United States

Securities and Exchange Commission

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. __)

| Filed by the registrant | ☒ |

| Filed by a party other than the registrant | ☐ |

| Check the appropriate box: |

|

☐ Preliminary Proxy Statement |

|

|

☐ Confidential, for use of the Commission |

|

|

Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☒ Definitive Proxy Statement |

|

|

☐ Definitive Additional Materials |

|

|

☐ Soliciting Material Under Rule 14a-12 |

| Guaranty Federal Bancshares, Inc. | ||

| (Name of Registrant as Specified in Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of filing fee (Check the appropriate box):

|

☒ No fee required |

|

|

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) |

Title of each class of securities to which transaction applies: |

| (2) |

Aggregate number of securities to which transaction applies: |

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11. (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) |

Proposed maximum aggregate value of transaction: |

| (5) |

Total fee paid: |

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) |

Amount previously paid: |

| (2) |

Form, Schedule or Registration Statement No.: |

| (3) |

Filing Party: |

| (4) |

Date Filed: |

GUARANTY FEDERAL BANCSHARES, INC.

2144 E. Republic Rd. Suite F200

SPRINGFIELD, MO 65804

(417) 520-4333

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 26, 2021

Notice is hereby given that an annual meeting of the stockholders (the “Meeting”) of Guaranty Federal Bancshares, Inc. (the “Company”) will be held at the Guaranty Bank headquarters, 2144 E. Republic Rd., Suite F200, Springfield, Missouri, on May 26, 2021, at 6:00 p.m., local time. Stockholders of record at the close of business on April 5, 2021 are the stockholders entitled to notice of and to vote at the Meeting. As part of our precautions regarding the coronavirus or COVID-19, we are planning for the possibility that the Meeting may be held solely by means of remote communication. If we take this step, we will announce the decision to do so in advance and will provide details on how to participate.

The Meeting is being held for the purpose of considering and acting upon:

|

1. |

The election of three directors. |

|

2. |

The advisory (non-binding) vote to approve the Company’s named executive officer compensation. |

|

3. |

The ratification of BKD, LLP as independent registered public accounting firm to the Company for the fiscal year ending December 31, 2021. |

|

4. |

Such other matters as may come properly before the Meeting or any adjournments thereof. Except with respect to procedural matters incident to the conduct of the Meeting, the Board of Directors is not aware of any other business to come before the Meeting. |

Important Notice Regarding the Availability of Proxy Materials for the 2021 Annual Stockholders’ Meeting to be Held on May 26, 2021. Pursuant to the rules promulgated by the Securities and Exchange Commission, we have elected to provide access to our proxy materials by notifying you of the availability of our proxy materials on the internet. We encourage you to access and review all of the important information contained in these proxy materials before voting. If you want to receive a paper or e-mail copy of these documents, you must request one. There is no charge to you for requesting a copy. Please make your request for a copy as instructed below on or before May 16, 2021 to facilitate timely delivery. This Notice of Annual Meeting, Proxy Statement, related materials and our 2020 Annual Report may be accessed at www.gbankmo.com or www.investorvote.com/GFED.

|

|

BY ORDER OF THE BOARD OF DIRECTORS |

|

|

|

|

|

|

|

/s/ James Batten |

|

|

|

|

|

|

|

James Batten |

|

| Chairman of the Board |

Springfield, Missouri

April 13, 2021

THE BOARD OF DIRECTORS URGES YOU TO VOTE YOUR PROXY AS PROVIDED IN THE PROXY MATERIALS AS SOON AS POSSIBLE, EVEN IF YOU CURRENTLY PLAN TO ATTEND THE ANNUAL MEETING. AS DESCRIBED HEREIN, YOU MAY VOTE ONLINE, USE THE TOLL-FREE TELEPHONE NUMBER, OR, IF YOU WISH TO VOTE BY PROXY CARD, REQUEST A PAPER COPY OF THE MATERIALS, THEN SIGN AND RETURN THE PROXY CARD IN THE POSTAGE PREPAID ENVELOPE IN WHICH THE PROXY CARD WILL BE MAILED TO YOU. THIS WILL NOT PREVENT YOU FROM VOTING IN PERSON AT THE ANNUAL MEETING IF YOU DESIRE, AND YOU MAY REVOKE YOUR PROXY AS DESCRIBED HEREIN AT ANY TIME PRIOR TO THE VOTE AT THE ANNUAL MEETING. IF YOU ARE A STOCKHOLDER WHOSE SHARES ARE NOT REGISTERED IN YOUR OWN NAME, YOU WILL NEED ADDITIONAL DOCUMENTATION FROM YOUR RECORD HOLDER TO VOTE PERSONALLY AT THE MEETING.

|

2144 E. Republic Rd. Ste F200 ▪ Springfield, MO 65804 |

April 13, 2021

Dear Fellow Stockholder:

On behalf of the Board of Directors and management of Guaranty Federal Bancshares, Inc., I cordially invite you to attend the 2021 Annual Meeting of Stockholders to be held at the Guaranty Bank headquarters, 2144 E. Republic Rd., Suite F200, Springfield, Missouri, on Wednesday, May 26, 2021 at 6:00 p.m., local time. The Notice of Annual Meeting of Stockholders and Proxy Statement describe the formal business to be transacted at the meeting. Following the formal meeting, I will report on the operations of the Company. Directors and officers of the Company, as well as representatives of BKD, LLP, our independent registered public accounting firm, will be present to respond to any questions that stockholders may have. As part of our precautions regarding the coronavirus or COVID-19, we are planning for the possibility that the annual meeting may be held solely by means of remote communication. If we take this step, we will announce the decision to do so in advance and will provide details on how to participate.

Whether or not you plan to attend the meeting, please vote online or via the toll-free telephone number, as provided in the proxy materials, or request a paper copy of the proxy materials to receive a proxy card as soon as possible to vote, sign and return in the postage prepaid envelope in which the proxy card will be mailed to you. This will not prevent you from voting in person at the meeting but will assure that your vote is counted if you are unable to attend the meeting.

Respectfully,

/s/ Shaun A. Burke

Shaun A. Burke

President and CEO

GUARANTY FEDERAL BANCSHARES, INC.

2144 E. REPUBLIC RD. SUITE F200

SPRINGFIELD, MISSOURI 65804

PROXY STATEMENT

This Proxy Statement has been prepared in connection with the solicitation of proxies by the Board of Directors of Guaranty Federal Bancshares, Inc. (the “Company”) for use at the annual meeting of stockholders to be held on May 26, 2021 (the “Annual Meeting”), and at any adjournment(s) thereof. The Annual Meeting will be held at 6:00 p.m., local time, at the Guaranty Bank headquarters, 2144 E. Republic Rd, Suite F200, Springfield, Missouri. As part of our precautions regarding the coronavirus or COVID-19, we are planning for the possibility that the Annual Meeting may be held solely by means of remote communication. If we take this step, we will announce the decision to do so in advance and will provide details on how to participate. This Proxy Statement will first be made available to stockholders on April 13, 2021.

RECORD DATE--VOTING--VOTE REQUIRED FOR APPROVAL

All persons who were holders of record of the common stock, par value $0.10 per share (“Common Stock”) of the Company at the close of business on April 5, 2021 (the “Record Date”) will be entitled to notice of and to cast votes at the Annual Meeting. Article XIII of the Company’s Restated Certificate of Incorporation provides that the number of shares of Common Stock that may be voted by a record holder who beneficially owns Common Stock in excess of 10% of the outstanding shares of Common Stock as of the Record Date (the “Limit”), will be determined pursuant to a formula set forth in Article XIII. However, if the Company’s Board of Directors (the “Board of Directors” or the “Board”) approved the acquisition of the shares of Common Stock that resulted in the record owner beneficially owning more than 10% of the outstanding Common Stock, Article XIII is not applicable. Further, this restriction does not apply to employee benefit plans of the Company.

Voting may be by proxy or in person. As of the Record Date, the Company had 4,385,031 shares of Common Stock issued and outstanding. Holders of a majority of the outstanding shares of Common Stock entitled to vote (after giving effect, if required, to Article XIII) will constitute a quorum for purposes of transacting business at the Annual Meeting.

