UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| þ | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |

REALNETWORKS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

RealNetworks, Inc. 2601 Elliott Avenue, Suite 1000, Seattle, WA 98121

September 21, 2010

Dear Shareholder:

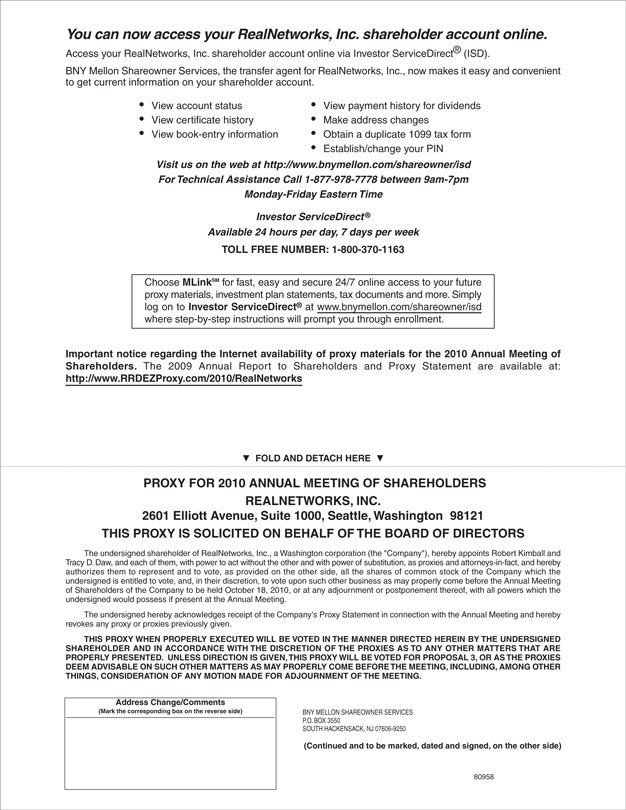

You are cordially invited to attend the RealNetworks, Inc. 2010 Annual Meeting of Shareholders (the “Annual Meeting”) to be held at 2:00 p.m. on Monday, October 18, 2010 at the Bell Harbor International Conference Center, 2211 Alaskan Way, Seattle, Washington 98121.

At the Annual Meeting, the following matters of business will be presented:

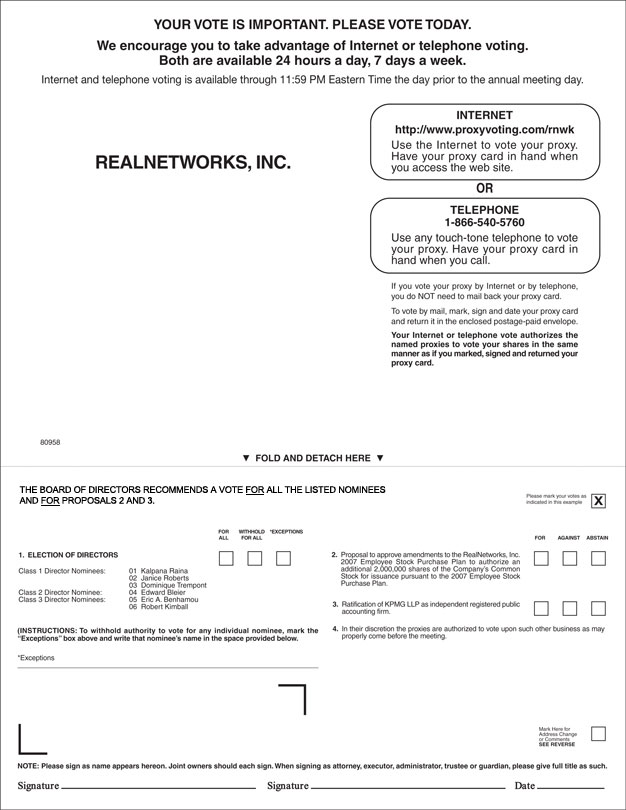

| 1. | The election of Kalpana Raina, Janice Roberts and Dominique Trempont as Class 1 directors, each to serve for a three-year term, the election of Edward Bleier as a Class 2 director to serve for a one-year term, and the election of Eric Benhamou and Robert Kimball as Class 3 directors, each to serve for a two-year term; |

| 2. | The approval of an amendment to the RealNetworks, Inc. 2007 Employee Stock Purchase Plan to authorize an additional 2,000,000 shares of the Company’s Common Stock for issuance pursuant to the 2007 Employee Stock Purchase Plan; |

| 3. | The ratification of the appointment of KPMG LLP as RealNetworks, Inc.’s independent registered public accounting firm for the fiscal year ending December 31, 2010; and |

| 4. | The transaction of any other business properly presented at the meeting. |

Detailed information as to the business to be transacted at the Annual Meeting is contained in the accompanying Notice of Annual Meeting of Shareholders and Proxy Statement.

The Board of Directors unanimously recommends a vote “For” each of the foregoing proposals.

We encourage you to join us and participate in the meeting. If you are unable to do so, you have the option to vote in one of three ways:

| 1. | Sign and return the enclosed proxy card as soon as possible in the envelope provided; |

| 2. | Call the toll-free telephone number shown on your proxy card; or |

| 3. | Vote via the Internet as described in the accompanying proxy statement. |

On behalf of the Board of Directors, I would like to express our appreciation for your support of RealNetworks. We look forward to seeing you at the meeting.

Sincerely,

ROBERT KIMBALL

President and Chief Executive Officer

REALNETWORKS, INC.

2601 Elliott Avenue, Suite 1000

Seattle, Washington 98121

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

September 21, 2010

To the Shareholders of RealNetworks, Inc.:

NOTICE IS HEREBY GIVEN that the 2010 Annual Meeting of Shareholders of RealNetworks, Inc., a Washington corporation, will be held on Monday, October 18, 2010, at 2:00 p.m., local time, at the Bell Harbor International Conference Center, 2211 Alaskan Way, Seattle, Washington 98121. At the Annual Meeting, the following business matters will be presented:

| 1. | The election of Kalpana Raina, Janice Roberts and Dominique Trempont as Class 1 directors, each to serve for a three-year term, the election of Edward Bleier as a Class 2 director to serve for a one-year term, and the election of Eric Benhamou and Robert Kimball as Class 3 directors, each to serve for a two-year term; |

| 2. | The approval of an amendment to the RealNetworks, Inc. 2007 Employee Stock Purchase Plan to authorize an additional 2,000,000 shares of the Company’s Common Stock for issuance pursuant to the 2007 Employee Stock Purchase Plan; |

| 3. | The ratification of the appointment of KPMG LLP as RealNetworks, Inc.’s independent registered public accounting firm for the fiscal year ending December 31, 2010; and |

| 4. | The transaction of any other business properly presented at the meeting. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

This Proxy Statement is being issued in connection with the solicitation of a proxy on the enclosed form by the Board of Directors of RealNetworks, Inc. for use at RealNetworks, Inc.’s 2010 Annual Meeting of Shareholders. You are entitled to vote at the Annual Meeting if you were a shareholder of record at the close of business on September 3, 2010. A list of shareholders as of that date will be available at the meeting and for ten days prior to the meeting at the principal executive offices of RealNetworks, Inc. located at 2601 Elliott Avenue, Suite 1000, Seattle, Washington 98121.

The 2009 Annual Report and this Proxy Statement can be viewed at http://www.RRDEZProxy.com/2010/RealNetworks in accordance with the rules of the U.S. Securities and Exchange Commission.

BY ORDER OF THE BOARD OF DIRECTORS

TRACY D. DAW

Chief Legal Officer and Corporate Secretary

Seattle, Washington

September 21, 2010

YOUR VOTE IS IMPORTANT!

All shareholders are cordially invited to attend the Annual Meeting in person. Regardless of whether you plan to attend the meeting, please vote by telephone or Internet, as described in the accompanying Proxy Statement, or complete, date, sign and return the enclosed proxy card as promptly as possible in order to ensure your representation at the meeting. A return envelope (which is postage prepaid if mailed in the United States) is enclosed for that purpose. You may still vote in person if you attend the meeting, even if you have given your proxy. Please note, however, that if a broker, bank or other nominee holds your shares of record and you wish to vote at the meeting, you must obtain from the record holder a proxy card issued in your name.

