Executive Compensation and Director Compensation" section below for additional information with respect to the Compensation Committee.

Nominating and Corporate Governance Committee

During 2014, the Nominating and Corporate Governance Committee consisted of Messrs. Foley and Scanlon, with Mr. Foley serving as the chairperson of this committee. As mentioned previously, Mr. Foley resigned from our Board and the Nominating and Corporate Governance Committee in connection with the Spin-off Transaction with FNF. Mr. Scanlon continues to serve as a member of our Board. Effective February 3, 2015, the Nominating and Corporate Governance Committee was reconstituted to consist of Messrs. Stout, Glassman and McClure, with Mr. Stout serving as the chairperson of this committee. This committee's responsibilities, as contemplated by its written charter, are:

21

• | identifying and selecting qualified candidates to become new members of, or fill any vacancies on, our Board of Directors consistent with criteria approved by the Board; |

• | selecting or recommending to the Board of Directors the selection of nominees for election to the Board of Directors at the next annual meeting of stockholders (or special meeting of stockholders at which directors are to be elected); |

• | assisting our Board of Directors in the development and review of our Corporate Governance Guidelines and principles applicable to our company; and |

• | providing oversight of the evaluation of our Board of Directors. |

The Nominating and Corporate Governance Committee has a policy that it will consider director candidates nominated by stockholders. The Nominating and Corporate Governance Committee evaluates nominees for director, including candidates nominated by stockholders, by the following qualifications and criteria:

(i) | diversity of viewpoints, background, experience and other demographics of the Board; |

(ii) | personal and professional integrity, ethics and values; |

(iii) | experience in corporate management, such as serving as an officer or former officer of a publicly held company, and a general understanding of marketing, finance and other elements relevant to the success of a publicly traded company in today’s business environment; |

(iv) | experience relevant to the Company’s industry and with relevant social policy concerns; |

(v) | experience as a board member or executive officer of another publicly held company; |

(vi) | relevant academic expertise; |

(vii) | practical and mature business judgment, including the ability to make independent analytical inquiries; |

(viii) | promotion of diverse business or career experience relevant to the success of the Company; and |

(ix) | any other relevant qualifications, attributes or skills. |

Special Committee

In 2014, the Board appointed Messrs. Weber, Hagenbuch and Stout, each of whom were independent of FNF and its affiliates, to a Special Committee of the Board to evaluate FNF’s proposal for the Spin-off Transaction and report to the Board its recommendations and conclusions with respect to such proposal.

Discussion of our Compensation Policies and Procedures as They Relate to Risk Management

We reviewed our compensation policies and practices for all employees, including our named executive officers, and determined that our compensation programs are not reasonably likely to have a material adverse effect on our company. In conducting this review, we analyzed the structure of our executive, non-officer, and sales incentive programs and the internal controls that are in place for each program. We also reviewed data compiled across our global operations which included our consolidated operating income, operating cash flow, new business awards, and total compensation expenses and incentive expenses (including as a percentage of both net sales revenue and total compensation expenses).