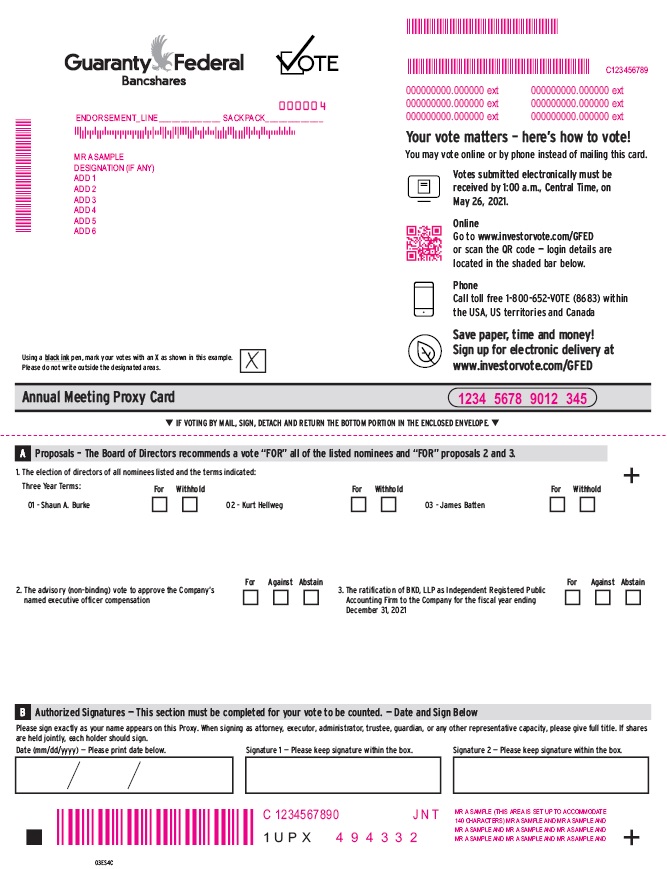

Stockholders are urged to vote in one of the following manners: (i) via the Internet at www.investorvote.com/GFED; (ii) by telephone at 1-800-652-VOTE (8683); or (iii), for stockholders who request a paper copy, by indicating their vote in the appropriate spaces on the proxy card. Each proxy solicited hereby, if properly submitted or executed, duly received by the Board of Directors and not revoked prior to the Annual Meeting, will be voted at the Annual Meeting in accordance with the stockholder’s instructions indicated thereon. Where no instructions are indicated, proxies will be voted by those named in the proxies FOR the approval of the specific proposals presented in this Proxy Statement and on the proxy card and in the discretion of those named in the proxies upon any other business that may properly come before the Annual Meeting or any adjournment thereof. Each stockholder shall have one vote for each share of Common Stock owned. No appraisal or dissenters’ rights exist for any action to be taken at the Annual Meeting.

A stockholder giving a proxy has the power to revoke the proxy at any time before it is exercised by submitting a valid, later-dated proxy card/voting instruction form, submitting a valid, subsequent vote by telephone or the internet, filing with the Secretary of the Company written instructions revoking the proxy or completing a written ballot at the Annual Meeting. If your shares are held in a brokerage account in your broker or nominee’s name, you should follow the instructions for changing or revoking your vote provided by your broker or nominee.

To the extent necessary to assure sufficient representation at the Annual Meeting, proxies may be solicited by officers, directors and regular employees of the Company personally, by telephone, by internet or by further correspondence. Officers, directors and regular employees of the Company will not be compensated for their solicitation efforts. The cost of soliciting proxies from stockholders will be borne by the Company. The Company will also reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy materials to the beneficial owners of Common Stock.

Regardless of the number of shares of the Company’s Common Stock owned, it is important that stockholders be represented by proxy or be present in person at the Annual Meeting. In order for any proposals considered at the Annual Meeting to be approved by the Company’s stockholders, a quorum must be present. Stockholders are requested to vote by visiting the internet at www.investorvote.com/GFED, calling 1-800-652-VOTE (8683) or by requesting a paper proxy card and returning it signed and dated in the enclosed postage-paid envelope.

Only holders of record of the Common Stock on the Record Date are entitled to vote at the Annual Meeting. An abstention occurs when a holder of record of Common Stock who has the right to vote such shares on a particular matter does not vote such shares on that matter. Brokers who are record holders of Common Stock are entitled to vote the shares they hold for their customers in “street name” only on routine matters when their customers (i.e. the “beneficial owners”) do not instruct the brokers how to vote their shares on that routine matter. Only Proposal Three, the ratification of BKD, LLP as the Company’s independent registered public accounting firm, is deemed to be a routine matter. Therefore, brokers will be entitled to vote shares of Common Stock they hold in street name for their customers in the absence of instructions on how to vote by the beneficial owners only on Proposal Three. Proposals One and Two are not deemed to be routine matters and, as such, brokers are not entitled to vote shares of Common Stock they hold in street name on Proposals One and Two in the absence of instructions from the beneficial owners on how to vote their shares. These are referred to as “broker non-votes”.

Proposal 1 is the election of nominees for positions as directors of the Company. Directors are elected by a plurality of the votes cast, meaning that the three director nominees who receive the highest number of shares voted “for” their election are elected. Withheld votes will have no effect on the election of the nominees for positions as directors. Because the election of directors is considered to be a non-routine matter, brokers are not entitled to vote in the election. Accordingly, broker non-votes will have no effect on the election of the nominees for positions as directors.

Proposal 2 is the advisory (non-binding) vote on named executive officers’ compensation. Approval requires the affirmative vote of the holders of a majority of the outstanding shares of Common Stock present in person or represented by proxy and entitled to vote on that matter at the Annual Meeting. This means that of the shares represented at the meeting and entitled to vote, a majority of them must be voted for Proposal 2 for it to be approved. Abstentions will have the same effect as a vote “against” Proposal 2. Because Proposal 2 is deemed to be a non-routine matter, brokers are not entitled to vote on it. Accordingly, broker non-votes will have no effect on the vote for Proposal 2.

Proposal 3 is the ratification of BKD, LLP as the Company’s independent registered public accounting firm for the Company’s fiscal year ending December 31, 2021. Approval requires the affirmative vote of the holders of a majority of the outstanding shares of Common Stock present in person or represented by proxy and entitled to vote on that matter at the Annual Meeting. This means that of the shares represented at the meeting and entitled to vote, a majority of them must be voted for Proposal 3 for it to be approved. Abstentions will have the same effect as a vote “against” Proposal 3. Because ratification of accountants is deemed to be a routine matter permitting brokers to vote even in the absence of instructions from the beneficial owner, there will not be broker non-votes with respect to Proposal 3.

Article XIII of the Company’s Restated Certificate of Incorporation restricts the voting of all shares of Common Stock beneficially owned by record holders who beneficially own in excess of the Limit unless the Board approved the acquisition of the shares that resulted in the record owner beneficially owning more than the Limit.

SECURITIES OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Persons and groups owning in excess of 5% of the Common Stock are required to file certain reports regarding such ownership pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Article XIII of the Restated Certificate of Incorporation of the Company restricts the voting of all shares of Common Stock beneficially owned by record holders who beneficially own in excess of 10% of the outstanding shares of Common Stock unless the Board approved the acquisition of the shares that resulted in the record owner beneficially owning more than the Limit. This restriction does not apply to employee benefit plans of the Company. The following table sets forth, as of the Record Date, persons or groups who are known by the Company to beneficially own more than 5% of the Common Stock.

|

Name and Address of Beneficial Owner |

Amount and Nature of Beneficial Ownership |

Percent of Total Outstanding Common Shares |

||||||

| Castle Creek Capital Parners V, LP | ||||||||

| 6051 El Tordo | ||||||||

| Racho Santa Fe, CA 92067 | 918,804 | (1) | 20.95% | |||||

| FJ Capital Management, LLC | ||||||||

| 1313 Dolley Madison Blvd, Ste 306 | ||||||||

| McLean, VA 22101 | 429,959 | (2) | 9.81% | |||||

(1) Information based solely on a joint Schedule 13D/A filed with the Securities and Exchange Commission (the “SEC”) on March 6, 2018 by Castle Creek Capital Partners V, LP (“Fund V”), Castle Creek Capital V LLC (“CCC V”), John M. Eggemeyer III, Mark G. Merlo, John T. Pietrzak and J. Mikesell Thomas as the “Reporting Persons.” Each of the Reporting Persons may be deemed to be the beneficial owner of the 918,804 shares of Common Stock held directly by Fund V. CCC V is the sole general partner of Fund V. Mr. Eggemeyer, Mr. Merlo, Mr. Pietrzak, and Mr. Thomas share voting and dispositive power over the 918,804 shares beneficially owned by Fund V, due to the fact that each is a managing principal of CCC V. CCC V, Mr. Eggemeyer, Mr. Merlo, Mr. Pietrzak, and Mr. Thomas each disclaim beneficial ownership of the Common Stock, except to the extent of their respective pecuniary interest in Fund V. The record holder of the shares of Common Stock beneficially owned by Fund V may vote all 918,804 shares of Common Stock beneficially owned by it, without restrictions on voting imposed by Article XIII of the Company’s Restated Certificate of Incorporation, because the Board of Directors approved the acquisition of the shares of Common Stock that exceed the Limit.