REALNETWORKS, INC.

2010 PROXY STATEMENT

INFORMATION CONCERNING PROXY SOLICITATION AND VOTING

General

The enclosed proxy is solicited on behalf of the Board of Directors of RealNetworks, Inc. for use at the Annual Meeting of Shareholders to be held Monday, October 18, 2010, at 2:00 p.m., local time, or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Shareholders. The Annual Meeting will be held at the Bell Harbor International Conference Center, 2211 Alaskan Way, Seattle, Washington 98121.

These proxy solicitation materials and RealNetworks’ Annual Report to Shareholders for the fiscal year ended December 31, 2009, including financial statements, were mailed on or about September 21, 2010, to all shareholders entitled to vote at the Annual Meeting.

Record Date and Quorum

Shareholders of record at the close of business on September 3, 2010, the record date, are entitled to notice of and to vote their shares at the Annual Meeting. At the record date, 135,638,895 shares of RealNetworks’ common stock, $0.001 par value per share, were issued and outstanding. The common stock is listed for trading on the Nasdaq Global Select Market under the symbol RNWK. The presence in person or by proxy of the holders of record of a majority of the outstanding shares of common stock entitled to vote is required to constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and broker non-votes (which occur when a broker indicates on a proxy card that it is not voting on a matter) are considered as shares present at the Annual Meeting for the purpose of determining a quorum.

How to Vote

Registered shareholders can vote by telephone, by the Internet or by mail, as described below. If you are a beneficial shareholder, please refer to your proxy card or the information forwarded by your broker, bank or other holder of record to see what options are available to you.

Registered shareholders may cast their vote by:

| (1) | Signing, dating and promptly mailing the proxy card in the enclosed postage-paid envelope; |

| (2) | Accessing the Internet website www.proxyvoting.com/rnwk and following the instructions provided on the website; or |

| (3) | Calling 1-866-540-5760 and voting by following the instructions provided on the phone line. |

We encourage you to vote your shares in advance of the Annual Meeting date even if you plan on attending the Annual Meeting.

Vote Required, Abstentions and Broker Non-Votes

Each holder of record of common stock on the record date is entitled to one vote for each share held on all matters to be voted on at the Annual Meeting.

1

If a quorum is present at the Annual Meeting, the six candidates for director who receive the highest number of affirmative votes will be elected. Shareholders are not entitled to cumulate votes for the election of directors.

If a quorum is present at the Annual Meeting, Proposal 2 will be approved if a majority of the shares present in person or by proxy at the Annual Meeting vote to approve the proposal and Proposal 3 will be approved if the number of votes cast in favor of this proposal exceeds the number of votes cast against the proposal.

Brokers who hold shares for the accounts of their clients may vote such shares either as directed by their clients or, in the case of “uninstructed shares,” in their own discretion if permitted by the stock exchange or other organization of which they are members. Certain types of proposals are “non-discretionary,” however, and brokers who have received no instructions from their clients do not have discretion to vote such uninstructed shares on those items. At this year’s meeting, brokers will have discretion to vote uninstructed shares on the ratification of the appointment of the independent registered accounting firm only (Proposal 3). Brokers do not have discretionary voting authority to vote uninstructed shares in the election of directors or on the proposal to amend the Company’s 2007 Employee Stock Purchase Plan (the “2007 ESPP”), in each case, absent voting instructions from their clients. Therefore, if you do not provide voting instructions to your broker with respect to the election of directors (Proposal 1) or the proposal to amend the 2007 ESPP (Proposal 2), your broker cannot vote your shares on these proposals.

The failure of a brokerage firm or other intermediary to vote its customers’ shares at the Annual Meeting will have no effect on Proposal 3 since the approval of that proposal is based on the number of votes actually cast for or against the proposal (as applicable). Additionally, broker non-votes (i.e., votes from shares held of record by brokers as to which the beneficial owners have given no voting instructions) will not be counted as votes for or against a matter where the approval of such matter only requires a majority of the shares voting thereon and, accordingly, will have no effect on Proposal 2.

Shareholders may abstain from voting on the nominees for director, on Proposal 2 and on Proposal 3. Abstention from voting on the nominees for director and on Proposal 3 will have no effect, since the approval of each matter is based solely on the number of votes actually cast for or against the proposal (as applicable). Abstention from voting on Proposal 2 will have the same effect as votes against that proposal.

Votes cast by proxy or in person at the Annual Meeting will be tabulated by the inspector of election appointed for the Annual Meeting. The inspector of election will determine whether or not a quorum is present at the Annual Meeting.

Revocability of Proxies

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to the Corporate Secretary of RealNetworks at RealNetworks’ principal offices as set forth above in the Notice of Annual Meeting a written notice of revocation or a duly executed proxy bearing a later date or by attending the Annual Meeting and voting in person.

Proxy Solicitation

The expense of preparing, printing and mailing this Proxy Statement and the proxies solicited hereby will be borne by RealNetworks. Proxies will be solicited by mail and may also be solicited by RealNetworks’ directors, officers and other employees, without additional remuneration, in person or by telephone, electronic mail or facsimile transmission. RealNetworks will also request brokerage firms, banks, nominees, custodians and fiduciaries to forward proxy materials to the beneficial owners of shares of common stock as of the record date and will reimburse such persons for the cost of forwarding the proxy materials in accordance with customary practice. Your cooperation in promptly voting your shares and submitting your proxy by telephone, Internet or by completing and returning the enclosed proxy card will help to avoid additional expense.

2

Shareholder Proposals for 2011 Annual Meeting

An eligible shareholder who desires to have a qualified proposal considered for inclusion in the proxy statement and form of proxy prepared in connection with RealNetworks’ 2011 annual meeting of shareholders must deliver a copy of the proposal to the Corporate Secretary of RealNetworks, at the principal offices of RealNetworks, not less than one hundred twenty (120) days prior to the first anniversary of the date that this Proxy Statement was released to RealNetworks’ shareholders, or, if the date of RealNetworks’ 2011 Annual Meeting has been changed by more than 30 days from the date of RealNetworks’ 2010 Annual Meeting, then no later than a reasonable time before RealNetworks begins to print and mail its proxy materials. To be eligible to submit a proposal for inclusion in our proxy statement, a shareholder must have continually been a record or beneficial owner of shares of common stock having a market value of at least $2,000 (or representing at least 1% of the shares entitled to vote on the proposal), for a period of at least one year prior to submitting the proposal, and the shareholder must continue to hold the shares through the date on which the meeting is held.

A shareholder of record who intends to submit a proposal at the 2011 annual meeting of shareholders that is not eligible or not intended for inclusion in RealNetworks’ proxy statement must provide written notice to RealNetworks, addressed to the Corporate Secretary at the principal offices of RealNetworks, not less than one hundred twenty (120) days prior to the first anniversary of the date that this Proxy Statement was released to RealNetworks’ shareholders, or, if the date of RealNetworks’ 2011 Annual Meeting has been changed by more than 30 days from the date of RealNetworks’ 2010 Annual Meeting, then no later than a reasonable time before RealNetworks begins to print and mail its proxy materials. The notice must also satisfy certain additional requirements specified in RealNetworks’ Bylaws. A copy of the Bylaws will be sent to any shareholder upon written request to the Corporate Secretary of RealNetworks.

Shareholder Communication with the Board of Directors

Shareholders who wish to communicate with RealNetworks’ Board of Directors, or with any individual member of the Board, may do so by sending such communication in writing to the attention of the Corporate Secretary at the address of our principal executive office with a request to forward the same to the intended recipient. Shareholder communications must include confirmation that the sender is a shareholder of RealNetworks. All such communications will be reviewed by RealNetworks’ Corporate Secretary or Chief Financial Officer in order to create an appropriate record of the communication, to assure director privacy, and to determine whether the communication relates to matters that are appropriate for review by RealNetworks’ Board of Directors or by any individual director. Communications will not be forwarded to Board members that (i) are unrelated to RealNetworks’ business, (ii) contain improper commercial solicitations, (iii) contain material that is not appropriate for review by the Board of Directors based upon RealNetworks’ Bylaws and the established practice and procedure of the Board, or (iv) contain other improper or immaterial information.

Householding Information

If you share an address with another shareholder, each shareholder may not receive a separate copy of our Annual Report, proxy materials or Notice of Internet Availability of Proxy Materials. Shareholders who do not receive a separate copy of our Annual Report, proxy materials or Notice of Internet Availability of Proxy Materials, but would like to receive a separate copy or additional copies, may request these materials by sending an e-mail to investor_relations@real.com, calling 1-206-892-6320 or writing to: Investor Relations, RealNetworks, Inc., 2601 Elliott Avenue, Suite 1000, Seattle, WA 98121.

Shareholders who share an address and receive multiple copies of our Annual Report, proxy materials or Notice of Internet Availability of Proxy Materials may also request to receive a single copy by following the instructions above. Current and prospective investors can also access our Form 10-K, proxy statement and other financial information on the Investor Relations section of our web site at www.realnetworks.com/company/investor.

3

PROPOSAL 1 — ELECTION OF DIRECTORS

RealNetworks’ Amended and Restated Bylaws provide for a Board of Directors that consists of not less than two and no more than nine members. RealNetworks’ Amended and Restated Articles of Incorporation provide that the directors will be divided into three classes, with each class as nearly equal in number of directors as possible and serving for staggered, three-year terms. The authorized number of directors is currently set at nine, and nine directors currently serve on the Board.

Six directors are to be elected at the Annual Meeting, and each director elected will serve until the expiration of his or her term or until his or her earlier retirement, resignation, removal, or the election of his or her successor. Three Class 1 directors are to be elected to serve until the 2013 annual meeting of shareholders. Kalpana Raina, Janice Roberts and Dominique Trempont are the nominees who currently serve as Class 1 directors. Ms. Raina’s term as a Class 1 director expires at the Annual Meeting. Mr. Trempont and Ms. Roberts were appointed to the Board effective July 23, 2010 and August 27, 2010, respectively, and classified as Class 1 directors, and their initial terms also expire at the Annual Meeting.

One Class 2 director, Edward Bleier, is to be elected to serve until the 2011 annual meeting of shareholders. Mr. Bleier, whose term expires at the Annual Meeting, served as a Class 1 director until the Board approved a reclassification of Mr. Bleier from Class 1 to Class 2 in August 2010.

Two Class 3 directors are to be elected to serve until the 2012 annual meeting of shareholders. Robert Kimball was appointed as a Class 3 director on January 12, 2010, and his initial term expires at the Annual Meeting. Eric Benhamou, whose term expires at the Annual Meeting, served as a Class 1 director until the Board approved a reclassification of Mr. Benhamou from Class 1 to Class 3 in August 2010.

Jonathan Klein and Pradeep Jotwani are Class 2 directors whose terms expire at the 2011 annual meeting of shareholders and Robert Glaser is a Class 3 director whose term expires at the 2012 annual meeting of shareholders.

All six nominees have been nominated by the Nominating and Corporate Governance Committee of the Board of Directors, comprised of non-management directors, and recommended to the shareholders by the Board of Directors for election at the Annual Meeting. The accompanying proxy will be voted FOR the election of Messrs. Benhamou, Bleier, Kimball and Trempont, Ms. Raina and Ms. Roberts to the Board of Directors, except where authority to so vote is withheld. Proxies may not be voted for a greater number of persons than the number of nominees named. The nominees have consented to serve as directors of RealNetworks if elected. If at the time of the Annual Meeting a nominee is unable or declines to serve as a director, the discretionary authority provided in the enclosed proxy will be exercised to vote for a substitute candidate designated by the Nominating and Corporate Governance Committee of the Board of Directors. The Board of Directors has no reason to believe that any of the nominees will be unable, or will decline, to serve as a director.

4

Nominees for Director

Class 1 Director Nominees

| Biographical Information |

Specific Experience, | |||

| Kalpana Raina Age 54 Director since 2001 |

Ms. Raina is the managing partner of 252 Solutions, LLC, an advisory firm. Previously, Ms. Raina was a senior executive with The Bank of New York, a global financial services company. She joined The Bank of New York in 1989 and held a variety of leadership positions, most recently Executive Vice President and Head of European Country Management and Corporate Banking. Prior to that, she served in Mumbai, India as the bank’s Executive Vice President, International. During her eighteen-year career with the bank she had responsibility for clients in the Media, Telecommunications, Healthcare, Retailing, Hotels and Leisure and Financial services industries in Asia, Europe, and the United States. Ms. Raina has served as a director of John Wiley & Sons, Inc., a publicly-traded global publisher of print and electronic products, since September 2009 and as a director of Information Services Group, Inc., a publicly-traded company specializing in the assessment, evaluation, negotiation, and management of service contracts between clients and their outside contractors, since August 2009. Ms. Raina is a member of Women Corporate Directors and The National Association of Corporate Directors and a past member of The US- India Business Council. Ms. Raina holds a B.A. Honors degree from Panjab University, India and an M.A. degree in English Literature from McMaster University. | Senior leadership experience

Management advisory experience

Financial experience

Service as a director of public companies | ||

| Janice Roberts Age 54 Director since 2010 |

Janice Roberts has served as a Managing Director of Mayfield Fund, a Silicon Valley-based venture capital firm, since 2000. Ms. Roberts’ current areas of investment interest include mobility, wireless communications, networking and consumer companies. From 1992 to 2002, Ms. Roberts was employed by 3Com Corporation, a networking company that was acquired by Hewlett Packard in April 2010, where she held various executive positions, most recently serving as President of 3Com Ventures, the investment division of 3Com Corporation, and Senior Vice President, Business Development and Global Marketing. Ms. Roberts managed a number of the new business initiatives at 3Com, including its Palm Computing subsidiary. Previously, Ms. Roberts was managing Director and President of BICC Data Networks Ltd., which was acquired by 3Com in 1992. Ms. Roberts’ early career was based in Europe and included various technology-related marketing and general management positions. Ms. Roberts serves on the boards of several private companies and the advisory boards of the Forum for Women Entrepreneurs | Senior leadership experience

Management advisory experience

Executive-level experience with technology companies, including companies focused on mobile and wireless communications technologies | ||

5

| Biographical Information |

Specific Experience, | |||

| and Executives, Illuminate Ventures, INSEAD Business School West Coast Council, and SALT Branding. Ms. Roberts is actively involved with the Center for Entrepreneurial Studies at the Stanford School of Business. She holds a Bachelor of Commerce degree (Honours) from the University of Birmingham in the United Kingdom. | ||||

| Dominique Trempont Age 56 Director since 2010 |

Mr. Trempont has served as a director of Finisar Corporation, a company that develops and markets high speed data communication systems and software for networking and storage, since September 2005. Mr. Trempont has also served as a director of Energy Recovery, Inc., a manufacturer of efficient energy recovery devices utilized in the water desalination industry, since July 2008. From October 2006 to April 2010, Mr. Trempont served as a director of 3Com Corporation, a networking company that was acquired by Hewlett Packard in April 2010. From September 2003 to September 2005, Mr. Trempont was CEO-in-Residence at Battery Ventures, a venture capital firm. Prior to joining Battery Ventures, Mr. Trempont was Chairman, President and Chief Executive Officer of Kanisa, Inc., a software company focused on enterprise self-service applications, from 1999 to 2002. Mr. Trempont was President and CEO of Gemplus Corporation, a smart card company, from 1997 to 1999. Prior to Gemplus, Mr. Trempont served as Chief Financial Officer and head of Operations at NeXT Software. Mr. Trempont began his career at Raychem Corporation, a materials science and engineering company focused on telecommunications, electronics, automotive and other industries. Mr. Trempont earned an undergraduate degree in Economics from College St. Louis (Belgium), a B.A. with high honors in Business Administration and Computer Sciences (LSM) from the University of Louvain (Belgium) and a master’s degree in Business Administration from INSEAD (France/Singapore). | Senior leadership experience