(2) Information based solely on a joint Schedule 13G/A filed with the SEC on February 13, 2020 by FJ Capital Management LLC (“FJ Capital”), Financial Opportunity Fund LLC (“Financial Opportunity”), Financial Hybrid Opportunity Fund SPV I LLC (“Financial Hybrid Opportunity”), Martin Friedman(“Mr. Friedman”), Bridge Equities III, LLC (“Bridge III”), Bridge Equities VIII, LLC (“Bridge VIII”), Bridge Equities IX, LLC (“Bridge IX”), Bridge Equities X, LLC (“Bridge X”), Bridge Equities XI, LLC (“Bridge XI”), SunBridge Manager, LLC (“SunBridge Manager”), SunBridge Holdings, LLC (“SunBridge Holdings”) and Realty Investment Company, Inc. (“RIC”) as the “Reporting Persons.”

According to such Schedule 13G/A, each Reporting Person beneficially owns an aggregate of the following number of shares: FJ Capital - 429,959 shares, Financial Opportunity – 119,101 shares, Financial Hybrid Opportunity – 37,136 shares, Mr. Friedman – 429,959 shares, Bridge III – 240,591 shares, Bridge VIII – 2,730 shares, Bridge IX – 3,178 shares, Bridge X – 2,243 shares, Bridge XI – 8,551 shares, SunBridge Manager – 257,293 shares, SunBridge Holdings - 257,293 shares, and RIC – 257,293 shares.

According to such Schedule 13G/A, each Reporting Person shares voting power with respect to the following number of shares: FJ Capital - 429,959 shares, Financial Opportunity – 119,101 shares, Financial Hybrid Opportunity – 37,136 shares, Mr. Friedman – 429,959 shares, Bridge III – 240,591 shares, Bridge VIII – 2,730 shares, Bridge IX – 3,178 shares, Bridge X – 2,243 shares, Bridge XI – 8,551 shares, SunBridge Manager – 257,293 shares, SunBridge Holdings - 257,293 shares, and RIC – 257,293 shares. According to such Schedule 13G/A, each Reporting Person shares dispositive power with respect to the following number of shares: FJ Capital – 172,666 shares, Financial Opportunity – 119,101 shares, Financial Hybrid Opportunity – 37,136 shares, Mr. Friedman – 172,666 shares, Bridge III – 240,591 shares, Bridge VIII – 2,730 shares, Bridge IX – 3,178 shares, Bridge X – 2,243 shares, Bridge XI – 8,551 shares, SunBridge Manager – 257,293 shares, SunBridge Holdings - 257,293 shares, and RIC – 257,293 shares. According to such Schedule 13G/A, no Reporting Person has sole voting or dispositive power with respect to any of the shares.

The following table sets forth certain information as of the Record Date, with respect to the shares of Common Stock beneficially owned by each of the directors, nominees for director and Named Executive Officers (as defined below in the section titled “Summary Compensation Table”) of the Company, and the total shares beneficially owned by directors and executive officers as a group. The Company’s policy is for each director with five years or more of experience on the Board to own a minimum of 2,500 shares, exclusive of stock grants and non-exercised stock options. Directors with less than five years of experience on the Board are required to own a minimum of 500 shares for each full year of service on the Board, up to 2,500 shares. Less than 1% stock ownership is shown below with an asterisk (*).

| Name of Beneficial Owner |

Amount and Nature of Beneficial Ownership (1) |

Percent of Total Outstanding Common Shares |

||||||

| Shaun A. Burke | 66,996 | 1.5% | ||||||

| Kurt Hellweg | 99,854 | 2.3% | ||||||

| Tim Rosenbury | 25,566 | * | ||||||

| Jamie Sivils, III | 27,408 | * | ||||||

| James Batten | 26,363 | * | ||||||

| John Griesemer | 131,189 | 3.0% | ||||||

| David Moore | 7,617 | * | ||||||

| Greg Horton | 6,233 | * | ||||||

| Tony Scavuzzo | 918,804 | (2) | 21.0% | |||||

| Carter Peters | 34,325 | * | ||||||

| Sheri Biser | 20,874 | * | ||||||

| Robin Robeson | 17,291 | * | ||||||

| Craig Dunn | 1,500 | * | ||||||

| Total owned by all directors and executive officers as a group (Thirteen persons) | 1,384,020 | 31.6% | ||||||

|

(1) |

Amounts may include shares held directly, as well as shares held jointly with family members, in retirement accounts, in a fiduciary capacity, by certain family members, by certain related entities or by trusts of which the directors and executive officers are trustees or substantial beneficiaries, with respect to which shares the respective director or executive officer may be deemed to have sole or shared voting and/or investment powers. Due to the rules for determining beneficial ownership, the same securities may be attributed as being beneficially owned by more than one person. The holders may disclaim beneficial ownership of the included shares which are owned by or with family members, trusts or other entities. |

|

|

|

| (2) |

Includes 918,804 shares held by Castle Creek Capital Partners V, LP. Mr. Scavuzzo is a Principal at Castle Creek and Disclaims beneficial ownership. |

PROPOSAL 1: ELECTION OF DIRECTORS

The number of directors constituting the Board will be nine. The Board is divided into three classes. The term of office of one class of directors expires each year in rotation so that the class up for election at each annual meeting of stockholders has served for a three-year term. The terms of three of the present directors (Messrs. Burke, Hellweg and Batten) are expiring at the Annual Meeting.

Messrs. Burke, Hellweg and Batten have been nominated, upon the recommendation of the Nominating Committee of the Board, by the Board and, upon election at the Annual Meeting, will hold office for a three-year term expiring in 2024 or until their successors are elected and qualified. Each nominee has indicated that he is willing and able to serve as a director if elected and has consented to being named as a nominee in this Proxy Statement.

Unless otherwise specified on the proxies received by the Company, it is intended that each properly executed or submitted proxy received in response to this solicitation will be voted in favor of the election of each person named in the following table to be a director of the Company for the term as indicated, or until his successor is elected and qualified. There are no arrangements or understandings between the nominees or directors and any other person pursuant to which any such person was or is selected as a director or nominee.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

THAT YOU VOTE FOR THE FOLLOWING NOMINEES FOR THREE-YEAR TERMS EXPIRING 2024

|

Name |

Age (1) |

Director Since |

Current Term Expires |

|

Shaun Burke |

57 |

2004 |

2021 |

|

Kurt Hellweg |

63 |

2000 |

2021 |

|

James R Batten, Chairman |

58 |

2006 |

2021 |

In addition to the three nominees proposed to serve on the Board as described above, the following individuals are also directors of the Company, each serving for the current term indicated.

Directors Who Are Not Nominees

Who Will Continue in Office After the Annual Meeting

|

Name |

Age (1) |

Director Since |

Current Term Expires |

|

Greg A. Horton |

61 |

2016 |

2022 |

|

Tim Rosenbury |

64 |

2002 |

2022 |

|

Tony Scavuzzo |

39 |

2018 |

2022 |

|

David T. Moore |

49 |

2014 |

2023 |

|

James L. Sivils |

56 |

2002 |

2023 |

|

John F. Griesemer |

53 |

2008 |

2023 |

|

(1) |

As of the Record Date |

Biographical Information

Set forth below are brief summaries of the background and business experience, including principal occupation, of each nominee and director currently serving on the Board.

James R. Batten, CPA, was Chief Financial Officer of International Dehydrated Foods (“IDF”), a privately-held manufacturer of ingredients for the food industry, from September 2016 through January 2020. Prior to joining IDF, Mr. Batten served as a management consultant serving businesses and non-profit organizations from March 2014 through August 2016. Mr. Batten was the Executive Vice President of Convoy of Hope, an international nonprofit relief organization from April 2009 through February 2014. Mr. Batten served as Chief Operations Officer and Executive Vice President of AG Financial Solutions from September 2007 through March 2009. Mr. Batten served as the Executive Vice President of Finance, Chief Financial Officer and Treasurer of O’Reilly Automotive, Inc. (NASDAQ: ORLY) from January 1993 through March 2007. Prior to joining O’Reilly, Mr. Batten was employed by the accounting firms of Whitlock, Selim & Keehn, from 1986 to 1993 and Deloitte, Haskins & Sells from 1984 until 1986. Mr. Batten is a member of the Board of AG Financial Solutions, Foundation Capital Resources, and Gilsbar, LLC and Treasurer of Hope Church. Mr. Batten is a former member of the NASDAQ Issuer Affairs Committee. He has also served on a number of other professional and civic boards including the Springfield Area Chamber of Commerce, Big Brothers Big Sisters of the Ozarks and New Covenant Academy. Mr. Batten’s extensive experience in public accounting and long tenure with a publicly-traded company, along with strong community service makes him a valuable member of the Board.