Management advisory experience

Financial experience

Executive-level experience with technology companies

Service as a director of public companies | ||

| Class 2 Director Nominee | ||||

| Edward Bleier Age 80 Director since 1999 |

Mr. Bleier has served as a director of CKX, Inc., a publicly-traded company engaged in the ownership, development and commercial utilization of entertainment content, since February 2005 and was appointed Chairman of the Board in May 2010. He has served as a director of Blockbuster Inc, a publicly-traded provider of in-home movie and game entertainment since May 2005. Mr. Bleier is retired from Warner Bros. where he served, partly, as President of Domestic Pay-TV, Cable and Networks Features, which encompasses feature films, TV | Senior executive leadership and business strategy experience

Extensive experience in the media and entertainment industry as a result of his 35-year career as an executive at Warner Bros. | ||

6

| Biographical Information |

Specific Experience, | |||

| programming, animation, network sales, video-on-demand and consumer marketing. Additionally, Mr. Bleier serves as Chairman Emeritus of the Advisory Board of the Center for Communication, Chairman of the Guild Hall’s Academy of the Arts, a director of The Dana Foundation, a trustee of The Bleier Center for Television and Popular Culture at Syracuse University and a member of the Council on Foreign Relations. He also authored the 2003 New York Times bestseller “The Thanksgiving Ceremony.” Mr. Bleier holds a B.S. degree from Syracuse University. | Service as a director of public companies | |||

| Class 3 Director Nominees | ||||

| Eric A. Benhamou Age 54 Director since 2003 |

Mr. Benhamou was appointed lead independent director of RealNetworks’ Board of Directors in 2008. Mr. Benhamou has served as chairman of the board of directors of Cypress Semiconductor, Inc., a publicly-traded semiconductor company, since 1993 and as chairman of the board of directors of 3Com Corporation, a provider of secure, converged voice and data networking solutions from 1994 to April 2010. He served as chief executive officer of Palm, Inc., a publicly-traded provider of mobile products and solutions, from 2001 until 2003 and as chairman of the board of directors until October 2007. He also served as chief executive officer of 3Com from 1990 to 2000. Mr. Benhamou co-founded Bridge Communications, an early networking pioneer, and was vice president of engineering until its merger with 3Com in 1987. He has served as a director of SVB Financial Group, a publicly-traded financial services company, since 2005 and as a director of Voltaire Ltd., a publicly-traded provider of server, storage switching and software solutions, since March 2007. Mr. Benhamou serves on the executive committee of TechNet and is vice chairman of the board of governors of Ben Gurion University of the Negev. He is the chief executive officer of Benhamou Global Ventures, an investment firm he founded in 2003, and serves on the boards of directors of several private companies. Mr. Benhamou holds a M.S. degree from Stanford University’s School of Engineering and a Diplôme d’Ingénieur from Ecole Nationale Supérieure d’Arts et Métiers, Paris. | Experience with technology companies through service on the boards of directors of various public and private companies

Senior leadership/CEO experience

Service as Chairman of the Board of various public companies

Management advisory experience

Financial and accounting experience | ||

| Robert Kimball Age 46 Director since 2010 |

Mr. Kimball has served as President and Chief Executive Officer of RealNetworks since July 2010, and served as President and Acting Chief Executive Officer from January 2010 to July 2010. Mr. Kimball has also served as a director of RealNetworks since January 2010. Mr. Kimball joined RealNetworks in 1999 and has held various positions including Executive Vice President, Legal and Business | Business strategy and executive-level experience with technology companies, including seven years of service as an executive and General Counsel of RealNetworks | ||

7

| Biographical Information |

Specific Experience, | |||

| Affairs, General Counsel and Corporate Secretary from January 2009 to January 2010, Senior Vice President, Legal and Business Affairs, General Counsel and Corporate Secretary from January 2005 to January 2009, and Vice President, Legal and Business Affairs, General Counsel and Corporate Secretary from January 2003 to January 2005. Mr. Kimball holds a B.A. with distinction from the University of Michigan and a J.D., magna cum laude, from the University of Michigan Law School. | Experience concerning governance, government processes and law

Historical knowledge of RealNetworks through over ten years of service as an employee |

Director Independence

The Board has determined that (i) Messrs. Benhamou, Bleier and Trempont, Ms. Raina and Ms. Roberts are independent under the Nasdaq listing standards and (ii) all directors who are not standing for election at the Annual Meeting, other than Mr. Glaser, are independent under the Nasdaq listing standards and the applicable rules promulgated by the Securities and Exchange Commission (the “SEC”).

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE NOMINEES NAMED IN PROPOSAL 1.

8

BOARD OF DIRECTORS

The business of RealNetworks is managed under the direction of a Board of Directors, which has responsibility for establishing broad corporate policies and for the overall performance of RealNetworks. It is not, however, involved in operating details on a day-to-day basis.

Identification, Evaluation and Qualification of Director Nominees

In general, all Board members are responsible for identifying and submitting candidates for consideration as directors. The name of each candidate is presented to the Nominating and Corporate Governance Committee, or, if determined by the Committee in its discretion, to a third-party search firm engaged by the Committee as part of a process overseen by the Committee, with a reasonably detailed statement of his or her qualifications for serving as a director of RealNetworks. The Committee or the search firm will consider candidates presented, and those candidates that meet the criteria for serving as determined by the Committee will be interviewed and evaluated by members of the Committee, and the other directors are also given the opportunity to meet with and interview the candidates. The Committee will then recommend to the full Board the nominees that it has determined best suit the Board’s needs.

Three new director nominees are being presented to the shareholders for election at the Annual Meeting. Robert Kimball, who currently serves as the Company’s President and Chief Executive Officer, was appointed to the Board of Directors on January 12, 2010 when he was also named President and Acting Chief Executive Officer. Mr. Kimball’s appointment to the Board did not follow the general nomination procedures that are described above because the Board determined that the Company’s principal executive officer should also serve as a director. Janice Roberts and Dominique Trempont were initially identified as potential nominees by a third-party search firm, which received their names from a non-management director. The search firm was paid to assist the Committee in identifying and screening potential director nominees and to coordinate interview schedules and other logistics relating to the evaluation of candidates. Following this process led by the Nominating and Corporate Governance Committee, each of Ms. Roberts and Mr. Trempont were recommended for appointment to the Board of Directors by the Nominating and Corporate Governance Committee.

Qualifications required of individuals who are considered as board nominees will vary according to the particular areas of expertise being sought as a complement to RealNetworks’ existing board composition at the time of any vacancy. All directors should possess the background, skills, expertise, and commitment necessary to make a significant contribution to RealNetworks. Relevant qualifications for RealNetworks’ directors include: (1) exemplary personal and professional ethics and integrity; (2) the ability to engage in objective, fair and forthright deliberations; (3) operating experience at a policy-making level in business(es) relevant to RealNetworks’ current and future plans; (4) independent judgment; (5) adequate time and personal commitment to provide guidance and insight to management; (6) a commitment to provide long term value to RealNetworks’ shareholders; (7) sophisticated business skills to enable rigorous and creative analysis of complex issues; and (8) understanding and experience in relevant markets, technology, operations, finance or marketing in the context of an assessment of the perceived needs of the Board as determined from time to time.

While RealNetworks does not have a formal policy or guidelines regarding diversity of membership of its Board of Directors, the Board recognizes the value of having a Board of Directors that encompasses a broad range of skills, expertise, contacts, industry knowledge and diversity of opinion. Therefore, the Board gives consideration to obtaining a diversity of experience and perspective within the Board and solicits directors’ views on a variety of topics, including whether directors as a whole have the appropriate mix of characteristics, attributes, business experience and background to effectively serve as a director of RealNetworks.

The Committee will evaluate potential nominees by reviewing qualifications and references, conducting interviews and reviewing such other information as the Committee members may deem relevant. The Nominating and Corporate Governance Committee may also retain a search firm for this purpose from time to time. Once the Nominating and Corporate Governance Committee has approved a candidate, the Committee will recommend the candidate to the full Board for appointment. The Board ultimately makes all nominations for directors to be considered and voted upon at RealNetworks’ annual meetings of shareholders.

9

Shareholder Nominations and Recommendations for Director Candidates

Shareholder Nominations for Director

Pursuant to RealNetworks’ Amended and Restated Bylaws, shareholders who wish to nominate one or more candidates for election as directors at an annual meeting of shareholders must give notice of the proposal to nominate such candidate(s) in writing to the Corporate Secretary of RealNetworks not less than 120 days before the first anniversary of the date that RealNetworks’ proxy statement was released to shareholders in connection with the previous year’s annual meeting, or, if the date of the annual meeting at which the shareholder proposes to make such nomination is more than 30 days from the first anniversary of the date of the previous year’s annual meeting, then the shareholder must give notice in a reasonable time before RealNetworks begins to print and mail its proxy materials. The notice must satisfy certain requirements specified in RealNetworks’ Amended and Restated Bylaws, a copy of which will be sent to any shareholder upon written request to the Corporate Secretary of RealNetworks. The Nominating and Corporate Governance Committee will evaluate shareholder nominees using the same standards it uses to evaluate other nominees.

No shareholder has presented a timely notice of a proposal to nominate a director this year. Accordingly, the only directors to be elected at the Annual Meeting are Messrs. Benhamou, Bleier, Kimball and Trempont, Ms. Raina and Ms. Roberts. No other nominations are before, or may be brought at, the Annual Meeting.

Shareholder Recommendations for Director

In addition to the general nomination rights of shareholders, the Nominating and Corporate Governance Committee of the Board of Directors will consider Board candidates recommended by qualified shareholders in accordance with a written policy adopted by the Board. To be a qualified shareholder eligible to recommend a candidate to serve on the Board, a shareholder must have continuously held at least 2% of RealNetworks’ outstanding securities for at least 12 months prior to the date of the submission of the recommendation.

A qualified shareholder may recommend a Board candidate for evaluation by the Committee by delivering a written notice to the Committee subject to the requirements set forth below. The notice must be received by the Committee not less than 120 days before the first anniversary of the date that RealNetworks’ proxy statement was released to shareholders in connection with the previous year’s annual meeting. Where RealNetworks changes its annual meeting date by more than 30 days from year to year, the notice must be received by the Committee no later than the close of business on the 10th day following the day on which notice of the date of the upcoming annual meeting is publicly disclosed.

Any Board candidate recommended by a shareholder must be independent of the recommending shareholder in all respects (e.g., free of material personal, professional, financial or business relationships from the proposing shareholder), as determined by the Committee or applicable law. Any Board candidate recommended by a shareholder must also qualify as an “independent director” under applicable Nasdaq rules.

The notice shall also contain or be accompanied by (i) proof of the required stock ownership (including the required holding period) of the proposing shareholder, (ii) a written statement that the qualified shareholder intends to continue to own the required percentage of shares through the date of the annual meeting with respect to which the Board candidate is proposed to be nominated, (iii) the name or names of each shareholder submitting the proposal, the name of the Board candidate, and the written consent of each such shareholder and the Board candidate to be publicly identified, (iv) the recommending shareholder’s business address and contact information, and (v) all other information that would be required to be disclosed in a proxy statement or other filings required to be made in connection with the solicitation of proxies for election of directors pursuant to Section 14 of the Securities Exchange Act of 1934, as amended.

With respect to the proposed Board candidate, the following information must be provided:

| • | name, age, business and residence addresses; |

| • | principal occupation or employment; |

10

| • | number of shares of RealNetworks’ stock beneficially owned (if any); |

| • | a written resume of personal and professional experiences; |

| • | a statement from the recommending shareholder in support of the candidate, references for the candidate, and an indication of the candidate’s willingness to serve, if elected; |

| • | all other information relating to the proposed Board candidate that would be required to be disclosed in a proxy statement or other filings required to be made in connection with the solicitation of proxies for election of directors pursuant to Section 14 of the Securities Exchange Act of 1934, as amended, and the regulations promulgated thereunder; and |

| • | information, documents or affidavits demonstrating to what extent the proposed Board candidate meets the required minimum criteria established by the Committee, and the desirable qualities or skills, described in the RealNetworks policy regarding director nominations. |

The notice must also include a written statement that the recommending shareholder and the proposed Board candidate will make available to the Committee all information reasonably requested in furtherance of the Committee’s evaluation as well as the signature of each proposed Board candidate and of each shareholder submitting the recommendation.

The notice must be delivered in writing, by registered or certified, first-class mail, postage prepaid, to Chair, Nominating and Corporate Governance Committee, RealNetworks, Inc., c/o Corporate Secretary, 2601 Elliott Avenue, Suite 1000, Seattle, WA 98121.

Board Leadership Structure

Currently, the positions of Chief Executive Officer and Chairman of the Board are held by two different individuals. Robert Kimball presently serves as Chief Executive Officer and a member of the Board, and Robert Glaser serves as Chairman of the Board of Directors. On January 12, 2010, Mr. Glaser resigned as our CEO but retained the position of Chairman of the Board. At that time the Board determined that, although no formal policy was in place, the separation of these positions would allow Mr. Kimball to devote his time to the Company’s key strategic objectives. Moreover, the Board recognized the value of leveraging Mr. Glaser’s longtime leadership and knowledge of the Company through the role of Chairman. The Board and the Nominating and Corporate Governance Committee will continue to assess the appropriateness of this structure as part of the Board’s broader strategic planning process.

In 2008, prior to the separation of the positions of CEO and Chairman, our Board determined that it was appropriate to appoint a lead independent director. Since that time, Eric Benhamou has served as our lead independent director, providing strong leadership among the independent directors of our Board. As lead independent director, Mr. Benhamou is responsible for presiding over executive sessions of the independent directors, advising as to the quality, quantity and timeliness of the flow of information from management necessary for independent directors to effectively and responsibly perform their duties, coordinating the activities of the other independent directors, and acting as principal liaison between independent directors and management.

The Board believes that its current leadership structure consisting of a separate Chairman and CEO, and a lead independent director gives the Board flexibility to meet varying business, personnel and organizational needs over time, and demonstrates its commitment to good corporate governance.

11

Continuing Directors — Not Standing for Election This Year

The following individuals are Class 2 Directors whose terms continue until 2011:

| Biographical Information |

Specific Experience, | |||

| Pradeep Jotwani Age 55 Director since 2008 |

Mr. Jotwani has served on the board of directors of Akeena Solar, Inc., a publicly-traded manufacturer and installer of solar power systems, since August 2009. Mr. Jotwani served as a consulting operating executive at Vector Capital, a private equity firm, from May 2009 to April 2010. From 1982 through 2007, he held a number of senior management positions in Europe and the United States with Hewlett-Packard Company, a leading provider of printing and personal computing products and IT services, software and solutions. From 2002 to 2007, Mr. Jotwani served as Senior Vice President and head of Hewlett-Packard’s $16 billion Printing Supplies business and prior to that was President of Hewlett-Packard’s Consumer Business Organization. Mr. Jotwani serves on the board of directors of Printronix, Inc., a leading provider of line matrix printers for the industrial marketplace. He also serves as a trustee of the Crystal Springs Uplands School and he serves on the advisory board of the Markulla Center of Applied Ethics at Santa Clara University. Mr. Jotwani holds a Bachelor’s degree in Mechanical Engineering from the Indian Institute of Technology in Kanpur, India, a Master’s degree in Industrial Engineering from the University of Wisconsin in Madison and a Master’s degree in Business Administration from Stanford University. | Senior leadership and business strategy experience with technology companies

Industry experience through employment with technology companies

Service as a director of public companies | ||

| Jonathan D. Klein Age 50 Director since 2003 |

Mr. Klein is a co-founder of Getty Images, Inc., a provider of imagery and related products and services, where he has served as Chief Executive Officer and a director since its inception in 1995. Prior to founding Getty Images, Mr. Klein served as a director of London-based investment bank Hambros Bank Limited, where he led the bank’s media industry group. Mr. Klein also serves on the boards of Getty Investments L.L.C., Daylife, Life.com, The Groton School, the Global Business Coalition on HIV/AIDS and Friends of the Global Fight Against AIDS, Tuberculosis and Malaria. Mr. Klein holds a Master’s Degree from Cambridge University. | Senior leadership and business strategy experience gained through founding a company and through service as a Chief Executive Officer