John F. Griesemer has been President and Chief Executive Officer of Erlen Group since 2017 and a member of the Board of Directors of the Erlen Group since 1993. The Erlen Group is a privately-held family of industrial companies, including Springfield Underground, Westside Stone, and Joplin Stone. Mr. Griesemer holds a B.S. degree in Industrial Management and Engineering from Purdue University. He is the past Chairman and current member of the Board of Mercy Springfield Communities, member of the Springfield Catholic Schools Board and a member of the Board of the National Stone Sand and Gravel Association. He is a past Member of the Board of the Missouri Limestone Producers Association, Catholic Campus Ministries, Junior Achievement of the Ozarks and Ozark Technical Community College Foundation. Mr. Griesemer brings to the Board a strong organizational and leadership background, management experience and deep ties in the local community.

Kurt D. Hellweg is the Chairman of the Board of IsoNova Technologies, L.L.C. (“IsoNova”), which is a joint venture with Rembrandt Enterprises, Inc., and past Chairman of the Board of International Dehydrated Foods, Inc. (“IDF”), American Dehydrated Foods, Inc. (“ADF”) and Food Ingredients Technology Company, L.L.C. (“FITCO”), which is a joint venture with Mars Petcare. IsoNova, IDF, ADF and FITCO are privately-held companies that manufacture and market ingredients for both the food and feed industries. Mr. Hellweg joined ADF in 1987 and has previously served as Vice President of Sales, Senior Vice President of Operations, and President and Chief Operating Officer. Prior to joining ADF, Mr. Hellweg was an officer in the U.S. Navy from 1980 to 1987. During that time, he served tours as a helicopter pilot in the Atlantic Fleet and as an instructor pilot. Mr. Hellweg holds a B.S. degree in Engineering from the University of Nebraska. He is a past Board Member of the Springfield Area Chamber of Commerce, the Springfield Area Arts Council, and the Springfield Symphony. He is the founding member of the Greater Ozarks Chapter of World Presidents’ Organization (“WPO”) (where he is still active) and has previously chaired the Greater Ozarks Chapter of the Young Presidents’ Organization. He is a Black Belt in Taekwondo, a member of Mensa, and enjoys competing in ultra-distance bicycling races. He currently serves on the following Boards in addition to IsoNova: CoxHealth, the Darr Family Foundation and Hammons Products Company. Mr. Hellweg brings to the Board a strong organizational and leadership background, a long history with the Company and deep ties in the local community.

Tim Rosenbury, a member of the American Institute of Architects, is the Director of Quality of Place Initiatives for The City of Springfield, Missouri. In his role he oversees capital investments in infrastructure and facilities, with an emphasis on design quality and civic engagement. He retired from the practice of architecture on February 29, 2020, after 35 years as a Partner of Butler, Rosenbury & Partners, Inc., an architecture and planning firm in Springfield, Missouri. He graduated with a B.Arch. from Mississippi State University in 1980, which in 1999 awarded him the designation of Alumni Fellow, and for which he serves on the professional advisory board of The School of Architecture. He is a member of a number of professional and civic organizations, many of which he has held leadership positions, including Chairman of the Springfield Area Chamber of Commerce and President of the Board of Education for Springfield Public Schools. Mr. Rosenbury brings to the Board strong community leadership and significant experience in general business and real estate development and management.

James L. Sivils, III, JD, has been the Chief Executive Officer of Environmental Works, Inc., a privately-held environmental consulting firm with offices in Springfield, Missouri, Kansas City, Missouri and St. Louis, Missouri, since 2013. Mr. Sivils began his career as a Missouri licensed attorney in 1990. In 1993, Mr. Sivils began developing real estate and became a licensed Missouri real estate broker. Mr. Sivils has developed numerous commercial and residential projects in Southwest Missouri. Mr. Sivils holds a J.D. degree from the University of Missouri – Kansas City Law School and a B.A. degree from the University of Missouri – Columbia. Mr. Sivils is a member and past Chapter Chair of the Ozarks Chapter of the Young Presidents’ Organization (YPO) and is now a member and Chapter Chair of the Ozarks Chapter of YPO-Gold. Mr. Sivils’ legal background, knowledge and experience with real estate matters and experience running a company with over 200 employees make him a valuable resource to the Board.

David T. Moore is President, Chief Executive Officer, and member of the Board of Directors of Paul Mueller Company. Paul Mueller Company is a publicly-held manufacturer of milk cooling equipment and processing equipment headquartered in Springfield, Missouri. Mr. Moore has worked at Paul Mueller Company since 2002, serving as the President since 2011. Additionally, he has been a member of the company’s Board of Directors since 1997. Prior to joining Paul Mueller Company, Mr. Moore was Vice President of Product Development at Corporate Document Systems, a computer software company, for six years. Mr. Moore holds an MBA from The University of Chicago - Booth School of Business and a B.A. from Middlebury College. Mr. Moore is a valuable asset to the Board due to his significant experience in public company management, corporate governance, business acquisition and integration, and information and technology development. In addition, Mr. Moore has long-term personal and business ties to the local community.

Greg A. Horton, CPA, is Chief Executive Officer and co-owner of Integrity Home Care & Hospice, a privately-held multi-line home health care enterprise that has over 2,000 employees and serves over 5,000 clients in Missouri and Kansas, and co-founder of its affiliate, Integrity Pharmacy. Prior to launching Integrity Home Care & Hospice in 2000, Mr. Horton was a partner in the accounting firm Whitlock, Selim & Keehn, LLP. He has twenty years of experience in public accounting with an emphasis in management consulting, information systems, and auditing services. Mr. Horton holds a Bachelor of Science in Business Administration with an Accounting Specialization from Central Missouri State University. He is a member of the American Institute of Certified Public Accountants and has been active in board and volunteer service with the Fellowship of Christian Athletes, Boys & Girls Town of Missouri, Rotary Club of Springfield Southeast, and the Springfield Area Chamber of Commerce. Greg is a board member of Foundation Capital Resources, Inc. and Developmental Center of the Ozarks. Mr. Horton’s expertise in large service-based organizations and his background in public accounting make him a valuable resource to the Board.

Tony Scavuzzo, is a Chartered Financial Analyst and is a Principal at Castle Creek Capital, an alternative asset management firm, joining the firm in 2009. Mr. Scavuzzo is responsible for the identification and evaluation of investment opportunities, transaction execution, and portfolio company monitoring. He has led or supported investments in numerous recapitalizations, distressed, and growth situations and works with executive management teams on strategic planning, operational improvements, acquisitions, and capital financings. Mr. Scavuzzo currently serves on the boards of directors of Enterprise Financial Services Corp. (Nasdaq: EFSC) and SouthCrest Financial Group, Inc. (OTC Pink: SGSC). Mr. Scavuzzo also currently serves on the boards of directors of the following private banking institutions: First Bancshares of Texas, Inc., McGregor Bancshares and Lincoln Bancshares Inc. Mr. Scavuzzo previously served on the boards of directors of other public and privately-owned financial and banking institutions. Most recently, he served as a member of the board of directors of Trinity Capital Corp (OTC: TRIN) until it was acquired by Enterprise Financial Services Corp in March 2019 and the board of directors of MBT Financial Corp. (previously Nasdaq: MBFT). Mr. Scavuzzo was formerly Treasurer and member of the Board of Directors for the CFA Society of San Diego and past Chairman of the Finance Committee for the CFA Society of Chicago. Mr. Scavuzzo holds an MBA in Finance, Accounting and Entrepreneurship from the University of Chicago Booth School of Business and a BBA in Finance from the University of Iowa. He is also a CFA Charterholder. Mr. Scavuzzo brings to the Board his many years of extensive experience with multiple financial institutions.