Service as a director of public companies

Media industry experience | ||

12

The following individual is a Class 3 Director whose term continues until 2013:

| Biographical Information |

Specific Experience, | |||

| Robert Glaser Age 48 Director since 1994 |

Mr. Glaser has served as Chairman of the Board of Directors of RealNetworks since its inception in 1994 and as Chief Executive Officer of RealNetworks from 1994 until January 2010. Mr. Glaser has served as a venture partner at Accel Partners, a venture capital firm, since May 2010. Mr. Glaser’s professional experience also includes ten years of employment with Microsoft Corporation where he focused on the development of new businesses related to the convergence of the computer, consumer electronics and media industries. Mr. Glaser holds a B.A. and an M.A. in Economics and a B.S. in Computer Science from Yale University. | Senior leadership and business strategy experience gained through founding a company and through service as an executive at technology companies

Historical knowledge of RealNetworks through 16 years of service as Chief Executive Officer and Chairman of the Board |

Meetings of the Board and Committees

The Board meets on a regularly scheduled basis during the year to review significant developments affecting RealNetworks and to act on matters requiring Board approval. It also holds special meetings when an important matter requires Board action between regularly scheduled meetings. The Board of Directors met 16 times during RealNetworks’ fiscal year ended December 31, 2009. The independent members of the Board of Directors regularly met in executive session without management present. No incumbent member attended fewer than 75% of the aggregate number of meetings of the Board of Directors held during the period for which he or she has been a director. No incumbent member attended fewer than 75% of the aggregate number of meetings of any Board committees on which he or she served held during the periods that he or she served during the fiscal year.

Committees of the Board

The Board of Directors has an Audit Committee, a Compensation Committee, a Nominating and Corporate Governance Committee and a Strategic Transactions Committee. Applying the rules of the Nasdaq Stock Market and the SEC, the Board has determined that all members of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee are “independent.” Committee membership as of September 3, 2010, the record date, was as follows:

| Audit Committee |

Nominating and Corporate |

Compensation Committee |

Strategic

Transactions | |||

| Eric A. Benhamou* |

Edward Bleier | Eric A. Benhamou | Robert Glaser* | |||

| Pradeep Jotwani |

Jonathan Klein | Pradeep Jotwani* | Jonathan Klein | |||

| Kalpana Raina |

Kalpana Raina* | Janice Roberts | Eric A. Benhamou | |||

| Dominique Trempont |

Dominique Trempont |

| * | Chairman |

Audit Committee. The Audit Committee provides oversight of our accounting and financial reporting processes and financial statement audits, reviews RealNetworks’ internal accounting procedures and consults with and reviews the services provided by its independent auditors. All of the members of our Audit Committee

13

are financially literate pursuant to Nasdaq rules, and our Board has designated Mr. Benhamou as the Audit Committee Financial Expert, as defined by the SEC and applicable listing standards. From January 1, 2009 to May 1, 2009, the Audit Committee was composed of Jeremy Jaech, Messrs. Benhamou and Jotwani and Ms. Raina. Mr. Jaech resigned from the Board effective May 1, 2009. From May 2, 2009 to June 28, 2009, the Audit Committee was composed of Messrs. Benhamou, Jotwani and Ms. Raina. From June 29, 2009 to September 9, 2009, the Audit Committee was composed of John Chapple, Messrs. Benhamou and Jotwani and Ms. Raina. Mr. Chapple resigned from the Board effective September 9, 2009. From September 10, 2009 to December 31, 2009, the Audit Committee was composed of Messrs. Benhamou and Jotwani and Ms. Raina. The Board of Directors has adopted a written charter for the Audit Committee which can be found on our corporate website at www.realnetworks.com/company/investor under the caption “Corporate Governance.” The Audit Committee met six times during the fiscal year ended December 31, 2009.

Compensation Committee. The Compensation Committee establishes, reviews and recommends to the Board the compensation and benefits to be provided to the executive officers of RealNetworks and reviews general policy matters relating to employee compensation and benefits. Prior to May 2, 2009, the Compensation Committee was composed of Messrs. Benhamou, Jotwani and Jaech. From May 2, 2009 to June 28, 2009, the Compensation Committee was composed of Messrs. Benhamou and Jotwani. From June 29, 2009 to September 9, 2009, the Compensation Committee was composed of Messrs .Benhamou, Jotwani and Chapple. From September 10, 2009 through December 31, 2009, the Compensation Committee was composed of Messrs. Benhamou and Jotwani. The Board of Directors has adopted a written charter for the Compensation Committee which can be found on our corporate website at www.realnetworks.com/company/investor under the caption “Corporate Governance.” The Compensation Committee met eight times during the fiscal year ended December 31, 2009 and took action by unanimous written consent on 11 other occasions.

The Compensation Committee has the authority to retain a compensation consultant to assist in the evaluation of executive compensation and has the authority to approve the consultant’s fees and retention terms. In 2009, the Compensation Committee engaged Frederic W. Cook & Co., Inc. (“Cook”) as its compensation consultant to provide analyses and make recommendations concerning non-management director compensation. Cook was also engaged by RealNetworks’ human resources department to provide guidance and recommendations in connection with RealNetworks’ stock option exchange program for employees other than Section 16 officers. In this role, Cook worked with and received instructions from members of our human resources department.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee searches for and recommends to the Board potential nominees for Board positions, makes recommendations to the Board regarding size and composition of the Board, and develops and recommends to the Board the governance principles applicable to RealNetworks. The Board of Directors has adopted a written charter for the Nominating and Corporate Governance Committee which can be found on our corporate website at www.realnetworks.com/company/investor under the caption “Corporate Governance.” The Nominating and Corporate Governance Committee met six times during the fiscal year ended December 31, 2009.

Strategic Transactions Committee. Pursuant to our Amended and Restated Articles of Incorporation, the approval of the Strategic Transactions Committee is required before the Board of Directors may:

| • | adopt a plan of merger; |

| • | authorize the sale, lease, exchange or mortgage of (a) assets representing more than 50% of the book value of RealNetworks’ assets prior to the transaction or (b) any other asset or assets on which the long-term business strategy of RealNetworks is substantially dependent; |

| • | authorize the voluntary dissolution of RealNetworks; or |

| • | take any action that has the effect of the foregoing clauses. |

14

From January 1, 2009 to May 1, 2009, the Strategic Transactions Committee was composed of Messrs. Glaser, Klein and Jaech. Mr. Jaech resigned from the Board of Directors effective of May 1, 2009. From May 2, 2009 to December 31, 2009, the Strategic Transactions Committee was composed of Messrs. Glaser and Klein. A written charter for the Strategic Transactions Committee can be found on our corporate website at www.realnetworks.com/company/investor under the caption “Corporate Governance.” The Strategic Transactions Committee met one time during the fiscal year ended December 31, 2009.

Board Oversight of Risk

The Company’s management team is responsible for the day-to-day management of risks the Company faces, while the Board of Directors oversees the Company’s risk management, both as a full Board of Directors and through its committees. The Board obtains information and insight on the Company’s risk management from the Company’s senior executives who attend Board meetings and are available to address any questions or concerns raised by the Board on risk management-related and any other matters. The Board also gains information from presentations prepared by senior management on strategic and significant operational matters involving our business. The Board of Directors also periodically reviews and approves the Company’s strategic plans and initiatives, including the related expected opportunities and challenges facing the business and the execution of those plans.

The Board of Directors has delegated the oversight of certain risk areas to Board committees that assist the Board in fulfilling its risk oversight responsibility. For example, the Audit Committee has the responsibility to consider and discuss the Company’s major financial risk exposures and the steps management has taken to monitor and control these risks. The Audit Committee also monitors compliance with legal and regulatory requirements, reviews legal matters that could have a significant financial impact on the Company and oversees the performance of the Company’s internal audit function. In addition, the Audit Committee monitors the Company’s code of ethics and oversees the Company’s procedures for handling employee complaints regarding accounting, accounting controls and auditing matters.