Shaun A. Burke joined the Bank in March 2004 as President and Chief Executive Officer and was appointed President and Chief Executive Officer of the Company in February 2005. He has over 37 years of banking experience. Mr. Burke received a Bachelor of Science Degree in Finance from Missouri State University and is a graduate of the Graduate School of Banking of Colorado. Mr. Burke served as Chairman of the Board of the Missouri Bankers Association in 2018 and 2019 and previously served as Chairman of the Legislative Affairs Committee and Chairman of the Audit Committee. In 2019, he was appointed to the Government Relations Council of the American Bankers Association and previously served on the Community Bankers Council from 2014 to 2017. In March 2016, he was appointed to the Federal Reserve Bank of St. Louis’ Community Depository Institutions Advisory Council and served a term ending in 2018. From 2012 to 2014, he was a Board Member of the Springfield Area Chamber of Commerce serving as Vice Chairman of Economic Development in 2014. From 2009 through 2014, he was a Board Member of the Springfield Business Development Corporation, the economic development subsidiary of the Springfield Area Chamber of Commerce serving as President in 2012. He is also a past Member of the United Way Allocations and Agency Relations Executive Committee, Salvation Army Board, and Big Brothers Big Sisters Board. Mr. Burke brings to the Board his many years of banking experience and an extensive knowledge of the bank and its history.

Director Independence

The Board has determined that all of the directors, except for Mr. Burke who is an executive officer of the Company, are “independent directors” as that term is defined in Rule 5605(a)(2) of the Marketplace Rules of The NASDAQ Stock Market (“NASDAQ”). These directors constitute a majority of the Board.

Board Leadership Structure

Throughout its history, the Company has kept the positions of Chairman of the Board and Chief Executive Officer separate. Mr. Batten has held the position of Chairman of the Board since 2016 and Mr. Burke holds the position of Chief Executive Officer. Mr. Batten is considered to be “independent” according to NASDAQ listing requirements.

The Board believes that having separate positions and having an independent outside director serve as Chairman is the appropriate leadership structure for the Company at this time and demonstrates our commitment to good corporate governance. Separating these positions allows our Chief Executive Officer to focus on our day-to-day business, while allowing the Chairman to lead the Board in its fundamental role of providing advice to and independent oversight of management. We believe that having an independent Chairman eliminates the conflicts of interest that may arise when the positions are held by one person. In addition, this leadership structure allows the Board to more effectively monitor and evaluate the performance of our Chief Executive Officer.

Board’s Role in Risk Oversight

It is necessary to effectively manage risk when managing and operating any financial institution. We face a number of risks, including but not limited to, general economic risks, credit risks, regulatory risks, audit risks, information security and technology risks, reputational risks, business competition, risks of natural disasters and pandemics and other public health crises. Management is responsible for the day-to-day management of risks the Company faces, while the Board, as a whole and through its committees, has responsibility for the general oversight of risk management. In its role of risk oversight, the Board has the responsibility to satisfy itself that the risk management processes and procedures designed and implemented by management are appropriate and functioning as designed.

While the full Board is charged with ultimate oversight responsibility for risk management, various committees of the Board and members of management also have specific responsibilities with respect to our risk oversight. Each Board committee has been assigned oversight responsibility for specific areas of risk and risk management, and each committee considers risks within its areas of responsibility. Each of these committees receives regular reports from management regarding our risks and reports regularly to the Board concerning risk.

We believe that providing for full and open communication between management and the Board is essential for effective risk management and oversight. Certain senior management personnel, consistent with their specific areas of responsibility, attend Board meetings and/or Board committee meetings on a regular and consistent basis. We have regular and ongoing reporting and communication mechanisms in place to ensure that oversight is effective.

Meetings and Committees of the Board of Directors

The business of the Company is conducted at regular and special meetings of the full Board of Directors and its standing committees. The standing committees consist of the Executive, Audit, Compensation, Nominating, Investment, Special, Building and Asset/Liability. During the twelve months ended December 31, 2020, the Board held twelve regular meetings. All directors attended at least 75% of the aggregate of the total number of those meetings and the number of meetings held by all committees of the Board of Directors on which they served.

Although the Company does not have a formal policy regarding director attendance at the Company’s annual stockholders’ meeting, all directors are expected to attend these annual meetings absent extenuating circumstances. All current directors attended the Company’s annual meeting of stockholders held on May 27, 2020 with the exception of Mr. Scavuzzo.

Stockholder Communications with Directors

Stockholders and other interested persons who wish to communicate with the Board of Directors of the Company, or any individual director, should send their written correspondence by mail to: Vicki Lindsay, Secretary, Guaranty Federal Bancshares, Inc., 2144 E. Republic Rd., Ste F200, Springfield, Missouri, 65804.

Audit Committee

The Company has a separately designated Audit Committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Audit Committee of the Board currently consists of four directors: Messrs. Committee Chairman Moore, Horton, Batten, and Hellweg, each of whom is an “independent director” as defined under the NASDAQ listing standards and the criteria for independence set forth in Rule 10A-3 of the Exchange Act. The Board has determined that Mr. Moore qualifies as an Audit Committee Financial Expert, as defined in the rules and regulations of the SEC. This standing committee, among other things, (i) regularly meets with the internal auditor to review audit programs and the results of audits of specific areas as well as other regulatory compliance issues, (ii) meets at least annually in executive session with the Company’s independent auditors to review the results of the annual audit and other related matters, and (iii) meets quarterly with management and the independent auditors to review the Company’s financial statements and significant findings based on the independent auditor’s review. The Audit Committee is responsible for hiring, retaining, compensating and terminating the Company’s independent auditors. The Audit Committee operates under a written charter adopted by the Company’s Board of Directors. A copy of the Audit Committee Charter can be viewed on our Guaranty Bank website at www.gbankmo.com by clicking on “Stock Performance” and then “Committee Charting” under “Corporate Information” under “Investor Menu”.

During the twelve months ended December 31, 2020, the Audit Committee met five times.

Nominating Committee

The Nominating Committee of the Board is to be comprised of three or more directors as appointed by the Board, each of whom is required to be an “independent director” as defined under the NASDAQ listing standards. Currently, the Nominating Committee consists of four directors, Messrs. Committee Chairman Sivils, Batten, Moore, and Horton, each of whom is an “independent director.” During the twelve months ended December 31, 2020, the Nominating Committee met two times. The Nominating Committee operates under a formal written charter adopted by the Board of Directors. A copy of the Nominating Committee Charter can be viewed on our Guaranty Bank website at www.gbankmo.com by clicking on “Stock Performance” and then “Committee Charting” under “Corporate Information” under “Investor Menu”.

The Nominating Committee is responsible for identifying individuals qualified to serve as members of the Board and recommending to the Board the director nominees for election and appointment to the Board, as well as director nominees for each of the committees of the Board. In accordance with its charter, the Nominating Committee recommends candidates (including incumbent nominees) based on the following criteria: business experience, education, integrity and reputation, independence, conflicts of interest, diversity, age, number of other directorships and commitments (including charitable obligations), tenure on the Board, attendance at Board and committee meetings, stock ownership, specialized knowledge (such as an understanding of banking, accounting, marketing, finance, regulation and public policy) and a commitment to the Company’s communities and shared values, as well as overall experience in the context of the needs of the Board as a whole. The Nominating Committee monitors the mix of skills and experience of its directors and committee members in order to assess whether the Board has the appropriate tools to perform its oversight function effectively. The Nominating Committee does not have a separate diversity policy, but the Nominating Committee does consider the diversity of its directors and nominees in terms of knowledge, experience, skills, expertise, and other demographics which may contribute to the Board.

With respect to nominating existing directors, the Nominating Committee reviews relevant information available to it and assesses their continued ability and willingness to serve as a director. The Nominating Committee will also assess such person’s contribution in light of the mix of skills and experience the Nominating Committee has deemed appropriate for the Board as a whole. With respect to nominations of new directors, the Nominating Committee will conduct a thorough search to identify candidates based upon criteria the Nominating Committee deems appropriate and considering the mix of skills and experience necessary to complement existing members of the Board. The Nominating Committee will then review selected candidates and make its recommendation to the Board.

Nominations by a stockholder will be considered by the Nominating Committee if such nomination is written and delivered or mailed by first class United States mail, postage prepaid, to the Secretary of the Company between 30 and 60 days prior to the meeting at which such nominee may be considered. However, if less than 31 days’ notice of the meeting is given by the Company to stockholders, written notice of the stockholder nomination must be given to the Secretary of the Company as provided above no later than the tenth day after notice of the meeting was mailed to stockholders. A nomination must set forth, with respect to the nominee, (i) name, age, and business address and if known, the residence address, (ii) principal occupation or employment, (iii) Common Stock beneficially owned, and (iv) other information that would be required in a proxy statement including such nominee’s written consent to be named in the proxy statement as a nominee and to serving as a director if elected. The stockholder giving notice must list his or her name and address, as they appear on the Company’s books, and the amount of Common Stock beneficially owned by him or her. In addition, the stockholder making such nomination must promptly provide to the Company any other information reasonably requested by the Company. Nominations from stockholders will be considered and evaluated using the same criteria as all other nominations.

Compensation Committee

The Board of Directors of the Company and the Board of Directors of the Bank are comprised of the same persons. The Compensation Committee of the Company’s Board of Directors and of the Bank’s Board of Directors (the “Compensation Committee”) are comprised of the same persons and consist solely of non-employee directors of the Company and the Bank, namely Messrs. Committee Chairman Hellweg, Griesemer, Moore, Scavuzzo and Horton. Each of these committee members is an “independent director” as defined under the NASDAQ listing standards. The Company has no employees and relies on employees of the Bank for the limited services received by the Company. All compensation paid to executive officers of the Company is paid by the Bank.

The Compensation Committee, together with the full Board, is responsible for designing the compensation and benefit plans for all executive officers and directors of the Company and all employees, executive officers and directors of the Bank, including the Chief Executive Officer, based on its review of performance measures, industry salary surveys and the recommendations of management concerning compensation. See “Report on Executive Compensation” below. The Compensation Committee recommends adjustments to the compensation of the Chief Executive Officer and the other Named Executive Officers of the Company based upon its assessment of individual performance and the Bank’s performance, and makes other recommendations, when appropriate, to the full Board of Directors. Independent consultants may be engaged directly by the Compensation Committee to evaluate the Company’s executive compensation. The Compensation Committee, together with the full Board, determines the compensation of all other officers. The Compensation Committee may delegate its authority to a subcommittee of the Compensation Committee.

During the twelve months ended December 31, 2020, the Compensation Committee met one time. The Compensation Committee operates under a formal written charter adopted by the Company’s and the Bank’s boards of directors. A copy of the Compensation Committee Charter can be viewed on our Guaranty Bank website at www.gbankmo.com by clicking on “Stock Performance” and then “Committee Charting” under “Corporate Information” under “Investor Menu”.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

During the year ended December 31, 2020, the Compensation Committee was comprised of Messrs. Committee Chairman Hellweg, Griesemer, Moore, Scavuzzo and Horton, each of whom is a non‑employee director of the Company and the Bank. Mr. Burke, the current President and Chief Executive Officer of the Company and the Bank, did not serve as a member of the Compensation Committee during 2020. No executive officer of the Company served on the compensation committee or board of directors of any company that employed any member of the Compensation Committee or Board of Directors.

COMPENSATION DISCUSSION AND ANALYSIS

Overall Compensation Philosophy and Objectives

The Compensation Committee, together with the full Board, has designed the compensation and benefit plans for all employees, executive officers and directors in order to attract and retain individuals who have the skills, experience and work ethic to provide a coordinated work force that will effectively and efficiently carry out the policies adopted by the Board and to manage the Company and the Bank to meet the Company’s mission, goals and objectives.

To determine the compensation of executive officers and directors, the Compensation Committee reviews industry compensation statistics based on our asset size, makes cost of living adjustments, and establishes salary ranges for each executive officer and fees for the Board. The Compensation Committee then reviews (i) the financial performance of the Bank over the most recently completed fiscal year (including Return on Assets, Return on Equity, asset quality, etc.) compared to results at comparable companies within the industry, and (ii) the responsibilities and performance of each executive officer and the salary compensation levels of each executive officer compared to like positions at comparable companies within the industry. The Compensation Committee evaluates all factors subjectively in the sense that they do not attempt to tie any factors to a specific level of compensation.

The Compensation Committee offers long-term incentives for executive officers and other management personnel primarily in the form of restricted stock awards. We believe that our stock award programs are an important component of compensation to attract and retain talented executives, provide an incentive for long-term corporate performance, and to align the long-term interests of executives and stockholders.

All executive officers may participate on an equal, non-discriminatory basis with all other employees of the Bank in the Bank’s contributory 401(k) tax-deferred savings plan, medical insurance plan, long-term disability plan and group life insurance plan. The Compensation Committee recommends all compensation and benefit plans to the full Board for approval annually and, where necessary, for the Board to submit to the stockholders for approval.

Executive Compensation Philosophy and Objectives

The Compensation Committee is guided by the following four key principles in determining the compensation of the Company’s executive officers:

|

● |

Competition. Compensation should reflect the competitive marketplace, so the Company can attract, retain and motivate talented personnel. |

|

● |

Accountability for Business Performance. Compensation should be tied in part to the Company’s financial performance, so that executives are held accountable through their compensation for the performance of the Company. |

|

● |

Accountability for Individual Performance. Compensation should be tied in part to the individual’s performance to reflect individual contributions to the Company’s performance. |

|

● |

Alignment with Stockholder Interests. Compensation should be tied in part to the Company’s stock performance through long-term incentives such as restricted stock, to align the executive’s interests with those of the Company’s stockholders. |

Consideration of 2020 Say on Pay

At the Company’s 2020 annual meeting of stockholders, 95.50% of voting stockholders approved the non-binding advisory proposal on the compensation of the Named Executive Officers (or “NEOs”), commonly referred to as a “say-on-pay” vote.

The Board and the Compensation Committee pay careful attention to communications received from stockholders regarding executive compensation, including the non-binding advisory vote. The Company carefully considered the result of the 2020 advisory vote on executive compensation but not for specific 2020 compensation decisions. Based on this consideration and the other factors described in this Compensation Discussion and Analysis, the Compensation Committee did not materially alter the policies or structure for the NEOs’ compensation for 2021.

Report on Executive Compensation

The compensation of the Chief Executive Officer (the “CEO”) and other NEOs is recommended by the Compensation Committee with final approval from the full Board. The CEO is not a member of the Compensation Committee and does not attend any Compensation Committee meetings unless specifically requested to do so by the Chairman of the Compensation Committee. The CEO may act as a key discussion partner with the Compensation Committee members to provide information regarding business context, the market environment and our strategic direction. The CEO also provides recommendations to the Compensation Committee on individual performance evaluations and compensation for the NEOs, other than himself. The Compensation Committee strives to provide total compensation that is aligned and competitive with compensation data, based on a peer group of selected public-traded companies within the banking industry, a similar geographic location and with comparable financial performance. This information was compiled in 2019 by ChaseCompGroup, LLC, a compensation consulting group engaged by the Compensation Committee. The peer group provides a reference point when making pay decisions and benchmarking short-term and long-term incentive plan awards and mechanics. The compensation packages reflect a range based on this analysis, augmented by the performance of the individual executive officer and the Company. Grants under the various equity plans described below are intended to provide long-term incentive to stay with the Company, but should not replace, or override, maintenance of the compensation ranges established from the peer group.

The Compensation Committee has reviewed all components of the CEO’s and the other NEO’s compensation, including salary, bonus, accumulated and realized and unrealized stock options and restricted stock awards. Based on this review, the Committee finds the CEO’s and other NEOs’ total compensation in the aggregate to be reasonable and not excessive. It should be noted that when the Compensation Committee considers any component of the CEO’s and other NEOs’ total compensation, the aggregate amounts and mix of all the components, including accumulated and realized and unrealized stock options and restricted stock awards, are taken into consideration in the Committee’s decisions.

COMPENSATION COMMITTEE REPORT

The Compensation Committee reviewed and discussed the Compensation Discussion and Analysis included in this Proxy Statement with management. Based on such review and discussion, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this Proxy Statement for filing with the SEC and incorporated by reference in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020.

| MEMBERS OF THE COMPENSATION COMMITTEE |

| Kurt D. Hellweg, Chairman | John F. Griesemer | |

| David T. Moore | Greg A. Horton | |

| Tony Scavuzzo |

Summary Compensation Table

The following table sets forth information with respect to the compensation awarded to, paid to or earned for the periods indicated by the Chief Executive Officer (“CEO”), the Chief Financial Officer (“CFO”), the Chief Operating Officer (“COO”), the Chief Credit Officer (“CCO”) and the Chief Commercial Banking Officer (“CCBO”). These executive officers are collectively referred to as the “Named Executive Officers” or “NEOs”. During the fiscal year ended December 31, 2020, no other person served as the CEO or CFO of the Company, and no other executive officer received annual compensation that exceeded $100,000.