The Audit Committee also reviews the annual comprehensive enterprise risk assessment performed by the Company’s internal audit department that encompasses a number of significant areas of risk, including strategic, operational, compliance, investment and financial risks. This assessment process is designed to gather data regarding the most important risks that could impact the Company’s ability to achieve its objectives and execute its strategies and entails reviewing critical Company policies and strategies as well as monitoring of emerging industry trends and issues. The assessment is reviewed by the Company’s Chief Executive Officer and Chief Financial Officer and presented to the Audit Committee to facilitate discussion of any high risk areas.

The Board of Directors has also delegated to other committees the oversight of risk within their areas of responsibilities and expertise. The Compensation Committee reviews and approves the compensation for the Company’s executive officers (other than the Chief Executive Officer) and its relationship to the Company’s strategy and business plans and, in connection with those responsibilities, conducts an annual review of the Company’s risk assessment of its compensation policies and practices for its employees. The Nominating and Corporate Governance Committee oversees the risk associated with the Company’s corporate governance policies and practices. Each Board Committee is responsible for reporting its findings and recommendations, as appropriate, to the full Board of Directors.

Policy Regarding Director Attendance at Annual Meetings of Shareholders

We have a policy that at least one member of our Board of Directors will attend each annual meeting of shareholders, and all directors are encouraged to attend shareholder meetings. We will reimburse directors for reasonable expenses incurred in attending annual meetings of shareholders. One director attended the annual meeting of shareholders held on September 21, 2009.

15

Code of Business Conduct and Ethics

RealNetworks has adopted a Code of Business Conduct and Ethics that applies to all of RealNetworks’ employees, officers and directors. RealNetworks’ Code of Business Conduct and Ethics is publicly available on its website (www.realnetworks.com/company/investor under the caption “Corporate Governance”), or can be obtained without charge by written request to RealNetworks’ Corporate Secretary at the address of RealNetworks’ principal executive office. RealNetworks intends to satisfy the disclosure requirements under Item 5.05 of Form 8-K regarding an amendment to or waiver from the application of the Code of Business Conduct and Ethics that applies to the Chief Executive Officer or the Chief Financial Officer, and any other applicable accounting and financial employee, by posting such information on its website at www.realnetworks.com/company/investor under the caption “Corporate Governance.”

16

VOTING SECURITIES AND PRINCIPAL HOLDERS

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth, as of September 3, 2010, information regarding beneficial ownership of the Common Stock by (a) each person known to RealNetworks to be the beneficial owner of more than five percent of RealNetworks’ outstanding common stock, (b) each director, (c) RealNetworks’ Chief Executive Officer during the year ended December 31, 2009, (d) RealNetworks’ Chief Financial Officer during the year ended December 31, 2009, (e) the three other most highly compensated executive officers serving as executive officers during the year ended December 31, 2009, and (f) all of RealNetworks’ executive officers and directors as a group. Percentage of beneficial ownership is based on 135,638,895 shares outstanding as of September 3, 2010. The mailing address for each named executive officer and director in the table below is c/o RealNetworks, Inc., 2601 Elliott Avenue, Suite 1000, Seattle, Washington 98121.

| Name of Beneficial Owner |

Number of Shares of Common Stock Beneficially Owned(1) |

Percentage of Common Stock Outstanding |

|||

| Robert Glaser(2) |

51,797,024 | 38.0 | % | ||

| T. Rowe Price Associates, Inc.(3) |

9,857,900 | 7.3 | |||

| Dimensional Fund Advisors LP(4) |

8,613,647 | 6.4 | |||

| Eric A. Benhamou(5) |

322,920 | * | |||

| Edward Bleier(6) |

451,000 | * | |||

| Pradeep Jotwani(7) |

90,000 | * | |||

| Robert Kimball(8) |

982,197 | * | |||

| Jonathan D. Klein(9) |

369,898 | * | |||

| Kalpana Raina(10) |

362,343 | * | |||

| Janice Roberts |

0 | * | |||

| Dominique Trempont |

0 | * | |||

| Michael Eggers(11) |

475,926 | * | |||

| John Barbour(12) |

437,500 | * | |||

| John Giamatteo(13) |

33,712 | * | |||

| Hank Skorny(14) |

129,375 | * | |||

| All directors and executive officers as a group (13 persons)(15) |

55,856,679 | 39.9 | % |

| * | Less than 1%. |

| (1) | Beneficial ownership is determined in accordance with rules of the SEC and includes shares over which the beneficial owner exercises voting or investment power. Shares of Common Stock subject to options currently exercisable or exercisable within 60 days of September 3, 2010 are deemed outstanding for the purpose of computing the percentage ownership of the person holding the options, but are not deemed outstanding for the purpose of computing the percentage ownership of any other person. Except as otherwise indicated, and subject to community property laws where applicable, RealNetworks believes, based on information provided by such persons, that the persons named in the table above have sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them. |

| (2) | Includes 1,836,405 shares of Common Stock owned by the Glaser Progress Foundation, of which Mr. Glaser is trustee. Mr. Glaser disclaims beneficial ownership of these shares. Also includes 625,000 shares of Common Stock issuable upon exercise of options exercisable within 60 days of September 3, 2010. |

17

| (3) | Information is based on a Schedule 13G filed with the SEC on February 12, 2010 by T. Rowe Price Associates, Inc. (“Price Associates”). Price Associates reported that as of December 31, 2009, it beneficially owned an aggregate of 9,857,900 shares of common stock and that its address is 100 E. Pratt Street, Baltimore, Maryland 21202. These securities are owned by various individual and institutional investors including T. Rowe Price Science & Technology Fund, Inc. which owns 6,859,600 shares representing 5% of the shares outstanding, for which Price Associates serves as investment adviser with power to direct investments and/or sole power to vote the securities. For purposes of the reporting requirements of the Securities Exchange Act of 1934, Price Associates is deemed to be a beneficial owner of such securities; however, Price Associates, Inc. expressly disclaims that it is the beneficial owner of such securities. |

| (4) | Information is based on a Schedule 13G filed with the SEC on February 8, 2010 by Dimensional Fund Advisors LP (“Dimensional”). Dimensional reported that as of December 31, 2009, it beneficially owned an aggregate of 8,613,647 shares of common stock and that its address is Palisades West, Building One, 6300 Bee Cave Road, Austin, Texas 78746. Dimensional furnishes investment advice to four investment companies registered under the Investment Company Act of 1940, and serves as investment manager to certain other commingled group trusts and separate accounts. While Dimensional possesses investment and/or voting power over these shares and therefore may be deemed to be the beneficial owner of such shares, Dimensional disclaims beneficial ownership of these shares. |

| (5) | Includes 32,920 shares of common stock owned by the Eric and Illeana Benhamou Living Trust. Also includes 290,000 shares of common stock issuable upon exercise of options exercisable within 60 days of September 3, 2010. |

| (6) | Includes 450,000 shares of common stock issuable upon exercise of options exercisable within 60 days of September 3, 2010. |

| (7) | Includes 90,000 shares of common stock issuable upon exercise of options exercisable within 60 days of September 3, 2010. |

| (8) | Includes 951,764 shares of common stock issuable upon exercise of options exercisable within 60 days of September 3, 2010. |

| (9) | Includes 325,000 shares of common stock issuable upon exercise of options exercisable within 60 days of September 3, 2010. |

| (10) | Includes 360,000 shares of common stock issuable upon exercise of options exercisable within 60 days of September 3, 2010. |

| (11) | Includes 455,013 shares of common stock issuable upon exercise of options exercisable within 60 days of September 3, 2010. |

| (12) | Includes 437,500 shares of common stock issuable upon exercise of options exercisable within 60 days of September 3, 2010. Mr. Barbour’s employment by RealNetworks, Inc. terminated on August 13, 2010. |

| (13) | Based on direct holdings as of September 3, 2010. Mr. Giamatteo’s employment by RealNetworks terminated on April 2, 2010. |

| (14) | Includes 129,375 shares of common stock issuable upon exercise of options exercisable within 60 days of September 3, 2010. |

| (15) | Includes an aggregate of 4,069,902 shares of common stock issuable upon exercise of options exercisable within 60 days of September 3, 2010. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities and Exchange Act of 1934, as amended, requires RealNetworks’ executive officers, directors, and persons who own more than ten percent of a registered class of RealNetworks’ equity securities to file reports of ownership and changes of ownership with the SEC. Executive officers, directors and greater than ten percent shareholders are required by SEC regulation to furnish RealNetworks with copies of all such reports they file. Specific due dates have been established by the SEC, and RealNetworks is required to disclose in this Proxy Statement any failure to file by those dates.

18

Based solely on its review of the copies of such reports received by RealNetworks, and on written representations by the executive officers and directors of RealNetworks regarding their compliance with the applicable reporting requirements under Section 16(a) of the Exchange Act, RealNetworks believes that, with respect to its fiscal year ended December 31, 2009, all of the executive officers and directors of RealNetworks, and all of the persons known to RealNetworks to own more than ten percent of the Common Stock, complied with all such reporting requirements.

Compensation Committee Interlocks and Insider Participation

From January 1, 2009 to May 1, 2009, the Compensation Committee was composed of Messrs. Benhamou, Jotwani and Jaech. Mr. Jaech resigned from the Board of Directors effective of May 1, 2009. From May 2, 2009 to June 28, 2009, the Compensation Committee was composed of Messrs. Benhamou and Jotwani. From June 29, 2009 to September 9, 2009, the Compensation Committee was composed of Messrs. Benhamou, Jotwani and Chapple. Mr. Chapple resigned from the Board of Directors effective September 9, 2009. From September 10, 2009 through December 31, 2009, the Compensation Committee was composed of Messrs. Benhamou and Jotwani. In 2009, no executive officer of RealNetworks served as a member of the board of directors or compensation committee of any entity that had one or more executive officers serving as a member of RealNetworks’ Board of Directors or Compensation Committee. In addition, no interlocking relationship existed between any member of our Compensation Committee and any member of the compensation committee of any other company.

Change-in-Control Arrangements

RealNetworks 2005 Stock Incentive Plan. The Compensation Committee of the Board of Directors may determine at the time an award is granted under the RealNetworks, Inc. 2005 Stock Incentive Plan, as amended and restated (the “2005 Plan”), that upon a “Change of Control” of RealNetworks (as that term may be defined in the agreement evidencing an award), (a) options and stock appreciation rights outstanding as of the date of the Change of Control immediately vest and become fully exercisable or may be cancelled and terminated without payment therefor if the fair market value of one share of RealNetworks’ Common Stock as of the date of the Change of Control is less than the per share option exercise price or stock appreciation right grant price, (b) restrictions and deferral limitations on restricted stock awards lapse and the restricted stock becomes free of all restrictions and limitations and becomes fully vested, (c) performance awards shall be considered to be earned and payable (either in full or pro rata based on the portion of performance period completed as of the date of the Change of Control), and any deferral or other restriction shall lapse and such performance awards shall be immediately settled or distributed, (d) the restrictions and deferral limitations and other conditions applicable to any other stock unit awards or any other awards shall lapse, and such other stock unit awards or such other awards shall become free of all restrictions, limitations or conditions and become fully vested and transferable to the full extent of the original grant, and (e) such other additional benefits as the Compensation Committee deems appropriate shall apply, subject in each case to any terms and conditions contained in the agreement evidencing such award.

For purposes of the 2005 Plan, a “Change of Control” shall mean an event described in an agreement evidencing an award or such other event as determined in the sole discretion of the Board. The Compensation Committee may determine that, upon the occurrence of a Change of Control of RealNetworks, each option and stock appreciation right outstanding shall terminate within a specified number of days after notice to the participant, and/or that each participant shall receive, with respect to each share of Common Stock subject to such option or stock appreciation right, an amount equal to the excess of the fair market value of such share immediately prior to the occurrence of such Change of Control over the exercise price per share of such option and/or stock appreciation right; such amount to be payable in cash, in one or more kinds of stock or property, or in a combination thereof, as the Committee, in its discretion, shall determine.

19

If in the event of a Change of Control the successor company assumes or substitutes for an option, stock appreciation right, share of restricted stock or other stock unit award, then such outstanding option, stock appreciation right, share of restricted stock or other stock unit award shall not be accelerated as described above. An option, stock appreciation right, share of restricted stock or other stock unit award shall be considered assumed or substituted for if following the Change of Control the award confers the right to purchase or receive, for each share subject to the option, stock appreciation right, restricted stock award or other stock unit award immediately prior to the Change of Control, the consideration received in the transaction constituting a Change of Control by holders of shares for each share held on the effective date of such transaction; provided, however, that if such consideration received in the transaction constituting a Change of Control is not solely common stock of the successor company, the Committee may, with the consent of the successor company, provide that the consideration to be received upon the exercise or vesting of an option, stock appreciation right, restricted stock award or other stock unit award, for each share subject thereto, will be solely common stock of the successor company substantially equal in fair market value to the per share consideration received by holders of shares in the transaction constituting a Change of Control. Notwithstanding the foregoing, on such terms and conditions as may be set forth in the agreement evidencing an award, in the event of a termination of a participant’s employment in such successor company within a specified time period following such Change in Control, each award held by such participant at the time of the Change in Control shall be accelerated as described above.

RealNetworks 1996 Stock Option Plan, 2000 Stock Option Plan and 2002 Director Stock Option Plan. Under RealNetworks’ 1996 Stock Option Plan (the “1996 Plan”), 2000 Stock Option Plan (the “2000 Plan”) and 2002 Director Stock Option Plan (the “2002 Plan”), as any of such plans have been amended and restated (the “Plans”), each outstanding option issued under the Plans will become exercisable in full in respect of the aggregate number of shares covered thereby in the event of:

| • | any merger, consolidation or binding share exchange pursuant to which shares of Common Stock are changed or converted into or exchanged for cash, securities or other property, other than any such transaction in which the persons who hold Common Stock immediately prior to the transaction have immediately following the transaction the same proportionate ownership of the common stock of, and the same voting power with respect to, the surviving corporation; |

| • | any merger, consolidation or binding share exchange in which the persons who hold Common Stock immediately prior to the transaction have immediately following the transaction less than a majority of the combined voting power of the outstanding capital stock of RealNetworks ordinarily (and apart from rights accruing under special circumstances) having the right to vote in the election of directors; |

| • | any liquidation or dissolution of RealNetworks; |

| • | any sale, lease, exchange or other transfer not in the ordinary course of business (in one transaction or a series of related transactions) of all, or substantially all, of the assets of RealNetworks; or |

| • | any transaction (or series of related transactions), consummated without the approval or recommendation of the Board of Directors, in which (i) any person, corporation or other entity (excluding RealNetworks and any employee benefit plan sponsored by RealNetworks) purchases any Common Stock (or securities convertible into Common Stock) for cash, securities or any other consideration pursuant to a tender offer or exchange offer, or (ii) any person, corporation or other entity (excluding RealNetworks and any employee benefit plan sponsored by RealNetworks) becomes the direct or indirect beneficial owner of securities of RealNetworks representing fifty percent (50%) or more of the combined voting power of the then outstanding securities of RealNetworks ordinarily (and apart from rights accruing under special circumstances) having the right to vote in the election of directors. |

Except as otherwise provided in an agreement evidencing an award under the Plans, the administrator of the Plans may, in its discretion, determine that outstanding options issued under the Plans will not become exercisable on an accelerated basis in connection with any of the transactions described above if the RealNetworks Board of Directors or the surviving or acquiring corporation, as the case may be, has taken action

20

to provide for (a) the substitution of outstanding options granted under the Plans for equitable options in the surviving or acquiring corporation, (b) the assumption of such options by the surviving or acquiring corporation, or (c) the cash payment to each holder of an option of such amount as the plan administrator shall determine represents the then value of such options.