|

Name and Principal Position |

Year |

Salary (1) |

Bonus (2) |

Stock Awards (3) |

Option Awards |

Non-Equity Incentive Plan Compensation |

Nonqualified Deferred Compensation |

All Other Compensation |

Total Compensation |

||||||||||||||||||||||||

|

Shaun A. Burke |

2020 |

$ | 326,655 | $ | 81,932 | $ | 63,995 | $ | - | $ | - | $ | - | $ | 12,959 | (4) | $ | 485,541 | |||||||||||||||

|

President/CEO |

2019 |

320,300 | 95,266 | - | - | - | - | 16,977 | (4) | 432,543 | |||||||||||||||||||||||

|

2018 |

314,167 | 108,282 | - | - | - | - | 17,041 | (4) | 439,490 | ||||||||||||||||||||||||

|

Carter Peters |

2020 |

217,770 | 54,621 | 35,551 | - | - | - | 15,006 | (5) | 322,948 | |||||||||||||||||||||||

|

EVP/CFO |

2019 |

213,500 | 63,510 | - | - | - | - | 16,613 | (5) | 293,623 | |||||||||||||||||||||||

|

2018 |

208,333 | 72,188 | - | - | - | - | 13,447 | (5) | 293,968 | ||||||||||||||||||||||||

|

Robin Robeson |

2020 |

237,473 | 59,563 | 38,769 | - | - | - | 8,630 | (6) | 344,435 | |||||||||||||||||||||||

|

EVP/COO |

2019 |

232,817 | 69,257 | - | - | - | - | 11,200 | (6) | 313,274 | |||||||||||||||||||||||

|

2018 |

226,667 | 78,719 | - | - | - | - | 8,276 | (6) | 313,662 | ||||||||||||||||||||||||

|

Sheri Biser |

2020 |

197,825 | 49,689 | 32,349 | - | - | - | 7,913 | (7) | 287,776 | |||||||||||||||||||||||

|

EVP/CCO |

2019 |

191,333 | 57,225 | - | - | - | - | 10,170 | (7) | 258,728 | |||||||||||||||||||||||

|

2018 |

181,833 | 62,907 | - | - | - | - | 7,273 | (7) | 252,013 | ||||||||||||||||||||||||

|

Craig Dunn |

2020 |

157,670 | 56,250 | 36,613 | - | - | - | 8,100 | (8) | 258,633 | |||||||||||||||||||||||

|

EVP/CCBO |

|||||||||||||||||||||||||||||||||

|

(1) |

No director fees were paid to Mr. Burke for any of the years presented. Mr. Dunn was employed by the Company as its Chief Commercial Banking Officer in April 2020. |

|

(2) |

Cash bonuses were awarded to NEOs for 2020 in accordance with established annual incentive compensation arrangements as described in more detail below under “Executive Incentive Compensation Annual Plan”. |

|

(3) |

This column represents compensation related to performance share unit awards granted in accordance with established long-term incentive performance share arrangements as described in more detail below under “Long-Term Incentive Performance Share Arrangements”. Amounts represent the aggregate grant date fair value computed in accordance with Accounting Standards Codification Topic 718 (“ASC Topic 718”). The compensation amount is estimated utilizing the threshold level incentive. The number of shares used and grant price to each executive was as follows: Mr. Burke: – 4,097 shares at a per share grant price of $15.62; Mr. Peters – 2,276 shares at a per share grant price of $15.62; Ms. Robeson – 2,482 shares at a per share grant price of $15.62; Ms. Biser – 2,071 shares at a per share grant price of $15.62; and Mr. Dunn – 2,344 shares at a per share grant price of $14.34. The performance share unit awards will vest on December 31, 2022. |

|

(4) |

Amount is comprised of payments to Mr. Burke of $7,589, $11,200, and $11,000 in 2020, 2019, and 2018, respectively, for the Company’s 401(k) matching contribution and payments of $5,370, $5,777, and $6,041, respectively, for country club dues. |

|

(5) |

Amount is comprised of payments to Mr. Peters of $8,711, $8,333 and $7,900 in 2020, 2019, and 2018, respectively, for the Company’s 401(k) matching contribution and payments of $6,295, $5,413, and $5,114, respectively, for country club dues. |

|

(6) |

Amount is comprised of payments to Ms. Robeson of $8,630, $11,200, and $8,276 in 2020, 2019, and 2018, respectively, for the Company’s 401(k) matching contribution. |

|

(7) |

Amount is comprised of payments to Ms. Biser of $7,913, $10,170, and $7,273 in 2020, 2019, and 2018, respectively, for the Company’s 401(k) matching contribution. |

|

(8) |

Amount is comprised of payments to Mr. Dunn of $4,500 in 2020 for the Company’s 401(k) matching contributions and payments of $3,600 for county club dues |

Employment Agreements, Potential Payments Upon Termination or Change-in-Control

In March 2014, the Company entered into employment agreements with the NEOs then in office, namely Mr. Burke, Mr. Peters, Ms. Robeson and Ms. Biser, and were amended in June 2016. In April 2020, the Company entered into an employment agreement with Mr. Dunn. Each employment agreement has a term of one year, which automatically renews each year unless terminated, or unless earlier terminated pursuant to its terms, and sets forth a minimum base salary payable to the officer and provides that the officer is eligible to participate in the Company’s bonus, incentive, retirement, health and other insurance benefit plans made available to executive-level employees.

Each employment agreement obligates the Company to pay the officer severance in the event the officer’s employment is terminated by the Company without cause. In the event of the officer’s involuntary termination without cause prior to a change in control of the Company (as defined in the employment agreement), each officer other than Mr. Burke would receive 6 months base pay. Mr. Burke would receive 12 months base pay. Such severance would be made in periodic installments and is conditioned upon the officer executing a release and waiver of claims in favor of the Company.

In the event of involuntary termination without cause within 12 months after a change in control of the Company, each officer other than Mr. Burke would receive 24 months base pay. Mr. Burke would receive 36 months base pay. Such severance would be made in a single lump sum and is conditioned upon the officer executing a release and waiver of claims in favor of the Company.

As a condition of entering into the employment agreement, each officer has agreed not to divulge any confidential information during his or her employment or to solicit the Company’s employees or customers for a period of 12 months (24 months in the case of Mr. Burke) following the officer’s termination of employment.

Executive Incentive Compensation Annual Plan

On March 24, 2020, the Company entered into incentive compensation arrangements for Mr. Burke, Mr. Peters, Ms. Robeson, and Ms. Biser and, on May 11, 2020, for Mr. Dunn with respect to bonuses payable in 2021 for the calendar year 2020. Pursuant to these plans, a maximum amount of 50% of base pay may be paid to each of them, 100% of which bonus amount will be paid in cash. There are three possible levels of incentive awards: threshold (25%); target (50%); and maximum (100%). For any bonus amount to be paid, the threshold level of performance must be achieved. The three performance measurements of the Company (and the weight given to each measurement) applicable to each award level are as follows: (i) return on average assets (50%); (ii) net interest margin (25%); and (iii) efficiency ratio (25%). Certain criteria, however, must be satisfied before an award is paid under these plans. The Board may adjust the incentive based on achievement of the above measurements and other criteria and other pertinent factors including, but not limited to, the executive’s contribution to the Bank’s goals and objective, attitude, teamwork, initiative, interpersonal relationships and adherence to policies. The Board will also consider the executive’s overall compensation relevant to peer group.

In February 2021, the Board upon recommendation of the Compensation Committee approved the grant of bonuses for 2020 to each of the NEOs as set forth in “Bonus” column for 2020 in the Summary Compensation Table above and such bonuses were paid in cash.

Long-Term Incentive Performance Share Arrangements

On March 19, 2020, the Company entered into long-term incentive performance share arrangements for Mr. Burke, Mr. Peters, Ms. Robeson, and Ms. Biser and, on May 11, 2020, for Mr. Dunn. As used herein, “Grant Date” shall mean May 11, 2020 for Mr. Dunn and March 19, 2020 for the other NEOs. The performance period under the plans began May 11, 2020 for Mr. Dunn and March 19, 2020 for the other NEOs and ends December 31, 2022 (the “Performance Period”). One hundred percent (100%) of the incentive amount is granted in performance units (the “Units”), representing the right to receive, on a one-for-one basis, shares of the Company’s Common Stock to the extent earned. The plan is to pay a maximum number of shares of which there are three possible levels of incentive awards: threshold (25%); target (50%); and maximum (100%). For any bonus amount to be paid, the threshold level of performance must have been achieved. The bonus amount is to be prorated for performance achievements between the threshold and target levels and between the target and maximum levels. The two performance measurements of the Company (and the weight given to each measurement) applicable to each award level are as follows: (i) Return on Average Assets (50%) and (ii) Earnings Per Share (50%). There are also other minimum criteria that must all have been satisfied before an award is to be paid under the plan. These plans are to pay a maximum number of shares per individual as follows: Mr. Burke – 16,386 shares; Mr. Peters – 9,104 shares; Ms. Robeson – 9,927 shares; Ms. Biser – 8,283 shares; and Mr. Dunn – 9,375 shares.

Outstanding Equity Awards at Fiscal Year End 2020

The following table summarized the option and stock awards the Company has made to the NEOs which were outstanding as of December 31, 2020.

|

OPTION AWARDS |

STOCK AWARDS |

|||||||||||||||||||||||||||

|

Name and Principal Position |

Number of Securities Underlying Unexercised Options (#) Exercisable |

Number of Securities Underlying Unexercised Options (#) Unexercisable |

Equity Incentive Plan Awards:Number of Securities Underlying Unexercised Unearned Options (#) |

Option Exercise Price |

Option Expiration Date |

Equity Incentive Plan Awards:Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) |

Equity Incentive Plan Awards:Market or Payout Value Unearned of Shares, Units or Other Rights That Have Not Vested ($)(6) |

|||||||||||||||||||||

|

Shaun A. Burke |

- | - | - | $ | - | - | 16,386 | (1) | $ | 286,100 | ||||||||||||||||||

|

President/CEO |

||||||||||||||||||||||||||||

|

Carter Peters |

- | - | - | - | - | 9,104 | (2) | $ | 158,956 | |||||||||||||||||||

|

EVP/CFO |

||||||||||||||||||||||||||||

|

Sheri Biser |

- | - | - | - | - | 8,283 | (3) | $ | 144,621 | |||||||||||||||||||

|

EVP/CCO |

||||||||||||||||||||||||||||

|

Robin Robeson |

- | - | - | - | - | 9,927 | (4) | $ | 173,325 | |||||||||||||||||||

|

EVP/COO |

||||||||||||||||||||||||||||

|

Craig Dunn |

- | - | - | - | - | 9,375 | (5) | $ | 163,688 | |||||||||||||||||||

|

EVP/CCBO |

||||||||||||||||||||||||||||

|

(1) |

Restricted stock awards vest as follows: 16,386 – 12/31/22 |

|

(2) |

Restricted stock awards vest as follows: 9,104 – 12/31/22 |

|

(3) |

Restricted stock awards vest as follows: 8,283 – 12/31/22 |

|

(4) |

Restricted stock awards vest as follows: 9,927 – 12/31/22 |

|

(5) |

Restricted stock awards vest as follows: 9,375 – 12/31/22 |

|

(6) |

Represents aggregate unvested stock awards at a per share price of $17.46, the closing price of the Company’s Common Stock on December 31, 2020. |

Directors’ Compensation

During 2020, each non-employee member of the Board received cash compensation from the Bank of $830 per each Bank board meeting attended, payable monthly. In addition to the cash compensation, each non-employee member of the Board receives equity compensation from the Company. Directors receive fees for committee memberships or attendance at committee meetings comprised of $200 per meeting for the Executive, Audit and Compensation Committees and $125 per meeting for any other committee. Asset/Liability Committee members receive a $200 monthly fee. The Chairman of the Board receives an additional $500 monthly fee in addition to the regular per meeting fee. The Chairman of the Audit Committee receives an additional $417 monthly fee in addition to the regular per meeting fee. Building and Compensation Committees Chairman receives an additional $170 monthly fee in addition to the regular per meeting fee.

Directors may participate in the Company’s 2015 Equity Plan. During fiscal years 2020, 2019, and 2018, restricted stock awards of 797 shares, 786 shares, and 836 shares, respectively, were granted to each independent, non-employee director (except Mr. Scavuzzo) to provide equity compensation from the Company. Annual equity compensation is determined at the discretion of the Compensation Committee.

The following table sets forth information with respect to the compensation received in fiscal years 2020, 2019, and 2018 for serving as a non-employee director of the Company and the Bank.

|

Name |

Year |

Fees Earned or Paid in Cash ($) |

Stock Awards ($)(1) |

Total Compensa- tion ($) |

|||||||||

|

James Batten |

2020 |

15,350 | 18,730 | 34,080 | |||||||||

|

2019 |

14,215 | 18,746 | 32,961 | ||||||||||

|

2018 |

14,060 | 18,735 | 32,795 | ||||||||||

|

Kurt Hellweg |

2020 |

13,795 | 18,730 | 32,525 | |||||||||

|

2019 |

11,030 | 18,746 | 29,776 | ||||||||||

|

2018 |

13,215 | 18,735 | 31,950 | ||||||||||

|

Tim Rosenbury |

2020 |

12,920 | 18,730 | 31,650 | |||||||||

|

2019 |

12,340 | 18,746 | 31,086 | ||||||||||

|

2018 |

13,500 | 18,735 | 32,235 | ||||||||||

|

James Sivils |

2020 |

10,880 | 18,730 | 29,610 | |||||||||

|

2019 |

11,005 | 18,746 | 29,751 | ||||||||||

|

2018 |

12,210 | 18,735 | 30,945 | ||||||||||

|

John Griesemer |

2020 |

11,695 | 18,730 | 30,425 | |||||||||

|

2019 |

14,435 | 18,746 | 33,181 | ||||||||||

|

2018 |

13,685 | 18,735 | 32,420 | ||||||||||

|

David Moore |

2020 |

15,184 | 18,730 | 33,914 | |||||||||

|

2019 |

15,798 | 18,746 | 34,544 | ||||||||||

|

2018 |

13,250 | 18,735 | 31,985 | ||||||||||

|

Greg Horton |

2020 |

11,210 | 18,730 | 29,940 | |||||||||

|

2019 |

11,410 | 18,746 | 30,156 | ||||||||||

|

2018 |

10,960 | 18,735 | 29,695 | ||||||||||

|

Tony Scavuzzo |

2020 |

12,560 | - | 12,560 | |||||||||

|

2019 |

11,150 | - | 11,150 | ||||||||||

|

2018 |

5,980 | - | 5,980 | ||||||||||

|

(1) |

This column represents equity compensation from the Company and is the aggregate grant date fair value of restricted stock awards granted under the 2015 Equity Plan. The compensation for 2020 per director of $18,730 represents 797 shares granted at a per share price of $23.50. The compensation for 2019 per director of $18,746 represents 786 shares granted at a per price share of $23.85. The compensation for 2018 per director of $18,735 represents 836 shares granted at a per price share of $22.41. |

Indebtedness of Management and Directors and Transactions with Certain Related Persons

Loans made to a director or executive officer in excess of the greater of $25,000 or 5% of the Company’s capital and surplus (up to a maximum of $500,000) must be approved in advance by a majority of the disinterested members of the Board of Directors. The Bank, like other financial institutions, provides loans to its officers, directors, and employees to purchase or refinance personal residences as well as consumer loans. As an additional benefit to eligible Bank directors and employees, the Bank offers an employee mortgage loan program (the “Loan Program”). The Loan Program provides mortgage loans at favorable interest rates, namely a one-year adjustable- rate mortgage priced at the Bank’s cost of funds with a 1% floor. The purpose of the loan must be to purchase or refinance a primary or secondary residence (i.e., no investment properties). All full-time employees that have completed the 30-day probation period are eligible to participate in this Loan Program. Underwriting includes standard application and financial disclosures, which must qualify to standard secondary market requirements. The borrower is responsible for all third-party closing costs. The index rate is the Bank’s all-in cost of funds with a 1% floor. The index will be the last month-end calculation within 45 days prior to closing. The maximum adjustment per year is 2% with a 6% lifetime maximum. Each loan has up to a 30-year note/amortization. If the borrower’s employment is terminated for reasons other than normal retirement, disability or death, or if the property securing the promissory note evidencing each eligible participant’s loan (the “Note”) ceases to be the primary or secondary residence of the employee, the interest rate will adjust to the rate that would have been in effect pursuant to the original provision of the Note. The payment will adjust the following month to amortize the outstanding balance of the Note using the new interest rate and the remaining term. Other than the interest rate with respect to the Loan Program, all loans provided under the Loan Program and any other loans provided to directors and executive officers have been made in the ordinary course of business, on substantially the same terms and collateral as those of comparable transactions prevailing at the time, and, in the opinion of management of the Company, do not involve more than the normal risk of collectability or present other unfavorable features.

No directors, executive officers or their affiliates had aggregate indebtedness to the Company or the Bank on below market rate loans exceeding the lesser of (i) $120,000 or (ii) one percent of the average of the Company’s total assets at year-end for the last two completed fiscal years, at any time since January 1, 2020 except as noted in the following table.

|

Name |

Position |

Date of Loan |

Largest Principal Amount Outstanding Since 01/01/20 |

Principal Balance as of 12/31/20 |

Interest Rate at 12/31/20 |

Type |

||||||||||

|

The Burke Family Trust (Shaun A. Burke) |

President, CEO & Director |

1/14/2011 |

$ | 212,215 | $ | - | N/A |

Home Mortgage |

||||||||

|